Accounting Assignment: Acquisition Analysis, Consolidation and Equity

VerifiedAdded on 2019/12/28

|10

|1466

|64

Homework Assignment

AI Summary

This document presents comprehensive solutions to accounting questions, focusing on acquisition analysis, consolidation, and equity accounting. It includes detailed journal entries for acquisition analysis, encompassing accumulated depreciation, depreciation expenses, deferred tax liabilities, and cost of sales. Pre-acquisition entries are also provided, addressing retained earnings, share capital, general reserves, and business combination valuation. The assignment further explores the acquisition analysis of Sahara Ltd, calculating the net fair value of identifiable assets and liabilities, consideration transferred, and goodwill. Worksheet entries at 30 June 2017 are provided to illustrate business combination valuation entries. The document also includes consolidated financial statements and statements of equity changes.

ACCOUNTING

QUESTIONS

QUESTIONS

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

QUESTION 1..................................................................................................................................3

QUESTION 2..................................................................................................................................6

Acquisition analysis.....................................................................................................................6

Worksheet entries at 30 June 2017..............................................................................................2

P re-aquisition entries..................................................................................................................3

Consolidated financial statements...............................................................................................4

Prepare statements of equity of changes......................................................................................5

QUESTION 1..................................................................................................................................3

QUESTION 2..................................................................................................................................6

Acquisition analysis.....................................................................................................................6

Worksheet entries at 30 June 2017..............................................................................................2

P re-aquisition entries..................................................................................................................3

Consolidated financial statements...............................................................................................4

Prepare statements of equity of changes......................................................................................5

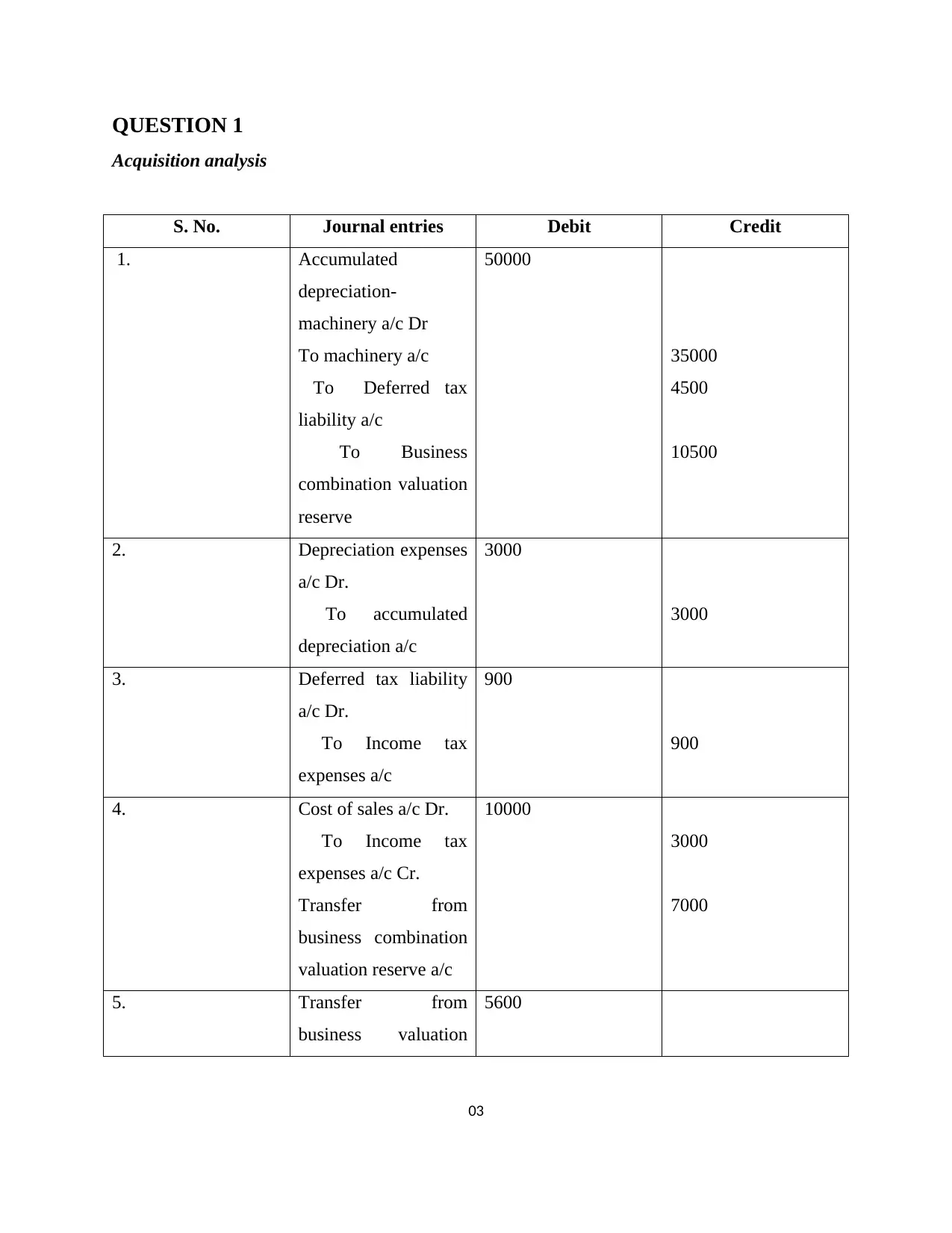

QUESTION 1

Acquisition analysis

S. No. Journal entries Debit Credit

1. Accumulated

depreciation-

machinery a/c Dr

To machinery a/c

To Deferred tax

liability a/c

To Business

combination valuation

reserve

50000

35000

4500

10500

2. Depreciation expenses

a/c Dr.

To accumulated

depreciation a/c

3000

3000

3. Deferred tax liability

a/c Dr.

To Income tax

expenses a/c

900

900

4. Cost of sales a/c Dr.

To Income tax

expenses a/c Cr.

Transfer from

business combination

valuation reserve a/c

10000

3000

7000

5. Transfer from

business valuation

5600

03

Acquisition analysis

S. No. Journal entries Debit Credit

1. Accumulated

depreciation-

machinery a/c Dr

To machinery a/c

To Deferred tax

liability a/c

To Business

combination valuation

reserve

50000

35000

4500

10500

2. Depreciation expenses

a/c Dr.

To accumulated

depreciation a/c

3000

3000

3. Deferred tax liability

a/c Dr.

To Income tax

expenses a/c

900

900

4. Cost of sales a/c Dr.

To Income tax

expenses a/c Cr.

Transfer from

business combination

valuation reserve a/c

10000

3000

7000

5. Transfer from

business valuation

5600

03

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

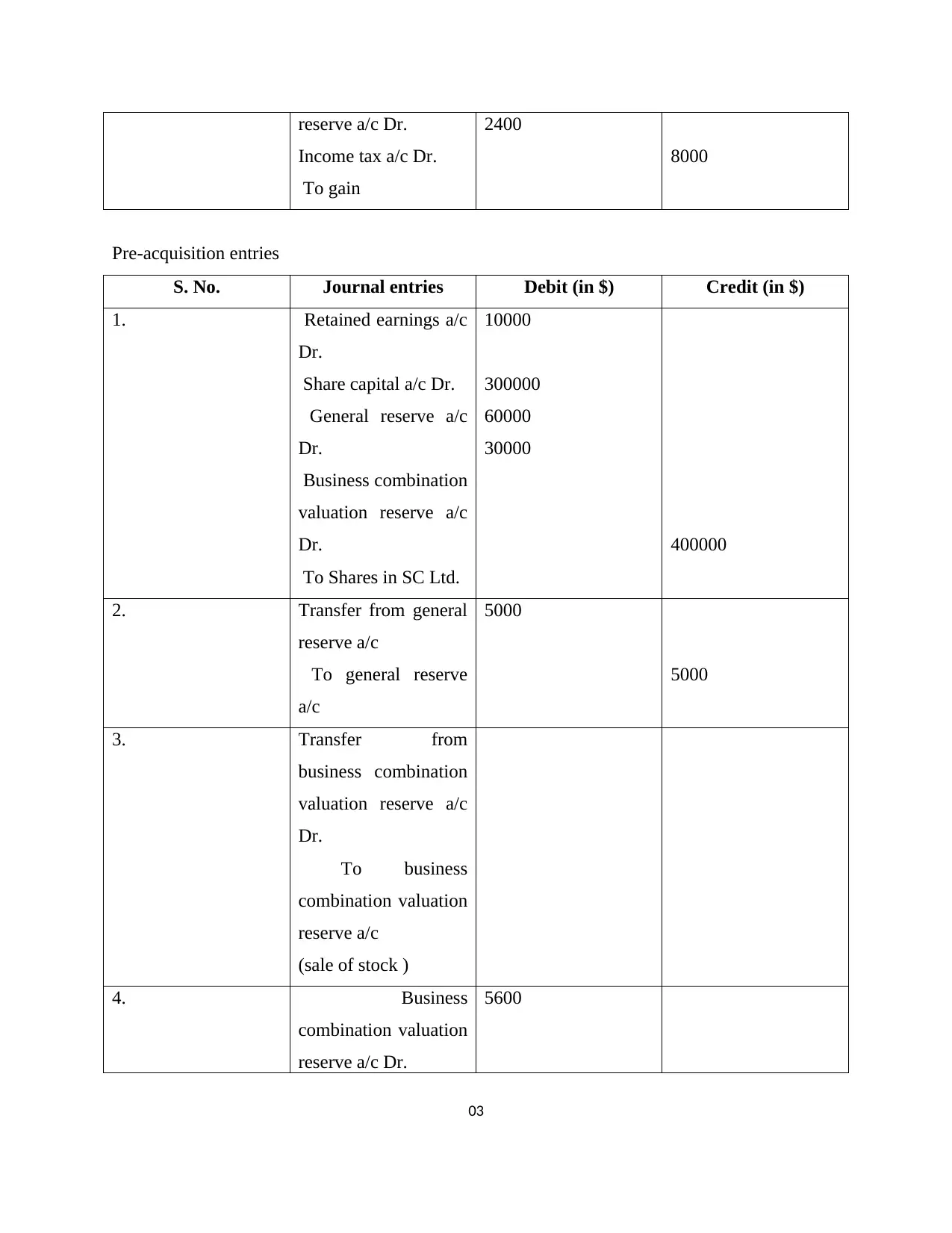

reserve a/c Dr.

Income tax a/c Dr.

To gain

2400

8000

Pre-acquisition entries

S. No. Journal entries Debit (in $) Credit (in $)

1. Retained earnings a/c

Dr.

Share capital a/c Dr.

General reserve a/c

Dr.

Business combination

valuation reserve a/c

Dr.

To Shares in SC Ltd.

10000

300000

60000

30000

400000

2. Transfer from general

reserve a/c

To general reserve

a/c

5000

5000

3. Transfer from

business combination

valuation reserve a/c

Dr.

To business

combination valuation

reserve a/c

(sale of stock )

4. Business

combination valuation

reserve a/c Dr.

5600

03

Income tax a/c Dr.

To gain

2400

8000

Pre-acquisition entries

S. No. Journal entries Debit (in $) Credit (in $)

1. Retained earnings a/c

Dr.

Share capital a/c Dr.

General reserve a/c

Dr.

Business combination

valuation reserve a/c

Dr.

To Shares in SC Ltd.

10000

300000

60000

30000

400000

2. Transfer from general

reserve a/c

To general reserve

a/c

5000

5000

3. Transfer from

business combination

valuation reserve a/c

Dr.

To business

combination valuation

reserve a/c

(sale of stock )

4. Business

combination valuation

reserve a/c Dr.

5600

03

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

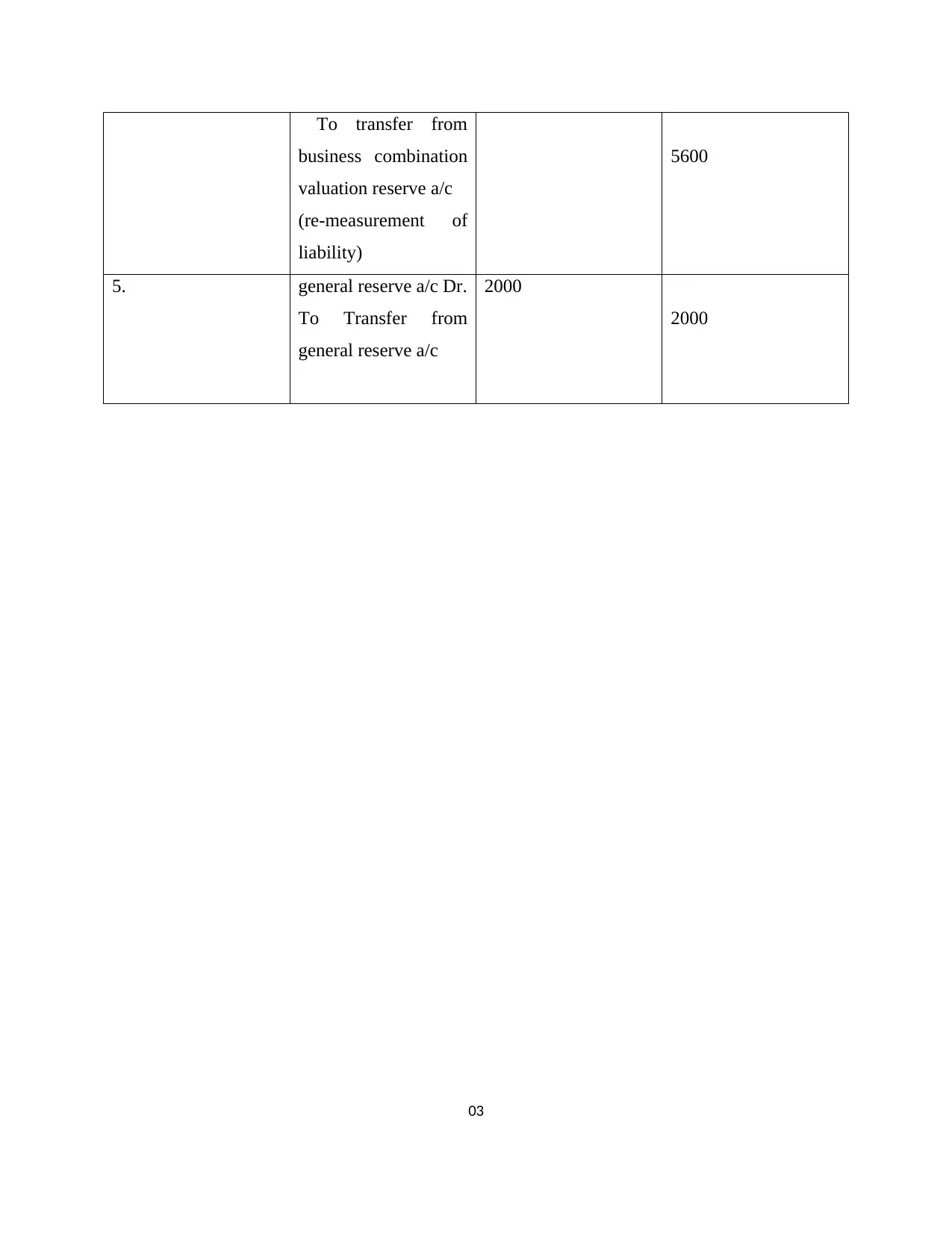

To transfer from

business combination

valuation reserve a/c

(re-measurement of

liability)

5600

5. general reserve a/c Dr.

To Transfer from

general reserve a/c

2000

2000

03

business combination

valuation reserve a/c

(re-measurement of

liability)

5600

5. general reserve a/c Dr.

To Transfer from

general reserve a/c

2000

2000

03

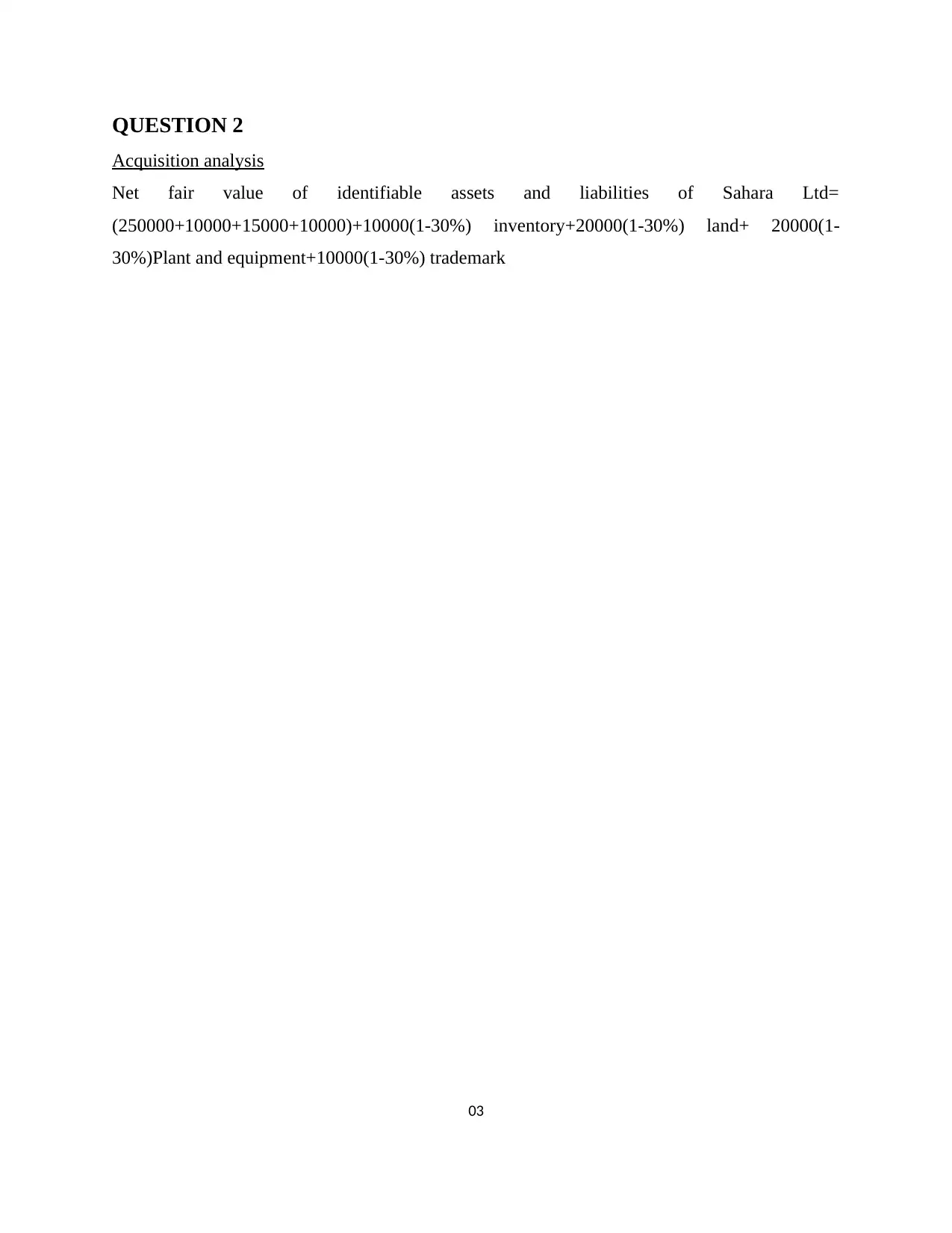

QUESTION 2

Acquisition analysis

Net fair value of identifiable assets and liabilities of Sahara Ltd=

(250000+10000+15000+10000)+10000(1-30%) inventory+20000(1-30%) land+ 20000(1-

30%)Plant and equipment+10000(1-30%) trademark

03

Acquisition analysis

Net fair value of identifiable assets and liabilities of Sahara Ltd=

(250000+10000+15000+10000)+10000(1-30%) inventory+20000(1-30%) land+ 20000(1-

30%)Plant and equipment+10000(1-30%) trademark

03

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

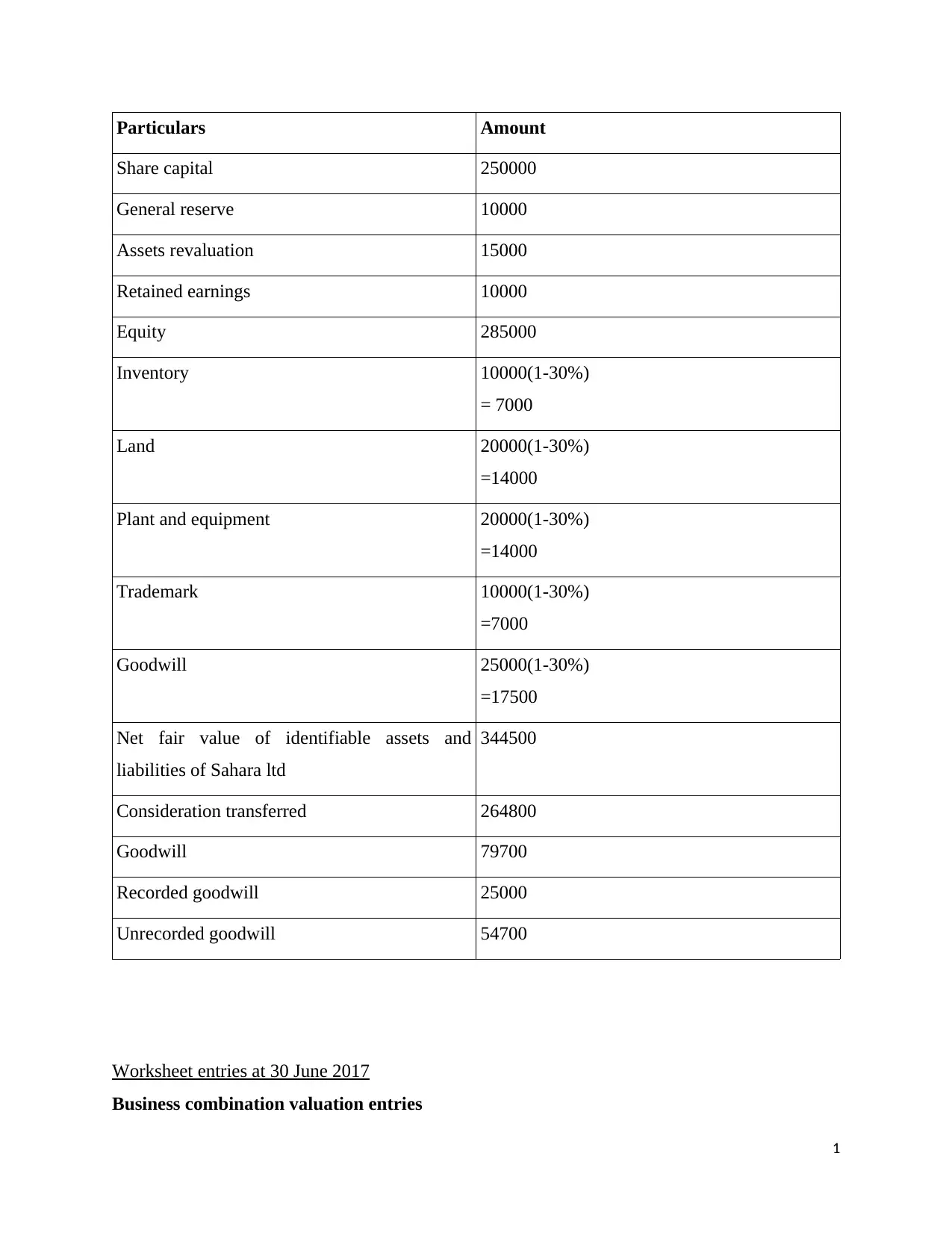

Particulars Amount

Share capital 250000

General reserve 10000

Assets revaluation 15000

Retained earnings 10000

Equity 285000

Inventory 10000(1-30%)

= 7000

Land 20000(1-30%)

=14000

Plant and equipment 20000(1-30%)

=14000

Trademark 10000(1-30%)

=7000

Goodwill 25000(1-30%)

=17500

Net fair value of identifiable assets and

liabilities of Sahara ltd

344500

Consideration transferred 264800

Goodwill 79700

Recorded goodwill 25000

Unrecorded goodwill 54700

Worksheet entries at 30 June 2017

Business combination valuation entries

1

Share capital 250000

General reserve 10000

Assets revaluation 15000

Retained earnings 10000

Equity 285000

Inventory 10000(1-30%)

= 7000

Land 20000(1-30%)

=14000

Plant and equipment 20000(1-30%)

=14000

Trademark 10000(1-30%)

=7000

Goodwill 25000(1-30%)

=17500

Net fair value of identifiable assets and

liabilities of Sahara ltd

344500

Consideration transferred 264800

Goodwill 79700

Recorded goodwill 25000

Unrecorded goodwill 54700

Worksheet entries at 30 June 2017

Business combination valuation entries

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

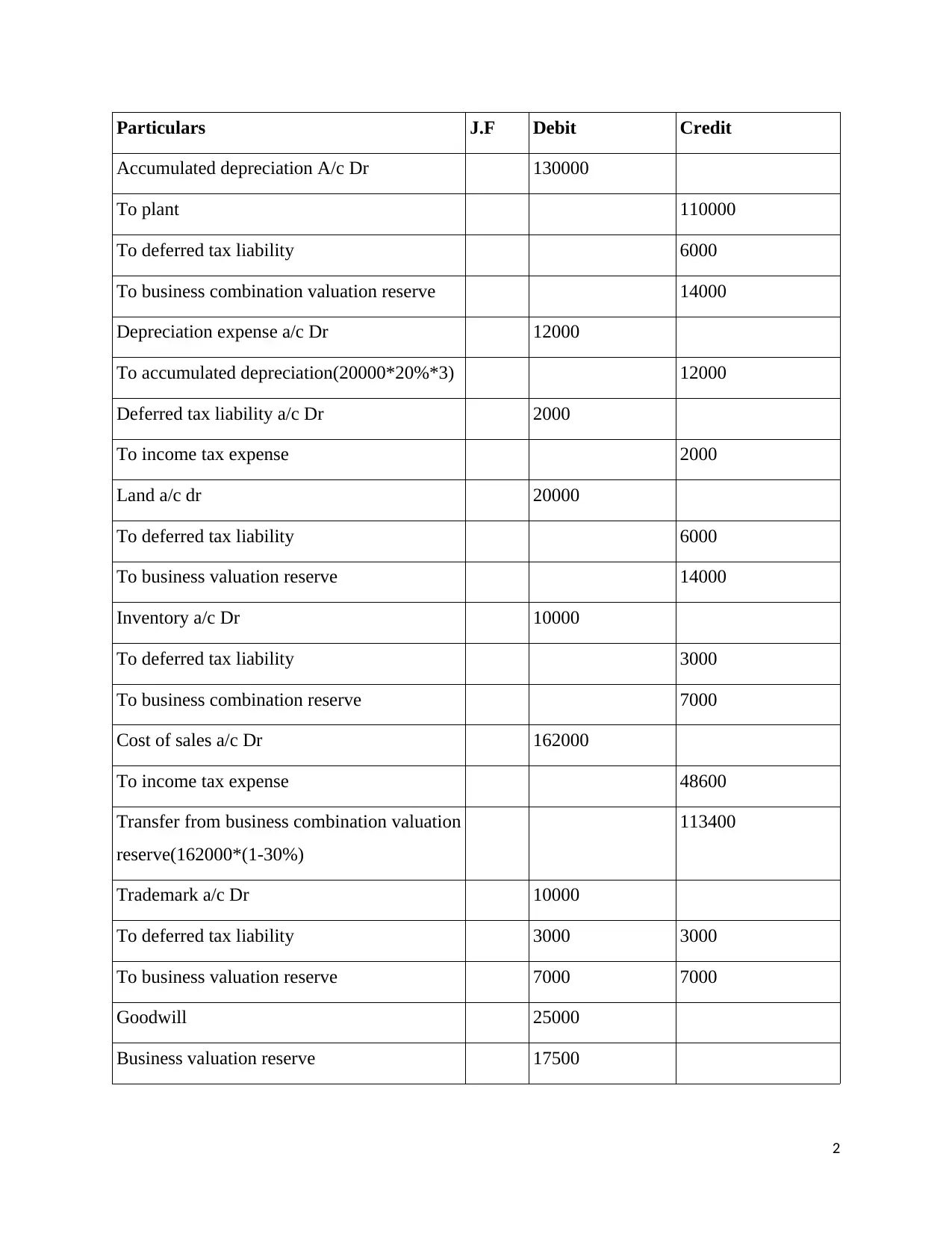

Particulars J.F Debit Credit

Accumulated depreciation A/c Dr 130000

To plant 110000

To deferred tax liability 6000

To business combination valuation reserve 14000

Depreciation expense a/c Dr 12000

To accumulated depreciation(20000*20%*3) 12000

Deferred tax liability a/c Dr 2000

To income tax expense 2000

Land a/c dr 20000

To deferred tax liability 6000

To business valuation reserve 14000

Inventory a/c Dr 10000

To deferred tax liability 3000

To business combination reserve 7000

Cost of sales a/c Dr 162000

To income tax expense 48600

Transfer from business combination valuation

reserve(162000*(1-30%)

113400

Trademark a/c Dr 10000

To deferred tax liability 3000 3000

To business valuation reserve 7000 7000

Goodwill 25000

Business valuation reserve 17500

2

Accumulated depreciation A/c Dr 130000

To plant 110000

To deferred tax liability 6000

To business combination valuation reserve 14000

Depreciation expense a/c Dr 12000

To accumulated depreciation(20000*20%*3) 12000

Deferred tax liability a/c Dr 2000

To income tax expense 2000

Land a/c dr 20000

To deferred tax liability 6000

To business valuation reserve 14000

Inventory a/c Dr 10000

To deferred tax liability 3000

To business combination reserve 7000

Cost of sales a/c Dr 162000

To income tax expense 48600

Transfer from business combination valuation

reserve(162000*(1-30%)

113400

Trademark a/c Dr 10000

To deferred tax liability 3000 3000

To business valuation reserve 7000 7000

Goodwill 25000

Business valuation reserve 17500

2

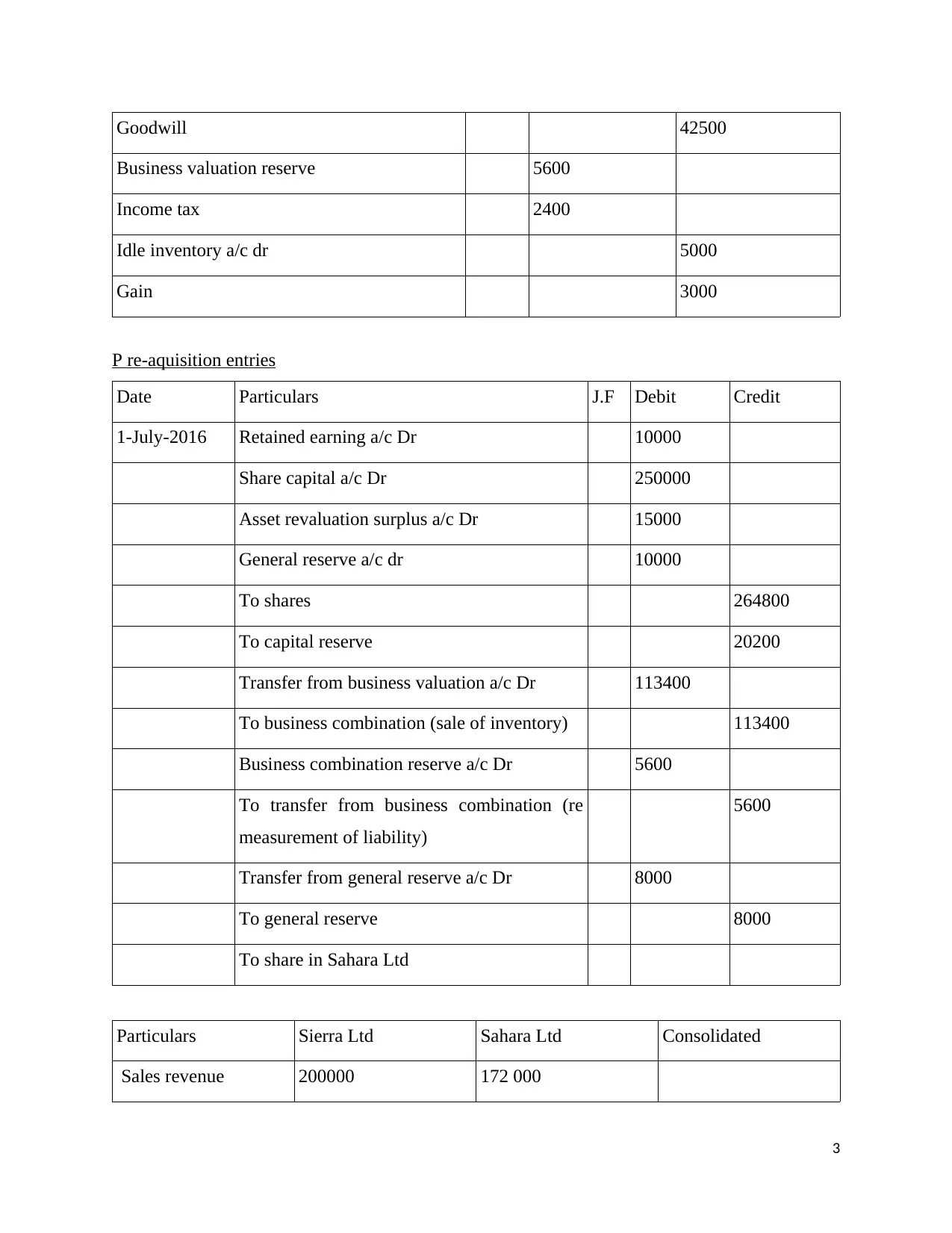

Goodwill 42500

Business valuation reserve 5600

Income tax 2400

Idle inventory a/c dr 5000

Gain 3000

P re-aquisition entries

Date Particulars J.F Debit Credit

1-July-2016 Retained earning a/c Dr 10000

Share capital a/c Dr 250000

Asset revaluation surplus a/c Dr 15000

General reserve a/c dr 10000

To shares 264800

To capital reserve 20200

Transfer from business valuation a/c Dr 113400

To business combination (sale of inventory) 113400

Business combination reserve a/c Dr 5600

To transfer from business combination (re

measurement of liability)

5600

Transfer from general reserve a/c Dr 8000

To general reserve 8000

To share in Sahara Ltd

Particulars Sierra Ltd Sahara Ltd Consolidated

Sales revenue 200000 172 000

3

Business valuation reserve 5600

Income tax 2400

Idle inventory a/c dr 5000

Gain 3000

P re-aquisition entries

Date Particulars J.F Debit Credit

1-July-2016 Retained earning a/c Dr 10000

Share capital a/c Dr 250000

Asset revaluation surplus a/c Dr 15000

General reserve a/c dr 10000

To shares 264800

To capital reserve 20200

Transfer from business valuation a/c Dr 113400

To business combination (sale of inventory) 113400

Business combination reserve a/c Dr 5600

To transfer from business combination (re

measurement of liability)

5600

Transfer from general reserve a/c Dr 8000

To general reserve 8000

To share in Sahara Ltd

Particulars Sierra Ltd Sahara Ltd Consolidated

Sales revenue 200000 172 000

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

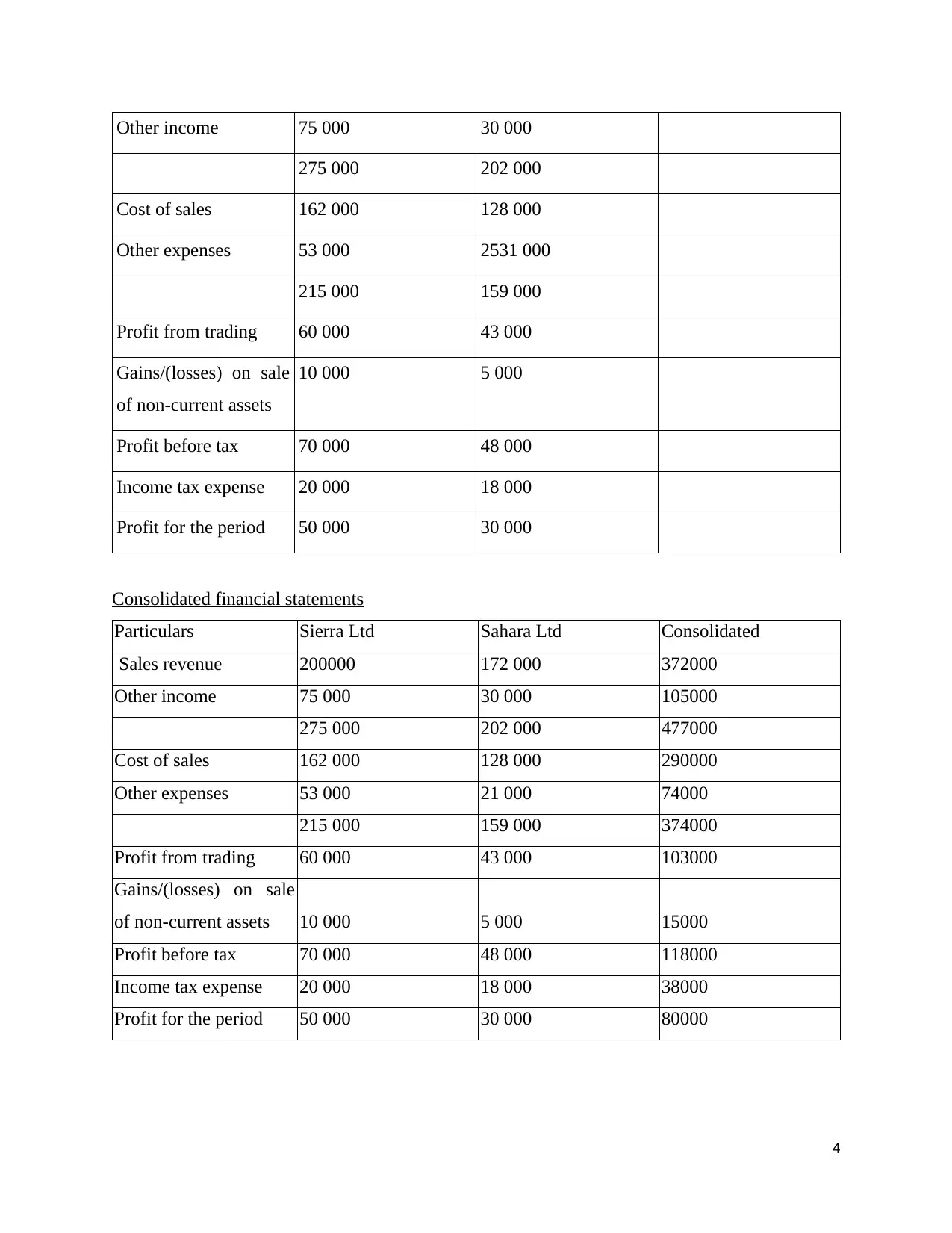

Other income 75 000 30 000

275 000 202 000

Cost of sales 162 000 128 000

Other expenses 53 000 2531 000

215 000 159 000

Profit from trading 60 000 43 000

Gains/(losses) on sale

of non-current assets

10 000 5 000

Profit before tax 70 000 48 000

Income tax expense 20 000 18 000

Profit for the period 50 000 30 000

Consolidated financial statements

Particulars Sierra Ltd Sahara Ltd Consolidated

Sales revenue 200000 172 000 372000

Other income 75 000 30 000 105000

275 000 202 000 477000

Cost of sales 162 000 128 000 290000

Other expenses 53 000 21 000 74000

215 000 159 000 374000

Profit from trading 60 000 43 000 103000

Gains/(losses) on sale

of non-current assets 10 000 5 000 15000

Profit before tax 70 000 48 000 118000

Income tax expense 20 000 18 000 38000

Profit for the period 50 000 30 000 80000

4

275 000 202 000

Cost of sales 162 000 128 000

Other expenses 53 000 2531 000

215 000 159 000

Profit from trading 60 000 43 000

Gains/(losses) on sale

of non-current assets

10 000 5 000

Profit before tax 70 000 48 000

Income tax expense 20 000 18 000

Profit for the period 50 000 30 000

Consolidated financial statements

Particulars Sierra Ltd Sahara Ltd Consolidated

Sales revenue 200000 172 000 372000

Other income 75 000 30 000 105000

275 000 202 000 477000

Cost of sales 162 000 128 000 290000

Other expenses 53 000 21 000 74000

215 000 159 000 374000

Profit from trading 60 000 43 000 103000

Gains/(losses) on sale

of non-current assets 10 000 5 000 15000

Profit before tax 70 000 48 000 118000

Income tax expense 20 000 18 000 38000

Profit for the period 50 000 30 000 80000

4

1 out of 10

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.