ACCT20074: Analysis of Financial and Sustainability Reporting Concepts

VerifiedAdded on 2023/03/30

|19

|3775

|215

Report

AI Summary

This report, prepared for ACCT20074, examines contemporary accounting theory, focusing on financial and sustainability reporting. Part A delves into the conceptual framework for financial reporting, exploring its historical development in the USA, UK, and Australia, as well as issues raised by accounting professionals regarding its application of IASB/IFRS. It also discusses the framework's benefits and limitations, and evaluates the annual report of Australian Agricultural Company Limited (AACL) based on the framework's guidelines. Part B shifts the focus to sustainability reporting, comparing the Global Reporting Initiative (GRI) and the International Integrated Reporting Framework. It also assesses the usefulness of conventional accounting techniques for sustainability reporting, applies relevant theories, and analyzes the integrated reporting practices of a South African company, comparing them with the sustainability reporting of AACL. The report concludes with an overview of the key findings and implications of the analysis.

ACCT20074 Contemporary Accounting Theory

1

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Executive Summary

This report has been prepared under two sections. The first section is regarding the

discussion and usefulness of conceptual framework for guiding the financial reports preparation

of business entities across the world by the use of an ASX listed entity. The other section is

sustainability reporting and it has presented a discussion about the difference in global reporting

initiatives and integrated reporting frameworks used for sustainable reporting. This has been

conducted through comparing the integrated reports prepared by a South African Company with

the sustainable reports developed by the ASX listed entity.

2

This report has been prepared under two sections. The first section is regarding the

discussion and usefulness of conceptual framework for guiding the financial reports preparation

of business entities across the world by the use of an ASX listed entity. The other section is

sustainability reporting and it has presented a discussion about the difference in global reporting

initiatives and integrated reporting frameworks used for sustainable reporting. This has been

conducted through comparing the integrated reports prepared by a South African Company with

the sustainable reports developed by the ASX listed entity.

2

Contents

Executive Summary.........................................................................................................................2

Introduction......................................................................................................................................4

Part A: Conceptual Framework.......................................................................................................4

Section A: Literature Regarding the History and Development of the Conceptual Framework. 4

Section B: Issues Raised by the Accounting Professionals in the Application of IASB/IFRS

Financial Reporting......................................................................................................................5

Section C: Potential Benefits and limitations of conceptual framework for financial reporting. 5

Section D: Use of conceptual framework to evaluate the annual report of Australian

Agricultural Company Limited (AACL).....................................................................................6

Part B: Integrated reporting...........................................................................................................11

Section A: Comparison of Global Reporting Initiative (GRI) and International Integrated

Reporting Framework for Social Responsibility Reporting:.....................................................11

Section B: Examination of Usefulness of Conventional Accounting Techniques for Sustainable

Reporting....................................................................................................................................11

Section C: Application of Theories for Explaining the Contents of Sustainability Reporting. .12

Section D: Application of the integrated reporting framework by the selected South Africa

Company (Bidvest Group Limited)...........................................................................................12

Section E: Evaluation and comparison of reporting practices with integrated reporting

components index and practices in selected South African company.......................................15

Conclusion.....................................................................................................................................16

References......................................................................................................................................17

3

Executive Summary.........................................................................................................................2

Introduction......................................................................................................................................4

Part A: Conceptual Framework.......................................................................................................4

Section A: Literature Regarding the History and Development of the Conceptual Framework. 4

Section B: Issues Raised by the Accounting Professionals in the Application of IASB/IFRS

Financial Reporting......................................................................................................................5

Section C: Potential Benefits and limitations of conceptual framework for financial reporting. 5

Section D: Use of conceptual framework to evaluate the annual report of Australian

Agricultural Company Limited (AACL).....................................................................................6

Part B: Integrated reporting...........................................................................................................11

Section A: Comparison of Global Reporting Initiative (GRI) and International Integrated

Reporting Framework for Social Responsibility Reporting:.....................................................11

Section B: Examination of Usefulness of Conventional Accounting Techniques for Sustainable

Reporting....................................................................................................................................11

Section C: Application of Theories for Explaining the Contents of Sustainability Reporting. .12

Section D: Application of the integrated reporting framework by the selected South Africa

Company (Bidvest Group Limited)...........................................................................................12

Section E: Evaluation and comparison of reporting practices with integrated reporting

components index and practices in selected South African company.......................................15

Conclusion.....................................................................................................................................16

References......................................................................................................................................17

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Introduction

This report has been carried out in the context of illustrating the usefulness of two

important concepts of business reporting, that is financial and sustainability reporting, As such,

the first section has provided analysis and description regarding the various issues such as

usefulness of conceptual framework, its various benefits and limitations and its applicability

within a selected ASX listed entity to demonstrate the contemporary trends in financial reporting.

The other section has highlighted the development of sustainability frameworks such as GRIO or

integrated reporting and the limitations of conventional accounting techniques to produce social

and environmental disclosures of a company. It has also detailed regarding the various criteria of

integrated reporting system by taking an example of a South African company and comparing it

with the sustainability reporting system of the selected ASX listed entity.

Part A: Conceptual Framework

Section A: Literature Regarding the History and Development of the Conceptual

Framework

The normative theory of accounting has provided the primary basis for developing the

conceptual framework (CF) for the purpose of financial reporting. The theory has provided a

theoretical basis to the development and establishment of standard accounting policies and

concepts (Seng, 2014). The CF has been provided by the IASB for the purpose of achieving

uniformity in the financial reporting process of business corporations across the world. The

IASB has placed greater emphasis on implementation of the principles of conceptual accounting

framework to improve the international comparability within the financial reporting system of

businesses (Dean and Clarke, 2003). The adoption of CF of accounting within the developed

countries such as the UK, Australia and the US can be linked with the progress made by the

accounting standard-setters in these countries for developing a proper system for measurement of

assets and liabilities, measuring the business performance, protection of interests of end-users

and reducing the occurrence of corporate scandals (Chua, Chee and Cheong, 2012).

For example, in the US there has been the development of Accounting Principles Board

(APB) for providing accounting principles and concepts to develop financial reports. There has

4

This report has been carried out in the context of illustrating the usefulness of two

important concepts of business reporting, that is financial and sustainability reporting, As such,

the first section has provided analysis and description regarding the various issues such as

usefulness of conceptual framework, its various benefits and limitations and its applicability

within a selected ASX listed entity to demonstrate the contemporary trends in financial reporting.

The other section has highlighted the development of sustainability frameworks such as GRIO or

integrated reporting and the limitations of conventional accounting techniques to produce social

and environmental disclosures of a company. It has also detailed regarding the various criteria of

integrated reporting system by taking an example of a South African company and comparing it

with the sustainability reporting system of the selected ASX listed entity.

Part A: Conceptual Framework

Section A: Literature Regarding the History and Development of the Conceptual

Framework

The normative theory of accounting has provided the primary basis for developing the

conceptual framework (CF) for the purpose of financial reporting. The theory has provided a

theoretical basis to the development and establishment of standard accounting policies and

concepts (Seng, 2014). The CF has been provided by the IASB for the purpose of achieving

uniformity in the financial reporting process of business corporations across the world. The

IASB has placed greater emphasis on implementation of the principles of conceptual accounting

framework to improve the international comparability within the financial reporting system of

businesses (Dean and Clarke, 2003). The adoption of CF of accounting within the developed

countries such as the UK, Australia and the US can be linked with the progress made by the

accounting standard-setters in these countries for developing a proper system for measurement of

assets and liabilities, measuring the business performance, protection of interests of end-users

and reducing the occurrence of corporate scandals (Chua, Chee and Cheong, 2012).

For example, in the US there has been the development of Accounting Principles Board

(APB) for providing accounting principles and concepts to develop financial reports. There has

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

been development of True blood Committee in the year 1971 that has outlined the objectives and

qualitative characteristics of financial reporting. The APB has been replaced FASB in the year

2005 for converging with the international accounting standards and thereby adopting the CF

principles of financial reporting. The adoption of the CF in the UK can be traced back to the year

1991 when ASB (Accounting Standards Board) adopted the International Accounting Standards

Committee (IASC) framework. The integration of CF within the accounting profession in

Australia can be traced back to the year 2005 when the decision has been undertaken by the

Financial Reporting Council in the year 2005 to adopt IFRS and promoting international

comparability in their financial reporting systems (Barth, 2008). The FASB and IASB has been

working in integration with each other since the year 2005 to converge the international

accounting standards and causing the adoption of CF within the financial reporting system of all

countries across the world (Macías and Muiño, 2011).

Section B: Issues Raised by the Accounting Professionals in the Application of IASB/IFRS

Financial Reporting

The AASB has promoted the use of IFRS for developing financial reports by business

corporations within Australia in order to make the financial information more comparable and

useful for making economic decisions by the end-users. However, there have been various issues

raised by the various accounting bodies in Australia such as CPA that is restricting its wider

acceptance within the accounting system of the country (Lonergan, 2005). The major issue that is

present in this context is regarding the significant costs that have to be faced by businesses to

adopt the CF within their financial reporting system. The costs have to be realized for providing

training to the accountants to make them understand regarding the application of new accounting

standards and policies as per the IASB for preparation of financial statements. This is posing to

be quite problematic for small-sized business entities as the benefits that can be achieved by

them with the use of IASB CF can be significantly overweighed by the cost that is incurred in its

adoption (Wong, 2004). Also, the AASB has not considered the implications of adopting CF on

compliance with the Corporations Act 2001 by business entities (AASB adoption of IASB

standards by 2005, 2004).

5

qualitative characteristics of financial reporting. The APB has been replaced FASB in the year

2005 for converging with the international accounting standards and thereby adopting the CF

principles of financial reporting. The adoption of the CF in the UK can be traced back to the year

1991 when ASB (Accounting Standards Board) adopted the International Accounting Standards

Committee (IASC) framework. The integration of CF within the accounting profession in

Australia can be traced back to the year 2005 when the decision has been undertaken by the

Financial Reporting Council in the year 2005 to adopt IFRS and promoting international

comparability in their financial reporting systems (Barth, 2008). The FASB and IASB has been

working in integration with each other since the year 2005 to converge the international

accounting standards and causing the adoption of CF within the financial reporting system of all

countries across the world (Macías and Muiño, 2011).

Section B: Issues Raised by the Accounting Professionals in the Application of IASB/IFRS

Financial Reporting

The AASB has promoted the use of IFRS for developing financial reports by business

corporations within Australia in order to make the financial information more comparable and

useful for making economic decisions by the end-users. However, there have been various issues

raised by the various accounting bodies in Australia such as CPA that is restricting its wider

acceptance within the accounting system of the country (Lonergan, 2005). The major issue that is

present in this context is regarding the significant costs that have to be faced by businesses to

adopt the CF within their financial reporting system. The costs have to be realized for providing

training to the accountants to make them understand regarding the application of new accounting

standards and policies as per the IASB for preparation of financial statements. This is posing to

be quite problematic for small-sized business entities as the benefits that can be achieved by

them with the use of IASB CF can be significantly overweighed by the cost that is incurred in its

adoption (Wong, 2004). Also, the AASB has not considered the implications of adopting CF on

compliance with the Corporations Act 2001 by business entities (AASB adoption of IASB

standards by 2005, 2004).

5

Section C: Potential Benefits and limitations of conceptual framework for financial

reporting

Some defined benefits of conceptual framework for financial reporting are discussed as follows:

Financial reporting using conceptual framework has boosted user’s trust and

perception on financial information provided in report (Fajard, 2016). It facilitates

accounting problem discussion and guides accounting standard maker for better

regulation.

Conceptual framework is a standard framework through which various fundamental

accounting practices can be tested objectively.

Reliability of financial reporting has been increased by using conceptual framework.

Improved communication is possible between accountants and standard makers.

This framework offers all logical and objective aspect. (Silvia, 2016).

This framework gives an opportunity to make decision about correct accounting

practices and methods to comply with requirements of the accounting standards

Some limitations also exist in conceptual framework despite of its benefits discussed as follows:

Developing countries find the establishment of conceptual framework very time

consuming and expensive. While developed countries can set up their own conceptual

framework for their accounting principles.

Rigidity is one of the limitations of conceptual framework. This limitation does not

allow anyone to introduce new ideas. Accounting following the conceptual

framework is inflexible and it does not provide much direction to accounting

(Tschopp and Nastanski, 2014).

There are so many conflicts between accounting standards and conceptual

framework. This conflict arises because of the use of accounting standard which are

in use before the use of conceptual framework

The Conceptual framework may not be acceptable to or beneficial for all users. The

framework may be favorable to only some user in majority. (Pacter, 2013).

6

reporting

Some defined benefits of conceptual framework for financial reporting are discussed as follows:

Financial reporting using conceptual framework has boosted user’s trust and

perception on financial information provided in report (Fajard, 2016). It facilitates

accounting problem discussion and guides accounting standard maker for better

regulation.

Conceptual framework is a standard framework through which various fundamental

accounting practices can be tested objectively.

Reliability of financial reporting has been increased by using conceptual framework.

Improved communication is possible between accountants and standard makers.

This framework offers all logical and objective aspect. (Silvia, 2016).

This framework gives an opportunity to make decision about correct accounting

practices and methods to comply with requirements of the accounting standards

Some limitations also exist in conceptual framework despite of its benefits discussed as follows:

Developing countries find the establishment of conceptual framework very time

consuming and expensive. While developed countries can set up their own conceptual

framework for their accounting principles.

Rigidity is one of the limitations of conceptual framework. This limitation does not

allow anyone to introduce new ideas. Accounting following the conceptual

framework is inflexible and it does not provide much direction to accounting

(Tschopp and Nastanski, 2014).

There are so many conflicts between accounting standards and conceptual

framework. This conflict arises because of the use of accounting standard which are

in use before the use of conceptual framework

The Conceptual framework may not be acceptable to or beneficial for all users. The

framework may be favorable to only some user in majority. (Pacter, 2013).

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Section D: Use of conceptual framework to evaluate the annual report of Australian

Agricultural Company Limited (AACL)

D (I): Number of financial statements and their components

In this part annual report of AACL is to be evaluated using conceptual framework, to

check whether AACL has been successfully applied all the guidelines and information provided

in the conceptual framework.

According to the conceptual framework company needs to produce four types of financial

statements or reports (Conceptual Framework, 2018). Below mentioned statements are prepared

by AACL as per the conceptual framework:

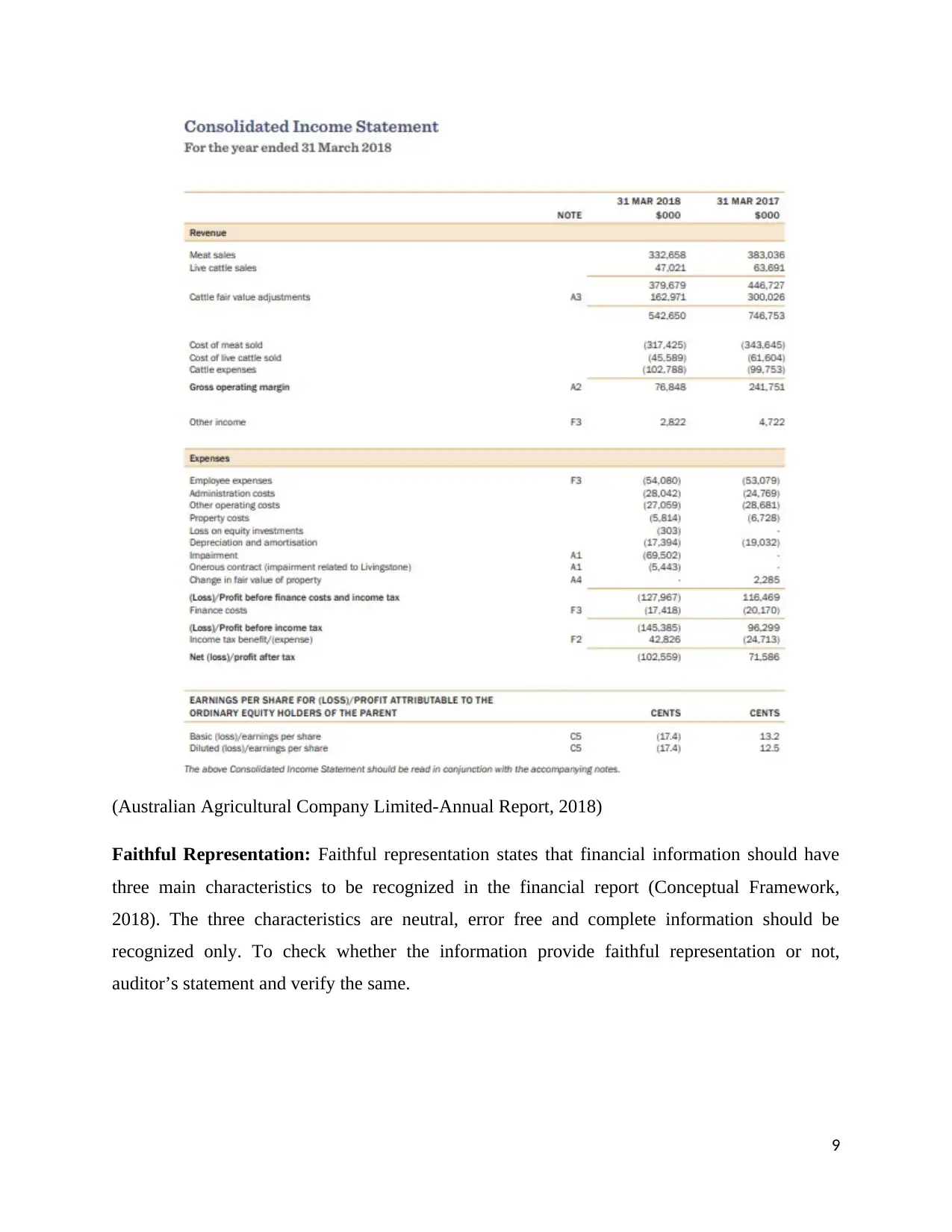

Income Statement: Company’s financial performance is reflected by the income

statement prepared by the company for the particular year. In the annual report of AACL

consolidated income statement is provided to show financial performance of the company

and its all subsidiaries by reflecting revenue and expenses of the year.

Balance sheet: AACL has provided consolidated balance sheet to reflect the financial

position of holding and it’s all the subsidiary companies. The basic element of the

balance sheet is assets, liabilities and equity (Conceptual Framework, 2018).

Statement of changes in equity: The statement of changes in equity has been

consolidated and it discloses the contribution and distribution made by the shareholders.

Statement of cash flow: AACL has prepared the consolidated cash flow statement to

state the liquidity position of the group. This statement discloses the information about

various cash flow activities such as operating activities, financing activities and investing

activities (Australian Agricultural Company Limited-Annual Report, 2018).

AACL has provided notes to accounts to provide details of measurement, recognition and

other information. Notes to accounts are the most important part of financial statement as it

discloses the assumptions, methods and judgments used to estimate the amount of all financial

items (Australian Agricultural Company Limited-Annual Report, 2018).

D (II): Principle of recognition and measurement bases used for assets, revenue and

liabilities

7

Agricultural Company Limited (AACL)

D (I): Number of financial statements and their components

In this part annual report of AACL is to be evaluated using conceptual framework, to

check whether AACL has been successfully applied all the guidelines and information provided

in the conceptual framework.

According to the conceptual framework company needs to produce four types of financial

statements or reports (Conceptual Framework, 2018). Below mentioned statements are prepared

by AACL as per the conceptual framework:

Income Statement: Company’s financial performance is reflected by the income

statement prepared by the company for the particular year. In the annual report of AACL

consolidated income statement is provided to show financial performance of the company

and its all subsidiaries by reflecting revenue and expenses of the year.

Balance sheet: AACL has provided consolidated balance sheet to reflect the financial

position of holding and it’s all the subsidiary companies. The basic element of the

balance sheet is assets, liabilities and equity (Conceptual Framework, 2018).

Statement of changes in equity: The statement of changes in equity has been

consolidated and it discloses the contribution and distribution made by the shareholders.

Statement of cash flow: AACL has prepared the consolidated cash flow statement to

state the liquidity position of the group. This statement discloses the information about

various cash flow activities such as operating activities, financing activities and investing

activities (Australian Agricultural Company Limited-Annual Report, 2018).

AACL has provided notes to accounts to provide details of measurement, recognition and

other information. Notes to accounts are the most important part of financial statement as it

discloses the assumptions, methods and judgments used to estimate the amount of all financial

items (Australian Agricultural Company Limited-Annual Report, 2018).

D (II): Principle of recognition and measurement bases used for assets, revenue and

liabilities

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Revenue: AACL has recognized its revenue through agricultural produces. IAS 41

deals with the accounting from agricultural activities. Agricultural produce is

recognized at fair value minus estimated cost of sales and any changes in above

amount are included in profit and loss.

Assets: Company has disclosed many assets in its balance sheet. AACL has

recognized cattle at fair value with required adjustments.Property and improvements

except industrial property and improvements are taken at amount reached after

revaluation, the amount is the fair value at the date of revaluation minus any

subsequent depreciation accumulated on buildings and impairment losses. Trade

receivables are non–interest bearing and impairment is recognized when there is

objective evidence of non-collectability of trade receivables (Conceptual Framework,

2018).

Liabilities: Trade payable are non-encumbrance and will be payable within 30 days

which are agreed upon. Amount received in respect of advance sales is considered as

deferred revenue. Trade payables have been recognized at amortized cost when

company is obliged to make payments. Provisions are recognized when future

obligation to settle the same arises. Borrowings are measured at fair value fewer

amounts paid for transaction cost. Subsequently measured at amortized cost through

using the effective interest method (Australian Agricultural Company Limited-

Annual Report, 2018).

D (III): Qualitative characteristics of financial information that have been presented in

the financial statements AACL

Relevance: Relevance means the financial information should provide amount that is

predictable and confirm that can influence the economic decision of users (Conceptual

Framework, 2018). Financial information about revenue has relevance characteristic that can

influence the decision of stakeholders. AACL has included this financial information in its

financial statements.

8

deals with the accounting from agricultural activities. Agricultural produce is

recognized at fair value minus estimated cost of sales and any changes in above

amount are included in profit and loss.

Assets: Company has disclosed many assets in its balance sheet. AACL has

recognized cattle at fair value with required adjustments.Property and improvements

except industrial property and improvements are taken at amount reached after

revaluation, the amount is the fair value at the date of revaluation minus any

subsequent depreciation accumulated on buildings and impairment losses. Trade

receivables are non–interest bearing and impairment is recognized when there is

objective evidence of non-collectability of trade receivables (Conceptual Framework,

2018).

Liabilities: Trade payable are non-encumbrance and will be payable within 30 days

which are agreed upon. Amount received in respect of advance sales is considered as

deferred revenue. Trade payables have been recognized at amortized cost when

company is obliged to make payments. Provisions are recognized when future

obligation to settle the same arises. Borrowings are measured at fair value fewer

amounts paid for transaction cost. Subsequently measured at amortized cost through

using the effective interest method (Australian Agricultural Company Limited-

Annual Report, 2018).

D (III): Qualitative characteristics of financial information that have been presented in

the financial statements AACL

Relevance: Relevance means the financial information should provide amount that is

predictable and confirm that can influence the economic decision of users (Conceptual

Framework, 2018). Financial information about revenue has relevance characteristic that can

influence the decision of stakeholders. AACL has included this financial information in its

financial statements.

8

(Australian Agricultural Company Limited-Annual Report, 2018)

Faithful Representation: Faithful representation states that financial information should have

three main characteristics to be recognized in the financial report (Conceptual Framework,

2018). The three characteristics are neutral, error free and complete information should be

recognized only. To check whether the information provide faithful representation or not,

auditor’s statement and verify the same.

9

Faithful Representation: Faithful representation states that financial information should have

three main characteristics to be recognized in the financial report (Conceptual Framework,

2018). The three characteristics are neutral, error free and complete information should be

recognized only. To check whether the information provide faithful representation or not,

auditor’s statement and verify the same.

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

(Australian Agricultural Company Limited-Annual Report, 2018)

10

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Part B: Integrated reporting

Section A: Comparison of Global Reporting Initiative (GRI) and International Integrated

Reporting Framework for Social Responsibility Reporting:

GRI makes it understand and it communicates to business and governments their effect

on serious sustainability issues such as climate change, human rights. Multi-stakeholders have

been contributed in development of GRI sustainability reporting standard. The GRI

Sustainability Reporting Standards are adopted globally for sustainability reporting (GRI, 2017).

The exercise of revealing sustainability information stimulates accountability, helps in

recognition and manage risks and enables organizations to grasp new opportunities. GRI

Standards reporting supports companies protect the environment and improve society, while

simultaneously flourishing economically by governance improvement and stakeholders’

relations.

Integrated reporting requires inclusion of non-traditional information also in financial

reporting to provide its users the information about company’s social responsibilities. Integrated

reporting can be said a step forward to GRI framework because it emphasizes the entity to adopt

integrated approach rather than focusing only on traditional approach. It requires the business to

demonstrate the ways of making long term strategy and operational activities considering

integrated risk and opportunities. The principles given by the International Integrated Reporting

Council (IIRC) for developing integrated reports are strategic pivot, linked with information,

strengthen stakeholders’ relationship, substance, incisive, well-grounded and steady. It is very

crucial for the future of the earth. Most economists consider that putting a shield on greenhouse

gas outpouring and putting in a shadow price on carbon is the most systematic way to control

emissions. (The IIRC, 2017).

Section B: Examination of Usefulness of Conventional Accounting Techniques for

Sustainable Reporting

The conventional accounting approaches such as CF for financial reporting has provided

guidance regarding the ways in which financial reports should be developed and presented to the

end-users. However, it has not proved to be of any use to develop and produce the sustainable

reports and the main focus is only to guide the business entities regarding the presentation of

11

Section A: Comparison of Global Reporting Initiative (GRI) and International Integrated

Reporting Framework for Social Responsibility Reporting:

GRI makes it understand and it communicates to business and governments their effect

on serious sustainability issues such as climate change, human rights. Multi-stakeholders have

been contributed in development of GRI sustainability reporting standard. The GRI

Sustainability Reporting Standards are adopted globally for sustainability reporting (GRI, 2017).

The exercise of revealing sustainability information stimulates accountability, helps in

recognition and manage risks and enables organizations to grasp new opportunities. GRI

Standards reporting supports companies protect the environment and improve society, while

simultaneously flourishing economically by governance improvement and stakeholders’

relations.

Integrated reporting requires inclusion of non-traditional information also in financial

reporting to provide its users the information about company’s social responsibilities. Integrated

reporting can be said a step forward to GRI framework because it emphasizes the entity to adopt

integrated approach rather than focusing only on traditional approach. It requires the business to

demonstrate the ways of making long term strategy and operational activities considering

integrated risk and opportunities. The principles given by the International Integrated Reporting

Council (IIRC) for developing integrated reports are strategic pivot, linked with information,

strengthen stakeholders’ relationship, substance, incisive, well-grounded and steady. It is very

crucial for the future of the earth. Most economists consider that putting a shield on greenhouse

gas outpouring and putting in a shadow price on carbon is the most systematic way to control

emissions. (The IIRC, 2017).

Section B: Examination of Usefulness of Conventional Accounting Techniques for

Sustainable Reporting

The conventional accounting approaches such as CF for financial reporting has provided

guidance regarding the ways in which financial reports should be developed and presented to the

end-users. However, it has not proved to be of any use to develop and produce the sustainable

reports and the main focus is only to guide the business entities regarding the presentation of

11

sustainable information (Information Resources, 2015). The major limitation of conventional

accounting technique is that its main focus is only to meet the needs of investors and it has not

placed any importance on the necessity for businesses to achieve the trust and faith of all its

stakeholders including community and environment in which it operates. It has mainly described

the accounting policies and concepts that require recording and disclosure of information in

monetary terms. As such, it is not useful for presenting the information that cannot be stated in

monetary terms such as social and environmental performance (Dragomir, 2011). For example, it

is not useful for identification and reporting of social costs and profits as it cannot be explicitly

stated in the monetary terms. Therefore, it can be said that traditional accounting approaches

such as CF are manner useful for reporting the information which is non-financial in nature

(Ivan, 2009).

Section C: Application of Theories for Explaining the Contents of Sustainability Reporting

The stakeholder theory has provided a foundation for developing and presenting the

information about sustainable performance of the company. This is because it has stated the need

for businesses to consider the needs of all its stakeholders not just the shareholders or investors.

Therefore, considering the needs of all the stakeholders requires developing a sustainable report

which provides actions that are undertaken by a company in producing social and environmental

information (Manetti, 2011). Other than this, legitimacy theory that has focused on the

motivation for business managers to develop and produce sustainable reports has also proved to

be useful for developing the manner in which sustainability information need to be reported. It

has stated that it is important for business to create their legitimate image within the society in

which it exist and this can be achieved by improving transparency within their operations

through providing the information about the social and environmental measures that have been

undertaken to promote their development (Villiers and Maroun, 2017). The theory has been

helpful in identifying the different social and environmental context in which information should

be reported so that it is able to achieve the needs and interests of all the stakeholder groups.

Section D: Application of the integrated reporting framework by the selected South Africa

Company (Bidvest Group Limited)

Bidvest Group has produced the integrated report fir year 2018 and it has prepared its

report through using the IIRC integrated framework. There are total 7 major components of the

12

accounting technique is that its main focus is only to meet the needs of investors and it has not

placed any importance on the necessity for businesses to achieve the trust and faith of all its

stakeholders including community and environment in which it operates. It has mainly described

the accounting policies and concepts that require recording and disclosure of information in

monetary terms. As such, it is not useful for presenting the information that cannot be stated in

monetary terms such as social and environmental performance (Dragomir, 2011). For example, it

is not useful for identification and reporting of social costs and profits as it cannot be explicitly

stated in the monetary terms. Therefore, it can be said that traditional accounting approaches

such as CF are manner useful for reporting the information which is non-financial in nature

(Ivan, 2009).

Section C: Application of Theories for Explaining the Contents of Sustainability Reporting

The stakeholder theory has provided a foundation for developing and presenting the

information about sustainable performance of the company. This is because it has stated the need

for businesses to consider the needs of all its stakeholders not just the shareholders or investors.

Therefore, considering the needs of all the stakeholders requires developing a sustainable report

which provides actions that are undertaken by a company in producing social and environmental

information (Manetti, 2011). Other than this, legitimacy theory that has focused on the

motivation for business managers to develop and produce sustainable reports has also proved to

be useful for developing the manner in which sustainability information need to be reported. It

has stated that it is important for business to create their legitimate image within the society in

which it exist and this can be achieved by improving transparency within their operations

through providing the information about the social and environmental measures that have been

undertaken to promote their development (Villiers and Maroun, 2017). The theory has been

helpful in identifying the different social and environmental context in which information should

be reported so that it is able to achieve the needs and interests of all the stakeholder groups.

Section D: Application of the integrated reporting framework by the selected South Africa

Company (Bidvest Group Limited)

Bidvest Group has produced the integrated report fir year 2018 and it has prepared its

report through using the IIRC integrated framework. There are total 7 major components of the

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.