Comprehensive Financial Performance Evaluation: Air New Zealand

VerifiedAdded on 2023/06/13

|40

|7049

|282

Report

AI Summary

This report provides a comprehensive financial performance analysis of Air New Zealand Company, examining its current situation, strategic posture, internal environment, and key financial ratios from 2013 to 2017. It assesses liquidity, profitability, efficiency, and solvency using metrics like current ratio, quick ratio, net profit margin, return on equity, receivable turnover, creditor's turnover, asset turnover, debt to equity ratio, and gearing ratio. The analysis includes a SWOT analysis, IFAS and EFAS tables, and recommendations for strategic alternatives. The report concludes that Air New Zealand has generally improved its profitability and efficiency but needs to carefully manage its debt levels and receivable turnover to optimize financial performance. The document includes financial statements and ratio calculations to support its findings.

RUNNING HEAD: Financial Performance of Air New Zealand Company 1 | P a g e

Name of the student

Topic- Financial Performance of Air New Zealand Company

University Name-

Name of the student

Topic- Financial Performance of Air New Zealand Company

University Name-

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Financial Performance of Air New Zealand Company 2 | P a g e

Table of Contents

Table of Contents........................................................................................................................................2

Introduction.................................................................................................................................................3

Description of the Company....................................................................................................................3

Current situation of the Air New Zealand Company...................................................................................3

Strategic posture of the Air New Zealand Company...............................................................................4

Internal environment: Strength and Weakness of Air New Zealand Company........................................5

Summary of Internal Factors.....................................................................................................................11

Top Management of the Air New Zealand Company................................................................................16

ANALYSIS OF STRATEGIC FACTORS (SWOT).................................................................................17

STRATEGIC ALTERNATIVES & RECOMMENDED STRATEGY.....................................................19

References.................................................................................................................................................20

Exhibit.......................................................................................................................................................23

EFAS Table for Air New Zealand Company 2017....................................................................................23

IFAS Table for (name of Corporation) 2016.....................................................................................24

TOWS Matrix....................................................................................................................................27

Financial Ratio Analysis for (name of Corporation) 2014, 2015, and 2016 Years.............................28

Board of Directors Table for (name of Corporation) 2017.................................................................30

Top Management Table for (Air New Zealand) 2017........................................................................31

Appendix-2................................................................................................................................................33

Income statement of Air New Zealand Company......................................................................................33

Table of Contents

Table of Contents........................................................................................................................................2

Introduction.................................................................................................................................................3

Description of the Company....................................................................................................................3

Current situation of the Air New Zealand Company...................................................................................3

Strategic posture of the Air New Zealand Company...............................................................................4

Internal environment: Strength and Weakness of Air New Zealand Company........................................5

Summary of Internal Factors.....................................................................................................................11

Top Management of the Air New Zealand Company................................................................................16

ANALYSIS OF STRATEGIC FACTORS (SWOT).................................................................................17

STRATEGIC ALTERNATIVES & RECOMMENDED STRATEGY.....................................................19

References.................................................................................................................................................20

Exhibit.......................................................................................................................................................23

EFAS Table for Air New Zealand Company 2017....................................................................................23

IFAS Table for (name of Corporation) 2016.....................................................................................24

TOWS Matrix....................................................................................................................................27

Financial Ratio Analysis for (name of Corporation) 2014, 2015, and 2016 Years.............................28

Board of Directors Table for (name of Corporation) 2017.................................................................30

Top Management Table for (Air New Zealand) 2017........................................................................31

Appendix-2................................................................................................................................................33

Income statement of Air New Zealand Company......................................................................................33

Financial Performance of Air New Zealand Company 3 | P a g e

Introduction

With the ramified economic changes and complex business structure of the organization,

each and every organization needs to take effective financial business decision making. There are

several financial tools which could be gauged by the business organizations to make effective

financial decisions with a view to increasing the overall return on capital employed. In this

report, the financial performance of the Air New Zealand Company has been taken into

consideration. This report reflects the key financial performance and effective business

functioning of Air New Zealand Company.

Description of the Company

Air New Zealand Limited is the flag carrier airline of New Zealand Company based in

Auckland, the airline operates scheduled passenger flights to more than 30 domestics and 31

international destinations in 19th countries around the Pacific Rim and the United Kingdom.

This company was incorporated under the corporation act of New Zealand.

Air New Zealand has been providing its air and cargo services in the Airline industry of

New Zealand and other countries as well (Air New Zealand, 2017).

This company was founded in 1940 and managed by New Zealand government agency to

start up new airline business

Current situation of the Air New Zealand Company

After analyzing the financial performance of Air New Zealand Company, it is observed that

management of the company is planning to expand its business by entering into strategic alliance

with other organization. It is the group of airlines that offer international and domestic

passengers and cargo transportation services. The company aims to become the number one

airline company by serving district airline services for the best support of the customers. The

existing value chain activities of the company are divided into two main parts such as inbound

activities and outbound activities (Yahoo Finance, 2017).

Introduction

With the ramified economic changes and complex business structure of the organization,

each and every organization needs to take effective financial business decision making. There are

several financial tools which could be gauged by the business organizations to make effective

financial decisions with a view to increasing the overall return on capital employed. In this

report, the financial performance of the Air New Zealand Company has been taken into

consideration. This report reflects the key financial performance and effective business

functioning of Air New Zealand Company.

Description of the Company

Air New Zealand Limited is the flag carrier airline of New Zealand Company based in

Auckland, the airline operates scheduled passenger flights to more than 30 domestics and 31

international destinations in 19th countries around the Pacific Rim and the United Kingdom.

This company was incorporated under the corporation act of New Zealand.

Air New Zealand has been providing its air and cargo services in the Airline industry of

New Zealand and other countries as well (Air New Zealand, 2017).

This company was founded in 1940 and managed by New Zealand government agency to

start up new airline business

Current situation of the Air New Zealand Company

After analyzing the financial performance of Air New Zealand Company, it is observed that

management of the company is planning to expand its business by entering into strategic alliance

with other organization. It is the group of airlines that offer international and domestic

passengers and cargo transportation services. The company aims to become the number one

airline company by serving district airline services for the best support of the customers. The

existing value chain activities of the company are divided into two main parts such as inbound

activities and outbound activities (Yahoo Finance, 2017).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Financial Performance of Air New Zealand Company 4 | P a g e

Current performance of Air New Zealand Company

The stock price of the company is NZ$ 3.38 -0.04 (-1.03%) which reflects that company

has reduced its market value by 1.03% since last one year. The key person of the company is

Christopher Luxon, CEO. The total revenue of the company is NZ$5,231 million (2016) which is

20% higher as compared to last five year annual data. In addition to this, the overall profit of the

company is NZ$463 million (2016 which shows that company has created strong value and

return on profit (Duchin and Sosyura, 2014).

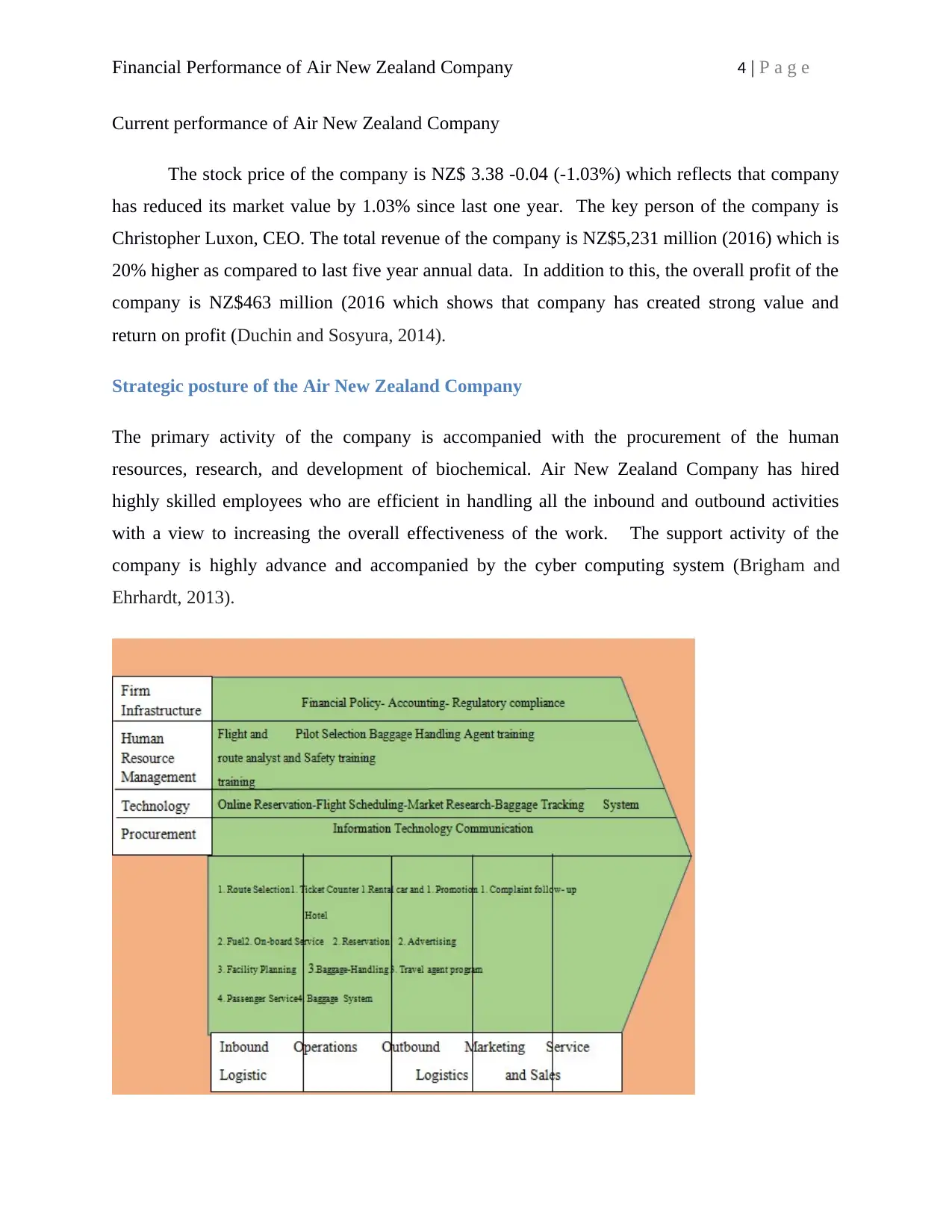

Strategic posture of the Air New Zealand Company

The primary activity of the company is accompanied with the procurement of the human

resources, research, and development of biochemical. Air New Zealand Company has hired

highly skilled employees who are efficient in handling all the inbound and outbound activities

with a view to increasing the overall effectiveness of the work. The support activity of the

company is highly advance and accompanied by the cyber computing system (Brigham and

Ehrhardt, 2013).

Current performance of Air New Zealand Company

The stock price of the company is NZ$ 3.38 -0.04 (-1.03%) which reflects that company

has reduced its market value by 1.03% since last one year. The key person of the company is

Christopher Luxon, CEO. The total revenue of the company is NZ$5,231 million (2016) which is

20% higher as compared to last five year annual data. In addition to this, the overall profit of the

company is NZ$463 million (2016 which shows that company has created strong value and

return on profit (Duchin and Sosyura, 2014).

Strategic posture of the Air New Zealand Company

The primary activity of the company is accompanied with the procurement of the human

resources, research, and development of biochemical. Air New Zealand Company has hired

highly skilled employees who are efficient in handling all the inbound and outbound activities

with a view to increasing the overall effectiveness of the work. The support activity of the

company is highly advance and accompanied by the cyber computing system (Brigham and

Ehrhardt, 2013).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Financial Performance of Air New Zealand Company 5 | P a g e

Internal environment: Strength and Weakness of Air New Zealand Company

Internal environment ‘analysis of New Zealand Company

The current performance of Air New Zealand Company could be analyzed on the basis of

financial performance of the company. After analyzing the annual report and financial statement

of the company, it is observed that company has increased its overall return on capital employed

by the company (Baños-Caballero, et al. 2014).

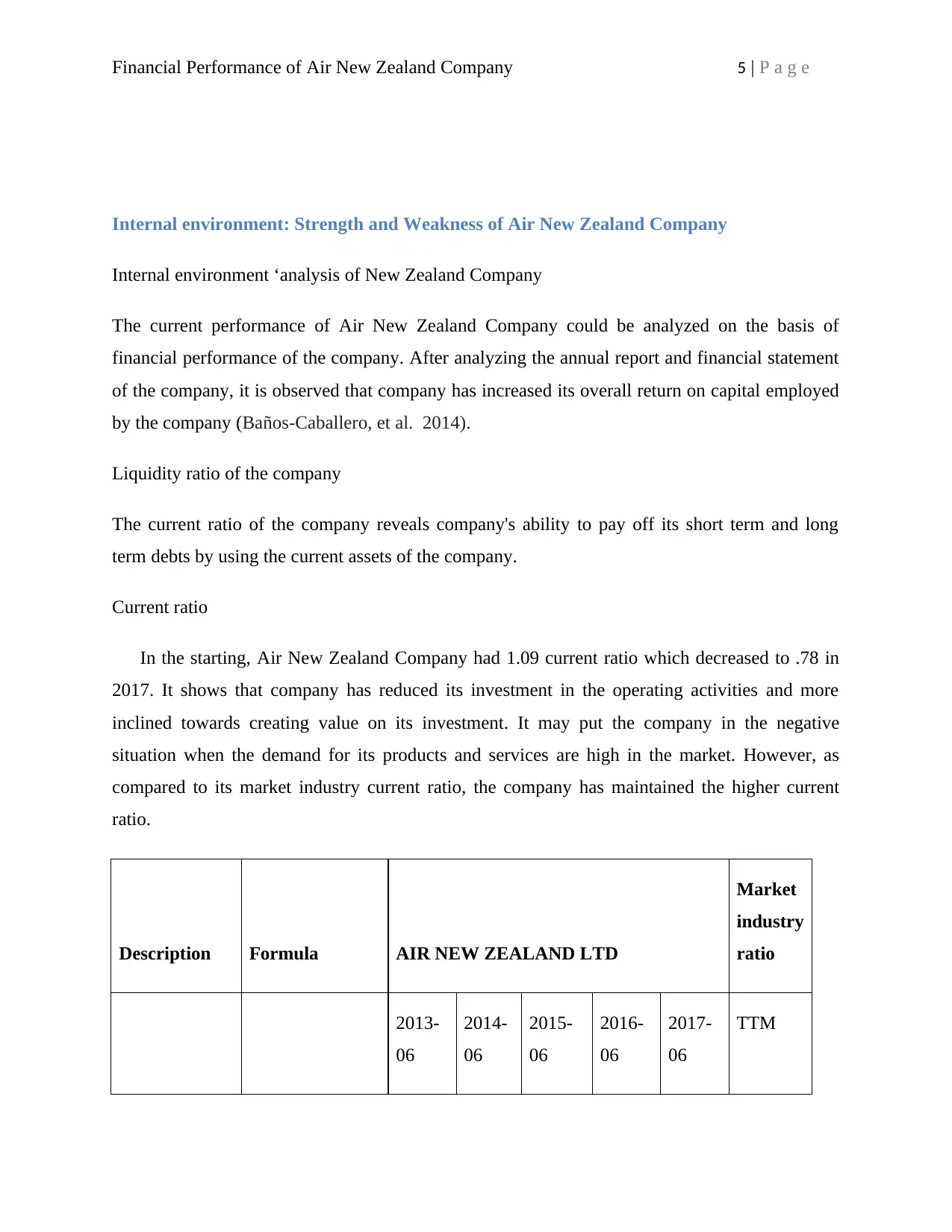

Liquidity ratio of the company

The current ratio of the company reveals company's ability to pay off its short term and long

term debts by using the current assets of the company.

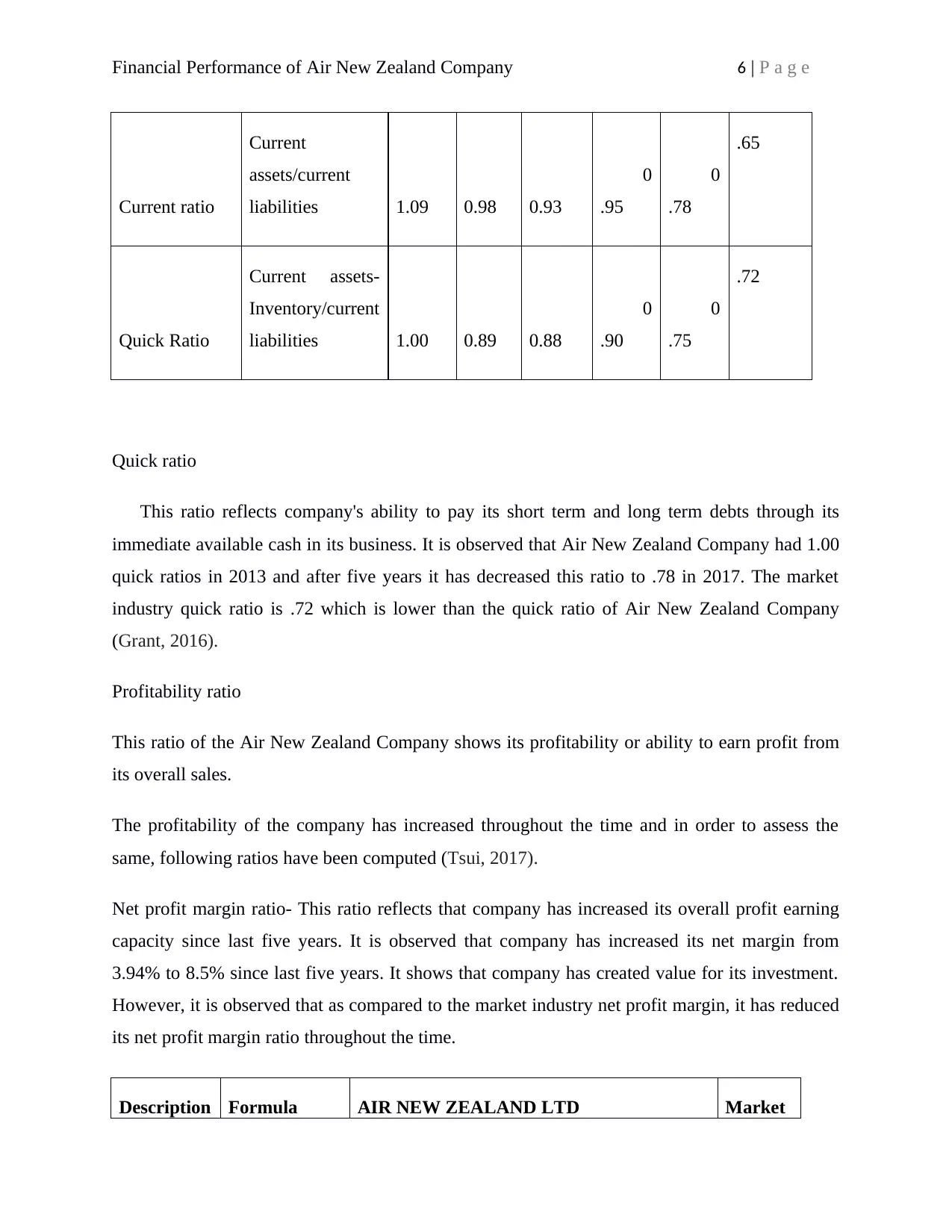

Current ratio

In the starting, Air New Zealand Company had 1.09 current ratio which decreased to .78 in

2017. It shows that company has reduced its investment in the operating activities and more

inclined towards creating value on its investment. It may put the company in the negative

situation when the demand for its products and services are high in the market. However, as

compared to its market industry current ratio, the company has maintained the higher current

ratio.

Description Formula AIR NEW ZEALAND LTD

Market

industry

ratio

2013-

06

2014-

06

2015-

06

2016-

06

2017-

06

TTM

Internal environment: Strength and Weakness of Air New Zealand Company

Internal environment ‘analysis of New Zealand Company

The current performance of Air New Zealand Company could be analyzed on the basis of

financial performance of the company. After analyzing the annual report and financial statement

of the company, it is observed that company has increased its overall return on capital employed

by the company (Baños-Caballero, et al. 2014).

Liquidity ratio of the company

The current ratio of the company reveals company's ability to pay off its short term and long

term debts by using the current assets of the company.

Current ratio

In the starting, Air New Zealand Company had 1.09 current ratio which decreased to .78 in

2017. It shows that company has reduced its investment in the operating activities and more

inclined towards creating value on its investment. It may put the company in the negative

situation when the demand for its products and services are high in the market. However, as

compared to its market industry current ratio, the company has maintained the higher current

ratio.

Description Formula AIR NEW ZEALAND LTD

Market

industry

ratio

2013-

06

2014-

06

2015-

06

2016-

06

2017-

06

TTM

Financial Performance of Air New Zealand Company 6 | P a g e

Current ratio

Current

assets/current

liabilities 1.09 0.98 0.93

0

.95

0

.78

.65

Quick Ratio

Current assets-

Inventory/current

liabilities 1.00 0.89 0.88

0

.90

0

.75

.72

Quick ratio

This ratio reflects company's ability to pay its short term and long term debts through its

immediate available cash in its business. It is observed that Air New Zealand Company had 1.00

quick ratios in 2013 and after five years it has decreased this ratio to .78 in 2017. The market

industry quick ratio is .72 which is lower than the quick ratio of Air New Zealand Company

(Grant, 2016).

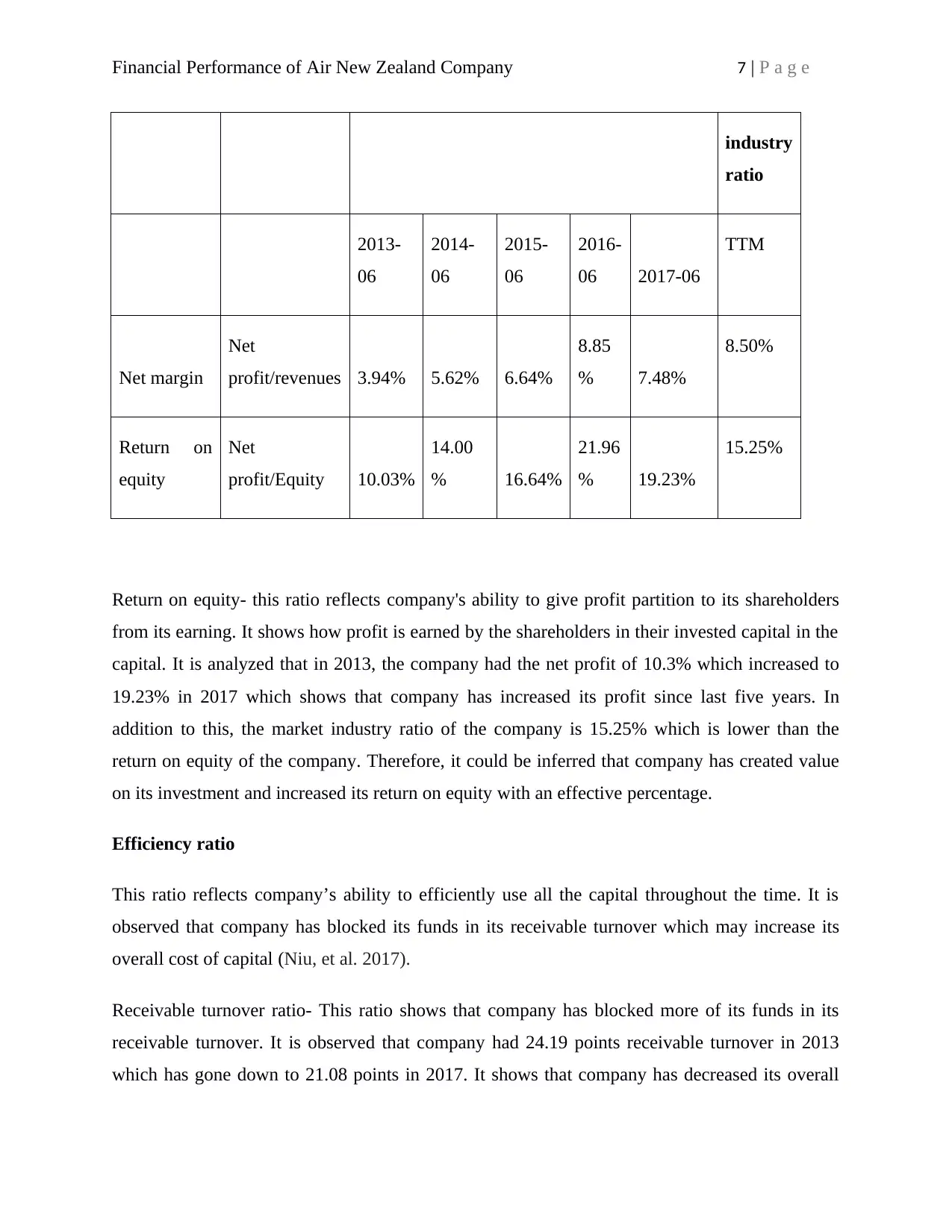

Profitability ratio

This ratio of the Air New Zealand Company shows its profitability or ability to earn profit from

its overall sales.

The profitability of the company has increased throughout the time and in order to assess the

same, following ratios have been computed (Tsui, 2017).

Net profit margin ratio- This ratio reflects that company has increased its overall profit earning

capacity since last five years. It is observed that company has increased its net margin from

3.94% to 8.5% since last five years. It shows that company has created value for its investment.

However, it is observed that as compared to the market industry net profit margin, it has reduced

its net profit margin ratio throughout the time.

Description Formula AIR NEW ZEALAND LTD Market

Current ratio

Current

assets/current

liabilities 1.09 0.98 0.93

0

.95

0

.78

.65

Quick Ratio

Current assets-

Inventory/current

liabilities 1.00 0.89 0.88

0

.90

0

.75

.72

Quick ratio

This ratio reflects company's ability to pay its short term and long term debts through its

immediate available cash in its business. It is observed that Air New Zealand Company had 1.00

quick ratios in 2013 and after five years it has decreased this ratio to .78 in 2017. The market

industry quick ratio is .72 which is lower than the quick ratio of Air New Zealand Company

(Grant, 2016).

Profitability ratio

This ratio of the Air New Zealand Company shows its profitability or ability to earn profit from

its overall sales.

The profitability of the company has increased throughout the time and in order to assess the

same, following ratios have been computed (Tsui, 2017).

Net profit margin ratio- This ratio reflects that company has increased its overall profit earning

capacity since last five years. It is observed that company has increased its net margin from

3.94% to 8.5% since last five years. It shows that company has created value for its investment.

However, it is observed that as compared to the market industry net profit margin, it has reduced

its net profit margin ratio throughout the time.

Description Formula AIR NEW ZEALAND LTD Market

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Financial Performance of Air New Zealand Company 7 | P a g e

industry

ratio

2013-

06

2014-

06

2015-

06

2016-

06 2017-06

TTM

Net margin

Net

profit/revenues 3.94% 5.62% 6.64%

8.85

% 7.48%

8.50%

Return on

equity

Net

profit/Equity 10.03%

14.00

% 16.64%

21.96

% 19.23%

15.25%

Return on equity- this ratio reflects company's ability to give profit partition to its shareholders

from its earning. It shows how profit is earned by the shareholders in their invested capital in the

capital. It is analyzed that in 2013, the company had the net profit of 10.3% which increased to

19.23% in 2017 which shows that company has increased its profit since last five years. In

addition to this, the market industry ratio of the company is 15.25% which is lower than the

return on equity of the company. Therefore, it could be inferred that company has created value

on its investment and increased its return on equity with an effective percentage.

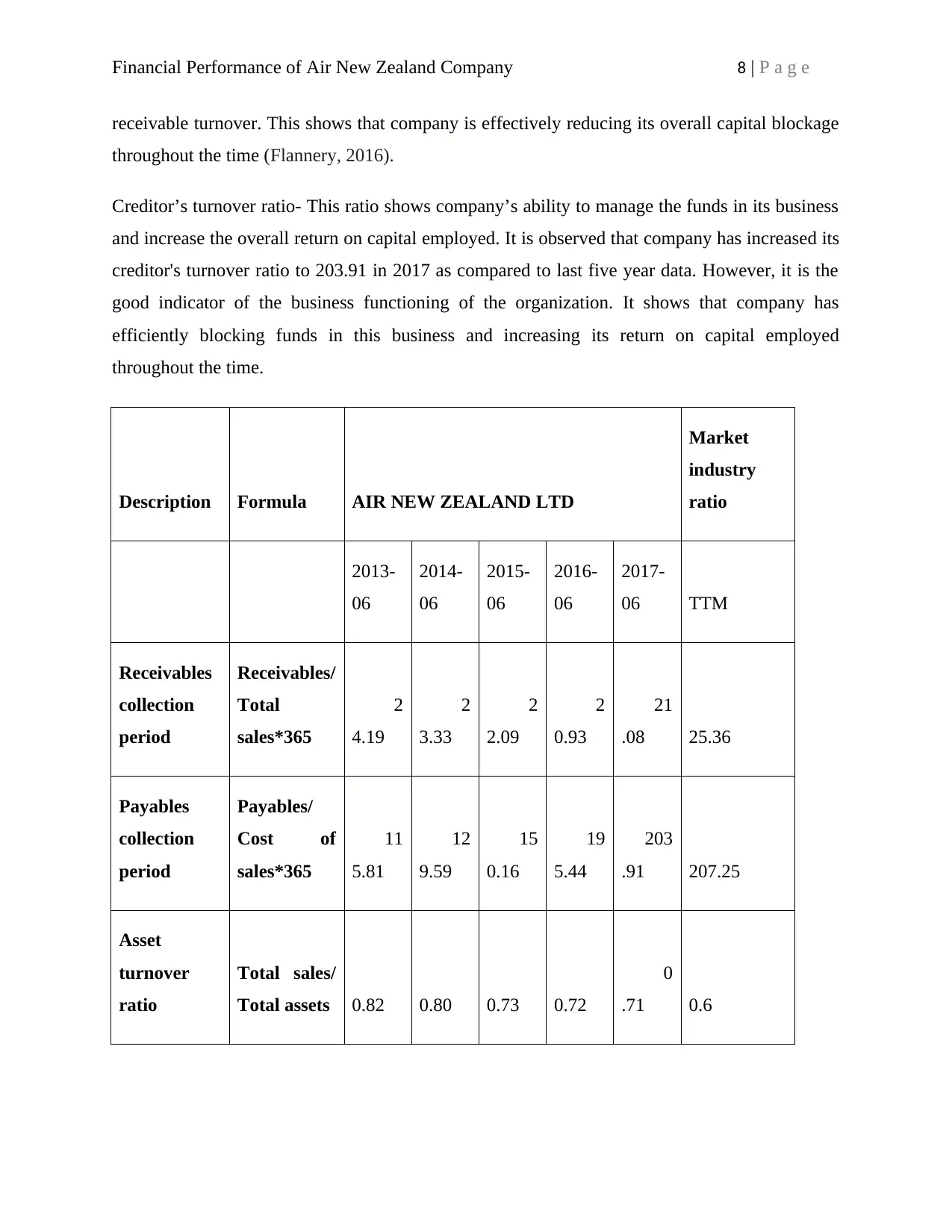

Efficiency ratio

This ratio reflects company’s ability to efficiently use all the capital throughout the time. It is

observed that company has blocked its funds in its receivable turnover which may increase its

overall cost of capital (Niu, et al. 2017).

Receivable turnover ratio- This ratio shows that company has blocked more of its funds in its

receivable turnover. It is observed that company had 24.19 points receivable turnover in 2013

which has gone down to 21.08 points in 2017. It shows that company has decreased its overall

industry

ratio

2013-

06

2014-

06

2015-

06

2016-

06 2017-06

TTM

Net margin

Net

profit/revenues 3.94% 5.62% 6.64%

8.85

% 7.48%

8.50%

Return on

equity

Net

profit/Equity 10.03%

14.00

% 16.64%

21.96

% 19.23%

15.25%

Return on equity- this ratio reflects company's ability to give profit partition to its shareholders

from its earning. It shows how profit is earned by the shareholders in their invested capital in the

capital. It is analyzed that in 2013, the company had the net profit of 10.3% which increased to

19.23% in 2017 which shows that company has increased its profit since last five years. In

addition to this, the market industry ratio of the company is 15.25% which is lower than the

return on equity of the company. Therefore, it could be inferred that company has created value

on its investment and increased its return on equity with an effective percentage.

Efficiency ratio

This ratio reflects company’s ability to efficiently use all the capital throughout the time. It is

observed that company has blocked its funds in its receivable turnover which may increase its

overall cost of capital (Niu, et al. 2017).

Receivable turnover ratio- This ratio shows that company has blocked more of its funds in its

receivable turnover. It is observed that company had 24.19 points receivable turnover in 2013

which has gone down to 21.08 points in 2017. It shows that company has decreased its overall

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Financial Performance of Air New Zealand Company 8 | P a g e

receivable turnover. This shows that company is effectively reducing its overall capital blockage

throughout the time (Flannery, 2016).

Creditor’s turnover ratio- This ratio shows company’s ability to manage the funds in its business

and increase the overall return on capital employed. It is observed that company has increased its

creditor's turnover ratio to 203.91 in 2017 as compared to last five year data. However, it is the

good indicator of the business functioning of the organization. It shows that company has

efficiently blocking funds in this business and increasing its return on capital employed

throughout the time.

Description Formula AIR NEW ZEALAND LTD

Market

industry

ratio

2013-

06

2014-

06

2015-

06

2016-

06

2017-

06 TTM

Receivables

collection

period

Receivables/

Total

sales*365

2

4.19

2

3.33

2

2.09

2

0.93

21

.08 25.36

Payables

collection

period

Payables/

Cost of

sales*365

11

5.81

12

9.59

15

0.16

19

5.44

203

.91 207.25

Asset

turnover

ratio

Total sales/

Total assets 0.82 0.80 0.73 0.72

0

.71 0.6

receivable turnover. This shows that company is effectively reducing its overall capital blockage

throughout the time (Flannery, 2016).

Creditor’s turnover ratio- This ratio shows company’s ability to manage the funds in its business

and increase the overall return on capital employed. It is observed that company has increased its

creditor's turnover ratio to 203.91 in 2017 as compared to last five year data. However, it is the

good indicator of the business functioning of the organization. It shows that company has

efficiently blocking funds in this business and increasing its return on capital employed

throughout the time.

Description Formula AIR NEW ZEALAND LTD

Market

industry

ratio

2013-

06

2014-

06

2015-

06

2016-

06

2017-

06 TTM

Receivables

collection

period

Receivables/

Total

sales*365

2

4.19

2

3.33

2

2.09

2

0.93

21

.08 25.36

Payables

collection

period

Payables/

Cost of

sales*365

11

5.81

12

9.59

15

0.16

19

5.44

203

.91 207.25

Asset

turnover

ratio

Total sales/

Total assets 0.82 0.80 0.73 0.72

0

.71 0.6

Financial Performance of Air New Zealand Company 9 | P a g e

Assets turnover ratio- This ratio shows company’s ability to deploy its overall sales to create

value. It is observed that company has increased its assets turnover ratio by increasing its overall

creditors throughout the time. The assets turnover of the market industry is .6 which is lower

than the data shown by the Air New Zealand Company. Therefore, it is inferred that company

has maintained an effective assets turnover ratio.

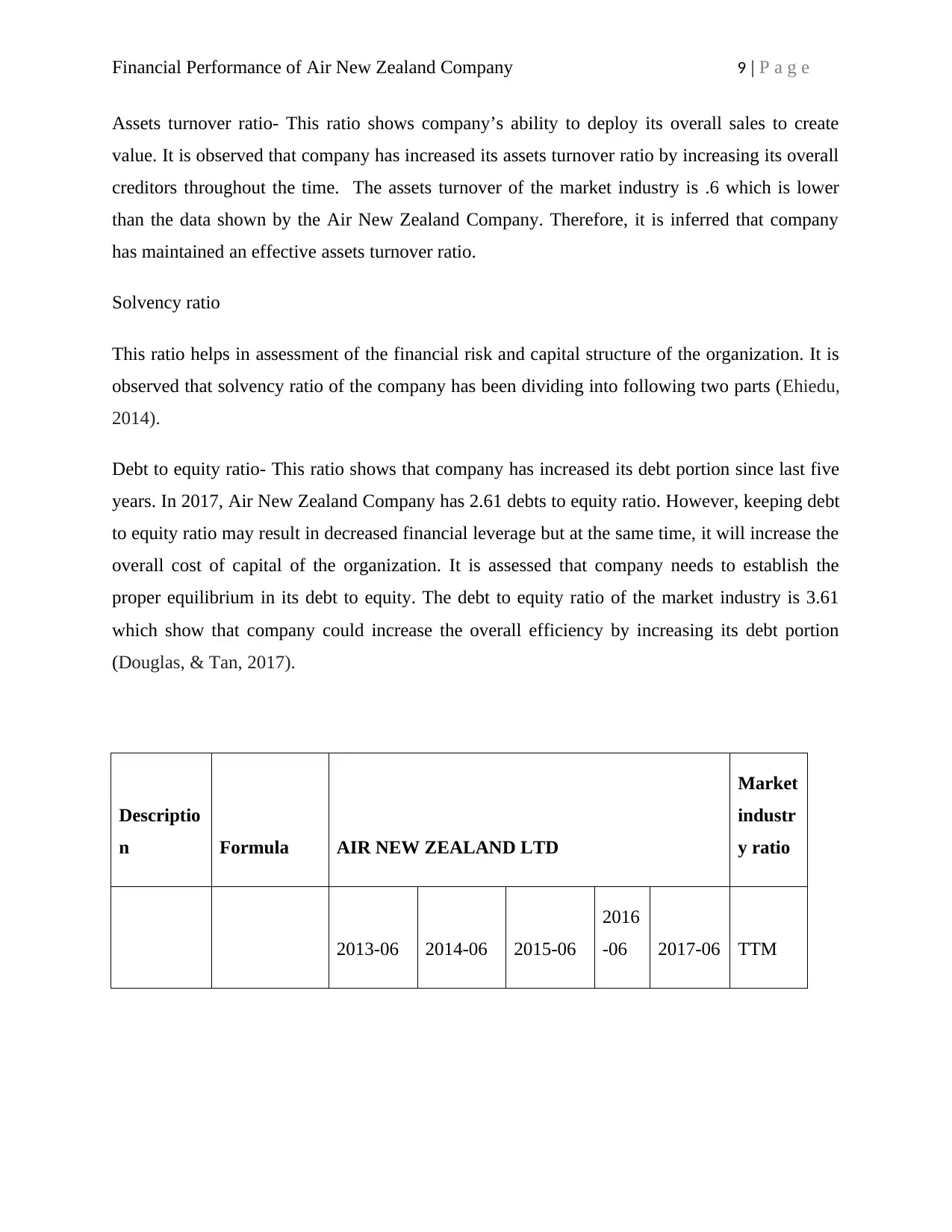

Solvency ratio

This ratio helps in assessment of the financial risk and capital structure of the organization. It is

observed that solvency ratio of the company has been dividing into following two parts (Ehiedu,

2014).

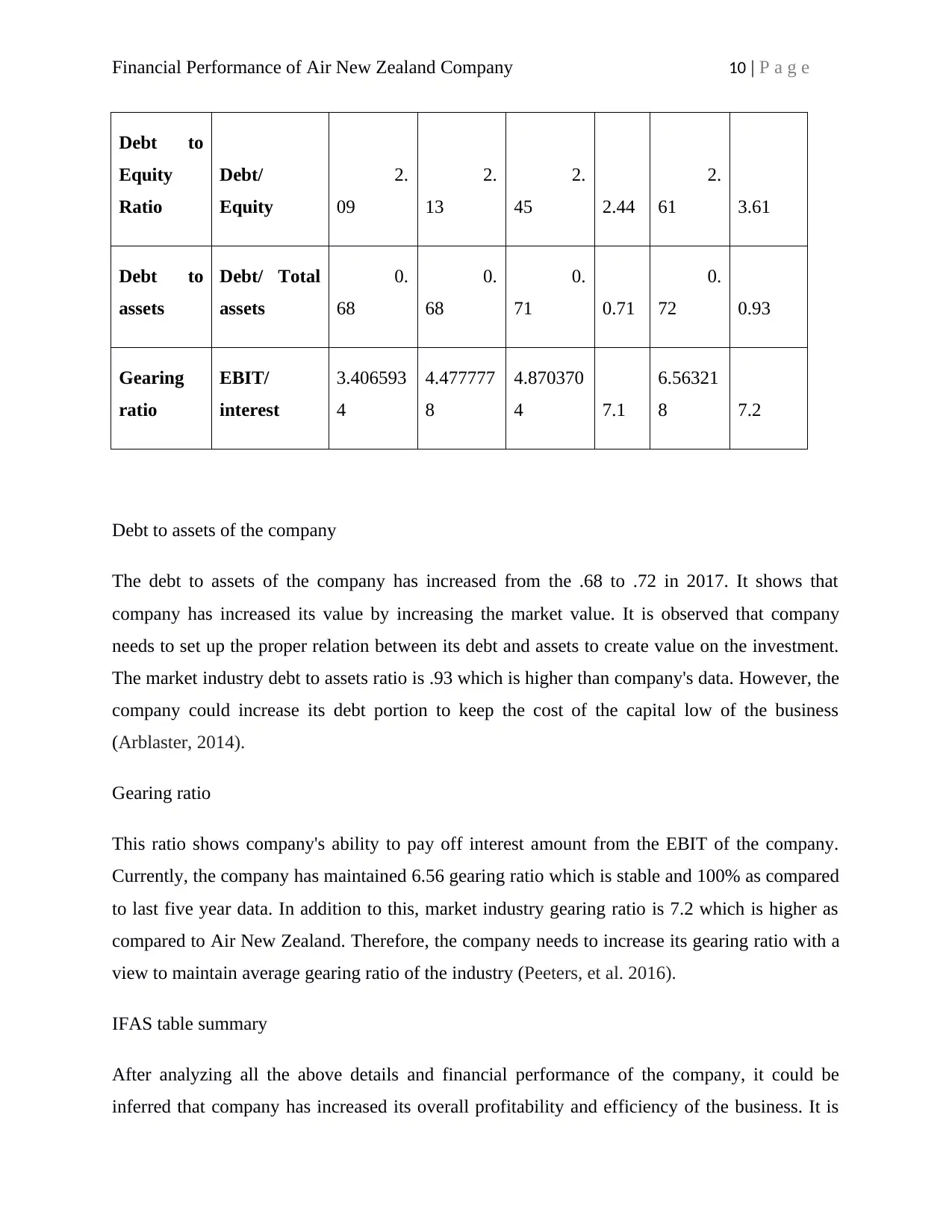

Debt to equity ratio- This ratio shows that company has increased its debt portion since last five

years. In 2017, Air New Zealand Company has 2.61 debts to equity ratio. However, keeping debt

to equity ratio may result in decreased financial leverage but at the same time, it will increase the

overall cost of capital of the organization. It is assessed that company needs to establish the

proper equilibrium in its debt to equity. The debt to equity ratio of the market industry is 3.61

which show that company could increase the overall efficiency by increasing its debt portion

(Douglas, & Tan, 2017).

Descriptio

n Formula AIR NEW ZEALAND LTD

Market

industr

y ratio

2013-06 2014-06 2015-06

2016

-06 2017-06 TTM

Assets turnover ratio- This ratio shows company’s ability to deploy its overall sales to create

value. It is observed that company has increased its assets turnover ratio by increasing its overall

creditors throughout the time. The assets turnover of the market industry is .6 which is lower

than the data shown by the Air New Zealand Company. Therefore, it is inferred that company

has maintained an effective assets turnover ratio.

Solvency ratio

This ratio helps in assessment of the financial risk and capital structure of the organization. It is

observed that solvency ratio of the company has been dividing into following two parts (Ehiedu,

2014).

Debt to equity ratio- This ratio shows that company has increased its debt portion since last five

years. In 2017, Air New Zealand Company has 2.61 debts to equity ratio. However, keeping debt

to equity ratio may result in decreased financial leverage but at the same time, it will increase the

overall cost of capital of the organization. It is assessed that company needs to establish the

proper equilibrium in its debt to equity. The debt to equity ratio of the market industry is 3.61

which show that company could increase the overall efficiency by increasing its debt portion

(Douglas, & Tan, 2017).

Descriptio

n Formula AIR NEW ZEALAND LTD

Market

industr

y ratio

2013-06 2014-06 2015-06

2016

-06 2017-06 TTM

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Financial Performance of Air New Zealand Company 10 | P a g e

Debt to

Equity

Ratio

Debt/

Equity

2.

09

2.

13

2.

45 2.44

2.

61 3.61

Debt to

assets

Debt/ Total

assets

0.

68

0.

68

0.

71 0.71

0.

72 0.93

Gearing

ratio

EBIT/

interest

3.406593

4

4.477777

8

4.870370

4 7.1

6.56321

8 7.2

Debt to assets of the company

The debt to assets of the company has increased from the .68 to .72 in 2017. It shows that

company has increased its value by increasing the market value. It is observed that company

needs to set up the proper relation between its debt and assets to create value on the investment.

The market industry debt to assets ratio is .93 which is higher than company's data. However, the

company could increase its debt portion to keep the cost of the capital low of the business

(Arblaster, 2014).

Gearing ratio

This ratio shows company's ability to pay off interest amount from the EBIT of the company.

Currently, the company has maintained 6.56 gearing ratio which is stable and 100% as compared

to last five year data. In addition to this, market industry gearing ratio is 7.2 which is higher as

compared to Air New Zealand. Therefore, the company needs to increase its gearing ratio with a

view to maintain average gearing ratio of the industry (Peeters, et al. 2016).

IFAS table summary

After analyzing all the above details and financial performance of the company, it could be

inferred that company has increased its overall profitability and efficiency of the business. It is

Debt to

Equity

Ratio

Debt/

Equity

2.

09

2.

13

2.

45 2.44

2.

61 3.61

Debt to

assets

Debt/ Total

assets

0.

68

0.

68

0.

71 0.71

0.

72 0.93

Gearing

ratio

EBIT/

interest

3.406593

4

4.477777

8

4.870370

4 7.1

6.56321

8 7.2

Debt to assets of the company

The debt to assets of the company has increased from the .68 to .72 in 2017. It shows that

company has increased its value by increasing the market value. It is observed that company

needs to set up the proper relation between its debt and assets to create value on the investment.

The market industry debt to assets ratio is .93 which is higher than company's data. However, the

company could increase its debt portion to keep the cost of the capital low of the business

(Arblaster, 2014).

Gearing ratio

This ratio shows company's ability to pay off interest amount from the EBIT of the company.

Currently, the company has maintained 6.56 gearing ratio which is stable and 100% as compared

to last five year data. In addition to this, market industry gearing ratio is 7.2 which is higher as

compared to Air New Zealand. Therefore, the company needs to increase its gearing ratio with a

view to maintain average gearing ratio of the industry (Peeters, et al. 2016).

IFAS table summary

After analyzing all the above details and financial performance of the company, it could be

inferred that company has increased its overall profitability and efficiency of the business. It is

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Financial Performance of Air New Zealand Company 11 | P a g e

assessed that company has efficiently used its capital and blocked less amount of funds in its

business. It is revealed that company has a low financial risk in its business. If it wants to lower

down its cost of capital of the business then the same could be easily done by the management of

the company by increasing the debt portion (White, Sondh, and Fried, 2015).

Corporate culture

The corporate culture of the Air New Zealand Company is highly advance and all the employees

of the company need to follow standards work policies and rules. It is observed that company has

installed advanced system and technologies in its business with a view to set up new automation

in the work system of the organization. The corporate culture of the company is highly open and

employees oriented which is designed with a view to promote the employees and set up nexus

between employee’s growth and organization development (Brown, 2016).

Corporate resources

This ratio analysis helps in assessment of the financial performance of the company by

establishing the relation between the two factors. It is observed that company has increased its

profitability and overall turnover since last five year which is the positive indicator of the

effective business functioning of the organization. However, with the changes in time, the

company has increased its debt portion with a view to reducing the cost of capital of the business

and ultimately it has resulted to increase in the financial risk of the organization. The total

resources of the company are NZ $ 7,251.00 million which shows that company has a strong

financial position (Vibart, et al. 2015).

Summary of Internal Factors

This internal factor analysis summary assists in evaluating the strength, weakness,

opportunity, and threats of the organization. It is observed that company has strong research and

development department which is indulged in identifying the proper development of the

business. The strong management team of the Air New Zealand accompanied or accustomed to

act as per the directions and instruction of the Christopher Luxon, CEO is also making efforts to

assessed that company has efficiently used its capital and blocked less amount of funds in its

business. It is revealed that company has a low financial risk in its business. If it wants to lower

down its cost of capital of the business then the same could be easily done by the management of

the company by increasing the debt portion (White, Sondh, and Fried, 2015).

Corporate culture

The corporate culture of the Air New Zealand Company is highly advance and all the employees

of the company need to follow standards work policies and rules. It is observed that company has

installed advanced system and technologies in its business with a view to set up new automation

in the work system of the organization. The corporate culture of the company is highly open and

employees oriented which is designed with a view to promote the employees and set up nexus

between employee’s growth and organization development (Brown, 2016).

Corporate resources

This ratio analysis helps in assessment of the financial performance of the company by

establishing the relation between the two factors. It is observed that company has increased its

profitability and overall turnover since last five year which is the positive indicator of the

effective business functioning of the organization. However, with the changes in time, the

company has increased its debt portion with a view to reducing the cost of capital of the business

and ultimately it has resulted to increase in the financial risk of the organization. The total

resources of the company are NZ $ 7,251.00 million which shows that company has a strong

financial position (Vibart, et al. 2015).

Summary of Internal Factors

This internal factor analysis summary assists in evaluating the strength, weakness,

opportunity, and threats of the organization. It is observed that company has strong research and

development department which is indulged in identifying the proper development of the

business. The strong management team of the Air New Zealand accompanied or accustomed to

act as per the directions and instruction of the Christopher Luxon, CEO is also making efforts to

Financial Performance of Air New Zealand Company 12 | P a g e

implement the strategic plan. The team of Air New Zealand has consistently increased its overall

turnover by attracting more clients through its high discounts and offers. The total revenue of the

company is NZ$5,231 million (2016) which is 20% higher as compared to last five year annual

data. In New Zealand, Air New Zealand has set up its business on an international level by

customizing its air services to local and international clients (Weygandt, Kimmel, and Kieso,

2015).

implement the strategic plan. The team of Air New Zealand has consistently increased its overall

turnover by attracting more clients through its high discounts and offers. The total revenue of the

company is NZ$5,231 million (2016) which is 20% higher as compared to last five year annual

data. In New Zealand, Air New Zealand has set up its business on an international level by

customizing its air services to local and international clients (Weygandt, Kimmel, and Kieso,

2015).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 40

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.