Australia's Economic Growth: Trends, Challenges, and Opportunities

VerifiedAdded on 2023/06/11

|11

|2654

|67

Report

AI Summary

This report provides a detailed analysis of Australia's economic growth over the past decade, examining the fluctuating growth rates from 2005 to 2016, the impact of the global financial crisis and the mining boom, and the subsequent challenges faced by the Australian economy. It identifies key factors contributing to growth variance, including global events, internal policies, commodity prices, and investment levels. The report also highlights major challenges such as unemployment, low commodity prices, and the need for a more conducive macroeconomic environment. It further discusses the effectiveness of fiscal and monetary policies implemented by the Australian government to stimulate economic activity and suggests the need for addressing wage growth, infrastructure investment, and technological advancement to enhance Australia's economic performance. The report concludes by emphasizing the importance of a business-friendly environment and strategic policy interventions to overcome the current economic challenges and foster sustainable growth.

Australia 1

Economics Assignment

Students Name

Institution

Economics Assignment

Students Name

Institution

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Australia 2

AUSTRALIAN ECONOMIC GROWTH RATE

Noteworthy, the Australian economy steadily grew between the year 2005 and the year 2008

from $693.764 billion to 1.55 trillion respectively. However, the Australian economic growth decreased

in the year 2009 recording a GDP of $927.168billion.Luckily, the economic activity picked up in the year

2010 at $1.143 trillion and later declined to $1.391trillion in the year 2011 before picking up again in the

year 2012 at $1.583trillion and 1.567trillion in the year 2013, which was a small reduction from the

previous year’s gross domestic product. Predominantly, the Australian economic performances has been

steadily declining since the year 2013 to the year 2016.Specifically, the economic performance of the

Australian economy stood at $1.46 trillion in the year 2014 and $1.345trillion in the year 2015 .Further,

the Australian economic performance stood at $1.205 trillion in the year 2016.There are various factors

responsible for the fluctuating performance. Prior to the global financial crisis(2005),the Australian

economy was booming due to the strong financial framework, high commodity prices, high levels of

foreign investment and high employment opportunities which boosting the Australian economic growth.

Particularly, between the years 2008 and 2014, the Australian economy was recovering from the

global financial crisis and low global commodity prices. The rise of the Australian economy is due to the

mining industry fortunes and the dollar appreciation during the period. However, the post mining boom

period has left employment, low investment rates among other economic challenges. Following the end of

the boom, there has been increased rate in unemployment which has led to high welfare costs and

underutilization of Australia’s natural resources which has slowed down the economic growth pace of the

Australian economy .Also, the reduced pricing of commodities has not helped matters economically. It is

imperative that the Australian government employ respective fiscal and monetary policies to boost the

macroeconomic environment for economic growth and activity.

AUSTRALIAN ECONOMIC GROWTH RATE

Noteworthy, the Australian economy steadily grew between the year 2005 and the year 2008

from $693.764 billion to 1.55 trillion respectively. However, the Australian economic growth decreased

in the year 2009 recording a GDP of $927.168billion.Luckily, the economic activity picked up in the year

2010 at $1.143 trillion and later declined to $1.391trillion in the year 2011 before picking up again in the

year 2012 at $1.583trillion and 1.567trillion in the year 2013, which was a small reduction from the

previous year’s gross domestic product. Predominantly, the Australian economic performances has been

steadily declining since the year 2013 to the year 2016.Specifically, the economic performance of the

Australian economy stood at $1.46 trillion in the year 2014 and $1.345trillion in the year 2015 .Further,

the Australian economic performance stood at $1.205 trillion in the year 2016.There are various factors

responsible for the fluctuating performance. Prior to the global financial crisis(2005),the Australian

economy was booming due to the strong financial framework, high commodity prices, high levels of

foreign investment and high employment opportunities which boosting the Australian economic growth.

Particularly, between the years 2008 and 2014, the Australian economy was recovering from the

global financial crisis and low global commodity prices. The rise of the Australian economy is due to the

mining industry fortunes and the dollar appreciation during the period. However, the post mining boom

period has left employment, low investment rates among other economic challenges. Following the end of

the boom, there has been increased rate in unemployment which has led to high welfare costs and

underutilization of Australia’s natural resources which has slowed down the economic growth pace of the

Australian economy .Also, the reduced pricing of commodities has not helped matters economically. It is

imperative that the Australian government employ respective fiscal and monetary policies to boost the

macroeconomic environment for economic growth and activity.

Australia 3

FACTORS FOR THE GROWTH VARIANCE

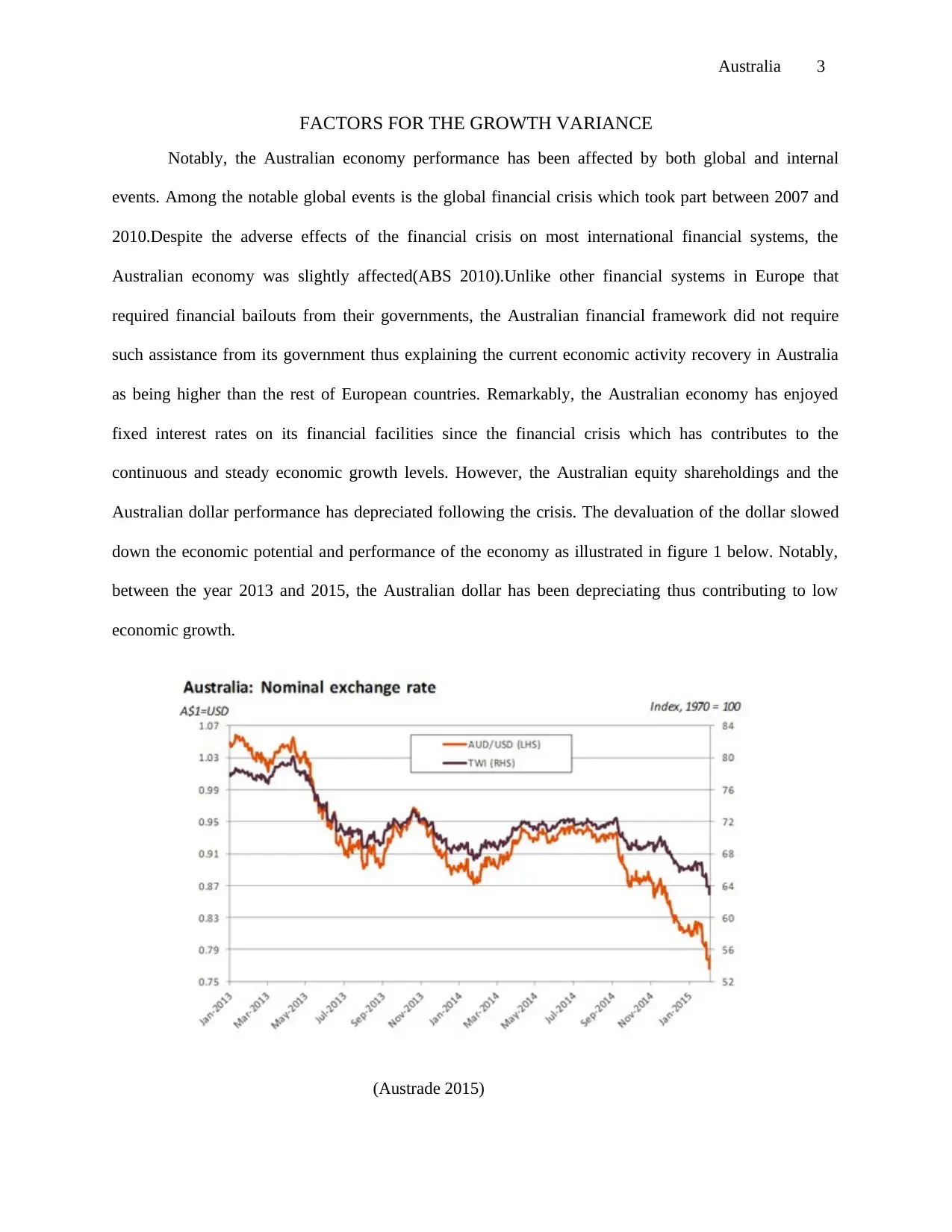

Notably, the Australian economy performance has been affected by both global and internal

events. Among the notable global events is the global financial crisis which took part between 2007 and

2010.Despite the adverse effects of the financial crisis on most international financial systems, the

Australian economy was slightly affected(ABS 2010).Unlike other financial systems in Europe that

required financial bailouts from their governments, the Australian financial framework did not require

such assistance from its government thus explaining the current economic activity recovery in Australia

as being higher than the rest of European countries. Remarkably, the Australian economy has enjoyed

fixed interest rates on its financial facilities since the financial crisis which has contributes to the

continuous and steady economic growth levels. However, the Australian equity shareholdings and the

Australian dollar performance has depreciated following the crisis. The devaluation of the dollar slowed

down the economic potential and performance of the economy as illustrated in figure 1 below. Notably,

between the year 2013 and 2015, the Australian dollar has been depreciating thus contributing to low

economic growth.

(Austrade 2015)

FACTORS FOR THE GROWTH VARIANCE

Notably, the Australian economy performance has been affected by both global and internal

events. Among the notable global events is the global financial crisis which took part between 2007 and

2010.Despite the adverse effects of the financial crisis on most international financial systems, the

Australian economy was slightly affected(ABS 2010).Unlike other financial systems in Europe that

required financial bailouts from their governments, the Australian financial framework did not require

such assistance from its government thus explaining the current economic activity recovery in Australia

as being higher than the rest of European countries. Remarkably, the Australian economy has enjoyed

fixed interest rates on its financial facilities since the financial crisis which has contributes to the

continuous and steady economic growth levels. However, the Australian equity shareholdings and the

Australian dollar performance has depreciated following the crisis. The devaluation of the dollar slowed

down the economic potential and performance of the economy as illustrated in figure 1 below. Notably,

between the year 2013 and 2015, the Australian dollar has been depreciating thus contributing to low

economic growth.

(Austrade 2015)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Australia 4

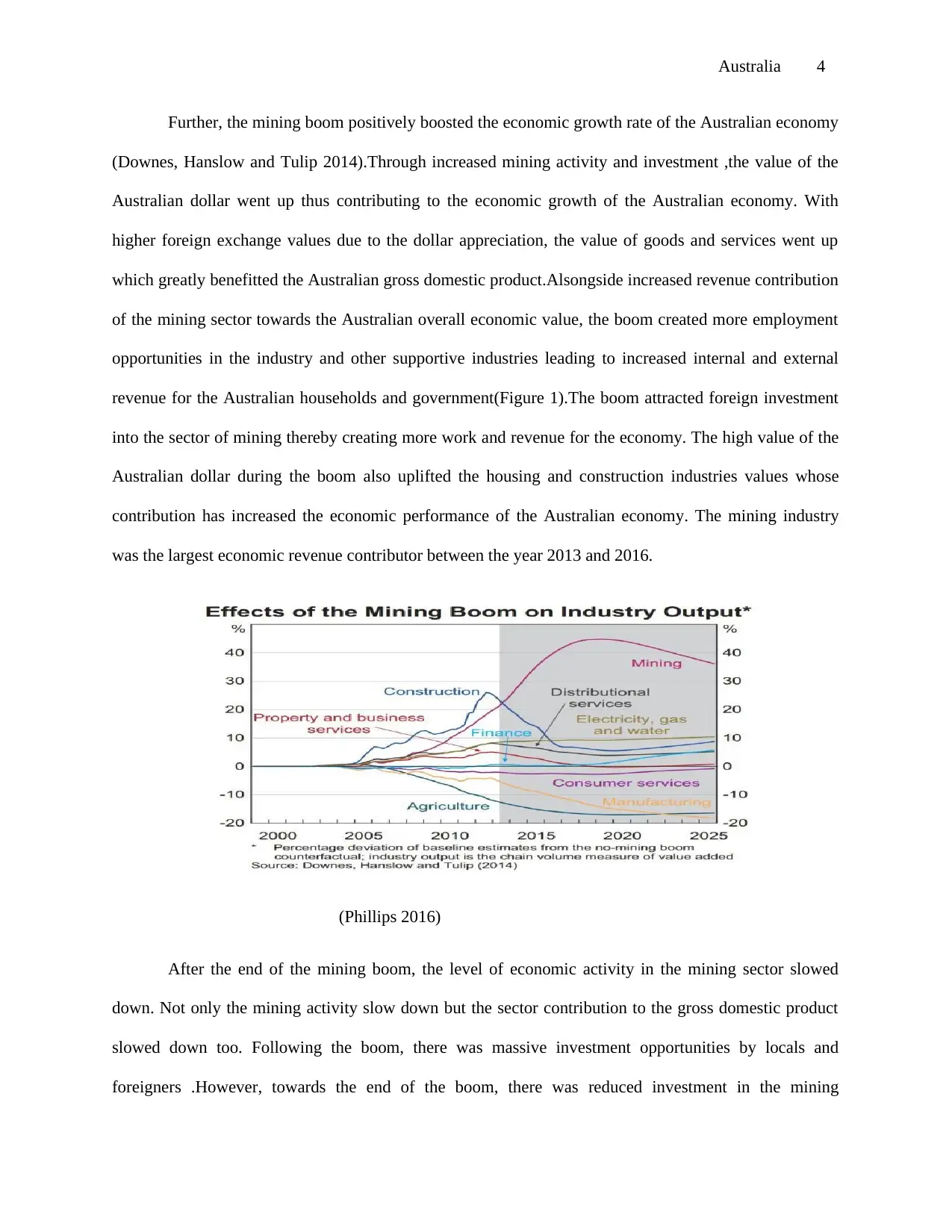

Further, the mining boom positively boosted the economic growth rate of the Australian economy

(Downes, Hanslow and Tulip 2014).Through increased mining activity and investment ,the value of the

Australian dollar went up thus contributing to the economic growth of the Australian economy. With

higher foreign exchange values due to the dollar appreciation, the value of goods and services went up

which greatly benefitted the Australian gross domestic product.Alsongside increased revenue contribution

of the mining sector towards the Australian overall economic value, the boom created more employment

opportunities in the industry and other supportive industries leading to increased internal and external

revenue for the Australian households and government(Figure 1).The boom attracted foreign investment

into the sector of mining thereby creating more work and revenue for the economy. The high value of the

Australian dollar during the boom also uplifted the housing and construction industries values whose

contribution has increased the economic performance of the Australian economy. The mining industry

was the largest economic revenue contributor between the year 2013 and 2016.

(Phillips 2016)

After the end of the mining boom, the level of economic activity in the mining sector slowed

down. Not only the mining activity slow down but the sector contribution to the gross domestic product

slowed down too. Following the boom, there was massive investment opportunities by locals and

foreigners .However, towards the end of the boom, there was reduced investment in the mining

Further, the mining boom positively boosted the economic growth rate of the Australian economy

(Downes, Hanslow and Tulip 2014).Through increased mining activity and investment ,the value of the

Australian dollar went up thus contributing to the economic growth of the Australian economy. With

higher foreign exchange values due to the dollar appreciation, the value of goods and services went up

which greatly benefitted the Australian gross domestic product.Alsongside increased revenue contribution

of the mining sector towards the Australian overall economic value, the boom created more employment

opportunities in the industry and other supportive industries leading to increased internal and external

revenue for the Australian households and government(Figure 1).The boom attracted foreign investment

into the sector of mining thereby creating more work and revenue for the economy. The high value of the

Australian dollar during the boom also uplifted the housing and construction industries values whose

contribution has increased the economic performance of the Australian economy. The mining industry

was the largest economic revenue contributor between the year 2013 and 2016.

(Phillips 2016)

After the end of the mining boom, the level of economic activity in the mining sector slowed

down. Not only the mining activity slow down but the sector contribution to the gross domestic product

slowed down too. Following the boom, there was massive investment opportunities by locals and

foreigners .However, towards the end of the boom, there was reduced investment in the mining

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Australia 5

sector(Yoemens 2016).With the reduced mining activity, some of the employees in the mining sector and

supportive businesses began losing their jobs since most employees are struggling to service .This layoffs

contributed to high unemployment rates years after the boom thus slowing down economic activity in

Australia and the mining sector of the economy (Kent 2016).Particularly ,the rate of economic activity

have reduced in the Australian Victorian state as contrasted with the Tasmanian state performance(Uren

2016).In addition to lost employment opportunities, there is the massive fall in commodity prices which

has also contributed to the reduced economic performance in the Australian state among other nations

globally. There is need for the Australian economy to address its wage rate and crate more employment

opportunities.

Subsequently, other Australian industries have had to take over from the mining industry since

its declining performance over the past few years. Currently, there is notable performance in the

Australian service, Agriculture and manufacturing industries among others as part of the transition

process. The Australian housing sector has recovered due to the high commodity prices instituted by the

mining industry during the boom and other favorable internal macroeconomic factors (Bramble

2015).The performance of other Australian industries has contributed to the current economic

performance after the boom and the financial crisis that affect most global nations. Due to the increase in

household income during the boom, there is more private and public consumption of commodities and

services alongside investment opportunities which have slightly contributed to the slight economic

performance of the Australian economy over the past ten years. The post mining boom era has left the

Australian economy not bad thereof due to the impact it had on other industries in the economy during the

boom. The Australian economy is still on the decline thus the need to create a business friendly

environment for economic activity.

Following the end of the global economic crisis, it was prudent that the Australian government

implement various fiscal and monetary policies to boost economic recovery. The Australian government

implemented discretionary monetary policies to stir economic activity within its borders. Particularly, the

sector(Yoemens 2016).With the reduced mining activity, some of the employees in the mining sector and

supportive businesses began losing their jobs since most employees are struggling to service .This layoffs

contributed to high unemployment rates years after the boom thus slowing down economic activity in

Australia and the mining sector of the economy (Kent 2016).Particularly ,the rate of economic activity

have reduced in the Australian Victorian state as contrasted with the Tasmanian state performance(Uren

2016).In addition to lost employment opportunities, there is the massive fall in commodity prices which

has also contributed to the reduced economic performance in the Australian state among other nations

globally. There is need for the Australian economy to address its wage rate and crate more employment

opportunities.

Subsequently, other Australian industries have had to take over from the mining industry since

its declining performance over the past few years. Currently, there is notable performance in the

Australian service, Agriculture and manufacturing industries among others as part of the transition

process. The Australian housing sector has recovered due to the high commodity prices instituted by the

mining industry during the boom and other favorable internal macroeconomic factors (Bramble

2015).The performance of other Australian industries has contributed to the current economic

performance after the boom and the financial crisis that affect most global nations. Due to the increase in

household income during the boom, there is more private and public consumption of commodities and

services alongside investment opportunities which have slightly contributed to the slight economic

performance of the Australian economy over the past ten years. The post mining boom era has left the

Australian economy not bad thereof due to the impact it had on other industries in the economy during the

boom. The Australian economy is still on the decline thus the need to create a business friendly

environment for economic activity.

Following the end of the global economic crisis, it was prudent that the Australian government

implement various fiscal and monetary policies to boost economic recovery. The Australian government

implemented discretionary monetary policies to stir economic activity within its borders. Particularly, the

Australia 6

Australian government implemented two financial stimulus packages to its economy(Chhabra 2009).The

Reserve Bank, which is Australia’s central bank implemented a 100 basis reduced interest rate to stir

economic activity and investment(Kennedy 2009).The low interest rates were meant to encourage

investment and consumption to stir economic growth and performance in the country. The first stimulus

packages was meant to increase household incomes to encourage consumption and investment. Despite

the fact that the Australian economy was not badly affected by the global financial crisis, the rate of

economic growth had been affected thus the necessitating the injection of the stimulus package. There is

need for effective fiscal and monetary policies to create a conducive business environment for economic

activities to thrive. Predominantly, fiscal and monetary measures have been effective in boosting

economic performance in economies.

Predominantly, economic growth depends on conducive macro and micro economic

environments .However, currently, the Australian economy is lacking in a conducive business

environment due to the reduced foreign and local investment levels which used to provide employment

opportunities and increase household revenue. The reduced investment levels due to low commodity

prices, dollar depreciation, unfavorable taxation regimes for investment, high unemployment levels and

low wage growth levels among other factors have led to reduced economic activities in the Australian

economy. The impacts of the financial setback and the demise of the boom are partly responsible for the

reduced level of economic activity in the Australian economy. In addition to the above setbacks, there is

reduced disposable income for most of the Australian household due to the low wage rates that haven’t

been reviewed for a relatively long time. Usually, increases in household income is likely to trigger

consumption and investment levels in the country .However, due to the constant minimal wage,

Australian households are more into saving than investing or consuming commodities and services to

levels that might boost the Australian economic performance.

Overall, the Australian economy is considered among the top performing economies in the

world.However,the challenges posed by the depreciation of the Australian currency, fall in the

Australian government implemented two financial stimulus packages to its economy(Chhabra 2009).The

Reserve Bank, which is Australia’s central bank implemented a 100 basis reduced interest rate to stir

economic activity and investment(Kennedy 2009).The low interest rates were meant to encourage

investment and consumption to stir economic growth and performance in the country. The first stimulus

packages was meant to increase household incomes to encourage consumption and investment. Despite

the fact that the Australian economy was not badly affected by the global financial crisis, the rate of

economic growth had been affected thus the necessitating the injection of the stimulus package. There is

need for effective fiscal and monetary policies to create a conducive business environment for economic

activities to thrive. Predominantly, fiscal and monetary measures have been effective in boosting

economic performance in economies.

Predominantly, economic growth depends on conducive macro and micro economic

environments .However, currently, the Australian economy is lacking in a conducive business

environment due to the reduced foreign and local investment levels which used to provide employment

opportunities and increase household revenue. The reduced investment levels due to low commodity

prices, dollar depreciation, unfavorable taxation regimes for investment, high unemployment levels and

low wage growth levels among other factors have led to reduced economic activities in the Australian

economy. The impacts of the financial setback and the demise of the boom are partly responsible for the

reduced level of economic activity in the Australian economy. In addition to the above setbacks, there is

reduced disposable income for most of the Australian household due to the low wage rates that haven’t

been reviewed for a relatively long time. Usually, increases in household income is likely to trigger

consumption and investment levels in the country .However, due to the constant minimal wage,

Australian households are more into saving than investing or consuming commodities and services to

levels that might boost the Australian economic performance.

Overall, the Australian economy is considered among the top performing economies in the

world.However,the challenges posed by the depreciation of the Australian currency, fall in the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Australia 7

commodity pricing, the rise in unemployment levels due to end of the boom and the global economic

crisis have contributed to the slow pace of economic growth levels thus necessitating the need for the

application of the fiscal and monetary measures by the Reserve Bank to boost the Australian economic

performance and activity for the benefit of the Australian population and the global economy.

GROWTH CHALLENGES

Similarly, the Australian economy is facing economic growth challenges like the rest of the

world. Unemployment is one of the key inhibitors of Australian economic growth rate. Due to the fact

that most of Australia’s employed population is aging and most of the youths are unemployed, this is a

major skill and labor market gap that needs to be addressed imperatively (Carvarlho

2015).Unemployment slows down economic growth due to high welfare dependency and underutilization

of economic resources. In addition, there is need for overcoming the current low commodity prices so as

to boost economic activity. Low commodity prices degrade the value of goods and services thus leading

to low revenue which is not good for the growth of any economy (Fraser 2015).Alongside low

commodity pricing, the Australian dollar appreciation is key to economic development due to the fact that

it has the ability to add value to the economy. Typically, appreciation of the dollar increased the revenue

value and the value for commodities which will directly impact on the economic value of the

country .Currently, the Australian macroeconomic environment isn’t conducive for supporting economic

growth.

In addition, the growth of the Chinese economy has also uplifted the Australian economic

performance. Noteworthy, the Chinese economy is one of the key trading partners for the Australian

economy. The economic dominance of the Chinese economy on a global level cannot be ignored. The

abundance of Australian raw materials has earned it a larger market share in the growing Chinese

economy and other Asian nations (Charlton 2015).Iron and coal minerals are among the top products

exported by the Australians to the Chinese economy. The demand for raw materials of the Chinese

economy has increased the exportation volume of the Australian products, minerals, beef and other

commodity pricing, the rise in unemployment levels due to end of the boom and the global economic

crisis have contributed to the slow pace of economic growth levels thus necessitating the need for the

application of the fiscal and monetary measures by the Reserve Bank to boost the Australian economic

performance and activity for the benefit of the Australian population and the global economy.

GROWTH CHALLENGES

Similarly, the Australian economy is facing economic growth challenges like the rest of the

world. Unemployment is one of the key inhibitors of Australian economic growth rate. Due to the fact

that most of Australia’s employed population is aging and most of the youths are unemployed, this is a

major skill and labor market gap that needs to be addressed imperatively (Carvarlho

2015).Unemployment slows down economic growth due to high welfare dependency and underutilization

of economic resources. In addition, there is need for overcoming the current low commodity prices so as

to boost economic activity. Low commodity prices degrade the value of goods and services thus leading

to low revenue which is not good for the growth of any economy (Fraser 2015).Alongside low

commodity pricing, the Australian dollar appreciation is key to economic development due to the fact that

it has the ability to add value to the economy. Typically, appreciation of the dollar increased the revenue

value and the value for commodities which will directly impact on the economic value of the

country .Currently, the Australian macroeconomic environment isn’t conducive for supporting economic

growth.

In addition, the growth of the Chinese economy has also uplifted the Australian economic

performance. Noteworthy, the Chinese economy is one of the key trading partners for the Australian

economy. The economic dominance of the Chinese economy on a global level cannot be ignored. The

abundance of Australian raw materials has earned it a larger market share in the growing Chinese

economy and other Asian nations (Charlton 2015).Iron and coal minerals are among the top products

exported by the Australians to the Chinese economy. The demand for raw materials of the Chinese

economy has increased the exportation volume of the Australian products, minerals, beef and other

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Australia 8

products whose revenue has substantially boosted the growth of the Australian economy. China’s

economy is a large market due to its large population and its growing economic demand for raw

materials. Noteworthy, most of the Australian revenue is from exportation of commodities, raw materials.

Also, the Australian economy exports much of its produce to the United States and the European Union

market. The Australian economy abundance in raw materials makes the market for their products global

thus more exportation revenue.

Usually, favorable taxation regimes are a huge incentive for foreign and domestic investment

thus the need for the Australian government to provide flexible and favorable tax breaks and concessions

to corporate bodies .Also, in the event that there is a favorable wage growth in the Australian economy,

many persons will seek to be employed thus reducing the relatively high real wage and other forms of

unemployment being experienced in Australia (Clarke 2018).For investment to occur, there is need for

accessible and efficient physical infrastructure thus the need for the Australian government to invest more

in its infrastructure to encourage investment and expansion of existing investments through better

infrastructure and tax concessions. Regarding technological advancement, the Australian government

needs to fully support research and development due to the benefits it has to offers such as innovative,

efficient and competitive products and ways of doing business which will boost the economic

performance of respective industries (Treasury 2010).

products whose revenue has substantially boosted the growth of the Australian economy. China’s

economy is a large market due to its large population and its growing economic demand for raw

materials. Noteworthy, most of the Australian revenue is from exportation of commodities, raw materials.

Also, the Australian economy exports much of its produce to the United States and the European Union

market. The Australian economy abundance in raw materials makes the market for their products global

thus more exportation revenue.

Usually, favorable taxation regimes are a huge incentive for foreign and domestic investment

thus the need for the Australian government to provide flexible and favorable tax breaks and concessions

to corporate bodies .Also, in the event that there is a favorable wage growth in the Australian economy,

many persons will seek to be employed thus reducing the relatively high real wage and other forms of

unemployment being experienced in Australia (Clarke 2018).For investment to occur, there is need for

accessible and efficient physical infrastructure thus the need for the Australian government to invest more

in its infrastructure to encourage investment and expansion of existing investments through better

infrastructure and tax concessions. Regarding technological advancement, the Australian government

needs to fully support research and development due to the benefits it has to offers such as innovative,

efficient and competitive products and ways of doing business which will boost the economic

performance of respective industries (Treasury 2010).

Australia 9

References

ABS. (2010).The global financial crisis and its impact on Australia. Retrieved from

http://www.abs.gov.au/AUSSTATS/abs@.nsf/Lookup/1301.0Chapter27092009%E2%80%9310

Austrade, (2015, Australia Nominal exchange rate. Retrieved from

https://www.austrade.gov.au/News/Economic-analysis/the-dollar-and-competitiveness>

Bramble, T. (2015).The Australian economy after the mining boom. Retrieved from

https://redflag.org.au/article/australian-economy-after-mining-boom

Carvarlho, P. (2015).Youth Unemployment in Australia. Retrieved from

http://www.cis.org.au/app/uploads/2015/11/rr7-snapshot.pdf

Charlton, A. (2015).China’s rising impact on Australia’s economy. Retrieved from

https://d3fy651gv2fhd3.cloudfront.net/charts/australia-gdp-growth.png?

s=aunagdpc&v=201803231519v

Chhabra, V. (2009).RBA Economics Competition 2009.Retrieved from

https://www.rba.gov.au/education/talks-and-events/economics-competition/2009/pdf/first-

year.pdf

Clarke, C. (2018, January 4).Low wages, High debts and housing bubble threaten the Australian economy

in 2018.The ABC News. Retrieved from t http://www.abc.net.au/news/2018-01-04/australian-

economy-threatened-by-low-wages-high-debts-bubble/9286048

References

ABS. (2010).The global financial crisis and its impact on Australia. Retrieved from

http://www.abs.gov.au/AUSSTATS/abs@.nsf/Lookup/1301.0Chapter27092009%E2%80%9310

Austrade, (2015, Australia Nominal exchange rate. Retrieved from

https://www.austrade.gov.au/News/Economic-analysis/the-dollar-and-competitiveness>

Bramble, T. (2015).The Australian economy after the mining boom. Retrieved from

https://redflag.org.au/article/australian-economy-after-mining-boom

Carvarlho, P. (2015).Youth Unemployment in Australia. Retrieved from

http://www.cis.org.au/app/uploads/2015/11/rr7-snapshot.pdf

Charlton, A. (2015).China’s rising impact on Australia’s economy. Retrieved from

https://d3fy651gv2fhd3.cloudfront.net/charts/australia-gdp-growth.png?

s=aunagdpc&v=201803231519v

Chhabra, V. (2009).RBA Economics Competition 2009.Retrieved from

https://www.rba.gov.au/education/talks-and-events/economics-competition/2009/pdf/first-

year.pdf

Clarke, C. (2018, January 4).Low wages, High debts and housing bubble threaten the Australian economy

in 2018.The ABC News. Retrieved from t http://www.abc.net.au/news/2018-01-04/australian-

economy-threatened-by-low-wages-high-debts-bubble/9286048

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Australia 10

Debelle, G. (2009).Some effects of the global financial crisis on Australian Financial Markets. Retrieved

from at https://www.rba.gov.au/speeches/2009/sp-ag-310309.html

Downes, P, Hanslow, K & Tulip, P. (2014).The effect of the mining boom on the Australian Economy.

Retrieved from http://rba.gov.au/publications/rdp/2014/pdf/rdp2014-08.pdf

Fraser, J. (2015).The Australian economy and challenges of change. Retrieved from

https://treasury.gov.au/speech/the-australian-economy-and-challenges-of-change/

Kennedy, S. (2009).Australia’s response to the global financial crisis .Retrieved from

https://treasury.gov.au/speech/australias-response-to-the-global-financial-crisis/

Kent, C. (2016).After the Boom .RBA. [Online].Available at https://www.rba.gov.au/speeches/216/sp-ag-

2016-09-13.html

Philips, K, (2016).The mining boom that changed Australia. Retrieved from

http://www.abc.net.au/radionational/programs/rearvision/the-mining-boom-that-changed-

australia/7319586>

Trading Economics. (2018).Australia GDP growth rate 1959-2018.Trading Economics. Retrieved from

https://tradingeconomics.com/australia/gdp-growth

Treasury. (2010).The economic outlook and challenges for the Australian economy. Retrieved from

https://treasury.gov.au/publication/economic-roundup-issue-1-2010/economic-roundup-issue-1-

2010/the-economic-outlook-and-challenges-for-the-australian-economy/

Uren, D. (2016, December 8).End of the mining boom” now being felt”. The Australian. Available at

https://www.theaustralian.com.au/business/mining-energy/end-of-mining-boom-now-being-felt/

news-story/fdf9acdc32267b30fa07dfd9aba1bdcb

World Bank Group. (2018).GDP (Current US$).World Bank. Retrieved from

[https://data.worldbank.org/indicator/NY.GDP.MKTP.CD?locations=AU

Debelle, G. (2009).Some effects of the global financial crisis on Australian Financial Markets. Retrieved

from at https://www.rba.gov.au/speeches/2009/sp-ag-310309.html

Downes, P, Hanslow, K & Tulip, P. (2014).The effect of the mining boom on the Australian Economy.

Retrieved from http://rba.gov.au/publications/rdp/2014/pdf/rdp2014-08.pdf

Fraser, J. (2015).The Australian economy and challenges of change. Retrieved from

https://treasury.gov.au/speech/the-australian-economy-and-challenges-of-change/

Kennedy, S. (2009).Australia’s response to the global financial crisis .Retrieved from

https://treasury.gov.au/speech/australias-response-to-the-global-financial-crisis/

Kent, C. (2016).After the Boom .RBA. [Online].Available at https://www.rba.gov.au/speeches/216/sp-ag-

2016-09-13.html

Philips, K, (2016).The mining boom that changed Australia. Retrieved from

http://www.abc.net.au/radionational/programs/rearvision/the-mining-boom-that-changed-

australia/7319586>

Trading Economics. (2018).Australia GDP growth rate 1959-2018.Trading Economics. Retrieved from

https://tradingeconomics.com/australia/gdp-growth

Treasury. (2010).The economic outlook and challenges for the Australian economy. Retrieved from

https://treasury.gov.au/publication/economic-roundup-issue-1-2010/economic-roundup-issue-1-

2010/the-economic-outlook-and-challenges-for-the-australian-economy/

Uren, D. (2016, December 8).End of the mining boom” now being felt”. The Australian. Available at

https://www.theaustralian.com.au/business/mining-energy/end-of-mining-boom-now-being-felt/

news-story/fdf9acdc32267b30fa07dfd9aba1bdcb

World Bank Group. (2018).GDP (Current US$).World Bank. Retrieved from

[https://data.worldbank.org/indicator/NY.GDP.MKTP.CD?locations=AU

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Australia 11

Yeomens, J. (2016).Australia’s mining boom turns to dust as commodity prices collapse. Retrieved from

https://www.telegraph.co.uk/finance/newsbysector/industry/mining/12142813/Australias-mining-

boom-turns-to-dust-as-commodity-prices-collapse.html

Yeomens, J. (2016).Australia’s mining boom turns to dust as commodity prices collapse. Retrieved from

https://www.telegraph.co.uk/finance/newsbysector/industry/mining/12142813/Australias-mining-

boom-turns-to-dust-as-commodity-prices-collapse.html

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.