ECON 11026 - RBA Policy, Economic Indicators & Case Study 2017

VerifiedAdded on 2023/06/15

|20

|4112

|59

Case Study

AI Summary

This case study delves into the Reserve Bank of Australia's (RBA) monetary policy decisions, particularly focusing on the historically low cash rate of 1.50 percent. It examines the goals of monetary policy, including price stability, money neutrality, exchange rate stability, economic growth, and full employment, and discusses the functions of money and the RBA. The study emphasizes the importance of considering the economic performance of key trade partners like Japan, China, the USA, and India when formulating monetary policy. It justifies the low cash rate in terms of stimulating investment and maintaining economic growth, while also addressing its impact on the housing market. The analysis further explores the equilibrium in the money market and the mechanism of monetary transmission. Finally, it reviews key economic performance indicators of Australia and discusses strategies for sustaining economic growth.

Running Head: PRINCIPLE OF ECONOMICS

Principle of Economics

Name of the Student

Name of the University

Author note

Principle of Economics

Name of the Student

Name of the University

Author note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1PRINCIPLE OF ECONOMICS

Table of Contents

Introduction:....................................................................................................................................2

Goals of Monetary Policy :..............................................................................................................2

Functions of money :.......................................................................................................................4

Function of Reserve Bank of Australia:..........................................................................................4

Importance of economic performance of Japan, China, USA and India:........................................4

Justification of a historically low cash rate of 1.50 percent :..........................................................6

Equilibrium in the money market:...................................................................................................7

Mechanism of monetary transmission:............................................................................................9

Economic performance indicators of Australia:............................................................................10

Economic growth and determinants of the long run growth:........................................................14

Sustaining economic growth of Australia:....................................................................................15

Conclusion:....................................................................................................................................15

Reference List:...............................................................................................................................17

Table of Contents

Introduction:....................................................................................................................................2

Goals of Monetary Policy :..............................................................................................................2

Functions of money :.......................................................................................................................4

Function of Reserve Bank of Australia:..........................................................................................4

Importance of economic performance of Japan, China, USA and India:........................................4

Justification of a historically low cash rate of 1.50 percent :..........................................................6

Equilibrium in the money market:...................................................................................................7

Mechanism of monetary transmission:............................................................................................9

Economic performance indicators of Australia:............................................................................10

Economic growth and determinants of the long run growth:........................................................14

Sustaining economic growth of Australia:....................................................................................15

Conclusion:....................................................................................................................................15

Reference List:...............................................................................................................................17

2PRINCIPLE OF ECONOMICS

Introduction:

In this paper, a case study is formulated in reference to Reserve Bank of Australia’s

monetary policy statement. In the last media release of RBA, on 5th December the board

members of RBA have decided to keep the cash rate at a neutral level of 1.50 percent. RBA

designs its monetary policy depending on the prevailing economic scenario. Cash rate is the

instrument used by RBA to stabilize inflation and other monetary policy goals. RBA conducts a

discussion board every year and then takes its decision on prevailing and future cash rate. In

2008, global economy was severely hit by financial crisis. In order to protect the economy from

external shocks, RBA decides to cut the prevailing cash rate. The RBA at that time set the cash

rate around 2 percent. In 2016, RBA revised the cash rate twice. First in May, when cash rate

was cut to 1.75. In August, cash rate cut by 0.25 and it was set at 1.50 percent.

While deciding over cash rate, RBA considers economic condition of is economic and

trade partners. Japan, India, China and USA are some countries maintaining close relation with

Australia. The domestic economic performances indicators include consumption, investment,

GDP, government expenditure and housing market.

Goals of Monetary Policy:

Fiscal and monetary policy are two important policy tools used by government to

stabilize economy. In Australia, monetary policy is considered to be more effective as compared

to the monetary policy. The main goal of monetary policy is to attain a price level stability by

setting a low inflation target. The major objectives of monetary policy are the following.

Stable price level: This is the first and foremost important monetary policy goal. The supply of

money is controlled to attain the set inflation target. However, the inflation target is different for

Introduction:

In this paper, a case study is formulated in reference to Reserve Bank of Australia’s

monetary policy statement. In the last media release of RBA, on 5th December the board

members of RBA have decided to keep the cash rate at a neutral level of 1.50 percent. RBA

designs its monetary policy depending on the prevailing economic scenario. Cash rate is the

instrument used by RBA to stabilize inflation and other monetary policy goals. RBA conducts a

discussion board every year and then takes its decision on prevailing and future cash rate. In

2008, global economy was severely hit by financial crisis. In order to protect the economy from

external shocks, RBA decides to cut the prevailing cash rate. The RBA at that time set the cash

rate around 2 percent. In 2016, RBA revised the cash rate twice. First in May, when cash rate

was cut to 1.75. In August, cash rate cut by 0.25 and it was set at 1.50 percent.

While deciding over cash rate, RBA considers economic condition of is economic and

trade partners. Japan, India, China and USA are some countries maintaining close relation with

Australia. The domestic economic performances indicators include consumption, investment,

GDP, government expenditure and housing market.

Goals of Monetary Policy:

Fiscal and monetary policy are two important policy tools used by government to

stabilize economy. In Australia, monetary policy is considered to be more effective as compared

to the monetary policy. The main goal of monetary policy is to attain a price level stability by

setting a low inflation target. The major objectives of monetary policy are the following.

Stable price level: This is the first and foremost important monetary policy goal. The supply of

money is controlled to attain the set inflation target. However, the inflation target is different for

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3PRINCIPLE OF ECONOMICS

different countries (Kiley & Roberts, 2017). All countries sets its inflation goals to a low to

moderate level. Tight monetary policy is followed to reduce inflation rate while ease monetary

policy is followed to increase the price level and boost economic growth.

Money neutrality: Change in real economic variables often resulted from fluctuations in the

money supply. Once the effect of money supply is neutralized then economy become more

stabilized. This secures the economy from fluctuations caused from business cycle, fluctuation in

price level or volatility in trade cycles.

Stable exchange rate: A related objective of monetary policy is to stabilize the exchange rate. A

less volatile exchange rate helps the nation to maintain a stable trade volume. Exchange rate is

related with the interest rate (Blanchard, Rogoff & Rajan, 2016). Thus, monetary authority by

adjusting interest rate can influence the exchange rate under a flexible exchange rate system.

Economic growth: All the policies in the economy are designed to attain stable economic

growth. Government by controlling money supply and inflation targets to maintain a stable

growth rate of the economy.

Full Employment: Along with economic growth, policymaker also targets to achieve full

employment. The economic growth attained with suitable monetary policy framework helps to

attain full employment by opening new employment opportunities.

Functions of money:

The main function of money is the use of it for transaction. In order to exchange goods or

services the most convenient medium is money. Earlier that is before the advent of money people

are supposed to exchange goods using barter system. However, with barter system due to lack of

proper measurement units the transaction could not be undertaken properly. Money solves this

different countries (Kiley & Roberts, 2017). All countries sets its inflation goals to a low to

moderate level. Tight monetary policy is followed to reduce inflation rate while ease monetary

policy is followed to increase the price level and boost economic growth.

Money neutrality: Change in real economic variables often resulted from fluctuations in the

money supply. Once the effect of money supply is neutralized then economy become more

stabilized. This secures the economy from fluctuations caused from business cycle, fluctuation in

price level or volatility in trade cycles.

Stable exchange rate: A related objective of monetary policy is to stabilize the exchange rate. A

less volatile exchange rate helps the nation to maintain a stable trade volume. Exchange rate is

related with the interest rate (Blanchard, Rogoff & Rajan, 2016). Thus, monetary authority by

adjusting interest rate can influence the exchange rate under a flexible exchange rate system.

Economic growth: All the policies in the economy are designed to attain stable economic

growth. Government by controlling money supply and inflation targets to maintain a stable

growth rate of the economy.

Full Employment: Along with economic growth, policymaker also targets to achieve full

employment. The economic growth attained with suitable monetary policy framework helps to

attain full employment by opening new employment opportunities.

Functions of money:

The main function of money is the use of it for transaction. In order to exchange goods or

services the most convenient medium is money. Earlier that is before the advent of money people

are supposed to exchange goods using barter system. However, with barter system due to lack of

proper measurement units the transaction could not be undertaken properly. Money solves this

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4PRINCIPLE OF ECONOMICS

problem and provide a suitable unit for capturing worth of any produced goods or service.

Money is used as a store of value (Sardoni, 2015). It is possible to store money for a long

horizon and thus determines purchasing power in future. The value of money though fluctuates

with level of inflation but it always holds some worth. The value of any stored wealth is also

measured in terms of money.

Function of Reserve Bank of Australia:

Reserve Bank of Australia is the central monetary authority. It takes all the decision

related to money supply, interest rate and other money market decision in favor of Australia’s

prosperity. RBA aims to maintain a stable value of Australian dollar, prints currency, maintain

full employment and overall well-being (Cheung, Manning & Moore, 2014). Achieving a stable

price level is one of the primary objectives RBA. The targeted inflation rate in Australia lies

between 2-3 percent. RBA also looks after all other form of financial transaction like control of

foreign exchange reserve, control overseas financial transaction and control other functions of

banks.

Importance of economic performance of Japan, China, USA and India:

In times of taking decision regarding cash rates, RBA needs to consider economic

performance of nation whose economy is related with Australian economy. Economic expansion

of trade partners positively influences economic performance of Australia. During volatile

economic condition of partner countries, strong domestic support is needed to overcome external

shocks.

China is one nation whose economic movement affects Australia the most. There is a

bilateral trade and financial relation between China and Australia. China is one of the fastest

problem and provide a suitable unit for capturing worth of any produced goods or service.

Money is used as a store of value (Sardoni, 2015). It is possible to store money for a long

horizon and thus determines purchasing power in future. The value of money though fluctuates

with level of inflation but it always holds some worth. The value of any stored wealth is also

measured in terms of money.

Function of Reserve Bank of Australia:

Reserve Bank of Australia is the central monetary authority. It takes all the decision

related to money supply, interest rate and other money market decision in favor of Australia’s

prosperity. RBA aims to maintain a stable value of Australian dollar, prints currency, maintain

full employment and overall well-being (Cheung, Manning & Moore, 2014). Achieving a stable

price level is one of the primary objectives RBA. The targeted inflation rate in Australia lies

between 2-3 percent. RBA also looks after all other form of financial transaction like control of

foreign exchange reserve, control overseas financial transaction and control other functions of

banks.

Importance of economic performance of Japan, China, USA and India:

In times of taking decision regarding cash rates, RBA needs to consider economic

performance of nation whose economy is related with Australian economy. Economic expansion

of trade partners positively influences economic performance of Australia. During volatile

economic condition of partner countries, strong domestic support is needed to overcome external

shocks.

China is one nation whose economic movement affects Australia the most. There is a

bilateral trade and financial relation between China and Australia. China is one of the fastest

5PRINCIPLE OF ECONOMICS

growing developing nation in world. In achieving the growth rate China needs some external

support. Most of the raw material, which China demands, come from Australia. China provides

an extended domestic market for goods exported from Australia. Australia has a large stock of

mineral resources (Pascali, 2017). The mineral resources are exported to China to support the

energy sector. In terms of service, Australia assists China in its education service. China invests

in different projects of Australia. Fluctuations in such investments affects Australian economy.

USA is another nation influencing economic behavior of Australia. USA is regarded as

the most powerful and largest economy in the globe. Australia and USA singed an effective

bilateral trade agreement in 2005 to strengthen their economic relation. The two nations

exchanged goods and services worth billions of dollar each year (Mascitelli & Wilson, 2018).

USA makes capital investment in Australia. The firms in USA operate their plants in Australia.

These create both employment opportunity and economic prosperity.

Australia has established a trade relation with India. India is the fifth largest market for

Australian export. Billions of worth of goods are exchange between these two nations. Australia

exports minerals, vegetables and services to India. India with its economic growth invests in

different sectors of Australia (Xiang, Kuang & Li, 2017). The attractive sectors for investment

include manufacturing, energy and resource sector and other services.

Another important trade partner of Australia is Japan. Japan makes adequate capital

investment in Australia. The Japan Australian Economic Partnership in 2014 strengthens the

relation between Australia and Japan (Piggott & Woodland, 2016). With this agreement the all

the trade and investment barriers has been eliminated. Like other nation, Australia exports

energy and minerals to Japan.

growing developing nation in world. In achieving the growth rate China needs some external

support. Most of the raw material, which China demands, come from Australia. China provides

an extended domestic market for goods exported from Australia. Australia has a large stock of

mineral resources (Pascali, 2017). The mineral resources are exported to China to support the

energy sector. In terms of service, Australia assists China in its education service. China invests

in different projects of Australia. Fluctuations in such investments affects Australian economy.

USA is another nation influencing economic behavior of Australia. USA is regarded as

the most powerful and largest economy in the globe. Australia and USA singed an effective

bilateral trade agreement in 2005 to strengthen their economic relation. The two nations

exchanged goods and services worth billions of dollar each year (Mascitelli & Wilson, 2018).

USA makes capital investment in Australia. The firms in USA operate their plants in Australia.

These create both employment opportunity and economic prosperity.

Australia has established a trade relation with India. India is the fifth largest market for

Australian export. Billions of worth of goods are exchange between these two nations. Australia

exports minerals, vegetables and services to India. India with its economic growth invests in

different sectors of Australia (Xiang, Kuang & Li, 2017). The attractive sectors for investment

include manufacturing, energy and resource sector and other services.

Another important trade partner of Australia is Japan. Japan makes adequate capital

investment in Australia. The Japan Australian Economic Partnership in 2014 strengthens the

relation between Australia and Japan (Piggott & Woodland, 2016). With this agreement the all

the trade and investment barriers has been eliminated. Like other nation, Australia exports

energy and minerals to Japan.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6PRINCIPLE OF ECONOMICS

The evaluation of economic relation between Australia and these nations gives rationale

of taking economic status of these countries in designing monetary policy framework. The trade

and economic relation makes Australian economy dependent on these nations. USA suffered a

financial crisis in 2008 following crisis in the housing market. The crisis spread out from USA.

This time RBA had cut cash rate for monetary expansion. China is growing at a rapid rate

following investment in housing market and development of infrastructure (Chacko & Davis,

2017). Government in USA has recently raised the interest rate. Japan and India also revises

policies to boost their economic growth. Following changes in these economies Australian

economy is affected either through altering trade volume or through changing financial

investment. Therefore, RBA takes into consideration the economic performance and status of

these nations in deciding interest rate.

Justification of a historically low cash rate of 1.50 percent:

Cash rate sets by the RBA controls the investible funds in the economy. Based on the

cash rate, the commercial banks determines the interest rate prevailing in the economy. A low

cash rate means a low interest rate. This increases investment in the economy. This provides

rationale for lowering the cash rate. However, the policy has an adverse impact of raising

economic debt. With the aim of stimulating investment, RBA in 2011 has announced a cut in the

prevailing cash rate. In the month of May in 2015, RBA has settled the interest rate at 2.0

percent. The RBA has kept the cash rate fixed for one year. Finally, after two times revision by

0.25 basis point, cash rate finally settled at 1.50 percent. The low cash rate though helps

Australia to maintain a stable growth but it adversely affect the property market. The low cash

rate make it easier to borrow funds easily. As a result, debt in housing market has significantly

raised in the short span. However, no increase in household income is recorded (smh.com.au,

The evaluation of economic relation between Australia and these nations gives rationale

of taking economic status of these countries in designing monetary policy framework. The trade

and economic relation makes Australian economy dependent on these nations. USA suffered a

financial crisis in 2008 following crisis in the housing market. The crisis spread out from USA.

This time RBA had cut cash rate for monetary expansion. China is growing at a rapid rate

following investment in housing market and development of infrastructure (Chacko & Davis,

2017). Government in USA has recently raised the interest rate. Japan and India also revises

policies to boost their economic growth. Following changes in these economies Australian

economy is affected either through altering trade volume or through changing financial

investment. Therefore, RBA takes into consideration the economic performance and status of

these nations in deciding interest rate.

Justification of a historically low cash rate of 1.50 percent:

Cash rate sets by the RBA controls the investible funds in the economy. Based on the

cash rate, the commercial banks determines the interest rate prevailing in the economy. A low

cash rate means a low interest rate. This increases investment in the economy. This provides

rationale for lowering the cash rate. However, the policy has an adverse impact of raising

economic debt. With the aim of stimulating investment, RBA in 2011 has announced a cut in the

prevailing cash rate. In the month of May in 2015, RBA has settled the interest rate at 2.0

percent. The RBA has kept the cash rate fixed for one year. Finally, after two times revision by

0.25 basis point, cash rate finally settled at 1.50 percent. The low cash rate though helps

Australia to maintain a stable growth but it adversely affect the property market. The low cash

rate make it easier to borrow funds easily. As a result, debt in housing market has significantly

raised in the short span. However, no increase in household income is recorded (smh.com.au,

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7PRINCIPLE OF ECONOMICS

2018). Following the experience in the housing market, RBA has now decided to introduce

lending constraint in the property market. However, RBA cannot increase the cash rate, as it will

then affect the productive investment as well. For this, RBA has announced to keep a neutral

cash rate to maintain a balance growth rate.

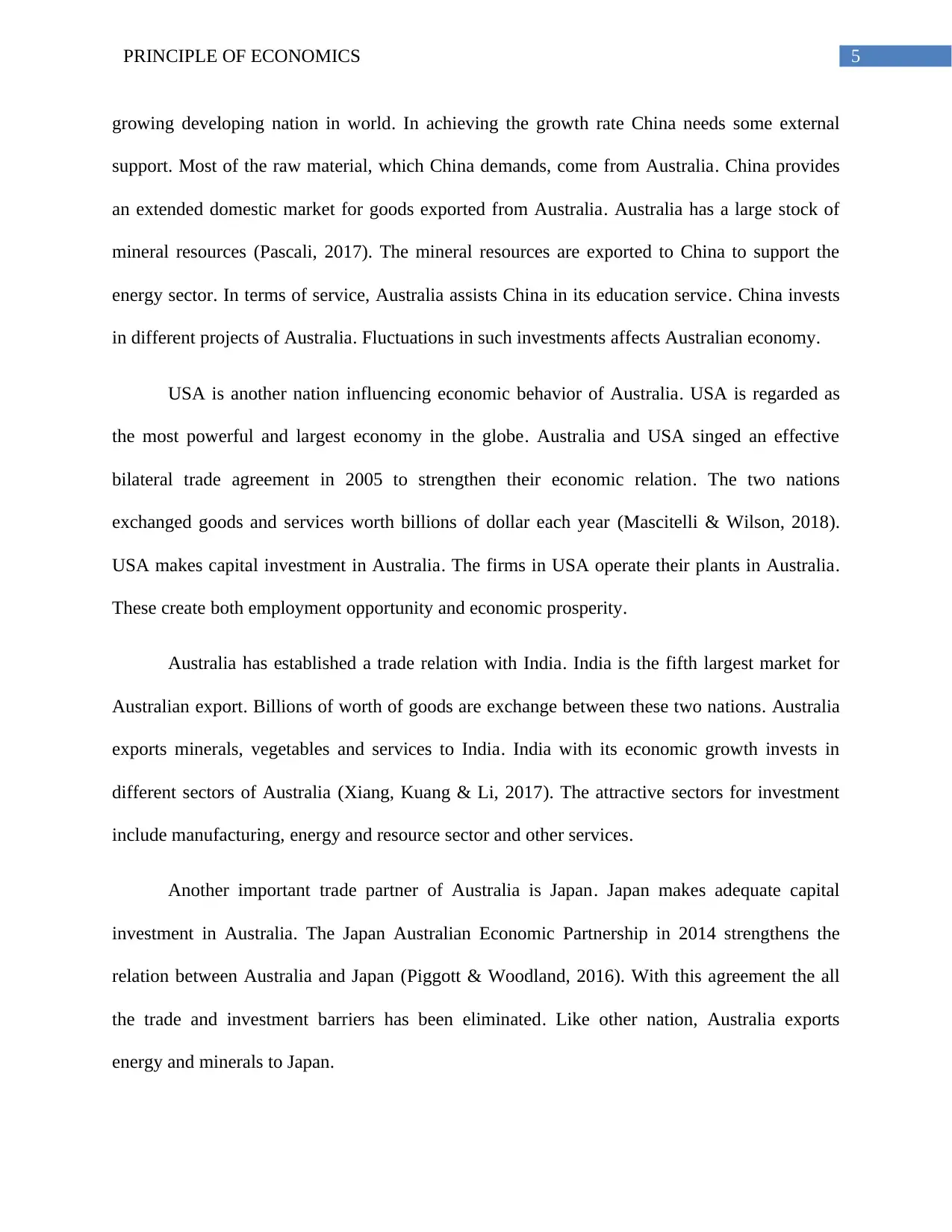

Equilibrium in the money market:

Money market equilibrium is ascertained from a balancing state of money demand and

money supply in the economy. The demand and supply relating to real money balances is

considered as two most vital elements of money market (Bernanke et al., 2015). The model of

liquidity preference presumes the supply of money in the economy is regarded as fixed.

The instances of real money balance is stated below in the illustrations;

( M

P )

S

= M

P

The liquidity preference theory takes into the consideration the converse association

between demand for money and interest rate.

( M

P )D

=L(r )

Equilibrium is determined in the following manner

( M

P )

S

=( M

P ) D

2018). Following the experience in the housing market, RBA has now decided to introduce

lending constraint in the property market. However, RBA cannot increase the cash rate, as it will

then affect the productive investment as well. For this, RBA has announced to keep a neutral

cash rate to maintain a balance growth rate.

Equilibrium in the money market:

Money market equilibrium is ascertained from a balancing state of money demand and

money supply in the economy. The demand and supply relating to real money balances is

considered as two most vital elements of money market (Bernanke et al., 2015). The model of

liquidity preference presumes the supply of money in the economy is regarded as fixed.

The instances of real money balance is stated below in the illustrations;

( M

P )

S

= M

P

The liquidity preference theory takes into the consideration the converse association

between demand for money and interest rate.

( M

P )D

=L(r )

Equilibrium is determined in the following manner

( M

P )

S

=( M

P ) D

8PRINCIPLE OF ECONOMICS

Figure 1: Figure illustrating money market equilibrium

(Source: As Created by Author)

The interest rate prevail in an economy is ascertained from state of equilibrium in the

money market. The monetary policy performed by RBA helps in influencing the supply of

money with the help of changes in rate of cash. Cash rate change helps in influencing the

economic variables with the help of monetary transition mechanism.

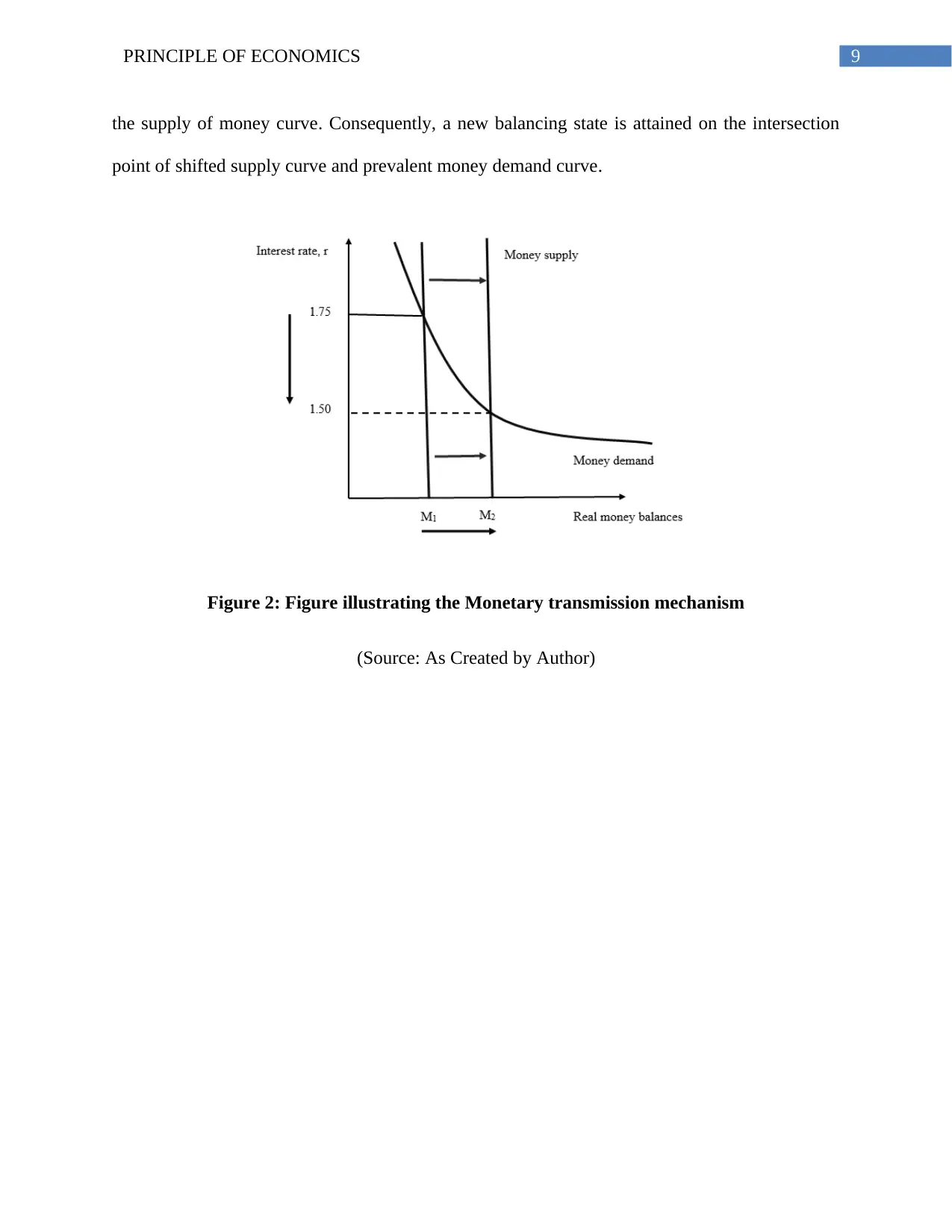

Mechanism of monetary transmission:

The impact of monetary policy helps in transmitting the goods and money market with

the help of varied channels. RBA during the month of August in 2016, lower the rate of cash by

0.25 points and the overall cash rate lowered from 1.75 to 1.50. together with the rate of interest,

the equilibrium quantity of money also reduced (Cowen & Tabarrok, 2015). Cutting down of the

cash rate, results in lowering down of the money supply. As a result of this it reflected a shift in

Figure 1: Figure illustrating money market equilibrium

(Source: As Created by Author)

The interest rate prevail in an economy is ascertained from state of equilibrium in the

money market. The monetary policy performed by RBA helps in influencing the supply of

money with the help of changes in rate of cash. Cash rate change helps in influencing the

economic variables with the help of monetary transition mechanism.

Mechanism of monetary transmission:

The impact of monetary policy helps in transmitting the goods and money market with

the help of varied channels. RBA during the month of August in 2016, lower the rate of cash by

0.25 points and the overall cash rate lowered from 1.75 to 1.50. together with the rate of interest,

the equilibrium quantity of money also reduced (Cowen & Tabarrok, 2015). Cutting down of the

cash rate, results in lowering down of the money supply. As a result of this it reflected a shift in

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9PRINCIPLE OF ECONOMICS

the supply of money curve. Consequently, a new balancing state is attained on the intersection

point of shifted supply curve and prevalent money demand curve.

Figure 2: Figure illustrating the Monetary transmission mechanism

(Source: As Created by Author)

the supply of money curve. Consequently, a new balancing state is attained on the intersection

point of shifted supply curve and prevalent money demand curve.

Figure 2: Figure illustrating the Monetary transmission mechanism

(Source: As Created by Author)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10PRINCIPLE OF ECONOMICS

Economic performance indicators of Australia:

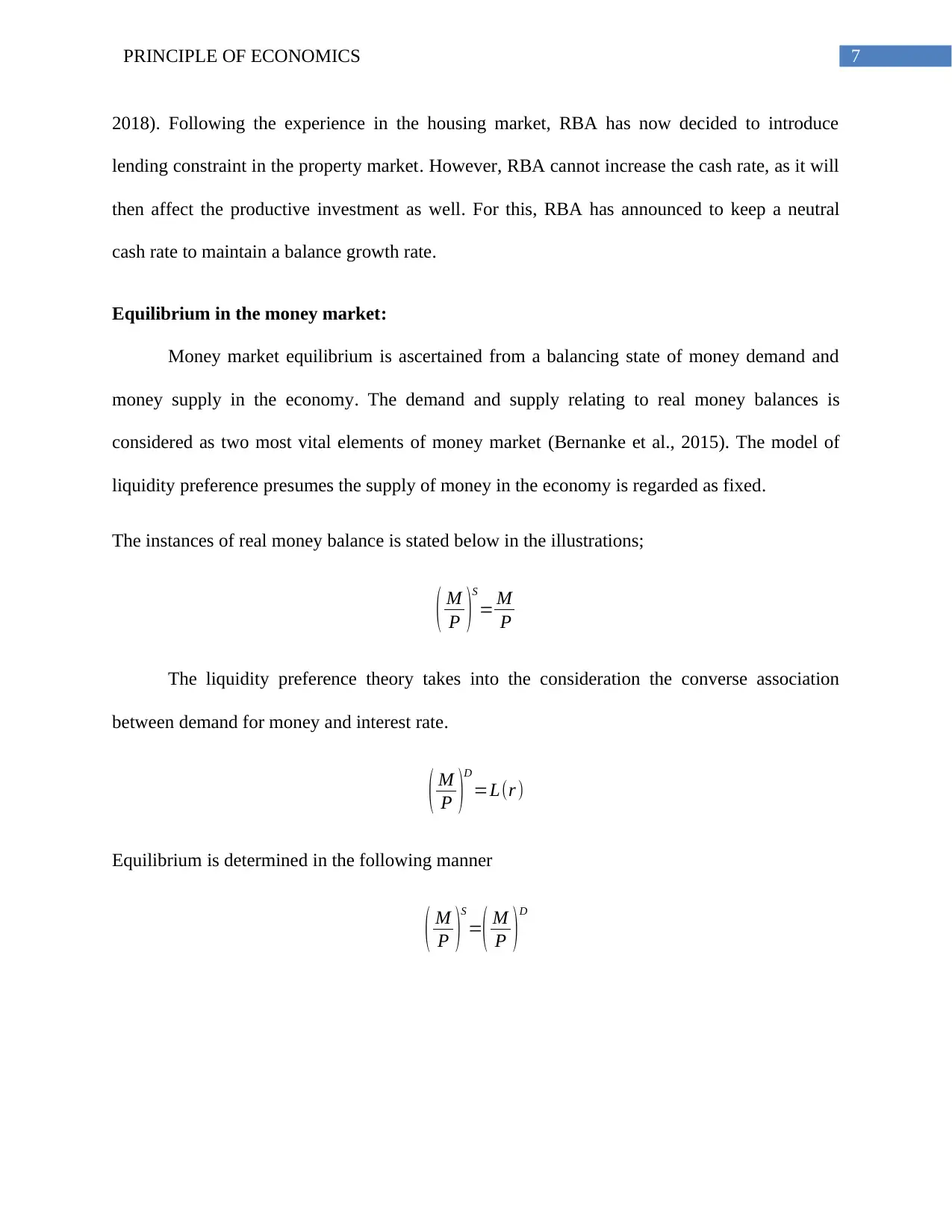

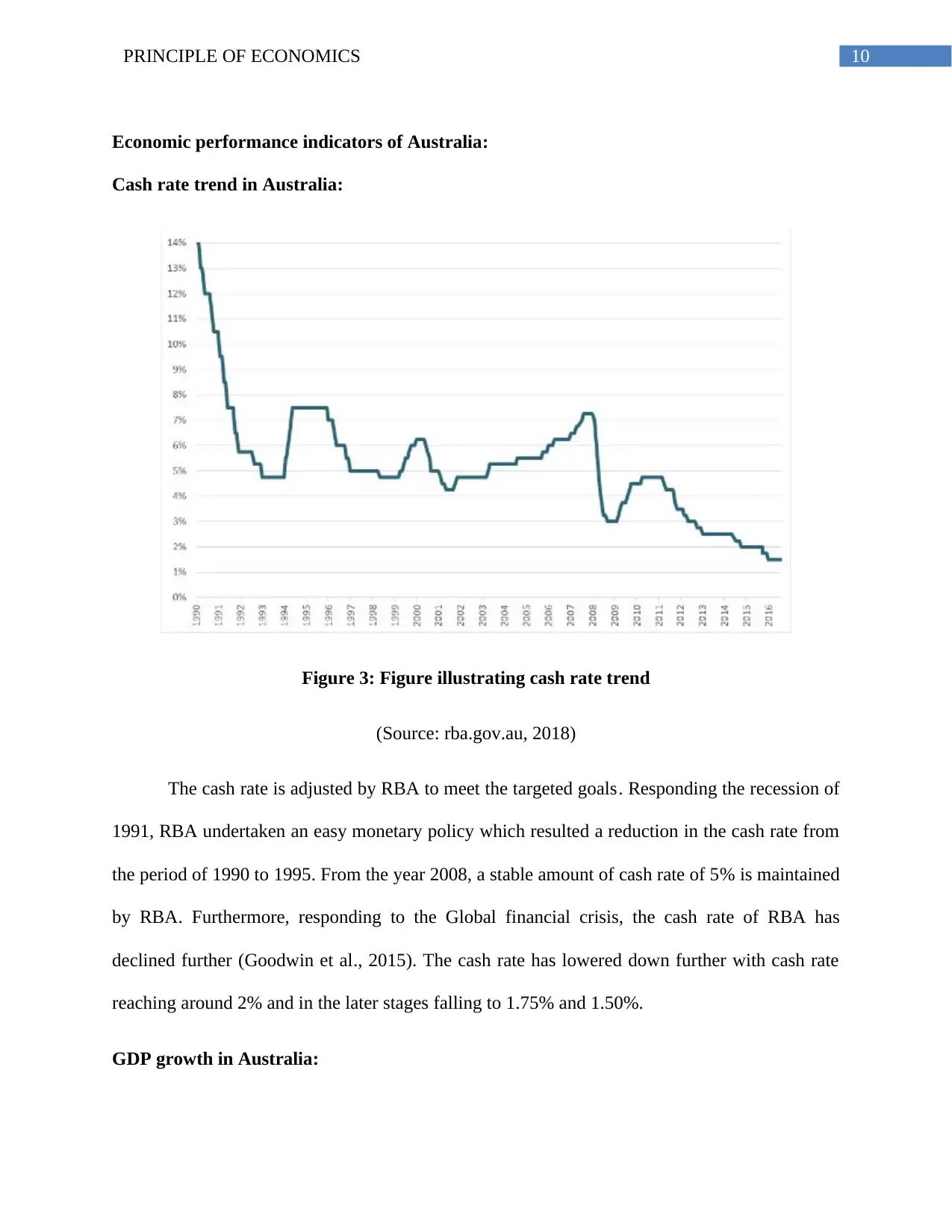

Cash rate trend in Australia:

Figure 3: Figure illustrating cash rate trend

(Source: rba.gov.au, 2018)

The cash rate is adjusted by RBA to meet the targeted goals. Responding the recession of

1991, RBA undertaken an easy monetary policy which resulted a reduction in the cash rate from

the period of 1990 to 1995. From the year 2008, a stable amount of cash rate of 5% is maintained

by RBA. Furthermore, responding to the Global financial crisis, the cash rate of RBA has

declined further (Goodwin et al., 2015). The cash rate has lowered down further with cash rate

reaching around 2% and in the later stages falling to 1.75% and 1.50%.

GDP growth in Australia:

Economic performance indicators of Australia:

Cash rate trend in Australia:

Figure 3: Figure illustrating cash rate trend

(Source: rba.gov.au, 2018)

The cash rate is adjusted by RBA to meet the targeted goals. Responding the recession of

1991, RBA undertaken an easy monetary policy which resulted a reduction in the cash rate from

the period of 1990 to 1995. From the year 2008, a stable amount of cash rate of 5% is maintained

by RBA. Furthermore, responding to the Global financial crisis, the cash rate of RBA has

declined further (Goodwin et al., 2015). The cash rate has lowered down further with cash rate

reaching around 2% and in the later stages falling to 1.75% and 1.50%.

GDP growth in Australia:

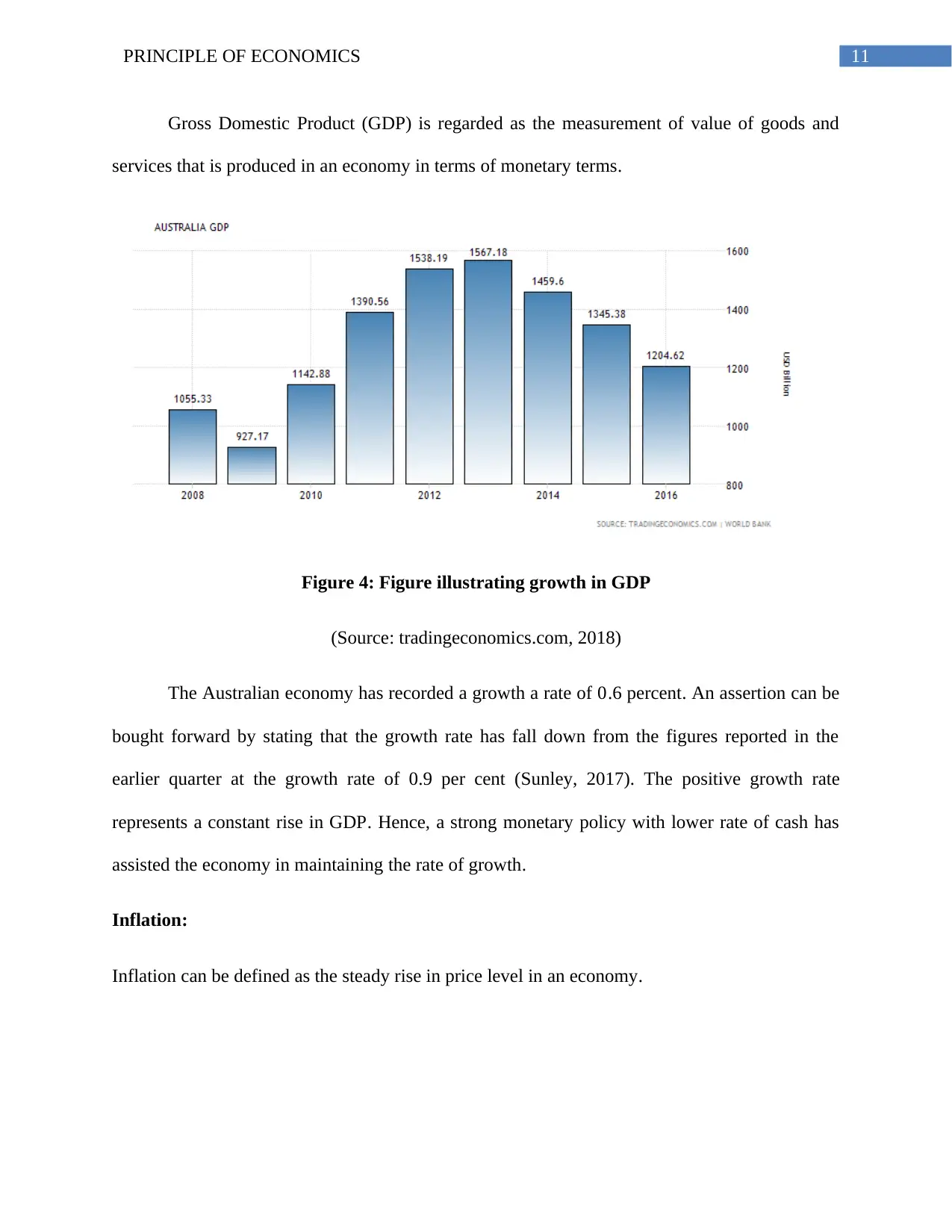

11PRINCIPLE OF ECONOMICS

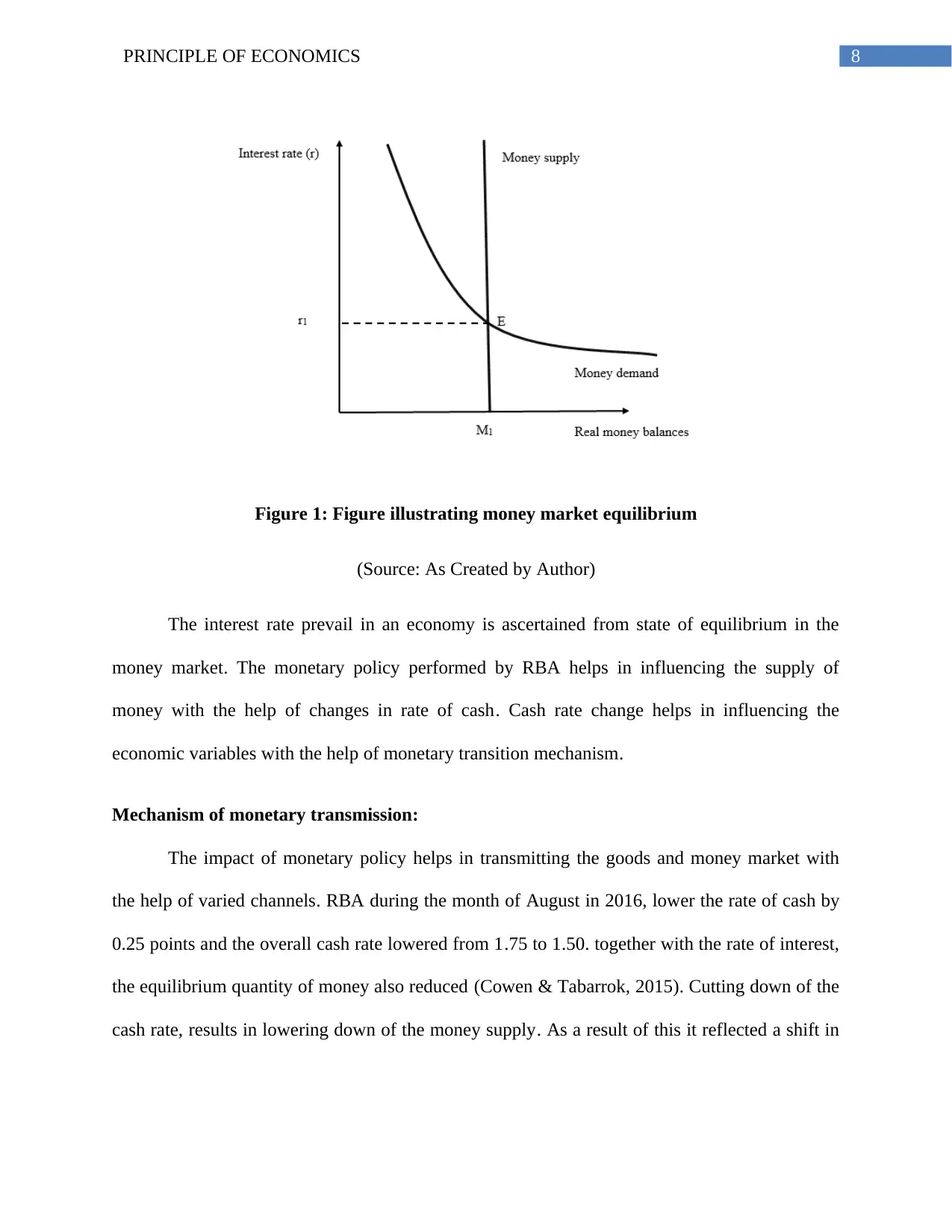

Gross Domestic Product (GDP) is regarded as the measurement of value of goods and

services that is produced in an economy in terms of monetary terms.

Figure 4: Figure illustrating growth in GDP

(Source: tradingeconomics.com, 2018)

The Australian economy has recorded a growth a rate of 0.6 percent. An assertion can be

bought forward by stating that the growth rate has fall down from the figures reported in the

earlier quarter at the growth rate of 0.9 per cent (Sunley, 2017). The positive growth rate

represents a constant rise in GDP. Hence, a strong monetary policy with lower rate of cash has

assisted the economy in maintaining the rate of growth.

Inflation:

Inflation can be defined as the steady rise in price level in an economy.

Gross Domestic Product (GDP) is regarded as the measurement of value of goods and

services that is produced in an economy in terms of monetary terms.

Figure 4: Figure illustrating growth in GDP

(Source: tradingeconomics.com, 2018)

The Australian economy has recorded a growth a rate of 0.6 percent. An assertion can be

bought forward by stating that the growth rate has fall down from the figures reported in the

earlier quarter at the growth rate of 0.9 per cent (Sunley, 2017). The positive growth rate

represents a constant rise in GDP. Hence, a strong monetary policy with lower rate of cash has

assisted the economy in maintaining the rate of growth.

Inflation:

Inflation can be defined as the steady rise in price level in an economy.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 20

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.