IIT Advanced Diploma of Accounting: ADACC Chapter 9 Assessment

VerifiedAdded on 2023/01/13

|23

|3447

|34

Homework Assignment

AI Summary

This document presents the solutions to the ADACC Chapter 9 assessment, focusing on financial accounting principles. The assessment covers a range of topics including journal entries for asset revaluations, the manipulation of cash flows versus profit, the role of accounting standards in defining GAAP, the differences between reserves and provisions, the rules for consolidated accounts, journal entries for tax liabilities, changes in accounting policy, impairment losses, and the recognition of investments and financial statement items. The answers demonstrate understanding of accounting concepts, calculations, and the application of relevant accounting standards. The assessment includes short answer questions requiring concise explanations and calculations where necessary. The answers are presented in the format specified by the assessment brief, including proper referencing and adherence to word limits.

Advanced Diploma

of Accounting

Student

Assessment Booklet

of Accounting

Student

Assessment Booklet

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ADACC – Chapter 9

Please note: It is a requirement for students to make their submissions using

this electronic assessment booklet. At the facilitator’s discretion any

submissions made in another format may not be accepted. If you are

completing the course via various computers, please save the one booklet on a

USB so you can send the submission in using the one file

Getting Started

Please insert your NAME, DATE and the Manual Version Number on the first

page of your Assessment Booklet.

Answering Assessment Questions

Each Assessment Booklet contains blank spaces for following assessment items:

Short Answer Questions

When submitting Assessment Booklets for marking, please ensure that the entire

booklet is completed.

Short Answer Questions

Using the space/s provided, please complete your answers making sure to:

Please restrict your answers to no more than 300 words per question

Please include any calculations that you used to reach your answer

Referencing Your Answers

Students undertaking the course must exhibit a range of skills in order to be

confirmed as competent in their course. These skills include:

Understanding a question.

Possessing knowledge about the issue, which in some assessments

includes locating information from references.

Providing an answer, this shows personal understanding.

Please make sure that all assessments are documented in a way that

exhibits your personal study and/or research. To that end would you

please acknowledge all material and sources used in the presentation of your

assessment whether they are books, articles, reports, Internet searches, or any

other document or personal communication. For example if:

An idea is sourced; reference it e.g. (Bagra 2010).

You are directly quoting, wrap it in quote marks e.g. “Tom Horner sat in a

corner” (Peters 2007 page 7).

You are quoting from the internet include quote marks and the web

reference e.g. “ban on conflicted remuneration structures including

commissions” <http://futureofadvice.treasury.gov.au/content/Content.asp

x?doc=reforms.htm> accessed on the 28th of December 2012.

Please note: It is a requirement for students to make their submissions using

this electronic assessment booklet. At the facilitator’s discretion any

submissions made in another format may not be accepted. If you are

completing the course via various computers, please save the one booklet on a

USB so you can send the submission in using the one file

Getting Started

Please insert your NAME, DATE and the Manual Version Number on the first

page of your Assessment Booklet.

Answering Assessment Questions

Each Assessment Booklet contains blank spaces for following assessment items:

Short Answer Questions

When submitting Assessment Booklets for marking, please ensure that the entire

booklet is completed.

Short Answer Questions

Using the space/s provided, please complete your answers making sure to:

Please restrict your answers to no more than 300 words per question

Please include any calculations that you used to reach your answer

Referencing Your Answers

Students undertaking the course must exhibit a range of skills in order to be

confirmed as competent in their course. These skills include:

Understanding a question.

Possessing knowledge about the issue, which in some assessments

includes locating information from references.

Providing an answer, this shows personal understanding.

Please make sure that all assessments are documented in a way that

exhibits your personal study and/or research. To that end would you

please acknowledge all material and sources used in the presentation of your

assessment whether they are books, articles, reports, Internet searches, or any

other document or personal communication. For example if:

An idea is sourced; reference it e.g. (Bagra 2010).

You are directly quoting, wrap it in quote marks e.g. “Tom Horner sat in a

corner” (Peters 2007 page 7).

You are quoting from the internet include quote marks and the web

reference e.g. “ban on conflicted remuneration structures including

commissions” <http://futureofadvice.treasury.gov.au/content/Content.asp

x?doc=reforms.htm> accessed on the 28th of December 2012.

ADACC – Chapter 9

Please note that no more than 5% of direct quoting which is referenced is

deemed to be acceptable and no amount of direct quoting without referencing

is deemed acceptable. Any direct quoting should form only a small portion of any

answer and the answer should demonstrate the student understands and can

interpret the question and provide an appropriate answer.

Whilst this will require more work for you I hope you will understand that we are

trying to maintain high standards and support your progression into further

qualifications.

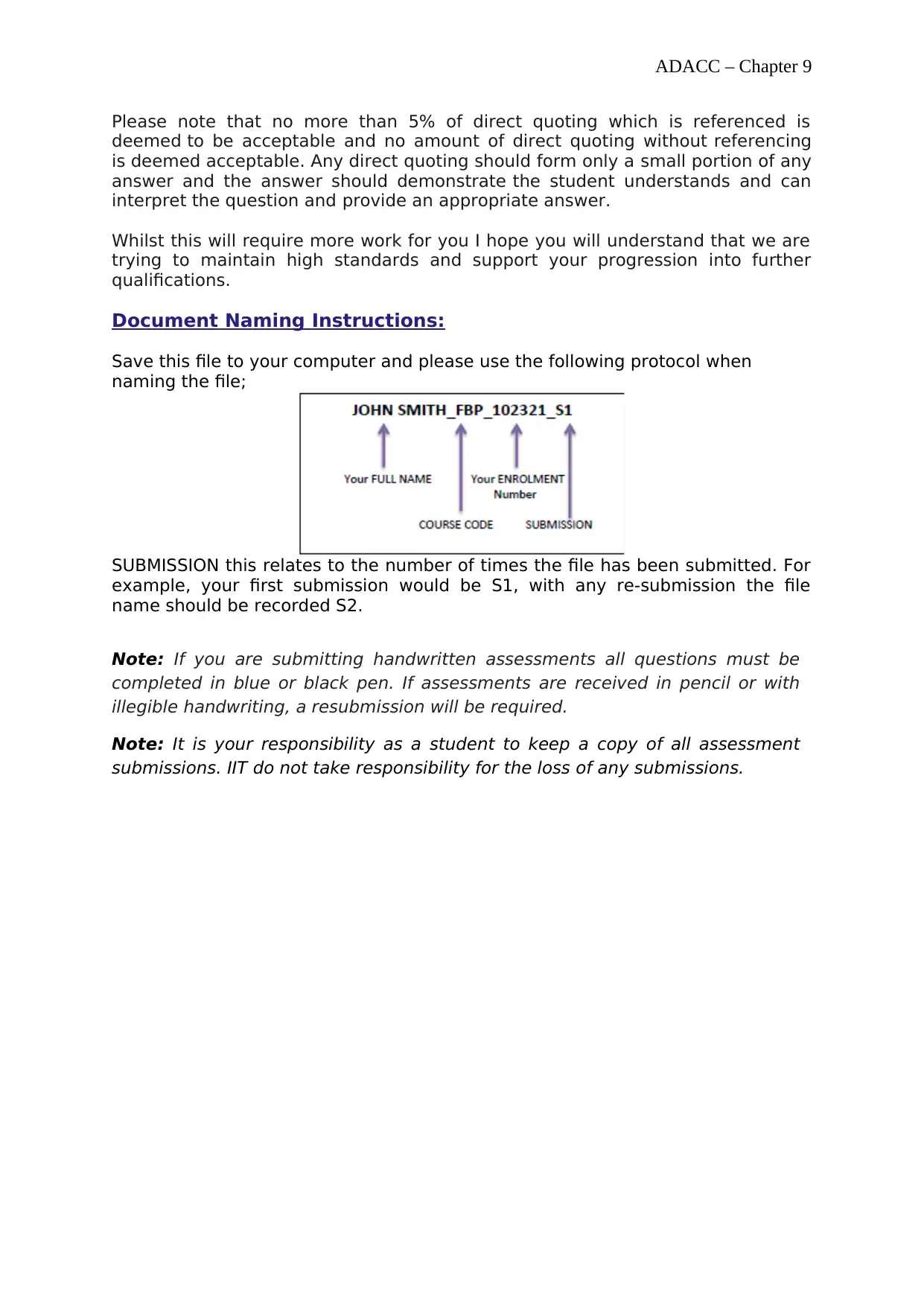

Document Naming Instructions:

Save this file to your computer and please use the following protocol when

naming the file;

SUBMISSION this relates to the number of times the file has been submitted. For

example, your first submission would be S1, with any re-submission the file

name should be recorded S2.

Note: If you are submitting handwritten assessments all questions must be

completed in blue or black pen. If assessments are received in pencil or with

illegible handwriting, a resubmission will be required.

Note: It is your responsibility as a student to keep a copy of all assessment

submissions. IIT do not take responsibility for the loss of any submissions.

Distance Education Students

Please note that no more than 5% of direct quoting which is referenced is

deemed to be acceptable and no amount of direct quoting without referencing

is deemed acceptable. Any direct quoting should form only a small portion of any

answer and the answer should demonstrate the student understands and can

interpret the question and provide an appropriate answer.

Whilst this will require more work for you I hope you will understand that we are

trying to maintain high standards and support your progression into further

qualifications.

Document Naming Instructions:

Save this file to your computer and please use the following protocol when

naming the file;

SUBMISSION this relates to the number of times the file has been submitted. For

example, your first submission would be S1, with any re-submission the file

name should be recorded S2.

Note: If you are submitting handwritten assessments all questions must be

completed in blue or black pen. If assessments are received in pencil or with

illegible handwriting, a resubmission will be required.

Note: It is your responsibility as a student to keep a copy of all assessment

submissions. IIT do not take responsibility for the loss of any submissions.

Distance Education Students

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ADACC – Chapter 9

Student Declaration

I understand that by completing this form I am bound by the

following declaration.

To the best of my knowledge and belief, no part of this

assignment for the above unit has been copied from any other

student’s work or from any other source except where due

acknowledgment is made in the text, or has been written for

me by another person.

Name: Date:

Student Declaration

I understand that by completing this form I am bound by the

following declaration.

To the best of my knowledge and belief, no part of this

assignment for the above unit has been copied from any other

student’s work or from any other source except where due

acknowledgment is made in the text, or has been written for

me by another person.

Name: Date:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ADACC – Chapter 9

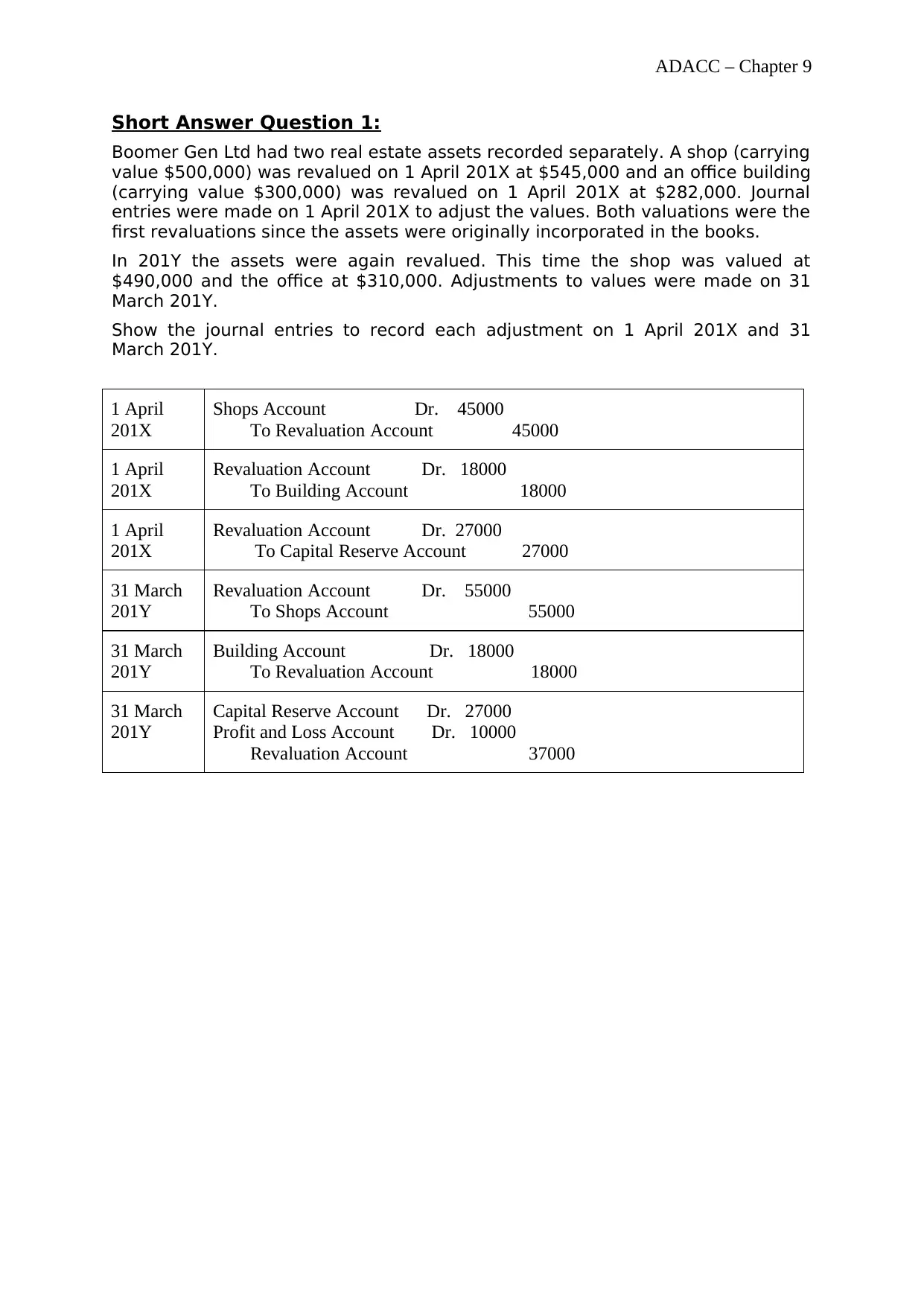

Short Answer Question 1:

Boomer Gen Ltd had two real estate assets recorded separately. A shop (carrying

value $500,000) was revalued on 1 April 201X at $545,000 and an office building

(carrying value $300,000) was revalued on 1 April 201X at $282,000. Journal

entries were made on 1 April 201X to adjust the values. Both valuations were the

first revaluations since the assets were originally incorporated in the books.

In 201Y the assets were again revalued. This time the shop was valued at

$490,000 and the office at $310,000. Adjustments to values were made on 31

March 201Y.

Show the journal entries to record each adjustment on 1 April 201X and 31

March 201Y.

1 April

201X

Shops Account Dr. 45000

To Revaluation Account 45000

1 April

201X

Revaluation Account Dr. 18000

To Building Account 18000

1 April

201X

Revaluation Account Dr. 27000

To Capital Reserve Account 27000

31 March

201Y

Revaluation Account Dr. 55000

To Shops Account 55000

31 March

201Y

Building Account Dr. 18000

To Revaluation Account 18000

31 March

201Y

Capital Reserve Account Dr. 27000

Profit and Loss Account Dr. 10000

Revaluation Account 37000

Short Answer Question 1:

Boomer Gen Ltd had two real estate assets recorded separately. A shop (carrying

value $500,000) was revalued on 1 April 201X at $545,000 and an office building

(carrying value $300,000) was revalued on 1 April 201X at $282,000. Journal

entries were made on 1 April 201X to adjust the values. Both valuations were the

first revaluations since the assets were originally incorporated in the books.

In 201Y the assets were again revalued. This time the shop was valued at

$490,000 and the office at $310,000. Adjustments to values were made on 31

March 201Y.

Show the journal entries to record each adjustment on 1 April 201X and 31

March 201Y.

1 April

201X

Shops Account Dr. 45000

To Revaluation Account 45000

1 April

201X

Revaluation Account Dr. 18000

To Building Account 18000

1 April

201X

Revaluation Account Dr. 27000

To Capital Reserve Account 27000

31 March

201Y

Revaluation Account Dr. 55000

To Shops Account 55000

31 March

201Y

Building Account Dr. 18000

To Revaluation Account 18000

31 March

201Y

Capital Reserve Account Dr. 27000

Profit and Loss Account Dr. 10000

Revaluation Account 37000

ADACC – Chapter 9

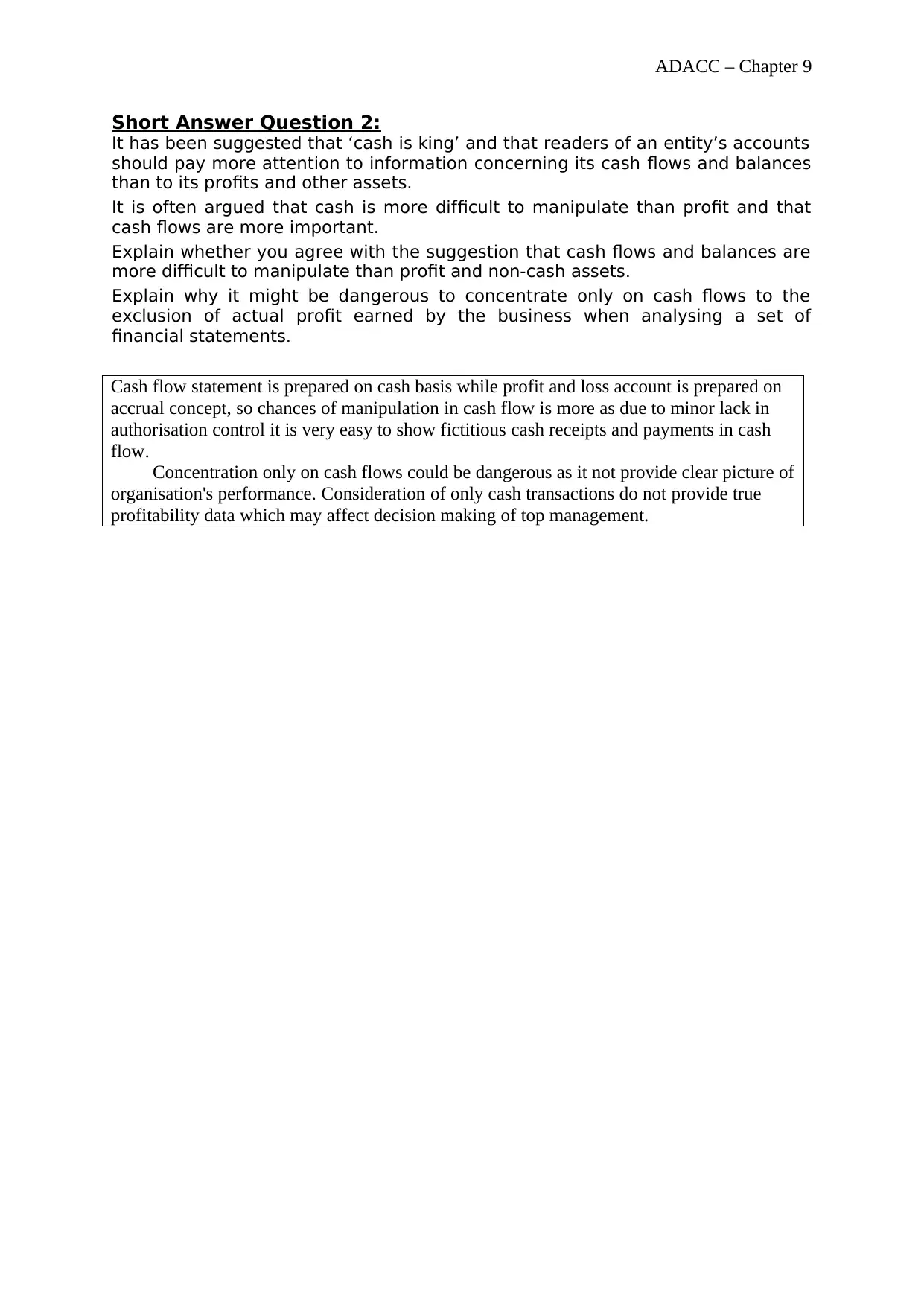

Short Answer Question 2:

It has been suggested that ‘cash is king’ and that readers of an entity’s accounts

should pay more attention to information concerning its cash flows and balances

than to its profits and other assets.

It is often argued that cash is more difficult to manipulate than profit and that

cash flows are more important.

Explain whether you agree with the suggestion that cash flows and balances are

more difficult to manipulate than profit and non-cash assets.

Explain why it might be dangerous to concentrate only on cash flows to the

exclusion of actual profit earned by the business when analysing a set of

financial statements.

Cash flow statement is prepared on cash basis while profit and loss account is prepared on

accrual concept, so chances of manipulation in cash flow is more as due to minor lack in

authorisation control it is very easy to show fictitious cash receipts and payments in cash

flow.

Concentration only on cash flows could be dangerous as it not provide clear picture of

organisation's performance. Consideration of only cash transactions do not provide true

profitability data which may affect decision making of top management.

Short Answer Question 2:

It has been suggested that ‘cash is king’ and that readers of an entity’s accounts

should pay more attention to information concerning its cash flows and balances

than to its profits and other assets.

It is often argued that cash is more difficult to manipulate than profit and that

cash flows are more important.

Explain whether you agree with the suggestion that cash flows and balances are

more difficult to manipulate than profit and non-cash assets.

Explain why it might be dangerous to concentrate only on cash flows to the

exclusion of actual profit earned by the business when analysing a set of

financial statements.

Cash flow statement is prepared on cash basis while profit and loss account is prepared on

accrual concept, so chances of manipulation in cash flow is more as due to minor lack in

authorisation control it is very easy to show fictitious cash receipts and payments in cash

flow.

Concentration only on cash flows could be dangerous as it not provide clear picture of

organisation's performance. Consideration of only cash transactions do not provide true

profitability data which may affect decision making of top management.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ADACC – Chapter 9

Short Answer Question 3:

Would it be possible for accounting standard-setters to define and provide a

guide to what constitutes GAAP?

Accounting standards are set of authorized standards to guide entire process of financial

reporting which are principle sources of GAAP. AS generally specifies how to record

transactions as well as any financial events including recognising, measuring, presenting

and disclosing financial statements. So standards are already acting as guidance for

defining GAAP in practically.

Short Answer Question 3:

Would it be possible for accounting standard-setters to define and provide a

guide to what constitutes GAAP?

Accounting standards are set of authorized standards to guide entire process of financial

reporting which are principle sources of GAAP. AS generally specifies how to record

transactions as well as any financial events including recognising, measuring, presenting

and disclosing financial statements. So standards are already acting as guidance for

defining GAAP in practically.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ADACC – Chapter 9

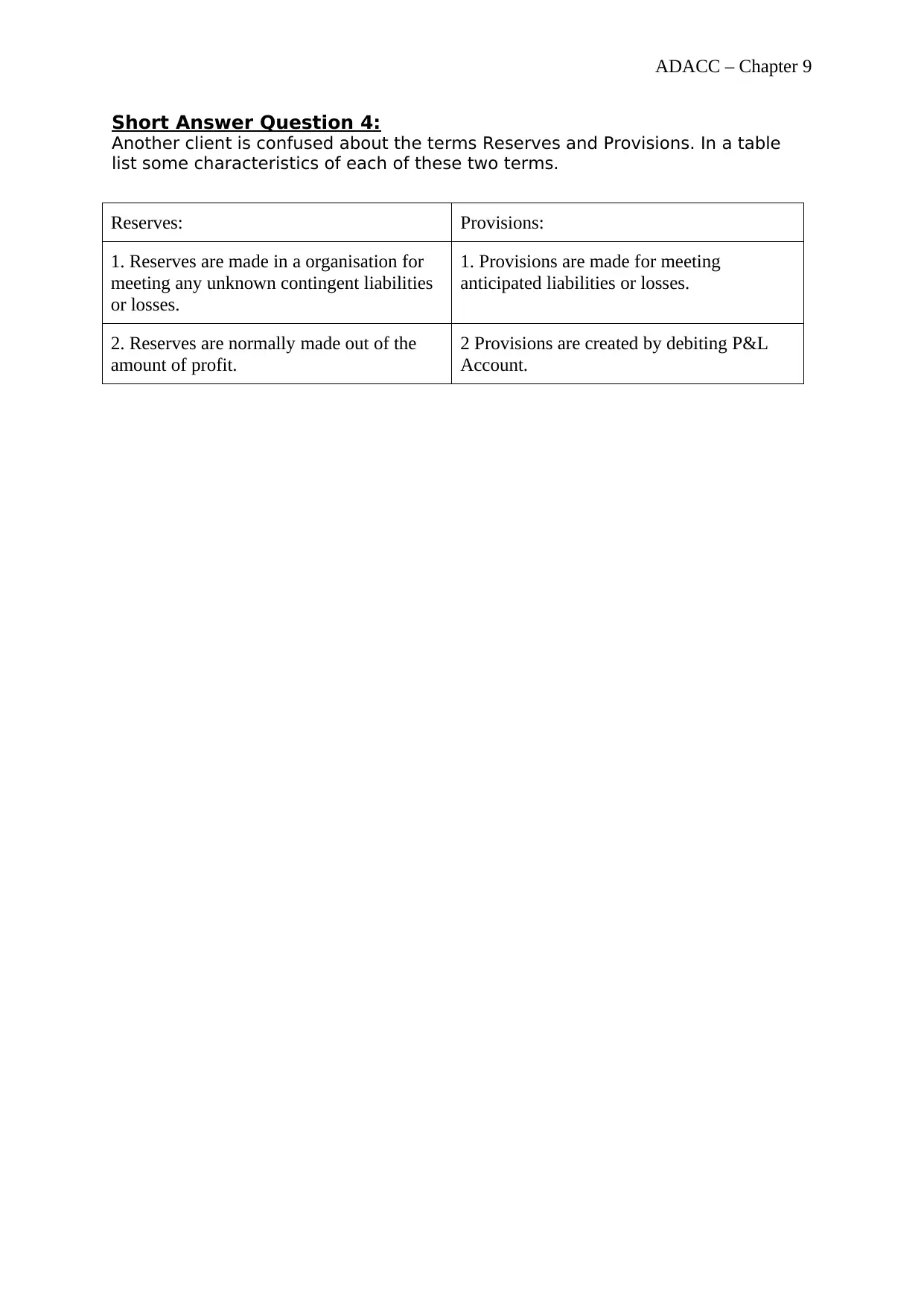

Short Answer Question 4:

Another client is confused about the terms Reserves and Provisions. In a table

list some characteristics of each of these two terms.

Reserves: Provisions:

1. Reserves are made in a organisation for

meeting any unknown contingent liabilities

or losses.

1. Provisions are made for meeting

anticipated liabilities or losses.

2. Reserves are normally made out of the

amount of profit.

2 Provisions are created by debiting P&L

Account.

Short Answer Question 4:

Another client is confused about the terms Reserves and Provisions. In a table

list some characteristics of each of these two terms.

Reserves: Provisions:

1. Reserves are made in a organisation for

meeting any unknown contingent liabilities

or losses.

1. Provisions are made for meeting

anticipated liabilities or losses.

2. Reserves are normally made out of the

amount of profit.

2 Provisions are created by debiting P&L

Account.

ADACC – Chapter 9

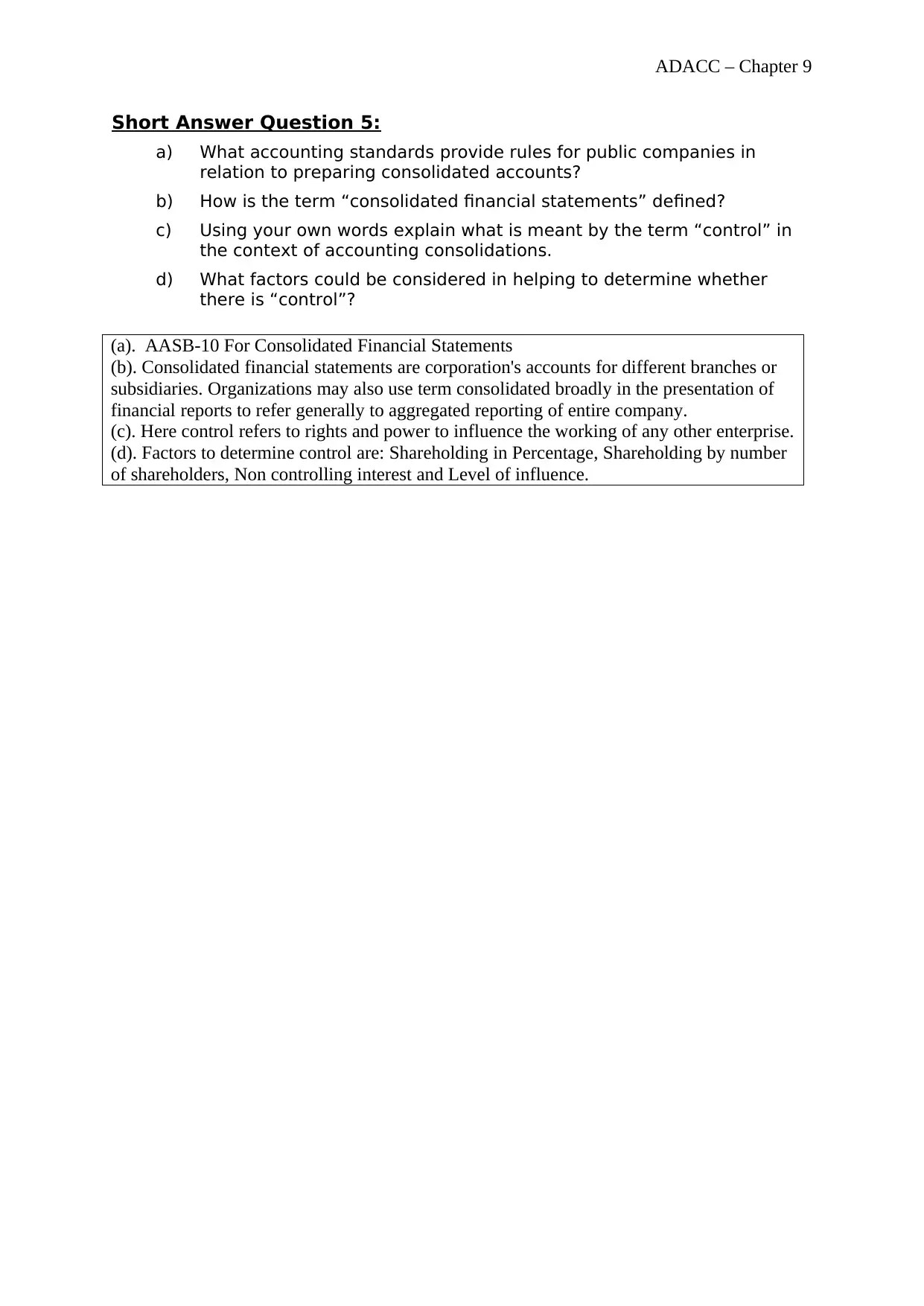

Short Answer Question 5:

a) What accounting standards provide rules for public companies in

relation to preparing consolidated accounts?

b) How is the term “consolidated financial statements” defined?

c) Using your own words explain what is meant by the term “control” in

the context of accounting consolidations.

d) What factors could be considered in helping to determine whether

there is “control”?

(a). AASB-10 For Consolidated Financial Statements

(b). Consolidated financial statements are corporation's accounts for different branches or

subsidiaries. Organizations may also use term consolidated broadly in the presentation of

financial reports to refer generally to aggregated reporting of entire company.

(c). Here control refers to rights and power to influence the working of any other enterprise.

(d). Factors to determine control are: Shareholding in Percentage, Shareholding by number

of shareholders, Non controlling interest and Level of influence.

Short Answer Question 5:

a) What accounting standards provide rules for public companies in

relation to preparing consolidated accounts?

b) How is the term “consolidated financial statements” defined?

c) Using your own words explain what is meant by the term “control” in

the context of accounting consolidations.

d) What factors could be considered in helping to determine whether

there is “control”?

(a). AASB-10 For Consolidated Financial Statements

(b). Consolidated financial statements are corporation's accounts for different branches or

subsidiaries. Organizations may also use term consolidated broadly in the presentation of

financial reports to refer generally to aggregated reporting of entire company.

(c). Here control refers to rights and power to influence the working of any other enterprise.

(d). Factors to determine control are: Shareholding in Percentage, Shareholding by number

of shareholders, Non controlling interest and Level of influence.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ADACC – Chapter 9

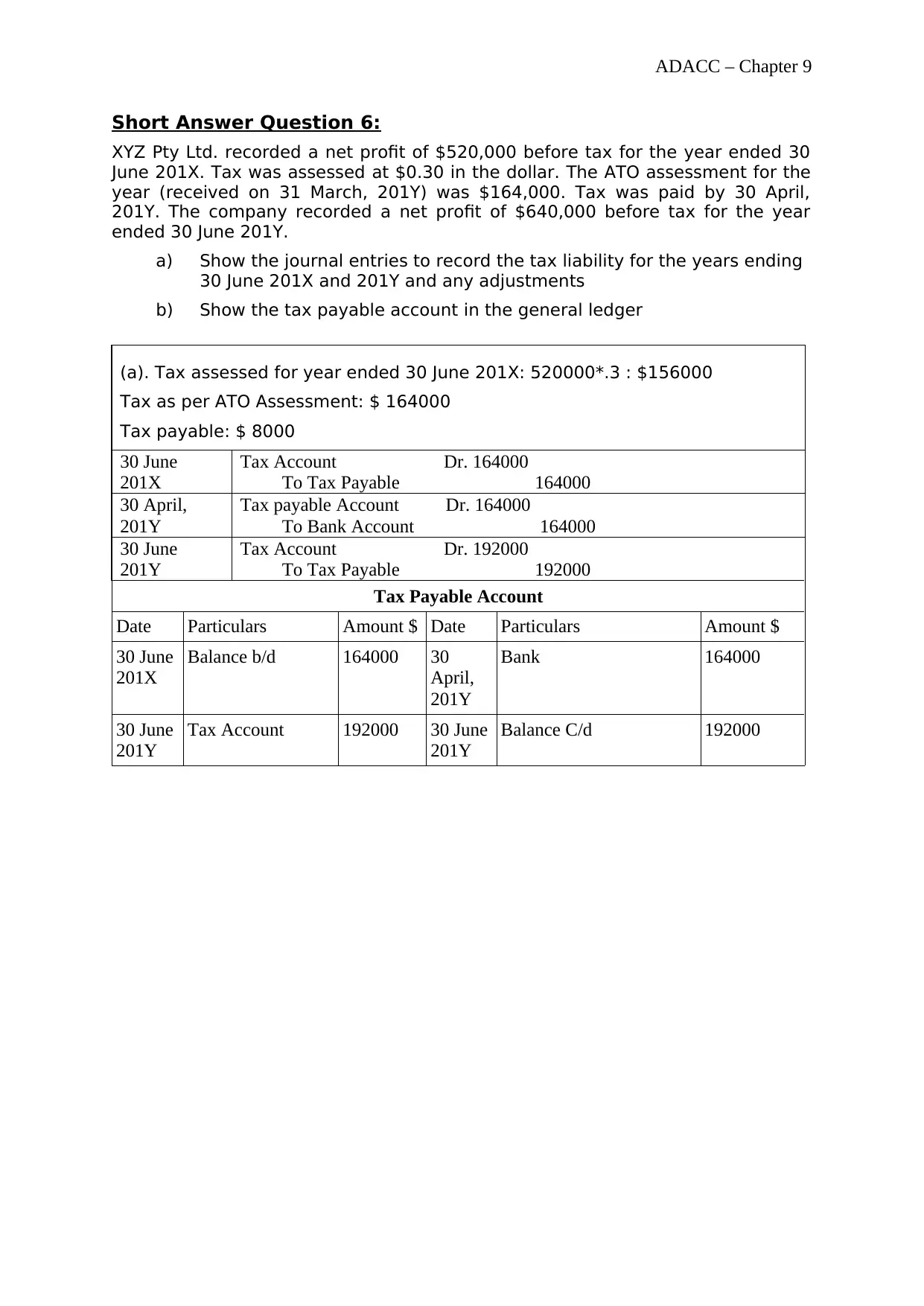

Short Answer Question 6:

XYZ Pty Ltd. recorded a net profit of $520,000 before tax for the year ended 30

June 201X. Tax was assessed at $0.30 in the dollar. The ATO assessment for the

year (received on 31 March, 201Y) was $164,000. Tax was paid by 30 April,

201Y. The company recorded a net profit of $640,000 before tax for the year

ended 30 June 201Y.

a) Show the journal entries to record the tax liability for the years ending

30 June 201X and 201Y and any adjustments

b) Show the tax payable account in the general ledger

(a). Tax assessed for year ended 30 June 201X: 520000*.3 : $156000

Tax as per ATO Assessment: $ 164000

Tax payable: $ 8000

30 June

201X

Tax Account Dr. 164000

To Tax Payable 164000

30 April,

201Y

Tax payable Account Dr. 164000

To Bank Account 164000

30 June

201Y

Tax Account Dr. 192000

To Tax Payable 192000

Tax Payable Account

Date Particulars Amount $ Date Particulars Amount $

30 June

201X

Balance b/d 164000 30

April,

201Y

Bank 164000

30 June

201Y

Tax Account 192000 30 June

201Y

Balance C/d 192000

Short Answer Question 6:

XYZ Pty Ltd. recorded a net profit of $520,000 before tax for the year ended 30

June 201X. Tax was assessed at $0.30 in the dollar. The ATO assessment for the

year (received on 31 March, 201Y) was $164,000. Tax was paid by 30 April,

201Y. The company recorded a net profit of $640,000 before tax for the year

ended 30 June 201Y.

a) Show the journal entries to record the tax liability for the years ending

30 June 201X and 201Y and any adjustments

b) Show the tax payable account in the general ledger

(a). Tax assessed for year ended 30 June 201X: 520000*.3 : $156000

Tax as per ATO Assessment: $ 164000

Tax payable: $ 8000

30 June

201X

Tax Account Dr. 164000

To Tax Payable 164000

30 April,

201Y

Tax payable Account Dr. 164000

To Bank Account 164000

30 June

201Y

Tax Account Dr. 192000

To Tax Payable 192000

Tax Payable Account

Date Particulars Amount $ Date Particulars Amount $

30 June

201X

Balance b/d 164000 30

April,

201Y

Bank 164000

30 June

201Y

Tax Account 192000 30 June

201Y

Balance C/d 192000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ADACC – Chapter 9

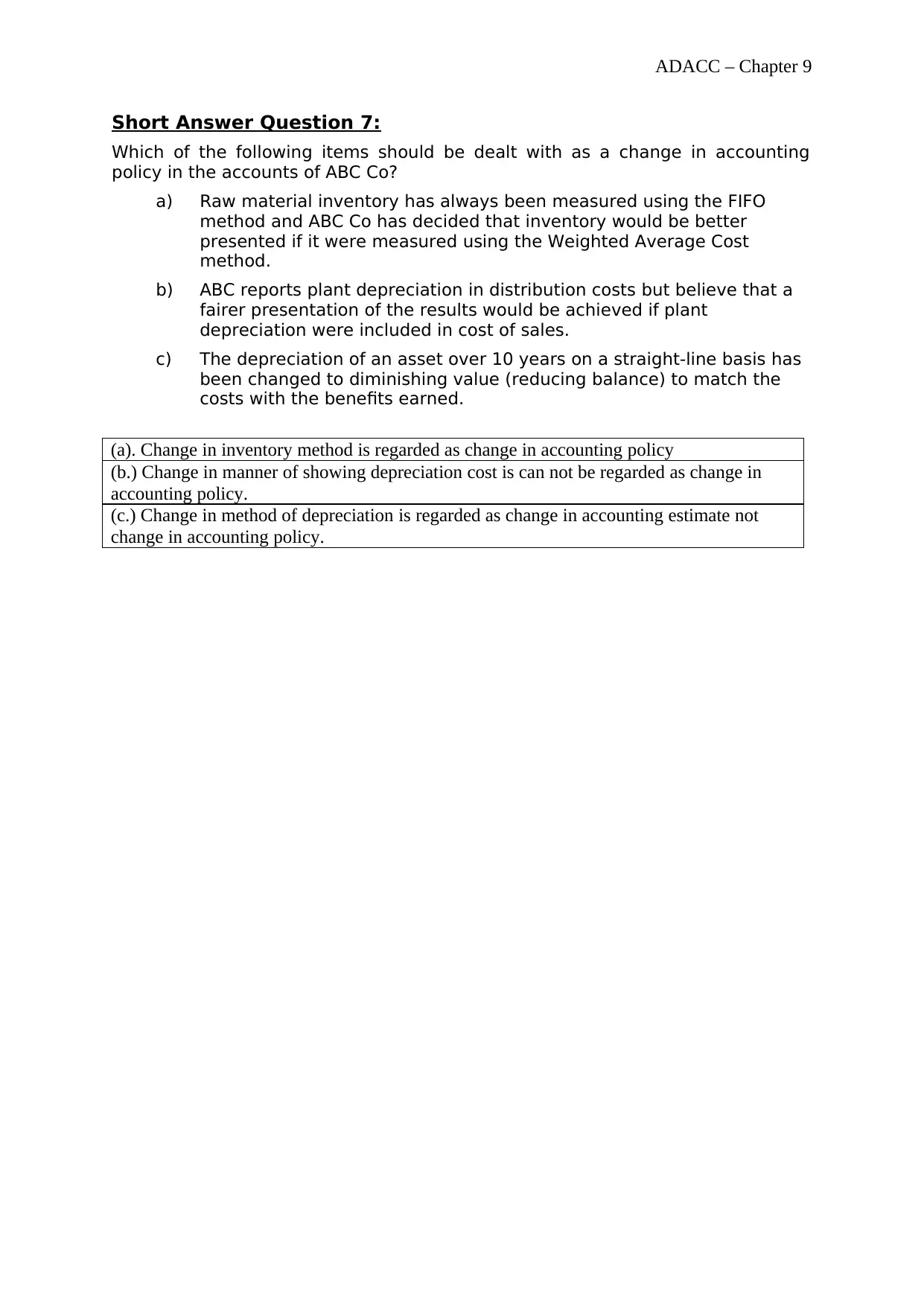

Short Answer Question 7:

Which of the following items should be dealt with as a change in accounting

policy in the accounts of ABC Co?

a) Raw material inventory has always been measured using the FIFO

method and ABC Co has decided that inventory would be better

presented if it were measured using the Weighted Average Cost

method.

b) ABC reports plant depreciation in distribution costs but believe that a

fairer presentation of the results would be achieved if plant

depreciation were included in cost of sales.

c) The depreciation of an asset over 10 years on a straight-line basis has

been changed to diminishing value (reducing balance) to match the

costs with the benefits earned.

(a). Change in inventory method is regarded as change in accounting policy

(b.) Change in manner of showing depreciation cost is can not be regarded as change in

accounting policy.

(c.) Change in method of depreciation is regarded as change in accounting estimate not

change in accounting policy.

Short Answer Question 7:

Which of the following items should be dealt with as a change in accounting

policy in the accounts of ABC Co?

a) Raw material inventory has always been measured using the FIFO

method and ABC Co has decided that inventory would be better

presented if it were measured using the Weighted Average Cost

method.

b) ABC reports plant depreciation in distribution costs but believe that a

fairer presentation of the results would be achieved if plant

depreciation were included in cost of sales.

c) The depreciation of an asset over 10 years on a straight-line basis has

been changed to diminishing value (reducing balance) to match the

costs with the benefits earned.

(a). Change in inventory method is regarded as change in accounting policy

(b.) Change in manner of showing depreciation cost is can not be regarded as change in

accounting policy.

(c.) Change in method of depreciation is regarded as change in accounting estimate not

change in accounting policy.

ADACC – Chapter 9

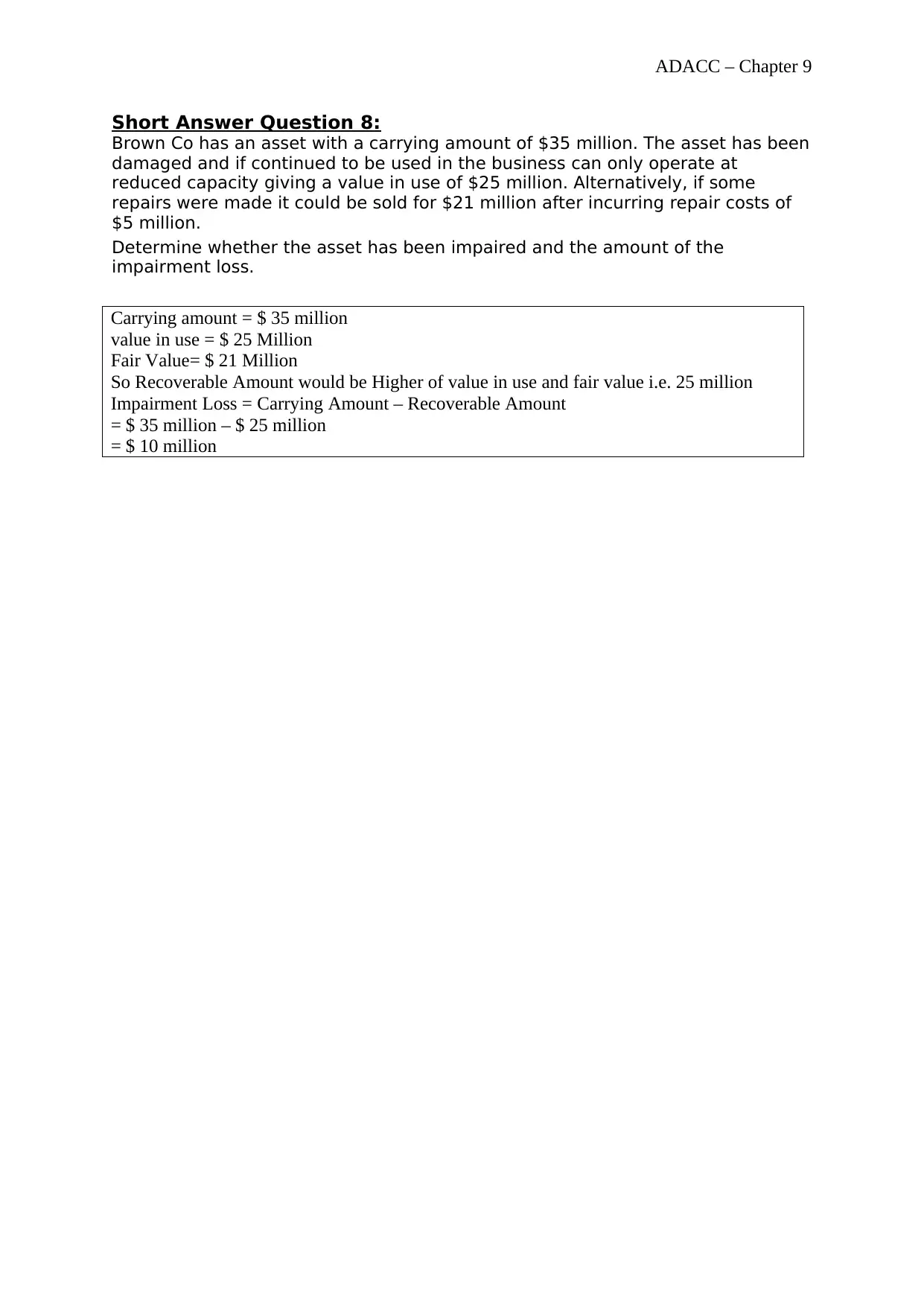

Short Answer Question 8:

Brown Co has an asset with a carrying amount of $35 million. The asset has been

damaged and if continued to be used in the business can only operate at

reduced capacity giving a value in use of $25 million. Alternatively, if some

repairs were made it could be sold for $21 million after incurring repair costs of

$5 million.

Determine whether the asset has been impaired and the amount of the

impairment loss.

Carrying amount = $ 35 million

value in use = $ 25 Million

Fair Value= $ 21 Million

So Recoverable Amount would be Higher of value in use and fair value i.e. 25 million

Impairment Loss = Carrying Amount – Recoverable Amount

= $ 35 million – $ 25 million

= $ 10 million

Short Answer Question 8:

Brown Co has an asset with a carrying amount of $35 million. The asset has been

damaged and if continued to be used in the business can only operate at

reduced capacity giving a value in use of $25 million. Alternatively, if some

repairs were made it could be sold for $21 million after incurring repair costs of

$5 million.

Determine whether the asset has been impaired and the amount of the

impairment loss.

Carrying amount = $ 35 million

value in use = $ 25 Million

Fair Value= $ 21 Million

So Recoverable Amount would be Higher of value in use and fair value i.e. 25 million

Impairment Loss = Carrying Amount – Recoverable Amount

= $ 35 million – $ 25 million

= $ 10 million

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 23

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.