Report on Financial Accounting Principles and Practices Analysis

VerifiedAdded on 2020/10/04

|30

|6507

|439

Report

AI Summary

This report provides a detailed overview of financial accounting principles and their practical applications. It begins with an introduction to financial accounting, its purposes, and the importance of financial statements such as the balance sheet, income statement, and cash flow statement. The report then delves into the regulations governing financial accounting, including the roles of the IASB and IFRS, and specific standards like IFRS 9 and IFRS 10. Key accounting principles and rules are explained, including the business entity concept, money measurement concept, dual aspect concept, and accounting conventions. The report further examines accounting conventions related to consistency and material disclosure. Several client examples are provided, including journal entries, profit and loss statements, and statements of financial position, to illustrate the application of these principles. The report concludes with a summary of the key concepts and principles discussed throughout the analysis. This document is contributed by a student to be published on the website Desklib, a platform which provides all the necessary AI based study tools for students.

Financial Accounting

Principles

Principles

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

INTRODUCTION...........................................................................................................................1

Business Report...............................................................................................................................1

1. Financial accounting and its purposes.....................................................................................1

2. Regulation related with the financial accounting....................................................................3

3. Accounting principles and rules..............................................................................................4

4. Accounting conventions related to concepts of consistency and Material disclosure.............6

CLIENT 1........................................................................................................................................7

Journal entries of David Study’s..................................................................................................7

CLIENT 2......................................................................................................................................14

Profit and Loss statement for Peter DOO..................................................................................14

b) Statement of financial position for Peter Doo as at 31st July 2018........................................15

CLIENT 3......................................................................................................................................16

a) Profit and loss statement of Bowling Ltd..............................................................................16

(b) Statement of financial statement of Bowling ltd..................................................................17

C. Accounting concepts.............................................................................................................19

CLIENT 4......................................................................................................................................20

Client 5...........................................................................................................................................24

Client 6...........................................................................................................................................25

CONCLUSION..............................................................................................................................26

REFERENCES..............................................................................................................................28

INTRODUCTION...........................................................................................................................1

Business Report...............................................................................................................................1

1. Financial accounting and its purposes.....................................................................................1

2. Regulation related with the financial accounting....................................................................3

3. Accounting principles and rules..............................................................................................4

4. Accounting conventions related to concepts of consistency and Material disclosure.............6

CLIENT 1........................................................................................................................................7

Journal entries of David Study’s..................................................................................................7

CLIENT 2......................................................................................................................................14

Profit and Loss statement for Peter DOO..................................................................................14

b) Statement of financial position for Peter Doo as at 31st July 2018........................................15

CLIENT 3......................................................................................................................................16

a) Profit and loss statement of Bowling Ltd..............................................................................16

(b) Statement of financial statement of Bowling ltd..................................................................17

C. Accounting concepts.............................................................................................................19

CLIENT 4......................................................................................................................................20

Client 5...........................................................................................................................................24

Client 6...........................................................................................................................................25

CONCLUSION..............................................................................................................................26

REFERENCES..............................................................................................................................28

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Financial accounting is part of accounting as it keeps track of financial transaction of

business. With the help of pre set guideline, it records, summarized and presented in a financial

report. These transaction are summarized in the preparation of financial statements which

includes the balance sheet, cash flow and income statement. This is helpful in measuring

company's overall financial performance. These financial statement are helpful in decision

making of organisation. As these are prepared for the external and internal stakeholder in order

to provide actual financial position. To better understand this concept the company Airdri is

being selected. The main objective of this report is to get information of use of financial

accounting principles while making financial statements. The double entry book keeping

system , use of trial balance, preparation of final accounts of various client is being prepared and

discussed in this report. Apart from this profit and loss account, balance sheet, creation of bank

reconciliation statements is also being prepared in this present report.

Business Report

1. Financial accounting and its purposes

Financial Accounting:

The financial accounting is a process of recording, evaluating, monitor and controlling of

different transaction of business. There are various financial statements which are prepared, these

statements are trading and profit and loss account, balance sheet and cash flow statement. These

financial statements are given to internal and external stakeholders of business in order to make

them aware about actual financial position of business (Tsalavoutas, André and Evans, 2012)

. These reports are very helpful as Airdri can get loan from bank on the basis of these reports, the

credit score of company is being determines on the basis of these reports and Airdri can attract

new investors in order to get investment. The main aim of financial accounting is give

information to external stakeholders and parties outside the organisation. The different purpose

of financial accounting is discussed below:

To record business transactions in books of prime entry.

Posting into respective ledger accounts.

Preparing of profit and loss statement and balance sheet.

Income Statement:

1

Financial accounting is part of accounting as it keeps track of financial transaction of

business. With the help of pre set guideline, it records, summarized and presented in a financial

report. These transaction are summarized in the preparation of financial statements which

includes the balance sheet, cash flow and income statement. This is helpful in measuring

company's overall financial performance. These financial statement are helpful in decision

making of organisation. As these are prepared for the external and internal stakeholder in order

to provide actual financial position. To better understand this concept the company Airdri is

being selected. The main objective of this report is to get information of use of financial

accounting principles while making financial statements. The double entry book keeping

system , use of trial balance, preparation of final accounts of various client is being prepared and

discussed in this report. Apart from this profit and loss account, balance sheet, creation of bank

reconciliation statements is also being prepared in this present report.

Business Report

1. Financial accounting and its purposes

Financial Accounting:

The financial accounting is a process of recording, evaluating, monitor and controlling of

different transaction of business. There are various financial statements which are prepared, these

statements are trading and profit and loss account, balance sheet and cash flow statement. These

financial statements are given to internal and external stakeholders of business in order to make

them aware about actual financial position of business (Tsalavoutas, André and Evans, 2012)

. These reports are very helpful as Airdri can get loan from bank on the basis of these reports, the

credit score of company is being determines on the basis of these reports and Airdri can attract

new investors in order to get investment. The main aim of financial accounting is give

information to external stakeholders and parties outside the organisation. The different purpose

of financial accounting is discussed below:

To record business transactions in books of prime entry.

Posting into respective ledger accounts.

Preparing of profit and loss statement and balance sheet.

Income Statement:

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

This is one of crucial financial statement which is prepared to determine income and

expenses for a specific given time period. This is helpful for company to know the performance

of business within a given period of time. As main focus of income statement is on revenues,

expenses, gains and Losses of Company. Revenues include operating and non operating revenue

for business. The companies are obliged to keep record of its revenues in order to pay off their

expenses (Peytcheva, Wright and Majoor, 2014).

Purpose of Income Statement:

The main aim of this income statement is find out the profit and loss of company for a

particular period.

This provides actual and realistic information of financial earning for particular financial

year.

Balance Sheet:

Balance sheet is a crucial financial statement which is prepared by the companies at the

end of an accounting year. This is also known as financial position which displays the detail

information of assets, liabilities and owner's equity. The balance sheet gives actual financial

position of every business to its external and internal stakeholders of business (Oulasvirta, 2014).

Purpose of Balance Sheet:

The main purpose of preparing balance sheet is to get actual financial position of

company. To know detail of current, non current liabilities and assets of business.

Cash Flow statement:

Cash flow is a statement which is keep records of all transaction which is related with

cash. As company record their cash related transaction which is done by the company is financial

year. This displays the changes of cash and cash equivalent which are influenced by fluctuation

in balance sheet. The chartered accountant or an accountant of company is obliged to make

record of all transaction which are related with cash and its equivalent.

Purpose of cash flow statement:

To give detail information of cash receipts and cash payments

This also provide the net changes in cash which is resulted from operating, investing and

financing activities.

2

expenses for a specific given time period. This is helpful for company to know the performance

of business within a given period of time. As main focus of income statement is on revenues,

expenses, gains and Losses of Company. Revenues include operating and non operating revenue

for business. The companies are obliged to keep record of its revenues in order to pay off their

expenses (Peytcheva, Wright and Majoor, 2014).

Purpose of Income Statement:

The main aim of this income statement is find out the profit and loss of company for a

particular period.

This provides actual and realistic information of financial earning for particular financial

year.

Balance Sheet:

Balance sheet is a crucial financial statement which is prepared by the companies at the

end of an accounting year. This is also known as financial position which displays the detail

information of assets, liabilities and owner's equity. The balance sheet gives actual financial

position of every business to its external and internal stakeholders of business (Oulasvirta, 2014).

Purpose of Balance Sheet:

The main purpose of preparing balance sheet is to get actual financial position of

company. To know detail of current, non current liabilities and assets of business.

Cash Flow statement:

Cash flow is a statement which is keep records of all transaction which is related with

cash. As company record their cash related transaction which is done by the company is financial

year. This displays the changes of cash and cash equivalent which are influenced by fluctuation

in balance sheet. The chartered accountant or an accountant of company is obliged to make

record of all transaction which are related with cash and its equivalent.

Purpose of cash flow statement:

To give detail information of cash receipts and cash payments

This also provide the net changes in cash which is resulted from operating, investing and

financing activities.

2

2. Regulation related with the financial accounting

There are various rules, regulation and policies which are formulated by the financial

bodies, these rules needs to be followed by the business. The regulation assist business to

maintain their financial accounts in effective manner. As it is very important to follow all rules

and regulations in effective way so they can perform their work smoothly. As Airdri is following

all the rules and regulations which is formulated by various bodies. There are some regulations

which are discussed below:

IASB:

This stands for International Accounting Standard Board. This is an independent private

sector body which develops and approve the international financial reporting standards for the

various companies which can direct them at the time of recording transaction in the financial

statements. The IFRS was introduced by IASB to give proper direction to companies while they

are preparing their financial statements.

IFRS:

The IFRS is International Financial Reporting Standards which was set up for betterment

of accountants and managers in order to expand their business at global level. As this set a

worldwide language for various companies. As it has replaced different accounting standards

which was previously set up. The various IFRS standards are there, some of these is being

explained below:

IFRS 9:

International financial reporting standard 9 talks about recording and accounting of

financial instruments in different statements. This gives direction to company to manner in which

all financial assets and liabilities are determined and measured.

IFRS 10:

This is related with the presentation and preparation of consolidated financial statements

when an entity controls one or more other entities. As this standard defines the principle of

Control and set control as basis for the consolidation. The standard defined an investment entity

and sets out the exception of consolidating particular subsidiaries of an investment entity.

As these kinds of standards are formulated in order to prevent the frauds in financial

statement of business organisation. These standards needs to be followed by the organisation

while preparing financial statement of organisations.

3

There are various rules, regulation and policies which are formulated by the financial

bodies, these rules needs to be followed by the business. The regulation assist business to

maintain their financial accounts in effective manner. As it is very important to follow all rules

and regulations in effective way so they can perform their work smoothly. As Airdri is following

all the rules and regulations which is formulated by various bodies. There are some regulations

which are discussed below:

IASB:

This stands for International Accounting Standard Board. This is an independent private

sector body which develops and approve the international financial reporting standards for the

various companies which can direct them at the time of recording transaction in the financial

statements. The IFRS was introduced by IASB to give proper direction to companies while they

are preparing their financial statements.

IFRS:

The IFRS is International Financial Reporting Standards which was set up for betterment

of accountants and managers in order to expand their business at global level. As this set a

worldwide language for various companies. As it has replaced different accounting standards

which was previously set up. The various IFRS standards are there, some of these is being

explained below:

IFRS 9:

International financial reporting standard 9 talks about recording and accounting of

financial instruments in different statements. This gives direction to company to manner in which

all financial assets and liabilities are determined and measured.

IFRS 10:

This is related with the presentation and preparation of consolidated financial statements

when an entity controls one or more other entities. As this standard defines the principle of

Control and set control as basis for the consolidation. The standard defined an investment entity

and sets out the exception of consolidating particular subsidiaries of an investment entity.

As these kinds of standards are formulated in order to prevent the frauds in financial

statement of business organisation. These standards needs to be followed by the organisation

while preparing financial statement of organisations.

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3. Accounting principles and rules

There is general rules, principles and concepts which govern the field of accounting. As

these rules are referred as principles and guidelines which forms the groundwork on which more

detailed, complicated and legalistic accounting rules are based. These principles define the

criteria of accounting in order to maintain all the relevant transaction in their books of accounts.

The basic accounting principles are:

Business Entity Concept:

The business entity concept is based on that, according to this concept business and its

owner is separate from each other. As transaction which are related with business should be

recorded separately from its owners. This is a very important concept as if business transactions

are mixed up with the owner personal transaction than it would not produce authentic financial

statements.

Money measurement concept:

This is the concepts which assumes that all business transaction should be in terms of

money. As this concept focus on the quantitative information instead of qualitative information.

The accounting records only those transaction which are related with real value and which have

some monetary amount.

Dual Aspect Concept:

As this concept or principle defines that business should record their transaction as

double entry system. As single entry system is not reliable and relevant for businesses. The dual

aspect concept says that debit and credit should be equal (Peytcheva, Wright and Majoor, 2014).

Going concern concept:

The going concern concept refers that a business is expected to run for longer period of

time. This is also known as continuing concern concept.

Cost Principle:

The principal of cost is defines that assets and investment should be recorded as original

acquisition cost. The cost includes the purchasing cost of assets and its installation cost at the

time of its purchase or acquisition in a financial period. As from next financial year the assets

will be recorded after subtracting depreciation from it.

Accounting year principle:

4

There is general rules, principles and concepts which govern the field of accounting. As

these rules are referred as principles and guidelines which forms the groundwork on which more

detailed, complicated and legalistic accounting rules are based. These principles define the

criteria of accounting in order to maintain all the relevant transaction in their books of accounts.

The basic accounting principles are:

Business Entity Concept:

The business entity concept is based on that, according to this concept business and its

owner is separate from each other. As transaction which are related with business should be

recorded separately from its owners. This is a very important concept as if business transactions

are mixed up with the owner personal transaction than it would not produce authentic financial

statements.

Money measurement concept:

This is the concepts which assumes that all business transaction should be in terms of

money. As this concept focus on the quantitative information instead of qualitative information.

The accounting records only those transaction which are related with real value and which have

some monetary amount.

Dual Aspect Concept:

As this concept or principle defines that business should record their transaction as

double entry system. As single entry system is not reliable and relevant for businesses. The dual

aspect concept says that debit and credit should be equal (Peytcheva, Wright and Majoor, 2014).

Going concern concept:

The going concern concept refers that a business is expected to run for longer period of

time. This is also known as continuing concern concept.

Cost Principle:

The principal of cost is defines that assets and investment should be recorded as original

acquisition cost. The cost includes the purchasing cost of assets and its installation cost at the

time of its purchase or acquisition in a financial period. As from next financial year the assets

will be recorded after subtracting depreciation from it.

Accounting year principle:

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

The accounting year principle talks about the recording of accounting transaction in same

year from which they are related. As an accounting transaction should be recorded in the same

year in which they occur. For example : The operating expenses for the year 2018 would be

recorded in the financial statement of 2018 only.

Matching Principle:

The matching principle refers that expenses are recorded in the accounting year should

match to the revenues of that particular year. As this principle enables that expenses and

revenues should be match to same accounting year (Oulasvirta, 2014).

Realisation Principles-

This concept is related with the revenue recognition. As it avoids the overstatement of

profit which means the revenues will be recorded only when its earned. It is an exception to

accrual concept. The advance payment is not being considered as profit and it will not be

recorded in the books of accounts until it earned.

Accounting Rule:

There are some accounting rule which is used for recording the transaction of accounts.

As these rules enables an accountant to record transaction according to rules described. There are

three rules for accounting which are classified in three accounts (Donelson, McInnis and

Mergenthaler, 2012). These are Personal account, real account and nominal account. The rules

for these accounts are described below:

Debit the receiver and credit the giver:

This is the first rule of accounting which is applied on personal account. As according to

this rule receiver should be debited and giver should be credited. The personal accounts are

related with individual, firm and companies. As an example it includes debtors, creditors, banks,

outstanding or prepaid expenses, drawing etc. For example Paid Real pvt ltd 24000 by check so

it will be recorded as

Real pvt ltd. A/c Dr. 24000

to Bank a/c 24000

The receiver is an artificial person so it has been debited according to rule and paid

through check so bank has been credited.

Debit what comes in and credit what goes out:

5

year from which they are related. As an accounting transaction should be recorded in the same

year in which they occur. For example : The operating expenses for the year 2018 would be

recorded in the financial statement of 2018 only.

Matching Principle:

The matching principle refers that expenses are recorded in the accounting year should

match to the revenues of that particular year. As this principle enables that expenses and

revenues should be match to same accounting year (Oulasvirta, 2014).

Realisation Principles-

This concept is related with the revenue recognition. As it avoids the overstatement of

profit which means the revenues will be recorded only when its earned. It is an exception to

accrual concept. The advance payment is not being considered as profit and it will not be

recorded in the books of accounts until it earned.

Accounting Rule:

There are some accounting rule which is used for recording the transaction of accounts.

As these rules enables an accountant to record transaction according to rules described. There are

three rules for accounting which are classified in three accounts (Donelson, McInnis and

Mergenthaler, 2012). These are Personal account, real account and nominal account. The rules

for these accounts are described below:

Debit the receiver and credit the giver:

This is the first rule of accounting which is applied on personal account. As according to

this rule receiver should be debited and giver should be credited. The personal accounts are

related with individual, firm and companies. As an example it includes debtors, creditors, banks,

outstanding or prepaid expenses, drawing etc. For example Paid Real pvt ltd 24000 by check so

it will be recorded as

Real pvt ltd. A/c Dr. 24000

to Bank a/c 24000

The receiver is an artificial person so it has been debited according to rule and paid

through check so bank has been credited.

Debit what comes in and credit what goes out:

5

This is second rule and it is used for real accounts. This rule includes transaction related

with purchase of assets and raw material etc. Tangible and intangible comes under this category.

Tangible assets are those which can be touched or feel physically. Some example of this

is building, machinery, stocks etc.

Intangible assets are those which cannot be touched and felt physically like goodwill,

patents and trademark etc.

For example:

Purchased furniture for 10000 in cash

Furniture A/C Dr. 10000

To cash a/c 10000

As furniture has been purchased so it has been debited according to rule and cash has

been paid so it has been credited.

Debit all expenses and credit all incomes:

This rule is applicable on nominal account. The nominal account is related with recording

of expenses and expense. The income related to this rule is being credited and expenses would be

debited. Like for example operating expenses of business these would be debited and cash or

bank would be credited.

4. Accounting conventions related to concepts of consistency and Material disclosure

Consistency convention:

The convention of accounting refers to the rules, practice and policies needs to be

followed by organisation in order to prepare and maintain books of accounts so that it can be

maintain consistently and same financial periods. As if changes made in any accounting policies

than it will affect the accounting result (Chiang, Nouri and Samanta, 2014). Thus, this concept

make ensure that methods of preparing of financial statement should consistent every year so that

comparison can be made easily. The companies like Airdri required to analyse the financial

statements and information in order to make financial and investment related decisions. The

consistency helps the auditors also to make comparison and analysis of financial statement of

companies. As an example, a sole trader is recording it’s all transaction in single entry system

but previous year sole traded recorded its transaction in double entry system, so it will change

the result for that particular year in which company used single entry system instead of double

entry system.

6

with purchase of assets and raw material etc. Tangible and intangible comes under this category.

Tangible assets are those which can be touched or feel physically. Some example of this

is building, machinery, stocks etc.

Intangible assets are those which cannot be touched and felt physically like goodwill,

patents and trademark etc.

For example:

Purchased furniture for 10000 in cash

Furniture A/C Dr. 10000

To cash a/c 10000

As furniture has been purchased so it has been debited according to rule and cash has

been paid so it has been credited.

Debit all expenses and credit all incomes:

This rule is applicable on nominal account. The nominal account is related with recording

of expenses and expense. The income related to this rule is being credited and expenses would be

debited. Like for example operating expenses of business these would be debited and cash or

bank would be credited.

4. Accounting conventions related to concepts of consistency and Material disclosure

Consistency convention:

The convention of accounting refers to the rules, practice and policies needs to be

followed by organisation in order to prepare and maintain books of accounts so that it can be

maintain consistently and same financial periods. As if changes made in any accounting policies

than it will affect the accounting result (Chiang, Nouri and Samanta, 2014). Thus, this concept

make ensure that methods of preparing of financial statement should consistent every year so that

comparison can be made easily. The companies like Airdri required to analyse the financial

statements and information in order to make financial and investment related decisions. The

consistency helps the auditors also to make comparison and analysis of financial statement of

companies. As an example, a sole trader is recording it’s all transaction in single entry system

but previous year sole traded recorded its transaction in double entry system, so it will change

the result for that particular year in which company used single entry system instead of double

entry system.

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Material disclosure convention:

The principle of material disclosure talks about that all material and necessary

information and fact should be disclosed in financial reports of company. The company can not

hide any information related to material. As all financial information should be fully disclosed to

all the business users whether it’s internal or external (Caria and Rodrigues, 2014). The internal

users are like board of directors, managers, shareholders and other members of management etc.

On the other hand external users are suppliers, government, tax department and other financial

institution which provides loans to business. The disclosure enable auditor to make correct

assessment about profitability and financial performance of business. With help of proper

disclosure one can make better decision for its business.

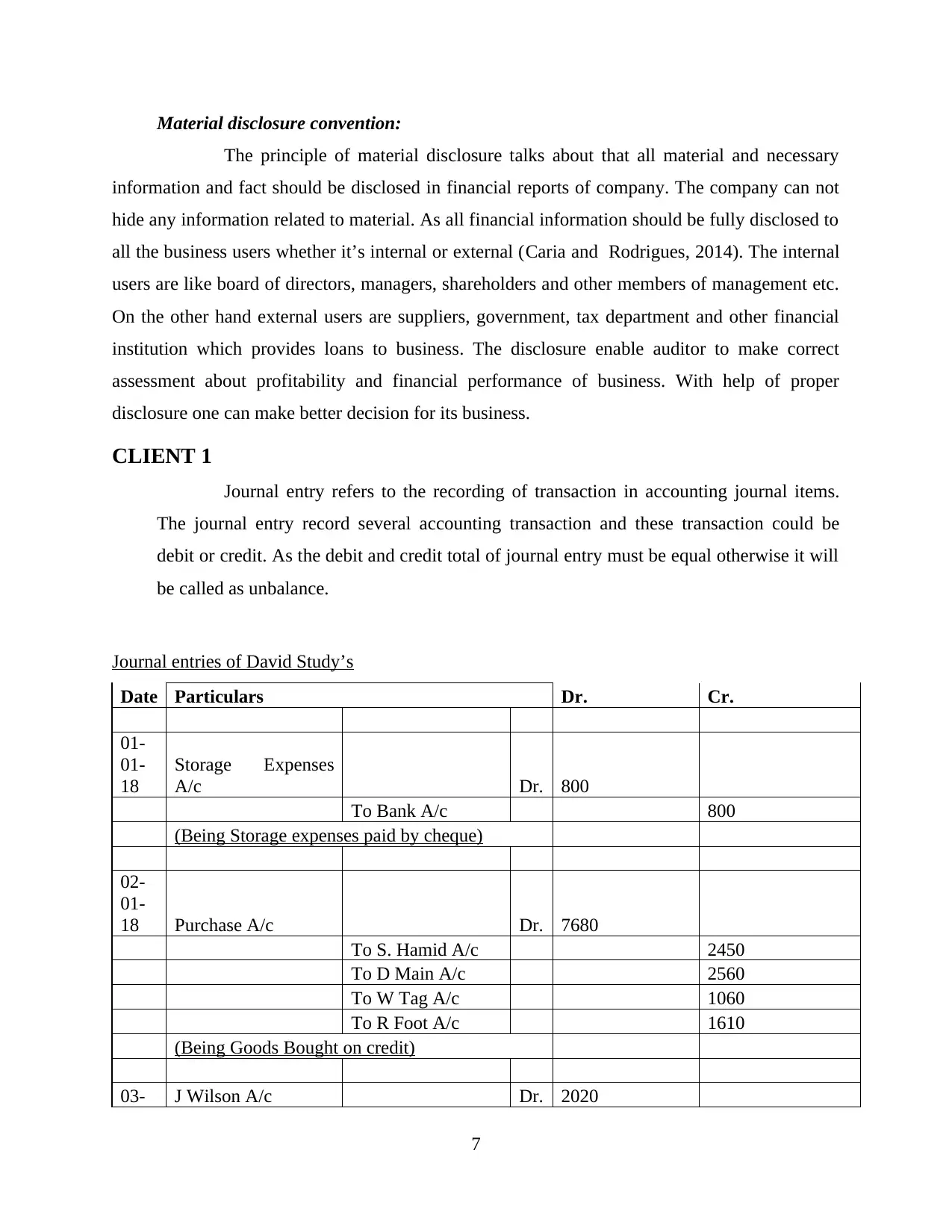

CLIENT 1

Journal entry refers to the recording of transaction in accounting journal items.

The journal entry record several accounting transaction and these transaction could be

debit or credit. As the debit and credit total of journal entry must be equal otherwise it will

be called as unbalance.

Journal entries of David Study’s

Date Particulars Dr. Cr.

01-

01-

18

Storage Expenses

A/c Dr. 800

To Bank A/c 800

(Being Storage expenses paid by cheque)

02-

01-

18 Purchase A/c Dr. 7680

To S. Hamid A/c 2450

To D Main A/c 2560

To W Tag A/c 1060

To R Foot A/c 1610

(Being Goods Bought on credit)

03- J Wilson A/c Dr. 2020

7

The principle of material disclosure talks about that all material and necessary

information and fact should be disclosed in financial reports of company. The company can not

hide any information related to material. As all financial information should be fully disclosed to

all the business users whether it’s internal or external (Caria and Rodrigues, 2014). The internal

users are like board of directors, managers, shareholders and other members of management etc.

On the other hand external users are suppliers, government, tax department and other financial

institution which provides loans to business. The disclosure enable auditor to make correct

assessment about profitability and financial performance of business. With help of proper

disclosure one can make better decision for its business.

CLIENT 1

Journal entry refers to the recording of transaction in accounting journal items.

The journal entry record several accounting transaction and these transaction could be

debit or credit. As the debit and credit total of journal entry must be equal otherwise it will

be called as unbalance.

Journal entries of David Study’s

Date Particulars Dr. Cr.

01-

01-

18

Storage Expenses

A/c Dr. 800

To Bank A/c 800

(Being Storage expenses paid by cheque)

02-

01-

18 Purchase A/c Dr. 7680

To S. Hamid A/c 2450

To D Main A/c 2560

To W Tag A/c 1060

To R Foot A/c 1610

(Being Goods Bought on credit)

03- J Wilson A/c Dr. 2020

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

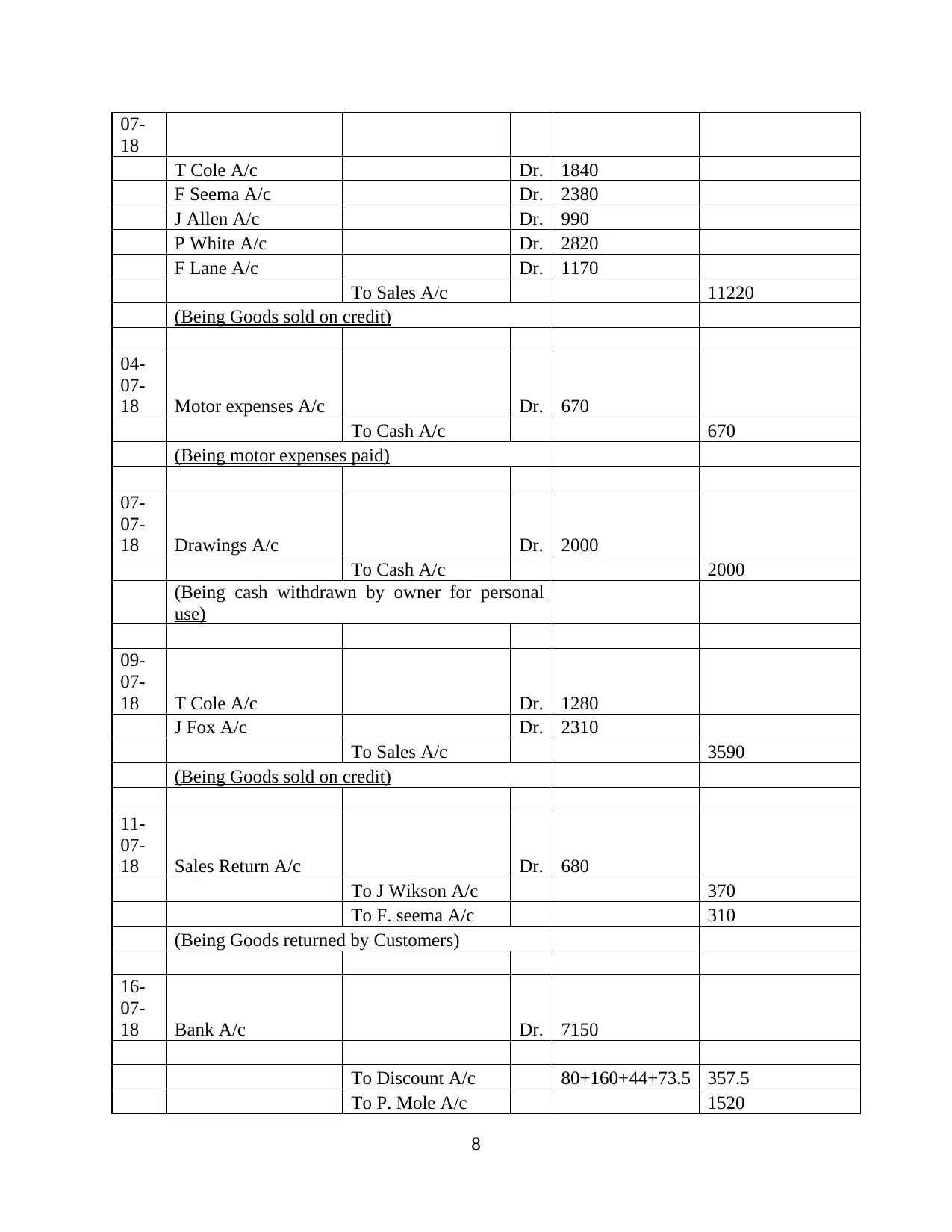

07-

18

T Cole A/c Dr. 1840

F Seema A/c Dr. 2380

J Allen A/c Dr. 990

P White A/c Dr. 2820

F Lane A/c Dr. 1170

To Sales A/c 11220

(Being Goods sold on credit)

04-

07-

18 Motor expenses A/c Dr. 670

To Cash A/c 670

(Being motor expenses paid)

07-

07-

18 Drawings A/c Dr. 2000

To Cash A/c 2000

(Being cash withdrawn by owner for personal

use)

09-

07-

18 T Cole A/c Dr. 1280

J Fox A/c Dr. 2310

To Sales A/c 3590

(Being Goods sold on credit)

11-

07-

18 Sales Return A/c Dr. 680

To J Wikson A/c 370

To F. seema A/c 310

(Being Goods returned by Customers)

16-

07-

18 Bank A/c Dr. 7150

To Discount A/c 80+160+44+73.5 357.5

To P. Mole A/c 1520

8

18

T Cole A/c Dr. 1840

F Seema A/c Dr. 2380

J Allen A/c Dr. 990

P White A/c Dr. 2820

F Lane A/c Dr. 1170

To Sales A/c 11220

(Being Goods sold on credit)

04-

07-

18 Motor expenses A/c Dr. 670

To Cash A/c 670

(Being motor expenses paid)

07-

07-

18 Drawings A/c Dr. 2000

To Cash A/c 2000

(Being cash withdrawn by owner for personal

use)

09-

07-

18 T Cole A/c Dr. 1280

J Fox A/c Dr. 2310

To Sales A/c 3590

(Being Goods sold on credit)

11-

07-

18 Sales Return A/c Dr. 680

To J Wikson A/c 370

To F. seema A/c 310

(Being Goods returned by Customers)

16-

07-

18 Bank A/c Dr. 7150

To Discount A/c 80+160+44+73.5 357.5

To P. Mole A/c 1520

8

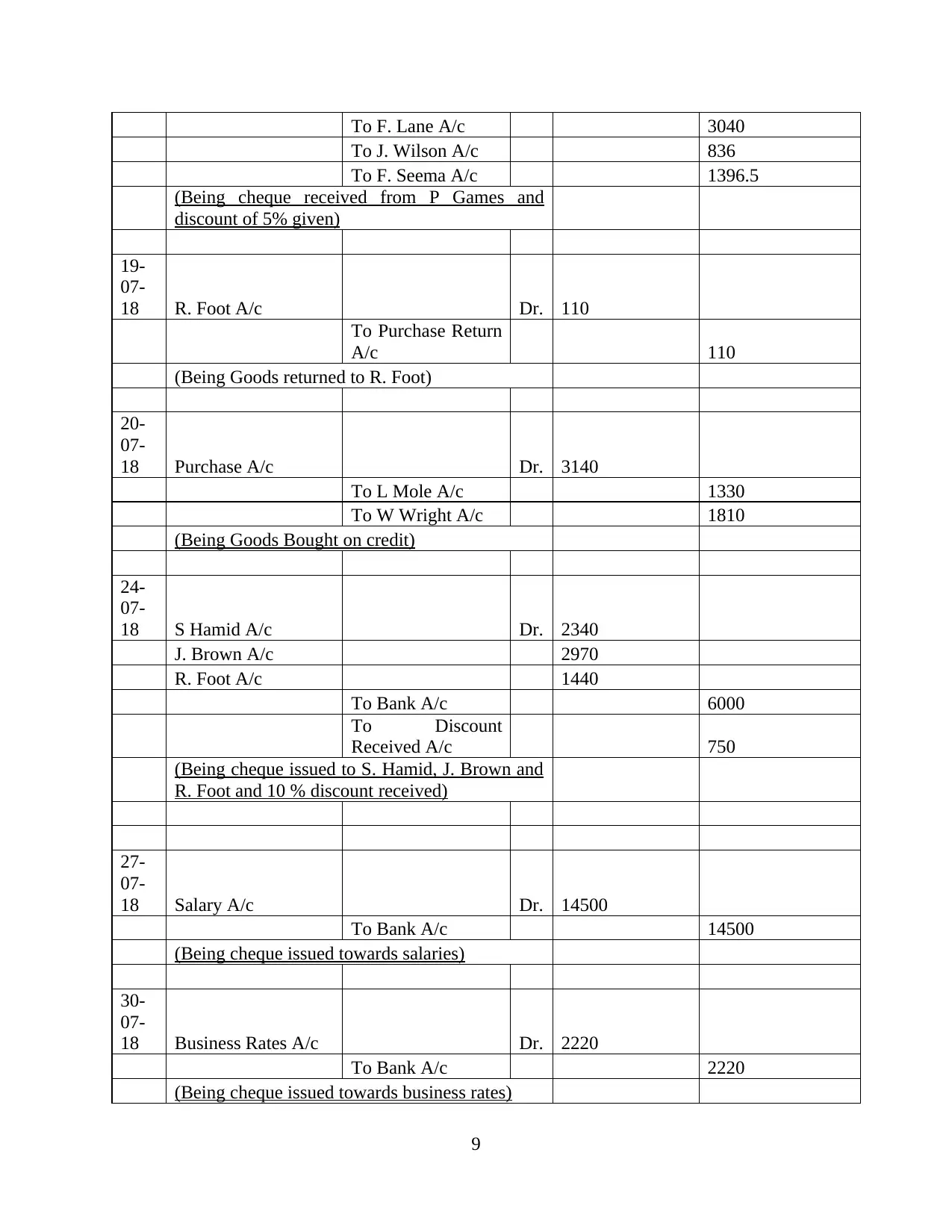

To F. Lane A/c 3040

To J. Wilson A/c 836

To F. Seema A/c 1396.5

(Being cheque received from P Games and

discount of 5% given)

19-

07-

18 R. Foot A/c Dr. 110

To Purchase Return

A/c 110

(Being Goods returned to R. Foot)

20-

07-

18 Purchase A/c Dr. 3140

To L Mole A/c 1330

To W Wright A/c 1810

(Being Goods Bought on credit)

24-

07-

18 S Hamid A/c Dr. 2340

J. Brown A/c 2970

R. Foot A/c 1440

To Bank A/c 6000

To Discount

Received A/c 750

(Being cheque issued to S. Hamid, J. Brown and

R. Foot and 10 % discount received)

27-

07-

18 Salary A/c Dr. 14500

To Bank A/c 14500

(Being cheque issued towards salaries)

30-

07-

18 Business Rates A/c Dr. 2220

To Bank A/c 2220

(Being cheque issued towards business rates)

9

To J. Wilson A/c 836

To F. Seema A/c 1396.5

(Being cheque received from P Games and

discount of 5% given)

19-

07-

18 R. Foot A/c Dr. 110

To Purchase Return

A/c 110

(Being Goods returned to R. Foot)

20-

07-

18 Purchase A/c Dr. 3140

To L Mole A/c 1330

To W Wright A/c 1810

(Being Goods Bought on credit)

24-

07-

18 S Hamid A/c Dr. 2340

J. Brown A/c 2970

R. Foot A/c 1440

To Bank A/c 6000

To Discount

Received A/c 750

(Being cheque issued to S. Hamid, J. Brown and

R. Foot and 10 % discount received)

27-

07-

18 Salary A/c Dr. 14500

To Bank A/c 14500

(Being cheque issued towards salaries)

30-

07-

18 Business Rates A/c Dr. 2220

To Bank A/c 2220

(Being cheque issued towards business rates)

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 30

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.