Business Transaction Recording: Journal, Ledger, Ratios - Anne York

VerifiedAdded on 2023/06/17

|14

|1864

|223

Homework Assignment

AI Summary

This assignment provides a detailed solution for recording and analyzing business transactions for Anne York. It includes journal entries for October 2021, followed by the creation of ledger accounts for various items such as purchases, Home Ltd, computer, printer, bank, sales, repairing, cash, Rayan, laptop, wages, drawings, flat, car, capital, and rent. A trial balance as of October 31, 2021, is presented, followed by an income statement and balance sheet. The assignment also includes an analysis of financial ratios such as net profit margin, gross profit ratio, current ratio, acid ratio, accounts receivable period, and accounts payable period, providing insights into the company's financial performance. The document is available on Desklib, where students can find a wide array of solved assignments and study resources.

Recording Business Transactions

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

ASSESSMENT.....................................................................................................................................4

Part A:...............................................................................................................................................4

Part B...............................................................................................................................................11

REFERNCES......................................................................................................................................14

ASSESSMENT.....................................................................................................................................4

Part A:...............................................................................................................................................4

Part B...............................................................................................................................................11

REFERNCES......................................................................................................................................14

ASSESSMENT

Part A:

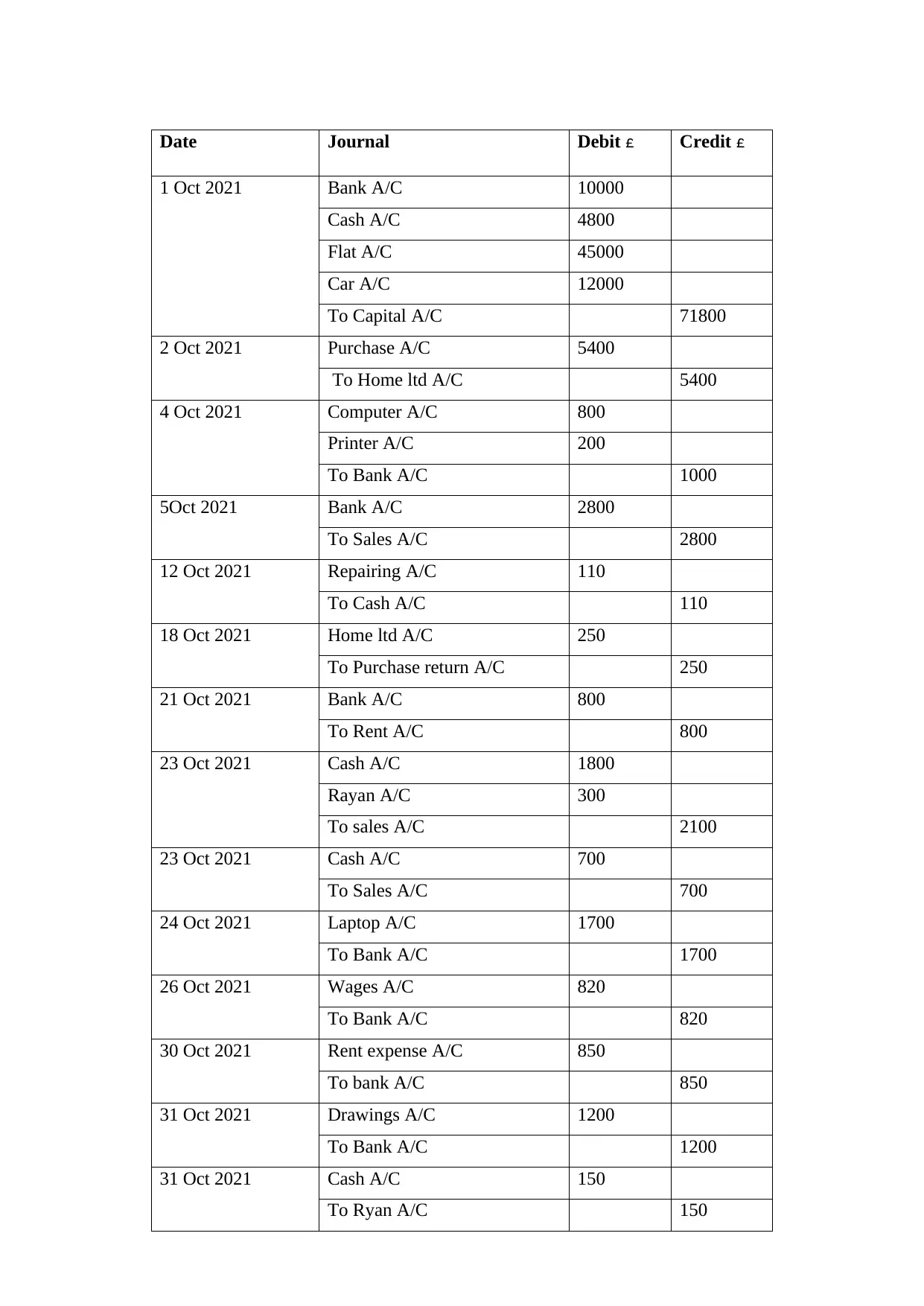

a) Journal entry of Anne York as at October 2021

Part A:

a) Journal entry of Anne York as at October 2021

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Date Journal Debit £ Credit £

1 Oct 2021 Bank A/C 10000

Cash A/C 4800

Flat A/C 45000

Car A/C 12000

To Capital A/C 71800

2 Oct 2021 Purchase A/C 5400

To Home ltd A/C 5400

4 Oct 2021 Computer A/C 800

Printer A/C 200

To Bank A/C 1000

5Oct 2021 Bank A/C 2800

To Sales A/C 2800

12 Oct 2021 Repairing A/C 110

To Cash A/C 110

18 Oct 2021 Home ltd A/C 250

To Purchase return A/C 250

21 Oct 2021 Bank A/C 800

To Rent A/C 800

23 Oct 2021 Cash A/C 1800

Rayan A/C 300

To sales A/C 2100

23 Oct 2021 Cash A/C 700

To Sales A/C 700

24 Oct 2021 Laptop A/C 1700

To Bank A/C 1700

26 Oct 2021 Wages A/C 820

To Bank A/C 820

30 Oct 2021 Rent expense A/C 850

To bank A/C 850

31 Oct 2021 Drawings A/C 1200

To Bank A/C 1200

31 Oct 2021 Cash A/C 150

To Ryan A/C 150

1 Oct 2021 Bank A/C 10000

Cash A/C 4800

Flat A/C 45000

Car A/C 12000

To Capital A/C 71800

2 Oct 2021 Purchase A/C 5400

To Home ltd A/C 5400

4 Oct 2021 Computer A/C 800

Printer A/C 200

To Bank A/C 1000

5Oct 2021 Bank A/C 2800

To Sales A/C 2800

12 Oct 2021 Repairing A/C 110

To Cash A/C 110

18 Oct 2021 Home ltd A/C 250

To Purchase return A/C 250

21 Oct 2021 Bank A/C 800

To Rent A/C 800

23 Oct 2021 Cash A/C 1800

Rayan A/C 300

To sales A/C 2100

23 Oct 2021 Cash A/C 700

To Sales A/C 700

24 Oct 2021 Laptop A/C 1700

To Bank A/C 1700

26 Oct 2021 Wages A/C 820

To Bank A/C 820

30 Oct 2021 Rent expense A/C 850

To bank A/C 850

31 Oct 2021 Drawings A/C 1200

To Bank A/C 1200

31 Oct 2021 Cash A/C 150

To Ryan A/C 150

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

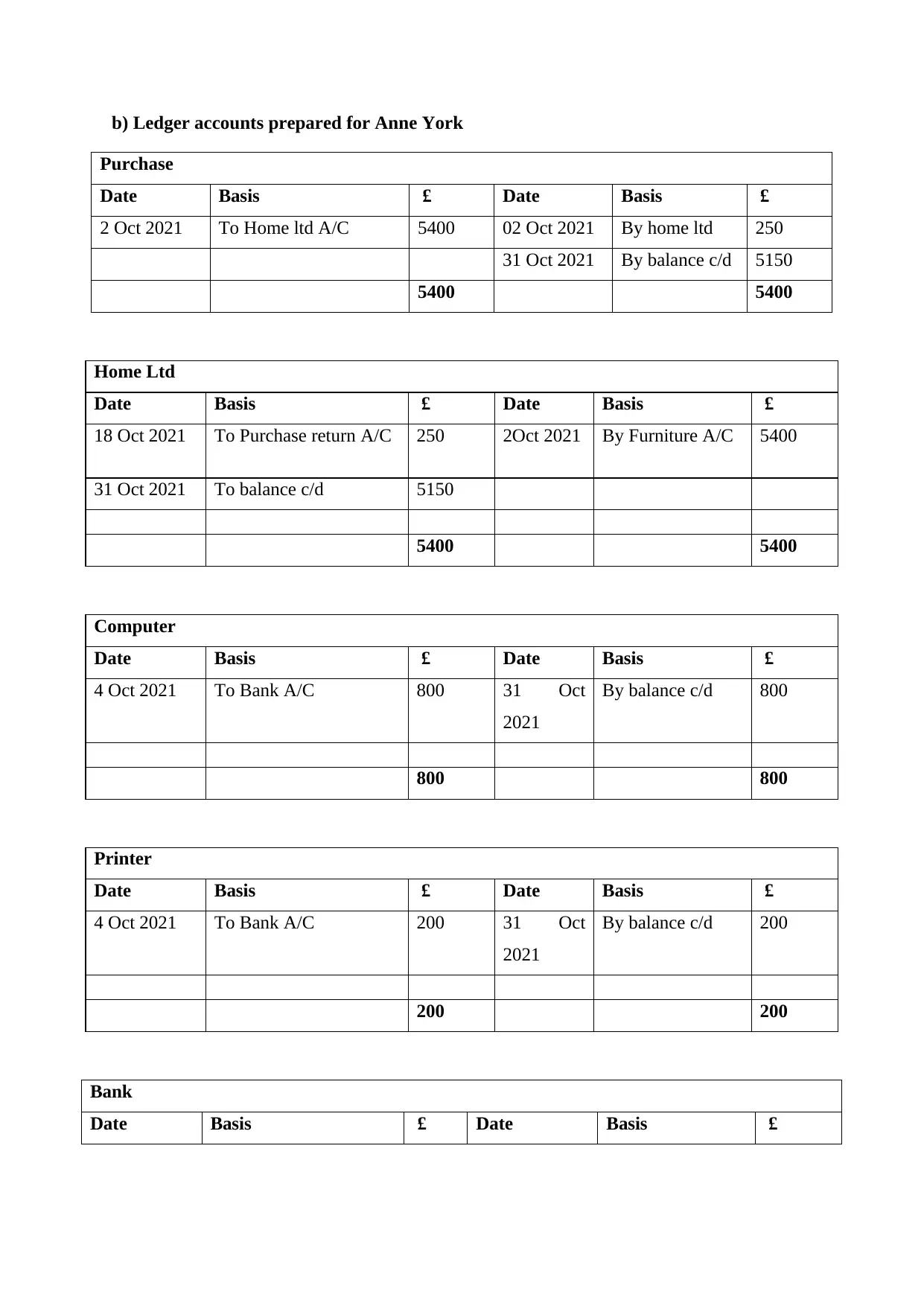

b) Ledger accounts prepared for Anne York

Purchase

Date Basis £ Date Basis £

2 Oct 2021 To Home ltd A/C 5400 02 Oct 2021 By home ltd 250

31 Oct 2021 By balance c/d 5150

5400 5400

Home Ltd

Date Basis £ Date Basis £

18 Oct 2021 To Purchase return A/C 250 2Oct 2021 By Furniture A/C 5400

31 Oct 2021 To balance c/d 5150

5400 5400

Computer

Date Basis £ Date Basis £

4 Oct 2021 To Bank A/C 800 31 Oct

2021

By balance c/d 800

800 800

Printer

Date Basis £ Date Basis £

4 Oct 2021 To Bank A/C 200 31 Oct

2021

By balance c/d 200

200 200

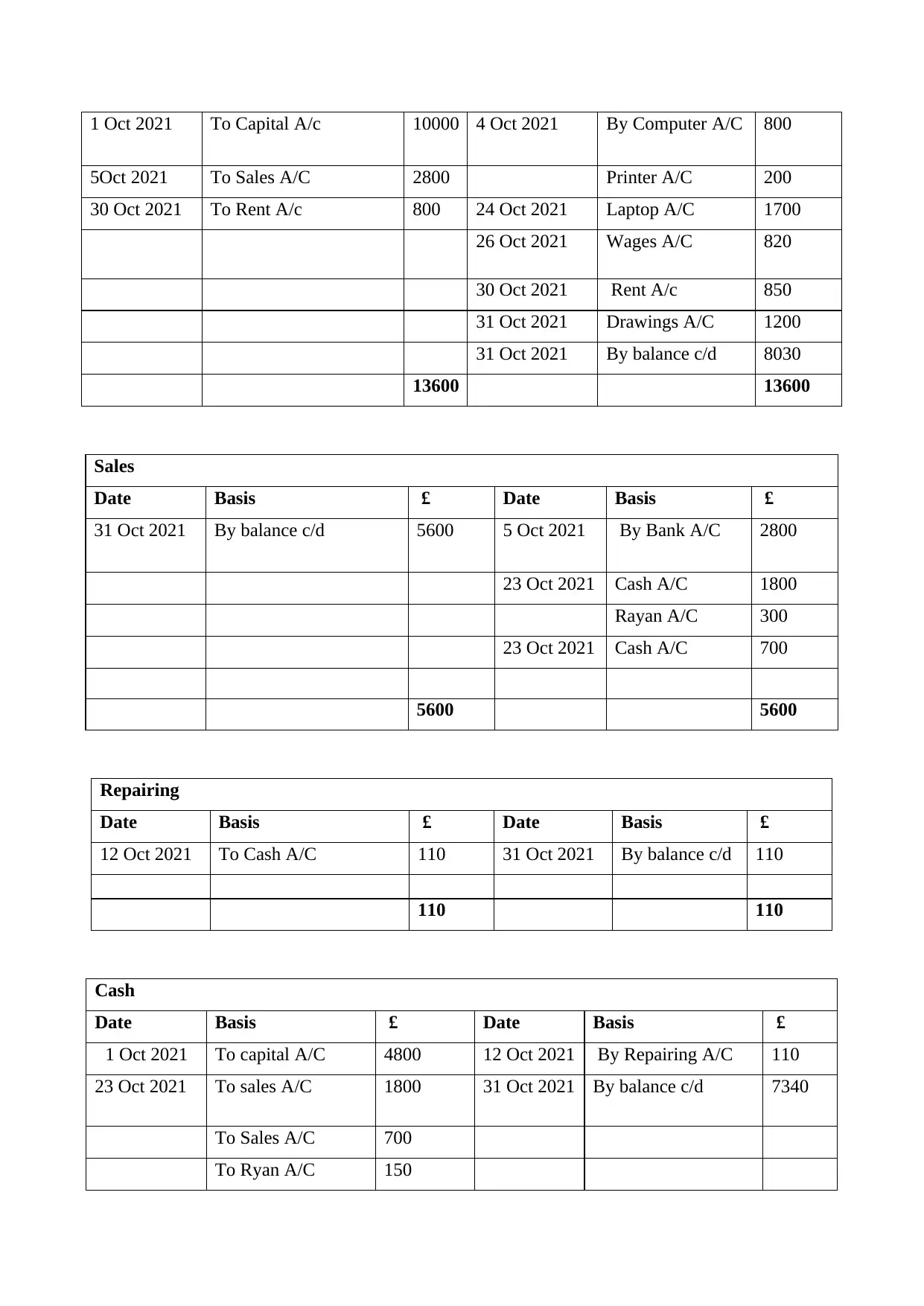

Bank

Date Basis £ Date Basis £

Purchase

Date Basis £ Date Basis £

2 Oct 2021 To Home ltd A/C 5400 02 Oct 2021 By home ltd 250

31 Oct 2021 By balance c/d 5150

5400 5400

Home Ltd

Date Basis £ Date Basis £

18 Oct 2021 To Purchase return A/C 250 2Oct 2021 By Furniture A/C 5400

31 Oct 2021 To balance c/d 5150

5400 5400

Computer

Date Basis £ Date Basis £

4 Oct 2021 To Bank A/C 800 31 Oct

2021

By balance c/d 800

800 800

Printer

Date Basis £ Date Basis £

4 Oct 2021 To Bank A/C 200 31 Oct

2021

By balance c/d 200

200 200

Bank

Date Basis £ Date Basis £

1 Oct 2021 To Capital A/c 10000 4 Oct 2021 By Computer A/C 800

5Oct 2021 To Sales A/C 2800 Printer A/C 200

30 Oct 2021 To Rent A/c 800 24 Oct 2021 Laptop A/C 1700

26 Oct 2021 Wages A/C 820

30 Oct 2021 Rent A/c 850

31 Oct 2021 Drawings A/C 1200

31 Oct 2021 By balance c/d 8030

13600 13600

Sales

Date Basis £ Date Basis £

31 Oct 2021 By balance c/d 5600 5 Oct 2021 By Bank A/C 2800

23 Oct 2021 Cash A/C 1800

Rayan A/C 300

23 Oct 2021 Cash A/C 700

5600 5600

Repairing

Date Basis £ Date Basis £

12 Oct 2021 To Cash A/C 110 31 Oct 2021 By balance c/d 110

110 110

Cash

Date Basis £ Date Basis £

1 Oct 2021 To capital A/C 4800 12 Oct 2021 By Repairing A/C 110

23 Oct 2021 To sales A/C 1800 31 Oct 2021 By balance c/d 7340

To Sales A/C 700

To Ryan A/C 150

5Oct 2021 To Sales A/C 2800 Printer A/C 200

30 Oct 2021 To Rent A/c 800 24 Oct 2021 Laptop A/C 1700

26 Oct 2021 Wages A/C 820

30 Oct 2021 Rent A/c 850

31 Oct 2021 Drawings A/C 1200

31 Oct 2021 By balance c/d 8030

13600 13600

Sales

Date Basis £ Date Basis £

31 Oct 2021 By balance c/d 5600 5 Oct 2021 By Bank A/C 2800

23 Oct 2021 Cash A/C 1800

Rayan A/C 300

23 Oct 2021 Cash A/C 700

5600 5600

Repairing

Date Basis £ Date Basis £

12 Oct 2021 To Cash A/C 110 31 Oct 2021 By balance c/d 110

110 110

Cash

Date Basis £ Date Basis £

1 Oct 2021 To capital A/C 4800 12 Oct 2021 By Repairing A/C 110

23 Oct 2021 To sales A/C 1800 31 Oct 2021 By balance c/d 7340

To Sales A/C 700

To Ryan A/C 150

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

7450 7450

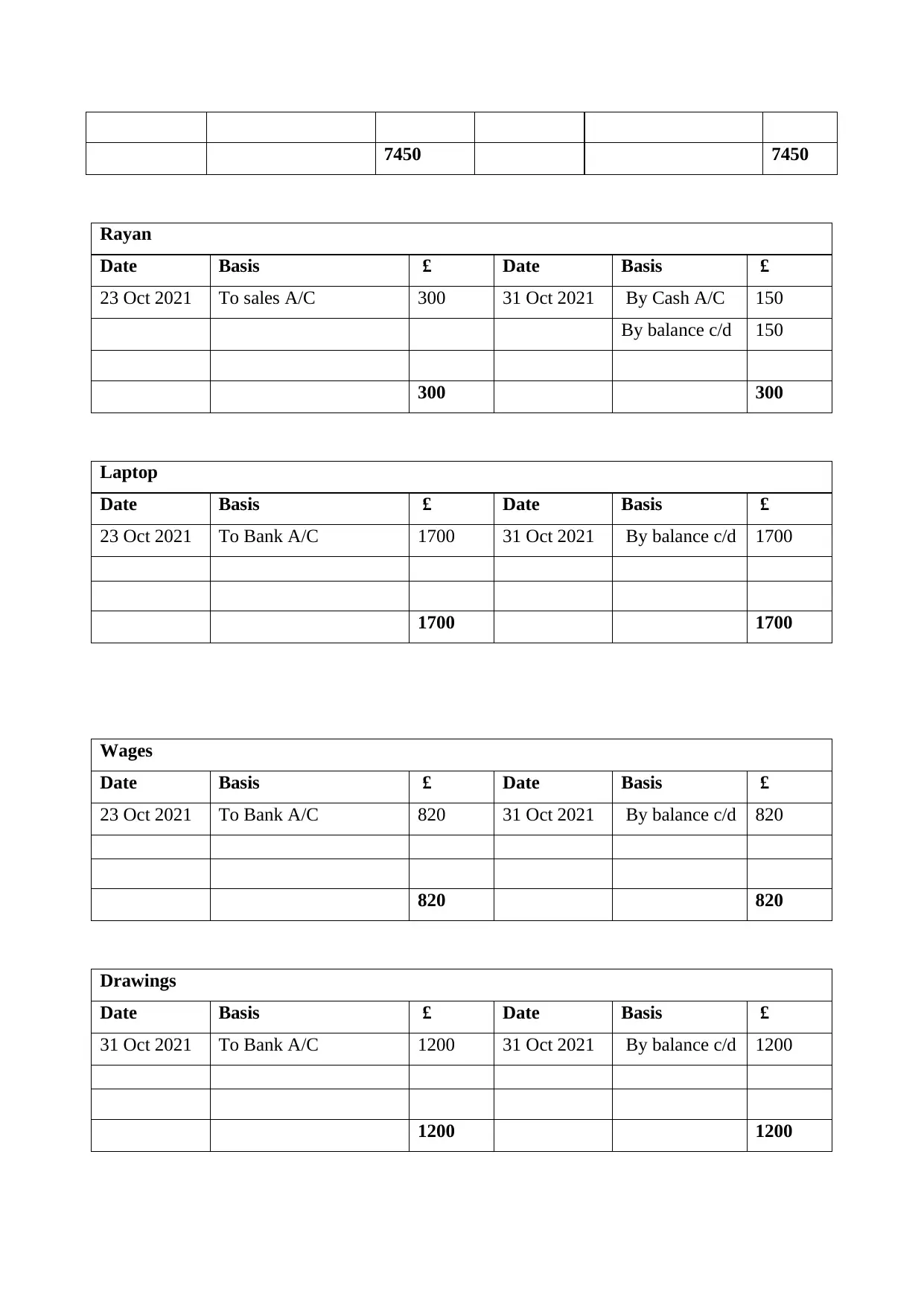

Rayan

Date Basis £ Date Basis £

23 Oct 2021 To sales A/C 300 31 Oct 2021 By Cash A/C 150

By balance c/d 150

300 300

Laptop

Date Basis £ Date Basis £

23 Oct 2021 To Bank A/C 1700 31 Oct 2021 By balance c/d 1700

1700 1700

Wages

Date Basis £ Date Basis £

23 Oct 2021 To Bank A/C 820 31 Oct 2021 By balance c/d 820

820 820

Drawings

Date Basis £ Date Basis £

31 Oct 2021 To Bank A/C 1200 31 Oct 2021 By balance c/d 1200

1200 1200

Rayan

Date Basis £ Date Basis £

23 Oct 2021 To sales A/C 300 31 Oct 2021 By Cash A/C 150

By balance c/d 150

300 300

Laptop

Date Basis £ Date Basis £

23 Oct 2021 To Bank A/C 1700 31 Oct 2021 By balance c/d 1700

1700 1700

Wages

Date Basis £ Date Basis £

23 Oct 2021 To Bank A/C 820 31 Oct 2021 By balance c/d 820

820 820

Drawings

Date Basis £ Date Basis £

31 Oct 2021 To Bank A/C 1200 31 Oct 2021 By balance c/d 1200

1200 1200

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Flat

Date Basis £ Date Basis £

1 Oct 2021 To Capital a/c 45000 31 Oct 2021 By balance c/d 45000

45000 45000

Car

Date Basis £ Date Basis £

1 Oct 2021 To capital a/c 12000 31 Oct 2021 By balance c/d 12000

1200 12000

Capital

Date Basis £ Date Basis £

31 Oct 2021 To balance c/d 71800 1 Oct 2021 By Bank a/c 10000

By Cash a/c 4800

By flat a/c 45000

By car a/c 12000

71800 71800

Rent

Date Particulars Ref Amount Date Particulars Ref Amount

21/10/21 Bank 850 30/10/21 Bank 800

31/10/21 Balance c/d 50

850 850

b) Trial Balance as at 31 October 2021

Date Basis £ Date Basis £

1 Oct 2021 To Capital a/c 45000 31 Oct 2021 By balance c/d 45000

45000 45000

Car

Date Basis £ Date Basis £

1 Oct 2021 To capital a/c 12000 31 Oct 2021 By balance c/d 12000

1200 12000

Capital

Date Basis £ Date Basis £

31 Oct 2021 To balance c/d 71800 1 Oct 2021 By Bank a/c 10000

By Cash a/c 4800

By flat a/c 45000

By car a/c 12000

71800 71800

Rent

Date Particulars Ref Amount Date Particulars Ref Amount

21/10/21 Bank 850 30/10/21 Bank 800

31/10/21 Balance c/d 50

850 850

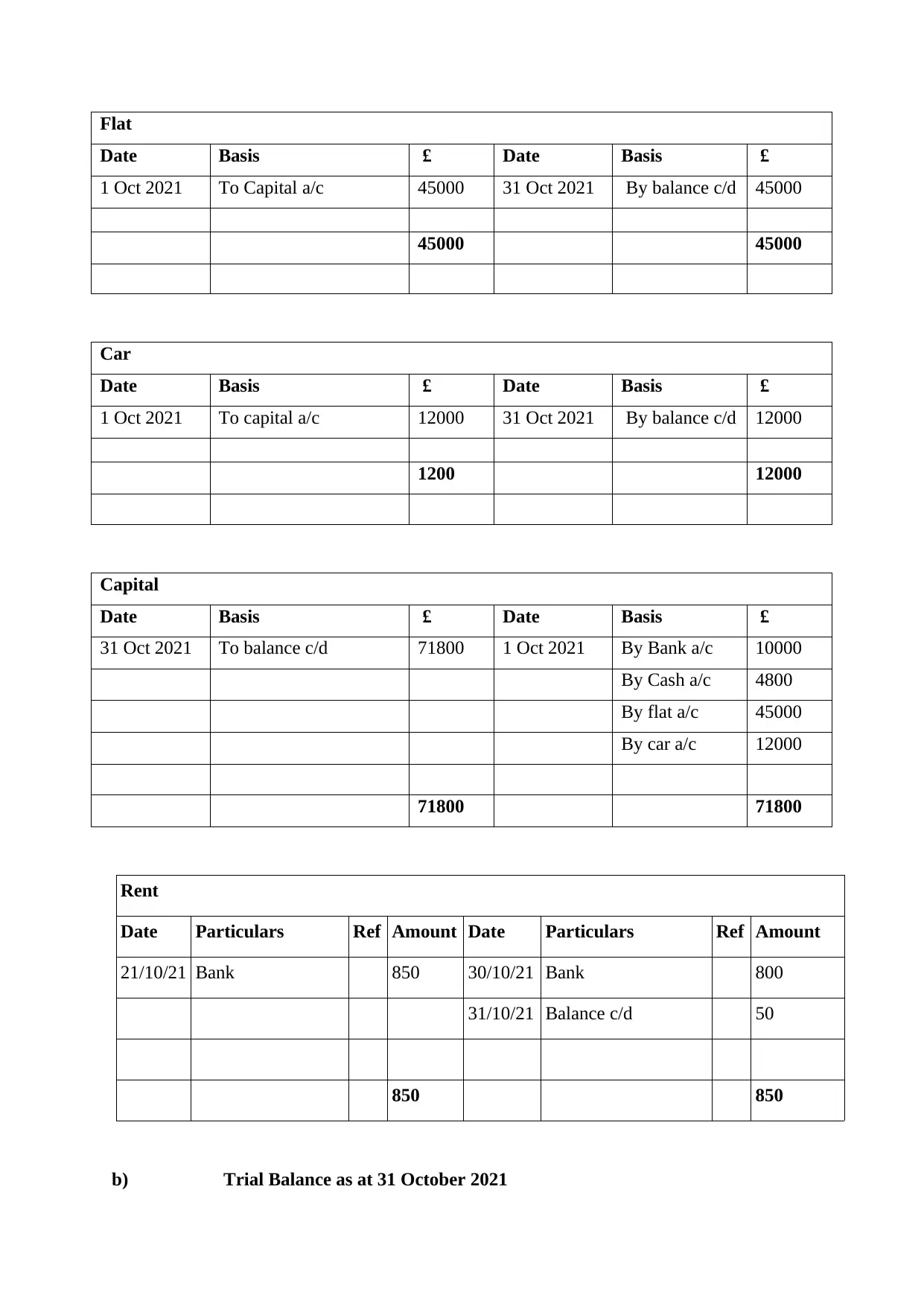

b) Trial Balance as at 31 October 2021

d) Income Statement of Anne York as on 1st October 2021

Basis £ £

Net sales 5600

Less COGS

Opening inventory 0

Purchase 5150

Closing inventory (320) 4830

Gross profit 770

Less operating expenses

Rent 50

Accounts Debit Credit

£ £

Purchase 5150

Home ltd 5150

Computer 800

Printer 200

Bank 8030

Sales 5600

Repairing 110

Cash 7340

Rayan 150

Laptop 1700

Wages 820

Drawings 1200

Flat 45000

Car 12000

Capital 71800

Rent 50

82550 82550

Basis £ £

Net sales 5600

Less COGS

Opening inventory 0

Purchase 5150

Closing inventory (320) 4830

Gross profit 770

Less operating expenses

Rent 50

Accounts Debit Credit

£ £

Purchase 5150

Home ltd 5150

Computer 800

Printer 200

Bank 8030

Sales 5600

Repairing 110

Cash 7340

Rayan 150

Laptop 1700

Wages 820

Drawings 1200

Flat 45000

Car 12000

Capital 71800

Rent 50

82550 82550

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

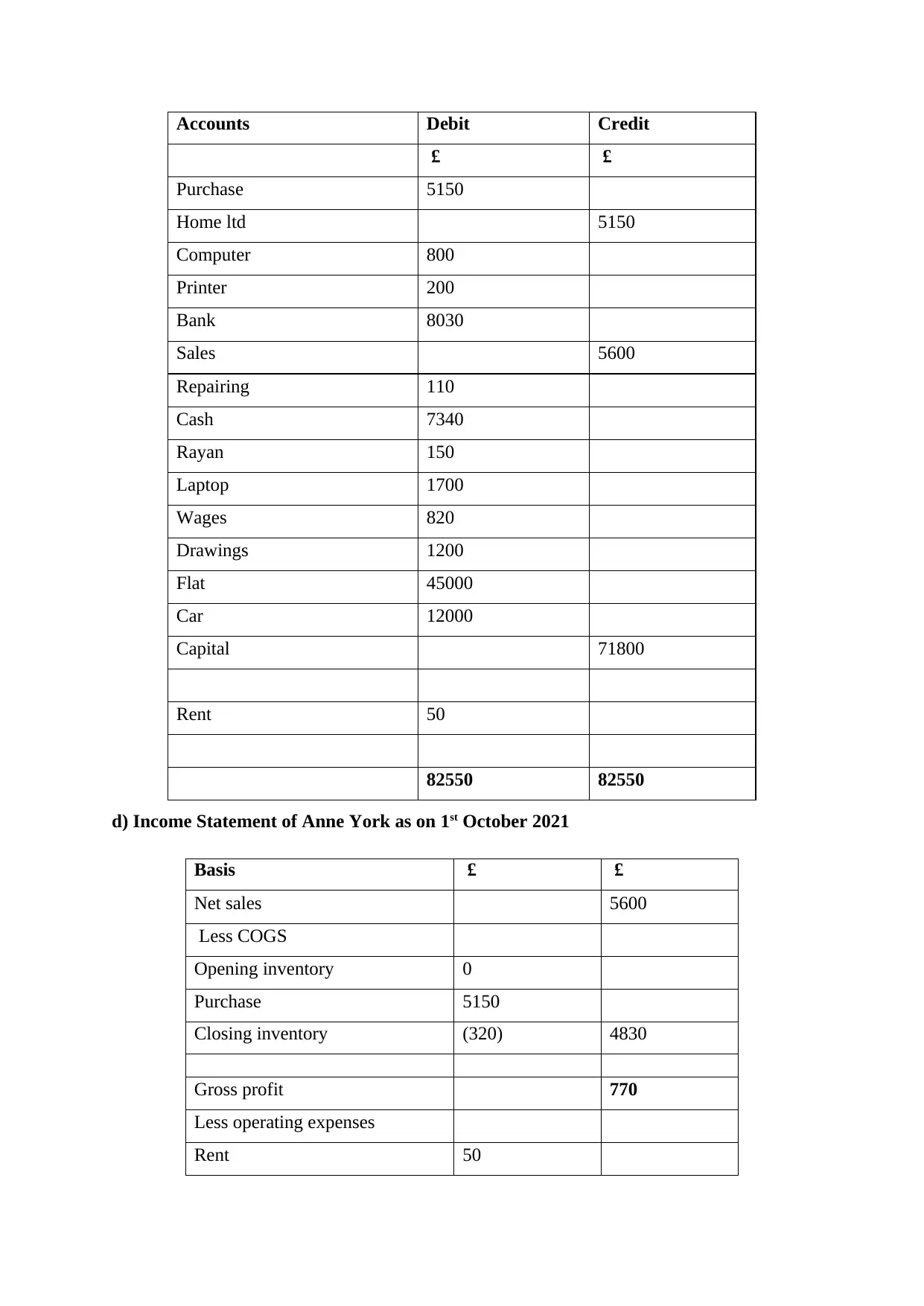

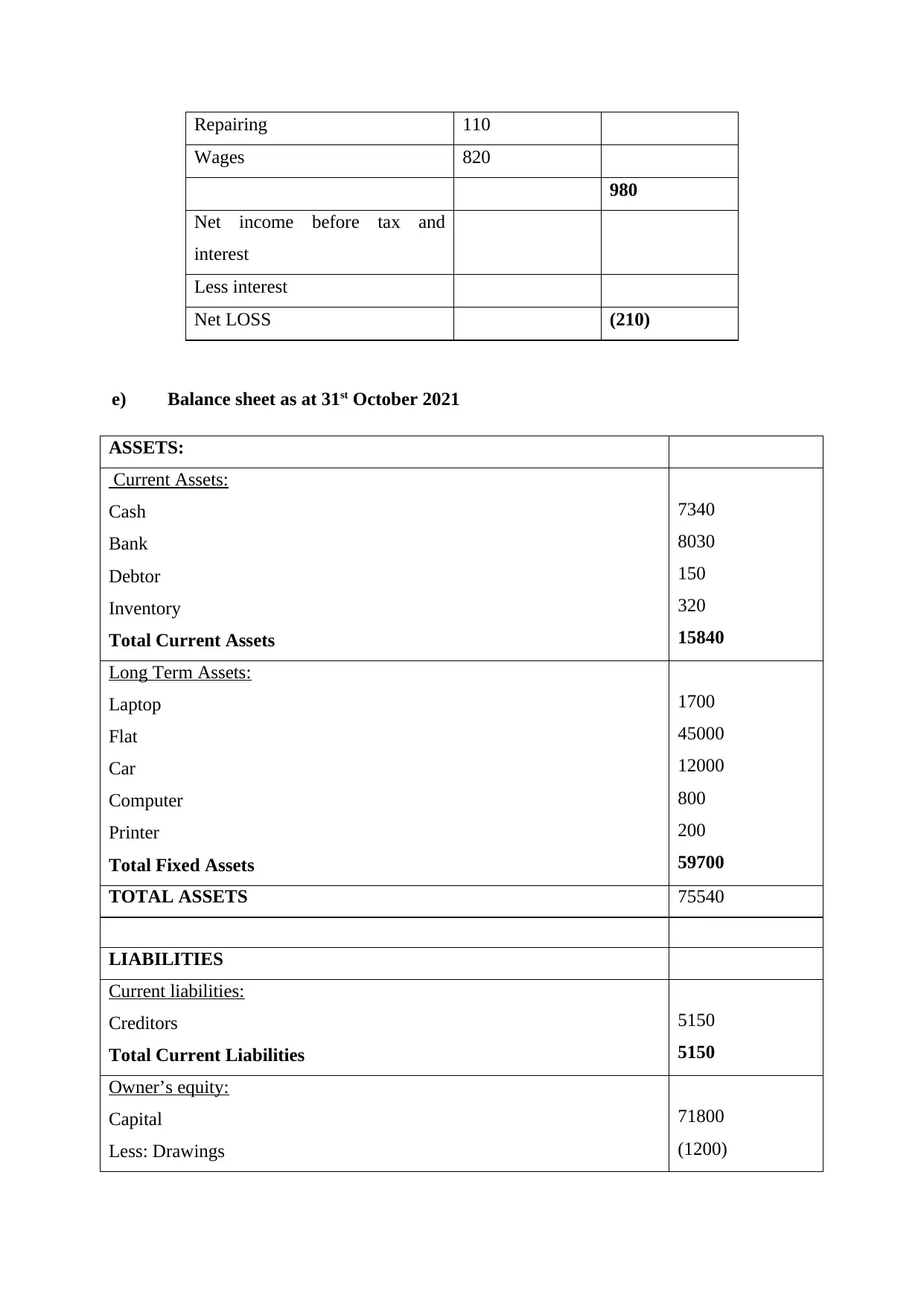

Repairing 110

Wages 820

980

Net income before tax and

interest

Less interest

Net LOSS (210)

e) Balance sheet as at 31st October 2021

ASSETS:

Current Assets:

Cash

Bank

Debtor

Inventory

Total Current Assets

7340

8030

150

320

15840

Long Term Assets:

Laptop

Flat

Car

Computer

Printer

Total Fixed Assets

1700

45000

12000

800

200

59700

TOTAL ASSETS 75540

LIABILITIES

Current liabilities:

Creditors

Total Current Liabilities

5150

5150

Owner’s equity:

Capital

Less: Drawings

71800

(1200)

Wages 820

980

Net income before tax and

interest

Less interest

Net LOSS (210)

e) Balance sheet as at 31st October 2021

ASSETS:

Current Assets:

Cash

Bank

Debtor

Inventory

Total Current Assets

7340

8030

150

320

15840

Long Term Assets:

Laptop

Flat

Car

Computer

Printer

Total Fixed Assets

1700

45000

12000

800

200

59700

TOTAL ASSETS 75540

LIABILITIES

Current liabilities:

Creditors

Total Current Liabilities

5150

5150

Owner’s equity:

Capital

Less: Drawings

71800

(1200)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

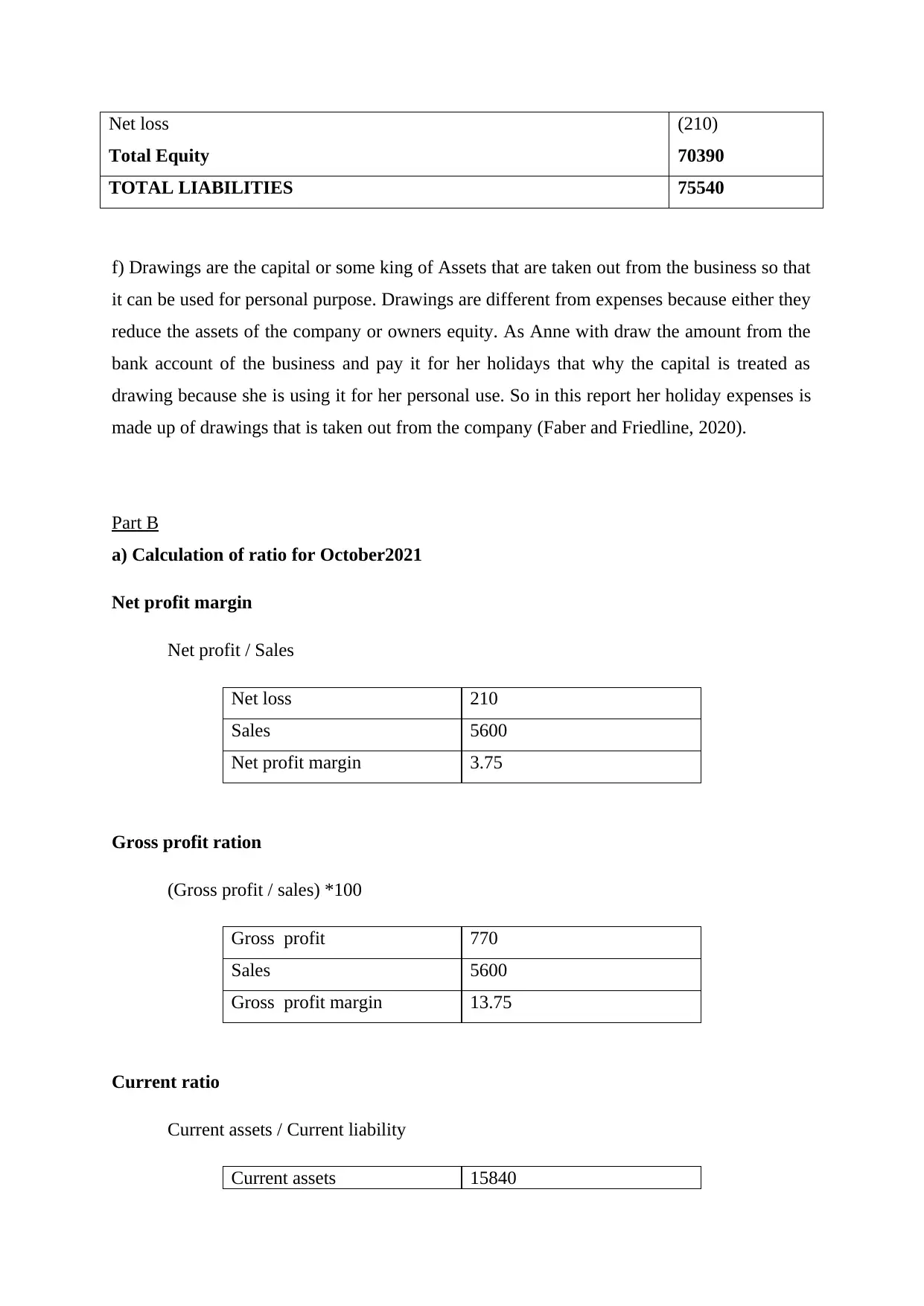

Net loss

Total Equity

(210)

70390

TOTAL LIABILITIES 75540

f) Drawings are the capital or some king of Assets that are taken out from the business so that

it can be used for personal purpose. Drawings are different from expenses because either they

reduce the assets of the company or owners equity. As Anne with draw the amount from the

bank account of the business and pay it for her holidays that why the capital is treated as

drawing because she is using it for her personal use. So in this report her holiday expenses is

made up of drawings that is taken out from the company (Faber and Friedline, 2020).

Part B

a) Calculation of ratio for October2021

Net profit margin

Net profit / Sales

Net loss 210

Sales 5600

Net profit margin 3.75

Gross profit ration

(Gross profit / sales) *100

Gross profit 770

Sales 5600

Gross profit margin 13.75

Current ratio

Current assets / Current liability

Current assets 15840

Total Equity

(210)

70390

TOTAL LIABILITIES 75540

f) Drawings are the capital or some king of Assets that are taken out from the business so that

it can be used for personal purpose. Drawings are different from expenses because either they

reduce the assets of the company or owners equity. As Anne with draw the amount from the

bank account of the business and pay it for her holidays that why the capital is treated as

drawing because she is using it for her personal use. So in this report her holiday expenses is

made up of drawings that is taken out from the company (Faber and Friedline, 2020).

Part B

a) Calculation of ratio for October2021

Net profit margin

Net profit / Sales

Net loss 210

Sales 5600

Net profit margin 3.75

Gross profit ration

(Gross profit / sales) *100

Gross profit 770

Sales 5600

Gross profit margin 13.75

Current ratio

Current assets / Current liability

Current assets 15840

Current liability 5150

Current ratio 3.10

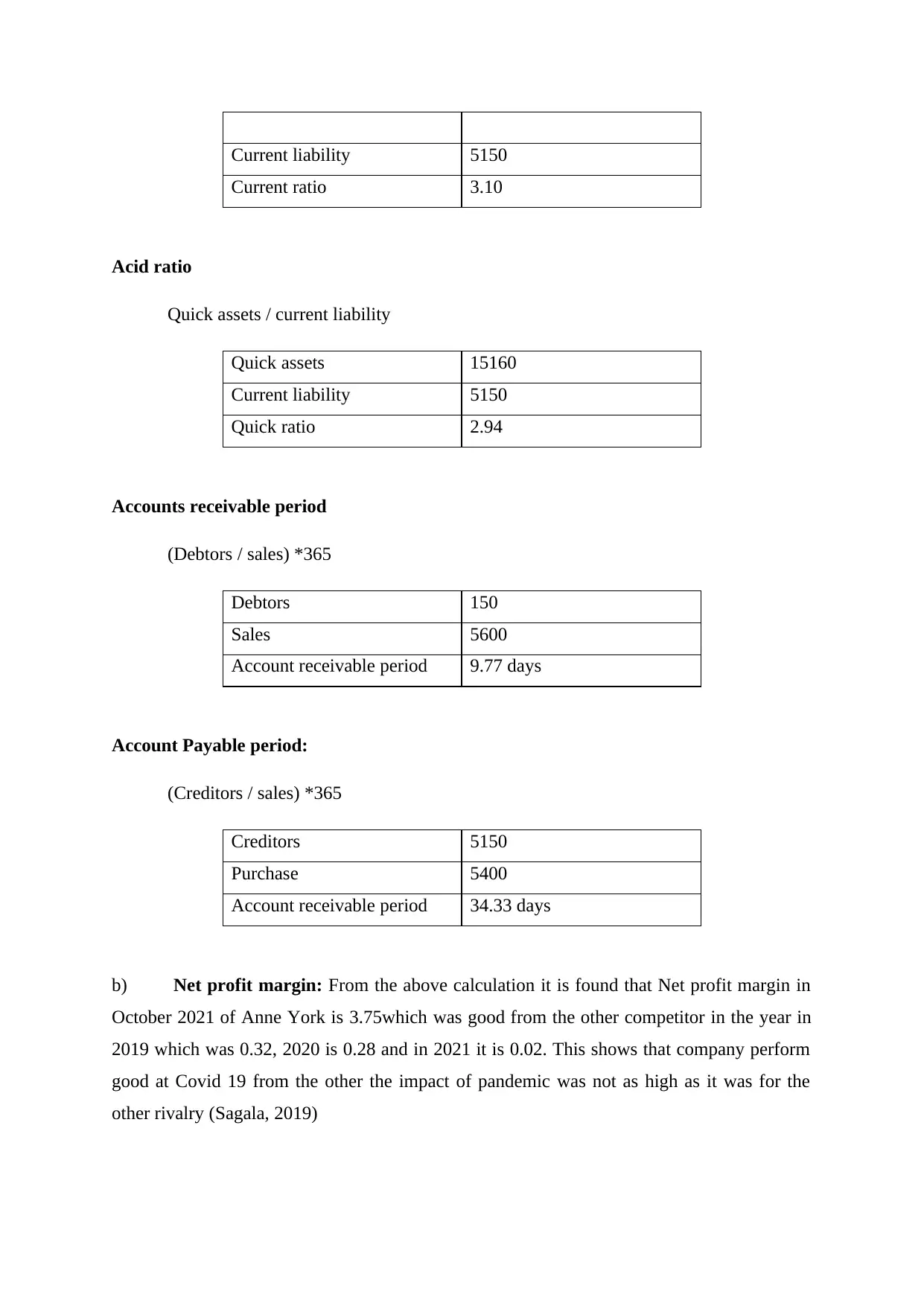

Acid ratio

Quick assets / current liability

Quick assets 15160

Current liability 5150

Quick ratio 2.94

Accounts receivable period

(Debtors / sales) *365

Debtors 150

Sales 5600

Account receivable period 9.77 days

Account Payable period:

(Creditors / sales) *365

Creditors 5150

Purchase 5400

Account receivable period 34.33 days

b) Net profit margin: From the above calculation it is found that Net profit margin in

October 2021 of Anne York is 3.75which was good from the other competitor in the year in

2019 which was 0.32, 2020 is 0.28 and in 2021 it is 0.02. This shows that company perform

good at Covid 19 from the other the impact of pandemic was not as high as it was for the

other rivalry (Sagala, 2019)

Current ratio 3.10

Acid ratio

Quick assets / current liability

Quick assets 15160

Current liability 5150

Quick ratio 2.94

Accounts receivable period

(Debtors / sales) *365

Debtors 150

Sales 5600

Account receivable period 9.77 days

Account Payable period:

(Creditors / sales) *365

Creditors 5150

Purchase 5400

Account receivable period 34.33 days

b) Net profit margin: From the above calculation it is found that Net profit margin in

October 2021 of Anne York is 3.75which was good from the other competitor in the year in

2019 which was 0.32, 2020 is 0.28 and in 2021 it is 0.02. This shows that company perform

good at Covid 19 from the other the impact of pandemic was not as high as it was for the

other rivalry (Sagala, 2019)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.