Audit Assurance and Practice: ARAFURA Resources Limited Report

VerifiedAdded on 2021/06/17

|22

|4293

|23

Report

AI Summary

This report, prepared from the perspective of an accounting firm manager, details the initial phases of an audit for ARAFURA Resources Limited, a company involved in leasing and servicing mining machinery. The report begins with an executive summary outlining the significant risk areas, including plant and equipment, machinery finance liabilities, accounts receivable, and lease income. It analyzes these areas, discusses potential audit risks, and suggests mitigation steps. The report further analyzes financial ratios and evaluates internal controls, including their effectiveness in mitigating risks and the required tests of control. It also addresses internal weaknesses in contract payroll. The report covers business transactions, investments, financing activities, and financial reporting practices, as well as analytical procedures applied to the statement of financial position and financial performance over three years. The report also highlights material account balances and the relevant financial report assertions applicable to each account, providing a comprehensive set of audit work steps for each material balance.

ARAFURA Resources Limited-

Audit assurance and

practice

Audit Planning and Internal Control

Name of the Author

Audit assurance and

practice

Audit Planning and Internal Control

Name of the Author

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

EXECUTIVE SUMMARY

The purpose of this report is to elaborate the initial phases of work in conduct of any

audit. Before any audit work is commenced, the auditor must complete some preliminary

works and they are to be discussed herein. This report is written from the view point of the

manager of an accounting firm. The client here is ARAFURA Resources Limited engaged in

the business of leasing and servicing large mining machinery to that region’s gold mines. The

first section deals with the significant risk areas and accounts being, Plant and equipment,

Machinery Finance Liabilities, Accounts Receivable and Lease income. These areas are

being analysed by the auditor and the audit risk that may exist and the steps to alleviate that

risk is mentioned. The second section shows the outlined analysis of the different ratios done

by the auditor using the additional information obtained. Moving ahead the report deals with

potentially effective internal controls in the client’s business and states the kind of risk they

can alleviate and at the same time the test of control required for every kind of internal

control is stated. In the last the contract payroll’s internal weakness is stated.

The purpose of this report is to elaborate the initial phases of work in conduct of any

audit. Before any audit work is commenced, the auditor must complete some preliminary

works and they are to be discussed herein. This report is written from the view point of the

manager of an accounting firm. The client here is ARAFURA Resources Limited engaged in

the business of leasing and servicing large mining machinery to that region’s gold mines. The

first section deals with the significant risk areas and accounts being, Plant and equipment,

Machinery Finance Liabilities, Accounts Receivable and Lease income. These areas are

being analysed by the auditor and the audit risk that may exist and the steps to alleviate that

risk is mentioned. The second section shows the outlined analysis of the different ratios done

by the auditor using the additional information obtained. Moving ahead the report deals with

potentially effective internal controls in the client’s business and states the kind of risk they

can alleviate and at the same time the test of control required for every kind of internal

control is stated. In the last the contract payroll’s internal weakness is stated.

Table of Contents

EXECUTIVE SUMMARY...........................................................................................................................1

Introduction...........................................................................................................................................3

Description of ARAFURA Resources Limited......................................................................................3

Understand the nature of the entity and its industry............................................................................3

Business Transactions of the company..............................................................................................3

Investments and investment activities..............................................................................................3

Financing and financing activities......................................................................................................3

Financial reporting practices..............................................................................................................3

Analytical procedures of the Statement of Financial Position and of Financial Performance over the

last three years......................................................................................................................................4

Consideration of the account balances are considered “material”.......................................................4

Ten different material account balances, five assets and five liabilities................................................6

List the relevant financial report assertions and explain why the selected assertions are applicable to

each account..........................................................................................................................................7

Comprehensive set of audit work steps for each material account balance.........................................8

Conclusion.............................................................................................................................................9

References...........................................................................................................................................10

EXECUTIVE SUMMARY...........................................................................................................................1

Introduction...........................................................................................................................................3

Description of ARAFURA Resources Limited......................................................................................3

Understand the nature of the entity and its industry............................................................................3

Business Transactions of the company..............................................................................................3

Investments and investment activities..............................................................................................3

Financing and financing activities......................................................................................................3

Financial reporting practices..............................................................................................................3

Analytical procedures of the Statement of Financial Position and of Financial Performance over the

last three years......................................................................................................................................4

Consideration of the account balances are considered “material”.......................................................4

Ten different material account balances, five assets and five liabilities................................................6

List the relevant financial report assertions and explain why the selected assertions are applicable to

each account..........................................................................................................................................7

Comprehensive set of audit work steps for each material account balance.........................................8

Conclusion.............................................................................................................................................9

References...........................................................................................................................................10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Introduction

Substantive Tests of balances are used to decrease the threats so that the audit risks

can be accomplished. They are implemented to examine the dollar value of transactions.

They are tests of audit which are used to justify the closing balance of ledger accounts. They

assure the authenticity of the transactions and recognize any substantial misstatements in

them, if any.

Description of ARAFURA Resources Limited

Arafura Resources Limited is mineral extraction company based in Australia. Its

major business transactions comprise of extracting the rarest of the rare minerals of earth. Its

headquarters are situated in Perth, Western Australia. It was listed on the Australian Stock

Exchange in the year 2003. One of its flagship projects is Nolans Rare Earths Project which

is situated in the Northern Territory of Australia.

Understand the nature of the entity and its industry

Business Transactions of the company

In the implementation of the audit programs for account balances, the auditors are concerned

about the overstatement or understatement of the account balances of the ledger accounts. In

this regard, the tests of controls and substantive tests of transactions are two major processes

for collection of evidences. The responsibility of the auditor is to coordinate the audit

approach specified in the audit program ensuring that the effective methods of audit

processes are implemented. In the process, the auditor must apply the substantive tests and

make use of direct tests of balances.

The business transactions of the company comprise of extraction of the rarest of the rare

minerals present on this earth. It will become the permanent supplier of neodymium and

praseodymium (NdPr) from Noland which is one of the major projects of the company. It is

situated almost 135 Km in the Northern Territory of Australia.

The mineral tenure over the Nolans project is secured by three major extraction licenses and

it has also applied for four mineral leases. Once these leases are granted, the company shall

Substantive Tests of balances are used to decrease the threats so that the audit risks

can be accomplished. They are implemented to examine the dollar value of transactions.

They are tests of audit which are used to justify the closing balance of ledger accounts. They

assure the authenticity of the transactions and recognize any substantial misstatements in

them, if any.

Description of ARAFURA Resources Limited

Arafura Resources Limited is mineral extraction company based in Australia. Its

major business transactions comprise of extracting the rarest of the rare minerals of earth. Its

headquarters are situated in Perth, Western Australia. It was listed on the Australian Stock

Exchange in the year 2003. One of its flagship projects is Nolans Rare Earths Project which

is situated in the Northern Territory of Australia.

Understand the nature of the entity and its industry

Business Transactions of the company

In the implementation of the audit programs for account balances, the auditors are concerned

about the overstatement or understatement of the account balances of the ledger accounts. In

this regard, the tests of controls and substantive tests of transactions are two major processes

for collection of evidences. The responsibility of the auditor is to coordinate the audit

approach specified in the audit program ensuring that the effective methods of audit

processes are implemented. In the process, the auditor must apply the substantive tests and

make use of direct tests of balances.

The business transactions of the company comprise of extraction of the rarest of the rare

minerals present on this earth. It will become the permanent supplier of neodymium and

praseodymium (NdPr) from Noland which is one of the major projects of the company. It is

situated almost 135 Km in the Northern Territory of Australia.

The mineral tenure over the Nolans project is secured by three major extraction licenses and

it has also applied for four mineral leases. Once these leases are granted, the company shall

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

initiate the mineral processing extractions and many other infrastructure elements related to

the project.

The major asset of the project is the phosphate deposits which are the biggest and most

extensively explored deposits on this earth (ARAFURA Resources Limited, 2017).

Investments and investment activities

In the year 2015, the company had invested in the property, plant and equipment amounting

to $110,010. The payments for extraction and evaluation amounted to $6,189,149 and it had

received the Research and Development rebate on its capitalized part amounting to

$2,263,935. So, the net cash outflow from investing activities in the year 2015 was

$4,035,224 (ARAFURA Resources Limited, 2015).

In the year 2016, the company invested $523 in property, plant and machinery and the

investments in extraction and evaluation activities amounted to $4,072,639. Moreover, it

received $ 2,515,992 as a Research and Development Incentive Rebate on its capitalized

portion. The expenses on other investment activities were $51,229. So the net cash outflow

from investing activities was $1,608,469 (ARAFURA Resources Limited, 2016).

In the year 2017, the company invested $55396 in property, machinery and equipment and it

invested $3,364,107 in its extraction and evaluation activities. It received $ 313,250 from the

sale of its tenements and $905,760 from the R&D Incentive rebate. So, the company invested

$2,200,493 at the end of the financial year 2017.

The company invested $ 182500 as provision for lease incentive in 2015 and $ 421,693 as

lease commitments in the year 2016 whereas it invested $ 629,761 in the year 2017.

Financing and financing activities

In the year 2017, the company had financed its activities from the proceeds from issue of

shares amounting to $6,764,740 whereas it paid $309,099 as transaction costs of the

shares .However, there were no financing activities in the years 2015 and 2016 (Demirel, and

Ero, 2016).

the project.

The major asset of the project is the phosphate deposits which are the biggest and most

extensively explored deposits on this earth (ARAFURA Resources Limited, 2017).

Investments and investment activities

In the year 2015, the company had invested in the property, plant and equipment amounting

to $110,010. The payments for extraction and evaluation amounted to $6,189,149 and it had

received the Research and Development rebate on its capitalized part amounting to

$2,263,935. So, the net cash outflow from investing activities in the year 2015 was

$4,035,224 (ARAFURA Resources Limited, 2015).

In the year 2016, the company invested $523 in property, plant and machinery and the

investments in extraction and evaluation activities amounted to $4,072,639. Moreover, it

received $ 2,515,992 as a Research and Development Incentive Rebate on its capitalized

portion. The expenses on other investment activities were $51,229. So the net cash outflow

from investing activities was $1,608,469 (ARAFURA Resources Limited, 2016).

In the year 2017, the company invested $55396 in property, machinery and equipment and it

invested $3,364,107 in its extraction and evaluation activities. It received $ 313,250 from the

sale of its tenements and $905,760 from the R&D Incentive rebate. So, the company invested

$2,200,493 at the end of the financial year 2017.

The company invested $ 182500 as provision for lease incentive in 2015 and $ 421,693 as

lease commitments in the year 2016 whereas it invested $ 629,761 in the year 2017.

Financing and financing activities

In the year 2017, the company had financed its activities from the proceeds from issue of

shares amounting to $6,764,740 whereas it paid $309,099 as transaction costs of the

shares .However, there were no financing activities in the years 2015 and 2016 (Demirel, and

Ero, 2016).

Its total equity amounted to $130,385,162 in 2015 whereas $98,494,227 was reported as total

equity in the year 2016. While it amounted to $101,564,849 in the year 2017. The company

raised $ 3.6 Million through institutional investors in Australia and abroad in the year 2017.

It had fully paid up shares amounting to $194,128,196 in the year 2015 and 2016 whereas

$200,590,837 in the year 2017.

Financial reporting practices

The company prepares and lodges the financial reports in accordance with the Australian

Securities and Investment Commission (ASIC). Furthermore, the company is adopting the

Australian equivalent of the International Financial Reporting Standards. The company is

also complying with the AASB 101 Presentation of Financial Statements which provides for

the presentation of the general purpose financial statements in such a way that they can be

compared with the financial statements of the previous years as well as with the financial

statements of the companies operating in the same industry (Lourenço and Branco, 2015).

.

The accounting standards adopted by the company must be harmonized by the International

Financial Reporting Standards (IFRS). The accounts of the company are audited by BDO

Audit (WA) Pty Ltd (Baki, Uthman, and Sanni, 2014).

Analytical procedures of the Statement of Financial

Position and of Financial Performance over the last

three years

Ratio Analysis

Liquidity ratio

The liquidity and the financial health of the

company can be assessed with the help of

Current ratio, Quick ratio, Financial Leverage

and the Debt /Equity Ratio.

The current ratio is Current assets /current

liabilities of the company. The ideal current

equity in the year 2016. While it amounted to $101,564,849 in the year 2017. The company

raised $ 3.6 Million through institutional investors in Australia and abroad in the year 2017.

It had fully paid up shares amounting to $194,128,196 in the year 2015 and 2016 whereas

$200,590,837 in the year 2017.

Financial reporting practices

The company prepares and lodges the financial reports in accordance with the Australian

Securities and Investment Commission (ASIC). Furthermore, the company is adopting the

Australian equivalent of the International Financial Reporting Standards. The company is

also complying with the AASB 101 Presentation of Financial Statements which provides for

the presentation of the general purpose financial statements in such a way that they can be

compared with the financial statements of the previous years as well as with the financial

statements of the companies operating in the same industry (Lourenço and Branco, 2015).

.

The accounting standards adopted by the company must be harmonized by the International

Financial Reporting Standards (IFRS). The accounts of the company are audited by BDO

Audit (WA) Pty Ltd (Baki, Uthman, and Sanni, 2014).

Analytical procedures of the Statement of Financial

Position and of Financial Performance over the last

three years

Ratio Analysis

Liquidity ratio

The liquidity and the financial health of the

company can be assessed with the help of

Current ratio, Quick ratio, Financial Leverage

and the Debt /Equity Ratio.

The current ratio is Current assets /current

liabilities of the company. The ideal current

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

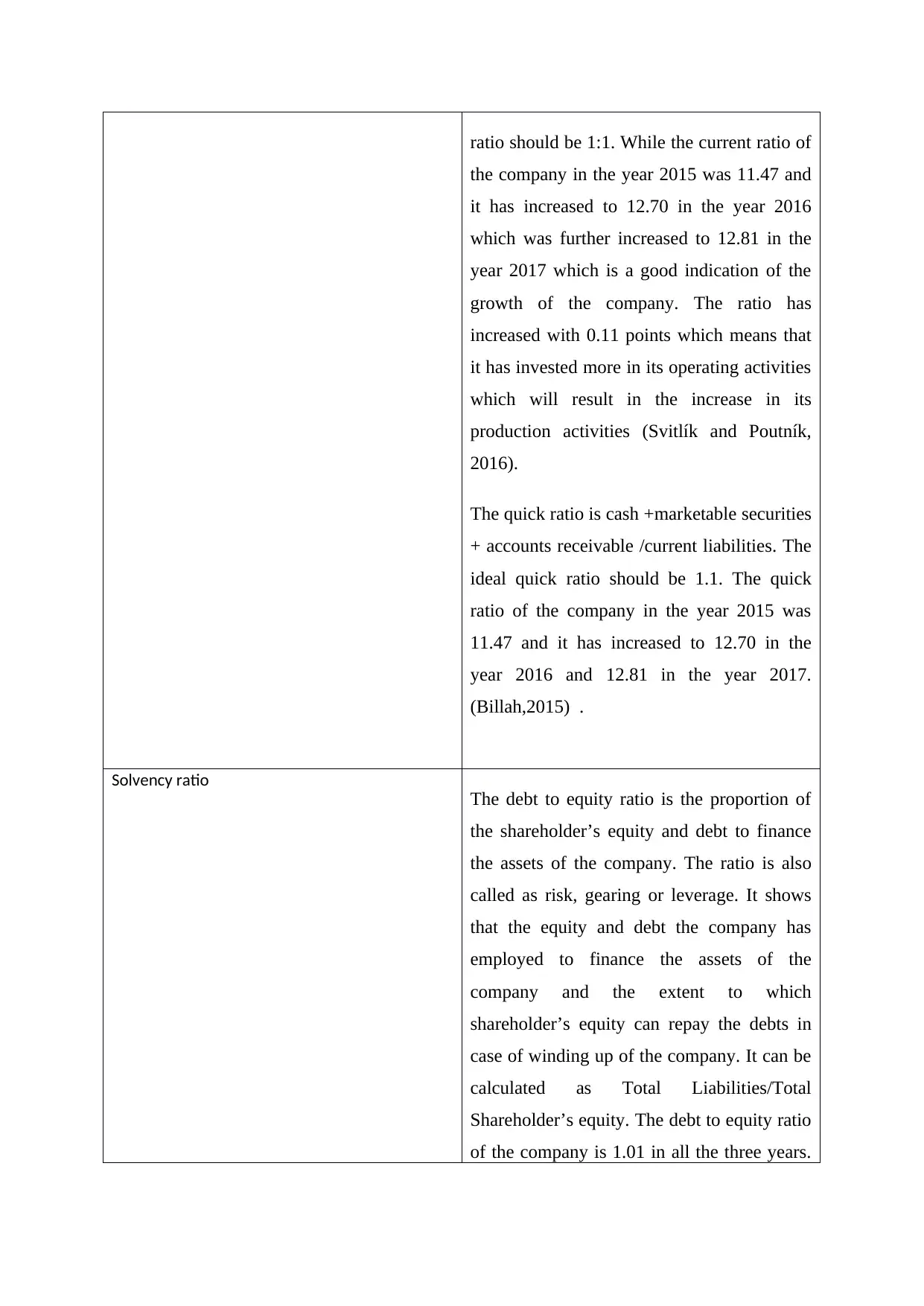

ratio should be 1:1. While the current ratio of

the company in the year 2015 was 11.47 and

it has increased to 12.70 in the year 2016

which was further increased to 12.81 in the

year 2017 which is a good indication of the

growth of the company. The ratio has

increased with 0.11 points which means that

it has invested more in its operating activities

which will result in the increase in its

production activities (Svitlík and Poutník,

2016).

The quick ratio is cash +marketable securities

+ accounts receivable /current liabilities. The

ideal quick ratio should be 1.1. The quick

ratio of the company in the year 2015 was

11.47 and it has increased to 12.70 in the

year 2016 and 12.81 in the year 2017.

(Billah,2015) .

Solvency ratio

The debt to equity ratio is the proportion of

the shareholder’s equity and debt to finance

the assets of the company. The ratio is also

called as risk, gearing or leverage. It shows

that the equity and debt the company has

employed to finance the assets of the

company and the extent to which

shareholder’s equity can repay the debts in

case of winding up of the company. It can be

calculated as Total Liabilities/Total

Shareholder’s equity. The debt to equity ratio

of the company is 1.01 in all the three years.

the company in the year 2015 was 11.47 and

it has increased to 12.70 in the year 2016

which was further increased to 12.81 in the

year 2017 which is a good indication of the

growth of the company. The ratio has

increased with 0.11 points which means that

it has invested more in its operating activities

which will result in the increase in its

production activities (Svitlík and Poutník,

2016).

The quick ratio is cash +marketable securities

+ accounts receivable /current liabilities. The

ideal quick ratio should be 1.1. The quick

ratio of the company in the year 2015 was

11.47 and it has increased to 12.70 in the

year 2016 and 12.81 in the year 2017.

(Billah,2015) .

Solvency ratio

The debt to equity ratio is the proportion of

the shareholder’s equity and debt to finance

the assets of the company. The ratio is also

called as risk, gearing or leverage. It shows

that the equity and debt the company has

employed to finance the assets of the

company and the extent to which

shareholder’s equity can repay the debts in

case of winding up of the company. It can be

calculated as Total Liabilities/Total

Shareholder’s equity. The debt to equity ratio

of the company is 1.01 in all the three years.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

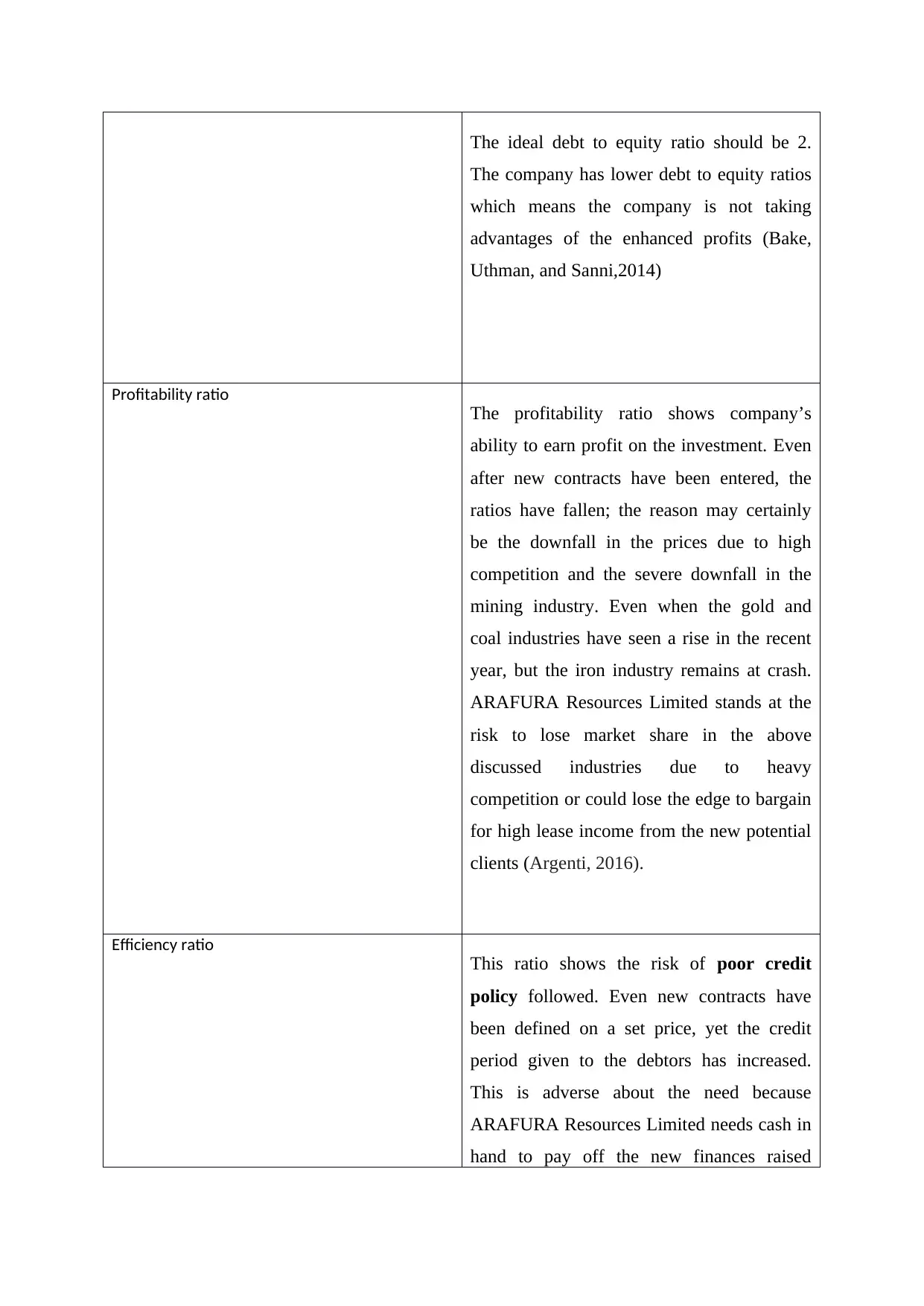

The ideal debt to equity ratio should be 2.

The company has lower debt to equity ratios

which means the company is not taking

advantages of the enhanced profits (Bake,

Uthman, and Sanni,2014)

Profitability ratio

The profitability ratio shows company’s

ability to earn profit on the investment. Even

after new contracts have been entered, the

ratios have fallen; the reason may certainly

be the downfall in the prices due to high

competition and the severe downfall in the

mining industry. Even when the gold and

coal industries have seen a rise in the recent

year, but the iron industry remains at crash.

ARAFURA Resources Limited stands at the

risk to lose market share in the above

discussed industries due to heavy

competition or could lose the edge to bargain

for high lease income from the new potential

clients (Argenti, 2016).

Efficiency ratio

This ratio shows the risk of poor credit

policy followed. Even new contracts have

been defined on a set price, yet the credit

period given to the debtors has increased.

This is adverse about the need because

ARAFURA Resources Limited needs cash in

hand to pay off the new finances raised

The company has lower debt to equity ratios

which means the company is not taking

advantages of the enhanced profits (Bake,

Uthman, and Sanni,2014)

Profitability ratio

The profitability ratio shows company’s

ability to earn profit on the investment. Even

after new contracts have been entered, the

ratios have fallen; the reason may certainly

be the downfall in the prices due to high

competition and the severe downfall in the

mining industry. Even when the gold and

coal industries have seen a rise in the recent

year, but the iron industry remains at crash.

ARAFURA Resources Limited stands at the

risk to lose market share in the above

discussed industries due to heavy

competition or could lose the edge to bargain

for high lease income from the new potential

clients (Argenti, 2016).

Efficiency ratio

This ratio shows the risk of poor credit

policy followed. Even new contracts have

been defined on a set price, yet the credit

period given to the debtors has increased.

This is adverse about the need because

ARAFURA Resources Limited needs cash in

hand to pay off the new finances raised

(Ooghe, & De Prijcker, 2008).

Consideration of the account balances are considered

“material”

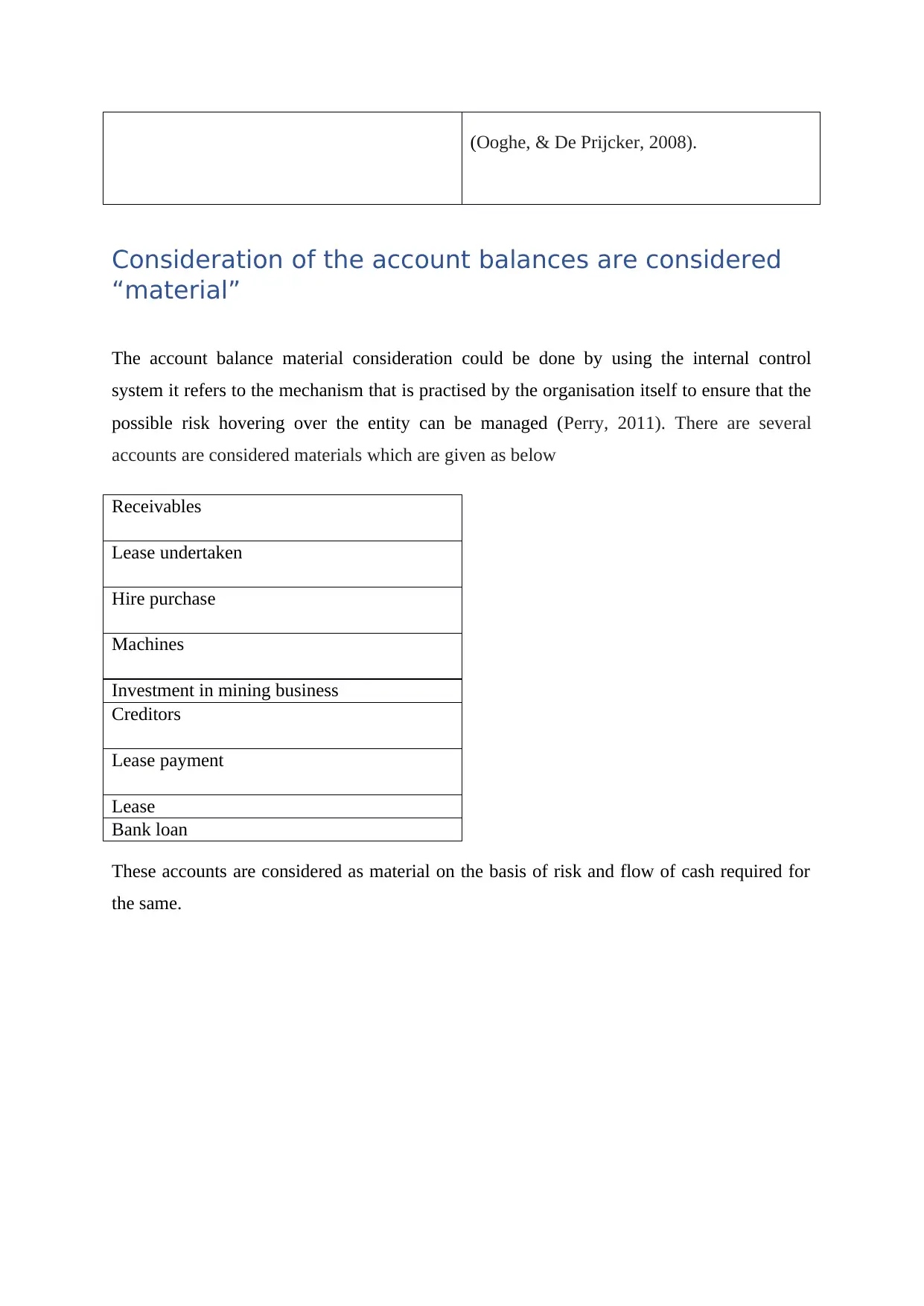

The account balance material consideration could be done by using the internal control

system it refers to the mechanism that is practised by the organisation itself to ensure that the

possible risk hovering over the entity can be managed (Perry, 2011). There are several

accounts are considered materials which are given as below

Receivables

Lease undertaken

Hire purchase

Machines

Investment in mining business

Creditors

Lease payment

Lease

Bank loan

These accounts are considered as material on the basis of risk and flow of cash required for

the same.

Consideration of the account balances are considered

“material”

The account balance material consideration could be done by using the internal control

system it refers to the mechanism that is practised by the organisation itself to ensure that the

possible risk hovering over the entity can be managed (Perry, 2011). There are several

accounts are considered materials which are given as below

Receivables

Lease undertaken

Hire purchase

Machines

Investment in mining business

Creditors

Lease payment

Lease

Bank loan

These accounts are considered as material on the basis of risk and flow of cash required for

the same.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

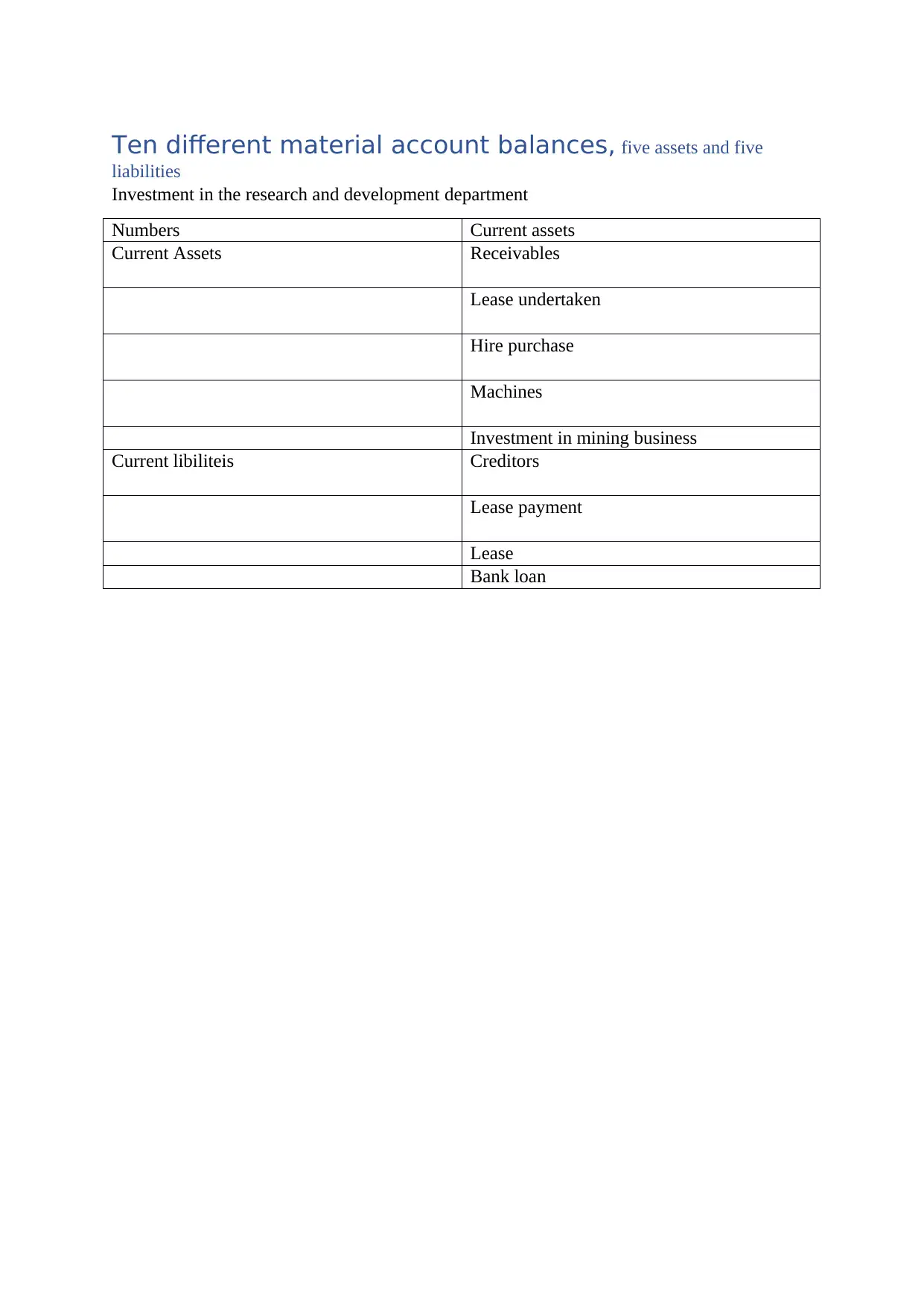

Ten different material account balances, five assets and five

liabilities

Investment in the research and development department

Numbers Current assets

Current Assets Receivables

Lease undertaken

Hire purchase

Machines

Investment in mining business

Current libiliteis Creditors

Lease payment

Lease

Bank loan

liabilities

Investment in the research and development department

Numbers Current assets

Current Assets Receivables

Lease undertaken

Hire purchase

Machines

Investment in mining business

Current libiliteis Creditors

Lease payment

Lease

Bank loan

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

List the relevant financial report assertions and explain

why the selected assertions are applicable to each

account

In ascertaining the risk concerned with significant accounts related to any client, the auditor

is required to verify the various assertions made by the management regarding the assets,

liabilities and equity balances on the grounds of existence, completeness, rights & obligations

and valuation, and regarding the transactions on grounds of occurrence, completeness,

accuracy, cut-off and classification. These assertions are the management’s representation

which they believe to be true and in good faith. They pave the ground of audit risk.

ACCOUNT ANALYSIS AUDIT RISK AUDIT STEPS TO

REDUCE RISK

Plant and equipment Its observed that due

to changes in market

scenario and

customer’s demands,

the demand for

already owned

machines has

radically declined

and new computer-

controlled equipment

have been purchased.

Existence: it’s related

to the representation

given by the

management

regarding the

physical availability

of assets that are

purchased and that

already existed.

There may stand a

chance of forged

purchase documents

to abscond cash and

no actual purchases

being made.

Completeness: there

To reduce the risk

regarding the actual

existence and

disclosure

completeness of

assets, physical

verification should be

undertaken, and a

checklist of assets

reflected in the

balance sheet should

be made.

To ensure the correct

valuation, valuation

experts in the

concerned field can

why the selected assertions are applicable to each

account

In ascertaining the risk concerned with significant accounts related to any client, the auditor

is required to verify the various assertions made by the management regarding the assets,

liabilities and equity balances on the grounds of existence, completeness, rights & obligations

and valuation, and regarding the transactions on grounds of occurrence, completeness,

accuracy, cut-off and classification. These assertions are the management’s representation

which they believe to be true and in good faith. They pave the ground of audit risk.

ACCOUNT ANALYSIS AUDIT RISK AUDIT STEPS TO

REDUCE RISK

Plant and equipment Its observed that due

to changes in market

scenario and

customer’s demands,

the demand for

already owned

machines has

radically declined

and new computer-

controlled equipment

have been purchased.

Existence: it’s related

to the representation

given by the

management

regarding the

physical availability

of assets that are

purchased and that

already existed.

There may stand a

chance of forged

purchase documents

to abscond cash and

no actual purchases

being made.

Completeness: there

To reduce the risk

regarding the actual

existence and

disclosure

completeness of

assets, physical

verification should be

undertaken, and a

checklist of assets

reflected in the

balance sheet should

be made.

To ensure the correct

valuation, valuation

experts in the

concerned field can

may stand a stand a

risk that all the

equipment required

to be disclosed in the

balance sheet aren’t

done so.

be contacted. They

may help in assessing

the true valuation in

ARAFURA

Resources Limited’s

context (Dow, et

al...2013).

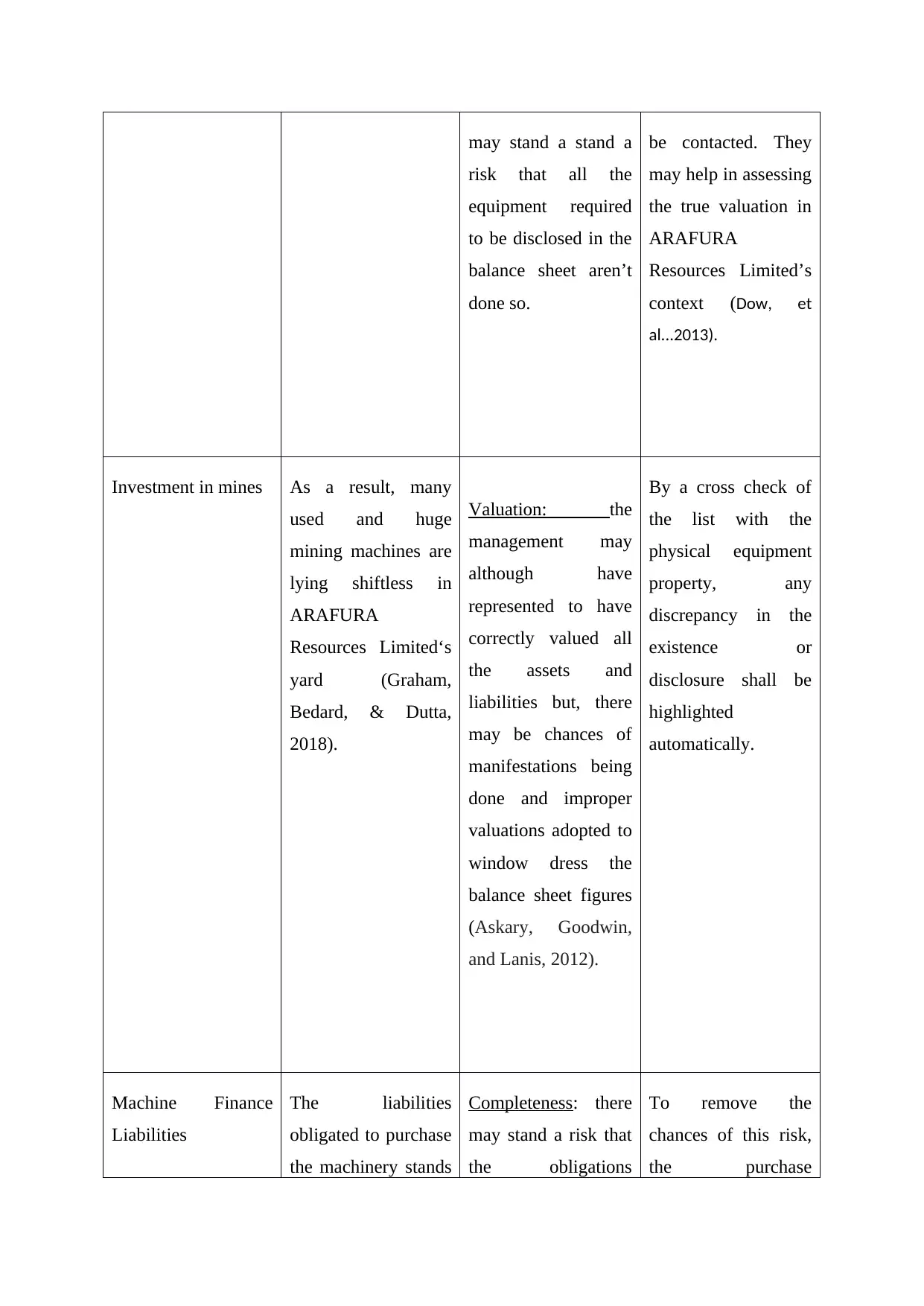

Investment in mines As a result, many

used and huge

mining machines are

lying shiftless in

ARAFURA

Resources Limited‘s

yard (Graham,

Bedard, & Dutta,

2018).

Valuation: the

management may

although have

represented to have

correctly valued all

the assets and

liabilities but, there

may be chances of

manifestations being

done and improper

valuations adopted to

window dress the

balance sheet figures

(Askary, Goodwin,

and Lanis, 2012).

By a cross check of

the list with the

physical equipment

property, any

discrepancy in the

existence or

disclosure shall be

highlighted

automatically.

Machine Finance

Liabilities

The liabilities

obligated to purchase

the machinery stands

Completeness: there

may stand a risk that

the obligations

To remove the

chances of this risk,

the purchase

risk that all the

equipment required

to be disclosed in the

balance sheet aren’t

done so.

be contacted. They

may help in assessing

the true valuation in

ARAFURA

Resources Limited’s

context (Dow, et

al...2013).

Investment in mines As a result, many

used and huge

mining machines are

lying shiftless in

ARAFURA

Resources Limited‘s

yard (Graham,

Bedard, & Dutta,

2018).

Valuation: the

management may

although have

represented to have

correctly valued all

the assets and

liabilities but, there

may be chances of

manifestations being

done and improper

valuations adopted to

window dress the

balance sheet figures

(Askary, Goodwin,

and Lanis, 2012).

By a cross check of

the list with the

physical equipment

property, any

discrepancy in the

existence or

disclosure shall be

highlighted

automatically.

Machine Finance

Liabilities

The liabilities

obligated to purchase

the machinery stands

Completeness: there

may stand a risk that

the obligations

To remove the

chances of this risk,

the purchase

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 22

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.