Comprehensive Financial Performance Analysis of Amcor Ltd (2016)

VerifiedAdded on 2020/05/04

|17

|2902

|123

Report

AI Summary

This report provides a comprehensive financial analysis of Amcor Ltd, a multinational packaging business. It begins with an executive summary and a table of contents. Part I focuses on debt valuation, examining long-term and short-term debts, comparing debt structures, analyzing industry influences, and calculating the cost of debt. Part II delves into share valuation, including the cost of equity, analysis of reported earnings, valuation using a comparable approach (PE ratio), a discussion of a reasonable approach based on market price, and essential data for share valuation. Part III covers the calculation of the Weighted Average Cost of Capital (WACC), tax rate considerations, differences between cost of debt and equity, the impact of current liabilities, the major value for WACC, and the application of WACC in investment decisions. It also discusses capital structure and optimal capital structure. Finally, Part IV offers a comparative analysis of Amcor Ltd's financial performance against industry averages, including ROA, ROE, and revenue growth. The report utilizes data from Amcor Ltd's annual reports and relevant financial models.

Running head: ACCOUNTING

Accounting

Name of the Student:

Name of the University:

Authors Note:

Accounting

Name of the Student:

Name of the University:

Authors Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1ACCOUNTING

Executive Summary

In this report, an attempt is made to analyse the financial performance of the company. In

order to do that the debt, equity and valuation of the company is analysed. The result of the

analysis show that the company is performing reasonably well than its competitors.

Executive Summary

In this report, an attempt is made to analyse the financial performance of the company. In

order to do that the debt, equity and valuation of the company is analysed. The result of the

analysis show that the company is performing reasonably well than its competitors.

2ACCOUNTING

Table of Contents

Part I:..........................................................................................................................................1

1..............................................................................................................................................1

Long term and Short term debts:............................................................................................1

Comparing Debt Structure:....................................................................................................2

Influence of industry in the debt of the company:.................................................................3

Cost of debt............................................................................................................................3

Part II:.........................................................................................................................................4

Cost of Equity:.......................................................................................................................4

2..............................................................................................................................................4

Analysis of the firm’s reported earnings:...............................................................................4

3..............................................................................................................................................5

Valuation of companies stock using comparable approach...................................................5

4..............................................................................................................................................6

Reasonable Approach based on the current market price......................................................6

5..............................................................................................................................................6

Additional information and data essential to value firm’s share:..........................................6

Part III........................................................................................................................................6

Part IV:.....................................................................................................................................10

Comparative Analysis of financial performance of company and industry:........................10

Literature search on company:.............................................................................................10

Table of Contents

Part I:..........................................................................................................................................1

1..............................................................................................................................................1

Long term and Short term debts:............................................................................................1

Comparing Debt Structure:....................................................................................................2

Influence of industry in the debt of the company:.................................................................3

Cost of debt............................................................................................................................3

Part II:.........................................................................................................................................4

Cost of Equity:.......................................................................................................................4

2..............................................................................................................................................4

Analysis of the firm’s reported earnings:...............................................................................4

3..............................................................................................................................................5

Valuation of companies stock using comparable approach...................................................5

4..............................................................................................................................................6

Reasonable Approach based on the current market price......................................................6

5..............................................................................................................................................6

Additional information and data essential to value firm’s share:..........................................6

Part III........................................................................................................................................6

Part IV:.....................................................................................................................................10

Comparative Analysis of financial performance of company and industry:........................10

Literature search on company:.............................................................................................10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3ACCOUNTING

Other items that are relevant to the company:.....................................................................11

Reference..................................................................................................................................12

Other items that are relevant to the company:.....................................................................11

Reference..................................................................................................................................12

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4ACCOUNTING

Part I:

Debt Valuation:

1.

Long term and Short term debts:

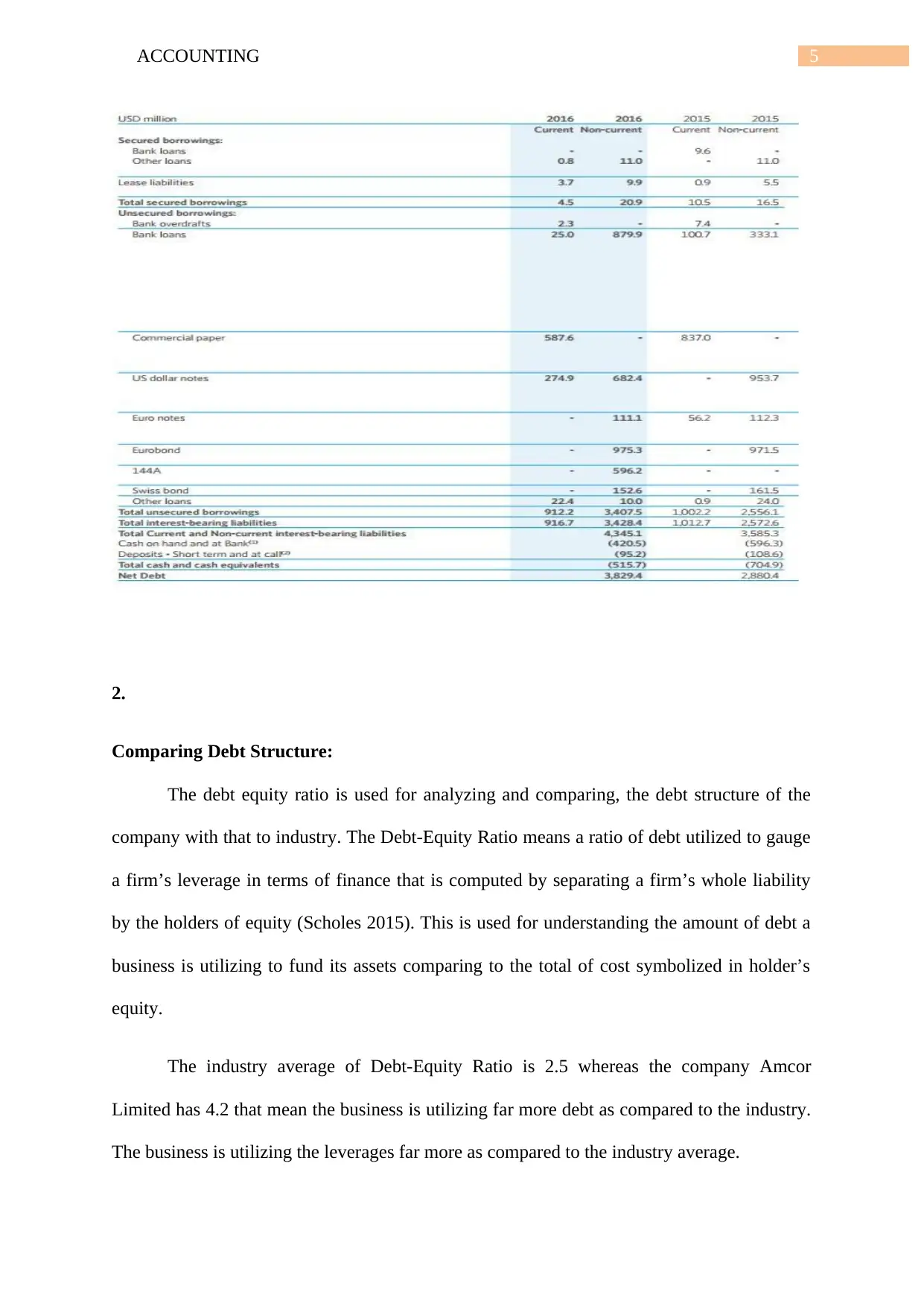

In observing and critically examining the annual report of Amcor Ltd, that is a

multinational packaging business. Amcor has a strong balance sheet and an exceptional

liability profile. The Amcor Ltd borrowed finance from various financial organizations and

debt providers in the way of overdrafts, loans, corporate bonds, commercial paper and

unsecured notes (Franks 2014). The company has a good mix of floating and fixed rate of

interests and utilizes the rate of interest swaps to supply additional elasticity in administering

the expense of interest borrowings. The liabilities that bear interests are categorized under

current liability except for some liabilities where the company has a right to postpone the

settlement on unconditional terms for minimum of 12 months subsequent to the end of the

year that are categorized under non-current liabilities. The total current interest bearing debts

is $ 916.7 and non-current interest bearing debts is $ 3428.4 in 2016. The company has

utilized Euro bonds, Swiss bonds, etc for Long-term debts and commercial papers, bank

overdrafts are utilized for Short-term debts. This is being nicely displayed in the below figure

that is taken from annual report.

Part I:

Debt Valuation:

1.

Long term and Short term debts:

In observing and critically examining the annual report of Amcor Ltd, that is a

multinational packaging business. Amcor has a strong balance sheet and an exceptional

liability profile. The Amcor Ltd borrowed finance from various financial organizations and

debt providers in the way of overdrafts, loans, corporate bonds, commercial paper and

unsecured notes (Franks 2014). The company has a good mix of floating and fixed rate of

interests and utilizes the rate of interest swaps to supply additional elasticity in administering

the expense of interest borrowings. The liabilities that bear interests are categorized under

current liability except for some liabilities where the company has a right to postpone the

settlement on unconditional terms for minimum of 12 months subsequent to the end of the

year that are categorized under non-current liabilities. The total current interest bearing debts

is $ 916.7 and non-current interest bearing debts is $ 3428.4 in 2016. The company has

utilized Euro bonds, Swiss bonds, etc for Long-term debts and commercial papers, bank

overdrafts are utilized for Short-term debts. This is being nicely displayed in the below figure

that is taken from annual report.

5ACCOUNTING

2.

Comparing Debt Structure:

The debt equity ratio is used for analyzing and comparing, the debt structure of the

company with that to industry. The Debt-Equity Ratio means a ratio of debt utilized to gauge

a firm’s leverage in terms of finance that is computed by separating a firm’s whole liability

by the holders of equity (Scholes 2015). This is used for understanding the amount of debt a

business is utilizing to fund its assets comparing to the total of cost symbolized in holder’s

equity.

The industry average of Debt-Equity Ratio is 2.5 whereas the company Amcor

Limited has 4.2 that mean the business is utilizing far more debt as compared to the industry.

The business is utilizing the leverages far more as compared to the industry average.

2.

Comparing Debt Structure:

The debt equity ratio is used for analyzing and comparing, the debt structure of the

company with that to industry. The Debt-Equity Ratio means a ratio of debt utilized to gauge

a firm’s leverage in terms of finance that is computed by separating a firm’s whole liability

by the holders of equity (Scholes 2015). This is used for understanding the amount of debt a

business is utilizing to fund its assets comparing to the total of cost symbolized in holder’s

equity.

The industry average of Debt-Equity Ratio is 2.5 whereas the company Amcor

Limited has 4.2 that mean the business is utilizing far more debt as compared to the industry.

The business is utilizing the leverages far more as compared to the industry average.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6ACCOUNTING

3.

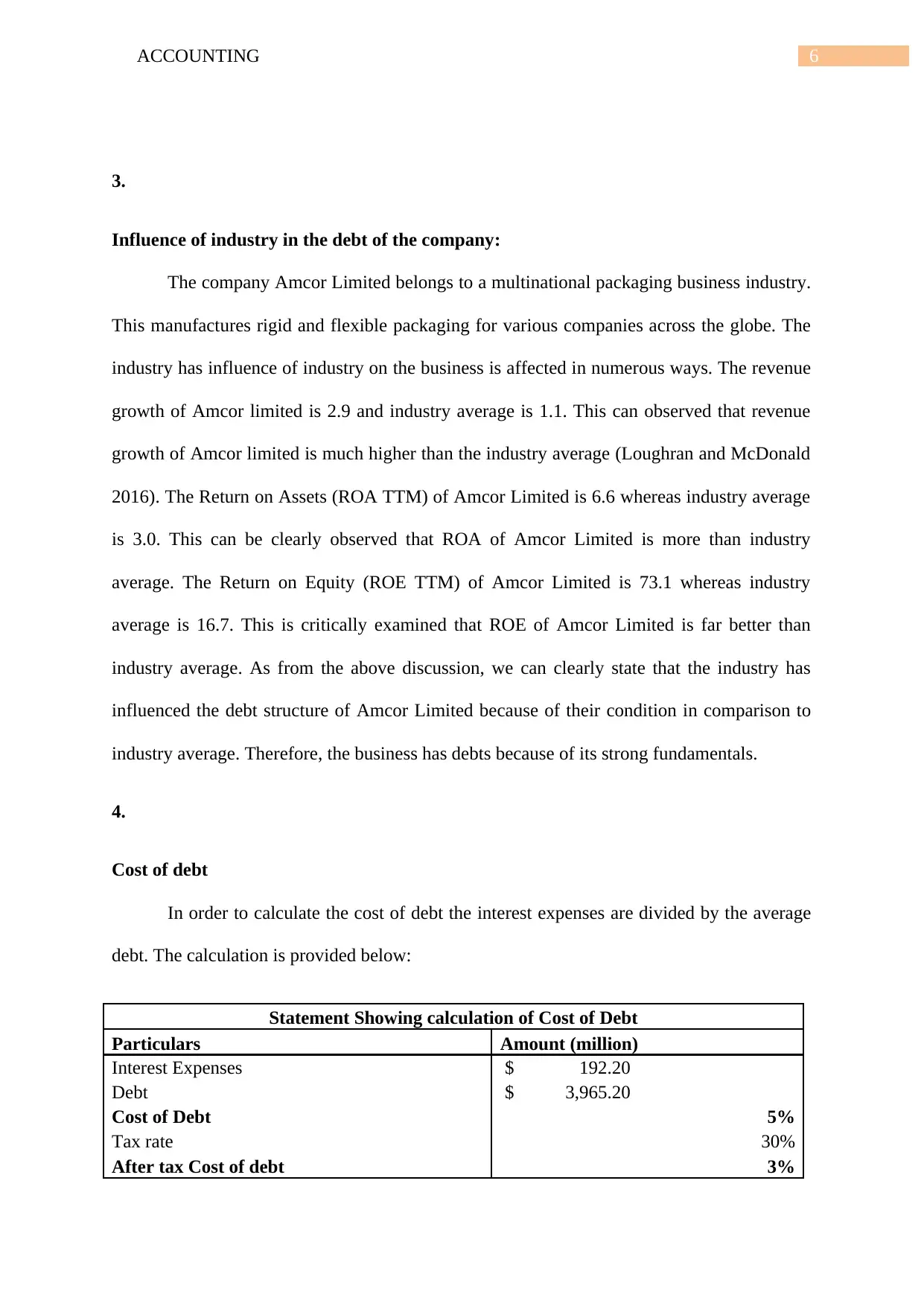

Influence of industry in the debt of the company:

The company Amcor Limited belongs to a multinational packaging business industry.

This manufactures rigid and flexible packaging for various companies across the globe. The

industry has influence of industry on the business is affected in numerous ways. The revenue

growth of Amcor limited is 2.9 and industry average is 1.1. This can observed that revenue

growth of Amcor limited is much higher than the industry average (Loughran and McDonald

2016). The Return on Assets (ROA TTM) of Amcor Limited is 6.6 whereas industry average

is 3.0. This can be clearly observed that ROA of Amcor Limited is more than industry

average. The Return on Equity (ROE TTM) of Amcor Limited is 73.1 whereas industry

average is 16.7. This is critically examined that ROE of Amcor Limited is far better than

industry average. As from the above discussion, we can clearly state that the industry has

influenced the debt structure of Amcor Limited because of their condition in comparison to

industry average. Therefore, the business has debts because of its strong fundamentals.

4.

Cost of debt

In order to calculate the cost of debt the interest expenses are divided by the average

debt. The calculation is provided below:

Statement Showing calculation of Cost of Debt

Particulars Amount (million)

Interest Expenses $ 192.20

Debt $ 3,965.20

Cost of Debt 5%

Tax rate 30%

After tax Cost of debt 3%

3.

Influence of industry in the debt of the company:

The company Amcor Limited belongs to a multinational packaging business industry.

This manufactures rigid and flexible packaging for various companies across the globe. The

industry has influence of industry on the business is affected in numerous ways. The revenue

growth of Amcor limited is 2.9 and industry average is 1.1. This can observed that revenue

growth of Amcor limited is much higher than the industry average (Loughran and McDonald

2016). The Return on Assets (ROA TTM) of Amcor Limited is 6.6 whereas industry average

is 3.0. This can be clearly observed that ROA of Amcor Limited is more than industry

average. The Return on Equity (ROE TTM) of Amcor Limited is 73.1 whereas industry

average is 16.7. This is critically examined that ROE of Amcor Limited is far better than

industry average. As from the above discussion, we can clearly state that the industry has

influenced the debt structure of Amcor Limited because of their condition in comparison to

industry average. Therefore, the business has debts because of its strong fundamentals.

4.

Cost of debt

In order to calculate the cost of debt the interest expenses are divided by the average

debt. The calculation is provided below:

Statement Showing calculation of Cost of Debt

Particulars Amount (million)

Interest Expenses $ 192.20

Debt $ 3,965.20

Cost of Debt 5%

Tax rate 30%

After tax Cost of debt 3%

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7ACCOUNTING

Part II:

Share Valuation:

1.

Cost of Equity:

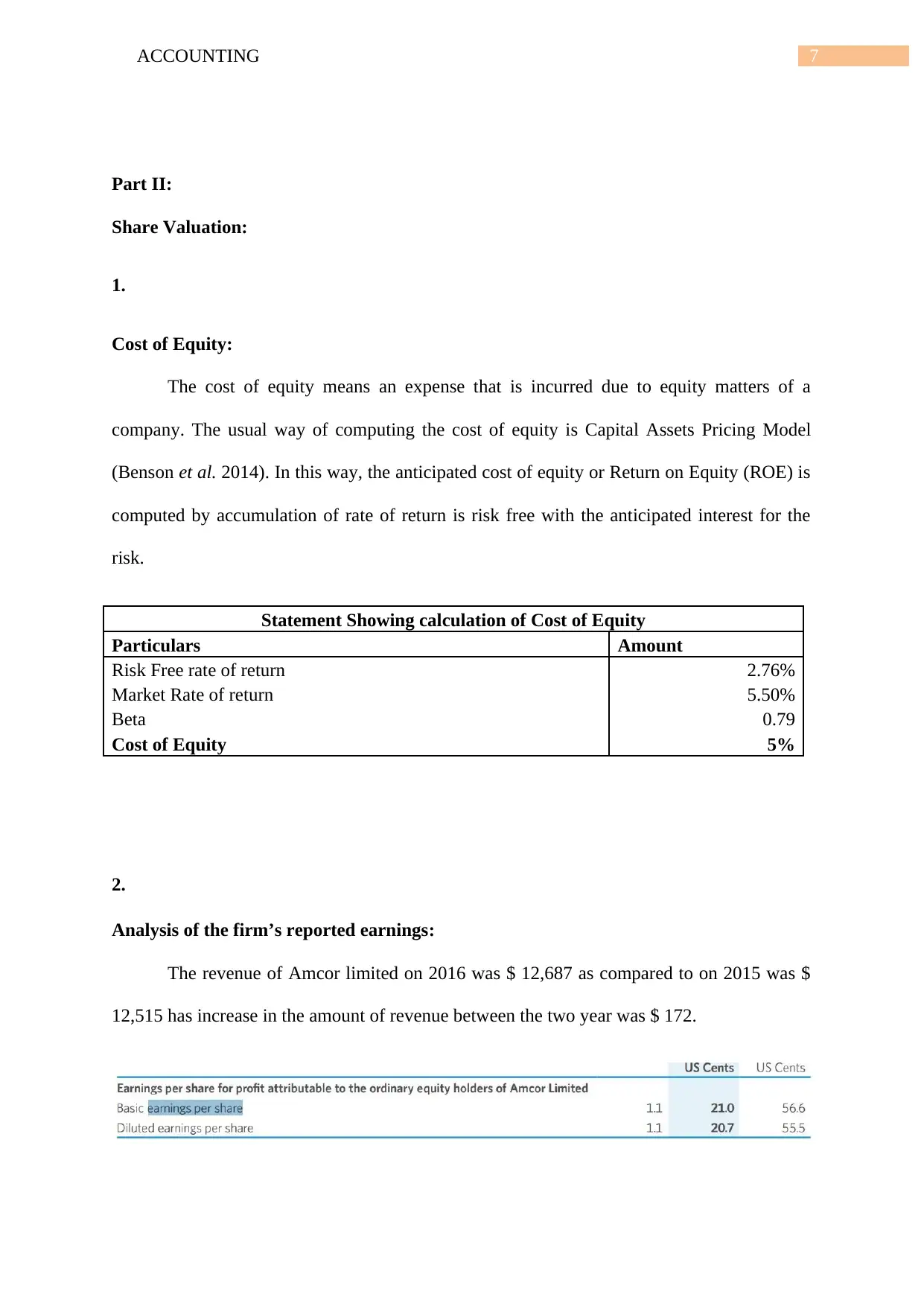

The cost of equity means an expense that is incurred due to equity matters of a

company. The usual way of computing the cost of equity is Capital Assets Pricing Model

(Benson et al. 2014). In this way, the anticipated cost of equity or Return on Equity (ROE) is

computed by accumulation of rate of return is risk free with the anticipated interest for the

risk.

Statement Showing calculation of Cost of Equity

Particulars Amount

Risk Free rate of return 2.76%

Market Rate of return 5.50%

Beta 0.79

Cost of Equity 5%

2.

Analysis of the firm’s reported earnings:

The revenue of Amcor limited on 2016 was $ 12,687 as compared to on 2015 was $

12,515 has increase in the amount of revenue between the two year was $ 172.

Part II:

Share Valuation:

1.

Cost of Equity:

The cost of equity means an expense that is incurred due to equity matters of a

company. The usual way of computing the cost of equity is Capital Assets Pricing Model

(Benson et al. 2014). In this way, the anticipated cost of equity or Return on Equity (ROE) is

computed by accumulation of rate of return is risk free with the anticipated interest for the

risk.

Statement Showing calculation of Cost of Equity

Particulars Amount

Risk Free rate of return 2.76%

Market Rate of return 5.50%

Beta 0.79

Cost of Equity 5%

2.

Analysis of the firm’s reported earnings:

The revenue of Amcor limited on 2016 was $ 12,687 as compared to on 2015 was $

12,515 has increase in the amount of revenue between the two year was $ 172.

8ACCOUNTING

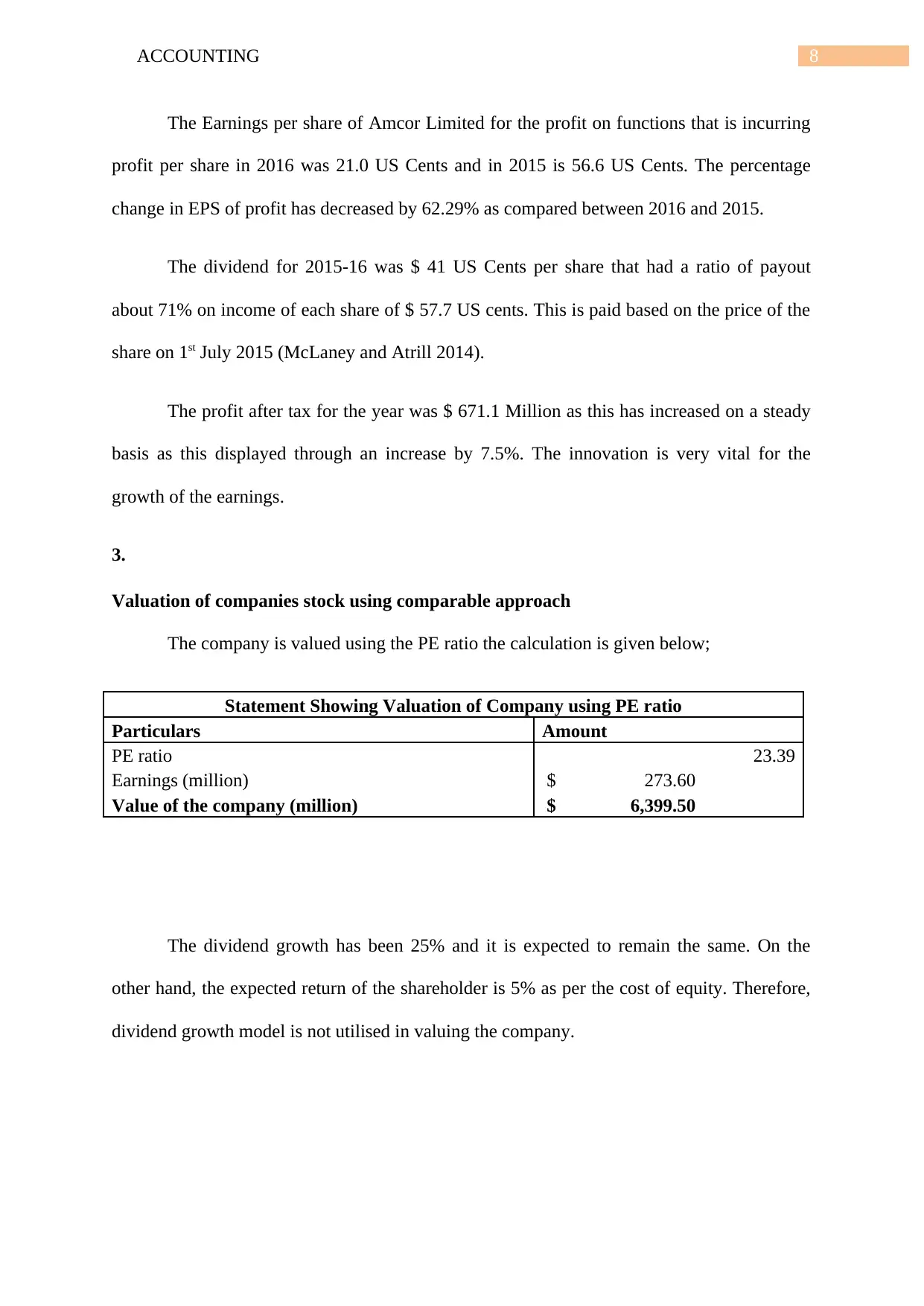

The Earnings per share of Amcor Limited for the profit on functions that is incurring

profit per share in 2016 was 21.0 US Cents and in 2015 is 56.6 US Cents. The percentage

change in EPS of profit has decreased by 62.29% as compared between 2016 and 2015.

The dividend for 2015-16 was $ 41 US Cents per share that had a ratio of payout

about 71% on income of each share of $ 57.7 US cents. This is paid based on the price of the

share on 1st July 2015 (McLaney and Atrill 2014).

The profit after tax for the year was $ 671.1 Million as this has increased on a steady

basis as this displayed through an increase by 7.5%. The innovation is very vital for the

growth of the earnings.

3.

Valuation of companies stock using comparable approach

The company is valued using the PE ratio the calculation is given below;

Statement Showing Valuation of Company using PE ratio

Particulars Amount

PE ratio 23.39

Earnings (million) $ 273.60

Value of the company (million) $ 6,399.50

The dividend growth has been 25% and it is expected to remain the same. On the

other hand, the expected return of the shareholder is 5% as per the cost of equity. Therefore,

dividend growth model is not utilised in valuing the company.

The Earnings per share of Amcor Limited for the profit on functions that is incurring

profit per share in 2016 was 21.0 US Cents and in 2015 is 56.6 US Cents. The percentage

change in EPS of profit has decreased by 62.29% as compared between 2016 and 2015.

The dividend for 2015-16 was $ 41 US Cents per share that had a ratio of payout

about 71% on income of each share of $ 57.7 US cents. This is paid based on the price of the

share on 1st July 2015 (McLaney and Atrill 2014).

The profit after tax for the year was $ 671.1 Million as this has increased on a steady

basis as this displayed through an increase by 7.5%. The innovation is very vital for the

growth of the earnings.

3.

Valuation of companies stock using comparable approach

The company is valued using the PE ratio the calculation is given below;

Statement Showing Valuation of Company using PE ratio

Particulars Amount

PE ratio 23.39

Earnings (million) $ 273.60

Value of the company (million) $ 6,399.50

The dividend growth has been 25% and it is expected to remain the same. On the

other hand, the expected return of the shareholder is 5% as per the cost of equity. Therefore,

dividend growth model is not utilised in valuing the company.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9ACCOUNTING

4.

Reasonable Approach based on the current market price

The business can assess its company through utilizing the P/E ratio and the dividend

growth model. In the present scenario, the corporation has declared dividend as a result the

dividend growth model can be implemented in evaluating the firm. For that reason, in the

current scenario the P/E ratio and dividend growth model can be implemented for evaluating

and computation of the firm (Cahan 2016). The most appropriate model is the PE ratio.

5.

Additional information and data essential to value firm’s share:

The supplementary information that is utilized for the assessment of the shares of the

firm are market capital, net profit after tax, the change of the earning per share of the firm to

its peers and dividend per share (Contessotto and Moroney 2014).

Part III

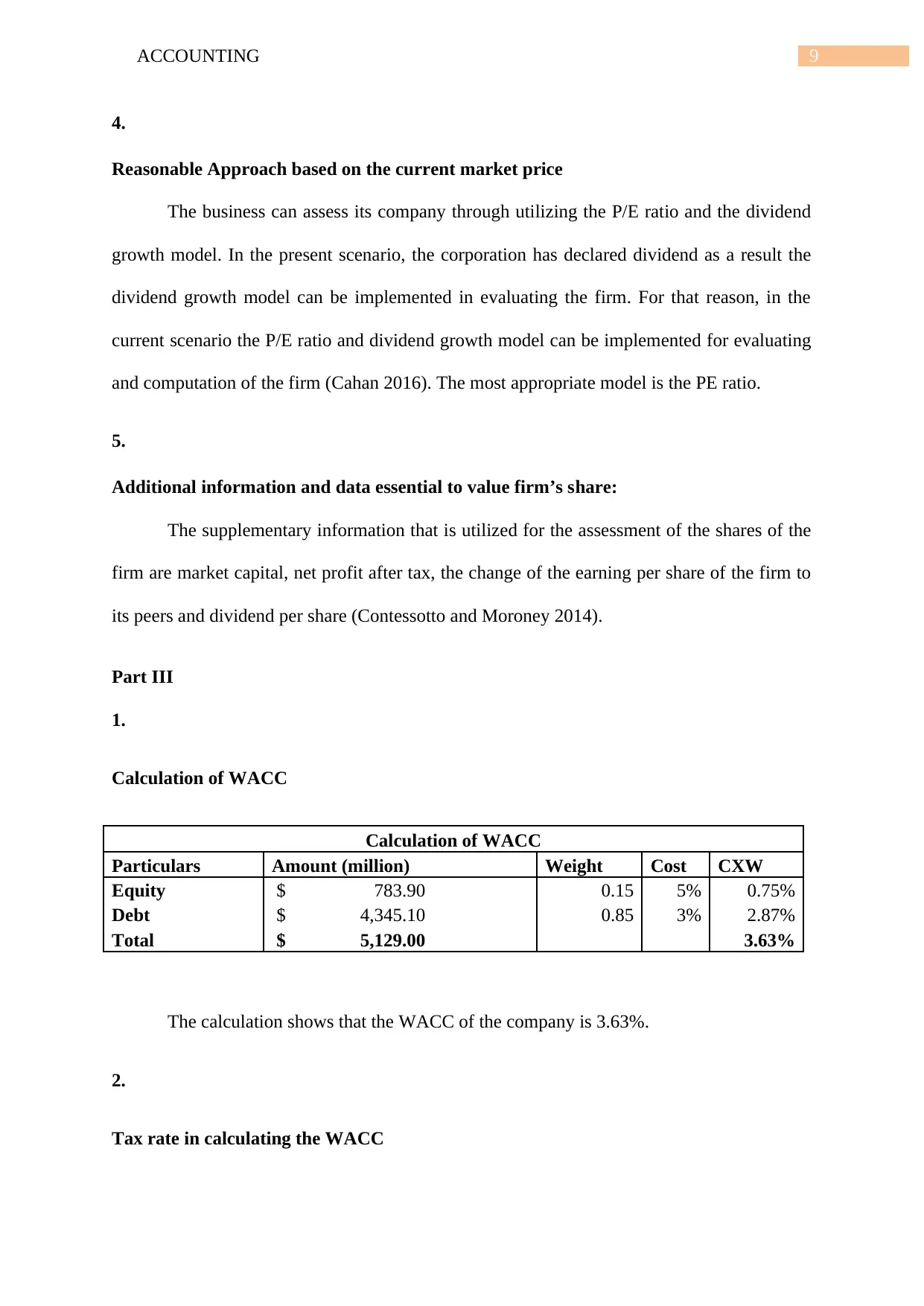

1.

Calculation of WACC

Calculation of WACC

Particulars Amount (million) Weight Cost CXW

Equity $ 783.90 0.15 5% 0.75%

Debt $ 4,345.10 0.85 3% 2.87%

Total $ 5,129.00 3.63%

The calculation shows that the WACC of the company is 3.63%.

2.

Tax rate in calculating the WACC

4.

Reasonable Approach based on the current market price

The business can assess its company through utilizing the P/E ratio and the dividend

growth model. In the present scenario, the corporation has declared dividend as a result the

dividend growth model can be implemented in evaluating the firm. For that reason, in the

current scenario the P/E ratio and dividend growth model can be implemented for evaluating

and computation of the firm (Cahan 2016). The most appropriate model is the PE ratio.

5.

Additional information and data essential to value firm’s share:

The supplementary information that is utilized for the assessment of the shares of the

firm are market capital, net profit after tax, the change of the earning per share of the firm to

its peers and dividend per share (Contessotto and Moroney 2014).

Part III

1.

Calculation of WACC

Calculation of WACC

Particulars Amount (million) Weight Cost CXW

Equity $ 783.90 0.15 5% 0.75%

Debt $ 4,345.10 0.85 3% 2.87%

Total $ 5,129.00 3.63%

The calculation shows that the WACC of the company is 3.63%.

2.

Tax rate in calculating the WACC

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10ACCOUNTING

The Tax rate of a company is considered as an important element since it is used for

the calculation of the company’s cost of debt and interest bearing securities (Choi and Young

2015). In this case, the rate of tax considered for the calculation of weighted average cost of

capital is 30.30%

3.

Difference between cost of debt and cost of equity

The major differences that lies between cost of debt and cost of equity can be highlighted

in the following manner:

The expected return of the shareholders of a company is generally known as the cost

of equity. Whereas on the other hand the return expected by the loan providers of the

company is known as cost of debt (Su and Wells 2015).

Cost of debt is much cheaper than the cost of equity. The cost of equity remains

usually above 25% while the cost of debt is only 4 to 8 percentage.

The cost of debt is subject to deduction of tax while in case of cost of equity; it is not

subject to tax deduction.

4.

Current Liability in the calculation of WACC

While calculating the cost of capital of a company, the current liabilities can be

included. However, including current liabilities in the calculation of cost of capital have some

pros and cons (Giacobbe et al. 2016). The pros and cons are as discussed here.

The Tax rate of a company is considered as an important element since it is used for

the calculation of the company’s cost of debt and interest bearing securities (Choi and Young

2015). In this case, the rate of tax considered for the calculation of weighted average cost of

capital is 30.30%

3.

Difference between cost of debt and cost of equity

The major differences that lies between cost of debt and cost of equity can be highlighted

in the following manner:

The expected return of the shareholders of a company is generally known as the cost

of equity. Whereas on the other hand the return expected by the loan providers of the

company is known as cost of debt (Su and Wells 2015).

Cost of debt is much cheaper than the cost of equity. The cost of equity remains

usually above 25% while the cost of debt is only 4 to 8 percentage.

The cost of debt is subject to deduction of tax while in case of cost of equity; it is not

subject to tax deduction.

4.

Current Liability in the calculation of WACC

While calculating the cost of capital of a company, the current liabilities can be

included. However, including current liabilities in the calculation of cost of capital have some

pros and cons (Giacobbe et al. 2016). The pros and cons are as discussed here.

11ACCOUNTING

Major Pros of including current liabilities in Cost of Capital:

It provides relaxed eligibility than banks.

It facilitates the company in acquisition of short term loans much quickly.

It requires less paperwork that in turn helps in processing the loans must faster and

smooth.

Major Cons of including Current Liabilities in Cost of Capital are:

The cost of the rate of interest in much higher.

It involves high-cycle of risk

It makes a habit for borrowers to take loans much often and hence it might end up in

spending much more than the borrower can actually afford.

5.

Major Value for WACC calculation

The debt-equity ratio of the company is 4.2 which suggests that the company is using more

debt than equity. Thus, the major component observed while calculating the weighted

average cost of capital is debt.

While assessing any investment decision or project, if it is observed that the cost of

capital is high than the return on investment then the project will be accepted else the project

will be rejected.

6.

Major Pros of including current liabilities in Cost of Capital:

It provides relaxed eligibility than banks.

It facilitates the company in acquisition of short term loans much quickly.

It requires less paperwork that in turn helps in processing the loans must faster and

smooth.

Major Cons of including Current Liabilities in Cost of Capital are:

The cost of the rate of interest in much higher.

It involves high-cycle of risk

It makes a habit for borrowers to take loans much often and hence it might end up in

spending much more than the borrower can actually afford.

5.

Major Value for WACC calculation

The debt-equity ratio of the company is 4.2 which suggests that the company is using more

debt than equity. Thus, the major component observed while calculating the weighted

average cost of capital is debt.

While assessing any investment decision or project, if it is observed that the cost of

capital is high than the return on investment then the project will be accepted else the project

will be rejected.

6.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.