Analysis of Advance Management Accounting Report - Finance

VerifiedAdded on 2021/01/02

|21

|7569

|77

Report

AI Summary

This report delves into the realm of advance management accounting, providing a comprehensive analysis of its core components and applications. It commences with an examination of the significance of financial information for various stakeholders, including investors, senior management, and lenders, emphasizing its role in strategic planning and decision-making. The report then explores microeconomic tools and techniques, such as cost accounting, unit cost techniques, ABC costing, and price optimization, highlighting their importance in financial management. Furthermore, it delves into variance analysis, analyzing actual and standard costs to manage variances effectively. The report also discusses the impact of internal and external factors on the changing business environment. The report concludes by summarizing key findings and providing recommendations for enhancing communication and decision-making processes. This report is valuable for students and professionals seeking to understand and apply advanced management accounting principles.

Advance Management

Accounting

Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

Table of Contents.............................................................................................................................2

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

P1: Objective of financial information in respect to their shareholders.................................1

P2: Different accounting microeconomic tools and techniques.............................................3

M1: Benefits of using financial information which would be developed to support financial

planning..................................................................................................................................5

D1: Evaluation of financial information that supported by effective judgement...................5

TASK 2............................................................................................................................................5

P3: Concept of variance analysis and importance for an organisation...................................5

M2: Significance of large range of accounting techniques....................................................8

D2: Application of accounting tools and techniques..............................................................8

TASK 3............................................................................................................................................8

P4: Analysis of actual and standard cost to manage variance................................................8

M3: Analyse of measuring merits and demerit of types of variances..................................10

D3: Implication of various changes and suggestion for upcoming communication............11

TASK 4..........................................................................................................................................11

P5: Some external and internal factors those are related with changing environment.........11

M4: Analysing all impacts by using various types of changes............................................16

CONCLUSION..............................................................................................................................16

REFERENCES..............................................................................................................................17

Table of Contents.............................................................................................................................2

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

P1: Objective of financial information in respect to their shareholders.................................1

P2: Different accounting microeconomic tools and techniques.............................................3

M1: Benefits of using financial information which would be developed to support financial

planning..................................................................................................................................5

D1: Evaluation of financial information that supported by effective judgement...................5

TASK 2............................................................................................................................................5

P3: Concept of variance analysis and importance for an organisation...................................5

M2: Significance of large range of accounting techniques....................................................8

D2: Application of accounting tools and techniques..............................................................8

TASK 3............................................................................................................................................8

P4: Analysis of actual and standard cost to manage variance................................................8

M3: Analyse of measuring merits and demerit of types of variances..................................10

D3: Implication of various changes and suggestion for upcoming communication............11

TASK 4..........................................................................................................................................11

P5: Some external and internal factors those are related with changing environment.........11

M4: Analysing all impacts by using various types of changes............................................16

CONCLUSION..............................................................................................................................16

REFERENCES..............................................................................................................................17

INTRODUCTION

Advance accounting is one of the primary tools and techniques which are needed to be

implemented by an organisation to control their financial operations in effective manner. It seems

to be utmost terms of formulating the flexibility structure of various companies. It is used to

track its day to day proceedings and doubled activities for carrying out operation management

accounting tools of an organisation. It seems to be essential aspects for formulating the

appropriate account reports that define planning in terms of short term and future decision

making of an organisation (Merchant, 2012). It seems to be effective aspects that define measure,

communicate and make relevant data that would remain crucial in respect of making effective

decision in coming period of time. This particular project is providing vital information about

importance of financial data in accordance to financial information for stakeholder. Apart from

this, evaluation of financial information is being done in order to support effective planning and

decision making in coming period of time. Microeconomic aspects are being used to in this

particular project to defined certain concepts such as costing and factors related with financial

information clearly examine under this particular report.

TASK 1

P1: Objective of financial information in respect to their shareholders

In every business organisation, information that remain connected with financial capital

and component that are associated with effective planning of company future. There are various

important aspects as well as measurement tools which will be taken into consideration in an

organisation in respect to overcome and reduce the financial issues and strategies those are not

able to delivery well organise services. It is needed for every organisation in respect to present

financial information and their associated detail in such a manner so that stakeholder of an

organisation would be able to show and define planning in more effective or systematic manner.

The stakeholder is an organisation can be associated in financial aspects of every business

performance and administration (Laine, Paranko and Suomala, 2012). In accordance with this,

they are more interested in how a company perform with all kind of implications that are

affecting their overall performances. The way in which financial data is being used and complied

into financial statements is more difficult task for a user. Mainly internal stakeholder with having

interest in financial information consists of manager, employees and other board of member.

However, financial information which is being presented must be relevant in terms of defining

1

Advance accounting is one of the primary tools and techniques which are needed to be

implemented by an organisation to control their financial operations in effective manner. It seems

to be utmost terms of formulating the flexibility structure of various companies. It is used to

track its day to day proceedings and doubled activities for carrying out operation management

accounting tools of an organisation. It seems to be essential aspects for formulating the

appropriate account reports that define planning in terms of short term and future decision

making of an organisation (Merchant, 2012). It seems to be effective aspects that define measure,

communicate and make relevant data that would remain crucial in respect of making effective

decision in coming period of time. This particular project is providing vital information about

importance of financial data in accordance to financial information for stakeholder. Apart from

this, evaluation of financial information is being done in order to support effective planning and

decision making in coming period of time. Microeconomic aspects are being used to in this

particular project to defined certain concepts such as costing and factors related with financial

information clearly examine under this particular report.

TASK 1

P1: Objective of financial information in respect to their shareholders

In every business organisation, information that remain connected with financial capital

and component that are associated with effective planning of company future. There are various

important aspects as well as measurement tools which will be taken into consideration in an

organisation in respect to overcome and reduce the financial issues and strategies those are not

able to delivery well organise services. It is needed for every organisation in respect to present

financial information and their associated detail in such a manner so that stakeholder of an

organisation would be able to show and define planning in more effective or systematic manner.

The stakeholder is an organisation can be associated in financial aspects of every business

performance and administration (Laine, Paranko and Suomala, 2012). In accordance with this,

they are more interested in how a company perform with all kind of implications that are

affecting their overall performances. The way in which financial data is being used and complied

into financial statements is more difficult task for a user. Mainly internal stakeholder with having

interest in financial information consists of manager, employees and other board of member.

However, financial information which is being presented must be relevant in terms of defining

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

the profitability, position and capital structure of an organisation. Financial information would

remain important for various types of stakeholder in other sectors that are mentioned underneath:

Investors: They are known as one of the primary part of an organisation on which future

of the company depends. There are various types of investors are available in business in respect

of making valuable contribution in their financial resources. Investors used to put their capital in

that entire business plan whose position is much stronger as compare to other. Various types of

information are related to financial growth and analysis is taken into account by investors,

shareholders and financial organization (Talha, Raja and Seetharaman, 2010). Some of the

crucial component that remains associated with analysing profitability and financial regulatory

are required to be taken into consideration. Evaluation of financial statements, data analysis,

income statement and cash flow interpretation are categorised into this context.

It has been found that different shareholders are accordance with this is being defined the

financial data which would remain available in several perspectives. There are various groups of

investors that would remain associated with getting sufficient amount of gain for an organisation

in coming period of time. Every analysis in terms of formulating the stages is determined as

important aspect to gain maximum profitability for an organisation.

Purpose and presentation: The primary objective of using the financial statements

by the investors is to analyse the equity which is especially important to investors that

shows changes in various elements. They used to analyse the changes and make investment

plan to earn maximum profits. All the future decision is based on the analysis done by the

investors after making use of various statements such as income statement, balance sheet

and cash flow.

Senior management: This happens to be associated with internal stakeholder types.

Every information associated with growth, sustainability as well as investment are necessary

financial matters those are used by senior managers of an organisation. It is the primary

responsibility of management to make regular analysis of various data from operation level to

make valuable path during execution of planning (Kinney, Raiborn and Poznanski, 2011). This

information would not only have accredited with manages to formulate financial strategies and

interpretation the best possible matters which are more reliable during the period of time. With

the use of effective financial planning that aid manger to make effective decision regarding

increase their customer based by diversifying their business from zero to maximum. By the help

2

remain important for various types of stakeholder in other sectors that are mentioned underneath:

Investors: They are known as one of the primary part of an organisation on which future

of the company depends. There are various types of investors are available in business in respect

of making valuable contribution in their financial resources. Investors used to put their capital in

that entire business plan whose position is much stronger as compare to other. Various types of

information are related to financial growth and analysis is taken into account by investors,

shareholders and financial organization (Talha, Raja and Seetharaman, 2010). Some of the

crucial component that remains associated with analysing profitability and financial regulatory

are required to be taken into consideration. Evaluation of financial statements, data analysis,

income statement and cash flow interpretation are categorised into this context.

It has been found that different shareholders are accordance with this is being defined the

financial data which would remain available in several perspectives. There are various groups of

investors that would remain associated with getting sufficient amount of gain for an organisation

in coming period of time. Every analysis in terms of formulating the stages is determined as

important aspect to gain maximum profitability for an organisation.

Purpose and presentation: The primary objective of using the financial statements

by the investors is to analyse the equity which is especially important to investors that

shows changes in various elements. They used to analyse the changes and make investment

plan to earn maximum profits. All the future decision is based on the analysis done by the

investors after making use of various statements such as income statement, balance sheet

and cash flow.

Senior management: This happens to be associated with internal stakeholder types.

Every information associated with growth, sustainability as well as investment are necessary

financial matters those are used by senior managers of an organisation. It is the primary

responsibility of management to make regular analysis of various data from operation level to

make valuable path during execution of planning (Kinney, Raiborn and Poznanski, 2011). This

information would not only have accredited with manages to formulate financial strategies and

interpretation the best possible matters which are more reliable during the period of time. With

the use of effective financial planning that aid manger to make effective decision regarding

increase their customer based by diversifying their business from zero to maximum. By the help

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

of this, financial evaluation of business leaders and managers would be able to make reliable and

harmonious relationship among stakeholder as well as company’s financiers. Although this

information will remain associated to make financial planning and deriving appropriate structure

in more accurate manner.

Purpose and presentation: For the managers, they used to determine the availability of

cash and other resources by the help of various statements. The purpose is to provide people with

data regarding the business so that corrective decisions can easily be taken into account at the

right time. Some of them are creditors and debtors.

Lender: It is one of the crucial matters that is presented in impressive and effective

financial data to lender is subject to reflect positive image of business in respect to various

lenders. This seems to more crucial part for getting financial assistance that would help from

lender and other financial institutions. It would provide effective analysis for repayment and

redemption ability of an organisation (Mat and Smith, 2014). In accordance with analysing the

financial information would have required to be repaid as per the current loan and advance taken

by an organization. Through examine certain benefits and minimum interest rate loan for an

organisation must be maintain positive and negative credit score in respect of measuring the

positive aspect to get future financial assistance that are helpful from lenders.

Purpose and presentation: It has been found that lenders are entirely relies on financial

information to obtain critical data regarding the financial position and risk of businesses. They

used to calculate ROE in order to determine the overall position of the company.

P2: Different accounting microeconomic tools and techniques

There are certain crucial principles of microeconomic aspects which assume that, if all

other factors remain equal as the price of products increase during the time. It has been seen that

the demand for that particular products or services gets decline drastically. It involves as all

factors of resources that are available and usage which will make impacts on an individual and

various business (Ahmad, 2013). As company’s owner, understanding of core microeconomic

factors are more affecting their business which will be helpful in planning and formulation of

specific strategies and other crucial aspects. There are various factors which are taken into

account in respect to management accounting techniques and their application is to assist the

organization overall growth and financial stability in coming period of time. In accordance to

that there are various accounting tools and techniques those are being used by managers in

3

harmonious relationship among stakeholder as well as company’s financiers. Although this

information will remain associated to make financial planning and deriving appropriate structure

in more accurate manner.

Purpose and presentation: For the managers, they used to determine the availability of

cash and other resources by the help of various statements. The purpose is to provide people with

data regarding the business so that corrective decisions can easily be taken into account at the

right time. Some of them are creditors and debtors.

Lender: It is one of the crucial matters that is presented in impressive and effective

financial data to lender is subject to reflect positive image of business in respect to various

lenders. This seems to more crucial part for getting financial assistance that would help from

lender and other financial institutions. It would provide effective analysis for repayment and

redemption ability of an organisation (Mat and Smith, 2014). In accordance with analysing the

financial information would have required to be repaid as per the current loan and advance taken

by an organization. Through examine certain benefits and minimum interest rate loan for an

organisation must be maintain positive and negative credit score in respect of measuring the

positive aspect to get future financial assistance that are helpful from lenders.

Purpose and presentation: It has been found that lenders are entirely relies on financial

information to obtain critical data regarding the financial position and risk of businesses. They

used to calculate ROE in order to determine the overall position of the company.

P2: Different accounting microeconomic tools and techniques

There are certain crucial principles of microeconomic aspects which assume that, if all

other factors remain equal as the price of products increase during the time. It has been seen that

the demand for that particular products or services gets decline drastically. It involves as all

factors of resources that are available and usage which will make impacts on an individual and

various business (Ahmad, 2013). As company’s owner, understanding of core microeconomic

factors are more affecting their business which will be helpful in planning and formulation of

specific strategies and other crucial aspects. There are various factors which are taken into

account in respect to management accounting techniques and their application is to assist the

organization overall growth and financial stability in coming period of time. In accordance to

that there are various accounting tools and techniques those are being used by managers in

3

respect to examine strategies and tactics uses by organisations in respect to increase profitability

position of the company in near period of time. Some crucial accounting techniques are

mentioned under below:

Cost accounting techniques: This seems to be one of the significant tools which would

be use by management to determine all those costs which are used during the time of production

process. These specific techniques used to consider all types of costing methods that are useful

for an organization (Horngren and et. al., 2010). Cost analysis is one of the major task that are

associated with determining overall cost of types which are incurred in production of product and

services for an organisation. Generally, all those cost which are directly related with the

production process are take into account so that better outcomes can be attain in coming period

of time.

Unit cost techniques: This accounting tools is also considering as one of the primary

management accounting techniques which would be determine the cost invested to a specific

units of product produced by the company. It is mostly helpful for small or mid size businesses

which deals in minimum production. All the necessary aspect is taken into consideration which

would remain with manufacturing of units. It is more vital for all managers and account officers

to consider cost of every unit in order to make effective pricing and gain margin. It would be

helpful to analyse the profitability aspects of an organisation (Fowler, 2011).

ABC costing: This seems to be the most emerging cost accounting tools and techniques

which is used globally by the organisation in terms of evaluating the profitability aspects. There

are various types of process and allocation of resources those are divided as per the priority and

need of functions as well as operations. Most of the accounting tools are used to make effective

decision making in coming period of time. There are various types of activities those are more

effectively followed in accordance with executing the plans in more specific manner. There are

mainly five processes that define in this context like, cost of object, direct cost, overhead and

allocation of base and other costs (Paisey and Paisey, 2010). Overhead costs are considered as

assumption which will be used under these costing techniques.

Price optimisation techniques: It is known as one of the major accounting techniques

that contain the numerical analysis and techniques in respect to analyse various prices of

products which are being set by the company (Chandra, 2011). The main motive behind using

these techniques is to determine customer point of views about all those prices which are fixed

4

position of the company in near period of time. Some crucial accounting techniques are

mentioned under below:

Cost accounting techniques: This seems to be one of the significant tools which would

be use by management to determine all those costs which are used during the time of production

process. These specific techniques used to consider all types of costing methods that are useful

for an organization (Horngren and et. al., 2010). Cost analysis is one of the major task that are

associated with determining overall cost of types which are incurred in production of product and

services for an organisation. Generally, all those cost which are directly related with the

production process are take into account so that better outcomes can be attain in coming period

of time.

Unit cost techniques: This accounting tools is also considering as one of the primary

management accounting techniques which would be determine the cost invested to a specific

units of product produced by the company. It is mostly helpful for small or mid size businesses

which deals in minimum production. All the necessary aspect is taken into consideration which

would remain with manufacturing of units. It is more vital for all managers and account officers

to consider cost of every unit in order to make effective pricing and gain margin. It would be

helpful to analyse the profitability aspects of an organisation (Fowler, 2011).

ABC costing: This seems to be the most emerging cost accounting tools and techniques

which is used globally by the organisation in terms of evaluating the profitability aspects. There

are various types of process and allocation of resources those are divided as per the priority and

need of functions as well as operations. Most of the accounting tools are used to make effective

decision making in coming period of time. There are various types of activities those are more

effectively followed in accordance with executing the plans in more specific manner. There are

mainly five processes that define in this context like, cost of object, direct cost, overhead and

allocation of base and other costs (Paisey and Paisey, 2010). Overhead costs are considered as

assumption which will be used under these costing techniques.

Price optimisation techniques: It is known as one of the major accounting techniques

that contain the numerical analysis and techniques in respect to analyse various prices of

products which are being set by the company (Chandra, 2011). The main motive behind using

these techniques is to determine customer point of views about all those prices which are fixed

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

by the company is affordable in coming period of time for various customers. The most valuable

aspects for these cost prices is to determine and analyse financial cost of operation management

in organisation matter. The management always tries to increase the productivity of the company

by using appropriate tools and techniques. Increasing the operating profit can only be done in

case operating cost get reduced by the company which is primary objective for every department.

These types of accounting techniques are mostly used in airlines, hotels, banking and other

important businesses.

According to the all above discussed techniques, it is concluded that these are not only

helpful in formulating accounting procedures but can also be reliable in future decision-making.

This will assist managers to forecast plan, analyse overall growth and create various

opportunities in coming period of time.

Cost benefits analysis: It is done in order to determine if an investment or decision is

effective or to verifying whether their benefits balance the costs and by what value. Most

of the business analyst used to sums the advantage of a situation or action and then

deduct the cost related with taking that particular action.

CVP analysis: It is basically an effective tool to analyse how changes in cost and volume

affects a company’s operating income as well as total revenue. In order to perform this

analysis, there are various assumption that are made such as sales price per units would

remain constant.

Budgets: One of the major factors which a company used to take into account is the

company’s financial strength. On that particular basis, manager of owner of the company

used to make investment in different projects. Some valuable budgets are, cash budget,

production, master and operational budgets.

Variances: It is known as overall analysis of the quantitative investigation of various

difference among actual and standard budgets. By the help of this, management used to

keep control on their operation performance and activities of an organisation.

M1: Benefits of using financial information which would be developed to support financial

planning

According to the evaluation of financial data in respect to develop financial planning for

an organisation to make appropriate decision-making in coming period of time. All this

information’s are analysing in order to make organisation more stable and predicate future gains

5

aspects for these cost prices is to determine and analyse financial cost of operation management

in organisation matter. The management always tries to increase the productivity of the company

by using appropriate tools and techniques. Increasing the operating profit can only be done in

case operating cost get reduced by the company which is primary objective for every department.

These types of accounting techniques are mostly used in airlines, hotels, banking and other

important businesses.

According to the all above discussed techniques, it is concluded that these are not only

helpful in formulating accounting procedures but can also be reliable in future decision-making.

This will assist managers to forecast plan, analyse overall growth and create various

opportunities in coming period of time.

Cost benefits analysis: It is done in order to determine if an investment or decision is

effective or to verifying whether their benefits balance the costs and by what value. Most

of the business analyst used to sums the advantage of a situation or action and then

deduct the cost related with taking that particular action.

CVP analysis: It is basically an effective tool to analyse how changes in cost and volume

affects a company’s operating income as well as total revenue. In order to perform this

analysis, there are various assumption that are made such as sales price per units would

remain constant.

Budgets: One of the major factors which a company used to take into account is the

company’s financial strength. On that particular basis, manager of owner of the company

used to make investment in different projects. Some valuable budgets are, cash budget,

production, master and operational budgets.

Variances: It is known as overall analysis of the quantitative investigation of various

difference among actual and standard budgets. By the help of this, management used to

keep control on their operation performance and activities of an organisation.

M1: Benefits of using financial information which would be developed to support financial

planning

According to the evaluation of financial data in respect to develop financial planning for

an organisation to make appropriate decision-making in coming period of time. All this

information’s are analysing in order to make organisation more stable and predicate future gains

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

for the company. Financial decision-making is determining under this circumstance which is

subject to valuable effective preparation and strategies.

D1: Evaluation of financial information that supported by effective judgement

It has been seen that effective management assist an administration to determine essential

aspects in which financial decision and other planning activities are done by an organization

during the period of time. By the help of effective management system that used to examine the

attitude and evaluate financial plans that can be effective impact within an organisation in

accordance of financial plan which is more valuable for dynamic of an organisation. In case ever

a company make any kind of decision, they need to make use of accounting systems in more

reliable manner.

TASK 2

P3: Concept of variance analysis and importance for an organisation

Variance analysis: It is known as one of the quantitative investigation of various among

actual and strategic behaviour. It is used to maintain reliable control during a business operation.

Like for example, if a company sale a total of $10000 unit and actual sales are $8000, variance

analysis used to yield a valuable difference of $2000.

Negative variance: It has been found that a favourable positive variance or benefit. The

main reason behind this is that some actual expenses than budgeted is favourable for the

company.

Positive variance: An unfavourable budget variance that is continuously generating

losses and shortfalls would have considered as negative variances.

Controlling and correcting variances:

It is important budget variance evaluation that is meant to generate information about

actual vs budgeted outcomes. It is primary tools in business for making outgoing expenses and

revenues. It is primary tools in business for future planning and monitoring spending.

Reporting system used in monitoring and controlling of variances: This seems to be

considered as one of the effective format and timing of project monitoring and reporting that

used to be varies in every current projects.

Variance report: It is considered as primary report which is prepared for the purpose of

analysing planned financial results and actual outcomes. The difference among budget and actual

is termed as variance.

6

subject to valuable effective preparation and strategies.

D1: Evaluation of financial information that supported by effective judgement

It has been seen that effective management assist an administration to determine essential

aspects in which financial decision and other planning activities are done by an organization

during the period of time. By the help of effective management system that used to examine the

attitude and evaluate financial plans that can be effective impact within an organisation in

accordance of financial plan which is more valuable for dynamic of an organisation. In case ever

a company make any kind of decision, they need to make use of accounting systems in more

reliable manner.

TASK 2

P3: Concept of variance analysis and importance for an organisation

Variance analysis: It is known as one of the quantitative investigation of various among

actual and strategic behaviour. It is used to maintain reliable control during a business operation.

Like for example, if a company sale a total of $10000 unit and actual sales are $8000, variance

analysis used to yield a valuable difference of $2000.

Negative variance: It has been found that a favourable positive variance or benefit. The

main reason behind this is that some actual expenses than budgeted is favourable for the

company.

Positive variance: An unfavourable budget variance that is continuously generating

losses and shortfalls would have considered as negative variances.

Controlling and correcting variances:

It is important budget variance evaluation that is meant to generate information about

actual vs budgeted outcomes. It is primary tools in business for making outgoing expenses and

revenues. It is primary tools in business for future planning and monitoring spending.

Reporting system used in monitoring and controlling of variances: This seems to be

considered as one of the effective format and timing of project monitoring and reporting that

used to be varies in every current projects.

Variance report: It is considered as primary report which is prepared for the purpose of

analysing planned financial results and actual outcomes. The difference among budget and actual

is termed as variance.

6

Schedule variance: It refers as difference among cost of work that is performed and cost

of scheduled work. It is the indicators of whether a project is ahead or behind the

deadline.

Cost variance: It happens to be the completed work that is compared to the planned by

the company. It is calculated as difference among the earned value and actual cost.

It is utmost and simple for of cost variance analysis which is used to determine standard

budget to that with actual one. Reporting on the reasons for analysing comparison is taken into

consideration. The portion of variance is based on variance that are arises in between actual and

expected price of product and services attained during the period of time. Cost accounting is one

of the crucial management activities for evaluating element that are considered in management

accounting techniques. It is more crucial aspect for an organisation to determine the financial

data in terms of deploying the future planning those are consider in this contrivance evaluation is

one of the major concept which will be examine the difference among actual outcomes and

estimated balances (Elhamma and Zhang, 2013).

It is one of the significant evaluations of future cost of operations and administration of

an organisation in terms of maximising the future profitability and reducing the cost of

production during the period of time. There are various types of budgets that are prepared in

respect to estimate overall price of products and overheads in companies prospective. The

primary aspects would remain associated to the cost variance are determine in terms of material,

overhead and other direct labour costs. These types of budget are used to formulate specific

terms of estimated cost of products and overheads aspects in organisational level. Most common

aspects are remaining associated with the analysis of variances analysis on the basis of standard

cost and actual estimation (Guthrie, Ricceri and Dumay, 2012). It consists of cost variance

analysis in respect of material, overhead viable cost and direct cost of productions.

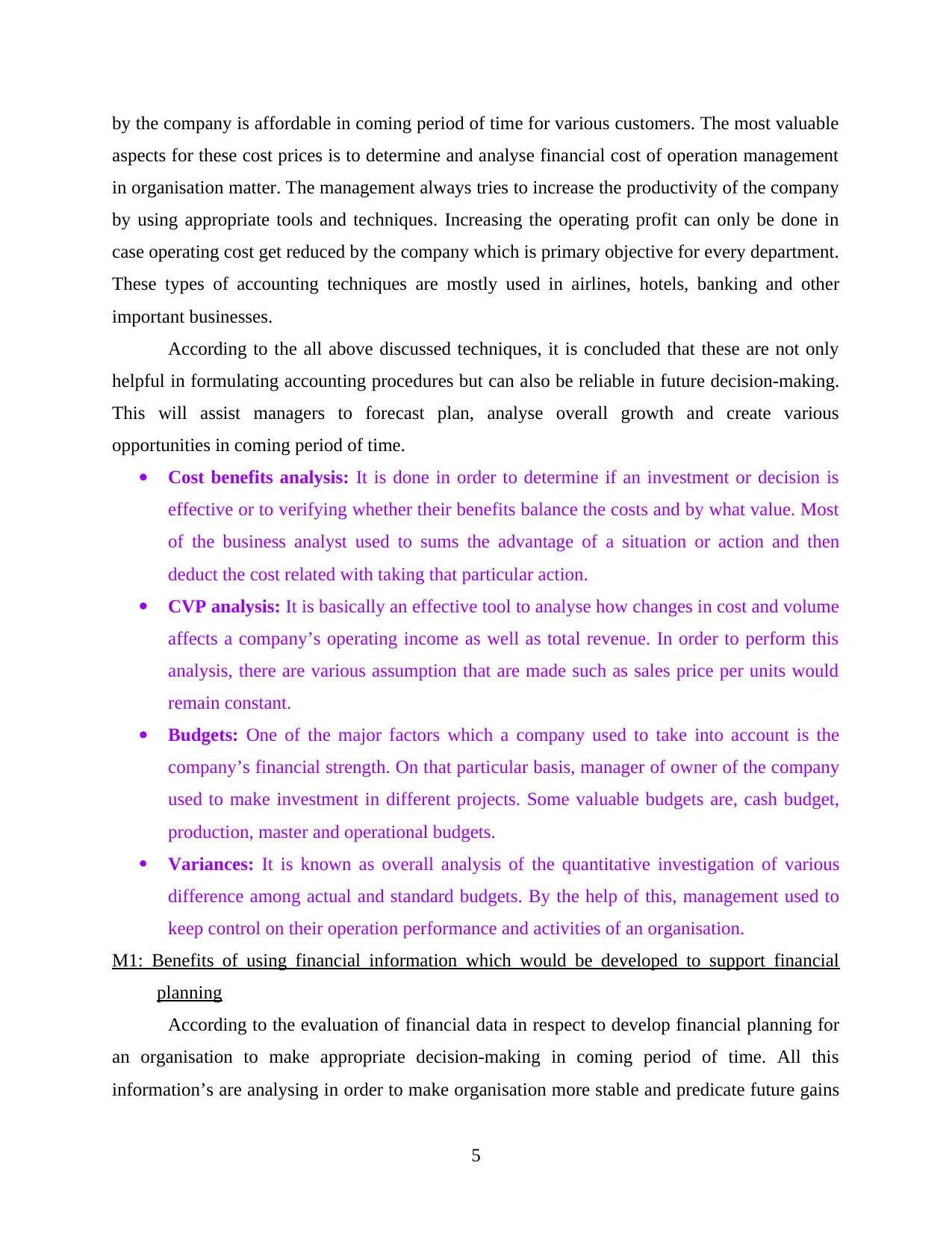

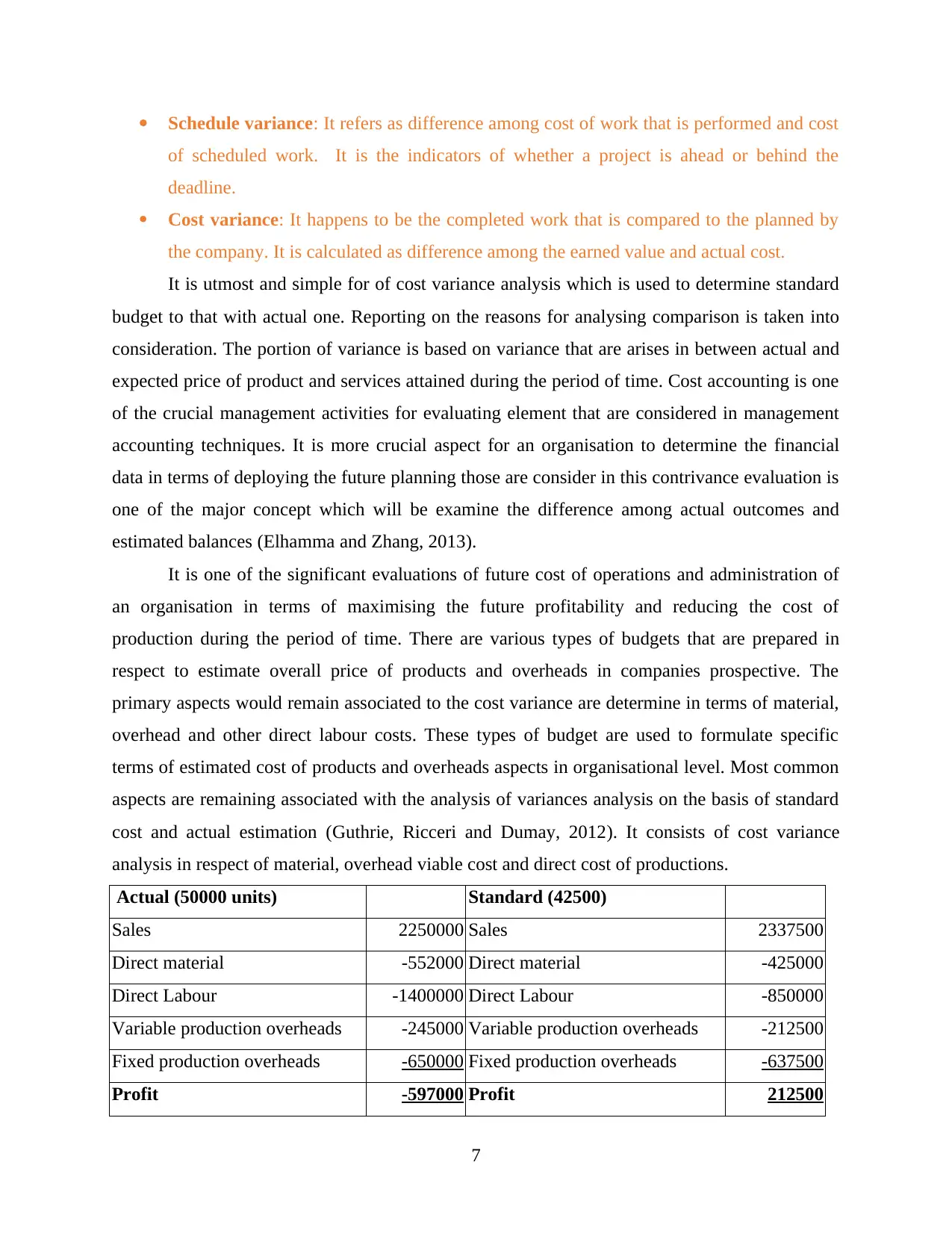

Actual (50000 units) Standard (42500)

Sales 2250000 Sales 2337500

Direct material -552000 Direct material -425000

Direct Labour -1400000 Direct Labour -850000

Variable production overheads -245000 Variable production overheads -212500

Fixed production overheads -650000 Fixed production overheads -637500

Profit -597000 Profit 212500

7

of scheduled work. It is the indicators of whether a project is ahead or behind the

deadline.

Cost variance: It happens to be the completed work that is compared to the planned by

the company. It is calculated as difference among the earned value and actual cost.

It is utmost and simple for of cost variance analysis which is used to determine standard

budget to that with actual one. Reporting on the reasons for analysing comparison is taken into

consideration. The portion of variance is based on variance that are arises in between actual and

expected price of product and services attained during the period of time. Cost accounting is one

of the crucial management activities for evaluating element that are considered in management

accounting techniques. It is more crucial aspect for an organisation to determine the financial

data in terms of deploying the future planning those are consider in this contrivance evaluation is

one of the major concept which will be examine the difference among actual outcomes and

estimated balances (Elhamma and Zhang, 2013).

It is one of the significant evaluations of future cost of operations and administration of

an organisation in terms of maximising the future profitability and reducing the cost of

production during the period of time. There are various types of budgets that are prepared in

respect to estimate overall price of products and overheads in companies prospective. The

primary aspects would remain associated to the cost variance are determine in terms of material,

overhead and other direct labour costs. These types of budget are used to formulate specific

terms of estimated cost of products and overheads aspects in organisational level. Most common

aspects are remaining associated with the analysis of variances analysis on the basis of standard

cost and actual estimation (Guthrie, Ricceri and Dumay, 2012). It consists of cost variance

analysis in respect of material, overhead viable cost and direct cost of productions.

Actual (50000 units) Standard (42500)

Sales 2250000 Sales 2337500

Direct material -552000 Direct material -425000

Direct Labour -1400000 Direct Labour -850000

Variable production overheads -245000 Variable production overheads -212500

Fixed production overheads -650000 Fixed production overheads -637500

Profit -597000 Profit 212500

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

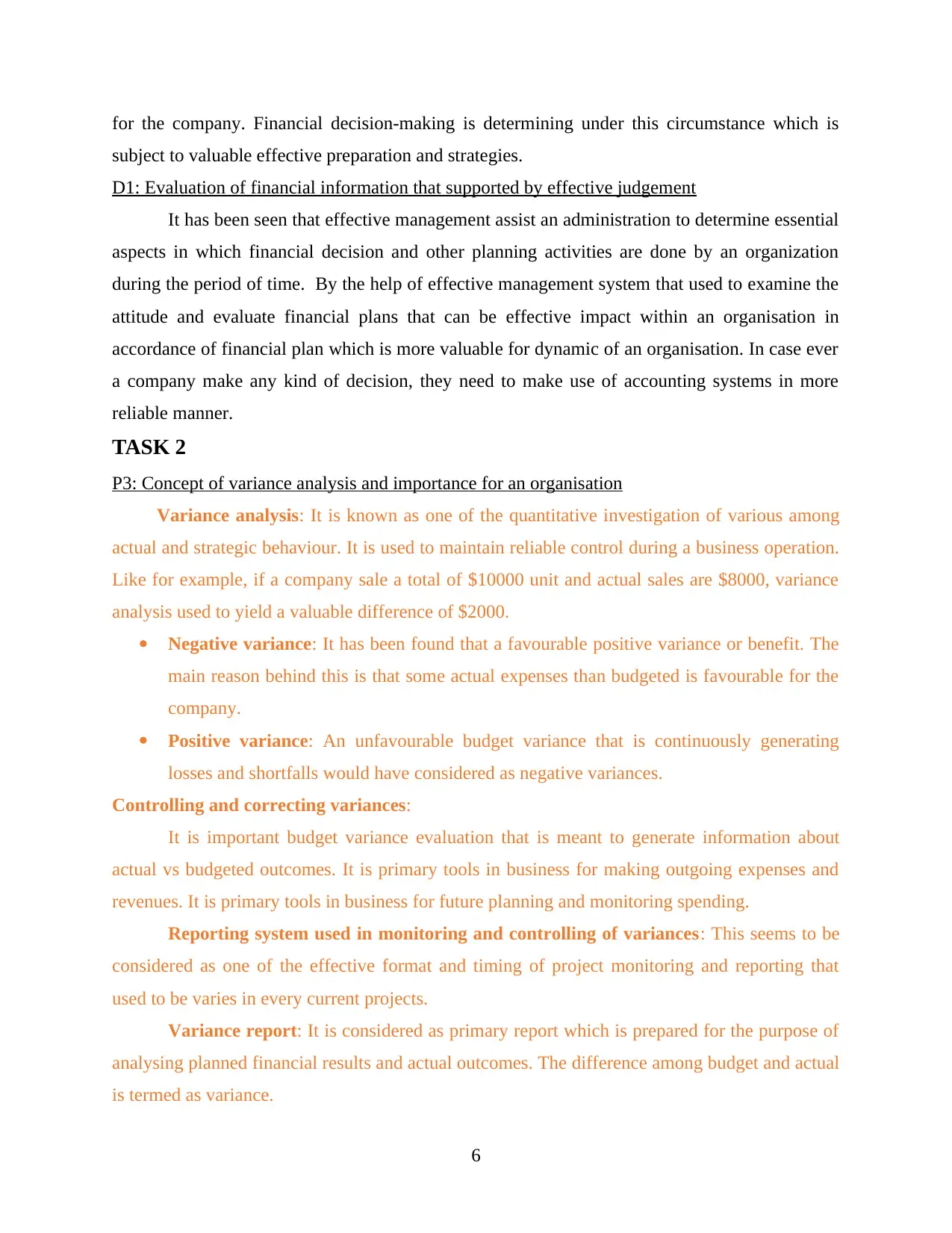

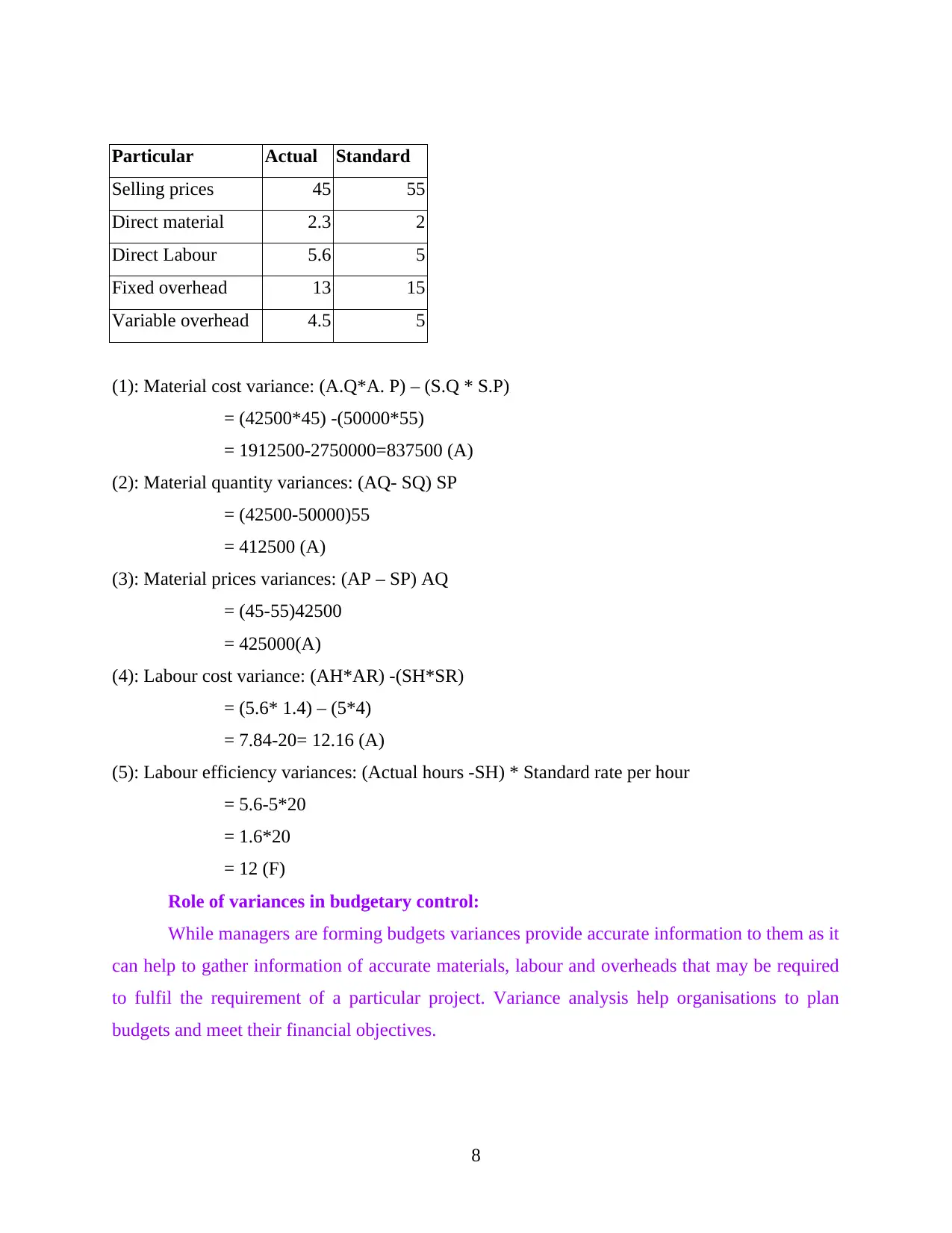

Particular Actual Standard

Selling prices 45 55

Direct material 2.3 2

Direct Labour 5.6 5

Fixed overhead 13 15

Variable overhead 4.5 5

(1): Material cost variance: (A.Q*A. P) – (S.Q * S.P)

= (42500*45) -(50000*55)

= 1912500-2750000=837500 (A)

(2): Material quantity variances: (AQ- SQ) SP

= (42500-50000)55

= 412500 (A)

(3): Material prices variances: (AP – SP) AQ

= (45-55)42500

= 425000(A)

(4): Labour cost variance: (AH*AR) -(SH*SR)

= (5.6* 1.4) – (5*4)

= 7.84-20= 12.16 (A)

(5): Labour efficiency variances: (Actual hours -SH) * Standard rate per hour

= 5.6-5*20

= 1.6*20

= 12 (F)

Role of variances in budgetary control:

While managers are forming budgets variances provide accurate information to them as it

can help to gather information of accurate materials, labour and overheads that may be required

to fulfil the requirement of a particular project. Variance analysis help organisations to plan

budgets and meet their financial objectives.

8

Selling prices 45 55

Direct material 2.3 2

Direct Labour 5.6 5

Fixed overhead 13 15

Variable overhead 4.5 5

(1): Material cost variance: (A.Q*A. P) – (S.Q * S.P)

= (42500*45) -(50000*55)

= 1912500-2750000=837500 (A)

(2): Material quantity variances: (AQ- SQ) SP

= (42500-50000)55

= 412500 (A)

(3): Material prices variances: (AP – SP) AQ

= (45-55)42500

= 425000(A)

(4): Labour cost variance: (AH*AR) -(SH*SR)

= (5.6* 1.4) – (5*4)

= 7.84-20= 12.16 (A)

(5): Labour efficiency variances: (Actual hours -SH) * Standard rate per hour

= 5.6-5*20

= 1.6*20

= 12 (F)

Role of variances in budgetary control:

While managers are forming budgets variances provide accurate information to them as it

can help to gather information of accurate materials, labour and overheads that may be required

to fulfil the requirement of a particular project. Variance analysis help organisations to plan

budgets and meet their financial objectives.

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

M2: Significance of large range of accounting techniques

There are various crucial benefits which are always remain associated with the

management accounting techniques. Some of them are discussed underneath:

Benefits:

According to the above analysis, management accounting techniques used to make

appropriate decision-making become for reliable and easy way for analysis.

Complex business equation would be more easily sorted out by the assistance of

management information systems in effective manner.

Disadvantage:

Formulation of management accounting techniques are increasing overall work load and

additional work impacts in terms of controlling overall records and data of the company.

Company required to paid additional cost to implement the effective records of specific

information of an organisation (Williams and Seaman, 2010).

D2: Application of accounting tools and techniques

According to the above analysis, it has been determining that variances evaluation is

being use as management tools that become more reliable and efficient in coming period of time.

By the help of price optimisation techniques, a company would be able to analyse their

economical perception of the company regarding various products that are produced by an

organisation within an accounting period of time.

TASK 3

P4: Analysis of actual and standard cost to manage variance

There are various types of costs which are associated with the company. These are either

directly or indirectly related with the production process. The function of standard operation in

cost accounting is more concern about standard costs that are allowed and actual data would be

recorded in an account. Variance valuation can be considering more effective process of

calculating the amount which causes among actual and budgeted costs of production during an

accounting period of time. Cost accounting seems to be one of the most reliable accounting

process which will taken into account more recording, classifying and evaluating various course

of actions. There are certain aspects which are needed to be taken into account. Some of them are

discussed underneath:

9

There are various crucial benefits which are always remain associated with the

management accounting techniques. Some of them are discussed underneath:

Benefits:

According to the above analysis, management accounting techniques used to make

appropriate decision-making become for reliable and easy way for analysis.

Complex business equation would be more easily sorted out by the assistance of

management information systems in effective manner.

Disadvantage:

Formulation of management accounting techniques are increasing overall work load and

additional work impacts in terms of controlling overall records and data of the company.

Company required to paid additional cost to implement the effective records of specific

information of an organisation (Williams and Seaman, 2010).

D2: Application of accounting tools and techniques

According to the above analysis, it has been determining that variances evaluation is

being use as management tools that become more reliable and efficient in coming period of time.

By the help of price optimisation techniques, a company would be able to analyse their

economical perception of the company regarding various products that are produced by an

organisation within an accounting period of time.

TASK 3

P4: Analysis of actual and standard cost to manage variance

There are various types of costs which are associated with the company. These are either

directly or indirectly related with the production process. The function of standard operation in

cost accounting is more concern about standard costs that are allowed and actual data would be

recorded in an account. Variance valuation can be considering more effective process of

calculating the amount which causes among actual and budgeted costs of production during an

accounting period of time. Cost accounting seems to be one of the most reliable accounting

process which will taken into account more recording, classifying and evaluating various course

of actions. There are certain aspects which are needed to be taken into account. Some of them are

discussed underneath:

9

Standard costing: It is one of the necessary aspects that are taken into account in

evaluating management accounting matters. It would to assist all activities and periodic analysis

which causes specific analysis of accounting variances (Pavlatos and Kostakis, 2015). It is one of

the primary tools which is one responsible for evaluating standard cost and variations in

formulating necessary factors that are affecting various types of costs those are related with the

company. Accounting to this costing system that will be analyse to figuring overall actual cost

that used analysing material, labour and other overhead costs.

Such kind of cost is associated with all specific kind of variations that are relies on actual

and estimated cost of productions. Direct material analysis is only basic concept which will be

taken into account in accordance with determining overall financial position of the company.

Variances accounting analysis is effective accounting that can assist an organisation to

demonstrate major aspects in respect to build effective costing system within internal department

of an organisation. There are is effective reasoning of profit margin collected from actual

outcomes which are done in respect to companies’ perspective. According to the variance

analysis process associated with taking corrective period of time.

Actual costing: It is known as one of the effective recording costs that are based on

various aspects such as cost of material. There are certain crucial aspects that are needed to be

taken into account those are related with allocation of cost in specific manner. It does not

incorporate at standard amount of that are being charged during an accounting period. Similar

costing system is more normal costing, where the key differences are considering to budgeted

amount of overhead (Micheli and Manzoni, 2010). This costing technique is playing one of the

crucial roles in terms of evaluating certain variation among standard cost estimations. According

per above mentioned case studies, it has been giving sufficient amount of gain in terms of

50000units and actual outputs was delivering with 42500units. The main motive of budgeting

will remain connected with tracking the detailed of spending and controlling overall cost of

production.

Correct variances:

Certain differences that are arise during calculation of various outcomes in respect to

actual and budgets outcomes. It used to analyse such kind of variance evaluation, cost effective

analysis and proper allocation of financial resources in order to make strategic planning. This is

considering more reliable factors that assist an organisation to eliminate cost of operations and

10

evaluating management accounting matters. It would to assist all activities and periodic analysis

which causes specific analysis of accounting variances (Pavlatos and Kostakis, 2015). It is one of

the primary tools which is one responsible for evaluating standard cost and variations in

formulating necessary factors that are affecting various types of costs those are related with the

company. Accounting to this costing system that will be analyse to figuring overall actual cost

that used analysing material, labour and other overhead costs.

Such kind of cost is associated with all specific kind of variations that are relies on actual

and estimated cost of productions. Direct material analysis is only basic concept which will be

taken into account in accordance with determining overall financial position of the company.

Variances accounting analysis is effective accounting that can assist an organisation to

demonstrate major aspects in respect to build effective costing system within internal department

of an organisation. There are is effective reasoning of profit margin collected from actual

outcomes which are done in respect to companies’ perspective. According to the variance

analysis process associated with taking corrective period of time.

Actual costing: It is known as one of the effective recording costs that are based on

various aspects such as cost of material. There are certain crucial aspects that are needed to be

taken into account those are related with allocation of cost in specific manner. It does not

incorporate at standard amount of that are being charged during an accounting period. Similar

costing system is more normal costing, where the key differences are considering to budgeted

amount of overhead (Micheli and Manzoni, 2010). This costing technique is playing one of the

crucial roles in terms of evaluating certain variation among standard cost estimations. According

per above mentioned case studies, it has been giving sufficient amount of gain in terms of

50000units and actual outputs was delivering with 42500units. The main motive of budgeting

will remain connected with tracking the detailed of spending and controlling overall cost of

production.

Correct variances:

Certain differences that are arise during calculation of various outcomes in respect to

actual and budgets outcomes. It used to analyse such kind of variance evaluation, cost effective

analysis and proper allocation of financial resources in order to make strategic planning. This is

considering more reliable factors that assist an organisation to eliminate cost of operations and

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 21

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.