ACCT 1211 Assignment 7: Comprehensive Accounting Problems

VerifiedAdded on 2023/05/28

|8

|781

|76

Homework Assignment

AI Summary

This assignment solution covers various accounting concepts and problems. Question 1 presents a single-step income statement, balance sheet, and capital account calculations for Nothing New Ltd. Question 2 analyzes the company's net profit percentage. Question 3 provides journal entries for transactions in the books of Toy Store and Toy Warehouse. Question 4 delves into inventory valuation using both average cost and FIFO methods, including detailed calculations and a comparison of gross profit under each method. The assignment demonstrates the application of accounting principles to real-world business scenarios, including financial statement preparation, journal entries, and inventory management.

Running head: ACCOUNTING

ACCOUNTING

Name of the Student:

Name of the University:

Author’s Note:

ACCOUNTING

Name of the Student:

Name of the University:

Author’s Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1ACCOUNTING

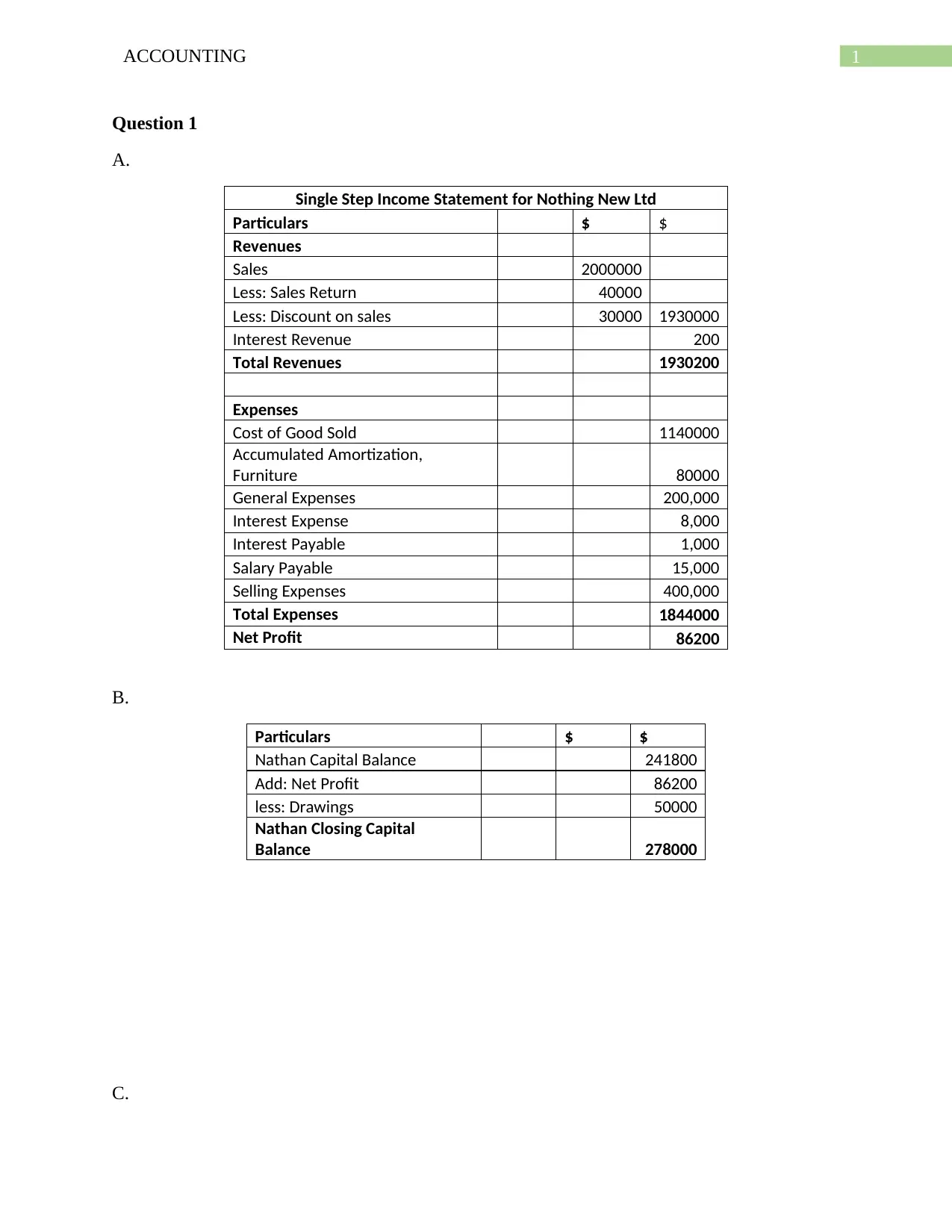

Question 1

A.

Single Step Income Statement for Nothing New Ltd

Particulars $ $

Revenues

Sales 2000000

Less: Sales Return 40000

Less: Discount on sales 30000 1930000

Interest Revenue 200

Total Revenues 1930200

Expenses

Cost of Good Sold 1140000

Accumulated Amortization,

Furniture 80000

General Expenses 200,000

Interest Expense 8,000

Interest Payable 1,000

Salary Payable 15,000

Selling Expenses 400,000

Total Expenses 1844000

Net Profit 86200

B.

Particulars $ $

Nathan Capital Balance 241800

Add: Net Profit 86200

less: Drawings 50000

Nathan Closing Capital

Balance 278000

C.

Question 1

A.

Single Step Income Statement for Nothing New Ltd

Particulars $ $

Revenues

Sales 2000000

Less: Sales Return 40000

Less: Discount on sales 30000 1930000

Interest Revenue 200

Total Revenues 1930200

Expenses

Cost of Good Sold 1140000

Accumulated Amortization,

Furniture 80000

General Expenses 200,000

Interest Expense 8,000

Interest Payable 1,000

Salary Payable 15,000

Selling Expenses 400,000

Total Expenses 1844000

Net Profit 86200

B.

Particulars $ $

Nathan Capital Balance 241800

Add: Net Profit 86200

less: Drawings 50000

Nathan Closing Capital

Balance 278000

C.

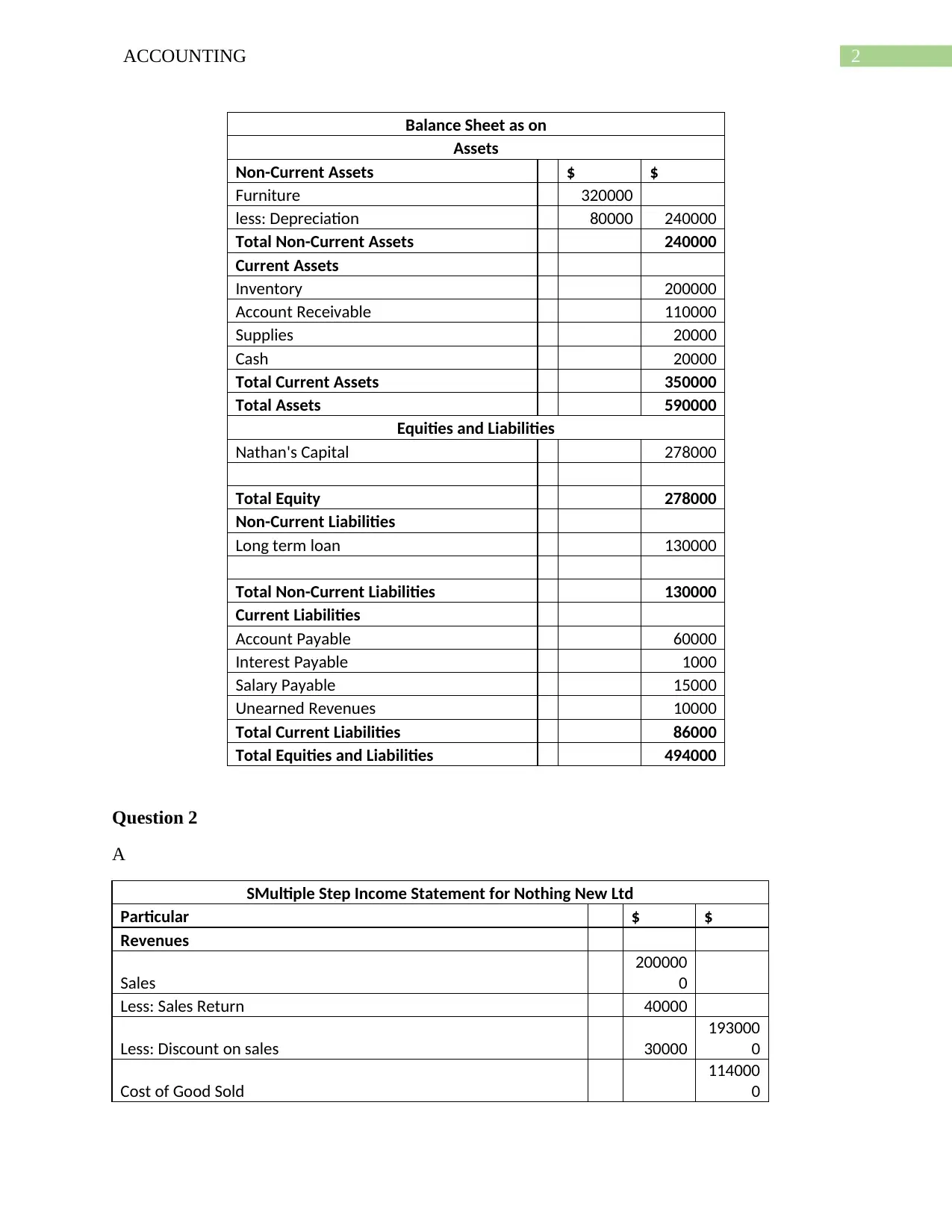

2ACCOUNTING

Balance Sheet as on

Assets

Non-Current Assets $ $

Furniture 320000

less: Depreciation 80000 240000

Total Non-Current Assets 240000

Current Assets

Inventory 200000

Account Receivable 110000

Supplies 20000

Cash 20000

Total Current Assets 350000

Total Assets 590000

Equities and Liabilities

Nathan's Capital 278000

Total Equity 278000

Non-Current Liabilities

Long term loan 130000

Total Non-Current Liabilities 130000

Current Liabilities

Account Payable 60000

Interest Payable 1000

Salary Payable 15000

Unearned Revenues 10000

Total Current Liabilities 86000

Total Equities and Liabilities 494000

Question 2

A

SMultiple Step Income Statement for Nothing New Ltd

Particular $ $

Revenues

Sales

200000

0

Less: Sales Return 40000

Less: Discount on sales 30000

193000

0

Cost of Good Sold

114000

0

Balance Sheet as on

Assets

Non-Current Assets $ $

Furniture 320000

less: Depreciation 80000 240000

Total Non-Current Assets 240000

Current Assets

Inventory 200000

Account Receivable 110000

Supplies 20000

Cash 20000

Total Current Assets 350000

Total Assets 590000

Equities and Liabilities

Nathan's Capital 278000

Total Equity 278000

Non-Current Liabilities

Long term loan 130000

Total Non-Current Liabilities 130000

Current Liabilities

Account Payable 60000

Interest Payable 1000

Salary Payable 15000

Unearned Revenues 10000

Total Current Liabilities 86000

Total Equities and Liabilities 494000

Question 2

A

SMultiple Step Income Statement for Nothing New Ltd

Particular $ $

Revenues

Sales

200000

0

Less: Sales Return 40000

Less: Discount on sales 30000

193000

0

Cost of Good Sold

114000

0

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

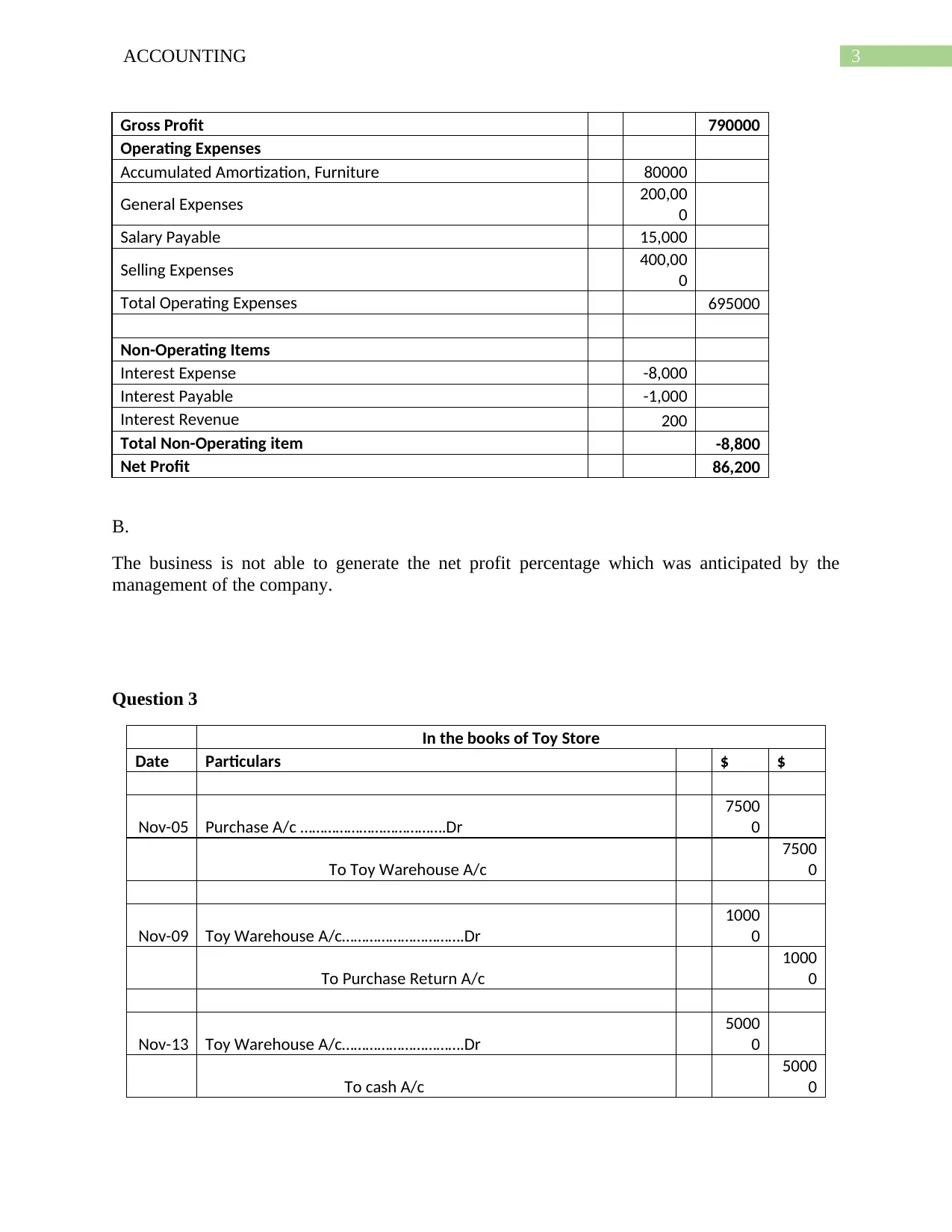

3ACCOUNTING

Gross Profit 790000

Operating Expenses

Accumulated Amortization, Furniture 80000

General Expenses 200,00

0

Salary Payable 15,000

Selling Expenses 400,00

0

Total Operating Expenses 695000

Non-Operating Items

Interest Expense -8,000

Interest Payable -1,000

Interest Revenue 200

Total Non-Operating item -8,800

Net Profit 86,200

B.

The business is not able to generate the net profit percentage which was anticipated by the

management of the company.

Question 3

In the books of Toy Store

Date Particulars $ $

Nov-05 Purchase A/c ……………………………….Dr

7500

0

To Toy Warehouse A/c

7500

0

Nov-09 Toy Warehouse A/c………………………….Dr

1000

0

To Purchase Return A/c

1000

0

Nov-13 Toy Warehouse A/c………………………….Dr

5000

0

To cash A/c

5000

0

Gross Profit 790000

Operating Expenses

Accumulated Amortization, Furniture 80000

General Expenses 200,00

0

Salary Payable 15,000

Selling Expenses 400,00

0

Total Operating Expenses 695000

Non-Operating Items

Interest Expense -8,000

Interest Payable -1,000

Interest Revenue 200

Total Non-Operating item -8,800

Net Profit 86,200

B.

The business is not able to generate the net profit percentage which was anticipated by the

management of the company.

Question 3

In the books of Toy Store

Date Particulars $ $

Nov-05 Purchase A/c ……………………………….Dr

7500

0

To Toy Warehouse A/c

7500

0

Nov-09 Toy Warehouse A/c………………………….Dr

1000

0

To Purchase Return A/c

1000

0

Nov-13 Toy Warehouse A/c………………………….Dr

5000

0

To cash A/c

5000

0

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

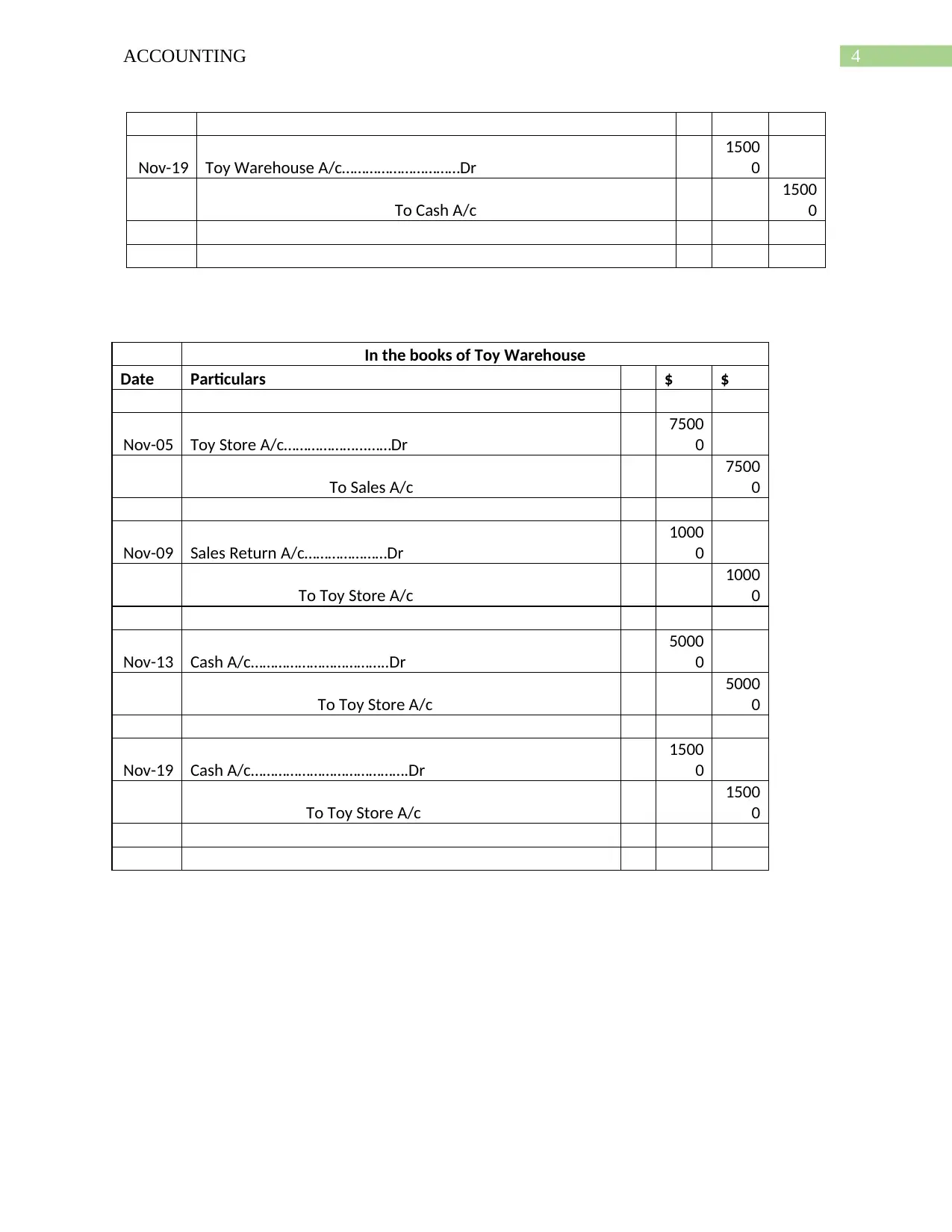

4ACCOUNTING

Nov-19 Toy Warehouse A/c…………………………Dr

1500

0

To Cash A/c

1500

0

In the books of Toy Warehouse

Date Particulars $ $

Nov-05 Toy Store A/c………………...……Dr

7500

0

To Sales A/c

7500

0

Nov-09 Sales Return A/c…………………Dr

1000

0

To Toy Store A/c

1000

0

Nov-13 Cash A/c……………………………..Dr

5000

0

To Toy Store A/c

5000

0

Nov-19 Cash A/c………………………………….Dr

1500

0

To Toy Store A/c

1500

0

Nov-19 Toy Warehouse A/c…………………………Dr

1500

0

To Cash A/c

1500

0

In the books of Toy Warehouse

Date Particulars $ $

Nov-05 Toy Store A/c………………...……Dr

7500

0

To Sales A/c

7500

0

Nov-09 Sales Return A/c…………………Dr

1000

0

To Toy Store A/c

1000

0

Nov-13 Cash A/c……………………………..Dr

5000

0

To Toy Store A/c

5000

0

Nov-19 Cash A/c………………………………….Dr

1500

0

To Toy Store A/c

1500

0

5ACCOUNTING

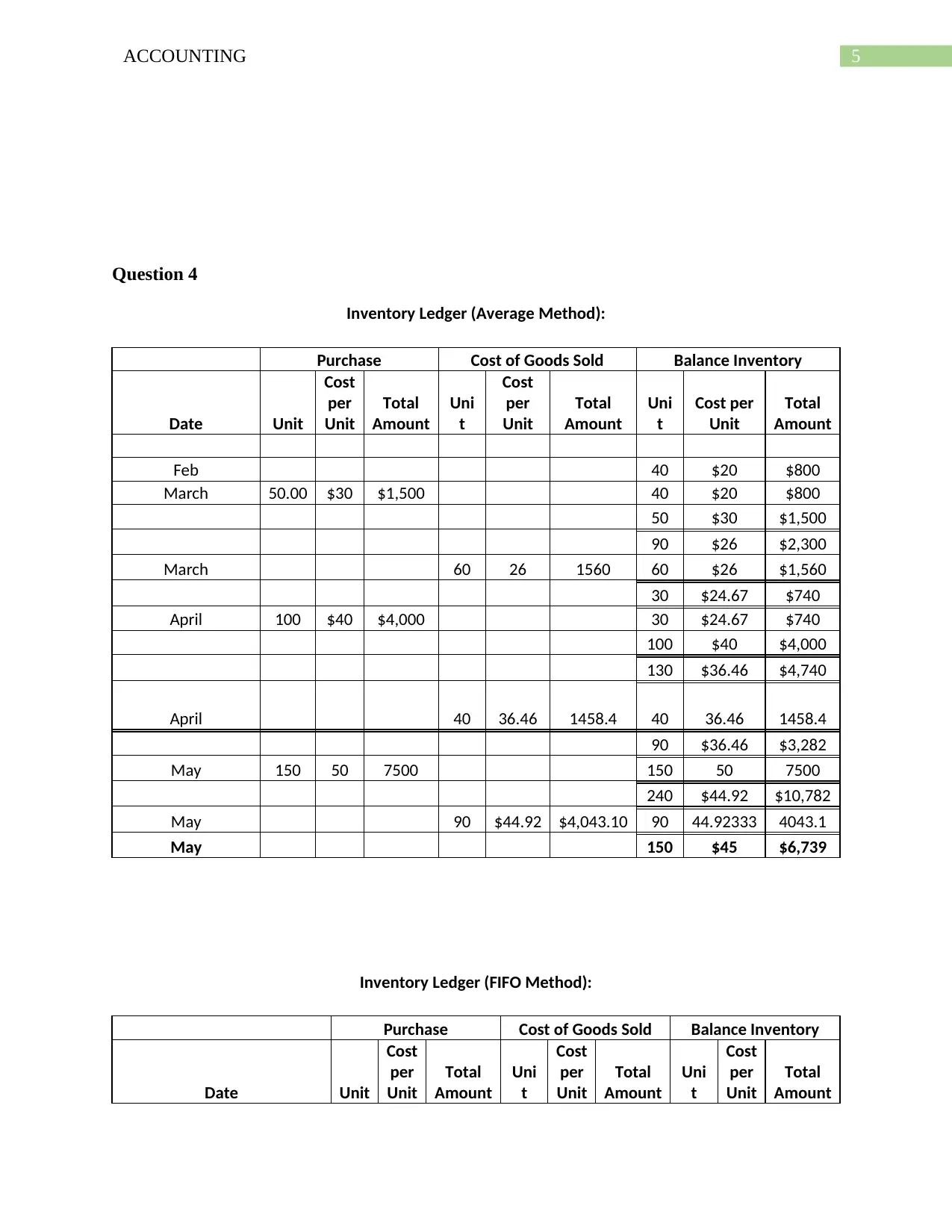

Question 4

Inventory Ledger (Average Method):

Purchase Cost of Goods Sold Balance Inventory

Date Unit

Cost

per

Unit

Total

Amount

Uni

t

Cost

per

Unit

Total

Amount

Uni

t

Cost per

Unit

Total

Amount

Feb 40 $20 $800

March 50.00 $30 $1,500 40 $20 $800

50 $30 $1,500

90 $26 $2,300

March 60 26 1560 60 $26 $1,560

30 $24.67 $740

April 100 $40 $4,000 30 $24.67 $740

100 $40 $4,000

130 $36.46 $4,740

April 40 36.46 1458.4 40 36.46 1458.4

90 $36.46 $3,282

May 150 50 7500 150 50 7500

240 $44.92 $10,782

May 90 $44.92 $4,043.10 90 44.92333 4043.1

May 150 $45 $6,739

Inventory Ledger (FIFO Method):

Purchase Cost of Goods Sold Balance Inventory

Date Unit

Cost

per

Unit

Total

Amount

Uni

t

Cost

per

Unit

Total

Amount

Uni

t

Cost

per

Unit

Total

Amount

Question 4

Inventory Ledger (Average Method):

Purchase Cost of Goods Sold Balance Inventory

Date Unit

Cost

per

Unit

Total

Amount

Uni

t

Cost

per

Unit

Total

Amount

Uni

t

Cost per

Unit

Total

Amount

Feb 40 $20 $800

March 50.00 $30 $1,500 40 $20 $800

50 $30 $1,500

90 $26 $2,300

March 60 26 1560 60 $26 $1,560

30 $24.67 $740

April 100 $40 $4,000 30 $24.67 $740

100 $40 $4,000

130 $36.46 $4,740

April 40 36.46 1458.4 40 36.46 1458.4

90 $36.46 $3,282

May 150 50 7500 150 50 7500

240 $44.92 $10,782

May 90 $44.92 $4,043.10 90 44.92333 4043.1

May 150 $45 $6,739

Inventory Ledger (FIFO Method):

Purchase Cost of Goods Sold Balance Inventory

Date Unit

Cost

per

Unit

Total

Amount

Uni

t

Cost

per

Unit

Total

Amount

Uni

t

Cost

per

Unit

Total

Amount

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6ACCOUNTING

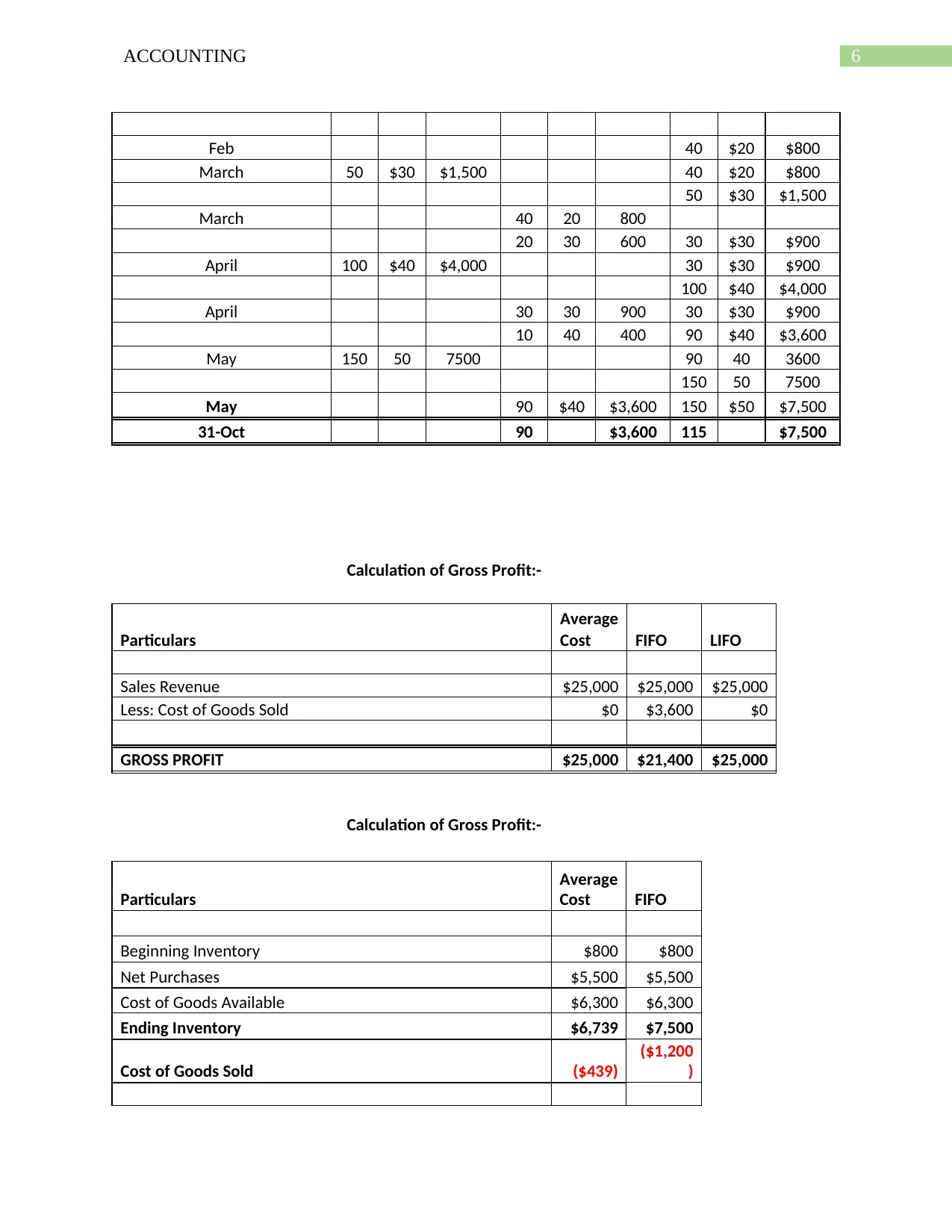

Feb 40 $20 $800

March 50 $30 $1,500 40 $20 $800

50 $30 $1,500

March 40 20 800

20 30 600 30 $30 $900

April 100 $40 $4,000 30 $30 $900

100 $40 $4,000

April 30 30 900 30 $30 $900

10 40 400 90 $40 $3,600

May 150 50 7500 90 40 3600

150 50 7500

May 90 $40 $3,600 150 $50 $7,500

31-Oct 90 $3,600 115 $7,500

Calculation of Gross Profit:-

Particulars

Average

Cost FIFO LIFO

Sales Revenue $25,000 $25,000 $25,000

Less: Cost of Goods Sold $0 $3,600 $0

GROSS PROFIT $25,000 $21,400 $25,000

Calculation of Gross Profit:-

Particulars

Average

Cost FIFO

Beginning Inventory $800 $800

Net Purchases $5,500 $5,500

Cost of Goods Available $6,300 $6,300

Ending Inventory $6,739 $7,500

Cost of Goods Sold ($439)

($1,200

)

Feb 40 $20 $800

March 50 $30 $1,500 40 $20 $800

50 $30 $1,500

March 40 20 800

20 30 600 30 $30 $900

April 100 $40 $4,000 30 $30 $900

100 $40 $4,000

April 30 30 900 30 $30 $900

10 40 400 90 $40 $3,600

May 150 50 7500 90 40 3600

150 50 7500

May 90 $40 $3,600 150 $50 $7,500

31-Oct 90 $3,600 115 $7,500

Calculation of Gross Profit:-

Particulars

Average

Cost FIFO LIFO

Sales Revenue $25,000 $25,000 $25,000

Less: Cost of Goods Sold $0 $3,600 $0

GROSS PROFIT $25,000 $21,400 $25,000

Calculation of Gross Profit:-

Particulars

Average

Cost FIFO

Beginning Inventory $800 $800

Net Purchases $5,500 $5,500

Cost of Goods Available $6,300 $6,300

Ending Inventory $6,739 $7,500

Cost of Goods Sold ($439)

($1,200

)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7ACCOUNTING

1 out of 8

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.