FINA6000 - Managing Finance: ASX Company Financial Analysis Report

VerifiedAdded on 2022/09/18

|39

|5023

|24

Report

AI Summary

This report provides a comprehensive financial analysis of two ASX-listed companies, AusNet Services Limited and AGL Limited, both operating in the utilities industry. The analysis includes a detailed examination of their financial performance, focusing on profitability, liquidity, and investment ratios. The report also delves into the capital structures of both companies, calculating the weighted average cost of capital and exploring relative valuation based on market-to-book value ratios. Through this in-depth assessment, the report aims to provide insights into the financial health and investment potential of each company, ultimately concluding with a recommendation on which company presents a more favorable investment opportunity. The analysis covers a five-year period and utilizes various financial metrics to assess the companies' efficiency and effectiveness. The report includes an executive summary, introduction, financial analysis, profitability ratios, liquidity ratios, investment ratios, capital structures, historical weighted average cost of capital, discounted cash flow approach, relative valuation, conclusion, references, and an appendix.

MANAGING FINANCE 1

MANAGING

FINANCE

MANAGING

FINANCE

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

MANAGING FINANCE 2

Executive summary:

This report aims selecting two comapneis that are listed on ASX. The companies chosen are

AusNet Services Limited and AGL Limited. Both of these companies belong to the industry

of “Utilities”. The report contains the financial analysis of these companies. Also, it talks

about the weighted average cost of capital, capital structure, and financial ratios. In the end it

talks about the relative book value per share of these companies. Form the report, it can be

stated that an investment should be done in AGL Limited since it seems to be improving in

terms of its efficiency and effectiveness.

Executive summary:

This report aims selecting two comapneis that are listed on ASX. The companies chosen are

AusNet Services Limited and AGL Limited. Both of these companies belong to the industry

of “Utilities”. The report contains the financial analysis of these companies. Also, it talks

about the weighted average cost of capital, capital structure, and financial ratios. In the end it

talks about the relative book value per share of these companies. Form the report, it can be

stated that an investment should be done in AGL Limited since it seems to be improving in

terms of its efficiency and effectiveness.

MANAGING FINANCE 3

Contents

Introduction:...............................................................................................................................4

Financial analysis:......................................................................................................................4

Profitability ratios:...............................................................................................................11

Liquidity ratios:....................................................................................................................12

Investment ratios:.................................................................................................................13

Capital structures of the companies:........................................................................................14

Historical weighted average cost of capital:............................................................................17

Discounted cash flow approach:..............................................................................................19

Relative valuation which is based on a market to book value ratio:........................................21

Conclusion:..............................................................................................................................22

References:...............................................................................................................................23

References...........................................................................................................................23

Appendix:................................................................................................................................24

Contents

Introduction:...............................................................................................................................4

Financial analysis:......................................................................................................................4

Profitability ratios:...............................................................................................................11

Liquidity ratios:....................................................................................................................12

Investment ratios:.................................................................................................................13

Capital structures of the companies:........................................................................................14

Historical weighted average cost of capital:............................................................................17

Discounted cash flow approach:..............................................................................................19

Relative valuation which is based on a market to book value ratio:........................................21

Conclusion:..............................................................................................................................22

References:...............................................................................................................................23

References...........................................................................................................................23

Appendix:................................................................................................................................24

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

MANAGING FINANCE 4

Introduction:

The first company chosen for the purposes of this assignment is AusNet Services which is a

company incorporated in Australia and is an energy company. The company is listed on the

Australian Securities Exchange and also on the Singapore Exchange. The shares to the extent

of 31.1% has been owned by Singapore Power and to the extent of 19.9% by the State Grid

Corporation of china and the remaining % has been owned by the public at large. Singapore

Power has been owned by Singapore investment fund Temasek which is owned by the

Singapore government. Sate Grid company is the company which is an electric company

owned by the state and has a monopoly over the country of China and is also the largest

utility company in the world (AusNet Services, 2020).

The second company chosen for review is AGL Energy Limited which is again a listed

company on Australian Stock Exchange. This is the company which is involved in the

activities of generation, retailing of electricity and has for the residential and the commercial

purposes. The company generates energy from various power stations and use the thermal

power, natural gas, wind power along with hydroelectricity, solar energy etc. sources (AGL

Limited, 2020).

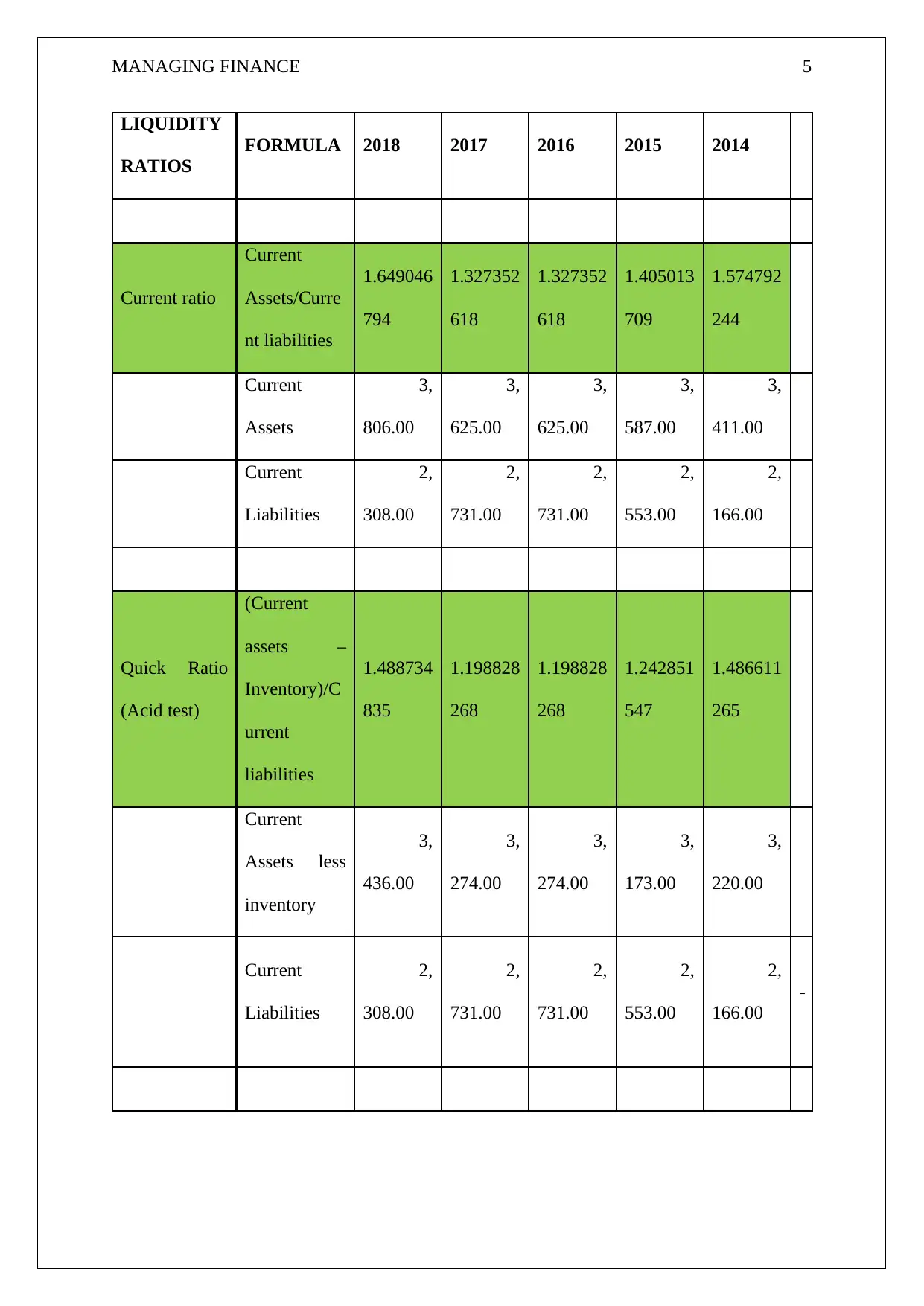

Financial analysis:

The following table shows the calculated ratios:

30 June ended

Particulars Formula (Amounts in $ in millions)

Introduction:

The first company chosen for the purposes of this assignment is AusNet Services which is a

company incorporated in Australia and is an energy company. The company is listed on the

Australian Securities Exchange and also on the Singapore Exchange. The shares to the extent

of 31.1% has been owned by Singapore Power and to the extent of 19.9% by the State Grid

Corporation of china and the remaining % has been owned by the public at large. Singapore

Power has been owned by Singapore investment fund Temasek which is owned by the

Singapore government. Sate Grid company is the company which is an electric company

owned by the state and has a monopoly over the country of China and is also the largest

utility company in the world (AusNet Services, 2020).

The second company chosen for review is AGL Energy Limited which is again a listed

company on Australian Stock Exchange. This is the company which is involved in the

activities of generation, retailing of electricity and has for the residential and the commercial

purposes. The company generates energy from various power stations and use the thermal

power, natural gas, wind power along with hydroelectricity, solar energy etc. sources (AGL

Limited, 2020).

Financial analysis:

The following table shows the calculated ratios:

30 June ended

Particulars Formula (Amounts in $ in millions)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

MANAGING FINANCE 5

LIQUIDITY

RATIOS

FORMULA 2018 2017 2016 2015 2014

Current ratio

Current

Assets/Curre

nt liabilities

1.649046

794

1.327352

618

1.327352

618

1.405013

709

1.574792

244

Current

Assets

3,

806.00

3,

625.00

3,

625.00

3,

587.00

3,

411.00

Current

Liabilities

2,

308.00

2,

731.00

2,

731.00

2,

553.00

2,

166.00

Quick Ratio

(Acid test)

(Current

assets –

Inventory)/C

urrent

liabilities

1.488734

835

1.198828

268

1.198828

268

1.242851

547

1.486611

265

Current

Assets less

inventory

3,

436.00

3,

274.00

3,

274.00

3,

173.00

3,

220.00

Current

Liabilities

2,

308.00

2,

731.00

2,

731.00

2,

553.00

2,

166.00

-

LIQUIDITY

RATIOS

FORMULA 2018 2017 2016 2015 2014

Current ratio

Current

Assets/Curre

nt liabilities

1.649046

794

1.327352

618

1.327352

618

1.405013

709

1.574792

244

Current

Assets

3,

806.00

3,

625.00

3,

625.00

3,

587.00

3,

411.00

Current

Liabilities

2,

308.00

2,

731.00

2,

731.00

2,

553.00

2,

166.00

Quick Ratio

(Acid test)

(Current

assets –

Inventory)/C

urrent

liabilities

1.488734

835

1.198828

268

1.198828

268

1.242851

547

1.486611

265

Current

Assets less

inventory

3,

436.00

3,

274.00

3,

274.00

3,

173.00

3,

220.00

Current

Liabilities

2,

308.00

2,

731.00

2,

731.00

2,

553.00

2,

166.00

-

MANAGING FINANCE 6

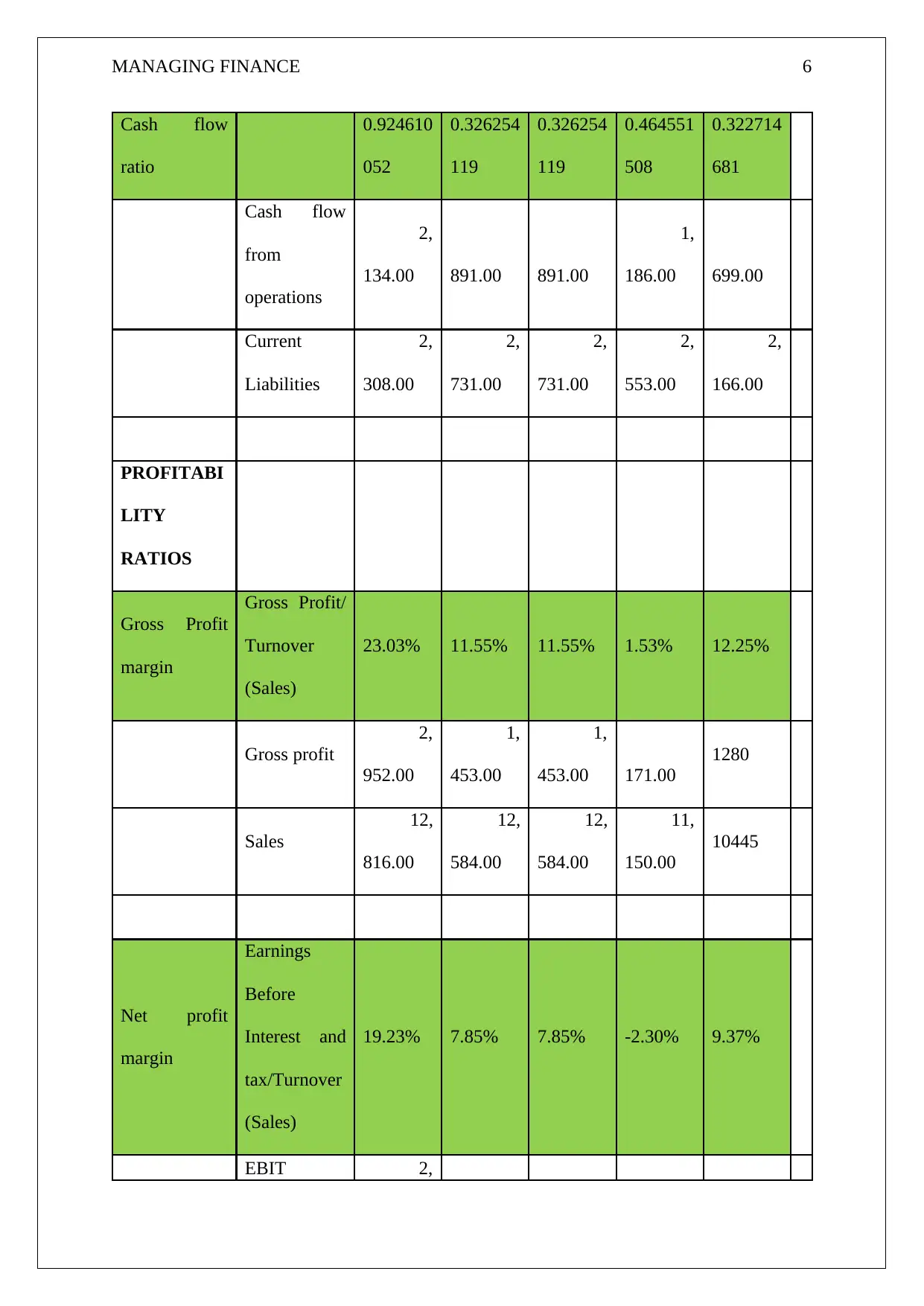

Cash flow

ratio

0.924610

052

0.326254

119

0.326254

119

0.464551

508

0.322714

681

Cash flow

from

operations

2,

134.00 891.00 891.00

1,

186.00 699.00

Current

Liabilities

2,

308.00

2,

731.00

2,

731.00

2,

553.00

2,

166.00

PROFITABI

LITY

RATIOS

Gross Profit

margin

Gross Profit/

Turnover

(Sales)

23.03% 11.55% 11.55% 1.53% 12.25%

Gross profit

2,

952.00

1,

453.00

1,

453.00 171.00

1280

Sales

12,

816.00

12,

584.00

12,

584.00

11,

150.00

10445

Net profit

margin

Earnings

Before

Interest and

tax/Turnover

(Sales)

19.23% 7.85% 7.85% -2.30% 9.37%

EBIT 2,

Cash flow

ratio

0.924610

052

0.326254

119

0.326254

119

0.464551

508

0.322714

681

Cash flow

from

operations

2,

134.00 891.00 891.00

1,

186.00 699.00

Current

Liabilities

2,

308.00

2,

731.00

2,

731.00

2,

553.00

2,

166.00

PROFITABI

LITY

RATIOS

Gross Profit

margin

Gross Profit/

Turnover

(Sales)

23.03% 11.55% 11.55% 1.53% 12.25%

Gross profit

2,

952.00

1,

453.00

1,

453.00 171.00

1280

Sales

12,

816.00

12,

584.00

12,

584.00

11,

150.00

10445

Net profit

margin

Earnings

Before

Interest and

tax/Turnover

(Sales)

19.23% 7.85% 7.85% -2.30% 9.37%

EBIT 2,

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

MANAGING FINANCE 7

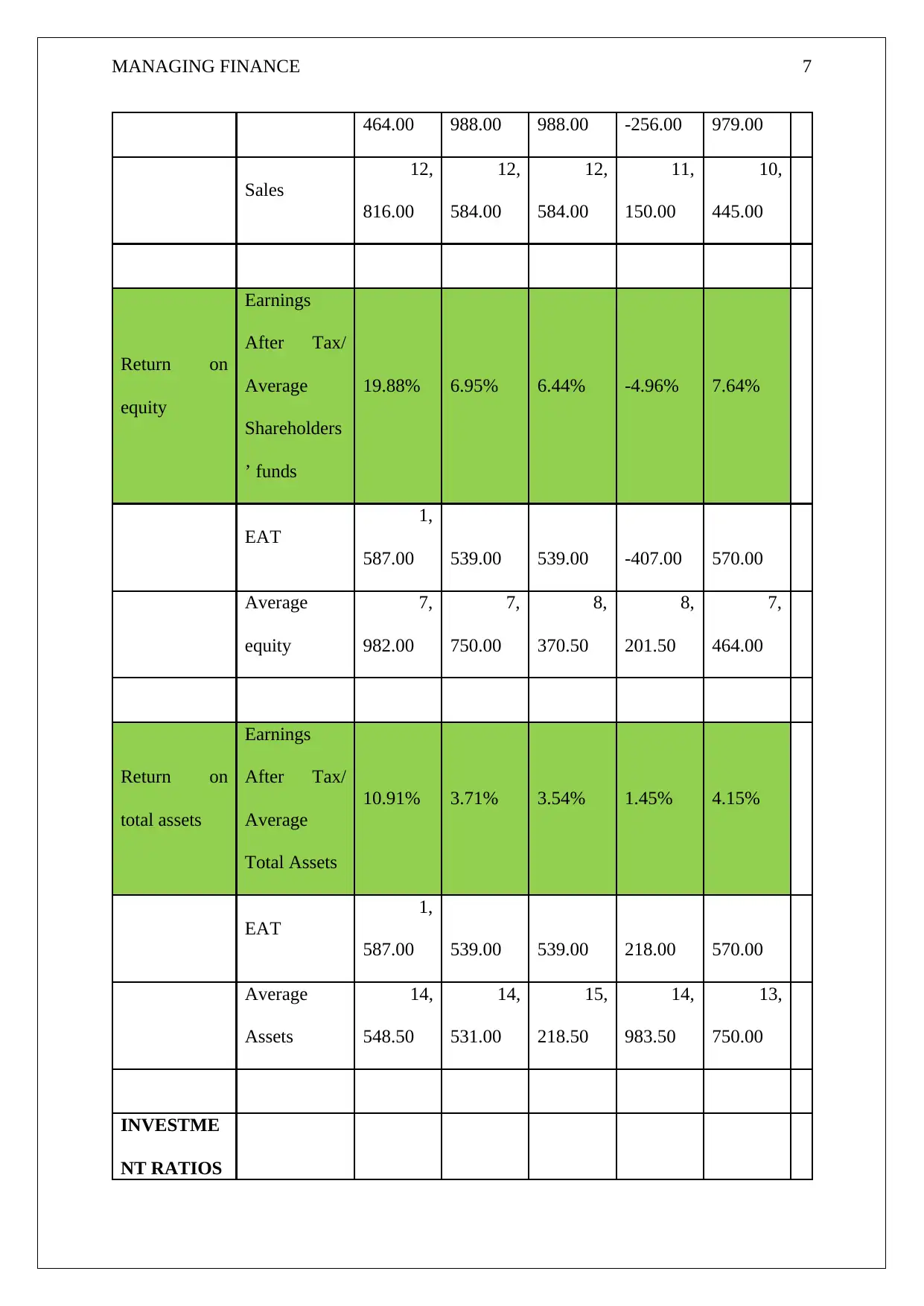

464.00 988.00 988.00 -256.00 979.00

Sales

12,

816.00

12,

584.00

12,

584.00

11,

150.00

10,

445.00

Return on

equity

Earnings

After Tax/

Average

Shareholders

’ funds

19.88% 6.95% 6.44% -4.96% 7.64%

EAT

1,

587.00 539.00 539.00 -407.00 570.00

Average

equity

7,

982.00

7,

750.00

8,

370.50

8,

201.50

7,

464.00

Return on

total assets

Earnings

After Tax/

Average

Total Assets

10.91% 3.71% 3.54% 1.45% 4.15%

EAT

1,

587.00 539.00 539.00 218.00 570.00

Average

Assets

14,

548.50

14,

531.00

15,

218.50

14,

983.50

13,

750.00

INVESTME

NT RATIOS

464.00 988.00 988.00 -256.00 979.00

Sales

12,

816.00

12,

584.00

12,

584.00

11,

150.00

10,

445.00

Return on

equity

Earnings

After Tax/

Average

Shareholders

’ funds

19.88% 6.95% 6.44% -4.96% 7.64%

EAT

1,

587.00 539.00 539.00 -407.00 570.00

Average

equity

7,

982.00

7,

750.00

8,

370.50

8,

201.50

7,

464.00

Return on

total assets

Earnings

After Tax/

Average

Total Assets

10.91% 3.71% 3.54% 1.45% 4.15%

EAT

1,

587.00 539.00 539.00 218.00 570.00

Average

Assets

14,

548.50

14,

531.00

15,

218.50

14,

983.50

13,

750.00

INVESTME

NT RATIOS

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

MANAGING FINANCE 8

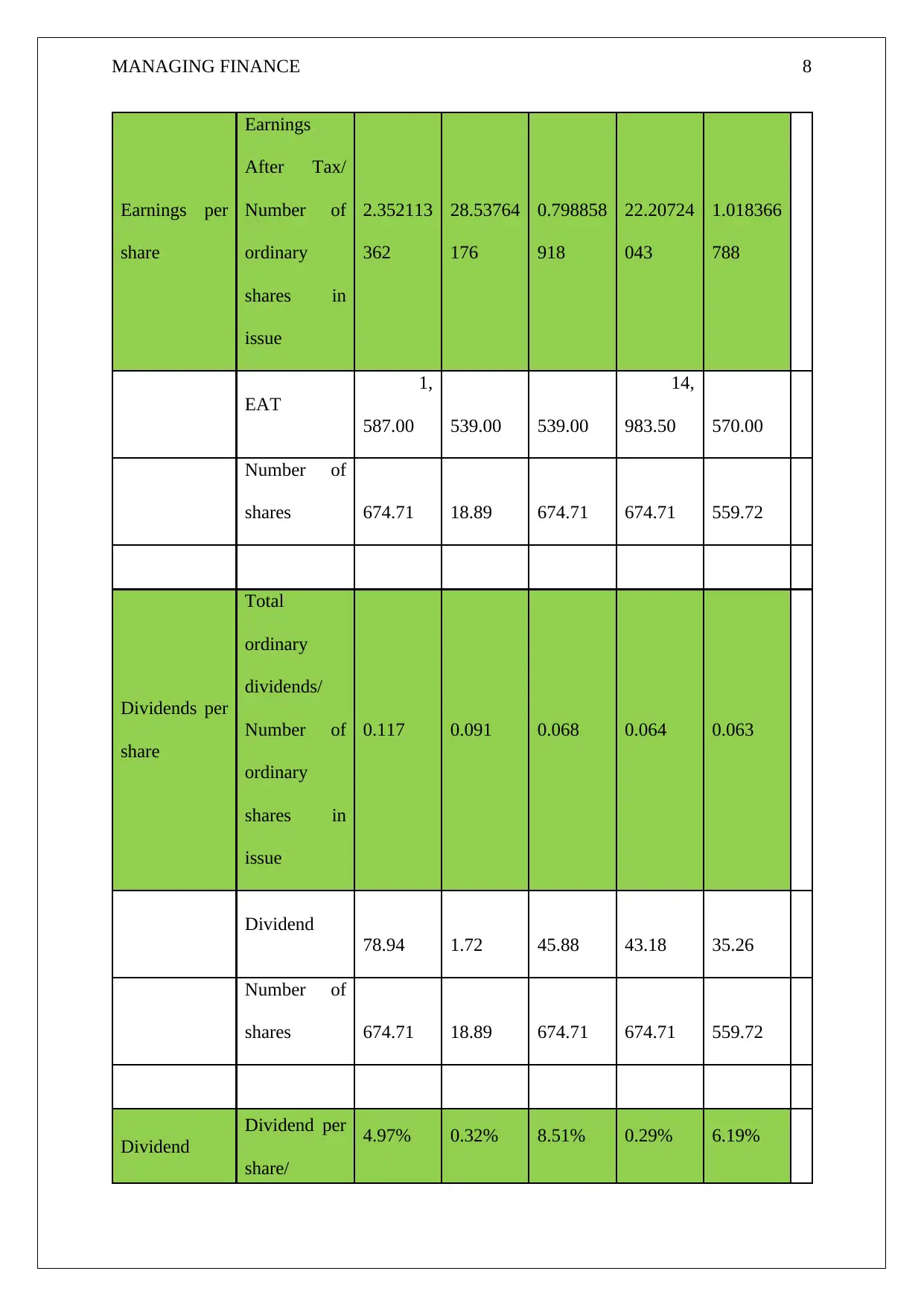

Earnings per

share

Earnings

After Tax/

Number of

ordinary

shares in

issue

2.352113

362

28.53764

176

0.798858

918

22.20724

043

1.018366

788

EAT

1,

587.00 539.00 539.00

14,

983.50 570.00

Number of

shares 674.71 18.89 674.71 674.71 559.72

Dividends per

share

Total

ordinary

dividends/

Number of

ordinary

shares in

issue

0.117 0.091 0.068 0.064 0.063

Dividend

78.94 1.72 45.88 43.18 35.26

Number of

shares 674.71 18.89 674.71 674.71 559.72

Dividend

Dividend per

share/

4.97% 0.32% 8.51% 0.29% 6.19%

Earnings per

share

Earnings

After Tax/

Number of

ordinary

shares in

issue

2.352113

362

28.53764

176

0.798858

918

22.20724

043

1.018366

788

EAT

1,

587.00 539.00 539.00

14,

983.50 570.00

Number of

shares 674.71 18.89 674.71 674.71 559.72

Dividends per

share

Total

ordinary

dividends/

Number of

ordinary

shares in

issue

0.117 0.091 0.068 0.064 0.063

Dividend

78.94 1.72 45.88 43.18 35.26

Number of

shares 674.71 18.89 674.71 674.71 559.72

Dividend

Dividend per

share/

4.97% 0.32% 8.51% 0.29% 6.19%

MANAGING FINANCE 9

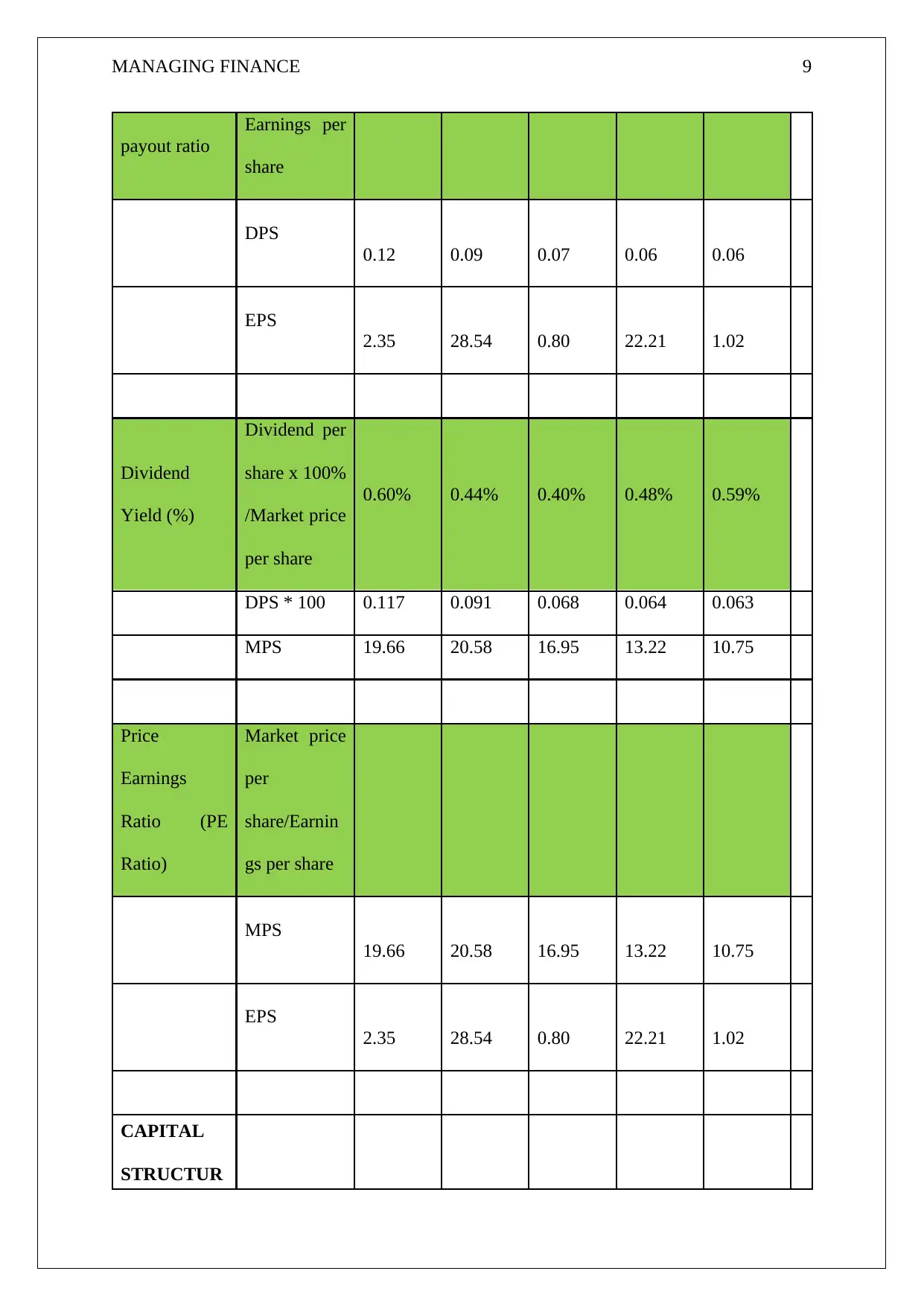

payout ratio

Earnings per

share

DPS

0.12 0.09 0.07 0.06 0.06

EPS

2.35 28.54 0.80 22.21 1.02

Dividend

Yield (%)

Dividend per

share x 100%

/Market price

per share

0.60% 0.44% 0.40% 0.48% 0.59%

DPS * 100 0.117 0.091 0.068 0.064 0.063

MPS 19.66 20.58 16.95 13.22 10.75

Price

Earnings

Ratio (PE

Ratio)

Market price

per

share/Earnin

gs per share

MPS

19.66 20.58 16.95 13.22 10.75

EPS

2.35 28.54 0.80 22.21 1.02

CAPITAL

STRUCTUR

payout ratio

Earnings per

share

DPS

0.12 0.09 0.07 0.06 0.06

EPS

2.35 28.54 0.80 22.21 1.02

Dividend

Yield (%)

Dividend per

share x 100%

/Market price

per share

0.60% 0.44% 0.40% 0.48% 0.59%

DPS * 100 0.117 0.091 0.068 0.064 0.063

MPS 19.66 20.58 16.95 13.22 10.75

Price

Earnings

Ratio (PE

Ratio)

Market price

per

share/Earnin

gs per share

MPS

19.66 20.58 16.95 13.22 10.75

EPS

2.35 28.54 0.80 22.21 1.02

CAPITAL

STRUCTUR

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

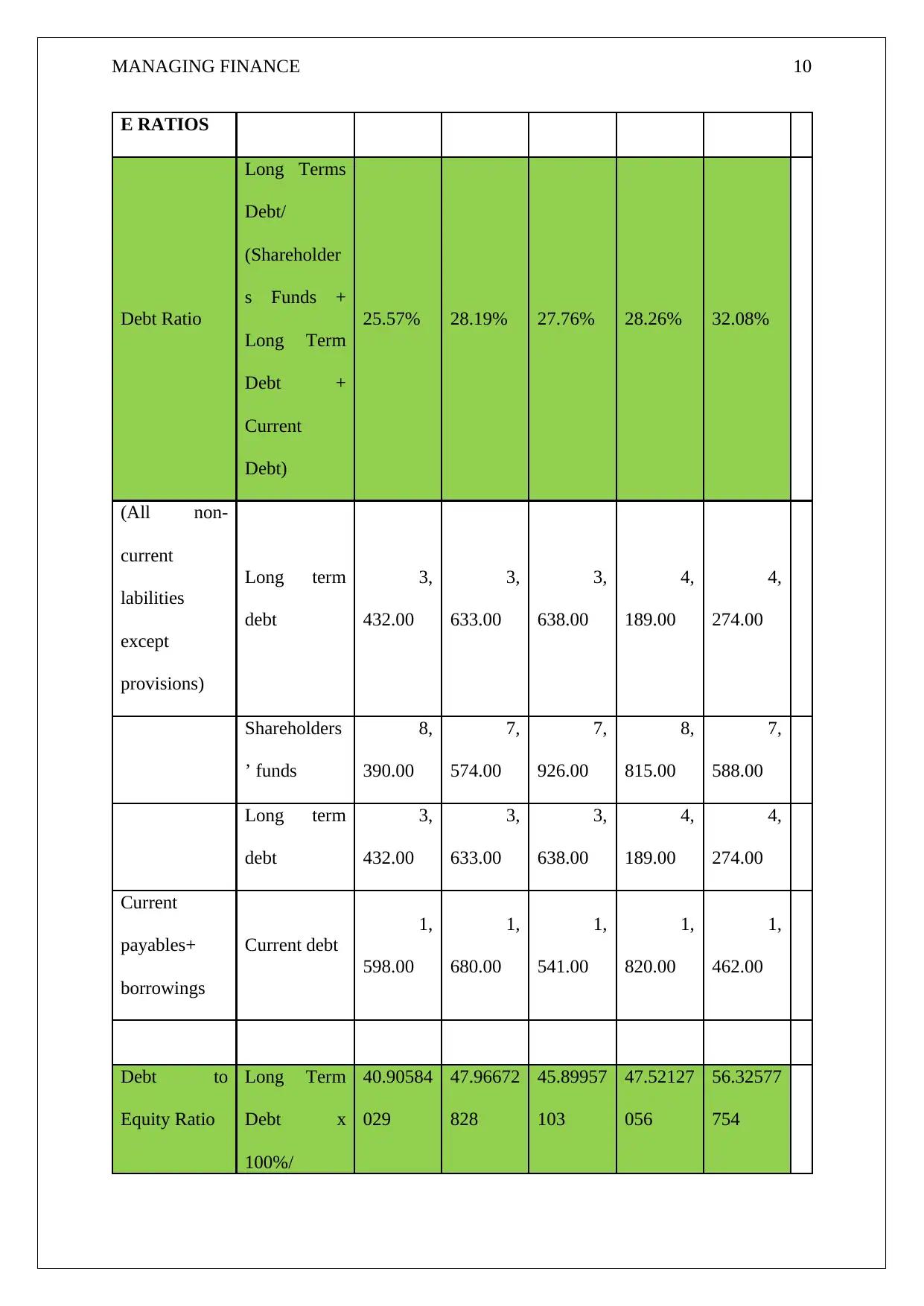

MANAGING FINANCE 10

E RATIOS

Debt Ratio

Long Terms

Debt/

(Shareholder

s Funds +

Long Term

Debt +

Current

Debt)

25.57% 28.19% 27.76% 28.26% 32.08%

(All non-

current

labilities

except

provisions)

Long term

debt

3,

432.00

3,

633.00

3,

638.00

4,

189.00

4,

274.00

Shareholders

’ funds

8,

390.00

7,

574.00

7,

926.00

8,

815.00

7,

588.00

Long term

debt

3,

432.00

3,

633.00

3,

638.00

4,

189.00

4,

274.00

Current

payables+

borrowings

Current debt

1,

598.00

1,

680.00

1,

541.00

1,

820.00

1,

462.00

Debt to

Equity Ratio

Long Term

Debt x

100%/

40.90584

029

47.96672

828

45.89957

103

47.52127

056

56.32577

754

E RATIOS

Debt Ratio

Long Terms

Debt/

(Shareholder

s Funds +

Long Term

Debt +

Current

Debt)

25.57% 28.19% 27.76% 28.26% 32.08%

(All non-

current

labilities

except

provisions)

Long term

debt

3,

432.00

3,

633.00

3,

638.00

4,

189.00

4,

274.00

Shareholders

’ funds

8,

390.00

7,

574.00

7,

926.00

8,

815.00

7,

588.00

Long term

debt

3,

432.00

3,

633.00

3,

638.00

4,

189.00

4,

274.00

Current

payables+

borrowings

Current debt

1,

598.00

1,

680.00

1,

541.00

1,

820.00

1,

462.00

Debt to

Equity Ratio

Long Term

Debt x

100%/

40.90584

029

47.96672

828

45.89957

103

47.52127

056

56.32577

754

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

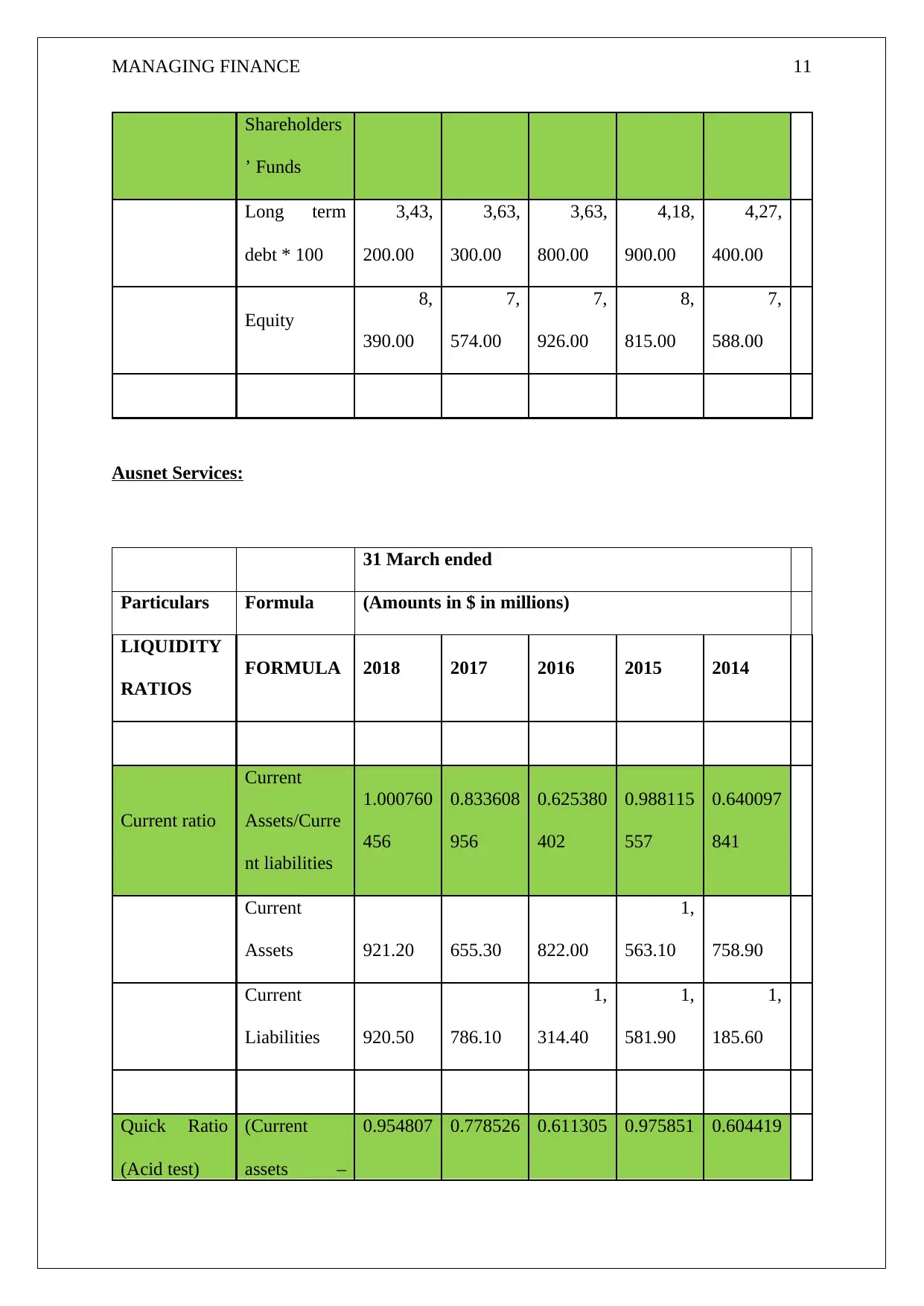

MANAGING FINANCE 11

Shareholders

’ Funds

Long term

debt * 100

3,43,

200.00

3,63,

300.00

3,63,

800.00

4,18,

900.00

4,27,

400.00

Equity

8,

390.00

7,

574.00

7,

926.00

8,

815.00

7,

588.00

Ausnet Services:

31 March ended

Particulars Formula (Amounts in $ in millions)

LIQUIDITY

RATIOS

FORMULA 2018 2017 2016 2015 2014

Current ratio

Current

Assets/Curre

nt liabilities

1.000760

456

0.833608

956

0.625380

402

0.988115

557

0.640097

841

Current

Assets 921.20 655.30 822.00

1,

563.10 758.90

Current

Liabilities 920.50 786.10

1,

314.40

1,

581.90

1,

185.60

Quick Ratio

(Acid test)

(Current

assets –

0.954807 0.778526 0.611305 0.975851 0.604419

Shareholders

’ Funds

Long term

debt * 100

3,43,

200.00

3,63,

300.00

3,63,

800.00

4,18,

900.00

4,27,

400.00

Equity

8,

390.00

7,

574.00

7,

926.00

8,

815.00

7,

588.00

Ausnet Services:

31 March ended

Particulars Formula (Amounts in $ in millions)

LIQUIDITY

RATIOS

FORMULA 2018 2017 2016 2015 2014

Current ratio

Current

Assets/Curre

nt liabilities

1.000760

456

0.833608

956

0.625380

402

0.988115

557

0.640097

841

Current

Assets 921.20 655.30 822.00

1,

563.10 758.90

Current

Liabilities 920.50 786.10

1,

314.40

1,

581.90

1,

185.60

Quick Ratio

(Acid test)

(Current

assets –

0.954807 0.778526 0.611305 0.975851 0.604419

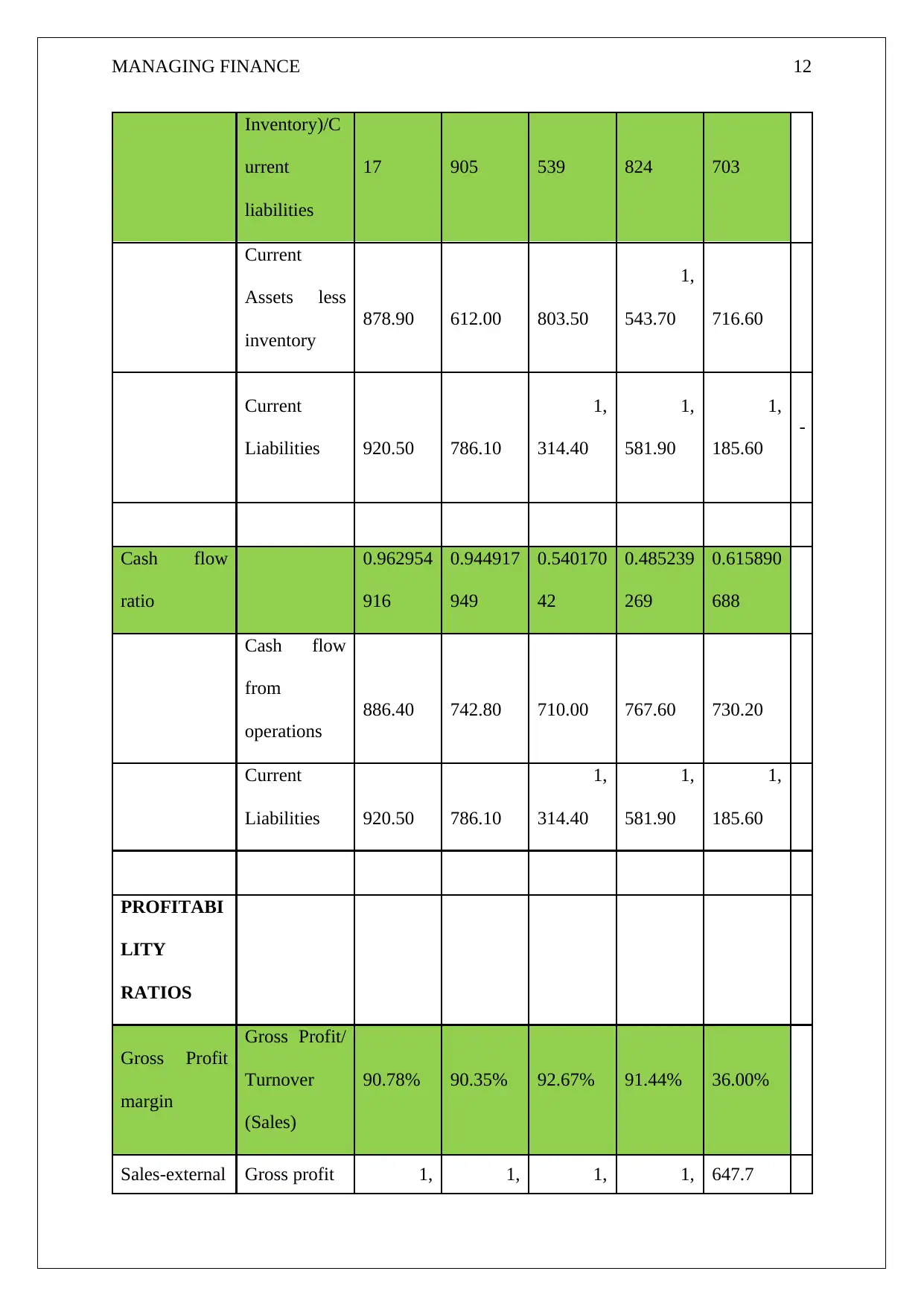

MANAGING FINANCE 12

Inventory)/C

urrent

liabilities

17 905 539 824 703

Current

Assets less

inventory

878.90 612.00 803.50

1,

543.70 716.60

Current

Liabilities 920.50 786.10

1,

314.40

1,

581.90

1,

185.60

-

Cash flow

ratio

0.962954

916

0.944917

949

0.540170

42

0.485239

269

0.615890

688

Cash flow

from

operations

886.40 742.80 710.00 767.60 730.20

Current

Liabilities 920.50 786.10

1,

314.40

1,

581.90

1,

185.60

PROFITABI

LITY

RATIOS

Gross Profit

margin

Gross Profit/

Turnover

(Sales)

90.78% 90.35% 92.67% 91.44% 36.00%

Sales-external Gross profit 1, 1, 1, 1, 647.7

Inventory)/C

urrent

liabilities

17 905 539 824 703

Current

Assets less

inventory

878.90 612.00 803.50

1,

543.70 716.60

Current

Liabilities 920.50 786.10

1,

314.40

1,

581.90

1,

185.60

-

Cash flow

ratio

0.962954

916

0.944917

949

0.540170

42

0.485239

269

0.615890

688

Cash flow

from

operations

886.40 742.80 710.00 767.60 730.20

Current

Liabilities 920.50 786.10

1,

314.40

1,

581.90

1,

185.60

PROFITABI

LITY

RATIOS

Gross Profit

margin

Gross Profit/

Turnover

(Sales)

90.78% 90.35% 92.67% 91.44% 36.00%

Sales-external Gross profit 1, 1, 1, 1, 647.7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 39

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.