University Corporate Accounting Project Report Analysis

VerifiedAdded on 2023/06/10

|7

|830

|124

Project

AI Summary

This project report provides solutions to a corporate accounting assignment, covering multiple-choice questions and in-depth problem-solving. The assignment addresses topics such as investment valuation using the equity method, the preparation of general-purpose financial statements, and the recording of consolidation worksheet entries. It also includes detailed journal entries for business combinations, asset purchases, and depreciation calculations. Furthermore, the report explores different types of liquidation, unrealized profits, and residual value, providing definitions and explanations with relevant references. The solutions demonstrate a comprehensive understanding of corporate accounting principles and their practical application.

Project Report: Corporate Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

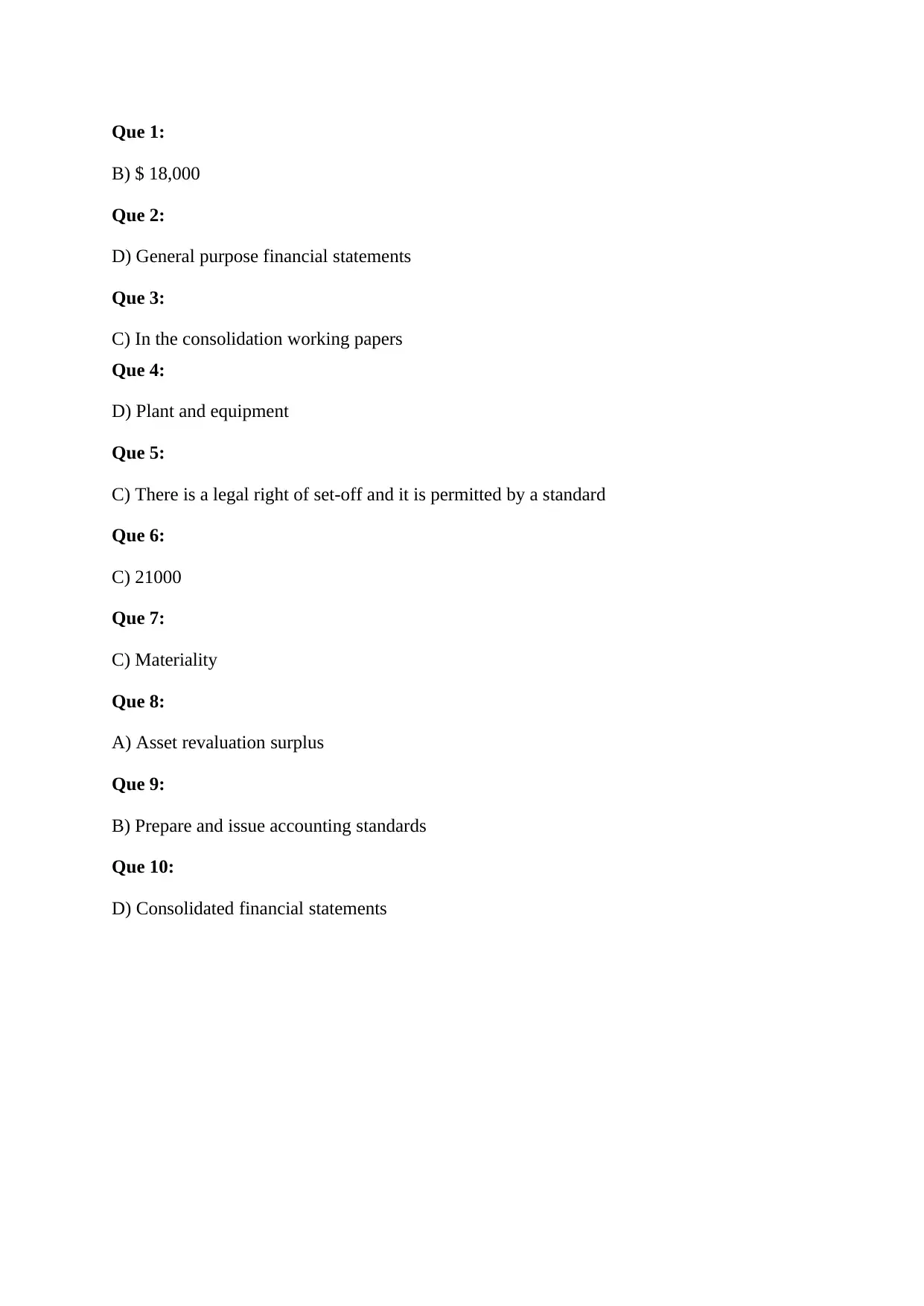

Que 1:

B) $ 18,000

Que 2:

D) General purpose financial statements

Que 3:

C) In the consolidation working papers

Que 4:

D) Plant and equipment

Que 5:

C) There is a legal right of set-off and it is permitted by a standard

Que 6:

C) 21000

Que 7:

C) Materiality

Que 8:

A) Asset revaluation surplus

Que 9:

B) Prepare and issue accounting standards

Que 10:

D) Consolidated financial statements

B) $ 18,000

Que 2:

D) General purpose financial statements

Que 3:

C) In the consolidation working papers

Que 4:

D) Plant and equipment

Que 5:

C) There is a legal right of set-off and it is permitted by a standard

Que 6:

C) 21000

Que 7:

C) Materiality

Que 8:

A) Asset revaluation surplus

Que 9:

B) Prepare and issue accounting standards

Que 10:

D) Consolidated financial statements

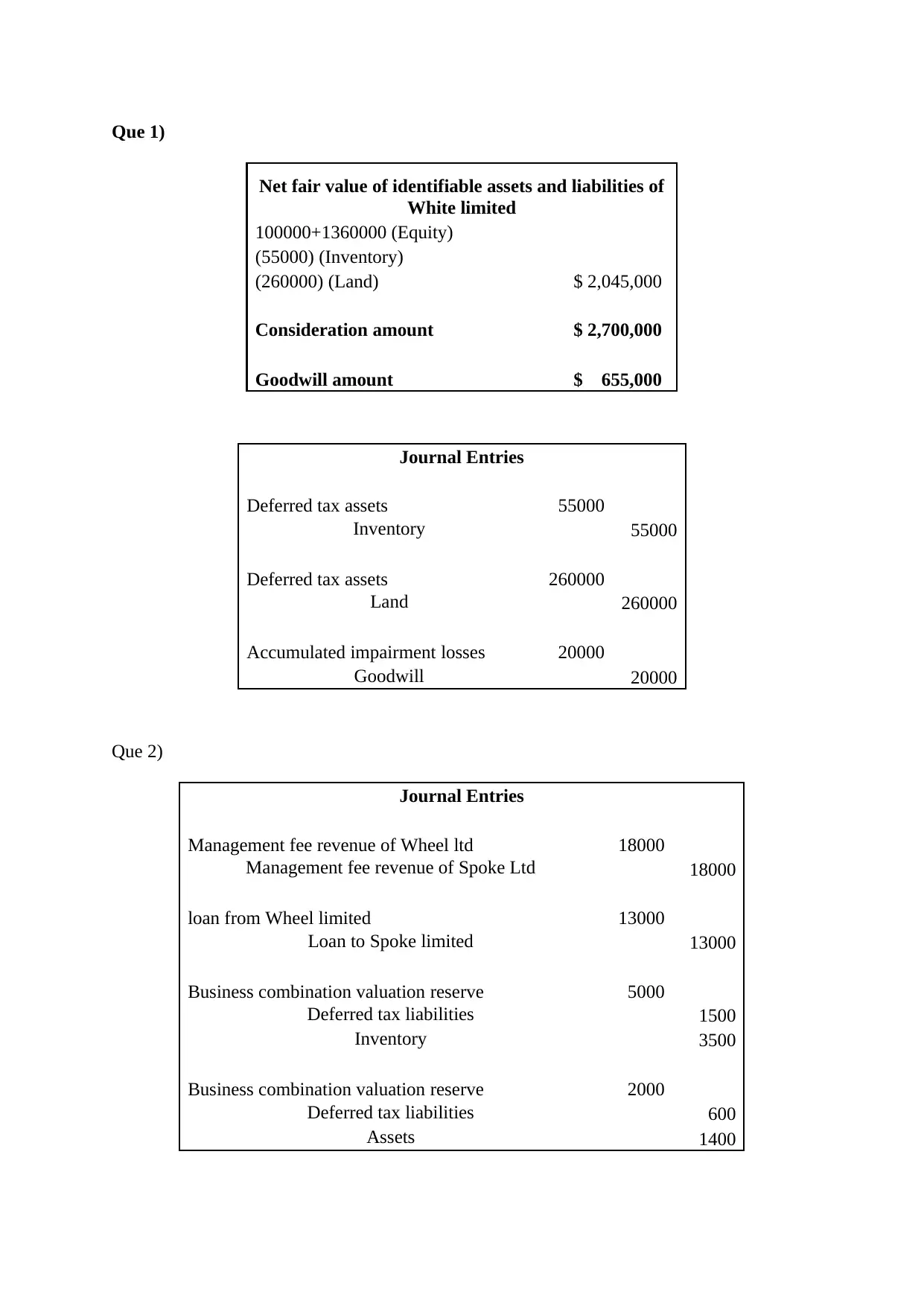

Que 1)

Net fair value of identifiable assets and liabilities of

White limited

100000+1360000 (Equity)

(55000) (Inventory)

(260000) (Land) $ 2,045,000

Consideration amount $ 2,700,000

Goodwill amount $ 655,000

Journal Entries

Deferred tax assets 55000

Inventory 55000

Deferred tax assets 260000

Land 260000

Accumulated impairment losses 20000

Goodwill 20000

Que 2)

Journal Entries

Management fee revenue of Wheel ltd 18000

Management fee revenue of Spoke Ltd 18000

loan from Wheel limited 13000

Loan to Spoke limited 13000

Business combination valuation reserve 5000

Deferred tax liabilities 1500

Inventory 3500

Business combination valuation reserve 2000

Deferred tax liabilities 600

Assets 1400

Net fair value of identifiable assets and liabilities of

White limited

100000+1360000 (Equity)

(55000) (Inventory)

(260000) (Land) $ 2,045,000

Consideration amount $ 2,700,000

Goodwill amount $ 655,000

Journal Entries

Deferred tax assets 55000

Inventory 55000

Deferred tax assets 260000

Land 260000

Accumulated impairment losses 20000

Goodwill 20000

Que 2)

Journal Entries

Management fee revenue of Wheel ltd 18000

Management fee revenue of Spoke Ltd 18000

loan from Wheel limited 13000

Loan to Spoke limited 13000

Business combination valuation reserve 5000

Deferred tax liabilities 1500

Inventory 3500

Business combination valuation reserve 2000

Deferred tax liabilities 600

Assets 1400

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

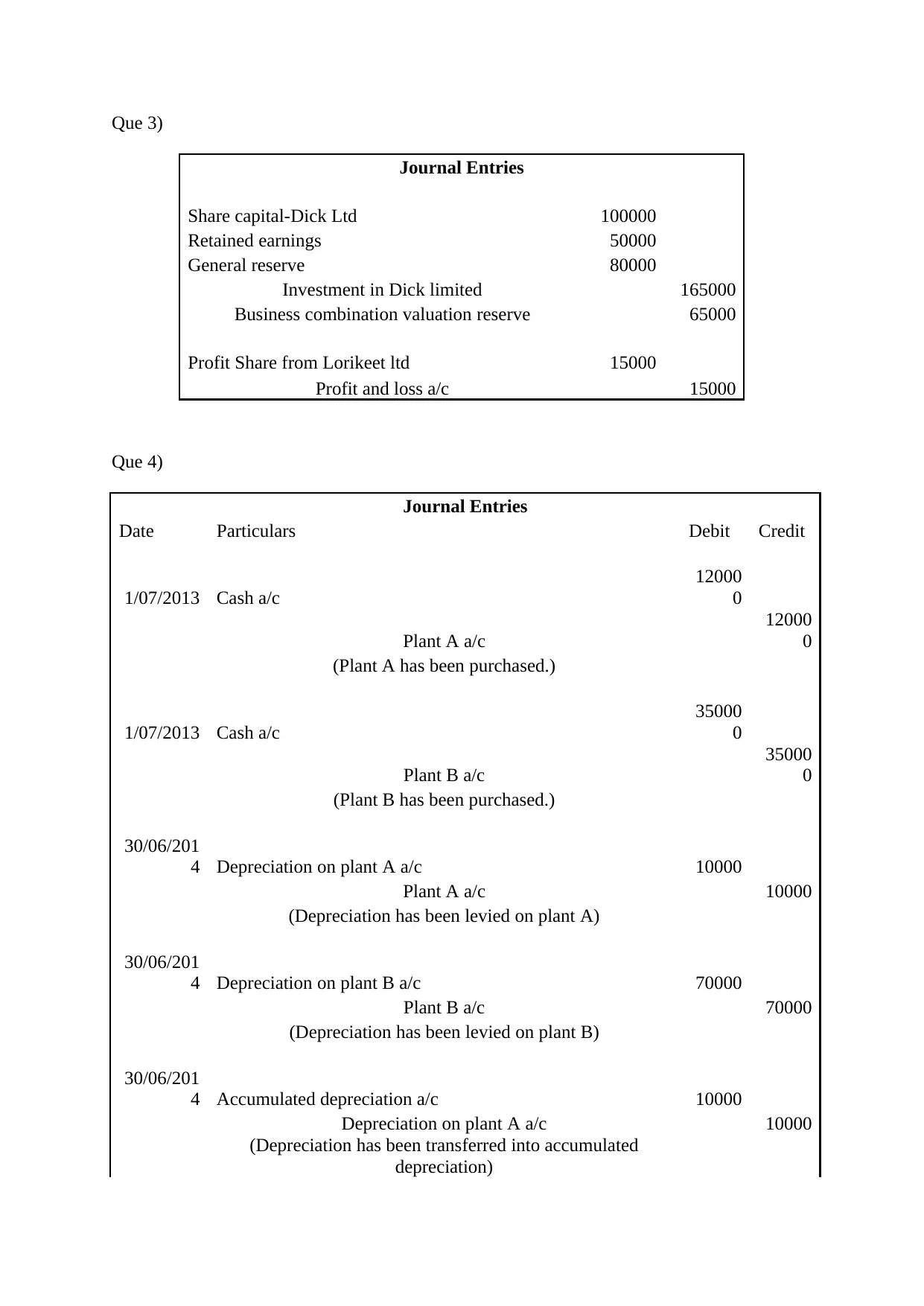

Que 3)

Journal Entries

Share capital-Dick Ltd 100000

Retained earnings 50000

General reserve 80000

Investment in Dick limited 165000

Business combination valuation reserve 65000

Profit Share from Lorikeet ltd 15000

Profit and loss a/c 15000

Que 4)

Journal Entries

Date Particulars Debit Credit

1/07/2013 Cash a/c

12000

0

Plant A a/c

12000

0

(Plant A has been purchased.)

1/07/2013 Cash a/c

35000

0

Plant B a/c

35000

0

(Plant B has been purchased.)

30/06/201

4 Depreciation on plant A a/c 10000

Plant A a/c 10000

(Depreciation has been levied on plant A)

30/06/201

4 Depreciation on plant B a/c 70000

Plant B a/c 70000

(Depreciation has been levied on plant B)

30/06/201

4 Accumulated depreciation a/c 10000

Depreciation on plant A a/c 10000

(Depreciation has been transferred into accumulated

depreciation)

Journal Entries

Share capital-Dick Ltd 100000

Retained earnings 50000

General reserve 80000

Investment in Dick limited 165000

Business combination valuation reserve 65000

Profit Share from Lorikeet ltd 15000

Profit and loss a/c 15000

Que 4)

Journal Entries

Date Particulars Debit Credit

1/07/2013 Cash a/c

12000

0

Plant A a/c

12000

0

(Plant A has been purchased.)

1/07/2013 Cash a/c

35000

0

Plant B a/c

35000

0

(Plant B has been purchased.)

30/06/201

4 Depreciation on plant A a/c 10000

Plant A a/c 10000

(Depreciation has been levied on plant A)

30/06/201

4 Depreciation on plant B a/c 70000

Plant B a/c 70000

(Depreciation has been levied on plant B)

30/06/201

4 Accumulated depreciation a/c 10000

Depreciation on plant A a/c 10000

(Depreciation has been transferred into accumulated

depreciation)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

30/06/201

4 Accumulated depreciation a/c 70000

Depreciation on plant B a/c 70000

(Depreciation has been transferred into accumulated

depreciation)

30/06/201

5 Depreciation on plant A a/c 10000

Plant A a/c 10000

(Depreciation has been levied on plant A)

30/06/201

5 Depreciation on plant B a/c 70000

Plant B a/c 70000

(Depreciation has been levied on plant B)

30/06/201

5 Accumulated depreciation a/c 10000

Depreciation on plant A a/c 10000

(Depreciation has been transferred into accumulated

depreciation)

0/01/1900 Accumulated depreciation a/c 70000

Depreciation on plant B a/c 70000

(Depreciation has been transferred into accumulated

depreciation)

Que 5)

Different type of liquidation:

Liquidation is a process in which an organization terminates its operations. Mainly

there are three ways to liquidate the organization:

Members voluntary liquidation:

In this case, the company is solvent and all the creditors have been paid in full and the

remaining funds of the company has been transferred to the shareholders and the directors. In

this process the directors and the shareholders closes the company with huge reserve (Kaplan

and Atkinson, 2015).

Creditors voluntary liquidation:

4 Accumulated depreciation a/c 70000

Depreciation on plant B a/c 70000

(Depreciation has been transferred into accumulated

depreciation)

30/06/201

5 Depreciation on plant A a/c 10000

Plant A a/c 10000

(Depreciation has been levied on plant A)

30/06/201

5 Depreciation on plant B a/c 70000

Plant B a/c 70000

(Depreciation has been levied on plant B)

30/06/201

5 Accumulated depreciation a/c 10000

Depreciation on plant A a/c 10000

(Depreciation has been transferred into accumulated

depreciation)

0/01/1900 Accumulated depreciation a/c 70000

Depreciation on plant B a/c 70000

(Depreciation has been transferred into accumulated

depreciation)

Que 5)

Different type of liquidation:

Liquidation is a process in which an organization terminates its operations. Mainly

there are three ways to liquidate the organization:

Members voluntary liquidation:

In this case, the company is solvent and all the creditors have been paid in full and the

remaining funds of the company has been transferred to the shareholders and the directors. In

this process the directors and the shareholders closes the company with huge reserve (Kaplan

and Atkinson, 2015).

Creditors voluntary liquidation:

In this case, the company is insolvent and all the creditors have not been paid in full. In

this process the creditors pressurise closes the company.

Court voluntary liquidation:

In this case, the directors of the creditors of the company apply in the country to closes

and liquidate the company (Madhura, 2014).

Unrealized profits:

Unrealized profit is the amount which exists on the paper in order to get from an

investment. It is a profitable state for an organization that has yet to be sold and get in

exchange the cash. Such as in case of transfer of assets among the company the company has

not generated any profit but it has been shown in the accounting books of the company (Lord,

2007).

Residual value:

Residual value is the estimated in context with the fixed assets which could be got by

the organization at the end of the life cycle of that particular assets. The residual value of

assets depends on the nature of the asset. Residual value is one of the important aspects of an

asset which impacts on the depreciation and other aspect of the company (Higgins, 2012).

this process the creditors pressurise closes the company.

Court voluntary liquidation:

In this case, the directors of the creditors of the company apply in the country to closes

and liquidate the company (Madhura, 2014).

Unrealized profits:

Unrealized profit is the amount which exists on the paper in order to get from an

investment. It is a profitable state for an organization that has yet to be sold and get in

exchange the cash. Such as in case of transfer of assets among the company the company has

not generated any profit but it has been shown in the accounting books of the company (Lord,

2007).

Residual value:

Residual value is the estimated in context with the fixed assets which could be got by

the organization at the end of the life cycle of that particular assets. The residual value of

assets depends on the nature of the asset. Residual value is one of the important aspects of an

asset which impacts on the depreciation and other aspect of the company (Higgins, 2012).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

References:

Higgins, R. C., 2012. Analysis for financial management. McGraw-Hill/Irwin.

Kaplan, R.S. and Atkinson, A.A., 2015. Advanced management accounting. PHI Learning.

Lord, B.R., 2007. Strategic management accounting. Issues in Management Accounting, 3.

Madura, J. 2014. Financial Markets and Institutions. Cengage Learning.

Higgins, R. C., 2012. Analysis for financial management. McGraw-Hill/Irwin.

Kaplan, R.S. and Atkinson, A.A., 2015. Advanced management accounting. PHI Learning.

Lord, B.R., 2007. Strategic management accounting. Issues in Management Accounting, 3.

Madura, J. 2014. Financial Markets and Institutions. Cengage Learning.

1 out of 7

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.