SITXFIN005 Manage Physical Assets - AIC Advanced Hospitality Task

VerifiedAdded on 2023/06/13

|21

|7609

|489

Homework Assignment

AI Summary

This assignment solution for SITXFIN005 Manage Physical Assets, completed at Australian Ideal College, addresses various aspects of physical asset management within the tourism, hospitality, and event industries. It includes discussions on how business objectives like profitability, growth, and quality of service influence asset management methods. The assignment provides examples of different types of physical assets, their maintenance requirements, and key considerations for long-term assessment and acquisition, including budget parameters, environmental sustainability, and suitability to products and services. Furthermore, it outlines the details needed in an asset register and compares the features, advantages, and disadvantages of financing options such as hire purchase and leasing. This document provides a detailed overview of the assignment and can be found with other solved assignments on Desklib.

Australian Ideal College

Registered as Australian Ideal College Pty Ltd

RTO No.: 91679 | CRICOS Provider Code: 03053G

Sydney Campus: Level 7 & 8, 75 King Street, Sydney NSW 2000 Australia

Adelaide Campus: Level 3, 21-23 Rundle Mall, Adelaide SA 5000 Australia

Hobart Campus: GRD Floor, 116 Murray Street, Hobart TAS 7000 Australia

T: +61-2-9262 2968 (Sydney) | +61-8-8123 5780 (Adelaide) | +61-3-6231 2141 (Hobart)

E: info@aic.edu.au | W: www.aic.edu.au

AIC- SITXFIN005-AT1-V1.0 Page 1 of 21

Educating for Excellence

Assessment Submission Sheet

Course SIT60316 Advanced Diploma of Hospitality Management

Unit Code SITXFIN005

Unit Name Manage physical assets

Assessor

Name

Student

Name

Student ID

Date Due

Please read and sign this assessment coversheet and submit it together with your assessment to

your Assessor by the due date.

Student Declaration

I declare that the work submitted is my own, and has not been copied or plagiarised from any

person or source.

I have read the Plagiarism Policy and Assessment Appeal and Reassessment Policy in the

Student Handbook and I understand all the rules and guidelines for undertaking assessments.

I understand that by typing my full name in the student field this is equivalent to a hand-written

signature.

I give permission for my assessment material to be used for continuous improvement purposes.

Student

Signature

Date

Submitted

Assessor Use Only

Assessment Items Result

Task 1 Assessment Task 1 – Short Answers S NS

Task 2 Assessment Task 2 – Project S NS

Overall result for this unit C NYC

Student Declaration: I declare that I have

been assessed in this unit, and I have been

advised of my result. I am also aware of my

appeal rights.

Assessor Declaration: I declare that I have

conducted a fair, valid, reliable and flexible

assessment with this student, and I have

provided appropriate feedback

Signature Signatur

e

Date

Registered as Australian Ideal College Pty Ltd

RTO No.: 91679 | CRICOS Provider Code: 03053G

Sydney Campus: Level 7 & 8, 75 King Street, Sydney NSW 2000 Australia

Adelaide Campus: Level 3, 21-23 Rundle Mall, Adelaide SA 5000 Australia

Hobart Campus: GRD Floor, 116 Murray Street, Hobart TAS 7000 Australia

T: +61-2-9262 2968 (Sydney) | +61-8-8123 5780 (Adelaide) | +61-3-6231 2141 (Hobart)

E: info@aic.edu.au | W: www.aic.edu.au

AIC- SITXFIN005-AT1-V1.0 Page 1 of 21

Educating for Excellence

Assessment Submission Sheet

Course SIT60316 Advanced Diploma of Hospitality Management

Unit Code SITXFIN005

Unit Name Manage physical assets

Assessor

Name

Student

Name

Student ID

Date Due

Please read and sign this assessment coversheet and submit it together with your assessment to

your Assessor by the due date.

Student Declaration

I declare that the work submitted is my own, and has not been copied or plagiarised from any

person or source.

I have read the Plagiarism Policy and Assessment Appeal and Reassessment Policy in the

Student Handbook and I understand all the rules and guidelines for undertaking assessments.

I understand that by typing my full name in the student field this is equivalent to a hand-written

signature.

I give permission for my assessment material to be used for continuous improvement purposes.

Student

Signature

Date

Submitted

Assessor Use Only

Assessment Items Result

Task 1 Assessment Task 1 – Short Answers S NS

Task 2 Assessment Task 2 – Project S NS

Overall result for this unit C NYC

Student Declaration: I declare that I have

been assessed in this unit, and I have been

advised of my result. I am also aware of my

appeal rights.

Assessor Declaration: I declare that I have

conducted a fair, valid, reliable and flexible

assessment with this student, and I have

provided appropriate feedback

Signature Signatur

e

Date

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

AIC- SITXFIN005-AT1-V1.0 Page 2 of 21

Australian Ideal College

Registered as Australian Ideal College Pty Ltd

RTO No.: 91679 | CRICOS Provider Code: 03053G

Sydney Campus: Level 7 & 8, 75 King Street, Sydney NSW 2000 Australia

Adelaide Campus: Level 3, 21-23 Rundle Mall, Adelaide SA 5000 Australia

Hobart Campus: GRD Floor, 116 Murray Street, Hobart TAS 7000 Australia

T: +61-2-9262 2968 (Sydney) | +61-8-8123 5780 (Adelaide) | +61-3-6231 2141 (Hobart)

E: info@aic.edu.au | W: www.aic.edu.au

Educating for Excellence

Assessor’s Comments

Australian Ideal College

Registered as Australian Ideal College Pty Ltd

RTO No.: 91679 | CRICOS Provider Code: 03053G

Sydney Campus: Level 7 & 8, 75 King Street, Sydney NSW 2000 Australia

Adelaide Campus: Level 3, 21-23 Rundle Mall, Adelaide SA 5000 Australia

Hobart Campus: GRD Floor, 116 Murray Street, Hobart TAS 7000 Australia

T: +61-2-9262 2968 (Sydney) | +61-8-8123 5780 (Adelaide) | +61-3-6231 2141 (Hobart)

E: info@aic.edu.au | W: www.aic.edu.au

Educating for Excellence

Assessor’s Comments

AIC- SITXFIN005-AT1-V1.0 Page 3 of 21

Australian Ideal College

Registered as Australian Ideal College Pty Ltd

RTO No.: 91679 | CRICOS Provider Code: 03053G

Sydney Campus: Level 7 & 8, 75 King Street, Sydney NSW 2000 Australia

Adelaide Campus: Level 3, 21-23 Rundle Mall, Adelaide SA 5000 Australia

Hobart Campus: GRD Floor, 116 Murray Street, Hobart TAS 7000 Australia

T: +61-2-9262 2968 (Sydney) | +61-8-8123 5780 (Adelaide) | +61-3-6231 2141 (Hobart)

E: info@aic.edu.au | W: www.aic.edu.au

Educating for Excellence

Task 1

Assessment Instructions

This is an individual assessment. Please understand the questions before you start answering them.

Ask your trainer of you are unsure of any questions.

To be deemed competent you will need to successfully demonstrate the following:

You must submit:

All questions must be answered satisfactorily

Procedure

1. How can the following business objectives influence the methods used for

managing physical assets in an organisation? Provide 1 example for each:

Profitability

It is one of the main and the key goal of any organisation to remain in the market and attain

more physical assets. The rate of return of the capital which is invested is to be generated

and the total cost should be identified before taking any decision.

Growth

It is expanding the business economically and in monetary terms as well. For this, the

lifecycle of the products and the utilization of the assets should be considered by checking on

the amount of work that is performed in the organization (Chattopadhyay, 2021).

Providing quality products and services to customers

The resources, for example, furniture and offices accordingly impact the conceivable rating

that can be acquired. Essential arrangements will bring about a lower rating, which will affect

the value that can be placed on a room. Spending more and guaranteeing customary upkeep

exercises are done can bring about a higher rating, which will then, at that point, permit a

more exorbitant cost to be charged. The profit from speculation again should be determined

cautiously

Australian Ideal College

Registered as Australian Ideal College Pty Ltd

RTO No.: 91679 | CRICOS Provider Code: 03053G

Sydney Campus: Level 7 & 8, 75 King Street, Sydney NSW 2000 Australia

Adelaide Campus: Level 3, 21-23 Rundle Mall, Adelaide SA 5000 Australia

Hobart Campus: GRD Floor, 116 Murray Street, Hobart TAS 7000 Australia

T: +61-2-9262 2968 (Sydney) | +61-8-8123 5780 (Adelaide) | +61-3-6231 2141 (Hobart)

E: info@aic.edu.au | W: www.aic.edu.au

Educating for Excellence

Task 1

Assessment Instructions

This is an individual assessment. Please understand the questions before you start answering them.

Ask your trainer of you are unsure of any questions.

To be deemed competent you will need to successfully demonstrate the following:

You must submit:

All questions must be answered satisfactorily

Procedure

1. How can the following business objectives influence the methods used for

managing physical assets in an organisation? Provide 1 example for each:

Profitability

It is one of the main and the key goal of any organisation to remain in the market and attain

more physical assets. The rate of return of the capital which is invested is to be generated

and the total cost should be identified before taking any decision.

Growth

It is expanding the business economically and in monetary terms as well. For this, the

lifecycle of the products and the utilization of the assets should be considered by checking on

the amount of work that is performed in the organization (Chattopadhyay, 2021).

Providing quality products and services to customers

The resources, for example, furniture and offices accordingly impact the conceivable rating

that can be acquired. Essential arrangements will bring about a lower rating, which will affect

the value that can be placed on a room. Spending more and guaranteeing customary upkeep

exercises are done can bring about a higher rating, which will then, at that point, permit a

more exorbitant cost to be charged. The profit from speculation again should be determined

cautiously

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

AIC- SITXFIN005-AT1-V1.0 Page 4 of 21

Australian Ideal College

Registered as Australian Ideal College Pty Ltd

RTO No.: 91679 | CRICOS Provider Code: 03053G

Sydney Campus: Level 7 & 8, 75 King Street, Sydney NSW 2000 Australia

Adelaide Campus: Level 3, 21-23 Rundle Mall, Adelaide SA 5000 Australia

Hobart Campus: GRD Floor, 116 Murray Street, Hobart TAS 7000 Australia

T: +61-2-9262 2968 (Sydney) | +61-8-8123 5780 (Adelaide) | +61-3-6231 2141 (Hobart)

E: info@aic.edu.au | W: www.aic.edu.au

Educating for Excellence

Adhering to:

1. codes of conduct

2. environmental sustainability philosophies and practices

Outside impacts may likewise be viewed as while settling on essential resource the board

choices. Industry Codes of Conduct and Accreditation Schemes might direct somewhat the

way that choice should be made. For instance, the Star Ratings Australia Accommodation

Classification Scheme covers a wide reach of accommodation and comprises appraisals from

one to five stars in Australia and New Zealand. One star offers clean fundamental

convenience, while five stars demonstrate exceptional worldwide guidelines.

Industry accreditation schemes

When a major amount of capital is invested in the business, certain research is done before

investing. The expenditure which is to be made for the improvement in the organization is to

be justified strategically.

Australian Ideal College

Registered as Australian Ideal College Pty Ltd

RTO No.: 91679 | CRICOS Provider Code: 03053G

Sydney Campus: Level 7 & 8, 75 King Street, Sydney NSW 2000 Australia

Adelaide Campus: Level 3, 21-23 Rundle Mall, Adelaide SA 5000 Australia

Hobart Campus: GRD Floor, 116 Murray Street, Hobart TAS 7000 Australia

T: +61-2-9262 2968 (Sydney) | +61-8-8123 5780 (Adelaide) | +61-3-6231 2141 (Hobart)

E: info@aic.edu.au | W: www.aic.edu.au

Educating for Excellence

Adhering to:

1. codes of conduct

2. environmental sustainability philosophies and practices

Outside impacts may likewise be viewed as while settling on essential resource the board

choices. Industry Codes of Conduct and Accreditation Schemes might direct somewhat the

way that choice should be made. For instance, the Star Ratings Australia Accommodation

Classification Scheme covers a wide reach of accommodation and comprises appraisals from

one to five stars in Australia and New Zealand. One star offers clean fundamental

convenience, while five stars demonstrate exceptional worldwide guidelines.

Industry accreditation schemes

When a major amount of capital is invested in the business, certain research is done before

investing. The expenditure which is to be made for the improvement in the organization is to

be justified strategically.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

AIC- SITXFIN005-AT1-V1.0 Page 5 of 21

Australian Ideal College

Registered as Australian Ideal College Pty Ltd

RTO No.: 91679 | CRICOS Provider Code: 03053G

Sydney Campus: Level 7 & 8, 75 King Street, Sydney NSW 2000 Australia

Adelaide Campus: Level 3, 21-23 Rundle Mall, Adelaide SA 5000 Australia

Hobart Campus: GRD Floor, 116 Murray Street, Hobart TAS 7000 Australia

T: +61-2-9262 2968 (Sydney) | +61-8-8123 5780 (Adelaide) | +61-3-6231 2141 (Hobart)

E: info@aic.edu.au | W: www.aic.edu.au

Educating for Excellence

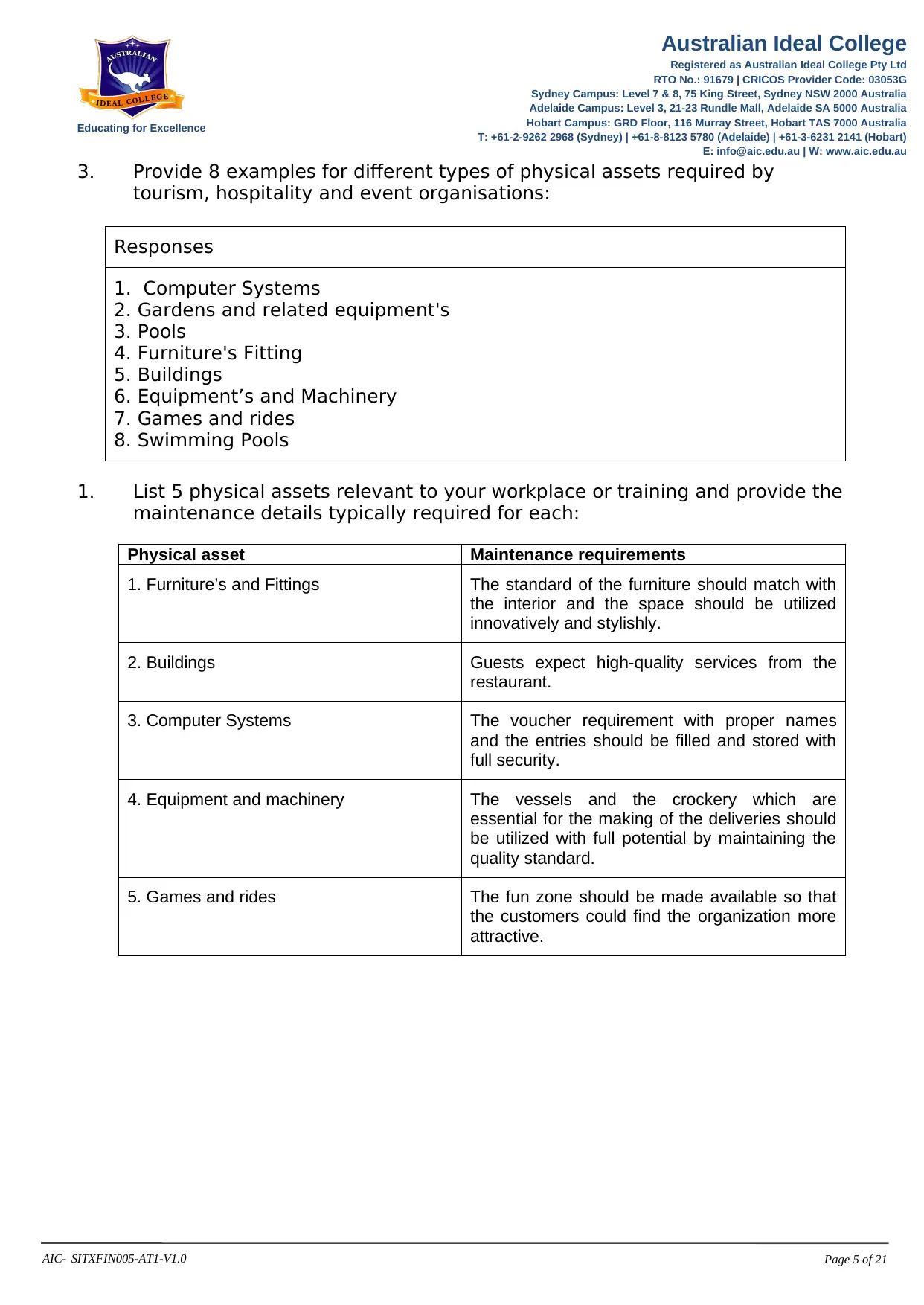

3. Provide 8 examples for different types of physical assets required by

tourism, hospitality and event organisations:

Responses

1. Computer Systems

2. Gardens and related equipment's

3. Pools

4. Furniture's Fitting

5. Buildings

6. Equipment’s and Machinery

7. Games and rides

8. Swimming Pools

1. List 5 physical assets relevant to your workplace or training and provide the

maintenance details typically required for each:

Physical asset Maintenance requirements

1. Furniture’s and Fittings The standard of the furniture should match with

the interior and the space should be utilized

innovatively and stylishly.

2. Buildings Guests expect high-quality services from the

restaurant.

3. Computer Systems The voucher requirement with proper names

and the entries should be filled and stored with

full security.

4. Equipment and machinery The vessels and the crockery which are

essential for the making of the deliveries should

be utilized with full potential by maintaining the

quality standard.

5. Games and rides The fun zone should be made available so that

the customers could find the organization more

attractive.

Australian Ideal College

Registered as Australian Ideal College Pty Ltd

RTO No.: 91679 | CRICOS Provider Code: 03053G

Sydney Campus: Level 7 & 8, 75 King Street, Sydney NSW 2000 Australia

Adelaide Campus: Level 3, 21-23 Rundle Mall, Adelaide SA 5000 Australia

Hobart Campus: GRD Floor, 116 Murray Street, Hobart TAS 7000 Australia

T: +61-2-9262 2968 (Sydney) | +61-8-8123 5780 (Adelaide) | +61-3-6231 2141 (Hobart)

E: info@aic.edu.au | W: www.aic.edu.au

Educating for Excellence

3. Provide 8 examples for different types of physical assets required by

tourism, hospitality and event organisations:

Responses

1. Computer Systems

2. Gardens and related equipment's

3. Pools

4. Furniture's Fitting

5. Buildings

6. Equipment’s and Machinery

7. Games and rides

8. Swimming Pools

1. List 5 physical assets relevant to your workplace or training and provide the

maintenance details typically required for each:

Physical asset Maintenance requirements

1. Furniture’s and Fittings The standard of the furniture should match with

the interior and the space should be utilized

innovatively and stylishly.

2. Buildings Guests expect high-quality services from the

restaurant.

3. Computer Systems The voucher requirement with proper names

and the entries should be filled and stored with

full security.

4. Equipment and machinery The vessels and the crockery which are

essential for the making of the deliveries should

be utilized with full potential by maintaining the

quality standard.

5. Games and rides The fun zone should be made available so that

the customers could find the organization more

attractive.

AIC- SITXFIN005-AT1-V1.0 Page 6 of 21

Australian Ideal College

Registered as Australian Ideal College Pty Ltd

RTO No.: 91679 | CRICOS Provider Code: 03053G

Sydney Campus: Level 7 & 8, 75 King Street, Sydney NSW 2000 Australia

Adelaide Campus: Level 3, 21-23 Rundle Mall, Adelaide SA 5000 Australia

Hobart Campus: GRD Floor, 116 Murray Street, Hobart TAS 7000 Australia

T: +61-2-9262 2968 (Sydney) | +61-8-8123 5780 (Adelaide) | +61-3-6231 2141 (Hobart)

E: info@aic.edu.au | W: www.aic.edu.au

Educating for Excellence

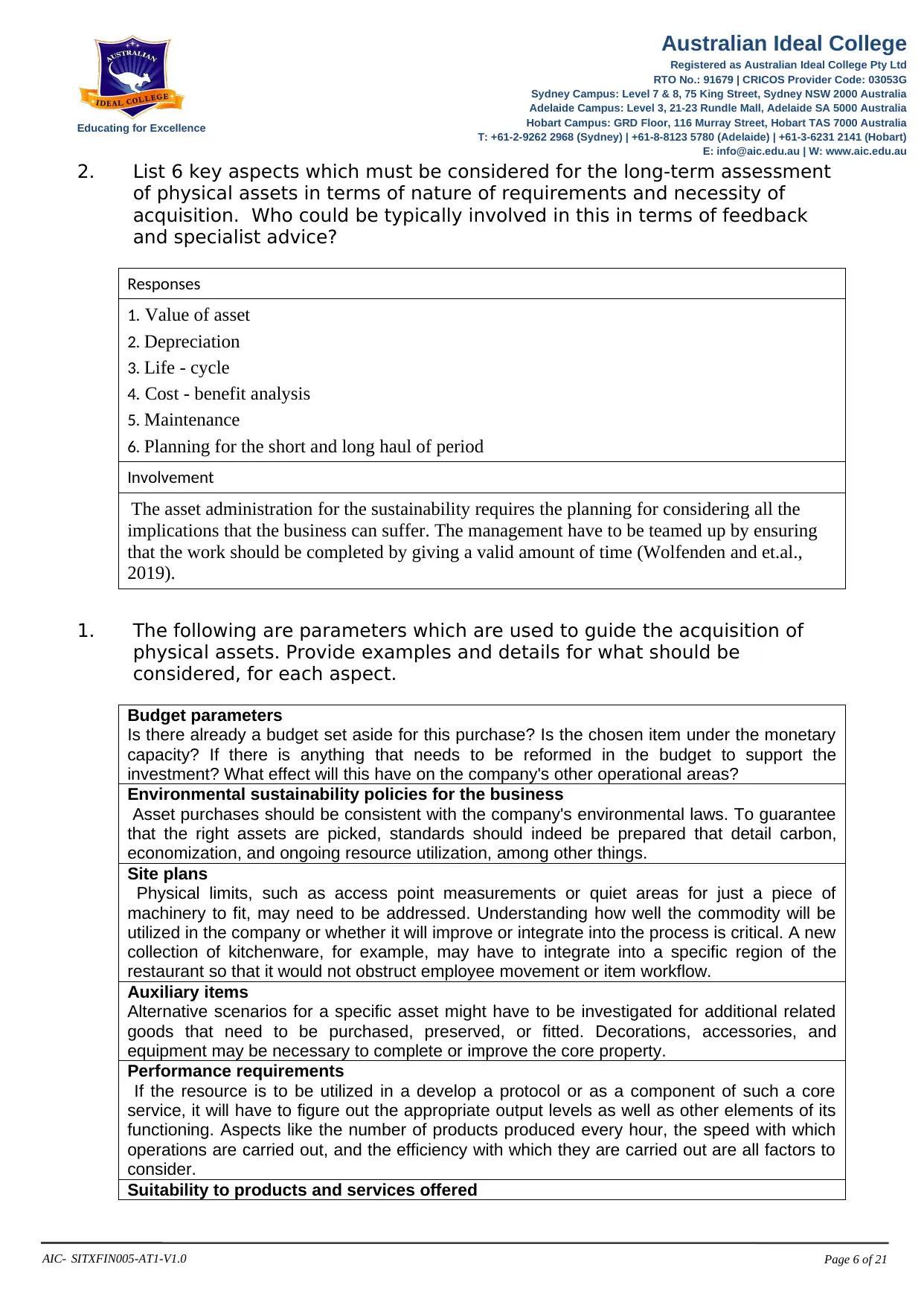

2. List 6 key aspects which must be considered for the long-term assessment

of physical assets in terms of nature of requirements and necessity of

acquisition. Who could be typically involved in this in terms of feedback

and specialist advice?

Responses

1. Value of asset

2. Depreciation

3. Life - cycle

4. Cost - benefit analysis

5. Maintenance

6. Planning for the short and long haul of period

Involvement

The asset administration for the sustainability requires the planning for considering all the

implications that the business can suffer. The management have to be teamed up by ensuring

that the work should be completed by giving a valid amount of time (Wolfenden and et.al.,

2019).

1. The following are parameters which are used to guide the acquisition of

physical assets. Provide examples and details for what should be

considered, for each aspect.

Budget parameters

Is there already a budget set aside for this purchase? Is the chosen item under the monetary

capacity? If there is anything that needs to be reformed in the budget to support the

investment? What effect will this have on the company's other operational areas?

Environmental sustainability policies for the business

Asset purchases should be consistent with the company's environmental laws. To guarantee

that the right assets are picked, standards should indeed be prepared that detail carbon,

economization, and ongoing resource utilization, among other things.

Site plans

Physical limits, such as access point measurements or quiet areas for just a piece of

machinery to fit, may need to be addressed. Understanding how well the commodity will be

utilized in the company or whether it will improve or integrate into the process is critical. A new

collection of kitchenware, for example, may have to integrate into a specific region of the

restaurant so that it would not obstruct employee movement or item workflow.

Auxiliary items

Alternative scenarios for a specific asset might have to be investigated for additional related

goods that need to be purchased, preserved, or fitted. Decorations, accessories, and

equipment may be necessary to complete or improve the core property.

Performance requirements

If the resource is to be utilized in a develop a protocol or as a component of such a core

service, it will have to figure out the appropriate output levels as well as other elements of its

functioning. Aspects like the number of products produced every hour, the speed with which

operations are carried out, and the efficiency with which they are carried out are all factors to

consider.

Suitability to products and services offered

Australian Ideal College

Registered as Australian Ideal College Pty Ltd

RTO No.: 91679 | CRICOS Provider Code: 03053G

Sydney Campus: Level 7 & 8, 75 King Street, Sydney NSW 2000 Australia

Adelaide Campus: Level 3, 21-23 Rundle Mall, Adelaide SA 5000 Australia

Hobart Campus: GRD Floor, 116 Murray Street, Hobart TAS 7000 Australia

T: +61-2-9262 2968 (Sydney) | +61-8-8123 5780 (Adelaide) | +61-3-6231 2141 (Hobart)

E: info@aic.edu.au | W: www.aic.edu.au

Educating for Excellence

2. List 6 key aspects which must be considered for the long-term assessment

of physical assets in terms of nature of requirements and necessity of

acquisition. Who could be typically involved in this in terms of feedback

and specialist advice?

Responses

1. Value of asset

2. Depreciation

3. Life - cycle

4. Cost - benefit analysis

5. Maintenance

6. Planning for the short and long haul of period

Involvement

The asset administration for the sustainability requires the planning for considering all the

implications that the business can suffer. The management have to be teamed up by ensuring

that the work should be completed by giving a valid amount of time (Wolfenden and et.al.,

2019).

1. The following are parameters which are used to guide the acquisition of

physical assets. Provide examples and details for what should be

considered, for each aspect.

Budget parameters

Is there already a budget set aside for this purchase? Is the chosen item under the monetary

capacity? If there is anything that needs to be reformed in the budget to support the

investment? What effect will this have on the company's other operational areas?

Environmental sustainability policies for the business

Asset purchases should be consistent with the company's environmental laws. To guarantee

that the right assets are picked, standards should indeed be prepared that detail carbon,

economization, and ongoing resource utilization, among other things.

Site plans

Physical limits, such as access point measurements or quiet areas for just a piece of

machinery to fit, may need to be addressed. Understanding how well the commodity will be

utilized in the company or whether it will improve or integrate into the process is critical. A new

collection of kitchenware, for example, may have to integrate into a specific region of the

restaurant so that it would not obstruct employee movement or item workflow.

Auxiliary items

Alternative scenarios for a specific asset might have to be investigated for additional related

goods that need to be purchased, preserved, or fitted. Decorations, accessories, and

equipment may be necessary to complete or improve the core property.

Performance requirements

If the resource is to be utilized in a develop a protocol or as a component of such a core

service, it will have to figure out the appropriate output levels as well as other elements of its

functioning. Aspects like the number of products produced every hour, the speed with which

operations are carried out, and the efficiency with which they are carried out are all factors to

consider.

Suitability to products and services offered

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

AIC- SITXFIN005-AT1-V1.0 Page 7 of 21

Australian Ideal College

Registered as Australian Ideal College Pty Ltd

RTO No.: 91679 | CRICOS Provider Code: 03053G

Sydney Campus: Level 7 & 8, 75 King Street, Sydney NSW 2000 Australia

Adelaide Campus: Level 3, 21-23 Rundle Mall, Adelaide SA 5000 Australia

Hobart Campus: GRD Floor, 116 Murray Street, Hobart TAS 7000 Australia

T: +61-2-9262 2968 (Sydney) | +61-8-8123 5780 (Adelaide) | +61-3-6231 2141 (Hobart)

E: info@aic.edu.au | W: www.aic.edu.au

Educating for Excellence

All commodities should be carefully evaluated that they are suitable for the target use. To

make sure the right quality of service and client outcomes can be reached, a company's

goods/services must always be assessed. For reference, an automobile must be fit for a

particular usage.

1. Which details need to be recorded in an asset register for each physical

asset?

Responses

The coding system issued to each object can be written down as a barcode scanner, with a

copy tangibly linked to the asset. This makes it simple to keep track of and identify each item.

This materialistic worldview of documenting aids in the prevention of theft and enhances the

productivity of stocktaking. The asset management registry will keep track of the history of

each asset

Australian Ideal College

Registered as Australian Ideal College Pty Ltd

RTO No.: 91679 | CRICOS Provider Code: 03053G

Sydney Campus: Level 7 & 8, 75 King Street, Sydney NSW 2000 Australia

Adelaide Campus: Level 3, 21-23 Rundle Mall, Adelaide SA 5000 Australia

Hobart Campus: GRD Floor, 116 Murray Street, Hobart TAS 7000 Australia

T: +61-2-9262 2968 (Sydney) | +61-8-8123 5780 (Adelaide) | +61-3-6231 2141 (Hobart)

E: info@aic.edu.au | W: www.aic.edu.au

Educating for Excellence

All commodities should be carefully evaluated that they are suitable for the target use. To

make sure the right quality of service and client outcomes can be reached, a company's

goods/services must always be assessed. For reference, an automobile must be fit for a

particular usage.

1. Which details need to be recorded in an asset register for each physical

asset?

Responses

The coding system issued to each object can be written down as a barcode scanner, with a

copy tangibly linked to the asset. This makes it simple to keep track of and identify each item.

This materialistic worldview of documenting aids in the prevention of theft and enhances the

productivity of stocktaking. The asset management registry will keep track of the history of

each asset

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

AIC- SITXFIN005-AT1-V1.0 Page 8 of 21

Australian Ideal College

Registered as Australian Ideal College Pty Ltd

RTO No.: 91679 | CRICOS Provider Code: 03053G

Sydney Campus: Level 7 & 8, 75 King Street, Sydney NSW 2000 Australia

Adelaide Campus: Level 3, 21-23 Rundle Mall, Adelaide SA 5000 Australia

Hobart Campus: GRD Floor, 116 Murray Street, Hobart TAS 7000 Australia

T: +61-2-9262 2968 (Sydney) | +61-8-8123 5780 (Adelaide) | +61-3-6231 2141 (Hobart)

E: info@aic.edu.au | W: www.aic.edu.au

Educating for Excellence

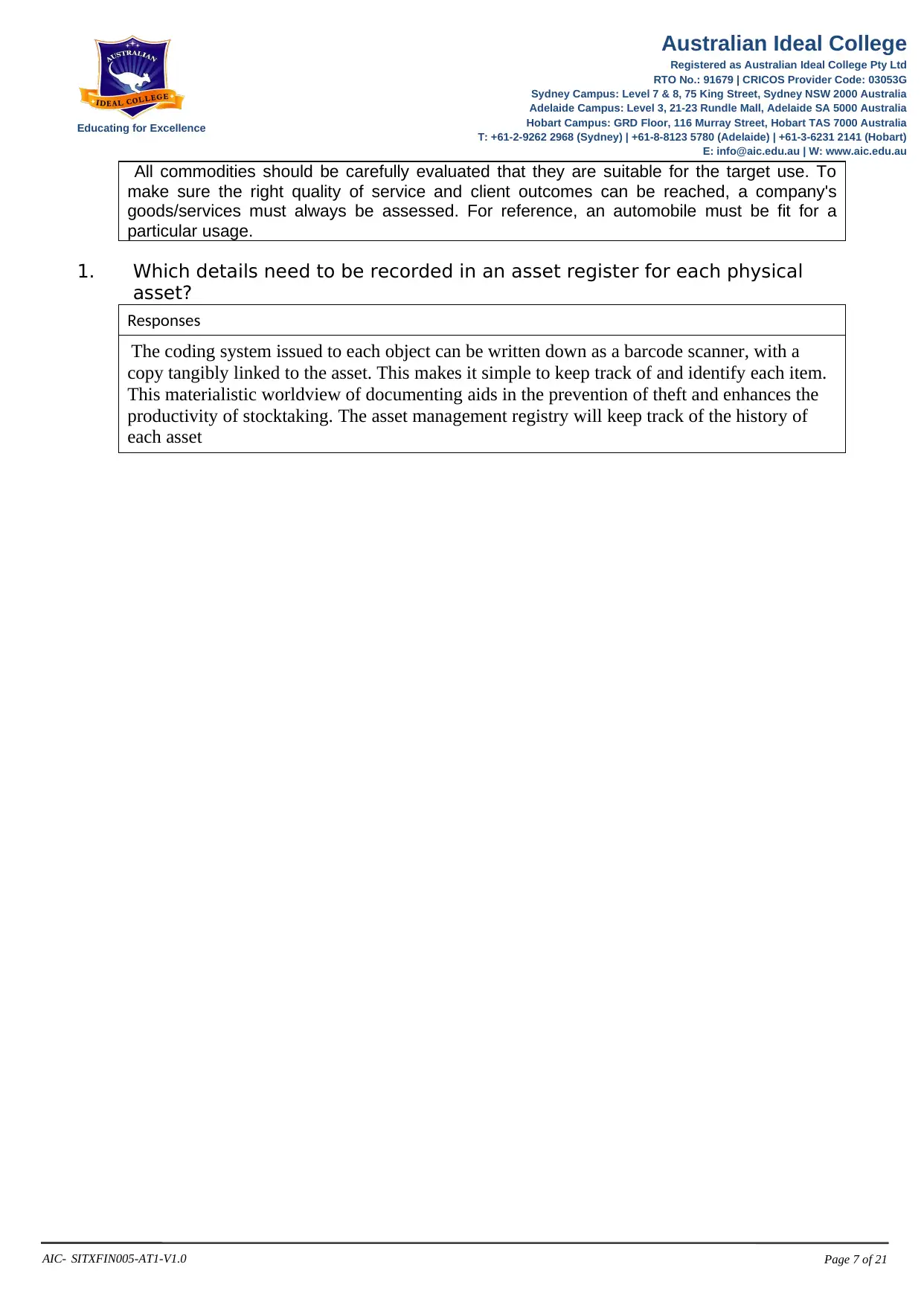

1. Provide an overview of the features, advantages and disadvantages of

each of the following financing options when acquiring assets:

1. Hire purchase

Pros Cons

Less incurring of capital

expenditure

Termination of the lease is

costly

The purchasing option is

available at the end of the

lease

Does not give full control on

the asset.

2. Lease

Pros Cons

Less incurring of capital

expenditure

Termination of a lease is

costly

The purchasing option is

available at the end of the

lease

Does not give full control on

the asset.

3. Purchase

Advantages Disadvantages

Elevation in the value of

equity

Maintenance costs

Ownership of asset High risk

4. Rent

Advantages Disadvantages

Tax deductions No ownership

No maintenance costs High cost for utilising

Australian Ideal College

Registered as Australian Ideal College Pty Ltd

RTO No.: 91679 | CRICOS Provider Code: 03053G

Sydney Campus: Level 7 & 8, 75 King Street, Sydney NSW 2000 Australia

Adelaide Campus: Level 3, 21-23 Rundle Mall, Adelaide SA 5000 Australia

Hobart Campus: GRD Floor, 116 Murray Street, Hobart TAS 7000 Australia

T: +61-2-9262 2968 (Sydney) | +61-8-8123 5780 (Adelaide) | +61-3-6231 2141 (Hobart)

E: info@aic.edu.au | W: www.aic.edu.au

Educating for Excellence

1. Provide an overview of the features, advantages and disadvantages of

each of the following financing options when acquiring assets:

1. Hire purchase

Pros Cons

Less incurring of capital

expenditure

Termination of the lease is

costly

The purchasing option is

available at the end of the

lease

Does not give full control on

the asset.

2. Lease

Pros Cons

Less incurring of capital

expenditure

Termination of a lease is

costly

The purchasing option is

available at the end of the

lease

Does not give full control on

the asset.

3. Purchase

Advantages Disadvantages

Elevation in the value of

equity

Maintenance costs

Ownership of asset High risk

4. Rent

Advantages Disadvantages

Tax deductions No ownership

No maintenance costs High cost for utilising

AIC- SITXFIN005-AT1-V1.0 Page 9 of 21

Australian Ideal College

Registered as Australian Ideal College Pty Ltd

RTO No.: 91679 | CRICOS Provider Code: 03053G

Sydney Campus: Level 7 & 8, 75 King Street, Sydney NSW 2000 Australia

Adelaide Campus: Level 3, 21-23 Rundle Mall, Adelaide SA 5000 Australia

Hobart Campus: GRD Floor, 116 Murray Street, Hobart TAS 7000 Australia

T: +61-2-9262 2968 (Sydney) | +61-8-8123 5780 (Adelaide) | +61-3-6231 2141 (Hobart)

E: info@aic.edu.au | W: www.aic.edu.au

Educating for Excellence

1. Explain the methods for calculating the depreciation of assets using each of

the following methods:

Prime cost method

It is also called the straight line method which is utilised for calculating the depreciable amount

on the asset. This method deducts the fixed amount every year till the asset is useful. It

considering the three item while computing the amount which are:

1. Cost price

2. Expected useful life

3. Expected residual value

Annual depreciation amount = (cost - residual value) ÷ life

Diminishing Value Method

It is also referred to as the amount which is deducted every year on the specific rate. It changes every

year.

The formula is:

Depreciation amount = base value * (days held ÷ 365) * (200% ÷ asset's effective life)

2. Go to the ATO website link provided below and source the information for

the current simplified depreciation rules which apply:

https://www.ato.gov.au/business/depreciation-and-capital-expenses-and-allowances/simpler-

depreciation-for-small-business/ (checked on 14 Dec 2020)

Responses

Depreciation occurs for a variety of causes. Office furniture depreciates mostly due to software

degradation, which implies that better gear will rapidly outperform older machines. Industrial

deterioration happens whenever the assets are no longer required leading to a decline of

quantity demanded or service is offered. The depreciation of office furniture is mostly due to the

physical breakdown. Because advancements in technology in office equipment are

considerably slower than those in computing, depreciation plays a little influence. Regularly

used equipment may degenerate as a result of the damage that comes with it.

1. Provide 4 examples of sources for data to enable you to estimate reliable

acquisition costs. What does this need to consider in terms of contractual

obligations and ongoing maintenance?

Responses

1. Staffing required for maintenance

2. Maintenance that is required

3. Service location, for instance, that can be performed off after far from

high-traffic areas

4. Maintenance work is expected to take a certain amount of time

Aspects to consider

The goal of planned maintenance is to maintain the firm working smoothly

in all sectors. A firm must retain a particular standard of hygiene and a

Australian Ideal College

Registered as Australian Ideal College Pty Ltd

RTO No.: 91679 | CRICOS Provider Code: 03053G

Sydney Campus: Level 7 & 8, 75 King Street, Sydney NSW 2000 Australia

Adelaide Campus: Level 3, 21-23 Rundle Mall, Adelaide SA 5000 Australia

Hobart Campus: GRD Floor, 116 Murray Street, Hobart TAS 7000 Australia

T: +61-2-9262 2968 (Sydney) | +61-8-8123 5780 (Adelaide) | +61-3-6231 2141 (Hobart)

E: info@aic.edu.au | W: www.aic.edu.au

Educating for Excellence

1. Explain the methods for calculating the depreciation of assets using each of

the following methods:

Prime cost method

It is also called the straight line method which is utilised for calculating the depreciable amount

on the asset. This method deducts the fixed amount every year till the asset is useful. It

considering the three item while computing the amount which are:

1. Cost price

2. Expected useful life

3. Expected residual value

Annual depreciation amount = (cost - residual value) ÷ life

Diminishing Value Method

It is also referred to as the amount which is deducted every year on the specific rate. It changes every

year.

The formula is:

Depreciation amount = base value * (days held ÷ 365) * (200% ÷ asset's effective life)

2. Go to the ATO website link provided below and source the information for

the current simplified depreciation rules which apply:

https://www.ato.gov.au/business/depreciation-and-capital-expenses-and-allowances/simpler-

depreciation-for-small-business/ (checked on 14 Dec 2020)

Responses

Depreciation occurs for a variety of causes. Office furniture depreciates mostly due to software

degradation, which implies that better gear will rapidly outperform older machines. Industrial

deterioration happens whenever the assets are no longer required leading to a decline of

quantity demanded or service is offered. The depreciation of office furniture is mostly due to the

physical breakdown. Because advancements in technology in office equipment are

considerably slower than those in computing, depreciation plays a little influence. Regularly

used equipment may degenerate as a result of the damage that comes with it.

1. Provide 4 examples of sources for data to enable you to estimate reliable

acquisition costs. What does this need to consider in terms of contractual

obligations and ongoing maintenance?

Responses

1. Staffing required for maintenance

2. Maintenance that is required

3. Service location, for instance, that can be performed off after far from

high-traffic areas

4. Maintenance work is expected to take a certain amount of time

Aspects to consider

The goal of planned maintenance is to maintain the firm working smoothly

in all sectors. A firm must retain a particular standard of hygiene and a

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

AIC- SITXFIN005-AT1-V1.0 Page 10 of 21

Australian Ideal College

Registered as Australian Ideal College Pty Ltd

RTO No.: 91679 | CRICOS Provider Code: 03053G

Sydney Campus: Level 7 & 8, 75 King Street, Sydney NSW 2000 Australia

Adelaide Campus: Level 3, 21-23 Rundle Mall, Adelaide SA 5000 Australia

Hobart Campus: GRD Floor, 116 Murray Street, Hobart TAS 7000 Australia

T: +61-2-9262 2968 (Sydney) | +61-8-8123 5780 (Adelaide) | +61-3-6231 2141 (Hobart)

E: info@aic.edu.au | W: www.aic.edu.au

Educating for Excellence

professional image that visitors demand

It can only be carried out along with the least amount of disturbance to

routine maintenance although with the least amount of annoyance to guests

and workers.

1. List 3 examples for environmental sustainability that applies to physical

assets and outline the environmental and financial benefits as applicable:

Example Environmental and financial benefits

Using the recycled water Maintaining your vehicle on a routine

basis might also reduce pollution.

Take a machine that spills because of

a metal-binding defect

Dropping usage of power electricity This immediately leads to higher

usage of water by the company,

which is harmful to both the

environment and the water bill.

Because periodic inspection is not

performed, the break remains

unaddressed, resulting in a faster-

than-expected asset retirement

Sinking water wastage This has an impact on the

environment because of those

pollutants related to new cleaner's

production, as well as the net profit

Australian Ideal College

Registered as Australian Ideal College Pty Ltd

RTO No.: 91679 | CRICOS Provider Code: 03053G

Sydney Campus: Level 7 & 8, 75 King Street, Sydney NSW 2000 Australia

Adelaide Campus: Level 3, 21-23 Rundle Mall, Adelaide SA 5000 Australia

Hobart Campus: GRD Floor, 116 Murray Street, Hobart TAS 7000 Australia

T: +61-2-9262 2968 (Sydney) | +61-8-8123 5780 (Adelaide) | +61-3-6231 2141 (Hobart)

E: info@aic.edu.au | W: www.aic.edu.au

Educating for Excellence

professional image that visitors demand

It can only be carried out along with the least amount of disturbance to

routine maintenance although with the least amount of annoyance to guests

and workers.

1. List 3 examples for environmental sustainability that applies to physical

assets and outline the environmental and financial benefits as applicable:

Example Environmental and financial benefits

Using the recycled water Maintaining your vehicle on a routine

basis might also reduce pollution.

Take a machine that spills because of

a metal-binding defect

Dropping usage of power electricity This immediately leads to higher

usage of water by the company,

which is harmful to both the

environment and the water bill.

Because periodic inspection is not

performed, the break remains

unaddressed, resulting in a faster-

than-expected asset retirement

Sinking water wastage This has an impact on the

environment because of those

pollutants related to new cleaner's

production, as well as the net profit

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

AIC- SITXFIN005-AT1-V1.0 Page 11 of 21

Australian Ideal College

Registered as Australian Ideal College Pty Ltd

RTO No.: 91679 | CRICOS Provider Code: 03053G

Sydney Campus: Level 7 & 8, 75 King Street, Sydney NSW 2000 Australia

Adelaide Campus: Level 3, 21-23 Rundle Mall, Adelaide SA 5000 Australia

Hobart Campus: GRD Floor, 116 Murray Street, Hobart TAS 7000 Australia

T: +61-2-9262 2968 (Sydney) | +61-8-8123 5780 (Adelaide) | +61-3-6231 2141 (Hobart)

E: info@aic.edu.au | W: www.aic.edu.au

Educating for Excellence

Task 2

Assessment Instructions

This is an individual assessment. There are three parts to this assessment. Please ask your trainer if

you need any information.

To be deemed competent you will need to successfully demonstrate the following:

You must submit:

Resource acquisition plan for 3 different resources

Completed asset register for 3 assets

Resource management strategy

Procedure

Part A

Requires you to develop a resource acquisition plan for the acquisition of 3 different resources from

the following main categories:

buildings

computer systems

equipment fixtures, fittings and furniture in one of the following:

1. accommodation establishments

2. commercial kitchens

3. restaurants and bars

4. storage areas

5. tourism, hospitality and event offices

6. transportation depots

gardens

pools

rides and games

vehicles

vessels

Part B

Requires you to develop an asset register which needs to list the details for the 3 new physical assets

you have determined in Part A. You must include the maintenance requirements and schedule of

maintenance for each asset.

Part C

Requires you to develop a resource management strategy which provides details on how the

efficiency of each asset is monitored

Australian Ideal College

Registered as Australian Ideal College Pty Ltd

RTO No.: 91679 | CRICOS Provider Code: 03053G

Sydney Campus: Level 7 & 8, 75 King Street, Sydney NSW 2000 Australia

Adelaide Campus: Level 3, 21-23 Rundle Mall, Adelaide SA 5000 Australia

Hobart Campus: GRD Floor, 116 Murray Street, Hobart TAS 7000 Australia

T: +61-2-9262 2968 (Sydney) | +61-8-8123 5780 (Adelaide) | +61-3-6231 2141 (Hobart)

E: info@aic.edu.au | W: www.aic.edu.au

Educating for Excellence

Task 2

Assessment Instructions

This is an individual assessment. There are three parts to this assessment. Please ask your trainer if

you need any information.

To be deemed competent you will need to successfully demonstrate the following:

You must submit:

Resource acquisition plan for 3 different resources

Completed asset register for 3 assets

Resource management strategy

Procedure

Part A

Requires you to develop a resource acquisition plan for the acquisition of 3 different resources from

the following main categories:

buildings

computer systems

equipment fixtures, fittings and furniture in one of the following:

1. accommodation establishments

2. commercial kitchens

3. restaurants and bars

4. storage areas

5. tourism, hospitality and event offices

6. transportation depots

gardens

pools

rides and games

vehicles

vessels

Part B

Requires you to develop an asset register which needs to list the details for the 3 new physical assets

you have determined in Part A. You must include the maintenance requirements and schedule of

maintenance for each asset.

Part C

Requires you to develop a resource management strategy which provides details on how the

efficiency of each asset is monitored

AIC- SITXFIN005-AT1-V1.0 Page 12 of 21

Australian Ideal College

Registered as Australian Ideal College Pty Ltd

RTO No.: 91679 | CRICOS Provider Code: 03053G

Sydney Campus: Level 7 & 8, 75 King Street, Sydney NSW 2000 Australia

Adelaide Campus: Level 3, 21-23 Rundle Mall, Adelaide SA 5000 Australia

Hobart Campus: GRD Floor, 116 Murray Street, Hobart TAS 7000 Australia

T: +61-2-9262 2968 (Sydney) | +61-8-8123 5780 (Adelaide) | +61-3-6231 2141 (Hobart)

E: info@aic.edu.au | W: www.aic.edu.au

Educating for Excellence

PART A – Acquisition Plan

Task:

You are required to choose 3 different physical assets, relevant for an organisation in the Tourism,

hospitality or event industries, which may include any of the following:

buildings

computer systems

equipment fixtures, fittings and furniture in one of the following:

1. accommodation establishments

2. commercial kitchens

3. restaurants and bars

4. storage areas

5. tourism, hospitality and event offices

6. transportation depots

gardens

pools

rides and games

vehicles

vessels

1. Provide an overview of the business activities of the organisation relevant to the

physical assets selected.

2. List the purpose of the acquisition or replacement of the physical assets, providing

detailed information what informs the decision to acquire these new assets.

3. Write an overview of specifications for each asset which clearly outline what

requirements each asset needs to fulfil in terms of capacity, performance, size,

location requirements and maximum budget for each or for the overall budget

parameter.

4. Obtain 3 prices or quotes from different suppliers or sources for each asset. Attach the

correspondence and final quote received for each asset to this project.

5. Contact a financial institution and at least 2 different suppliers and obtain information

on 3 different financing options available and costs (attach copies of your

correspondence).

6. Calculate the finance variants offered to you and determine the best options for each

asset. Your options need to include potential factors for depreciation, consideration for

technology changes and financial impacts on the organisation and financial aspects

Australian Ideal College

Registered as Australian Ideal College Pty Ltd

RTO No.: 91679 | CRICOS Provider Code: 03053G

Sydney Campus: Level 7 & 8, 75 King Street, Sydney NSW 2000 Australia

Adelaide Campus: Level 3, 21-23 Rundle Mall, Adelaide SA 5000 Australia

Hobart Campus: GRD Floor, 116 Murray Street, Hobart TAS 7000 Australia

T: +61-2-9262 2968 (Sydney) | +61-8-8123 5780 (Adelaide) | +61-3-6231 2141 (Hobart)

E: info@aic.edu.au | W: www.aic.edu.au

Educating for Excellence

PART A – Acquisition Plan

Task:

You are required to choose 3 different physical assets, relevant for an organisation in the Tourism,

hospitality or event industries, which may include any of the following:

buildings

computer systems

equipment fixtures, fittings and furniture in one of the following:

1. accommodation establishments

2. commercial kitchens

3. restaurants and bars

4. storage areas

5. tourism, hospitality and event offices

6. transportation depots

gardens

pools

rides and games

vehicles

vessels

1. Provide an overview of the business activities of the organisation relevant to the

physical assets selected.

2. List the purpose of the acquisition or replacement of the physical assets, providing

detailed information what informs the decision to acquire these new assets.

3. Write an overview of specifications for each asset which clearly outline what

requirements each asset needs to fulfil in terms of capacity, performance, size,

location requirements and maximum budget for each or for the overall budget

parameter.

4. Obtain 3 prices or quotes from different suppliers or sources for each asset. Attach the

correspondence and final quote received for each asset to this project.

5. Contact a financial institution and at least 2 different suppliers and obtain information

on 3 different financing options available and costs (attach copies of your

correspondence).

6. Calculate the finance variants offered to you and determine the best options for each

asset. Your options need to include potential factors for depreciation, consideration for

technology changes and financial impacts on the organisation and financial aspects

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 21

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.