Advanced Financial Accounting Assignment: ACC204, Semester 2, Analysis

VerifiedAdded on 2023/04/10

|10

|1151

|71

Homework Assignment

AI Summary

This document provides a comprehensive solution to an Advanced Financial Accounting assignment. It addresses the revaluation of non-current assets according to fair value principles, referencing AASB 116 and including journal entries for Anderson Pty Ltd. The assignment also covers the fair value determination and journal entries for debentures issued by Kruger Ltd, referencing AASB 9. Furthermore, it analyzes a construction contract for Sun City Limited, calculating gross profit and providing journal entries under the percentage of completion method. Finally, it revisits the asset revaluation for AD Pty Limited, mirroring the principles applied to Anderson Pty Ltd. All solutions include detailed calculations and journal entries to facilitate understanding of the accounting principles.

Running head: ADVANCED FINANICAL ACCOUNTING

Advanced Financial Accounting

Name of the Student:

Name of the University:

Author’s Note:

Advanced Financial Accounting

Name of the Student:

Name of the University:

Author’s Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1ADVANCED FINANICAL ACCOUNTING

Table of Contents

Answer to question 1:.................................................................................................................2

Sub part a:..............................................................................................................................2

Sub part b:..............................................................................................................................3

Answer to question 2:.................................................................................................................3

Sub part a:..............................................................................................................................3

Sub part b:..............................................................................................................................4

Answer to question 3:.................................................................................................................4

Sub part a:..............................................................................................................................4

Sub part b:..............................................................................................................................5

Sub part c:..............................................................................................................................5

Answer to question 4:.................................................................................................................6

Sub part a:..............................................................................................................................6

Sub part b:..............................................................................................................................8

References and Bibliography:....................................................................................................9

Table of Contents

Answer to question 1:.................................................................................................................2

Sub part a:..............................................................................................................................2

Sub part b:..............................................................................................................................3

Answer to question 2:.................................................................................................................3

Sub part a:..............................................................................................................................3

Sub part b:..............................................................................................................................4

Answer to question 3:.................................................................................................................4

Sub part a:..............................................................................................................................4

Sub part b:..............................................................................................................................5

Sub part c:..............................................................................................................................5

Answer to question 4:.................................................................................................................6

Sub part a:..............................................................................................................................6

Sub part b:..............................................................................................................................8

References and Bibliography:....................................................................................................9

2ADVANCED FINANICAL ACCOUNTING

Answer to question 1:

Sub part a:

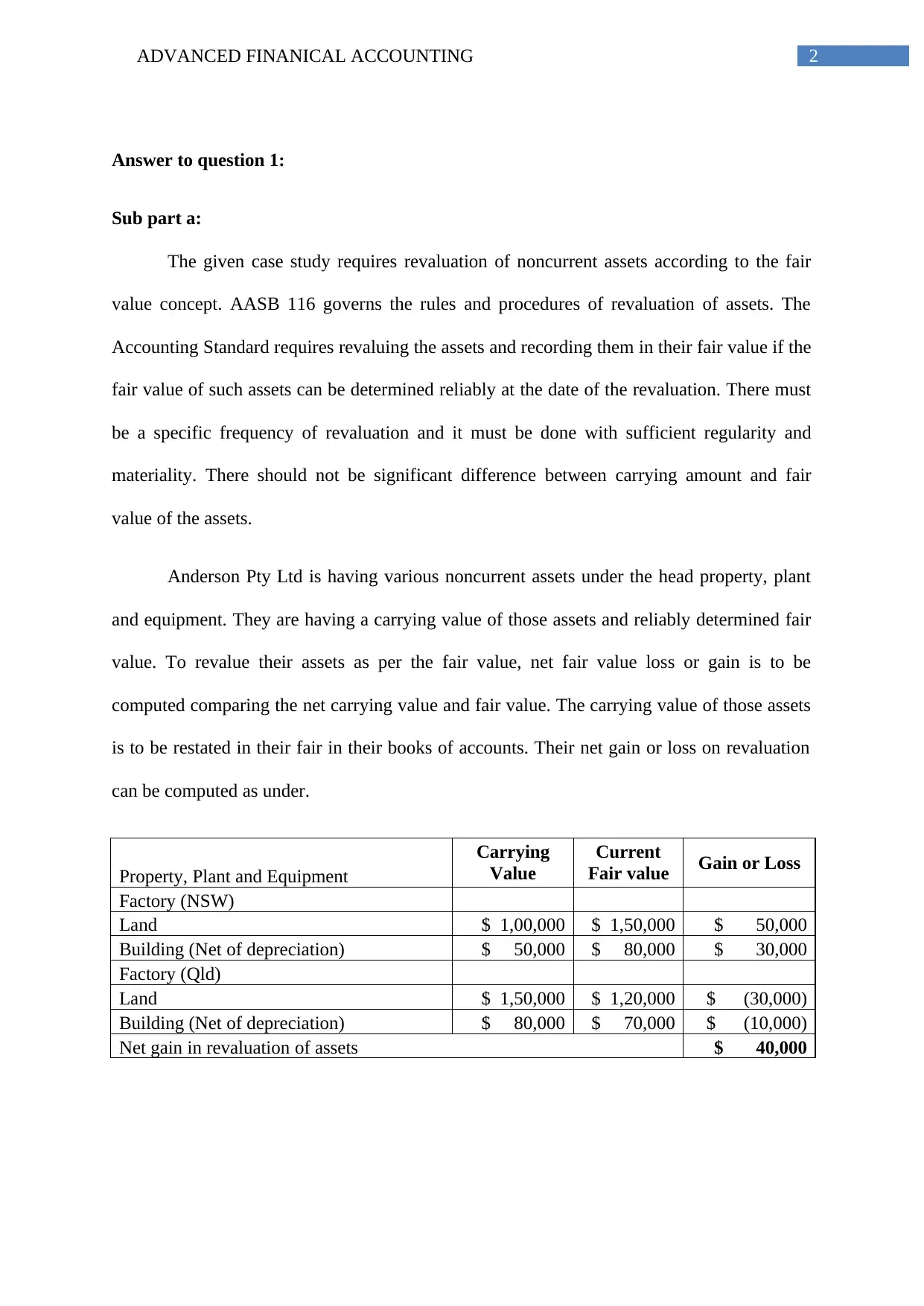

The given case study requires revaluation of noncurrent assets according to the fair

value concept. AASB 116 governs the rules and procedures of revaluation of assets. The

Accounting Standard requires revaluing the assets and recording them in their fair value if the

fair value of such assets can be determined reliably at the date of the revaluation. There must

be a specific frequency of revaluation and it must be done with sufficient regularity and

materiality. There should not be significant difference between carrying amount and fair

value of the assets.

Anderson Pty Ltd is having various noncurrent assets under the head property, plant

and equipment. They are having a carrying value of those assets and reliably determined fair

value. To revalue their assets as per the fair value, net fair value loss or gain is to be

computed comparing the net carrying value and fair value. The carrying value of those assets

is to be restated in their fair in their books of accounts. Their net gain or loss on revaluation

can be computed as under.

Property, Plant and Equipment

Carrying

Value

Current

Fair value Gain or Loss

Factory (NSW)

Land $ 1,00,000 $ 1,50,000 $ 50,000

Building (Net of depreciation) $ 50,000 $ 80,000 $ 30,000

Factory (Qld)

Land $ 1,50,000 $ 1,20,000 $ (30,000)

Building (Net of depreciation) $ 80,000 $ 70,000 $ (10,000)

Net gain in revaluation of assets $ 40,000

Answer to question 1:

Sub part a:

The given case study requires revaluation of noncurrent assets according to the fair

value concept. AASB 116 governs the rules and procedures of revaluation of assets. The

Accounting Standard requires revaluing the assets and recording them in their fair value if the

fair value of such assets can be determined reliably at the date of the revaluation. There must

be a specific frequency of revaluation and it must be done with sufficient regularity and

materiality. There should not be significant difference between carrying amount and fair

value of the assets.

Anderson Pty Ltd is having various noncurrent assets under the head property, plant

and equipment. They are having a carrying value of those assets and reliably determined fair

value. To revalue their assets as per the fair value, net fair value loss or gain is to be

computed comparing the net carrying value and fair value. The carrying value of those assets

is to be restated in their fair in their books of accounts. Their net gain or loss on revaluation

can be computed as under.

Property, Plant and Equipment

Carrying

Value

Current

Fair value Gain or Loss

Factory (NSW)

Land $ 1,00,000 $ 1,50,000 $ 50,000

Building (Net of depreciation) $ 50,000 $ 80,000 $ 30,000

Factory (Qld)

Land $ 1,50,000 $ 1,20,000 $ (30,000)

Building (Net of depreciation) $ 80,000 $ 70,000 $ (10,000)

Net gain in revaluation of assets $ 40,000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3ADVANCED FINANICAL ACCOUNTING

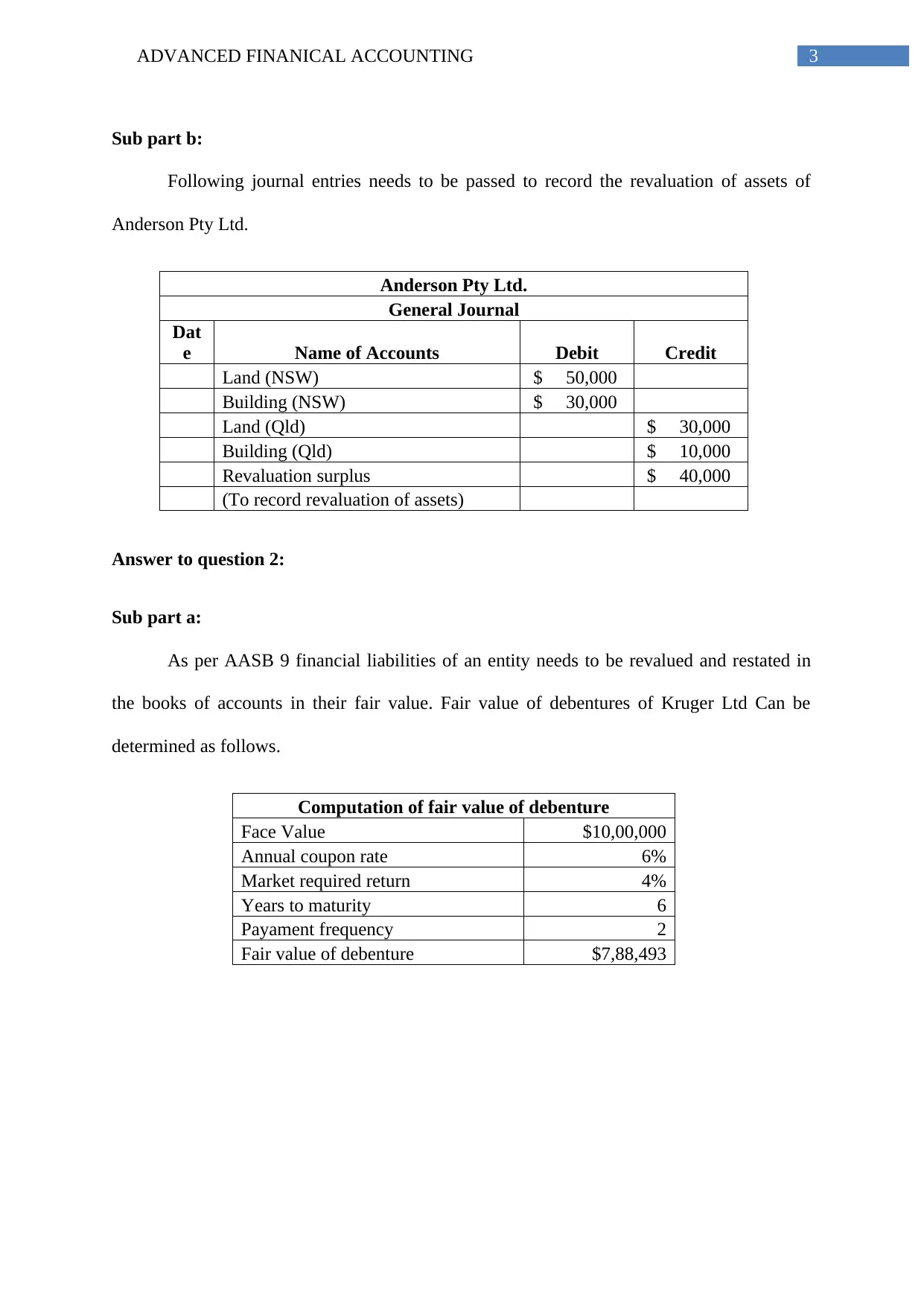

Sub part b:

Following journal entries needs to be passed to record the revaluation of assets of

Anderson Pty Ltd.

Anderson Pty Ltd.

General Journal

Dat

e Name of Accounts Debit Credit

Land (NSW) $ 50,000

Building (NSW) $ 30,000

Land (Qld) $ 30,000

Building (Qld) $ 10,000

Revaluation surplus $ 40,000

(To record revaluation of assets)

Answer to question 2:

Sub part a:

As per AASB 9 financial liabilities of an entity needs to be revalued and restated in

the books of accounts in their fair value. Fair value of debentures of Kruger Ltd Can be

determined as follows.

Computation of fair value of debenture

Face Value $10,00,000

Annual coupon rate 6%

Market required return 4%

Years to maturity 6

Payament frequency 2

Fair value of debenture $7,88,493

Sub part b:

Following journal entries needs to be passed to record the revaluation of assets of

Anderson Pty Ltd.

Anderson Pty Ltd.

General Journal

Dat

e Name of Accounts Debit Credit

Land (NSW) $ 50,000

Building (NSW) $ 30,000

Land (Qld) $ 30,000

Building (Qld) $ 10,000

Revaluation surplus $ 40,000

(To record revaluation of assets)

Answer to question 2:

Sub part a:

As per AASB 9 financial liabilities of an entity needs to be revalued and restated in

the books of accounts in their fair value. Fair value of debentures of Kruger Ltd Can be

determined as follows.

Computation of fair value of debenture

Face Value $10,00,000

Annual coupon rate 6%

Market required return 4%

Years to maturity 6

Payament frequency 2

Fair value of debenture $7,88,493

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4ADVANCED FINANICAL ACCOUNTING

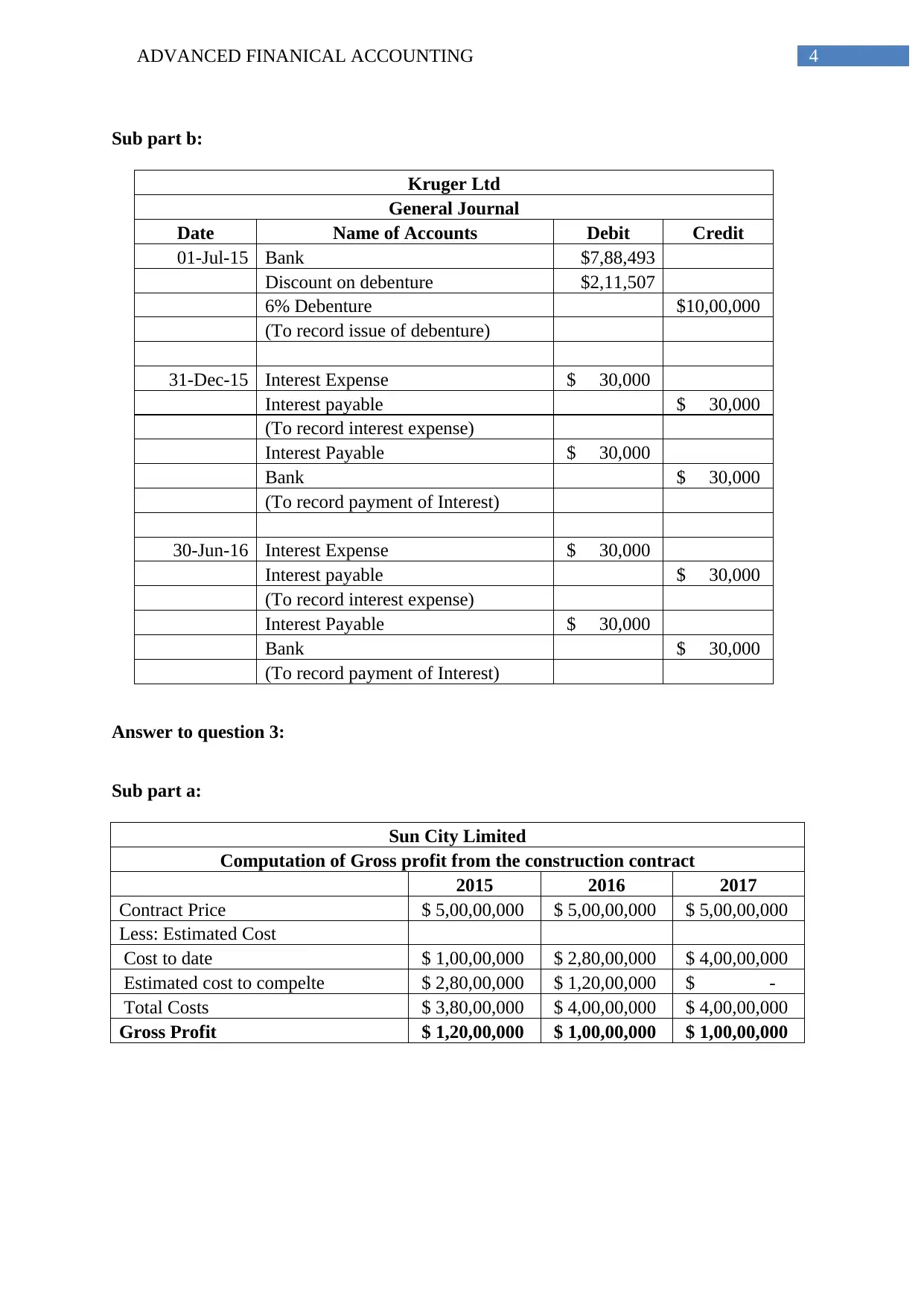

Sub part b:

Kruger Ltd

General Journal

Date Name of Accounts Debit Credit

01-Jul-15 Bank $7,88,493

Discount on debenture $2,11,507

6% Debenture $10,00,000

(To record issue of debenture)

31-Dec-15 Interest Expense $ 30,000

Interest payable $ 30,000

(To record interest expense)

Interest Payable $ 30,000

Bank $ 30,000

(To record payment of Interest)

30-Jun-16 Interest Expense $ 30,000

Interest payable $ 30,000

(To record interest expense)

Interest Payable $ 30,000

Bank $ 30,000

(To record payment of Interest)

Answer to question 3:

Sub part a:

Sun City Limited

Computation of Gross profit from the construction contract

2015 2016 2017

Contract Price $ 5,00,00,000 $ 5,00,00,000 $ 5,00,00,000

Less: Estimated Cost

Cost to date $ 1,00,00,000 $ 2,80,00,000 $ 4,00,00,000

Estimated cost to compelte $ 2,80,00,000 $ 1,20,00,000 $ -

Total Costs $ 3,80,00,000 $ 4,00,00,000 $ 4,00,00,000

Gross Profit $ 1,20,00,000 $ 1,00,00,000 $ 1,00,00,000

Sub part b:

Kruger Ltd

General Journal

Date Name of Accounts Debit Credit

01-Jul-15 Bank $7,88,493

Discount on debenture $2,11,507

6% Debenture $10,00,000

(To record issue of debenture)

31-Dec-15 Interest Expense $ 30,000

Interest payable $ 30,000

(To record interest expense)

Interest Payable $ 30,000

Bank $ 30,000

(To record payment of Interest)

30-Jun-16 Interest Expense $ 30,000

Interest payable $ 30,000

(To record interest expense)

Interest Payable $ 30,000

Bank $ 30,000

(To record payment of Interest)

Answer to question 3:

Sub part a:

Sun City Limited

Computation of Gross profit from the construction contract

2015 2016 2017

Contract Price $ 5,00,00,000 $ 5,00,00,000 $ 5,00,00,000

Less: Estimated Cost

Cost to date $ 1,00,00,000 $ 2,80,00,000 $ 4,00,00,000

Estimated cost to compelte $ 2,80,00,000 $ 1,20,00,000 $ -

Total Costs $ 3,80,00,000 $ 4,00,00,000 $ 4,00,00,000

Gross Profit $ 1,20,00,000 $ 1,00,00,000 $ 1,00,00,000

5ADVANCED FINANICAL ACCOUNTING

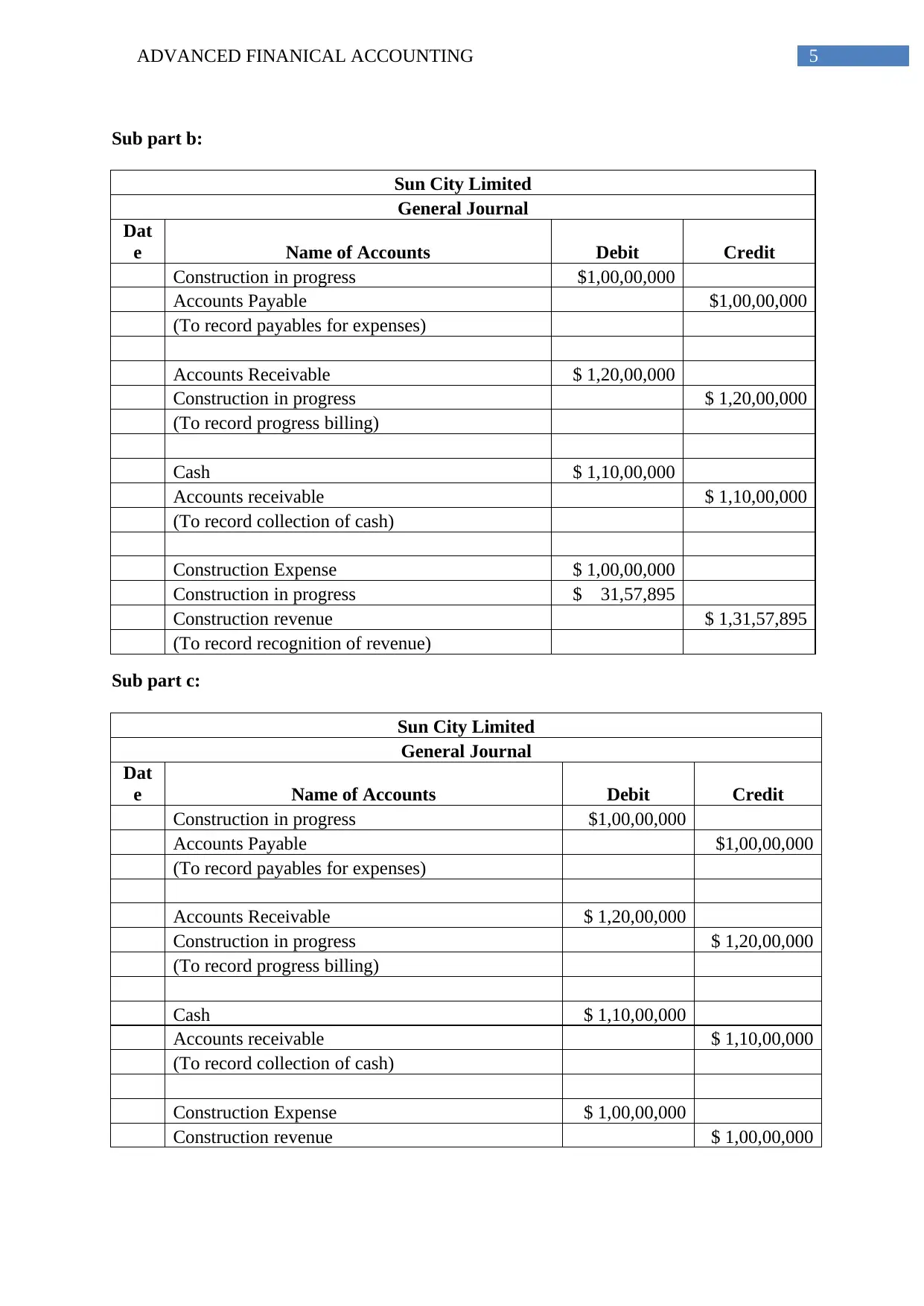

Sub part b:

Sun City Limited

General Journal

Dat

e Name of Accounts Debit Credit

Construction in progress $1,00,00,000

Accounts Payable $1,00,00,000

(To record payables for expenses)

Accounts Receivable $ 1,20,00,000

Construction in progress $ 1,20,00,000

(To record progress billing)

Cash $ 1,10,00,000

Accounts receivable $ 1,10,00,000

(To record collection of cash)

Construction Expense $ 1,00,00,000

Construction in progress $ 31,57,895

Construction revenue $ 1,31,57,895

(To record recognition of revenue)

Sub part c:

Sun City Limited

General Journal

Dat

e Name of Accounts Debit Credit

Construction in progress $1,00,00,000

Accounts Payable $1,00,00,000

(To record payables for expenses)

Accounts Receivable $ 1,20,00,000

Construction in progress $ 1,20,00,000

(To record progress billing)

Cash $ 1,10,00,000

Accounts receivable $ 1,10,00,000

(To record collection of cash)

Construction Expense $ 1,00,00,000

Construction revenue $ 1,00,00,000

Sub part b:

Sun City Limited

General Journal

Dat

e Name of Accounts Debit Credit

Construction in progress $1,00,00,000

Accounts Payable $1,00,00,000

(To record payables for expenses)

Accounts Receivable $ 1,20,00,000

Construction in progress $ 1,20,00,000

(To record progress billing)

Cash $ 1,10,00,000

Accounts receivable $ 1,10,00,000

(To record collection of cash)

Construction Expense $ 1,00,00,000

Construction in progress $ 31,57,895

Construction revenue $ 1,31,57,895

(To record recognition of revenue)

Sub part c:

Sun City Limited

General Journal

Dat

e Name of Accounts Debit Credit

Construction in progress $1,00,00,000

Accounts Payable $1,00,00,000

(To record payables for expenses)

Accounts Receivable $ 1,20,00,000

Construction in progress $ 1,20,00,000

(To record progress billing)

Cash $ 1,10,00,000

Accounts receivable $ 1,10,00,000

(To record collection of cash)

Construction Expense $ 1,00,00,000

Construction revenue $ 1,00,00,000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6ADVANCED FINANICAL ACCOUNTING

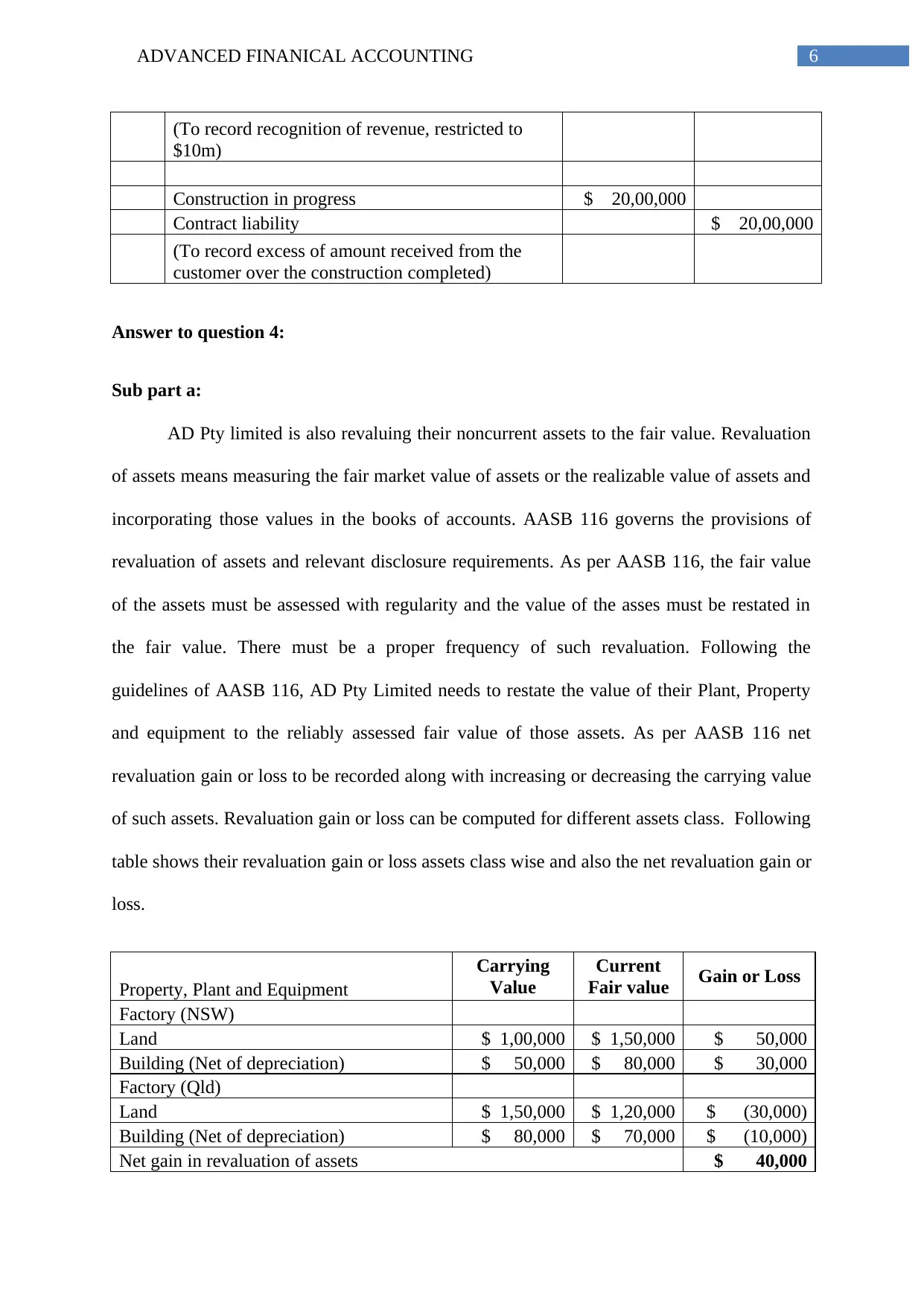

(To record recognition of revenue, restricted to

$10m)

Construction in progress $ 20,00,000

Contract liability $ 20,00,000

(To record excess of amount received from the

customer over the construction completed)

Answer to question 4:

Sub part a:

AD Pty limited is also revaluing their noncurrent assets to the fair value. Revaluation

of assets means measuring the fair market value of assets or the realizable value of assets and

incorporating those values in the books of accounts. AASB 116 governs the provisions of

revaluation of assets and relevant disclosure requirements. As per AASB 116, the fair value

of the assets must be assessed with regularity and the value of the asses must be restated in

the fair value. There must be a proper frequency of such revaluation. Following the

guidelines of AASB 116, AD Pty Limited needs to restate the value of their Plant, Property

and equipment to the reliably assessed fair value of those assets. As per AASB 116 net

revaluation gain or loss to be recorded along with increasing or decreasing the carrying value

of such assets. Revaluation gain or loss can be computed for different assets class. Following

table shows their revaluation gain or loss assets class wise and also the net revaluation gain or

loss.

Property, Plant and Equipment

Carrying

Value

Current

Fair value Gain or Loss

Factory (NSW)

Land $ 1,00,000 $ 1,50,000 $ 50,000

Building (Net of depreciation) $ 50,000 $ 80,000 $ 30,000

Factory (Qld)

Land $ 1,50,000 $ 1,20,000 $ (30,000)

Building (Net of depreciation) $ 80,000 $ 70,000 $ (10,000)

Net gain in revaluation of assets $ 40,000

(To record recognition of revenue, restricted to

$10m)

Construction in progress $ 20,00,000

Contract liability $ 20,00,000

(To record excess of amount received from the

customer over the construction completed)

Answer to question 4:

Sub part a:

AD Pty limited is also revaluing their noncurrent assets to the fair value. Revaluation

of assets means measuring the fair market value of assets or the realizable value of assets and

incorporating those values in the books of accounts. AASB 116 governs the provisions of

revaluation of assets and relevant disclosure requirements. As per AASB 116, the fair value

of the assets must be assessed with regularity and the value of the asses must be restated in

the fair value. There must be a proper frequency of such revaluation. Following the

guidelines of AASB 116, AD Pty Limited needs to restate the value of their Plant, Property

and equipment to the reliably assessed fair value of those assets. As per AASB 116 net

revaluation gain or loss to be recorded along with increasing or decreasing the carrying value

of such assets. Revaluation gain or loss can be computed for different assets class. Following

table shows their revaluation gain or loss assets class wise and also the net revaluation gain or

loss.

Property, Plant and Equipment

Carrying

Value

Current

Fair value Gain or Loss

Factory (NSW)

Land $ 1,00,000 $ 1,50,000 $ 50,000

Building (Net of depreciation) $ 50,000 $ 80,000 $ 30,000

Factory (Qld)

Land $ 1,50,000 $ 1,20,000 $ (30,000)

Building (Net of depreciation) $ 80,000 $ 70,000 $ (10,000)

Net gain in revaluation of assets $ 40,000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7ADVANCED FINANICAL ACCOUNTING

8ADVANCED FINANICAL ACCOUNTING

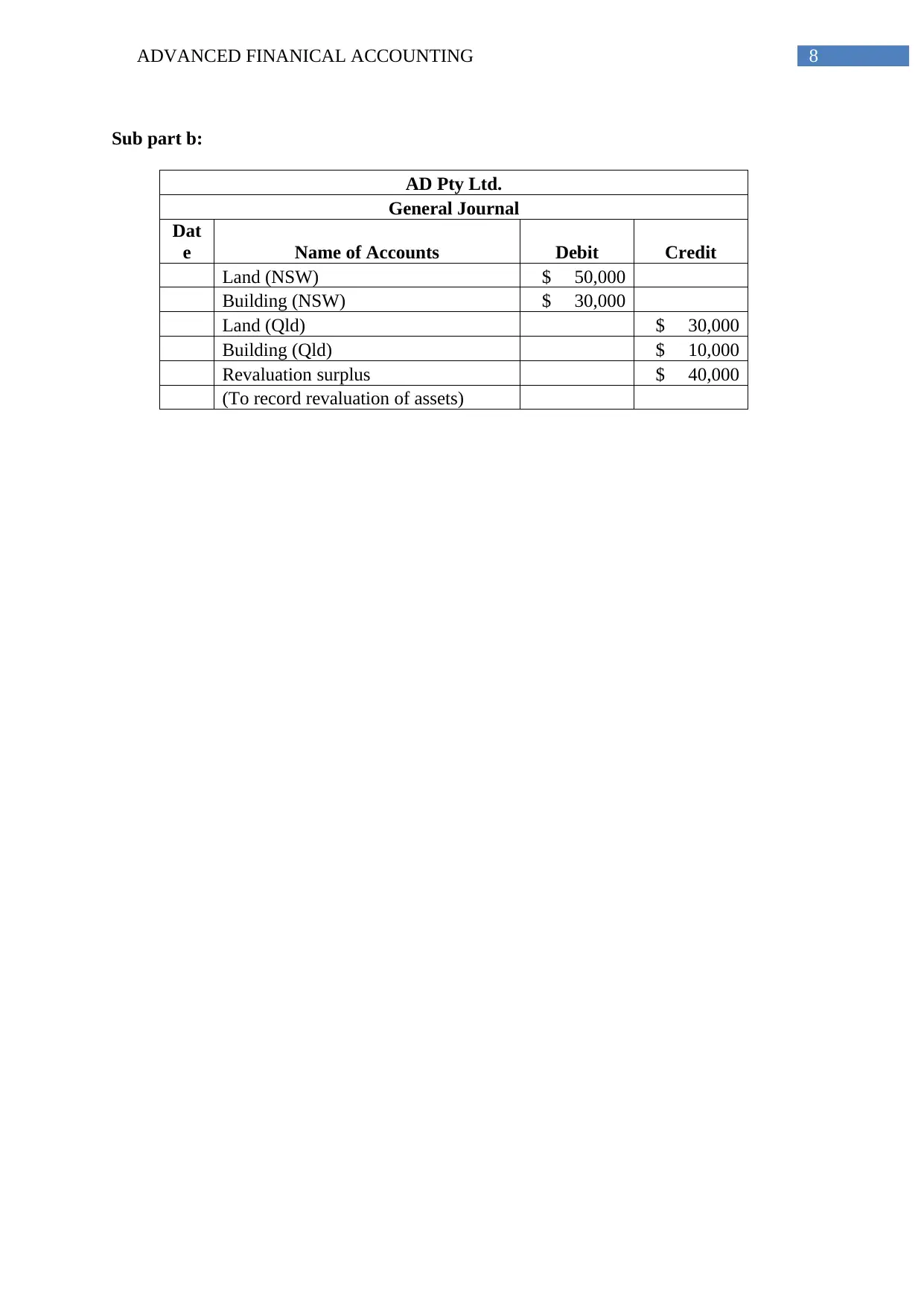

Sub part b:

AD Pty Ltd.

General Journal

Dat

e Name of Accounts Debit Credit

Land (NSW) $ 50,000

Building (NSW) $ 30,000

Land (Qld) $ 30,000

Building (Qld) $ 10,000

Revaluation surplus $ 40,000

(To record revaluation of assets)

Sub part b:

AD Pty Ltd.

General Journal

Dat

e Name of Accounts Debit Credit

Land (NSW) $ 50,000

Building (NSW) $ 30,000

Land (Qld) $ 30,000

Building (Qld) $ 10,000

Revaluation surplus $ 40,000

(To record revaluation of assets)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9ADVANCED FINANICAL ACCOUNTING

References and Bibliography:

AASB, Compiled AASB Standard. "Investment property." (2015).

Bond, D., Govendir, B. and Wells, P., 2016. An evaluation of asset impairment decisions by

Australian firms and whether this was impacted by AASB 136.

Hu, F., Percy, M. and Yao, D., 2015. Asset revaluations and earnings management: Evidence

from Australian companies. Corporate Ownership and Control, 13(1), pp.930-939.

Joubert, M., Garvie, L. and Parle, G., 2017. Implications of the New Accounting Standard for

Leases AASB 16 (IFRS 16) with the Inclusion of Operating Leases in the Balance Sheet. The

Journal of New Business Ideas & Trends, 15(2), pp.1-11.

References and Bibliography:

AASB, Compiled AASB Standard. "Investment property." (2015).

Bond, D., Govendir, B. and Wells, P., 2016. An evaluation of asset impairment decisions by

Australian firms and whether this was impacted by AASB 136.

Hu, F., Percy, M. and Yao, D., 2015. Asset revaluations and earnings management: Evidence

from Australian companies. Corporate Ownership and Control, 13(1), pp.930-939.

Joubert, M., Garvie, L. and Parle, G., 2017. Implications of the New Accounting Standard for

Leases AASB 16 (IFRS 16) with the Inclusion of Operating Leases in the Balance Sheet. The

Journal of New Business Ideas & Trends, 15(2), pp.1-11.

1 out of 10

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.