Management Accounting Report: Aston Martin and Financial Analysis

VerifiedAdded on 2023/01/19

|23

|5645

|31

Report

AI Summary

This management accounting report provides a detailed analysis of Aston Martin Lagonda Global Holding Plc's financial strategies and performance. It begins with an introduction to management accounting, its system, and reporting, including the differences between management and financial accounting. The report delves into cost accounting systems, inventory management, job order costing, and price optimization. It then explores various reporting types, such as performance reports, budget reports, cost reports, and accounts ageing reports. The report further examines costing techniques, including direct and indirect costs, fixed and variable costs, and cost analysis methods like cost-volume-profit and flexible budgeting. Marginal and absorption costing techniques are also discussed, along with their applications and interpretations. The report also covers planning tools used in budgetary control, including capital budgets and the behavioral implications of budgeting. The report also analyzes the internal and external factors of the company. Finally, the report addresses the adaptation of management accounting in response to financial problems, comparing different organizations and highlighting the characteristics of a management accountant. The conclusion summarizes the key findings, and references and an appendix are included.

Management

Accounting

Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

P1 Management Accounting System:....................................................................................1

Management Accounting:..................................................................................................1

Management accounting system:.......................................................................................2

M1 Benefits of management accounting system....................................................................3

P2 Management Accounting Reporting:................................................................................3

Management accounting reporting:...................................................................................3

Different types of reports...................................................................................................4

TASK 2............................................................................................................................................5

P3 Appropriate costing techniques:........................................................................................5

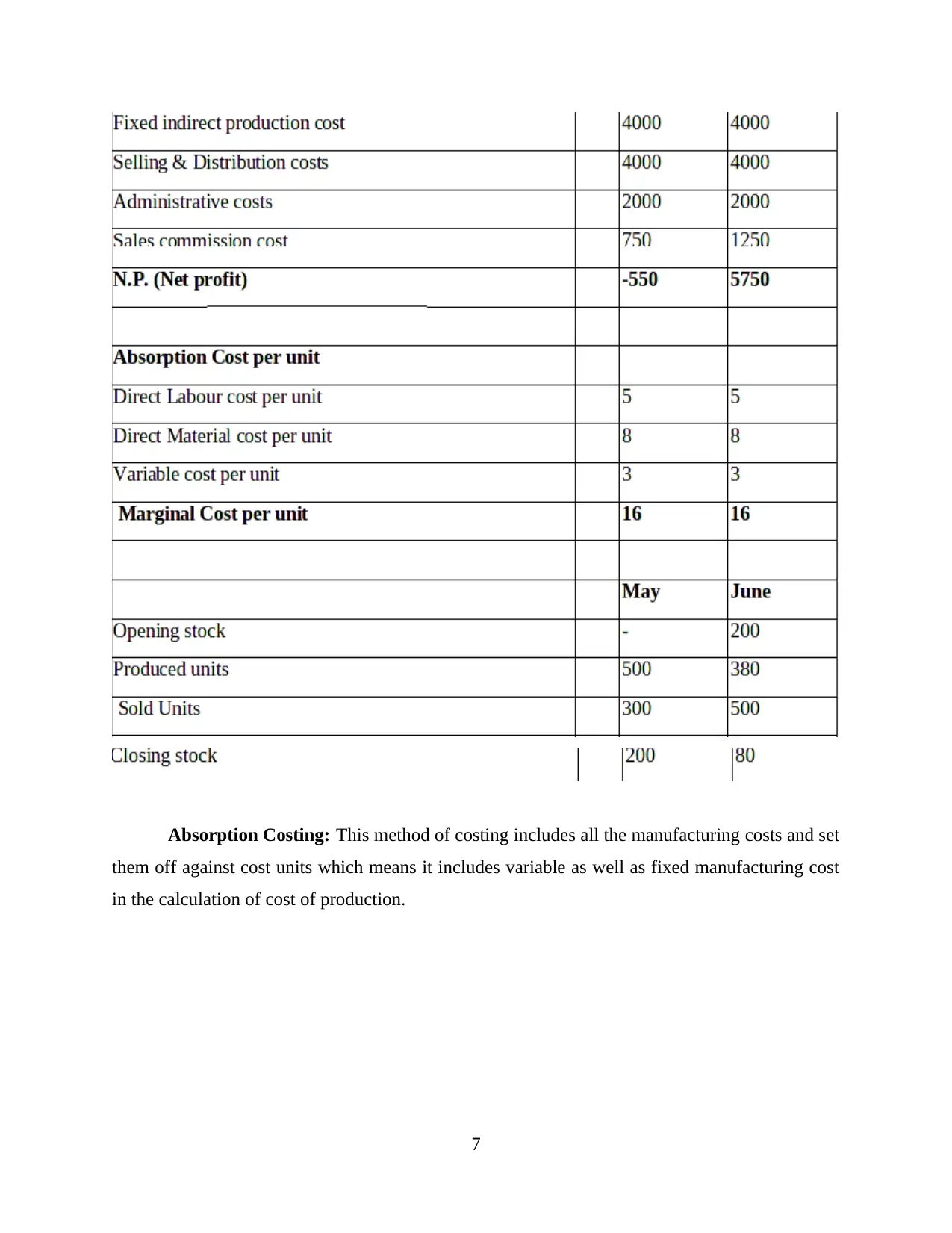

Appropriate application of Marginal Costing.........................................................................6

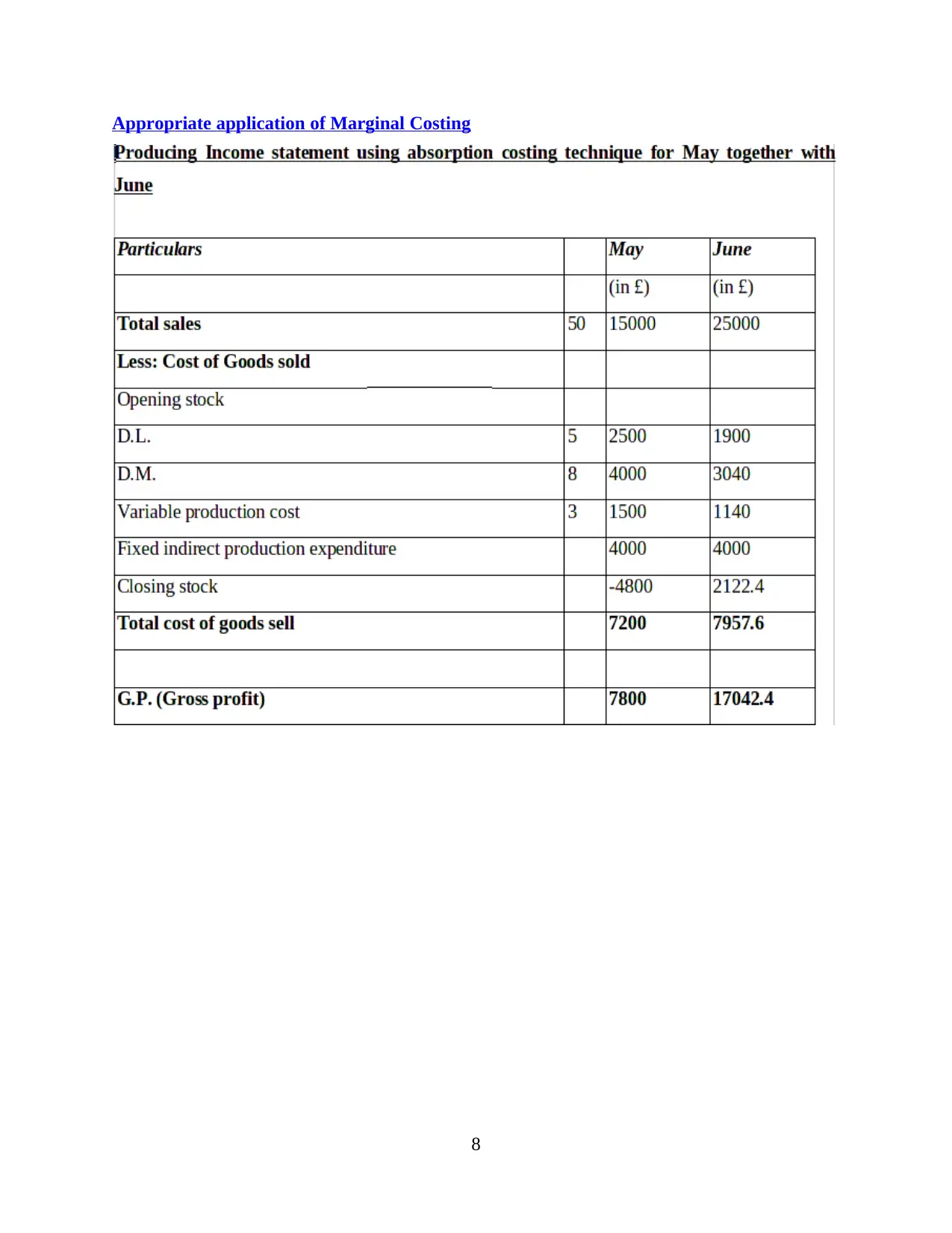

Appropriate application of Marginal Costing.........................................................................8

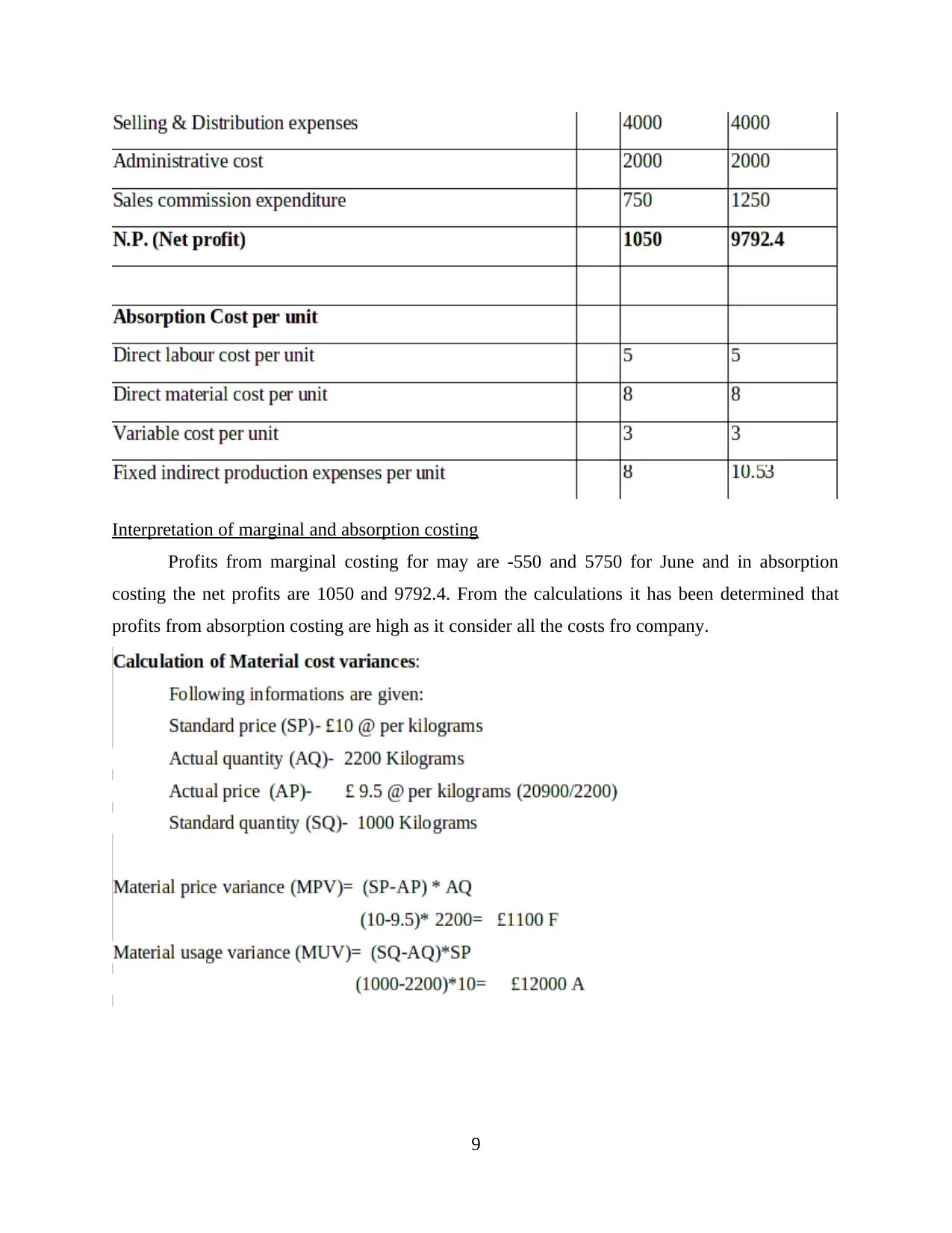

Interpretation of marginal and absorption costing..................................................................9

TASK 3..........................................................................................................................................10

P4 Planning tools used by budgetary control:......................................................................10

Budget:.............................................................................................................................10

Behavioural implications of budget:................................................................................11

Common Costing Systems:.............................................................................................12

External and Internal Analysis of Aston Martin:.............................................................12

M3 Analysis of different planning tools for preparing and forecasting budgets:.................14

TASK 4..........................................................................................................................................14

P5 Adaptation of management accounting in response to financial problems.....................14

Financial Problems:.........................................................................................................14

Comparison of different organizations in context with financial problems:...................15

Characteristics of management accountant:....................................................................16

M4 Analysis of management accounting techniques in leading sustainable success:........16

CONCLUSION..............................................................................................................................16

REFERENCES..............................................................................................................................18

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

P1 Management Accounting System:....................................................................................1

Management Accounting:..................................................................................................1

Management accounting system:.......................................................................................2

M1 Benefits of management accounting system....................................................................3

P2 Management Accounting Reporting:................................................................................3

Management accounting reporting:...................................................................................3

Different types of reports...................................................................................................4

TASK 2............................................................................................................................................5

P3 Appropriate costing techniques:........................................................................................5

Appropriate application of Marginal Costing.........................................................................6

Appropriate application of Marginal Costing.........................................................................8

Interpretation of marginal and absorption costing..................................................................9

TASK 3..........................................................................................................................................10

P4 Planning tools used by budgetary control:......................................................................10

Budget:.............................................................................................................................10

Behavioural implications of budget:................................................................................11

Common Costing Systems:.............................................................................................12

External and Internal Analysis of Aston Martin:.............................................................12

M3 Analysis of different planning tools for preparing and forecasting budgets:.................14

TASK 4..........................................................................................................................................14

P5 Adaptation of management accounting in response to financial problems.....................14

Financial Problems:.........................................................................................................14

Comparison of different organizations in context with financial problems:...................15

Characteristics of management accountant:....................................................................16

M4 Analysis of management accounting techniques in leading sustainable success:........16

CONCLUSION..............................................................................................................................16

REFERENCES..............................................................................................................................18

APPENDIX....................................................................................................................................20

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Management accounting which is also known as managerial accounting is a framework

that is basically used by the managers to maintain and control the internal affairs of an

organization. This is utilized for filtering the internal informations of the establishment and make

it valuable for the administration so that they can make effective decisions and control over the

functions of the firm.

This report covers a detailed description about management accounting in context with

the Aston Martin Lagonda Global Holding Plc which is an independent manufacturer company

of Britain established by Lionel Martin and Robert Bamford in 1913 and manufactures luxury

sport cars. It includes management accounting system and reporting, their benefits, cost

accounting system and techniques, planning tools for accounting and financial governance.

TASK 1

P1 Management Accounting System:

Management Accounting:

Management accounting is a set of so many activities such as collection, classification,

recording and presentation of financial and non-financial data in such a manner that internal

stakeholder such as managers can utilize this information in planning, operating, managing and

controlling the internal process of functioning in an efficient and effective manner.

Origin, role and principle of management accounting:

Managerial accounting was developed at the beginning of nineteenth century by the

business persons of large organizations who find it necessary to manage and control internal

operations in order to survive in the market. Management accounting plays a significant role in

cost reduction and control, profit maximization, price fixing, stock management, planning and

decision making for future operations (Jamil and others, 2015). It basically follows two major

principles that are principle if causality and principle of analogy.

Difference between management and financial accounting:

Management Accounting Financial Accounting

Management accounting provides sufficient

reports and informations to the internal

Financial accounting renders reports and

informations related to the funds which can be

1

Management accounting which is also known as managerial accounting is a framework

that is basically used by the managers to maintain and control the internal affairs of an

organization. This is utilized for filtering the internal informations of the establishment and make

it valuable for the administration so that they can make effective decisions and control over the

functions of the firm.

This report covers a detailed description about management accounting in context with

the Aston Martin Lagonda Global Holding Plc which is an independent manufacturer company

of Britain established by Lionel Martin and Robert Bamford in 1913 and manufactures luxury

sport cars. It includes management accounting system and reporting, their benefits, cost

accounting system and techniques, planning tools for accounting and financial governance.

TASK 1

P1 Management Accounting System:

Management Accounting:

Management accounting is a set of so many activities such as collection, classification,

recording and presentation of financial and non-financial data in such a manner that internal

stakeholder such as managers can utilize this information in planning, operating, managing and

controlling the internal process of functioning in an efficient and effective manner.

Origin, role and principle of management accounting:

Managerial accounting was developed at the beginning of nineteenth century by the

business persons of large organizations who find it necessary to manage and control internal

operations in order to survive in the market. Management accounting plays a significant role in

cost reduction and control, profit maximization, price fixing, stock management, planning and

decision making for future operations (Jamil and others, 2015). It basically follows two major

principles that are principle if causality and principle of analogy.

Difference between management and financial accounting:

Management Accounting Financial Accounting

Management accounting provides sufficient

reports and informations to the internal

Financial accounting renders reports and

informations related to the funds which can be

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

stakeholders such as managers and owners. utilized by external stakeholders.

This methods has no specific format or

standards to be followed (Theriou and

Aggelidis, 2014).

Financial accountant has to follow some

standards and reporting formats to prepare the

reports and documents.

Management accounting system:

Managerial accounting system is a framework used by the internal managers to provide

sufficient data and information that is required for management reporting system. Management

accounting system is created to identify, analyse and communicated the data within the

establishment. The management accountants of Aston Martin developed various management

accounting systems to assess the actual performance of the company that are described below:

Cost Accounting System: Costing system or cost accounting system is a framework that

is developed by the establishments to evaluate the cost of production, cost reduction, profitability

analysis and cost control. This system is followed by the selected organization in order to

evaluate detailed information of cost of production of their cars and other services. It also help in

measuring the financial performance of the company.

Inventory management system: Inventory management system is evolved within the

organizations to monitor and control the purchase, usage and storage of the items or components

which are required for the production. The administration of Aston Martin follow this system to

oversee the production from purchase of raw material to availability of finished goods. The

management is also ensures the quality of the cars and effective shipping to the customers.

Job order costing system: Job order costing refers to the structure for assigning

manufacturing cost to specific batch of the products or item. This system involves the practise of

data accumulation on the costs that are related to a particular job or product. The respective firm

uses this system to evaluate the cost of direct labour, direct material and overheads. It also

provide help in calculating the cost of customised cars (Tappura and others, 2015).

Price optimization system: Price optimization system is a mathematical analysis that is

used to determine the reaction or behaviour of the customers in relation to the different prices for

the business offerings. The management of Aston Martin applies this techniques to calculate the

2

This methods has no specific format or

standards to be followed (Theriou and

Aggelidis, 2014).

Financial accountant has to follow some

standards and reporting formats to prepare the

reports and documents.

Management accounting system:

Managerial accounting system is a framework used by the internal managers to provide

sufficient data and information that is required for management reporting system. Management

accounting system is created to identify, analyse and communicated the data within the

establishment. The management accountants of Aston Martin developed various management

accounting systems to assess the actual performance of the company that are described below:

Cost Accounting System: Costing system or cost accounting system is a framework that

is developed by the establishments to evaluate the cost of production, cost reduction, profitability

analysis and cost control. This system is followed by the selected organization in order to

evaluate detailed information of cost of production of their cars and other services. It also help in

measuring the financial performance of the company.

Inventory management system: Inventory management system is evolved within the

organizations to monitor and control the purchase, usage and storage of the items or components

which are required for the production. The administration of Aston Martin follow this system to

oversee the production from purchase of raw material to availability of finished goods. The

management is also ensures the quality of the cars and effective shipping to the customers.

Job order costing system: Job order costing refers to the structure for assigning

manufacturing cost to specific batch of the products or item. This system involves the practise of

data accumulation on the costs that are related to a particular job or product. The respective firm

uses this system to evaluate the cost of direct labour, direct material and overheads. It also

provide help in calculating the cost of customised cars (Tappura and others, 2015).

Price optimization system: Price optimization system is a mathematical analysis that is

used to determine the reaction or behaviour of the customers in relation to the different prices for

the business offerings. The management of Aston Martin applies this techniques to calculate the

2

optimum price for its cars and other products and generate the desired profit with maximum

customer satisfaction.

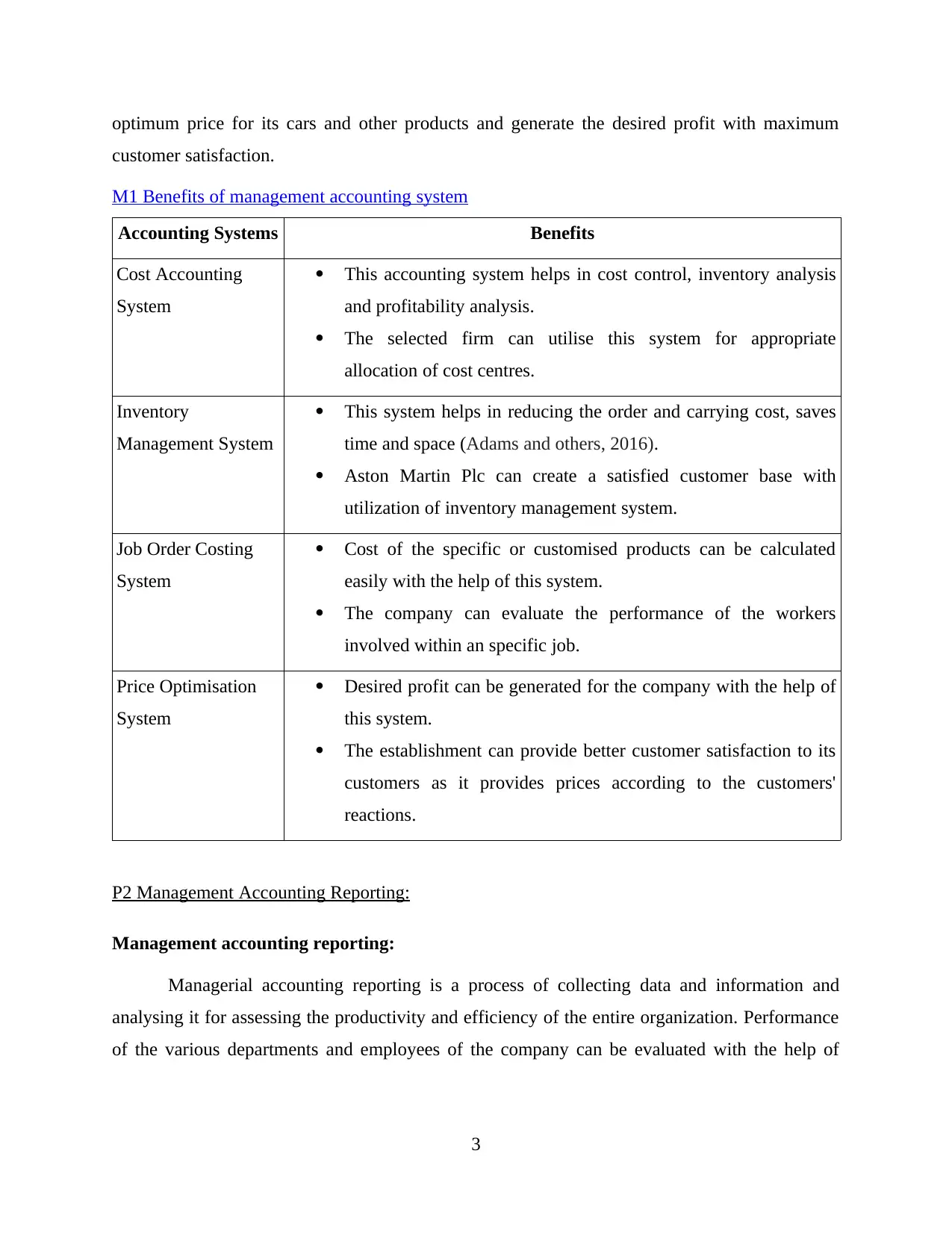

M1 Benefits of management accounting system

Accounting Systems Benefits

Cost Accounting

System

This accounting system helps in cost control, inventory analysis

and profitability analysis.

The selected firm can utilise this system for appropriate

allocation of cost centres.

Inventory

Management System

This system helps in reducing the order and carrying cost, saves

time and space (Adams and others, 2016).

Aston Martin Plc can create a satisfied customer base with

utilization of inventory management system.

Job Order Costing

System

Cost of the specific or customised products can be calculated

easily with the help of this system.

The company can evaluate the performance of the workers

involved within an specific job.

Price Optimisation

System

Desired profit can be generated for the company with the help of

this system.

The establishment can provide better customer satisfaction to its

customers as it provides prices according to the customers'

reactions.

P2 Management Accounting Reporting:

Management accounting reporting:

Managerial accounting reporting is a process of collecting data and information and

analysing it for assessing the productivity and efficiency of the entire organization. Performance

of the various departments and employees of the company can be evaluated with the help of

3

customer satisfaction.

M1 Benefits of management accounting system

Accounting Systems Benefits

Cost Accounting

System

This accounting system helps in cost control, inventory analysis

and profitability analysis.

The selected firm can utilise this system for appropriate

allocation of cost centres.

Inventory

Management System

This system helps in reducing the order and carrying cost, saves

time and space (Adams and others, 2016).

Aston Martin Plc can create a satisfied customer base with

utilization of inventory management system.

Job Order Costing

System

Cost of the specific or customised products can be calculated

easily with the help of this system.

The company can evaluate the performance of the workers

involved within an specific job.

Price Optimisation

System

Desired profit can be generated for the company with the help of

this system.

The establishment can provide better customer satisfaction to its

customers as it provides prices according to the customers'

reactions.

P2 Management Accounting Reporting:

Management accounting reporting:

Managerial accounting reporting is a process of collecting data and information and

analysing it for assessing the productivity and efficiency of the entire organization. Performance

of the various departments and employees of the company can be evaluated with the help of

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

these reports. An effective accounting reporting and information system should contain some

characteristics that are mentioned below:

Relevance: The information renders by the reporting system should be relevant to its

users. It means it should include all the materialistic data and content within it.

Trustworthy: The data in the reports must be updated and reliable so that managers can

make plans and decisions according to the current situations confidently (Klychova and others,

2014).

Accuracy: The data included in the reporting system must be accurate without any

mistakes and errors so that estimations can be calculated in the most effective manner.

Different types of reports

Performance Report: Performance reports are the evaluation of productivity and

efficiency of any individual or activity. These reports helps the mangers in planning for future

requirements in production (Melloni, 2015). The managerial accountant of selected organization

prepares this report on a quarterly basis to evaluate and comparing actual performance of the

employees to the budgeted figures.

Budget Report: All the organizations prepared budgets for different departments at the

beginning of the financial period. These budgets are compared with the actual outcomes at the

end of the accounting period. The variances and the reasons behind them are mentioned within

the budget reports. Aston Martin creates budget reports to find out the deviations and rectify

them accordingly.

Cost report: Managerial accounting system calculates the cost of manufacturing. The cost

of raw material, labour cost and other overheads are summarised in the cost reports. This report

allows the managers the ability to calculate the cost value of products and selling prices. The

management of Aston Martin prepares this cost report for each production to control and plan for

profit margins.

Accounts Ageing report: Accounts ageing report is a summary of receipts that are due

from the customers' side. This reports include all the information about trade debtors and all the

receivables, due dates and interest over the dues (Armitage, Webb and Glynn, 2016). The

management team of Aston Martin create this report on a regular basis so that it can review its

credit policies and increase the debtor turnover ratio. It helps in collecting the credits on time.

4

characteristics that are mentioned below:

Relevance: The information renders by the reporting system should be relevant to its

users. It means it should include all the materialistic data and content within it.

Trustworthy: The data in the reports must be updated and reliable so that managers can

make plans and decisions according to the current situations confidently (Klychova and others,

2014).

Accuracy: The data included in the reporting system must be accurate without any

mistakes and errors so that estimations can be calculated in the most effective manner.

Different types of reports

Performance Report: Performance reports are the evaluation of productivity and

efficiency of any individual or activity. These reports helps the mangers in planning for future

requirements in production (Melloni, 2015). The managerial accountant of selected organization

prepares this report on a quarterly basis to evaluate and comparing actual performance of the

employees to the budgeted figures.

Budget Report: All the organizations prepared budgets for different departments at the

beginning of the financial period. These budgets are compared with the actual outcomes at the

end of the accounting period. The variances and the reasons behind them are mentioned within

the budget reports. Aston Martin creates budget reports to find out the deviations and rectify

them accordingly.

Cost report: Managerial accounting system calculates the cost of manufacturing. The cost

of raw material, labour cost and other overheads are summarised in the cost reports. This report

allows the managers the ability to calculate the cost value of products and selling prices. The

management of Aston Martin prepares this cost report for each production to control and plan for

profit margins.

Accounts Ageing report: Accounts ageing report is a summary of receipts that are due

from the customers' side. This reports include all the information about trade debtors and all the

receivables, due dates and interest over the dues (Armitage, Webb and Glynn, 2016). The

management team of Aston Martin create this report on a regular basis so that it can review its

credit policies and increase the debtor turnover ratio. It helps in collecting the credits on time.

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TASK 2

P3 Appropriate costing techniques:

Cost: Cost can be defined as the amount that is incurred by the manufacturer in the entire

process of the sale of the products or services. The amount paid for raw material, labour cost,

other overheads such as administrative expenses, selling expenses, etc. are the costs for Aston

Martin that can be divided into such categories:

Direct cost: Direct cost is the type of cost that can be linked to the products directly.

These cost shows direct impact over the cost of the products such as labour cost, material cost,

machine hours, etc.

Indirect cost: The costs that are not directly accountable or assigned to a cost centre or

object are called indirect costs such as administration cost, security cost, personnel salary, etc.

Fixed cost: Fixed costs are those costs which do not increase or decrease with the change

in production level. These are the charges that company have to pay whether production is zero.

Variable cost: Variables costs as the name defines are the costs that fluctuate with the

change in the production level. Cost of raw material, packaging charges are the example of

variable costs (Laviana and others, 2016).

Cost Analysis: Cost analysis can be referred as to the evaluation of cost- output

relationship. This analysis method is used by the Aston Martin to assess the benefits of several

activities which are performed by the company to generate profit. Cost analysis is crucial for the

company to evaluate the cost of its products in context with other substitute products available in

the market.

Cost Volume profit: The analysis of cost volume profit is a method that evaluate the

impact of various level of costs and volumes over the operating profit of the firm. Aston Martin

use this break even analysis to find out the maximum level of production along with maximum

profitability.

Flexible Budgeting: Flexible budget is a type of budget that flex or adjust with the

changes in level or activity of the production. The management of the selected firm prepared

flexible budget to calculate the deviation among various level of production.

Cost Variance: Cost variance is the difference between estimated or standard costs and

actual costs. Aston Martin use this method to find out the reasons behind the variance and rectify

them accordingly (Kaunang and Walandouw, 2015).

5

P3 Appropriate costing techniques:

Cost: Cost can be defined as the amount that is incurred by the manufacturer in the entire

process of the sale of the products or services. The amount paid for raw material, labour cost,

other overheads such as administrative expenses, selling expenses, etc. are the costs for Aston

Martin that can be divided into such categories:

Direct cost: Direct cost is the type of cost that can be linked to the products directly.

These cost shows direct impact over the cost of the products such as labour cost, material cost,

machine hours, etc.

Indirect cost: The costs that are not directly accountable or assigned to a cost centre or

object are called indirect costs such as administration cost, security cost, personnel salary, etc.

Fixed cost: Fixed costs are those costs which do not increase or decrease with the change

in production level. These are the charges that company have to pay whether production is zero.

Variable cost: Variables costs as the name defines are the costs that fluctuate with the

change in the production level. Cost of raw material, packaging charges are the example of

variable costs (Laviana and others, 2016).

Cost Analysis: Cost analysis can be referred as to the evaluation of cost- output

relationship. This analysis method is used by the Aston Martin to assess the benefits of several

activities which are performed by the company to generate profit. Cost analysis is crucial for the

company to evaluate the cost of its products in context with other substitute products available in

the market.

Cost Volume profit: The analysis of cost volume profit is a method that evaluate the

impact of various level of costs and volumes over the operating profit of the firm. Aston Martin

use this break even analysis to find out the maximum level of production along with maximum

profitability.

Flexible Budgeting: Flexible budget is a type of budget that flex or adjust with the

changes in level or activity of the production. The management of the selected firm prepared

flexible budget to calculate the deviation among various level of production.

Cost Variance: Cost variance is the difference between estimated or standard costs and

actual costs. Aston Martin use this method to find out the reasons behind the variance and rectify

them accordingly (Kaunang and Walandouw, 2015).

5

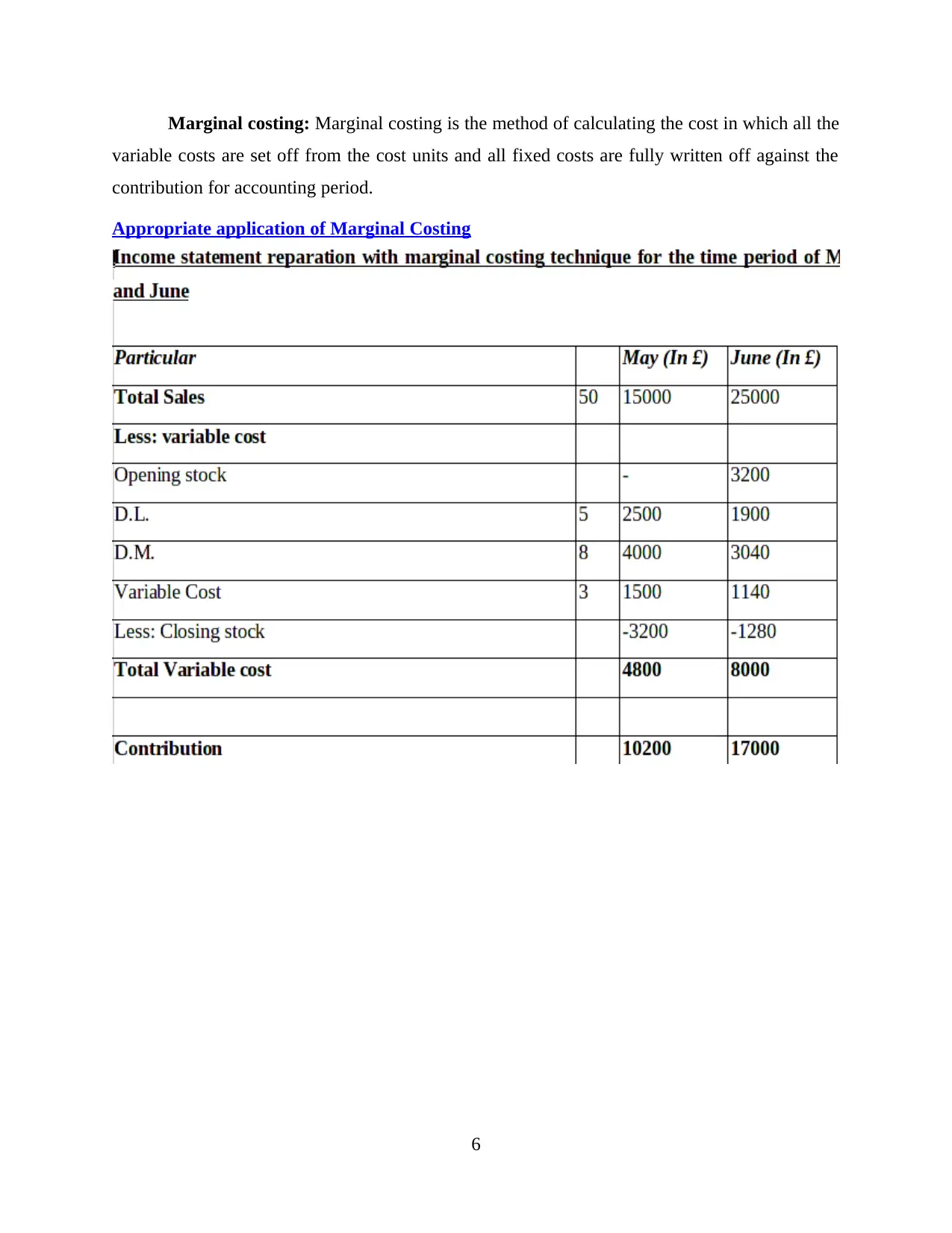

Marginal costing: Marginal costing is the method of calculating the cost in which all the

variable costs are set off from the cost units and all fixed costs are fully written off against the

contribution for accounting period.

Appropriate application of Marginal Costing

6

variable costs are set off from the cost units and all fixed costs are fully written off against the

contribution for accounting period.

Appropriate application of Marginal Costing

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Absorption Costing: This method of costing includes all the manufacturing costs and set

them off against cost units which means it includes variable as well as fixed manufacturing cost

in the calculation of cost of production.

7

them off against cost units which means it includes variable as well as fixed manufacturing cost

in the calculation of cost of production.

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Appropriate application of Marginal Costing

8

8

Interpretation of marginal and absorption costing

Profits from marginal costing for may are -550 and 5750 for June and in absorption

costing the net profits are 1050 and 9792.4. From the calculations it has been determined that

profits from absorption costing are high as it consider all the costs fro company.

9

Profits from marginal costing for may are -550 and 5750 for June and in absorption

costing the net profits are 1050 and 9792.4. From the calculations it has been determined that

profits from absorption costing are high as it consider all the costs fro company.

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 23

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.