Management Accounting Report: Airdri Ltd. Financial Analysis

VerifiedAdded on 2021/02/19

|20

|5346

|45

Report

AI Summary

This report provides a detailed analysis of management accounting practices within Airdri Ltd., a company specializing in the manufacturing of warm air hand dryers. The report begins with an introduction to management accounting and its significance in decision-making, followed by an examination of various management accounting systems employed by Airdri Ltd., including cost accounting, price optimization, job costing, and inventory management. It also explores the benefits of these systems. The report then delves into management reporting systems, such as performance reports, budget reports, cost reports, and aging reports, highlighting their usefulness. Furthermore, the report discusses different costing methods, specifically marginal and absorption costing, and their application in calculating net profitability. It also covers budgetary control tools, their advantages, and disadvantages. Finally, the report examines how Airdri Ltd. utilizes management accounting systems to address financial problems, emphasizing how these systems can lead to sustainable success. The report concludes with a summary of the key findings and a list of references.

Management

Accounting

Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

P1: Various management accounting systems along with its requirements within an

organisation..................................................................................................................................1

P2: Various management reporting system along with its benefits to an organisation...............2

M1. Evaluation of benefits of various management accounting systems....................................4

D1 Management accounting system and management accounting reporting are integrated with

organisation process.....................................................................................................................4

TASK 2............................................................................................................................................5

P3: Different costing methods and its use to calculate net profitability......................................5

M2: Management accounting techniques and financial reporting documents............................9

D2. Financial reports which applies to interpret many business activities..................................9

TASK 3............................................................................................................................................9

P4: Budgetary control tools along with its benefits and drawbacks to an organisation..............9

M3. Usage of different planning tools for preparing and forecasting budgets..........................12

TASK 4..........................................................................................................................................12

P5: Comparison of how organisation adopt management accounting system so as to respond to

financial problems.....................................................................................................................12

M4 Analysis of how in responding to financial problems management accounting can lead

organisations to sustainable success..........................................................................................14

D3 Various planning tools to resolve financial problems.........................................................14

CONCLUSION..............................................................................................................................14

REFERENCES..............................................................................................................................15

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

P1: Various management accounting systems along with its requirements within an

organisation..................................................................................................................................1

P2: Various management reporting system along with its benefits to an organisation...............2

M1. Evaluation of benefits of various management accounting systems....................................4

D1 Management accounting system and management accounting reporting are integrated with

organisation process.....................................................................................................................4

TASK 2............................................................................................................................................5

P3: Different costing methods and its use to calculate net profitability......................................5

M2: Management accounting techniques and financial reporting documents............................9

D2. Financial reports which applies to interpret many business activities..................................9

TASK 3............................................................................................................................................9

P4: Budgetary control tools along with its benefits and drawbacks to an organisation..............9

M3. Usage of different planning tools for preparing and forecasting budgets..........................12

TASK 4..........................................................................................................................................12

P5: Comparison of how organisation adopt management accounting system so as to respond to

financial problems.....................................................................................................................12

M4 Analysis of how in responding to financial problems management accounting can lead

organisations to sustainable success..........................................................................................14

D3 Various planning tools to resolve financial problems.........................................................14

CONCLUSION..............................................................................................................................14

REFERENCES..............................................................................................................................15

INTRODUCTION

Management accounting refers to the provision of financial information which assist

management to make corrective decision for the development and growth of business. According

to ICMA, Management accounting is an application of professional knowledge and skills in

maintaining financial accounts in such an understandable manner which makes easy for the

management to frame an effective policies and control of operations of an organisation. The

present assignment report is based on Airdri Ltd. which deals in designing and manufacturing

warm air hand dryers consuming less energy and having unique features which is engaged in

manufacturing sector located in United Market. The report mentions the management accounting

and reporting systems along with their types and application within an organisation. In addition

with this, two costing methods which includes marginal and absorption are properly explain

under this report with a proper calculation of net profitability. Apart from this, planning tools to

control budget and use of management system to resolve financial issues are also discussed

under this report.

TASK 1

P1: Various management accounting systems along with its requirements within an organisation

Management accounting system :

It refers to the formulating and supply financial information to the organisational managers

on proper time so this helps in their regular as well as short term decision making. It is a

procedure that recognize, summarise , record and present all the financial data or written record

in the books of accounts like balance sheet, profit and loss account, cash flow statements etc.

Airdri Ltd. company use many accounting systems to keep their financial records that are

necessary in decision making process that helps in achieving their organisational goals

(Arnaboldi, Lapsley and Steccolini, 2015) The systems that are used by Airdri Ltd. company are

given as follows :-

Cost accounting system :- It is system that is used by Airdri Ltd. company to calculate

the entire expenditure which is incurred in supply large varieties of goods and services after

apportion cost to all monetary service individually. It is very appropriate to followed by the

company which is distributed its goods and services in various available range. Airdri Ltd. is

used this system to find out the actual cost occurred at the time of production to find out the

1

Management accounting refers to the provision of financial information which assist

management to make corrective decision for the development and growth of business. According

to ICMA, Management accounting is an application of professional knowledge and skills in

maintaining financial accounts in such an understandable manner which makes easy for the

management to frame an effective policies and control of operations of an organisation. The

present assignment report is based on Airdri Ltd. which deals in designing and manufacturing

warm air hand dryers consuming less energy and having unique features which is engaged in

manufacturing sector located in United Market. The report mentions the management accounting

and reporting systems along with their types and application within an organisation. In addition

with this, two costing methods which includes marginal and absorption are properly explain

under this report with a proper calculation of net profitability. Apart from this, planning tools to

control budget and use of management system to resolve financial issues are also discussed

under this report.

TASK 1

P1: Various management accounting systems along with its requirements within an organisation

Management accounting system :

It refers to the formulating and supply financial information to the organisational managers

on proper time so this helps in their regular as well as short term decision making. It is a

procedure that recognize, summarise , record and present all the financial data or written record

in the books of accounts like balance sheet, profit and loss account, cash flow statements etc.

Airdri Ltd. company use many accounting systems to keep their financial records that are

necessary in decision making process that helps in achieving their organisational goals

(Arnaboldi, Lapsley and Steccolini, 2015) The systems that are used by Airdri Ltd. company are

given as follows :-

Cost accounting system :- It is system that is used by Airdri Ltd. company to calculate

the entire expenditure which is incurred in supply large varieties of goods and services after

apportion cost to all monetary service individually. It is very appropriate to followed by the

company which is distributed its goods and services in various available range. Airdri Ltd. is

used this system to find out the actual cost occurred at the time of production to find out the

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

profitability in the future of each and every product that is delivered to the customers (Bryer,

2013).

Price optimisation system :- This system is used by Airdri Ltd. company to find out the

variation in the perception of the customers at different price level of product and services that is

offered by different channels. This system is used by the company to find the profit margin in

context to change in price so it helps them in setting their price of the product by making

particular profit in future period of time. In this managers of Airdri Ltd. appoint researcher to

conduct the particular research regarding the satisfaction level of the customers towards the

existing price of the product or if it will get change in future period of time.

Job costing system :- It refers to the system that helps Airdri Ltd. company in

calculating the total manufacturing cost of the each commodity that is incurred in providing

varieties of goods and services after apportion cost to all fiscal service individually. It is very

appropriate to adopt by the enterprise which is deliver its goods and services in variety of price.

Airdri Ltd. company uses such system to estimate the cost of each commodity so this helps the

enterprise to find out future profit that is generated by each and every commodity (Cheng, 2012).

Inventory management system :- This is a system which is used to track the level of

stock available in the industry that includes availability of raw material, organisational assets,

etc. It also helps an enterprise to fulfil their customer needs and demand on time to build brand

faithfulness and trust towards the enterprise. Airdri Ltd. company uses this system to know the

availability of the stock so that it prevents from the overstock in which company has excessive

stock and under stock in the industry. Inventory management system also maintain the whole

data regarding availability of stock in the Airdri Ltd. company.

P2: Various management reporting system along with its benefits to an organisation

There are various management reporting system which can be adopted by AIRDRI LTD.

company in order to continue its operations more smoothly. Here are some types of reporting

systems with brief description:

PERFORMANCE REPORT:

It is a report or a detailed statement that measures routine activity in terms of success

over a specified time frame. The report should provide all the needed information to readers.

They are routinely prepare by AIRDRI LTD. and it contains performance indicators which will

2

2013).

Price optimisation system :- This system is used by Airdri Ltd. company to find out the

variation in the perception of the customers at different price level of product and services that is

offered by different channels. This system is used by the company to find the profit margin in

context to change in price so it helps them in setting their price of the product by making

particular profit in future period of time. In this managers of Airdri Ltd. appoint researcher to

conduct the particular research regarding the satisfaction level of the customers towards the

existing price of the product or if it will get change in future period of time.

Job costing system :- It refers to the system that helps Airdri Ltd. company in

calculating the total manufacturing cost of the each commodity that is incurred in providing

varieties of goods and services after apportion cost to all fiscal service individually. It is very

appropriate to adopt by the enterprise which is deliver its goods and services in variety of price.

Airdri Ltd. company uses such system to estimate the cost of each commodity so this helps the

enterprise to find out future profit that is generated by each and every commodity (Cheng, 2012).

Inventory management system :- This is a system which is used to track the level of

stock available in the industry that includes availability of raw material, organisational assets,

etc. It also helps an enterprise to fulfil their customer needs and demand on time to build brand

faithfulness and trust towards the enterprise. Airdri Ltd. company uses this system to know the

availability of the stock so that it prevents from the overstock in which company has excessive

stock and under stock in the industry. Inventory management system also maintain the whole

data regarding availability of stock in the Airdri Ltd. company.

P2: Various management reporting system along with its benefits to an organisation

There are various management reporting system which can be adopted by AIRDRI LTD.

company in order to continue its operations more smoothly. Here are some types of reporting

systems with brief description:

PERFORMANCE REPORT:

It is a report or a detailed statement that measures routine activity in terms of success

over a specified time frame. The report should provide all the needed information to readers.

They are routinely prepare by AIRDRI LTD. and it contains performance indicators which will

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

measures the achievements of employees and company both on a regular basis (Kober,

Subraamanniam and Watson, 2012).

Usefulness: it involves collecting all the information related to work performance,

creating reports, analyzing it and sending it to respective managers or stakeholders. In AIRDRI

LTD. it is a part of communicating management plan and it contains details required by them. It

serves as a base for evaluating performance and communicating various programs.

BUDGET REPORT:

It is an internal report which compares estimated budgeted and it compares estimation

with the actual performance over a given period of time. In AIRDRI LTD. company it is prepare

to compare closeness of budgeted performance with actual one during an accounting period. It

often differ from actual outcome because it estimates future expenditures (Lachmann, Knauer

and Trapp, 2013).

Usefulness: Managers can find out how accurate their predictions were related to

expenditure and can accordingly estimate their next budget. They can correct those performance

which are not inline with the financial goals of budgets. It can help AIRDRI LTD. company to

manage its cost among certain projects or departments.

Cost reports:

It is a financial report that identifies, computes and offer a summary of expenses for a

specified project in an accounting year. It offers managers to realize the cost and estimates profit

margins and monitor ongoing projects to correct waste area through cost control.

Usefulness: it is matched with the estimated revenue to evaluate profitability. AIRDRI

LTD. company can identify profitable area of business to put additional efforts there instead of

sections with less profits. It provides understanding of all expenses for better utilization of

resources. If the management wishes to expand, diversify or shut down certain operations, this

report will help in determining future plans.

AGING REPORT:

It is that report which shows how long you had an asset or how long a bill has gone

unpaid. It arises when company provides goods or services on credit and allow customer to pay

after some days. It comprises list of each customer and unpaid sales invoices (Morden, 2016).

Usefulness: If AIRDRI LTD. company have older accounts payable then it should take

immediate and effective actions to correct cash flow. Reviewing aging reports monthly can help

3

Subraamanniam and Watson, 2012).

Usefulness: it involves collecting all the information related to work performance,

creating reports, analyzing it and sending it to respective managers or stakeholders. In AIRDRI

LTD. it is a part of communicating management plan and it contains details required by them. It

serves as a base for evaluating performance and communicating various programs.

BUDGET REPORT:

It is an internal report which compares estimated budgeted and it compares estimation

with the actual performance over a given period of time. In AIRDRI LTD. company it is prepare

to compare closeness of budgeted performance with actual one during an accounting period. It

often differ from actual outcome because it estimates future expenditures (Lachmann, Knauer

and Trapp, 2013).

Usefulness: Managers can find out how accurate their predictions were related to

expenditure and can accordingly estimate their next budget. They can correct those performance

which are not inline with the financial goals of budgets. It can help AIRDRI LTD. company to

manage its cost among certain projects or departments.

Cost reports:

It is a financial report that identifies, computes and offer a summary of expenses for a

specified project in an accounting year. It offers managers to realize the cost and estimates profit

margins and monitor ongoing projects to correct waste area through cost control.

Usefulness: it is matched with the estimated revenue to evaluate profitability. AIRDRI

LTD. company can identify profitable area of business to put additional efforts there instead of

sections with less profits. It provides understanding of all expenses for better utilization of

resources. If the management wishes to expand, diversify or shut down certain operations, this

report will help in determining future plans.

AGING REPORT:

It is that report which shows how long you had an asset or how long a bill has gone

unpaid. It arises when company provides goods or services on credit and allow customer to pay

after some days. It comprises list of each customer and unpaid sales invoices (Morden, 2016).

Usefulness: If AIRDRI LTD. company have older accounts payable then it should take

immediate and effective actions to correct cash flow. Reviewing aging reports monthly can help

3

in identifying specific items which need action for strategic decisions. It tracks specific items and

helps to identify accounts receivables or payable for the company.

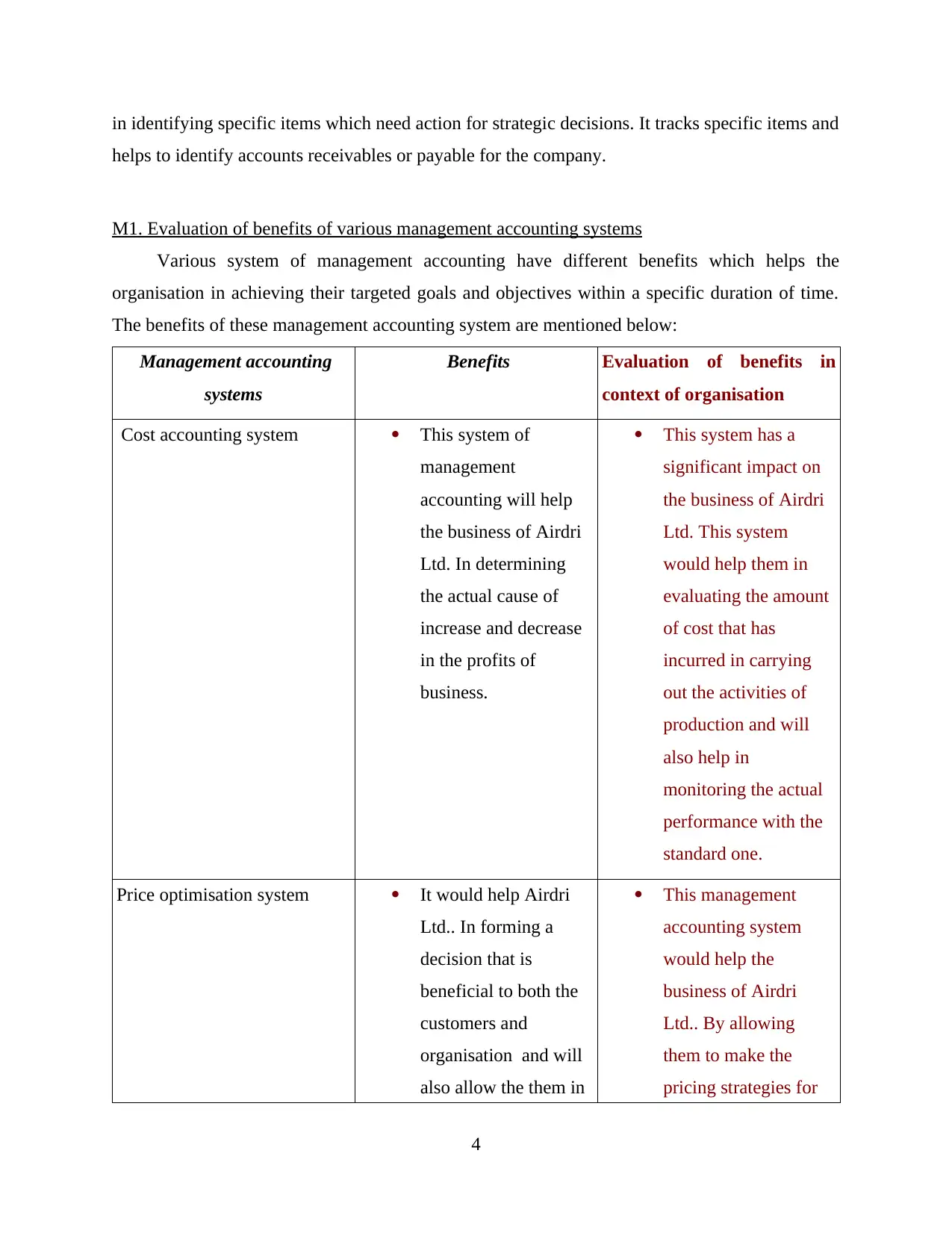

M1. Evaluation of benefits of various management accounting systems

Various system of management accounting have different benefits which helps the

organisation in achieving their targeted goals and objectives within a specific duration of time.

The benefits of these management accounting system are mentioned below:

Management accounting

systems

Benefits Evaluation of benefits in

context of organisation

Cost accounting system This system of

management

accounting will help

the business of Airdri

Ltd. In determining

the actual cause of

increase and decrease

in the profits of

business.

This system has a

significant impact on

the business of Airdri

Ltd. This system

would help them in

evaluating the amount

of cost that has

incurred in carrying

out the activities of

production and will

also help in

monitoring the actual

performance with the

standard one.

Price optimisation system It would help Airdri

Ltd.. In forming a

decision that is

beneficial to both the

customers and

organisation and will

also allow the them in

This management

accounting system

would help the

business of Airdri

Ltd.. By allowing

them to make the

pricing strategies for

4

helps to identify accounts receivables or payable for the company.

M1. Evaluation of benefits of various management accounting systems

Various system of management accounting have different benefits which helps the

organisation in achieving their targeted goals and objectives within a specific duration of time.

The benefits of these management accounting system are mentioned below:

Management accounting

systems

Benefits Evaluation of benefits in

context of organisation

Cost accounting system This system of

management

accounting will help

the business of Airdri

Ltd. In determining

the actual cause of

increase and decrease

in the profits of

business.

This system has a

significant impact on

the business of Airdri

Ltd. This system

would help them in

evaluating the amount

of cost that has

incurred in carrying

out the activities of

production and will

also help in

monitoring the actual

performance with the

standard one.

Price optimisation system It would help Airdri

Ltd.. In forming a

decision that is

beneficial to both the

customers and

organisation and will

also allow the them in

This management

accounting system

would help the

business of Airdri

Ltd.. By allowing

them to make the

pricing strategies for

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

assigning the prices

optimally.

their product which

are suitable to their

customers.

Inventory management system This system involves

balancing the level of

inventory in an

organisation . This

will support the

business of Airdri Ltd.

by minimising the cost

and maximising the

sales and profits of the

business by achieving

effectivity.

This will support the

business of Airdri Ltd.

By providing them the

information about the

level of stock

available to them and

what should be the

amount of production

should be their as per

the requirement of

their customers. This

will help the business

in capturing a large

customers.

D1 Management accounting system and management accounting reporting are integrated with

organisation process.

For the gainful of Airdri Ltd., mix between the executives bookkeeping framework and

bookkeeping announcing should be done that help the board in settling on a powerful choices

and plans in accomplishment of hierarchical objectives and targets. For instance, keeping up

records of exchanges made by Airdri Ltd. in administrative reports can be conceivable just if the

executives bookkeeping frameworks are utilized, for example, stock administration framework

help in giving adequate data about the present degree of stock which further to be recorded under

stock administration report.

5

optimally.

their product which

are suitable to their

customers.

Inventory management system This system involves

balancing the level of

inventory in an

organisation . This

will support the

business of Airdri Ltd.

by minimising the cost

and maximising the

sales and profits of the

business by achieving

effectivity.

This will support the

business of Airdri Ltd.

By providing them the

information about the

level of stock

available to them and

what should be the

amount of production

should be their as per

the requirement of

their customers. This

will help the business

in capturing a large

customers.

D1 Management accounting system and management accounting reporting are integrated with

organisation process.

For the gainful of Airdri Ltd., mix between the executives bookkeeping framework and

bookkeeping announcing should be done that help the board in settling on a powerful choices

and plans in accomplishment of hierarchical objectives and targets. For instance, keeping up

records of exchanges made by Airdri Ltd. in administrative reports can be conceivable just if the

executives bookkeeping frameworks are utilized, for example, stock administration framework

help in giving adequate data about the present degree of stock which further to be recorded under

stock administration report.

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TASK 2

P3: Different costing methods and its use to calculate net profitability

Cost: It refers to the amount which spends in manufacturing something that will be sold or

retain to meet the requirements of an organisation. It consists of two types which includes

marginal and absorption costing method. Thus, AIRDRI LTD. need to use these methods while

calculating their net profitability. Here are the brief description of these two costing methods:

Marginal costing: It is also termed as variable costing due to allowing only variable cost

to include in the calculation process of net profitability. It is usually adopted by small and

medium sized organisation as this method facilitate them to show high profitability in their

financial statements so that maximum number of investors will be easily attracted

Absorption costing: It is also termed as full costing method due to including both fixed

and variable cost in the calculation process of net profitability. It is most usable method by large

sized organisation as this method allows them to show actual profitability under their financial

statement so that loyal shareholders will be easily retained with company for longer duration

(Absorption costing, 2018).

AIRDRI LTD. company need to adopt suitable costing method according to their main

objective and vision. For this, the accounting manager need to use both these costing methods as

taking examples so that the corrective decision could be made in respect of using costing method

to calculate their net profitability. Here are the calculations of net profitability by using these two

methods:

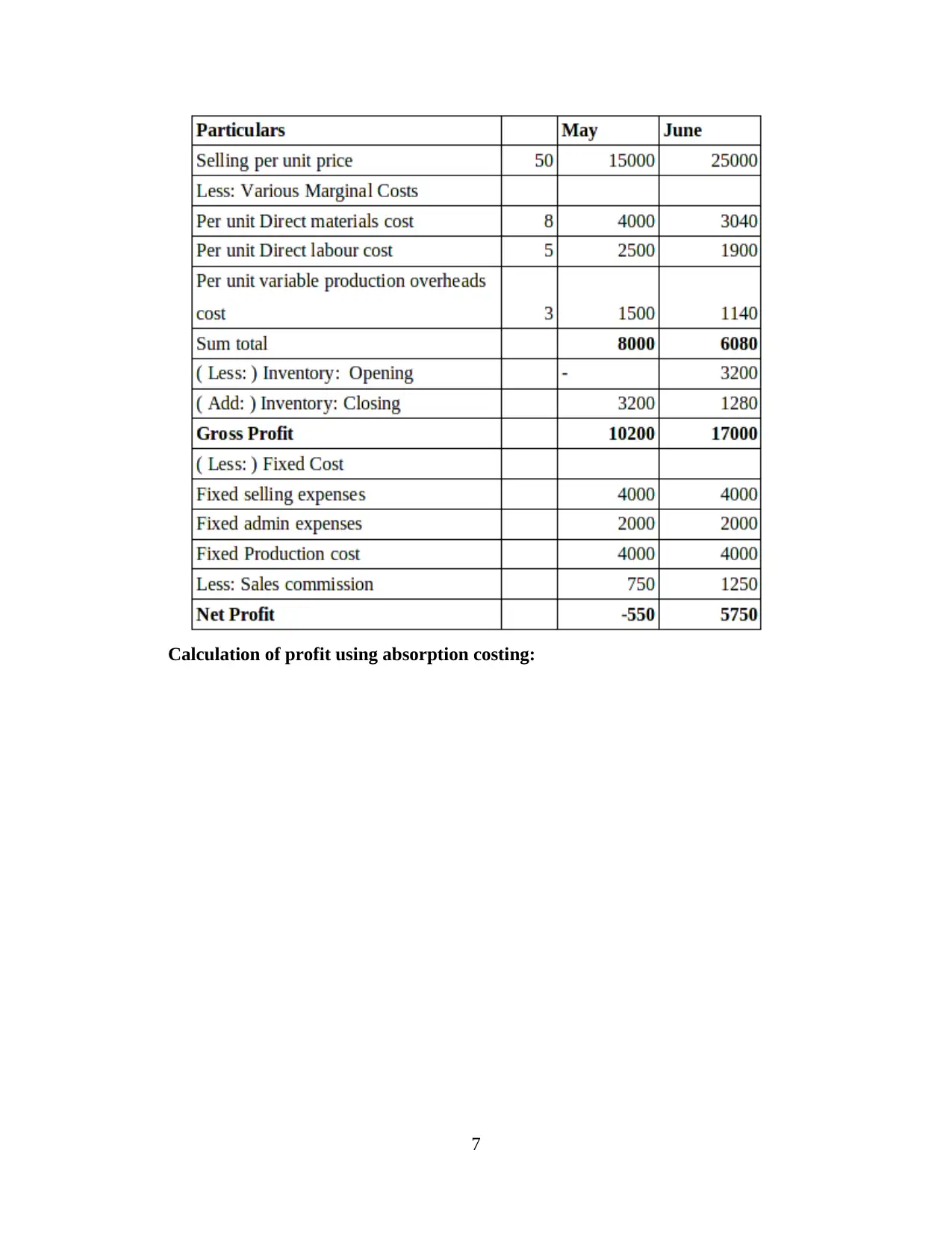

Calculation of profit using marginal costing:

6

P3: Different costing methods and its use to calculate net profitability

Cost: It refers to the amount which spends in manufacturing something that will be sold or

retain to meet the requirements of an organisation. It consists of two types which includes

marginal and absorption costing method. Thus, AIRDRI LTD. need to use these methods while

calculating their net profitability. Here are the brief description of these two costing methods:

Marginal costing: It is also termed as variable costing due to allowing only variable cost

to include in the calculation process of net profitability. It is usually adopted by small and

medium sized organisation as this method facilitate them to show high profitability in their

financial statements so that maximum number of investors will be easily attracted

Absorption costing: It is also termed as full costing method due to including both fixed

and variable cost in the calculation process of net profitability. It is most usable method by large

sized organisation as this method allows them to show actual profitability under their financial

statement so that loyal shareholders will be easily retained with company for longer duration

(Absorption costing, 2018).

AIRDRI LTD. company need to adopt suitable costing method according to their main

objective and vision. For this, the accounting manager need to use both these costing methods as

taking examples so that the corrective decision could be made in respect of using costing method

to calculate their net profitability. Here are the calculations of net profitability by using these two

methods:

Calculation of profit using marginal costing:

6

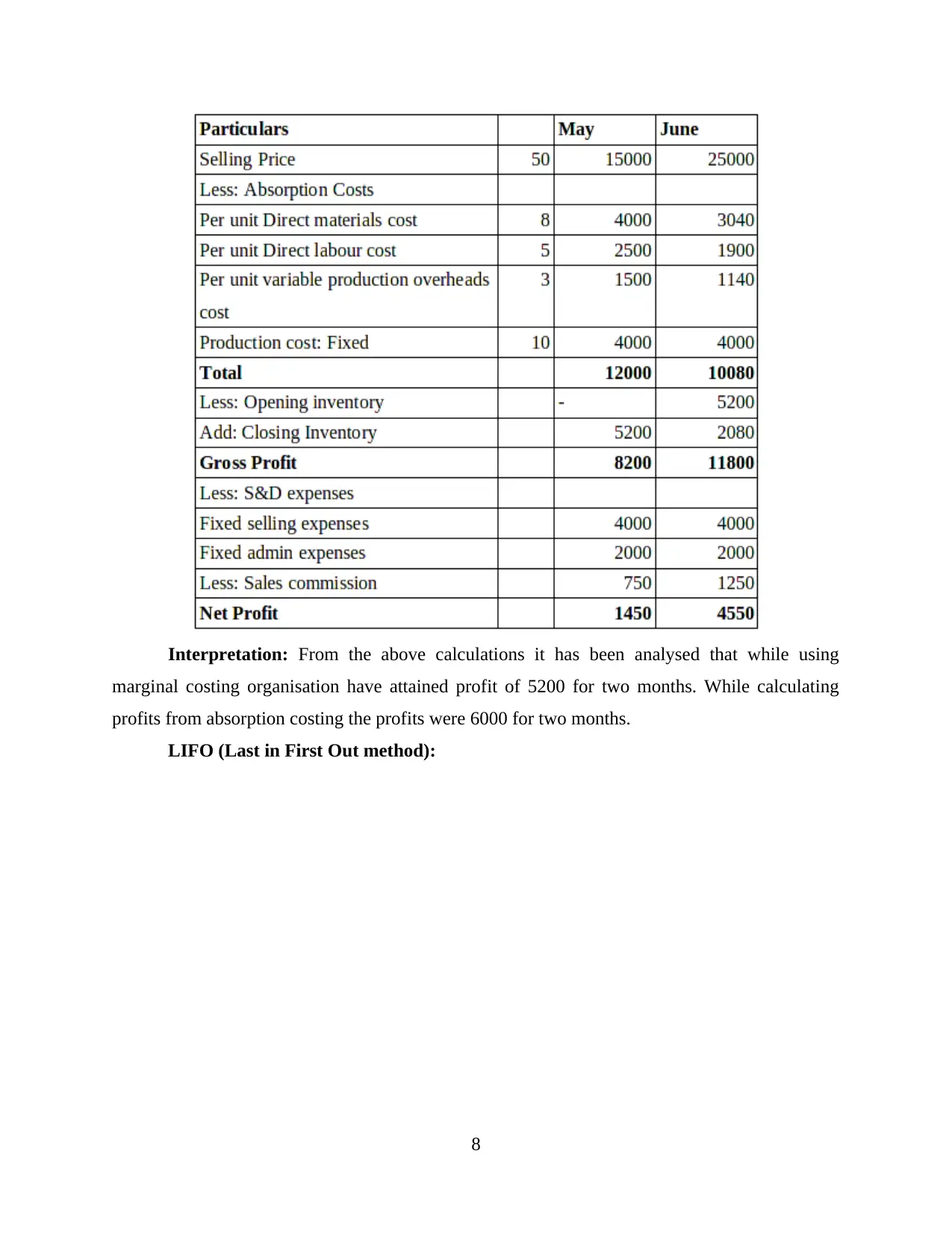

Calculation of profit using absorption costing:

7

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Interpretation: From the above calculations it has been analysed that while using

marginal costing organisation have attained profit of 5200 for two months. While calculating

profits from absorption costing the profits were 6000 for two months.

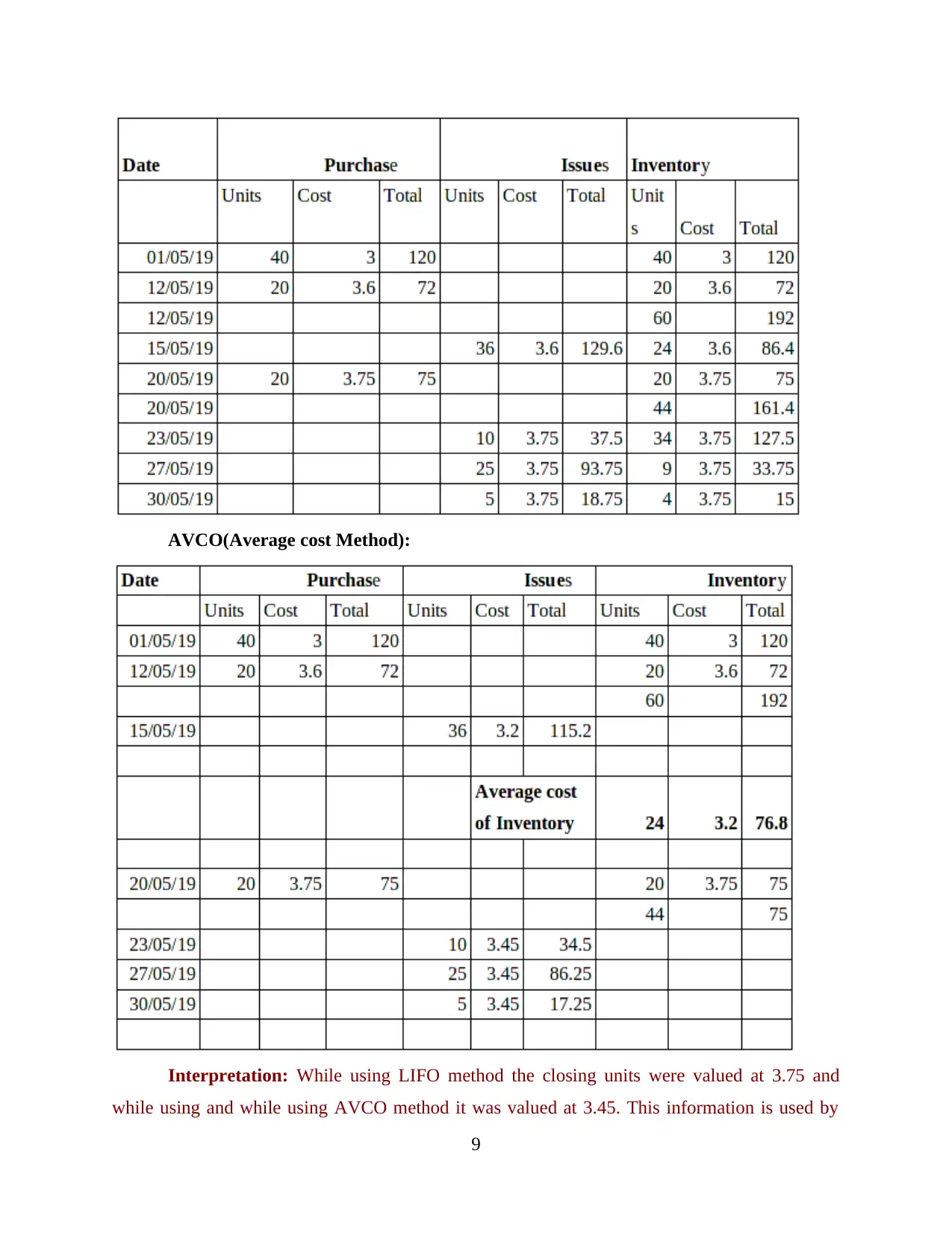

LIFO (Last in First Out method):

8

marginal costing organisation have attained profit of 5200 for two months. While calculating

profits from absorption costing the profits were 6000 for two months.

LIFO (Last in First Out method):

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

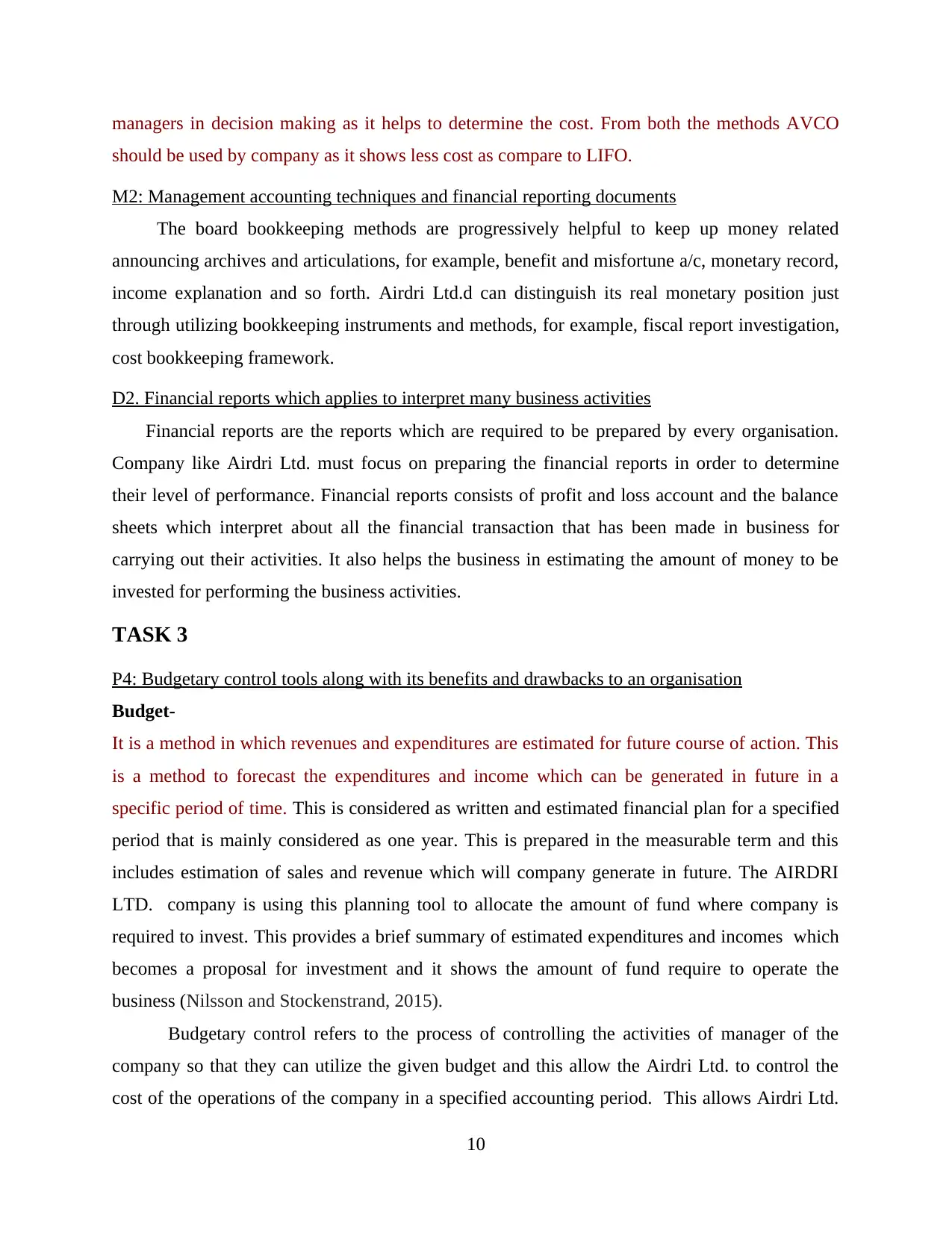

AVCO(Average cost Method):

Interpretation: While using LIFO method the closing units were valued at 3.75 and

while using and while using AVCO method it was valued at 3.45. This information is used by

9

Interpretation: While using LIFO method the closing units were valued at 3.75 and

while using and while using AVCO method it was valued at 3.45. This information is used by

9

managers in decision making as it helps to determine the cost. From both the methods AVCO

should be used by company as it shows less cost as compare to LIFO.

M2: Management accounting techniques and financial reporting documents

The board bookkeeping methods are progressively helpful to keep up money related

announcing archives and articulations, for example, benefit and misfortune a/c, monetary record,

income explanation and so forth. Airdri Ltd.d can distinguish its real monetary position just

through utilizing bookkeeping instruments and methods, for example, fiscal report investigation,

cost bookkeeping framework.

D2. Financial reports which applies to interpret many business activities

Financial reports are the reports which are required to be prepared by every organisation.

Company like Airdri Ltd. must focus on preparing the financial reports in order to determine

their level of performance. Financial reports consists of profit and loss account and the balance

sheets which interpret about all the financial transaction that has been made in business for

carrying out their activities. It also helps the business in estimating the amount of money to be

invested for performing the business activities.

TASK 3

P4: Budgetary control tools along with its benefits and drawbacks to an organisation

Budget-

It is a method in which revenues and expenditures are estimated for future course of action. This

is a method to forecast the expenditures and income which can be generated in future in a

specific period of time. This is considered as written and estimated financial plan for a specified

period that is mainly considered as one year. This is prepared in the measurable term and this

includes estimation of sales and revenue which will company generate in future. The AIRDRI

LTD. company is using this planning tool to allocate the amount of fund where company is

required to invest. This provides a brief summary of estimated expenditures and incomes which

becomes a proposal for investment and it shows the amount of fund require to operate the

business (Nilsson and Stockenstrand, 2015).

Budgetary control refers to the process of controlling the activities of manager of the

company so that they can utilize the given budget and this allow the Airdri Ltd. to control the

cost of the operations of the company in a specified accounting period. This allows Airdri Ltd.

10

should be used by company as it shows less cost as compare to LIFO.

M2: Management accounting techniques and financial reporting documents

The board bookkeeping methods are progressively helpful to keep up money related

announcing archives and articulations, for example, benefit and misfortune a/c, monetary record,

income explanation and so forth. Airdri Ltd.d can distinguish its real monetary position just

through utilizing bookkeeping instruments and methods, for example, fiscal report investigation,

cost bookkeeping framework.

D2. Financial reports which applies to interpret many business activities

Financial reports are the reports which are required to be prepared by every organisation.

Company like Airdri Ltd. must focus on preparing the financial reports in order to determine

their level of performance. Financial reports consists of profit and loss account and the balance

sheets which interpret about all the financial transaction that has been made in business for

carrying out their activities. It also helps the business in estimating the amount of money to be

invested for performing the business activities.

TASK 3

P4: Budgetary control tools along with its benefits and drawbacks to an organisation

Budget-

It is a method in which revenues and expenditures are estimated for future course of action. This

is a method to forecast the expenditures and income which can be generated in future in a

specific period of time. This is considered as written and estimated financial plan for a specified

period that is mainly considered as one year. This is prepared in the measurable term and this

includes estimation of sales and revenue which will company generate in future. The AIRDRI

LTD. company is using this planning tool to allocate the amount of fund where company is

required to invest. This provides a brief summary of estimated expenditures and incomes which

becomes a proposal for investment and it shows the amount of fund require to operate the

business (Nilsson and Stockenstrand, 2015).

Budgetary control refers to the process of controlling the activities of manager of the

company so that they can utilize the given budget and this allow the Airdri Ltd. to control the

cost of the operations of the company in a specified accounting period. This allows Airdri Ltd.

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 20

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.