Audit and Assurance Assignment: Elmo Software Audit Plan

VerifiedAdded on 2023/01/05

|13

|3047

|85

Report

AI Summary

This assignment provides a detailed audit plan for Elmo Software Limited, a company listed on the Australian Securities Exchange. Part A focuses on preliminary risk assessment, evaluating factors such as customer retention, key personnel, and over-reliance on software services. It also includes an analytical review of the company's financial performance, using financial statements to assess asset growth, liability changes, and cash flow. Furthermore, the assignment addresses audit planning materiality. Part B delves into the quality and effectiveness of independent audits in Australia, discussing key concerns and potential solutions. This includes conducting effective audit reviews, addressing audit concerns, and improving audit firm action plans to enhance audit quality. The report also addresses specific audit areas, such as intangible assets and trade payables.

Running head: AUDIT AND ASSURANCE

Audit and assurance

Name of the student

Name of the university

Authors note

Audit and assurance

Name of the student

Name of the university

Authors note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

AUDIT AND ASSURANCE

Executive summary

The study topic discusses about the key preliminary risk assessment as well as the analytical

review of the financial statement and the company performance have been provided in this

case. On the other hand the quality standards of the audit process have been implied. Apart

from this the key measurement policies and processes have been done.

AUDIT AND ASSURANCE

Executive summary

The study topic discusses about the key preliminary risk assessment as well as the analytical

review of the financial statement and the company performance have been provided in this

case. On the other hand the quality standards of the audit process have been implied. Apart

from this the key measurement policies and processes have been done.

2

AUDIT AND ASSURANCE

Table of Contents

Introduction....................................................................................................................3

Discussion......................................................................................................................3

Part A: AUDITING AND ASSURANCE.................................................................3

Risk assessment of Elmo software limited.............................................................3

Part B: QUALITY AND EFFECTIVENESS OF INDEPENDENT AUDIT................6

Main concerns on the quality and effectiveness of independent audit in Australia...6

Addressing the audit concerns...................................................................................8

Conclusion....................................................................................................................10

References....................................................................................................................11

AUDIT AND ASSURANCE

Table of Contents

Introduction....................................................................................................................3

Discussion......................................................................................................................3

Part A: AUDITING AND ASSURANCE.................................................................3

Risk assessment of Elmo software limited.............................................................3

Part B: QUALITY AND EFFECTIVENESS OF INDEPENDENT AUDIT................6

Main concerns on the quality and effectiveness of independent audit in Australia...6

Addressing the audit concerns...................................................................................8

Conclusion....................................................................................................................10

References....................................................................................................................11

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

AUDIT AND ASSURANCE

Introduction

The study topic deals with the preliminary risk assessment of Elmo software limited.

On the other hand the analytical review of the financial statement have been covered from the

company report. In the second part of the study the audit quality and effectiveness have been

done along with how the concerns could be effective for the regulator as well as for the

company auditor have also been addressed.

Discussion

Part A: AUDITING AND ASSURANCE

Risk assessment of Elmo software limited

The group’s core operations are conducted by a number of risks status. However some

of the risk factor are not directly linked up with the operation of the Elmo Company. Hence it

is important for the company could look to mitigate the overall risks status. Thus the risks are

likely to add the summary which is generally concerned by the business risk. However there

is no guarantee or assurance that all these risks will be impacting the business of the company

(Drogalas et al. 2015). Hence there are some possible risk factors which needs to address in

this case. These are as follows-

Failure to retain and attract new customers

The basic success area for the ELMO software are relied on the ability to retain and

attract new customers as well as to add more revenue to the business. The customer of the

company had no problem to renew the service offerings at the end of the service process.

Thus the company cannot guarantee that it could successfully increase the company from the

existing customers at the time of the cross selling the other modules to the customers (Garcia-

Blandon and Argiles 2015). On the other hand if the customers are not using the ELMO

AUDIT AND ASSURANCE

Introduction

The study topic deals with the preliminary risk assessment of Elmo software limited.

On the other hand the analytical review of the financial statement have been covered from the

company report. In the second part of the study the audit quality and effectiveness have been

done along with how the concerns could be effective for the regulator as well as for the

company auditor have also been addressed.

Discussion

Part A: AUDITING AND ASSURANCE

Risk assessment of Elmo software limited

The group’s core operations are conducted by a number of risks status. However some

of the risk factor are not directly linked up with the operation of the Elmo Company. Hence it

is important for the company could look to mitigate the overall risks status. Thus the risks are

likely to add the summary which is generally concerned by the business risk. However there

is no guarantee or assurance that all these risks will be impacting the business of the company

(Drogalas et al. 2015). Hence there are some possible risk factors which needs to address in

this case. These are as follows-

Failure to retain and attract new customers

The basic success area for the ELMO software are relied on the ability to retain and

attract new customers as well as to add more revenue to the business. The customer of the

company had no problem to renew the service offerings at the end of the service process.

Thus the company cannot guarantee that it could successfully increase the company from the

existing customers at the time of the cross selling the other modules to the customers (Garcia-

Blandon and Argiles 2015). On the other hand if the customers are not using the ELMO

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

AUDIT AND ASSURANCE

Company’s module then they do not tend to use the same in the Elmo platform. Thus the

process could be making an adverse effect to the customers (Endaya & Hanefah, 2013).

Ability to attract and retain key personnel

It is seen that the perceived control of the component will be very much dependable

on the success factor of the company. Thus it is important to retain the key and effective

personnel and the old people who are directly linked up with the company. Hence the loss of

those personnel could cost the company a huge amount of money or expertise and the same

could be having a negative impact over the operating and financial performance of ELMO

software.

Over reliance on the software service of the company.

The business model of ELMO software is heavily relied on the customer satisfaction

with the process in which the company focus on. Hence the talent management process for

the software solutions depends on the industry norms as well as the changing regulations

related to the customer taste and preference. Thus basically the success factor of Elmo

depends upon the adaptability and the success factor where the future updates for the success

factor depends upon the success factor. Hence it will lead to reduced sales and usage of the

products, loss of customers.

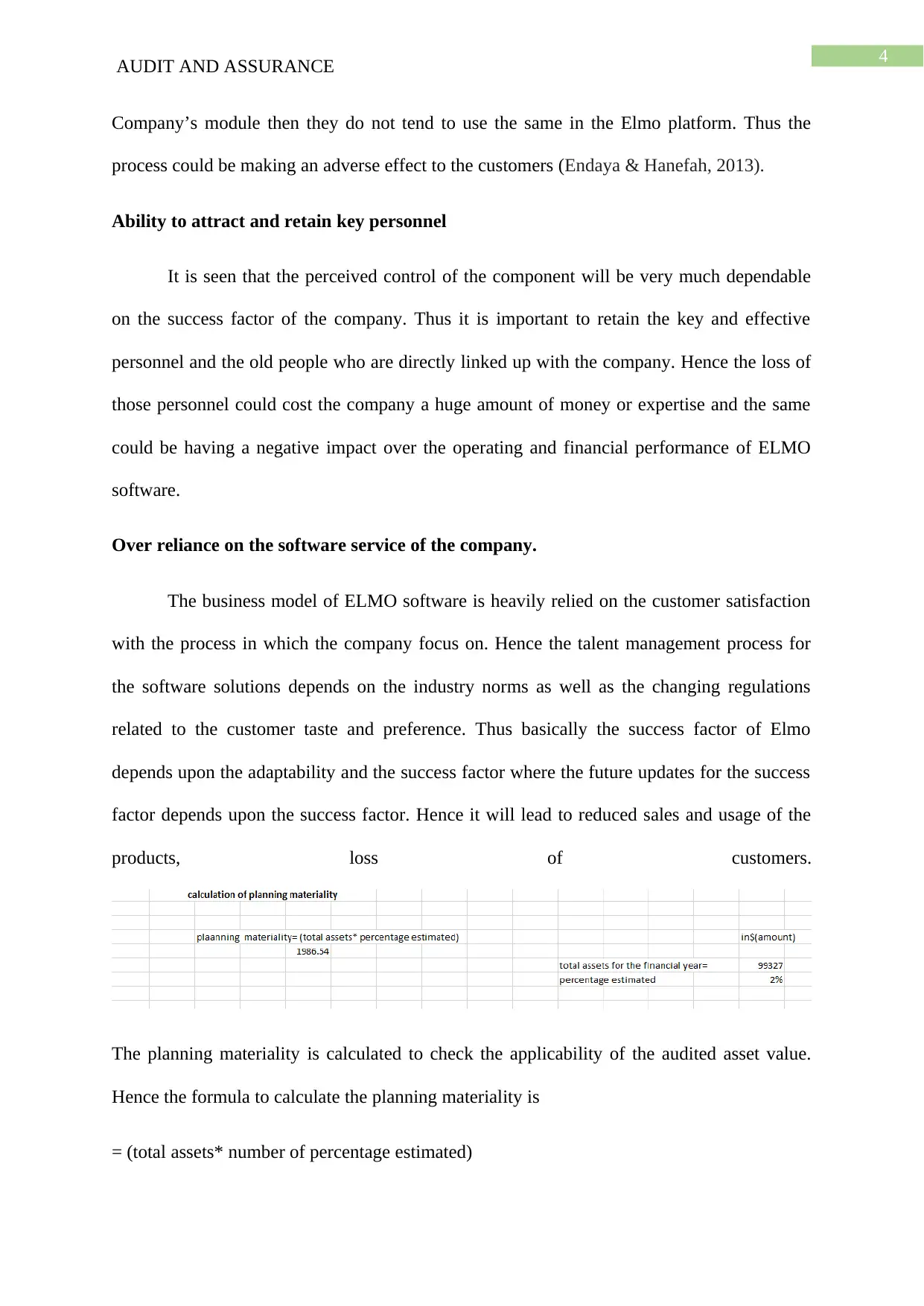

The planning materiality is calculated to check the applicability of the audited asset value.

Hence the formula to calculate the planning materiality is

= (total assets* number of percentage estimated)

AUDIT AND ASSURANCE

Company’s module then they do not tend to use the same in the Elmo platform. Thus the

process could be making an adverse effect to the customers (Endaya & Hanefah, 2013).

Ability to attract and retain key personnel

It is seen that the perceived control of the component will be very much dependable

on the success factor of the company. Thus it is important to retain the key and effective

personnel and the old people who are directly linked up with the company. Hence the loss of

those personnel could cost the company a huge amount of money or expertise and the same

could be having a negative impact over the operating and financial performance of ELMO

software.

Over reliance on the software service of the company.

The business model of ELMO software is heavily relied on the customer satisfaction

with the process in which the company focus on. Hence the talent management process for

the software solutions depends on the industry norms as well as the changing regulations

related to the customer taste and preference. Thus basically the success factor of Elmo

depends upon the adaptability and the success factor where the future updates for the success

factor depends upon the success factor. Hence it will lead to reduced sales and usage of the

products, loss of customers.

The planning materiality is calculated to check the applicability of the audited asset value.

Hence the formula to calculate the planning materiality is

= (total assets* number of percentage estimated)

5

AUDIT AND ASSURANCE

Hence the value calculated for this purpose is $1986.54. Hence this value is helpful to

calculate the effective net assets value for the company.

Analytical review of the company performance

The financial statements are considered as an important tools. It provides the detailed

report of the financial performance of the company as a whole. Hence the consolidated

statement of the financial position, statement of change in equity, cash flow statement have

been well effective to determine the overall performance of the company. Hence from the

annual report it is seen that the companies total asset have been increased to $99329 in the

year 2018 than 2017 whereas the overall liability have also increased to $26088 from 2017.

The company have new property for the business purpose as well as the capital costs have

also increased. Hence in the year 2018 the company had earned a lot of revenue in that

period. Hence the earning from the shares have also increased. From the cash flow statement

it is seen that then net cash flow from the operating activities have been recorded as $4118 in

the year 2018 than that of 2017. On the other hand the company had invested a good amount

of money in acquiring assets and expansion of business. Hence the investment have increased

to $27772 in the financial year. Lastly the company had earned a good amount of profit from

the issue of share and debenture as a whole. Thus it can be said that the overall performance

of the company had been very much satisfying in the financial year (Zhang et al. 2016).

Specific audit areas

The company audit areas are related to those practises which an auditor is used to

check while performing the relevant financial activities as a whole. Hence the most areas

which the company auditor is used to check is based on the change in the assets and liability

valuation. Hence the first audit area of concern for the company is the intangible assets. the

internal assets are acquired as a business combination part which is generally measured by

AUDIT AND ASSURANCE

Hence the value calculated for this purpose is $1986.54. Hence this value is helpful to

calculate the effective net assets value for the company.

Analytical review of the company performance

The financial statements are considered as an important tools. It provides the detailed

report of the financial performance of the company as a whole. Hence the consolidated

statement of the financial position, statement of change in equity, cash flow statement have

been well effective to determine the overall performance of the company. Hence from the

annual report it is seen that the companies total asset have been increased to $99329 in the

year 2018 than 2017 whereas the overall liability have also increased to $26088 from 2017.

The company have new property for the business purpose as well as the capital costs have

also increased. Hence in the year 2018 the company had earned a lot of revenue in that

period. Hence the earning from the shares have also increased. From the cash flow statement

it is seen that then net cash flow from the operating activities have been recorded as $4118 in

the year 2018 than that of 2017. On the other hand the company had invested a good amount

of money in acquiring assets and expansion of business. Hence the investment have increased

to $27772 in the financial year. Lastly the company had earned a good amount of profit from

the issue of share and debenture as a whole. Thus it can be said that the overall performance

of the company had been very much satisfying in the financial year (Zhang et al. 2016).

Specific audit areas

The company audit areas are related to those practises which an auditor is used to

check while performing the relevant financial activities as a whole. Hence the most areas

which the company auditor is used to check is based on the change in the assets and liability

valuation. Hence the first audit area of concern for the company is the intangible assets. the

internal assets are acquired as a business combination part which is generally measured by

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

AUDIT AND ASSURANCE

the fair value of the assets. Hence the intangible assets are not amortised and subsequently

not measured by the cost less depreciation. Hence the impairment on the profit and loss is

possible though the intangible asset valuation. On the other hand the goodwill is not

amortised which indicates the Impairment of the intangible assets. Hence the profit and loss

are subsequently reversed. Hence the company auditor can use the same process to review the

changes in the intangible asset valuation.

Trade payable

The credit value or the credit period are also needed to review in audit. The creditors

are the liabilities to the organisation where it is unpaid. Since the nature of the creditors are

short term hence they could not be discounted in the process. Thus it is important for the

company auditor to cross check the number of days it took to dissolve the credit period.

Apart from this the other considered areas of auditing is related to the depreciation and

amortisation, trade receivable, tax calculation and the overall net profit which have been

collected in the financial year.

Part B: QUALITY AND EFFECTIVENESS OF INDEPENDENT AUDIT

Main concerns on the quality and effectiveness of independent audit in Australia

The main concerns which are related to the auditing perspectives and improvement of the

auditing is based on the quality and effectiveness of the audit process of the auditor. Hence It

is important to maintain the independence of the auditor. Thus the key improvemental

initiatives could be as follows-

Conduction of effective and quality audit review.

AUDIT AND ASSURANCE

the fair value of the assets. Hence the intangible assets are not amortised and subsequently

not measured by the cost less depreciation. Hence the impairment on the profit and loss is

possible though the intangible asset valuation. On the other hand the goodwill is not

amortised which indicates the Impairment of the intangible assets. Hence the profit and loss

are subsequently reversed. Hence the company auditor can use the same process to review the

changes in the intangible asset valuation.

Trade payable

The credit value or the credit period are also needed to review in audit. The creditors

are the liabilities to the organisation where it is unpaid. Since the nature of the creditors are

short term hence they could not be discounted in the process. Thus it is important for the

company auditor to cross check the number of days it took to dissolve the credit period.

Apart from this the other considered areas of auditing is related to the depreciation and

amortisation, trade receivable, tax calculation and the overall net profit which have been

collected in the financial year.

Part B: QUALITY AND EFFECTIVENESS OF INDEPENDENT AUDIT

Main concerns on the quality and effectiveness of independent audit in Australia

The main concerns which are related to the auditing perspectives and improvement of the

auditing is based on the quality and effectiveness of the audit process of the auditor. Hence It

is important to maintain the independence of the auditor. Thus the key improvemental

initiatives could be as follows-

Conduction of effective and quality audit review.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

AUDIT AND ASSURANCE

Remediating findings by obtaining the basic audit evidence necessary to the form an

option on the financial report.

Identifying the root causes of the findings from the old quality issues and the audit

inspections.

In order to develop and monitor the revised action plan to ensure that those are

effective.

To improve the staff structure to ensure that they are resourced to undertake increase

complex audit and accounting standard in future (Ghafran and O'Sullivan 2013).

Audit firm quality reviews

Thus conducting an effective audit process and to ensure the quality the effectiveness

in the audit process and to ensure the same. As per the ASIC standard process the audit

inspections and the audit quality control is an important area to remediate the deficiencies by

obtaining the audit process.

Hence the partner and firms should not hesitate to revisit the audited entity to

undertake additional work. Hence there is an Importance to work on the audit areas for the

reporting period. Thus the audit report is necessary and sustainable and that the market can be

properly informed if any material misstatement have been detected.

On the other hand the confidentially restrictions have imposed on the ASIC under the

Australian security and standard have been amended to the audit commission act 2001 were

amended to the process. Hence this techniques is not only applicable in the Australia but also

all over the globe. Hence the auditing entities have used the regulatory guide 260 that

includes the audit independency and quality audit process.

Effective root cause analysis conduction

AUDIT AND ASSURANCE

Remediating findings by obtaining the basic audit evidence necessary to the form an

option on the financial report.

Identifying the root causes of the findings from the old quality issues and the audit

inspections.

In order to develop and monitor the revised action plan to ensure that those are

effective.

To improve the staff structure to ensure that they are resourced to undertake increase

complex audit and accounting standard in future (Ghafran and O'Sullivan 2013).

Audit firm quality reviews

Thus conducting an effective audit process and to ensure the quality the effectiveness

in the audit process and to ensure the same. As per the ASIC standard process the audit

inspections and the audit quality control is an important area to remediate the deficiencies by

obtaining the audit process.

Hence the partner and firms should not hesitate to revisit the audited entity to

undertake additional work. Hence there is an Importance to work on the audit areas for the

reporting period. Thus the audit report is necessary and sustainable and that the market can be

properly informed if any material misstatement have been detected.

On the other hand the confidentially restrictions have imposed on the ASIC under the

Australian security and standard have been amended to the audit commission act 2001 were

amended to the process. Hence this techniques is not only applicable in the Australia but also

all over the globe. Hence the auditing entities have used the regulatory guide 260 that

includes the audit independency and quality audit process.

Effective root cause analysis conduction

8

AUDIT AND ASSURANCE

In order to find the root audit because it is important to review the quality audit

programme and the effective audit programme. Hence there is a need of individual

engagement issues and thematic findings across the engagement. Thus it is important to

develop a culture and good working environment these are as follows-

Recognise and accept the findings.

To support the improvement to the audit quality.

Support and to undertake genuine root cause identification.

To implement the effective solutions to address the root cause of the audit

deficiencies

Audit firm actions plans to improve the audit quality

The auditors needs to focus on the maintaining the audit quality and appropriately balance

the imperativeness with the risks and the commercial changes to the audit services and the

reputation of the market. Thus the firm needs to focus on:

The culture of the firm which includes strong messages over the Importance of the audit

quality to set examples and set standards in the audit independence.

Addressing the audit concerns

As per the department of audit and accounts have performed the financial and

compliance audit and the other compliance activities. Hence the internal audit and other

compliance along with the process needs to be closely monitored with the external audits as

to track thee identified issues and the standard business practise. Hence the five most

identified issued across all the issues related to the changes in the process of resolutions as a

whole. Hence as per the financial issues 2011 it is seen that differences had been associated

with the key issues and the engagements related to the process as well as the audit

engagements. Hence the common audit Issues faced by the company auditors are as follows-

AUDIT AND ASSURANCE

In order to find the root audit because it is important to review the quality audit

programme and the effective audit programme. Hence there is a need of individual

engagement issues and thematic findings across the engagement. Thus it is important to

develop a culture and good working environment these are as follows-

Recognise and accept the findings.

To support the improvement to the audit quality.

Support and to undertake genuine root cause identification.

To implement the effective solutions to address the root cause of the audit

deficiencies

Audit firm actions plans to improve the audit quality

The auditors needs to focus on the maintaining the audit quality and appropriately balance

the imperativeness with the risks and the commercial changes to the audit services and the

reputation of the market. Thus the firm needs to focus on:

The culture of the firm which includes strong messages over the Importance of the audit

quality to set examples and set standards in the audit independence.

Addressing the audit concerns

As per the department of audit and accounts have performed the financial and

compliance audit and the other compliance activities. Hence the internal audit and other

compliance along with the process needs to be closely monitored with the external audits as

to track thee identified issues and the standard business practise. Hence the five most

identified issued across all the issues related to the changes in the process of resolutions as a

whole. Hence as per the financial issues 2011 it is seen that differences had been associated

with the key issues and the engagements related to the process as well as the audit

engagements. Hence the common audit Issues faced by the company auditors are as follows-

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9

AUDIT AND ASSURANCE

Inadequate internal audit

The management is tasked to maintain the internal control of a necessary level and

look to provide the reasonable assurance to the balance and the amount are been properly

documented, processed and reported. On the other hand the implemented policies and

procedures will ensure all the balance and the respective changes that are also properly

documented and processed. Hence the company management needs to provide proper rules

and should look to update the internal audit rules and regulations. It is also important to the

company regulator to do independent auditing.

Inadequate accounting process

The main concern behind the inadequacy of the accounting process is based on the

wrong audit of the financial report. Hence wrong way of auditing is an area of concern for

this aspect. On the other hand the management needs to establish, maintain and monitor the

internal control for the purpose to ensure that there is a fair way of presentation to the

financial reports. Hence it is important for the company auditor to apply the effective and

proper audit process as well as there is also a need to reconciliation of the financial statement

as well as to review the same. Thus there is a need of appropriate segregation of the process

as it needs.

Inadequate control over the financial reporting

The misstatement in the auditing happens if there is no such adequate audit control

which had been presented to the company auditor who had presented the audit including the

ledgers posting. Hence the company regulators need to come up with an effective solution to

the process. Thus the company management needs to come up with an effective solution

AUDIT AND ASSURANCE

Inadequate internal audit

The management is tasked to maintain the internal control of a necessary level and

look to provide the reasonable assurance to the balance and the amount are been properly

documented, processed and reported. On the other hand the implemented policies and

procedures will ensure all the balance and the respective changes that are also properly

documented and processed. Hence the company management needs to provide proper rules

and should look to update the internal audit rules and regulations. It is also important to the

company regulator to do independent auditing.

Inadequate accounting process

The main concern behind the inadequacy of the accounting process is based on the

wrong audit of the financial report. Hence wrong way of auditing is an area of concern for

this aspect. On the other hand the management needs to establish, maintain and monitor the

internal control for the purpose to ensure that there is a fair way of presentation to the

financial reports. Hence it is important for the company auditor to apply the effective and

proper audit process as well as there is also a need to reconciliation of the financial statement

as well as to review the same. Thus there is a need of appropriate segregation of the process

as it needs.

Inadequate control over the financial reporting

The misstatement in the auditing happens if there is no such adequate audit control

which had been presented to the company auditor who had presented the audit including the

ledgers posting. Hence the company regulators need to come up with an effective solution to

the process. Thus the company management needs to come up with an effective solution

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10

AUDIT AND ASSURANCE

which includes that the management needs to implement and maintain the internal control

system towards the issue of the preparation of the financial statements as a whole.

Conclusion

Hence it can be concluded from the study that Elmo software limited had successfully

applied the techniques which have been useful to mitigate the risks. On the other hand the

performance analysis from the annual report of the company had suggested towards the

sustainability of the company financial performance. On the other hand the main audit areas

relating to the concerns and the audit effectiveness have implied in Australia as well as the

measurement areas have also got implemented in this case.

AUDIT AND ASSURANCE

which includes that the management needs to implement and maintain the internal control

system towards the issue of the preparation of the financial statements as a whole.

Conclusion

Hence it can be concluded from the study that Elmo software limited had successfully

applied the techniques which have been useful to mitigate the risks. On the other hand the

performance analysis from the annual report of the company had suggested towards the

sustainability of the company financial performance. On the other hand the main audit areas

relating to the concerns and the audit effectiveness have implied in Australia as well as the

measurement areas have also got implemented in this case.

11

AUDIT AND ASSURANCE

References

Abbott, L.J., Daugherty, B., Parker, S. and Peters, G.F., 2016. Internal audit quality and

financial reporting quality: The joint importance of independence and competence. Journal

of Accounting Research, 54(1), pp.3-40.

Alzeban, A. and Gwilliam, D., 2014. Factors affecting the internal audit effectiveness: A

survey of the Saudi public sector. Journal of International Accounting, Auditing and

Taxation, 23(2), pp.74-86.

Alzeban, A. and Gwilliam, D., 2014. Factors affecting the internal audit effectiveness: A

survey of the Saudi public sector. Journal of International Accounting, Auditing and

Taxation, 23(2), pp.74-86.

Alzeban, A. and Gwilliam, D., 2014. Factors affecting the internal audit effectiveness: A

survey of the Saudi public sector. Journal of International Accounting, Auditing and

Taxation, 23(2), pp.74-86.

Drogalas, G., Karagiorgos, T. and Arabatzis, K., 2015. Factors associated with internal audit

effectiveness: Evidence from Greece. Drogalas, G., Karagiorgos T. & Arampatzis K.(2015).

Factors associated with Internal Audit Effectiveness: Evidence from Greece. Journal of

Accounting and Taxation, 7(7), pp.113-122.

Endaya, K.A. and Hanefah, M.M., 2013. Internal audit effectiveness: An approach

proposition to develop the theoretical framework. Research Journal of Finance and

Accounting, 4(10), pp.92-102.

Garcia-Blandon, J. and Argiles, J.M., 2015. Audit firm tenure and independence: A

comprehensive investigation of audit qualifications in Spain. Journal of international

accounting, auditing and taxation, 24, pp.82-93.

AUDIT AND ASSURANCE

References

Abbott, L.J., Daugherty, B., Parker, S. and Peters, G.F., 2016. Internal audit quality and

financial reporting quality: The joint importance of independence and competence. Journal

of Accounting Research, 54(1), pp.3-40.

Alzeban, A. and Gwilliam, D., 2014. Factors affecting the internal audit effectiveness: A

survey of the Saudi public sector. Journal of International Accounting, Auditing and

Taxation, 23(2), pp.74-86.

Alzeban, A. and Gwilliam, D., 2014. Factors affecting the internal audit effectiveness: A

survey of the Saudi public sector. Journal of International Accounting, Auditing and

Taxation, 23(2), pp.74-86.

Alzeban, A. and Gwilliam, D., 2014. Factors affecting the internal audit effectiveness: A

survey of the Saudi public sector. Journal of International Accounting, Auditing and

Taxation, 23(2), pp.74-86.

Drogalas, G., Karagiorgos, T. and Arabatzis, K., 2015. Factors associated with internal audit

effectiveness: Evidence from Greece. Drogalas, G., Karagiorgos T. & Arampatzis K.(2015).

Factors associated with Internal Audit Effectiveness: Evidence from Greece. Journal of

Accounting and Taxation, 7(7), pp.113-122.

Endaya, K.A. and Hanefah, M.M., 2013. Internal audit effectiveness: An approach

proposition to develop the theoretical framework. Research Journal of Finance and

Accounting, 4(10), pp.92-102.

Garcia-Blandon, J. and Argiles, J.M., 2015. Audit firm tenure and independence: A

comprehensive investigation of audit qualifications in Spain. Journal of international

accounting, auditing and taxation, 24, pp.82-93.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.