Audit Assurance and Compliance: DIPL Financial Analysis Report

VerifiedAdded on 2020/03/02

|9

|2081

|78

Homework Assignment

AI Summary

This assignment delves into the realm of audit assurance and compliance, focusing on the financial report of DIPL. It commences with an application of analytical procedures to DIPL's financial information, examining the implications of the audit plan and the dissemination of financial statements. The analysis includes ratio analysis of current ratio, profit margin and solvency ratio over a period of three years (2013-2015). The assignment then identifies inherent risk factors arising from the nature of DIPL's business operations, such as potential misstatements due to omissions by accountants, IT implementation issues, and staff handling of cash receipts. Furthermore, it explores how these risks can affect material misstatements in financial reports, considering factors like pressure on employees, management integrity, and the nature of the business. Finally, the assignment identifies and explains two key fraud risk factors relating to misstatements from fraudulent financial reporting, including asset loss and workforce engagement and the improper financial announcements. The analysis draws on various research articles and provides a comprehensive understanding of the audit process and the associated risks.

Running head: AUDIT ASSURANCE AND COMPLIANCE

Audit Assurance and Compliance

Name of Student:

Name of University:

Author’s Note:

Audit Assurance and Compliance

Name of Student:

Name of University:

Author’s Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1AUDIT ASSURANCE AND COMPLIANCE

Table of Contents

Answer to Question 1:.....................................................................................................................2

Answer to Question 2:.....................................................................................................................3

Answer to Question 3:.....................................................................................................................5

Reference.........................................................................................................................................9

Table of Contents

Answer to Question 1:.....................................................................................................................2

Answer to Question 2:.....................................................................................................................3

Answer to Question 3:.....................................................................................................................5

Reference.........................................................................................................................................9

2AUDIT ASSURANCE AND COMPLIANCE

Answer to Question 1:

Application of analytical procedures to the financial report information of DIPL

The report has emphasized on the different aspects of DIPL which has stated on the

development of the audit plan. The main implications of the audit plan have been further seen to

be based on the guidelines which have been related to undertaking of the overall audit process. In

general the assessor has considered the reasonable aversions which have been related to the

clientele misunderstanding. The different types of analytical approach have shown the

dissemination of the information as per the financial declarations of the company. The important

evaluation has been based on the approach such as financial analysts, financial declarations and

accountants which are seen to be important for making business decisions (Messier 2014).

The important form of the analytical approach has been further seen to be based on the

common sizing of the analysis with the reference point. This is seen to conducive for the

comparison.

Explanation of the way the results influence planning decisions for the audit

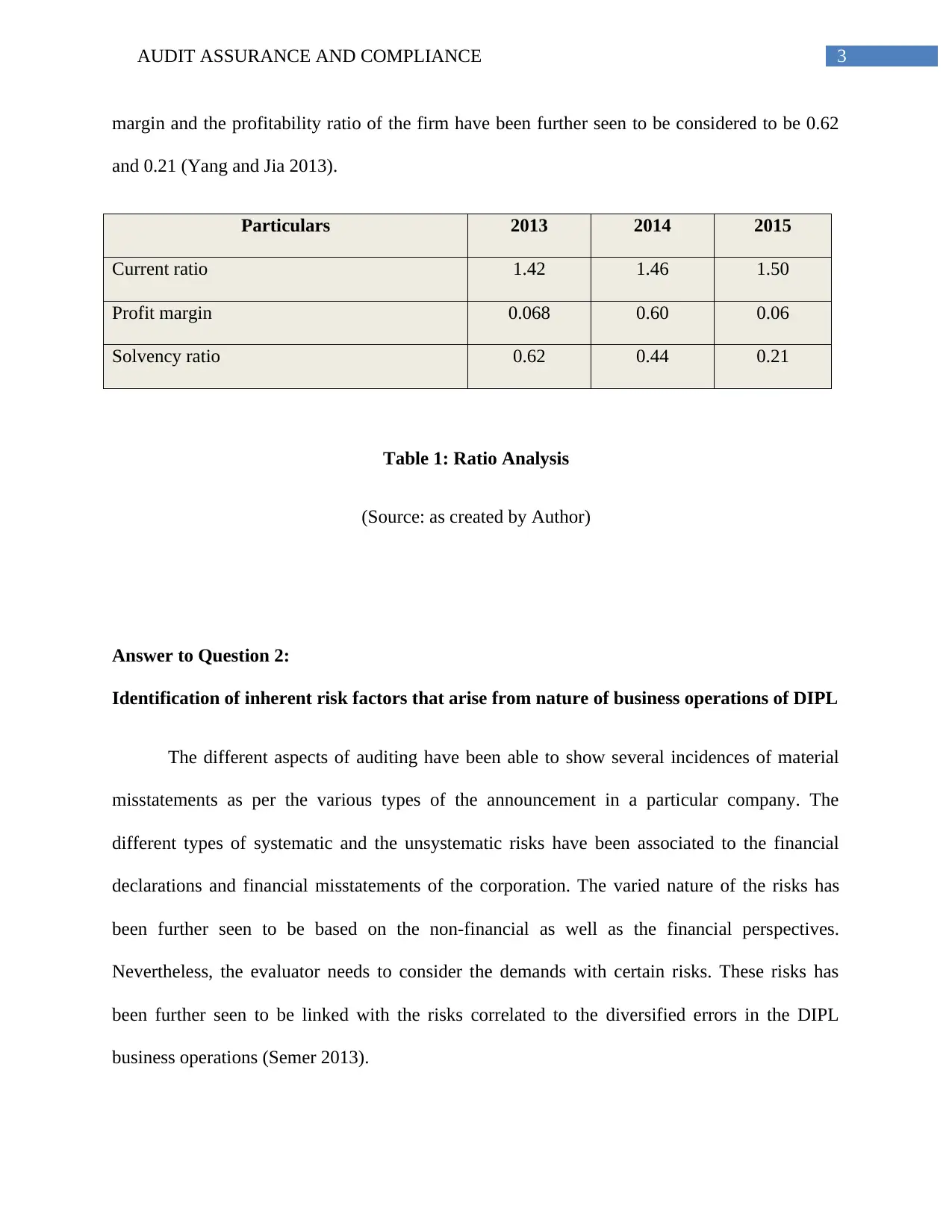

The planning decision has been further seen to be assumed as per the results of the

analytical approach which has been able to state the various approach of the dissemination of the

financial statements on the financial statements. For example, the different types of the outcomes

of the ratio have been further based on the different types of the analysis based on the various

considerations taken from 2013. Based on the consideration of the current analysis it has been

seen that current ratio of DIPL is 1.42 in 2013, 1.46 in 2014 and 1.5 in 2015. The profitability of

the ratio has been computed as per 0.68 in 2013, 0.60 in 2014 and 0.06 in 2015. The profit

Answer to Question 1:

Application of analytical procedures to the financial report information of DIPL

The report has emphasized on the different aspects of DIPL which has stated on the

development of the audit plan. The main implications of the audit plan have been further seen to

be based on the guidelines which have been related to undertaking of the overall audit process. In

general the assessor has considered the reasonable aversions which have been related to the

clientele misunderstanding. The different types of analytical approach have shown the

dissemination of the information as per the financial declarations of the company. The important

evaluation has been based on the approach such as financial analysts, financial declarations and

accountants which are seen to be important for making business decisions (Messier 2014).

The important form of the analytical approach has been further seen to be based on the

common sizing of the analysis with the reference point. This is seen to conducive for the

comparison.

Explanation of the way the results influence planning decisions for the audit

The planning decision has been further seen to be assumed as per the results of the

analytical approach which has been able to state the various approach of the dissemination of the

financial statements on the financial statements. For example, the different types of the outcomes

of the ratio have been further based on the different types of the analysis based on the various

considerations taken from 2013. Based on the consideration of the current analysis it has been

seen that current ratio of DIPL is 1.42 in 2013, 1.46 in 2014 and 1.5 in 2015. The profitability of

the ratio has been computed as per 0.68 in 2013, 0.60 in 2014 and 0.06 in 2015. The profit

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3AUDIT ASSURANCE AND COMPLIANCE

margin and the profitability ratio of the firm have been further seen to be considered to be 0.62

and 0.21 (Yang and Jia 2013).

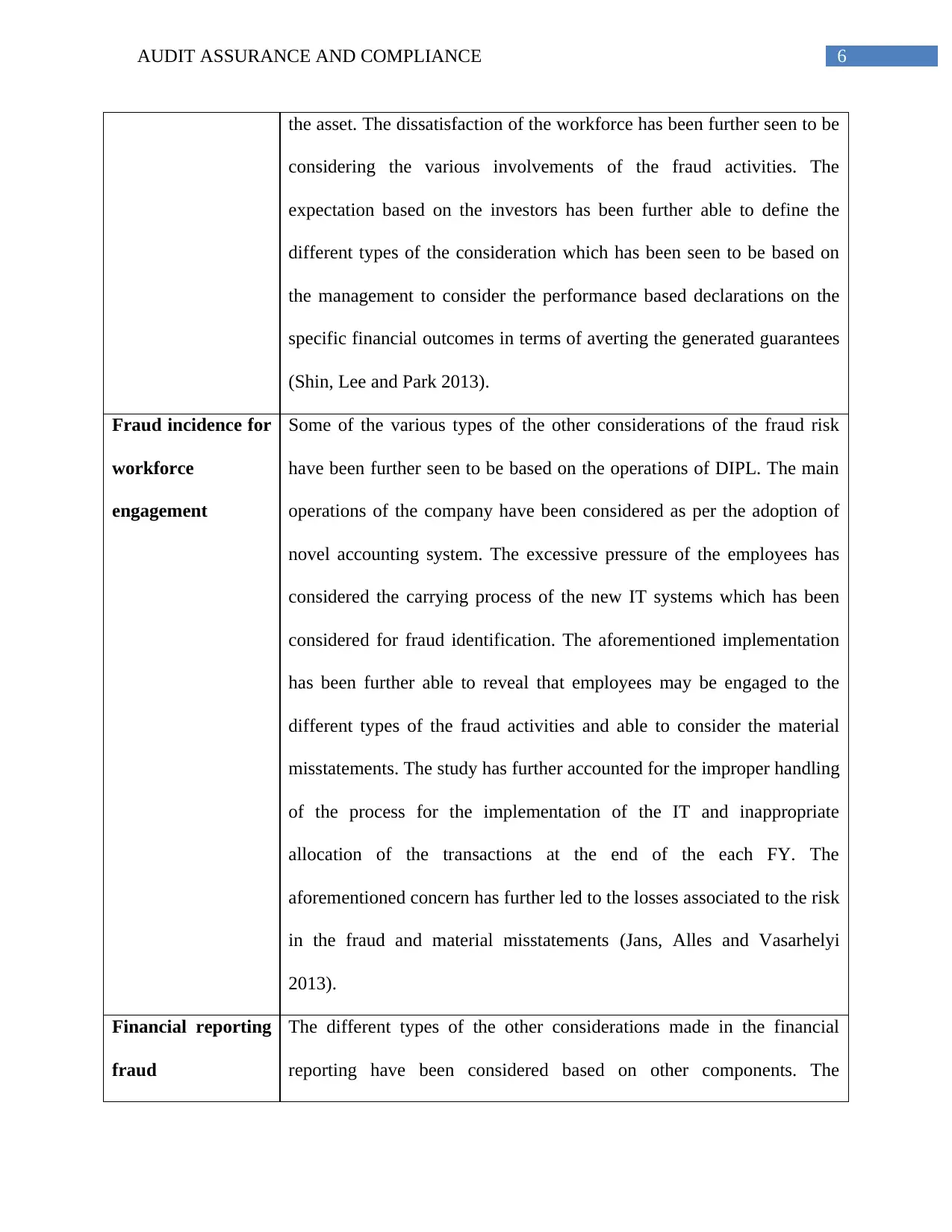

Particulars 2013 2014 2015

Current ratio 1.42 1.46 1.50

Profit margin 0.068 0.60 0.06

Solvency ratio 0.62 0.44 0.21

Table 1: Ratio Analysis

(Source: as created by Author)

Answer to Question 2:

Identification of inherent risk factors that arise from nature of business operations of DIPL

The different aspects of auditing have been able to show several incidences of material

misstatements as per the various types of the announcement in a particular company. The

different types of systematic and the unsystematic risks have been associated to the financial

declarations and financial misstatements of the corporation. The varied nature of the risks has

been further seen to be based on the non-financial as well as the financial perspectives.

Nevertheless, the evaluator needs to consider the demands with certain risks. These risks has

been further seen to be linked with the risks correlated to the diversified errors in the DIPL

business operations (Semer 2013).

margin and the profitability ratio of the firm have been further seen to be considered to be 0.62

and 0.21 (Yang and Jia 2013).

Particulars 2013 2014 2015

Current ratio 1.42 1.46 1.50

Profit margin 0.068 0.60 0.06

Solvency ratio 0.62 0.44 0.21

Table 1: Ratio Analysis

(Source: as created by Author)

Answer to Question 2:

Identification of inherent risk factors that arise from nature of business operations of DIPL

The different aspects of auditing have been able to show several incidences of material

misstatements as per the various types of the announcement in a particular company. The

different types of systematic and the unsystematic risks have been associated to the financial

declarations and financial misstatements of the corporation. The varied nature of the risks has

been further seen to be based on the non-financial as well as the financial perspectives.

Nevertheless, the evaluator needs to consider the demands with certain risks. These risks has

been further seen to be linked with the risks correlated to the diversified errors in the DIPL

business operations (Semer 2013).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4AUDIT ASSURANCE AND COMPLIANCE

As per the given scenario, the transactions are seen to be based on the omissions made by

the accountants in the DIPL corporations. The sequential segregation of the information can be

further be disseminated as per the various types of the consideration which has been seen to be

associated to the essential planning of the sales. In addition to this, the financial declarations are

considered as per the accomplishments of the profit incurred from the revenue and sales. The

analysis of the present study has been further able to reveal that the IT implementation has been

able to generate particular issues. DIPL Corporation has been seen to have adequate staff to

handle the execution and the installation to carry the testing of the new arrangement by the end

of the financial year (Broberg, Umans and Gerlofstig 2013).

The various aspect of the DIPL has been further able to record the cash receipts

considered by the finance professionals and the various concerns which have not been properly

looked after. The staff member has been able to follow an appropriate order for the registration

of sequence of account receivables (Garg and Bawa 2016).

Risk and way it might affect the risk of material misstatement in the financial report

The various types of the inherent nature of the risks have been seen to be considered

based on the following factors for the susceptibility towards financial misstatements.

Excessive pressure on employees and management- These considerations has been identified

with the lack of proper bookkeeping method. The particular attributes has been related to

encountering of various types of the cash flow issues such as poor operating outcomes and poor

liquidity (Earley 2015).

As per the given scenario, the transactions are seen to be based on the omissions made by

the accountants in the DIPL corporations. The sequential segregation of the information can be

further be disseminated as per the various types of the consideration which has been seen to be

associated to the essential planning of the sales. In addition to this, the financial declarations are

considered as per the accomplishments of the profit incurred from the revenue and sales. The

analysis of the present study has been further able to reveal that the IT implementation has been

able to generate particular issues. DIPL Corporation has been seen to have adequate staff to

handle the execution and the installation to carry the testing of the new arrangement by the end

of the financial year (Broberg, Umans and Gerlofstig 2013).

The various aspect of the DIPL has been further able to record the cash receipts

considered by the finance professionals and the various concerns which have not been properly

looked after. The staff member has been able to follow an appropriate order for the registration

of sequence of account receivables (Garg and Bawa 2016).

Risk and way it might affect the risk of material misstatement in the financial report

The various types of the inherent nature of the risks have been seen to be considered

based on the following factors for the susceptibility towards financial misstatements.

Excessive pressure on employees and management- These considerations has been identified

with the lack of proper bookkeeping method. The particular attributes has been related to

encountering of various types of the cash flow issues such as poor operating outcomes and poor

liquidity (Earley 2015).

5AUDIT ASSURANCE AND COMPLIANCE

Risks of errors or else incorrect misrepresentation- The various types o the identified risks

has been further related to the complexity and errors related to the misrepresentation of the

statements.

Integrity of the entire management- The management of DIPL has been seen to lack the

various aspects of the expectation to prepare for the reputational loss in the given concern and

business community.

Unusual pressure on management- During the availability of the incentives schemes, the

management has been also seen to present an unfavourable decision.

Nature of entity business- The various nature of growth aspect of DIPL has been seen to lead to

the growth in the major economic competitive circumstances. The various types of the

mentioned facts has been seen to be considered as per the different types of the inherent risks

associated to the business entity and the required for the structure of audit planning (Kober, Lee

and Ng 2013).

Answer to Question 3:

A) Identification and explanation of two key fraud risk factors relating to

misstatements arising from fraudulent financial reporting

Asset Loss The associated risk of the asset loss has been able to consider the various

amounts of losses which have been seen to be associated to the fraud of

Risks of errors or else incorrect misrepresentation- The various types o the identified risks

has been further related to the complexity and errors related to the misrepresentation of the

statements.

Integrity of the entire management- The management of DIPL has been seen to lack the

various aspects of the expectation to prepare for the reputational loss in the given concern and

business community.

Unusual pressure on management- During the availability of the incentives schemes, the

management has been also seen to present an unfavourable decision.

Nature of entity business- The various nature of growth aspect of DIPL has been seen to lead to

the growth in the major economic competitive circumstances. The various types of the

mentioned facts has been seen to be considered as per the different types of the inherent risks

associated to the business entity and the required for the structure of audit planning (Kober, Lee

and Ng 2013).

Answer to Question 3:

A) Identification and explanation of two key fraud risk factors relating to

misstatements arising from fraudulent financial reporting

Asset Loss The associated risk of the asset loss has been able to consider the various

amounts of losses which have been seen to be associated to the fraud of

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6AUDIT ASSURANCE AND COMPLIANCE

the asset. The dissatisfaction of the workforce has been further seen to be

considering the various involvements of the fraud activities. The

expectation based on the investors has been further able to define the

different types of the consideration which has been seen to be based on

the management to consider the performance based declarations on the

specific financial outcomes in terms of averting the generated guarantees

(Shin, Lee and Park 2013).

Fraud incidence for

workforce

engagement

Some of the various types of the other considerations of the fraud risk

have been further seen to be based on the operations of DIPL. The main

operations of the company have been considered as per the adoption of

novel accounting system. The excessive pressure of the employees has

considered the carrying process of the new IT systems which has been

considered for fraud identification. The aforementioned implementation

has been further able to reveal that employees may be engaged to the

different types of the fraud activities and able to consider the material

misstatements. The study has further accounted for the improper handling

of the process for the implementation of the IT and inappropriate

allocation of the transactions at the end of the each FY. The

aforementioned concern has further led to the losses associated to the risk

in the fraud and material misstatements (Jans, Alles and Vasarhelyi

2013).

Financial reporting

fraud

The different types of the other considerations made in the financial

reporting have been considered based on other components. The

the asset. The dissatisfaction of the workforce has been further seen to be

considering the various involvements of the fraud activities. The

expectation based on the investors has been further able to define the

different types of the consideration which has been seen to be based on

the management to consider the performance based declarations on the

specific financial outcomes in terms of averting the generated guarantees

(Shin, Lee and Park 2013).

Fraud incidence for

workforce

engagement

Some of the various types of the other considerations of the fraud risk

have been further seen to be based on the operations of DIPL. The main

operations of the company have been considered as per the adoption of

novel accounting system. The excessive pressure of the employees has

considered the carrying process of the new IT systems which has been

considered for fraud identification. The aforementioned implementation

has been further able to reveal that employees may be engaged to the

different types of the fraud activities and able to consider the material

misstatements. The study has further accounted for the improper handling

of the process for the implementation of the IT and inappropriate

allocation of the transactions at the end of the each FY. The

aforementioned concern has further led to the losses associated to the risk

in the fraud and material misstatements (Jans, Alles and Vasarhelyi

2013).

Financial reporting

fraud

The different types of the other considerations made in the financial

reporting have been considered based on other components. The

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7AUDIT ASSURANCE AND COMPLIANCE

excessive amount of the compulsions has been able to highlight on the

announcements on financial management to adhere to meet certain goals

which are related to qualify for the debt acquisition. The increased nature

of the risk has been further seen to be based on the improper financial

announcements. Based on the given considerations financial position of

DIPL has been able to infer that the increasing revenue from 2013 to

2015. In addition to this, the total assets and the current assets have been

further considered to be increasing in nature. Furthermore, the total assets

and the current assets of DIPL corporation have been able to state on the

increasing nature. The gross profit of the corporation has also increased

from 2013 to 2015. The prominent matter of this has been seen with the

loan amounting to 7.5 million and in maintaining the current ratio of 1.5

and debt equity ratio has been also discerned to be lower than 1. This

particular requirement has been further seen to be considered as per the

improper reflection of the financial position. Hence DIPL has failed to

maintain the definite benchmark, thereby making it non-eligible for the

finance of the BDO finance (Chiu, Liu and Vasarhelyi 2014).

Unsuitable average

cost

As per the given case study analysis it has been discerned that the raw

materials has been valued as per the different rates of raw material

inventory at a particular cost which has been seen to be appropriate with

the present cost and the cost on paper has been identified to be more than

average. The fraud nature of the risk has been further seen to be

considered as per the various types the considerations which has been

excessive amount of the compulsions has been able to highlight on the

announcements on financial management to adhere to meet certain goals

which are related to qualify for the debt acquisition. The increased nature

of the risk has been further seen to be based on the improper financial

announcements. Based on the given considerations financial position of

DIPL has been able to infer that the increasing revenue from 2013 to

2015. In addition to this, the total assets and the current assets have been

further considered to be increasing in nature. Furthermore, the total assets

and the current assets of DIPL corporation have been able to state on the

increasing nature. The gross profit of the corporation has also increased

from 2013 to 2015. The prominent matter of this has been seen with the

loan amounting to 7.5 million and in maintaining the current ratio of 1.5

and debt equity ratio has been also discerned to be lower than 1. This

particular requirement has been further seen to be considered as per the

improper reflection of the financial position. Hence DIPL has failed to

maintain the definite benchmark, thereby making it non-eligible for the

finance of the BDO finance (Chiu, Liu and Vasarhelyi 2014).

Unsuitable average

cost

As per the given case study analysis it has been discerned that the raw

materials has been valued as per the different rates of raw material

inventory at a particular cost which has been seen to be appropriate with

the present cost and the cost on paper has been identified to be more than

average. The fraud nature of the risk has been further seen to be

considered as per the various types the considerations which has been

8AUDIT ASSURANCE AND COMPLIANCE

based on the various types of the concerns with new IT system and this

can be further monitored as per the evaluation of the financial statements.

based on the various types of the concerns with new IT system and this

can be further monitored as per the evaluation of the financial statements.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 9

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.