Financial Accounting Assignment: Comprehensive Solutions and Analysis

VerifiedAdded on 2022/12/27

|11

|1485

|70

Homework Assignment

AI Summary

This document provides a comprehensive set of solutions for an advanced financial accounting assignment. The solutions cover a range of topics, including asset acquisition, journal entries for revaluation losses, debenture accounting (issuance, interest, and redemption), lease accounting (present value calculations, journal entries for both lessee and lessor), deferred tax calculations, and foreign currency translation. Each question is answered with detailed step-by-step explanations, including journal entries, calculations, and relevant accounting principles. The document also includes a list of references to support the solutions provided. This resource is valuable for students studying financial accounting, providing a clear understanding of complex accounting concepts and practical application through detailed examples and explanations.

Advanced financial

Accounting

Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

MAIN BODY...................................................................................................................................1

Question 1....................................................................................................................................1

Question 2....................................................................................................................................1

Question 3....................................................................................................................................2

Question 4....................................................................................................................................3

Question 5....................................................................................................................................5

Question 5....................................................................................................................................6

REFERENCES................................................................................................................................8

MAIN BODY...................................................................................................................................1

Question 1....................................................................................................................................1

Question 2....................................................................................................................................1

Question 3....................................................................................................................................2

Question 4....................................................................................................................................3

Question 5....................................................................................................................................5

Question 5....................................................................................................................................6

REFERENCES................................................................................................................................8

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

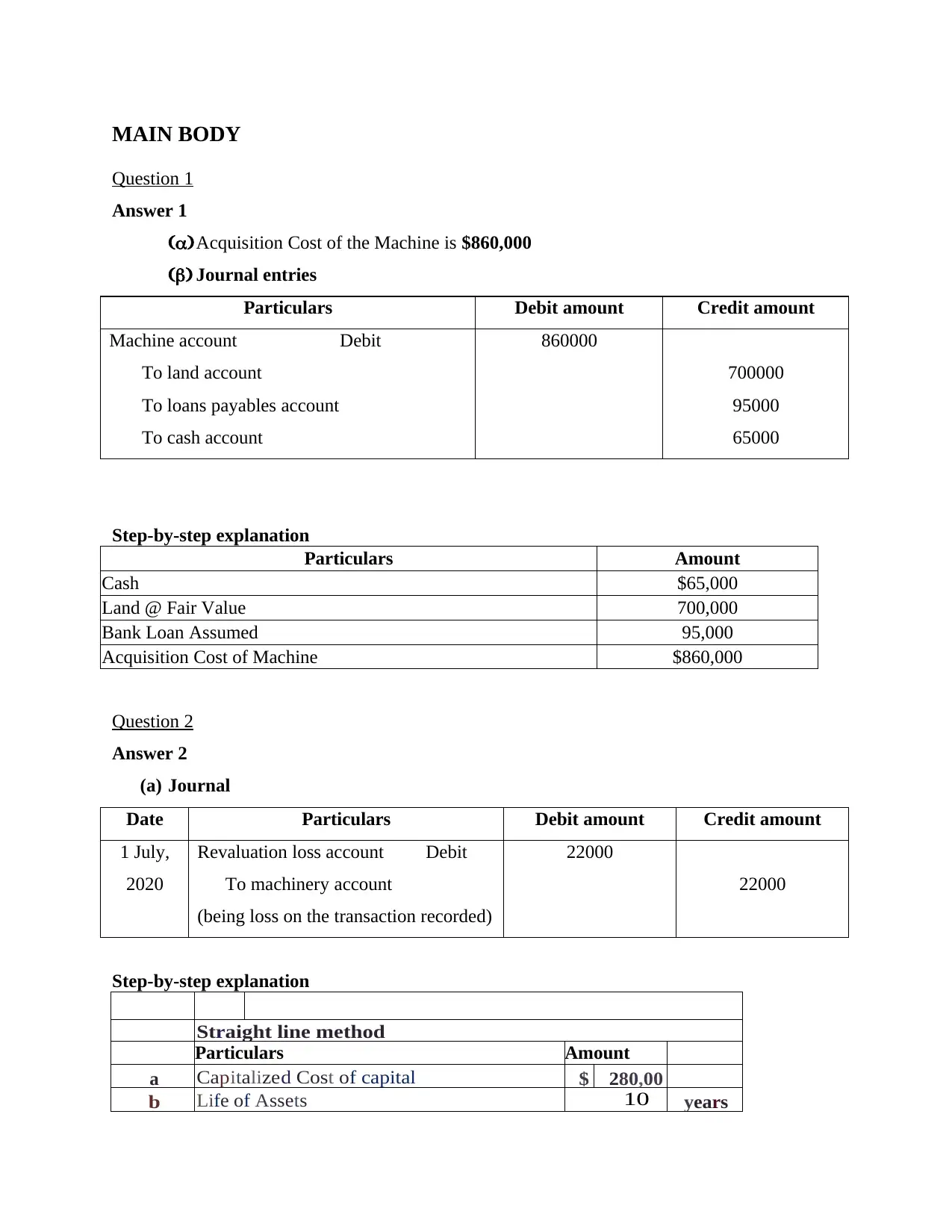

MAIN BODY

Question 1

Answer 1

(a)Acquisition Cost of the Machine is $860,000

(b) Journal entries

Particulars Debit amount Credit amount

Machine account Debit

To land account

To loans payables account

To cash account

860000

700000

95000

65000

Step-by-step explanation

Particulars Amount

Cash $65,000

Land @ Fair Value 700,000

Bank Loan Assumed 95,000

Acquisition Cost of Machine $860,000

Question 2

Answer 2

(a) Journal

Date Particulars Debit amount Credit amount

1 July,

2020

Revaluation loss account Debit

To machinery account

(being loss on the transaction recorded)

22000

22000

Step-by-step explanation

Straight line method

Particulars Amount

a Capitalized Cost of capital $ 280,00

b Life of Assets 10 years

Question 1

Answer 1

(a)Acquisition Cost of the Machine is $860,000

(b) Journal entries

Particulars Debit amount Credit amount

Machine account Debit

To land account

To loans payables account

To cash account

860000

700000

95000

65000

Step-by-step explanation

Particulars Amount

Cash $65,000

Land @ Fair Value 700,000

Bank Loan Assumed 95,000

Acquisition Cost of Machine $860,000

Question 2

Answer 2

(a) Journal

Date Particulars Debit amount Credit amount

1 July,

2020

Revaluation loss account Debit

To machinery account

(being loss on the transaction recorded)

22000

22000

Step-by-step explanation

Straight line method

Particulars Amount

a Capitalized Cost of capital $ 280,00

b Life of Assets 10 years

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

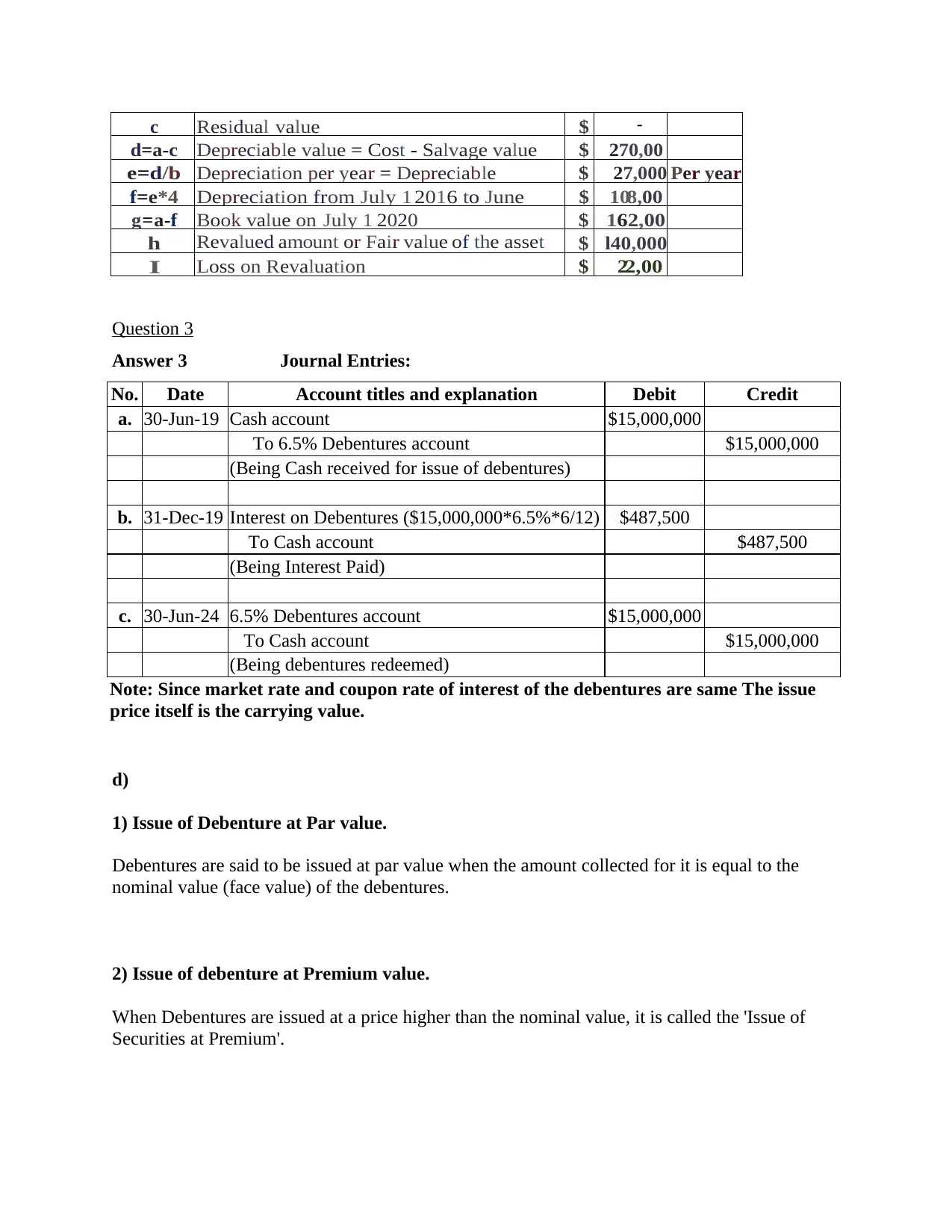

c Residual value $ -

d=a-c Depreciable value = Cost - Salvage value $ 270,00

e=d/b Depreciation per year = Depreciable $ 27,000 Per year

f=e*4 Depreciation from July 1 2016 to June $ 108,00

g=a-f Book value on July 1 2020 $ 162,00

h Revalued amount or Fair value of the asset $ l40,000

I Loss on Revaluation $ 22,00

Question 3

Answer 3 Journal Entries:

No. Date Account titles and explanation Debit Credit

a. 30-Jun-19 Cash account $15,000,000

To 6.5% Debentures account $15,000,000

(Being Cash received for issue of debentures)

b. 31-Dec-19 Interest on Debentures ($15,000,000*6.5%*6/12) $487,500

To Cash account $487,500

(Being Interest Paid)

c. 30-Jun-24 6.5% Debentures account $15,000,000

To Cash account $15,000,000

(Being debentures redeemed)

Note: Since market rate and coupon rate of interest of the debentures are same The issue

price itself is the carrying value.

d)

1) Issue of Debenture at Par value.

Debentures are said to be issued at par value when the amount collected for it is equal to the

nominal value (face value) of the debentures.

2) Issue of debenture at Premium value.

When Debentures are issued at a price higher than the nominal value, it is called the 'Issue of

Securities at Premium'.

d=a-c Depreciable value = Cost - Salvage value $ 270,00

e=d/b Depreciation per year = Depreciable $ 27,000 Per year

f=e*4 Depreciation from July 1 2016 to June $ 108,00

g=a-f Book value on July 1 2020 $ 162,00

h Revalued amount or Fair value of the asset $ l40,000

I Loss on Revaluation $ 22,00

Question 3

Answer 3 Journal Entries:

No. Date Account titles and explanation Debit Credit

a. 30-Jun-19 Cash account $15,000,000

To 6.5% Debentures account $15,000,000

(Being Cash received for issue of debentures)

b. 31-Dec-19 Interest on Debentures ($15,000,000*6.5%*6/12) $487,500

To Cash account $487,500

(Being Interest Paid)

c. 30-Jun-24 6.5% Debentures account $15,000,000

To Cash account $15,000,000

(Being debentures redeemed)

Note: Since market rate and coupon rate of interest of the debentures are same The issue

price itself is the carrying value.

d)

1) Issue of Debenture at Par value.

Debentures are said to be issued at par value when the amount collected for it is equal to the

nominal value (face value) of the debentures.

2) Issue of debenture at Premium value.

When Debentures are issued at a price higher than the nominal value, it is called the 'Issue of

Securities at Premium'.

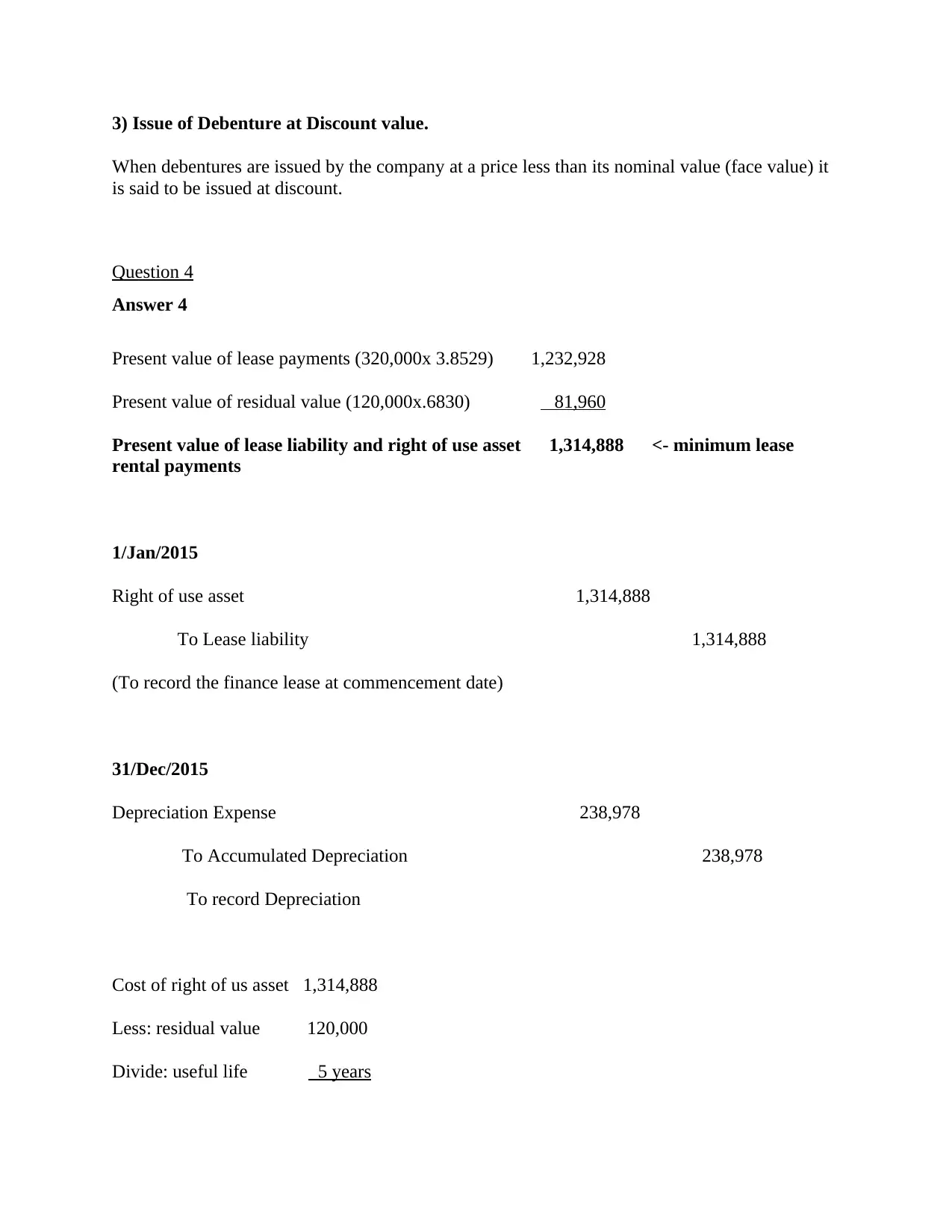

3) Issue of Debenture at Discount value.

When debentures are issued by the company at a price less than its nominal value (face value) it

is said to be issued at discount.

Question 4

Answer 4

Present value of lease payments (320,000x 3.8529) 1,232,928

Present value of residual value (120,000x.6830) 81,960

Present value of lease liability and right of use asset 1,314,888 <- minimum lease

rental payments

1/Jan/2015

Right of use asset 1,314,888

To Lease liability 1,314,888

(To record the finance lease at commencement date)

31/Dec/2015

Depreciation Expense 238,978

To Accumulated Depreciation 238,978

To record Depreciation

Cost of right of us asset 1,314,888

Less: residual value 120,000

Divide: useful life 5 years

When debentures are issued by the company at a price less than its nominal value (face value) it

is said to be issued at discount.

Question 4

Answer 4

Present value of lease payments (320,000x 3.8529) 1,232,928

Present value of residual value (120,000x.6830) 81,960

Present value of lease liability and right of use asset 1,314,888 <- minimum lease

rental payments

1/Jan/2015

Right of use asset 1,314,888

To Lease liability 1,314,888

(To record the finance lease at commencement date)

31/Dec/2015

Depreciation Expense 238,978

To Accumulated Depreciation 238,978

To record Depreciation

Cost of right of us asset 1,314,888

Less: residual value 120,000

Divide: useful life 5 years

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

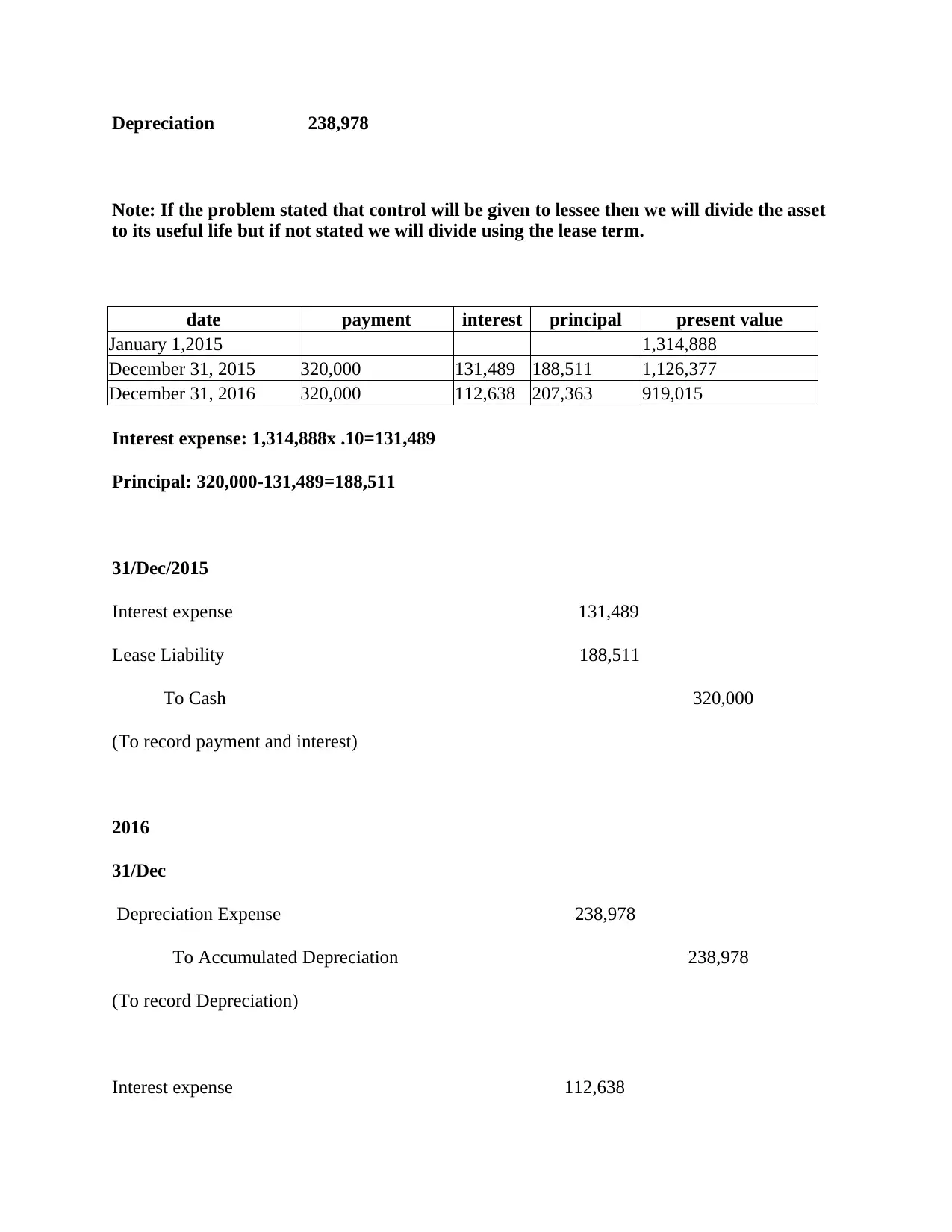

Depreciation 238,978

Note: If the problem stated that control will be given to lessee then we will divide the asset

to its useful life but if not stated we will divide using the lease term.

date payment interest principal present value

January 1,2015 1,314,888

December 31, 2015 320,000 131,489 188,511 1,126,377

December 31, 2016 320,000 112,638 207,363 919,015

Interest expense: 1,314,888x .10=131,489

Principal: 320,000-131,489=188,511

31/Dec/2015

Interest expense 131,489

Lease Liability 188,511

To Cash 320,000

(To record payment and interest)

2016

31/Dec

Depreciation Expense 238,978

To Accumulated Depreciation 238,978

(To record Depreciation)

Interest expense 112,638

Note: If the problem stated that control will be given to lessee then we will divide the asset

to its useful life but if not stated we will divide using the lease term.

date payment interest principal present value

January 1,2015 1,314,888

December 31, 2015 320,000 131,489 188,511 1,126,377

December 31, 2016 320,000 112,638 207,363 919,015

Interest expense: 1,314,888x .10=131,489

Principal: 320,000-131,489=188,511

31/Dec/2015

Interest expense 131,489

Lease Liability 188,511

To Cash 320,000

(To record payment and interest)

2016

31/Dec

Depreciation Expense 238,978

To Accumulated Depreciation 238,978

(To record Depreciation)

Interest expense 112,638

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Lease Liability 207,363

To Cash 320,000

(To record payment and interest)

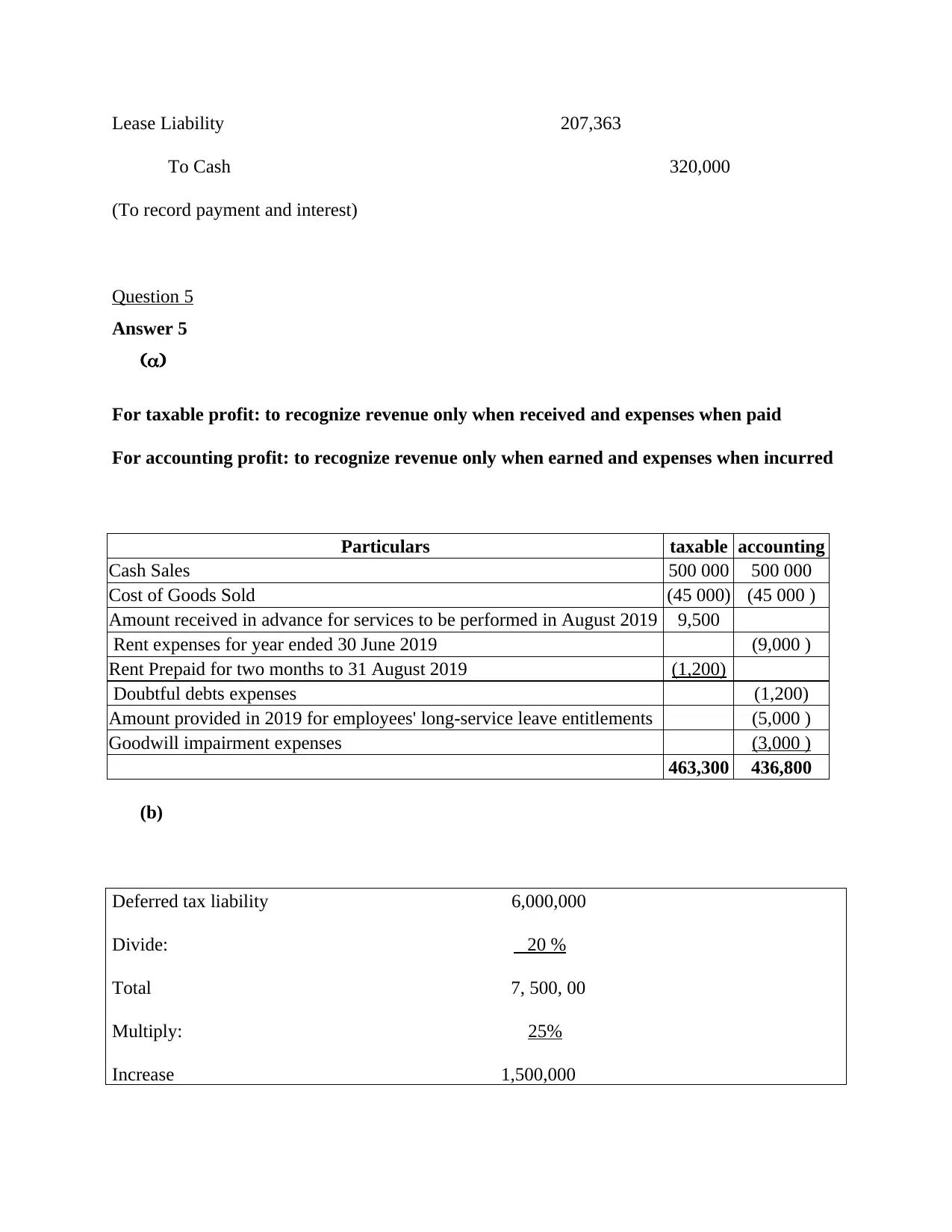

Question 5

Answer 5

(a)

For taxable profit: to recognize revenue only when received and expenses when paid

For accounting profit: to recognize revenue only when earned and expenses when incurred

Particulars taxable accounting

Cash Sales 500 000 500 000

Cost of Goods Sold (45 000) (45 000 )

Amount received in advance for services to be performed in August 2019 9,500

Rent expenses for year ended 30 June 2019 (9,000 )

Rent Prepaid for two months to 31 August 2019 (1,200)

Doubtful debts expenses (1,200)

Amount provided in 2019 for employees' long-service leave entitlements (5,000 )

Goodwill impairment expenses (3,000 )

463,300 436,800

(b)

Deferred tax liability 6,000,000

Divide: 20 %

Total 7, 500, 00

Multiply: 25%

Increase 1,500,000

To Cash 320,000

(To record payment and interest)

Question 5

Answer 5

(a)

For taxable profit: to recognize revenue only when received and expenses when paid

For accounting profit: to recognize revenue only when earned and expenses when incurred

Particulars taxable accounting

Cash Sales 500 000 500 000

Cost of Goods Sold (45 000) (45 000 )

Amount received in advance for services to be performed in August 2019 9,500

Rent expenses for year ended 30 June 2019 (9,000 )

Rent Prepaid for two months to 31 August 2019 (1,200)

Doubtful debts expenses (1,200)

Amount provided in 2019 for employees' long-service leave entitlements (5,000 )

Goodwill impairment expenses (3,000 )

463,300 436,800

(b)

Deferred tax liability 6,000,000

Divide: 20 %

Total 7, 500, 00

Multiply: 25%

Increase 1,500,000

Income tax expense 1,500,000

Deferred tax liability 1, 5000,000

Deferred tax asset 8,000,000

Divide: 20 %

Total 10, 000, 00

Multiply: 25%

Increase 2,000,000

Deferred tax asset 2,000,000

Income tax benefit 2,000,000

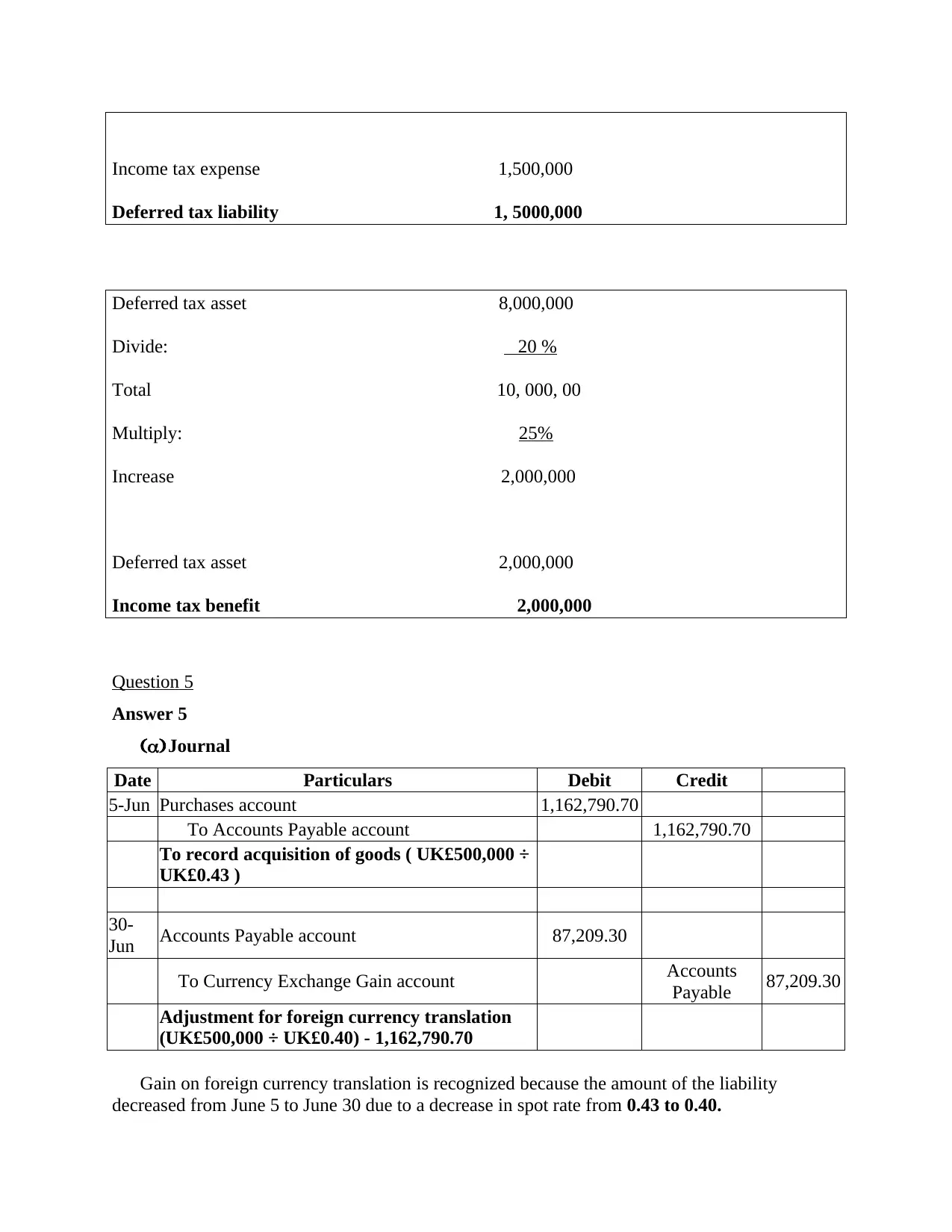

Question 5

Answer 5

(a)Journal

Date Particulars Debit Credit

5-Jun Purchases account 1,162,790.70

To Accounts Payable account 1,162,790.70

To record acquisition of goods ( UK£500,000 ÷

UK£0.43 )

30-

Jun Accounts Payable account 87,209.30

To Currency Exchange Gain account Accounts

Payable 87,209.30

Adjustment for foreign currency translation

(UK£500,000 ÷ UK£0.40) - 1,162,790.70

Gain on foreign currency translation is recognized because the amount of the liability

decreased from June 5 to June 30 due to a decrease in spot rate from 0.43 to 0.40.

Deferred tax liability 1, 5000,000

Deferred tax asset 8,000,000

Divide: 20 %

Total 10, 000, 00

Multiply: 25%

Increase 2,000,000

Deferred tax asset 2,000,000

Income tax benefit 2,000,000

Question 5

Answer 5

(a)Journal

Date Particulars Debit Credit

5-Jun Purchases account 1,162,790.70

To Accounts Payable account 1,162,790.70

To record acquisition of goods ( UK£500,000 ÷

UK£0.43 )

30-

Jun Accounts Payable account 87,209.30

To Currency Exchange Gain account Accounts

Payable 87,209.30

Adjustment for foreign currency translation

(UK£500,000 ÷ UK£0.40) - 1,162,790.70

Gain on foreign currency translation is recognized because the amount of the liability

decreased from June 5 to June 30 due to a decrease in spot rate from 0.43 to 0.40.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

(b)

Companies need to translate foreign currency transactions into local currency in order to

reconcile all financial statements in terms of local or functional currency. When it comes to

accounting, the financial statements have to be recorded in a single currency. This is why there is

a need to perform foreign currency translation (Porter, 2019). It is important because each

country has a different currency from one another. The exchange rate or the price of one

currency in terms of another, helps to determine a nation's economic health and hence the well-

being of all the people residing in it.

(c)

The movement must be recognized in the books as gain or loss from foreign currency

translation. When selling products or services to customers in a foreign currency, the value of

that currency changes based on the exchange rate. If the value of the currency goes up or down

after the invoice of a customer but before collecting payment, then it have made a foreign

currency gain or loss on that invoice (Herawati, 2018).

IAS 21 or also known as "The Effects of Changes in Foreign Exchange Rates" outlines

how to account for foreign currency transactions and operations in financial statements, and also

how to translate financial statements into a presentation currency. An entity is required to

determine a functional currency (for each of its operations if necessary) based on the primary

economic environment in which it operates and generally records foreign currency transactions

using the spot conversion rate to that functional currency on the date of the transaction (Hassan

and Marston, 2019).

Companies need to translate foreign currency transactions into local currency in order to

reconcile all financial statements in terms of local or functional currency. When it comes to

accounting, the financial statements have to be recorded in a single currency. This is why there is

a need to perform foreign currency translation (Porter, 2019). It is important because each

country has a different currency from one another. The exchange rate or the price of one

currency in terms of another, helps to determine a nation's economic health and hence the well-

being of all the people residing in it.

(c)

The movement must be recognized in the books as gain or loss from foreign currency

translation. When selling products or services to customers in a foreign currency, the value of

that currency changes based on the exchange rate. If the value of the currency goes up or down

after the invoice of a customer but before collecting payment, then it have made a foreign

currency gain or loss on that invoice (Herawati, 2018).

IAS 21 or also known as "The Effects of Changes in Foreign Exchange Rates" outlines

how to account for foreign currency transactions and operations in financial statements, and also

how to translate financial statements into a presentation currency. An entity is required to

determine a functional currency (for each of its operations if necessary) based on the primary

economic environment in which it operates and generally records foreign currency transactions

using the spot conversion rate to that functional currency on the date of the transaction (Hassan

and Marston, 2019).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

REFERENCES

Books and Journal

Porter, J. C., 2019. Beyond debits and credits: Using integrated projects to improve students’

understanding of financial accounting. Journal of Accounting Education. 46. pp.53-71.

Herawati, N. T., 2018. Financial Learning: Is It The Effective Way to Improve Financial Literacy

among Accounting Students?. In SHS Web of Conferences (Vol. 42, p. 00056). EDP

Sciences.

Bischof, J., Laux, C. and Leuz, C., 2019. Accounting for financial stability: Lessons from the

financial crisis and future challenges.

Trofimova, L. B. And et.al, 2019. Public sector entities reporting and Accounting information

system. Journal of Advanced Research in Dynamical and Control Systems. 11(S8).

pp.416-424.

Hassan, O. A. and Marston, C., 2019. Corporate financial disclosure measurement in the

empirical accounting literature: a review article. The International Journal of

Accounting. 54(02). p.1950006.

Miihkinen, A. and Virtanen, T., 2018. Development and application of assessment standards to

advanced written assignments. Accounting Education. 27(2). pp.121-159.

Eames, M., Luttman, S. and Parker, S., 2018. Accelerated vs. traditional accounting education

and CPA exam performance. Journal of Accounting Education. 44. pp.1-13.

Chychyla, R., Leone, A. J. and Minutti-Meza, M., 2019. Complexity of financial reporting

standards and accounting expertise. Journal of Accounting and Economics. 67(1).

pp.226-253.

Books and Journal

Porter, J. C., 2019. Beyond debits and credits: Using integrated projects to improve students’

understanding of financial accounting. Journal of Accounting Education. 46. pp.53-71.

Herawati, N. T., 2018. Financial Learning: Is It The Effective Way to Improve Financial Literacy

among Accounting Students?. In SHS Web of Conferences (Vol. 42, p. 00056). EDP

Sciences.

Bischof, J., Laux, C. and Leuz, C., 2019. Accounting for financial stability: Lessons from the

financial crisis and future challenges.

Trofimova, L. B. And et.al, 2019. Public sector entities reporting and Accounting information

system. Journal of Advanced Research in Dynamical and Control Systems. 11(S8).

pp.416-424.

Hassan, O. A. and Marston, C., 2019. Corporate financial disclosure measurement in the

empirical accounting literature: a review article. The International Journal of

Accounting. 54(02). p.1950006.

Miihkinen, A. and Virtanen, T., 2018. Development and application of assessment standards to

advanced written assignments. Accounting Education. 27(2). pp.121-159.

Eames, M., Luttman, S. and Parker, S., 2018. Accelerated vs. traditional accounting education

and CPA exam performance. Journal of Accounting Education. 44. pp.1-13.

Chychyla, R., Leone, A. J. and Minutti-Meza, M., 2019. Complexity of financial reporting

standards and accounting expertise. Journal of Accounting and Economics. 67(1).

pp.226-253.

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.