Comparative Financial Analysis: Alpha Ltd and Beta Ltd Investment

VerifiedAdded on 2022/12/29

|15

|1713

|59

Report

AI Summary

This report presents a comprehensive financial analysis comparing Alpha Ltd and Beta Ltd, utilizing various financial ratios to evaluate their performance and investment suitability. The analysis includes the calculation and interpretation of liquidity, profitability, efficiency, and solvency ratios for both companies. The current ratio, quick ratio, gross profit ratio, net profit ratio, return on capital employed, inventory ratio, account receivables ratio, fixed assets turnover ratio, debt-equity ratio, and proprietary ratio are all calculated and interpreted. The report concludes that Alpha Ltd is the more suitable company for potential investment based on its stronger financial position, particularly its higher current ratio, quick ratio, and efficiency in utilizing fixed assets. The findings highlight Alpha Ltd's better performance in managing its current obligations, generating profits, and utilizing its assets effectively, making it a more attractive investment option compared to Beta Ltd.

ACCOUNTING AND

FINANCE FOR MANAGER

FINANCE FOR MANAGER

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................3

MAIN BODY...................................................................................................................................3

(A) Calculation of ratios.............................................................................................................3

..........................................................................................................................................................4

(B) Interpretations of Ratio.......................................................................................................11

(C) the suitability for potential investment in one of the company...........................................13

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................14

INTRODUCTION...........................................................................................................................3

MAIN BODY...................................................................................................................................3

(A) Calculation of ratios.............................................................................................................3

..........................................................................................................................................................4

(B) Interpretations of Ratio.......................................................................................................11

(C) the suitability for potential investment in one of the company...........................................13

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................14

INTRODUCTION

In the present era every firm wants to know its overall financial performance to show its

investors that how much they earn or efficiently manage the liquidity. Ratio analysis helps the

company to analyse liquidity, operational efficiency, and profitability of the firm by comparing

two years financial performance. In this current report the suitability for potential investment in

one company will be highlighted. The present study will identify that which firm is most

appropriate for investment with the help of ratio analysis.

MAIN BODY

(A) Calculation of ratios

Liquidity ratios

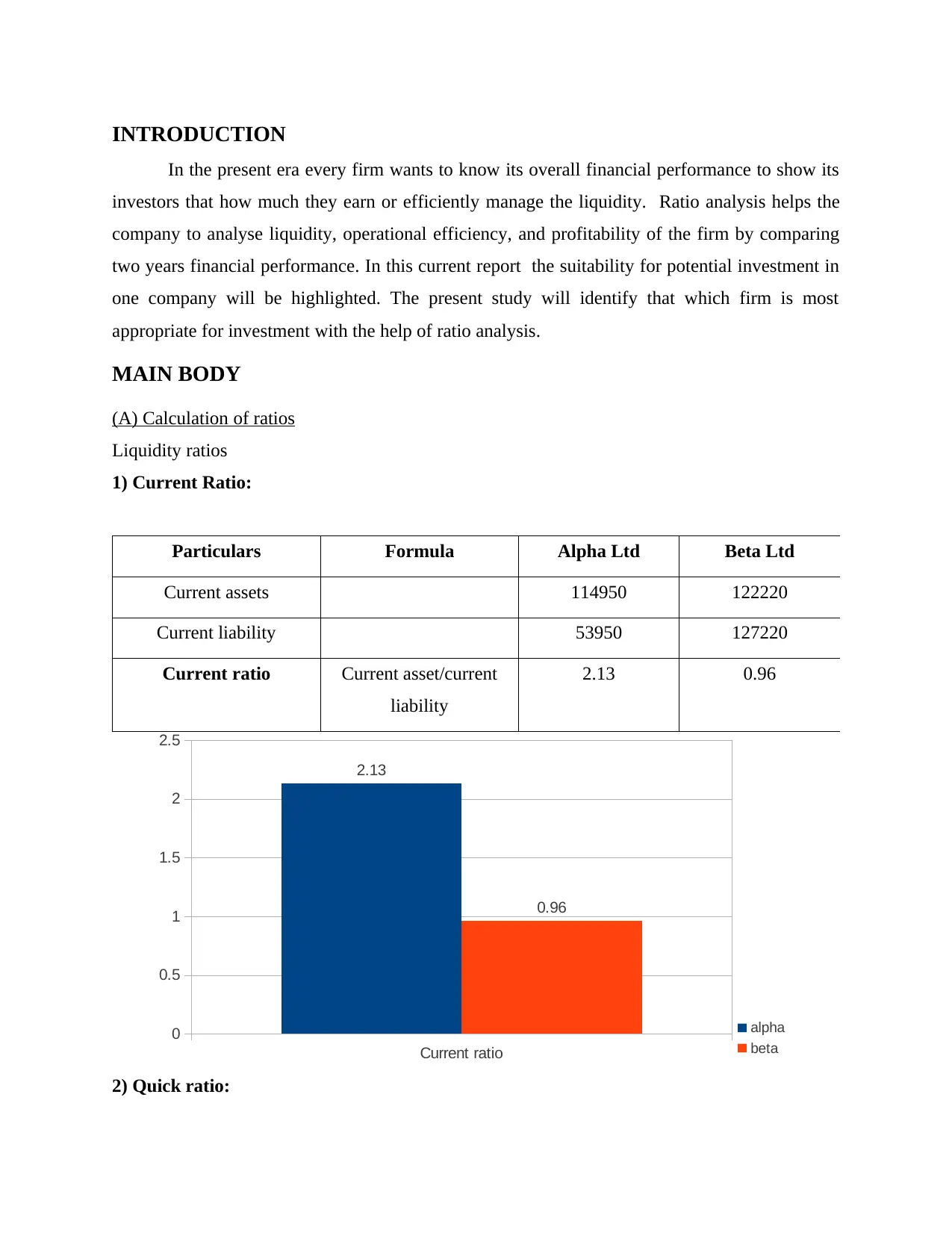

1) Current Ratio:

Particulars Formula Alpha Ltd Beta Ltd

Current assets 114950 122220

Current liability 53950 127220

Current ratio Current asset/current

liability

2.13 0.96

Current ratio

0

0.5

1

1.5

2

2.5

2.13

0.96

alpha

beta

2) Quick ratio:

In the present era every firm wants to know its overall financial performance to show its

investors that how much they earn or efficiently manage the liquidity. Ratio analysis helps the

company to analyse liquidity, operational efficiency, and profitability of the firm by comparing

two years financial performance. In this current report the suitability for potential investment in

one company will be highlighted. The present study will identify that which firm is most

appropriate for investment with the help of ratio analysis.

MAIN BODY

(A) Calculation of ratios

Liquidity ratios

1) Current Ratio:

Particulars Formula Alpha Ltd Beta Ltd

Current assets 114950 122220

Current liability 53950 127220

Current ratio Current asset/current

liability

2.13 0.96

Current ratio

0

0.5

1

1.5

2

2.5

2.13

0.96

alpha

beta

2) Quick ratio:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

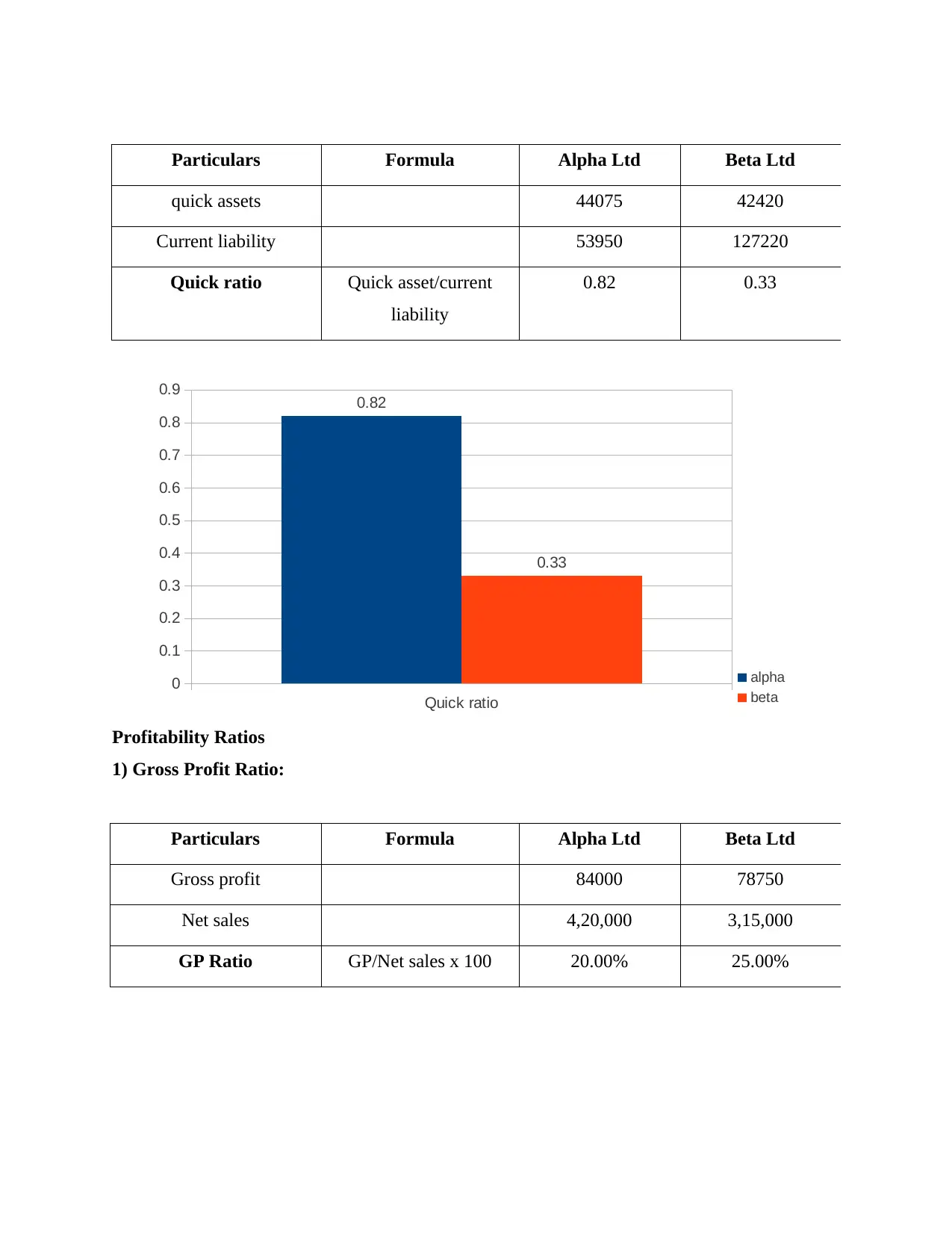

Particulars Formula Alpha Ltd Beta Ltd

quick assets 44075 42420

Current liability 53950 127220

Quick ratio Quick asset/current

liability

0.82 0.33

Quick ratio

0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9 0.82

0.33

alpha

beta

Profitability Ratios

1) Gross Profit Ratio:

Particulars Formula Alpha Ltd Beta Ltd

Gross profit 84000 78750

Net sales 4,20,000 3,15,000

GP Ratio GP/Net sales x 100 20.00% 25.00%

quick assets 44075 42420

Current liability 53950 127220

Quick ratio Quick asset/current

liability

0.82 0.33

Quick ratio

0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9 0.82

0.33

alpha

beta

Profitability Ratios

1) Gross Profit Ratio:

Particulars Formula Alpha Ltd Beta Ltd

Gross profit 84000 78750

Net sales 4,20,000 3,15,000

GP Ratio GP/Net sales x 100 20.00% 25.00%

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

GP ratio

0

5

10

15

20

25

30

20

25

alpha

beta

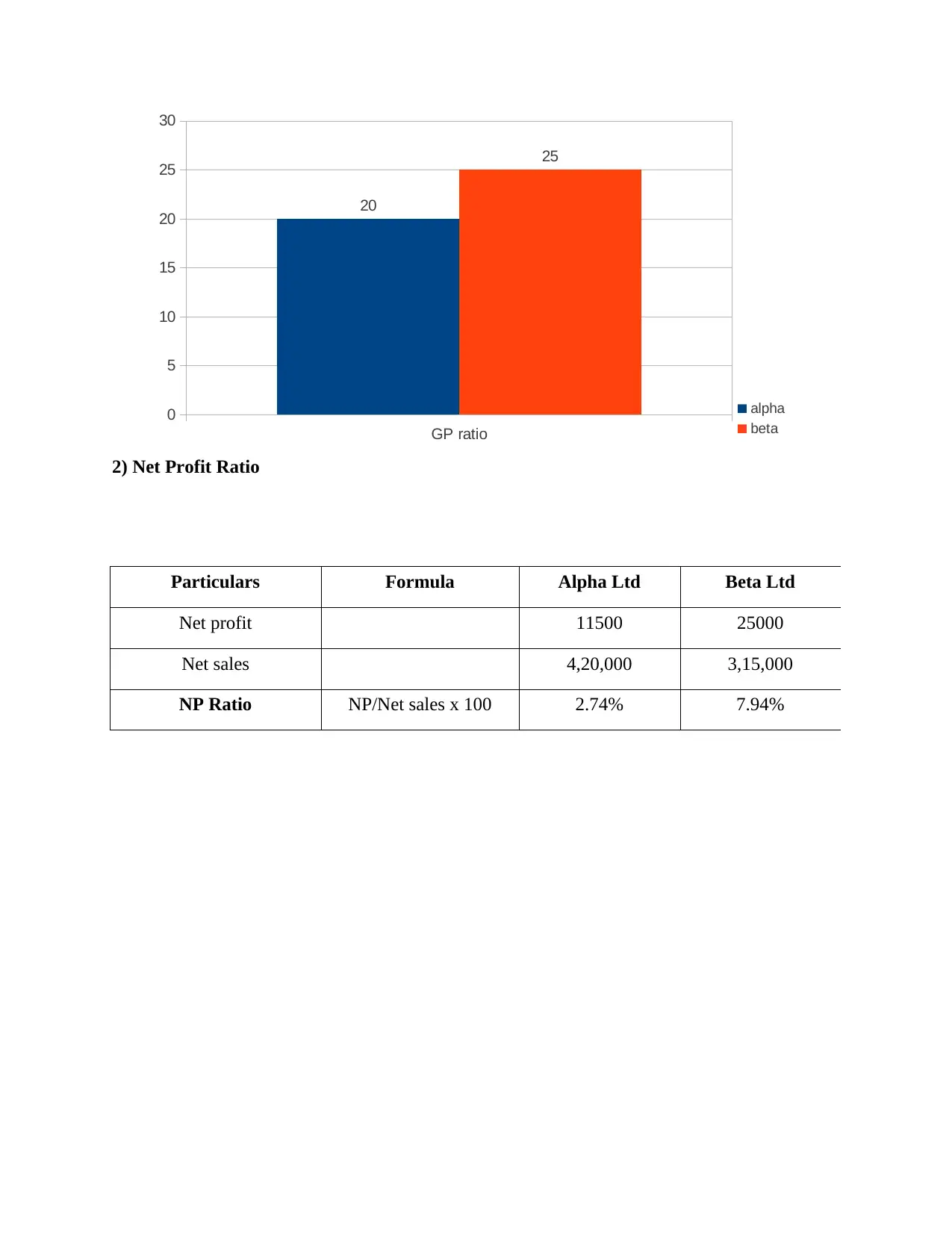

2) Net Profit Ratio

Particulars Formula Alpha Ltd Beta Ltd

Net profit 11500 25000

Net sales 4,20,000 3,15,000

NP Ratio NP/Net sales x 100 2.74% 7.94%

0

5

10

15

20

25

30

20

25

alpha

beta

2) Net Profit Ratio

Particulars Formula Alpha Ltd Beta Ltd

Net profit 11500 25000

Net sales 4,20,000 3,15,000

NP Ratio NP/Net sales x 100 2.74% 7.94%

NP ratio

0

1

2

3

4

5

6

7

8

9

2.74

7.94

alpha

beta

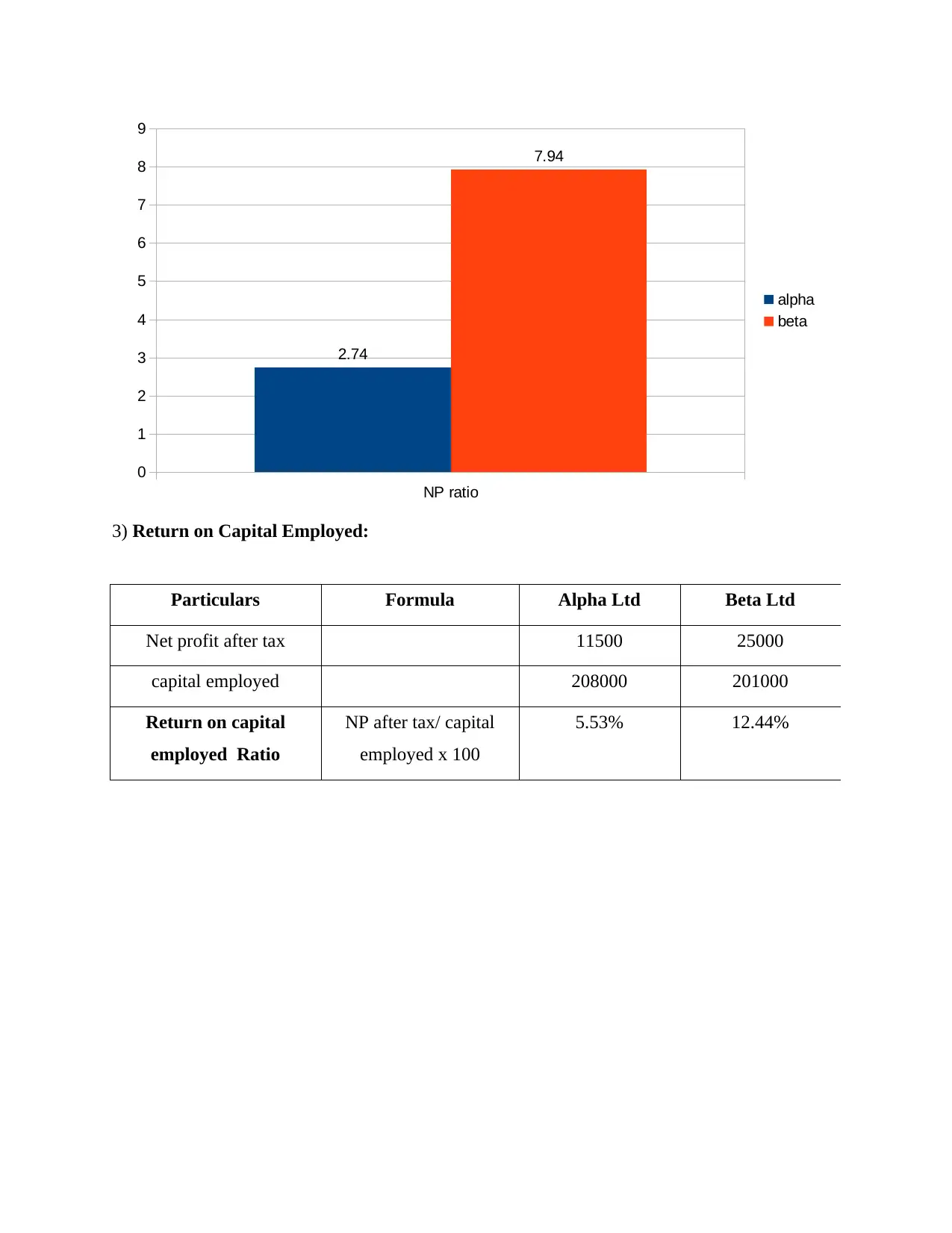

3) Return on Capital Employed:

Particulars Formula Alpha Ltd Beta Ltd

Net profit after tax 11500 25000

capital employed 208000 201000

Return on capital

employed Ratio

NP after tax/ capital

employed x 100

5.53% 12.44%

0

1

2

3

4

5

6

7

8

9

2.74

7.94

alpha

beta

3) Return on Capital Employed:

Particulars Formula Alpha Ltd Beta Ltd

Net profit after tax 11500 25000

capital employed 208000 201000

Return on capital

employed Ratio

NP after tax/ capital

employed x 100

5.53% 12.44%

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

return on capital employed

0

2

4

6

8

10

12

14

5.53

12.44

alpha

beta

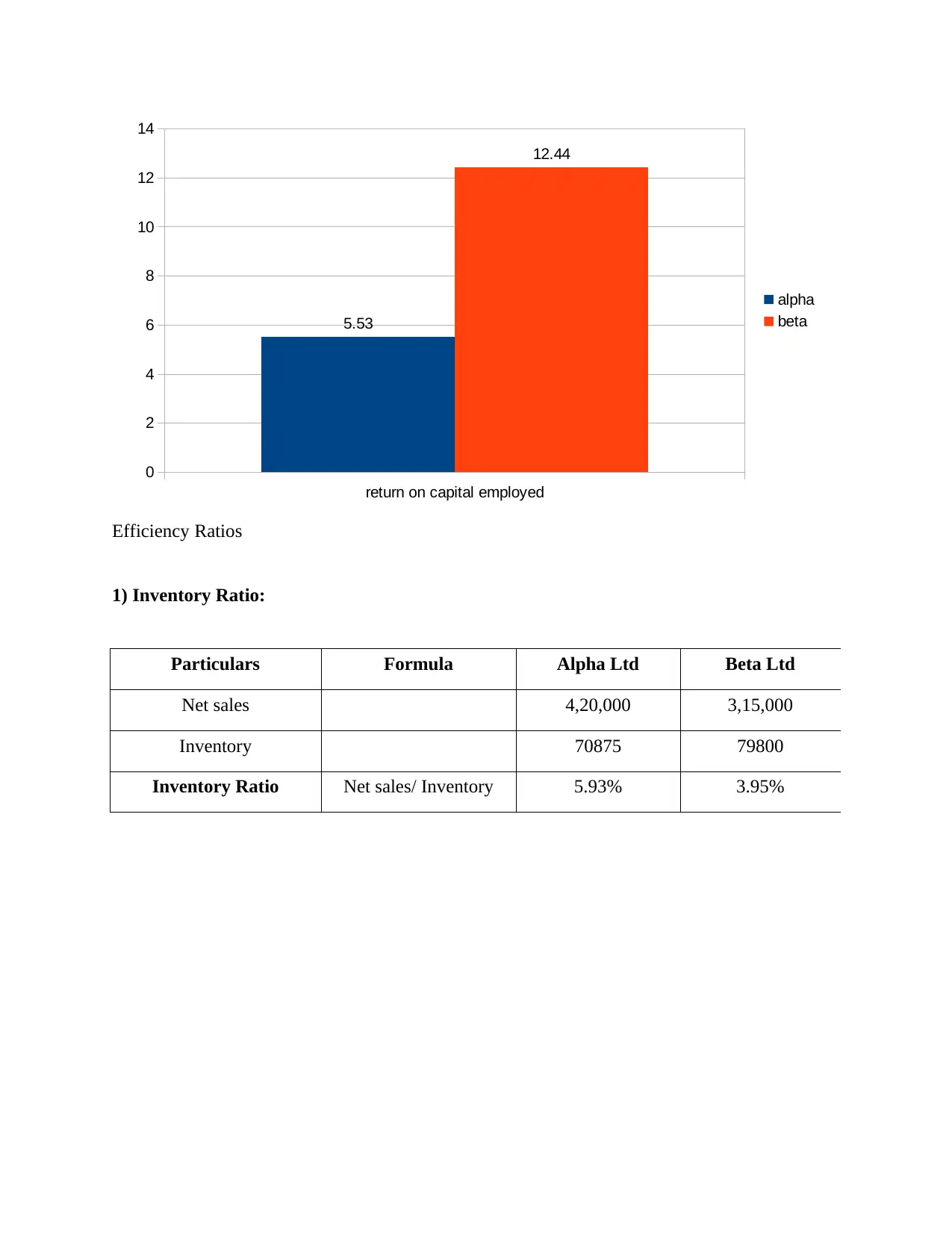

Efficiency Ratios

1) Inventory Ratio:

Particulars Formula Alpha Ltd Beta Ltd

Net sales 4,20,000 3,15,000

Inventory 70875 79800

Inventory Ratio Net sales/ Inventory 5.93% 3.95%

0

2

4

6

8

10

12

14

5.53

12.44

alpha

beta

Efficiency Ratios

1) Inventory Ratio:

Particulars Formula Alpha Ltd Beta Ltd

Net sales 4,20,000 3,15,000

Inventory 70875 79800

Inventory Ratio Net sales/ Inventory 5.93% 3.95%

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Inventory ratio

0

1

2

3

4

5

6

7

5.93

3.95

alpha

beta

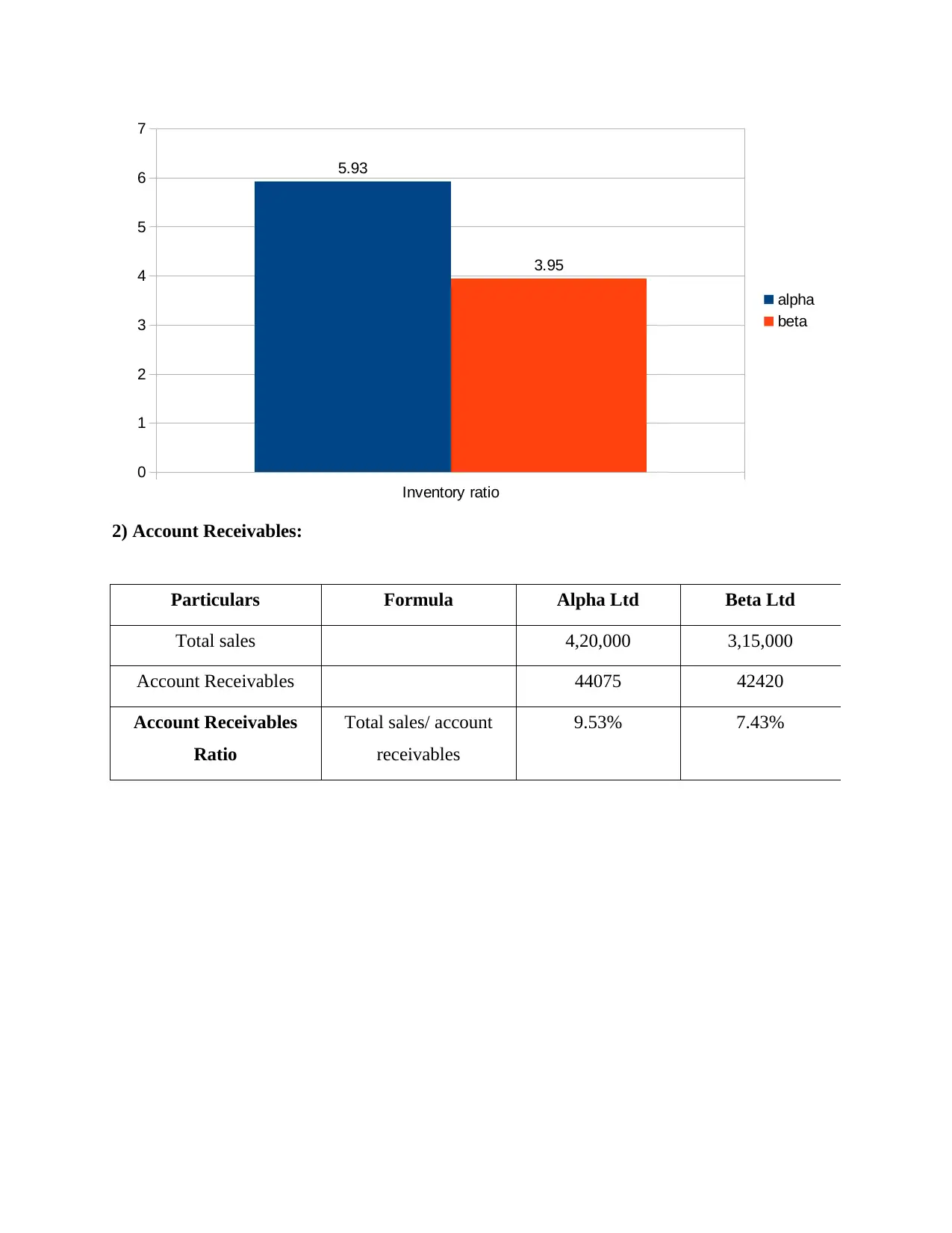

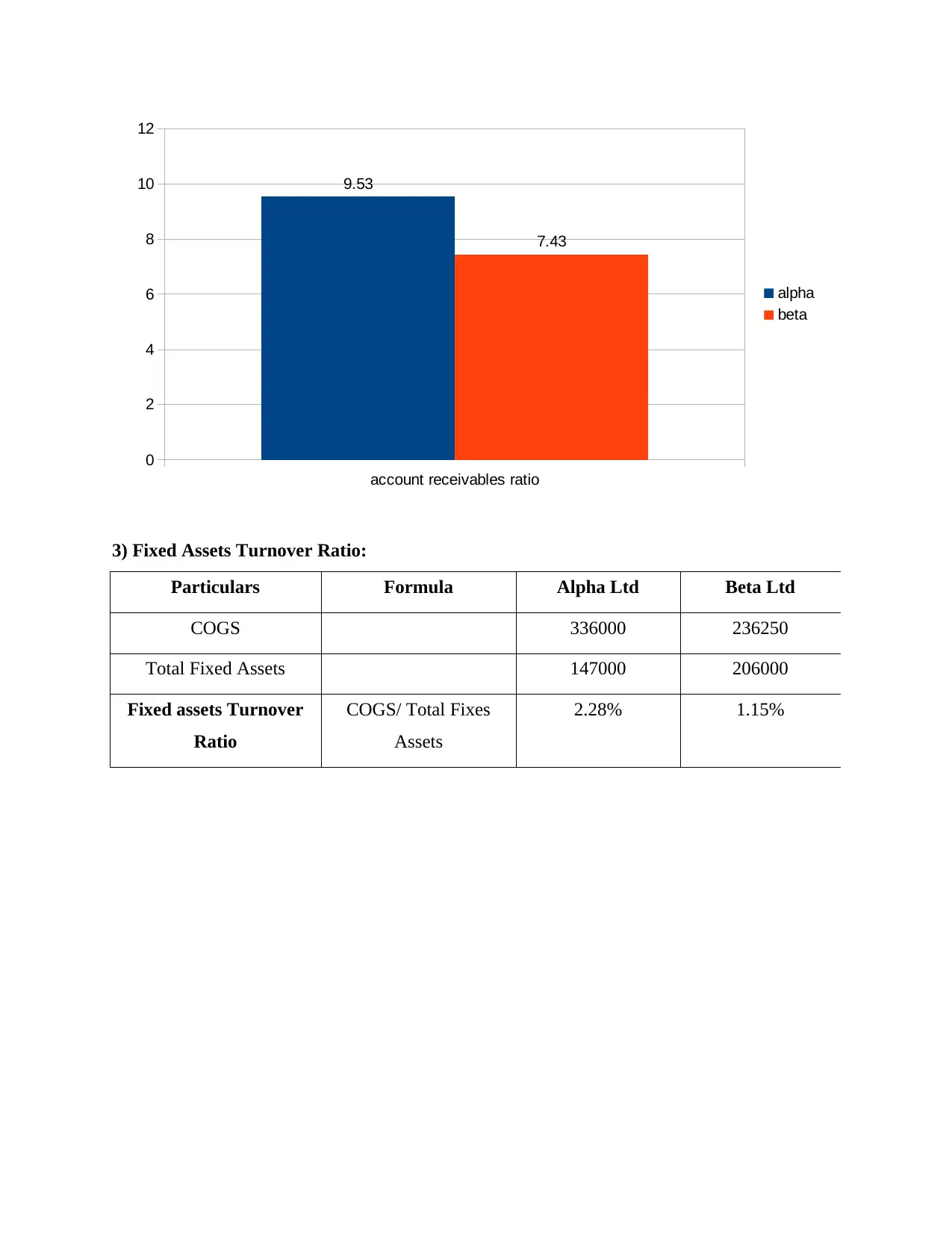

2) Account Receivables:

Particulars Formula Alpha Ltd Beta Ltd

Total sales 4,20,000 3,15,000

Account Receivables 44075 42420

Account Receivables

Ratio

Total sales/ account

receivables

9.53% 7.43%

0

1

2

3

4

5

6

7

5.93

3.95

alpha

beta

2) Account Receivables:

Particulars Formula Alpha Ltd Beta Ltd

Total sales 4,20,000 3,15,000

Account Receivables 44075 42420

Account Receivables

Ratio

Total sales/ account

receivables

9.53% 7.43%

account receivables ratio

0

2

4

6

8

10

12

9.53

7.43

alpha

beta

3) Fixed Assets Turnover Ratio:

Particulars Formula Alpha Ltd Beta Ltd

COGS 336000 236250

Total Fixed Assets 147000 206000

Fixed assets Turnover

Ratio

COGS/ Total Fixes

Assets

2.28% 1.15%

0

2

4

6

8

10

12

9.53

7.43

alpha

beta

3) Fixed Assets Turnover Ratio:

Particulars Formula Alpha Ltd Beta Ltd

COGS 336000 236250

Total Fixed Assets 147000 206000

Fixed assets Turnover

Ratio

COGS/ Total Fixes

Assets

2.28% 1.15%

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

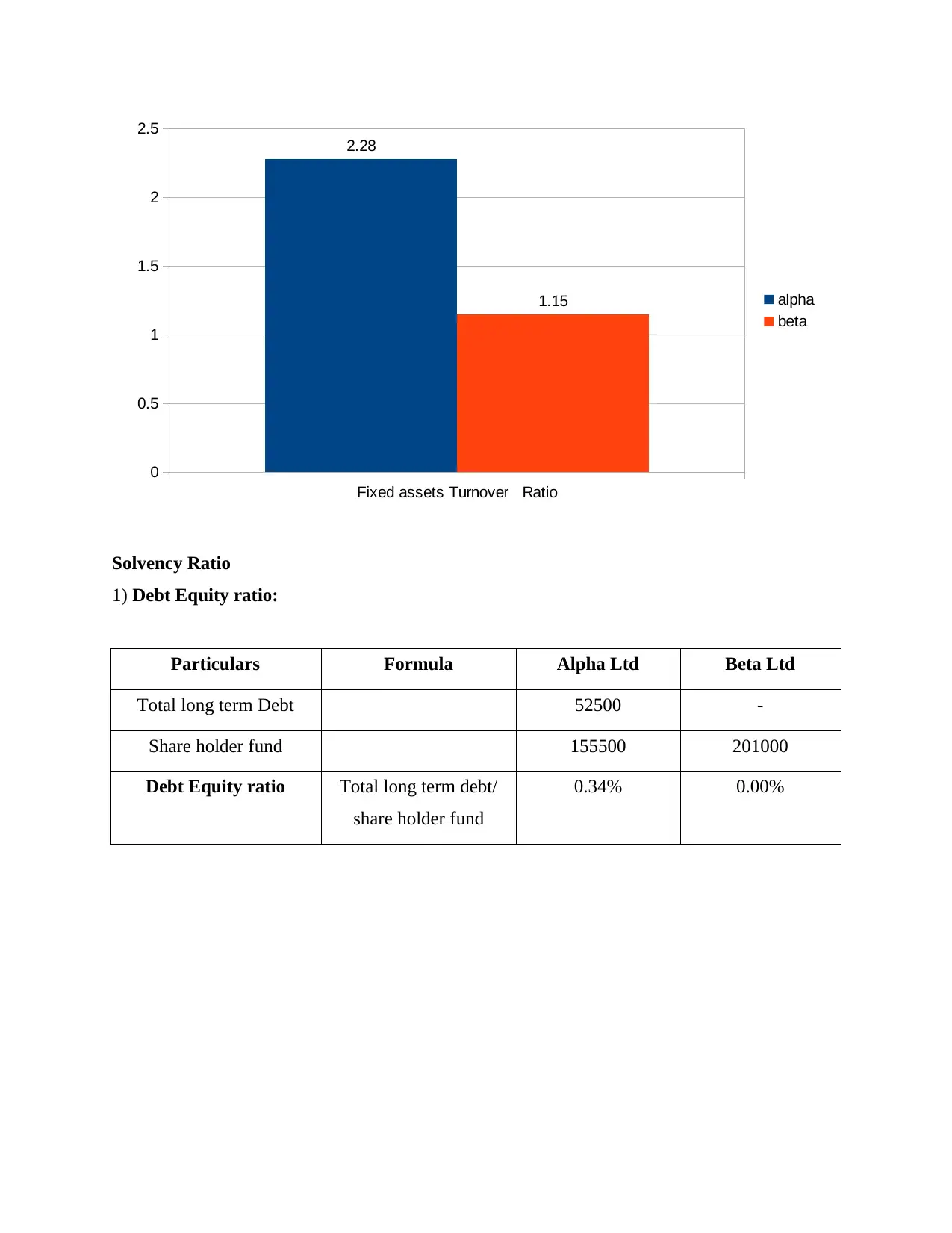

Fixed assets Turnover Ratio

0

0.5

1

1.5

2

2.5

2.28

1.15 alpha

beta

Solvency Ratio

1) Debt Equity ratio:

Particulars Formula Alpha Ltd Beta Ltd

Total long term Debt 52500 -

Share holder fund 155500 201000

Debt Equity ratio Total long term debt/

share holder fund

0.34% 0.00%

0

0.5

1

1.5

2

2.5

2.28

1.15 alpha

beta

Solvency Ratio

1) Debt Equity ratio:

Particulars Formula Alpha Ltd Beta Ltd

Total long term Debt 52500 -

Share holder fund 155500 201000

Debt Equity ratio Total long term debt/

share holder fund

0.34% 0.00%

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

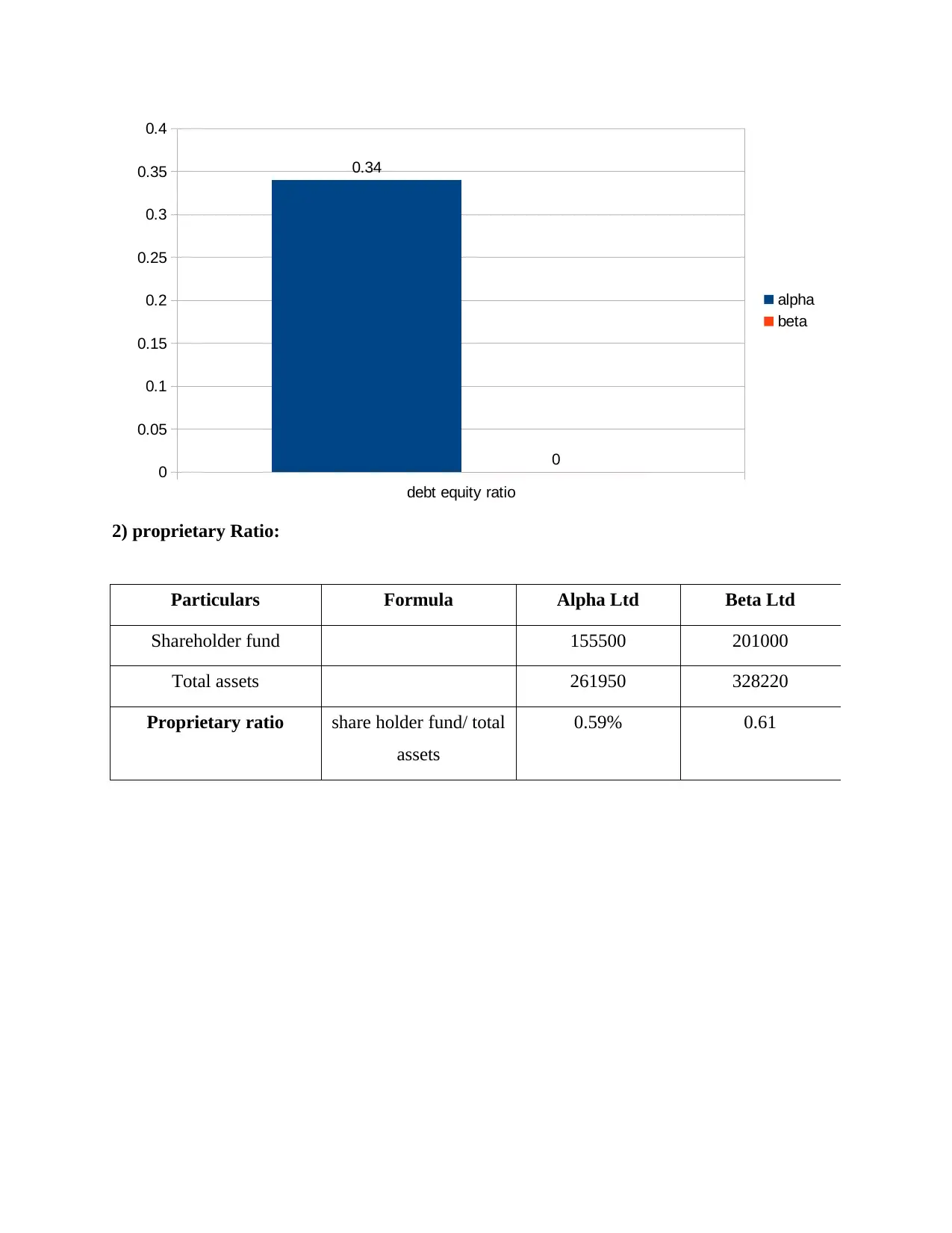

debt equity ratio

0

0.05

0.1

0.15

0.2

0.25

0.3

0.35

0.4

0.34

0

alpha

beta

2) proprietary Ratio:

Particulars Formula Alpha Ltd Beta Ltd

Shareholder fund 155500 201000

Total assets 261950 328220

Proprietary ratio share holder fund/ total

assets

0.59% 0.61

0

0.05

0.1

0.15

0.2

0.25

0.3

0.35

0.4

0.34

0

alpha

beta

2) proprietary Ratio:

Particulars Formula Alpha Ltd Beta Ltd

Shareholder fund 155500 201000

Total assets 261950 328220

Proprietary ratio share holder fund/ total

assets

0.59% 0.61

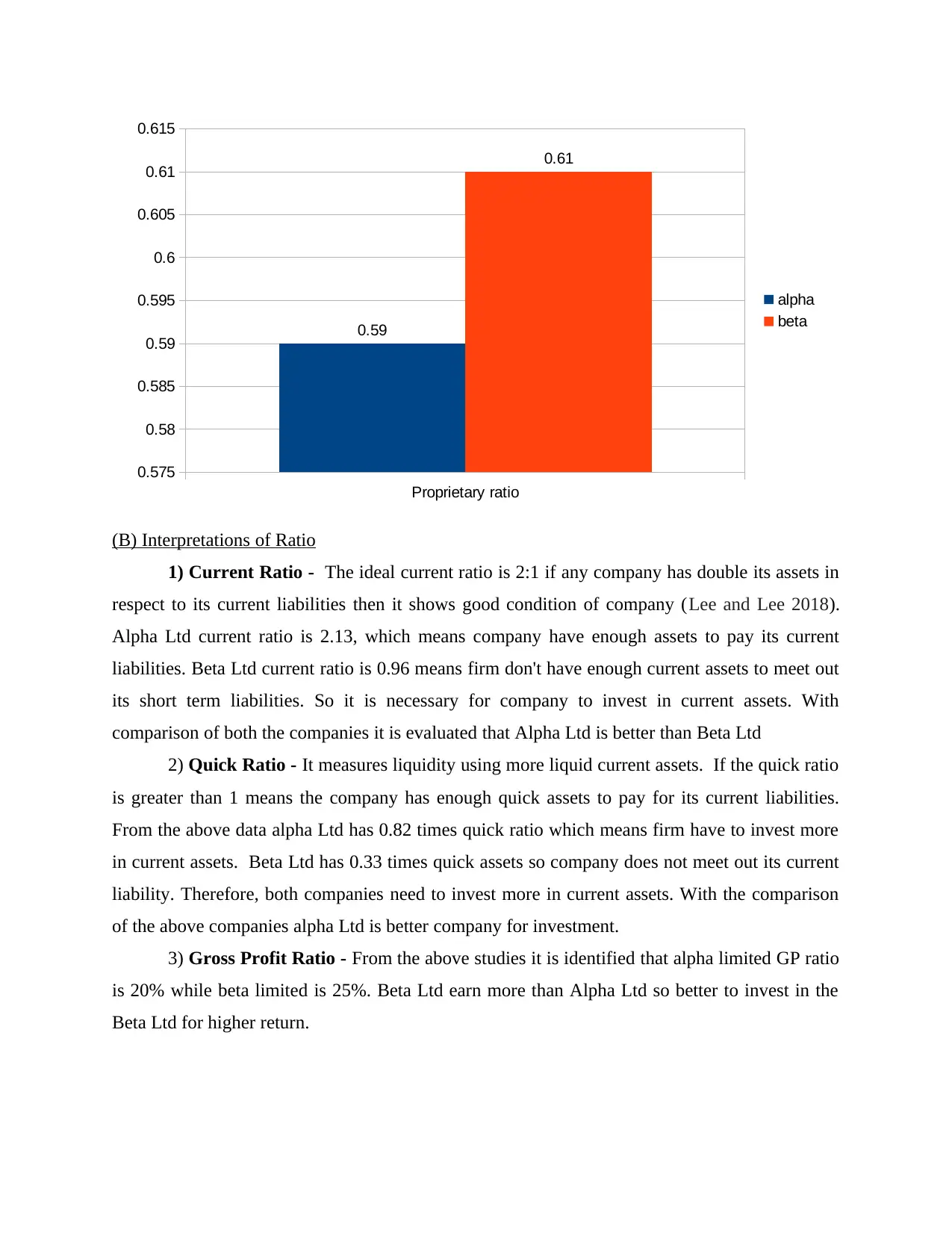

Proprietary ratio

0.575

0.58

0.585

0.59

0.595

0.6

0.605

0.61

0.615

0.59

0.61

alpha

beta

(B) Interpretations of Ratio

1) Current Ratio - The ideal current ratio is 2:1 if any company has double its assets in

respect to its current liabilities then it shows good condition of company (Lee and Lee 2018).

Alpha Ltd current ratio is 2.13, which means company have enough assets to pay its current

liabilities. Beta Ltd current ratio is 0.96 means firm don't have enough current assets to meet out

its short term liabilities. So it is necessary for company to invest in current assets. With

comparison of both the companies it is evaluated that Alpha Ltd is better than Beta Ltd

2) Quick Ratio - It measures liquidity using more liquid current assets. If the quick ratio

is greater than 1 means the company has enough quick assets to pay for its current liabilities.

From the above data alpha Ltd has 0.82 times quick ratio which means firm have to invest more

in current assets. Beta Ltd has 0.33 times quick assets so company does not meet out its current

liability. Therefore, both companies need to invest more in current assets. With the comparison

of the above companies alpha Ltd is better company for investment.

3) Gross Profit Ratio - From the above studies it is identified that alpha limited GP ratio

is 20% while beta limited is 25%. Beta Ltd earn more than Alpha Ltd so better to invest in the

Beta Ltd for higher return.

0.575

0.58

0.585

0.59

0.595

0.6

0.605

0.61

0.615

0.59

0.61

alpha

beta

(B) Interpretations of Ratio

1) Current Ratio - The ideal current ratio is 2:1 if any company has double its assets in

respect to its current liabilities then it shows good condition of company (Lee and Lee 2018).

Alpha Ltd current ratio is 2.13, which means company have enough assets to pay its current

liabilities. Beta Ltd current ratio is 0.96 means firm don't have enough current assets to meet out

its short term liabilities. So it is necessary for company to invest in current assets. With

comparison of both the companies it is evaluated that Alpha Ltd is better than Beta Ltd

2) Quick Ratio - It measures liquidity using more liquid current assets. If the quick ratio

is greater than 1 means the company has enough quick assets to pay for its current liabilities.

From the above data alpha Ltd has 0.82 times quick ratio which means firm have to invest more

in current assets. Beta Ltd has 0.33 times quick assets so company does not meet out its current

liability. Therefore, both companies need to invest more in current assets. With the comparison

of the above companies alpha Ltd is better company for investment.

3) Gross Profit Ratio - From the above studies it is identified that alpha limited GP ratio

is 20% while beta limited is 25%. Beta Ltd earn more than Alpha Ltd so better to invest in the

Beta Ltd for higher return.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.