Unit 5: Management Accounting Report - Airdri Ltd Financial Analysis

VerifiedAdded on 2021/02/19

|17

|3453

|35

Report

AI Summary

This report provides a detailed analysis of management accounting principles and their application within Airdri Ltd, a medium-sized organization serving clients in various sectors. The report begins with an introduction to management accounting, emphasizing its role in financial and management decision-making. It then delves into the specific management accounting systems employed by Airdri Ltd, including inventory management, cost accounting, price optimization, and job costing systems, highlighting their benefits and essential requirements. The report further examines different methodologies used in management accounting reporting, such as cost accounting, performance, budget, and inventory management reports, and how they contribute to organizational processes. Cost calculations using marginal and absorption costing techniques are presented, along with income statements for May and June. The report includes an analysis of material cost variances and discusses the advantages and disadvantages of various planning tools used for budgetary control. Finally, it explores how organizations adapt management accounting systems to respond to financial problems, emphasizing how these systems can lead to sustainable success. The report concludes by summarizing the key findings and referencing relevant sources.

Unit 5. Management

Accounting

Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

P1. Management accounting systems.....................................................................................1

P2 Different methodologies used in management accounting reporting;..............................3

M1. Benefits of management accounting systems.................................................................4

D1. Management accounting system and accounting reports are integrated within

organisational processes.........................................................................................................4

TASK 2............................................................................................................................................4

P3 Calculations of costs using appropriate techniques to prepare income statement............4

M2 Different techniques of management accounting system ...............................................9

D2 Interpret data for a range of business activities................................................................9

TASK 3............................................................................................................................................9

P4 Advantage and disadvantage of different types of planning tools used for budgetary control

................................................................................................................................................9

M3 Uses of different planning tools and their application for preparing and forecasting budget

..............................................................................................................................................11

TASK 4..........................................................................................................................................12

P5 . Compare how organisations are adapting management accounting systems to respond to

financial problems:...............................................................................................................12

M4 Responding to financial problems, management accounting can lead organisations to

sustainable success...............................................................................................................14

D3 Evaluate planning tools for accounting period to respond financial problems appropriately

..............................................................................................................................................14

CONCLUSION..............................................................................................................................14

REFERENCES..............................................................................................................................15

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

P1. Management accounting systems.....................................................................................1

P2 Different methodologies used in management accounting reporting;..............................3

M1. Benefits of management accounting systems.................................................................4

D1. Management accounting system and accounting reports are integrated within

organisational processes.........................................................................................................4

TASK 2............................................................................................................................................4

P3 Calculations of costs using appropriate techniques to prepare income statement............4

M2 Different techniques of management accounting system ...............................................9

D2 Interpret data for a range of business activities................................................................9

TASK 3............................................................................................................................................9

P4 Advantage and disadvantage of different types of planning tools used for budgetary control

................................................................................................................................................9

M3 Uses of different planning tools and their application for preparing and forecasting budget

..............................................................................................................................................11

TASK 4..........................................................................................................................................12

P5 . Compare how organisations are adapting management accounting systems to respond to

financial problems:...............................................................................................................12

M4 Responding to financial problems, management accounting can lead organisations to

sustainable success...............................................................................................................14

D3 Evaluate planning tools for accounting period to respond financial problems appropriately

..............................................................................................................................................14

CONCLUSION..............................................................................................................................14

REFERENCES..............................................................................................................................15

INTRODUCTION

Management accounting is the process where analysis of business activities is presented

to management for the purpose of facilitating financial as well as management decisions. It

includes application of skills along with knowledge while preparing accounting information in

order to assist managers for formulating policies to control operations at workplace

(Abdelmoneim Mohamed and Jones, 2014). To understand management accounting concept,

Aon Consulting is selected which is a medium size organisation and serves clients which are

operating in sectors related to retail, hospitality, construction as well as manufacturing in order to

provide information to take business decisions in effective manner. Airdri Ltd is one of its clients

and the report is based on such company. The report includes management accounting systems

along with methods in management accounting reporting. It also includes calculations of costs by

using appropriate techniques to prepare income statements. It further discusses about planning

tools along with various ways through which usage of management accounting for responding

towards financial problems.

TASK 1

P1. Management accounting systems.

Management accounting encompasses various methods as well as concepts which are

necessary for planning business actions along with controlling by evaluating performances and

interpreting the same. Financial along with non-financial information’s are presented through

such accounting to organisational management in order to forecast budgets, assist in planning as

well as in depth analysis of business activities. Such accounting helps managers in stock

evaluation, capital budgeting analysis, break even analysis and many more. Financial managers

provides timely as well as accurate financial along with statistical information to middle level

managers in order to take daily and short term decisions for the betterment of business. Different

management accounting systems used at Airdri Ltd are as follows:

Inventory management system: This system is used for keeping records of stock and is

considered as important system in any organisation. Inventory is used for raw material,

unfinished goods or finished products. It helps in stock level forecasting, materials tracking,

automatic reordering, inventory alerts and many more. It is used for determining goods available

through entire supply chain along with business operations procedures. It covers production to

Management accounting is the process where analysis of business activities is presented

to management for the purpose of facilitating financial as well as management decisions. It

includes application of skills along with knowledge while preparing accounting information in

order to assist managers for formulating policies to control operations at workplace

(Abdelmoneim Mohamed and Jones, 2014). To understand management accounting concept,

Aon Consulting is selected which is a medium size organisation and serves clients which are

operating in sectors related to retail, hospitality, construction as well as manufacturing in order to

provide information to take business decisions in effective manner. Airdri Ltd is one of its clients

and the report is based on such company. The report includes management accounting systems

along with methods in management accounting reporting. It also includes calculations of costs by

using appropriate techniques to prepare income statements. It further discusses about planning

tools along with various ways through which usage of management accounting for responding

towards financial problems.

TASK 1

P1. Management accounting systems.

Management accounting encompasses various methods as well as concepts which are

necessary for planning business actions along with controlling by evaluating performances and

interpreting the same. Financial along with non-financial information’s are presented through

such accounting to organisational management in order to forecast budgets, assist in planning as

well as in depth analysis of business activities. Such accounting helps managers in stock

evaluation, capital budgeting analysis, break even analysis and many more. Financial managers

provides timely as well as accurate financial along with statistical information to middle level

managers in order to take daily and short term decisions for the betterment of business. Different

management accounting systems used at Airdri Ltd are as follows:

Inventory management system: This system is used for keeping records of stock and is

considered as important system in any organisation. Inventory is used for raw material,

unfinished goods or finished products. It helps in stock level forecasting, materials tracking,

automatic reordering, inventory alerts and many more. It is used for determining goods available

through entire supply chain along with business operations procedures. It covers production to

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

retailing, shipping, warehouses where products are kept in stock (Bloomfield, 2015). This system

is essential required at Airdri Ltd to keep as well as tracking inventory in order to maintain

productivity within the business units. Inventory management system helps in assisting required

inventory, real time movement as well as different types of inventories required in completion of

projects. Such system provides various benefits in the form of managing stocks and placing next

orders whenever required before shortage of required inventory.

2

is essential required at Airdri Ltd to keep as well as tracking inventory in order to maintain

productivity within the business units. Inventory management system helps in assisting required

inventory, real time movement as well as different types of inventories required in completion of

projects. Such system provides various benefits in the form of managing stocks and placing next

orders whenever required before shortage of required inventory.

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Cost accounting system: This system is used for estimating product cost for the purpose

of valuation of inventory, controlling expenses as well as analysing profitability. Estimation of

actual cost is very necessary for any business enterprise. It encompasses activities based on

understanding, recording, analysing, classification as well as summarizing expenditures

associated with products or services. The essential requirement of this system is to estimate as

well as record the expenses like variable and fixed costs and so on. Managers of Airdri Ltd uses

such system to check reimbursement of associated financial products. With this system,

comparison between budgeted and actual costs can be done in effective manner which helps in

taking corrective decisions related to increasing profitability.

Price Optimisation system: Such system is a mathematical analysis which determines

perception of customers towards value of products or services. It helps in determining value of

organisational products which will meet objectives related to maximising operating profit. The

selected company uses this system to set prices of its financial products based on customer

expectations (Bagautdinova, Kundakchyan and Malakhov, 2013). Executives optimises prices by

understanding client perceptions which results in maintain relationships as well as increasing

profits. It benefits in reducing wastage in order to optimise prices by taking effective decisions.

The essential requirement of price optimisation system is to analyse review of clients towards

prices of investment as well as securities of the company.

Job costing system: This system is used for accumulation of information related to

expenses associated with particular tasks or service. Accumulated information helps in

submitting expense information to top level management for the purpose of reimbursement of

expenditures. It is used for analysing accuracy on estimation system where prices are quoted in

such a manner that allows reasonable profits. Airdri Ltd uses such system to make estimation of

individual unit expense in order to deliver products or services. The essential requirement of

such system is that it contains specialized rules which are applicable to all types of jobs and

helps in estimation of costs pertaining with particular job.

P2 Different methodologies used in management accounting reporting;

Cost accounting report: Cost accounting is a process of collecting, analysing,

classifying and reporting the data and information’s so that the cost of any project or process can

be calculated and after that the cost can be controlled efficiently. There are various different

reports are prepared to analyse the cost such as budget reports, cost centre reports, variance

3

of valuation of inventory, controlling expenses as well as analysing profitability. Estimation of

actual cost is very necessary for any business enterprise. It encompasses activities based on

understanding, recording, analysing, classification as well as summarizing expenditures

associated with products or services. The essential requirement of this system is to estimate as

well as record the expenses like variable and fixed costs and so on. Managers of Airdri Ltd uses

such system to check reimbursement of associated financial products. With this system,

comparison between budgeted and actual costs can be done in effective manner which helps in

taking corrective decisions related to increasing profitability.

Price Optimisation system: Such system is a mathematical analysis which determines

perception of customers towards value of products or services. It helps in determining value of

organisational products which will meet objectives related to maximising operating profit. The

selected company uses this system to set prices of its financial products based on customer

expectations (Bagautdinova, Kundakchyan and Malakhov, 2013). Executives optimises prices by

understanding client perceptions which results in maintain relationships as well as increasing

profits. It benefits in reducing wastage in order to optimise prices by taking effective decisions.

The essential requirement of price optimisation system is to analyse review of clients towards

prices of investment as well as securities of the company.

Job costing system: This system is used for accumulation of information related to

expenses associated with particular tasks or service. Accumulated information helps in

submitting expense information to top level management for the purpose of reimbursement of

expenditures. It is used for analysing accuracy on estimation system where prices are quoted in

such a manner that allows reasonable profits. Airdri Ltd uses such system to make estimation of

individual unit expense in order to deliver products or services. The essential requirement of

such system is that it contains specialized rules which are applicable to all types of jobs and

helps in estimation of costs pertaining with particular job.

P2 Different methodologies used in management accounting reporting;

Cost accounting report: Cost accounting is a process of collecting, analysing,

classifying and reporting the data and information’s so that the cost of any project or process can

be calculated and after that the cost can be controlled efficiently. There are various different

reports are prepared to analyse the cost such as budget reports, cost centre reports, variance

3

reports etc. Airdri Ltd. Prepare different cost accounting reports so that it can allocate the cost

to various cost centres, maintain the cost trend, analyse the budget compliances and discover

and control the causes of variance.

Performance Report: Performance report is a report that is prepared to analyse the

performance or efficiency of any person or activity. Performance report is prepared by the

individual unit expense organizations so that it can set some measurements to achieve its

objectives and compare the success of outcomes in relation to the measurements (Bargate, 2012).

The cost accounting management of the Airdri Ltd. prepares performance report for each and

every project and employee so that efficiency and capability can be measured. This procedure

helps in controlling the cost and managing the workforce. It also improves the communication

with internal and external stakeholders of the organization.

Budget Report: Budget report is a report that covers all the variances and causes of

variances between budgeted or estimated outcomes and actual results in relation to any activity

or project. This report helps the management to set the measurements for the performance report.

Airdri Ltd. prepares a budget report at the end of any project. This procedure helps the

organization in finding out the errors in budget, moderation in budget and controlling the cost

and adverse variances. It also assists the management in the direction of fund and finance

management.

Inventory Management Report: inventory is the goods held by the organization for the

purpose of sale and it is the major source of income. Inventory management report contains all

the information about the maintenance and recording of the inventory. This report contains all

the information about the stock of goods produced by the organization. The Management of

Airdri Ltd maintains a proper record of the stock with the help of advance technology. An

effective record keeping of the inventory helps the management to track the availability of the

products, minimise the cost of storage and maximise the profitability, automate the integration

among the different departments and achieve a high happy customer base.

M1. Benefits of management accounting systems.

Management accounting system is important for all types of business organisations as it

provides necessary information to make critical decisions which benefits the company (Collis

and Hussey, 2017). In reference to Airdri Ltd, all systems benefits in one or other way. Cost

accounting system benefits in collecting detailed information related to costs involved in

4

to various cost centres, maintain the cost trend, analyse the budget compliances and discover

and control the causes of variance.

Performance Report: Performance report is a report that is prepared to analyse the

performance or efficiency of any person or activity. Performance report is prepared by the

individual unit expense organizations so that it can set some measurements to achieve its

objectives and compare the success of outcomes in relation to the measurements (Bargate, 2012).

The cost accounting management of the Airdri Ltd. prepares performance report for each and

every project and employee so that efficiency and capability can be measured. This procedure

helps in controlling the cost and managing the workforce. It also improves the communication

with internal and external stakeholders of the organization.

Budget Report: Budget report is a report that covers all the variances and causes of

variances between budgeted or estimated outcomes and actual results in relation to any activity

or project. This report helps the management to set the measurements for the performance report.

Airdri Ltd. prepares a budget report at the end of any project. This procedure helps the

organization in finding out the errors in budget, moderation in budget and controlling the cost

and adverse variances. It also assists the management in the direction of fund and finance

management.

Inventory Management Report: inventory is the goods held by the organization for the

purpose of sale and it is the major source of income. Inventory management report contains all

the information about the maintenance and recording of the inventory. This report contains all

the information about the stock of goods produced by the organization. The Management of

Airdri Ltd maintains a proper record of the stock with the help of advance technology. An

effective record keeping of the inventory helps the management to track the availability of the

products, minimise the cost of storage and maximise the profitability, automate the integration

among the different departments and achieve a high happy customer base.

M1. Benefits of management accounting systems.

Management accounting system is important for all types of business organisations as it

provides necessary information to make critical decisions which benefits the company (Collis

and Hussey, 2017). In reference to Airdri Ltd, all systems benefits in one or other way. Cost

accounting system benefits in collecting detailed information related to costs involved in

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

manufacturing procedures at selected business. Inventory management system benefits in

keeping up dated information based on available along with required inventory to carry out

manufacturing procedures without any delays. Price optimisation system benefits chosen

company by analysing behaviour as well as perception of customers towards prices of financial

products. Job costing system benefits in accumulation of information based on associated costs

with specific job as well as service.

D1. Management accounting system and accounting reports are integrated within organisational

processes

Management accounting systems and reports both are interrelated with each other in

many ways. Without accounting systems it is not possible to prepare accounting reports and on

the other hand systems helps in making business decisions to face uncertain circumstances

arising at workplace (Demerjian and et.al., 2012). Managers of Airdri Ltd uses inventory

management system to provide detailed information related to raw materials, semi-finished as

well as finished products for the preparation of inventory reports. At the same time, cost

accounting system helps in preparing budgets as well as performance reports to know about

expenses along with income. Moreover, managers of chosen company prepare account

receivable reports by using price optimisation system which helps in determining prices of

various products.

TASK 2

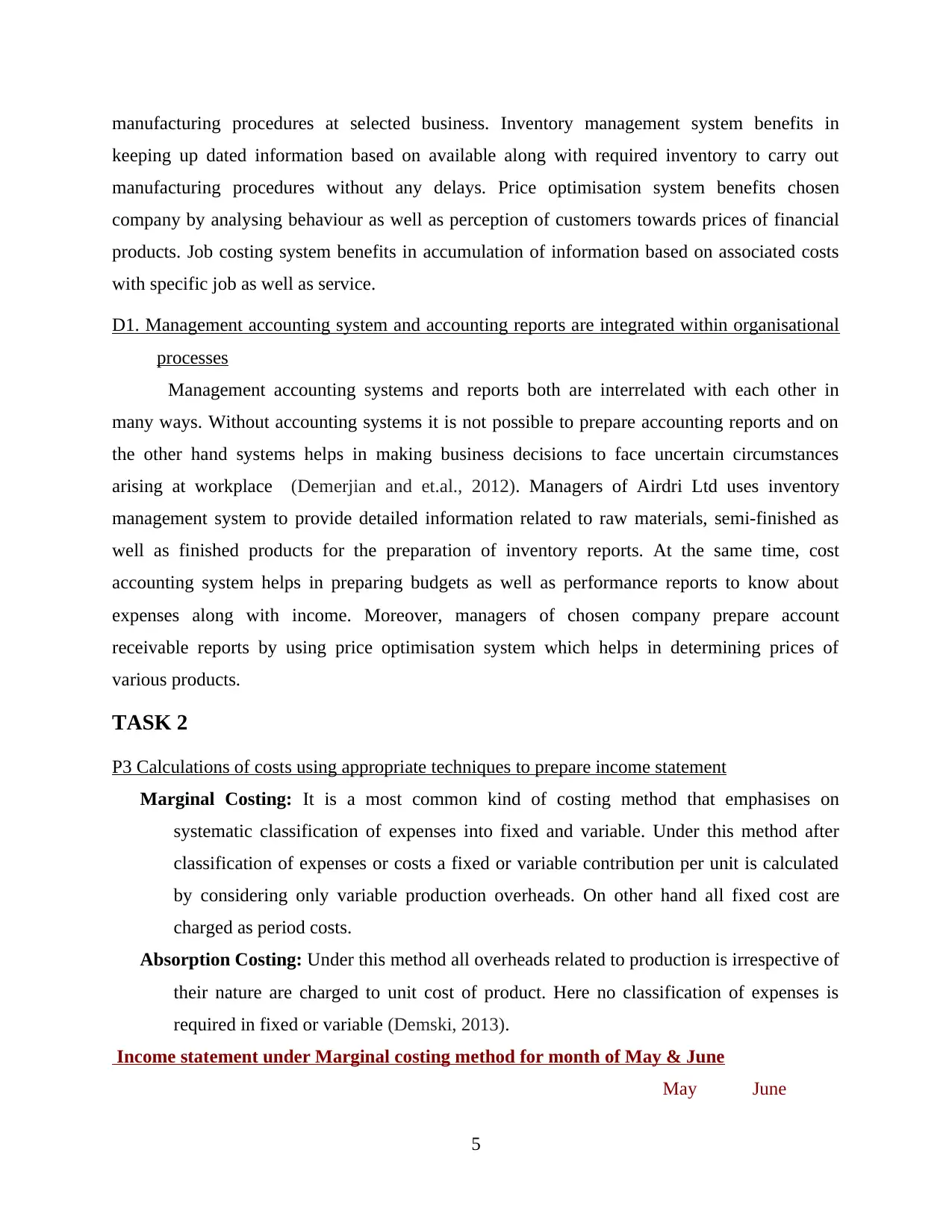

P3 Calculations of costs using appropriate techniques to prepare income statement

Marginal Costing: It is a most common kind of costing method that emphasises on

systematic classification of expenses into fixed and variable. Under this method after

classification of expenses or costs a fixed or variable contribution per unit is calculated

by considering only variable production overheads. On other hand all fixed cost are

charged as period costs.

Absorption Costing: Under this method all overheads related to production is irrespective of

their nature are charged to unit cost of product. Here no classification of expenses is

required in fixed or variable (Demski, 2013).

Income statement under Marginal costing method for month of May & June

May June

5

keeping up dated information based on available along with required inventory to carry out

manufacturing procedures without any delays. Price optimisation system benefits chosen

company by analysing behaviour as well as perception of customers towards prices of financial

products. Job costing system benefits in accumulation of information based on associated costs

with specific job as well as service.

D1. Management accounting system and accounting reports are integrated within organisational

processes

Management accounting systems and reports both are interrelated with each other in

many ways. Without accounting systems it is not possible to prepare accounting reports and on

the other hand systems helps in making business decisions to face uncertain circumstances

arising at workplace (Demerjian and et.al., 2012). Managers of Airdri Ltd uses inventory

management system to provide detailed information related to raw materials, semi-finished as

well as finished products for the preparation of inventory reports. At the same time, cost

accounting system helps in preparing budgets as well as performance reports to know about

expenses along with income. Moreover, managers of chosen company prepare account

receivable reports by using price optimisation system which helps in determining prices of

various products.

TASK 2

P3 Calculations of costs using appropriate techniques to prepare income statement

Marginal Costing: It is a most common kind of costing method that emphasises on

systematic classification of expenses into fixed and variable. Under this method after

classification of expenses or costs a fixed or variable contribution per unit is calculated

by considering only variable production overheads. On other hand all fixed cost are

charged as period costs.

Absorption Costing: Under this method all overheads related to production is irrespective of

their nature are charged to unit cost of product. Here no classification of expenses is

required in fixed or variable (Demski, 2013).

Income statement under Marginal costing method for month of May & June

May June

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Selling per unit price 50 15000 25000

Less: Various Marginal Costs

Per unit Direct materials cost -8 -2400 -4000

Per unit Direct labour cost -5 -1500 -2500

Per unit variable production overheads cost -3 -900 -1500

Contribution 10200 17000

Less: Variable selling commission 5% of sales revenue -750 -1250

Fixed Cost

Fixed selling expenses -4000 -4000

Fixed admin expenses -2000 -2000

Fixed Production cost -4000 -4000

Net profit -550 5750

Income statement under absorption costing method for month of May & June

May June

Sales 50 15000 25000

Less: cost of sales 26 -9880 -13000

Gross profit 5120 12000

Under/over absorbed production overhead 1000 -200

Less: S&D expenses

Fixed selling expenses -4000 -4000

Fixed admin expenses -2000 -2000

Less: Variable Sales commission 5% of sales revenue -750 -1250

Net Profit/loss -630 4550

Per unit Direct materials cost 8

Per unit Direct labour cost 5

Per unit variable production overheads cost 3

Absorbed fixed productin cost per unit 10

Cost of sales 26

6

Less: Various Marginal Costs

Per unit Direct materials cost -8 -2400 -4000

Per unit Direct labour cost -5 -1500 -2500

Per unit variable production overheads cost -3 -900 -1500

Contribution 10200 17000

Less: Variable selling commission 5% of sales revenue -750 -1250

Fixed Cost

Fixed selling expenses -4000 -4000

Fixed admin expenses -2000 -2000

Fixed Production cost -4000 -4000

Net profit -550 5750

Income statement under absorption costing method for month of May & June

May June

Sales 50 15000 25000

Less: cost of sales 26 -9880 -13000

Gross profit 5120 12000

Under/over absorbed production overhead 1000 -200

Less: S&D expenses

Fixed selling expenses -4000 -4000

Fixed admin expenses -2000 -2000

Less: Variable Sales commission 5% of sales revenue -750 -1250

Net Profit/loss -630 4550

Per unit Direct materials cost 8

Per unit Direct labour cost 5

Per unit variable production overheads cost 3

Absorbed fixed productin cost per unit 10

Cost of sales 26

6

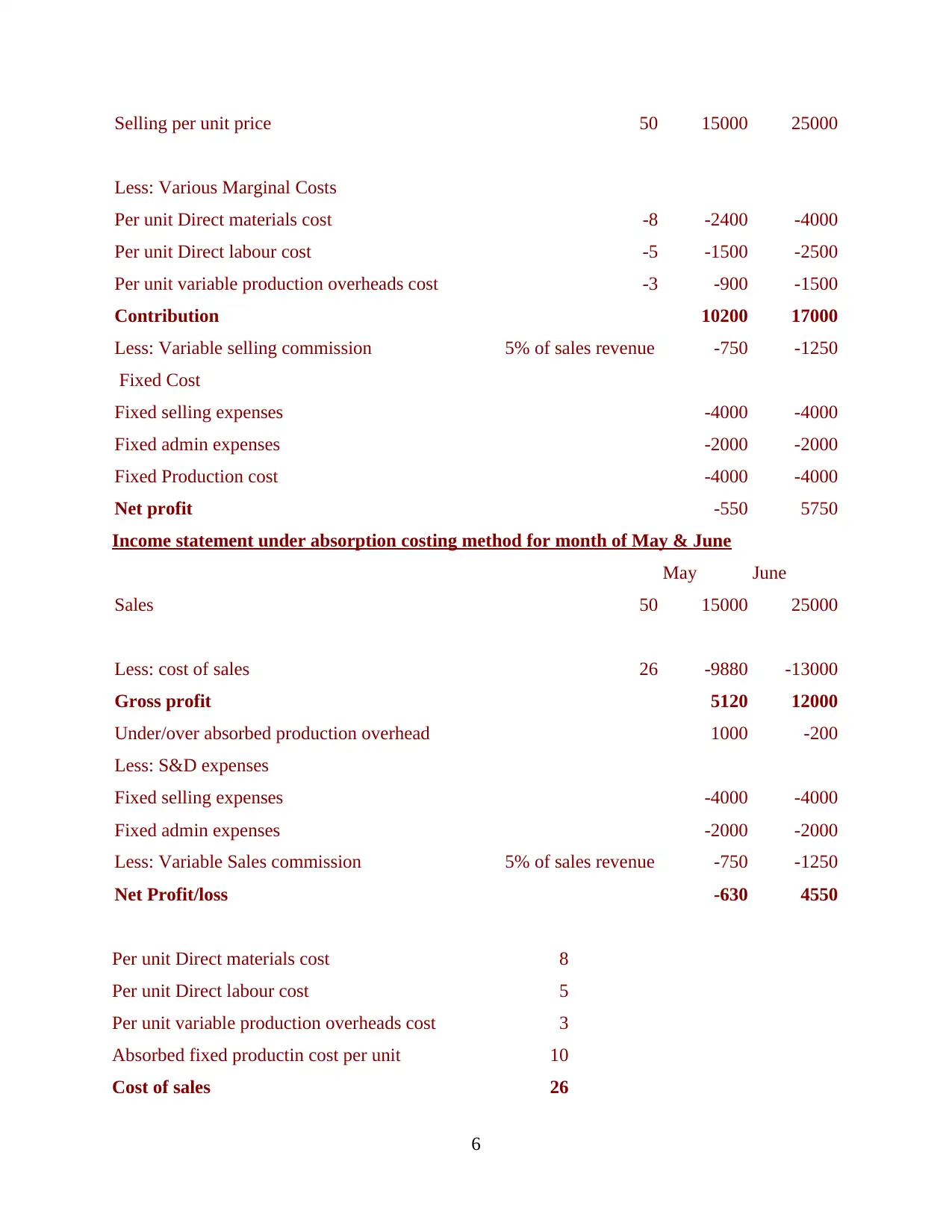

May June

Actual production overhead 5000 3800

Standard rate 4000 4000

Under/over absobed production overhead 1000 -200

Material cost variances:

Given information is as follows-

Standard price(SP)- £10 @ per kilograms

Actual price (AP)- £ 9.5 @ per kilograms (20900/2200)

Actual quantity (AQ)- 2200 Kilograms

Standard quantity(SQ)- 1000 Kilograms

Material price variance (MPV)= (SP-AP) * AQ

(10-9.5)* 2200= £1100 F

Material usage variance (MUV)= (SQ-AQ)*SP

(1000-2200)*10= £12000 A

Material cost variance (MCV)= Standard material cost- actual material cost

Valuation of closing stock using LIFO

Date Reference Purchase Issues Balance (Inventory)

Units £/Units £ Total Units £/Units £ Total Units £/Units £ Total

05/01 Previous balance

(inventory) 40 3.00 120.00

05/12 40 3.00 120.00

Bought 25 units

at £ 3.60 each 20 3.60 72. 20 3.60 72.00

05/15 20 3.60 72.

Issued 36 units 16 3.00 48. 24 3.00 72.00

05/20 24 3.00 72.00

7

Actual production overhead 5000 3800

Standard rate 4000 4000

Under/over absobed production overhead 1000 -200

Material cost variances:

Given information is as follows-

Standard price(SP)- £10 @ per kilograms

Actual price (AP)- £ 9.5 @ per kilograms (20900/2200)

Actual quantity (AQ)- 2200 Kilograms

Standard quantity(SQ)- 1000 Kilograms

Material price variance (MPV)= (SP-AP) * AQ

(10-9.5)* 2200= £1100 F

Material usage variance (MUV)= (SQ-AQ)*SP

(1000-2200)*10= £12000 A

Material cost variance (MCV)= Standard material cost- actual material cost

Valuation of closing stock using LIFO

Date Reference Purchase Issues Balance (Inventory)

Units £/Units £ Total Units £/Units £ Total Units £/Units £ Total

05/01 Previous balance

(inventory) 40 3.00 120.00

05/12 40 3.00 120.00

Bought 25 units

at £ 3.60 each 20 3.60 72. 20 3.60 72.00

05/15 20 3.60 72.

Issued 36 units 16 3.00 48. 24 3.00 72.00

05/20 24 3.00 72.00

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

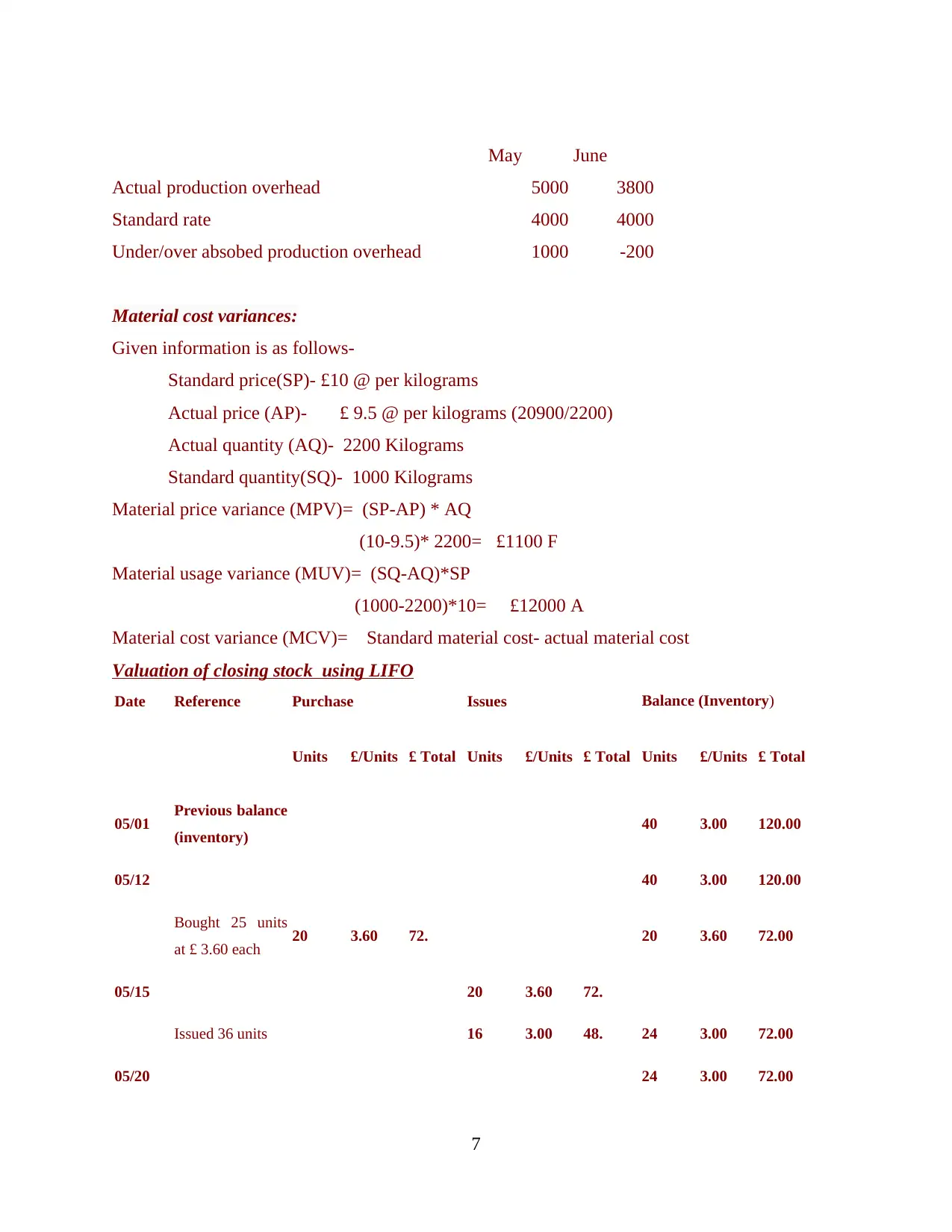

Bought 20 units

at £ 3.75 each 20 3.75 75. 20 3.75 75.00

05/23 Issued 10 units 10 3.75 37.5 24 3.00 72.00

10 3.75 37.50

05/27 9 3.75 33.75

Issued 25 units 25 3.00 75.00

05/30 Issued 5 units 5 3.00 15.00 4 3.75 15.00

Valuation of closing stock by using weighted average method:

05/01 Previous balance

(inventory) 40 3.0000 120.0000

05/12 Bought 25 units at £

3.60 each 25 3.60 90. 65 3.2308 210.0000

05/15 Issued 36 units 36 3.2308 116.307

7 29 3.2308 93.6923

05/20 Bought 20 units at £

3.75 each 20 3.75 75. 49 3.4427 168.6923

05/23 Issued 10 units 10 3.4427 34.4270 39 3.4427 134.2653

05/27 Issued 25 units 25 3.4427 86.0675 14 3.4427 48.1978

05/30 Issued 5 units 5 3.44 17.2135 9 3.4427 30.9843

M2 Different techniques of management accounting system

Use of different techniques along with management accounting systems provides a

framework for systematic presentation of financial information. Cost accountants and employees

of management can apply these techniques to compute the financial performance of company

over a particular period (Gullkvist, 2013). It provides detailed and relevant information about

company's performance to higher level managers for taking business decisions.

8

at £ 3.75 each 20 3.75 75. 20 3.75 75.00

05/23 Issued 10 units 10 3.75 37.5 24 3.00 72.00

10 3.75 37.50

05/27 9 3.75 33.75

Issued 25 units 25 3.00 75.00

05/30 Issued 5 units 5 3.00 15.00 4 3.75 15.00

Valuation of closing stock by using weighted average method:

05/01 Previous balance

(inventory) 40 3.0000 120.0000

05/12 Bought 25 units at £

3.60 each 25 3.60 90. 65 3.2308 210.0000

05/15 Issued 36 units 36 3.2308 116.307

7 29 3.2308 93.6923

05/20 Bought 20 units at £

3.75 each 20 3.75 75. 49 3.4427 168.6923

05/23 Issued 10 units 10 3.4427 34.4270 39 3.4427 134.2653

05/27 Issued 25 units 25 3.4427 86.0675 14 3.4427 48.1978

05/30 Issued 5 units 5 3.44 17.2135 9 3.4427 30.9843

M2 Different techniques of management accounting system

Use of different techniques along with management accounting systems provides a

framework for systematic presentation of financial information. Cost accountants and employees

of management can apply these techniques to compute the financial performance of company

over a particular period (Gullkvist, 2013). It provides detailed and relevant information about

company's performance to higher level managers for taking business decisions.

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

D2 Interpret data for a range of business activities

By applying marginal costing method in order to prepare income statement it has been

analysed that entity's profit is GBP 1050 in the month of May and GBP 5750 in the month of

June. Whereas as per absorption costing method profit is GBP 2450 in the month of May and

GBP 4750 in the month of June. Such difference is arise due to different treatment of fixed costs

in both methods. Under marginal costing fixed cost is regarded as period cost.

TASK 3

P4 Advantage and disadvantage of different types of planning tools used for budgetary control

Budget –Budget simply implies to projection. It is prepared by business enterprises to

estimate its performance in coming period. Budget in business context called as statement of

projection. Management and accountants in business organisation prepares different kind of

budgets to critically evaluate actual performance of business enterprise in near future. While

preparing budgets accountants first analyse the past trends and scenarios to increase the

reliability and accuracy of budgets (Kanellou and Spathis, 2013). Various budgets cover different

financial and monetary aspects of enterprise. It provides assistance in business processes related

to planning and decision-making. Budget gives a strong basis for preparation of strategies and

formulation of action plan. For effective budgetary control within a business enterprise

management, budget plays a vital role. Airdri Ltd, also emphasises on preparation of budgets for

implementation effective budgetary control system. In company manufacturing heads and

managers of production department prepare different budgets to assess under or over statement

of any expenses or income.

Cash Budget

Cash budget prepared by accountants and managers to compute the real flow whether in

flow or out flow within a business entity. This kind of budget only focuses on cash and cash

related aspects of business organisation. It provides a true image of organisation's position in

term of liquidity. Airdri Ltd also use cash budget to identify and improve the weak areas which

lead to negative cash flow or excessive cash outflow. For effective cash handling and

management, company is using information of cash budget. In company cash budget is prepared

department-wise by various departmental heads.

9

By applying marginal costing method in order to prepare income statement it has been

analysed that entity's profit is GBP 1050 in the month of May and GBP 5750 in the month of

June. Whereas as per absorption costing method profit is GBP 2450 in the month of May and

GBP 4750 in the month of June. Such difference is arise due to different treatment of fixed costs

in both methods. Under marginal costing fixed cost is regarded as period cost.

TASK 3

P4 Advantage and disadvantage of different types of planning tools used for budgetary control

Budget –Budget simply implies to projection. It is prepared by business enterprises to

estimate its performance in coming period. Budget in business context called as statement of

projection. Management and accountants in business organisation prepares different kind of

budgets to critically evaluate actual performance of business enterprise in near future. While

preparing budgets accountants first analyse the past trends and scenarios to increase the

reliability and accuracy of budgets (Kanellou and Spathis, 2013). Various budgets cover different

financial and monetary aspects of enterprise. It provides assistance in business processes related

to planning and decision-making. Budget gives a strong basis for preparation of strategies and

formulation of action plan. For effective budgetary control within a business enterprise

management, budget plays a vital role. Airdri Ltd, also emphasises on preparation of budgets for

implementation effective budgetary control system. In company manufacturing heads and

managers of production department prepare different budgets to assess under or over statement

of any expenses or income.

Cash Budget

Cash budget prepared by accountants and managers to compute the real flow whether in

flow or out flow within a business entity. This kind of budget only focuses on cash and cash

related aspects of business organisation. It provides a true image of organisation's position in

term of liquidity. Airdri Ltd also use cash budget to identify and improve the weak areas which

lead to negative cash flow or excessive cash outflow. For effective cash handling and

management, company is using information of cash budget. In company cash budget is prepared

department-wise by various departmental heads.

9

Advantage:

This budget help business entities in tracking of movement and flow of cash or cash

related items (Maher, Stickney and Weil, 2012). In Airdri it helps mangers in monitoring

cash flow and in effective cash management.

In Airdri, trough cash budget managers accumulate funds for future contingency to

ensure its availability of funds in future.

Disadvantage:

Approaches used in preparation of cash budgets sometime may be manipulative and does

not show real performance of entity. So in Airdri this budget is only used for internal

cash management not for reporting purpose.

Cash budget is some time fails to detect the fraud done by accountants due to avoidance

of accrual concept.

Operating Budget

This budget is prepared by entities while considering only operational expenses and

income incurred during a particular period. It contains estimation of income and expenses

concerned with operating functions of entity (Malinić and Todorović, 2012). In Airdri Ltd first

managers prepare different small budgets thereafter they prepare a complete operational budget

with help of such budgets. It is used by company to evaluate operational efficiencies and

performance in coming time period. This budget is significant as it covers all operational

activities and functions. As company is manufacturing hand dryers, production heads in

company prepare sub budgets than a complete operational budget is prepared by management to

assess its operational efficiencies related to activities of manufacturing processes.

Advantage

Managers in Airdri with help of this budget organise and control company's day to day

operations.

It assists entity in allocation of any weak operational area and provides a basis for

overcoming from such weakness.

Disadvantage

This budget is prepared normally on daily basis so practical implication of operational

budget is complex and consumes times (McLaren, Appleyard and Mitchell, 2016).

10

This budget help business entities in tracking of movement and flow of cash or cash

related items (Maher, Stickney and Weil, 2012). In Airdri it helps mangers in monitoring

cash flow and in effective cash management.

In Airdri, trough cash budget managers accumulate funds for future contingency to

ensure its availability of funds in future.

Disadvantage:

Approaches used in preparation of cash budgets sometime may be manipulative and does

not show real performance of entity. So in Airdri this budget is only used for internal

cash management not for reporting purpose.

Cash budget is some time fails to detect the fraud done by accountants due to avoidance

of accrual concept.

Operating Budget

This budget is prepared by entities while considering only operational expenses and

income incurred during a particular period. It contains estimation of income and expenses

concerned with operating functions of entity (Malinić and Todorović, 2012). In Airdri Ltd first

managers prepare different small budgets thereafter they prepare a complete operational budget

with help of such budgets. It is used by company to evaluate operational efficiencies and

performance in coming time period. This budget is significant as it covers all operational

activities and functions. As company is manufacturing hand dryers, production heads in

company prepare sub budgets than a complete operational budget is prepared by management to

assess its operational efficiencies related to activities of manufacturing processes.

Advantage

Managers in Airdri with help of this budget organise and control company's day to day

operations.

It assists entity in allocation of any weak operational area and provides a basis for

overcoming from such weakness.

Disadvantage

This budget is prepared normally on daily basis so practical implication of operational

budget is complex and consumes times (McLaren, Appleyard and Mitchell, 2016).

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.