Group Report: Analysis of Wesfarmers Financial Performance (BUS103)

VerifiedAdded on 2023/04/23

|12

|850

|55

Report

AI Summary

This report presents a comprehensive analysis of Wesfarmers, a major Australian retail company, examining its financial performance based on its annual report. The analysis includes an overview of the company's revenue recognition policy, valuation of plant property and equipment, and the role of its auditors. Key aspects of Wesfarmers' sustainability initiatives are also discussed. The report delves into profitability ratios, leverage ratios, and efficiency ratios, comparing the company's performance between 2017 and 2018. The findings highlight trends in return on total assets, net profit margin, debt-to-equity ratio, interest coverage ratio, asset turnover ratio, and inventory ratio. The analysis incorporates data from the company's annual reports and provides references for further study.

Wesfarmers

Analysis

Analysis

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Wesfarmers

Founded in the year 1914.

Involved in the business of chemical fertilizers,

coal mining, industrial and safety products

The areas the company is currently serving are

Australia, India, United Kingdom, New Zealand

and Ireland (Wesfarmers, 2018) .

The current revenue of the company is A$4.40

billion

The team is of 223000 employees

Founded in the year 1914.

Involved in the business of chemical fertilizers,

coal mining, industrial and safety products

The areas the company is currently serving are

Australia, India, United Kingdom, New Zealand

and Ireland (Wesfarmers, 2018) .

The current revenue of the company is A$4.40

billion

The team is of 223000 employees

Revenue Recognition Policy

Revenue is generally accepted accounting

principle which represents the specific or the

particular conditions where the company

uses it to account according to the different

situations (Kilroy and Schneider, 2017).

Revenue: At fair value

Criteria followed: Rules under sales of goods,

interest, dividends, rent from operating

lease.

Revenue is generally accepted accounting

principle which represents the specific or the

particular conditions where the company

uses it to account according to the different

situations (Kilroy and Schneider, 2017).

Revenue: At fair value

Criteria followed: Rules under sales of goods,

interest, dividends, rent from operating

lease.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Valuation of Plant property and

Equipment

The plant property and the equipment

are valued at cost of the asset or say

market value.

The fixed assets are depreciated on the

straight line method.

The expenses on the mining are

amortized over the life of mine

(Campbell, 2017).

Equipment

The plant property and the equipment

are valued at cost of the asset or say

market value.

The fixed assets are depreciated on the

straight line method.

The expenses on the mining are

amortized over the life of mine

(Campbell, 2017).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Auditors and the Audit

firm

The Ernst and Young is the auditing firm for

the Wesfarmers.

The primary purpose of the audit is to deliver

the opinion on the financial statements so as

to give the true and the fair value of the

financial statements (Chen, Lin and Siregar,

2018).

The third party audits are essential and

required to give the unbiased opinion on the

review of the financial statements.

firm

The Ernst and Young is the auditing firm for

the Wesfarmers.

The primary purpose of the audit is to deliver

the opinion on the financial statements so as

to give the true and the fair value of the

financial statements (Chen, Lin and Siregar,

2018).

The third party audits are essential and

required to give the unbiased opinion on the

review of the financial statements.

Initiatives towards the

Sustainability

The sustainability of the company can be

determined by the core values which are

as follows.

Employee ratio: Women's are 54%

Production: 96% of the fresh produces,

lamb, pork and chicken beef

(Wesfarmers, 2018)

Reduced the carbon emission by 6% as

compared to the last year.

Sustainability

The sustainability of the company can be

determined by the core values which are

as follows.

Employee ratio: Women's are 54%

Production: 96% of the fresh produces,

lamb, pork and chicken beef

(Wesfarmers, 2018)

Reduced the carbon emission by 6% as

compared to the last year.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

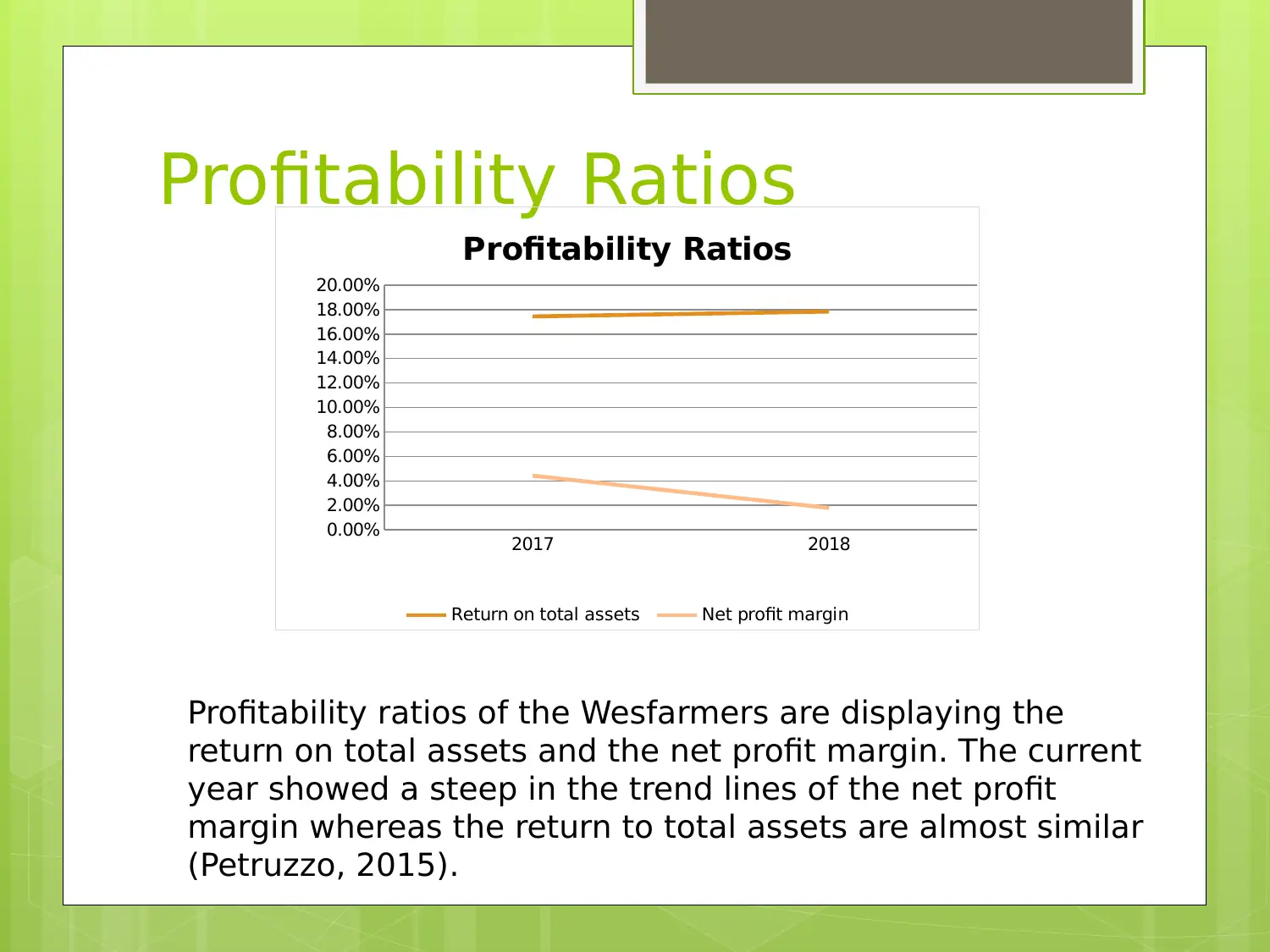

Profitability Ratios

2017 2018

0.00%

2.00%

4.00%

6.00%

8.00%

10.00%

12.00%

14.00%

16.00%

18.00%

20.00%

Profitability Ratios

Return on total assets Net profit margin

Profitability ratios of the Wesfarmers are displaying the

return on total assets and the net profit margin. The current

year showed a steep in the trend lines of the net profit

margin whereas the return to total assets are almost similar

(Petruzzo, 2015).

2017 2018

0.00%

2.00%

4.00%

6.00%

8.00%

10.00%

12.00%

14.00%

16.00%

18.00%

20.00%

Profitability Ratios

Return on total assets Net profit margin

Profitability ratios of the Wesfarmers are displaying the

return on total assets and the net profit margin. The current

year showed a steep in the trend lines of the net profit

margin whereas the return to total assets are almost similar

(Petruzzo, 2015).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

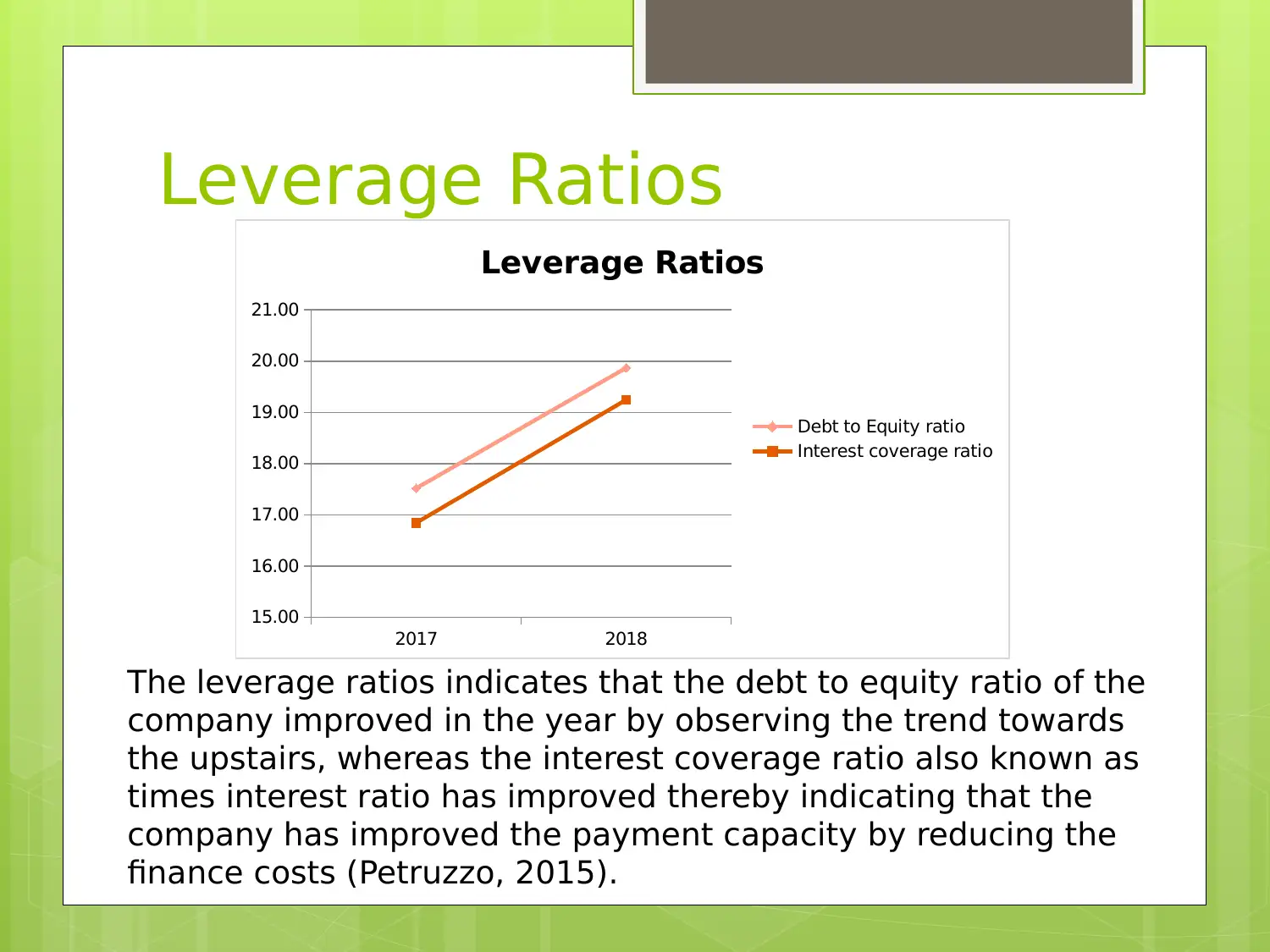

Leverage Ratios

2017 2018

15.00

16.00

17.00

18.00

19.00

20.00

21.00

Leverage Ratios

Debt to Equity ratio

Interest coverage ratio

The leverage ratios indicates that the debt to equity ratio of the

company improved in the year by observing the trend towards

the upstairs, whereas the interest coverage ratio also known as

times interest ratio has improved thereby indicating that the

company has improved the payment capacity by reducing the

finance costs (Petruzzo, 2015).

2017 2018

15.00

16.00

17.00

18.00

19.00

20.00

21.00

Leverage Ratios

Debt to Equity ratio

Interest coverage ratio

The leverage ratios indicates that the debt to equity ratio of the

company improved in the year by observing the trend towards

the upstairs, whereas the interest coverage ratio also known as

times interest ratio has improved thereby indicating that the

company has improved the payment capacity by reducing the

finance costs (Petruzzo, 2015).

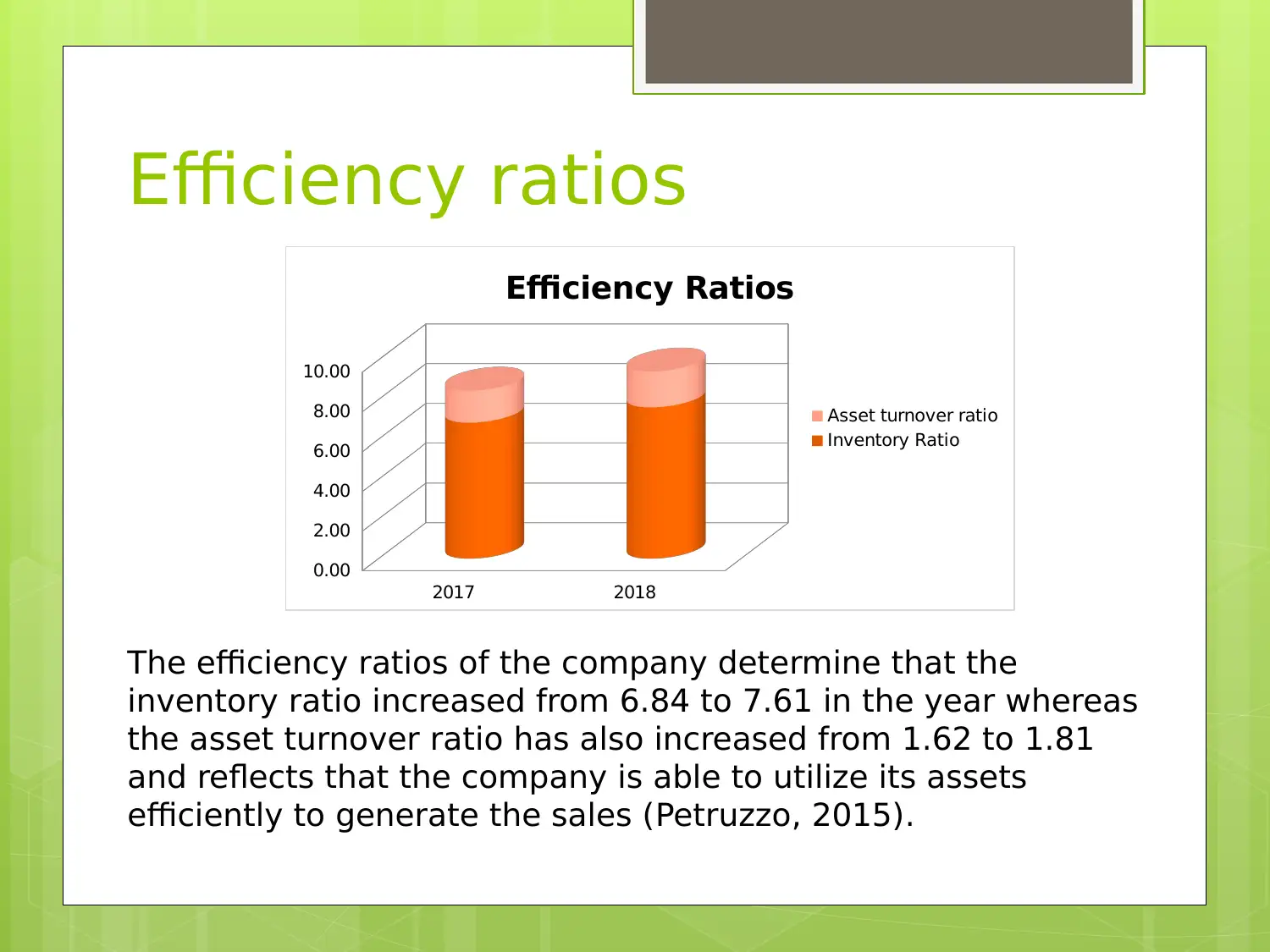

Efficiency ratios

2017 2018

0.00

2.00

4.00

6.00

8.00

10.00

Efficiency Ratios

Asset turnover ratio

Inventory Ratio

The efficiency ratios of the company determine that the

inventory ratio increased from 6.84 to 7.61 in the year whereas

the asset turnover ratio has also increased from 1.62 to 1.81

and reflects that the company is able to utilize its assets

efficiently to generate the sales (Petruzzo, 2015).

2017 2018

0.00

2.00

4.00

6.00

8.00

10.00

Efficiency Ratios

Asset turnover ratio

Inventory Ratio

The efficiency ratios of the company determine that the

inventory ratio increased from 6.84 to 7.61 in the year whereas

the asset turnover ratio has also increased from 1.62 to 1.81

and reflects that the company is able to utilize its assets

efficiently to generate the sales (Petruzzo, 2015).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

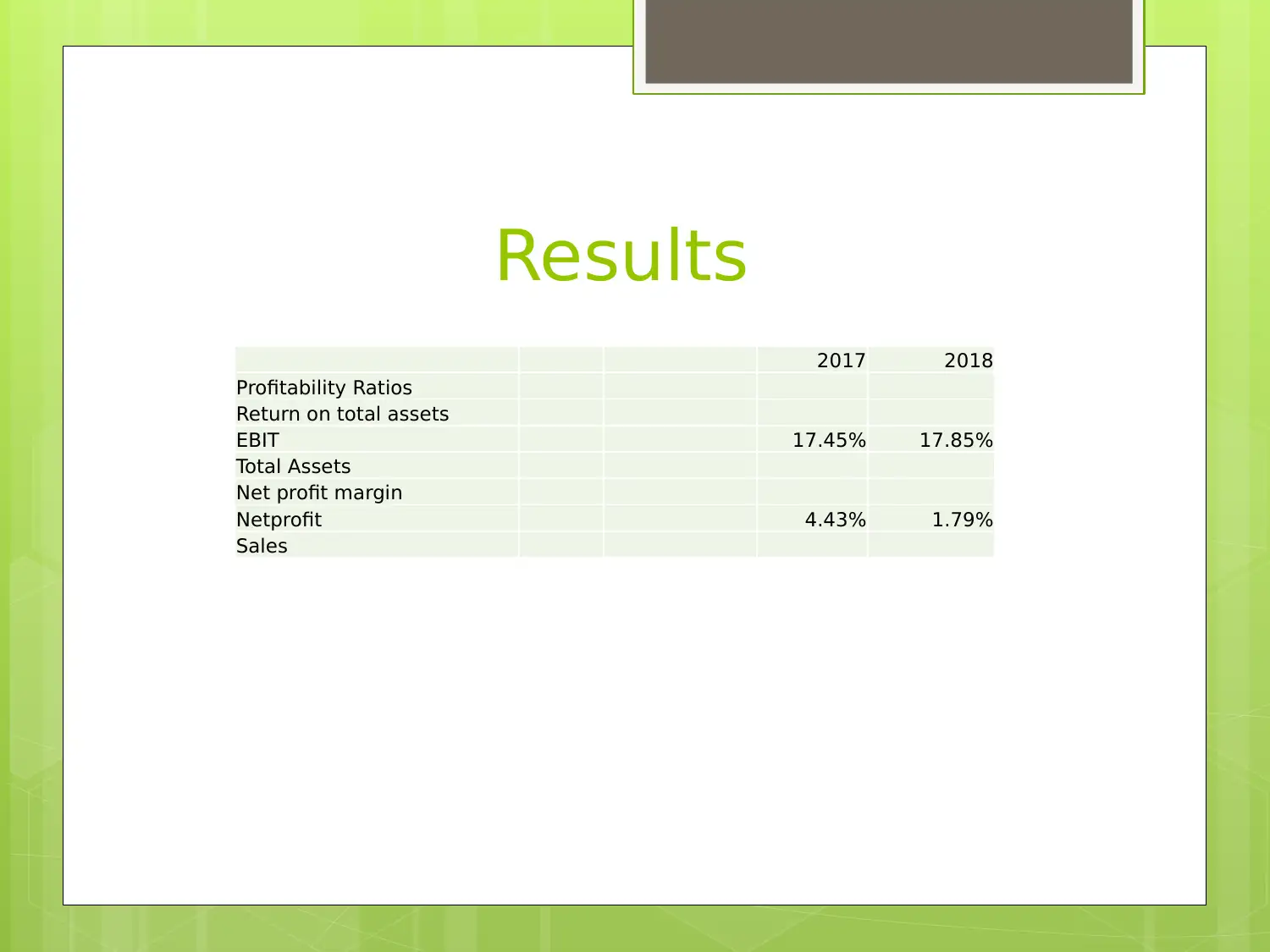

Results

2017 2018

Profitability Ratios

Return on total assets

EBIT 17.45% 17.85%

Total Assets

Net profit margin

Netprofit 4.43% 1.79%

Sales

2017 2018

Profitability Ratios

Return on total assets

EBIT 17.45% 17.85%

Total Assets

Net profit margin

Netprofit 4.43% 1.79%

Sales

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

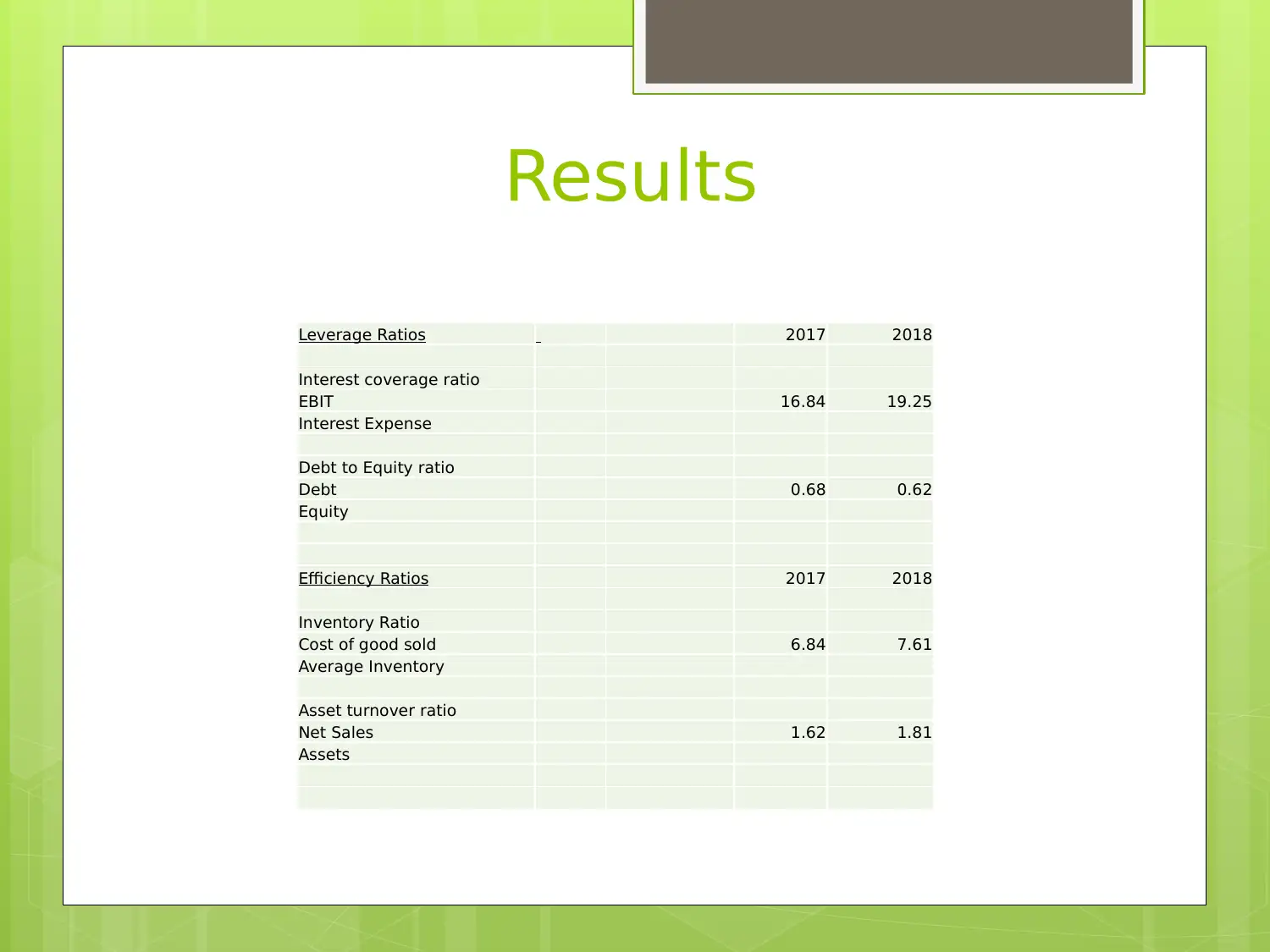

Results

Leverage Ratios 2017 2018

Interest coverage ratio

EBIT 16.84 19.25

Interest Expense

Debt to Equity ratio

Debt 0.68 0.62

Equity

Efficiency Ratios 2017 2018

Inventory Ratio

Cost of good sold 6.84 7.61

Average Inventory

Asset turnover ratio

Net Sales 1.62 1.81

Assets

Leverage Ratios 2017 2018

Interest coverage ratio

EBIT 16.84 19.25

Interest Expense

Debt to Equity ratio

Debt 0.68 0.62

Equity

Efficiency Ratios 2017 2018

Inventory Ratio

Cost of good sold 6.84 7.61

Average Inventory

Asset turnover ratio

Net Sales 1.62 1.81

Assets

References

Wesfarmers, (2018) Annual report [Online] Available from

https://www.wesfarmers.com.au/docs/default-source/reports/wes18-044-2018-annual-

report.pdf?sfvrsn=4

[Accessed on 21st January 2019]

Wesfarmers, (2018) Sustainability [Online] Available from

https://sustainability.wesfarmers.com.au/media/2467/sustainability_website_2018.pdf

[Accessed on 21st January 2019]

Campbell, J., 2017. Insights from the company monitor: Wesfarmers. Equity, 31(8),

p.16.

Kilroy, D. and Schneider, M., 2017. Valuing the Current Strategy. In Customer Value,

Shareholder Wealth, Community Wellbeing (pp. 109-141). Palgrave Macmillan, Cham.

Chen, K., Lin, A. and Siregar, D., 2018. Auditor Reputation, Auditor Independence and

the Underpricing of IPOs. Journal of Applied Business & Economics, 20(6).

Petruzzo, P., Gazarian, A., Kanitakis, J., Parmentier, H., Guigal, V., Guillot, M., Vial, C.,

Dubernard, J.M., Morelon, E. and Badet, L., 2015. Outcomes after bilateral hand

allotransplantation: a risk/benefit ratio analysis. Annals of surgery, 261(1), pp.213-

220.

Wesfarmers, (2018) Annual report [Online] Available from

https://www.wesfarmers.com.au/docs/default-source/reports/wes18-044-2018-annual-

report.pdf?sfvrsn=4

[Accessed on 21st January 2019]

Wesfarmers, (2018) Sustainability [Online] Available from

https://sustainability.wesfarmers.com.au/media/2467/sustainability_website_2018.pdf

[Accessed on 21st January 2019]

Campbell, J., 2017. Insights from the company monitor: Wesfarmers. Equity, 31(8),

p.16.

Kilroy, D. and Schneider, M., 2017. Valuing the Current Strategy. In Customer Value,

Shareholder Wealth, Community Wellbeing (pp. 109-141). Palgrave Macmillan, Cham.

Chen, K., Lin, A. and Siregar, D., 2018. Auditor Reputation, Auditor Independence and

the Underpricing of IPOs. Journal of Applied Business & Economics, 20(6).

Petruzzo, P., Gazarian, A., Kanitakis, J., Parmentier, H., Guigal, V., Guillot, M., Vial, C.,

Dubernard, J.M., Morelon, E. and Badet, L., 2015. Outcomes after bilateral hand

allotransplantation: a risk/benefit ratio analysis. Annals of surgery, 261(1), pp.213-

220.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.