Business Research Project: Director Pay vs. Company Profitability

VerifiedAdded on 2020/03/23

|22

|4343

|638

Project

AI Summary

This business research project examines the relationship between director remuneration and company profitability within the top 50 Australian companies over three financial years (2014-2016). The research investigates the extent to which director pay is associated with firm profit, using annual report data. It incorporates agency theory, resource dependency theory, and corporate law to establish a theoretical framework. The methodology involves data collection from annual reports, descriptive analysis, and correlation analysis to test the null hypothesis that there is no association between director remuneration and firm profits. The findings indicate that, across the three years, the remuneration earned by directors does not depend on the performance of the company. The project also reviews board diversity of expertise and heterogeneity, identifying gaps in the existing literature and concluding that the directors' remuneration does not influence company profit. The research aims to offer insights into corporate governance and financial performance within the Australian context.

Running Head: BUSINESS RESEARCH PROJECT

Business Research Project

Name of the Student

Name of the University

Author Note

Business Research Project

Name of the Student

Name of the University

Author Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1BUSINESS RESEARCH PROJECT

Executive Summary

The main aim of this research is to give details on a professional project aimed at finding

business performance of top 50 Australian companies. The research question is to what extent is

the profit of the firm associated with remuneration of the directors’ data that has been collected

from the annual reports of the top 50 Australian companies. This has been analyzed by

evaluating the correlation between the independent directors and profitability. The result is very

clear that on all the three years, remuneration earned by the directors of the company do not

depend on the performance of the company.

Executive Summary

The main aim of this research is to give details on a professional project aimed at finding

business performance of top 50 Australian companies. The research question is to what extent is

the profit of the firm associated with remuneration of the directors’ data that has been collected

from the annual reports of the top 50 Australian companies. This has been analyzed by

evaluating the correlation between the independent directors and profitability. The result is very

clear that on all the three years, remuneration earned by the directors of the company do not

depend on the performance of the company.

2BUSINESS RESEARCH PROJECT

Table of Contents

1.0 Introduction................................................................................................................................4

1.1 Problem Statement.................................................................................................................4

1.2 Research Aims and Research Questions................................................................................4

2.0 Literature Review......................................................................................................................5

2.1 Introduction............................................................................................................................5

1.3.2 Agency Theory...............................................................................................................5

1.3.3 Resource Dependency Theory........................................................................................6

1.3.4 Corporate Law................................................................................................................7

1.3.5 Board diversity of expertise:...........................................................................................7

1.3.6 Board heterogeneity and fit for purpose:........................................................................8

1.3.7 Gap in literature:.............................................................................................................8

1.3.8 Summary:........................................................................................................................9

3.0 Research Methodology............................................................................................................10

3.1 Data Collection....................................................................................................................10

3.2 Data Analysis.......................................................................................................................10

3.2.1 Descriptive Analysis.....................................................................................................11

3.2.2 Remuneration and Business Performance....................................................................11

Data Analysis.................................................................................................................................11

Table of Contents

1.0 Introduction................................................................................................................................4

1.1 Problem Statement.................................................................................................................4

1.2 Research Aims and Research Questions................................................................................4

2.0 Literature Review......................................................................................................................5

2.1 Introduction............................................................................................................................5

1.3.2 Agency Theory...............................................................................................................5

1.3.3 Resource Dependency Theory........................................................................................6

1.3.4 Corporate Law................................................................................................................7

1.3.5 Board diversity of expertise:...........................................................................................7

1.3.6 Board heterogeneity and fit for purpose:........................................................................8

1.3.7 Gap in literature:.............................................................................................................8

1.3.8 Summary:........................................................................................................................9

3.0 Research Methodology............................................................................................................10

3.1 Data Collection....................................................................................................................10

3.2 Data Analysis.......................................................................................................................10

3.2.1 Descriptive Analysis.....................................................................................................11

3.2.2 Remuneration and Business Performance....................................................................11

Data Analysis.................................................................................................................................11

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3BUSINESS RESEARCH PROJECT

Data Study.................................................................................................................................11

Correlation Analysis..................................................................................................................14

Conclusion.....................................................................................................................................17

References......................................................................................................................................18

Data Study.................................................................................................................................11

Correlation Analysis..................................................................................................................14

Conclusion.....................................................................................................................................17

References......................................................................................................................................18

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4BUSINESS RESEARCH PROJECT

1.0 Introduction

The most ideal career path for a student of Master of Professional Accounting student

would be to become a professional accountant. This research is about the study of the business

performances of top 50 Australian companies. The project background, research aims and

objectives and the literature review will constitute the first part. In the second part, the research

methodology, findings, discussions and conclusions will be explained.

1.1 Problem Statement

Fro the last few decades, general public get more interests in the way of companies

performing business and affecting the environment. This is mainly because different people have

different types of interests. Some are interested in shopping. So they will be concerned about the

retail stores and companies and would like to know about their profits or losses. Some people are

into investments. They will be interested in knowing the status of a financial company and judge

from there the appropriate company to choose. Similarly, people with different interests are

concerned about different types of industries. Thus, this research has been conducted.

1.2 Research Aims and Research Questions

The main aim of this research is to study the business performance of top 50 Australian

Companies over three financial years 2014, 2015 and 2016. Thus, the following research

questions can be framed to analyze the aim of this research:

To what extent is the profit of the firm associated to the remuneration of the directors?

1.0 Introduction

The most ideal career path for a student of Master of Professional Accounting student

would be to become a professional accountant. This research is about the study of the business

performances of top 50 Australian companies. The project background, research aims and

objectives and the literature review will constitute the first part. In the second part, the research

methodology, findings, discussions and conclusions will be explained.

1.1 Problem Statement

Fro the last few decades, general public get more interests in the way of companies

performing business and affecting the environment. This is mainly because different people have

different types of interests. Some are interested in shopping. So they will be concerned about the

retail stores and companies and would like to know about their profits or losses. Some people are

into investments. They will be interested in knowing the status of a financial company and judge

from there the appropriate company to choose. Similarly, people with different interests are

concerned about different types of industries. Thus, this research has been conducted.

1.2 Research Aims and Research Questions

The main aim of this research is to study the business performance of top 50 Australian

Companies over three financial years 2014, 2015 and 2016. Thus, the following research

questions can be framed to analyze the aim of this research:

To what extent is the profit of the firm associated to the remuneration of the directors?

5BUSINESS RESEARCH PROJECT

2.0 Literature Review

2.1 Introduction

This section of the study aims to focus on different theories that contains the information

on the relationship between the remuneration earned by the directors and the profits of the

companies. The basic theories that have been included in this section are the theory of the

agencies and the dependency theory of the resources. Moreover, discussion of the corporate law

has also been done to establish the relationship between the variablesdirectors’ remuneration and

profits of the companies and also by discussing the board diversity of expertise. Further, the gap

in the literature will be identified along with the limitations of this study.

1.3.2 Agency Theory

The major work that this board performs is exercising the control and the provision which

is related to the observation of management. This role which the board performs has been

evaluated via the theory of the agency. When ownership and control of the assets are separated,

the problem related to the agents arises. Moreover, the shareholders cannot influence any control

over the management practically. It is not possible for the shareholders to do so. A major role has

been played by the board to oversee the management and protect the shareholders’ rights along

with equitable treatments (Terjesen, Couto & Francisco, 2016). This conflict can give rise to

some moral risks and invalid information. As a result of this conflict, the directors are able to

collect a lot more information. With the help of this information collected, they try to gain the

trust of the principal and this might result in the fact that that this act will go for opposing the

principal (Low, Roberts & Whiting, 2015).

2.0 Literature Review

2.1 Introduction

This section of the study aims to focus on different theories that contains the information

on the relationship between the remuneration earned by the directors and the profits of the

companies. The basic theories that have been included in this section are the theory of the

agencies and the dependency theory of the resources. Moreover, discussion of the corporate law

has also been done to establish the relationship between the variablesdirectors’ remuneration and

profits of the companies and also by discussing the board diversity of expertise. Further, the gap

in the literature will be identified along with the limitations of this study.

1.3.2 Agency Theory

The major work that this board performs is exercising the control and the provision which

is related to the observation of management. This role which the board performs has been

evaluated via the theory of the agency. When ownership and control of the assets are separated,

the problem related to the agents arises. Moreover, the shareholders cannot influence any control

over the management practically. It is not possible for the shareholders to do so. A major role has

been played by the board to oversee the management and protect the shareholders’ rights along

with equitable treatments (Terjesen, Couto & Francisco, 2016). This conflict can give rise to

some moral risks and invalid information. As a result of this conflict, the directors are able to

collect a lot more information. With the help of this information collected, they try to gain the

trust of the principal and this might result in the fact that that this act will go for opposing the

principal (Low, Roberts & Whiting, 2015).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6BUSINESS RESEARCH PROJECT

According to the theory, the managers will not be involving themselves in any kinds of

behaviours that will be disadvantageous to the organization. The values of the shareholders are

increased due to the effectiveness of the agents. The need for monitoring the issue further will

thus be minimized as the cost of transaction will be increased. It is never possible to agree

completely with the shareholders in each and every such situation. Hence, according to the

corporate governance domain, it is important to find out a solution that will be effective to

control the stakeholders association and minimize the conflict between them (Adams et al.,

2015).

1.3.3 The Dependency Theory of the Resources

According to some observations, the organizational operating area is inclusive of the

ecosystem. The factors that are significant in this case are raw materials, labour and capital. The

better the availability of these factors, the ore will be the success of the company. Developing

strategic connections with other companies is critical. To do this, the directors have come up

with a theory. According to this theory, at least two of the major responsibilities of the directors

must be taken care of (Kaczmarek, Kimino & Pye, 2014). In order to retain the employees, the

directors will have to pay the employees a proper remuneration. This is one of the factors for the

retention of the employees (Triana, Miller & Trzebiatowski, 2013).

Now, as the employees will be working more for the company, the company will be

earning more profit based on the performance of the employees. This profit will influence the

remuneration earned by the independent directors. With the increase in the profits earned by the

company, it can be assumed that the remunerations earned by the directors will increase. All the

payments of the company are done on the basis of the profits earned by the company. Thus, the

According to the theory, the managers will not be involving themselves in any kinds of

behaviours that will be disadvantageous to the organization. The values of the shareholders are

increased due to the effectiveness of the agents. The need for monitoring the issue further will

thus be minimized as the cost of transaction will be increased. It is never possible to agree

completely with the shareholders in each and every such situation. Hence, according to the

corporate governance domain, it is important to find out a solution that will be effective to

control the stakeholders association and minimize the conflict between them (Adams et al.,

2015).

1.3.3 The Dependency Theory of the Resources

According to some observations, the organizational operating area is inclusive of the

ecosystem. The factors that are significant in this case are raw materials, labour and capital. The

better the availability of these factors, the ore will be the success of the company. Developing

strategic connections with other companies is critical. To do this, the directors have come up

with a theory. According to this theory, at least two of the major responsibilities of the directors

must be taken care of (Kaczmarek, Kimino & Pye, 2014). In order to retain the employees, the

directors will have to pay the employees a proper remuneration. This is one of the factors for the

retention of the employees (Triana, Miller & Trzebiatowski, 2013).

Now, as the employees will be working more for the company, the company will be

earning more profit based on the performance of the employees. This profit will influence the

remuneration earned by the independent directors. With the increase in the profits earned by the

company, it can be assumed that the remunerations earned by the directors will increase. All the

payments of the company are done on the basis of the profits earned by the company. Thus, the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7BUSINESS RESEARCH PROJECT

profits earned by the companies at the end of the financial year is said to be influencing the

remunerations earned by the independent directors (Ferreira, 2015).

1.3.4 Board diversity of expertise:

Very little research studies have been there in which the expertise of the directors and the

professional background have been analysed until today. According to Gray and Nowland

(2015), the board of expertise has been formed by the directors and they will be providing with

the classification of the expertise that the directors possess into 11 different groups. These groups

are formed of the groups of accountants, bankers, doctors, engineers, academics, consultants,

scientists, lawyers, politicians, executives and other CEO’s (Nielsen & Nielsen, 2013). In

accordance to the researchers, the board of expertise can be as diversified as stated above but the

performance of the firm is not dependent on this diversity. There has been found a negative

association between these non-business expertise and the performance of the firm (García-Meca,

García-Sánchez & Martínez-Ferrero, 2015).

1.3.5 Board heterogeneity and fit for purpose:

According to the discussed theories of the agencies and the resource dependencies,

different effective boards would be effective in enhancing the shareholders’ wealths and the

performance of the organizations. The homogeneous boards of the directors never used to

consider the different viewpoints of the backgrounds of gender, age, wealth and ethnicity

(Perryman, Fernando & Tripathy, 2016). The directors who do not have very good access with

the CEO of the company will be under strict monitoring (Martín-Ugedo&Minguez-Vera, 2014).

profits earned by the companies at the end of the financial year is said to be influencing the

remunerations earned by the independent directors (Ferreira, 2015).

1.3.4 Board diversity of expertise:

Very little research studies have been there in which the expertise of the directors and the

professional background have been analysed until today. According to Gray and Nowland

(2015), the board of expertise has been formed by the directors and they will be providing with

the classification of the expertise that the directors possess into 11 different groups. These groups

are formed of the groups of accountants, bankers, doctors, engineers, academics, consultants,

scientists, lawyers, politicians, executives and other CEO’s (Nielsen & Nielsen, 2013). In

accordance to the researchers, the board of expertise can be as diversified as stated above but the

performance of the firm is not dependent on this diversity. There has been found a negative

association between these non-business expertise and the performance of the firm (García-Meca,

García-Sánchez & Martínez-Ferrero, 2015).

1.3.5 Board heterogeneity and fit for purpose:

According to the discussed theories of the agencies and the resource dependencies,

different effective boards would be effective in enhancing the shareholders’ wealths and the

performance of the organizations. The homogeneous boards of the directors never used to

consider the different viewpoints of the backgrounds of gender, age, wealth and ethnicity

(Perryman, Fernando & Tripathy, 2016). The directors who do not have very good access with

the CEO of the company will be under strict monitoring (Martín-Ugedo&Minguez-Vera, 2014).

8BUSINESS RESEARCH PROJECT

1.3.6 Literature Gap

A lot of theories are present in support of the matter of the relation of the board of

directors and the shareholders’ wealth. This research is mainly based on the profit of the

organization and remunerations earned as a result by the independent directors. The profit of the

organization is in turn dependent on the shareholders. Thus, the above literature was worth

discussing. The “UK Corporate Governance Code 2014”, “Sarbanes-Oxley Act 2002” and the

“ASX Corporate Governance Principles and Recommendations 2014” improve the beliefs of the

independent directors. This research explores the dependencies of the remunerations of the board

of directors of a company with the profit earned by the company in a financial year.

3.0 Research Methodology

3.1 Data Collection

The main aim of this research is to study the business performance of top 50 Australian

Companies over three financial years 2014, 2015 and 2016. To do this research, the yearly

profits of the companies and the remuneration of the directors of the respective companies are

collected from the annual reports of the respective companies. The data thus collected for this

research can be termed as secondary data as the data was collected from previous records and not

directly from the field of research. The 50 companies that were selected belonged to various

sectors such as utilities, materials, financials, consumer discretionary, industrials, energy, health

care, real estates, consumer staples, information technology and telecommunication services. The

profits and the remunerations of the directors of these different sectors will be compared in this

study.

1.3.6 Literature Gap

A lot of theories are present in support of the matter of the relation of the board of

directors and the shareholders’ wealth. This research is mainly based on the profit of the

organization and remunerations earned as a result by the independent directors. The profit of the

organization is in turn dependent on the shareholders. Thus, the above literature was worth

discussing. The “UK Corporate Governance Code 2014”, “Sarbanes-Oxley Act 2002” and the

“ASX Corporate Governance Principles and Recommendations 2014” improve the beliefs of the

independent directors. This research explores the dependencies of the remunerations of the board

of directors of a company with the profit earned by the company in a financial year.

3.0 Research Methodology

3.1 Data Collection

The main aim of this research is to study the business performance of top 50 Australian

Companies over three financial years 2014, 2015 and 2016. To do this research, the yearly

profits of the companies and the remuneration of the directors of the respective companies are

collected from the annual reports of the respective companies. The data thus collected for this

research can be termed as secondary data as the data was collected from previous records and not

directly from the field of research. The 50 companies that were selected belonged to various

sectors such as utilities, materials, financials, consumer discretionary, industrials, energy, health

care, real estates, consumer staples, information technology and telecommunication services. The

profits and the remunerations of the directors of these different sectors will be compared in this

study.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9BUSINESS RESEARCH PROJECT

3.2 Data Analysis

Quantitative data, such as earnings per share and year-end share prices are collected from

annual reports and financial websites. Miles, Huberman and Saldana (2013) mentioned that it is

appropriate to use quantitative methods for researches that measure facts on variables where

reliability is important, a large number of samples and data can be analyzed statistically. They

will be analyzed by using correlation and regression analysis and by using t-test, so as to find out

the relationship between directors remuneration and business performance. MS Excel software is

used to conduct the analysis.

3.2.1 Descriptive Analysis

This is the first part of the analysis. In this part, the average remuneration of the directors

earned at the end of each financial year for each of the 11 sectors of the 50 selected companies.

Also, the average profit earned by the companies for these three years for the 11 sectors of 50

companies will also be determined and discussed.

3.2.2 Remuneration and Business Performance

This is the second part of the analysis. In this part the research questions will be

answered. To do that some hypothesis will be framed and the truthfulness of those hypotheses

will be tested using appropriate statistical techniques. To test the research question, whether

there is any relation between the remuneration of the directors and the firm’s performance,

correlation and regression analysis has been conducted.

Following the above discussions and the research questions framed above, the following

hypothesis can be framed.

3.2 Data Analysis

Quantitative data, such as earnings per share and year-end share prices are collected from

annual reports and financial websites. Miles, Huberman and Saldana (2013) mentioned that it is

appropriate to use quantitative methods for researches that measure facts on variables where

reliability is important, a large number of samples and data can be analyzed statistically. They

will be analyzed by using correlation and regression analysis and by using t-test, so as to find out

the relationship between directors remuneration and business performance. MS Excel software is

used to conduct the analysis.

3.2.1 Descriptive Analysis

This is the first part of the analysis. In this part, the average remuneration of the directors

earned at the end of each financial year for each of the 11 sectors of the 50 selected companies.

Also, the average profit earned by the companies for these three years for the 11 sectors of 50

companies will also be determined and discussed.

3.2.2 Remuneration and Business Performance

This is the second part of the analysis. In this part the research questions will be

answered. To do that some hypothesis will be framed and the truthfulness of those hypotheses

will be tested using appropriate statistical techniques. To test the research question, whether

there is any relation between the remuneration of the directors and the firm’s performance,

correlation and regression analysis has been conducted.

Following the above discussions and the research questions framed above, the following

hypothesis can be framed.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10BUSINESS RESEARCH PROJECT

Null Hypothesis (H01): There is no association between the remuneration earned by the

directors of the companies and the profits of the top 50 ASX listed companies.

Alternate Hypothesis (HA1): There is significant difference between the remuneration earned by

the directors of the companies and the profits of the top 50 ASX listed companies.

4.0 Data Analysis

4.1 Data Study

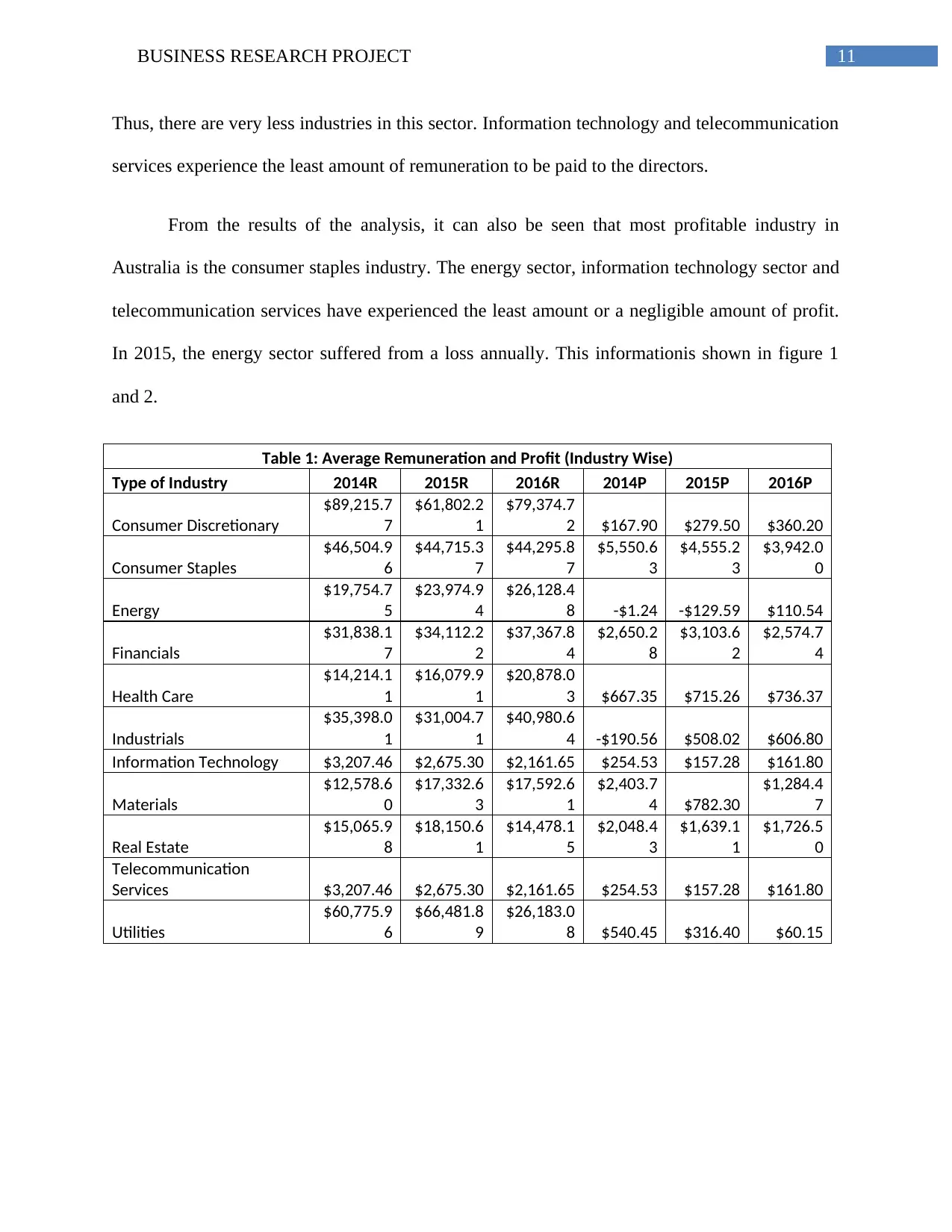

At first, from the data collected, a descriptive study of the observations has been done. It

can be seen that, of the 50 selected companies, one company belongs to the Consumer

discretionary sector, three companies belong to the consumer staples sector, 5 companies belong

to the energy sector, eleven companies belong to the financial sector, three companies belong to

the healthcare sector, one company belong to the information technology sector, nine companies

belong to the materials sector, 9 companies deal with real estates, one telecommunication

services providing company and finally 2 companies from the utilities sector. The average

remuneration and profit for the three years 2014, 2015 and 2016 is given in table 1. In the table

1, 2014 R, 2015R and 2016R are represented as the total remuneration earned by the directors of

the company in the financial years 2014, 2015 and 6016 respectively. Again, 2014P, 2015P and

2016P are represented as the performance (profit/ loss) of the firm for the years 2014, 2015 and

2016 respectively. It can be seen clearly from the calculations in table 1 that the maximum

amount of remuneration is paid by the consumer discretionary. It can also be seen that in the

chosen sample, only one company falls under this category. Thus, it can be said that the

consumer discretionary type of industry requires a lot of employments and thus the cost is high.

Null Hypothesis (H01): There is no association between the remuneration earned by the

directors of the companies and the profits of the top 50 ASX listed companies.

Alternate Hypothesis (HA1): There is significant difference between the remuneration earned by

the directors of the companies and the profits of the top 50 ASX listed companies.

4.0 Data Analysis

4.1 Data Study

At first, from the data collected, a descriptive study of the observations has been done. It

can be seen that, of the 50 selected companies, one company belongs to the Consumer

discretionary sector, three companies belong to the consumer staples sector, 5 companies belong

to the energy sector, eleven companies belong to the financial sector, three companies belong to

the healthcare sector, one company belong to the information technology sector, nine companies

belong to the materials sector, 9 companies deal with real estates, one telecommunication

services providing company and finally 2 companies from the utilities sector. The average

remuneration and profit for the three years 2014, 2015 and 2016 is given in table 1. In the table

1, 2014 R, 2015R and 2016R are represented as the total remuneration earned by the directors of

the company in the financial years 2014, 2015 and 6016 respectively. Again, 2014P, 2015P and

2016P are represented as the performance (profit/ loss) of the firm for the years 2014, 2015 and

2016 respectively. It can be seen clearly from the calculations in table 1 that the maximum

amount of remuneration is paid by the consumer discretionary. It can also be seen that in the

chosen sample, only one company falls under this category. Thus, it can be said that the

consumer discretionary type of industry requires a lot of employments and thus the cost is high.

11BUSINESS RESEARCH PROJECT

Thus, there are very less industries in this sector. Information technology and telecommunication

services experience the least amount of remuneration to be paid to the directors.

From the results of the analysis, it can also be seen that most profitable industry in

Australia is the consumer staples industry. The energy sector, information technology sector and

telecommunication services have experienced the least amount or a negligible amount of profit.

In 2015, the energy sector suffered from a loss annually. This informationis shown in figure 1

and 2.

Table 1: Average Remuneration and Profit (Industry Wise)

Type of Industry 2014R 2015R 2016R 2014P 2015P 2016P

Consumer Discretionary

$89,215.7

7

$61,802.2

1

$79,374.7

2 $167.90 $279.50 $360.20

Consumer Staples

$46,504.9

6

$44,715.3

7

$44,295.8

7

$5,550.6

3

$4,555.2

3

$3,942.0

0

Energy

$19,754.7

5

$23,974.9

4

$26,128.4

8 -$1.24 -$129.59 $110.54

Financials

$31,838.1

7

$34,112.2

2

$37,367.8

4

$2,650.2

8

$3,103.6

2

$2,574.7

4

Health Care

$14,214.1

1

$16,079.9

1

$20,878.0

3 $667.35 $715.26 $736.37

Industrials

$35,398.0

1

$31,004.7

1

$40,980.6

4 -$190.56 $508.02 $606.80

Information Technology $3,207.46 $2,675.30 $2,161.65 $254.53 $157.28 $161.80

Materials

$12,578.6

0

$17,332.6

3

$17,592.6

1

$2,403.7

4 $782.30

$1,284.4

7

Real Estate

$15,065.9

8

$18,150.6

1

$14,478.1

5

$2,048.4

3

$1,639.1

1

$1,726.5

0

Telecommunication

Services $3,207.46 $2,675.30 $2,161.65 $254.53 $157.28 $161.80

Utilities

$60,775.9

6

$66,481.8

9

$26,183.0

8 $540.45 $316.40 $60.15

Thus, there are very less industries in this sector. Information technology and telecommunication

services experience the least amount of remuneration to be paid to the directors.

From the results of the analysis, it can also be seen that most profitable industry in

Australia is the consumer staples industry. The energy sector, information technology sector and

telecommunication services have experienced the least amount or a negligible amount of profit.

In 2015, the energy sector suffered from a loss annually. This informationis shown in figure 1

and 2.

Table 1: Average Remuneration and Profit (Industry Wise)

Type of Industry 2014R 2015R 2016R 2014P 2015P 2016P

Consumer Discretionary

$89,215.7

7

$61,802.2

1

$79,374.7

2 $167.90 $279.50 $360.20

Consumer Staples

$46,504.9

6

$44,715.3

7

$44,295.8

7

$5,550.6

3

$4,555.2

3

$3,942.0

0

Energy

$19,754.7

5

$23,974.9

4

$26,128.4

8 -$1.24 -$129.59 $110.54

Financials

$31,838.1

7

$34,112.2

2

$37,367.8

4

$2,650.2

8

$3,103.6

2

$2,574.7

4

Health Care

$14,214.1

1

$16,079.9

1

$20,878.0

3 $667.35 $715.26 $736.37

Industrials

$35,398.0

1

$31,004.7

1

$40,980.6

4 -$190.56 $508.02 $606.80

Information Technology $3,207.46 $2,675.30 $2,161.65 $254.53 $157.28 $161.80

Materials

$12,578.6

0

$17,332.6

3

$17,592.6

1

$2,403.7

4 $782.30

$1,284.4

7

Real Estate

$15,065.9

8

$18,150.6

1

$14,478.1

5

$2,048.4

3

$1,639.1

1

$1,726.5

0

Telecommunication

Services $3,207.46 $2,675.30 $2,161.65 $254.53 $157.28 $161.80

Utilities

$60,775.9

6

$66,481.8

9

$26,183.0

8 $540.45 $316.40 $60.15

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 22

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.