Accounting Report: Analysis of Pioneer Credit and ASIC

VerifiedAdded on 2023/03/23

|23

|5277

|67

Report

AI Summary

This report provides a detailed analysis of the issues presented in an Australian Financial Review article titled "ASIC kept watch on Pioneer Credit for 12 months." The report examines the conflict between the Australian Securities and Investment Commission (ASIC) and Pioneer Credit regarding the company's valuation methods, exploring relevant accounting theories such as regulation, professionalism, ethics, and standard setting. It deconstructs the issues, applying theories like public interest theory, self-interest theory, and deontological theory to explain the behaviors of both parties. The report also discusses the significance of the conflict between the regulator and the regulated, as well as the issues covered in the exposure draft by the International Financial Reporting Standards (IFRS) Foundation. The analysis highlights the importance of ethical conduct, adherence to accounting standards, and the impact of regulatory oversight on financial reporting practices. The report concludes by emphasizing the importance of these issues for maintaining fairness and efficiency in the financial market.

Running head: ACCOUNTING

Accounting

Student Number:

Subject Code:

Assessment Number:

Tutor Name:

Accounting

Student Number:

Subject Code:

Assessment Number:

Tutor Name:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ACCOUNTING 2

Question one

This report presents a detailed analysis of finance and accounting article titled as “ASIC

kept watch on Pioneer Credit for 12 months”. This paper will start by giving a detailed

explanation of the issues presented in the article. The report will further look deeply into the

issues discussed using accounting theories. The report will conclude by highlighting the

importance of the article.

Australian Financial Review

Figure 1: ASIC kept watch on Pioneer Credit for 12 months (Frost, 2019a)

a. Key issues as found in the news article

This article captures two players in the financial sector, that is, the regulator and the

regulated. The Australian Security and Investment Commission (ASIC) who is the regulator

have questions on the accounting method adopted by Pioneer credit who is being regulated by

ASIC.

ASIC is the body charged with the responsibility of regulating and ensuring adherence to

the requirements of financial reporting and auditing in Australia. Theyensure that the corporation

Act is adhered to ("About us", 2019a). By ensuring compliance to the law, ASIC promotes fair

play in the market and improves investors’ confidence. Another role played by ASIC is to ensure

Question one

This report presents a detailed analysis of finance and accounting article titled as “ASIC

kept watch on Pioneer Credit for 12 months”. This paper will start by giving a detailed

explanation of the issues presented in the article. The report will further look deeply into the

issues discussed using accounting theories. The report will conclude by highlighting the

importance of the article.

Australian Financial Review

Figure 1: ASIC kept watch on Pioneer Credit for 12 months (Frost, 2019a)

a. Key issues as found in the news article

This article captures two players in the financial sector, that is, the regulator and the

regulated. The Australian Security and Investment Commission (ASIC) who is the regulator

have questions on the accounting method adopted by Pioneer credit who is being regulated by

ASIC.

ASIC is the body charged with the responsibility of regulating and ensuring adherence to

the requirements of financial reporting and auditing in Australia. Theyensure that the corporation

Act is adhered to ("About us", 2019a). By ensuring compliance to the law, ASIC promotes fair

play in the market and improves investors’ confidence. Another role played by ASIC is to ensure

ACCOUNTING 3

that the audit and the financial report are right and that they can be relied upon and help different

stakeholders in making informed decision.

On the other hand, Pioneer Credit is a company which specializes in the provision of

financial services to customers. It is based in Australia ("Leadership Principles", 2019b). This

company is one of the many others which are listed in the Australian Security exchange and

therefore has an obligation of submitting audited reports to ASIC.

As it recorded, ASIC is concerned about the valuation method used by Pioneer Credit.

They have questions which Pioneer Credit has not responded to fully. Prior to raising the issue

with Pioneer, ASIC has been seeking information about the company accounting standards from

whistle-blowers. Pioneer Credit has no plan of changing the controversial fair value method of

valuation.

Pioneer Credit has not provided enough information to their auditor so that he can rule

whether the accounting policies of the company is the ones accepted. The withholding of

information suggests that there is something malicious with the model. (Frost, 2019a).Despite

the fact that PwC auditor offered a qualified opinion, he declined to give details of the process

involved. Pioneer credit has made efforts to defend the legitimacy of their method by hiring a tax

specialist to defend their valuation method. The financial report by the company showed a

continuous decline in the share price. The company has even gone the extent of leasing property

from one of its directors (Pioneer Credit Limited, 2018). This can be a sign to communicate of

the failure of their valuation method. According to the article, a wife to the director who has

leased a property to the company is trading with the company. This leads to potential conflict of

interest.

The company highlight that their method of debt collection is customer friendly (Frost,

2019b). They also hold that it improves collaboration with the customer, a stand that is contrary

to what the customers say. Most of the customers are not happy at all.

b. Link major issues to topic and theory

i. Identify a range of relevant accounting theories that are applicable to

the issues reported in the news article

that the audit and the financial report are right and that they can be relied upon and help different

stakeholders in making informed decision.

On the other hand, Pioneer Credit is a company which specializes in the provision of

financial services to customers. It is based in Australia ("Leadership Principles", 2019b). This

company is one of the many others which are listed in the Australian Security exchange and

therefore has an obligation of submitting audited reports to ASIC.

As it recorded, ASIC is concerned about the valuation method used by Pioneer Credit.

They have questions which Pioneer Credit has not responded to fully. Prior to raising the issue

with Pioneer, ASIC has been seeking information about the company accounting standards from

whistle-blowers. Pioneer Credit has no plan of changing the controversial fair value method of

valuation.

Pioneer Credit has not provided enough information to their auditor so that he can rule

whether the accounting policies of the company is the ones accepted. The withholding of

information suggests that there is something malicious with the model. (Frost, 2019a).Despite

the fact that PwC auditor offered a qualified opinion, he declined to give details of the process

involved. Pioneer credit has made efforts to defend the legitimacy of their method by hiring a tax

specialist to defend their valuation method. The financial report by the company showed a

continuous decline in the share price. The company has even gone the extent of leasing property

from one of its directors (Pioneer Credit Limited, 2018). This can be a sign to communicate of

the failure of their valuation method. According to the article, a wife to the director who has

leased a property to the company is trading with the company. This leads to potential conflict of

interest.

The company highlight that their method of debt collection is customer friendly (Frost,

2019b). They also hold that it improves collaboration with the customer, a stand that is contrary

to what the customers say. Most of the customers are not happy at all.

b. Link major issues to topic and theory

i. Identify a range of relevant accounting theories that are applicable to

the issues reported in the news article

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ACCOUNTING 4

There are several theories which are applicable to the issues raised in the news article.

These are the theories of regulation, theories of professionalism and ethics in accounting and

theories of standard setting (ASIC, 2013, pp. 2). Regulation theories include self-interest theory,

public interest theory and capture theory. Theories relating to professionalism and ethics are

teleological and deontological theories. Lastly the theories of accounting standard setting are

the positive accounting theory and normative accounting theory.

ii. Deconstruct and evaluate the issues reported in the news article

through the use of theories

Accounting regulation and politics

The news article above is just a representation of the things that happening in the

corporate Australia. The issues discussed above clearly highlight some of the challenges

experience financial reporting environment in Australia. The most prominent issue raised in the

news article is the concern by Australian Securities and Investment Commission (AISC) over the

method of valuation used by Pioneer Credit.

To begin with, it is necessary for us to understand how the financial and accounting

regulation environment operates in Australia. Accounting regulation is process of providing an

oversight role to the accounting bodies to ensure that the accounting standards, principles and

policies are adhered to by firms ("About ASIC", 2019). Australian Securities and Investment

Commission is one of the bodies charged with the responsibility of regulating financial sector.

To achieve their responsibility, they have the following powers; power to make rules that ensures

integrity is adhered to within the financial markets. They also have powers to do investigation in

case the law has been broken. The main role of ASIC is to ensure that fairness and efficiency is

maintained in the financial sector. The functions, role and power of ASIC can clearly be

explained by the public interest theory. This theory assumes that any regulation brought forward

by the regulator is in the best interest of the public.

It is a requirement of the law that businesses in Australia should prepare and submit their

financial report to the Australian Investments and Securities Commission (AISC). This reporting

is supposed to be done annually. It is also important to note that for a company to be listed in the

Stock exchange Market, it must first comply with the reporting requirement ("Who we are",

There are several theories which are applicable to the issues raised in the news article.

These are the theories of regulation, theories of professionalism and ethics in accounting and

theories of standard setting (ASIC, 2013, pp. 2). Regulation theories include self-interest theory,

public interest theory and capture theory. Theories relating to professionalism and ethics are

teleological and deontological theories. Lastly the theories of accounting standard setting are

the positive accounting theory and normative accounting theory.

ii. Deconstruct and evaluate the issues reported in the news article

through the use of theories

Accounting regulation and politics

The news article above is just a representation of the things that happening in the

corporate Australia. The issues discussed above clearly highlight some of the challenges

experience financial reporting environment in Australia. The most prominent issue raised in the

news article is the concern by Australian Securities and Investment Commission (AISC) over the

method of valuation used by Pioneer Credit.

To begin with, it is necessary for us to understand how the financial and accounting

regulation environment operates in Australia. Accounting regulation is process of providing an

oversight role to the accounting bodies to ensure that the accounting standards, principles and

policies are adhered to by firms ("About ASIC", 2019). Australian Securities and Investment

Commission is one of the bodies charged with the responsibility of regulating financial sector.

To achieve their responsibility, they have the following powers; power to make rules that ensures

integrity is adhered to within the financial markets. They also have powers to do investigation in

case the law has been broken. The main role of ASIC is to ensure that fairness and efficiency is

maintained in the financial sector. The functions, role and power of ASIC can clearly be

explained by the public interest theory. This theory assumes that any regulation brought forward

by the regulator is in the best interest of the public.

It is a requirement of the law that businesses in Australia should prepare and submit their

financial report to the Australian Investments and Securities Commission (AISC). This reporting

is supposed to be done annually. It is also important to note that for a company to be listed in the

Stock exchange Market, it must first comply with the reporting requirement ("Who we are",

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ACCOUNTING 5

2019d). Another requirement for a company to be listed in the Stock market is that, it must abide

by the rule of periodic disclosure. Pioneer Credit limited as a financial institution has the

responsibility of preparing and submitting their financial report as stipulated in the law.

AISC has raised concerns about the method of valuation used by Pioneer Credit. The

method of valuation is in accordance with the set standards and policies. This is the reason why

ASIC is concerned. It has also been observed that this method is exploitative to the customers.

Despite failure of this method of valuation to yield positive results, Pioneer Credit has vowed not

change it current policy. The company has even gone a step further to seek the services of a tax

specialist to defend their method. The behaviors of Pioneer Credit can be explained by the self-

interest theory which states that people or institution only takes action which they feel with

benefit them.

PwC is an Audit Company which audited the financial reports of Pioneer credit. PwC has

a role of auditing the accounts of Pioneer Credit and giving their opinion concerning the state of

the account. In one of the report given by PwC, it stated that they had not received enough

information to enable judge where the accounting policies were the right one. Australian security

exchange (ASX) is the listing company. Their role in the current issue at hand is state whether

the reports provided by Pioneer Credit are comparable with those from other institution.

The standard and setting processes

A definition by the IFRS Foundation defines accounting standards as set of principles

that guides a company when preparing financial statements so that they can be in standardized

way. Standards in accounting facilitate easy comparison of financial reports. This is because the

procedure followed in their preparation is the same.

In Australia, the body charge with the responsibility of setting up standards is known as

the Australian Accounting Standards Board (AASB). This is a government agency which serves

the interest of the public. While AASB is concerned with the responsibility of formulation of

standards, ASIC is concerned with the enforcement of the standards set by AASB. On the other

hand International Accounting Standards Board formulates standards at international level.

AASB ensures that the local standards conform to the international standards ("About the

AASB", 2019). From the information provided, Pioneer Credit is not conformance to the

2019d). Another requirement for a company to be listed in the Stock market is that, it must abide

by the rule of periodic disclosure. Pioneer Credit limited as a financial institution has the

responsibility of preparing and submitting their financial report as stipulated in the law.

AISC has raised concerns about the method of valuation used by Pioneer Credit. The

method of valuation is in accordance with the set standards and policies. This is the reason why

ASIC is concerned. It has also been observed that this method is exploitative to the customers.

Despite failure of this method of valuation to yield positive results, Pioneer Credit has vowed not

change it current policy. The company has even gone a step further to seek the services of a tax

specialist to defend their method. The behaviors of Pioneer Credit can be explained by the self-

interest theory which states that people or institution only takes action which they feel with

benefit them.

PwC is an Audit Company which audited the financial reports of Pioneer credit. PwC has

a role of auditing the accounts of Pioneer Credit and giving their opinion concerning the state of

the account. In one of the report given by PwC, it stated that they had not received enough

information to enable judge where the accounting policies were the right one. Australian security

exchange (ASX) is the listing company. Their role in the current issue at hand is state whether

the reports provided by Pioneer Credit are comparable with those from other institution.

The standard and setting processes

A definition by the IFRS Foundation defines accounting standards as set of principles

that guides a company when preparing financial statements so that they can be in standardized

way. Standards in accounting facilitate easy comparison of financial reports. This is because the

procedure followed in their preparation is the same.

In Australia, the body charge with the responsibility of setting up standards is known as

the Australian Accounting Standards Board (AASB). This is a government agency which serves

the interest of the public. While AASB is concerned with the responsibility of formulation of

standards, ASIC is concerned with the enforcement of the standards set by AASB. On the other

hand International Accounting Standards Board formulates standards at international level.

AASB ensures that the local standards conform to the international standards ("About the

AASB", 2019). From the information provided, Pioneer Credit is not conformance to the

ACCOUNTING 6

accounting standards. The breach of accounting standards by Pioneer may cause it to be banned

from operating.

Professionalism and ethics in accounting

ASIC has a moral obligation of questioning of Pioneer Credit with regard to their method

of valuation. This is because it the body mandated by the law to do that. This can be effectively

explained by the deontological theory of ethic. This is doing right out of an intrinsic value in an

individual. PwC issued a qualified opinion on a controversial method of valuation (Henderson et

al, 2014, pp. 950-971). This may be explained by the egoistic theory. In this theory, an action is

termed moral if the end result of the action will be a benefit. Pioneer Credit also uses a

controversial valuation method out of the benefit that they seek to get. The tax specialist also acts

egoistically by defending Pioneer Credit. These behaviors can also be illustrated by the egoistic

theory.

The financial statements prepared do not provide enough information to the user. An

example is when PwC say that they have not been provided with sufficient information to enable

them to draw a reasonable conclusion. There is also conflict of interest when one of the directors

of Pioneer Credit leases his own property to the business.

iii. Present a logical conclusion regarding the significance of the issue

reported in the news article

The main issue that the clearly presents, is the conflict that arises between the regulator

and the regulated. In the financial market, there are several regulators. These regulators ensure

that there is fairness in the market and that public interest is taken care of. It is the duty of the

firms to ensure that they abide by the regulation provided by the regulators. Abiding by this

regulations and standards will reduce the conflict that may arise. Acting ethically and following

professional standards will also prevent occurrence of any conflict.

Question two

a. Outline the major issues covered in the exposure draft

There are different stakeholders involved in the current exposure draft. One of the

stakeholders in involved is the International Financial Reporting Standards (IFRS) Foundation

(IFRS, 2018c, pp. 1-4). It is an international body concerned with the responsibility of

accounting standards. The breach of accounting standards by Pioneer may cause it to be banned

from operating.

Professionalism and ethics in accounting

ASIC has a moral obligation of questioning of Pioneer Credit with regard to their method

of valuation. This is because it the body mandated by the law to do that. This can be effectively

explained by the deontological theory of ethic. This is doing right out of an intrinsic value in an

individual. PwC issued a qualified opinion on a controversial method of valuation (Henderson et

al, 2014, pp. 950-971). This may be explained by the egoistic theory. In this theory, an action is

termed moral if the end result of the action will be a benefit. Pioneer Credit also uses a

controversial valuation method out of the benefit that they seek to get. The tax specialist also acts

egoistically by defending Pioneer Credit. These behaviors can also be illustrated by the egoistic

theory.

The financial statements prepared do not provide enough information to the user. An

example is when PwC say that they have not been provided with sufficient information to enable

them to draw a reasonable conclusion. There is also conflict of interest when one of the directors

of Pioneer Credit leases his own property to the business.

iii. Present a logical conclusion regarding the significance of the issue

reported in the news article

The main issue that the clearly presents, is the conflict that arises between the regulator

and the regulated. In the financial market, there are several regulators. These regulators ensure

that there is fairness in the market and that public interest is taken care of. It is the duty of the

firms to ensure that they abide by the regulation provided by the regulators. Abiding by this

regulations and standards will reduce the conflict that may arise. Acting ethically and following

professional standards will also prevent occurrence of any conflict.

Question two

a. Outline the major issues covered in the exposure draft

There are different stakeholders involved in the current exposure draft. One of the

stakeholders in involved is the International Financial Reporting Standards (IFRS) Foundation

(IFRS, 2018c, pp. 1-4). It is an international body concerned with the responsibility of

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ACCOUNTING 7

developing accounting standards. There are several issues which have been captured in the

Onerous Contract exposure draft which seek to amend the provisions contained in IAS 37 of the

onerous contract ("Exposure Draft IAS 37: About", IFRS, 2019d). The current provision does

not highlight the cost that should be included in the determination of the ‘cost of fulfilling’ a

contract so as to help in the determination of which contract maybe onerous. The proposed

changes seek to fill that gap by specifying the costs to be included.

A request was tabled before the IFRS interpretation committee seeks a clarification on

the type of costs to include when founding out the cost of fulfilling construction contracts. IAS

11 which previously provided a guideline has already been withdrawn. Different stakeholders

had different views on the type of cost to be included. These differences probably may lead to a

potential material difference in the financial documents of firms. Material difference is has an

adverse effect to the materiality of the documents. This will further impact on the relevance of

the financial statements.

To address this accounting concern, the interpretation requested for comments from

different stakeholders. This would enable them to factor in thought from different parties and

therefore come up with an acceptable amendment. Basically, it can clearly be seen that this

exposure draft is trying to introduce a clause which will give clarity to the current AIS 37

provision.

b. Is there agreement among the various groups? Describe the issues where

there is agreement / disagreement and provide examples.

Different groups have provided their thought with regard to the proposed amendment.

Some have agreed with all the questions, other has agreed to some while others have totally

disagreed completely with the proposed amendment ("Exposure Draft IAS 37: View the

comment letters", IFRS, 2019c). This section will review comment by this different groups.

i. CPA Australia 2019

This body based in Australia supports the proposal of question 1 that the cost

of fulfilling a contract comprises the cost that relate directly to the contract. They also

give their thought of the recommendation that they think are necessary. They

developing accounting standards. There are several issues which have been captured in the

Onerous Contract exposure draft which seek to amend the provisions contained in IAS 37 of the

onerous contract ("Exposure Draft IAS 37: About", IFRS, 2019d). The current provision does

not highlight the cost that should be included in the determination of the ‘cost of fulfilling’ a

contract so as to help in the determination of which contract maybe onerous. The proposed

changes seek to fill that gap by specifying the costs to be included.

A request was tabled before the IFRS interpretation committee seeks a clarification on

the type of costs to include when founding out the cost of fulfilling construction contracts. IAS

11 which previously provided a guideline has already been withdrawn. Different stakeholders

had different views on the type of cost to be included. These differences probably may lead to a

potential material difference in the financial documents of firms. Material difference is has an

adverse effect to the materiality of the documents. This will further impact on the relevance of

the financial statements.

To address this accounting concern, the interpretation requested for comments from

different stakeholders. This would enable them to factor in thought from different parties and

therefore come up with an acceptable amendment. Basically, it can clearly be seen that this

exposure draft is trying to introduce a clause which will give clarity to the current AIS 37

provision.

b. Is there agreement among the various groups? Describe the issues where

there is agreement / disagreement and provide examples.

Different groups have provided their thought with regard to the proposed amendment.

Some have agreed with all the questions, other has agreed to some while others have totally

disagreed completely with the proposed amendment ("Exposure Draft IAS 37: View the

comment letters", IFRS, 2019c). This section will review comment by this different groups.

i. CPA Australia 2019

This body based in Australia supports the proposal of question 1 that the cost

of fulfilling a contract comprises the cost that relate directly to the contract. They also

give their thought of the recommendation that they think are necessary. They

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ACCOUNTING 8

recommend that IASB should define what economic benefit arising from a contract

entails. Without this clarification, then materiality problem will not have been solved.

CPA Australia

Figure 1: Exposure Draft ED/2018/2 - Onerous Contracts - Cost of Fulfilling a Contract:

CPA Australia (Pflugrath, 2019)

ii. CA Sri Lanka 2019

This the body established in Sri Lanka. This body speaks on behalf of a

country. They agree with the proposed charges and give a go ahead to the IFRS to

implement the charges. There however give suggestion on what should be added.

They are concerned that the proposal only targets construction industries. They

suggest that the scope should be widened to other industries as well.

recommend that IASB should define what economic benefit arising from a contract

entails. Without this clarification, then materiality problem will not have been solved.

CPA Australia

Figure 1: Exposure Draft ED/2018/2 - Onerous Contracts - Cost of Fulfilling a Contract:

CPA Australia (Pflugrath, 2019)

ii. CA Sri Lanka 2019

This the body established in Sri Lanka. This body speaks on behalf of a

country. They agree with the proposed charges and give a go ahead to the IFRS to

implement the charges. There however give suggestion on what should be added.

They are concerned that the proposal only targets construction industries. They

suggest that the scope should be widened to other industries as well.

ACCOUNTING 9

CA Sri Lanka

Figure 2: Exposure Draft ED/2018/2 - Onerous Contracts - Cost of Fulfilling a Contract:

CPA Australia (Jeyesinghe, 2019)

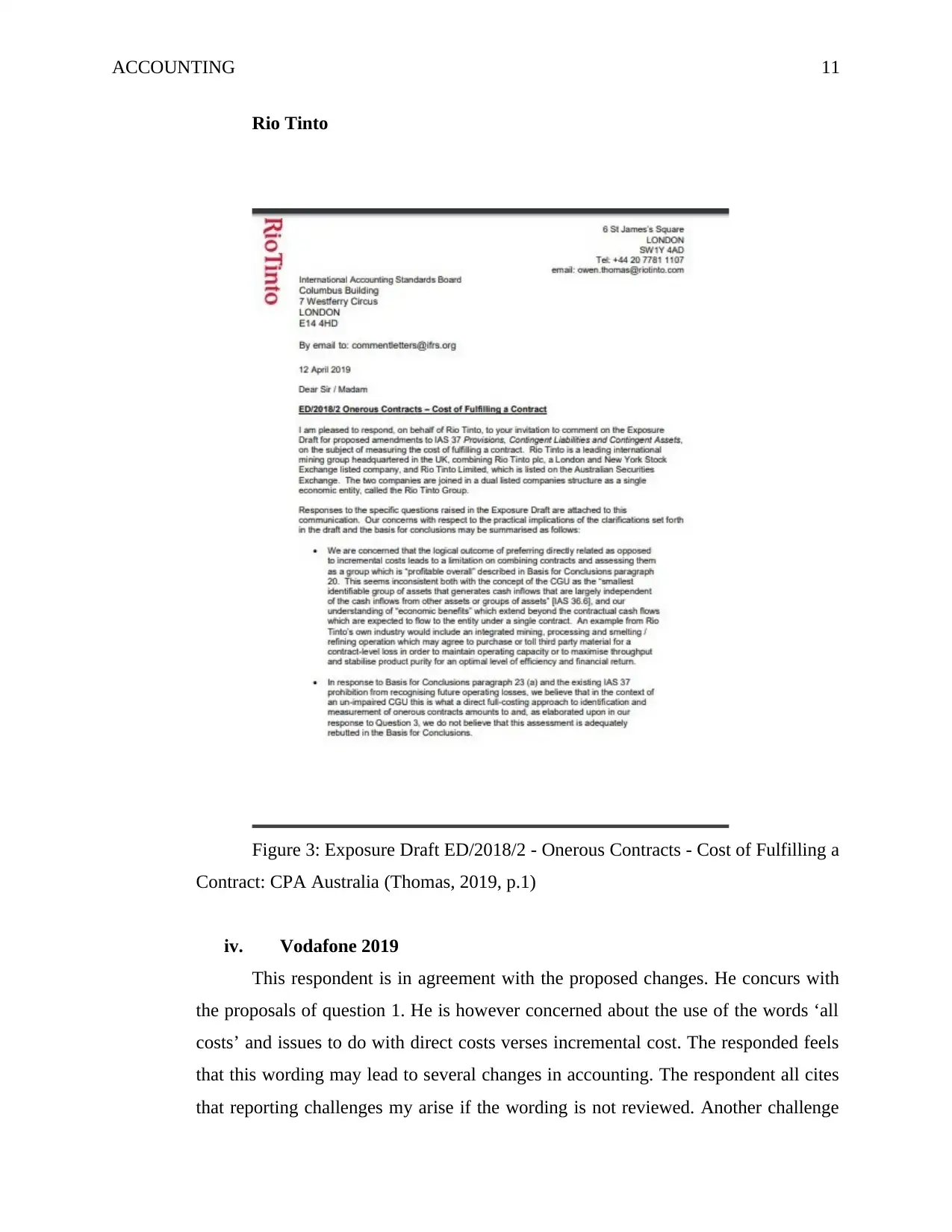

iii. Rio Tinto 2019

Rio Tinto is an industry which is involved in the production of goods. This

respondent has provided a comprehensive comment with regard to the proposed

changes. The respondent cites the limitation of the current proposal and gives his

alternative solution. In response to the first question, this responded raises several

CA Sri Lanka

Figure 2: Exposure Draft ED/2018/2 - Onerous Contracts - Cost of Fulfilling a Contract:

CPA Australia (Jeyesinghe, 2019)

iii. Rio Tinto 2019

Rio Tinto is an industry which is involved in the production of goods. This

respondent has provided a comprehensive comment with regard to the proposed

changes. The respondent cites the limitation of the current proposal and gives his

alternative solution. In response to the first question, this responded raises several

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ACCOUNTING 10

concerns. One of the concerns is that they do not concur with the preference given to

directly related costs as opposed to incremental costs. The respondent provides the

following solution to the concern raised. One of them is the use of both incremental

and directly related costs when measuring onerous provision.

concerns. One of the concerns is that they do not concur with the preference given to

directly related costs as opposed to incremental costs. The respondent provides the

following solution to the concern raised. One of them is the use of both incremental

and directly related costs when measuring onerous provision.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ACCOUNTING 11

Rio Tinto

Figure 3: Exposure Draft ED/2018/2 - Onerous Contracts - Cost of Fulfilling a

Contract: CPA Australia (Thomas, 2019, p.1)

iv. Vodafone 2019

This respondent is in agreement with the proposed changes. He concurs with

the proposals of question 1. He is however concerned about the use of the words ‘all

costs’ and issues to do with direct costs verses incremental cost. The responded feels

that this wording may lead to several changes in accounting. The respondent all cites

that reporting challenges my arise if the wording is not reviewed. Another challenge

Rio Tinto

Figure 3: Exposure Draft ED/2018/2 - Onerous Contracts - Cost of Fulfilling a

Contract: CPA Australia (Thomas, 2019, p.1)

iv. Vodafone 2019

This respondent is in agreement with the proposed changes. He concurs with

the proposals of question 1. He is however concerned about the use of the words ‘all

costs’ and issues to do with direct costs verses incremental cost. The responded feels

that this wording may lead to several changes in accounting. The respondent all cites

that reporting challenges my arise if the wording is not reviewed. Another challenge

ACCOUNTING 12

that may arise is the practicability of the proposal in some situations which he clearly

highlights. To address the highlighted concerns, the respondent proposes that

incremental cost should be allowed when conducting an onerous assessment in some

circumstances.

Vodafone 2019

Figure 4: Exposure Draft ED/2018/2 - Onerous Contracts - Cost of Fulfilling a Contract:

CPA Australia (Stephenson, 2019)

i. Can the behavior of the regulator be explained by ‘public interest theory’?

Justify your position.

The public interest theory of regulation holds that when a regulation is introduced by the

regulators, it is usually for the benefit of the public and not for self-interest. A regulation is said

have the interest of the public if the cost associated with implementing it is less when compared

that may arise is the practicability of the proposal in some situations which he clearly

highlights. To address the highlighted concerns, the respondent proposes that

incremental cost should be allowed when conducting an onerous assessment in some

circumstances.

Vodafone 2019

Figure 4: Exposure Draft ED/2018/2 - Onerous Contracts - Cost of Fulfilling a Contract:

CPA Australia (Stephenson, 2019)

i. Can the behavior of the regulator be explained by ‘public interest theory’?

Justify your position.

The public interest theory of regulation holds that when a regulation is introduced by the

regulators, it is usually for the benefit of the public and not for self-interest. A regulation is said

have the interest of the public if the cost associated with implementing it is less when compared

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 23

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.