ACCT20074: Analysis of Conceptual Framework and Reporting Practices

VerifiedAdded on 2023/04/04

|21

|4336

|411

Report

AI Summary

This report provides a critical analysis of the conceptual framework for financial reporting, examining its history, development, and application in various contexts. Part A focuses on the conceptual framework's evolution in the USA, UK, Australia, and globally under the IASB, addressing concerns from the Australian accounting profession and academics regarding its quality, benefits, and limitations. It also explores how Jupiter Mines (JMS), an Australian company in the Material Sector, applies this framework in its financial reporting, detailing the statements prepared and the recognition principles used for revenue, assets, and liabilities. Part B compares the international integrated reporting system against the sustainability reporting protocol, analyzing the strengths and limitations of conventional accounting. It further evaluates the reporting practices of Kumba Iron Ore Limited against its integrated reporting, providing a comprehensive overview of sustainability guidelines and integrated reporting theories. Desklib offers a wealth of similar reports and study resources for students.

Running head: CONTEMPORARY ACCOUNTING THEORY 1

ACCT20074 Contemporary Accounting Theory (Part A and B)

Student’s Name

Institution Affiliation

Date

ACCT20074 Contemporary Accounting Theory (Part A and B)

Student’s Name

Institution Affiliation

Date

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

CONTEMPORARY ACCOUNTING THEORY 2

1. Executive Summary

Concepts Statement, which is also known as Conceptual Frameworks, is a field of

accounting composed of inter-related fundamentals and objectives. The main objective of

these frameworks is identifying the purposes or goals of various financial fundamentals and

reporting of various companies, which evaluate the critical concepts used to achieve specific

objectives. In that case, this critical analysis, in part A, provides an evaluation of conceptual

framework and how the Jupiter Mines (JMS), in the Material Sector, utilizes this framework

in the selection of financial statements, circumstances and evens, which are speculated to be

reported or summarized. The section B of this paper compares the international integrated

reporting system against the sustainability reporting protocol, including the analysis of the

relevant limitations and strengths of conventional accounting in reference to the conceptual

framework. To effectively comprehend the rational of this report, theories will be applied to

illustrate and define the sustainability guidelines and integrated reporting. Lastly, the paper

will critically compare and evaluate the reporting practices of the Kumba Iron Ore Limited,

on an index, against the company’s integrated reporting.

1. Executive Summary

Concepts Statement, which is also known as Conceptual Frameworks, is a field of

accounting composed of inter-related fundamentals and objectives. The main objective of

these frameworks is identifying the purposes or goals of various financial fundamentals and

reporting of various companies, which evaluate the critical concepts used to achieve specific

objectives. In that case, this critical analysis, in part A, provides an evaluation of conceptual

framework and how the Jupiter Mines (JMS), in the Material Sector, utilizes this framework

in the selection of financial statements, circumstances and evens, which are speculated to be

reported or summarized. The section B of this paper compares the international integrated

reporting system against the sustainability reporting protocol, including the analysis of the

relevant limitations and strengths of conventional accounting in reference to the conceptual

framework. To effectively comprehend the rational of this report, theories will be applied to

illustrate and define the sustainability guidelines and integrated reporting. Lastly, the paper

will critically compare and evaluate the reporting practices of the Kumba Iron Ore Limited,

on an index, against the company’s integrated reporting.

CONTEMPORARY ACCOUNTING THEORY 3

2. Introduction

The framework documentation is mandated to present the fundamental concepts,

which underlie and govern the presentation and preparation of a company’s financial

statements. These statements are utilized by external users to formulate a Conceptual

Framework (CF) fundamental for financial evaluation. Thus, it relevant to comprehend the

documentation serves a critical aim of assisting the IASB to formulate revised financial

standards, which is relevant for financial statements applicable by companies when applying

financial protocols or handling problems evident in the compliance activities to specific

accounting standards. In that regard, this paper analyses the conceptual framework purposed

for financial reporting and its relevance and application in an Australian Company i.e. The

Jupiter Mines (JMS). The second paper of this paper will evaluate the sustainability and

integrated reporting frameworks applicable in a South African Company i.e. The Kumba Iron

Ore Limited.

3. Part A

a) Review of the history and development of the Conceptual Framework for

Financial Reporting

The development of the Conceptual Framework in the US, UK and globally started in

1976 and introduced by the FASB in the United States. This framework was formulated as a

basic for outlaying the relevant financial rules and mitigating the present accounting reporting

issues. From 1978 to 2010, the governing entity has issues 8 accounting statements regarding

the relevant financial reporting applied by various companies, including one SFAC No. 4,

which is a reporting that applies to non-business enterprises. However, SFACs No. 1, 2 and 3

have already been replaced, which leave only 5 as valid SFAC Nos. The reporting is the

SFAC No. 4, which represent the belated frameworks considered by the International

2. Introduction

The framework documentation is mandated to present the fundamental concepts,

which underlie and govern the presentation and preparation of a company’s financial

statements. These statements are utilized by external users to formulate a Conceptual

Framework (CF) fundamental for financial evaluation. Thus, it relevant to comprehend the

documentation serves a critical aim of assisting the IASB to formulate revised financial

standards, which is relevant for financial statements applicable by companies when applying

financial protocols or handling problems evident in the compliance activities to specific

accounting standards. In that regard, this paper analyses the conceptual framework purposed

for financial reporting and its relevance and application in an Australian Company i.e. The

Jupiter Mines (JMS). The second paper of this paper will evaluate the sustainability and

integrated reporting frameworks applicable in a South African Company i.e. The Kumba Iron

Ore Limited.

3. Part A

a) Review of the history and development of the Conceptual Framework for

Financial Reporting

The development of the Conceptual Framework in the US, UK and globally started in

1976 and introduced by the FASB in the United States. This framework was formulated as a

basic for outlaying the relevant financial rules and mitigating the present accounting reporting

issues. From 1978 to 2010, the governing entity has issues 8 accounting statements regarding

the relevant financial reporting applied by various companies, including one SFAC No. 4,

which is a reporting that applies to non-business enterprises. However, SFACs No. 1, 2 and 3

have already been replaced, which leave only 5 as valid SFAC Nos. The reporting is the

SFAC No. 4, which represent the belated frameworks considered by the International

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

CONTEMPORARY ACCOUNTING THEORY 4

Accounting Standards Committee (IASC). This accounting body was established in 1973,

which represented a predecessor entity of the accounting standards body globally. By 1st

April 2010, the accounting entity (IASB) assumed the role of IASC obliged to set out the

global accounting frameworks, despite the current standards being reference to as the

International Financial Reporting Standards (IFRS) (Timbate & Park, 2018). In 1975, the

entity presented its initial reporting of the IAS, which represented the accounting policy

disclosure (Crombie, 2012). The IASC presented its 28th IAS by April 1989, which

represented the financial statements for investment in the relevant associates. In that case, the

conceptual framework developed for the presentation and preparation of accounting

frameworks had been approved by April 1989 by the IASC.

This CF, in United Kingdom, was therefore published in 1989 and applied by the

IASB in 2001, despite its relevance in formulating and unindustrialized the IAS framework.

For the purpose of delayed issuance of the standard, the fundamental purpose of the CF is to

assist the financial entity to formulate International Accounting Standards in the future; and

allow the review of the present Standards paragraphs (IASB, 2010b and B1713) signifying

this framework. The accounting body committed itself into an agreement with the United

States’ FASB, which was referred as the 2nd Norwalk Agreement by 2002; and mandating

that two accounting entities would principally consider removing its present differences and

merge on the basis of the quality conceptual framework (Ehoff, 2010).

As for Australia, the CF was formulated by the AASB and AARF dated from 1985 to

1995. The accounting concepts considering the financial statement had been delivered before

2002, the moment when FRC decide to implement the International Accounting Standard in

Australia (Ehoff, 2010). The accounting statements included SAC 1, 2, 3 and 4.

Accounting Standards Committee (IASC). This accounting body was established in 1973,

which represented a predecessor entity of the accounting standards body globally. By 1st

April 2010, the accounting entity (IASB) assumed the role of IASC obliged to set out the

global accounting frameworks, despite the current standards being reference to as the

International Financial Reporting Standards (IFRS) (Timbate & Park, 2018). In 1975, the

entity presented its initial reporting of the IAS, which represented the accounting policy

disclosure (Crombie, 2012). The IASC presented its 28th IAS by April 1989, which

represented the financial statements for investment in the relevant associates. In that case, the

conceptual framework developed for the presentation and preparation of accounting

frameworks had been approved by April 1989 by the IASC.

This CF, in United Kingdom, was therefore published in 1989 and applied by the

IASB in 2001, despite its relevance in formulating and unindustrialized the IAS framework.

For the purpose of delayed issuance of the standard, the fundamental purpose of the CF is to

assist the financial entity to formulate International Accounting Standards in the future; and

allow the review of the present Standards paragraphs (IASB, 2010b and B1713) signifying

this framework. The accounting body committed itself into an agreement with the United

States’ FASB, which was referred as the 2nd Norwalk Agreement by 2002; and mandating

that two accounting entities would principally consider removing its present differences and

merge on the basis of the quality conceptual framework (Ehoff, 2010).

As for Australia, the CF was formulated by the AASB and AARF dated from 1985 to

1995. The accounting concepts considering the financial statement had been delivered before

2002, the moment when FRC decide to implement the International Accounting Standard in

Australia (Ehoff, 2010). The accounting statements included SAC 1, 2, 3 and 4.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

CONTEMPORARY ACCOUNTING THEORY 5

Following the joint project in 2004, the accounting bodies (FASB and IASB) had

agreed to include respective key components and concerns as an interlinked project to

formulate a single Conceptual Framework. This initiative as governed and established based

on the original FASB’s conceptual framework and the IASB’s framework. All the two boards

utilized the developed framework as a foundation of their accounting standards for financial

report.

b) Explanation of Australian accounting profession’s concerns regarding

Conceptual Framework

The Australian accounting profession has a different concern regarding the CF. The

Quasi-legislation denotes that the necessity for the Constitution-centred CF in Australia

makes it nearly impossible to ensure that documented accounting frameworks are consistent

and have been formulated logically (Chen, Ahmad & Kalra, 2018). According to Graymore

(2014), despite the fact that it is seemingly convenient to evaluate the fundamentals of

accounting in the term ‘objectives’ of the relevant accounting statements, the professions

claims that the looseness of the standards in Australia has presented more potential

accounting problems. The Australian Accounting Profession is more concerned with

evaluation the CF functions instead of its objectives in the evaluation of an entity’s financial

statements (Alfiero, Cane, Doronzo & Esposito, 2018). This further implies that the

professions currently rejects the reference and reasoning lines of CF on the basis on

accounting ’objectives’ in the evaluation of financial statements. As argued by Ehoff (2010),

the main reason for this is that the existence of CF is to establish the under-pinning

accounting frameworks, which enables the company to attain short-term accounting

objectives.

Following the joint project in 2004, the accounting bodies (FASB and IASB) had

agreed to include respective key components and concerns as an interlinked project to

formulate a single Conceptual Framework. This initiative as governed and established based

on the original FASB’s conceptual framework and the IASB’s framework. All the two boards

utilized the developed framework as a foundation of their accounting standards for financial

report.

b) Explanation of Australian accounting profession’s concerns regarding

Conceptual Framework

The Australian accounting profession has a different concern regarding the CF. The

Quasi-legislation denotes that the necessity for the Constitution-centred CF in Australia

makes it nearly impossible to ensure that documented accounting frameworks are consistent

and have been formulated logically (Chen, Ahmad & Kalra, 2018). According to Graymore

(2014), despite the fact that it is seemingly convenient to evaluate the fundamentals of

accounting in the term ‘objectives’ of the relevant accounting statements, the professions

claims that the looseness of the standards in Australia has presented more potential

accounting problems. The Australian Accounting Profession is more concerned with

evaluation the CF functions instead of its objectives in the evaluation of an entity’s financial

statements (Alfiero, Cane, Doronzo & Esposito, 2018). This further implies that the

professions currently rejects the reference and reasoning lines of CF on the basis on

accounting ’objectives’ in the evaluation of financial statements. As argued by Ehoff (2010),

the main reason for this is that the existence of CF is to establish the under-pinning

accounting frameworks, which enables the company to attain short-term accounting

objectives.

CONTEMPORARY ACCOUNTING THEORY 6

c) Discussion of academic’s concerns about the quality (potential benefits and

limitations) of the Conceptual Framework

The CF has potential benefits and limitations to consider as an academic concern.

Academic are concerned with accounting logic and consistency, which implies that

accounting standards established following the application of CF should be logical and

consistent (Ehoff, 2010).

Since many nations have established CF, which is similar globally (or might have

alternatively adopted the IASC frameworks), there is the need for countries to embrace

considerable global compatibility on the basic of various accounting standards (Prosic, 2015).

In that case, academic’s concern on quality features on the standard’s comparability and

consistency over the global financial reporting (whereby professions argues that it is relevant

for the evaluation of foreign investment capitals and flows. CF provides the global

fundamentals of accounting systems. In that case, the standard-setters are expected to be

accountable for all their financial decisions (Romolini, Fissi & Gori, 2017). In case these

decisions are retrieved from key concerns evaluated in the CF, the accounting professions

expect the standards to be clear thereby necessitating more explanation prior the

implementation.

The CF establishes an appropriate methodology of communicating the fundamental

concepts based on the present financial reports. Therefore, this framework provides the best

guidance for entities to reports on particular accounting standards and evaluation any

financial concern (Crombie, 2012). Accounting-setters will experience minimal political

pressure during the formulation of more accounting standards since the relevant concerns like

the objectives of financial reports, criterion to recognition have been considered following the

establishment of the CF (Alfiero, Cane, Doronzo & Esposito, 2018).

c) Discussion of academic’s concerns about the quality (potential benefits and

limitations) of the Conceptual Framework

The CF has potential benefits and limitations to consider as an academic concern.

Academic are concerned with accounting logic and consistency, which implies that

accounting standards established following the application of CF should be logical and

consistent (Ehoff, 2010).

Since many nations have established CF, which is similar globally (or might have

alternatively adopted the IASC frameworks), there is the need for countries to embrace

considerable global compatibility on the basic of various accounting standards (Prosic, 2015).

In that case, academic’s concern on quality features on the standard’s comparability and

consistency over the global financial reporting (whereby professions argues that it is relevant

for the evaluation of foreign investment capitals and flows. CF provides the global

fundamentals of accounting systems. In that case, the standard-setters are expected to be

accountable for all their financial decisions (Romolini, Fissi & Gori, 2017). In case these

decisions are retrieved from key concerns evaluated in the CF, the accounting professions

expect the standards to be clear thereby necessitating more explanation prior the

implementation.

The CF establishes an appropriate methodology of communicating the fundamental

concepts based on the present financial reports. Therefore, this framework provides the best

guidance for entities to reports on particular accounting standards and evaluation any

financial concern (Crombie, 2012). Accounting-setters will experience minimal political

pressure during the formulation of more accounting standards since the relevant concerns like

the objectives of financial reports, criterion to recognition have been considered following the

establishment of the CF (Alfiero, Cane, Doronzo & Esposito, 2018).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

CONTEMPORARY ACCOUNTING THEORY 7

A portion of the limitations that have been related to conceptual frameworks of

bookkeeping include: Conceptual frameworks are outrageous to formulate; the enhancement

of the CF is affected by the governmental actions (Ehoff, 2010). With this, some accountants

present the concern that CFs is more inclined to political procedures; Linked to the limitation

outlined above, whenever the CF considers involving accounting concerns, there is always an

issue of financial estimation of given assets as argued by (Molyneux & Wilson, 2017). The

CFs considers more on financial-related matters. In that case, this framework will consider

disregarding various execution segments such as ecological and social revealing components

(Alfiero, Cane, Doronzo & Esposito, 2018).. Moreover, through the evaluation of financial

execution, CFs critically transits the consideration of financial analysts based on corporate

execution.

d) Explanation of how the conceptual framework has been applied by the selected

Australian Company

(i) How many statements/reports have been prepared as per the Conceptual Framework

and what are their major components

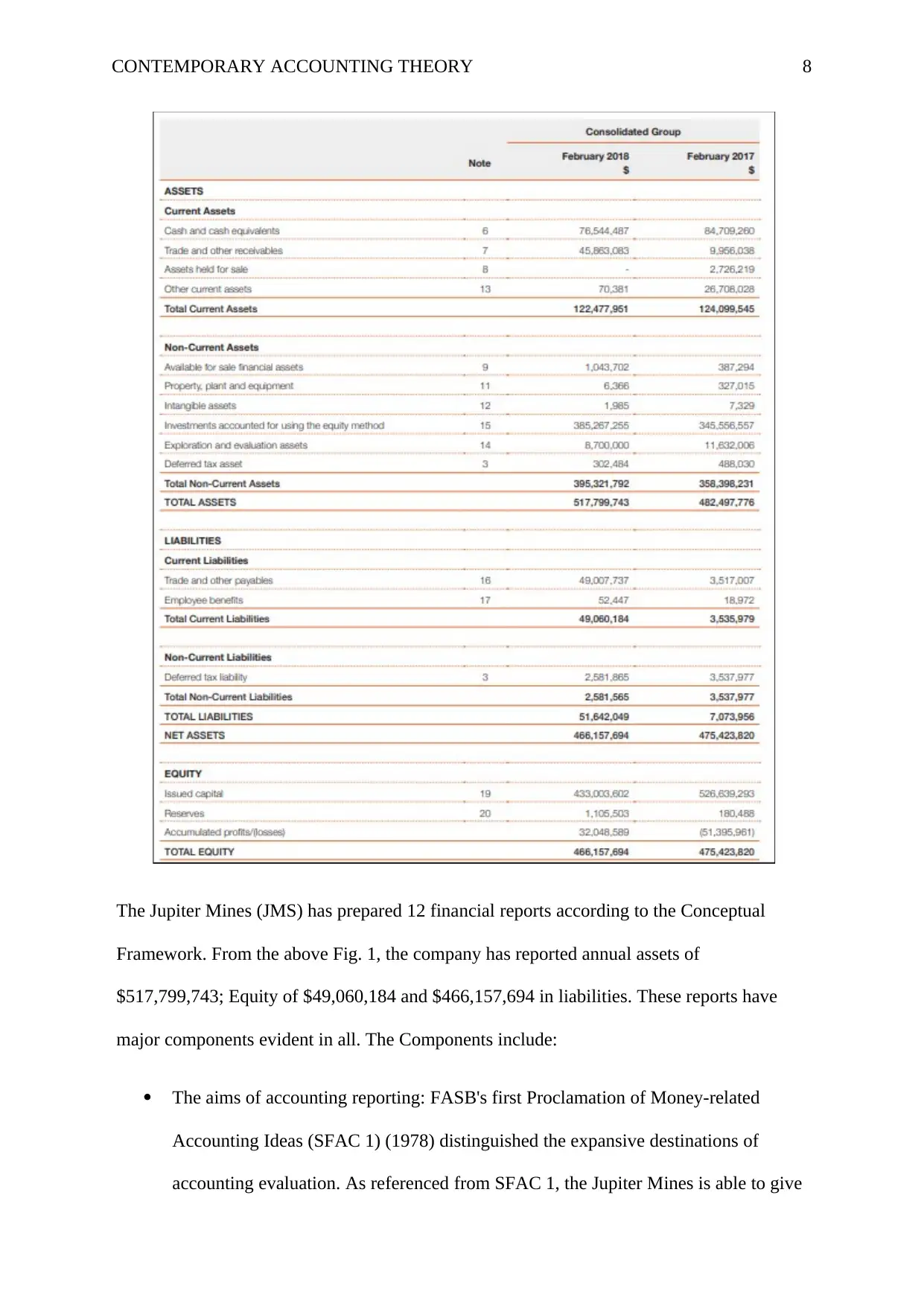

Fig. 1: Consolidate Financial Statement Position of JMS (28th Feb 2018)

A portion of the limitations that have been related to conceptual frameworks of

bookkeeping include: Conceptual frameworks are outrageous to formulate; the enhancement

of the CF is affected by the governmental actions (Ehoff, 2010). With this, some accountants

present the concern that CFs is more inclined to political procedures; Linked to the limitation

outlined above, whenever the CF considers involving accounting concerns, there is always an

issue of financial estimation of given assets as argued by (Molyneux & Wilson, 2017). The

CFs considers more on financial-related matters. In that case, this framework will consider

disregarding various execution segments such as ecological and social revealing components

(Alfiero, Cane, Doronzo & Esposito, 2018).. Moreover, through the evaluation of financial

execution, CFs critically transits the consideration of financial analysts based on corporate

execution.

d) Explanation of how the conceptual framework has been applied by the selected

Australian Company

(i) How many statements/reports have been prepared as per the Conceptual Framework

and what are their major components

Fig. 1: Consolidate Financial Statement Position of JMS (28th Feb 2018)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

CONTEMPORARY ACCOUNTING THEORY 8

The Jupiter Mines (JMS) has prepared 12 financial reports according to the Conceptual

Framework. From the above Fig. 1, the company has reported annual assets of

$517,799,743; Equity of $49,060,184 and $466,157,694 in liabilities. These reports have

major components evident in all. The Components include:

The aims of accounting reporting: FASB's first Proclamation of Money-related

Accounting Ideas (SFAC 1) (1978) distinguished the expansive destinations of

accounting evaluation. As referenced from SFAC 1, the Jupiter Mines is able to give

The Jupiter Mines (JMS) has prepared 12 financial reports according to the Conceptual

Framework. From the above Fig. 1, the company has reported annual assets of

$517,799,743; Equity of $49,060,184 and $466,157,694 in liabilities. These reports have

major components evident in all. The Components include:

The aims of accounting reporting: FASB's first Proclamation of Money-related

Accounting Ideas (SFAC 1) (1978) distinguished the expansive destinations of

accounting evaluation. As referenced from SFAC 1, the Jupiter Mines is able to give

CONTEMPORARY ACCOUNTING THEORY 9

data that is helpful to present to potential speculators and different clients in making

the balanced venture, credit, and comparable choices. From this starting point in

SFAC 1, the JMS communicated other progressively explicit targets.

The company has applied the CF into its efforts to determine the Fundamentals of Useful

Financial Data: The second component in the conceptual framework, according to the

company’s financial report is the characteristics (or subjective attributes) that budgetary data

ought to have in the event that it is to be valuable in basic leadership. In SFAC 2, the FASB

said that data is helpful on the off chance that it is (I) important, (ii) dependable, and (iii)

tantamount (Carnevale & Mazzuca, 2012). Data is pertinent on the off chance that it can have

any kind of effect in a choice. The data has this quality when it enables clients to anticipate

the future or assess the past and is gotten so as to influence their choices.

Moreover, the CF has been applied in the Financial Statement Elements. This is another

significant advancement in building up a conceptual framework, which focusses on deciding

the components of financial reports in the company. This includes characterizing the classes

of JMS’s data that ought to be contained in monetary reports. FASB's exchange of fiscal

summary components incorporates meanings of significant components, for example,

resources, liabilities, value, incomes, costs, additions, and misfortunes (Crombie, 2012).

Financial Measurement and Recognition: In SFAC 5, ‘Acknowledgment and Estimation in

Fiscal summaries of Business Ventures’, the FASB set up ideas for choosing (1) when things

ought to be introduced (or perceived) in the budget summaries, and (2) how to allocate or

measure financial items.

(ii) Which recognition principles and measurement bases have been applied for revenue,

assets and liabilities

data that is helpful to present to potential speculators and different clients in making

the balanced venture, credit, and comparable choices. From this starting point in

SFAC 1, the JMS communicated other progressively explicit targets.

The company has applied the CF into its efforts to determine the Fundamentals of Useful

Financial Data: The second component in the conceptual framework, according to the

company’s financial report is the characteristics (or subjective attributes) that budgetary data

ought to have in the event that it is to be valuable in basic leadership. In SFAC 2, the FASB

said that data is helpful on the off chance that it is (I) important, (ii) dependable, and (iii)

tantamount (Carnevale & Mazzuca, 2012). Data is pertinent on the off chance that it can have

any kind of effect in a choice. The data has this quality when it enables clients to anticipate

the future or assess the past and is gotten so as to influence their choices.

Moreover, the CF has been applied in the Financial Statement Elements. This is another

significant advancement in building up a conceptual framework, which focusses on deciding

the components of financial reports in the company. This includes characterizing the classes

of JMS’s data that ought to be contained in monetary reports. FASB's exchange of fiscal

summary components incorporates meanings of significant components, for example,

resources, liabilities, value, incomes, costs, additions, and misfortunes (Crombie, 2012).

Financial Measurement and Recognition: In SFAC 5, ‘Acknowledgment and Estimation in

Fiscal summaries of Business Ventures’, the FASB set up ideas for choosing (1) when things

ought to be introduced (or perceived) in the budget summaries, and (2) how to allocate or

measure financial items.

(ii) Which recognition principles and measurement bases have been applied for revenue,

assets and liabilities

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

CONTEMPORARY ACCOUNTING THEORY 10

Generally, the FASB argues that reporting on a company’s financial statements ought to be

perceived in the fiscal summaries in the event that they meet the accompanying recognition

principles and measurement bases:

Definitions: The thing meets the meaning of a component of budget reports;

Measurability: It has an important quality quantifiable with adequate dependability

Importance: The data about it is equipped for having any kind of effect on client

choices; and

Reliability: The JMS’s data is illustratively resolute, irrefutable, and impartial.

In SFAC 5, the FASB has expressed that a full arrangement of budget summaries should

appear: Money related position toward the finish of the period, Profit for the period and

Exhaustive salary for the period. This new idea is more extensive than profit and incorporates

all adjustments in proprietors' value other than those that came about because of exchanges

with the proprietors (Hodge, Rajgopal & Shevlin, 2009). A few changes in resource esteems

are incorporated into this idea however are barred from JMS income.

(iii) What qualitative characteristics of information exhibit in company’s various financial

reports?

The quantitative characteristics include:

Operationalization of the subjective attributes: To build an estimation apparatus, we

use earlier writing which characterizes money related detailing quality as far as the crucial

and upgrading subjective attributes fundamental choice convenience as characterized in the

ED. The basic subjective attributes (for example significance and loyal portrayal) are most

significant and decide the substance of money related detailing data (Alfiero, Cane, Doronzo

& Esposito, 2018). The improving subjective attributes (for example equivalence,

Generally, the FASB argues that reporting on a company’s financial statements ought to be

perceived in the fiscal summaries in the event that they meet the accompanying recognition

principles and measurement bases:

Definitions: The thing meets the meaning of a component of budget reports;

Measurability: It has an important quality quantifiable with adequate dependability

Importance: The data about it is equipped for having any kind of effect on client

choices; and

Reliability: The JMS’s data is illustratively resolute, irrefutable, and impartial.

In SFAC 5, the FASB has expressed that a full arrangement of budget summaries should

appear: Money related position toward the finish of the period, Profit for the period and

Exhaustive salary for the period. This new idea is more extensive than profit and incorporates

all adjustments in proprietors' value other than those that came about because of exchanges

with the proprietors (Hodge, Rajgopal & Shevlin, 2009). A few changes in resource esteems

are incorporated into this idea however are barred from JMS income.

(iii) What qualitative characteristics of information exhibit in company’s various financial

reports?

The quantitative characteristics include:

Operationalization of the subjective attributes: To build an estimation apparatus, we

use earlier writing which characterizes money related detailing quality as far as the crucial

and upgrading subjective attributes fundamental choice convenience as characterized in the

ED. The basic subjective attributes (for example significance and loyal portrayal) are most

significant and decide the substance of money related detailing data (Alfiero, Cane, Doronzo

& Esposito, 2018). The improving subjective attributes (for example equivalence,

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

CONTEMPORARY ACCOUNTING THEORY 11

understand-ability, practicality and unquestionable status) can improve choice value when the

crucial subjective attributes are set up. Be that as it may, they cannot decide accounting

detailing quality all alone.

Importance: ‘Significance’ feature of the company refers to its capability to

comprehend various concerns raised by clients as suppliers of capital in the company.

Considering the past literature, the relevance of operationalized applying various accounting

elements denotes corroborative and prescient framework. As discussed earlier in this paper,

accountants will critically evaluate the quality of financial earnings instead of accounting

reporting and its quality. This aspect is restrained due to the fact that it ignores non-financial

information and future financial-connected data that is accessible by shareholders (Mostyn,

2012). In order to enhance the quality extend, extensive and prescient analysis of the JMS;’s

financial statement is required.

4. Part B

a) Comparison of Sustainability Reporting Guidelines and International Integrated

Reporting Framework

Both the sustainability and international integrated reporting frameworks are

applicable in the business world today (Pérez-López, Moreno-Romero, & Barkemeyer,

2013). The role of businesses in the society today is gradually increasing, as compared its

initial obligation of evaluating its profitability or recording its finances. Therefore,

Sustainability Reporting Guideline presents the relevant standards applicable to the help

companies to enhance competitive advantage (Ceulemans, Lozano & Alonso-Almeida,

2015). Moreover, the component of environmental sustainability in the guideline is critically

recommended for firms to apply the world today compared to the integrated reporting.

However, this form of reporting concentrates more on a selected segment of the entity’s

understand-ability, practicality and unquestionable status) can improve choice value when the

crucial subjective attributes are set up. Be that as it may, they cannot decide accounting

detailing quality all alone.

Importance: ‘Significance’ feature of the company refers to its capability to

comprehend various concerns raised by clients as suppliers of capital in the company.

Considering the past literature, the relevance of operationalized applying various accounting

elements denotes corroborative and prescient framework. As discussed earlier in this paper,

accountants will critically evaluate the quality of financial earnings instead of accounting

reporting and its quality. This aspect is restrained due to the fact that it ignores non-financial

information and future financial-connected data that is accessible by shareholders (Mostyn,

2012). In order to enhance the quality extend, extensive and prescient analysis of the JMS;’s

financial statement is required.

4. Part B

a) Comparison of Sustainability Reporting Guidelines and International Integrated

Reporting Framework

Both the sustainability and international integrated reporting frameworks are

applicable in the business world today (Pérez-López, Moreno-Romero, & Barkemeyer,

2013). The role of businesses in the society today is gradually increasing, as compared its

initial obligation of evaluating its profitability or recording its finances. Therefore,

Sustainability Reporting Guideline presents the relevant standards applicable to the help

companies to enhance competitive advantage (Ceulemans, Lozano & Alonso-Almeida,

2015). Moreover, the component of environmental sustainability in the guideline is critically

recommended for firms to apply the world today compared to the integrated reporting.

However, this form of reporting concentrates more on a selected segment of the entity’s

CONTEMPORARY ACCOUNTING THEORY 12

status but unable to indicated the specific and relevant climatic transitions and environmental

factors (Crombie, 2012).

On the other hand, International Integrated Reporting Framework improves the firms’

reputation; thus, the profitability of the firm can be evaluated based on global norms and laws

(Messner, 2010). The reporting necessitates investors to build the relationship with both the

accounting and non-accounting data analysts to be able to effectively evaluate potential risks.

Numerous organizations have energetically begun to get readily integrated reports in different

configurations and each report has been shaped as per the requirements of business

properties. Moreover, integrated announcing standards and rules have been distributed by the

Worldwide Integrated Detailing Board, so as to give direction to report evaluators (Soyka,

2013).

b) Rigour (strength & limitations) of the conventional accounting, based upon the

Conceptual Framework for contents of sustainability as well as integrated

reports

Strengths

The Convectional Accounting is a significant tool that is applicable in the management of

businesses today. According to Ehoff (2010), convectional accounting is relevant because it

enables companies to report on financial profitability and performance, which also enables

investors to determine the internal financial health of the company. The conventional

accounting, centred on the CF provides a firm foundation for formulating future financial

statement standards, which enhance the sustainability status of specific companies (Alfiero,

Cane, Doronzo & Esposito, 2018). The strength evident in this framework is to permit the

introduction of accounting standards and international integrated reports, which clarify the

status but unable to indicated the specific and relevant climatic transitions and environmental

factors (Crombie, 2012).

On the other hand, International Integrated Reporting Framework improves the firms’

reputation; thus, the profitability of the firm can be evaluated based on global norms and laws

(Messner, 2010). The reporting necessitates investors to build the relationship with both the

accounting and non-accounting data analysts to be able to effectively evaluate potential risks.

Numerous organizations have energetically begun to get readily integrated reports in different

configurations and each report has been shaped as per the requirements of business

properties. Moreover, integrated announcing standards and rules have been distributed by the

Worldwide Integrated Detailing Board, so as to give direction to report evaluators (Soyka,

2013).

b) Rigour (strength & limitations) of the conventional accounting, based upon the

Conceptual Framework for contents of sustainability as well as integrated

reports

Strengths

The Convectional Accounting is a significant tool that is applicable in the management of

businesses today. According to Ehoff (2010), convectional accounting is relevant because it

enables companies to report on financial profitability and performance, which also enables

investors to determine the internal financial health of the company. The conventional

accounting, centred on the CF provides a firm foundation for formulating future financial

statement standards, which enhance the sustainability status of specific companies (Alfiero,

Cane, Doronzo & Esposito, 2018). The strength evident in this framework is to permit the

introduction of accounting standards and international integrated reports, which clarify the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 21

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.