Comprehensive Analysis of AUD/USD Exchange Rate and Economic Factors

VerifiedAdded on 2021/04/16

|8

|1226

|59

Report

AI Summary

This report provides an analysis of the AUD/USD exchange rate, examining the factors that influence its fluctuations. The report begins by explaining the basic supply and demand dynamics in the forex market and how they affect the Australian dollar's value. It then delves into specific economic factors such as inflation rates, interest rates, and the balance of payments, explaining how each of these elements impacts the AUD/USD exchange rate. The report also analyzes current trends, referencing an article discussing the recent appreciation of the Australian dollar and the expert opinions on its sustainability. Furthermore, it explores the potential impacts of AUD depreciation on firms, specifically those involved in imports, and suggests strategies the Reserve Bank of Australia could employ to increase the value of the Australian dollar, while also acknowledging the potential side effects of these interventions. The report concludes by advocating for long-term supply-side policies to strengthen the Australian economy.

AUD/USD EXCHANGE RATE 1

AUD/USD EXCHANGE RATE

By (Name)

Name of the class (course)

The Course instructor (Professor)

The Institution

The City and State location

The Date

AUD/USD EXCHANGE RATE

By (Name)

Name of the class (course)

The Course instructor (Professor)

The Institution

The City and State location

The Date

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

AUD/USD EXCHANGE RATE 2

a. Exchange rate determination

USD/AUD

Graph 1

Quantity (USD)

USD/AUD

Graph 2

Quantity (USD)

S0

S1

D

Q1 Q2

P1

P2

S

D0

D1

Q1 Q2

P0

P1

a. Exchange rate determination

USD/AUD

Graph 1

Quantity (USD)

USD/AUD

Graph 2

Quantity (USD)

S0

S1

D

Q1 Q2

P1

P2

S

D0

D1

Q1 Q2

P0

P1

AUD/USD EXCHANGE RATE 3

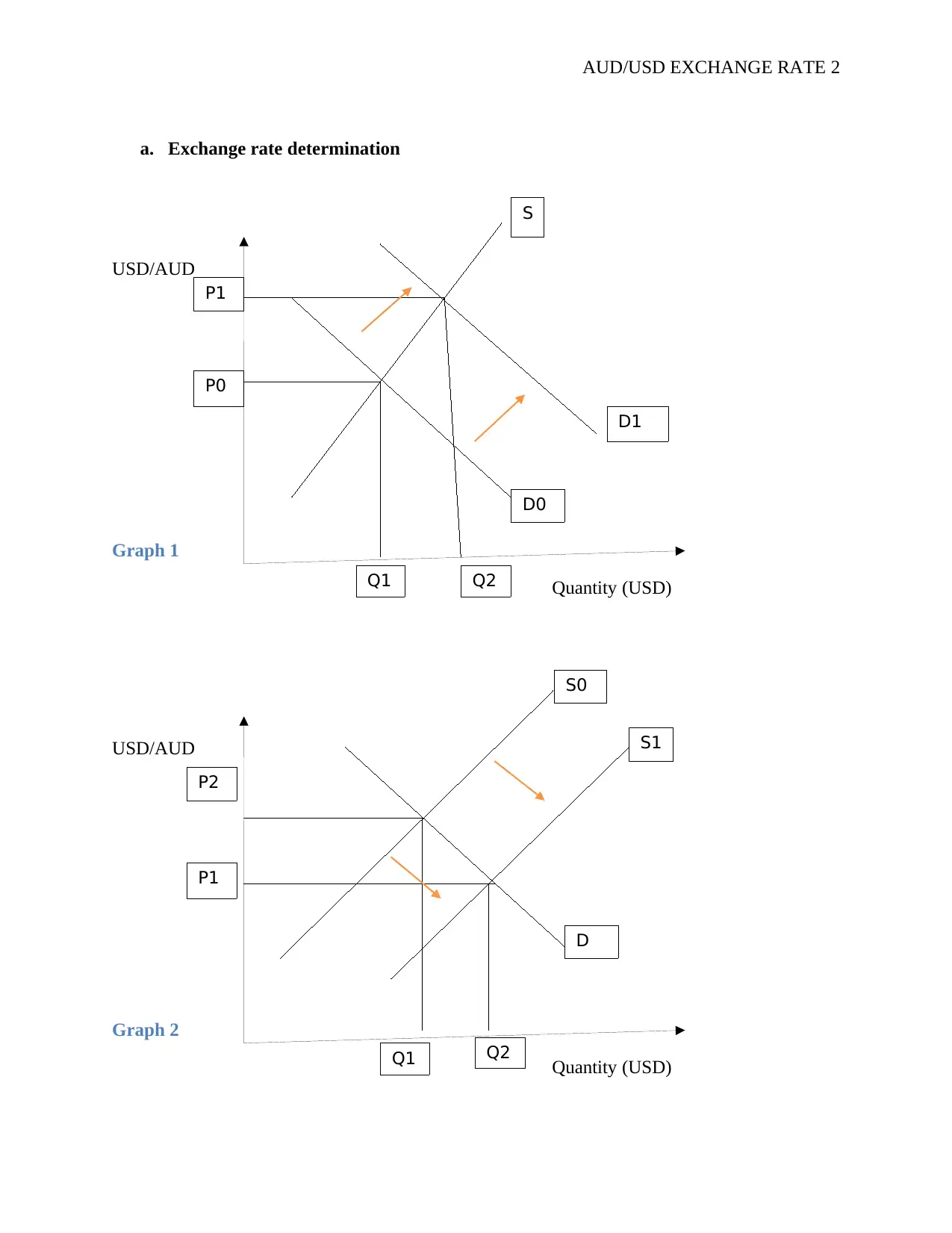

The value of Australian dollar in the forex market is influenced by the forces of supply

and demand. For example, if the demand for Australian dollar in American rise as depicted in

graph one, the supply-demand relationship will make the Australian dollar to appreciate. If the

demand falls, the value of Australian dollar will also decline. On the other hand, if the supply of

Australian dollars increases as shown in graph two, then its value will decline.

Factors Influencing the Fluctuation of the Australian Dollar

Inflation Rates

If inflation levels are low in Australian than in the United States, then the exports of

Australia to the United States will be more competitive and there will be a rise in demand for the

Australian dollar. As a result, the value of Australian dollar in comparison to U.S dollar will

increase. Conversely, if inflation is high in Australia compared to the United States, then the

value of Australian dollar will drop.

Interest Rates

If the interest rates in Australia are high than in the United States, more investors will be

drawn to deposit money in Australia since they will get better earning for saving in Australian

banks. Thus, the demand for Australian dollar will go up and cause an increase in its value.

Equally, if the interest rates in Australia drop, then the value of Australian dollar will decline.

Balance of Payments

If the current account deficit of Australia increases because it is spending more of Australian

dollars on imports than its proceeds from exports, then the Australian dollar will depreciate. On

The value of Australian dollar in the forex market is influenced by the forces of supply

and demand. For example, if the demand for Australian dollar in American rise as depicted in

graph one, the supply-demand relationship will make the Australian dollar to appreciate. If the

demand falls, the value of Australian dollar will also decline. On the other hand, if the supply of

Australian dollars increases as shown in graph two, then its value will decline.

Factors Influencing the Fluctuation of the Australian Dollar

Inflation Rates

If inflation levels are low in Australian than in the United States, then the exports of

Australia to the United States will be more competitive and there will be a rise in demand for the

Australian dollar. As a result, the value of Australian dollar in comparison to U.S dollar will

increase. Conversely, if inflation is high in Australia compared to the United States, then the

value of Australian dollar will drop.

Interest Rates

If the interest rates in Australia are high than in the United States, more investors will be

drawn to deposit money in Australia since they will get better earning for saving in Australian

banks. Thus, the demand for Australian dollar will go up and cause an increase in its value.

Equally, if the interest rates in Australia drop, then the value of Australian dollar will decline.

Balance of Payments

If the current account deficit of Australia increases because it is spending more of Australian

dollars on imports than its proceeds from exports, then the Australian dollar will depreciate. On

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

AUD/USD EXCHANGE RATE 4

the other hand, if Australia’s current account deficit declines due to high export earnings than

import expenditure, then Australian dollar will appreciate. Other factors that cause fluctuations in

Australian dollar include speculations, government debt, recession and political stability.

b. Movement in AUD

0.6400

0.6600

0.6800

0.7000

0.7200

0.7400

0.7600

0.7800

0.8000

0.8200

56.0

58.0

60.0

62.0

64.0

66.0

68.0

AUD/USD Exchange Rate

Australian Dollar Trade-

weighted Index

A$1=USD

Index, Axis 1970 = 100

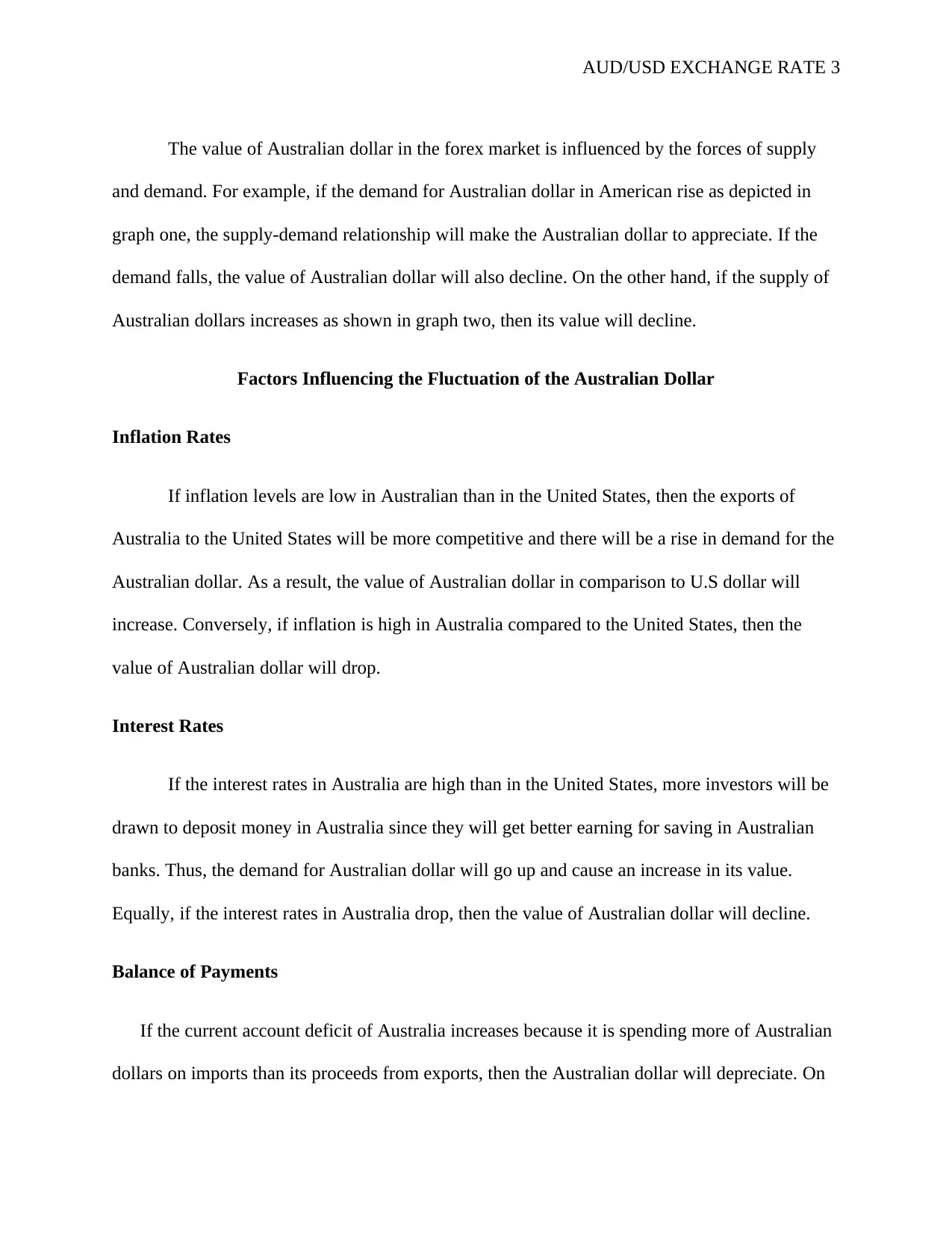

Graph 3: Source- Reserve Bank of Australia

When the price of Australian dollar rises or falls in comparison to the U.S dollar, the same

trend is experienced among other major trading partners. Moreover, the value of Australian

dollar in comparison to the U.S dollar has been rising and falling. This trend can be attributed to

several factors. For example, the fall and rise in the price of Australia’s export commodities such

as iron ore and ups and down in economic growth of the major trading partners.

the other hand, if Australia’s current account deficit declines due to high export earnings than

import expenditure, then Australian dollar will appreciate. Other factors that cause fluctuations in

Australian dollar include speculations, government debt, recession and political stability.

b. Movement in AUD

0.6400

0.6600

0.6800

0.7000

0.7200

0.7400

0.7600

0.7800

0.8000

0.8200

56.0

58.0

60.0

62.0

64.0

66.0

68.0

AUD/USD Exchange Rate

Australian Dollar Trade-

weighted Index

A$1=USD

Index, Axis 1970 = 100

Graph 3: Source- Reserve Bank of Australia

When the price of Australian dollar rises or falls in comparison to the U.S dollar, the same

trend is experienced among other major trading partners. Moreover, the value of Australian

dollar in comparison to the U.S dollar has been rising and falling. This trend can be attributed to

several factors. For example, the fall and rise in the price of Australia’s export commodities such

as iron ore and ups and down in economic growth of the major trading partners.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

AUD/USD EXCHANGE RATE 5

c. Article analysis

The article talks about the value of Australian dollar against the U.S dollar. According to this

article, the Australian dollar has been appreciating whereas the U.S dollar has been on the

decline. The appreciation of Australian dollar has been significantly caused by the increase in the

price of Australia’s exports such as the iron ore.

Although the Australian dollar has been increasing in value, the experts hold that the trend is

not sustainable and it is expected to depreciate. These experts provide several reasons behind

their argument. Foremost, the Federal Reserve is raising the interest rates while the reserve bank

of Australia leaves the cost of borrowing low (Ismail, 2018). The high-interest rates in the

United States will attract investors to save with the country’s banks to earn higher profits. As a

result, the demand for U.S dollar will increase and lead to a rise in its value against the

Australian dollar. The prices of Australia’s exports commodities such as iron ore are falling. This

fall will increase the current account deficit and thus a decline in the strength of Australian

dollar. Furthermore, China is a significant consumer of Australia’s commodities. Since the

Chinese growth is decelerating, this impact will be felt in Australia as the export income to

China will decline and hence a drop it Australian dollar.

Depreciation of Australian Dollar

c. Article analysis

The article talks about the value of Australian dollar against the U.S dollar. According to this

article, the Australian dollar has been appreciating whereas the U.S dollar has been on the

decline. The appreciation of Australian dollar has been significantly caused by the increase in the

price of Australia’s exports such as the iron ore.

Although the Australian dollar has been increasing in value, the experts hold that the trend is

not sustainable and it is expected to depreciate. These experts provide several reasons behind

their argument. Foremost, the Federal Reserve is raising the interest rates while the reserve bank

of Australia leaves the cost of borrowing low (Ismail, 2018). The high-interest rates in the

United States will attract investors to save with the country’s banks to earn higher profits. As a

result, the demand for U.S dollar will increase and lead to a rise in its value against the

Australian dollar. The prices of Australia’s exports commodities such as iron ore are falling. This

fall will increase the current account deficit and thus a decline in the strength of Australian

dollar. Furthermore, China is a significant consumer of Australia’s commodities. Since the

Chinese growth is decelerating, this impact will be felt in Australia as the export income to

China will decline and hence a drop it Australian dollar.

Depreciation of Australian Dollar

AUD/USD EXCHANGE RATE 6

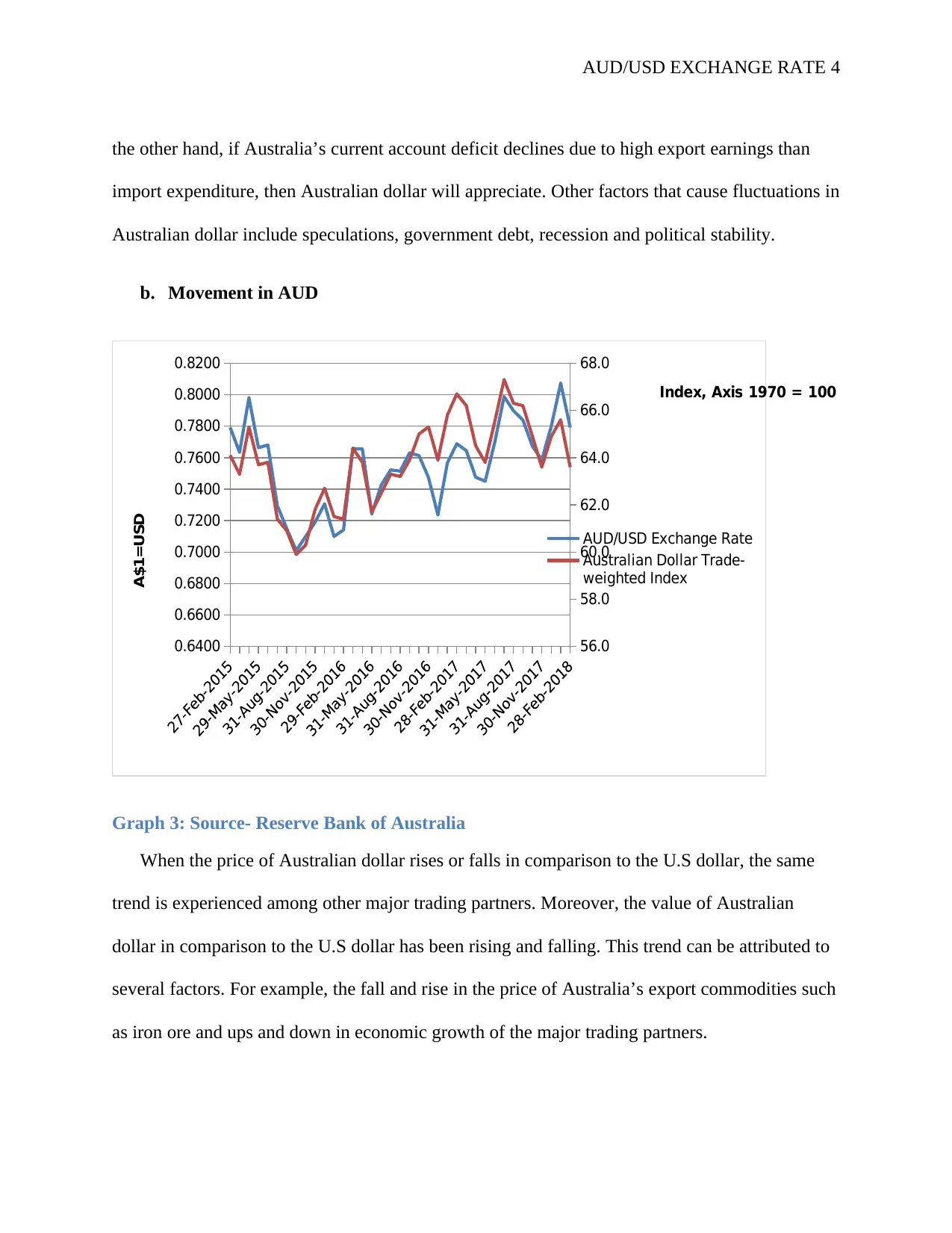

USD/AUD

Graph 4

Quantity (USD)

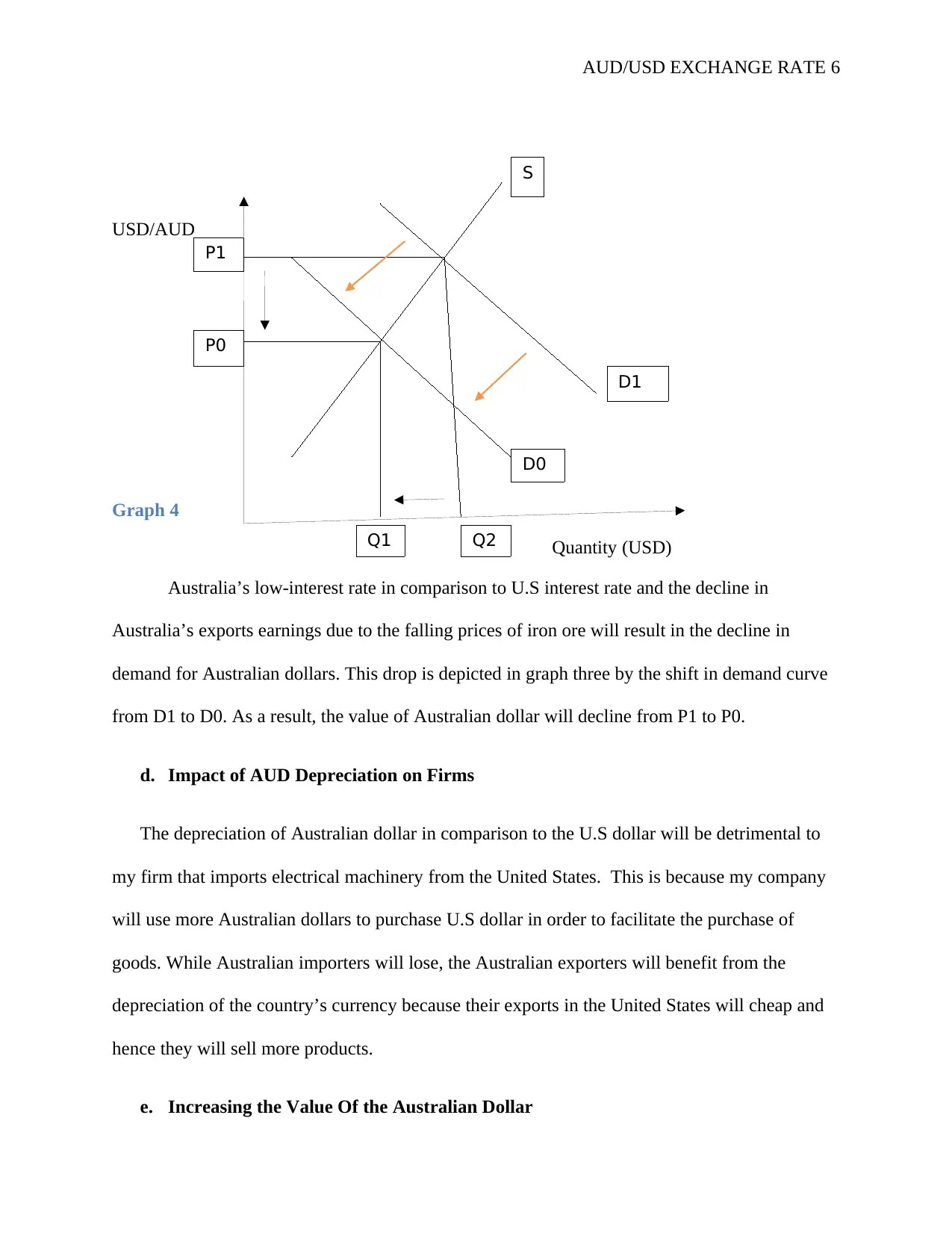

Australia’s low-interest rate in comparison to U.S interest rate and the decline in

Australia’s exports earnings due to the falling prices of iron ore will result in the decline in

demand for Australian dollars. This drop is depicted in graph three by the shift in demand curve

from D1 to D0. As a result, the value of Australian dollar will decline from P1 to P0.

d. Impact of AUD Depreciation on Firms

The depreciation of Australian dollar in comparison to the U.S dollar will be detrimental to

my firm that imports electrical machinery from the United States. This is because my company

will use more Australian dollars to purchase U.S dollar in order to facilitate the purchase of

goods. While Australian importers will lose, the Australian exporters will benefit from the

depreciation of the country’s currency because their exports in the United States will cheap and

hence they will sell more products.

e. Increasing the Value Of the Australian Dollar

S

D0

D1

Q1 Q2

P0

P1

USD/AUD

Graph 4

Quantity (USD)

Australia’s low-interest rate in comparison to U.S interest rate and the decline in

Australia’s exports earnings due to the falling prices of iron ore will result in the decline in

demand for Australian dollars. This drop is depicted in graph three by the shift in demand curve

from D1 to D0. As a result, the value of Australian dollar will decline from P1 to P0.

d. Impact of AUD Depreciation on Firms

The depreciation of Australian dollar in comparison to the U.S dollar will be detrimental to

my firm that imports electrical machinery from the United States. This is because my company

will use more Australian dollars to purchase U.S dollar in order to facilitate the purchase of

goods. While Australian importers will lose, the Australian exporters will benefit from the

depreciation of the country’s currency because their exports in the United States will cheap and

hence they will sell more products.

e. Increasing the Value Of the Australian Dollar

S

D0

D1

Q1 Q2

P0

P1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

AUD/USD EXCHANGE RATE 7

The reserve bank of Australian can deploy several approaches in order to bring AUD/USD

exchange rate from US 72C per AUD to US 80C per AUD. For instance, the bank can increase

the interest rates. Foremost, the high-interest rates will reduce the amount of money in

circulation. Higher interest rates will also increase the demand for Australian dollar as foreign

investors will save more with the country’s banks due to a better return. Increase in demand for

Australian dollar will make it appreciate. Moreover, the bank can increase the reserve

requirement for commercial banks and also buy government bonds and securities. These

approaches will reduce the amount of money in the Australian economy and strengthen the

currency.

Side Effects

Although the above approaches will help to increase the value of Australian dollar there

may cause some problems. High-interest rates, high reserve requirement and the purchase of

government bonds and securities will deny the Australian cash needed for consumption and

investments and hence slow economic growth. Appreciating the currency will also make

Australians exports to the United States expensive and hence uncompetitive. Therefore, these are

not reasonable economic policies. The government should focus on long-term supply-side

policies such as boosting productivity and cutting the cost of production to make the country’s

export industry competitive.

The reserve bank of Australian can deploy several approaches in order to bring AUD/USD

exchange rate from US 72C per AUD to US 80C per AUD. For instance, the bank can increase

the interest rates. Foremost, the high-interest rates will reduce the amount of money in

circulation. Higher interest rates will also increase the demand for Australian dollar as foreign

investors will save more with the country’s banks due to a better return. Increase in demand for

Australian dollar will make it appreciate. Moreover, the bank can increase the reserve

requirement for commercial banks and also buy government bonds and securities. These

approaches will reduce the amount of money in the Australian economy and strengthen the

currency.

Side Effects

Although the above approaches will help to increase the value of Australian dollar there

may cause some problems. High-interest rates, high reserve requirement and the purchase of

government bonds and securities will deny the Australian cash needed for consumption and

investments and hence slow economic growth. Appreciating the currency will also make

Australians exports to the United States expensive and hence uncompetitive. Therefore, these are

not reasonable economic policies. The government should focus on long-term supply-side

policies such as boosting productivity and cutting the cost of production to make the country’s

export industry competitive.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

AUD/USD EXCHANGE RATE 8

Reference list

Ismail, N., 2018. Australian dollar tipped to slide back to 70 US. [Online] Available at:

https://www.smh.com.au/business/investments/australian-dollar-tipped-to-slide-back-to-70-us-

cents-20180129-h0pp8v.html [Accessed 26 March 2018].

RESERVE BANK OF AUSTRALIA, 2018. Historical Data. [Online] Available at:

http://www.rba.gov.au/statistics/historical-data.html#exchange-rates [Accessed 27 March 2018].

Reference list

Ismail, N., 2018. Australian dollar tipped to slide back to 70 US. [Online] Available at:

https://www.smh.com.au/business/investments/australian-dollar-tipped-to-slide-back-to-70-us-

cents-20180129-h0pp8v.html [Accessed 26 March 2018].

RESERVE BANK OF AUSTRALIA, 2018. Historical Data. [Online] Available at:

http://www.rba.gov.au/statistics/historical-data.html#exchange-rates [Accessed 27 March 2018].

1 out of 8

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.