ACCG224: Financial Accounting and Reporting - PPE Policies

VerifiedAdded on 2022/10/19

|6

|848

|455

Report

AI Summary

This report examines the accounting policies and estimates related to Property, Plant, and Equipment (PPE), focusing on the application of professional judgment in financial accounting. The report analyzes the practices of AGL Energy, adhering to the AAS 108 guidelines for recognizing, measuring, and estimating the cost and value of PPE assets. It explores the use of the cost model for measuring PPE, including various cost elements, and the straight-line depreciation method. The report also covers impairment testing and the recognition of impairment losses. The conclusion emphasizes AGL's adherence to AAS 108 and the importance of consistent application of accounting policies, supported by material facts when policy changes are necessary. The report provides a comprehensive overview of accounting standards and their practical application in the context of financial reporting.

Running head: ACCOUNTING POLICIES AND ESTIMATES ON PPE

Accounting Policies and Estimates on PPE

Name

Institution

Accounting Policies and Estimates on PPE

Name

Institution

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ACCOUNTING POLICIES AND ESTIMATES ON PPE 2

PART C

Professional judgment in accounting is defined as the application of gained expertise

and experienced through practicing accounting and auditing to make accurate, reliable, and

trusted decisions (Foundation, 2014). In Australia, Listed companies are guided by the AAS

108 when choosing accounting policies to use in making professional judgments to estimate

the cost and value of Property, Plant, and Equipment (PPE) assets. This section examines

different account policies used by the AGL to estimate its PPE based on AAS 108 guidelines.

Paragraph 8 of the AAS 108 establishes that accounting policies help entities to include

only reliable and relevant information in their financial elements. Likewise, paragraph 13

states that entities should maintain consistency in applying selected accounting policies.

Paragraph 14 hold that policies can be changed under two circumstances. First, the Australian

Accounting Standard may require a policy to be changed. And, second, where the proposed

changes provide more reliable and relevant information compared to the previous policy

(Australian Accounting Standards Board, 2015).

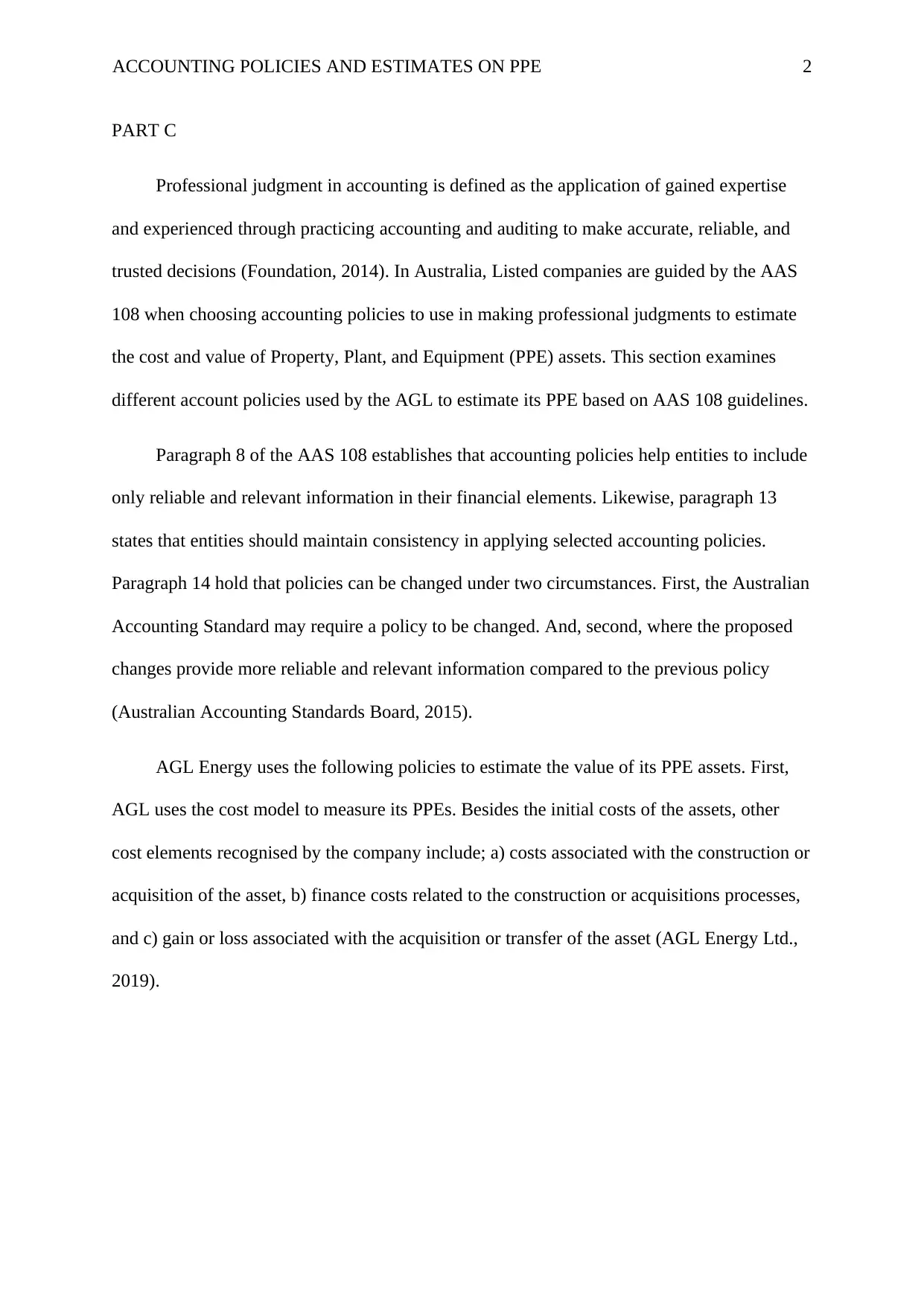

AGL Energy uses the following policies to estimate the value of its PPE assets. First,

AGL uses the cost model to measure its PPEs. Besides the initial costs of the assets, other

cost elements recognised by the company include; a) costs associated with the construction or

acquisition of the asset, b) finance costs related to the construction or acquisitions processes,

and c) gain or loss associated with the acquisition or transfer of the asset (AGL Energy Ltd.,

2019).

PART C

Professional judgment in accounting is defined as the application of gained expertise

and experienced through practicing accounting and auditing to make accurate, reliable, and

trusted decisions (Foundation, 2014). In Australia, Listed companies are guided by the AAS

108 when choosing accounting policies to use in making professional judgments to estimate

the cost and value of Property, Plant, and Equipment (PPE) assets. This section examines

different account policies used by the AGL to estimate its PPE based on AAS 108 guidelines.

Paragraph 8 of the AAS 108 establishes that accounting policies help entities to include

only reliable and relevant information in their financial elements. Likewise, paragraph 13

states that entities should maintain consistency in applying selected accounting policies.

Paragraph 14 hold that policies can be changed under two circumstances. First, the Australian

Accounting Standard may require a policy to be changed. And, second, where the proposed

changes provide more reliable and relevant information compared to the previous policy

(Australian Accounting Standards Board, 2015).

AGL Energy uses the following policies to estimate the value of its PPE assets. First,

AGL uses the cost model to measure its PPEs. Besides the initial costs of the assets, other

cost elements recognised by the company include; a) costs associated with the construction or

acquisition of the asset, b) finance costs related to the construction or acquisitions processes,

and c) gain or loss associated with the acquisition or transfer of the asset (AGL Energy Ltd.,

2019).

ACCOUNTING POLICIES AND ESTIMATES ON PPE 3

Source: AGL Energy Ltd., 2019, p 110

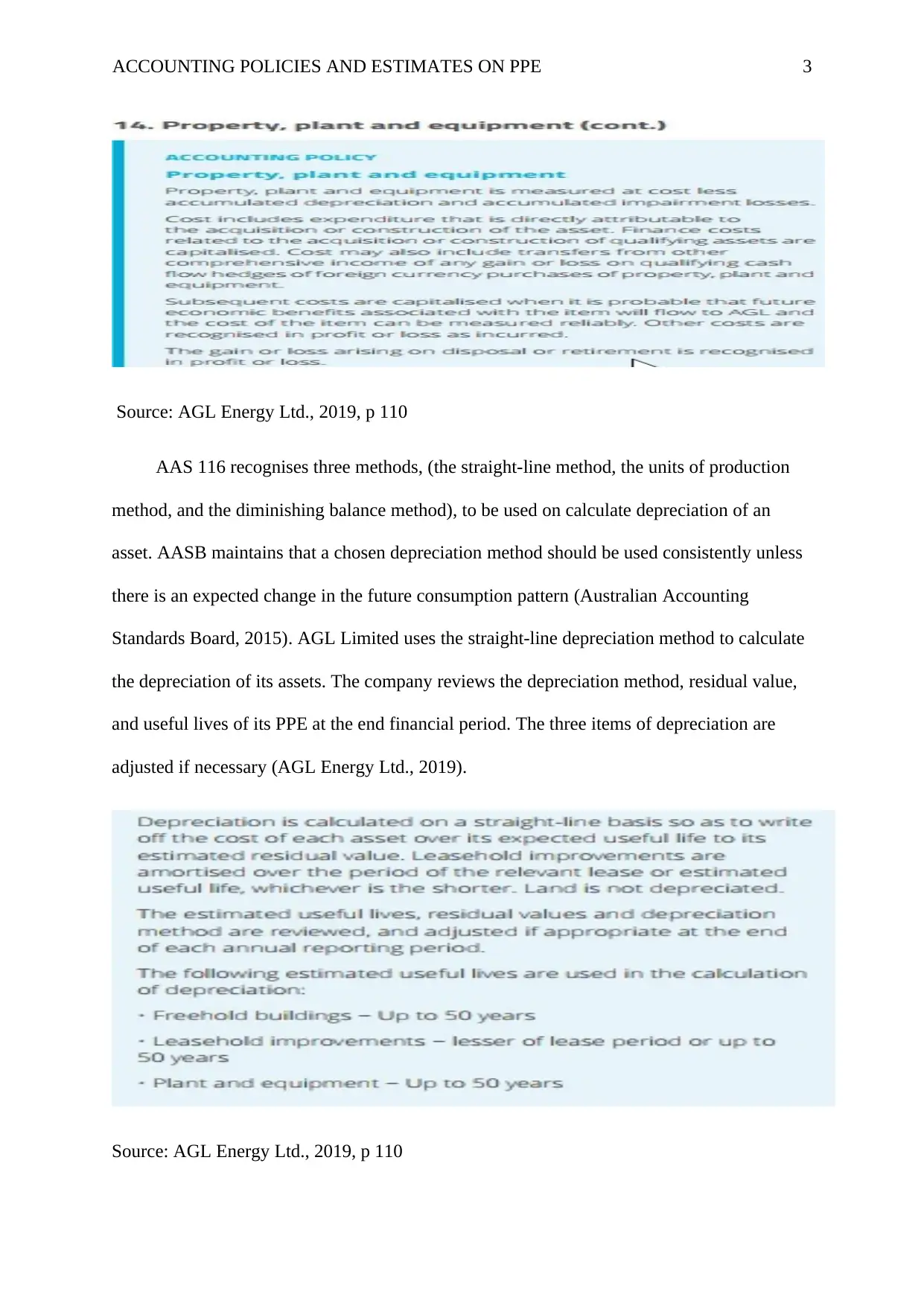

AAS 116 recognises three methods, (the straight-line method, the units of production

method, and the diminishing balance method), to be used on calculate depreciation of an

asset. AASB maintains that a chosen depreciation method should be used consistently unless

there is an expected change in the future consumption pattern (Australian Accounting

Standards Board, 2015). AGL Limited uses the straight-line depreciation method to calculate

the depreciation of its assets. The company reviews the depreciation method, residual value,

and useful lives of its PPE at the end financial period. The three items of depreciation are

adjusted if necessary (AGL Energy Ltd., 2019).

Source: AGL Energy Ltd., 2019, p 110

Source: AGL Energy Ltd., 2019, p 110

AAS 116 recognises three methods, (the straight-line method, the units of production

method, and the diminishing balance method), to be used on calculate depreciation of an

asset. AASB maintains that a chosen depreciation method should be used consistently unless

there is an expected change in the future consumption pattern (Australian Accounting

Standards Board, 2015). AGL Limited uses the straight-line depreciation method to calculate

the depreciation of its assets. The company reviews the depreciation method, residual value,

and useful lives of its PPE at the end financial period. The three items of depreciation are

adjusted if necessary (AGL Energy Ltd., 2019).

Source: AGL Energy Ltd., 2019, p 110

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ACCOUNTING POLICIES AND ESTIMATES ON PPE 4

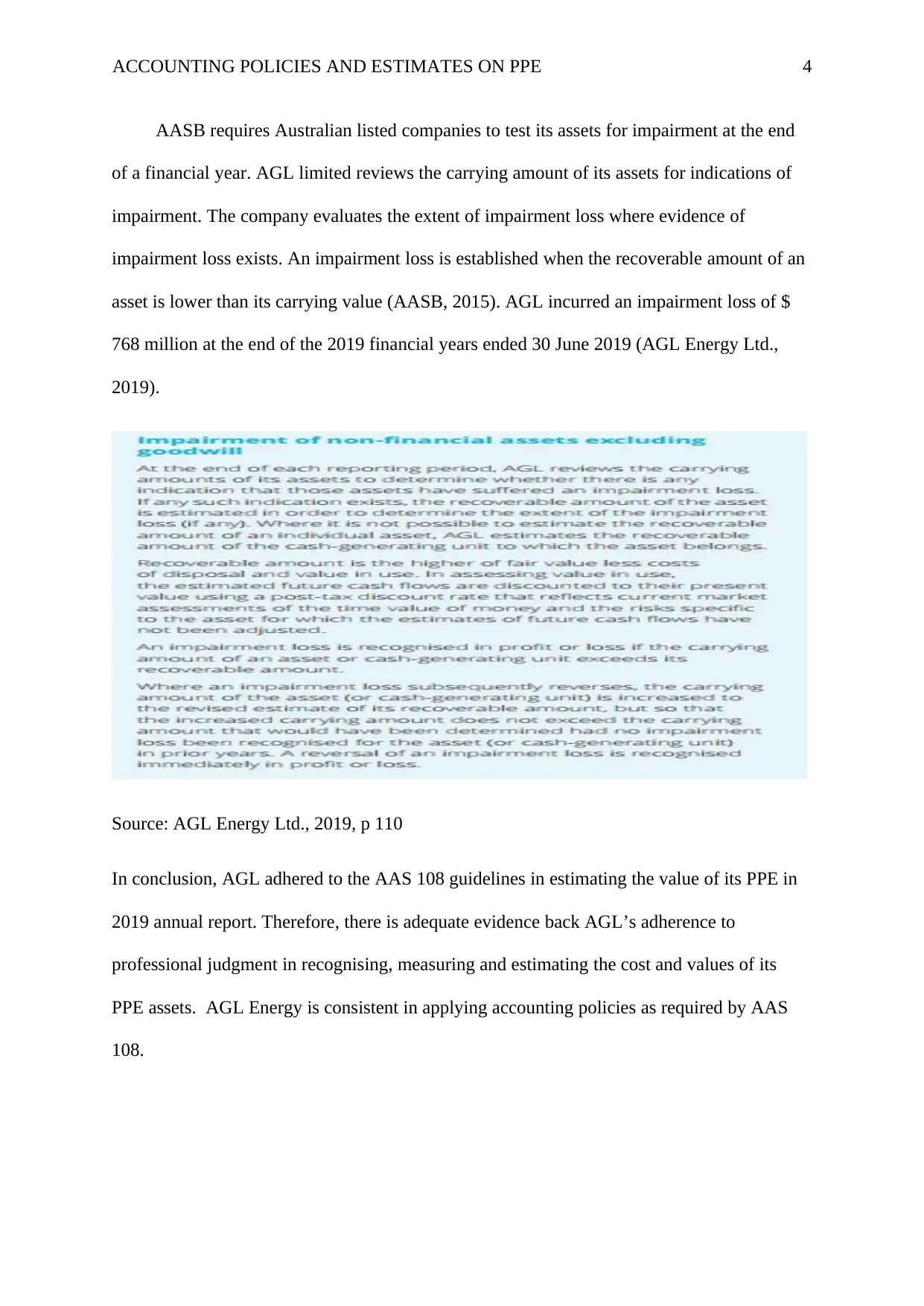

AASB requires Australian listed companies to test its assets for impairment at the end

of a financial year. AGL limited reviews the carrying amount of its assets for indications of

impairment. The company evaluates the extent of impairment loss where evidence of

impairment loss exists. An impairment loss is established when the recoverable amount of an

asset is lower than its carrying value (AASB, 2015). AGL incurred an impairment loss of $

768 million at the end of the 2019 financial years ended 30 June 2019 (AGL Energy Ltd.,

2019).

Source: AGL Energy Ltd., 2019, p 110

In conclusion, AGL adhered to the AAS 108 guidelines in estimating the value of its PPE in

2019 annual report. Therefore, there is adequate evidence back AGL’s adherence to

professional judgment in recognising, measuring and estimating the cost and values of its

PPE assets. AGL Energy is consistent in applying accounting policies as required by AAS

108.

AASB requires Australian listed companies to test its assets for impairment at the end

of a financial year. AGL limited reviews the carrying amount of its assets for indications of

impairment. The company evaluates the extent of impairment loss where evidence of

impairment loss exists. An impairment loss is established when the recoverable amount of an

asset is lower than its carrying value (AASB, 2015). AGL incurred an impairment loss of $

768 million at the end of the 2019 financial years ended 30 June 2019 (AGL Energy Ltd.,

2019).

Source: AGL Energy Ltd., 2019, p 110

In conclusion, AGL adhered to the AAS 108 guidelines in estimating the value of its PPE in

2019 annual report. Therefore, there is adequate evidence back AGL’s adherence to

professional judgment in recognising, measuring and estimating the cost and values of its

PPE assets. AGL Energy is consistent in applying accounting policies as required by AAS

108.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ACCOUNTING POLICIES AND ESTIMATES ON PPE 5

PART D

AAS 108 demonstrates that it is crucial for accountants to apply professional judgment

to achieve the most appropriate accounting estimates and choices. AASB 108 intended to

promote reliability and relevance of financial statements. AASB 108 also enhance the

comparability of financial statements over a given period as well as with other entities. Based

on the information provided by the AGL on recognition and measurement of its PPE s, the

company has demonstrated consistency in applying account policies which is the genesis of

obtaining professional judgments. AGL should continue adhering to guideline of AASB 108

and make a change of policy when need be. A change is policy should be supported by

material facts.

PART D

AAS 108 demonstrates that it is crucial for accountants to apply professional judgment

to achieve the most appropriate accounting estimates and choices. AASB 108 intended to

promote reliability and relevance of financial statements. AASB 108 also enhance the

comparability of financial statements over a given period as well as with other entities. Based

on the information provided by the AGL on recognition and measurement of its PPE s, the

company has demonstrated consistency in applying account policies which is the genesis of

obtaining professional judgments. AGL should continue adhering to guideline of AASB 108

and make a change of policy when need be. A change is policy should be supported by

material facts.

ACCOUNTING POLICIES AND ESTIMATES ON PPE 6

References

AASB. (2015). Accounting Policies, Changes in Accounting Estimates, and Errors. Sydney:

AASB. Retrieved 09 17, 2017, from

http://www.aasb.gov.au/admin/file/content105/c9/AASB136_07-04_COMPjun09_01

-10.pdf

AGL Energy Ltd. (2019). AGL Energy Limited Annual Report 2019. Sydney: AGL.

Retrieved from

https://www.agl.com.au/-/media/aglmedia/documents/about-agl/investors/annual-

reports/agl_annual_report_090819.pdf?

la=en&hash=2890C67A39531E9197467BBC1F87B463

Australian Accounting Standards Board. (2015). AASB 116: Property, Plant and Equipment.

Sydney: Australian Accounting Standards Board. Retrieved from

https://www.aasb.gov.au/admin/file/content105/c9/AASB116_08-

15_COMPoct15_01-18.pdf

Foundation, I. (2014). IFRS 9: Financial instruments. International Accounting Standards

Board.

References

AASB. (2015). Accounting Policies, Changes in Accounting Estimates, and Errors. Sydney:

AASB. Retrieved 09 17, 2017, from

http://www.aasb.gov.au/admin/file/content105/c9/AASB136_07-04_COMPjun09_01

-10.pdf

AGL Energy Ltd. (2019). AGL Energy Limited Annual Report 2019. Sydney: AGL.

Retrieved from

https://www.agl.com.au/-/media/aglmedia/documents/about-agl/investors/annual-

reports/agl_annual_report_090819.pdf?

la=en&hash=2890C67A39531E9197467BBC1F87B463

Australian Accounting Standards Board. (2015). AASB 116: Property, Plant and Equipment.

Sydney: Australian Accounting Standards Board. Retrieved from

https://www.aasb.gov.au/admin/file/content105/c9/AASB116_08-

15_COMPoct15_01-18.pdf

Foundation, I. (2014). IFRS 9: Financial instruments. International Accounting Standards

Board.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 6

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.