Analyzing AstraZeneca plc: Financial Decision-Making and Ratios

VerifiedAdded on 2023/05/27

|19

|3878

|186

Report

AI Summary

This report provides a comprehensive financial analysis of AstraZeneca plc, a pharmaceutical company, using key financial ratios over a five-year period to evaluate its performance in terms of profitability, liquidity, efficiency, and gearing. The analysis reveals fluctuations in net profit, a slight fall in liquidity, and an increase in debt levels, suggesting areas for improvement in efficiency and capital structure. Additionally, the report explores investment appraisal techniques such as NPV and IRR to assess the viability of potential investments, and considers the possibility of acquiring another company. It concludes with an overall assessment of AstraZeneca plc's financial health and strategic options.

Running head: FINANCE FOR DECISION MAKING

Finance for Decision Making

Name of the Student:

Name of the University:

Author’s Note

Finance for Decision Making

Name of the Student:

Name of the University:

Author’s Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1FINANCE FOR DECISION MAKING

Table of Contents

1. Introduction..............................................................................................................................3

1.1 Rationale of the Report..........................................................................................................3

1.2 Background of the Company............................................................................................3

1.3 Main Findings...................................................................................................................4

1.4 Structure of the Report......................................................................................................4

2. Evaluation of Current Financial Performance..........................................................................4

2.1 Ratio Analysis........................................................................................................................4

2.2 Evaluation of Ratios........................................................................................................10

2.3 Limitation of Financial Ratios........................................................................................11

3. Future Investment Appraisal..................................................................................................11

3.1 Evaluation of NPV Analysis................................................................................................12

3.2 Evaluation of IRR method..............................................................................................12

3.3 Investment Appraisal Results..........................................................................................12

4. Acquisition of Other Company..............................................................................................14

4.1 Rationale of Choosing the Company...................................................................................14

4.2 Synergy Gain to the Business.........................................................................................14

4.3 Financing Needs..............................................................................................................14

4.4 Risk and Uncertainties....................................................................................................15

4.5 Implication of the Results...............................................................................................15

Table of Contents

1. Introduction..............................................................................................................................3

1.1 Rationale of the Report..........................................................................................................3

1.2 Background of the Company............................................................................................3

1.3 Main Findings...................................................................................................................4

1.4 Structure of the Report......................................................................................................4

2. Evaluation of Current Financial Performance..........................................................................4

2.1 Ratio Analysis........................................................................................................................4

2.2 Evaluation of Ratios........................................................................................................10

2.3 Limitation of Financial Ratios........................................................................................11

3. Future Investment Appraisal..................................................................................................11

3.1 Evaluation of NPV Analysis................................................................................................12

3.2 Evaluation of IRR method..............................................................................................12

3.3 Investment Appraisal Results..........................................................................................12

4. Acquisition of Other Company..............................................................................................14

4.1 Rationale of Choosing the Company...................................................................................14

4.2 Synergy Gain to the Business.........................................................................................14

4.3 Financing Needs..............................................................................................................14

4.4 Risk and Uncertainties....................................................................................................15

4.5 Implication of the Results...............................................................................................15

2FINANCE FOR DECISION MAKING

5. Conclusion..............................................................................................................................15

Reference.......................................................................................................................................17

5. Conclusion..............................................................................................................................15

Reference.......................................................................................................................................17

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3FINANCE FOR DECISION MAKING

1. Introduction

1.1 Rationale of the Report

The main purpose of this assessment is to analyze the financial statement of a company which

is engaged in the business of Pharmaceutical Company. The assessment would be analyzing the

financial performance of the business on the basis of key financial ratios of the company and the

same is computed for a period of five years. The company has also undertaken an investment for

which an investment appraisal is to be undertaken. The business would also be analyzing the

ability of the business to acquire another company.

1.2 Background of the Company

AstraZeneca plc is engaged in the business of Pharmaceutical business and the company is

Anglo-swedish in nature and is also considered to be a multinational company. The headquarter

of the company is situated in Cambridge and the business expends extensively on Research and

Development and the activities of the business is mainly carried out in three sites which are

Cambridge, Gaithersbury and Maryland (Astrazeneca.com. 2018). The company is known to

produce the best medicines for serious diseases. The company was formed through a merger

agreement between companies Astra AB and Zeneca Group. The profit of the business for the

year 2017 is shown to be $ 2,868 million and the same is shown to have significantly improved

over the years. This shows that the business is growing in terms of generation of profits of the

business.

1. Introduction

1.1 Rationale of the Report

The main purpose of this assessment is to analyze the financial statement of a company which

is engaged in the business of Pharmaceutical Company. The assessment would be analyzing the

financial performance of the business on the basis of key financial ratios of the company and the

same is computed for a period of five years. The company has also undertaken an investment for

which an investment appraisal is to be undertaken. The business would also be analyzing the

ability of the business to acquire another company.

1.2 Background of the Company

AstraZeneca plc is engaged in the business of Pharmaceutical business and the company is

Anglo-swedish in nature and is also considered to be a multinational company. The headquarter

of the company is situated in Cambridge and the business expends extensively on Research and

Development and the activities of the business is mainly carried out in three sites which are

Cambridge, Gaithersbury and Maryland (Astrazeneca.com. 2018). The company is known to

produce the best medicines for serious diseases. The company was formed through a merger

agreement between companies Astra AB and Zeneca Group. The profit of the business for the

year 2017 is shown to be $ 2,868 million and the same is shown to have significantly improved

over the years. This shows that the business is growing in terms of generation of profits of the

business.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4FINANCE FOR DECISION MAKING

1.3 Main Findings

The main findings of the assessment is to effectively analyze the financial situation of the

AstraZeneca plc and also conduct investment appraisal techniques for deciding whether the

project which the management wants to invest in is worth making investment or not.

1.4 Structure of the Report

The assessment includes details analysis of the financial performance of the business for

which is to be evaluated with the help of key financial ratios which are included in section 2 of

the assessment. The section 3 of the assessment would be considering the investment which the

company is considering and the same will be evaluated on the basis of investment appraisal

techniques like NPV and IRR approach. The section 4 would be containing an analysis of the

option whether the company can acquire a business of a anther company or not. The last section

which is section 5 would be stating the conclusion of the analysis which is conducted in he

earlier sections.

2. Evaluation of Current Financial Performance

2.1 Ratio Analysis

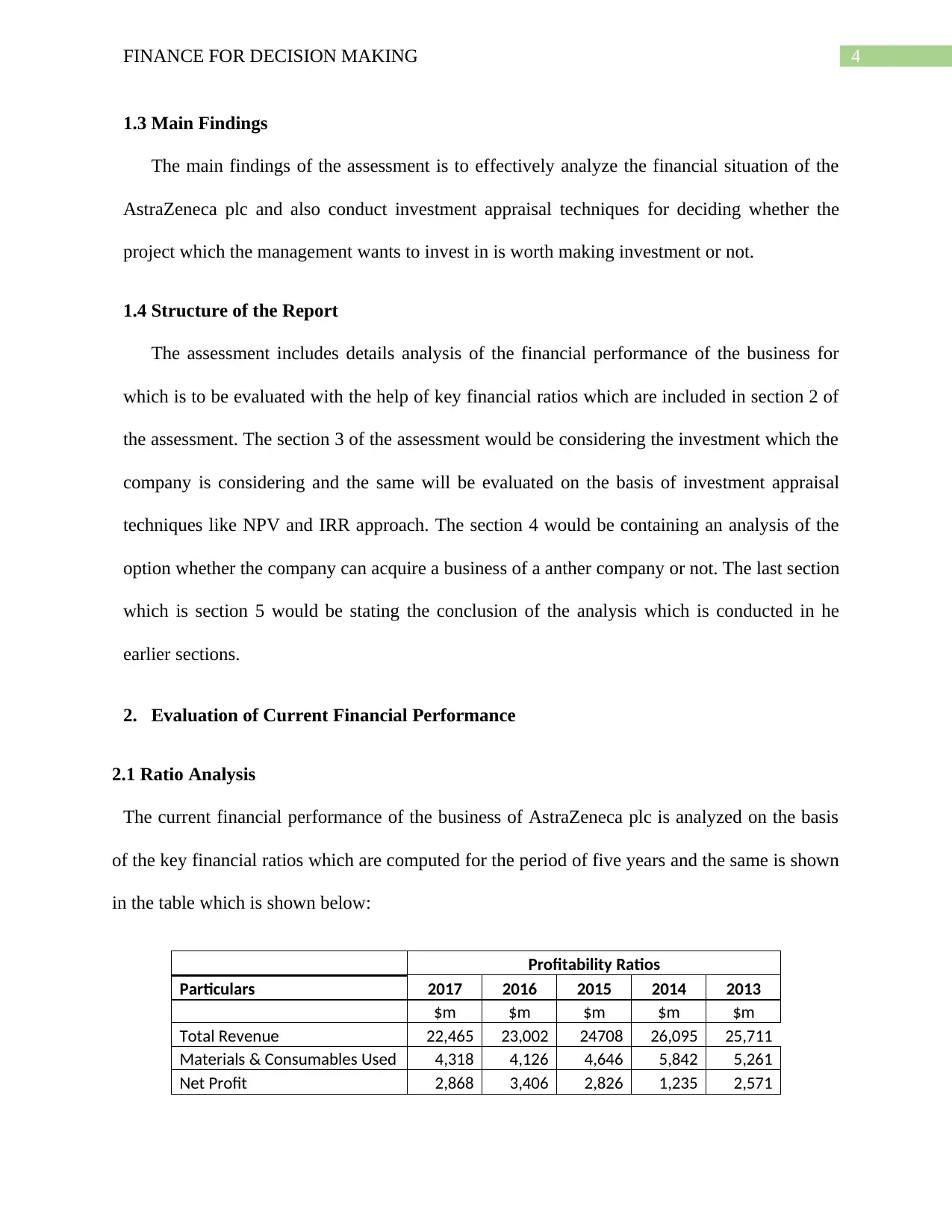

The current financial performance of the business of AstraZeneca plc is analyzed on the basis

of the key financial ratios which are computed for the period of five years and the same is shown

in the table which is shown below:

Profitability Ratios

Particulars 2017 2016 2015 2014 2013

$m $m $m $m $m

Total Revenue 22,465 23,002 24708 26,095 25,711

Materials & Consumables Used 4,318 4,126 4,646 5,842 5,261

Net Profit 2,868 3,406 2,826 1,235 2,571

1.3 Main Findings

The main findings of the assessment is to effectively analyze the financial situation of the

AstraZeneca plc and also conduct investment appraisal techniques for deciding whether the

project which the management wants to invest in is worth making investment or not.

1.4 Structure of the Report

The assessment includes details analysis of the financial performance of the business for

which is to be evaluated with the help of key financial ratios which are included in section 2 of

the assessment. The section 3 of the assessment would be considering the investment which the

company is considering and the same will be evaluated on the basis of investment appraisal

techniques like NPV and IRR approach. The section 4 would be containing an analysis of the

option whether the company can acquire a business of a anther company or not. The last section

which is section 5 would be stating the conclusion of the analysis which is conducted in he

earlier sections.

2. Evaluation of Current Financial Performance

2.1 Ratio Analysis

The current financial performance of the business of AstraZeneca plc is analyzed on the basis

of the key financial ratios which are computed for the period of five years and the same is shown

in the table which is shown below:

Profitability Ratios

Particulars 2017 2016 2015 2014 2013

$m $m $m $m $m

Total Revenue 22,465 23,002 24708 26,095 25,711

Materials & Consumables Used 4,318 4,126 4,646 5,842 5,261

Net Profit 2,868 3,406 2,826 1,235 2,571

5FINANCE FOR DECISION MAKING

Total Assets 63,354 62,526 60,056 58,595 55,899

Total equity 16,642 16,669 18,509 19,646 23,253

Gross Profit 18,147 18,876 20,062 20,253 20,450

Gross Profit Margin 80.78% 82.06% 81.20% 77.61% 79.54%

Net Profit Margin 12.77% 14.81% 11.44% 4.73% 10.00%

Gearing Ratios

Particulars 2017 2016 2015 2014 2013

$m $m $m $m $m

Total Assets 63354 62526 60056 58595 55899

Total equity 16642 16669 18509 19646 23253

Total Liabilities 46712 45857 41547 38949 32646

Debt-to-Equity Ratio 2.807 2.751 2.245 1.983 1.404

Debt Ratio 0.737 0.733 0.692 0.665 0.584

Efficiency Ratio

Particulars 2017 2016 2015 2014 2013

$m $m $m $m $m

Inventory 3,035 2,334 2,143 1,960 1,909

Trade Receivables 5,009 4,573 6,622 7,232 7,879

Cost of Goods Sold 4318 4126 4646 5842 5261

Sales Revenue 22465 23002 24708 26095 25711

Inventory Turnover Ratio 1.423 1.768 2.168 2.981 2.756

Receivables Turnover Ratio 4.485 5.030 3.731 3.608 3.263

Liquidity Ratio

Particulars 2017 2016 2015 2014 2013

$m $m $m $m $m

Current Assets 13,150 13,262 16,007 16,697 20,335

Current Liabilities 16,383 15,256 14,869 17,330 16,051

Inventory 3035 2334 2143 1960 1909

Current Ratio 0.803 0.869 1.077 0.963 1.267

Total Assets 63,354 62,526 60,056 58,595 55,899

Total equity 16,642 16,669 18,509 19,646 23,253

Gross Profit 18,147 18,876 20,062 20,253 20,450

Gross Profit Margin 80.78% 82.06% 81.20% 77.61% 79.54%

Net Profit Margin 12.77% 14.81% 11.44% 4.73% 10.00%

Gearing Ratios

Particulars 2017 2016 2015 2014 2013

$m $m $m $m $m

Total Assets 63354 62526 60056 58595 55899

Total equity 16642 16669 18509 19646 23253

Total Liabilities 46712 45857 41547 38949 32646

Debt-to-Equity Ratio 2.807 2.751 2.245 1.983 1.404

Debt Ratio 0.737 0.733 0.692 0.665 0.584

Efficiency Ratio

Particulars 2017 2016 2015 2014 2013

$m $m $m $m $m

Inventory 3,035 2,334 2,143 1,960 1,909

Trade Receivables 5,009 4,573 6,622 7,232 7,879

Cost of Goods Sold 4318 4126 4646 5842 5261

Sales Revenue 22465 23002 24708 26095 25711

Inventory Turnover Ratio 1.423 1.768 2.168 2.981 2.756

Receivables Turnover Ratio 4.485 5.030 3.731 3.608 3.263

Liquidity Ratio

Particulars 2017 2016 2015 2014 2013

$m $m $m $m $m

Current Assets 13,150 13,262 16,007 16,697 20,335

Current Liabilities 16,383 15,256 14,869 17,330 16,051

Inventory 3035 2334 2143 1960 1909

Current Ratio 0.803 0.869 1.077 0.963 1.267

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6FINANCE FOR DECISION MAKING

Quick ratio 0.617 0.716 0.932 0.850 1.148

Profitability Ratios

The above tables which are shown above, depicts the key areas of the business which are

liquidity, solvency, profitability and gearing ratios. The profitability ratio table shows gross

profit margin and net profit ratio of the business. Both the estimates are considered to be

important indicators for overall success of the business (Delen, Kuzey and Uyar 2013). The gross

profit ratio shows 80.28% for the year 2017 which depicts that the profitability of the business

has fallen slightly in comparison to previous year’s estimate. Similarly, the net profit ratio has

also decreased from previous year’s analysis which suggest that the overall profitability of

AstraZeneca plc has reduced significantly. The main reason which can be suggested for the fall

in the profitability of the business is due to fall in the sales of the business in comparison to

previous year. In a similar situation, the main competitor of AstraZeneca plc which is Pfizer has

experienced an increase in the profitability of the business (Ongore and Kusa 2013). The

profitability ratios of the business is depicted in the graph below:

Quick ratio 0.617 0.716 0.932 0.850 1.148

Profitability Ratios

The above tables which are shown above, depicts the key areas of the business which are

liquidity, solvency, profitability and gearing ratios. The profitability ratio table shows gross

profit margin and net profit ratio of the business. Both the estimates are considered to be

important indicators for overall success of the business (Delen, Kuzey and Uyar 2013). The gross

profit ratio shows 80.28% for the year 2017 which depicts that the profitability of the business

has fallen slightly in comparison to previous year’s estimate. Similarly, the net profit ratio has

also decreased from previous year’s analysis which suggest that the overall profitability of

AstraZeneca plc has reduced significantly. The main reason which can be suggested for the fall

in the profitability of the business is due to fall in the sales of the business in comparison to

previous year. In a similar situation, the main competitor of AstraZeneca plc which is Pfizer has

experienced an increase in the profitability of the business (Ongore and Kusa 2013). The

profitability ratios of the business is depicted in the graph below:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7FINANCE FOR DECISION MAKING

2017 2016 2015 2014 2013

0.00%

2.00%

4.00%

6.00%

8.00%

10.00%

12.00%

14.00%

16.00%

Net Profit Margin

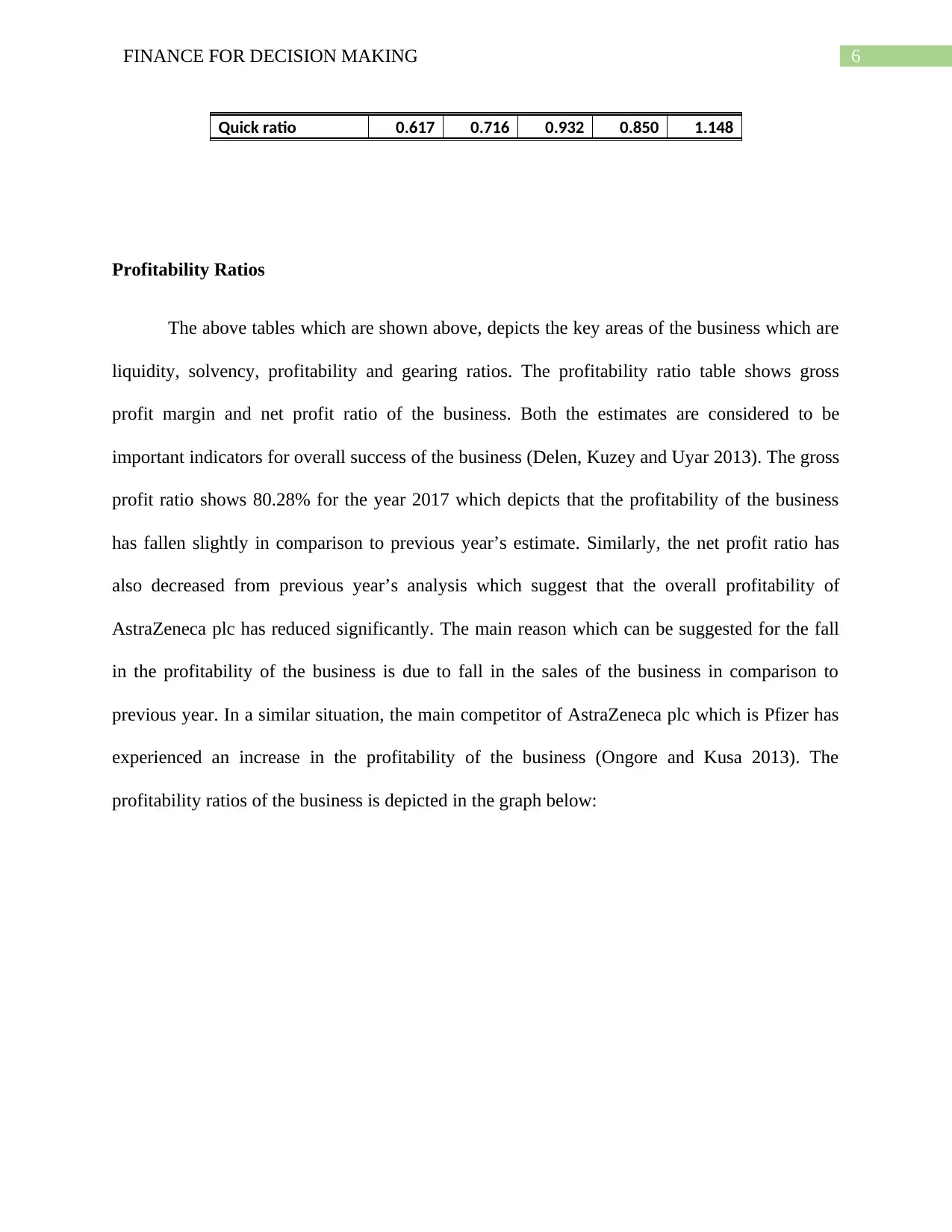

Figure 1: (Chart Showing Net profit ratio)

Source: (Created by the author)

The graph shows fluctuation in net profit of the business and the same is shown to be

highest in 2016 from where there is a slight fall.

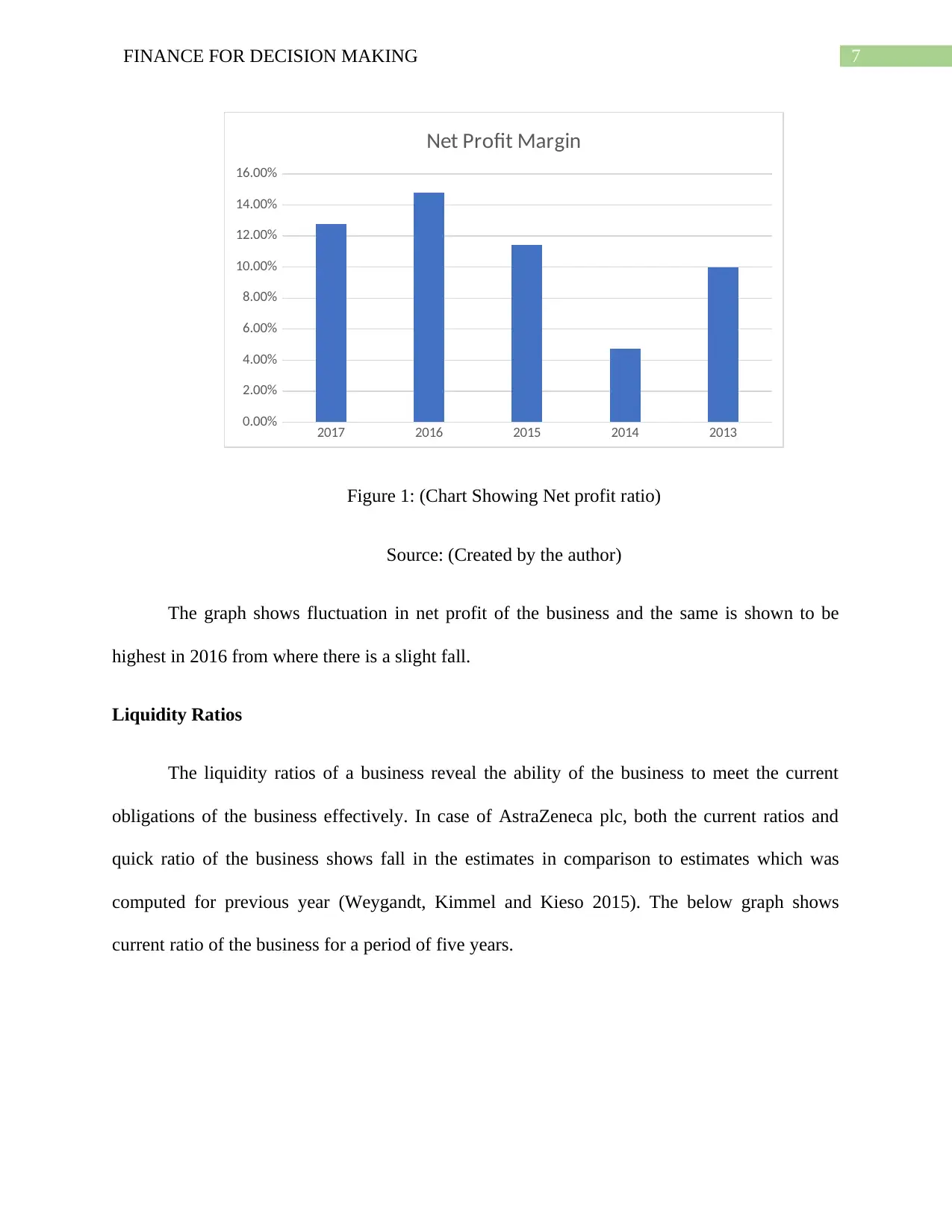

Liquidity Ratios

The liquidity ratios of a business reveal the ability of the business to meet the current

obligations of the business effectively. In case of AstraZeneca plc, both the current ratios and

quick ratio of the business shows fall in the estimates in comparison to estimates which was

computed for previous year (Weygandt, Kimmel and Kieso 2015). The below graph shows

current ratio of the business for a period of five years.

2017 2016 2015 2014 2013

0.00%

2.00%

4.00%

6.00%

8.00%

10.00%

12.00%

14.00%

16.00%

Net Profit Margin

Figure 1: (Chart Showing Net profit ratio)

Source: (Created by the author)

The graph shows fluctuation in net profit of the business and the same is shown to be

highest in 2016 from where there is a slight fall.

Liquidity Ratios

The liquidity ratios of a business reveal the ability of the business to meet the current

obligations of the business effectively. In case of AstraZeneca plc, both the current ratios and

quick ratio of the business shows fall in the estimates in comparison to estimates which was

computed for previous year (Weygandt, Kimmel and Kieso 2015). The below graph shows

current ratio of the business for a period of five years.

8FINANCE FOR DECISION MAKING

2017 2016 2015 2014 2013

0.000

0.200

0.400

0.600

0.800

1.000

1.200

1.400

Current Rati o

Figure 2: (Chart Showing Current ratio)

Source: (Created by the author)

The above chart represents the current ratio for AstraZeneca plc for a period of five years

and the estimates for the current year shows that improvement is need to be made to the current

ratio of the business or the business might face financial crisis in future.

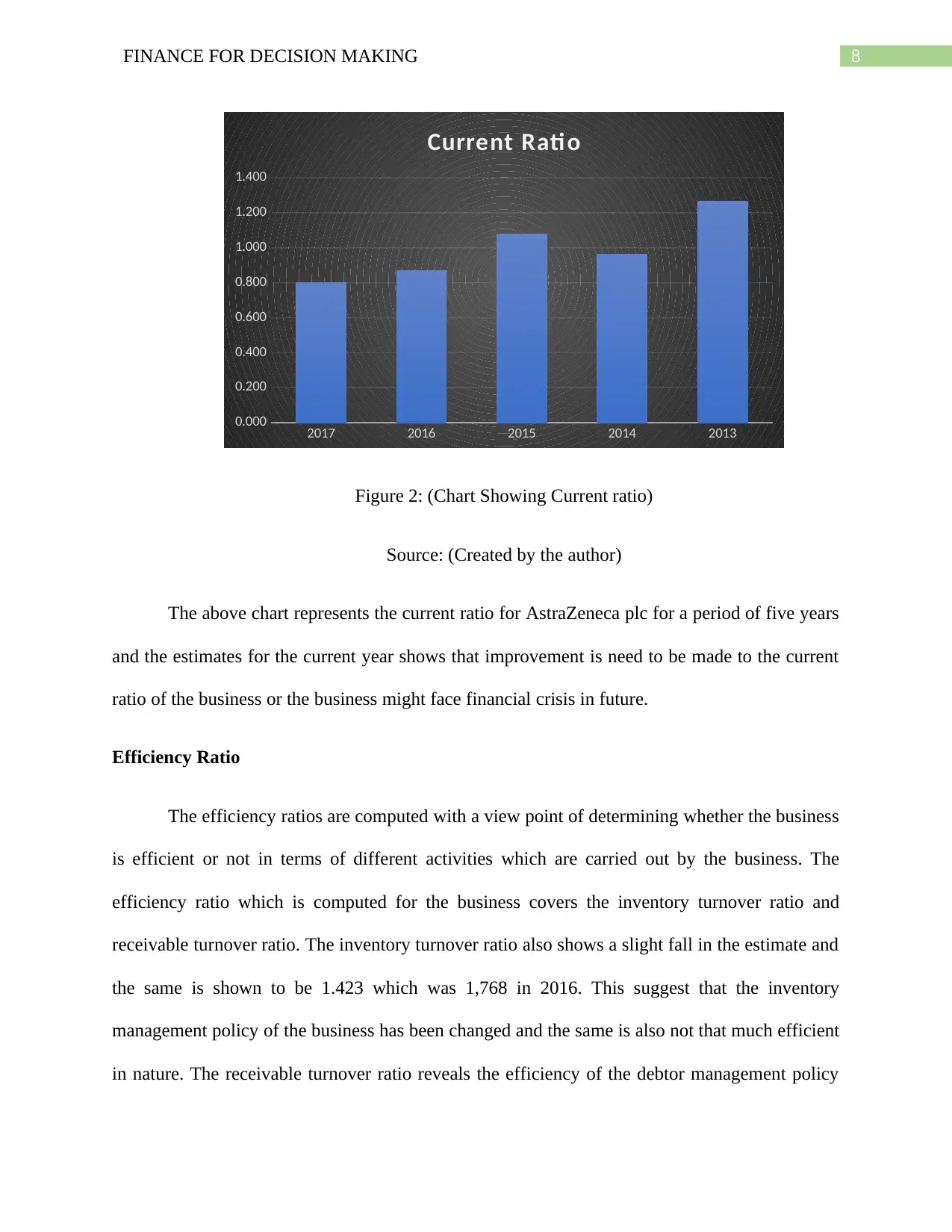

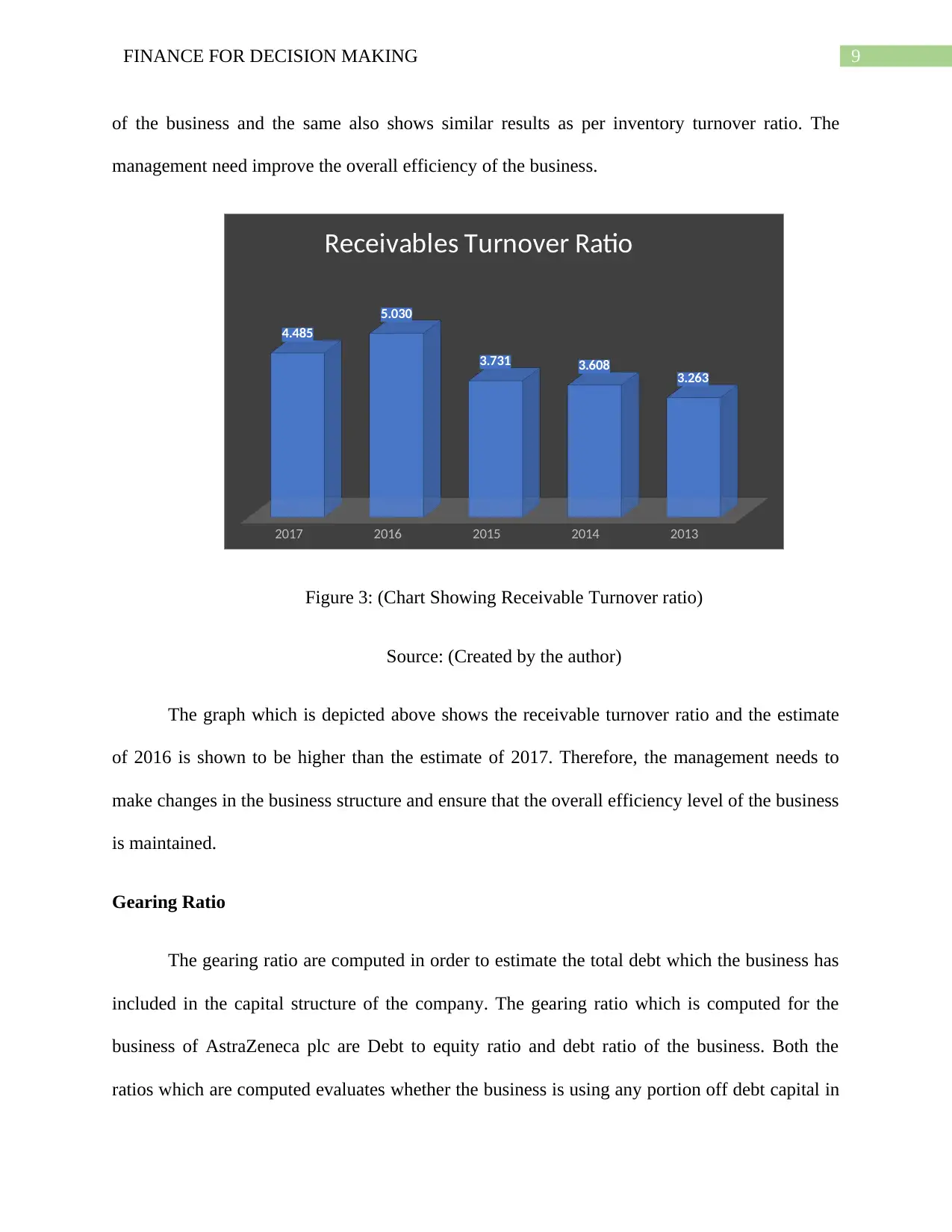

Efficiency Ratio

The efficiency ratios are computed with a view point of determining whether the business

is efficient or not in terms of different activities which are carried out by the business. The

efficiency ratio which is computed for the business covers the inventory turnover ratio and

receivable turnover ratio. The inventory turnover ratio also shows a slight fall in the estimate and

the same is shown to be 1.423 which was 1,768 in 2016. This suggest that the inventory

management policy of the business has been changed and the same is also not that much efficient

in nature. The receivable turnover ratio reveals the efficiency of the debtor management policy

2017 2016 2015 2014 2013

0.000

0.200

0.400

0.600

0.800

1.000

1.200

1.400

Current Rati o

Figure 2: (Chart Showing Current ratio)

Source: (Created by the author)

The above chart represents the current ratio for AstraZeneca plc for a period of five years

and the estimates for the current year shows that improvement is need to be made to the current

ratio of the business or the business might face financial crisis in future.

Efficiency Ratio

The efficiency ratios are computed with a view point of determining whether the business

is efficient or not in terms of different activities which are carried out by the business. The

efficiency ratio which is computed for the business covers the inventory turnover ratio and

receivable turnover ratio. The inventory turnover ratio also shows a slight fall in the estimate and

the same is shown to be 1.423 which was 1,768 in 2016. This suggest that the inventory

management policy of the business has been changed and the same is also not that much efficient

in nature. The receivable turnover ratio reveals the efficiency of the debtor management policy

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9FINANCE FOR DECISION MAKING

of the business and the same also shows similar results as per inventory turnover ratio. The

management need improve the overall efficiency of the business.

2017 2016 2015 2014 2013

4.485

5.030

3.731 3.608 3.263

Receivables Turnover Ratio

Figure 3: (Chart Showing Receivable Turnover ratio)

Source: (Created by the author)

The graph which is depicted above shows the receivable turnover ratio and the estimate

of 2016 is shown to be higher than the estimate of 2017. Therefore, the management needs to

make changes in the business structure and ensure that the overall efficiency level of the business

is maintained.

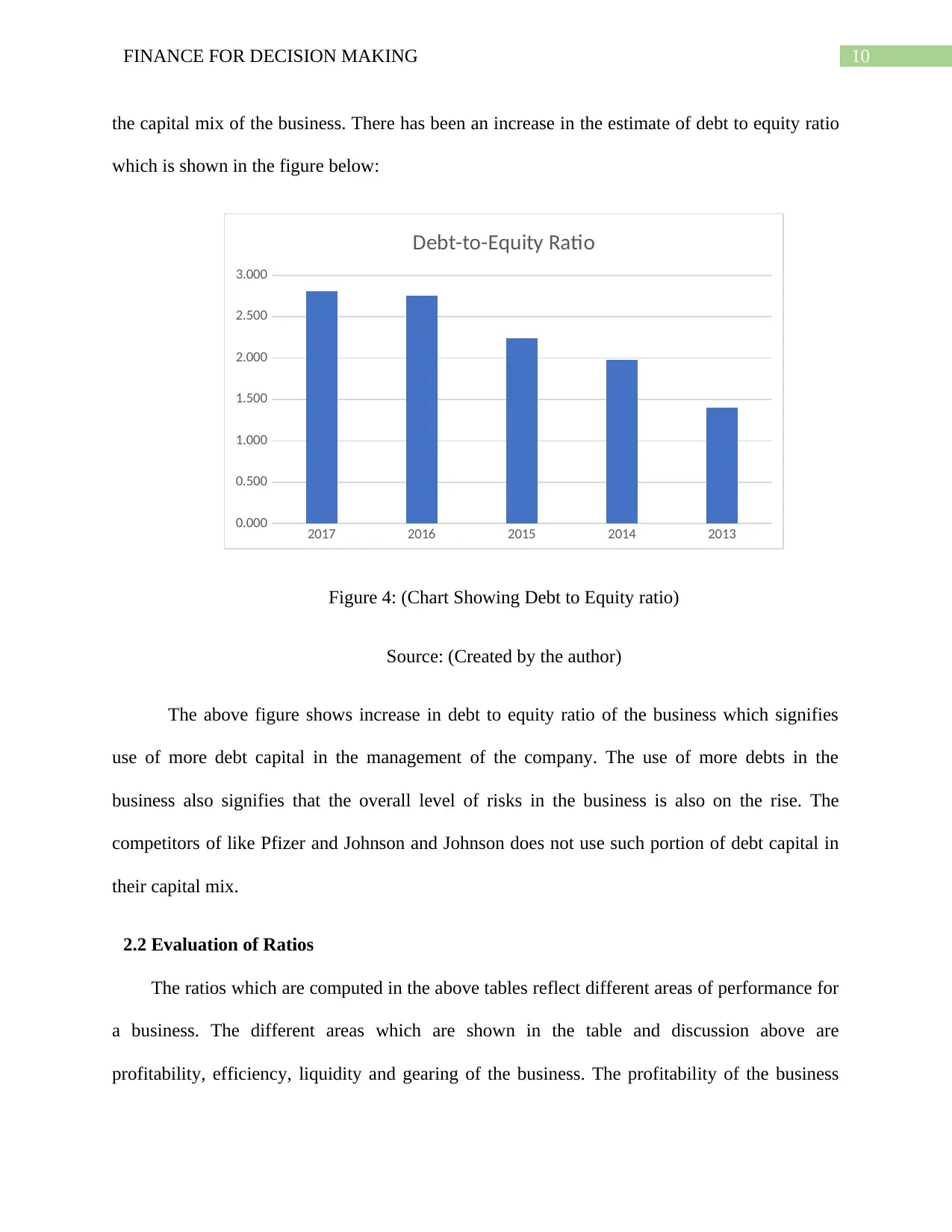

Gearing Ratio

The gearing ratio are computed in order to estimate the total debt which the business has

included in the capital structure of the company. The gearing ratio which is computed for the

business of AstraZeneca plc are Debt to equity ratio and debt ratio of the business. Both the

ratios which are computed evaluates whether the business is using any portion off debt capital in

of the business and the same also shows similar results as per inventory turnover ratio. The

management need improve the overall efficiency of the business.

2017 2016 2015 2014 2013

4.485

5.030

3.731 3.608 3.263

Receivables Turnover Ratio

Figure 3: (Chart Showing Receivable Turnover ratio)

Source: (Created by the author)

The graph which is depicted above shows the receivable turnover ratio and the estimate

of 2016 is shown to be higher than the estimate of 2017. Therefore, the management needs to

make changes in the business structure and ensure that the overall efficiency level of the business

is maintained.

Gearing Ratio

The gearing ratio are computed in order to estimate the total debt which the business has

included in the capital structure of the company. The gearing ratio which is computed for the

business of AstraZeneca plc are Debt to equity ratio and debt ratio of the business. Both the

ratios which are computed evaluates whether the business is using any portion off debt capital in

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10FINANCE FOR DECISION MAKING

the capital mix of the business. There has been an increase in the estimate of debt to equity ratio

which is shown in the figure below:

2017 2016 2015 2014 2013

0.000

0.500

1.000

1.500

2.000

2.500

3.000

Debt-to-Equity Ratio

Figure 4: (Chart Showing Debt to Equity ratio)

Source: (Created by the author)

The above figure shows increase in debt to equity ratio of the business which signifies

use of more debt capital in the management of the company. The use of more debts in the

business also signifies that the overall level of risks in the business is also on the rise. The

competitors of like Pfizer and Johnson and Johnson does not use such portion of debt capital in

their capital mix.

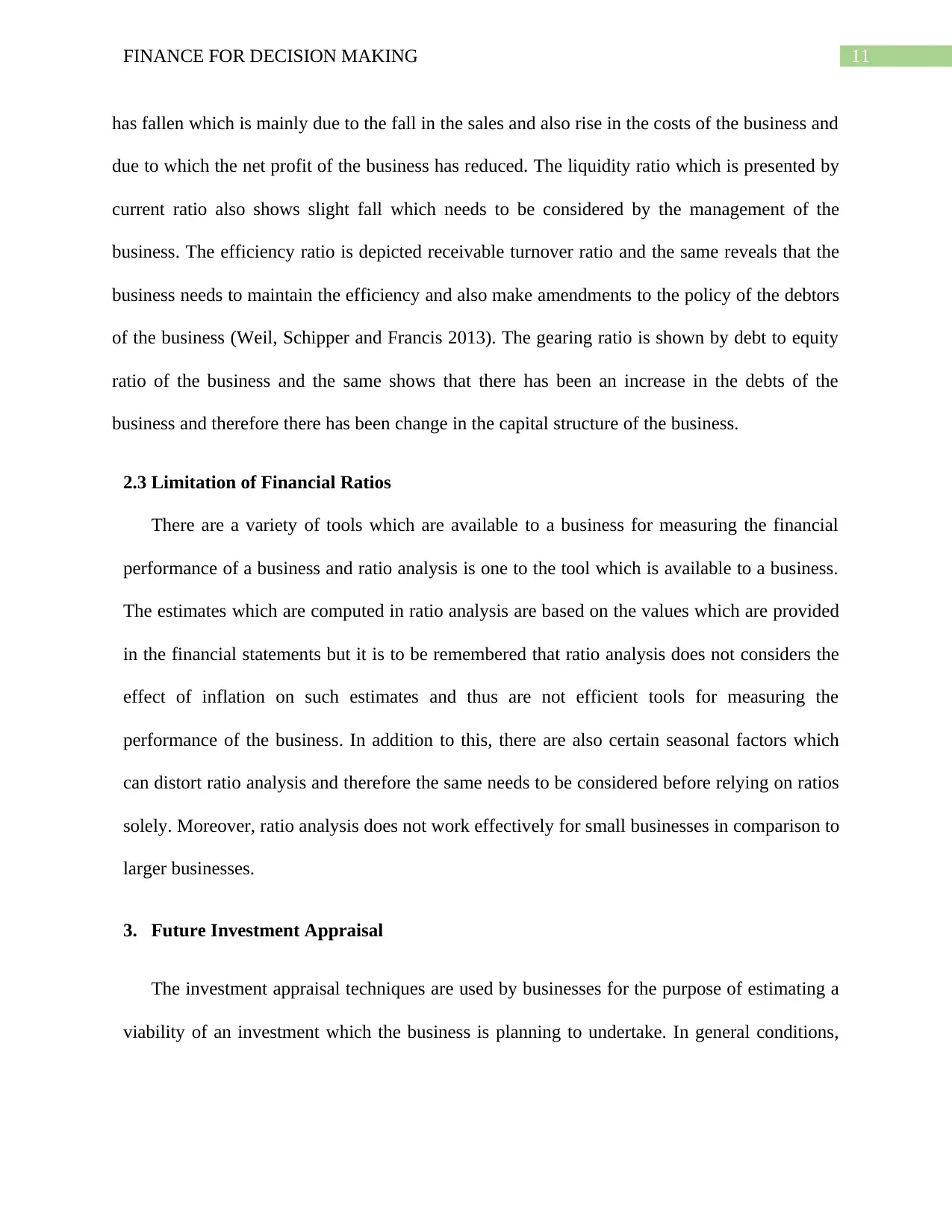

2.2 Evaluation of Ratios

The ratios which are computed in the above tables reflect different areas of performance for

a business. The different areas which are shown in the table and discussion above are

profitability, efficiency, liquidity and gearing of the business. The profitability of the business

the capital mix of the business. There has been an increase in the estimate of debt to equity ratio

which is shown in the figure below:

2017 2016 2015 2014 2013

0.000

0.500

1.000

1.500

2.000

2.500

3.000

Debt-to-Equity Ratio

Figure 4: (Chart Showing Debt to Equity ratio)

Source: (Created by the author)

The above figure shows increase in debt to equity ratio of the business which signifies

use of more debt capital in the management of the company. The use of more debts in the

business also signifies that the overall level of risks in the business is also on the rise. The

competitors of like Pfizer and Johnson and Johnson does not use such portion of debt capital in

their capital mix.

2.2 Evaluation of Ratios

The ratios which are computed in the above tables reflect different areas of performance for

a business. The different areas which are shown in the table and discussion above are

profitability, efficiency, liquidity and gearing of the business. The profitability of the business

11FINANCE FOR DECISION MAKING

has fallen which is mainly due to the fall in the sales and also rise in the costs of the business and

due to which the net profit of the business has reduced. The liquidity ratio which is presented by

current ratio also shows slight fall which needs to be considered by the management of the

business. The efficiency ratio is depicted receivable turnover ratio and the same reveals that the

business needs to maintain the efficiency and also make amendments to the policy of the debtors

of the business (Weil, Schipper and Francis 2013). The gearing ratio is shown by debt to equity

ratio of the business and the same shows that there has been an increase in the debts of the

business and therefore there has been change in the capital structure of the business.

2.3 Limitation of Financial Ratios

There are a variety of tools which are available to a business for measuring the financial

performance of a business and ratio analysis is one to the tool which is available to a business.

The estimates which are computed in ratio analysis are based on the values which are provided

in the financial statements but it is to be remembered that ratio analysis does not considers the

effect of inflation on such estimates and thus are not efficient tools for measuring the

performance of the business. In addition to this, there are also certain seasonal factors which

can distort ratio analysis and therefore the same needs to be considered before relying on ratios

solely. Moreover, ratio analysis does not work effectively for small businesses in comparison to

larger businesses.

3. Future Investment Appraisal

The investment appraisal techniques are used by businesses for the purpose of estimating a

viability of an investment which the business is planning to undertake. In general conditions,

has fallen which is mainly due to the fall in the sales and also rise in the costs of the business and

due to which the net profit of the business has reduced. The liquidity ratio which is presented by

current ratio also shows slight fall which needs to be considered by the management of the

business. The efficiency ratio is depicted receivable turnover ratio and the same reveals that the

business needs to maintain the efficiency and also make amendments to the policy of the debtors

of the business (Weil, Schipper and Francis 2013). The gearing ratio is shown by debt to equity

ratio of the business and the same shows that there has been an increase in the debts of the

business and therefore there has been change in the capital structure of the business.

2.3 Limitation of Financial Ratios

There are a variety of tools which are available to a business for measuring the financial

performance of a business and ratio analysis is one to the tool which is available to a business.

The estimates which are computed in ratio analysis are based on the values which are provided

in the financial statements but it is to be remembered that ratio analysis does not considers the

effect of inflation on such estimates and thus are not efficient tools for measuring the

performance of the business. In addition to this, there are also certain seasonal factors which

can distort ratio analysis and therefore the same needs to be considered before relying on ratios

solely. Moreover, ratio analysis does not work effectively for small businesses in comparison to

larger businesses.

3. Future Investment Appraisal

The investment appraisal techniques are used by businesses for the purpose of estimating a

viability of an investment which the business is planning to undertake. In general conditions,

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.