Comprehensive Report: Apple Inc. Foreign Exchange Rate and Arbitraging

VerifiedAdded on 2023/04/06

|13

|3469

|452

Report

AI Summary

This report provides a comprehensive analysis of Apple Inc.'s foreign exchange rate management and arbitraging strategies. It begins with an executive summary outlining the project's focus on arbitrage opportunities in the foreign exchange market, including different types of arbitrage and their impact. The report analyzes Apple Inc.'s practices, particularly retail arbitrage, and how the company mitigates foreign exchange risks while capitalizing on arbitrage opportunities. It explores the company's policies, the US economic policies, and methodologies for managing currency fluctuations. The report also covers the foreign exchange market dynamics, including factors influencing exchange rates, and how Apple Inc. benefits from its international sales and currency conversions, demonstrating how the company's financial strategies are influenced by the global market.

0

Running head: Report on Apple Inc Foreign exchange rate and Arbitraging

Report on Apple Inc Foreign exchange rate and Arbitraging

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Running head: Report on Apple Inc Foreign exchange rate and Arbitraging

Report on Apple Inc Foreign exchange rate and Arbitraging

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

Report on Apple Inc Foreign exchange rate and Arbitraging

Executive summary

The project is about investigating the characteristic of arbitrage opportunities in the foreign

exchange market. The types of Arbitrage are explained and the also the impact of arbitraging

on foreign exchange rate. A MNC is analyzed how that company has used Arbitraging from

their operation around the world. The product or services sold by this MNC is widely spread

across the globe and they are subject to open market arbitraging and foreign exchange factor.

The analysis marks existence of number of short lived arbitrage opportunities whose

transaction size is very significant in the world market. The study will be clearing many

concepts and points related to arbitraging because of foreign exchange rate.

The analysis is based on Apple Inc how it manages the foreign exchange rate and how the

company is successfully maintaining the arbitraging. Apple Inc is one of the biggest producer

of the Techno product. The company is committed to provide world class service to its

customers. Like any other company Apple Inc is also practices foreign exchange and

Arbitraging. The company practices business by taking all the factors for limiting risk while

following exchange operation.

Apple Inc has made a whole set of policies for foreign exchange rate risk mitigation and

taking the benefits of arbitraging. Apple Inc is US based multinational company with its head

quarter in Cupertino, California. The company is a huge producer of I-pad, I-phone,

consumer electronics and software. It is among the big four technological companies in the

world. Apple is well known for its size and revenues. Its overall annual revenue totals to

$265 billion for this 2018 fiscal year.

Arbitraging is instantly purchasing and selling of the same product in two different market by

realizing a profit on the change in price. There are many types of arbitraging that has been

discussed in the project and the retail arbitraging is the strategies used by apple Inc.

An exchange rate is the method of measuring the currency value of one country to the

currency value of the other country. The foreign currency exchange rates are a factor risk and

benefit for companies which sell or buy product or service across the globe the companies

needs to make proper strategies to mitigate the risk. The risk and mitigating risk factors have

been discussed in the project. How Apple Inc maintains stable currency exchange rate flow is

also explored.

Report on Apple Inc Foreign exchange rate and Arbitraging

Executive summary

The project is about investigating the characteristic of arbitrage opportunities in the foreign

exchange market. The types of Arbitrage are explained and the also the impact of arbitraging

on foreign exchange rate. A MNC is analyzed how that company has used Arbitraging from

their operation around the world. The product or services sold by this MNC is widely spread

across the globe and they are subject to open market arbitraging and foreign exchange factor.

The analysis marks existence of number of short lived arbitrage opportunities whose

transaction size is very significant in the world market. The study will be clearing many

concepts and points related to arbitraging because of foreign exchange rate.

The analysis is based on Apple Inc how it manages the foreign exchange rate and how the

company is successfully maintaining the arbitraging. Apple Inc is one of the biggest producer

of the Techno product. The company is committed to provide world class service to its

customers. Like any other company Apple Inc is also practices foreign exchange and

Arbitraging. The company practices business by taking all the factors for limiting risk while

following exchange operation.

Apple Inc has made a whole set of policies for foreign exchange rate risk mitigation and

taking the benefits of arbitraging. Apple Inc is US based multinational company with its head

quarter in Cupertino, California. The company is a huge producer of I-pad, I-phone,

consumer electronics and software. It is among the big four technological companies in the

world. Apple is well known for its size and revenues. Its overall annual revenue totals to

$265 billion for this 2018 fiscal year.

Arbitraging is instantly purchasing and selling of the same product in two different market by

realizing a profit on the change in price. There are many types of arbitraging that has been

discussed in the project and the retail arbitraging is the strategies used by apple Inc.

An exchange rate is the method of measuring the currency value of one country to the

currency value of the other country. The foreign currency exchange rates are a factor risk and

benefit for companies which sell or buy product or service across the globe the companies

needs to make proper strategies to mitigate the risk. The risk and mitigating risk factors have

been discussed in the project. How Apple Inc maintains stable currency exchange rate flow is

also explored.

2

Report on Apple Inc Foreign exchange rate and Arbitraging

The projects details about the policies used by the company and how does it benefits from

heading in the world of foreign exchange and arbitraging. The Arbitraging is in many forms

and the one that is followed by the company is highlighted. The project is study about how

the company is benefiting from the exchange rate and arbitraging and ho w the risk of

currency value change is mitigated and also the benefit taken by the company from

arbitraging.

Report on Apple Inc Foreign exchange rate and Arbitraging

The projects details about the policies used by the company and how does it benefits from

heading in the world of foreign exchange and arbitraging. The Arbitraging is in many forms

and the one that is followed by the company is highlighted. The project is study about how

the company is benefiting from the exchange rate and arbitraging and ho w the risk of

currency value change is mitigated and also the benefit taken by the company from

arbitraging.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

Report on Apple Inc Foreign exchange rate and Arbitraging

Table of Contents

Introduction................................................................................................................................4

Analysis......................................................................................................................................4

Types of Arbitraging:.............................................................................................................4

Foreign exchanges market..........................................................................................................5

The US economic policies.........................................................................................................6

The analysis Apple Inc:..............................................................................................................7

Retail Arbitrage:.........................................................................................................................8

How exchange rate effect the international business.............................................................8

Foreign exchange policy of Apple Inc:..................................................................................9

Policy formulation is based on these factor:..........................................................................9

Apple Inc. methodology to formulate the policy is:............................................................10

Conclusion................................................................................................................................10

Reference..................................................................................................................................11

Report on Apple Inc Foreign exchange rate and Arbitraging

Table of Contents

Introduction................................................................................................................................4

Analysis......................................................................................................................................4

Types of Arbitraging:.............................................................................................................4

Foreign exchanges market..........................................................................................................5

The US economic policies.........................................................................................................6

The analysis Apple Inc:..............................................................................................................7

Retail Arbitrage:.........................................................................................................................8

How exchange rate effect the international business.............................................................8

Foreign exchange policy of Apple Inc:..................................................................................9

Policy formulation is based on these factor:..........................................................................9

Apple Inc. methodology to formulate the policy is:............................................................10

Conclusion................................................................................................................................10

Reference..................................................................................................................................11

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

Report on Apple Inc Foreign exchange rate and Arbitraging

Introduction

Arbitraging is one of the most important pillar of financial economics. It is a

technique of simultaneously purchasing at a lesser pricing one market and selling at higher

price in other market to make profit on the spread between the prices. An investment practice

where one party attempts to profit from the inefficiencies in the price of another party by

making transactions that levels the effect of each other. An example is when something is

bought in one country may not be cheaper in other country here the person can gain the

benefit of exchange rate pricing. Or anything bought on the exchange market is sold

immediately back at higher price to other. Exchange rate market across the globe works on

arbitraging on foreign currency. There is a billion dollar market where the exchange rate

arbitrating is utilized to make huge gain. A stock is traded in multiple stock exchange and on

each stock exchange the quote price differs to a very minimum unit. Hence arbitrage is used

to take advantage of the price disparity.

Companies across the globe are utilizing the benefit of arbitraging and exchange rate

conversion. The benefits are huge in Arbitraging. The company Apple Inc is a huge buyer

and seller of electronic products. The company purchases the product from lower currency

value countries like China, Taiwan, India this is a benefiting factor for them as the arbitraging

is benefited from it. The project describes the calculation and the methodology how it

benefits from the currency exchange rate exploitations and Arbitraging.

Analysis

Types of Arbitraging:

Risk arbitrage: this is a kind of arbitraging of buying the stocks in the process of merger &

acquisition. These strategies are used in hedge funds where the target stock are bought and

sells the stock of the acquirer (Nosal, E., & Wang, T. 2004).

Retailer arbitrage- Retail itself means an individual seller who sells the product at different

price in different countries. The biggest example is of E-bay whose products are sold at

different price in different countries.

Report on Apple Inc Foreign exchange rate and Arbitraging

Introduction

Arbitraging is one of the most important pillar of financial economics. It is a

technique of simultaneously purchasing at a lesser pricing one market and selling at higher

price in other market to make profit on the spread between the prices. An investment practice

where one party attempts to profit from the inefficiencies in the price of another party by

making transactions that levels the effect of each other. An example is when something is

bought in one country may not be cheaper in other country here the person can gain the

benefit of exchange rate pricing. Or anything bought on the exchange market is sold

immediately back at higher price to other. Exchange rate market across the globe works on

arbitraging on foreign currency. There is a billion dollar market where the exchange rate

arbitrating is utilized to make huge gain. A stock is traded in multiple stock exchange and on

each stock exchange the quote price differs to a very minimum unit. Hence arbitrage is used

to take advantage of the price disparity.

Companies across the globe are utilizing the benefit of arbitraging and exchange rate

conversion. The benefits are huge in Arbitraging. The company Apple Inc is a huge buyer

and seller of electronic products. The company purchases the product from lower currency

value countries like China, Taiwan, India this is a benefiting factor for them as the arbitraging

is benefited from it. The project describes the calculation and the methodology how it

benefits from the currency exchange rate exploitations and Arbitraging.

Analysis

Types of Arbitraging:

Risk arbitrage: this is a kind of arbitraging of buying the stocks in the process of merger &

acquisition. These strategies are used in hedge funds where the target stock are bought and

sells the stock of the acquirer (Nosal, E., & Wang, T. 2004).

Retailer arbitrage- Retail itself means an individual seller who sells the product at different

price in different countries. The biggest example is of E-bay whose products are sold at

different price in different countries.

5

Report on Apple Inc Foreign exchange rate and Arbitraging

Covered interest arbitrage: It’s a financial instrument or a kind of security bought by an

investor in the denomination of a foreign currency and the risk of foreign exchange is hedged

by the sale of forward contract in the process of sale of the financial instrument in the home

currency.

Regulatory Arbitrage: A regulated arbitraging make the profit by benefiting from the

deviation of the regulatory positioning and the real risk.

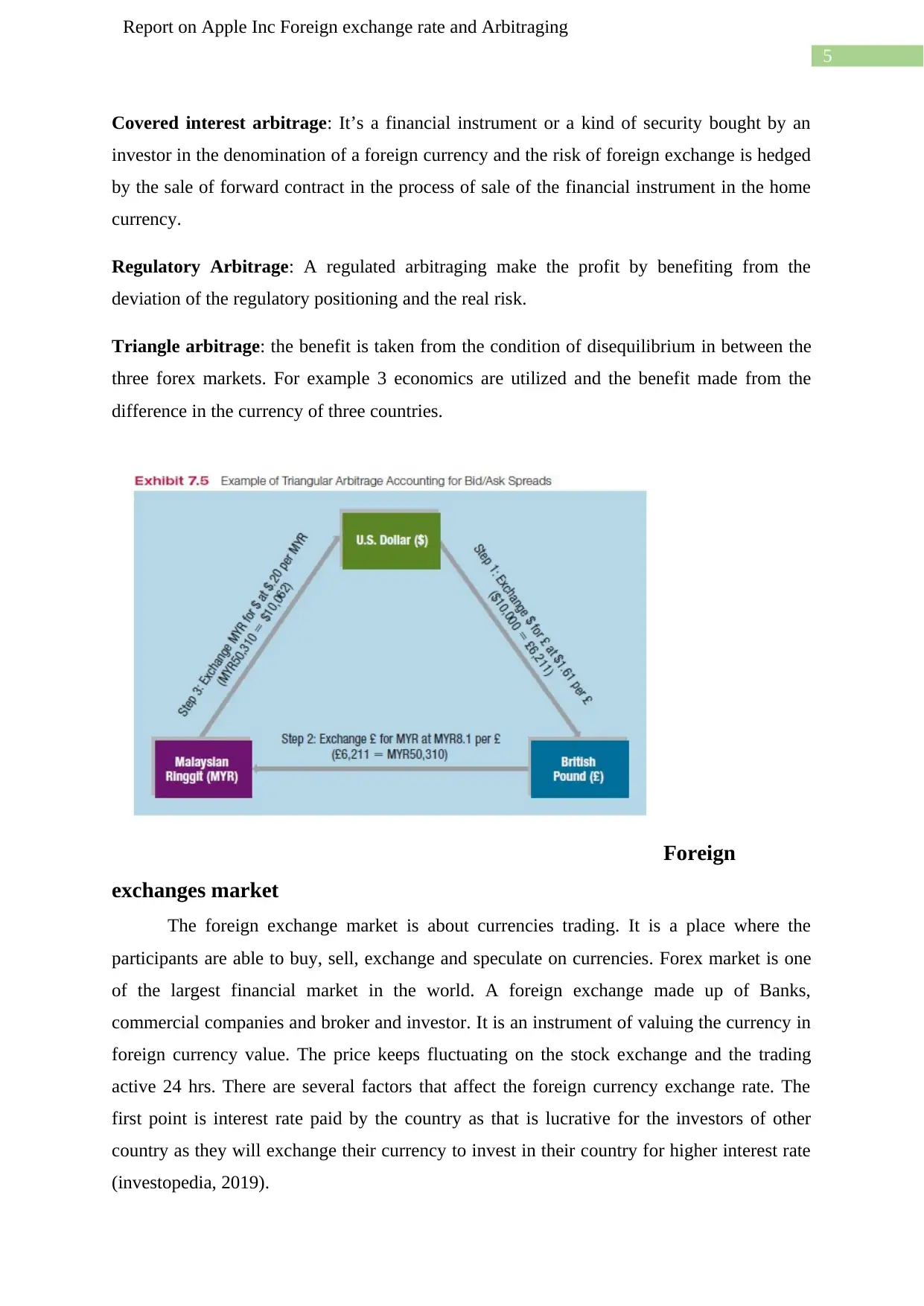

Triangle arbitrage: the benefit is taken from the condition of disequilibrium in between the

three forex markets. For example 3 economics are utilized and the benefit made from the

difference in the currency of three countries.

Foreign

exchanges market

The foreign exchange market is about currencies trading. It is a place where the

participants are able to buy, sell, exchange and speculate on currencies. Forex market is one

of the largest financial market in the world. A foreign exchange made up of Banks,

commercial companies and broker and investor. It is an instrument of valuing the currency in

foreign currency value. The price keeps fluctuating on the stock exchange and the trading

active 24 hrs. There are several factors that affect the foreign currency exchange rate. The

first point is interest rate paid by the country as that is lucrative for the investors of other

country as they will exchange their currency to invest in their country for higher interest rate

(investopedia, 2019).

Report on Apple Inc Foreign exchange rate and Arbitraging

Covered interest arbitrage: It’s a financial instrument or a kind of security bought by an

investor in the denomination of a foreign currency and the risk of foreign exchange is hedged

by the sale of forward contract in the process of sale of the financial instrument in the home

currency.

Regulatory Arbitrage: A regulated arbitraging make the profit by benefiting from the

deviation of the regulatory positioning and the real risk.

Triangle arbitrage: the benefit is taken from the condition of disequilibrium in between the

three forex markets. For example 3 economics are utilized and the benefit made from the

difference in the currency of three countries.

Foreign

exchanges market

The foreign exchange market is about currencies trading. It is a place where the

participants are able to buy, sell, exchange and speculate on currencies. Forex market is one

of the largest financial market in the world. A foreign exchange made up of Banks,

commercial companies and broker and investor. It is an instrument of valuing the currency in

foreign currency value. The price keeps fluctuating on the stock exchange and the trading

active 24 hrs. There are several factors that affect the foreign currency exchange rate. The

first point is interest rate paid by the country as that is lucrative for the investors of other

country as they will exchange their currency to invest in their country for higher interest rate

(investopedia, 2019).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

Report on Apple Inc Foreign exchange rate and Arbitraging

The second factor is the supply of the money by the central bank in one country. If the

supply increases than the value of the money will decrease. This will cause a hyperinflation

which will lead to value of money to decrease and there will be a debt war

(Economicdiscussion, 2019). The third factor is the financial stability of the country if the

country is not stable then the demand for that currency will be low as the interest rate for their

currency will not be paid in comparison to other country.

Forward contract: an agreement between two parties obliging the buyer to purchase the

asset at a fixed price at a future in time. Here the assets that traded are generally Oil, beef,

Orange juice and natural gas and some of the financial instruments are also a part of it. It is a

customized contract between two parties to buy or sell of an asset at a specified price.

Bid and ask spread: In simple words it is a difference between the price at which a trader

will buy and sell the currency. The bid price is at which the trader is willing to pay or “BID”

for a currency. Whereas the ask price is how much the dealer wants for the currency.

The US economic policies

Although the economic state of USA has faced many negative change at all level in

domestic and international level. The economies constantly developing still it is one of the

largest economy in the world. The US economy represents the 20% of the total global output.

The US economy features the most developed and technologically advanced country. The

economy is emerging from a period of many economics tensions (Kotabe, M. 1998). The

economy faced 2008 recession and it is recovering steadily the major factors that got affected

was the employment, foreign exchange due to the interest rate lowering. The most important

indicator of the economy is the GDP which measures the nation production. The GDP is 3%

the unemployment rate is 3.7%. The inflation rate is falling around 1.9%. US manufacturing

rate is expected to be around 3.9% (MONEYZINE, 2019).

These are the basic factors that defines the condition of an economy. The US

economy is considered the most stable economy and the rate are most suitable. The

companies in this region also benefits from the stable economy as the disturbance of political

and legislative are the least affecting the company productivity. The companies find the

policies formulated very suitable for them. Apple Inc is determined to produce innovative,

high quality product and services. There are many laws and rules and regulations that Apple

Inc follows to make the operation of the company smooth and ethical. The company has

Report on Apple Inc Foreign exchange rate and Arbitraging

The second factor is the supply of the money by the central bank in one country. If the

supply increases than the value of the money will decrease. This will cause a hyperinflation

which will lead to value of money to decrease and there will be a debt war

(Economicdiscussion, 2019). The third factor is the financial stability of the country if the

country is not stable then the demand for that currency will be low as the interest rate for their

currency will not be paid in comparison to other country.

Forward contract: an agreement between two parties obliging the buyer to purchase the

asset at a fixed price at a future in time. Here the assets that traded are generally Oil, beef,

Orange juice and natural gas and some of the financial instruments are also a part of it. It is a

customized contract between two parties to buy or sell of an asset at a specified price.

Bid and ask spread: In simple words it is a difference between the price at which a trader

will buy and sell the currency. The bid price is at which the trader is willing to pay or “BID”

for a currency. Whereas the ask price is how much the dealer wants for the currency.

The US economic policies

Although the economic state of USA has faced many negative change at all level in

domestic and international level. The economies constantly developing still it is one of the

largest economy in the world. The US economy represents the 20% of the total global output.

The US economy features the most developed and technologically advanced country. The

economy is emerging from a period of many economics tensions (Kotabe, M. 1998). The

economy faced 2008 recession and it is recovering steadily the major factors that got affected

was the employment, foreign exchange due to the interest rate lowering. The most important

indicator of the economy is the GDP which measures the nation production. The GDP is 3%

the unemployment rate is 3.7%. The inflation rate is falling around 1.9%. US manufacturing

rate is expected to be around 3.9% (MONEYZINE, 2019).

These are the basic factors that defines the condition of an economy. The US

economy is considered the most stable economy and the rate are most suitable. The

companies in this region also benefits from the stable economy as the disturbance of political

and legislative are the least affecting the company productivity. The companies find the

policies formulated very suitable for them. Apple Inc is determined to produce innovative,

high quality product and services. There are many laws and rules and regulations that Apple

Inc follows to make the operation of the company smooth and ethical. The company has

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

Report on Apple Inc Foreign exchange rate and Arbitraging

made a revenue of $229.2 billion for the year 2017 half of the revenue was only by selling the

I-phone. It is also said that 105 of the revenue of US is due to the sale of Apple product. The

principle are:

Policies: Honesty, respect, confidentiality and compliance. The honesty means to follow

honesty in business dealing, treating the customers and suppliers with respect and to maintain

the confidentiality of apple information and follow all the law and regulation.

The analysis Apple Inc:

Apple Inc. an American manufacturer of computer peripherals, personal computers,

and computer software. Headquarters are located in Cupertino, California. It is one of the

biggest multinational technology company that designs, develops and sells consumer

electronics, online services. The company is well known for selling I-phone smart phone.

The marketing strategy of the company is followed by many other technology selling

companies. The IOS and Mac laptop is also most expensive and sold products of the Apple

Inc drawing a huge amount of revenues.

The Company is a major giant and the revenue earned for the year2018 stands at 53.3

billion it is an increase of 175 from last quarter. This was due to sale of the international sale

which accounts for 60% of the total sale. The Q3 result are driven by strong sales of I-phone,

services internationally. Luca Maestri Apple’s CFO claims that $11.5 billion and the

operating cash flow is around $14.5 billion. The company paid a dividend of $20 billion to

the investors. Apple Inc makes international sales. The 5 biggest market is Europe which

accounts for 22% of the sales around 20 billion. The China is having a sale of about 19

billion almost around 16% of the total sale. Rest 6% of the sale comes from the Asia and

pacific region. The total revenue coming around 11 billion.

A foreign exchange risk is most affected to the institution who are involved in import

and export of the goods. The companies that offer services or product in multiple countries.

Here the investor should convert the currency to another currency to do any investment and

there arises a risk of change in the foreign currency rate which may or may not favor the

investor. The same risk is faced by Apple Inc as the business is highly expanded throughout

the globe (Jiang, Z. H. U. 2002).

Apple Inc covers the risk of foreign currency exchange rate fluctuation by currency-

Hedging contracts. These contracts are 12 months long duration. Apple has benefited by

Report on Apple Inc Foreign exchange rate and Arbitraging

made a revenue of $229.2 billion for the year 2017 half of the revenue was only by selling the

I-phone. It is also said that 105 of the revenue of US is due to the sale of Apple product. The

principle are:

Policies: Honesty, respect, confidentiality and compliance. The honesty means to follow

honesty in business dealing, treating the customers and suppliers with respect and to maintain

the confidentiality of apple information and follow all the law and regulation.

The analysis Apple Inc:

Apple Inc. an American manufacturer of computer peripherals, personal computers,

and computer software. Headquarters are located in Cupertino, California. It is one of the

biggest multinational technology company that designs, develops and sells consumer

electronics, online services. The company is well known for selling I-phone smart phone.

The marketing strategy of the company is followed by many other technology selling

companies. The IOS and Mac laptop is also most expensive and sold products of the Apple

Inc drawing a huge amount of revenues.

The Company is a major giant and the revenue earned for the year2018 stands at 53.3

billion it is an increase of 175 from last quarter. This was due to sale of the international sale

which accounts for 60% of the total sale. The Q3 result are driven by strong sales of I-phone,

services internationally. Luca Maestri Apple’s CFO claims that $11.5 billion and the

operating cash flow is around $14.5 billion. The company paid a dividend of $20 billion to

the investors. Apple Inc makes international sales. The 5 biggest market is Europe which

accounts for 22% of the sales around 20 billion. The China is having a sale of about 19

billion almost around 16% of the total sale. Rest 6% of the sale comes from the Asia and

pacific region. The total revenue coming around 11 billion.

A foreign exchange risk is most affected to the institution who are involved in import

and export of the goods. The companies that offer services or product in multiple countries.

Here the investor should convert the currency to another currency to do any investment and

there arises a risk of change in the foreign currency rate which may or may not favor the

investor. The same risk is faced by Apple Inc as the business is highly expanded throughout

the globe (Jiang, Z. H. U. 2002).

Apple Inc covers the risk of foreign currency exchange rate fluctuation by currency-

Hedging contracts. These contracts are 12 months long duration. Apple has benefited by

8

Report on Apple Inc Foreign exchange rate and Arbitraging

currency –hedging strategy of around $607 million. These hedging strategy has save the

company from huge losses. This step is taken to mitigate the risk which are associated with

volatility by transferring the risk (Apple, 2019). Other American companies has also suffered

from the same unfavorable currency headwinds. The champion is Apple Inc as this company

maintains the capital investment. The change in the price does not generally affects the price

of the product in other countries.

Retail Arbitrage:

Retail arbitraging is a term of currency arbitraging where a product is purchased for a

lower price or at the discounted price an then it is sold at a higher price in other market. There

for making profit from it. The Pros and Con of retail arbitraging is when the company is not

able to sell of the inventory bought. The pros is when the inventory is sold at a good pricing.

The process of procurement and selling the product by arbitraging is practiced by large

number of enterprise. Model remains the dominant theory to describe the relationship

between a stock's risk and return.

Apple is a big enterprise. It does not manufacture all its products and 80% of the

product is purchased from outside and assembled in USA. The product purchased from their

country is bought in their home currency. The currency needs to be converted back to the US

dollar. Thus every month the company makes proper arrangement to not only exploit the

foreign currency exchange rate but also benefits from Arbitraging. Apple Inc uses arbitraging

buy purchasing many important component of its product from other countries and after

manufacturing the product it sell it in their home country price. The suppliers are form any

different countries like China, japan, Malaysia, Taiwan and Philippines. The supply chain is

heavenly located in Asia accounting to 88%. The price of the product is based on many

factors on several factors like currency exchange rates, business practices, local import laws,

taxes and the cost of doing business. This factors varies from place to place a country to

country.

How exchange rate effect the international business.

The profitability of the company directly proportional to the exchange rate. Two

major factors affect the exchange rate:

The open market exchange rate: the interbank or the mid-market exchange rate or the real

exchange rate of one currency expressed in terms of other currency. The currency depreciates

Report on Apple Inc Foreign exchange rate and Arbitraging

currency –hedging strategy of around $607 million. These hedging strategy has save the

company from huge losses. This step is taken to mitigate the risk which are associated with

volatility by transferring the risk (Apple, 2019). Other American companies has also suffered

from the same unfavorable currency headwinds. The champion is Apple Inc as this company

maintains the capital investment. The change in the price does not generally affects the price

of the product in other countries.

Retail Arbitrage:

Retail arbitraging is a term of currency arbitraging where a product is purchased for a

lower price or at the discounted price an then it is sold at a higher price in other market. There

for making profit from it. The Pros and Con of retail arbitraging is when the company is not

able to sell of the inventory bought. The pros is when the inventory is sold at a good pricing.

The process of procurement and selling the product by arbitraging is practiced by large

number of enterprise. Model remains the dominant theory to describe the relationship

between a stock's risk and return.

Apple is a big enterprise. It does not manufacture all its products and 80% of the

product is purchased from outside and assembled in USA. The product purchased from their

country is bought in their home currency. The currency needs to be converted back to the US

dollar. Thus every month the company makes proper arrangement to not only exploit the

foreign currency exchange rate but also benefits from Arbitraging. Apple Inc uses arbitraging

buy purchasing many important component of its product from other countries and after

manufacturing the product it sell it in their home country price. The suppliers are form any

different countries like China, japan, Malaysia, Taiwan and Philippines. The supply chain is

heavenly located in Asia accounting to 88%. The price of the product is based on many

factors on several factors like currency exchange rates, business practices, local import laws,

taxes and the cost of doing business. This factors varies from place to place a country to

country.

How exchange rate effect the international business.

The profitability of the company directly proportional to the exchange rate. Two

major factors affect the exchange rate:

The open market exchange rate: the interbank or the mid-market exchange rate or the real

exchange rate of one currency expressed in terms of other currency. The currency depreciates

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9

Report on Apple Inc Foreign exchange rate and Arbitraging

it benefits the exporters and negatively impacts importers. And vise versa. For example if the

Yuan becomes cheaper electronics parts become attractive.

Foreign currency conversion fee: Generally when an intercontinental business is done the

payments made by the business incurs charges for converting the currency. For both the

payer and the receiver. Banks charges a premium on foreign money there can be third party

bank that may incur extra charge for making the deal (Calvo, G. A., & Rodriguez, C. A.

1977).

Foreign exchange policy of Apple Inc:

Effective foreign exchange management is comprised of tools for assuring the

profitability of the company’s first primary business. Thus to attain the object the company

has [prepared some policies. the absence of a foreign exchange management policy make she

company unprepared to control the adverse effect on fetch currency movement.

Policy formulation is based on these factor:

Transaction exposure: It is the income statement impact of all the payables and receivable

denominated foreign currency. The elements included are dividend, service fee, taxes and

duties.

Translation exposure: It is a risk of the company asset, liability, equity or income as they

will change as a result of the exchange rate. Balance sheet exposure that comes out of

segregation of financial statement of foreign entities into home currency.

Corporate earning exposure: it is assets susceptibility to loss It is a exposure of one tools

that allows the companies ot keep the track of their loss and liabilities by issuing proper

policies. Estimates the impact of currency movement on the after tax target of inflow an

outflow.

Operating exposure: it reflects the effect of exchange rate movement on an entity’s

projected cash flow. It is the extent to which a firm’s cash flow gets affected due to the

change in the exchange rate.

The foreign exchange policy depends on the accounting and cash flow subjects

overall depending on the goals risk tolerance. To make the policy consistent the already

existing company’s policies are set forth for consistency check. The objective and procedure

needs to minimize the negative effect of the currency fluctuation.

Report on Apple Inc Foreign exchange rate and Arbitraging

it benefits the exporters and negatively impacts importers. And vise versa. For example if the

Yuan becomes cheaper electronics parts become attractive.

Foreign currency conversion fee: Generally when an intercontinental business is done the

payments made by the business incurs charges for converting the currency. For both the

payer and the receiver. Banks charges a premium on foreign money there can be third party

bank that may incur extra charge for making the deal (Calvo, G. A., & Rodriguez, C. A.

1977).

Foreign exchange policy of Apple Inc:

Effective foreign exchange management is comprised of tools for assuring the

profitability of the company’s first primary business. Thus to attain the object the company

has [prepared some policies. the absence of a foreign exchange management policy make she

company unprepared to control the adverse effect on fetch currency movement.

Policy formulation is based on these factor:

Transaction exposure: It is the income statement impact of all the payables and receivable

denominated foreign currency. The elements included are dividend, service fee, taxes and

duties.

Translation exposure: It is a risk of the company asset, liability, equity or income as they

will change as a result of the exchange rate. Balance sheet exposure that comes out of

segregation of financial statement of foreign entities into home currency.

Corporate earning exposure: it is assets susceptibility to loss It is a exposure of one tools

that allows the companies ot keep the track of their loss and liabilities by issuing proper

policies. Estimates the impact of currency movement on the after tax target of inflow an

outflow.

Operating exposure: it reflects the effect of exchange rate movement on an entity’s

projected cash flow. It is the extent to which a firm’s cash flow gets affected due to the

change in the exchange rate.

The foreign exchange policy depends on the accounting and cash flow subjects

overall depending on the goals risk tolerance. To make the policy consistent the already

existing company’s policies are set forth for consistency check. The objective and procedure

needs to minimize the negative effect of the currency fluctuation.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10

Report on Apple Inc Foreign exchange rate and Arbitraging

Apple Inc. methodology to formulate the policy is:

To consider the financial objective: To minimize the loss that may result from earning

exposure. To ensure liquidity for global operation and to maintain access to local credit. It is

the practice of the firm to make proper objective to keep the operation work smooth.

Projection objective: The Company needs to take consideration when heading in the risk of

loss is minimal. The cost of covering the position is prohibited or the means to covering the

position are not available.

Establishing the risk threshold: It is the level above which the foreign currency exposure

needs protective actions. It defines the rate of fluctuation in corporate earnings resulting from

adverse exchange rate movement. In other words the amount of cash the company ready to

spend to reduce and protect exposure.

Allocation of treasury responsibility: The decision to allocating the treasury responsibility

is the degree to which exchange management is centralized. For allocating corporate

responsibility should approve techniques for hedging exposures.

Apple follows this rule to follow all objective of risk mitigation. Development of

control policy which is the trading environment need to have a control procedure that applies

to financial institution. It’s the responsibility of the company to address the needs of foreign.

New product development sometimes poses risk for corporate foreign exchange policy. The

company’s duty is to keep the record updated for no risk coming the way of transition. These

are major factors on which Apple Inc has formulated the foreign exchange policies. They

examine the policies to be aligned to the objective of the company. This leads to more

informed decision making and result in less surprises for future.

Report on Apple Inc Foreign exchange rate and Arbitraging

Apple Inc. methodology to formulate the policy is:

To consider the financial objective: To minimize the loss that may result from earning

exposure. To ensure liquidity for global operation and to maintain access to local credit. It is

the practice of the firm to make proper objective to keep the operation work smooth.

Projection objective: The Company needs to take consideration when heading in the risk of

loss is minimal. The cost of covering the position is prohibited or the means to covering the

position are not available.

Establishing the risk threshold: It is the level above which the foreign currency exposure

needs protective actions. It defines the rate of fluctuation in corporate earnings resulting from

adverse exchange rate movement. In other words the amount of cash the company ready to

spend to reduce and protect exposure.

Allocation of treasury responsibility: The decision to allocating the treasury responsibility

is the degree to which exchange management is centralized. For allocating corporate

responsibility should approve techniques for hedging exposures.

Apple follows this rule to follow all objective of risk mitigation. Development of

control policy which is the trading environment need to have a control procedure that applies

to financial institution. It’s the responsibility of the company to address the needs of foreign.

New product development sometimes poses risk for corporate foreign exchange policy. The

company’s duty is to keep the record updated for no risk coming the way of transition. These

are major factors on which Apple Inc has formulated the foreign exchange policies. They

examine the policies to be aligned to the objective of the company. This leads to more

informed decision making and result in less surprises for future.

11

Report on Apple Inc Foreign exchange rate and Arbitraging

Conclusion

The major conclusion from the analysis of the apple Inc is that it has adapted it

pricing factors that has not only benefitted it but also its suppliers. The company has huge

policies derived from many factors and the company has also made the proper execution of

the strategies to get the best outcome in the long term. Hedging is a factor that not only helps

the company from money loss but also maintains a stable position of the company. The

economic factors also plays a major factor in the making the company’s profitability. The

arbitraging factors are used by almost all international company that provides not only

service or that manufactures the product. The major factors analysis in this project is how the

company is benefiting from foreign exchange and arbitraging functions.

Report on Apple Inc Foreign exchange rate and Arbitraging

Conclusion

The major conclusion from the analysis of the apple Inc is that it has adapted it

pricing factors that has not only benefitted it but also its suppliers. The company has huge

policies derived from many factors and the company has also made the proper execution of

the strategies to get the best outcome in the long term. Hedging is a factor that not only helps

the company from money loss but also maintains a stable position of the company. The

economic factors also plays a major factor in the making the company’s profitability. The

arbitraging factors are used by almost all international company that provides not only

service or that manufactures the product. The major factors analysis in this project is how the

company is benefiting from foreign exchange and arbitraging functions.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.