Apple Inc. Investment Management Case Study and Analysis

VerifiedAdded on 2023/05/28

|20

|4073

|481

Project

AI Summary

This project presents an investment case study of Apple Inc., evaluating its performance in 2018. The analysis includes an introduction, investment case, sector outlook, fundamental analysis (including financial ratios, and technical analysis), and risk analysis. The investment case highlights Apple's increasing share price and dividend growth, while the sector outlook examines the positive economic conditions of the US and the growth within the technology sector. Fundamental analysis uses financial ratios to assess liquidity, profitability, and efficiency. The project also includes risk assessment and concludes with an overall investment recommendation for Apple Inc.

Running head: INVESTMENT MANAGEMENT

Investment Management

Name of the Student:

Name of the University:

Authors Note:

Investment Management

Name of the Student:

Name of the University:

Authors Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

INVESTMENT MANAGEMENT 2

Table of Contents

1. Introduction:...........................................................................................................................3

2. Investment Case:....................................................................................................................3

3. Sector Outlook:......................................................................................................................6

4. Fundamental Analysis:.........................................................................................................10

4.1 Financial Ratios:.................................................................................................................10

4.2 Fundamental Analysis:.......................................................................................................12

4.3 Technical Analysis:............................................................................................................14

5. Risk Analysis:......................................................................................................................15

6. Conclusion:..........................................................................................................................17

Reference and Bibliography:....................................................................................................18

Table of Contents

1. Introduction:...........................................................................................................................3

2. Investment Case:....................................................................................................................3

3. Sector Outlook:......................................................................................................................6

4. Fundamental Analysis:.........................................................................................................10

4.1 Financial Ratios:.................................................................................................................10

4.2 Fundamental Analysis:.......................................................................................................12

4.3 Technical Analysis:............................................................................................................14

5. Risk Analysis:......................................................................................................................15

6. Conclusion:..........................................................................................................................17

Reference and Bibliography:....................................................................................................18

INVESTMENT MANAGEMENT 3

1. Introduction:

The assessment aims in evaluating the performance of Apple Inc for the fiscal year of

2018. The performance is relatively evaluated with the help of financial ratios such as

liquidity, profitability and efficiency ratio. Furthermore, technical analysis is used for

analyzing the current financial trend of the company and determine whether the price will fall

or increase over time. In addition, the calculations are also conducted for the fundamental

analysis, which uses dividend discount model for analyzing the theoretical price of the stock

and comparing it with the current share price. Further evaluation is conducted on quantitative

and qualitative risk analysis for Apple Inc, which can eventually help in detecting the

strength, weakness, threat and opportunities for the company. The assessment provides

relevant information regarding the current stock prices and investment case, which can allow

investors to generate higher income over the period. Lastly, the evaluation has been

conducted on the economic condition of US to determine the impact it might have on the

performance of the Apple Inc.

2. Investment Case:

The stock selected for investment purpose is Apple Inc, as the organisation has been

generating high level of income over the period of time. In addition, the share price of Apple

Inc. has relevantly increased over the fiscal years, due to the improvements, which can be

achieved in previous fiscal years. Uechi et al. (2015) indicated that investors carefully sort

stocks for investment with the help of fundamental and technical analysis, which allows them

to make calculate investment decisions. The company has also increased the level of

dividends for each fiscal year, which can eventually help in generating high level of income

over for the investors. Apple Inc is considered a safe-haven for the investors, as it allows

1. Introduction:

The assessment aims in evaluating the performance of Apple Inc for the fiscal year of

2018. The performance is relatively evaluated with the help of financial ratios such as

liquidity, profitability and efficiency ratio. Furthermore, technical analysis is used for

analyzing the current financial trend of the company and determine whether the price will fall

or increase over time. In addition, the calculations are also conducted for the fundamental

analysis, which uses dividend discount model for analyzing the theoretical price of the stock

and comparing it with the current share price. Further evaluation is conducted on quantitative

and qualitative risk analysis for Apple Inc, which can eventually help in detecting the

strength, weakness, threat and opportunities for the company. The assessment provides

relevant information regarding the current stock prices and investment case, which can allow

investors to generate higher income over the period. Lastly, the evaluation has been

conducted on the economic condition of US to determine the impact it might have on the

performance of the Apple Inc.

2. Investment Case:

The stock selected for investment purpose is Apple Inc, as the organisation has been

generating high level of income over the period of time. In addition, the share price of Apple

Inc. has relevantly increased over the fiscal years, due to the improvements, which can be

achieved in previous fiscal years. Uechi et al. (2015) indicated that investors carefully sort

stocks for investment with the help of fundamental and technical analysis, which allows them

to make calculate investment decisions. The company has also increased the level of

dividends for each fiscal year, which can eventually help in generating high level of income

over for the investors. Apple Inc is considered a safe-haven for the investors, as it allows

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INVESTMENT MANAGEMENT 4

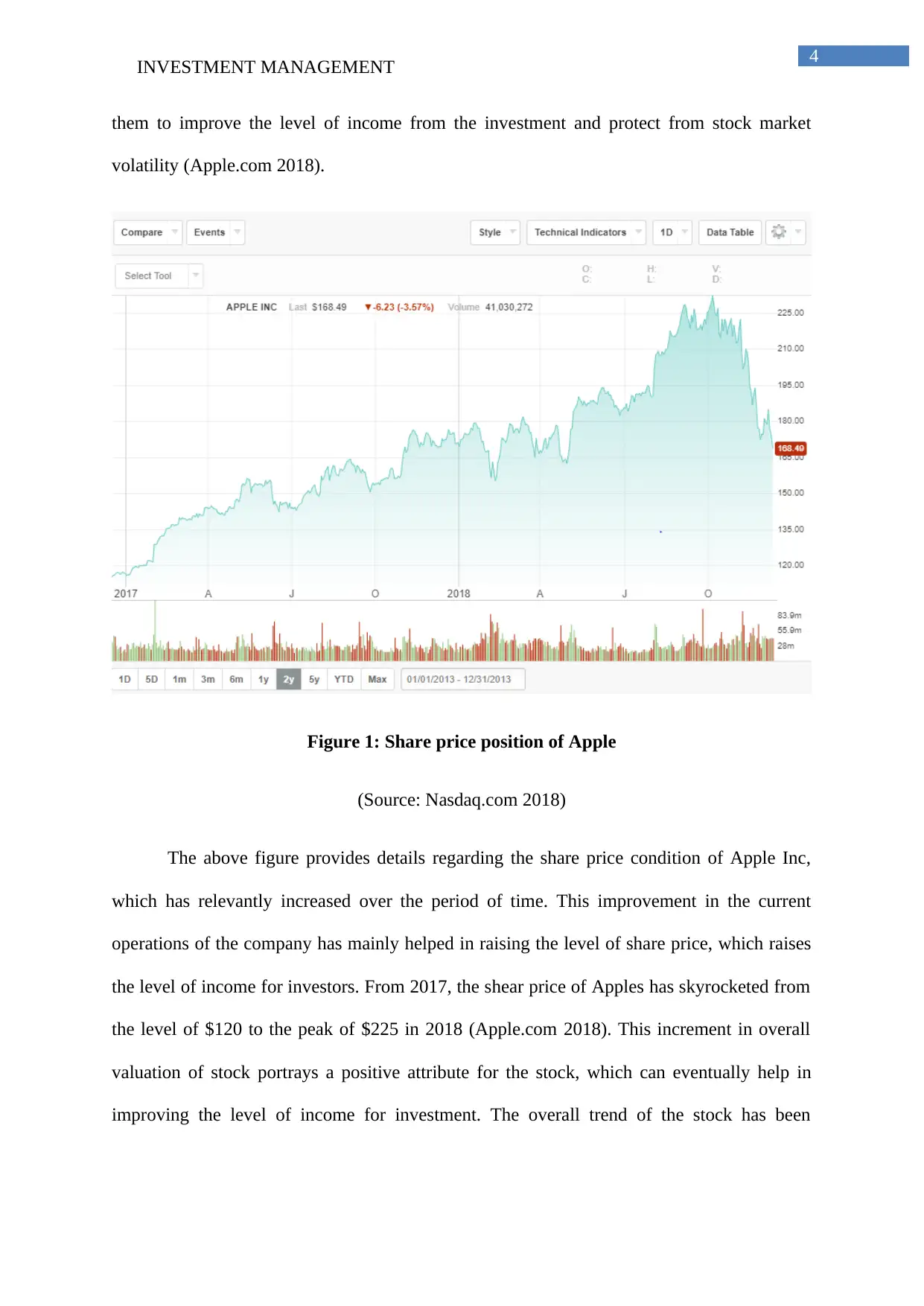

them to improve the level of income from the investment and protect from stock market

volatility (Apple.com 2018).

Figure 1: Share price position of Apple

(Source: Nasdaq.com 2018)

The above figure provides details regarding the share price condition of Apple Inc,

which has relevantly increased over the period of time. This improvement in the current

operations of the company has mainly helped in raising the level of share price, which raises

the level of income for investors. From 2017, the shear price of Apples has skyrocketed from

the level of $120 to the peak of $225 in 2018 (Apple.com 2018). This increment in overall

valuation of stock portrays a positive attribute for the stock, which can eventually help in

improving the level of income for investment. The overall trend of the stock has been

them to improve the level of income from the investment and protect from stock market

volatility (Apple.com 2018).

Figure 1: Share price position of Apple

(Source: Nasdaq.com 2018)

The above figure provides details regarding the share price condition of Apple Inc,

which has relevantly increased over the period of time. This improvement in the current

operations of the company has mainly helped in raising the level of share price, which raises

the level of income for investors. From 2017, the shear price of Apples has skyrocketed from

the level of $120 to the peak of $225 in 2018 (Apple.com 2018). This increment in overall

valuation of stock portrays a positive attribute for the stock, which can eventually help in

improving the level of income for investment. The overall trend of the stock has been

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

INVESTMENT MANAGEMENT 5

considered a positive and up, which is an optimistic factor for investors considering the

investment in Apple Inc.

Figure 2: Details of Apple

(Source: Nasdaq.com 2018)

The above figure depicts the key stock data, which can help in understanding the level

of key information for Apple Company. From the evaluation it can be detected that one-year

price target by NASDAQ is mainly at the levels of 227.5, while information regarding market

cap of the company is also disclosed. The other information also provided in the above

figures such as P/E ratio, annualized dividend, current yield, beta, 52 weeks high and low,

which are used by investors to evaluate the performance and future growth of a stock

(Apple.com 2018).

Apple Inc. was incorporated in 1977 in USA after which the organization effectively

increased its operations and provided high quality products and services to and consumer.

The organization has been improving its operational capability and generating higher

revenues by using innovative product that attracted more customers. Current revenue

considered a positive and up, which is an optimistic factor for investors considering the

investment in Apple Inc.

Figure 2: Details of Apple

(Source: Nasdaq.com 2018)

The above figure depicts the key stock data, which can help in understanding the level

of key information for Apple Company. From the evaluation it can be detected that one-year

price target by NASDAQ is mainly at the levels of 227.5, while information regarding market

cap of the company is also disclosed. The other information also provided in the above

figures such as P/E ratio, annualized dividend, current yield, beta, 52 weeks high and low,

which are used by investors to evaluate the performance and future growth of a stock

(Apple.com 2018).

Apple Inc. was incorporated in 1977 in USA after which the organization effectively

increased its operations and provided high quality products and services to and consumer.

The organization has been improving its operational capability and generating higher

revenues by using innovative product that attracted more customers. Current revenue

INVESTMENT MANAGEMENT 6

generation capability of the company is mainly are the levels of $265.595 Billion with a net

income of $59.53 Billion during the fiscal year of 2018 (Apple.com 2018). This incremental

revenues and net income of the company has a relatively improved the level of dividends that

could be provided to investors. The growth that has been witnessed by the organization over

the previous Physical use can eventually allow investors to increase returns and secure their

Investments from negative market volatility.

3. Sector Outlook:

The sector outlook analysis relevantly helps in detecting the overall stocks, which can

improve investors return generation capability. In addition, from the evaluation it can be

detected that investors use the sector outlook for analyzing the trend and opportunity for

investments in a particular organization. From the overall evaluation, it can be detected that

US has been one of the highest returns generating countries all around the world due to this

large market cap and GDP. Hence, investment in the companies originated from the country

would be beneficial for the organization for generating high level of income over the period

of time. Scarborough (2016) mentioned that industry analysis allows investor to understand

the level of investment opportunities, which can help in generating high level of income from

investment.

generation capability of the company is mainly are the levels of $265.595 Billion with a net

income of $59.53 Billion during the fiscal year of 2018 (Apple.com 2018). This incremental

revenues and net income of the company has a relatively improved the level of dividends that

could be provided to investors. The growth that has been witnessed by the organization over

the previous Physical use can eventually allow investors to increase returns and secure their

Investments from negative market volatility.

3. Sector Outlook:

The sector outlook analysis relevantly helps in detecting the overall stocks, which can

improve investors return generation capability. In addition, from the evaluation it can be

detected that investors use the sector outlook for analyzing the trend and opportunity for

investments in a particular organization. From the overall evaluation, it can be detected that

US has been one of the highest returns generating countries all around the world due to this

large market cap and GDP. Hence, investment in the companies originated from the country

would be beneficial for the organization for generating high level of income over the period

of time. Scarborough (2016) mentioned that industry analysis allows investor to understand

the level of investment opportunities, which can help in generating high level of income from

investment.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INVESTMENT MANAGEMENT 7

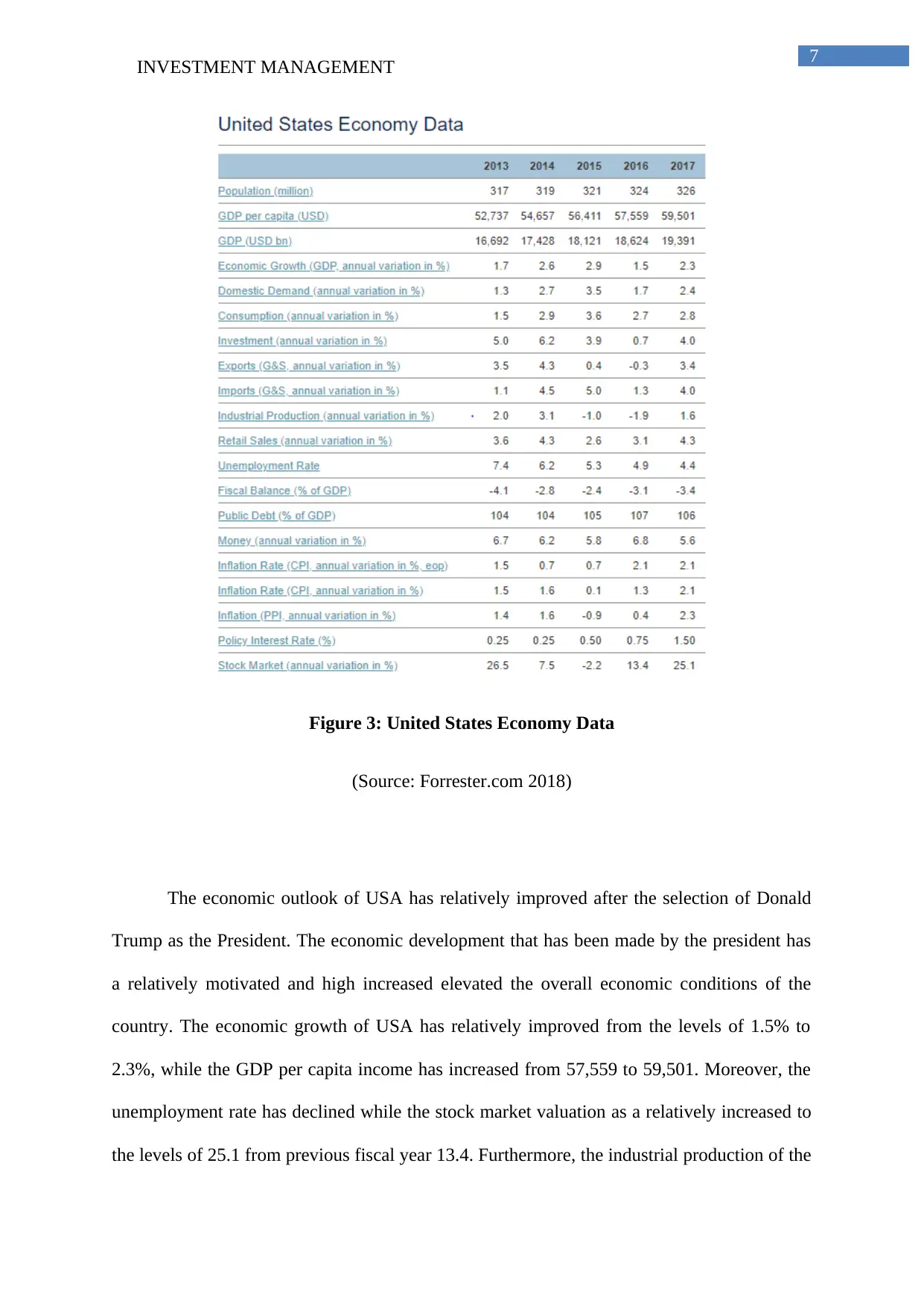

Figure 3: United States Economy Data

(Source: Forrester.com 2018)

The economic outlook of USA has relatively improved after the selection of Donald

Trump as the President. The economic development that has been made by the president has

a relatively motivated and high increased elevated the overall economic conditions of the

country. The economic growth of USA has relatively improved from the levels of 1.5% to

2.3%, while the GDP per capita income has increased from 57,559 to 59,501. Moreover, the

unemployment rate has declined while the stock market valuation as a relatively increased to

the levels of 25.1 from previous fiscal year 13.4. Furthermore, the industrial production of the

Figure 3: United States Economy Data

(Source: Forrester.com 2018)

The economic outlook of USA has relatively improved after the selection of Donald

Trump as the President. The economic development that has been made by the president has

a relatively motivated and high increased elevated the overall economic conditions of the

country. The economic growth of USA has relatively improved from the levels of 1.5% to

2.3%, while the GDP per capita income has increased from 57,559 to 59,501. Moreover, the

unemployment rate has declined while the stock market valuation as a relatively increased to

the levels of 25.1 from previous fiscal year 13.4. Furthermore, the industrial production of the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

INVESTMENT MANAGEMENT 8

economy was a relatively positive in comparison to previous year. The analysis of the overall

economy has a relatively highlighted the performance and improvements that has been

achieved by US in comparison to other countries. Hence, investment in US companies would

eventually security investment scope of an investor and allow them to generate high returns

and capital growth (Vogel 2014).

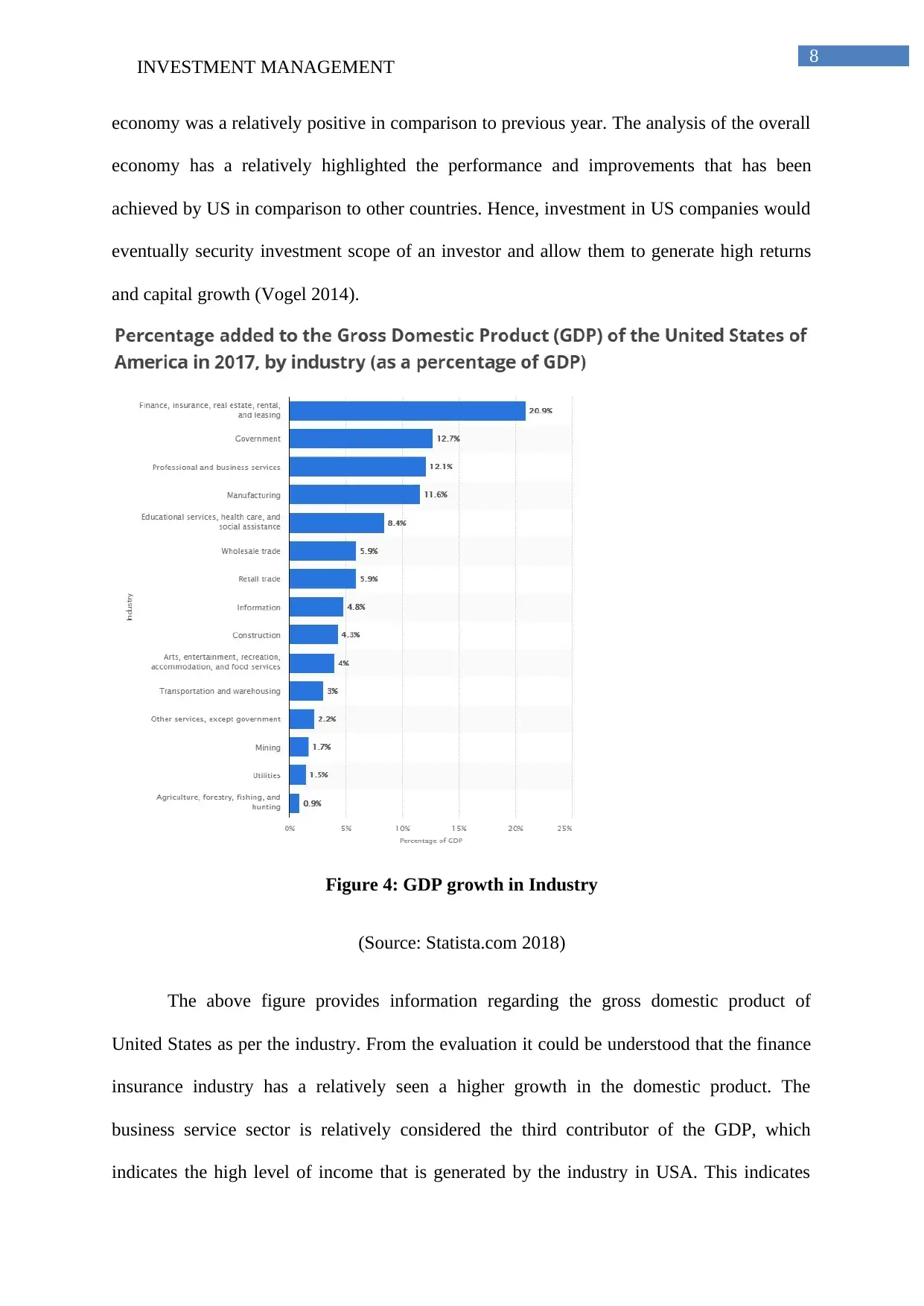

Figure 4: GDP growth in Industry

(Source: Statista.com 2018)

The above figure provides information regarding the gross domestic product of

United States as per the industry. From the evaluation it could be understood that the finance

insurance industry has a relatively seen a higher growth in the domestic product. The

business service sector is relatively considered the third contributor of the GDP, which

indicates the high level of income that is generated by the industry in USA. This indicates

economy was a relatively positive in comparison to previous year. The analysis of the overall

economy has a relatively highlighted the performance and improvements that has been

achieved by US in comparison to other countries. Hence, investment in US companies would

eventually security investment scope of an investor and allow them to generate high returns

and capital growth (Vogel 2014).

Figure 4: GDP growth in Industry

(Source: Statista.com 2018)

The above figure provides information regarding the gross domestic product of

United States as per the industry. From the evaluation it could be understood that the finance

insurance industry has a relatively seen a higher growth in the domestic product. The

business service sector is relatively considered the third contributor of the GDP, which

indicates the high level of income that is generated by the industry in USA. This indicates

INVESTMENT MANAGEMENT 9

that the selection of companies associated with technology could be selected for investment

purposes. The growth is relatively higher than other industry, which is of operating in USA

(Evans and Mathur 2014).

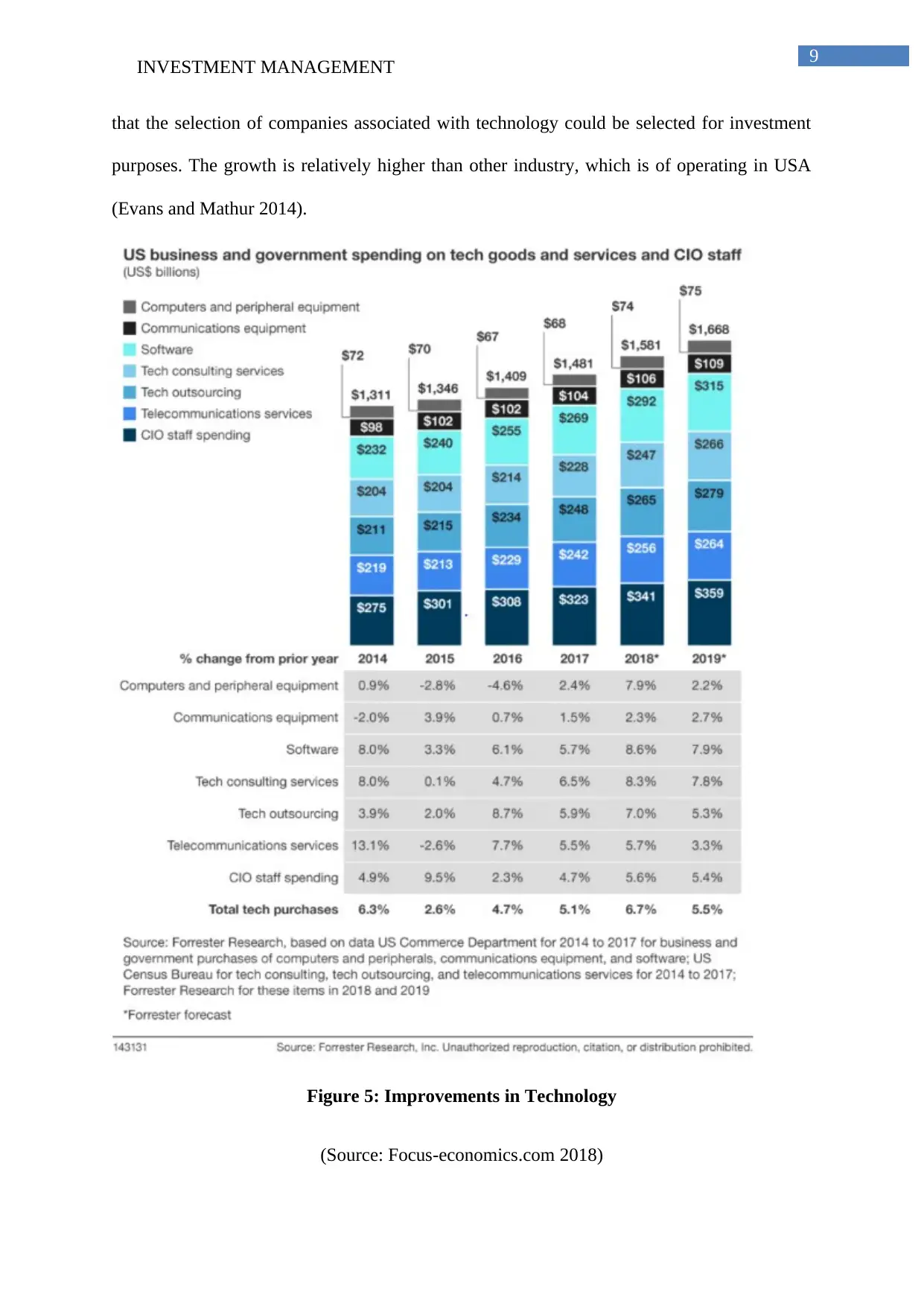

Figure 5: Improvements in Technology

(Source: Focus-economics.com 2018)

that the selection of companies associated with technology could be selected for investment

purposes. The growth is relatively higher than other industry, which is of operating in USA

(Evans and Mathur 2014).

Figure 5: Improvements in Technology

(Source: Focus-economics.com 2018)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INVESTMENT MANAGEMENT 10

Under the business service industry the Information Technology Sector is a relatively

considered to be one of the most adequate investment option. From the evaluation of the

above figure, it could be understood that US business and government spending have

conducted relevant improvements in the technology sector. The anticipation of 2019 overall

spending is relatively at the levels of $1,668 billion. This increases the chance of profitability

in the Information Technology Sector, which can be achieved by organisations, as higher

growth and Income prospects are anticipated. Hence, the investors for increasing the overall

investment capital and returns can select the organization that is working in Technology

Sector. Thus, selection of Apple Inc. is most preferable for the investors, as the risk from

investment is low and returns are higher (Greco, Figueira and Ehrgott 2016).

4. Fundamental Analysis:

4.1 Financial Ratios:

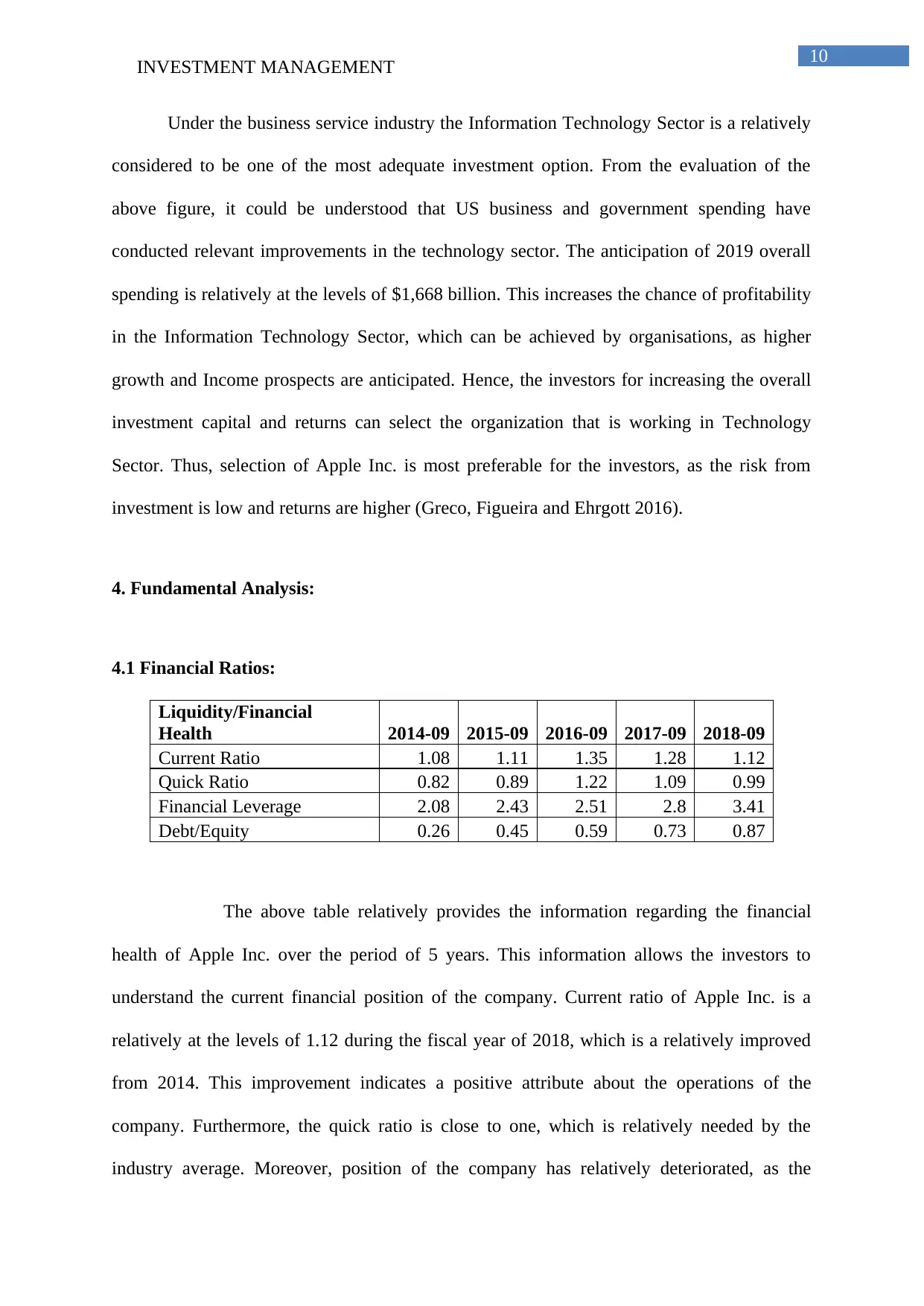

Liquidity/Financial

Health 2014-09 2015-09 2016-09 2017-09 2018-09

Current Ratio 1.08 1.11 1.35 1.28 1.12

Quick Ratio 0.82 0.89 1.22 1.09 0.99

Financial Leverage 2.08 2.43 2.51 2.8 3.41

Debt/Equity 0.26 0.45 0.59 0.73 0.87

The above table relatively provides the information regarding the financial

health of Apple Inc. over the period of 5 years. This information allows the investors to

understand the current financial position of the company. Current ratio of Apple Inc. is a

relatively at the levels of 1.12 during the fiscal year of 2018, which is a relatively improved

from 2014. This improvement indicates a positive attribute about the operations of the

company. Furthermore, the quick ratio is close to one, which is relatively needed by the

industry average. Moreover, position of the company has relatively deteriorated, as the

Under the business service industry the Information Technology Sector is a relatively

considered to be one of the most adequate investment option. From the evaluation of the

above figure, it could be understood that US business and government spending have

conducted relevant improvements in the technology sector. The anticipation of 2019 overall

spending is relatively at the levels of $1,668 billion. This increases the chance of profitability

in the Information Technology Sector, which can be achieved by organisations, as higher

growth and Income prospects are anticipated. Hence, the investors for increasing the overall

investment capital and returns can select the organization that is working in Technology

Sector. Thus, selection of Apple Inc. is most preferable for the investors, as the risk from

investment is low and returns are higher (Greco, Figueira and Ehrgott 2016).

4. Fundamental Analysis:

4.1 Financial Ratios:

Liquidity/Financial

Health 2014-09 2015-09 2016-09 2017-09 2018-09

Current Ratio 1.08 1.11 1.35 1.28 1.12

Quick Ratio 0.82 0.89 1.22 1.09 0.99

Financial Leverage 2.08 2.43 2.51 2.8 3.41

Debt/Equity 0.26 0.45 0.59 0.73 0.87

The above table relatively provides the information regarding the financial

health of Apple Inc. over the period of 5 years. This information allows the investors to

understand the current financial position of the company. Current ratio of Apple Inc. is a

relatively at the levels of 1.12 during the fiscal year of 2018, which is a relatively improved

from 2014. This improvement indicates a positive attribute about the operations of the

company. Furthermore, the quick ratio is close to one, which is relatively needed by the

industry average. Moreover, position of the company has relatively deteriorated, as the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

INVESTMENT MANAGEMENT 11

organization has increased the exposure debt to conduct its operation. Hence, the financial

health of the organization has deteriorated during 2018, as compared to 2017. This decline in

financial health indicates negative attribute for the company in short term where the values

have declined from 2017 to 2018. However, improvements can be witnessed when analyzing

the data on 5-year basis. This has relatively indicated that the progress of the organization is

adequate and portrays a positive attribute. Nevertheless, the accumulation of debt is a concern

for investors, while the rising share price and high dividend would eventually support the

investors with their investment (Ibn-Homaid and Tijani 2015).

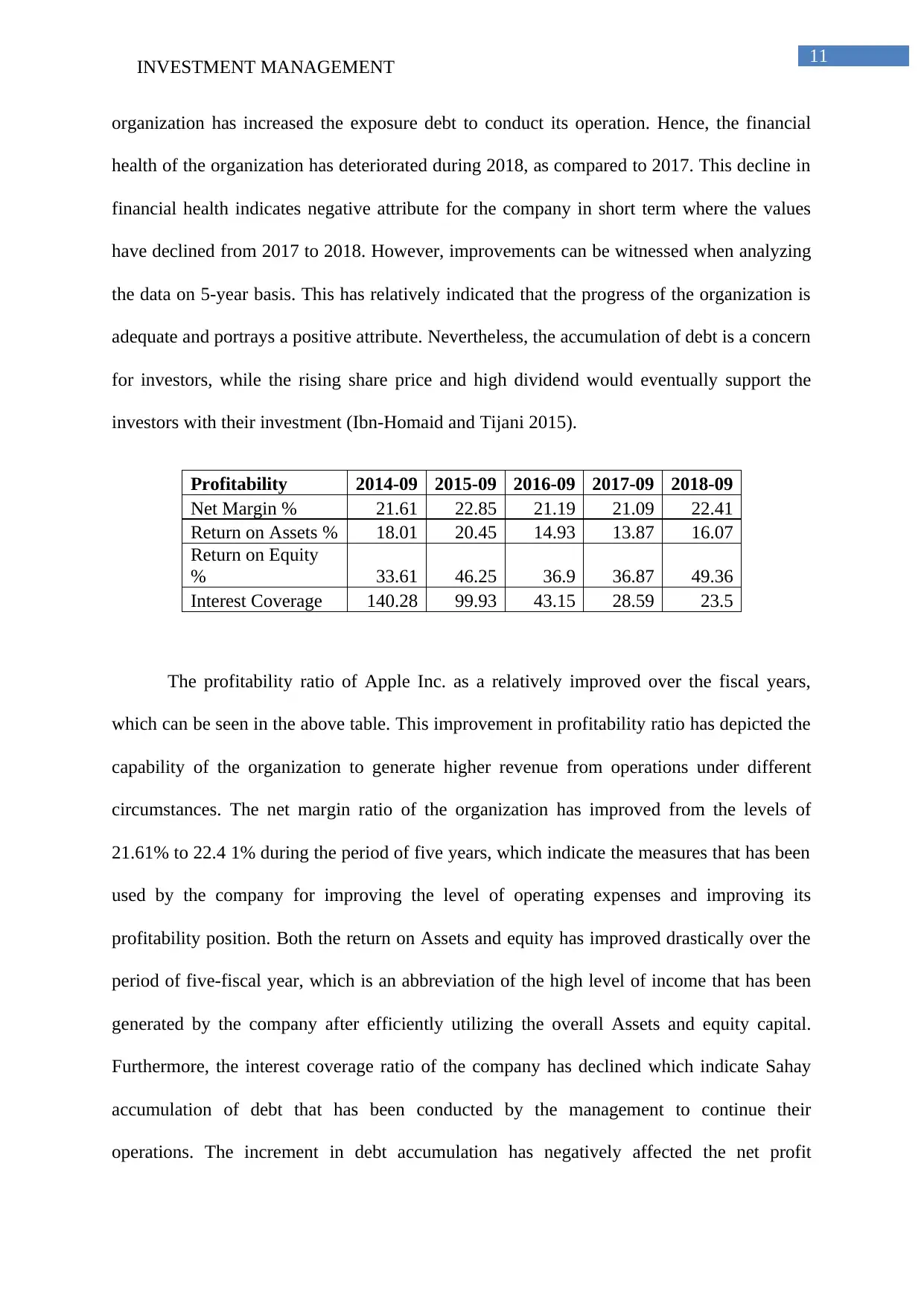

Profitability 2014-09 2015-09 2016-09 2017-09 2018-09

Net Margin % 21.61 22.85 21.19 21.09 22.41

Return on Assets % 18.01 20.45 14.93 13.87 16.07

Return on Equity

% 33.61 46.25 36.9 36.87 49.36

Interest Coverage 140.28 99.93 43.15 28.59 23.5

The profitability ratio of Apple Inc. as a relatively improved over the fiscal years,

which can be seen in the above table. This improvement in profitability ratio has depicted the

capability of the organization to generate higher revenue from operations under different

circumstances. The net margin ratio of the organization has improved from the levels of

21.61% to 22.4 1% during the period of five years, which indicate the measures that has been

used by the company for improving the level of operating expenses and improving its

profitability position. Both the return on Assets and equity has improved drastically over the

period of five-fiscal year, which is an abbreviation of the high level of income that has been

generated by the company after efficiently utilizing the overall Assets and equity capital.

Furthermore, the interest coverage ratio of the company has declined which indicate Sahay

accumulation of debt that has been conducted by the management to continue their

operations. The increment in debt accumulation has negatively affected the net profit

organization has increased the exposure debt to conduct its operation. Hence, the financial

health of the organization has deteriorated during 2018, as compared to 2017. This decline in

financial health indicates negative attribute for the company in short term where the values

have declined from 2017 to 2018. However, improvements can be witnessed when analyzing

the data on 5-year basis. This has relatively indicated that the progress of the organization is

adequate and portrays a positive attribute. Nevertheless, the accumulation of debt is a concern

for investors, while the rising share price and high dividend would eventually support the

investors with their investment (Ibn-Homaid and Tijani 2015).

Profitability 2014-09 2015-09 2016-09 2017-09 2018-09

Net Margin % 21.61 22.85 21.19 21.09 22.41

Return on Assets % 18.01 20.45 14.93 13.87 16.07

Return on Equity

% 33.61 46.25 36.9 36.87 49.36

Interest Coverage 140.28 99.93 43.15 28.59 23.5

The profitability ratio of Apple Inc. as a relatively improved over the fiscal years,

which can be seen in the above table. This improvement in profitability ratio has depicted the

capability of the organization to generate higher revenue from operations under different

circumstances. The net margin ratio of the organization has improved from the levels of

21.61% to 22.4 1% during the period of five years, which indicate the measures that has been

used by the company for improving the level of operating expenses and improving its

profitability position. Both the return on Assets and equity has improved drastically over the

period of five-fiscal year, which is an abbreviation of the high level of income that has been

generated by the company after efficiently utilizing the overall Assets and equity capital.

Furthermore, the interest coverage ratio of the company has declined which indicate Sahay

accumulation of debt that has been conducted by the management to continue their

operations. The increment in debt accumulation has negatively affected the net profit

INVESTMENT MANAGEMENT 12

conditions of the organization. However, the analysis directly indicates of positive attributes

of the profitability conditions of Apple, which can be used by the investors to conduct

adequate investments in the organization (Jordan 2014).

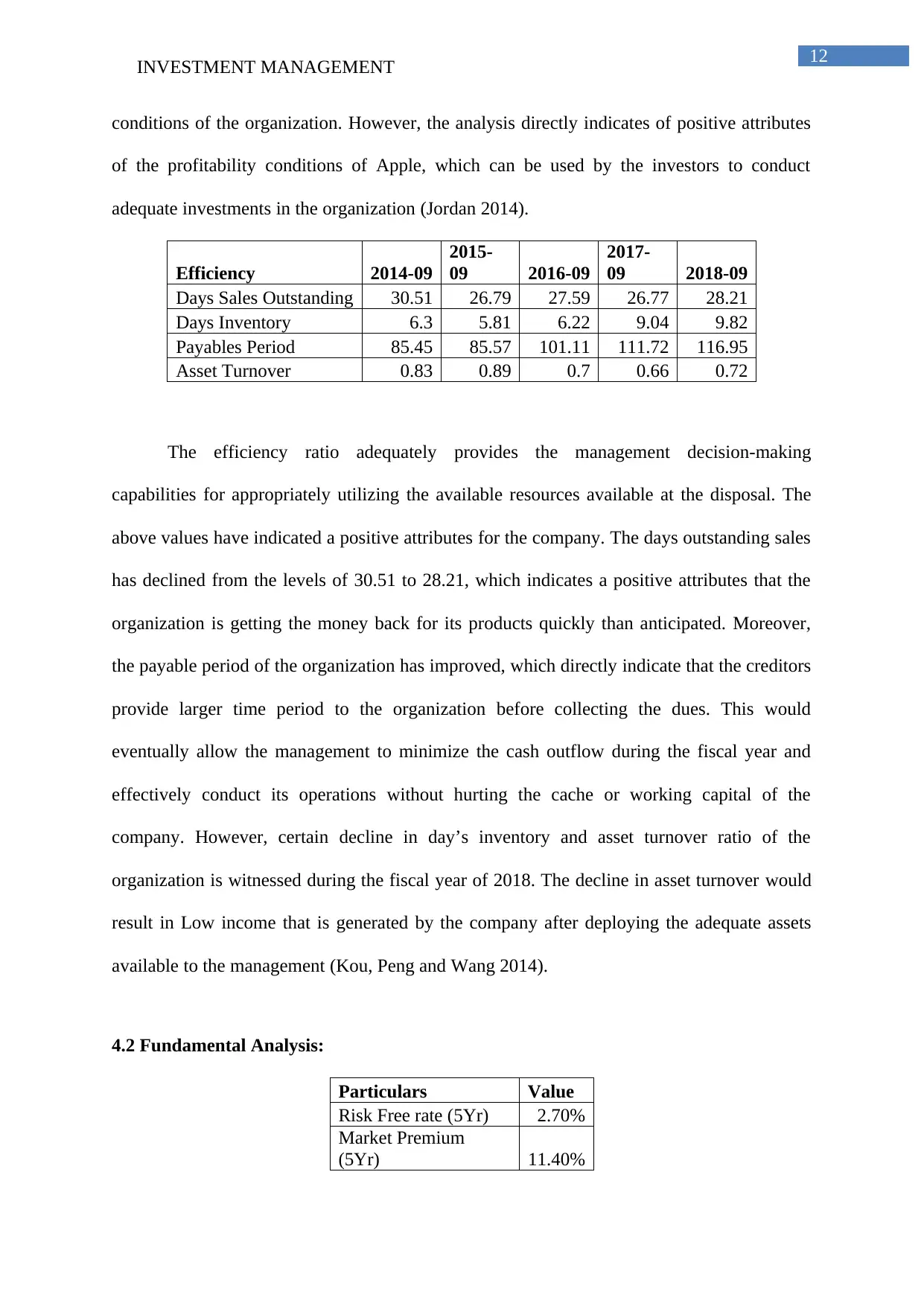

Efficiency 2014-09

2015-

09 2016-09

2017-

09 2018-09

Days Sales Outstanding 30.51 26.79 27.59 26.77 28.21

Days Inventory 6.3 5.81 6.22 9.04 9.82

Payables Period 85.45 85.57 101.11 111.72 116.95

Asset Turnover 0.83 0.89 0.7 0.66 0.72

The efficiency ratio adequately provides the management decision-making

capabilities for appropriately utilizing the available resources available at the disposal. The

above values have indicated a positive attributes for the company. The days outstanding sales

has declined from the levels of 30.51 to 28.21, which indicates a positive attributes that the

organization is getting the money back for its products quickly than anticipated. Moreover,

the payable period of the organization has improved, which directly indicate that the creditors

provide larger time period to the organization before collecting the dues. This would

eventually allow the management to minimize the cash outflow during the fiscal year and

effectively conduct its operations without hurting the cache or working capital of the

company. However, certain decline in day’s inventory and asset turnover ratio of the

organization is witnessed during the fiscal year of 2018. The decline in asset turnover would

result in Low income that is generated by the company after deploying the adequate assets

available to the management (Kou, Peng and Wang 2014).

4.2 Fundamental Analysis:

Particulars Value

Risk Free rate (5Yr) 2.70%

Market Premium

(5Yr) 11.40%

conditions of the organization. However, the analysis directly indicates of positive attributes

of the profitability conditions of Apple, which can be used by the investors to conduct

adequate investments in the organization (Jordan 2014).

Efficiency 2014-09

2015-

09 2016-09

2017-

09 2018-09

Days Sales Outstanding 30.51 26.79 27.59 26.77 28.21

Days Inventory 6.3 5.81 6.22 9.04 9.82

Payables Period 85.45 85.57 101.11 111.72 116.95

Asset Turnover 0.83 0.89 0.7 0.66 0.72

The efficiency ratio adequately provides the management decision-making

capabilities for appropriately utilizing the available resources available at the disposal. The

above values have indicated a positive attributes for the company. The days outstanding sales

has declined from the levels of 30.51 to 28.21, which indicates a positive attributes that the

organization is getting the money back for its products quickly than anticipated. Moreover,

the payable period of the organization has improved, which directly indicate that the creditors

provide larger time period to the organization before collecting the dues. This would

eventually allow the management to minimize the cash outflow during the fiscal year and

effectively conduct its operations without hurting the cache or working capital of the

company. However, certain decline in day’s inventory and asset turnover ratio of the

organization is witnessed during the fiscal year of 2018. The decline in asset turnover would

result in Low income that is generated by the company after deploying the adequate assets

available to the management (Kou, Peng and Wang 2014).

4.2 Fundamental Analysis:

Particulars Value

Risk Free rate (5Yr) 2.70%

Market Premium

(5Yr) 11.40%

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 20

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.