Financial Performance Comparison: Apple Inc. vs Samsung Corporation

VerifiedAdded on 2021/05/28

|6

|1233

|56

Report

AI Summary

This report presents a comparative financial analysis of Apple Inc. and Samsung Corporation, focusing on key financial ratios to assess their performance. The analysis covers profitability, liquidity, financial leverage, and efficiency measures. Profitability is evaluated using return on assets, gross margin profit, operating margin, and return on equity, revealing Apple's stronger performance. Liquidity is assessed through current and quick ratios, showing Samsung's advantage in meeting short-term obligations. Financial leverage is examined, indicating Apple's higher reliance on loans. Efficiency is measured by asset turnover and receivables turnover rates, where Samsung demonstrates slightly better asset utilization. The report concludes with recommendations, suggesting Samsung could improve by focusing on areas where Apple excels, particularly profitability, and suggests reducing costs of goods sold. The analysis utilizes financial statements and data from their respective websites and provides charts in the appendix for reference.

Introduction

Financial analysis is an integral success factor in any business. Through financial

analysis, the business managers are able to picture to growth of the business, profitability,

risks factors, as well as predict the future of the business. Financial analyses are usually

based on the financial statements of the business recorded one several financial years. To

carry out the analysis, financial ratios are used, which compare the business performance

across the years. Since such ratios are based on the particular business performance, they

can be used to compare the business with its competitors. This makes it easy to determine

is the business is outperforming the competitors, and thus identify the areas of

improvement.

In this analysis, two companies will be used; Apple Inc. and the Samsung

Corporation. These two companies are from the same industry; computer and similar

devices manufacturers as well as the related software. Financial statements were obtained

from their respective websites, for the purpose of this analysis. The charts negated from

the analysis will be attached at the appendix section. The analysis was based on the

following areas.

• Profitability of the company

To determine the profitability of each company, profitability ratios were used. The

results from each ratio are explained below. The trends over the last five years are shown

in Appendix II attached at the end of this report.

• Return on Assets

This study source was downloaded by 100000813193656 from CourseHero.com on 05-27-2021 09:26:22 GMT -05:00

https://www.coursehero.com/file/25288485/Apple-vs-Samsung-Financial-Analysisdocx/

This study resource was

shared via CourseHero.com

Financial analysis is an integral success factor in any business. Through financial

analysis, the business managers are able to picture to growth of the business, profitability,

risks factors, as well as predict the future of the business. Financial analyses are usually

based on the financial statements of the business recorded one several financial years. To

carry out the analysis, financial ratios are used, which compare the business performance

across the years. Since such ratios are based on the particular business performance, they

can be used to compare the business with its competitors. This makes it easy to determine

is the business is outperforming the competitors, and thus identify the areas of

improvement.

In this analysis, two companies will be used; Apple Inc. and the Samsung

Corporation. These two companies are from the same industry; computer and similar

devices manufacturers as well as the related software. Financial statements were obtained

from their respective websites, for the purpose of this analysis. The charts negated from

the analysis will be attached at the appendix section. The analysis was based on the

following areas.

• Profitability of the company

To determine the profitability of each company, profitability ratios were used. The

results from each ratio are explained below. The trends over the last five years are shown

in Appendix II attached at the end of this report.

• Return on Assets

This study source was downloaded by 100000813193656 from CourseHero.com on 05-27-2021 09:26:22 GMT -05:00

https://www.coursehero.com/file/25288485/Apple-vs-Samsung-Financial-Analysisdocx/

This study resource was

shared via CourseHero.com

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

The analysis showed that Apple has a healthier return on assets. While the

return in assets for Apple was 20.45%, Samsung has a ROA of 9.02%.

This an indication that Apple obtained more than double in return of every

unit of Asset in the company during the financial year, compared to

Samsung.

• Gross margin profit

Based on the gross margin profit ratio, Apple was more profitable that

Samsung during their latest reported financial years. Apple reported a

gross margin profit of 40.06, while Samsung has a gross margin profit of

37.79.

• Operating margin

During the 2015-09 financial year, Apple reported an operating margin of

30.48. On the other hand, Samsung had an operating margin of 12.14.

Under this ratio, it is clear that Apple was more profitable compared to

Samsung.

• Return on equity

As per the latest reported financial year’s statements, Apple had a ROE

46.25, whereas Samsung had a ROE of 13.09. This is a clear indication

that Apple was more profitable on this indicator than Samsung.

• Liquidity

Liquidity is the ability of a firm to meet its short term obligations. A company

with a high liquidity is considered to be in a healthier financial status than that

which has a low liquidity ratio. The trends in liquidity of the two firms are shown

This study source was downloaded by 100000813193656 from CourseHero.com on 05-27-2021 09:26:22 GMT -05:00

https://www.coursehero.com/file/25288485/Apple-vs-Samsung-Financial-Analysisdocx/

This study resource was

shared via CourseHero.com

return in assets for Apple was 20.45%, Samsung has a ROA of 9.02%.

This an indication that Apple obtained more than double in return of every

unit of Asset in the company during the financial year, compared to

Samsung.

• Gross margin profit

Based on the gross margin profit ratio, Apple was more profitable that

Samsung during their latest reported financial years. Apple reported a

gross margin profit of 40.06, while Samsung has a gross margin profit of

37.79.

• Operating margin

During the 2015-09 financial year, Apple reported an operating margin of

30.48. On the other hand, Samsung had an operating margin of 12.14.

Under this ratio, it is clear that Apple was more profitable compared to

Samsung.

• Return on equity

As per the latest reported financial year’s statements, Apple had a ROE

46.25, whereas Samsung had a ROE of 13.09. This is a clear indication

that Apple was more profitable on this indicator than Samsung.

• Liquidity

Liquidity is the ability of a firm to meet its short term obligations. A company

with a high liquidity is considered to be in a healthier financial status than that

which has a low liquidity ratio. The trends in liquidity of the two firms are shown

This study source was downloaded by 100000813193656 from CourseHero.com on 05-27-2021 09:26:22 GMT -05:00

https://www.coursehero.com/file/25288485/Apple-vs-Samsung-Financial-Analysisdocx/

This study resource was

shared via CourseHero.com

in appendix I.

• Current ratio

The current ratio for the Apple Company as reported in the latest financial

year was 1.11, while that of Samsung was 2.21. This shows that Samsung

was in a better position to meet its short—term obligations as compared to

the Apple Company.

• Quick ratio

Apple’s quick ratio in the latest reported financial year was 0.89, while

that of Samsung was 1.73. This shows that Samsung had a higher liquidity

than Apple.

• Financial leverage

Apple’s financial leverage was 2.43, while that of Samsung was 1.42. This

shows that Apple obtained much of its financing from Loans, which may

indicate a potential risk, in case of failure to generate profits from the

borrowed money. In that case, Samsung is in a healthier financial status

based on this measure.

• Measures of efficiency

The measures of efficiency evaluate the ability of the copay to generate revenue

from the assets. The trends in these ratios are shown in Appendix III.

• Asset turnover rate

The assets turnover rate reported by the Apple Company in its latest

financial statement was 0.89, whereas that of the Samsung Company was

This study source was downloaded by 100000813193656 from CourseHero.com on 05-27-2021 09:26:22 GMT -05:00

https://www.coursehero.com/file/25288485/Apple-vs-Samsung-Financial-Analysisdocx/

This study resource was

shared via CourseHero.com

• Current ratio

The current ratio for the Apple Company as reported in the latest financial

year was 1.11, while that of Samsung was 2.21. This shows that Samsung

was in a better position to meet its short—term obligations as compared to

the Apple Company.

• Quick ratio

Apple’s quick ratio in the latest reported financial year was 0.89, while

that of Samsung was 1.73. This shows that Samsung had a higher liquidity

than Apple.

• Financial leverage

Apple’s financial leverage was 2.43, while that of Samsung was 1.42. This

shows that Apple obtained much of its financing from Loans, which may

indicate a potential risk, in case of failure to generate profits from the

borrowed money. In that case, Samsung is in a healthier financial status

based on this measure.

• Measures of efficiency

The measures of efficiency evaluate the ability of the copay to generate revenue

from the assets. The trends in these ratios are shown in Appendix III.

• Asset turnover rate

The assets turnover rate reported by the Apple Company in its latest

financial statement was 0.89, whereas that of the Samsung Company was

This study source was downloaded by 100000813193656 from CourseHero.com on 05-27-2021 09:26:22 GMT -05:00

https://www.coursehero.com/file/25288485/Apple-vs-Samsung-Financial-Analysisdocx/

This study resource was

shared via CourseHero.com

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

0.92. This shows that Samsung was slightly more efficient than Apple Inc.

however, the difference was small, and thus considering the trend over the

last year would add more information. The trend shows that Samsung has

been more efficient in utilizing its assets than Apple Inc.

• Receivables turnover rate

The receivable’s turnover for the Apple Company during the last reported

financial year was 13.62, whereas that of the Samsung Company was 7.84.

This shows that it took Apple more time for the goods sold on credit to be

paid for, as compared to the Samsung Company. From the efficiency point

of view, Samsung was more efficient compared to the Apple Company.

Recommendation/ Conclusion

From the analysis it was clear that Samsung Company outperformed the industry

frontrunner; Apple Inc. for this reason, if the Samsung company could identify the areas

in which it was outperformed by its competitor Apple and do something, it could emerge

a superpower. The analysis revealed that Apple was better in profitability, and thus

Samsung should work to uplift its levels of profitability. This can be achieved by

reducing the COGs, which remain higher, compared to those incurred by the Apple

Company.

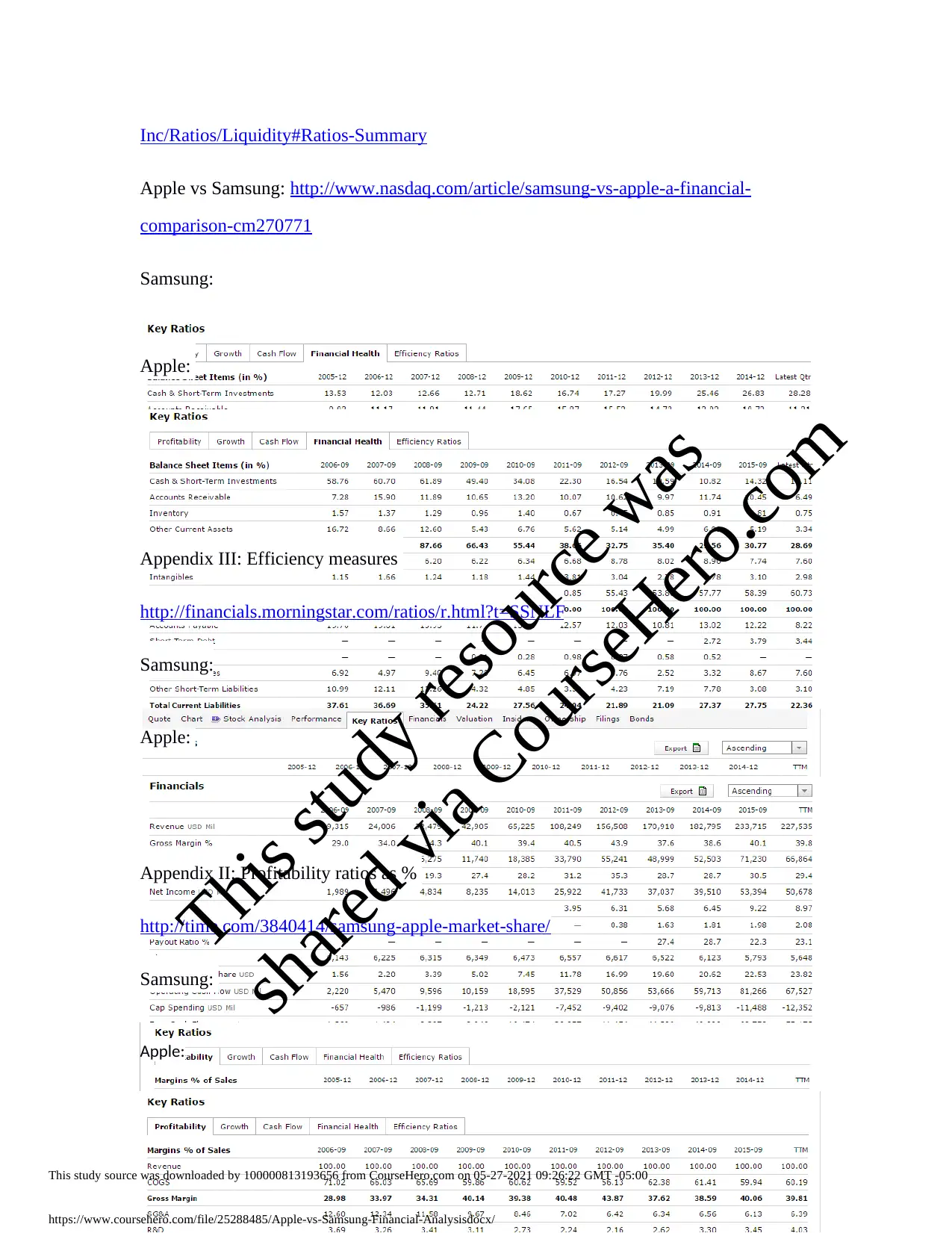

Appendix: I – Liquidity comparison charts

Apple: https://www.stock-analysis-on.net/NASDAQ/Company/Apple-

This study source was downloaded by 100000813193656 from CourseHero.com on 05-27-2021 09:26:22 GMT -05:00

https://www.coursehero.com/file/25288485/Apple-vs-Samsung-Financial-Analysisdocx/

This study resource was

shared via CourseHero.com

however, the difference was small, and thus considering the trend over the

last year would add more information. The trend shows that Samsung has

been more efficient in utilizing its assets than Apple Inc.

• Receivables turnover rate

The receivable’s turnover for the Apple Company during the last reported

financial year was 13.62, whereas that of the Samsung Company was 7.84.

This shows that it took Apple more time for the goods sold on credit to be

paid for, as compared to the Samsung Company. From the efficiency point

of view, Samsung was more efficient compared to the Apple Company.

Recommendation/ Conclusion

From the analysis it was clear that Samsung Company outperformed the industry

frontrunner; Apple Inc. for this reason, if the Samsung company could identify the areas

in which it was outperformed by its competitor Apple and do something, it could emerge

a superpower. The analysis revealed that Apple was better in profitability, and thus

Samsung should work to uplift its levels of profitability. This can be achieved by

reducing the COGs, which remain higher, compared to those incurred by the Apple

Company.

Appendix: I – Liquidity comparison charts

Apple: https://www.stock-analysis-on.net/NASDAQ/Company/Apple-

This study source was downloaded by 100000813193656 from CourseHero.com on 05-27-2021 09:26:22 GMT -05:00

https://www.coursehero.com/file/25288485/Apple-vs-Samsung-Financial-Analysisdocx/

This study resource was

shared via CourseHero.com

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Inc/Ratios/Liquidity#Ratios-Summary

Apple vs Samsung: http://www.nasdaq.com/article/samsung-vs-apple-a-financial-

comparison-cm270771

Samsung:

Apple:

Appendix III: Efficiency measures

http://financials.morningstar.com/ratios/r.html?t=SSNLF

Samsung:

Apple:

Appendix II: Profitability ratios as %

http://time.com/3840414/samsung-apple-market-share/

Samsung:

Apple:

This study source was downloaded by 100000813193656 from CourseHero.com on 05-27-2021 09:26:22 GMT -05:00

https://www.coursehero.com/file/25288485/Apple-vs-Samsung-Financial-Analysisdocx/

This study resource was

shared via CourseHero.com

Apple vs Samsung: http://www.nasdaq.com/article/samsung-vs-apple-a-financial-

comparison-cm270771

Samsung:

Apple:

Appendix III: Efficiency measures

http://financials.morningstar.com/ratios/r.html?t=SSNLF

Samsung:

Apple:

Appendix II: Profitability ratios as %

http://time.com/3840414/samsung-apple-market-share/

Samsung:

Apple:

This study source was downloaded by 100000813193656 from CourseHero.com on 05-27-2021 09:26:22 GMT -05:00

https://www.coursehero.com/file/25288485/Apple-vs-Samsung-Financial-Analysisdocx/

This study resource was

shared via CourseHero.com

This study source was downloaded by 100000813193656 from CourseHero.com on 05-27-2021 09:26:22 GMT -05:00

https://www.coursehero.com/file/25288485/Apple-vs-Samsung-Financial-Analysisdocx/

This study resource was

shared via CourseHero.com

Powered by TCPDF (www.tcpdf.org)

https://www.coursehero.com/file/25288485/Apple-vs-Samsung-Financial-Analysisdocx/

This study resource was

shared via CourseHero.com

Powered by TCPDF (www.tcpdf.org)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 6

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.