Value Proposition Analysis: American Express Credit Card and Visa

VerifiedAdded on 2021/06/17

|19

|3888

|181

Report

AI Summary

This report delves into the value proposition of American Express credit cards, examining their core features and benefits. It begins by exploring the customer perceived value of the Amex card, referencing the Woodruff Customer Value Hierarchy and the Holbrook Consumer Value model to understand how Amex can satisfy customer needs and provide value. The report then compares and contrasts American Express with Visa, highlighting key differences in their business models, market share, and offerings to cardholders and merchants. Furthermore, it outlines two distinct value propositions within the credit card sector: one for cardholders, emphasizing safety, rewards, and convenience, and another for merchants, focusing on increased sales, improved cash flow, and ease of transactions. The analysis aims to provide insights into how American Express can leverage these value propositions to maintain a competitive edge and enhance customer satisfaction in the financial services market.

Value Proposition to Customer

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

VALUE PROPOSITION 1

Contents

First Part:...............................................................................................................................................2

American Express Card:....................................................................................................................2

Customer perceived value of credit card............................................................................................2

Woodruff Customer Value Hierarchy................................................................................................3

Holbrook Consumer value model......................................................................................................4

Second Part............................................................................................................................................6

Compare and contrast between American Express and VISA...........................................................6

Two Value Propositions of Credit Card Sector..................................................................................8

Third Part.............................................................................................................................................10

Existing value proposition...............................................................................................................10

New Value Proposition:...................................................................................................................12

Value Criteria:.................................................................................................................................13

Implementation of New Proposition................................................................................................13

References...........................................................................................................................................16

Contents

First Part:...............................................................................................................................................2

American Express Card:....................................................................................................................2

Customer perceived value of credit card............................................................................................2

Woodruff Customer Value Hierarchy................................................................................................3

Holbrook Consumer value model......................................................................................................4

Second Part............................................................................................................................................6

Compare and contrast between American Express and VISA...........................................................6

Two Value Propositions of Credit Card Sector..................................................................................8

Third Part.............................................................................................................................................10

Existing value proposition...............................................................................................................10

New Value Proposition:...................................................................................................................12

Value Criteria:.................................................................................................................................13

Implementation of New Proposition................................................................................................13

References...........................................................................................................................................16

VALUE PROPOSITION 2

First Part:

American Express Card:

The American Express is a US based Multinational Company which deals in financial

services. It was founded by Dow Jones in 1850. The main products company are charge card,

traveler’s cheque and credit card. American Express is best known for its credit card.

American Express card is also known as Amex card. The American Express deals in an

electronic payment card which is issued and processed by American Express. Cards are

available for individual, corporate consumers and small businesses in the US and all around

the world (American Express, 2018)

Customer perceived value of credit card

In 2016, out of total dollar volume of credit cards transactions, the transaction of American

Express Credit card was 22.9%. In December 2017 Company had 112.8 million card users

which include 50 million card users in US, each card consist average yearly spending of

$18,519 (American Express, 2018)

First Part:

American Express Card:

The American Express is a US based Multinational Company which deals in financial

services. It was founded by Dow Jones in 1850. The main products company are charge card,

traveler’s cheque and credit card. American Express is best known for its credit card.

American Express card is also known as Amex card. The American Express deals in an

electronic payment card which is issued and processed by American Express. Cards are

available for individual, corporate consumers and small businesses in the US and all around

the world (American Express, 2018)

Customer perceived value of credit card

In 2016, out of total dollar volume of credit cards transactions, the transaction of American

Express Credit card was 22.9%. In December 2017 Company had 112.8 million card users

which include 50 million card users in US, each card consist average yearly spending of

$18,519 (American Express, 2018)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

VALUE PROPOSITION 3

Woodruff Customer Value Hierarchy

(Source: Phillips, 2012)

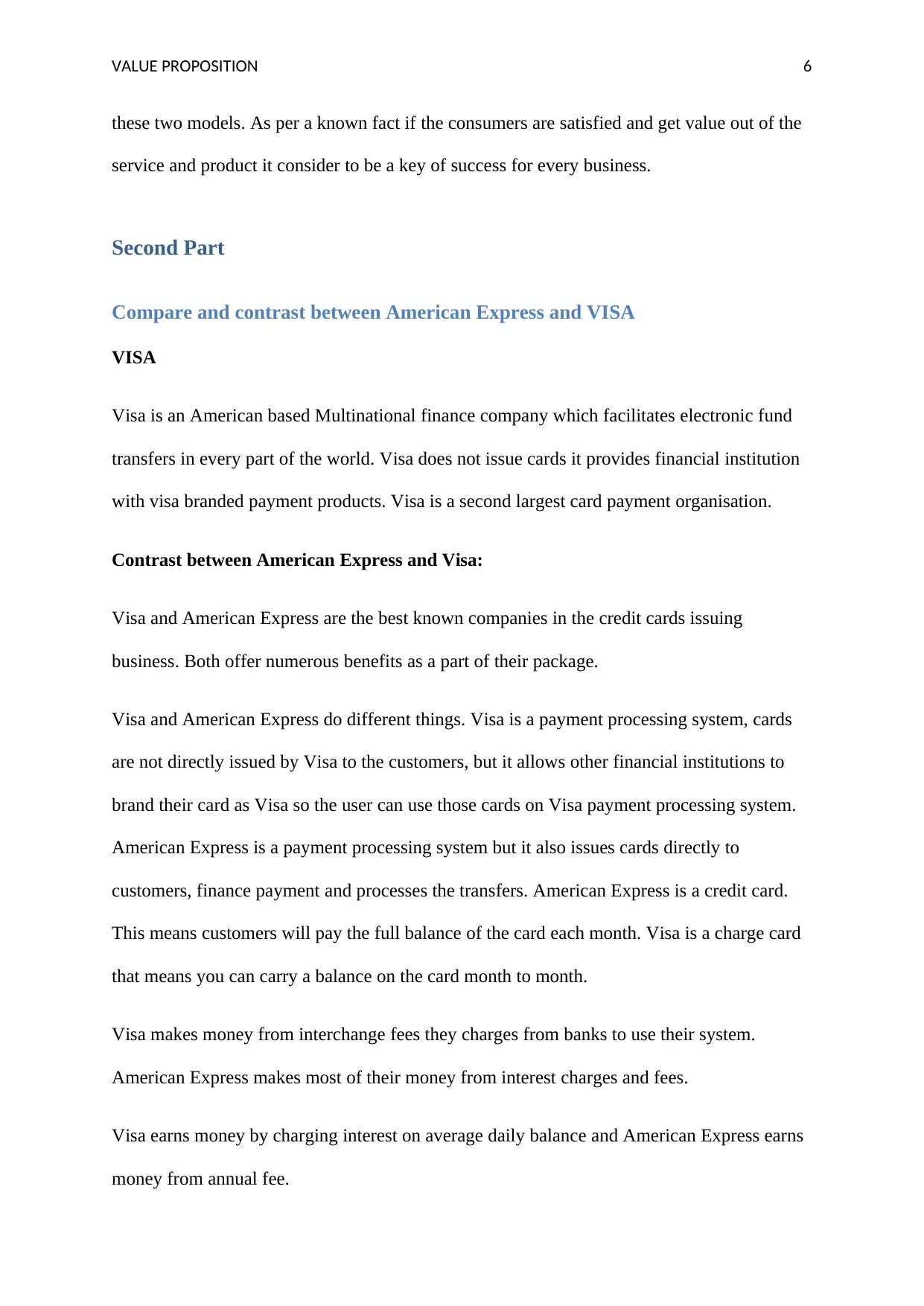

The basic idea of Woodruff customer value hierarchy is satisfying the need of customers.

Before introducing any service and product in the market the company needs to decide the

level of satisfaction, the said service and product are going to provide to the customers.

Satisfying customer value is a key to Woodruff customer value hierarchy model.

The Woodruff customer value hierarchy model includes three steps these are:

1. Service/Product attributes: The fundamental of this level of hierarchy is how

service or product going to satisfy the need of customers if they consume it. The

bottom layer of woodruff customer value hierarchy also includes characteristics of the

product or service which company is going to introduce in the market. It contains only

those characteristics or attributes which are necessary for product or service to

function.

2. Consequence layer: This level of woodruff customer value hierarchy includes

expectations of customers from the service and product. The attributes are decided to

Woodruff Customer Value Hierarchy

(Source: Phillips, 2012)

The basic idea of Woodruff customer value hierarchy is satisfying the need of customers.

Before introducing any service and product in the market the company needs to decide the

level of satisfaction, the said service and product are going to provide to the customers.

Satisfying customer value is a key to Woodruff customer value hierarchy model.

The Woodruff customer value hierarchy model includes three steps these are:

1. Service/Product attributes: The fundamental of this level of hierarchy is how

service or product going to satisfy the need of customers if they consume it. The

bottom layer of woodruff customer value hierarchy also includes characteristics of the

product or service which company is going to introduce in the market. It contains only

those characteristics or attributes which are necessary for product or service to

function.

2. Consequence layer: This level of woodruff customer value hierarchy includes

expectations of customers from the service and product. The attributes are decided to

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

VALUE PROPOSITION 4

satisfy the needs of customers. So when buyers buy the product they normally assume

that the service or product may contain those attributes which they are expecting.

3. End state: This stage includes additional features, attributes, benefits those are related

to service and product which provide a competitive advantage to the company. In

other words, we can say that it includes those additional attributes which customers

not expect from the service and product. But if they come to know about those

additional attributes they will surely buy the service and product (Yajing, 2014).

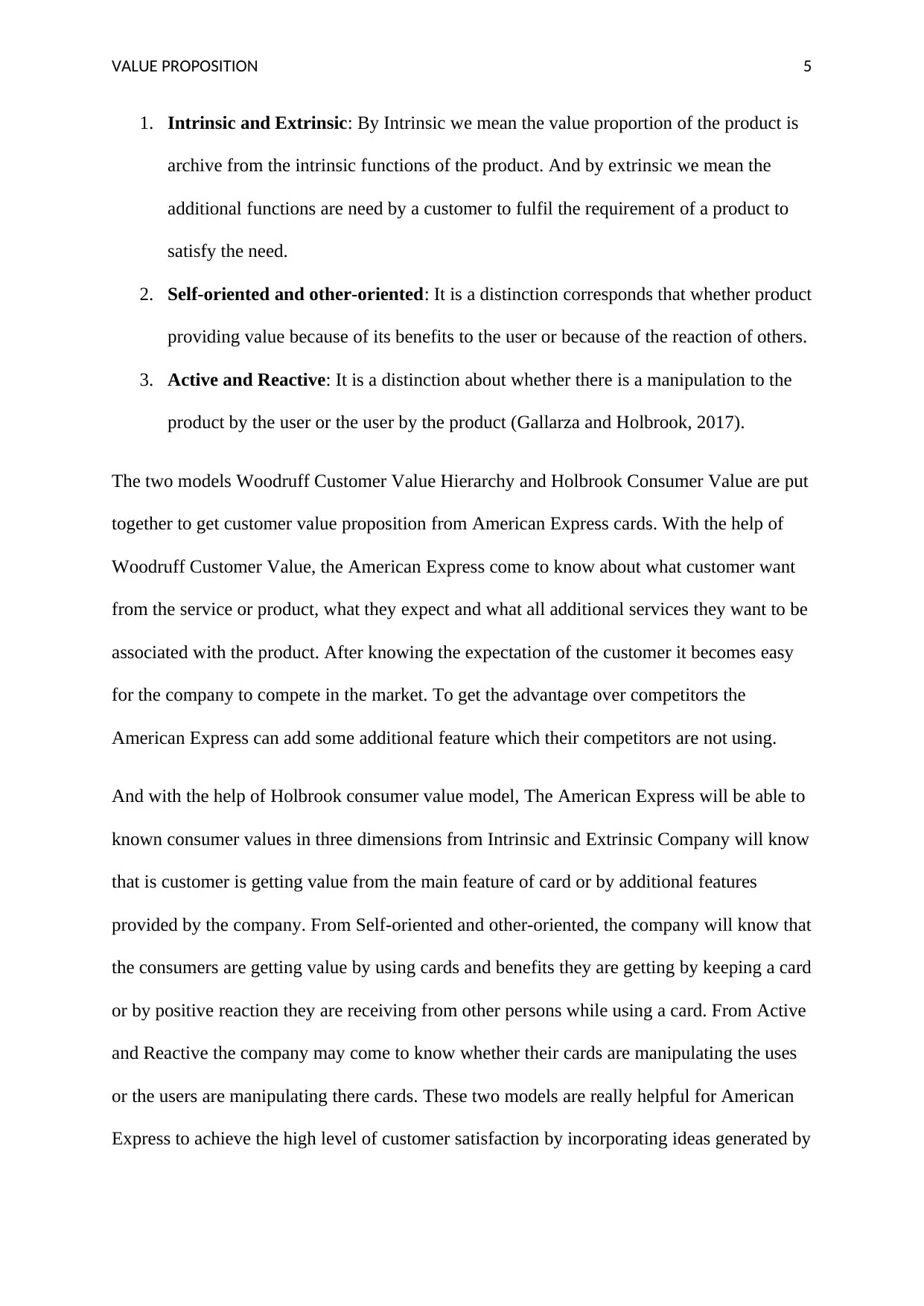

Holbrook Consumer value model

(Source: Carnie, 2018)

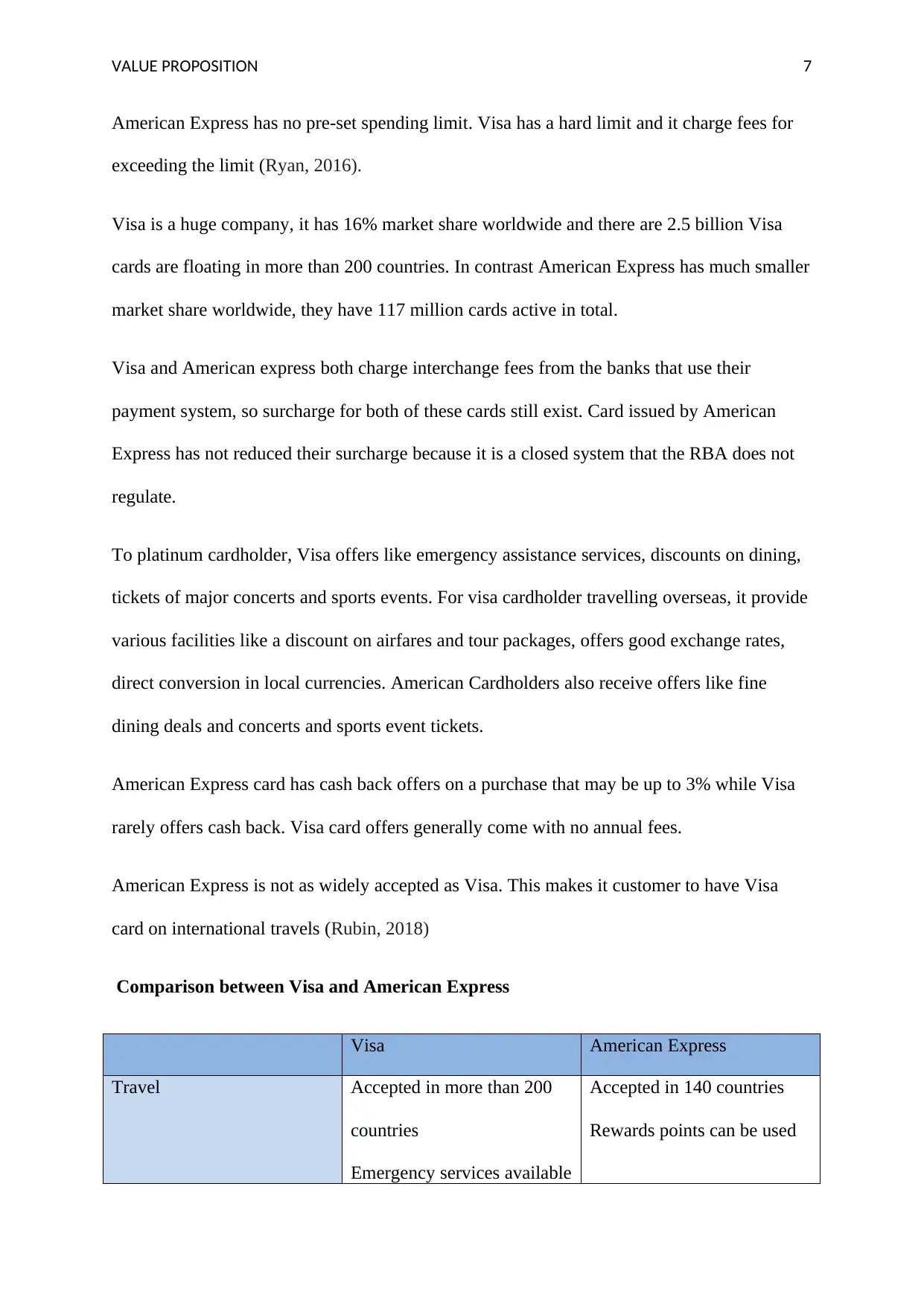

Holbrook consumer value model represents those characteristics or attributes that provide

consumers a level satisfaction and value to their money which they spend on buying service

and product. It contains the concept which indicates a position of maximum consumer value

proposition for the customer segment of interest.

Holbrook Consumer value contains three dimensions these are:

satisfy the needs of customers. So when buyers buy the product they normally assume

that the service or product may contain those attributes which they are expecting.

3. End state: This stage includes additional features, attributes, benefits those are related

to service and product which provide a competitive advantage to the company. In

other words, we can say that it includes those additional attributes which customers

not expect from the service and product. But if they come to know about those

additional attributes they will surely buy the service and product (Yajing, 2014).

Holbrook Consumer value model

(Source: Carnie, 2018)

Holbrook consumer value model represents those characteristics or attributes that provide

consumers a level satisfaction and value to their money which they spend on buying service

and product. It contains the concept which indicates a position of maximum consumer value

proposition for the customer segment of interest.

Holbrook Consumer value contains three dimensions these are:

VALUE PROPOSITION 5

1. Intrinsic and Extrinsic: By Intrinsic we mean the value proportion of the product is

archive from the intrinsic functions of the product. And by extrinsic we mean the

additional functions are need by a customer to fulfil the requirement of a product to

satisfy the need.

2. Self-oriented and other-oriented: It is a distinction corresponds that whether product

providing value because of its benefits to the user or because of the reaction of others.

3. Active and Reactive: It is a distinction about whether there is a manipulation to the

product by the user or the user by the product (Gallarza and Holbrook, 2017).

The two models Woodruff Customer Value Hierarchy and Holbrook Consumer Value are put

together to get customer value proposition from American Express cards. With the help of

Woodruff Customer Value, the American Express come to know about what customer want

from the service or product, what they expect and what all additional services they want to be

associated with the product. After knowing the expectation of the customer it becomes easy

for the company to compete in the market. To get the advantage over competitors the

American Express can add some additional feature which their competitors are not using.

And with the help of Holbrook consumer value model, The American Express will be able to

known consumer values in three dimensions from Intrinsic and Extrinsic Company will know

that is customer is getting value from the main feature of card or by additional features

provided by the company. From Self-oriented and other-oriented, the company will know that

the consumers are getting value by using cards and benefits they are getting by keeping a card

or by positive reaction they are receiving from other persons while using a card. From Active

and Reactive the company may come to know whether their cards are manipulating the uses

or the users are manipulating there cards. These two models are really helpful for American

Express to achieve the high level of customer satisfaction by incorporating ideas generated by

1. Intrinsic and Extrinsic: By Intrinsic we mean the value proportion of the product is

archive from the intrinsic functions of the product. And by extrinsic we mean the

additional functions are need by a customer to fulfil the requirement of a product to

satisfy the need.

2. Self-oriented and other-oriented: It is a distinction corresponds that whether product

providing value because of its benefits to the user or because of the reaction of others.

3. Active and Reactive: It is a distinction about whether there is a manipulation to the

product by the user or the user by the product (Gallarza and Holbrook, 2017).

The two models Woodruff Customer Value Hierarchy and Holbrook Consumer Value are put

together to get customer value proposition from American Express cards. With the help of

Woodruff Customer Value, the American Express come to know about what customer want

from the service or product, what they expect and what all additional services they want to be

associated with the product. After knowing the expectation of the customer it becomes easy

for the company to compete in the market. To get the advantage over competitors the

American Express can add some additional feature which their competitors are not using.

And with the help of Holbrook consumer value model, The American Express will be able to

known consumer values in three dimensions from Intrinsic and Extrinsic Company will know

that is customer is getting value from the main feature of card or by additional features

provided by the company. From Self-oriented and other-oriented, the company will know that

the consumers are getting value by using cards and benefits they are getting by keeping a card

or by positive reaction they are receiving from other persons while using a card. From Active

and Reactive the company may come to know whether their cards are manipulating the uses

or the users are manipulating there cards. These two models are really helpful for American

Express to achieve the high level of customer satisfaction by incorporating ideas generated by

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

VALUE PROPOSITION 6

these two models. As per a known fact if the consumers are satisfied and get value out of the

service and product it consider to be a key of success for every business.

Second Part

Compare and contrast between American Express and VISA

VISA

Visa is an American based Multinational finance company which facilitates electronic fund

transfers in every part of the world. Visa does not issue cards it provides financial institution

with visa branded payment products. Visa is a second largest card payment organisation.

Contrast between American Express and Visa:

Visa and American Express are the best known companies in the credit cards issuing

business. Both offer numerous benefits as a part of their package.

Visa and American Express do different things. Visa is a payment processing system, cards

are not directly issued by Visa to the customers, but it allows other financial institutions to

brand their card as Visa so the user can use those cards on Visa payment processing system.

American Express is a payment processing system but it also issues cards directly to

customers, finance payment and processes the transfers. American Express is a credit card.

This means customers will pay the full balance of the card each month. Visa is a charge card

that means you can carry a balance on the card month to month.

Visa makes money from interchange fees they charges from banks to use their system.

American Express makes most of their money from interest charges and fees.

Visa earns money by charging interest on average daily balance and American Express earns

money from annual fee.

these two models. As per a known fact if the consumers are satisfied and get value out of the

service and product it consider to be a key of success for every business.

Second Part

Compare and contrast between American Express and VISA

VISA

Visa is an American based Multinational finance company which facilitates electronic fund

transfers in every part of the world. Visa does not issue cards it provides financial institution

with visa branded payment products. Visa is a second largest card payment organisation.

Contrast between American Express and Visa:

Visa and American Express are the best known companies in the credit cards issuing

business. Both offer numerous benefits as a part of their package.

Visa and American Express do different things. Visa is a payment processing system, cards

are not directly issued by Visa to the customers, but it allows other financial institutions to

brand their card as Visa so the user can use those cards on Visa payment processing system.

American Express is a payment processing system but it also issues cards directly to

customers, finance payment and processes the transfers. American Express is a credit card.

This means customers will pay the full balance of the card each month. Visa is a charge card

that means you can carry a balance on the card month to month.

Visa makes money from interchange fees they charges from banks to use their system.

American Express makes most of their money from interest charges and fees.

Visa earns money by charging interest on average daily balance and American Express earns

money from annual fee.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

VALUE PROPOSITION 7

American Express has no pre-set spending limit. Visa has a hard limit and it charge fees for

exceeding the limit (Ryan, 2016).

Visa is a huge company, it has 16% market share worldwide and there are 2.5 billion Visa

cards are floating in more than 200 countries. In contrast American Express has much smaller

market share worldwide, they have 117 million cards active in total.

Visa and American express both charge interchange fees from the banks that use their

payment system, so surcharge for both of these cards still exist. Card issued by American

Express has not reduced their surcharge because it is a closed system that the RBA does not

regulate.

To platinum cardholder, Visa offers like emergency assistance services, discounts on dining,

tickets of major concerts and sports events. For visa cardholder travelling overseas, it provide

various facilities like a discount on airfares and tour packages, offers good exchange rates,

direct conversion in local currencies. American Cardholders also receive offers like fine

dining deals and concerts and sports event tickets.

American Express card has cash back offers on a purchase that may be up to 3% while Visa

rarely offers cash back. Visa card offers generally come with no annual fees.

American Express is not as widely accepted as Visa. This makes it customer to have Visa

card on international travels (Rubin, 2018)

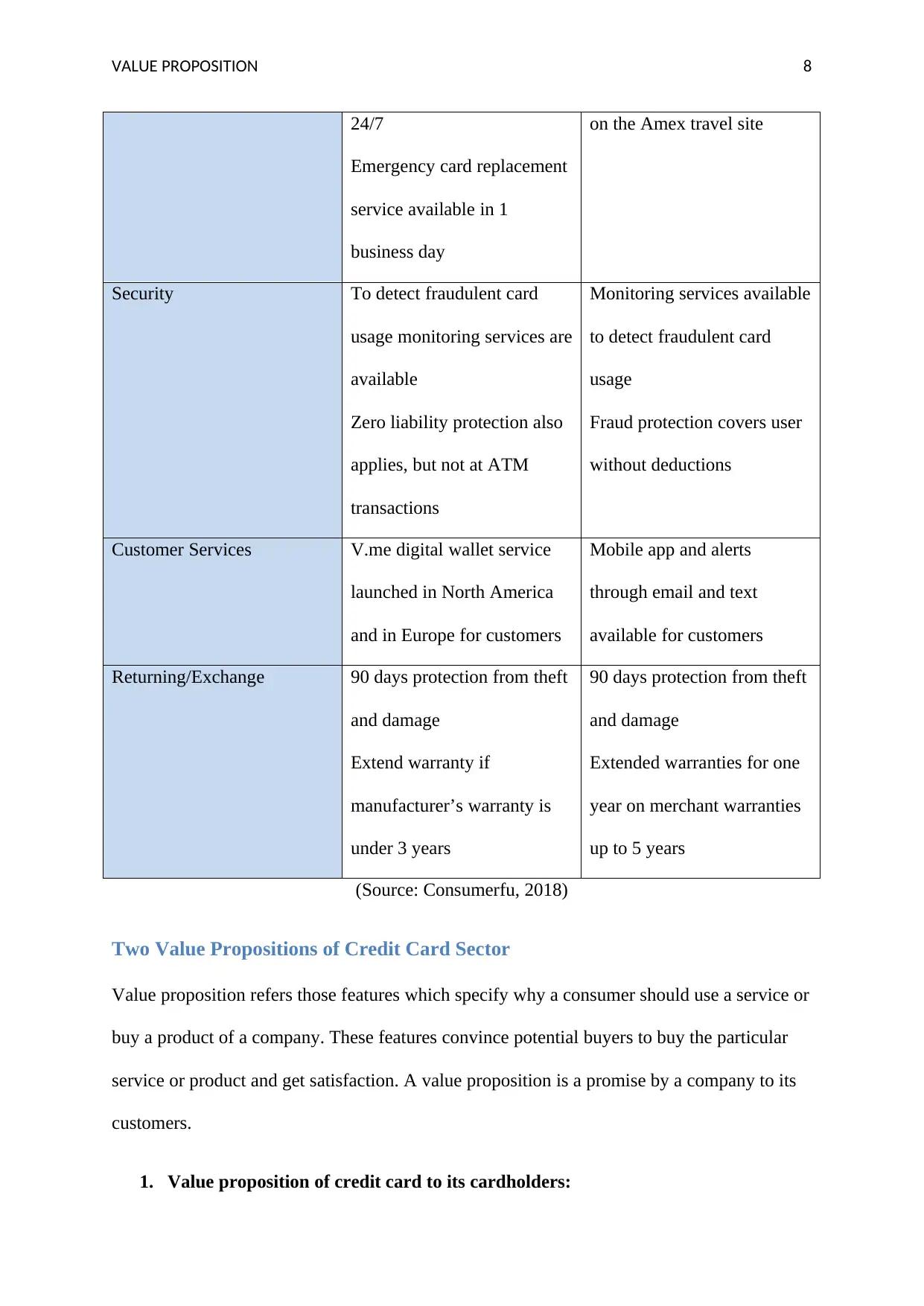

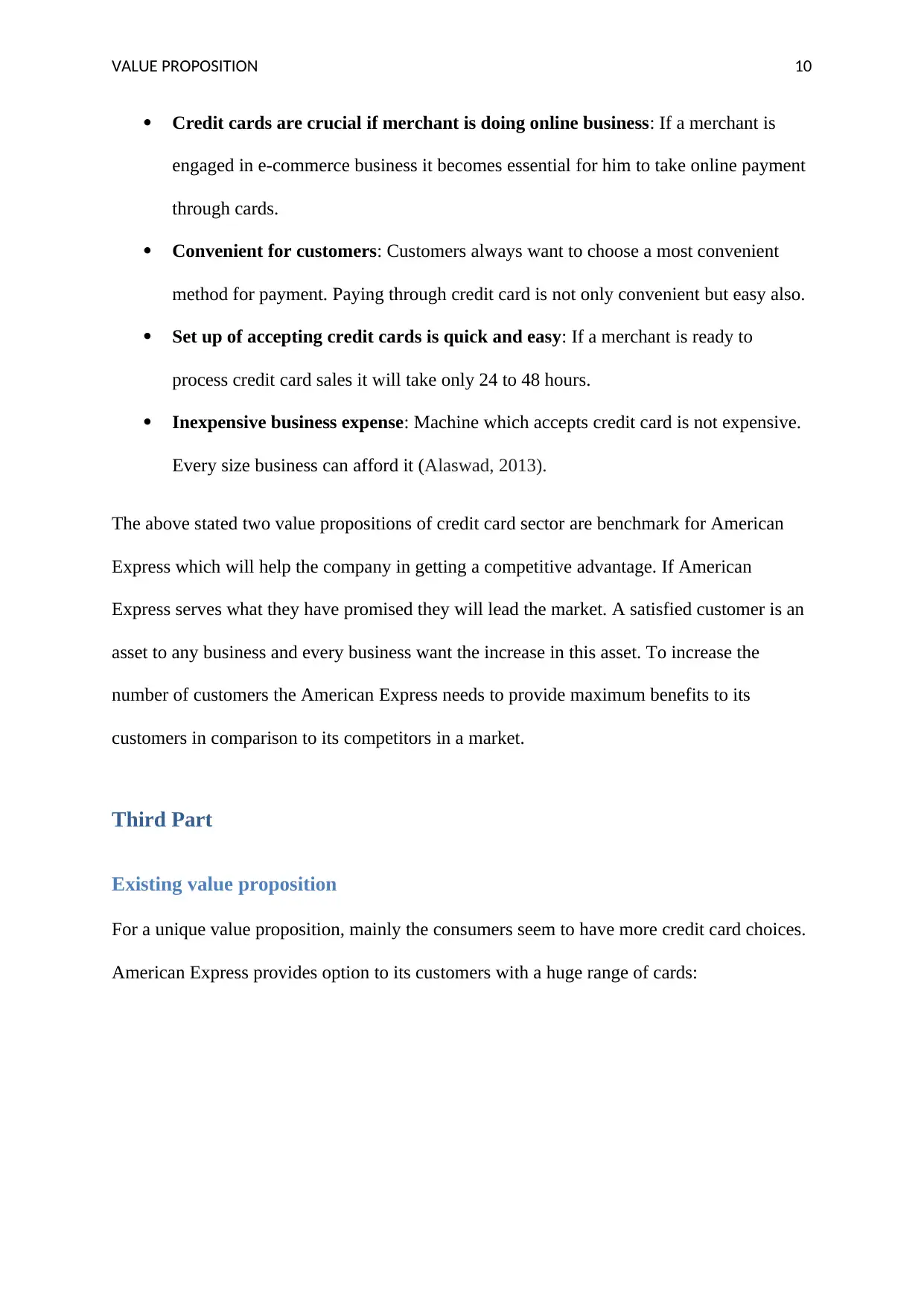

Comparison between Visa and American Express

Visa American Express

Travel Accepted in more than 200

countries

Emergency services available

Accepted in 140 countries

Rewards points can be used

American Express has no pre-set spending limit. Visa has a hard limit and it charge fees for

exceeding the limit (Ryan, 2016).

Visa is a huge company, it has 16% market share worldwide and there are 2.5 billion Visa

cards are floating in more than 200 countries. In contrast American Express has much smaller

market share worldwide, they have 117 million cards active in total.

Visa and American express both charge interchange fees from the banks that use their

payment system, so surcharge for both of these cards still exist. Card issued by American

Express has not reduced their surcharge because it is a closed system that the RBA does not

regulate.

To platinum cardholder, Visa offers like emergency assistance services, discounts on dining,

tickets of major concerts and sports events. For visa cardholder travelling overseas, it provide

various facilities like a discount on airfares and tour packages, offers good exchange rates,

direct conversion in local currencies. American Cardholders also receive offers like fine

dining deals and concerts and sports event tickets.

American Express card has cash back offers on a purchase that may be up to 3% while Visa

rarely offers cash back. Visa card offers generally come with no annual fees.

American Express is not as widely accepted as Visa. This makes it customer to have Visa

card on international travels (Rubin, 2018)

Comparison between Visa and American Express

Visa American Express

Travel Accepted in more than 200

countries

Emergency services available

Accepted in 140 countries

Rewards points can be used

VALUE PROPOSITION 8

24/7

Emergency card replacement

service available in 1

business day

on the Amex travel site

Security To detect fraudulent card

usage monitoring services are

available

Zero liability protection also

applies, but not at ATM

transactions

Monitoring services available

to detect fraudulent card

usage

Fraud protection covers user

without deductions

Customer Services V.me digital wallet service

launched in North America

and in Europe for customers

Mobile app and alerts

through email and text

available for customers

Returning/Exchange 90 days protection from theft

and damage

Extend warranty if

manufacturer’s warranty is

under 3 years

90 days protection from theft

and damage

Extended warranties for one

year on merchant warranties

up to 5 years

(Source: Consumerfu, 2018)

Two Value Propositions of Credit Card Sector

Value proposition refers those features which specify why a consumer should use a service or

buy a product of a company. These features convince potential buyers to buy the particular

service or product and get satisfaction. A value proposition is a promise by a company to its

customers.

1. Value proposition of credit card to its cardholders:

24/7

Emergency card replacement

service available in 1

business day

on the Amex travel site

Security To detect fraudulent card

usage monitoring services are

available

Zero liability protection also

applies, but not at ATM

transactions

Monitoring services available

to detect fraudulent card

usage

Fraud protection covers user

without deductions

Customer Services V.me digital wallet service

launched in North America

and in Europe for customers

Mobile app and alerts

through email and text

available for customers

Returning/Exchange 90 days protection from theft

and damage

Extend warranty if

manufacturer’s warranty is

under 3 years

90 days protection from theft

and damage

Extended warranties for one

year on merchant warranties

up to 5 years

(Source: Consumerfu, 2018)

Two Value Propositions of Credit Card Sector

Value proposition refers those features which specify why a consumer should use a service or

buy a product of a company. These features convince potential buyers to buy the particular

service or product and get satisfaction. A value proposition is a promise by a company to its

customers.

1. Value proposition of credit card to its cardholders:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

VALUE PROPOSITION 9

Safety: Making payment with credit cards is easy and quick. In case of fraud, you are

not out of money immediately.

Points and rewards: Many cards work on a points system where a customer can earn

up to five points by spending $1. In addition companies will offer special 3 months

promo period where spending in a certain category like restaurants, transportation by

which customer can double or triple their credit points.

Cash back: Many banks offer cash back if customers use their cards to make payment

of monthly bills or grocery purchase. Online shopping portals too have cash back

offers on various products.

Grace Period: Main advantage of credit card is a customer can defer their payments

till their bills are due. Bank offer a grace period of 50 days for paying back their dues

(Alaswad, 2013).

2. Value proposition of credit card to Merchants:

Accepting credit card can boost sales: Shoppers like to make payment quickly

without writing a check or run to ATM for cash. When merchant takes its business

from cash only to accept cards, its potential customer increase significantly. If more

customers are attracting toward your business it automatically increase sales.

Credit cards encourage impulse buying: If the customers are making payment

through card many studies indicates customer surely do impulse purchasing.

Improve cash flow: Credit card transactions are processed electronically, and the

amount deposited directly to a merchants bank account it leads to no more waiting

for checks to clear, no waiting to collect from customers that means less cash to

handle.

Safety: Making payment with credit cards is easy and quick. In case of fraud, you are

not out of money immediately.

Points and rewards: Many cards work on a points system where a customer can earn

up to five points by spending $1. In addition companies will offer special 3 months

promo period where spending in a certain category like restaurants, transportation by

which customer can double or triple their credit points.

Cash back: Many banks offer cash back if customers use their cards to make payment

of monthly bills or grocery purchase. Online shopping portals too have cash back

offers on various products.

Grace Period: Main advantage of credit card is a customer can defer their payments

till their bills are due. Bank offer a grace period of 50 days for paying back their dues

(Alaswad, 2013).

2. Value proposition of credit card to Merchants:

Accepting credit card can boost sales: Shoppers like to make payment quickly

without writing a check or run to ATM for cash. When merchant takes its business

from cash only to accept cards, its potential customer increase significantly. If more

customers are attracting toward your business it automatically increase sales.

Credit cards encourage impulse buying: If the customers are making payment

through card many studies indicates customer surely do impulse purchasing.

Improve cash flow: Credit card transactions are processed electronically, and the

amount deposited directly to a merchants bank account it leads to no more waiting

for checks to clear, no waiting to collect from customers that means less cash to

handle.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

VALUE PROPOSITION 10

Credit cards are crucial if merchant is doing online business: If a merchant is

engaged in e-commerce business it becomes essential for him to take online payment

through cards.

Convenient for customers: Customers always want to choose a most convenient

method for payment. Paying through credit card is not only convenient but easy also.

Set up of accepting credit cards is quick and easy: If a merchant is ready to

process credit card sales it will take only 24 to 48 hours.

Inexpensive business expense: Machine which accepts credit card is not expensive.

Every size business can afford it (Alaswad, 2013).

The above stated two value propositions of credit card sector are benchmark for American

Express which will help the company in getting a competitive advantage. If American

Express serves what they have promised they will lead the market. A satisfied customer is an

asset to any business and every business want the increase in this asset. To increase the

number of customers the American Express needs to provide maximum benefits to its

customers in comparison to its competitors in a market.

Third Part

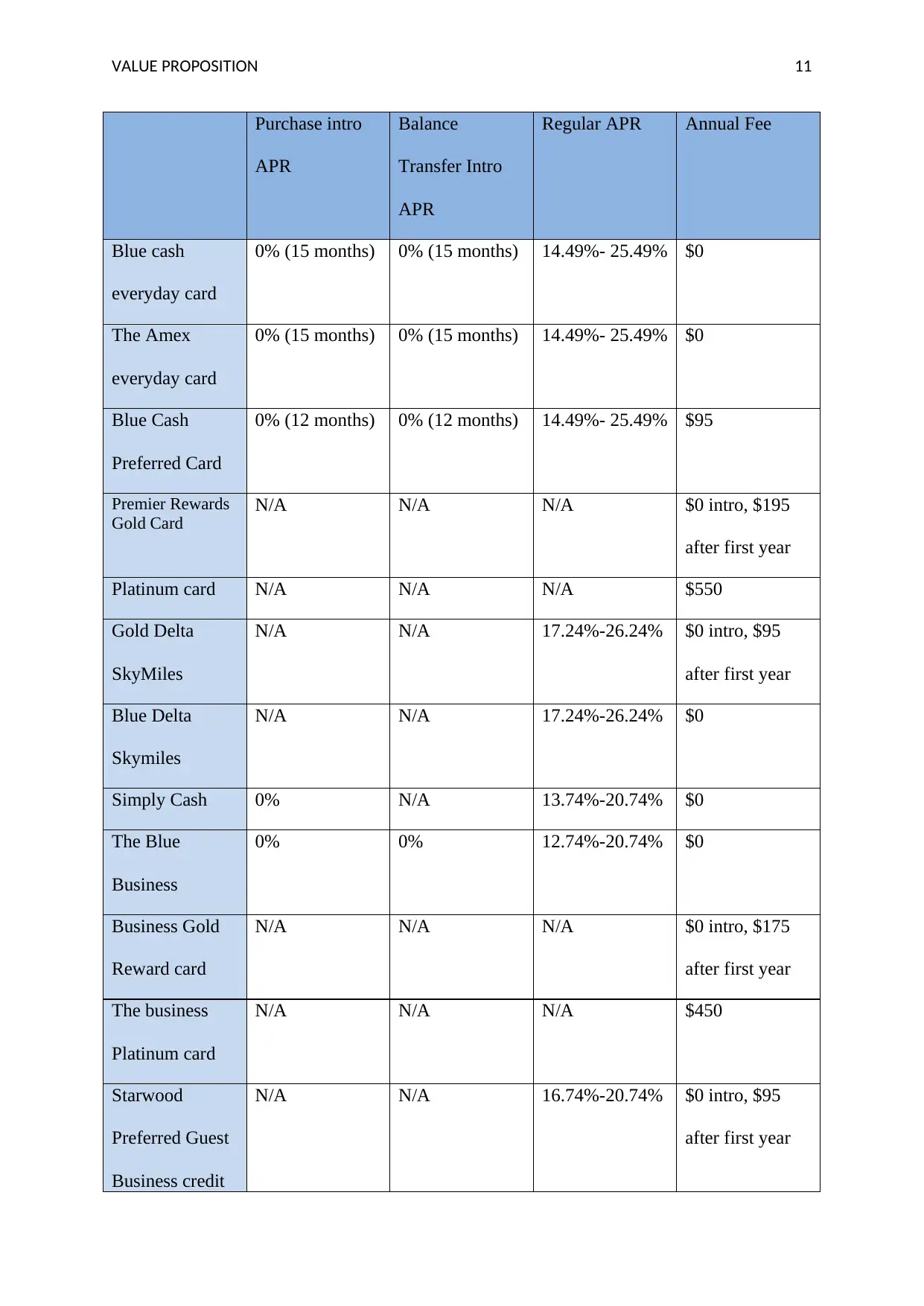

Existing value proposition

For a unique value proposition, mainly the consumers seem to have more credit card choices.

American Express provides option to its customers with a huge range of cards:

Credit cards are crucial if merchant is doing online business: If a merchant is

engaged in e-commerce business it becomes essential for him to take online payment

through cards.

Convenient for customers: Customers always want to choose a most convenient

method for payment. Paying through credit card is not only convenient but easy also.

Set up of accepting credit cards is quick and easy: If a merchant is ready to

process credit card sales it will take only 24 to 48 hours.

Inexpensive business expense: Machine which accepts credit card is not expensive.

Every size business can afford it (Alaswad, 2013).

The above stated two value propositions of credit card sector are benchmark for American

Express which will help the company in getting a competitive advantage. If American

Express serves what they have promised they will lead the market. A satisfied customer is an

asset to any business and every business want the increase in this asset. To increase the

number of customers the American Express needs to provide maximum benefits to its

customers in comparison to its competitors in a market.

Third Part

Existing value proposition

For a unique value proposition, mainly the consumers seem to have more credit card choices.

American Express provides option to its customers with a huge range of cards:

VALUE PROPOSITION 11

Purchase intro

APR

Balance

Transfer Intro

APR

Regular APR Annual Fee

Blue cash

everyday card

0% (15 months) 0% (15 months) 14.49%- 25.49% $0

The Amex

everyday card

0% (15 months) 0% (15 months) 14.49%- 25.49% $0

Blue Cash

Preferred Card

0% (12 months) 0% (12 months) 14.49%- 25.49% $95

Premier Rewards

Gold Card

N/A N/A N/A $0 intro, $195

after first year

Platinum card N/A N/A N/A $550

Gold Delta

SkyMiles

N/A N/A 17.24%-26.24% $0 intro, $95

after first year

Blue Delta

Skymiles

N/A N/A 17.24%-26.24% $0

Simply Cash 0% N/A 13.74%-20.74% $0

The Blue

Business

0% 0% 12.74%-20.74% $0

Business Gold

Reward card

N/A N/A N/A $0 intro, $175

after first year

The business

Platinum card

N/A N/A N/A $450

Starwood

Preferred Guest

Business credit

N/A N/A 16.74%-20.74% $0 intro, $95

after first year

Purchase intro

APR

Balance

Transfer Intro

APR

Regular APR Annual Fee

Blue cash

everyday card

0% (15 months) 0% (15 months) 14.49%- 25.49% $0

The Amex

everyday card

0% (15 months) 0% (15 months) 14.49%- 25.49% $0

Blue Cash

Preferred Card

0% (12 months) 0% (12 months) 14.49%- 25.49% $95

Premier Rewards

Gold Card

N/A N/A N/A $0 intro, $195

after first year

Platinum card N/A N/A N/A $550

Gold Delta

SkyMiles

N/A N/A 17.24%-26.24% $0 intro, $95

after first year

Blue Delta

Skymiles

N/A N/A 17.24%-26.24% $0

Simply Cash 0% N/A 13.74%-20.74% $0

The Blue

Business

0% 0% 12.74%-20.74% $0

Business Gold

Reward card

N/A N/A N/A $0 intro, $175

after first year

The business

Platinum card

N/A N/A N/A $450

Starwood

Preferred Guest

Business credit

N/A N/A 16.74%-20.74% $0 intro, $95

after first year

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.