Analysis of Accounting Theory and Contemporary Issues Frameworks

VerifiedAdded on 2023/03/30

|19

|3835

|289

Report

AI Summary

This report presents a comprehensive analysis of accounting theory and contemporary issues, focusing on the conceptual framework and integrated reporting. It begins with a literature review on the historical development of the conceptual framework in the USA, UK, and Australia, and addresses concerns raised by the Australian accounting profession. The report then analyzes the application of the conceptual framework by Ausdrill Limited, an ASX-listed company, examining its financial statements and accounting treatments. Subsequently, it explores corporate social responsibility by comparing the sustainability reporting guidelines of the IIRC and GRI. The analysis of the sustainability reporting framework is done by evaluating the annual report of Gold field limited, a South African company. The report includes detailed discussions of the conceptual framework's qualitative characteristics, relevance, and the impact of accounting standards on financial reporting quality. The analysis includes the financial reporting practices of Ausdrill and Gold Fields, including revenue recognition, financial instrument valuation, and the presentation of financial statements. Overall, the report provides insights into the practical application and implications of accounting theory and reporting frameworks.

Running head: ACCOUNTING THEORY AND CONTEMPORARY ISSUES

Accounting theory and contemporary issues

Name of the student

Name of the university

Student ID

Author note

Accounting theory and contemporary issues

Name of the student

Name of the university

Student ID

Author note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ACCOUNTING THEORY AND CONTEMPORARY ISSUES

Executive summary:

The report is divided into sections where first part focuses on the conceptual framework

while other part focuses on the integrated reporting framework. Analysis of the framework

has been done by evaluating the financial report of the companies chosen from different stock

exchange. One company is chosen from ASX named Ausdrill Company that is engaged in

offering mining services worldwide. Gold field limited is another company that is chosen

from Jonesburg stock exchange and is one of the largest firms of the world operating gold

mining. Analysis of all the facts regarding the reporting framework and accounting

treatments of differents financial components is done by retrieving the information presented

in the financial report of the company.

Executive summary:

The report is divided into sections where first part focuses on the conceptual framework

while other part focuses on the integrated reporting framework. Analysis of the framework

has been done by evaluating the financial report of the companies chosen from different stock

exchange. One company is chosen from ASX named Ausdrill Company that is engaged in

offering mining services worldwide. Gold field limited is another company that is chosen

from Jonesburg stock exchange and is one of the largest firms of the world operating gold

mining. Analysis of all the facts regarding the reporting framework and accounting

treatments of differents financial components is done by retrieving the information presented

in the financial report of the company.

ACCOUNTING THEORY AND CONTEMPORARY ISSUES

Table of Contents

Introduction:...............................................................................................................................3

Discussion:.................................................................................................................................3

Part A: Conceptual framework...................................................................................................3

Answer to requirement a)...........................................................................................................3

Answer to requirement b)...........................................................................................................4

Answer to requirement c)...........................................................................................................5

Answer to requirement d)...........................................................................................................6

Part B: Integrated/Sustainability reporting.................................................................................8

Answer to requirement a)...........................................................................................................8

Answer to requirement b)...........................................................................................................9

Answer to requirement c).........................................................................................................10

Answer to requirement d).........................................................................................................11

Answer to requirement e).........................................................................................................12

Conclusion:..............................................................................................................................13

Table of Contents

Introduction:...............................................................................................................................3

Discussion:.................................................................................................................................3

Part A: Conceptual framework...................................................................................................3

Answer to requirement a)...........................................................................................................3

Answer to requirement b)...........................................................................................................4

Answer to requirement c)...........................................................................................................5

Answer to requirement d)...........................................................................................................6

Part B: Integrated/Sustainability reporting.................................................................................8

Answer to requirement a)...........................................................................................................8

Answer to requirement b)...........................................................................................................9

Answer to requirement c).........................................................................................................10

Answer to requirement d).........................................................................................................11

Answer to requirement e).........................................................................................................12

Conclusion:..............................................................................................................................13

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ACCOUNTING THEORY AND CONTEMPORARY ISSUES

Introduction:

The report is prepared to conduct a literature review on the development and history

of the conceptual framework for the financial framework in the country like USA, UK and

Australia. The concerns raises by the accounting profession of Australia regarding the

application of the conceptual framework for the financial reporting has also been presented in

the report. Analysis of the conceptual framework and its application by the company has

been done by analyzing the company chosen from ASX that is Ausdrill limited. In the later

part of the report, a holistic view of the corporate social responsibility has been presented by

comparing the sustainability reporting guidelines of the IIRC (International Integrated

reporting council) and GRI (Global Reporting Initiative). The analysis of the sustainability

reporting framework is done by evaluating the annual report of one of the South African

company that is Gold field limited.

Discussion:

Part A: Conceptual framework

Answer to requirement a)

The adoption of the conceptual framework by the counties such as UK, Australia and

USA is associated with the long historical background. Conceptual framework can be defined

as the set statement of principles that helps in the development of new reporting practices by

providing generally accepted guidance. The conceptual framework was published in year

1989 by International accounting standard committee that intends to guide national and

international standard setters and assisting the preparers in dealing with the issues faced

(Aasb.gov.au, 2019).

Introduction:

The report is prepared to conduct a literature review on the development and history

of the conceptual framework for the financial framework in the country like USA, UK and

Australia. The concerns raises by the accounting profession of Australia regarding the

application of the conceptual framework for the financial reporting has also been presented in

the report. Analysis of the conceptual framework and its application by the company has

been done by analyzing the company chosen from ASX that is Ausdrill limited. In the later

part of the report, a holistic view of the corporate social responsibility has been presented by

comparing the sustainability reporting guidelines of the IIRC (International Integrated

reporting council) and GRI (Global Reporting Initiative). The analysis of the sustainability

reporting framework is done by evaluating the annual report of one of the South African

company that is Gold field limited.

Discussion:

Part A: Conceptual framework

Answer to requirement a)

The adoption of the conceptual framework by the counties such as UK, Australia and

USA is associated with the long historical background. Conceptual framework can be defined

as the set statement of principles that helps in the development of new reporting practices by

providing generally accepted guidance. The conceptual framework was published in year

1989 by International accounting standard committee that intends to guide national and

international standard setters and assisting the preparers in dealing with the issues faced

(Aasb.gov.au, 2019).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ACCOUNTING THEORY AND CONTEMPORARY ISSUES

When it comes to United Kingdom, the country is moving to the principles based

standards compared to rule based standards and such shifts necessities the introduction of the

conceptual framework for the country. In country like Australia and USA, the conceptual

framework existed since 1980s. UK has its own conceptual framework since year 1999 that is

they have adopted the principles issues by the accounting standard board since then. Creation

of conceptual framework is essential for UK because it helps in increasing the international

accounting needs. The development of principles statement became crucial for the country

because of the growing global economic cooperation and the influence of USA (Adams,

2015).

After the economic depression in year 1934 in the USA, Investors lost their

confidence for investing in the companies and one of the reasons cited was the inadequate

reporting practices. In this regard, the government intended to boost their accounting and

reporting practices and the adopting of single reporting practices contributed to enhancing the

reporting practices of the companies. Accordingly, the development of the conceptual

framework was done by with the FASB was entrusted with the responsibility provided by the

concerned authority (Corrado et al., 2015).

The development of the conceptual framework according to the Australian accounting

standard board in Australia has been different. It was so because the global competition was

required to be ensured as per the decision of the respective authority that mandated the

adoption of the conceptual framework. The conceptual framework in Australia was

developed by the Australian accounting standard over the period 1985-1995 and the concepts

of accounting has been released prior to 2002. The basic concepts that is used in the

preparation of the financial statement is described by the conceptual framework (Zalaghi &

Khazaei, 2016).

When it comes to United Kingdom, the country is moving to the principles based

standards compared to rule based standards and such shifts necessities the introduction of the

conceptual framework for the country. In country like Australia and USA, the conceptual

framework existed since 1980s. UK has its own conceptual framework since year 1999 that is

they have adopted the principles issues by the accounting standard board since then. Creation

of conceptual framework is essential for UK because it helps in increasing the international

accounting needs. The development of principles statement became crucial for the country

because of the growing global economic cooperation and the influence of USA (Adams,

2015).

After the economic depression in year 1934 in the USA, Investors lost their

confidence for investing in the companies and one of the reasons cited was the inadequate

reporting practices. In this regard, the government intended to boost their accounting and

reporting practices and the adopting of single reporting practices contributed to enhancing the

reporting practices of the companies. Accordingly, the development of the conceptual

framework was done by with the FASB was entrusted with the responsibility provided by the

concerned authority (Corrado et al., 2015).

The development of the conceptual framework according to the Australian accounting

standard board in Australia has been different. It was so because the global competition was

required to be ensured as per the decision of the respective authority that mandated the

adoption of the conceptual framework. The conceptual framework in Australia was

developed by the Australian accounting standard over the period 1985-1995 and the concepts

of accounting has been released prior to 2002. The basic concepts that is used in the

preparation of the financial statement is described by the conceptual framework (Zalaghi &

Khazaei, 2016).

ACCOUNTING THEORY AND CONTEMPORARY ISSUES

Answer to requirement b)

The application of the conceptual framework is of great concern to the accounting

profession in Australia. The introduction of the new conceptual framework has provided

benefits and comes with constraints too that is of concern to many accounting professions.

The initiation of the conceptual framework has accounted to the volatility in accounting for

fair value that is attributed to rising lobbying in the country. It has been identified that the

valuation of the intangible assets and financial instruments has been adversely impacted by

the volatility in such fair value accounting. In addition to this, the conceptual framework has

considerably impacted the procedures of recognition, measurement and the disclosures

policies of the liabilities and assets. This disadvantage concerned with the valuation of the

financial items because it needs to take into economic factors and it has been found that the

accounting model has certain economic consequences which might impact the financial

performance of the company. The contention that might arise between the accounting

measures and the framework that is used for the inception of the conceptual framework is

another disadvantage. Such contention is attributable to the distinction in the practices

endorsed by the recent conceptual framework and the former model of accounting. In

addition to this, people in the groups of users founds that the open gate offered by the

framework is not adequate.

Furthermore, the nonprofit organizations are also considerably impacted by the new

conceptual framework. The accounting doctrines for the sectors operating in Australia is

formulated by the Australian regulatory requirements. In light of the enforcements brought

down by the conceptual framework, the nonprofit organizations would be considerably

impacted.

Answer to requirement b)

The application of the conceptual framework is of great concern to the accounting

profession in Australia. The introduction of the new conceptual framework has provided

benefits and comes with constraints too that is of concern to many accounting professions.

The initiation of the conceptual framework has accounted to the volatility in accounting for

fair value that is attributed to rising lobbying in the country. It has been identified that the

valuation of the intangible assets and financial instruments has been adversely impacted by

the volatility in such fair value accounting. In addition to this, the conceptual framework has

considerably impacted the procedures of recognition, measurement and the disclosures

policies of the liabilities and assets. This disadvantage concerned with the valuation of the

financial items because it needs to take into economic factors and it has been found that the

accounting model has certain economic consequences which might impact the financial

performance of the company. The contention that might arise between the accounting

measures and the framework that is used for the inception of the conceptual framework is

another disadvantage. Such contention is attributable to the distinction in the practices

endorsed by the recent conceptual framework and the former model of accounting. In

addition to this, people in the groups of users founds that the open gate offered by the

framework is not adequate.

Furthermore, the nonprofit organizations are also considerably impacted by the new

conceptual framework. The accounting doctrines for the sectors operating in Australia is

formulated by the Australian regulatory requirements. In light of the enforcements brought

down by the conceptual framework, the nonprofit organizations would be considerably

impacted.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ACCOUNTING THEORY AND CONTEMPORARY ISSUES

Answer to requirement c)

The evaluation of the financial reporting quality is dependent upon the qualitative

characteristics that requires the company to maintain the provision of depicting quality

information so that they represent the true and fair information on the performance of the

company. Relevance is another essential characteristics that is used for satisfying the users of

the financial report about the information present in the financial report on the basis of which

they make investment decision. The proposed conceptual framework fails to examine the

potential benefits on the information for allowing the related liabilities and assets and

measuring expenses and income that are measured as a consequence despite the fact that the

basis of measurement of liabilities and assets do not respond to the current value. With regard

to the standard IAS 39, requires the measurement of the instrument of the fair value. Since

the entity has access to different market, there exist difference between the fair value in

orderly transactions and price paid by entity for financial instruments. There is no benefit for

the organization in having a different basis of measurement in the initial measurement.

It is sometimes difficult for the entity to measure the liabilities and assets at value

other than the current value and this adds to the difficulty in measuring the cost. As the cost is

inherently difficult to measure and there can be informational benefits in measuring the

current values. Furthermore, in the events of clash of accounting guidelines, there is some

disruption in the quality of the accounting standards followed by the company. Therefore, it

can be inferred that the quality of the conceptual framework is impacted by the facts

accounted in the significant issues.

Answer to requirement d)

Requirement i)

Answer to requirement c)

The evaluation of the financial reporting quality is dependent upon the qualitative

characteristics that requires the company to maintain the provision of depicting quality

information so that they represent the true and fair information on the performance of the

company. Relevance is another essential characteristics that is used for satisfying the users of

the financial report about the information present in the financial report on the basis of which

they make investment decision. The proposed conceptual framework fails to examine the

potential benefits on the information for allowing the related liabilities and assets and

measuring expenses and income that are measured as a consequence despite the fact that the

basis of measurement of liabilities and assets do not respond to the current value. With regard

to the standard IAS 39, requires the measurement of the instrument of the fair value. Since

the entity has access to different market, there exist difference between the fair value in

orderly transactions and price paid by entity for financial instruments. There is no benefit for

the organization in having a different basis of measurement in the initial measurement.

It is sometimes difficult for the entity to measure the liabilities and assets at value

other than the current value and this adds to the difficulty in measuring the cost. As the cost is

inherently difficult to measure and there can be informational benefits in measuring the

current values. Furthermore, in the events of clash of accounting guidelines, there is some

disruption in the quality of the accounting standards followed by the company. Therefore, it

can be inferred that the quality of the conceptual framework is impacted by the facts

accounted in the significant issues.

Answer to requirement d)

Requirement i)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ACCOUNTING THEORY AND CONTEMPORARY ISSUES

From the financial report of Ausdrill limited, it is found that the general purpose

financial statements have been prepared according to the requirement and the interpretations

of the AASB along with complying with the IFRS issued by the IASB. While preparing the

financial statements, organization has adopted the principle and guidance of the conceptual

framework. Ausdrill limited has prepared the statements such as consolidated statement of

profit and loss, consolidated statement of comprehensive income, consolidated statement of

cash flow consolidated statement of financial position and consolidated statement of changes

in equity. The components of the statement of financial position of Ausdrill limited include

total assets and total liabilities that comprises of current and non-current assets and liabilities.

Statement of comprehensive income include items of other comprehensive income, profit and

loss and equity holders. On other hand, consolidated statement of changes in equity involves

components such as total comprehensive income and the items involved in the transactions in

their owner capacity. Cash flow statement consist of the items involved in the cash flow from

operating activities, financing activities sand the investment activities. The disclosure of the

accounting treatments related to all the components and the financial items of different

financial statements has been adequately disclosed in the notes to financial statement

(Ausdrill.com.au, 2019).

Requirement ii)

Ausdrill limited has recognized the revenue in accordance with the standard AASB

115 revenue from contract with customers which is based on the principle that recognition of

revenue is done when the control of service and goods is transferred to the customers.

Recognition of revenue is done at fair value and this is done when it is reliable to measure the

revenue. The standard requires the company to make additional disclosure by seperatey

presenting the cost and assets. The impact of applying the new standard on the financial

statement of the group has been assessed by the company. It has been found from the

From the financial report of Ausdrill limited, it is found that the general purpose

financial statements have been prepared according to the requirement and the interpretations

of the AASB along with complying with the IFRS issued by the IASB. While preparing the

financial statements, organization has adopted the principle and guidance of the conceptual

framework. Ausdrill limited has prepared the statements such as consolidated statement of

profit and loss, consolidated statement of comprehensive income, consolidated statement of

cash flow consolidated statement of financial position and consolidated statement of changes

in equity. The components of the statement of financial position of Ausdrill limited include

total assets and total liabilities that comprises of current and non-current assets and liabilities.

Statement of comprehensive income include items of other comprehensive income, profit and

loss and equity holders. On other hand, consolidated statement of changes in equity involves

components such as total comprehensive income and the items involved in the transactions in

their owner capacity. Cash flow statement consist of the items involved in the cash flow from

operating activities, financing activities sand the investment activities. The disclosure of the

accounting treatments related to all the components and the financial items of different

financial statements has been adequately disclosed in the notes to financial statement

(Ausdrill.com.au, 2019).

Requirement ii)

Ausdrill limited has recognized the revenue in accordance with the standard AASB

115 revenue from contract with customers which is based on the principle that recognition of

revenue is done when the control of service and goods is transferred to the customers.

Recognition of revenue is done at fair value and this is done when it is reliable to measure the

revenue. The standard requires the company to make additional disclosure by seperatey

presenting the cost and assets. The impact of applying the new standard on the financial

statement of the group has been assessed by the company. It has been found from the

ACCOUNTING THEORY AND CONTEMPORARY ISSUES

assessment that the consolidated financial statements would not be impacted by the

application of the new standard (Ausdrill.com.au, 2019).

The financial liabilities and assets of the company is measured using a fair value

hierarchy that explains the estimates and judgment in determining the fair value of the

financial instruments. The financial instruments have been classified into three levels for

determining the level of fair value. Assets on other hand is measured and valued according to

the requirement of the relevant accounting standards. The measurement, classification and

recognition of the financial liabilities and assets is done according to AASB 9. Classification

and measurement of the equity that is available for sale is addressed by AASB 9 and there

would not be any change in the accounting for assets (Ausdrill.com.au, 2019).

Requirement iii)

The preparation of the financial statements of the group in accordance with the

relevance accounting standards has contributed in presentation of the relevant information. It

has also been opined by the auditors that the financial statement represents a true and fair

view of the financial figures depicted in the financial report of the company (Ausdrill.com.au,

2019). It can therefore inferred that the financial statements presents relevant information that

assist users in their decision making process.

Part B: Integrated/Sustainability reporting

Answer to requirement a)

The development of social and environmental is ensured by the framework of both the

Global reporting initiative and the IIRC (International integrated reporting framework) and

therefore, both the framework has got the same objective. Nevertheless, there are differences

between the procedure adopted by these two reporting framework. Integrated reporting

assessment that the consolidated financial statements would not be impacted by the

application of the new standard (Ausdrill.com.au, 2019).

The financial liabilities and assets of the company is measured using a fair value

hierarchy that explains the estimates and judgment in determining the fair value of the

financial instruments. The financial instruments have been classified into three levels for

determining the level of fair value. Assets on other hand is measured and valued according to

the requirement of the relevant accounting standards. The measurement, classification and

recognition of the financial liabilities and assets is done according to AASB 9. Classification

and measurement of the equity that is available for sale is addressed by AASB 9 and there

would not be any change in the accounting for assets (Ausdrill.com.au, 2019).

Requirement iii)

The preparation of the financial statements of the group in accordance with the

relevance accounting standards has contributed in presentation of the relevant information. It

has also been opined by the auditors that the financial statement represents a true and fair

view of the financial figures depicted in the financial report of the company (Ausdrill.com.au,

2019). It can therefore inferred that the financial statements presents relevant information that

assist users in their decision making process.

Part B: Integrated/Sustainability reporting

Answer to requirement a)

The development of social and environmental is ensured by the framework of both the

Global reporting initiative and the IIRC (International integrated reporting framework) and

therefore, both the framework has got the same objective. Nevertheless, there are differences

between the procedure adopted by these two reporting framework. Integrated reporting

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ACCOUNTING THEORY AND CONTEMPORARY ISSUES

framework concentrates on the disclosure of both the financial and non-financial information

by combining them and presenting it in the annual report of the company. Such disclosure

provides greater value to the shareholders by enhancing their process of decision making as it

makes the information more transparent. With the implementation of the global reporting

initiative, it is required by the business to communicate the impact of their sustainability

issues such as governance, human rights and climate change. The disclosure of the

sustainability information helps in identification and management of risks by enabling

organizations to seize risks. Reporting of the information using the platform of global

reporting initiative helps the organization in economically thriving and improving the society

and environment at the same time (Vaz et al., 2016).

Answer to requirement b)

It is observed that according to the sustainability reporting, the framework of

conventional accounting is subjected to the number of shortcomings and advantages. One of

the benefits over the traditional system of reporting is that it helps in the combination of both

the financial as well as non-financial assets. The impacts created on the busies due to the

operational activities brought by the environmental performance helps the stakeholders in

providing insight about the strategies undertaken by the company as disclosed by the

sustainability reporting. Furthermore, it has been found from that there are some drawback

associated with the reporting of system because it has the chances of misrepresenting the

information’s presented in the annual report of the company (Linsmeier, 2016).

The whole accounting system imbibes the concepts of integrated thinking by

combining the financial and non-financial information as against the integrated framework of

reporting. Such integrated reporting helps stakeholders by proving information and thereby

contributing to the clarification and transparency on the information presented in the report.

framework concentrates on the disclosure of both the financial and non-financial information

by combining them and presenting it in the annual report of the company. Such disclosure

provides greater value to the shareholders by enhancing their process of decision making as it

makes the information more transparent. With the implementation of the global reporting

initiative, it is required by the business to communicate the impact of their sustainability

issues such as governance, human rights and climate change. The disclosure of the

sustainability information helps in identification and management of risks by enabling

organizations to seize risks. Reporting of the information using the platform of global

reporting initiative helps the organization in economically thriving and improving the society

and environment at the same time (Vaz et al., 2016).

Answer to requirement b)

It is observed that according to the sustainability reporting, the framework of

conventional accounting is subjected to the number of shortcomings and advantages. One of

the benefits over the traditional system of reporting is that it helps in the combination of both

the financial as well as non-financial assets. The impacts created on the busies due to the

operational activities brought by the environmental performance helps the stakeholders in

providing insight about the strategies undertaken by the company as disclosed by the

sustainability reporting. Furthermore, it has been found from that there are some drawback

associated with the reporting of system because it has the chances of misrepresenting the

information’s presented in the annual report of the company (Linsmeier, 2016).

The whole accounting system imbibes the concepts of integrated thinking by

combining the financial and non-financial information as against the integrated framework of

reporting. Such integrated reporting helps stakeholders by proving information and thereby

contributing to the clarification and transparency on the information presented in the report.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ACCOUNTING THEORY AND CONTEMPORARY ISSUES

This would help the investors in making viable investment decisions which would thereby

contribute to the development and profitability position of the company. The definition of the

performance measure has encountered several issues as witnessed by the traditional

accounting system (Velte & Stawinoga, 2017).

Answer to requirement c)

The contents of integrated and sustainability reports can be described by the

application of some theories presented underneath:

Sustainability reporting- The two theories that can be applied to describing the

concepts of sustainability reporting is legitimacy and stakeholder theory. The stakeholder

theory tracks the behavior and attitude of managers and accounts for the business ethics that

is taken for the multiple constituencies and therefore it outlines the managers’ responsibility

in [preparing the financial report. Legitimacy theory on other hand mandates the organization

to perform sustainably by disclosing their environmental and social performance (Burke &

Clark, 2016). Therefore, from the analysis of both the theories, it can be inferred that the

company does reporting of their environmental and social performance as it provides a

detailed disclosure of the information.

Integrated reporting- The two theories that helps in explaining the concept of

integrated reporting is stakeholder and agency theory. It is required by the organization to

account the needs of all the stakeholders together so that their wealth can be maximized

altogether. This can be done by the presented of integrated information that comprise of

financial as well as non-financial information. As per the agency theory, management of the

organization is regarded as the agent of the stakeholder and it is their responsibility to report

on the sustainability performance as well because it forms the basis of investment decision

(Flower, 2015).

This would help the investors in making viable investment decisions which would thereby

contribute to the development and profitability position of the company. The definition of the

performance measure has encountered several issues as witnessed by the traditional

accounting system (Velte & Stawinoga, 2017).

Answer to requirement c)

The contents of integrated and sustainability reports can be described by the

application of some theories presented underneath:

Sustainability reporting- The two theories that can be applied to describing the

concepts of sustainability reporting is legitimacy and stakeholder theory. The stakeholder

theory tracks the behavior and attitude of managers and accounts for the business ethics that

is taken for the multiple constituencies and therefore it outlines the managers’ responsibility

in [preparing the financial report. Legitimacy theory on other hand mandates the organization

to perform sustainably by disclosing their environmental and social performance (Burke &

Clark, 2016). Therefore, from the analysis of both the theories, it can be inferred that the

company does reporting of their environmental and social performance as it provides a

detailed disclosure of the information.

Integrated reporting- The two theories that helps in explaining the concept of

integrated reporting is stakeholder and agency theory. It is required by the organization to

account the needs of all the stakeholders together so that their wealth can be maximized

altogether. This can be done by the presented of integrated information that comprise of

financial as well as non-financial information. As per the agency theory, management of the

organization is regarded as the agent of the stakeholder and it is their responsibility to report

on the sustainability performance as well because it forms the basis of investment decision

(Flower, 2015).

ACCOUNTING THEORY AND CONTEMPORARY ISSUES

Answer to requirement d)

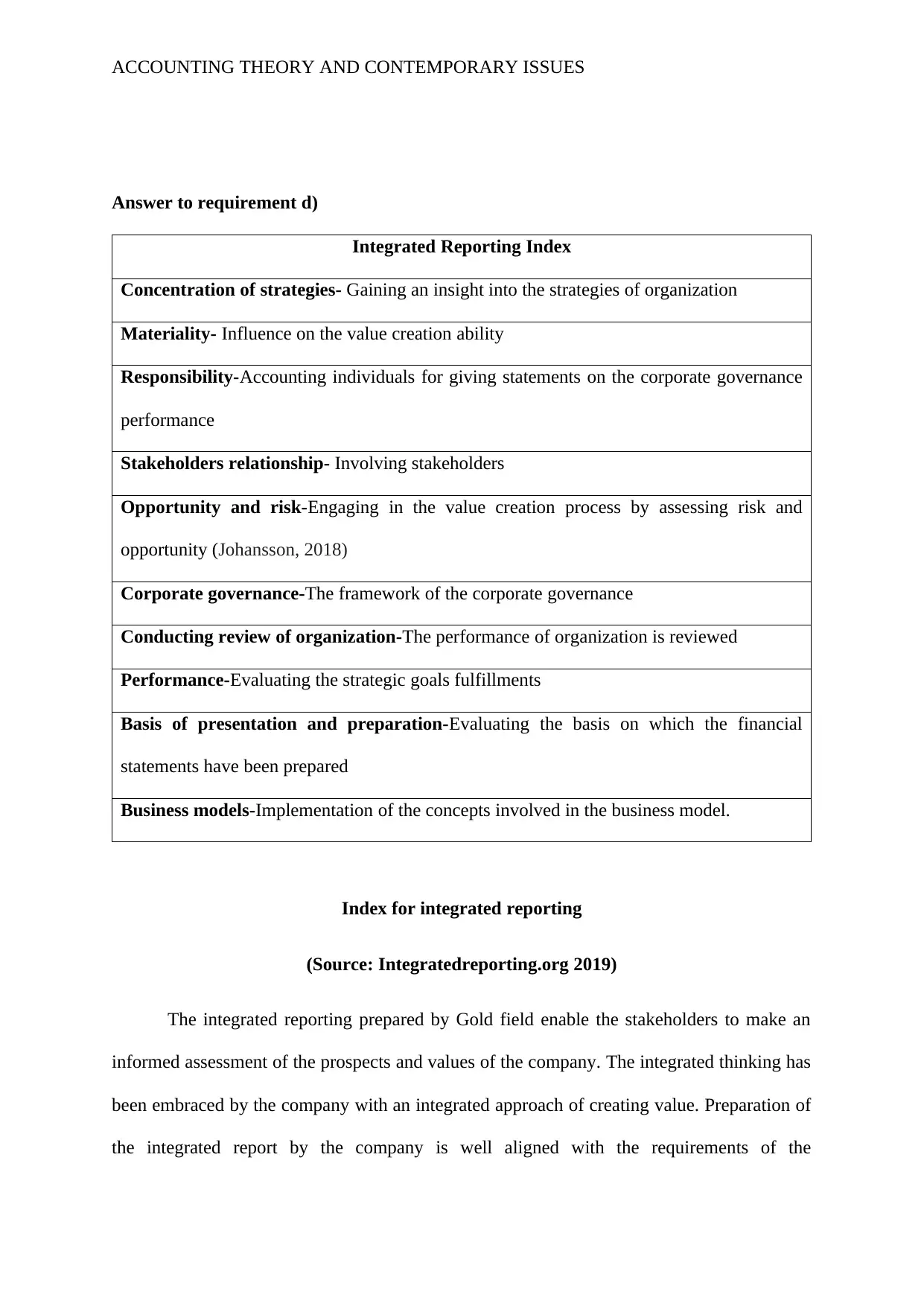

Integrated Reporting Index

Concentration of strategies- Gaining an insight into the strategies of organization

Materiality- Influence on the value creation ability

Responsibility-Accounting individuals for giving statements on the corporate governance

performance

Stakeholders relationship- Involving stakeholders

Opportunity and risk-Engaging in the value creation process by assessing risk and

opportunity (Johansson, 2018)

Corporate governance-The framework of the corporate governance

Conducting review of organization-The performance of organization is reviewed

Performance-Evaluating the strategic goals fulfillments

Basis of presentation and preparation-Evaluating the basis on which the financial

statements have been prepared

Business models-Implementation of the concepts involved in the business model.

Index for integrated reporting

(Source: Integratedreporting.org 2019)

The integrated reporting prepared by Gold field enable the stakeholders to make an

informed assessment of the prospects and values of the company. The integrated thinking has

been embraced by the company with an integrated approach of creating value. Preparation of

the integrated report by the company is well aligned with the requirements of the

Answer to requirement d)

Integrated Reporting Index

Concentration of strategies- Gaining an insight into the strategies of organization

Materiality- Influence on the value creation ability

Responsibility-Accounting individuals for giving statements on the corporate governance

performance

Stakeholders relationship- Involving stakeholders

Opportunity and risk-Engaging in the value creation process by assessing risk and

opportunity (Johansson, 2018)

Corporate governance-The framework of the corporate governance

Conducting review of organization-The performance of organization is reviewed

Performance-Evaluating the strategic goals fulfillments

Basis of presentation and preparation-Evaluating the basis on which the financial

statements have been prepared

Business models-Implementation of the concepts involved in the business model.

Index for integrated reporting

(Source: Integratedreporting.org 2019)

The integrated reporting prepared by Gold field enable the stakeholders to make an

informed assessment of the prospects and values of the company. The integrated thinking has

been embraced by the company with an integrated approach of creating value. Preparation of

the integrated report by the company is well aligned with the requirements of the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.