University Corporate Reporting Assignment: Tax and Consolidation

VerifiedAdded on 2020/02/24

|15

|1731

|32

Homework Assignment

AI Summary

This document presents a comprehensive solution to an advanced corporate reporting assignment, meticulously addressing tax accounting and consolidation principles. The assignment is divided into two main questions. Question 1 delves into current tax liabilities, requiring the preparation of a current tax worksheet, analysis of temporary differences, and the calculation of tax expense with corresponding journal entries. Question 2 focuses on business combinations and the preparation of consolidated financial statements. It involves detailed journal entries for pre-acquisition, non-controlling interest (NCI) calculations, and adjustments for intercompany transactions, including sales of inventory, machinery, and loan transactions. The solution culminates in the preparation of a consolidated income statement and balance sheet, demonstrating a strong understanding of complex financial reporting concepts. Bibliographies of the resources used are also provided.

Running head: ADVANCED CORPORATE REPORTING

Advanced Corporate Reporting

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Advanced Corporate Reporting

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1ADVANCED CORPORATE REPORTING

Table of Contents

Answer to Question 1:.....................................................................................................................2

Answer to Part A:........................................................................................................................2

Answer to Part B:.........................................................................................................................6

Answer to Part C:.........................................................................................................................7

Answer to Question 2:.....................................................................................................................7

Answer to Part 1:.........................................................................................................................7

Answer to Part 2:.......................................................................................................................14

Answer to Part 3:.......................................................................................................................18

Bibliographies:...............................................................................................................................21

Table of Contents

Answer to Question 1:.....................................................................................................................2

Answer to Part A:........................................................................................................................2

Answer to Part B:.........................................................................................................................6

Answer to Part C:.........................................................................................................................7

Answer to Question 2:.....................................................................................................................7

Answer to Part 1:.........................................................................................................................7

Answer to Part 2:.......................................................................................................................14

Answer to Part 3:.......................................................................................................................18

Bibliographies:...............................................................................................................................21

2ADVANCED CORPORATE REPORTING

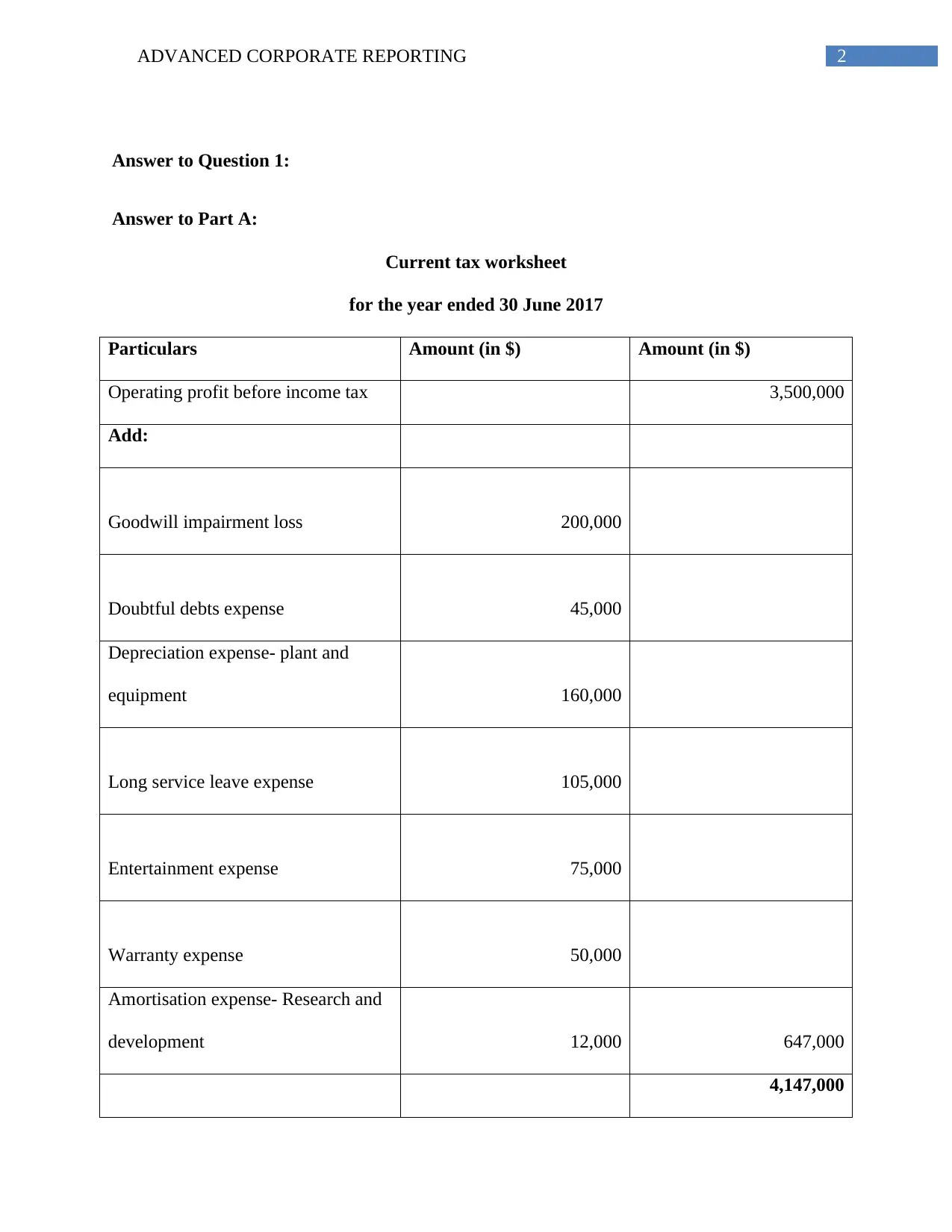

Answer to Question 1:

Answer to Part A:

Current tax worksheet

for the year ended 30 June 2017

Particulars Amount (in $) Amount (in $)

Operating profit before income tax 3,500,000

Add:

Goodwill impairment loss 200,000

Doubtful debts expense 45,000

Depreciation expense- plant and

equipment 160,000

Long service leave expense 105,000

Entertainment expense 75,000

Warranty expense 50,000

Amortisation expense- Research and

development 12,000 647,000

4,147,000

Answer to Question 1:

Answer to Part A:

Current tax worksheet

for the year ended 30 June 2017

Particulars Amount (in $) Amount (in $)

Operating profit before income tax 3,500,000

Add:

Goodwill impairment loss 200,000

Doubtful debts expense 45,000

Depreciation expense- plant and

equipment 160,000

Long service leave expense 105,000

Entertainment expense 75,000

Warranty expense 50,000

Amortisation expense- Research and

development 12,000 647,000

4,147,000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3ADVANCED CORPORATE REPORTING

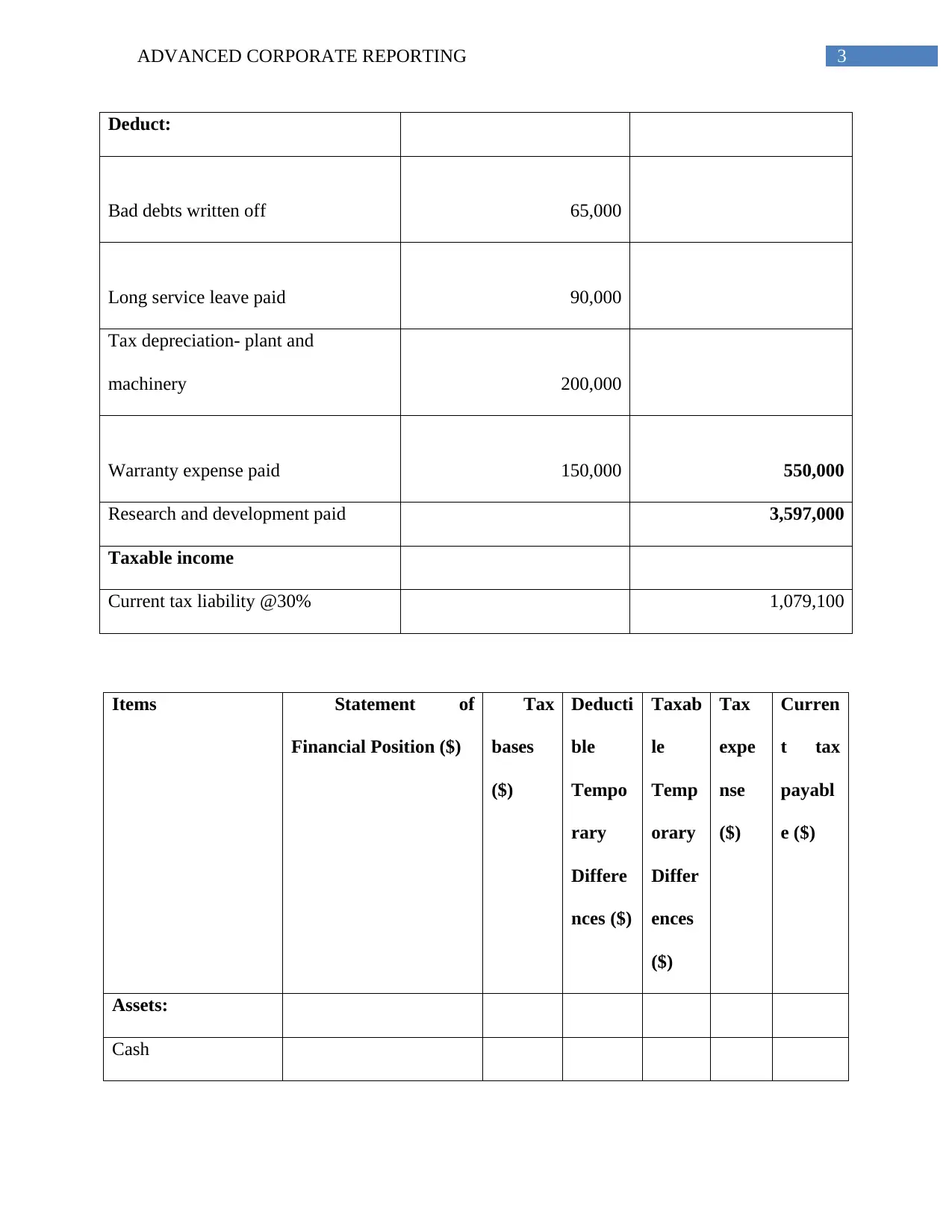

Deduct:

Bad debts written off 65,000

Long service leave paid 90,000

Tax depreciation- plant and

machinery 200,000

Warranty expense paid 150,000 550,000

Research and development paid 3,597,000

Taxable income

Current tax liability @30% 1,079,100

Items Statement of

Financial Position ($)

Tax

bases

($)

Deducti

ble

Tempo

rary

Differe

nces ($)

Taxab

le

Temp

orary

Differ

ences

($)

Tax

expe

nse

($)

Curren

t tax

payabl

e ($)

Assets:

Cash

Deduct:

Bad debts written off 65,000

Long service leave paid 90,000

Tax depreciation- plant and

machinery 200,000

Warranty expense paid 150,000 550,000

Research and development paid 3,597,000

Taxable income

Current tax liability @30% 1,079,100

Items Statement of

Financial Position ($)

Tax

bases

($)

Deducti

ble

Tempo

rary

Differe

nces ($)

Taxab

le

Temp

orary

Differ

ences

($)

Tax

expe

nse

($)

Curren

t tax

payabl

e ($)

Assets:

Cash

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4ADVANCED CORPORATE REPORTING

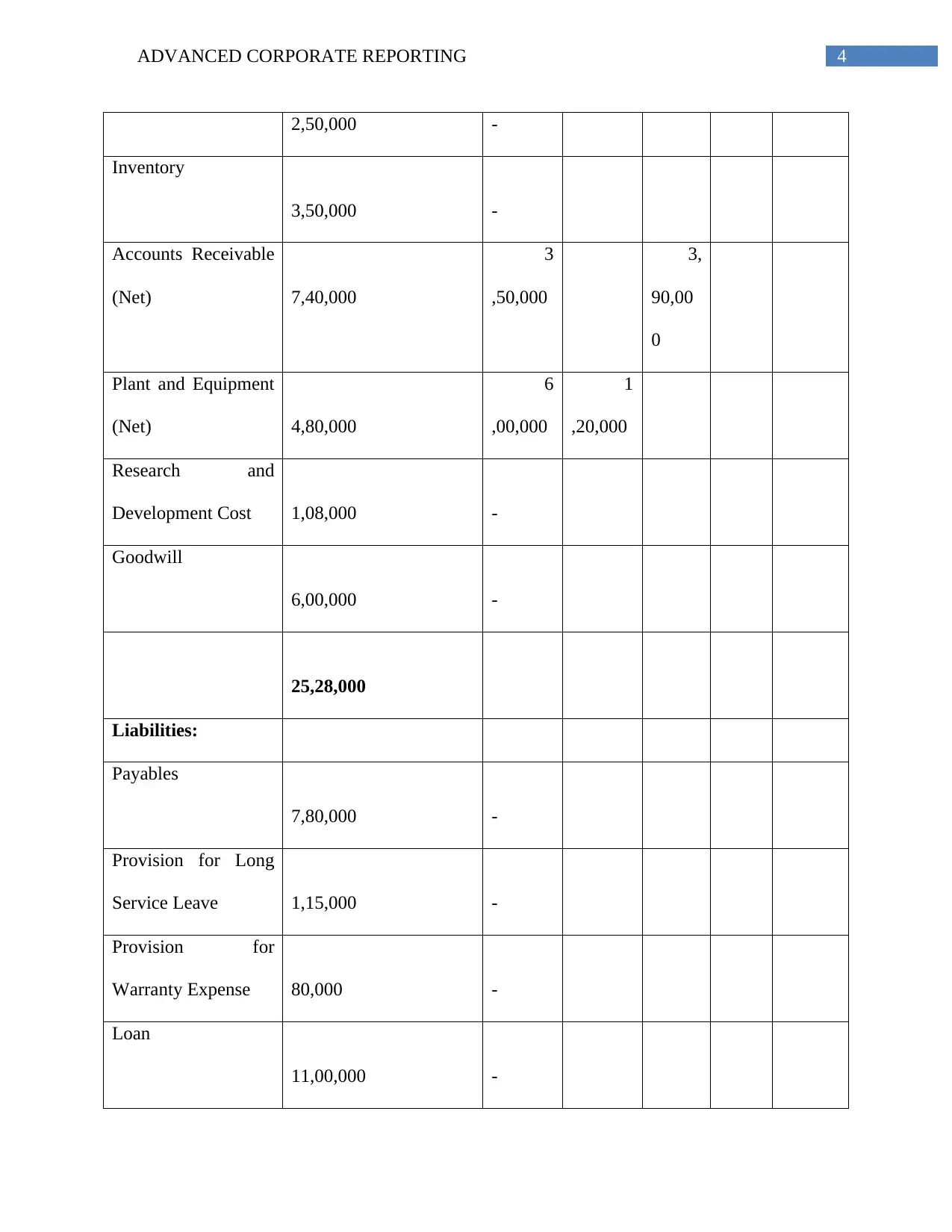

2,50,000 -

Inventory

3,50,000 -

Accounts Receivable

(Net) 7,40,000

3

,50,000

3,

90,00

0

Plant and Equipment

(Net) 4,80,000

6

,00,000

1

,20,000

Research and

Development Cost 1,08,000 -

Goodwill

6,00,000 -

25,28,000

Liabilities:

Payables

7,80,000 -

Provision for Long

Service Leave 1,15,000 -

Provision for

Warranty Expense 80,000 -

Loan

11,00,000 -

2,50,000 -

Inventory

3,50,000 -

Accounts Receivable

(Net) 7,40,000

3

,50,000

3,

90,00

0

Plant and Equipment

(Net) 4,80,000

6

,00,000

1

,20,000

Research and

Development Cost 1,08,000 -

Goodwill

6,00,000 -

25,28,000

Liabilities:

Payables

7,80,000 -

Provision for Long

Service Leave 1,15,000 -

Provision for

Warranty Expense 80,000 -

Loan

11,00,000 -

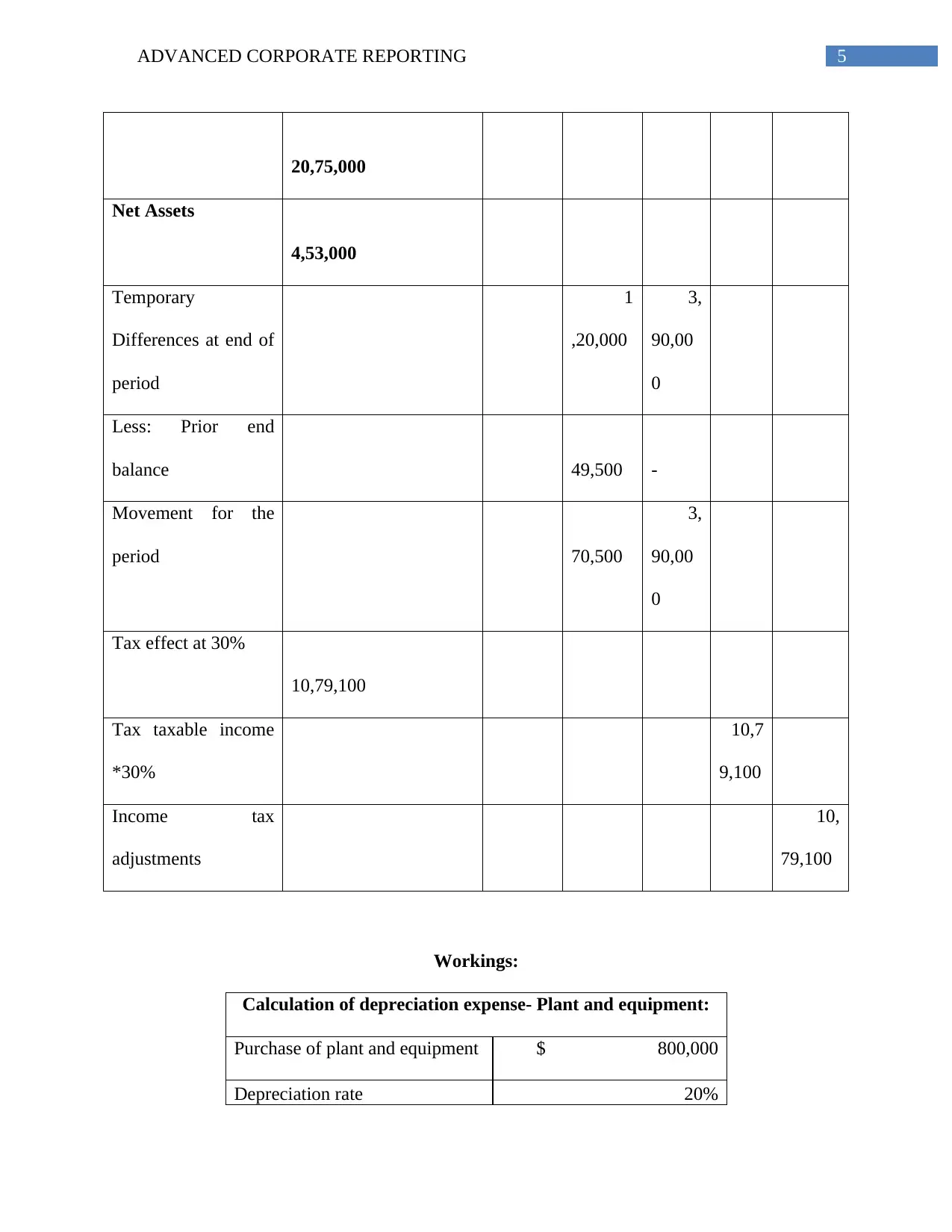

5ADVANCED CORPORATE REPORTING

20,75,000

Net Assets

4,53,000

Temporary

Differences at end of

period

1

,20,000

3,

90,00

0

Less: Prior end

balance 49,500 -

Movement for the

period 70,500

3,

90,00

0

Tax effect at 30%

10,79,100

Tax taxable income

*30%

10,7

9,100

Income tax

adjustments

10,

79,100

Workings:

Calculation of depreciation expense- Plant and equipment:

Purchase of plant and equipment $ 800,000

Depreciation rate 20%

20,75,000

Net Assets

4,53,000

Temporary

Differences at end of

period

1

,20,000

3,

90,00

0

Less: Prior end

balance 49,500 -

Movement for the

period 70,500

3,

90,00

0

Tax effect at 30%

10,79,100

Tax taxable income

*30%

10,7

9,100

Income tax

adjustments

10,

79,100

Workings:

Calculation of depreciation expense- Plant and equipment:

Purchase of plant and equipment $ 800,000

Depreciation rate 20%

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

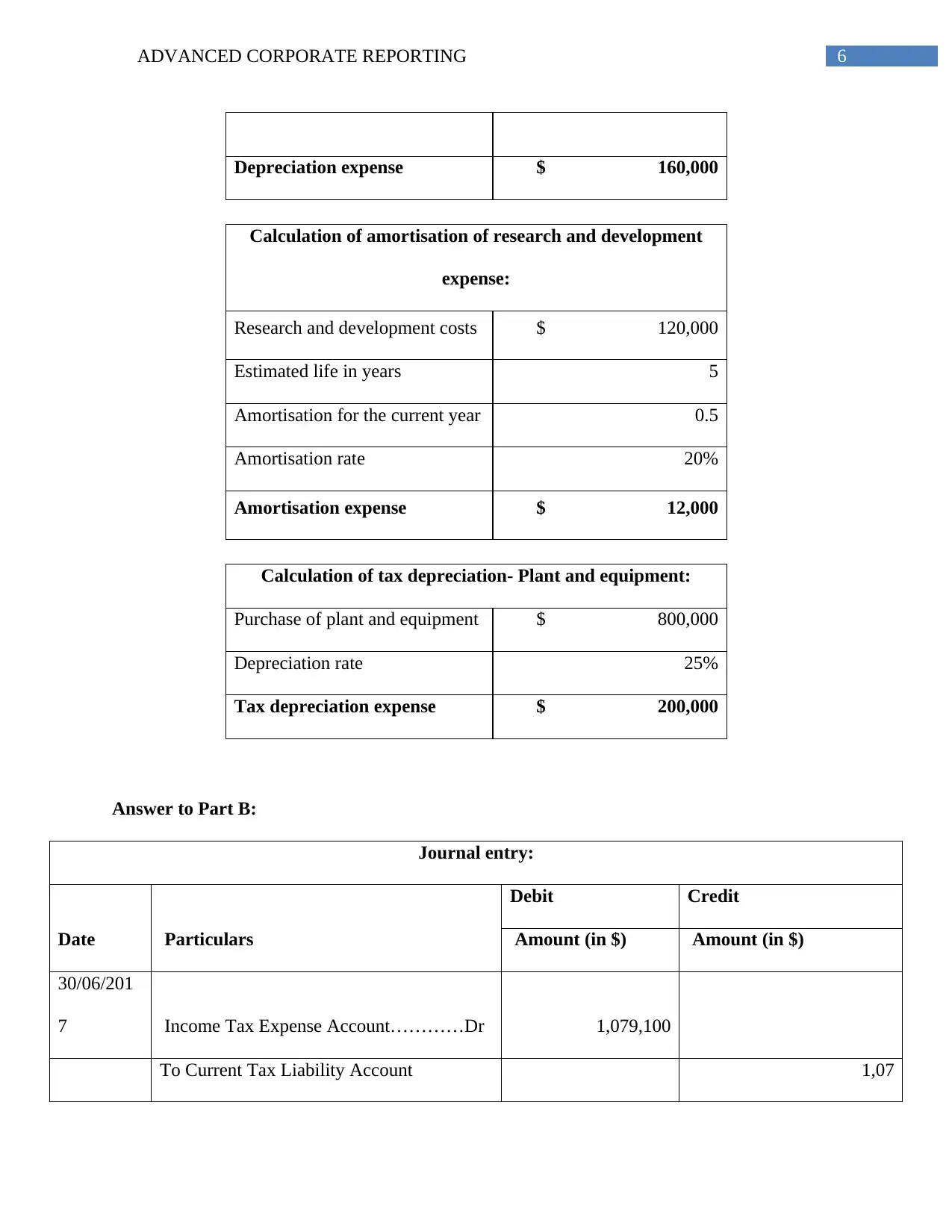

6ADVANCED CORPORATE REPORTING

Depreciation expense $ 160,000

Calculation of amortisation of research and development

expense:

Research and development costs $ 120,000

Estimated life in years 5

Amortisation for the current year 0.5

Amortisation rate 20%

Amortisation expense $ 12,000

Calculation of tax depreciation- Plant and equipment:

Purchase of plant and equipment $ 800,000

Depreciation rate 25%

Tax depreciation expense $ 200,000

Answer to Part B:

Journal entry:

Date Particulars

Debit Credit

Amount (in $) Amount (in $)

30/06/201

7 Income Tax Expense Account…………Dr 1,079,100

To Current Tax Liability Account 1,07

Depreciation expense $ 160,000

Calculation of amortisation of research and development

expense:

Research and development costs $ 120,000

Estimated life in years 5

Amortisation for the current year 0.5

Amortisation rate 20%

Amortisation expense $ 12,000

Calculation of tax depreciation- Plant and equipment:

Purchase of plant and equipment $ 800,000

Depreciation rate 25%

Tax depreciation expense $ 200,000

Answer to Part B:

Journal entry:

Date Particulars

Debit Credit

Amount (in $) Amount (in $)

30/06/201

7 Income Tax Expense Account…………Dr 1,079,100

To Current Tax Liability Account 1,07

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

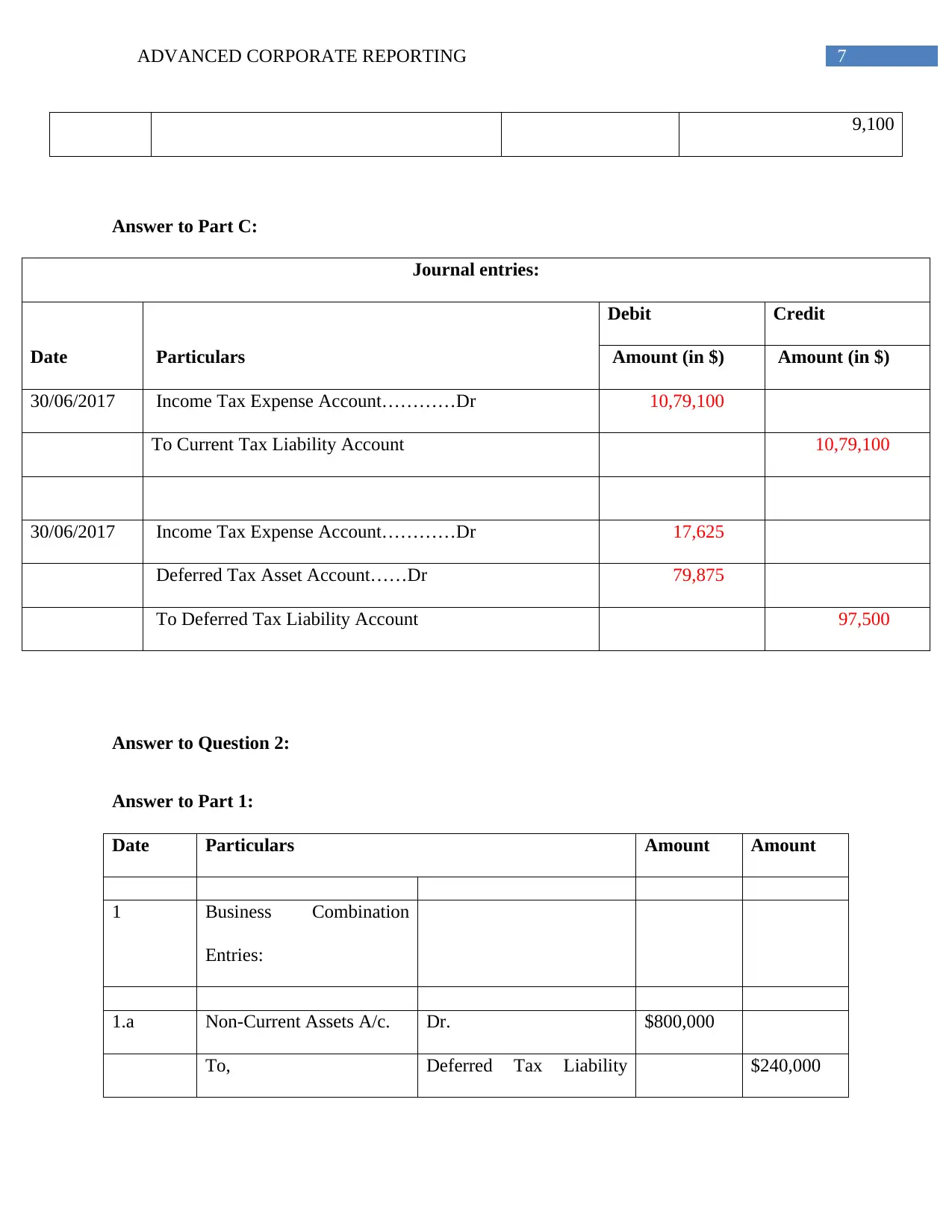

7ADVANCED CORPORATE REPORTING

9,100

Answer to Part C:

Journal entries:

Date Particulars

Debit Credit

Amount (in $) Amount (in $)

30/06/2017 Income Tax Expense Account…………Dr 10,79,100

To Current Tax Liability Account 10,79,100

30/06/2017 Income Tax Expense Account…………Dr 17,625

Deferred Tax Asset Account……Dr 79,875

To Deferred Tax Liability Account 97,500

Answer to Question 2:

Answer to Part 1:

Date Particulars Amount Amount

1 Business Combination

Entries:

1.a Non-Current Assets A/c. Dr. $800,000

To, Deferred Tax Liability $240,000

9,100

Answer to Part C:

Journal entries:

Date Particulars

Debit Credit

Amount (in $) Amount (in $)

30/06/2017 Income Tax Expense Account…………Dr 10,79,100

To Current Tax Liability Account 10,79,100

30/06/2017 Income Tax Expense Account…………Dr 17,625

Deferred Tax Asset Account……Dr 79,875

To Deferred Tax Liability Account 97,500

Answer to Question 2:

Answer to Part 1:

Date Particulars Amount Amount

1 Business Combination

Entries:

1.a Non-Current Assets A/c. Dr. $800,000

To, Deferred Tax Liability $240,000

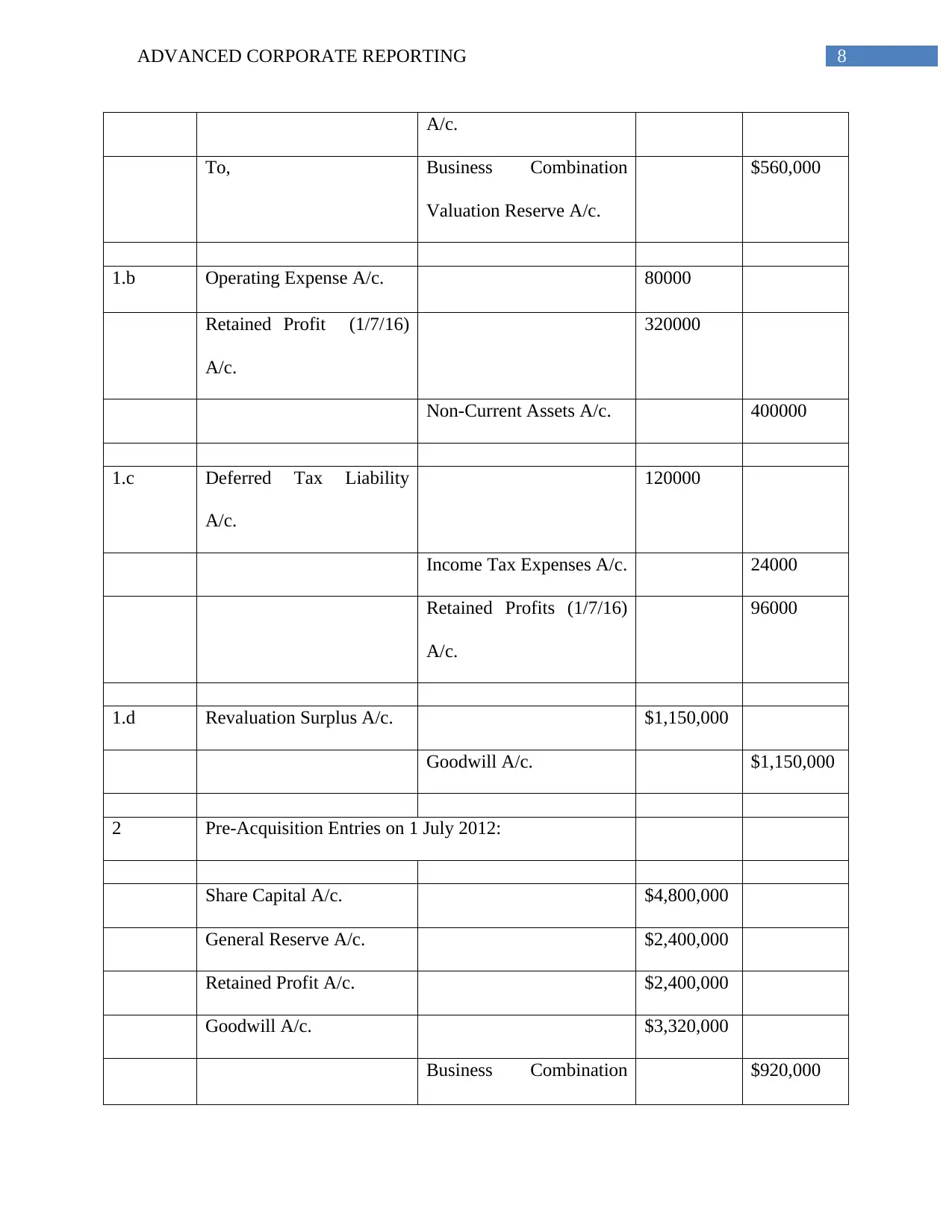

8ADVANCED CORPORATE REPORTING

A/c.

To, Business Combination

Valuation Reserve A/c.

$560,000

1.b Operating Expense A/c. 80000

Retained Profit (1/7/16)

A/c.

320000

Non-Current Assets A/c. 400000

1.c Deferred Tax Liability

A/c.

120000

Income Tax Expenses A/c. 24000

Retained Profits (1/7/16)

A/c.

96000

1.d Revaluation Surplus A/c. $1,150,000

Goodwill A/c. $1,150,000

2 Pre-Acquisition Entries on 1 July 2012:

Share Capital A/c. $4,800,000

General Reserve A/c. $2,400,000

Retained Profit A/c. $2,400,000

Goodwill A/c. $3,320,000

Business Combination $920,000

A/c.

To, Business Combination

Valuation Reserve A/c.

$560,000

1.b Operating Expense A/c. 80000

Retained Profit (1/7/16)

A/c.

320000

Non-Current Assets A/c. 400000

1.c Deferred Tax Liability

A/c.

120000

Income Tax Expenses A/c. 24000

Retained Profits (1/7/16)

A/c.

96000

1.d Revaluation Surplus A/c. $1,150,000

Goodwill A/c. $1,150,000

2 Pre-Acquisition Entries on 1 July 2012:

Share Capital A/c. $4,800,000

General Reserve A/c. $2,400,000

Retained Profit A/c. $2,400,000

Goodwill A/c. $3,320,000

Business Combination $920,000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9ADVANCED CORPORATE REPORTING

Valuation Reserve A/c.

Investment A/c. $12,000,00

0

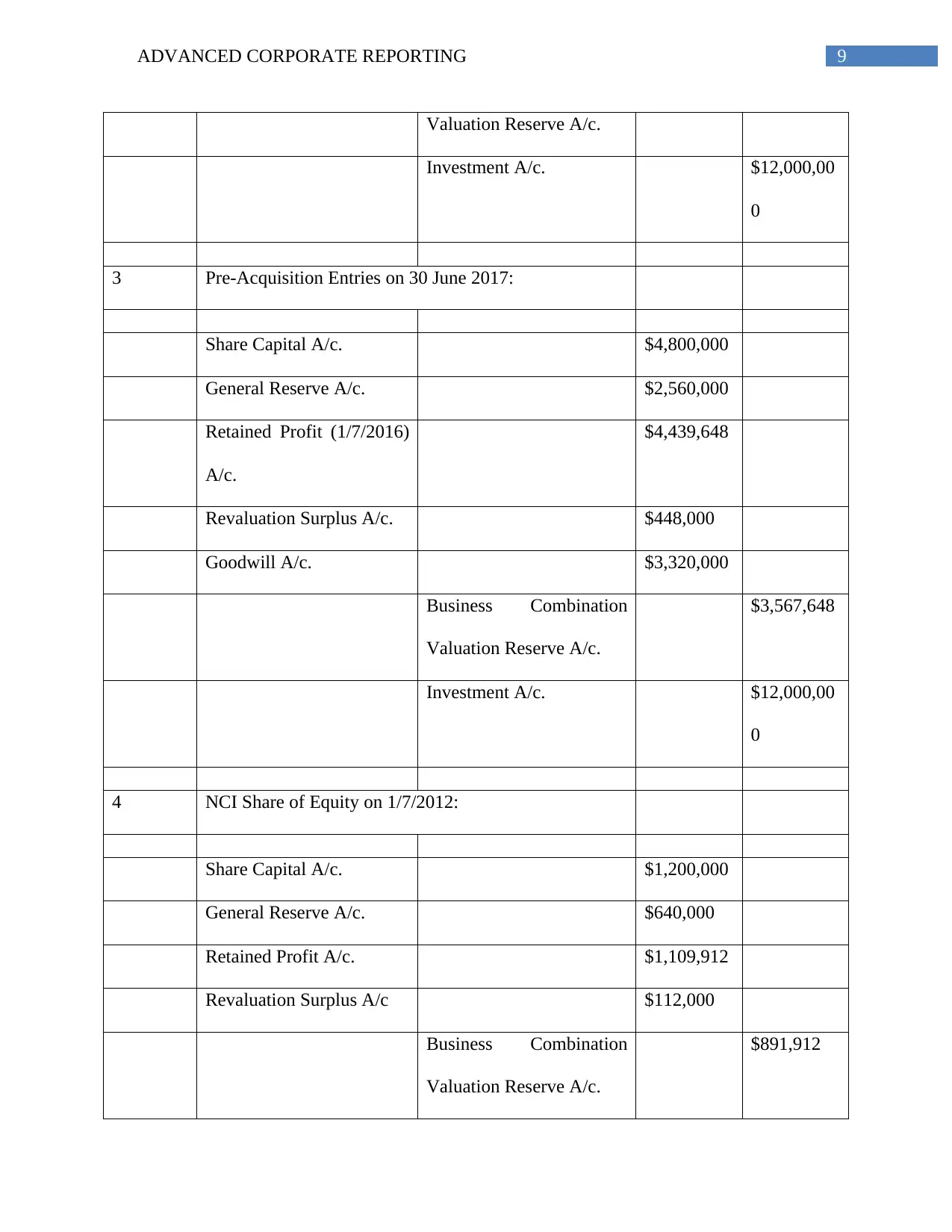

3 Pre-Acquisition Entries on 30 June 2017:

Share Capital A/c. $4,800,000

General Reserve A/c. $2,560,000

Retained Profit (1/7/2016)

A/c.

$4,439,648

Revaluation Surplus A/c. $448,000

Goodwill A/c. $3,320,000

Business Combination

Valuation Reserve A/c.

$3,567,648

Investment A/c. $12,000,00

0

4 NCI Share of Equity on 1/7/2012:

Share Capital A/c. $1,200,000

General Reserve A/c. $640,000

Retained Profit A/c. $1,109,912

Revaluation Surplus A/c $112,000

Business Combination

Valuation Reserve A/c.

$891,912

Valuation Reserve A/c.

Investment A/c. $12,000,00

0

3 Pre-Acquisition Entries on 30 June 2017:

Share Capital A/c. $4,800,000

General Reserve A/c. $2,560,000

Retained Profit (1/7/2016)

A/c.

$4,439,648

Revaluation Surplus A/c. $448,000

Goodwill A/c. $3,320,000

Business Combination

Valuation Reserve A/c.

$3,567,648

Investment A/c. $12,000,00

0

4 NCI Share of Equity on 1/7/2012:

Share Capital A/c. $1,200,000

General Reserve A/c. $640,000

Retained Profit A/c. $1,109,912

Revaluation Surplus A/c $112,000

Business Combination

Valuation Reserve A/c.

$891,912

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10ADVANCED CORPORATE REPORTING

NCI A/c. $2,170,000

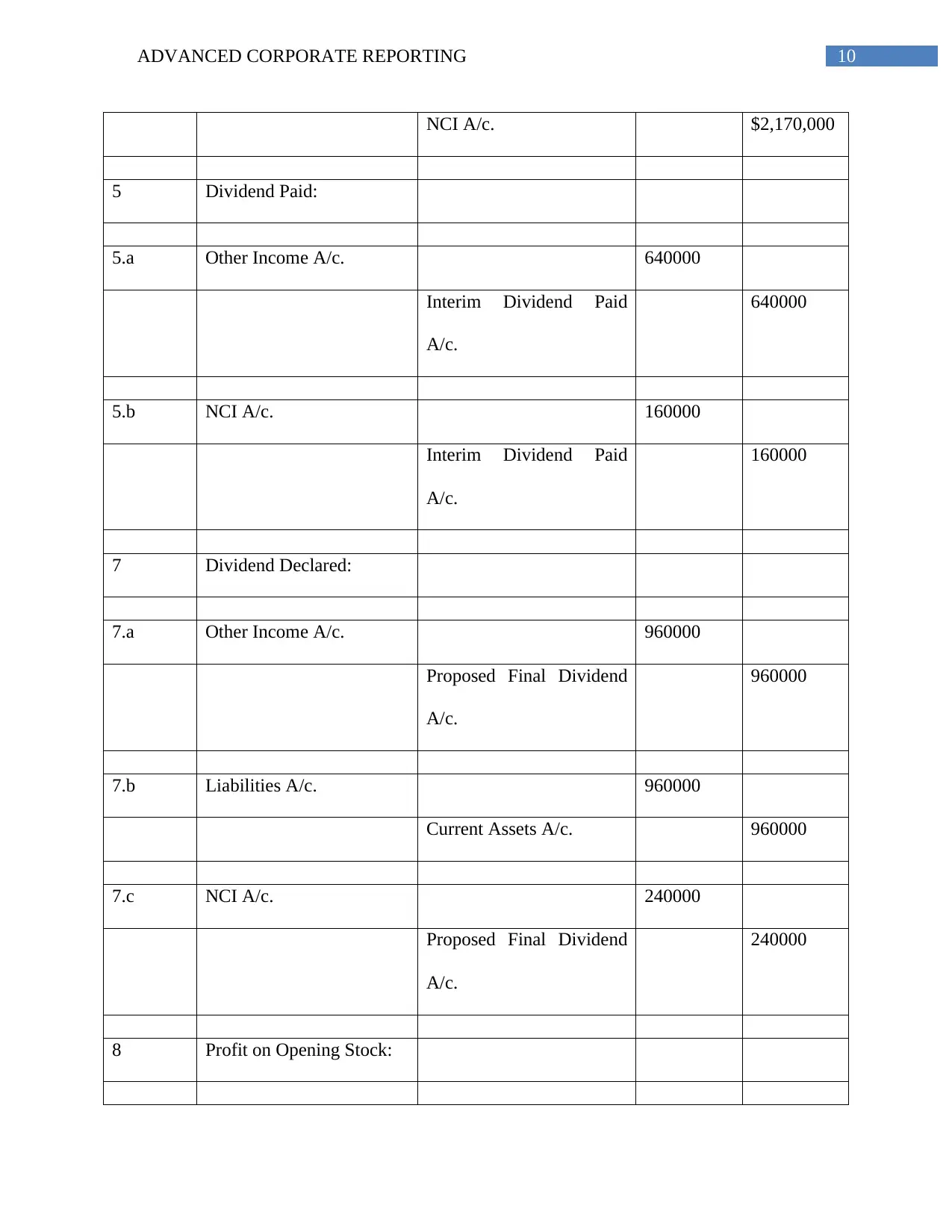

5 Dividend Paid:

5.a Other Income A/c. 640000

Interim Dividend Paid

A/c.

640000

5.b NCI A/c. 160000

Interim Dividend Paid

A/c.

160000

7 Dividend Declared:

7.a Other Income A/c. 960000

Proposed Final Dividend

A/c.

960000

7.b Liabilities A/c. 960000

Current Assets A/c. 960000

7.c NCI A/c. 240000

Proposed Final Dividend

A/c.

240000

8 Profit on Opening Stock:

NCI A/c. $2,170,000

5 Dividend Paid:

5.a Other Income A/c. 640000

Interim Dividend Paid

A/c.

640000

5.b NCI A/c. 160000

Interim Dividend Paid

A/c.

160000

7 Dividend Declared:

7.a Other Income A/c. 960000

Proposed Final Dividend

A/c.

960000

7.b Liabilities A/c. 960000

Current Assets A/c. 960000

7.c NCI A/c. 240000

Proposed Final Dividend

A/c.

240000

8 Profit on Opening Stock:

11ADVANCED CORPORATE REPORTING

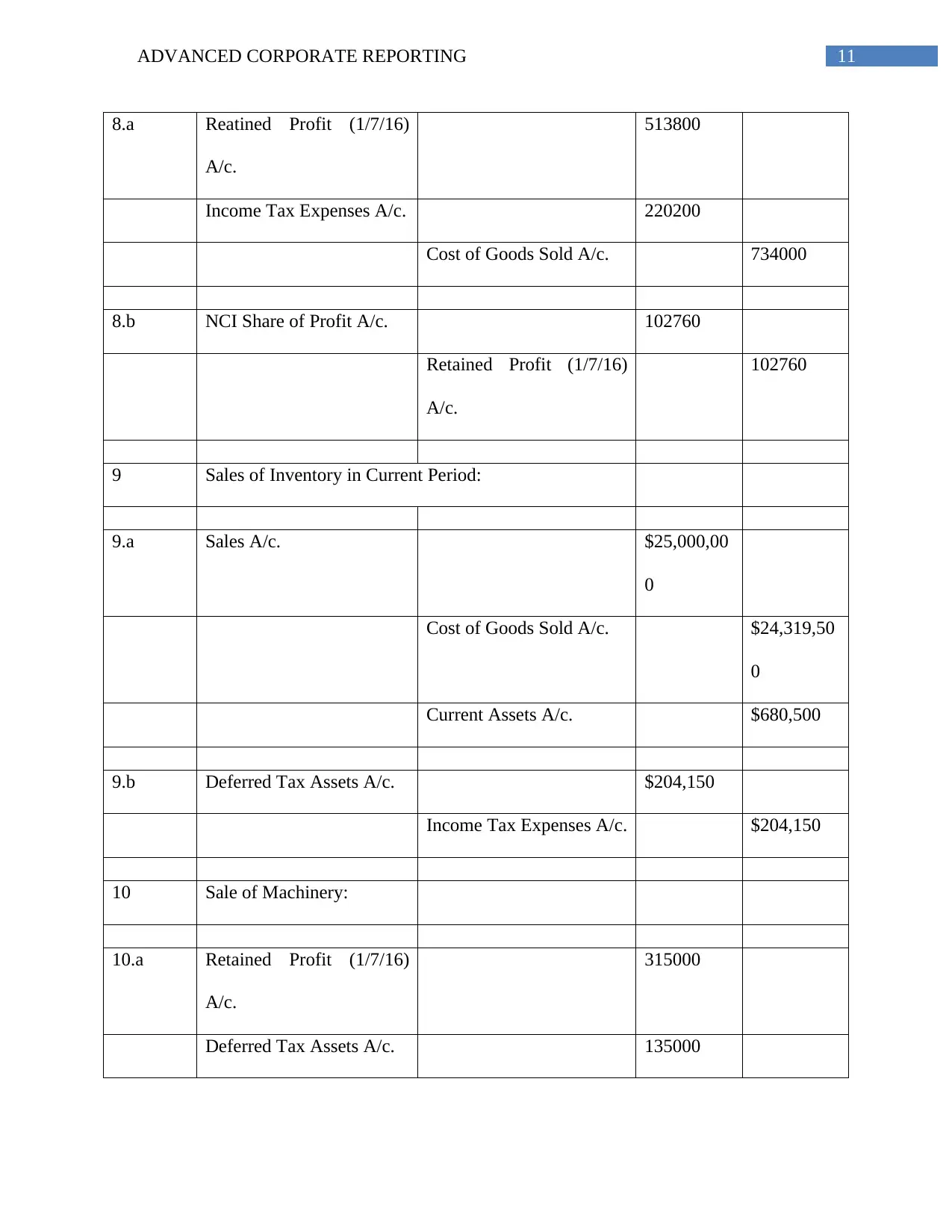

8.a Reatined Profit (1/7/16)

A/c.

513800

Income Tax Expenses A/c. 220200

Cost of Goods Sold A/c. 734000

8.b NCI Share of Profit A/c. 102760

Retained Profit (1/7/16)

A/c.

102760

9 Sales of Inventory in Current Period:

9.a Sales A/c. $25,000,00

0

Cost of Goods Sold A/c. $24,319,50

0

Current Assets A/c. $680,500

9.b Deferred Tax Assets A/c. $204,150

Income Tax Expenses A/c. $204,150

10 Sale of Machinery:

10.a Retained Profit (1/7/16)

A/c.

315000

Deferred Tax Assets A/c. 135000

8.a Reatined Profit (1/7/16)

A/c.

513800

Income Tax Expenses A/c. 220200

Cost of Goods Sold A/c. 734000

8.b NCI Share of Profit A/c. 102760

Retained Profit (1/7/16)

A/c.

102760

9 Sales of Inventory in Current Period:

9.a Sales A/c. $25,000,00

0

Cost of Goods Sold A/c. $24,319,50

0

Current Assets A/c. $680,500

9.b Deferred Tax Assets A/c. $204,150

Income Tax Expenses A/c. $204,150

10 Sale of Machinery:

10.a Retained Profit (1/7/16)

A/c.

315000

Deferred Tax Assets A/c. 135000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.