Consolidated Financial Statements: Advance Financial Accounting

VerifiedAdded on 2023/04/21

|7

|755

|116

Homework Assignment

AI Summary

This document presents a solution to an advanced financial accounting assignment involving the consolidation of Jenny Ltd. and Patricia Ltd. following Jenny Ltd.'s acquisition of Patricia Ltd.'s shares. The solution includes consolidated journal entries for the amalgamation, fair value adjustments of assets, and the elimination of inter-company transactions such as services, rent, debentures, inventory sales, machinery sales, and dividends. It also addresses the calculation of current and deferred tax liabilities, considering items like royalty revenue, goodwill amortization, entertainment expenses, depreciation, bad debts, and long service leave. The analysis incorporates acquisition details, share capital, retained earnings, general reserves, and goodwill calculations to provide a comprehensive financial consolidation.

Advance Financial Accounting

Advance Financial Accounting

1 | P a g e

Advance Financial Accounting

1 | P a g e

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Advance Financial Accounting

Contents

Solution: 1 (a)........................................................................................................................................3

Solution: 1 (b)........................................................................................................................................4

Solution: 2.............................................................................................................................................5

References:............................................................................................................................................6

2 | P a g e

Contents

Solution: 1 (a)........................................................................................................................................3

Solution: 1 (b)........................................................................................................................................4

Solution: 2.............................................................................................................................................5

References:............................................................................................................................................6

2 | P a g e

Advance Financial Accounting

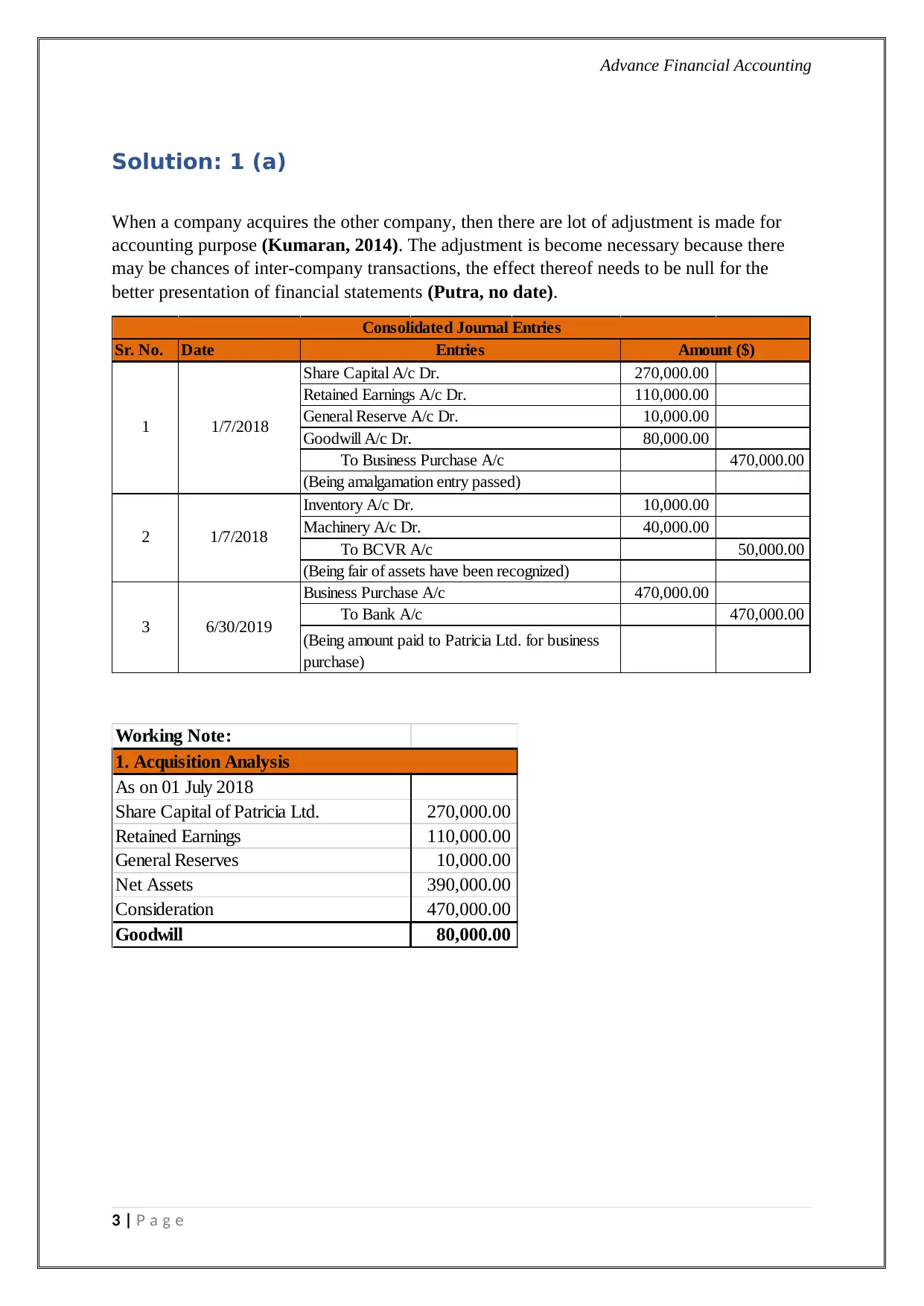

Solution: 1 (a)

When a company acquires the other company, then there are lot of adjustment is made for

accounting purpose (Kumaran, 2014). The adjustment is become necessary because there

may be chances of inter-company transactions, the effect thereof needs to be null for the

better presentation of financial statements (Putra, no date).

Sr. No. Date

270,000.00

110,000.00

10,000.00

80,000.00

470,000.00

10,000.00

40,000.00

50,000.00

470,000.00

470,000.00

Entries Amount ($)

Share Capital A/c Dr.

To Business Purchase A/c

(Being amalgamation entry passed)

General Reserve A/c Dr.

1/7/20181 Goodwill A/c Dr.

Retained Earnings A/c Dr.

To Bank A/c

(Being amount paid to Patricia Ltd. for business

purchase)

Inventory A/c Dr.

Machinery A/c Dr.

To BCVR A/c

(Being fair of assets have been recognized)

Business Purchase A/c

Consolidated Journal Entries

2 1/7/2018

3 6/30/2019

Working Note:

As on 01 July 2018

Share Capital of Patricia Ltd. 270,000.00

Retained Earnings 110,000.00

General Reserves 10,000.00

Net Assets 390,000.00

Consideration 470,000.00

Goodwill 80,000.00

1. Acquisition Analysis

3 | P a g e

Solution: 1 (a)

When a company acquires the other company, then there are lot of adjustment is made for

accounting purpose (Kumaran, 2014). The adjustment is become necessary because there

may be chances of inter-company transactions, the effect thereof needs to be null for the

better presentation of financial statements (Putra, no date).

Sr. No. Date

270,000.00

110,000.00

10,000.00

80,000.00

470,000.00

10,000.00

40,000.00

50,000.00

470,000.00

470,000.00

Entries Amount ($)

Share Capital A/c Dr.

To Business Purchase A/c

(Being amalgamation entry passed)

General Reserve A/c Dr.

1/7/20181 Goodwill A/c Dr.

Retained Earnings A/c Dr.

To Bank A/c

(Being amount paid to Patricia Ltd. for business

purchase)

Inventory A/c Dr.

Machinery A/c Dr.

To BCVR A/c

(Being fair of assets have been recognized)

Business Purchase A/c

Consolidated Journal Entries

2 1/7/2018

3 6/30/2019

Working Note:

As on 01 July 2018

Share Capital of Patricia Ltd. 270,000.00

Retained Earnings 110,000.00

General Reserves 10,000.00

Net Assets 390,000.00

Consideration 470,000.00

Goodwill 80,000.00

1. Acquisition Analysis

3 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Advance Financial Accounting

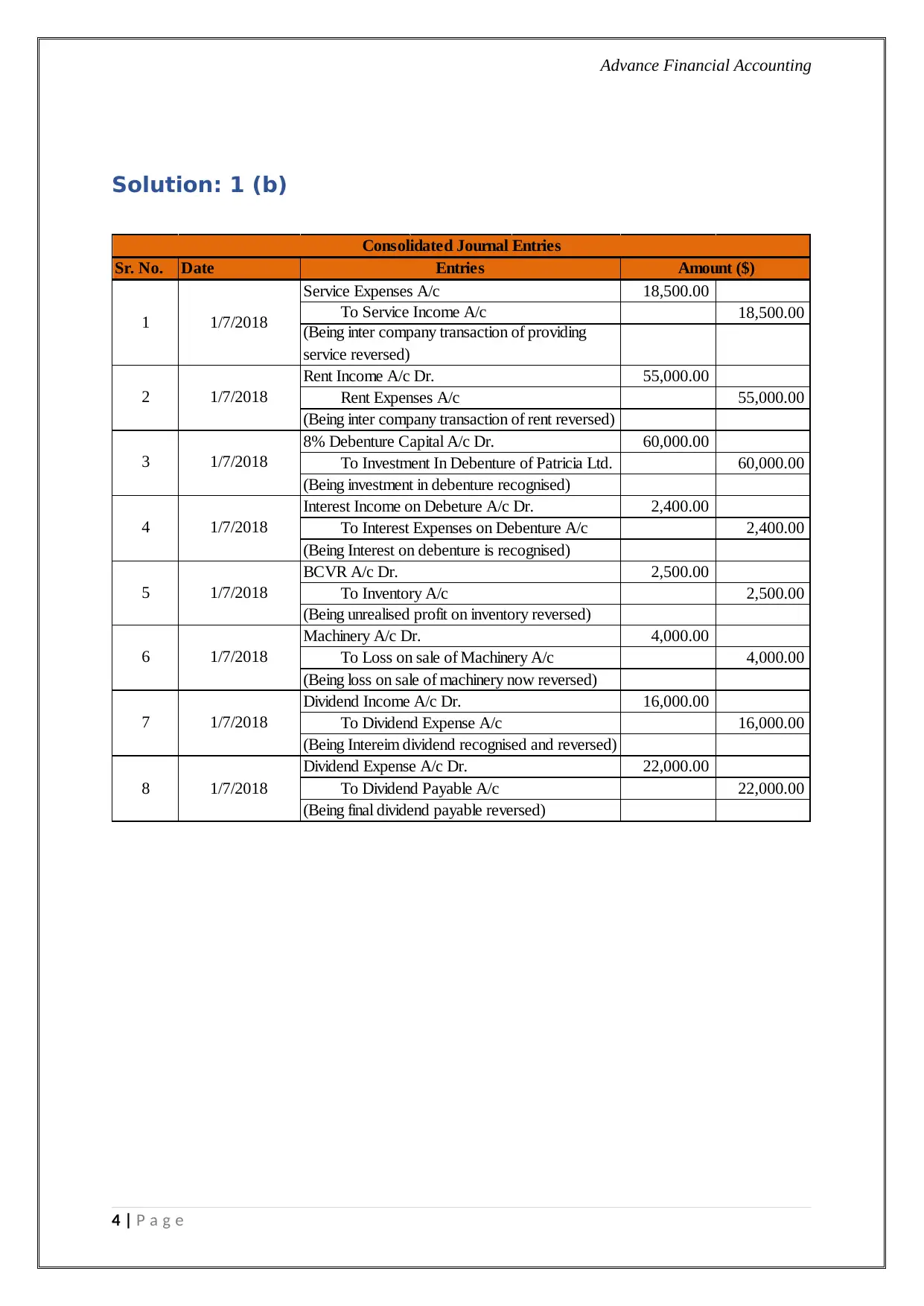

Solution: 1 (b)

Sr. No. Date

18,500.00

18,500.00

55,000.00

55,000.00

60,000.00

60,000.00

2,400.00

2,400.00

2,500.00

2,500.00

4,000.00

4,000.00

16,000.00

16,000.00

22,000.00

22,000.008 1/7/2018

Dividend Expense A/c Dr.

To Dividend Payable A/c

(Being final dividend payable reversed)

7 1/7/2018

Dividend Income A/c Dr.

To Dividend Expense A/c

(Being Intereim dividend recognised and reversed)

6 1/7/2018

Machinery A/c Dr.

To Loss on sale of Machinery A/c

(Being loss on sale of machinery now reversed)

4 1/7/2018

Interest Income on Debeture A/c Dr.

To Interest Expenses on Debenture A/c

(Being Interest on debenture is recognised)

5 1/7/2018

BCVR A/c Dr.

To Inventory A/c

(Being unrealised profit on inventory reversed)

2 1/7/2018

Rent Income A/c Dr.

Rent Expenses A/c

(Being inter company transaction of rent reversed)

3 1/7/2018

8% Debenture Capital A/c Dr.

To Investment In Debenture of Patricia Ltd.

(Being investment in debenture recognised)

1 1/7/2018

Service Expenses A/c

To Service Income A/c

(Being inter company transaction of providing

service reversed)

Consolidated Journal Entries

Entries Amount ($)

4 | P a g e

Solution: 1 (b)

Sr. No. Date

18,500.00

18,500.00

55,000.00

55,000.00

60,000.00

60,000.00

2,400.00

2,400.00

2,500.00

2,500.00

4,000.00

4,000.00

16,000.00

16,000.00

22,000.00

22,000.008 1/7/2018

Dividend Expense A/c Dr.

To Dividend Payable A/c

(Being final dividend payable reversed)

7 1/7/2018

Dividend Income A/c Dr.

To Dividend Expense A/c

(Being Intereim dividend recognised and reversed)

6 1/7/2018

Machinery A/c Dr.

To Loss on sale of Machinery A/c

(Being loss on sale of machinery now reversed)

4 1/7/2018

Interest Income on Debeture A/c Dr.

To Interest Expenses on Debenture A/c

(Being Interest on debenture is recognised)

5 1/7/2018

BCVR A/c Dr.

To Inventory A/c

(Being unrealised profit on inventory reversed)

2 1/7/2018

Rent Income A/c Dr.

Rent Expenses A/c

(Being inter company transaction of rent reversed)

3 1/7/2018

8% Debenture Capital A/c Dr.

To Investment In Debenture of Patricia Ltd.

(Being investment in debenture recognised)

1 1/7/2018

Service Expenses A/c

To Service Income A/c

(Being inter company transaction of providing

service reversed)

Consolidated Journal Entries

Entries Amount ($)

4 | P a g e

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Advance Financial Accounting

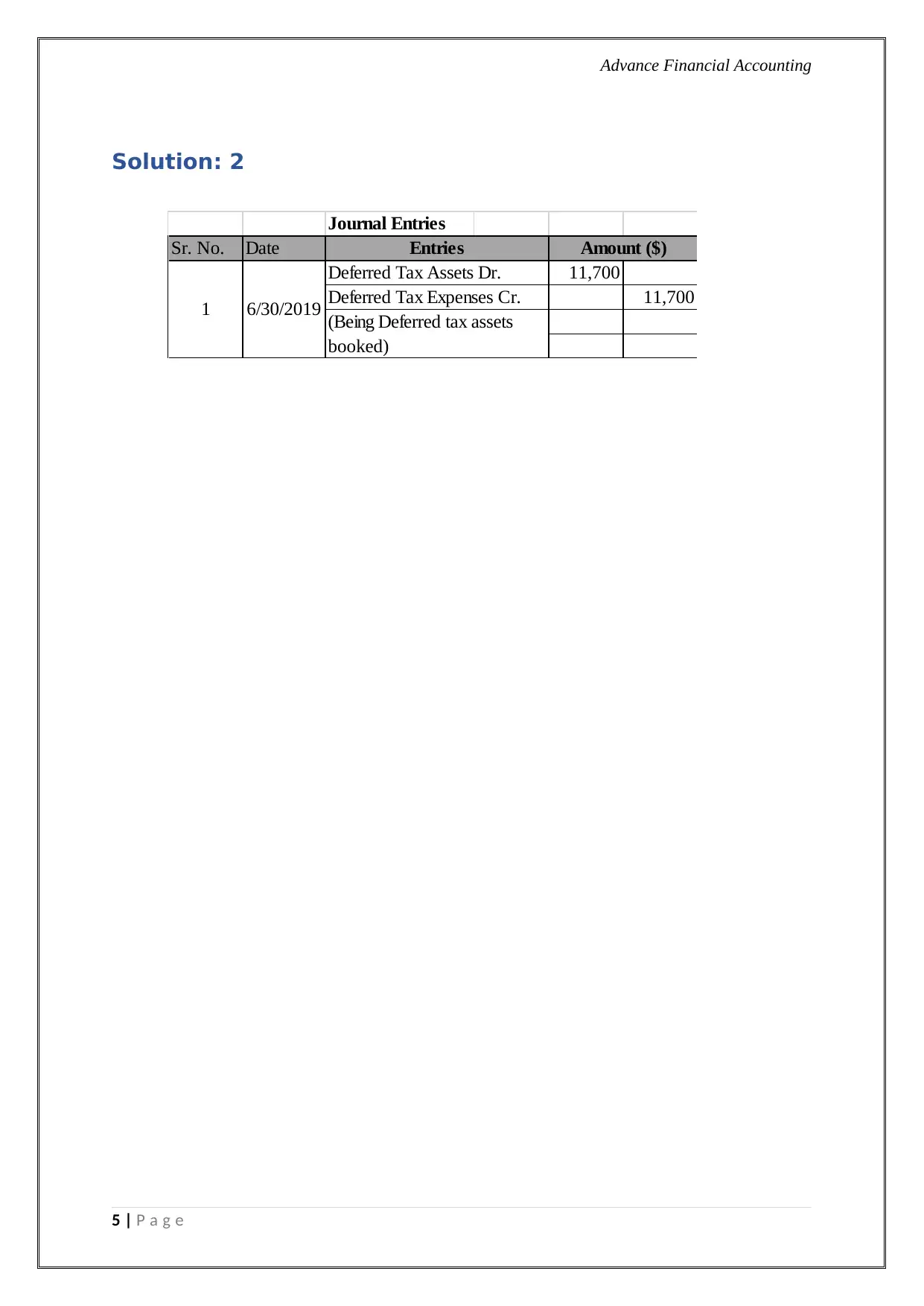

Solution: 2

Journal Entries

Sr. No. Date

11,700

11,700

Entries Amount ($)

1 6/30/2019

Deferred Tax Assets Dr.

Deferred Tax Expenses Cr.

(Being Deferred tax assets

booked)

5 | P a g e

Solution: 2

Journal Entries

Sr. No. Date

11,700

11,700

Entries Amount ($)

1 6/30/2019

Deferred Tax Assets Dr.

Deferred Tax Expenses Cr.

(Being Deferred tax assets

booked)

5 | P a g e

Advance Financial Accounting

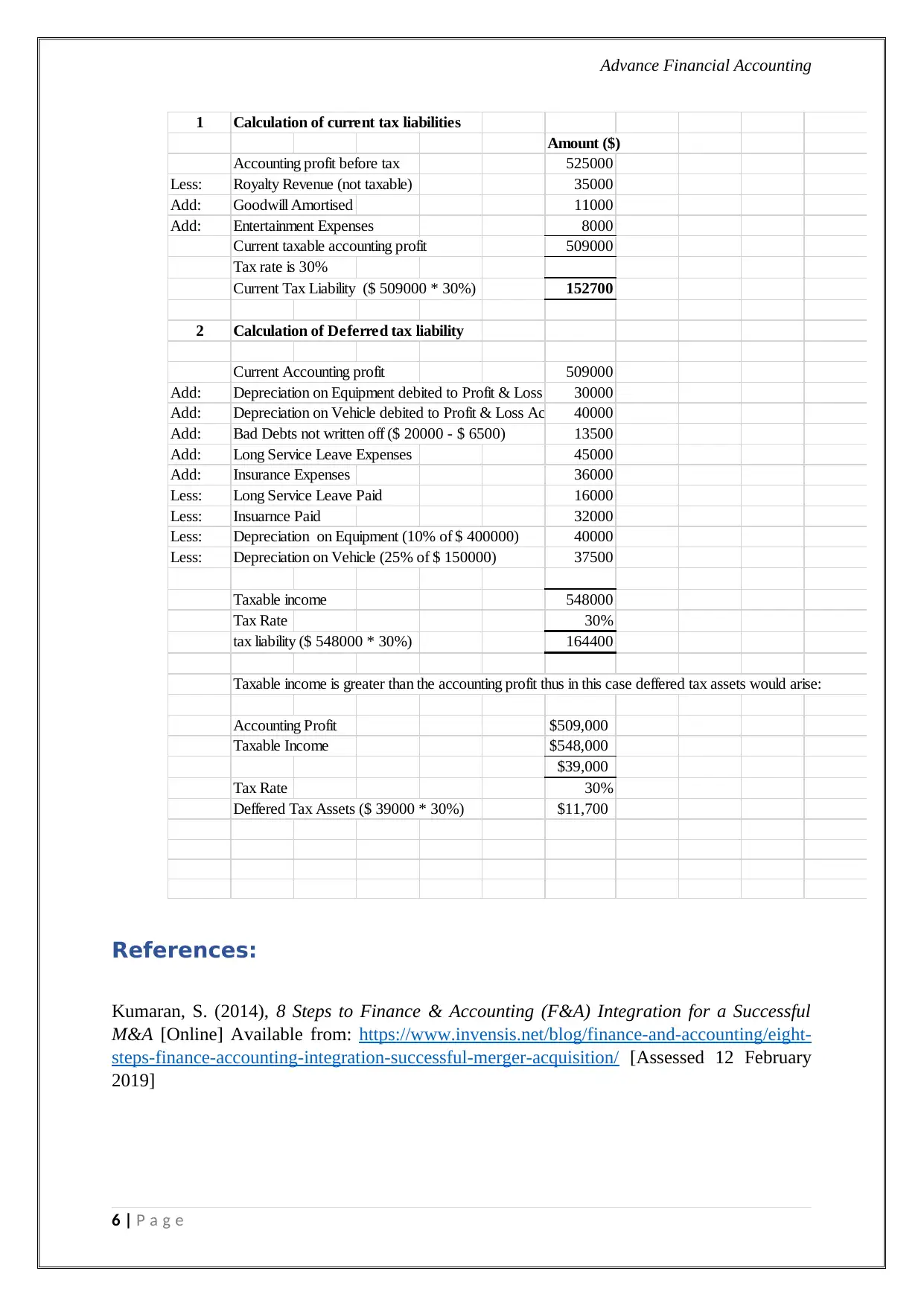

1 Calculation of current tax liabilities

Amount ($)

Accounting profit before tax 525000

Less: Royalty Revenue (not taxable) 35000

Add: Goodwill Amortised 11000

Add: Entertainment Expenses 8000

Current taxable accounting profit 509000

Tax rate is 30%

Current Tax Liability ($ 509000 * 30%) 152700

2 Calculation of Deferred tax liability

Current Accounting profit 509000

Add: Depreciation on Equipment debited to Profit & Loss Account30000

Add: Depreciation on Vehicle debited to Profit & Loss Account40000

Add: Bad Debts not written off ($ 20000 - $ 6500) 13500

Add: Long Service Leave Expenses 45000

Add: Insurance Expenses 36000

Less: Long Service Leave Paid 16000

Less: Insuarnce Paid 32000

Less: Depreciation on Equipment (10% of $ 400000) 40000

Less: Depreciation on Vehicle (25% of $ 150000) 37500

Taxable income 548000

Tax Rate 30%

tax liability ($ 548000 * 30%) 164400

Taxable income is greater than the accounting profit thus in this case deffered tax assets would arise:

Accounting Profit $509,000

Taxable Income $548,000

$39,000

Tax Rate 30%

Deffered Tax Assets ($ 39000 * 30%) $11,700

References:

Kumaran, S. (2014), 8 Steps to Finance & Accounting (F&A) Integration for a Successful

M&A [Online] Available from: https://www.invensis.net/blog/finance-and-accounting/eight-

steps-finance-accounting-integration-successful-merger-acquisition/ [Assessed 12 February

2019]

6 | P a g e

1 Calculation of current tax liabilities

Amount ($)

Accounting profit before tax 525000

Less: Royalty Revenue (not taxable) 35000

Add: Goodwill Amortised 11000

Add: Entertainment Expenses 8000

Current taxable accounting profit 509000

Tax rate is 30%

Current Tax Liability ($ 509000 * 30%) 152700

2 Calculation of Deferred tax liability

Current Accounting profit 509000

Add: Depreciation on Equipment debited to Profit & Loss Account30000

Add: Depreciation on Vehicle debited to Profit & Loss Account40000

Add: Bad Debts not written off ($ 20000 - $ 6500) 13500

Add: Long Service Leave Expenses 45000

Add: Insurance Expenses 36000

Less: Long Service Leave Paid 16000

Less: Insuarnce Paid 32000

Less: Depreciation on Equipment (10% of $ 400000) 40000

Less: Depreciation on Vehicle (25% of $ 150000) 37500

Taxable income 548000

Tax Rate 30%

tax liability ($ 548000 * 30%) 164400

Taxable income is greater than the accounting profit thus in this case deffered tax assets would arise:

Accounting Profit $509,000

Taxable Income $548,000

$39,000

Tax Rate 30%

Deffered Tax Assets ($ 39000 * 30%) $11,700

References:

Kumaran, S. (2014), 8 Steps to Finance & Accounting (F&A) Integration for a Successful

M&A [Online] Available from: https://www.invensis.net/blog/finance-and-accounting/eight-

steps-finance-accounting-integration-successful-merger-acquisition/ [Assessed 12 February

2019]

6 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Advance Financial Accounting

Putra, L. (no date), Accounting for business acquisition using purchase method [Online]

Available from: http://accounting-financial-tax.com/2013/01/accounting-for-business-

acquisition-using-purchase-method/ [Assessed 12 February 2019]

7 | P a g e

Putra, L. (no date), Accounting for business acquisition using purchase method [Online]

Available from: http://accounting-financial-tax.com/2013/01/accounting-for-business-

acquisition-using-purchase-method/ [Assessed 12 February 2019]

7 | P a g e

1 out of 7

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.