Comprehensive Auditing Analysis and Report: Vintage Energy Limited

VerifiedAdded on 2022/11/19

|19

|3834

|140

Report

AI Summary

This report provides an in-depth analysis of the auditing process applied to Vintage Energy Limited. It begins with an executive summary and table of contents, followed by an introduction that explains the importance of auditing in assessing the materiality of company financial statements and the role of auditors in mitigating business risks. The report then delves into the background and industry analysis of Vintage Energy Limited, highlighting the company's challenges and risks, such as lack of business, competitive pressure, and changes in government regulations. A detailed analysis of the company's financial statements is presented, including an examination of inherent and control risks, and the application of the audit risk model. The report also includes an analytical review of the company's financial ratios, such as current, debt, and debt-equity ratios. Furthermore, it covers the planning materiality, audit planning, and assertions for key accounts like cash and cash equivalents, trade receivables, and property, plant, and equipment. The report outlines audit work steps, sampling methods, and evidence requirements for each account, providing a comprehensive overview of the audit process.

Running head: AUDITING

AUDITING

Name of the Student

Name of the University

Author Note

AUDITING

Name of the Student

Name of the University

Author Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

AUDITING

Executive Summary

AUDITING

Executive Summary

2

AUDITING

Table of Contents

Introduction................................................................................................................................3

Background and Industry Analysis............................................................................................3

Analysis of Company Financial Statement................................................................................4

Analytical Review of the Company...........................................................................................5

Planning Materiality...................................................................................................................7

Audit Planning and Assertions...................................................................................................8

Conclusion................................................................................................................................12

Reference..................................................................................................................................14

AUDITING

Table of Contents

Introduction................................................................................................................................3

Background and Industry Analysis............................................................................................3

Analysis of Company Financial Statement................................................................................4

Analytical Review of the Company...........................................................................................5

Planning Materiality...................................................................................................................7

Audit Planning and Assertions...................................................................................................8

Conclusion................................................................................................................................12

Reference..................................................................................................................................14

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

AUDITING

Introduction

Auditing is the process that helps the auditor to know the materiality involved in

company financial statement. Auditor carries several processes to ascertain the business risk

in the company financial statement (Appelbaum, Kogan and Vasarhelyi 2017). Each

company should have proper internal control which helps them to minimise the risk

associated in company business activities. Auditor has to check the internal control system as

if the system is not working correctly, and then this will increase the risk in company

business. Auditor has to collect many audit evidences which will helps the auditor to form its

opinion upon the company financial report. Investors and other financial user take the

auditor’s report as the base of audit so if there is any material misstatement in company

financial statement than that should be recorded by the auditor in its auditor’s report. The

objective of this report is to show the analysis of company Vintage Ltd which is an energy-

based company. The report would analysis the risk that is faced by the business related to

different auditing norms. The financial ratio helps the auditor to ascertain the risk associated

in the company financial which assists it to carry different audit procedure upon the company

report (Babalola and Abiola 2013). Additionally, it also shows the different company account

which can get affected by material misstatement and the assertion taken by the auditor in

regards to that account.

Background and Industry Analysis

The assignment is based upon the company name Vintage Energy Limited which

carry its business operation in Australia. As per survey made upon the energy market it came

to picture that there is high growth phase in the industry. The company report shows that

there is loss in the business and company is not able to make profit by carrying its business

AUDITING

Introduction

Auditing is the process that helps the auditor to know the materiality involved in

company financial statement. Auditor carries several processes to ascertain the business risk

in the company financial statement (Appelbaum, Kogan and Vasarhelyi 2017). Each

company should have proper internal control which helps them to minimise the risk

associated in company business activities. Auditor has to check the internal control system as

if the system is not working correctly, and then this will increase the risk in company

business. Auditor has to collect many audit evidences which will helps the auditor to form its

opinion upon the company financial report. Investors and other financial user take the

auditor’s report as the base of audit so if there is any material misstatement in company

financial statement than that should be recorded by the auditor in its auditor’s report. The

objective of this report is to show the analysis of company Vintage Ltd which is an energy-

based company. The report would analysis the risk that is faced by the business related to

different auditing norms. The financial ratio helps the auditor to ascertain the risk associated

in the company financial which assists it to carry different audit procedure upon the company

report (Babalola and Abiola 2013). Additionally, it also shows the different company account

which can get affected by material misstatement and the assertion taken by the auditor in

regards to that account.

Background and Industry Analysis

The assignment is based upon the company name Vintage Energy Limited which

carry its business operation in Australia. As per survey made upon the energy market it came

to picture that there is high growth phase in the industry. The company report shows that

there is loss in the business and company is not able to make profit by carrying its business

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

AUDITING

activities (Bumgarner and Vasarhelyi 2018). Company has proper management process

which signifies that the company can profit in upcoming projects in the business.

Risk which is faced by a company shown below:

Lack of business – Company is not able to gain the proper amount of business in the

market; as a result, the overall profit of business will fall. Management of the

company has to change its marketing strategies in order to gain more revenue in the

business. Company should carry different marketing analysis which will help them to

know the internal and external environment that will help the company to obtain

proper information in company business.

Competitive Pressure – Industry in which the company is carrying its business

operation is very competitive (Christensen, Glover and Wood 2013). This competition

can affect the company power to earn profit in the business, and even the company

may lose its market position in the industry. Company should know who are the

competitors in the business which help them to make proper marketing strategies in

company business. It can do merger or acquisition of small business that will help the

company to gain a competitive advantage in company business.

Changes in Government Regulations – Government keeps on changing its

regulation in regards to the company carrying its business operation in the country. As

the change can give a negative impact on the company business activities; as a result,

it will not able to carry its operation easily in the market. As the company has taken

loan from different institution so if there is change in the interest rate than it may laid

to increase overall finance cost in the business. This will also affect the company

profit as it will be reduced due to the increase in overall company expenses.

AUDITING

activities (Bumgarner and Vasarhelyi 2018). Company has proper management process

which signifies that the company can profit in upcoming projects in the business.

Risk which is faced by a company shown below:

Lack of business – Company is not able to gain the proper amount of business in the

market; as a result, the overall profit of business will fall. Management of the

company has to change its marketing strategies in order to gain more revenue in the

business. Company should carry different marketing analysis which will help them to

know the internal and external environment that will help the company to obtain

proper information in company business.

Competitive Pressure – Industry in which the company is carrying its business

operation is very competitive (Christensen, Glover and Wood 2013). This competition

can affect the company power to earn profit in the business, and even the company

may lose its market position in the industry. Company should know who are the

competitors in the business which help them to make proper marketing strategies in

company business. It can do merger or acquisition of small business that will help the

company to gain a competitive advantage in company business.

Changes in Government Regulations – Government keeps on changing its

regulation in regards to the company carrying its business operation in the country. As

the change can give a negative impact on the company business activities; as a result,

it will not able to carry its operation easily in the market. As the company has taken

loan from different institution so if there is change in the interest rate than it may laid

to increase overall finance cost in the business. This will also affect the company

profit as it will be reduced due to the increase in overall company expenses.

5

AUDITING

Analysis of Company Financial Statement

The analysis of the company has based upon the company annual report 2018. The

company reports show that the auditor has given them Unqualified report which means the

company statement is showing true and fair value (Christensen, Olson and Omer 2014). As

per the company income statement is consider it shows that the company is not able to earn

profit in the business which signifies it is not having proper amount of customer in the

business. The auditor should verify the reason for the increase in company loss as the loss has

increased with a high margin from 2017 to 2018 which is not good sign upon the financial

health of company financial statement. Company should change their marketing strategies as

this will help them to gain proper advantage in the market as well as it will increase the

overall profit of the business.

Each company has to face specific risk while carrying the business activities in the

market (Corporate Finance Institute. 2019). Risks can be classified as control and inherent

risk. Inherent risk is those risk which occurs due to material misstatement in company

financial statement as there is no fault in company internal control system, but still these risks

can occur in the business. As if the company internal control is not working correctly, then

the financial statement can have control risk. The company can have both control and

inherent risk in their financial reporting. Management of business can apply audit risk model

to ascertain the risk associated in company business. Audit risk model builds a relationship

between the risks associated in company business and inherent and control risk. The formula

of audit risk is:

AR=DR × CR× IR

AUDITING

Analysis of Company Financial Statement

The analysis of the company has based upon the company annual report 2018. The

company reports show that the auditor has given them Unqualified report which means the

company statement is showing true and fair value (Christensen, Olson and Omer 2014). As

per the company income statement is consider it shows that the company is not able to earn

profit in the business which signifies it is not having proper amount of customer in the

business. The auditor should verify the reason for the increase in company loss as the loss has

increased with a high margin from 2017 to 2018 which is not good sign upon the financial

health of company financial statement. Company should change their marketing strategies as

this will help them to gain proper advantage in the market as well as it will increase the

overall profit of the business.

Each company has to face specific risk while carrying the business activities in the

market (Corporate Finance Institute. 2019). Risks can be classified as control and inherent

risk. Inherent risk is those risk which occurs due to material misstatement in company

financial statement as there is no fault in company internal control system, but still these risks

can occur in the business. As if the company internal control is not working correctly, then

the financial statement can have control risk. The company can have both control and

inherent risk in their financial reporting. Management of business can apply audit risk model

to ascertain the risk associated in company business. Audit risk model builds a relationship

between the risks associated in company business and inherent and control risk. The formula

of audit risk is:

AR=DR × CR× IR

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

AUDITING

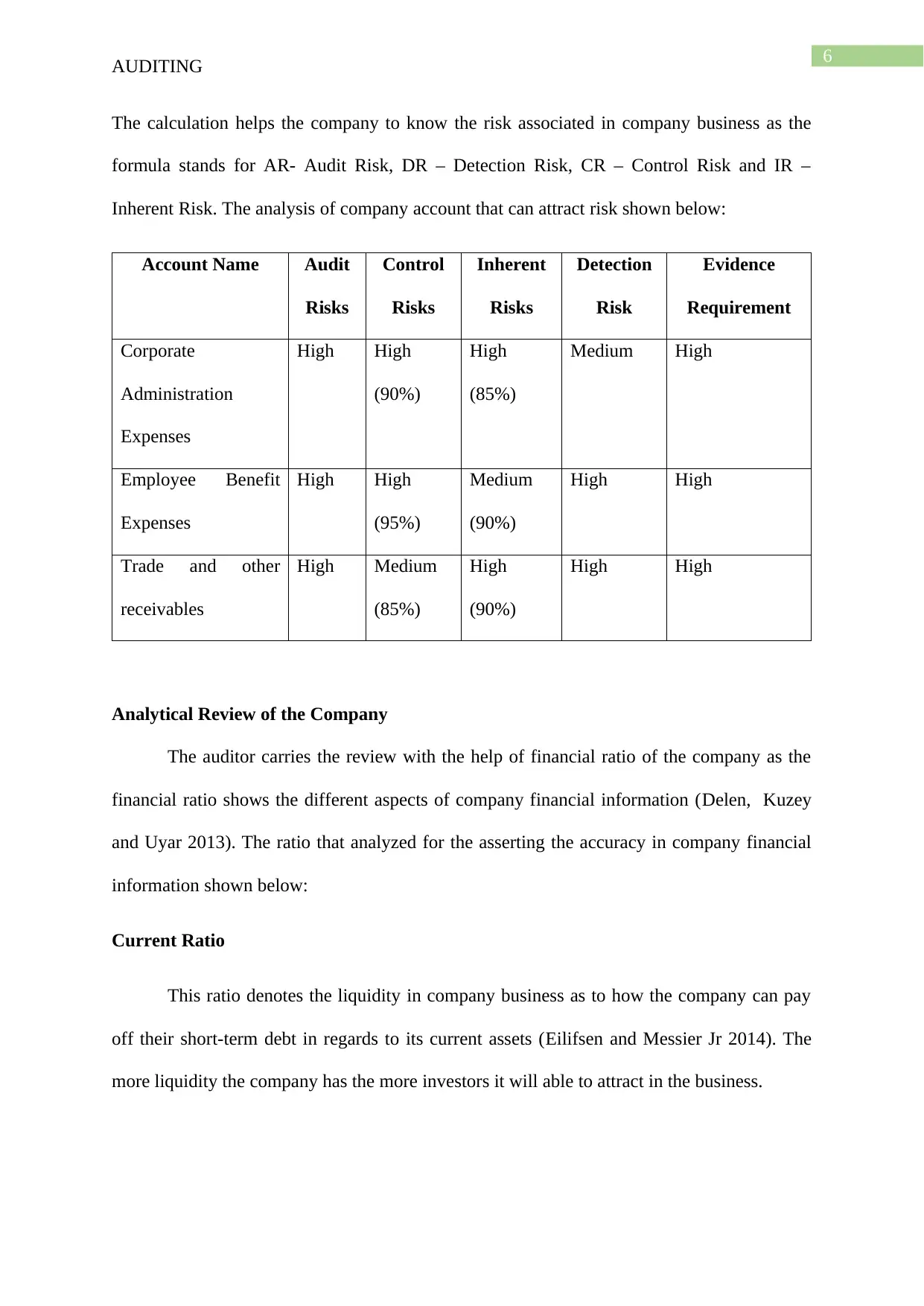

The calculation helps the company to know the risk associated in company business as the

formula stands for AR- Audit Risk, DR – Detection Risk, CR – Control Risk and IR –

Inherent Risk. The analysis of company account that can attract risk shown below:

Account Name Audit

Risks

Control

Risks

Inherent

Risks

Detection

Risk

Evidence

Requirement

Corporate

Administration

Expenses

High High

(90%)

High

(85%)

Medium High

Employee Benefit

Expenses

High High

(95%)

Medium

(90%)

High High

Trade and other

receivables

High Medium

(85%)

High

(90%)

High High

Analytical Review of the Company

The auditor carries the review with the help of financial ratio of the company as the

financial ratio shows the different aspects of company financial information (Delen, Kuzey

and Uyar 2013). The ratio that analyzed for the asserting the accuracy in company financial

information shown below:

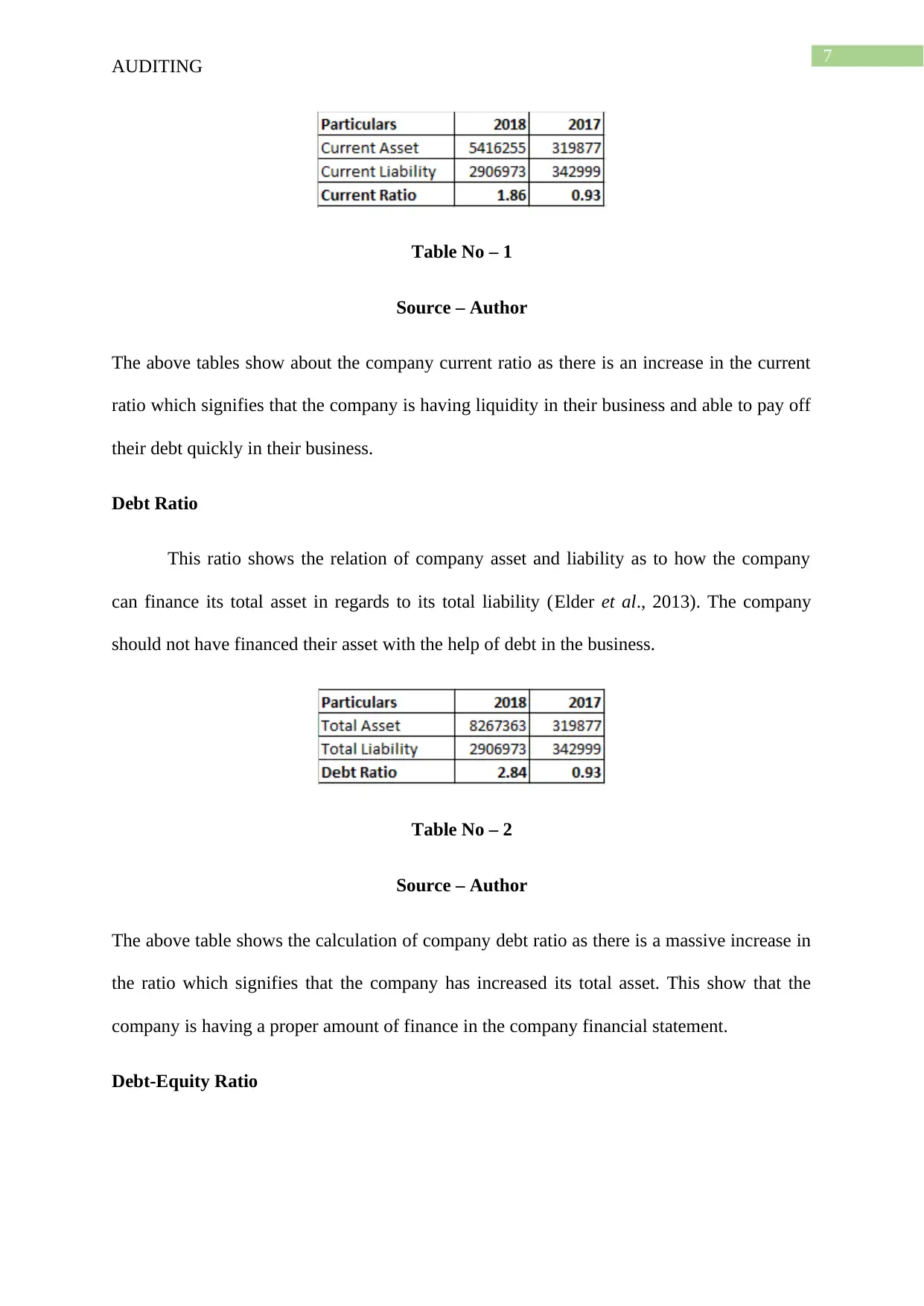

Current Ratio

This ratio denotes the liquidity in company business as to how the company can pay

off their short-term debt in regards to its current assets (Eilifsen and Messier Jr 2014). The

more liquidity the company has the more investors it will able to attract in the business.

AUDITING

The calculation helps the company to know the risk associated in company business as the

formula stands for AR- Audit Risk, DR – Detection Risk, CR – Control Risk and IR –

Inherent Risk. The analysis of company account that can attract risk shown below:

Account Name Audit

Risks

Control

Risks

Inherent

Risks

Detection

Risk

Evidence

Requirement

Corporate

Administration

Expenses

High High

(90%)

High

(85%)

Medium High

Employee Benefit

Expenses

High High

(95%)

Medium

(90%)

High High

Trade and other

receivables

High Medium

(85%)

High

(90%)

High High

Analytical Review of the Company

The auditor carries the review with the help of financial ratio of the company as the

financial ratio shows the different aspects of company financial information (Delen, Kuzey

and Uyar 2013). The ratio that analyzed for the asserting the accuracy in company financial

information shown below:

Current Ratio

This ratio denotes the liquidity in company business as to how the company can pay

off their short-term debt in regards to its current assets (Eilifsen and Messier Jr 2014). The

more liquidity the company has the more investors it will able to attract in the business.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

AUDITING

Table No – 1

Source – Author

The above tables show about the company current ratio as there is an increase in the current

ratio which signifies that the company is having liquidity in their business and able to pay off

their debt quickly in their business.

Debt Ratio

This ratio shows the relation of company asset and liability as to how the company

can finance its total asset in regards to its total liability (Elder et al., 2013). The company

should not have financed their asset with the help of debt in the business.

Table No – 2

Source – Author

The above table shows the calculation of company debt ratio as there is a massive increase in

the ratio which signifies that the company has increased its total asset. This show that the

company is having a proper amount of finance in the company financial statement.

Debt-Equity Ratio

AUDITING

Table No – 1

Source – Author

The above tables show about the company current ratio as there is an increase in the current

ratio which signifies that the company is having liquidity in their business and able to pay off

their debt quickly in their business.

Debt Ratio

This ratio shows the relation of company asset and liability as to how the company

can finance its total asset in regards to its total liability (Elder et al., 2013). The company

should not have financed their asset with the help of debt in the business.

Table No – 2

Source – Author

The above table shows the calculation of company debt ratio as there is a massive increase in

the ratio which signifies that the company has increased its total asset. This show that the

company is having a proper amount of finance in the company financial statement.

Debt-Equity Ratio

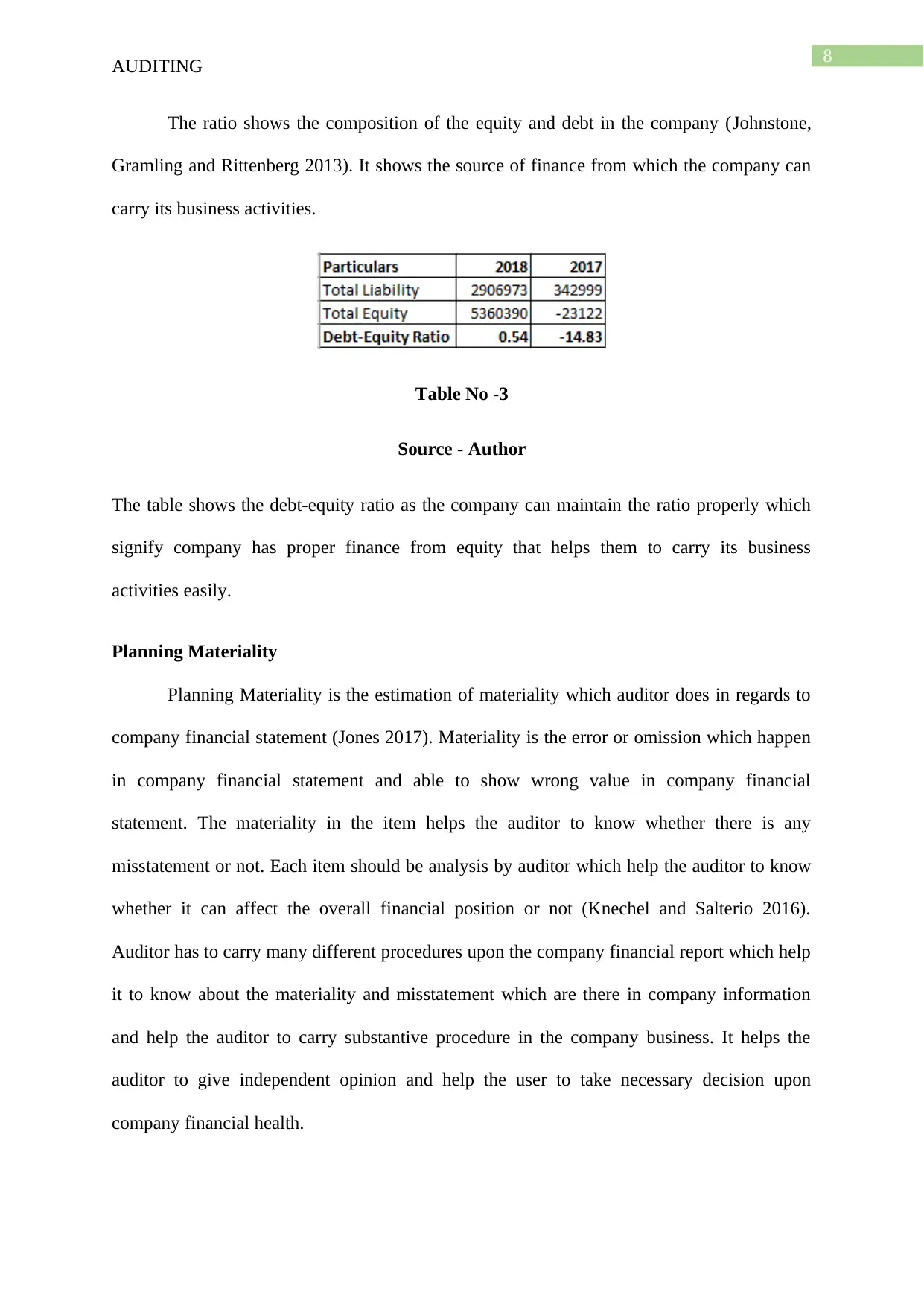

8

AUDITING

The ratio shows the composition of the equity and debt in the company (Johnstone,

Gramling and Rittenberg 2013). It shows the source of finance from which the company can

carry its business activities.

Table No -3

Source - Author

The table shows the debt-equity ratio as the company can maintain the ratio properly which

signify company has proper finance from equity that helps them to carry its business

activities easily.

Planning Materiality

Planning Materiality is the estimation of materiality which auditor does in regards to

company financial statement (Jones 2017). Materiality is the error or omission which happen

in company financial statement and able to show wrong value in company financial

statement. The materiality in the item helps the auditor to know whether there is any

misstatement or not. Each item should be analysis by auditor which help the auditor to know

whether it can affect the overall financial position or not (Knechel and Salterio 2016).

Auditor has to carry many different procedures upon the company financial report which help

it to know about the materiality and misstatement which are there in company information

and help the auditor to carry substantive procedure in the company business. It helps the

auditor to give independent opinion and help the user to take necessary decision upon

company financial health.

AUDITING

The ratio shows the composition of the equity and debt in the company (Johnstone,

Gramling and Rittenberg 2013). It shows the source of finance from which the company can

carry its business activities.

Table No -3

Source - Author

The table shows the debt-equity ratio as the company can maintain the ratio properly which

signify company has proper finance from equity that helps them to carry its business

activities easily.

Planning Materiality

Planning Materiality is the estimation of materiality which auditor does in regards to

company financial statement (Jones 2017). Materiality is the error or omission which happen

in company financial statement and able to show wrong value in company financial

statement. The materiality in the item helps the auditor to know whether there is any

misstatement or not. Each item should be analysis by auditor which help the auditor to know

whether it can affect the overall financial position or not (Knechel and Salterio 2016).

Auditor has to carry many different procedures upon the company financial report which help

it to know about the materiality and misstatement which are there in company information

and help the auditor to carry substantive procedure in the company business. It helps the

auditor to give independent opinion and help the user to take necessary decision upon

company financial health.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9

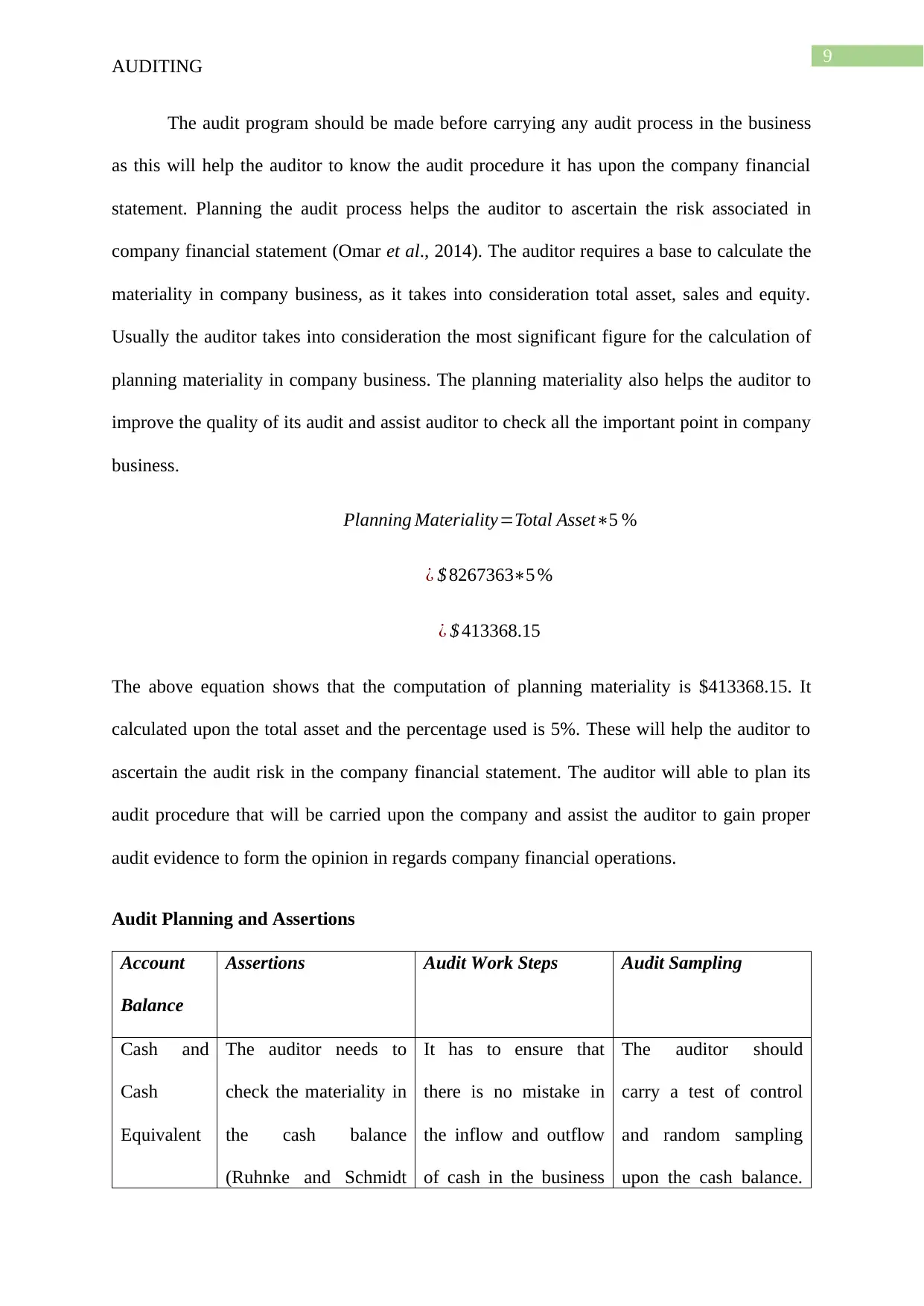

AUDITING

The audit program should be made before carrying any audit process in the business

as this will help the auditor to know the audit procedure it has upon the company financial

statement. Planning the audit process helps the auditor to ascertain the risk associated in

company financial statement (Omar et al., 2014). The auditor requires a base to calculate the

materiality in company business, as it takes into consideration total asset, sales and equity.

Usually the auditor takes into consideration the most significant figure for the calculation of

planning materiality in company business. The planning materiality also helps the auditor to

improve the quality of its audit and assist auditor to check all the important point in company

business.

Planning Materiality=Total Asset∗5 %

¿ $ 8267363∗5 %

¿ $ 413368.15

The above equation shows that the computation of planning materiality is $413368.15. It

calculated upon the total asset and the percentage used is 5%. These will help the auditor to

ascertain the audit risk in the company financial statement. The auditor will able to plan its

audit procedure that will be carried upon the company and assist the auditor to gain proper

audit evidence to form the opinion in regards company financial operations.

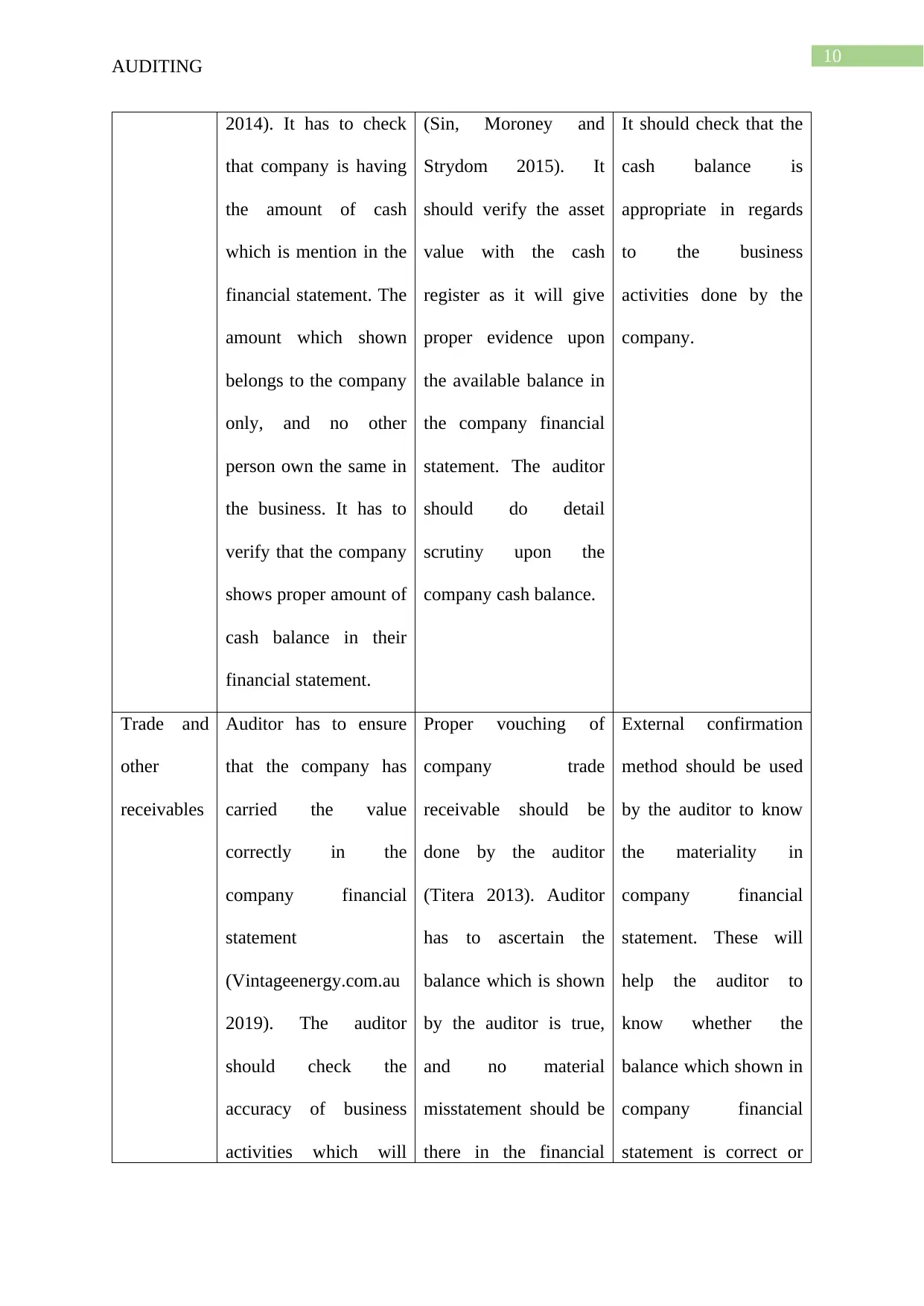

Audit Planning and Assertions

Account

Balance

Assertions Audit Work Steps Audit Sampling

Cash and

Cash

Equivalent

The auditor needs to

check the materiality in

the cash balance

(Ruhnke and Schmidt

It has to ensure that

there is no mistake in

the inflow and outflow

of cash in the business

The auditor should

carry a test of control

and random sampling

upon the cash balance.

AUDITING

The audit program should be made before carrying any audit process in the business

as this will help the auditor to know the audit procedure it has upon the company financial

statement. Planning the audit process helps the auditor to ascertain the risk associated in

company financial statement (Omar et al., 2014). The auditor requires a base to calculate the

materiality in company business, as it takes into consideration total asset, sales and equity.

Usually the auditor takes into consideration the most significant figure for the calculation of

planning materiality in company business. The planning materiality also helps the auditor to

improve the quality of its audit and assist auditor to check all the important point in company

business.

Planning Materiality=Total Asset∗5 %

¿ $ 8267363∗5 %

¿ $ 413368.15

The above equation shows that the computation of planning materiality is $413368.15. It

calculated upon the total asset and the percentage used is 5%. These will help the auditor to

ascertain the audit risk in the company financial statement. The auditor will able to plan its

audit procedure that will be carried upon the company and assist the auditor to gain proper

audit evidence to form the opinion in regards company financial operations.

Audit Planning and Assertions

Account

Balance

Assertions Audit Work Steps Audit Sampling

Cash and

Cash

Equivalent

The auditor needs to

check the materiality in

the cash balance

(Ruhnke and Schmidt

It has to ensure that

there is no mistake in

the inflow and outflow

of cash in the business

The auditor should

carry a test of control

and random sampling

upon the cash balance.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10

AUDITING

2014). It has to check

that company is having

the amount of cash

which is mention in the

financial statement. The

amount which shown

belongs to the company

only, and no other

person own the same in

the business. It has to

verify that the company

shows proper amount of

cash balance in their

financial statement.

(Sin, Moroney and

Strydom 2015). It

should verify the asset

value with the cash

register as it will give

proper evidence upon

the available balance in

the company financial

statement. The auditor

should do detail

scrutiny upon the

company cash balance.

It should check that the

cash balance is

appropriate in regards

to the business

activities done by the

company.

Trade and

other

receivables

Auditor has to ensure

that the company has

carried the value

correctly in the

company financial

statement

(Vintageenergy.com.au

2019). The auditor

should check the

accuracy of business

activities which will

Proper vouching of

company trade

receivable should be

done by the auditor

(Titera 2013). Auditor

has to ascertain the

balance which is shown

by the auditor is true,

and no material

misstatement should be

there in the financial

External confirmation

method should be used

by the auditor to know

the materiality in

company financial

statement. These will

help the auditor to

know whether the

balance which shown in

company financial

statement is correct or

AUDITING

2014). It has to check

that company is having

the amount of cash

which is mention in the

financial statement. The

amount which shown

belongs to the company

only, and no other

person own the same in

the business. It has to

verify that the company

shows proper amount of

cash balance in their

financial statement.

(Sin, Moroney and

Strydom 2015). It

should verify the asset

value with the cash

register as it will give

proper evidence upon

the available balance in

the company financial

statement. The auditor

should do detail

scrutiny upon the

company cash balance.

It should check that the

cash balance is

appropriate in regards

to the business

activities done by the

company.

Trade and

other

receivables

Auditor has to ensure

that the company has

carried the value

correctly in the

company financial

statement

(Vintageenergy.com.au

2019). The auditor

should check the

accuracy of business

activities which will

Proper vouching of

company trade

receivable should be

done by the auditor

(Titera 2013). Auditor

has to ascertain the

balance which is shown

by the auditor is true,

and no material

misstatement should be

there in the financial

External confirmation

method should be used

by the auditor to know

the materiality in

company financial

statement. These will

help the auditor to

know whether the

balance which shown in

company financial

statement is correct or

11

AUDITING

help it to know the risk

associated in company

reports.

reports. not.

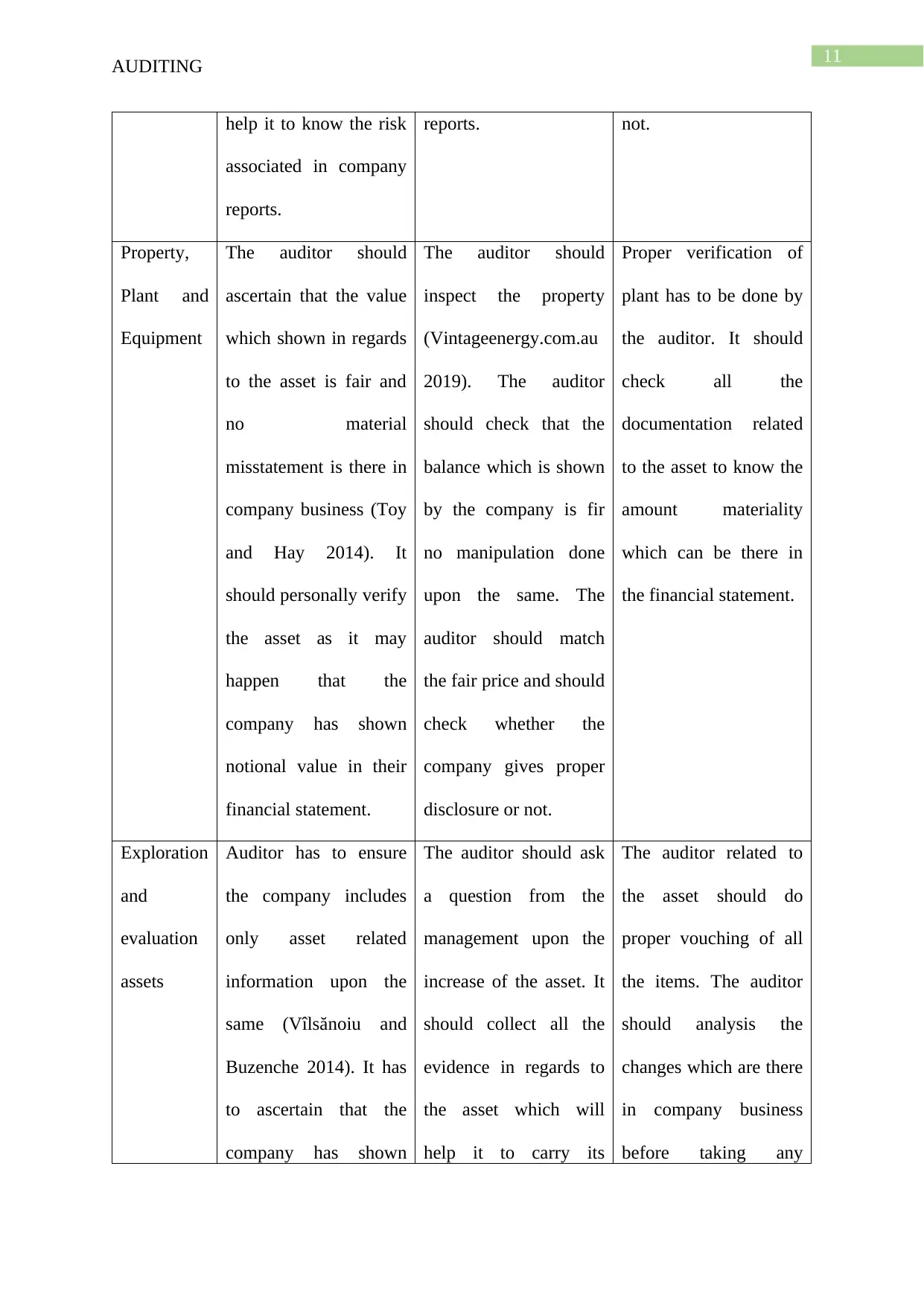

Property,

Plant and

Equipment

The auditor should

ascertain that the value

which shown in regards

to the asset is fair and

no material

misstatement is there in

company business (Toy

and Hay 2014). It

should personally verify

the asset as it may

happen that the

company has shown

notional value in their

financial statement.

The auditor should

inspect the property

(Vintageenergy.com.au

2019). The auditor

should check that the

balance which is shown

by the company is fir

no manipulation done

upon the same. The

auditor should match

the fair price and should

check whether the

company gives proper

disclosure or not.

Proper verification of

plant has to be done by

the auditor. It should

check all the

documentation related

to the asset to know the

amount materiality

which can be there in

the financial statement.

Exploration

and

evaluation

assets

Auditor has to ensure

the company includes

only asset related

information upon the

same (Vîlsănoiu and

Buzenche 2014). It has

to ascertain that the

company has shown

The auditor should ask

a question from the

management upon the

increase of the asset. It

should collect all the

evidence in regards to

the asset which will

help it to carry its

The auditor related to

the asset should do

proper vouching of all

the items. The auditor

should analysis the

changes which are there

in company business

before taking any

AUDITING

help it to know the risk

associated in company

reports.

reports. not.

Property,

Plant and

Equipment

The auditor should

ascertain that the value

which shown in regards

to the asset is fair and

no material

misstatement is there in

company business (Toy

and Hay 2014). It

should personally verify

the asset as it may

happen that the

company has shown

notional value in their

financial statement.

The auditor should

inspect the property

(Vintageenergy.com.au

2019). The auditor

should check that the

balance which is shown

by the company is fir

no manipulation done

upon the same. The

auditor should match

the fair price and should

check whether the

company gives proper

disclosure or not.

Proper verification of

plant has to be done by

the auditor. It should

check all the

documentation related

to the asset to know the

amount materiality

which can be there in

the financial statement.

Exploration

and

evaluation

assets

Auditor has to ensure

the company includes

only asset related

information upon the

same (Vîlsănoiu and

Buzenche 2014). It has

to ascertain that the

company has shown

The auditor should ask

a question from the

management upon the

increase of the asset. It

should collect all the

evidence in regards to

the asset which will

help it to carry its

The auditor related to

the asset should do

proper vouching of all

the items. The auditor

should analysis the

changes which are there

in company business

before taking any

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.