Nelson College Management Accounting Report: GSQ Limited Analysis

VerifiedAdded on 2023/01/12

|11

|698

|49

Report

AI Summary

This report delves into the realm of management accounting, specifically analyzing marginal and absorption costing methods. It begins with an introduction to management accounting and then proceeds to analyze the concepts of marginal and absorption costing. The report uses GSQ Limited as a case study to illustrate the application of these costing techniques. The report includes income statements prepared under both marginal and absorption costing, allowing for a comparison of their impacts on profit calculation. The analysis includes working notes to explain the calculations. The report concludes with a recommendation for GSQ Limited on which costing approach is most suitable, and a brief conclusion summarizing the key takeaways. References are provided at the end of the report.

Management Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENT

• INTRODUCTION

• MARGINAL COSTING

• ABSORPTIONAL COSTING

• ADVICE TO GSQ Limited

• CONCLUSION

• REFERENCES

• INTRODUCTION

• MARGINAL COSTING

• ABSORPTIONAL COSTING

• ADVICE TO GSQ Limited

• CONCLUSION

• REFERENCES

Introduction

• Management accounting is the concept of analysis and reporting income and

expenditures which an organization earns and expends while operating in

business environment.

• For this purpose, a company is selected which is GSQ Limited.

• In this presentation, an analysis of marginal and absorption costing is

conducted in order to advising GSQ about budgeting approach to follow.

• Management accounting is the concept of analysis and reporting income and

expenditures which an organization earns and expends while operating in

business environment.

• For this purpose, a company is selected which is GSQ Limited.

• In this presentation, an analysis of marginal and absorption costing is

conducted in order to advising GSQ about budgeting approach to follow.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

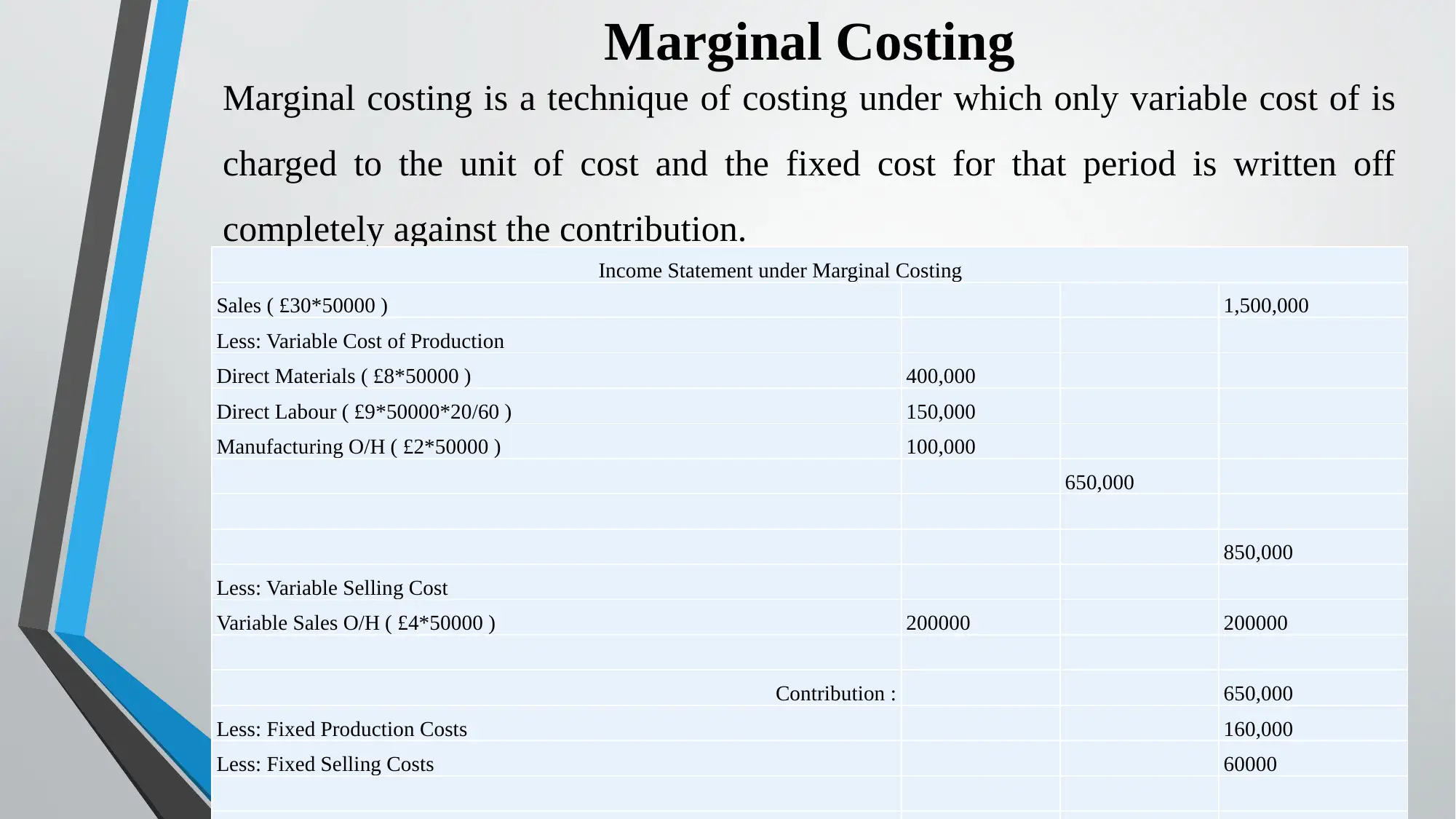

Marginal Costing

Marginal costing is a technique of costing under which only variable cost of is

charged to the unit of cost and the fixed cost for that period is written off

completely against the contribution.

Income Statement under Marginal Costing

Sales ( £30*50000 ) 1,500,000

Less: Variable Cost of Production

Direct Materials ( £8*50000 ) 400,000

Direct Labour ( £9*50000*20/60 ) 150,000

Manufacturing O/H ( £2*50000 ) 100,000

650,000

850,000

Less: Variable Selling Cost

Variable Sales O/H ( £4*50000 ) 200000 200000

Contribution : 650,000

Less: Fixed Production Costs 160,000

Less: Fixed Selling Costs 60000

Marginal costing is a technique of costing under which only variable cost of is

charged to the unit of cost and the fixed cost for that period is written off

completely against the contribution.

Income Statement under Marginal Costing

Sales ( £30*50000 ) 1,500,000

Less: Variable Cost of Production

Direct Materials ( £8*50000 ) 400,000

Direct Labour ( £9*50000*20/60 ) 150,000

Manufacturing O/H ( £2*50000 ) 100,000

650,000

850,000

Less: Variable Selling Cost

Variable Sales O/H ( £4*50000 ) 200000 200000

Contribution : 650,000

Less: Fixed Production Costs 160,000

Less: Fixed Selling Costs 60000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

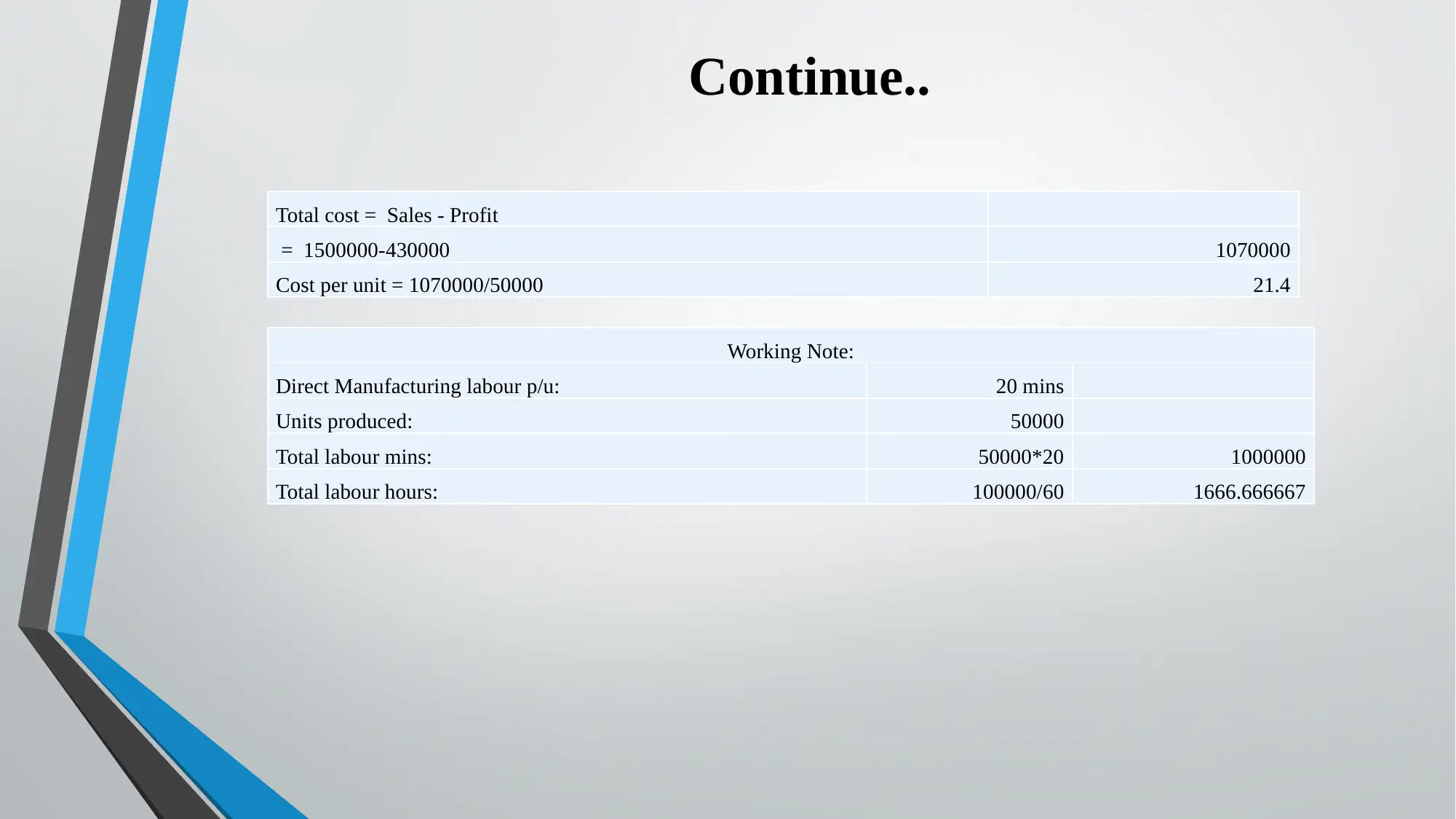

Continue..

Total cost = Sales - Profit

= 1500000-430000 1070000

Cost per unit = 1070000/50000 21.4

Working Note:

Direct Manufacturing labour p/u: 20 mins

Units produced: 50000

Total labour mins: 50000*20 1000000

Total labour hours: 100000/60 1666.666667

Total cost = Sales - Profit

= 1500000-430000 1070000

Cost per unit = 1070000/50000 21.4

Working Note:

Direct Manufacturing labour p/u: 20 mins

Units produced: 50000

Total labour mins: 50000*20 1000000

Total labour hours: 100000/60 1666.666667

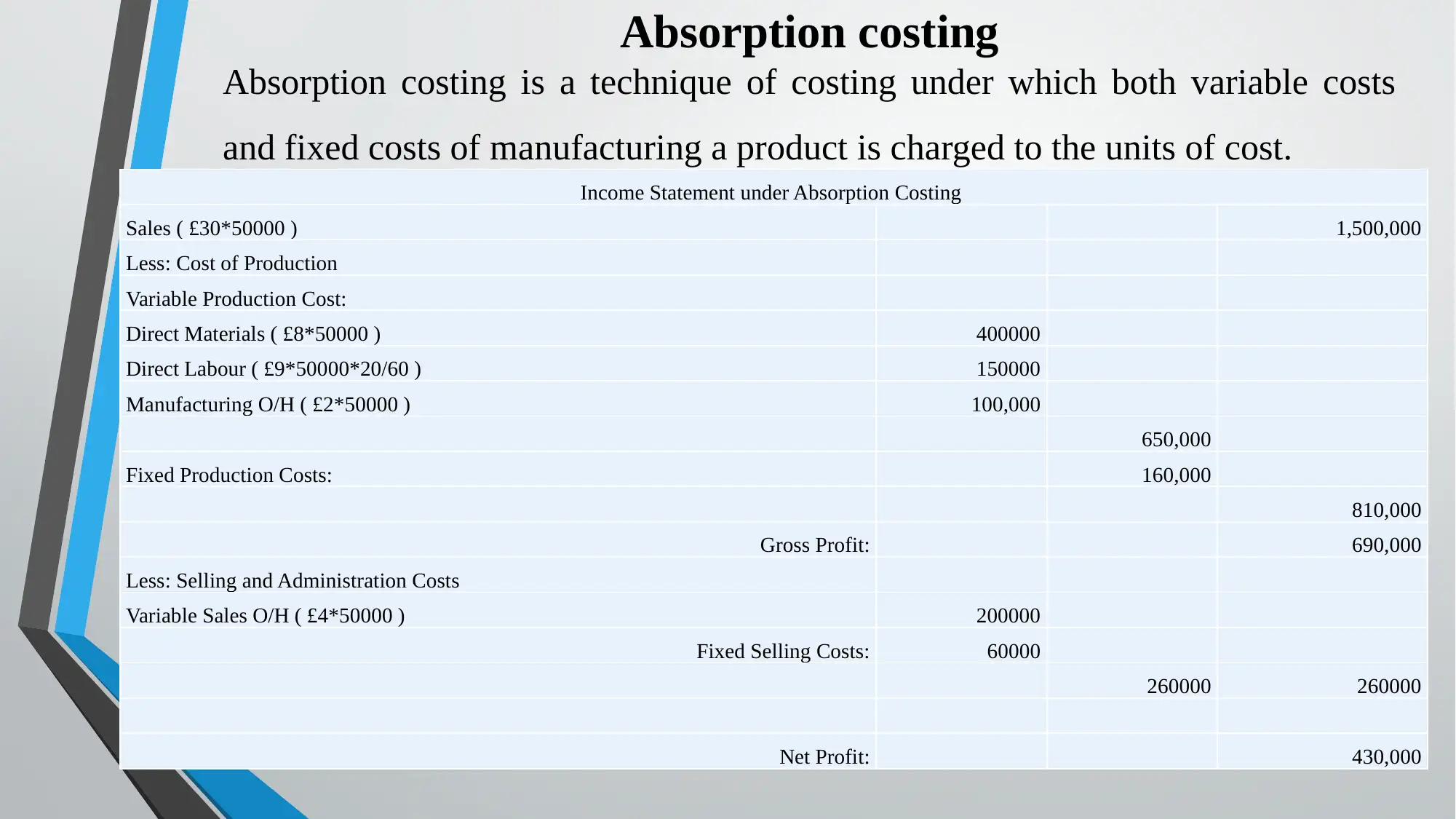

Absorption costing

Absorption costing is a technique of costing under which both variable costs

and fixed costs of manufacturing a product is charged to the units of cost.

Income Statement under Absorption Costing

Sales ( £30*50000 ) 1,500,000

Less: Cost of Production

Variable Production Cost:

Direct Materials ( £8*50000 ) 400000

Direct Labour ( £9*50000*20/60 ) 150000

Manufacturing O/H ( £2*50000 ) 100,000

650,000

Fixed Production Costs: 160,000

810,000

Gross Profit: 690,000

Less: Selling and Administration Costs

Variable Sales O/H ( £4*50000 ) 200000

Fixed Selling Costs: 60000

260000 260000

Net Profit: 430,000

Absorption costing is a technique of costing under which both variable costs

and fixed costs of manufacturing a product is charged to the units of cost.

Income Statement under Absorption Costing

Sales ( £30*50000 ) 1,500,000

Less: Cost of Production

Variable Production Cost:

Direct Materials ( £8*50000 ) 400000

Direct Labour ( £9*50000*20/60 ) 150000

Manufacturing O/H ( £2*50000 ) 100,000

650,000

Fixed Production Costs: 160,000

810,000

Gross Profit: 690,000

Less: Selling and Administration Costs

Variable Sales O/H ( £4*50000 ) 200000

Fixed Selling Costs: 60000

260000 260000

Net Profit: 430,000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

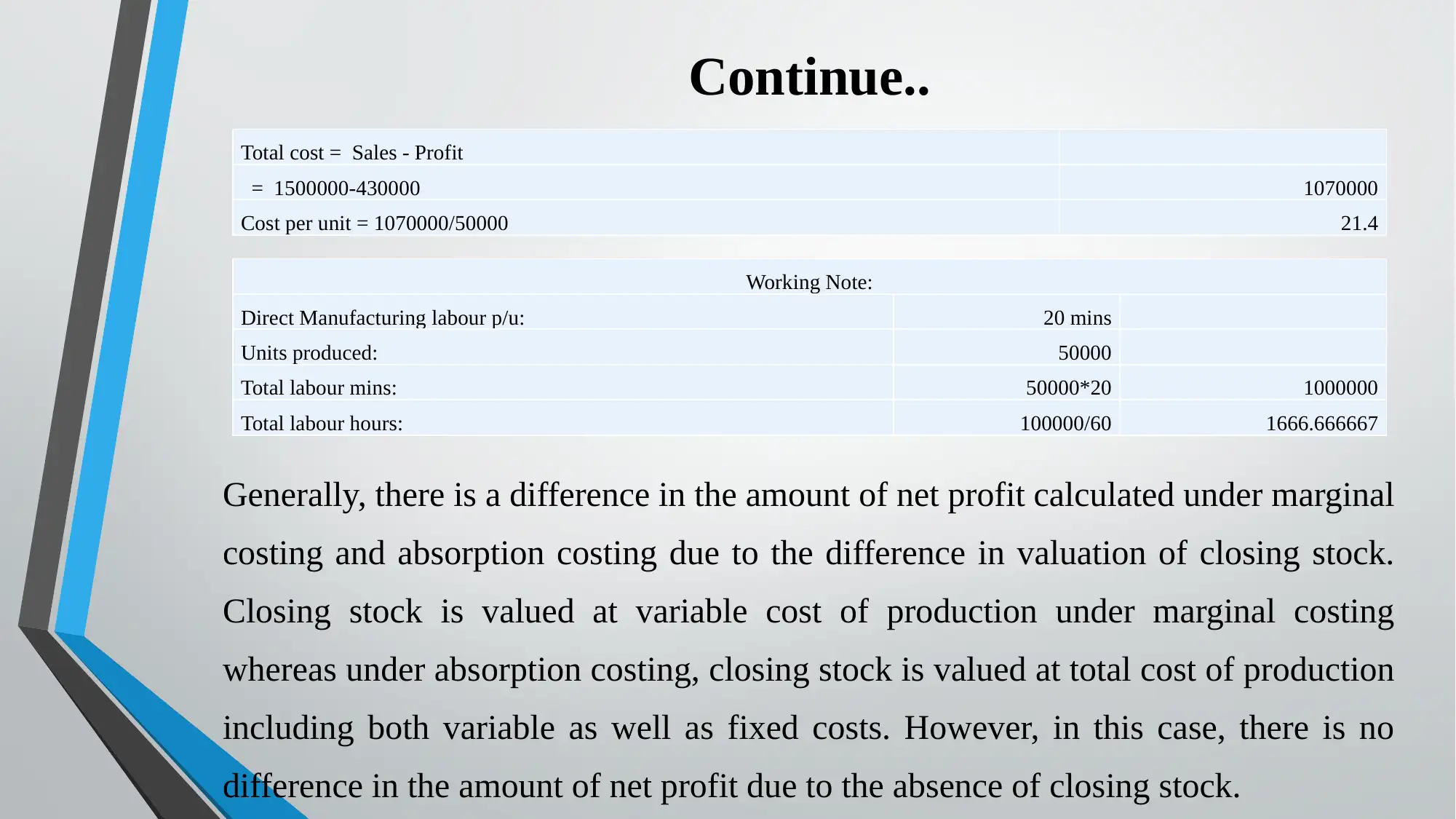

Continue..

Generally, there is a difference in the amount of net profit calculated under marginal

costing and absorption costing due to the difference in valuation of closing stock.

Closing stock is valued at variable cost of production under marginal costing

whereas under absorption costing, closing stock is valued at total cost of production

including both variable as well as fixed costs. However, in this case, there is no

difference in the amount of net profit due to the absence of closing stock.

Total cost = Sales - Profit

= 1500000-430000 1070000

Cost per unit = 1070000/50000 21.4

Working Note:

Direct Manufacturing labour p/u: 20 mins

Units produced: 50000

Total labour mins: 50000*20 1000000

Total labour hours: 100000/60 1666.666667

Generally, there is a difference in the amount of net profit calculated under marginal

costing and absorption costing due to the difference in valuation of closing stock.

Closing stock is valued at variable cost of production under marginal costing

whereas under absorption costing, closing stock is valued at total cost of production

including both variable as well as fixed costs. However, in this case, there is no

difference in the amount of net profit due to the absence of closing stock.

Total cost = Sales - Profit

= 1500000-430000 1070000

Cost per unit = 1070000/50000 21.4

Working Note:

Direct Manufacturing labour p/u: 20 mins

Units produced: 50000

Total labour mins: 50000*20 1000000

Total labour hours: 100000/60 1666.666667

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Advice to GSQ Ltd.

From the above discussion, it is quite clear that absorption costing is a better

approach for GSQ limited. Absorption costing takes into consideration both

variable costs of production as well as fixed costs of production which helps the

management to look at the total costs comprehensively. Absorption costing is a

better approach which helps in tracking profits more accurately. However,

marginal costing is more useful if the company has just started and the objective

is to find out contribution per unit and break-even point.

From the above discussion, it is quite clear that absorption costing is a better

approach for GSQ limited. Absorption costing takes into consideration both

variable costs of production as well as fixed costs of production which helps the

management to look at the total costs comprehensively. Absorption costing is a

better approach which helps in tracking profits more accurately. However,

marginal costing is more useful if the company has just started and the objective

is to find out contribution per unit and break-even point.

CONCLUSION

Management accounting and financial accounting are very different from each

other. It can be concluded that while financial accounting methods are used to

ascertain the financial position of the company, management accounting aims at

providing aid to the management in managing and controlling the operations of

the organisation.

Management accounting and financial accounting are very different from each

other. It can be concluded that while financial accounting methods are used to

ascertain the financial position of the company, management accounting aims at

providing aid to the management in managing and controlling the operations of

the organisation.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

REFERENCES

• Parker, L.D., 2012. Qualitative management accounting research: Assessing

deliverables and relevance. Critical perspectives on accounting. 23(1). pp.54-

70.

• Yalcin, S., 2012. Adoption and benefits of management accounting practices:

an inter-country comparison. Accounting in Europe. 9(1). pp.95-110.

• Parker, L.D., 2012. Qualitative management accounting research: Assessing

deliverables and relevance. Critical perspectives on accounting. 23(1). pp.54-

70.

• Yalcin, S., 2012. Adoption and benefits of management accounting practices:

an inter-country comparison. Accounting in Europe. 9(1). pp.95-110.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

THANKYOU

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.