Comprehensive Financial Analysis of Amaysim Limited (ASX Listed)

VerifiedAdded on 2021/06/17

|21

|5033

|44

Report

AI Summary

This report provides a comprehensive financial analysis of Amaysim Limited, a company listed on the Australian Securities Exchange (ASX). It begins with an overview of the company's profile and corporate governance structure, followed by a detailed examination of key financial ratios, including liquidity, profitability, and efficiency ratios, to assess Amaysim's financial health and operational performance. The report also includes the computation of the Weighted Average Cost of Capital (WACC) and beta to evaluate the company's risk profile, along with a debt ratio analysis. The analysis covers the period from 2016 to 2017. The report concludes with recommendations based on the financial analysis, offering insights into Amaysim's strengths, weaknesses, and potential areas for improvement. The report also includes the substantial stakeholders and board relationships.

qwertyuiopasdfghjklzxcvbnmqwerty

uiopasdfghjklzxcvbnmqwertyuiopasd

fghjklzxcvbnmqwertyuiopasdfghjklzx

cvbnmqwertyuiopasdfghjklzxcvbnmq

wertyuiopasdfghjklzxcvbnmqwertyui

opasdfghjklzxcvbnmqwertyuiopasdfg

hjklzxcvbnmqwertyuiopasdfghjklzxc

vbnmqwertyuiopasdfghjklzxcvbnmq

wertyuiopasdfghjklzxcvbnmqwertyui

opasdfghjklzxcvbnmqwertyuiopasdfg

hjklzxcvbnmqwertyuiopasdfghjklzxc

vbnmqwertyuiopasdfghjklzxcvbnmq

wertyuiopasdfghjklzxcvbnmqwertyui

opasdfghjklzxcvbnmqwertyuiopasdfg

hjklzxcvbnmrtyuiopasdfghjklzxcvbn

mqwertyuiopasdfghjklzxcvbnmqwert

yuiopasdfghjklzxcvbnmqwertyuiopas

FINANCE

uiopasdfghjklzxcvbnmqwertyuiopasd

fghjklzxcvbnmqwertyuiopasdfghjklzx

cvbnmqwertyuiopasdfghjklzxcvbnmq

wertyuiopasdfghjklzxcvbnmqwertyui

opasdfghjklzxcvbnmqwertyuiopasdfg

hjklzxcvbnmqwertyuiopasdfghjklzxc

vbnmqwertyuiopasdfghjklzxcvbnmq

wertyuiopasdfghjklzxcvbnmqwertyui

opasdfghjklzxcvbnmqwertyuiopasdfg

hjklzxcvbnmqwertyuiopasdfghjklzxc

vbnmqwertyuiopasdfghjklzxcvbnmq

wertyuiopasdfghjklzxcvbnmqwertyui

opasdfghjklzxcvbnmqwertyuiopasdfg

hjklzxcvbnmrtyuiopasdfghjklzxcvbn

mqwertyuiopasdfghjklzxcvbnmqwert

yuiopasdfghjklzxcvbnmqwertyuiopas

FINANCE

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Amaysim

Executive Summary

To analyse the business it is important to have an in-depth evaluation of the business function

together with the financials. The performance of a business can be ascertained through the

business function and its performance in the share market. In this report, the analysis of

Amaysim is done that is listed on the ASX. The report initiates with the business function

followed by the corporate governance. Ratio analysis is being done to know the performance

of the company in terms of various parameters. Further, the WACC and beta is computed to

know the risk worthiness. Further, the debt ratio is computed to know the level of debt of the

company. It is then followed by the recommendation.

2

Executive Summary

To analyse the business it is important to have an in-depth evaluation of the business function

together with the financials. The performance of a business can be ascertained through the

business function and its performance in the share market. In this report, the analysis of

Amaysim is done that is listed on the ASX. The report initiates with the business function

followed by the corporate governance. Ratio analysis is being done to know the performance

of the company in terms of various parameters. Further, the WACC and beta is computed to

know the risk worthiness. Further, the debt ratio is computed to know the level of debt of the

company. It is then followed by the recommendation.

2

Amaysim

Contents

Introduction...........................................................................................................................................3

1. Company profile............................................................................................................................4

2. Corporate Governance..................................................................................................................5

Substantial stakeholders....................................................................................................................5

3. Calculation of Performance Ratios.................................................................................................6

Liquidity ratios...............................................................................................................................6

Profitability ratios..........................................................................................................................7

Efficiency ratios..............................................................................................................................8

Market value share........................................................................................................................8

4. Graphs...........................................................................................................................................9

5. Announcements..........................................................................................................................10

6. Beta computation........................................................................................................................10

8. Debt ratio.....................................................................................................................................12

9. Dividend.......................................................................................................................................12

Recommendation and Conclusion.......................................................................................................14

References...........................................................................................................................................15

Appendix.............................................................................................................................................17

3

Contents

Introduction...........................................................................................................................................3

1. Company profile............................................................................................................................4

2. Corporate Governance..................................................................................................................5

Substantial stakeholders....................................................................................................................5

3. Calculation of Performance Ratios.................................................................................................6

Liquidity ratios...............................................................................................................................6

Profitability ratios..........................................................................................................................7

Efficiency ratios..............................................................................................................................8

Market value share........................................................................................................................8

4. Graphs...........................................................................................................................................9

5. Announcements..........................................................................................................................10

6. Beta computation........................................................................................................................10

8. Debt ratio.....................................................................................................................................12

9. Dividend.......................................................................................................................................12

Recommendation and Conclusion.......................................................................................................14

References...........................................................................................................................................15

Appendix.............................................................................................................................................17

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Amaysim

Introduction

In this report, AMAYSIM Limited listed on the ASX is selected for the purpose of study.

Before investing in a particular company it is important that the investors needs to have a

crystal clear view of the company’s functioning. This stretches from the ratio analysis to the

stock movement because one factor does not decide the functioning of the company.

Therefore, to understand the performance of the company, a comprehensive examination of

the various factors is evaluated. The scenario of the company depends on the acts of the

company. The company also tried to indulge into the business sector with the help of merging

with the Australian broadband services private limited in August 2016 which have helped

them a lot in order to accelerate the broadband services strategy and then create a leverage of

their status in the market. Also in the year 2017, the company have decided to use new

marketing techniques in order to enhance the broadband services by improvising new

unlimited data plans, no lock-in contracts, no activation fees and no expenses to be incurred

while switching plans.

4

Introduction

In this report, AMAYSIM Limited listed on the ASX is selected for the purpose of study.

Before investing in a particular company it is important that the investors needs to have a

crystal clear view of the company’s functioning. This stretches from the ratio analysis to the

stock movement because one factor does not decide the functioning of the company.

Therefore, to understand the performance of the company, a comprehensive examination of

the various factors is evaluated. The scenario of the company depends on the acts of the

company. The company also tried to indulge into the business sector with the help of merging

with the Australian broadband services private limited in August 2016 which have helped

them a lot in order to accelerate the broadband services strategy and then create a leverage of

their status in the market. Also in the year 2017, the company have decided to use new

marketing techniques in order to enhance the broadband services by improvising new

unlimited data plans, no lock-in contracts, no activation fees and no expenses to be incurred

while switching plans.

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Amaysim

1. Company profile

The AMAYSIM Limited Australia is a multiversity business that has been based on the

innovative technology and the main focus for them is to provide the best experience to their

customers. The company deals in the business of light and LED business model in which the

customer plays a very important role and no contracts are being taken so that the prices can

be transparent for the mobile devices, Broadband, and energy. After the company has

launched the BYO mobile services in the year 2010 it has observed use growth and the

mobile subscriber base have come up to approximately 1.07 million and those leading them

to become one of the largest mobile operators in Australia (Amaysim, 2017).

AMAYSIM Limited brand is powered by the Optus 4g+ network and is said to have one of

the best customer bases because of the top-notch service they have been providing them for

years. They make attractive offers to the customers by making simple and amazing mobile-

first customer experience platforms that are easy to understand and also very price efficient

so that major groups of the society can buy the product without hesitation (Parrino et. al,

2012). The customers have been given the service in which they are able to contact the care

service centre whenever they want so that the customer will not face any problem and also

give a good review for the product (Amaysim, 2017). The main focus of the company is to

improve the Technology and the customer base that will help them to grow with the help of

advancing new products and services regularly and keeping them involved in the process of

buying and selling. The strategy has made the form to a call from the mobile services

provider to become a big business that offers mobile phones, devices, broadband services,

and energy.

The company has also tried to improve the status of its energy providing branch by merging

with click energy group Holdings Private Limited which is an online Australian energy-

related retailer offering electricity and gas to the consumers. Also, it was observed that the

strategy of the firm was very similar to the merging company which will be helpful in

aligning their work with the management team and thus helps in enhancing the large-scale

operations that will be conducted by the firm in near future. It has been noticed that over

800,000 households have been indulged with the company in order to get the cross cell

potential at its best (Amaysim, 2017). The company has also made an execution team which

5

1. Company profile

The AMAYSIM Limited Australia is a multiversity business that has been based on the

innovative technology and the main focus for them is to provide the best experience to their

customers. The company deals in the business of light and LED business model in which the

customer plays a very important role and no contracts are being taken so that the prices can

be transparent for the mobile devices, Broadband, and energy. After the company has

launched the BYO mobile services in the year 2010 it has observed use growth and the

mobile subscriber base have come up to approximately 1.07 million and those leading them

to become one of the largest mobile operators in Australia (Amaysim, 2017).

AMAYSIM Limited brand is powered by the Optus 4g+ network and is said to have one of

the best customer bases because of the top-notch service they have been providing them for

years. They make attractive offers to the customers by making simple and amazing mobile-

first customer experience platforms that are easy to understand and also very price efficient

so that major groups of the society can buy the product without hesitation (Parrino et. al,

2012). The customers have been given the service in which they are able to contact the care

service centre whenever they want so that the customer will not face any problem and also

give a good review for the product (Amaysim, 2017). The main focus of the company is to

improve the Technology and the customer base that will help them to grow with the help of

advancing new products and services regularly and keeping them involved in the process of

buying and selling. The strategy has made the form to a call from the mobile services

provider to become a big business that offers mobile phones, devices, broadband services,

and energy.

The company has also tried to improve the status of its energy providing branch by merging

with click energy group Holdings Private Limited which is an online Australian energy-

related retailer offering electricity and gas to the consumers. Also, it was observed that the

strategy of the firm was very similar to the merging company which will be helpful in

aligning their work with the management team and thus helps in enhancing the large-scale

operations that will be conducted by the firm in near future. It has been noticed that over

800,000 households have been indulged with the company in order to get the cross cell

potential at its best (Amaysim, 2017). The company has also made an execution team which

5

Amaysim

have made strategies in order to make progress in this field and this work hard in order to get

all these products in the market under the name of AMAYSIM Limited thus making this very

important step in order to gain future importance in the cross-selling potential which will be

unlocked by the application of these kind of strategies. The company has made it clear that it

will be enhancing the technology platform and thus making the trademark of the company-

centric approach so that it may prevail in almost all Australian household in any form of

energy or service (Merchant, 2012).

2. Corporate Governance

The Board of Directors of the company has the duty of putting the business on the right track.

The company referred to here is Amaysim Group. The Board dominates the functions a.ong

with the financial position and thus the output presented by the company. Board decides the

strategy to be followed so that the business gets stronger with time and also decides the

investment sector along with the amount to be invested (Amaysim, 2017). The core of the

Board is to raise the performance rate of the company so as to increase the share price and the

generated revenue. It is the Board who is to see the expansion of the Amaysim Group. It is

the duty of the company to see that all the presented information by the company is made

available to the customers as soon as possible. Rules associated to the timely delivering of

essential and fair information by the company must be made as per the ASX Listing Rules

and the Corporations Act. The policies followed by the company show that how the outlets

of the Amaysim should work and what kind of working atmosphere should exist. Legal

guidance is also necessary for the expansion so that the outlets carry on their duty under the

legal rules and regulations that are framed as per the policies of the company.

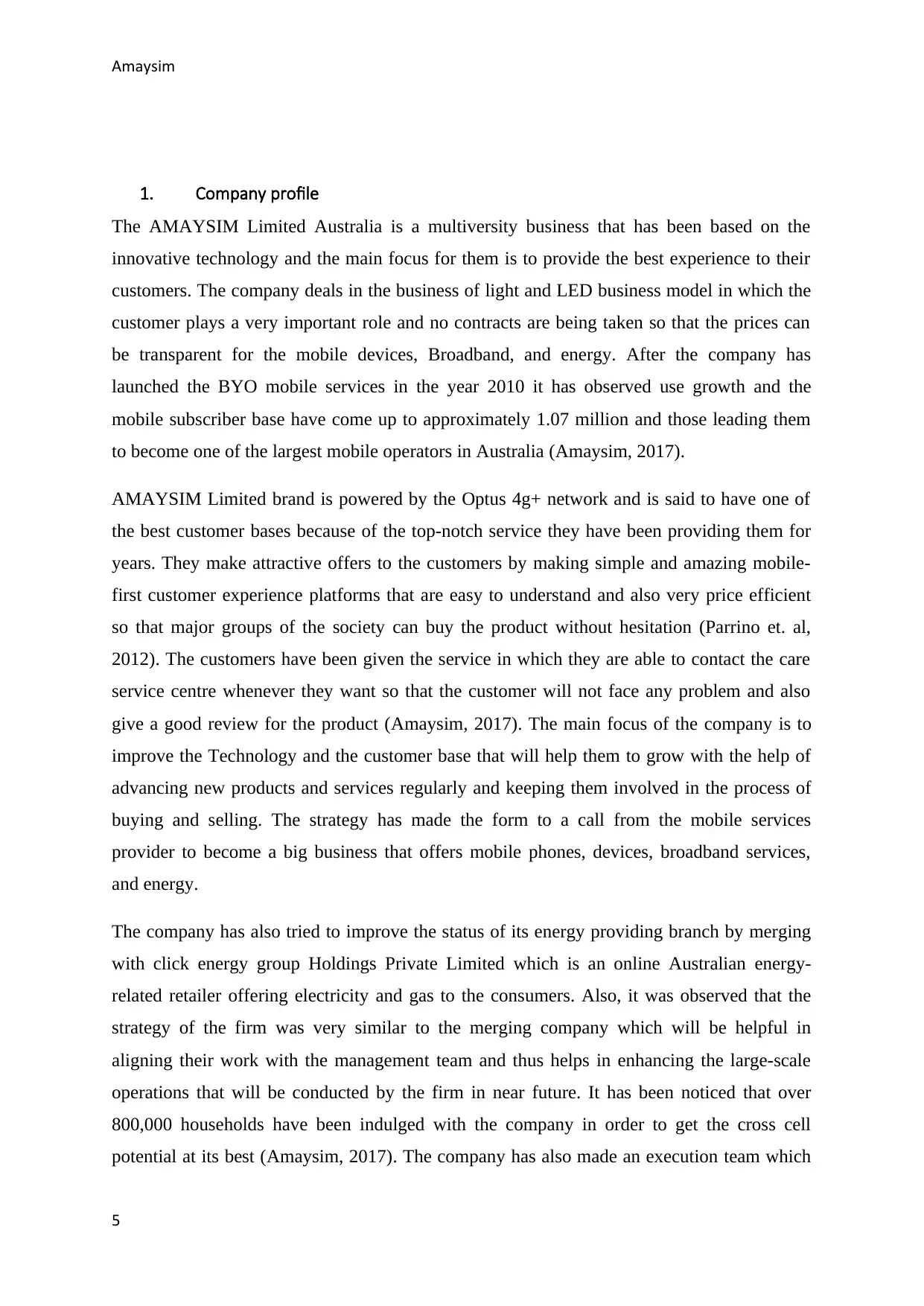

Substantial stakeholders

Name Equities %

Investmentaktiengesellschaft für langfristige Investoren TGV 27,094,691 12.9%

FIL Investment Management (Hong Kong) Ltd. 11,016,638 5.23%

Steamboat Capital Partners LLC 10,518,562 4.99%

Merlon Capital Partners Pty Ltd. 10,219,822 4.85%

Challenger Ltd. (Investment Management) 10,219,822 4.85%

6

have made strategies in order to make progress in this field and this work hard in order to get

all these products in the market under the name of AMAYSIM Limited thus making this very

important step in order to gain future importance in the cross-selling potential which will be

unlocked by the application of these kind of strategies. The company has made it clear that it

will be enhancing the technology platform and thus making the trademark of the company-

centric approach so that it may prevail in almost all Australian household in any form of

energy or service (Merchant, 2012).

2. Corporate Governance

The Board of Directors of the company has the duty of putting the business on the right track.

The company referred to here is Amaysim Group. The Board dominates the functions a.ong

with the financial position and thus the output presented by the company. Board decides the

strategy to be followed so that the business gets stronger with time and also decides the

investment sector along with the amount to be invested (Amaysim, 2017). The core of the

Board is to raise the performance rate of the company so as to increase the share price and the

generated revenue. It is the Board who is to see the expansion of the Amaysim Group. It is

the duty of the company to see that all the presented information by the company is made

available to the customers as soon as possible. Rules associated to the timely delivering of

essential and fair information by the company must be made as per the ASX Listing Rules

and the Corporations Act. The policies followed by the company show that how the outlets

of the Amaysim should work and what kind of working atmosphere should exist. Legal

guidance is also necessary for the expansion so that the outlets carry on their duty under the

legal rules and regulations that are framed as per the policies of the company.

Substantial stakeholders

Name Equities %

Investmentaktiengesellschaft für langfristige Investoren TGV 27,094,691 12.9%

FIL Investment Management (Hong Kong) Ltd. 11,016,638 5.23%

Steamboat Capital Partners LLC 10,518,562 4.99%

Merlon Capital Partners Pty Ltd. 10,219,822 4.85%

Challenger Ltd. (Investment Management) 10,219,822 4.85%

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Amaysim

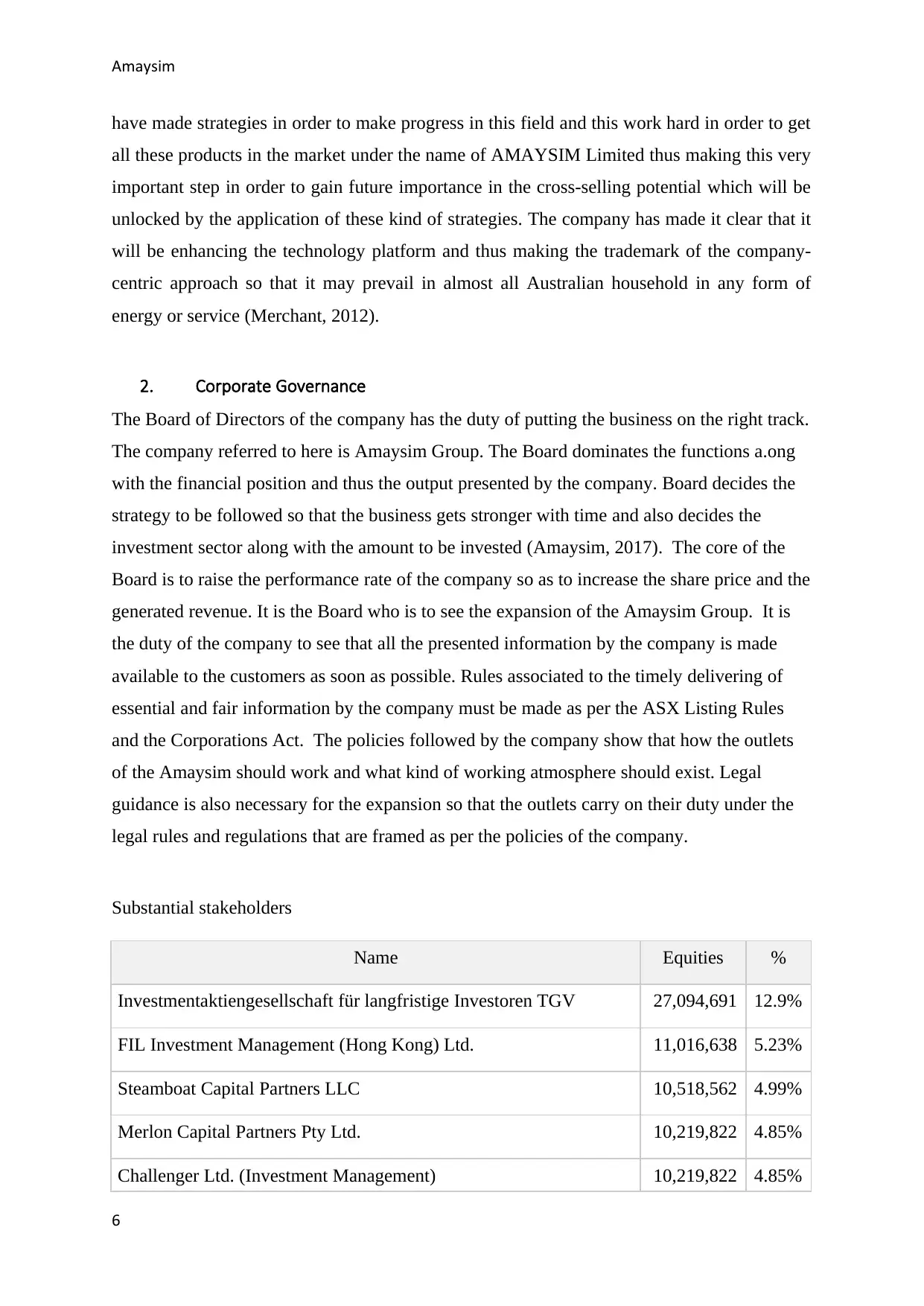

VP Bank AG (Private Banking) 10,162,583 4.82%

Investors Mutual Ltd. 9,515,156 4.51%

Colonial First State Asset Management (Australia) Ltd. 9,423,658 4.47%

AustralianSuper Pty Ltd. 9,264,873 4.40%

Antares Capital Partners Ltd. 8,761,330 4.16%

Name Board Relationships

Andrew Reitzer 23 Relationships

Julian Ismet Ogrin 7 Relationships

Maria Anne Martin 7 Relationships

Peter J. O'Connell 9 Relationships

Jodie Sangster 5 Relationships

3. Calculation of Performance Ratios

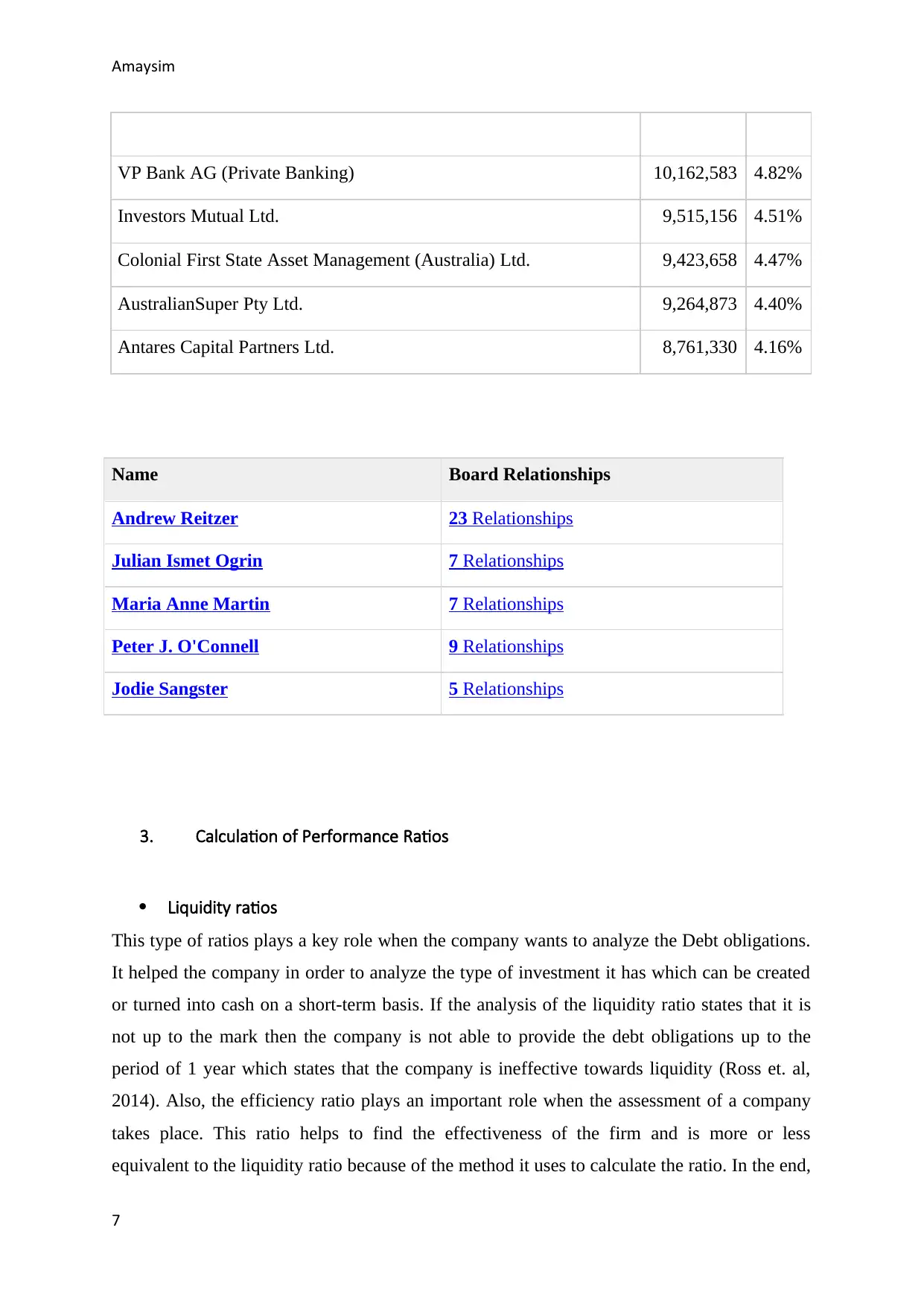

Liquidity ratios

This type of ratios plays a key role when the company wants to analyze the Debt obligations.

It helped the company in order to analyze the type of investment it has which can be created

or turned into cash on a short-term basis. If the analysis of the liquidity ratio states that it is

not up to the mark then the company is not able to provide the debt obligations up to the

period of 1 year which states that the company is ineffective towards liquidity (Ross et. al,

2014). Also, the efficiency ratio plays an important role when the assessment of a company

takes place. This ratio helps to find the effectiveness of the firm and is more or less

equivalent to the liquidity ratio because of the method it uses to calculate the ratio. In the end,

7

VP Bank AG (Private Banking) 10,162,583 4.82%

Investors Mutual Ltd. 9,515,156 4.51%

Colonial First State Asset Management (Australia) Ltd. 9,423,658 4.47%

AustralianSuper Pty Ltd. 9,264,873 4.40%

Antares Capital Partners Ltd. 8,761,330 4.16%

Name Board Relationships

Andrew Reitzer 23 Relationships

Julian Ismet Ogrin 7 Relationships

Maria Anne Martin 7 Relationships

Peter J. O'Connell 9 Relationships

Jodie Sangster 5 Relationships

3. Calculation of Performance Ratios

Liquidity ratios

This type of ratios plays a key role when the company wants to analyze the Debt obligations.

It helped the company in order to analyze the type of investment it has which can be created

or turned into cash on a short-term basis. If the analysis of the liquidity ratio states that it is

not up to the mark then the company is not able to provide the debt obligations up to the

period of 1 year which states that the company is ineffective towards liquidity (Ross et. al,

2014). Also, the efficiency ratio plays an important role when the assessment of a company

takes place. This ratio helps to find the effectiveness of the firm and is more or less

equivalent to the liquidity ratio because of the method it uses to calculate the ratio. In the end,

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Amaysim

it is clear that the management will be unable to use the funds and this will also be restricted

from earning profits (Petty et. al, 2012).

2016 2017

current ratio = CA/Cl 0.34285714 0.6031746

liquid ratio =quick assets/ current liabilities 0.34285714 0.6031746

The current ratio is used to find out that the rotation of words can be made with the help of

debtors and a stock present in the company or not. The main purpose is to clear the creditors

with the help of debtors and stock and as dividing current assets of the company with its

current liabilities (Melville, 2009). The quick ratios are used by the company in order to

evaluate the liabilities that it has to pay so that a better and clear view of the current ratios can

be included because there is the absence of stocks in this ratio (Lapsley et. al, 2012).

The quick ratio of the company is said to be one is to one that states that the liquidity strength

is good and also the company can meet the future applications in order to indulge in business

applications. Also, the fixed asset ratio of the company is depicting a uniform nature does

reflecting utilization of the Assets of both years and making it profitable for the firm.

As per the liquidity, it can be commented that the company is facing huge issue because the

current assets are insufficient to meet the liabilities. The standard ratio should be 1:1 that

indicates $1 of current asset for every $1 of current liabilities (Merchant et. al 2012).

However, both the current ratio and the quick ratio projects weakness in the company’s

liquidity and hence, will be difficult when it comes to the payment of liabilities.

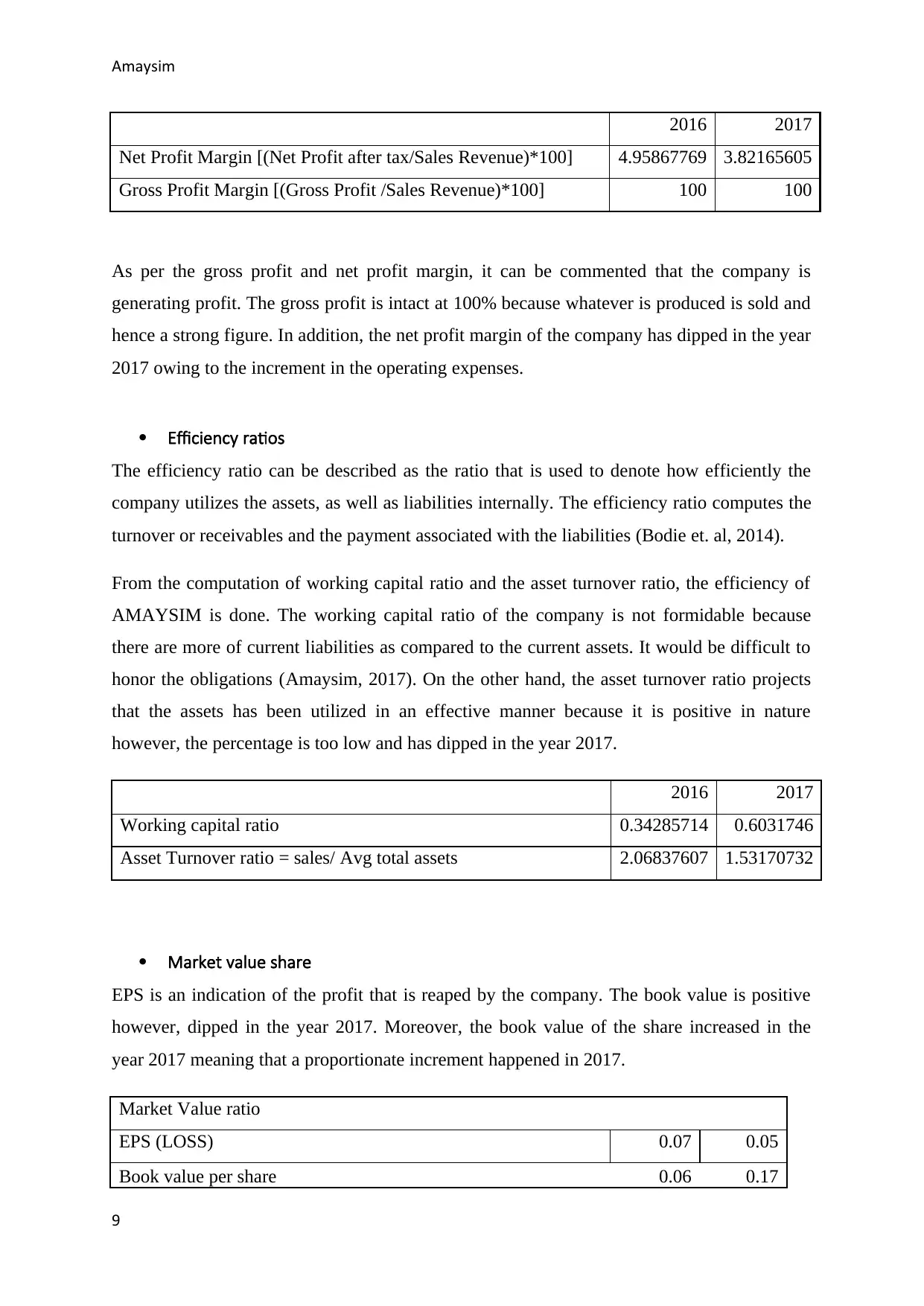

Profitability ratios

These types of ratios can be used in order to calculate the general earnings with respect to the

cost and other expenses that are incurred by the firm generally. The high value of ratios

depicts the superiority of the firm in the market in relation to its competitors. The difference

between the previous year’s ratio and the current ratio is also high then a positive working

environment of the firm is estimated thus making it very profitable as the net profit margin,

gross profit margin, and return on equity and return on assets will increase (Brealey et. al,

2011). Determination of this kind of profit margins will help the firm to determine the usage of

materials And Labour which have been used in the manufacturing process.

8

it is clear that the management will be unable to use the funds and this will also be restricted

from earning profits (Petty et. al, 2012).

2016 2017

current ratio = CA/Cl 0.34285714 0.6031746

liquid ratio =quick assets/ current liabilities 0.34285714 0.6031746

The current ratio is used to find out that the rotation of words can be made with the help of

debtors and a stock present in the company or not. The main purpose is to clear the creditors

with the help of debtors and stock and as dividing current assets of the company with its

current liabilities (Melville, 2009). The quick ratios are used by the company in order to

evaluate the liabilities that it has to pay so that a better and clear view of the current ratios can

be included because there is the absence of stocks in this ratio (Lapsley et. al, 2012).

The quick ratio of the company is said to be one is to one that states that the liquidity strength

is good and also the company can meet the future applications in order to indulge in business

applications. Also, the fixed asset ratio of the company is depicting a uniform nature does

reflecting utilization of the Assets of both years and making it profitable for the firm.

As per the liquidity, it can be commented that the company is facing huge issue because the

current assets are insufficient to meet the liabilities. The standard ratio should be 1:1 that

indicates $1 of current asset for every $1 of current liabilities (Merchant et. al 2012).

However, both the current ratio and the quick ratio projects weakness in the company’s

liquidity and hence, will be difficult when it comes to the payment of liabilities.

Profitability ratios

These types of ratios can be used in order to calculate the general earnings with respect to the

cost and other expenses that are incurred by the firm generally. The high value of ratios

depicts the superiority of the firm in the market in relation to its competitors. The difference

between the previous year’s ratio and the current ratio is also high then a positive working

environment of the firm is estimated thus making it very profitable as the net profit margin,

gross profit margin, and return on equity and return on assets will increase (Brealey et. al,

2011). Determination of this kind of profit margins will help the firm to determine the usage of

materials And Labour which have been used in the manufacturing process.

8

Amaysim

2016 2017

Net Profit Margin [(Net Profit after tax/Sales Revenue)*100] 4.95867769 3.82165605

Gross Profit Margin [(Gross Profit /Sales Revenue)*100] 100 100

As per the gross profit and net profit margin, it can be commented that the company is

generating profit. The gross profit is intact at 100% because whatever is produced is sold and

hence a strong figure. In addition, the net profit margin of the company has dipped in the year

2017 owing to the increment in the operating expenses.

Efficiency ratios

The efficiency ratio can be described as the ratio that is used to denote how efficiently the

company utilizes the assets, as well as liabilities internally. The efficiency ratio computes the

turnover or receivables and the payment associated with the liabilities (Bodie et. al, 2014).

From the computation of working capital ratio and the asset turnover ratio, the efficiency of

AMAYSIM is done. The working capital ratio of the company is not formidable because

there are more of current liabilities as compared to the current assets. It would be difficult to

honor the obligations (Amaysim, 2017). On the other hand, the asset turnover ratio projects

that the assets has been utilized in an effective manner because it is positive in nature

however, the percentage is too low and has dipped in the year 2017.

2016 2017

Working capital ratio 0.34285714 0.6031746

Asset Turnover ratio = sales/ Avg total assets 2.06837607 1.53170732

Market value share

EPS is an indication of the profit that is reaped by the company. The book value is positive

however, dipped in the year 2017. Moreover, the book value of the share increased in the

year 2017 meaning that a proportionate increment happened in 2017.

Market Value ratio

EPS (LOSS) 0.07 0.05

Book value per share 0.06 0.17

9

2016 2017

Net Profit Margin [(Net Profit after tax/Sales Revenue)*100] 4.95867769 3.82165605

Gross Profit Margin [(Gross Profit /Sales Revenue)*100] 100 100

As per the gross profit and net profit margin, it can be commented that the company is

generating profit. The gross profit is intact at 100% because whatever is produced is sold and

hence a strong figure. In addition, the net profit margin of the company has dipped in the year

2017 owing to the increment in the operating expenses.

Efficiency ratios

The efficiency ratio can be described as the ratio that is used to denote how efficiently the

company utilizes the assets, as well as liabilities internally. The efficiency ratio computes the

turnover or receivables and the payment associated with the liabilities (Bodie et. al, 2014).

From the computation of working capital ratio and the asset turnover ratio, the efficiency of

AMAYSIM is done. The working capital ratio of the company is not formidable because

there are more of current liabilities as compared to the current assets. It would be difficult to

honor the obligations (Amaysim, 2017). On the other hand, the asset turnover ratio projects

that the assets has been utilized in an effective manner because it is positive in nature

however, the percentage is too low and has dipped in the year 2017.

2016 2017

Working capital ratio 0.34285714 0.6031746

Asset Turnover ratio = sales/ Avg total assets 2.06837607 1.53170732

Market value share

EPS is an indication of the profit that is reaped by the company. The book value is positive

however, dipped in the year 2017. Moreover, the book value of the share increased in the

year 2017 meaning that a proportionate increment happened in 2017.

Market Value ratio

EPS (LOSS) 0.07 0.05

Book value per share 0.06 0.17

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Amaysim

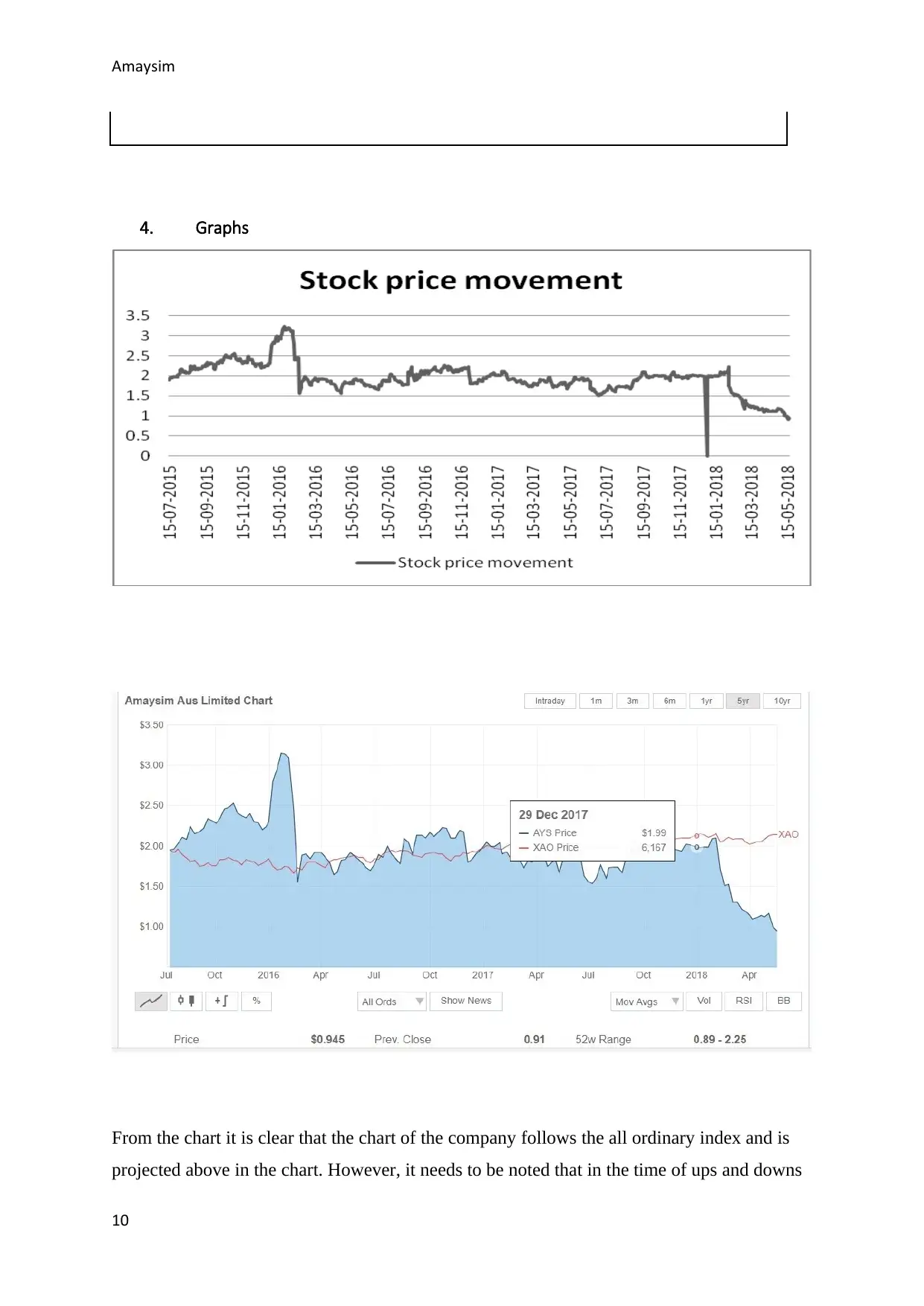

4. Graphs

From the chart it is clear that the chart of the company follows the all ordinary index and is

projected above in the chart. However, it needs to be noted that in the time of ups and downs

10

4. Graphs

From the chart it is clear that the chart of the company follows the all ordinary index and is

projected above in the chart. However, it needs to be noted that in the time of ups and downs

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Amaysim

it fails to match the line. In short, when there is a volatility, it fails to consider the line (Porter

& Norton, 2014).

5. Announcements

At the half year ending, the output shared by Telco showed that the total revenue which was

generated at the time was about $292-$294 million and in this, the company only generated

$17-$18 million. It was in these circumstances that the company raised the bar for the mobile

users by 10 percent but then also the APRU decreased to $22.46 which showed the downfall

to be of 7 percent which was similar to the downfall of the total revenue generated

(Amaysim, 2017).

The company in its presentation showed that the cheaper plans introduced by the company

was opted for by the customers which recharged with decreased data top-up and this

decreased the overall revenue. It shares have been seen to be unstable. It was seen to increase

by $1.50 in February 2015 but then it collapsed. Amaysim has been facing stiff competition

from Aldi who has been in the same field. They both are the seller of the Optus Spectrum

Extra features are the ones that allow Amaysim to dominate the market and that is the online

mode which attracts customers to join with a penny to spare and the cheaper plans have also

been a boon against the other telcos companies

The increment in the number of customers has led to increase in EBITDA of the Amaysim

Group which is seen to be beneficial for revenue generation

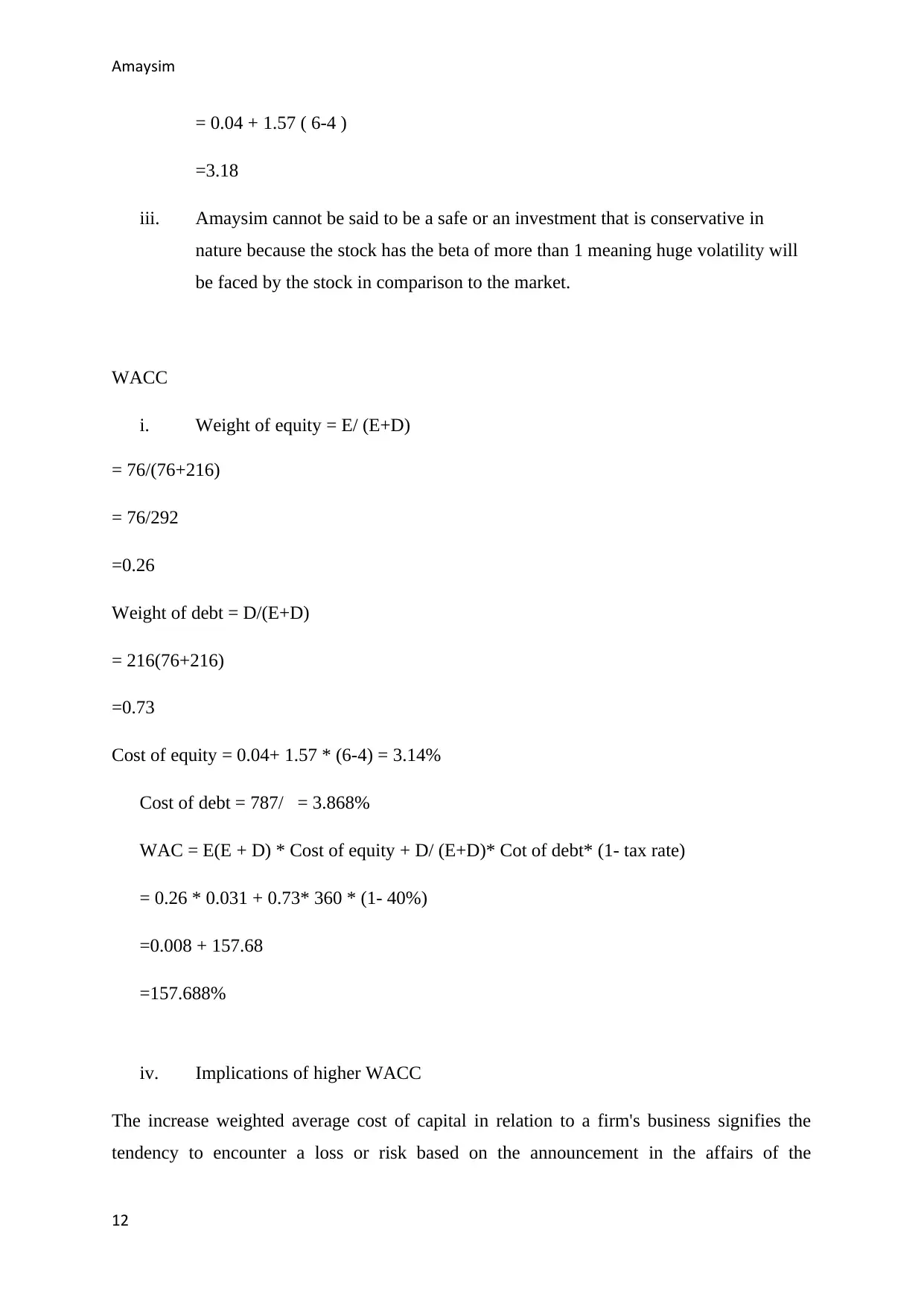

6. Beta computation

i. Beta is a measurement of the volatility of the stock in comparison to the market as

a whole. For Amaysim, the beta stands at 1.57. Since, the beta of the stock is more

than 1 it indicates that the volatility of the stock is more as compared to the market

volatility (Marsh, 2009).

ii. CAPM

E(R) = RFR + βstock (Rmarket – RFR)

11

it fails to match the line. In short, when there is a volatility, it fails to consider the line (Porter

& Norton, 2014).

5. Announcements

At the half year ending, the output shared by Telco showed that the total revenue which was

generated at the time was about $292-$294 million and in this, the company only generated

$17-$18 million. It was in these circumstances that the company raised the bar for the mobile

users by 10 percent but then also the APRU decreased to $22.46 which showed the downfall

to be of 7 percent which was similar to the downfall of the total revenue generated

(Amaysim, 2017).

The company in its presentation showed that the cheaper plans introduced by the company

was opted for by the customers which recharged with decreased data top-up and this

decreased the overall revenue. It shares have been seen to be unstable. It was seen to increase

by $1.50 in February 2015 but then it collapsed. Amaysim has been facing stiff competition

from Aldi who has been in the same field. They both are the seller of the Optus Spectrum

Extra features are the ones that allow Amaysim to dominate the market and that is the online

mode which attracts customers to join with a penny to spare and the cheaper plans have also

been a boon against the other telcos companies

The increment in the number of customers has led to increase in EBITDA of the Amaysim

Group which is seen to be beneficial for revenue generation

6. Beta computation

i. Beta is a measurement of the volatility of the stock in comparison to the market as

a whole. For Amaysim, the beta stands at 1.57. Since, the beta of the stock is more

than 1 it indicates that the volatility of the stock is more as compared to the market

volatility (Marsh, 2009).

ii. CAPM

E(R) = RFR + βstock (Rmarket – RFR)

11

Amaysim

= 0.04 + 1.57 ( 6-4 )

=3.18

iii. Amaysim cannot be said to be a safe or an investment that is conservative in

nature because the stock has the beta of more than 1 meaning huge volatility will

be faced by the stock in comparison to the market.

WACC

i. Weight of equity = E/ (E+D)

= 76/(76+216)

= 76/292

=0.26

Weight of debt = D/(E+D)

= 216(76+216)

=0.73

Cost of equity = 0.04+ 1.57 * (6-4) = 3.14%

Cost of debt = 787/ = 3.868%

WAC = E(E + D) * Cost of equity + D/ (E+D)* Cot of debt* (1- tax rate)

= 0.26 * 0.031 + 0.73* 360 * (1- 40%)

=0.008 + 157.68

=157.688%

iv. Implications of higher WACC

The increase weighted average cost of capital in relation to a firm's business signifies the

tendency to encounter a loss or risk based on the announcement in the affairs of the

12

= 0.04 + 1.57 ( 6-4 )

=3.18

iii. Amaysim cannot be said to be a safe or an investment that is conservative in

nature because the stock has the beta of more than 1 meaning huge volatility will

be faced by the stock in comparison to the market.

WACC

i. Weight of equity = E/ (E+D)

= 76/(76+216)

= 76/292

=0.26

Weight of debt = D/(E+D)

= 216(76+216)

=0.73

Cost of equity = 0.04+ 1.57 * (6-4) = 3.14%

Cost of debt = 787/ = 3.868%

WAC = E(E + D) * Cost of equity + D/ (E+D)* Cot of debt* (1- tax rate)

= 0.26 * 0.031 + 0.73* 360 * (1- 40%)

=0.008 + 157.68

=157.688%

iv. Implications of higher WACC

The increase weighted average cost of capital in relation to a firm's business signifies the

tendency to encounter a loss or risk based on the announcement in the affairs of the

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 21

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.