Money Laundering in Australia: Laws, Defenses, and Initiatives

VerifiedAdded on 2022/11/22

|13

|702

|326

Report

AI Summary

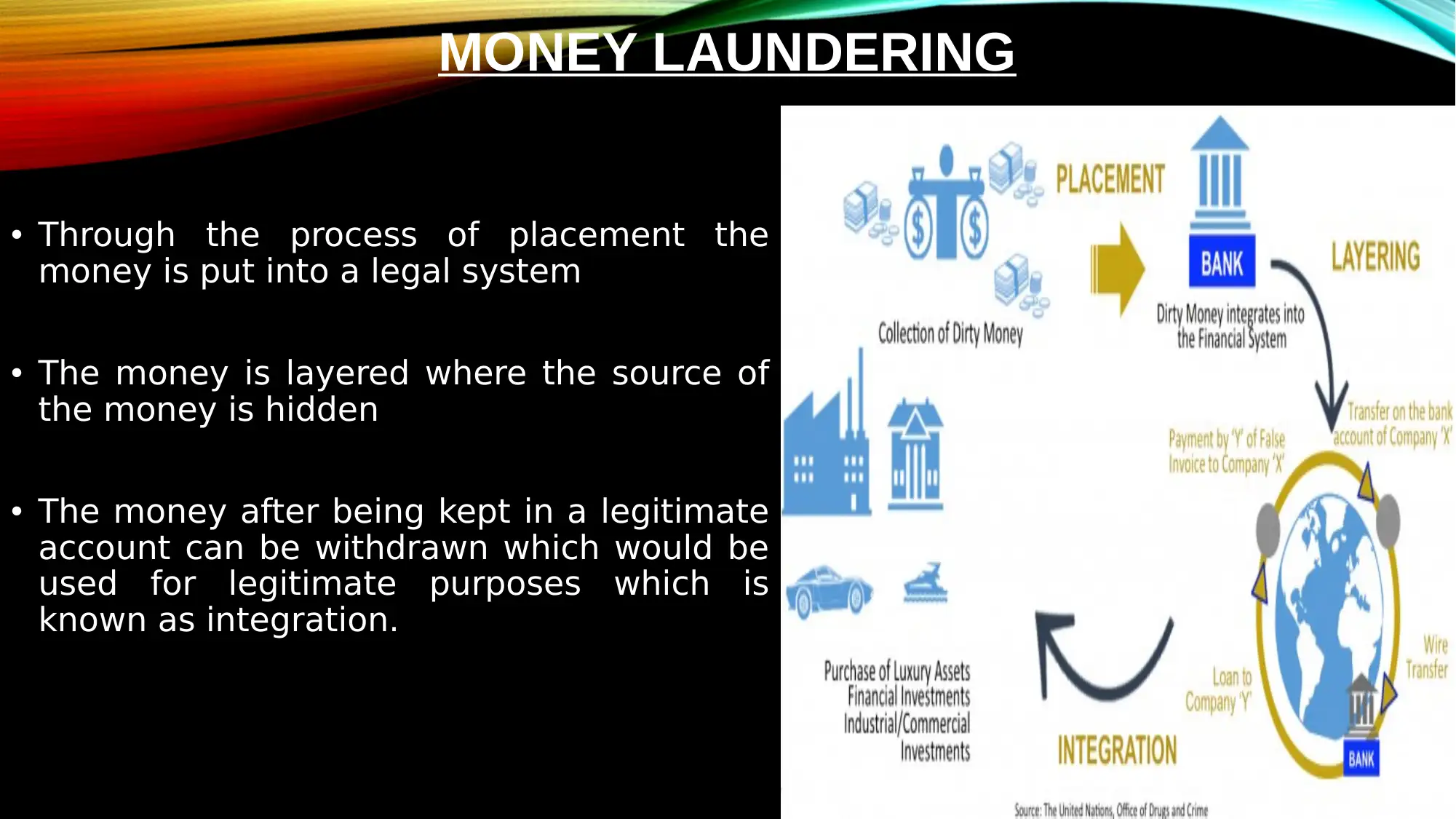

This report provides an overview of money laundering in Australia, defining the process and its various components, including drug trafficking, extortion, corruption, and fraud. It examines the legal framework, focusing on domestic laws designed to detect, deter, and prosecute money laundering crimes, and discusses the penalties for offenders. The report also highlights the role of international standards and the Financial Action Task Force (FATF) in combating money laundering. Furthermore, it analyzes the weaknesses of the Australian government's approach, such as limited coverage of real estate agents, accountants, and lawyers, along with a lack of specific regulations and cost-effectiveness concerns. The report details anti-money laundering initiatives, including the Criminal Code's extra-territorial jurisdiction, and the involvement of key agencies like the Australian Federal Police, Australian Taxation Office, and AUSTRAC. The conclusion emphasizes the serious threat money laundering poses to the economy and the need for effective regulations, while acknowledging the current limitations in achieving desired outcomes. References to relevant literature are included.

1 out of 13

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)