IIT ADACC Chapter 8 Assessment Booklet: Finance and Auditing

VerifiedAdded on 2022/09/01

|22

|3655

|16

Homework Assignment

AI Summary

This document presents the solutions to the ADACC Chapter 8 assessment, focusing on audit and reporting on financial systems and records. The assessment includes short answer questions addressing various aspects of auditing, such as the application of different international standards (ISAs, ISREs, ISAEs, ISRSs) to specific engagements, limitations of providing absolute assurance, identification of inherent and control risks within a company, and the assessment of audit risk related to customer groups. The solutions also delve into the analysis of financial ratios, the importance and practical application of materiality, the use of generalized audit software, and the rationale behind using non-statistical sampling. The document aims to provide comprehensive answers to the assessment questions, demonstrating an understanding of key auditing concepts and principles.

Advanced Diploma

of Accounting

Student

Assessment Booklet

Name:

Date:

Manual Version Number:

1

International Institute of Technology © VR20717

Registered Training Organisation 21421

of Accounting

Student

Assessment Booklet

Name:

Date:

Manual Version Number:

1

International Institute of Technology © VR20717

Registered Training Organisation 21421

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ADACC – Chapter 8

Please note: It is a requirement for students to make their submissions using

this electronic assessment booklet. At the facilitator’s discretion any

submissions made in another format may not be accepted. If you are

completing the course via various computers, please save the one booklet on a

USB so you can send the submission in using the one file

Getting Started

Please insert your NAME, DATE and the Manual Version Number on the first

page of your Assessment Booklet.

Answering Assessment Questions

Each Assessment Booklet contains blank spaces for following assessment items:

Short Answer Questions

When submitting Assessment Booklets for marking, please ensure that the entire

booklet is completed.

Short Answer Questions

Using the space/s provided, please complete your answers making sure to:

Please restrict your answers to no more than 300 words per question

Please include any calculations that you used to reach your answer

Referencing Your Answers

Students undertaking the course must exhibit a range of skills in order to be

confirmed as competent in their course. These skills include:

Understanding a question.

Possessing knowledge about the issue, which in some assessments

includes locating information from references.

Providing an answer, this shows personal understanding.

Please make sure that all assessments are documented in a way that

exhibits your personal study and/or research. To that end would you

please acknowledge all material and sources used in the presentation of your

assessment whether they are books, articles, reports, Internet searches, or any

other document or personal communication. For example if:

An idea is sourced; reference it e.g. (Bagra 2010).

You are directly quoting, wrap it in quote marks e.g. “Tom Horner sat in a

corner” (Peters 2007 page 7).

You are quoting from the internet include quote marks and the web

reference e.g. “ban on conflicted remuneration structures including

commissions” <http://futureofadvice.treasury.gov.au/content/Content.asp

x?doc=reforms.htm> accessed on the 28th of December 2012.

2

International Institute of Technology © VR20717

Registered Training Organisation 21421

Please note: It is a requirement for students to make their submissions using

this electronic assessment booklet. At the facilitator’s discretion any

submissions made in another format may not be accepted. If you are

completing the course via various computers, please save the one booklet on a

USB so you can send the submission in using the one file

Getting Started

Please insert your NAME, DATE and the Manual Version Number on the first

page of your Assessment Booklet.

Answering Assessment Questions

Each Assessment Booklet contains blank spaces for following assessment items:

Short Answer Questions

When submitting Assessment Booklets for marking, please ensure that the entire

booklet is completed.

Short Answer Questions

Using the space/s provided, please complete your answers making sure to:

Please restrict your answers to no more than 300 words per question

Please include any calculations that you used to reach your answer

Referencing Your Answers

Students undertaking the course must exhibit a range of skills in order to be

confirmed as competent in their course. These skills include:

Understanding a question.

Possessing knowledge about the issue, which in some assessments

includes locating information from references.

Providing an answer, this shows personal understanding.

Please make sure that all assessments are documented in a way that

exhibits your personal study and/or research. To that end would you

please acknowledge all material and sources used in the presentation of your

assessment whether they are books, articles, reports, Internet searches, or any

other document or personal communication. For example if:

An idea is sourced; reference it e.g. (Bagra 2010).

You are directly quoting, wrap it in quote marks e.g. “Tom Horner sat in a

corner” (Peters 2007 page 7).

You are quoting from the internet include quote marks and the web

reference e.g. “ban on conflicted remuneration structures including

commissions” <http://futureofadvice.treasury.gov.au/content/Content.asp

x?doc=reforms.htm> accessed on the 28th of December 2012.

2

International Institute of Technology © VR20717

Registered Training Organisation 21421

ADACC – Chapter 8

Please note that no more than 5% of direct quoting which is referenced is

deemed to be acceptable and no amount of direct quoting without referencing

is deemed acceptable. Any direct quoting should form only a small portion of any

answer and the answer should demonstrate the student understands and can

interpret the question and provide an appropriate answer.

Whilst this will require more work for you I hope you will understand that we are

trying to maintain high standards and support your progression into further

qualifications.

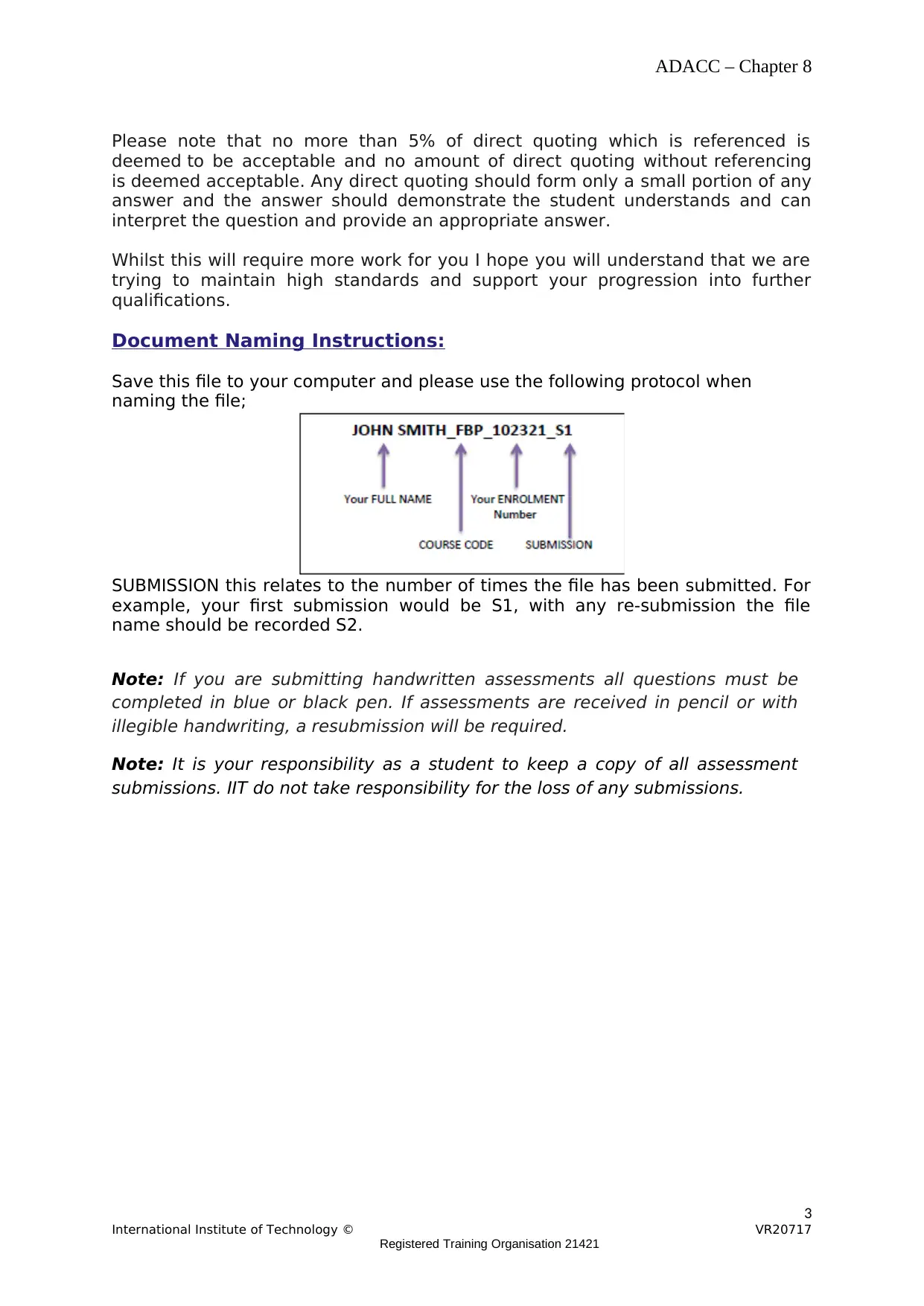

Document Naming Instructions:

Save this file to your computer and please use the following protocol when

naming the file;

SUBMISSION this relates to the number of times the file has been submitted. For

example, your first submission would be S1, with any re-submission the file

name should be recorded S2.

Note: If you are submitting handwritten assessments all questions must be

completed in blue or black pen. If assessments are received in pencil or with

illegible handwriting, a resubmission will be required.

Note: It is your responsibility as a student to keep a copy of all assessment

submissions. IIT do not take responsibility for the loss of any submissions.

Distance Education Students

3

International Institute of Technology © VR20717

Registered Training Organisation 21421

Please note that no more than 5% of direct quoting which is referenced is

deemed to be acceptable and no amount of direct quoting without referencing

is deemed acceptable. Any direct quoting should form only a small portion of any

answer and the answer should demonstrate the student understands and can

interpret the question and provide an appropriate answer.

Whilst this will require more work for you I hope you will understand that we are

trying to maintain high standards and support your progression into further

qualifications.

Document Naming Instructions:

Save this file to your computer and please use the following protocol when

naming the file;

SUBMISSION this relates to the number of times the file has been submitted. For

example, your first submission would be S1, with any re-submission the file

name should be recorded S2.

Note: If you are submitting handwritten assessments all questions must be

completed in blue or black pen. If assessments are received in pencil or with

illegible handwriting, a resubmission will be required.

Note: It is your responsibility as a student to keep a copy of all assessment

submissions. IIT do not take responsibility for the loss of any submissions.

Distance Education Students

3

International Institute of Technology © VR20717

Registered Training Organisation 21421

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ADACC – Chapter 8

Student Declaration

I understand that by completing this form I am bound by the

following declaration.

To the best of my knowledge and belief, no part of this

assignment for the above unit has been copied from any other

student’s work or from any other source except where due

acknowledgment is made in the text, or has been written for

me by another person.

Name: Date:

4

International Institute of Technology © VR20717

Registered Training Organisation 21421

Student Declaration

I understand that by completing this form I am bound by the

following declaration.

To the best of my knowledge and belief, no part of this

assignment for the above unit has been copied from any other

student’s work or from any other source except where due

acknowledgment is made in the text, or has been written for

me by another person.

Name: Date:

4

International Institute of Technology © VR20717

Registered Training Organisation 21421

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ADACC – Chapter 8

Short Answer Question 1:

Which types of international standard (ISAs, ISREs, ISAEs or ISRSs) apply to the

following type of engagement?

a) An audit of a client’s internal controls

b) Providing an opinion on whether historical financial statements have

been prepared in accordance with an identified financial reporting

framework

c) Providing an opinion on whether the corporate governance

arrangements in a company comply with a specific corporate

governance code

d) Preparing a tax return for a client.

a) For engagement of an auditor for an audit of a client’s internal

controls, the International Standards on Auditing (ISAs) are

applicable.

b) International Standards on Review Engagement (ISREs) is

applicable for engagement of an auditor for providing an

opinion on whether historical financial statements have been

prepared in accordance with an identified financial reporting

framework.

c) International Service Organisation Assurance Standards (ISAEs)

is applicable for engagement of an auditor providing an opinion

on whether historical financial statements have been prepared

in accordance with an identified financial reporting framework.

d) International Standards on Related Services (ISRSs) is

applicable for engagement for preparing a tax return for a

client.

5

International Institute of Technology © VR20717

Registered Training Organisation 21421

Short Answer Question 1:

Which types of international standard (ISAs, ISREs, ISAEs or ISRSs) apply to the

following type of engagement?

a) An audit of a client’s internal controls

b) Providing an opinion on whether historical financial statements have

been prepared in accordance with an identified financial reporting

framework

c) Providing an opinion on whether the corporate governance

arrangements in a company comply with a specific corporate

governance code

d) Preparing a tax return for a client.

a) For engagement of an auditor for an audit of a client’s internal

controls, the International Standards on Auditing (ISAs) are

applicable.

b) International Standards on Review Engagement (ISREs) is

applicable for engagement of an auditor for providing an

opinion on whether historical financial statements have been

prepared in accordance with an identified financial reporting

framework.

c) International Service Organisation Assurance Standards (ISAEs)

is applicable for engagement of an auditor providing an opinion

on whether historical financial statements have been prepared

in accordance with an identified financial reporting framework.

d) International Standards on Related Services (ISRSs) is

applicable for engagement for preparing a tax return for a

client.

5

International Institute of Technology © VR20717

Registered Training Organisation 21421

ADACC – Chapter 8

Short Answer Question 2:

Why is it not possible to provide absolute assurance with an assurance

engagement such as an annual audit?

Auditors are engaged for examining the correctness and trueness of the

information provided in the financial statement of an organisation and

making an opinion about the true and fair view of the financial

statement of the organisation. It means, the auditor provides and

assurance about the compliance of various standards in accounting and

reporting financial information of the organisation. Auditors are engaged

for a specified period of time and it is impossible to check all the

financial transactions from its initiation to the completion. Therefore,

they have to check the accounting and reporting of financial information

on a sample basis. An auditor cannot provide an absolute assurance as

the applications of testing and sampling makes the ability of the auditor

to detect material misstatement. Some other factors such as limitation

of the internal control systems, persuasive audit evidences and the

validity of the audit evidence also responsible for making the ability of

the auditor to restrict in providing an absolute assurance.

6

International Institute of Technology © VR20717

Registered Training Organisation 21421

Short Answer Question 2:

Why is it not possible to provide absolute assurance with an assurance

engagement such as an annual audit?

Auditors are engaged for examining the correctness and trueness of the

information provided in the financial statement of an organisation and

making an opinion about the true and fair view of the financial

statement of the organisation. It means, the auditor provides and

assurance about the compliance of various standards in accounting and

reporting financial information of the organisation. Auditors are engaged

for a specified period of time and it is impossible to check all the

financial transactions from its initiation to the completion. Therefore,

they have to check the accounting and reporting of financial information

on a sample basis. An auditor cannot provide an absolute assurance as

the applications of testing and sampling makes the ability of the auditor

to detect material misstatement. Some other factors such as limitation

of the internal control systems, persuasive audit evidences and the

validity of the audit evidence also responsible for making the ability of

the auditor to restrict in providing an absolute assurance.

6

International Institute of Technology © VR20717

Registered Training Organisation 21421

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ADACC – Chapter 8

Short Answer Question 3:

Identify the levels of inherent and control risk in the following company. On the

basis of the limited information available, state for each type of risk whether you

think it is high, medium or low.

Building Blocks Company is a construction company. The company builds

residential buildings in a number of towns and cities. The manager of the

business has worked his way up the company and believes that he really

understands how to make profits in this industry. He employs cheap labour by

using his knowledge of where casual labour meet and look for work. He also

utilises his knowledge and is able to take short-cuts from what he calls overly-

prudent health and safety bureaucratic regulations. He has been successful and

the company is generally profit-making but has had problems recently with a

group of workers who he had to dismiss due to theft of expensive building

materials.

In the given case study, the company is a construction company which

builds up buildings in various cities and towns. The managers of the

company is having a fair knowledge and experience in managing such

type of a business. With such an experience he manages to hire cheap

labours and to make profit there from.

Construction businesses are labour intensive in nature, without labours

the construction of buildings is not possible. Hence, they have to hire an

employ massive number of labours. It is difficult for a manager to

understand the mental perception and characteristics of all the labours.

Hence, theft of materials by the labours is an inherent risk for the

business.

On the other hand, it is the duty of the supervisors and managers to

ensure efficient management of the labours to increase the productivity

of labours and to detect mismanagement and theft of materials by the

labours. Hence, it is the internal control risk to ensure efficient

management and utilisation of labour force and detection of theft of

materials by the labours.

7

International Institute of Technology © VR20717

Registered Training Organisation 21421

Short Answer Question 3:

Identify the levels of inherent and control risk in the following company. On the

basis of the limited information available, state for each type of risk whether you

think it is high, medium or low.

Building Blocks Company is a construction company. The company builds

residential buildings in a number of towns and cities. The manager of the

business has worked his way up the company and believes that he really

understands how to make profits in this industry. He employs cheap labour by

using his knowledge of where casual labour meet and look for work. He also

utilises his knowledge and is able to take short-cuts from what he calls overly-

prudent health and safety bureaucratic regulations. He has been successful and

the company is generally profit-making but has had problems recently with a

group of workers who he had to dismiss due to theft of expensive building

materials.

In the given case study, the company is a construction company which

builds up buildings in various cities and towns. The managers of the

company is having a fair knowledge and experience in managing such

type of a business. With such an experience he manages to hire cheap

labours and to make profit there from.

Construction businesses are labour intensive in nature, without labours

the construction of buildings is not possible. Hence, they have to hire an

employ massive number of labours. It is difficult for a manager to

understand the mental perception and characteristics of all the labours.

Hence, theft of materials by the labours is an inherent risk for the

business.

On the other hand, it is the duty of the supervisors and managers to

ensure efficient management of the labours to increase the productivity

of labours and to detect mismanagement and theft of materials by the

labours. Hence, it is the internal control risk to ensure efficient

management and utilisation of labour force and detection of theft of

materials by the labours.

7

International Institute of Technology © VR20717

Registered Training Organisation 21421

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ADACC – Chapter 8

Short Answer Question 4:

The auditor is aware from knowledge of the industry that a major customer of an

audit client is in financial difficulty and may be unable to pay a significant

amount that it owes to the client. Explain how the auditor should make an

assessment of this risk.

Customer groups of an organisation also subject to audit risk and it must

be assessed properly. Risk associated with the customer group of the

organisation includes, the default risk of non-payment of dues in time.

To assess such risk, an auditor first need to ensure that the transactions

with the customers as recorded in the financial books of accounts are

true and correct. It must be checked and evaluated that the amount of

accounts receivables reported in the financial statement is correct. In

doing so, the auditor can select a sample of customer group and check

transactions completely to make a conclusion about the true and

correctness of the reported figures. As in such type of an industry, it is

common that the customer fails to pay dues, the percentage or the

industry average should be used for making a conclusion on the

reported amount of uncollectible debts for the company.

8

International Institute of Technology © VR20717

Registered Training Organisation 21421

Short Answer Question 4:

The auditor is aware from knowledge of the industry that a major customer of an

audit client is in financial difficulty and may be unable to pay a significant

amount that it owes to the client. Explain how the auditor should make an

assessment of this risk.

Customer groups of an organisation also subject to audit risk and it must

be assessed properly. Risk associated with the customer group of the

organisation includes, the default risk of non-payment of dues in time.

To assess such risk, an auditor first need to ensure that the transactions

with the customers as recorded in the financial books of accounts are

true and correct. It must be checked and evaluated that the amount of

accounts receivables reported in the financial statement is correct. In

doing so, the auditor can select a sample of customer group and check

transactions completely to make a conclusion about the true and

correctness of the reported figures. As in such type of an industry, it is

common that the customer fails to pay dues, the percentage or the

industry average should be used for making a conclusion on the

reported amount of uncollectible debts for the company.

8

International Institute of Technology © VR20717

Registered Training Organisation 21421

ADACC – Chapter 8

Short Answer Question 5:

An auditor finds from analytical procedures that there has been an increase in

the average inventory turnover period from 50 days in the previous year to

nearly 70 days in the current year. There has also been a reduction in the ratio of

total payroll costs to the number of employees.

What might these changes in ratios indicate?

Inventory turnover ratio indicates the inventory conversion cycle from

cash to inventory and again to cash. In another words it can be said

that, inventory turnover expresses the degree of inventory holding as a

proportion to the turnover of the company. High inventory turnover in

days means the company is holding higher amount of inventory and the

inventory conversion cycle is high. Therefore, changing inventory

turnover from 50 days to 70 days the company is holding more

inventory and the conversion cycle has been increased. It implies the

company is having more capital blockage in the inventory.

Reduction in total payroll cost to the number of employees, either

means increase in number of employees or a decrease in the total

payroll costs. Hence, in the given case study, the decrease in total

payroll cost to number of employees ration indicates that the company

has become efficient in utilisation of the labour forces of the company.

9

International Institute of Technology © VR20717

Registered Training Organisation 21421

Short Answer Question 5:

An auditor finds from analytical procedures that there has been an increase in

the average inventory turnover period from 50 days in the previous year to

nearly 70 days in the current year. There has also been a reduction in the ratio of

total payroll costs to the number of employees.

What might these changes in ratios indicate?

Inventory turnover ratio indicates the inventory conversion cycle from

cash to inventory and again to cash. In another words it can be said

that, inventory turnover expresses the degree of inventory holding as a

proportion to the turnover of the company. High inventory turnover in

days means the company is holding higher amount of inventory and the

inventory conversion cycle is high. Therefore, changing inventory

turnover from 50 days to 70 days the company is holding more

inventory and the conversion cycle has been increased. It implies the

company is having more capital blockage in the inventory.

Reduction in total payroll cost to the number of employees, either

means increase in number of employees or a decrease in the total

payroll costs. Hence, in the given case study, the decrease in total

payroll cost to number of employees ration indicates that the company

has become efficient in utilisation of the labour forces of the company.

9

International Institute of Technology © VR20717

Registered Training Organisation 21421

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ADACC – Chapter 8

Short Answer Question 6:

Explain why materiality is important but difficult to apply in practice.

Materiality for financial statements can be described as the presentation

of actual facts and figures or the actual financial results and financial

performance of the company. Therefore, to ensure that the financial

statements are free from material misstatements the materiality is

important. Different users uses and interprets the financial statements

in different ways and sense, also the needs for financial information of

different stakeholders are varying, that is why it is difficult to apply

materiality in practice.

10

International Institute of Technology © VR20717

Registered Training Organisation 21421

Short Answer Question 6:

Explain why materiality is important but difficult to apply in practice.

Materiality for financial statements can be described as the presentation

of actual facts and figures or the actual financial results and financial

performance of the company. Therefore, to ensure that the financial

statements are free from material misstatements the materiality is

important. Different users uses and interprets the financial statements

in different ways and sense, also the needs for financial information of

different stakeholders are varying, that is why it is difficult to apply

materiality in practice.

10

International Institute of Technology © VR20717

Registered Training Organisation 21421

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ADACC – Chapter 8

Short Answer Question 7:

How can generalised audit software be used to assist in performing substantive

procedures during an audit?

Generalised audit software helps and auditor to find audit risks involved

in various areas of financial accounting and reporting. Substantive

procedures is a process of ensuring the true and correctness of a fact or

figure reported in the financial statement. The substantive procedure

includes, checking of evaluation inspection, completeness, existence

and its disclosure in the financial statement. Therefore, automated

generalised audit software can help an auditor to check the existence,

completeness, its evaluation and disclosure in the financial statement as

and when a significant risk is suspected with a financial transaction.

11

International Institute of Technology © VR20717

Registered Training Organisation 21421

Short Answer Question 7:

How can generalised audit software be used to assist in performing substantive

procedures during an audit?

Generalised audit software helps and auditor to find audit risks involved

in various areas of financial accounting and reporting. Substantive

procedures is a process of ensuring the true and correctness of a fact or

figure reported in the financial statement. The substantive procedure

includes, checking of evaluation inspection, completeness, existence

and its disclosure in the financial statement. Therefore, automated

generalised audit software can help an auditor to check the existence,

completeness, its evaluation and disclosure in the financial statement as

and when a significant risk is suspected with a financial transaction.

11

International Institute of Technology © VR20717

Registered Training Organisation 21421

ADACC – Chapter 8

Short Answer Question 8:

Given that non-statistical sampling is less rigorous than statistical sampling, why

would an auditor use non-statistical sampling?

In auditing and checking the trueness and correctness of the financial

information reported in the financial statement, transactions are

selected on a sample basis and checked to make a conclusion about the

whole financial transactions. An unbiased sampling may help in better

understanding the population of the data. Hence, in selecting

transactions for auditing, non-statistical sampling methods are used. It

also help in focusing more on the more suspected areas of financial

accounting.

12

International Institute of Technology © VR20717

Registered Training Organisation 21421

Short Answer Question 8:

Given that non-statistical sampling is less rigorous than statistical sampling, why

would an auditor use non-statistical sampling?

In auditing and checking the trueness and correctness of the financial

information reported in the financial statement, transactions are

selected on a sample basis and checked to make a conclusion about the

whole financial transactions. An unbiased sampling may help in better

understanding the population of the data. Hence, in selecting

transactions for auditing, non-statistical sampling methods are used. It

also help in focusing more on the more suspected areas of financial

accounting.

12

International Institute of Technology © VR20717

Registered Training Organisation 21421

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 22

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.