ACC567 Financial Accounting 2: Comprehensive Acquisition Analysis

VerifiedAdded on 2023/06/08

|3

|551

|454

Practical Assignment

AI Summary

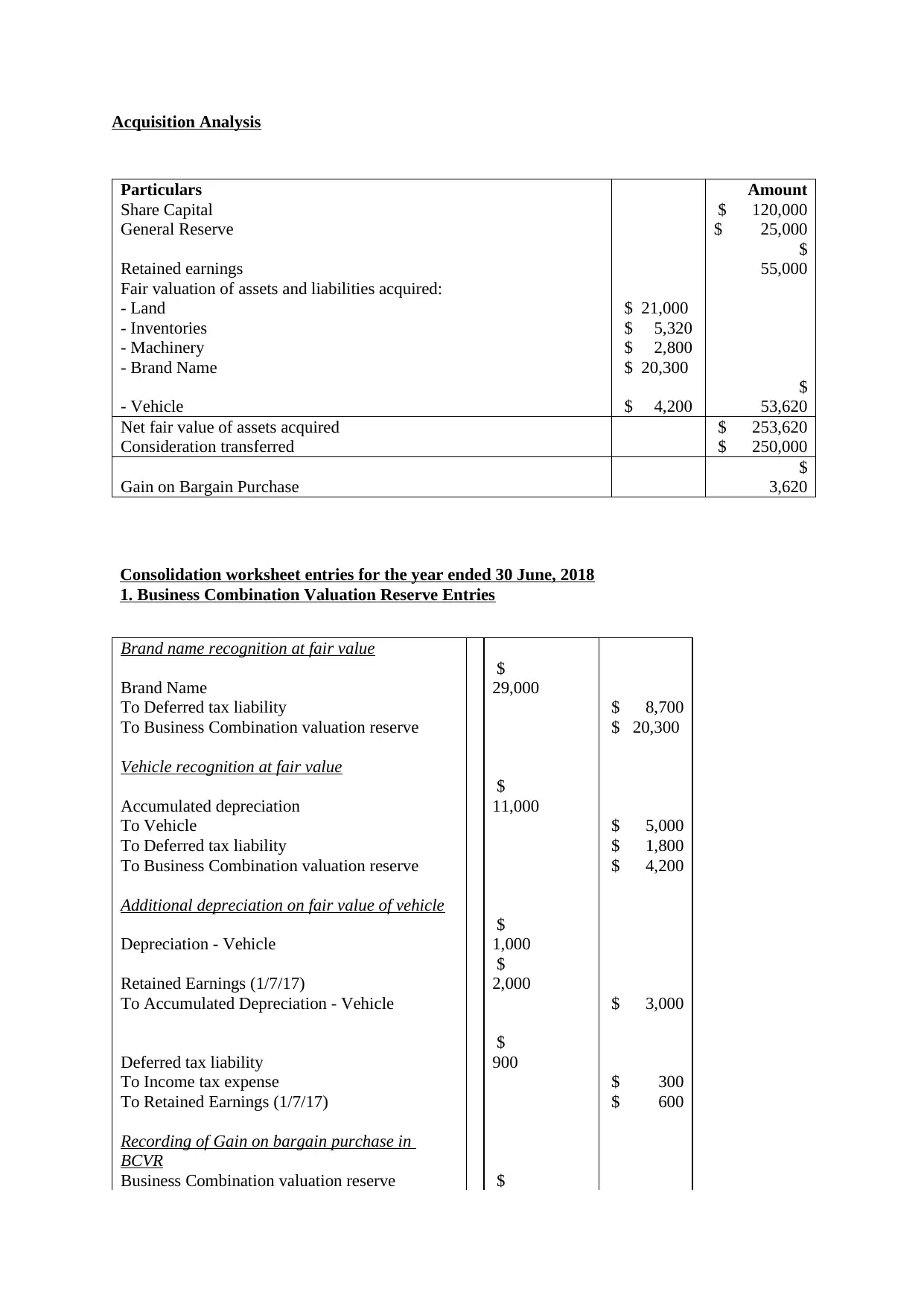

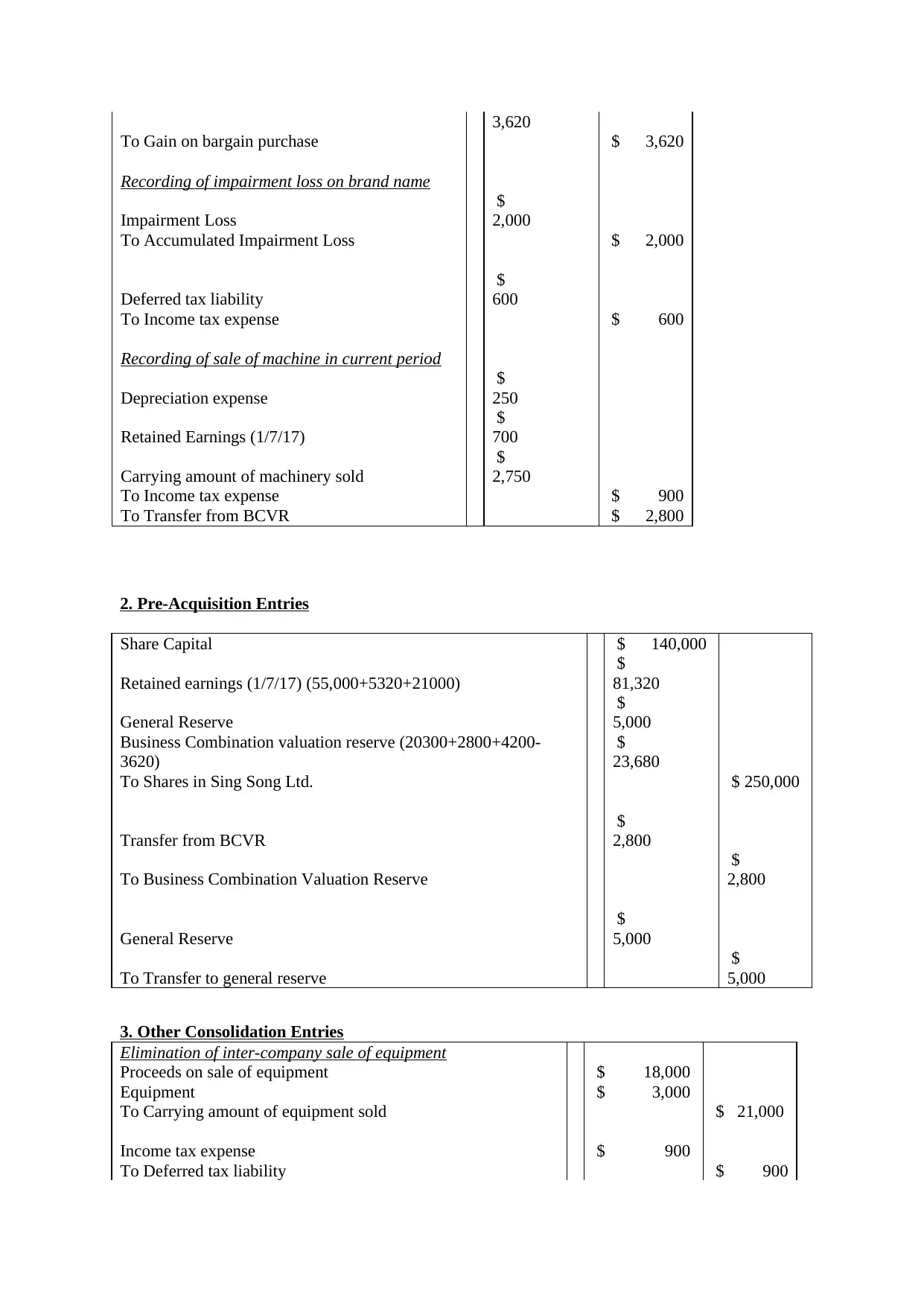

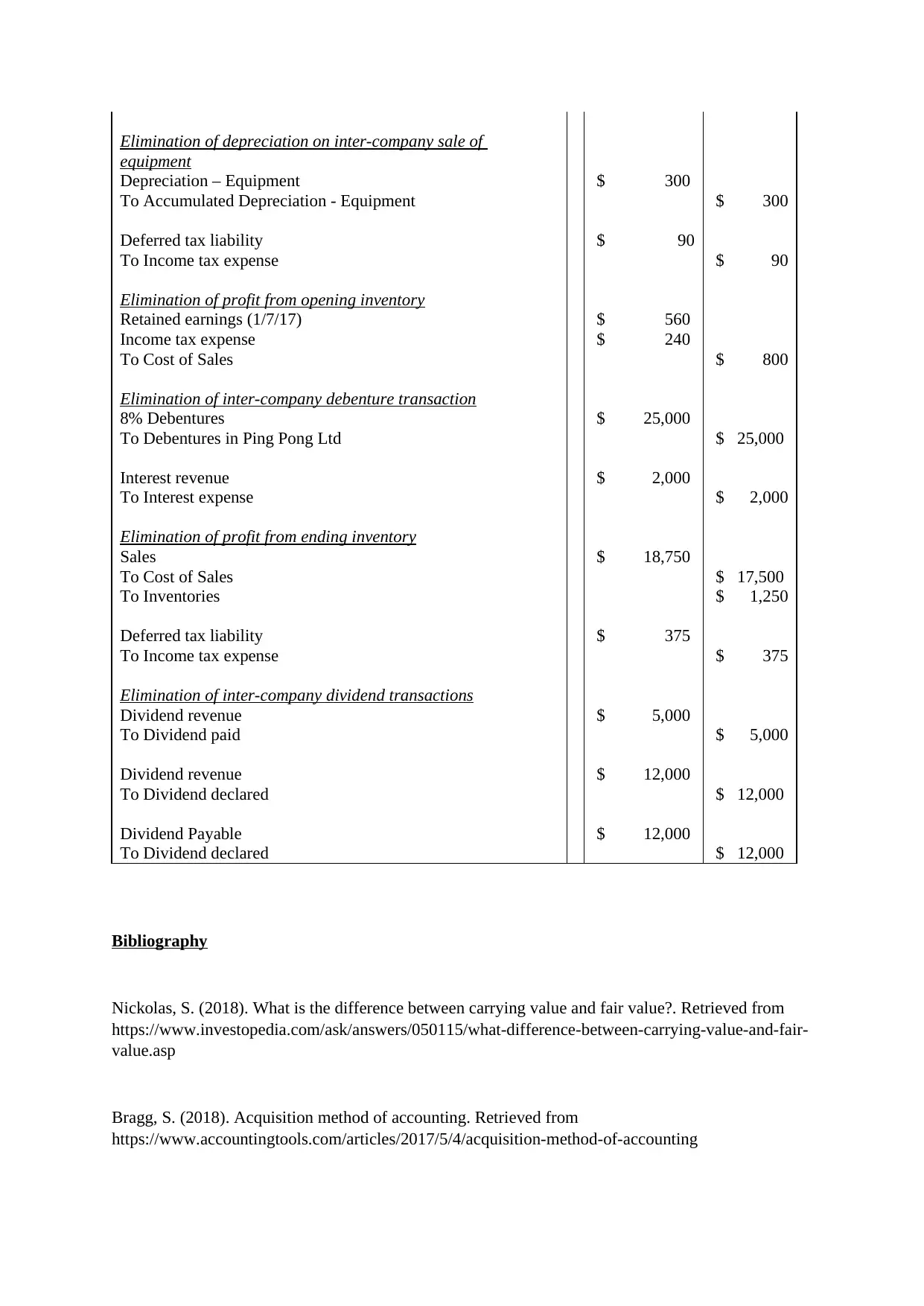

This document presents a detailed solution to an acquisition analysis problem, likely for a Financial Accounting course (ACC567). It includes calculations for fair valuation of assets and liabilities, consideration transferred, and gain on bargain purchase. The solution provides consolidation worksheet entries, including adjustments for brand name recognition, vehicle valuation, depreciation, impairment loss, and inter-company transactions such as sales of equipment and debentures. The entries cover pre-acquisition adjustments, elimination of inter-company profits, and dividend transactions, offering a comprehensive guide to handling complex consolidation issues in financial accounting. The document concludes with a bibliography referencing relevant accounting resources.

1 out of 3

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)