Housing Market Dynamics: Renting vs. Buying in Australia Analysis

VerifiedAdded on 2020/02/03

|18

|3391

|44

Report

AI Summary

This report delves into the complexities of the Australian housing market, examining the crucial decision of whether to rent or buy a home. It begins with an introduction that highlights the ongoing debate surrounding the valuation of Australian housing, influenced by factors like interest rates and inflation. The report is structured into three parts, with Part A exploring the various demand and supply factors that significantly impact housing prices and rental costs over the next decade. These factors include interest rates, lending conditions, demographics, immigration, government policies, and homeowner grants. Part B presents a detailed financial analysis comparing income growth, house value, expenses, and net disposable income over a 30-year period. The analysis includes tables illustrating the financial implications of buying a house, such as mortgage payments, maintenance costs, and accumulated net disposable income. The report concludes by summarizing the key findings and offering insights into the long-term financial implications of renting versus buying in the Australian context. The report provides a comparative financial analysis, including a table detailing income, expenses, and the value of buying a house over 30 years.

RENT OR BUY

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................4

partA)...............................................................................................................................................4

Part B...............................................................................................................................................6

PART C............................................................................................................................................7

CONCLUSION................................................................................................................................8

REFERNCES...................................................................................................................................9

2

INTRODUCTION...........................................................................................................................4

partA)...............................................................................................................................................4

Part B...............................................................................................................................................6

PART C............................................................................................................................................7

CONCLUSION................................................................................................................................8

REFERNCES...................................................................................................................................9

2

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

The people that are well informed have differ question regards to Australian housing is

under-valued, over-valued or just right. It is highly depend upon the country financial conditions

that can be determined in terms of country interest rate, inflation rate that are highly affecting the

loan of housing. The inflation rate also affecting the price of a house. Thus, if there the house

loan is depreciate that means that there is an increase the rate of interest and inflation rate.

Whereas, the home loan is depreciate its means that there is a decrease in the inflation rate as

well as inflation rate (Frañczuk,2013). Therefore, most of the people are confusing whether to

buy or purchase house that are directly depends upon the certainty or uncertainty of a country

conditions. In this present assignment there is a mainly discussion on whether the person buy or

rent the house for a accommodation purpose it is highly depends upon the economic condition of

a Australian country. Thereafter, there is an also discussion upon the factors of demand and

supply that highly affecting the price of housing and rent in next 10 years.

PARTA)

There are various factor of demand and supply that are highly impacting the price of

housing and rent in the next 10 years. These factors are describe as follows:-

Demand (Factors)

Interest rates- Interest rate basically a rate of inter bank changes in the form of treasury

bills etc. Due to change in interest rate, it will effect of purchasing power of individual

positively or negatively. Interest rate affect in housing in such a way that, if interest rate

was increases than the houses are available at a affordable price (Kim, Lee and Lee,

2014). Sell of home will rises and consumers are able to take low cost loan easily. If the

interest rate was decreases, than house prices will increases.

Lending conditions- The lending conditions such as mortgages which was provided by

banks for willingness of taking house. If bank gives mortgage with high multiples, than

the demand of house will be higher. Banks which provide mortgage is depends on

strength of inter bank lending sectors. If bank gives lower mortgage in income multiples

than the demand of house will be decreases.

4

The people that are well informed have differ question regards to Australian housing is

under-valued, over-valued or just right. It is highly depend upon the country financial conditions

that can be determined in terms of country interest rate, inflation rate that are highly affecting the

loan of housing. The inflation rate also affecting the price of a house. Thus, if there the house

loan is depreciate that means that there is an increase the rate of interest and inflation rate.

Whereas, the home loan is depreciate its means that there is a decrease in the inflation rate as

well as inflation rate (Frañczuk,2013). Therefore, most of the people are confusing whether to

buy or purchase house that are directly depends upon the certainty or uncertainty of a country

conditions. In this present assignment there is a mainly discussion on whether the person buy or

rent the house for a accommodation purpose it is highly depends upon the economic condition of

a Australian country. Thereafter, there is an also discussion upon the factors of demand and

supply that highly affecting the price of housing and rent in next 10 years.

PARTA)

There are various factor of demand and supply that are highly impacting the price of

housing and rent in the next 10 years. These factors are describe as follows:-

Demand (Factors)

Interest rates- Interest rate basically a rate of inter bank changes in the form of treasury

bills etc. Due to change in interest rate, it will effect of purchasing power of individual

positively or negatively. Interest rate affect in housing in such a way that, if interest rate

was increases than the houses are available at a affordable price (Kim, Lee and Lee,

2014). Sell of home will rises and consumers are able to take low cost loan easily. If the

interest rate was decreases, than house prices will increases.

Lending conditions- The lending conditions such as mortgages which was provided by

banks for willingness of taking house. If bank gives mortgage with high multiples, than

the demand of house will be higher. Banks which provide mortgage is depends on

strength of inter bank lending sectors. If bank gives lower mortgage in income multiples

than the demand of house will be decreases.

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Demographics- Demographics factors includes population, and number of reasons such

as marriage, children, cases of separations or divorce etc. which affect the housing and

rent. If all such factors are increases than the rate of house will be increases. If there were

high number of persons who have desire to get a house so that in this case the demand of

house will also increases as per the population. So that demographic factors make an

direct influence in demand of house.

Immigration- Immigration is same as Demographic factors. When person shift one place

to another place, they require house for living. So that such migration factor also make an

impact on house rate or rent prices (Wang, 2015). When there were increases in

immigration rate than the house price will also be increases. Migration is done by special

location such as any location which provide employment, education, healthcare services

etc. In such areas there house price were high.

Government policies- There are some government policies which also affect the demand

of housing and rent. Govt charges tax on housing, so that taxation policy will also make

an impact in housing. Govt charges wealth tax, Income tax or any kind of taxes on

individual's incomes. So that if the tax rate are higher than the price of house rate will

lower and If the tax charges by govt is lower than the price of house are higher.

Home- owner grant- Home owner grant is grant which was provided to home owner,

who can buy there home in first time by offering $7000 grant. Such grant is free from tax

and but it is restricted in some states where the property price is change. It requires only

for an Australian citizen, person does not buy there own property in it, person having 18

year above age or not the person or person's spouse can make claim on it etc. So that all

these factors which is related to home owner grant make an impact in home pricing.

Supply(Factors)

Land release- Land release objective is to increases the effectiveness of survey and

operation activities. Its main motive is to release the social group who live in a

community is to be release from mine remnants of war contamination. This process

overcome the challenges of land requirement for person's living. So that land release

affect the supply of house rate because if the price of land will high than the supply of

5

as marriage, children, cases of separations or divorce etc. which affect the housing and

rent. If all such factors are increases than the rate of house will be increases. If there were

high number of persons who have desire to get a house so that in this case the demand of

house will also increases as per the population. So that demographic factors make an

direct influence in demand of house.

Immigration- Immigration is same as Demographic factors. When person shift one place

to another place, they require house for living. So that such migration factor also make an

impact on house rate or rent prices (Wang, 2015). When there were increases in

immigration rate than the house price will also be increases. Migration is done by special

location such as any location which provide employment, education, healthcare services

etc. In such areas there house price were high.

Government policies- There are some government policies which also affect the demand

of housing and rent. Govt charges tax on housing, so that taxation policy will also make

an impact in housing. Govt charges wealth tax, Income tax or any kind of taxes on

individual's incomes. So that if the tax rate are higher than the price of house rate will

lower and If the tax charges by govt is lower than the price of house are higher.

Home- owner grant- Home owner grant is grant which was provided to home owner,

who can buy there home in first time by offering $7000 grant. Such grant is free from tax

and but it is restricted in some states where the property price is change. It requires only

for an Australian citizen, person does not buy there own property in it, person having 18

year above age or not the person or person's spouse can make claim on it etc. So that all

these factors which is related to home owner grant make an impact in home pricing.

Supply(Factors)

Land release- Land release objective is to increases the effectiveness of survey and

operation activities. Its main motive is to release the social group who live in a

community is to be release from mine remnants of war contamination. This process

overcome the challenges of land requirement for person's living. So that land release

affect the supply of house rate because if the price of land will high than the supply of

5

house rate will be increases and if the price of land is low than the supply of house will

be decreases.

Apartment versus housing- The Cost of apartment and house are differ to there

location, size, recent renovations, number of rooms , state etc. In home there owner pay

there loan payment in the based on credit risk and employment status. Home also carry

the extra cost such repair and maintenance. But apartments and home both are shares

same living space (Narajabad and Monnet, 2012). The main difference of home and

apartment are the control on space. Apartments rental structure are different from home

rental structure. So that all these kind of factors will affect the price rate of home. In such

a way, if apartment's prices are low than there will be high supply of apartments as

compare to home or if home prices are decreases than the supply of home is increases.

Micro lot property- Micro property includes such property which are allotted at micro

level in urban areas. So that there are any changes in micro property, it will automatically

affect the price of home.

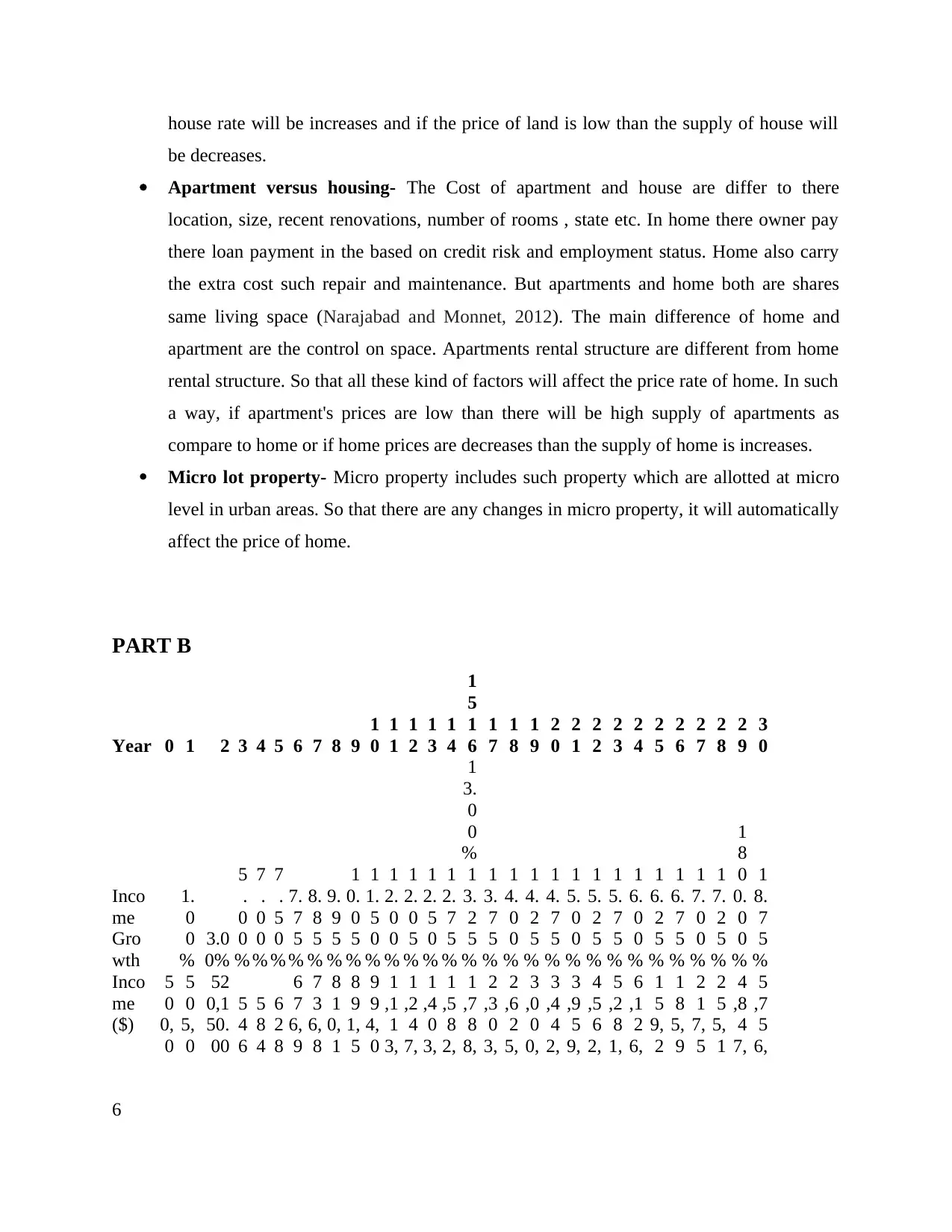

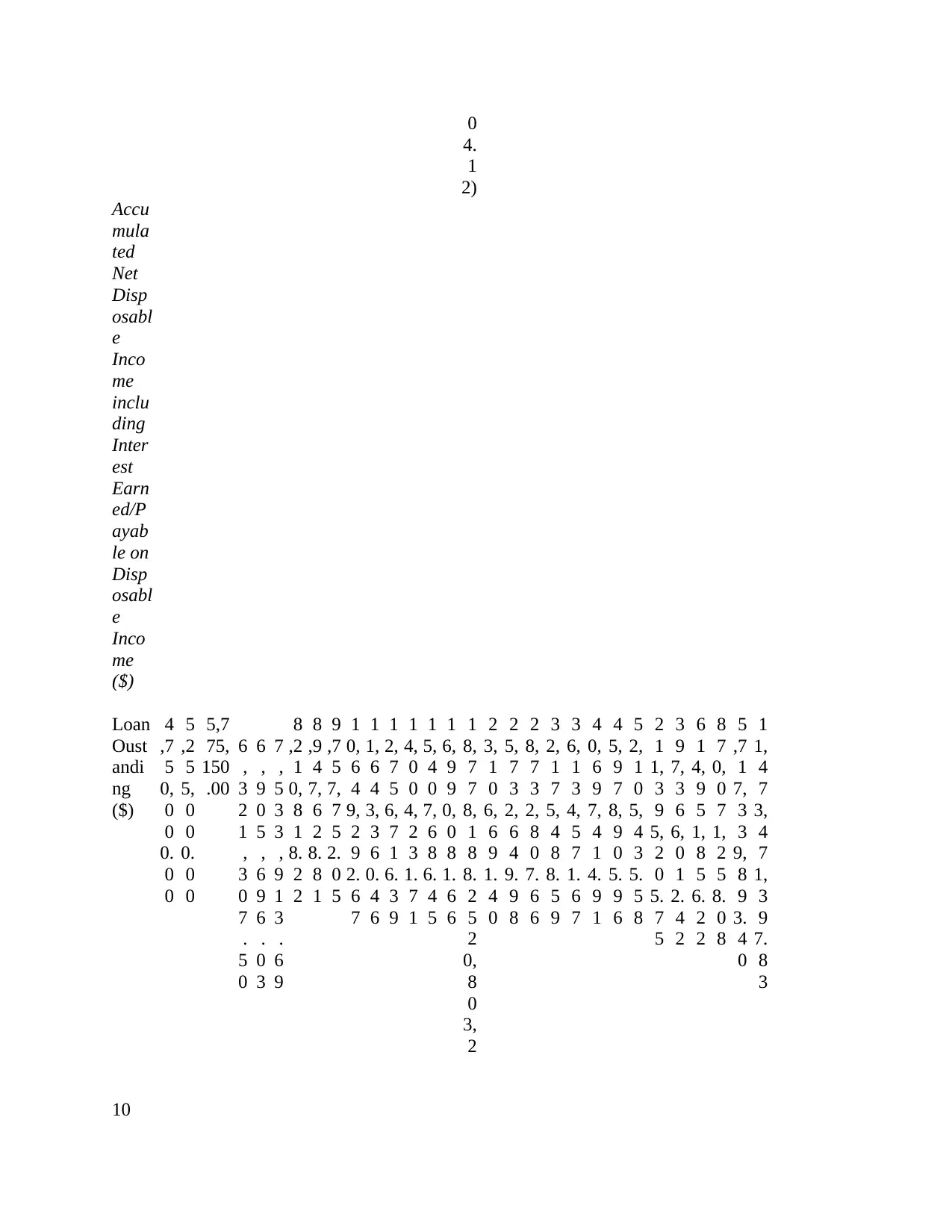

PART B

Year 0 1 2 3 4 5 6 7 8 9

1

0

1

1

1

2

1

3

1

4

1

5

1

6

1

7

1

8

1

9

2

0

2

1

2

2

2

3

2

4

2

5

2

6

2

7

2

8

2

9

3

0

Inco

me

Gro

wth

1.

0

0

%

3.0

0%

5

.

0

0

%

7

.

0

0

%

7

.

5

0

%

7.

7

5

%

8.

8

5

%

9.

9

5

%

1

0.

0

5

%

1

1.

5

0

%

1

2.

0

0

%

1

2.

0

5

%

1

2.

5

0

%

1

2.

7

5

%

1

3.

0

0

%

1

3.

2

5

%

1

3.

7

5

%

1

4.

0

0

%

1

4.

2

5

%

1

4.

7

5

%

1

5.

0

0

%

1

5.

2

5

%

1

5.

7

5

%

1

6.

0

0

%

1

6.

2

5

%

1

6.

7

5

%

1

7.

0

0

%

1

7.

2

5

%

1

8

0

0.

0

0

%

1

8.

7

5

%

Inco

me

($)

5

0

0,

0

5

0

5,

0

52

0,1

50.

00

5

4

6

5

8

4

6

2

8

6

7

6,

9

7

3

6,

8

8

1

0,

1

8

9

1,

5

9

9

4,

0

1

,1

1

3,

1

,2

4

7,

1

,4

0

3,

1

,5

8

2,

1

,7

8

8,

2

,3

0

3,

2

,6

2

5,

3

,0

0

0,

3

,4

4

2,

3

,9

5

9,

4

,5

6

2,

5

,2

8

1,

6

,1

2

6,

1

5

9,

2

1

8

5,

9

2

1

7,

5

2

5

5,

1

4

,8

4

7,

5

,7

5

6,

6

be decreases.

Apartment versus housing- The Cost of apartment and house are differ to there

location, size, recent renovations, number of rooms , state etc. In home there owner pay

there loan payment in the based on credit risk and employment status. Home also carry

the extra cost such repair and maintenance. But apartments and home both are shares

same living space (Narajabad and Monnet, 2012). The main difference of home and

apartment are the control on space. Apartments rental structure are different from home

rental structure. So that all these kind of factors will affect the price rate of home. In such

a way, if apartment's prices are low than there will be high supply of apartments as

compare to home or if home prices are decreases than the supply of home is increases.

Micro lot property- Micro property includes such property which are allotted at micro

level in urban areas. So that there are any changes in micro property, it will automatically

affect the price of home.

PART B

Year 0 1 2 3 4 5 6 7 8 9

1

0

1

1

1

2

1

3

1

4

1

5

1

6

1

7

1

8

1

9

2

0

2

1

2

2

2

3

2

4

2

5

2

6

2

7

2

8

2

9

3

0

Inco

me

Gro

wth

1.

0

0

%

3.0

0%

5

.

0

0

%

7

.

0

0

%

7

.

5

0

%

7.

7

5

%

8.

8

5

%

9.

9

5

%

1

0.

0

5

%

1

1.

5

0

%

1

2.

0

0

%

1

2.

0

5

%

1

2.

5

0

%

1

2.

7

5

%

1

3.

0

0

%

1

3.

2

5

%

1

3.

7

5

%

1

4.

0

0

%

1

4.

2

5

%

1

4.

7

5

%

1

5.

0

0

%

1

5.

2

5

%

1

5.

7

5

%

1

6.

0

0

%

1

6.

2

5

%

1

6.

7

5

%

1

7.

0

0

%

1

7.

2

5

%

1

8

0

0.

0

0

%

1

8.

7

5

%

Inco

me

($)

5

0

0,

0

5

0

5,

0

52

0,1

50.

00

5

4

6

5

8

4

6

2

8

6

7

6,

9

7

3

6,

8

8

1

0,

1

8

9

1,

5

9

9

4,

0

1

,1

1

3,

1

,2

4

7,

1

,4

0

3,

1

,5

8

2,

1

,7

8

8,

2

,3

0

3,

2

,6

2

5,

3

,0

0

0,

3

,4

4

2,

3

,9

5

9,

4

,5

6

2,

5

,2

8

1,

6

,1

2

6,

1

5

9,

2

1

8

5,

9

2

1

7,

5

2

5

5,

1

4

,8

4

7,

5

,7

5

6,

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

0

0.

0

0

0

0.

0

0

,

1

5

7

.

5

0

,

3

8

8

.

5

3

,

2

1

7

.

6

6

0

4.

5

3

1

0.

5

8

2

3.

2

4

4

0.

6

2

6

7.

7

9

3

5

5.

9

3

5

1

5.

3

2

4

5

4.

7

3

3

9

5.

2

1

1

0

6.

5

9

2,

0

2

5,

0

3

0.

7

1

4

7

2.

4

4

9

5

8.

5

8

1

5

7.

6

8

6

8

0.

9

3

0

8

3.

0

7

8

4

3.

2

4

4

9

1.

0

5

5

2

9.

6

2

8

9,

7

7

0.

1

7

7

0,

8

0

6.

6

7

8

5,

8

4

3.

8

0

1

9,

4

0

1.

8

6

2

6

8,

6

3

5.

3

1

1

3

1,

5

0

4.

4

4

Buy

Hous

e

Valu

e ($)

5

,0

0

0,

0

0

0.

0

0

5

,5

0

5,

0

0

0.

0

0

6,0

25,

150

.00

6

,

5

7

1

,

3

0

7

.

5

0

7

,

1

5

5

,

6

9

6

.

0

3

7

,

7

8

3

,

9

1

3

.

6

9

8

,4

6

0,

8

1

8.

2

2

9

,1

9

7,

6

2

8.

8

1

1

0,

0

0

7,

7

5

2.

0

5

1

0,

8

9

9,

2

9

2.

6

7

1

1,

8

9

3,

3

6

0.

4

6

1

3,

0

0

6,

7

1

6.

3

9

1

4,

2

5

4,

2

3

1.

7

1

1

5,

6

5

7,

6

8

6.

4

5

1

7,

2

4

0,

0

8

1.

6

6

1

9,

0

2

8,

1

8

8.

2

5

2

1,

0

5

3,

2

1

8.

9

7

2

3,

3

5

6,

6

9

1.

4

0

2

5,

9

8

2,

6

4

9.

9

8

2

8,

9

8

2,

8

0

7.

6

6

3

2,

4

2

5,

4

8

8.

5

9

3

6,

3

8

4,

5

7

1.

6

7

4

0,

9

4

7,

4

1

4.

9

1

4

6,

2

2

8,

9

0

5.

9

6

5

2,

3

5

5,

4

3

5.

5

8

2

1

1,

6

4

5,

2

0

5.

7

5

3

9

7,

6

1

6,

0

1

2.

4

2

6

1

5,

2

0

1,

8

5

6.

2

2

8

7

0,

3

2

1,

2

5

8.

0

8

5

,7

1

7,

5

8

9,

8

9

3.

4

0

1

1,

4

7

3,

7

2

1,

3

9

7.

8

3

Expe

nses:

Mort

gage

Pay

ment

($)

2

0

8,

5

0

0.

0

2

2

9,

5

5

8.

5

25

1,2

48.

76

2

7

,

4

0

2

2

9

8

,

3

9

3

2

4

,

5

8

3

5

2,

8

1

6.

1

3

8

3,

5

4

1.

1

4

1

7,

3

2

3.

2

4

5

4,

5

0

0.

5

4

9

5,

9

5

3.

1

5

4

2,

3

8

0.

0

5

9

4,

4

0

1.

4

6

5

2,

9

2

5.

5

7

1,

8

9

1,

1

4

7

9

3,

4

7

5.

4

9

7

3,

9

7

4.

0

1

,0

8

3,

4

7

6.

1

,2

0

8,

5

8

3.

1

,3

5

2,

1

4

2.

1

,5

1

7,

2

3

6.

1

,7

0

7,

5

0

7.

1

,9

2

7,

7

4

5.

2

,1

8

3,

2

2

1.

8

,8

2

5,

6

0

5.

1

6,

5

8

0,

5

8

2

5,

6

5

3,

9

1

3

6,

2

9

2,

3

9

2

3

8,

4

2

3,

4

4

7

8,

4

5

4,

1

7

0.

0

0

0

0.

0

0

,

1

5

7

.

5

0

,

3

8

8

.

5

3

,

2

1

7

.

6

6

0

4.

5

3

1

0.

5

8

2

3.

2

4

4

0.

6

2

6

7.

7

9

3

5

5.

9

3

5

1

5.

3

2

4

5

4.

7

3

3

9

5.

2

1

1

0

6.

5

9

2,

0

2

5,

0

3

0.

7

1

4

7

2.

4

4

9

5

8.

5

8

1

5

7.

6

8

6

8

0.

9

3

0

8

3.

0

7

8

4

3.

2

4

4

9

1.

0

5

5

2

9.

6

2

8

9,

7

7

0.

1

7

7

0,

8

0

6.

6

7

8

5,

8

4

3.

8

0

1

9,

4

0

1.

8

6

2

6

8,

6

3

5.

3

1

1

3

1,

5

0

4.

4

4

Buy

Hous

e

Valu

e ($)

5

,0

0

0,

0

0

0.

0

0

5

,5

0

5,

0

0

0.

0

0

6,0

25,

150

.00

6

,

5

7

1

,

3

0

7

.

5

0

7

,

1

5

5

,

6

9

6

.

0

3

7

,

7

8

3

,

9

1

3

.

6

9

8

,4

6

0,

8

1

8.

2

2

9

,1

9

7,

6

2

8.

8

1

1

0,

0

0

7,

7

5

2.

0

5

1

0,

8

9

9,

2

9

2.

6

7

1

1,

8

9

3,

3

6

0.

4

6

1

3,

0

0

6,

7

1

6.

3

9

1

4,

2

5

4,

2

3

1.

7

1

1

5,

6

5

7,

6

8

6.

4

5

1

7,

2

4

0,

0

8

1.

6

6

1

9,

0

2

8,

1

8

8.

2

5

2

1,

0

5

3,

2

1

8.

9

7

2

3,

3

5

6,

6

9

1.

4

0

2

5,

9

8

2,

6

4

9.

9

8

2

8,

9

8

2,

8

0

7.

6

6

3

2,

4

2

5,

4

8

8.

5

9

3

6,

3

8

4,

5

7

1.

6

7

4

0,

9

4

7,

4

1

4.

9

1

4

6,

2

2

8,

9

0

5.

9

6

5

2,

3

5

5,

4

3

5.

5

8

2

1

1,

6

4

5,

2

0

5.

7

5

3

9

7,

6

1

6,

0

1

2.

4

2

6

1

5,

2

0

1,

8

5

6.

2

2

8

7

0,

3

2

1,

2

5

8.

0

8

5

,7

1

7,

5

8

9,

8

9

3.

4

0

1

1,

4

7

3,

7

2

1,

3

9

7.

8

3

Expe

nses:

Mort

gage

Pay

ment

($)

2

0

8,

5

0

0.

0

2

2

9,

5

5

8.

5

25

1,2

48.

76

2

7

,

4

0

2

2

9

8

,

3

9

3

2

4

,

5

8

3

5

2,

8

1

6.

1

3

8

3,

5

4

1.

1

4

1

7,

3

2

3.

2

4

5

4,

5

0

0.

5

4

9

5,

9

5

3.

1

5

4

2,

3

8

0.

0

5

9

4,

4

0

1.

4

6

5

2,

9

2

5.

5

7

1,

8

9

1,

1

4

7

9

3,

4

7

5.

4

9

7

3,

9

7

4.

0

1

,0

8

3,

4

7

6.

1

,2

0

8,

5

8

3.

1

,3

5

2,

1

4

2.

1

,5

1

7,

2

3

6.

1

,7

0

7,

5

0

7.

1

,9

2

7,

7

4

5.

2

,1

8

3,

2

2

1.

8

,8

2

5,

6

0

5.

1

6,

5

8

0,

5

8

2

5,

6

5

3,

9

1

3

6,

2

9

2,

3

9

2

3

8,

4

2

3,

4

4

7

8,

4

5

4,

1

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

0 0

,

3

5

2

.

2

8

2

.

5

2

9

.

2

0 2 2 6 0 3 7 6 2

0.

5

3

5

8

7,

7

9

1,

9

2

3.

0

9 3

5

0

0

8

8

7

6

4

2

0

3

8

6

6

0

8

7.

7

2

7.

4

0

6.

4

6

9

8.

5

5

8

2.

2

9

Main

tenan

ce

Cost

s ($)

4

0,

0

0

0.

0

0

42,

000

.00

4

3

,

0

0

0

.

0

0

4

8

,

0

0

0

.

0

0

5

2

,

0

0

0

.

0

0

5

7,

0

0

0.

0

0

6

0,

0

0

0.

0

0

6

4,

0

0

0.

0

0

6

7,

0

0

0.

0

0

7

0,

0

0

0.

0

0

7

2,

0

0

0.

0

0

7

4,

0

0

0.

0

0

7

5,

0

0

0.

0

0

7

6,

0

0

0.

0

0

7

8,

0

0

0.

0

0

9

0,

0

0

0.

0

0

9

2,

0

0

0.

0

0

9

2,

0

0

0.

0

0

9

4,

0

0

0.

0

0

9

4,

5

0

0.

0

0

9

4,

5

0

0.

0

0

9

4,

6

0

0.

0

0

9

4,

6

5

0.

0

0

9

4,

6

5

0.

0

0

9

4,

6

5

0.

0

0

9

4,

6

7

5.

0

0

9

4,

6

7

5.

0

0

9

4,

7

0

0.

0

0

9

4,

7

0

0.

0

0

9

4,

7

5

0.

0

0

Buyi

ng

Cost

(valu

e is

acco

unte

d for

in

Loan

amo

unt)

($)

5

2,

2

2

2.

0

0 - -

Selli

ng

Cost

($) - - - - - - - - - - 0 0 0 0

0

0 0 0 0 0 0 0 0 0 0 0 0 0 0 0

Total

expe

2

0

3

2

29

3,2 2 3 3

4

0

4

4

4

8

5

2

5

6

6

1

6

6

7

2

7

1

8

7

1

0

1

1

1

3

1

4

1

6

1

8

2

0

2

2

8

9

1

6

2

5

3

6

2

3

4

7

8

,

3

5

2

.

2

8

2

.

5

2

9

.

2

0 2 2 6 0 3 7 6 2

0.

5

3

5

8

7,

7

9

1,

9

2

3.

0

9 3

5

0

0

8

8

7

6

4

2

0

3

8

6

6

0

8

7.

7

2

7.

4

0

6.

4

6

9

8.

5

5

8

2.

2

9

Main

tenan

ce

Cost

s ($)

4

0,

0

0

0.

0

0

42,

000

.00

4

3

,

0

0

0

.

0

0

4

8

,

0

0

0

.

0

0

5

2

,

0

0

0

.

0

0

5

7,

0

0

0.

0

0

6

0,

0

0

0.

0

0

6

4,

0

0

0.

0

0

6

7,

0

0

0.

0

0

7

0,

0

0

0.

0

0

7

2,

0

0

0.

0

0

7

4,

0

0

0.

0

0

7

5,

0

0

0.

0

0

7

6,

0

0

0.

0

0

7

8,

0

0

0.

0

0

9

0,

0

0

0.

0

0

9

2,

0

0

0.

0

0

9

2,

0

0

0.

0

0

9

4,

0

0

0.

0

0

9

4,

5

0

0.

0

0

9

4,

5

0

0.

0

0

9

4,

6

0

0.

0

0

9

4,

6

5

0.

0

0

9

4,

6

5

0.

0

0

9

4,

6

5

0.

0

0

9

4,

6

7

5.

0

0

9

4,

6

7

5.

0

0

9

4,

7

0

0.

0

0

9

4,

7

0

0.

0

0

9

4,

7

5

0.

0

0

Buyi

ng

Cost

(valu

e is

acco

unte

d for

in

Loan

amo

unt)

($)

5

2,

2

2

2.

0

0 - -

Selli

ng

Cost

($) - - - - - - - - - - 0 0 0 0

0

0 0 0 0 0 0 0 0 0 0 0 0 0 0 0

Total

expe

2

0

3

2

29

3,2 2 3 3

4

0

4

4

4

8

5

2

5

6

6

1

6

6

7

2

7

1

8

7

1

0

1

1

1

3

1

4

1

6

1

8

2

0

2

2

8

9

1

6

2

5

3

6

2

3

4

7

8

nses

8,

5

0

0.

0

0

1,

7

8

0.

5

0

48.

76

7

,

4

4

5

,

3

5

2

.

2

8

4

6

,

3

9

2

.

5

2

7

6

,

5

8

9

.

2

0

9,

8

1

6.

1

2

3,

5

4

1.

1

2

1,

3

2

3.

2

6

1,

5

0

0.

5

0

5,

9

5

3.

1

3

4

3

8

0.

0

7

3

5

9

2

2

1

6

8

4

0

1.

4

6

2

4

2

5

3

7

5

7

9

2

5.

5

2

4

8

6

2

6

7

9

9

6

7

1

4

0.

5

2

6

0

7

3

9

1

4

7

5.

4

5

0

1

1

0

5

4

7

8

7

8

8

1

9

2

3.

0

9

0

2

9

5

5

6

5

9

7

4.

0

3

1

5

5

4

3

2

7

5

4

7

6.

5

0

4

2

9

6

8

7

0

2

5

8

3.

0

7

9

4

0

5

2

4

4

6

6

4

2.

8

7

4

3

4

2

0

9

1

1

7

3

6.

6

3

8

5

1

9

4

8

0

2

1

0

7.

2

0

1

7

3

3

9

1

2

2

3

9

5.

3

7

8

6

5

4

6

1

7

7

8

7

1.

6

6

3

8

8

2

6

3

2

0

2

5

5.

0

7

9

8

1

1

0

7

6

7

5

2

6

2.

7

1

7

9

0

7

5

7

4

8

5

9

2.

4

0

4

4

8

0

4

3

8

7

0

9

6.

4

6

1

9

8

7

8

5

1

8

1

9

8.

5

5

4

6

1

4

8

5

4

8

9

3

2.

2

8

9

6

0

8

Accu

mula

ted

Net

Disp

osabl

e

Inco

me

($)

4

,7

9

1,

5

0

0.

0

0

5

,1

8

3,

2

1

9.

5

0

5,7

31,

901

.25

(

2

0

,

8

7

4

,

0

4

4

.

7

8

)

6

,

8

0

9

,

3

0

3

.

5

0

7

,

4

0

7

,

3

2

4

.

4

9

8

,0

5

1,

0

0

2.

1

0

8

,7

5

4,

0

8

7.

6

9

9

,5

2

6,

4

2

8.

7

8

1

0,

3

7

7,

7

9

2.

1

6

1

1,

3

2

7,

4

0

7.

3

3

1

2,

3

9

2,

3

3

6.

3

2

1

3,

5

8

5,

8

3

0.

2

5

1

4,

9

2

9,

7

6

0.

9

2

(

5

4,

7

2

7,

0

5

8.

8

7

)

1

8,

1

5

6,

7

1

2.

8

0

(6

6,

8

2

8,

7

2

2,

2

9

0,

7

1

7.

3

7

2

4,

8

0

7,

1

7

3.

4

8

2

7,

6

8

0,

2

2

4.

5

8

3

0,

9

7

8,

8

4

5.

7

2

3

4,

7

7

2,

8

3

5.

0

3

3

9,

1

4

5,

3

0

7.

7

1

4

4,

2

0

6,

5

1

0.

5

8

5

0,

0

7

7,

5

6

3.

9

2

2

0

2,

7

2

4,

9

5

0.

6

7

3

8

0,

9

4

0,

7

4

9.

7

0

5

8

9,

4

5

3,

2

6

3.

8

2

8

3

3,

9

3

4,

1

6

1.

6

2

5

,4

7

9,

0

7

1,

6

9

4.

8

4

1

0,

9

9

5,

1

7

2,

4

6

5.

5

4

9

8,

5

0

0.

0

0

1,

7

8

0.

5

0

48.

76

7

,

4

4

5

,

3

5

2

.

2

8

4

6

,

3

9

2

.

5

2

7

6

,

5

8

9

.

2

0

9,

8

1

6.

1

2

3,

5

4

1.

1

2

1,

3

2

3.

2

6

1,

5

0

0.

5

0

5,

9

5

3.

1

3

4

3

8

0.

0

7

3

5

9

2

2

1

6

8

4

0

1.

4

6

2

4

2

5

3

7

5

7

9

2

5.

5

2

4

8

6

2

6

7

9

9

6

7

1

4

0.

5

2

6

0

7

3

9

1

4

7

5.

4

5

0

1

1

0

5

4

7

8

7

8

8

1

9

2

3.

0

9

0

2

9

5

5

6

5

9

7

4.

0

3

1

5

5

4

3

2

7

5

4

7

6.

5

0

4

2

9

6

8

7

0

2

5

8

3.

0

7

9

4

0

5

2

4

4

6

6

4

2.

8

7

4

3

4

2

0

9

1

1

7

3

6.

6

3

8

5

1

9

4

8

0

2

1

0

7.

2

0

1

7

3

3

9

1

2

2

3

9

5.

3

7

8

6

5

4

6

1

7

7

8

7

1.

6

6

3

8

8

2

6

3

2

0

2

5

5.

0

7

9

8

1

1

0

7

6

7

5

2

6

2.

7

1

7

9

0

7

5

7

4

8

5

9

2.

4

0

4

4

8

0

4

3

8

7

0

9

6.

4

6

1

9

8

7

8

5

1

8

1

9

8.

5

5

4

6

1

4

8

5

4

8

9

3

2.

2

8

9

6

0

8

Accu

mula

ted

Net

Disp

osabl

e

Inco

me

($)

4

,7

9

1,

5

0

0.

0

0

5

,1

8

3,

2

1

9.

5

0

5,7

31,

901

.25

(

2

0

,

8

7

4

,

0

4

4

.

7

8

)

6

,

8

0

9

,

3

0

3

.

5

0

7

,

4

0

7

,

3

2

4

.

4

9

8

,0

5

1,

0

0

2.

1

0

8

,7

5

4,

0

8

7.

6

9

9

,5

2

6,

4

2

8.

7

8

1

0,

3

7

7,

7

9

2.

1

6

1

1,

3

2

7,

4

0

7.

3

3

1

2,

3

9

2,

3

3

6.

3

2

1

3,

5

8

5,

8

3

0.

2

5

1

4,

9

2

9,

7

6

0.

9

2

(

5

4,

7

2

7,

0

5

8.

8

7

)

1

8,

1

5

6,

7

1

2.

8

0

(6

6,

8

2

8,

7

2

2,

2

9

0,

7

1

7.

3

7

2

4,

8

0

7,

1

7

3.

4

8

2

7,

6

8

0,

2

2

4.

5

8

3

0,

9

7

8,

8

4

5.

7

2

3

4,

7

7

2,

8

3

5.

0

3

3

9,

1

4

5,

3

0

7.

7

1

4

4,

2

0

6,

5

1

0.

5

8

5

0,

0

7

7,

5

6

3.

9

2

2

0

2,

7

2

4,

9

5

0.

6

7

3

8

0,

9

4

0,

7

4

9.

7

0

5

8

9,

4

5

3,

2

6

3.

8

2

8

3

3,

9

3

4,

1

6

1.

6

2

5

,4

7

9,

0

7

1,

6

9

4.

8

4

1

0,

9

9

5,

1

7

2,

4

6

5.

5

4

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

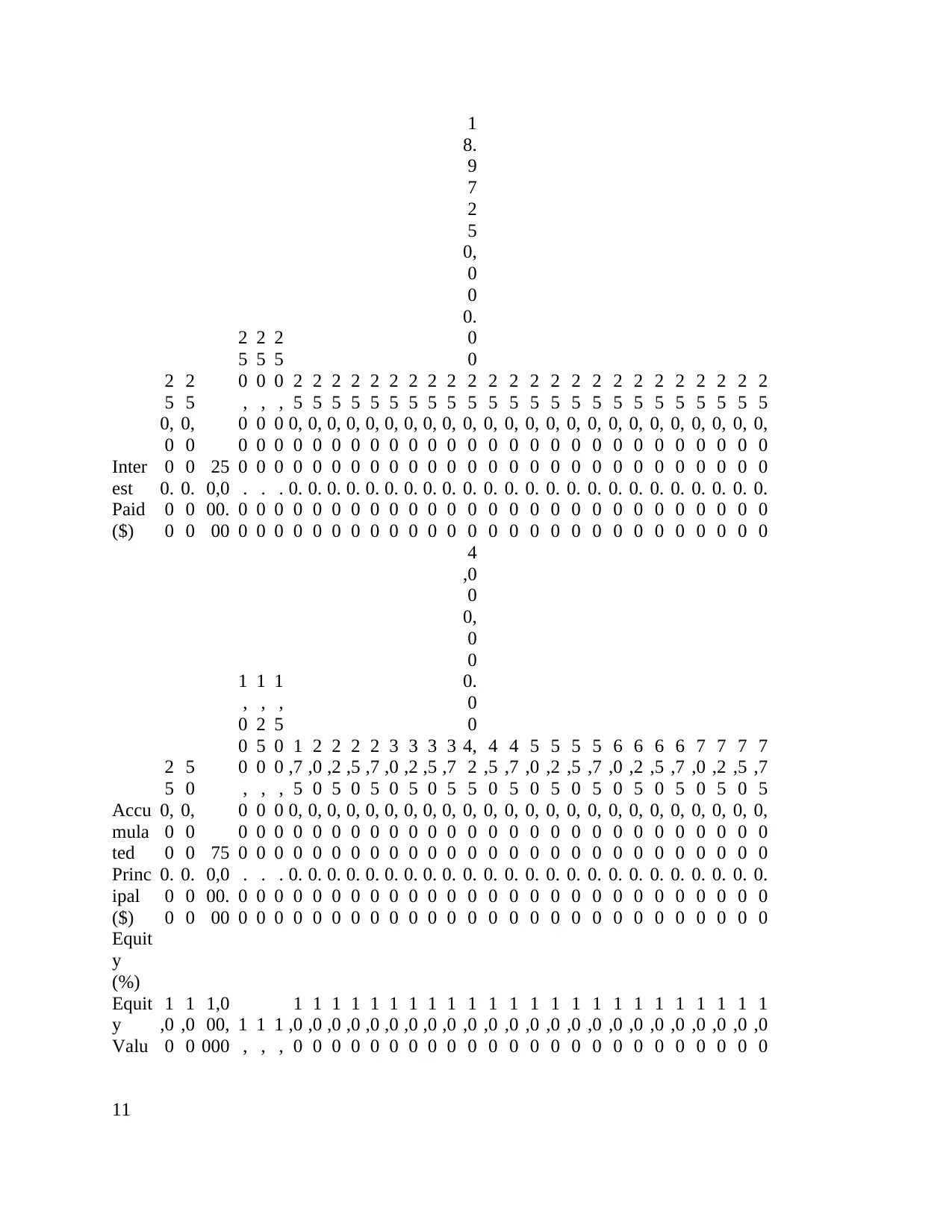

0

4.

1

2)

Accu

mula

ted

Net

Disp

osabl

e

Inco

me

inclu

ding

Inter

est

Earn

ed/P

ayab

le on

Disp

osabl

e

Inco

me

($)

Loan

Oust

andi

ng

($)

4

,7

5

0,

0

0

0.

0

0

5

,2

5

5,

0

0

0.

0

0

5,7

75,

150

.00

6

,

3

2

1

,

3

0

7

.

5

0

6

,

9

0

5

,

6

9

6

.

0

3

7

,

5

3

3

,

9

1

3

.

6

9

8

,2

1

0,

8

1

8.

2

2

8

,9

4

7,

6

2

8.

8

1

9

,7

5

7,

7

5

2.

0

5

1

0,

6

4

9,

2

9

2.

6

7

1

1,

6

4

3,

3

6

0.

4

6

1

2,

7

5

6,

7

1

6.

3

9

1

4,

0

0

4,

2

3

1.

7

1

1

5,

4

0

7,

6

8

6.

4

5

1

6,

9

9

0,

0

8

1.

6

6

1

8,

7

7

8,

1

8

8.

2

5

2

0,

8

0

3,

2

2

3,

1

0

6,

6

9

1.

4

0

2

5,

7

3

2,

6

4

9.

9

8

2

8,

7

3

2,

8

0

7.

6

6

3

2,

1

7

5,

4

8

8.

5

9

3

6,

1

3

4,

5

7

1.

6

7

4

0,

6

9

7,

4

1

4.

9

1

4

5,

9

7

8,

9

0

5.

9

6

5

2,

1

0

5,

4

3

5.

5

8

2

1

1,

3

9

5,

2

0

5.

7

5

3

9

7,

3

6

6,

0

1

2.

4

2

6

1

4,

9

5

1,

8

5

6.

2

2

8

7

0,

0

7

1,

2

5

8.

0

8

5

,7

1

7,

3

3

9,

8

9

3.

4

0

1

1,

4

7

3,

4

7

1,

3

9

7.

8

3

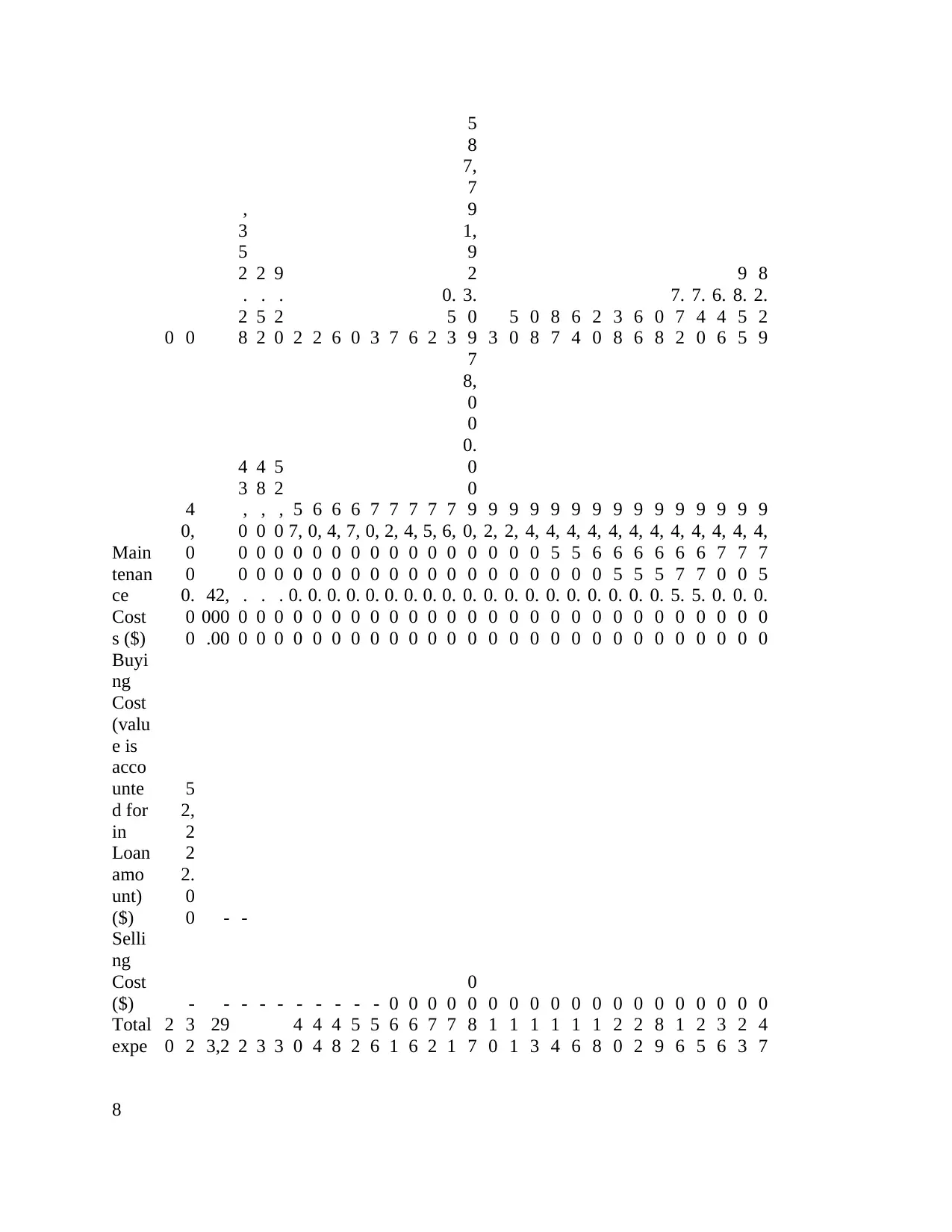

10

4.

1

2)

Accu

mula

ted

Net

Disp

osabl

e

Inco

me

inclu

ding

Inter

est

Earn

ed/P

ayab

le on

Disp

osabl

e

Inco

me

($)

Loan

Oust

andi

ng

($)

4

,7

5

0,

0

0

0.

0

0

5

,2

5

5,

0

0

0.

0

0

5,7

75,

150

.00

6

,

3

2

1

,

3

0

7

.

5

0

6

,

9

0

5

,

6

9

6

.

0

3

7

,

5

3

3

,

9

1

3

.

6

9

8

,2

1

0,

8

1

8.

2

2

8

,9

4

7,

6

2

8.

8

1

9

,7

5

7,

7

5

2.

0

5

1

0,

6

4

9,

2

9

2.

6

7

1

1,

6

4

3,

3

6

0.

4

6

1

2,

7

5

6,

7

1

6.

3

9

1

4,

0

0

4,

2

3

1.

7

1

1

5,

4

0

7,

6

8

6.

4

5

1

6,

9

9

0,

0

8

1.

6

6

1

8,

7

7

8,

1

8

8.

2

5

2

0,

8

0

3,

2

2

3,

1

0

6,

6

9

1.

4

0

2

5,

7

3

2,

6

4

9.

9

8

2

8,

7

3

2,

8

0

7.

6

6

3

2,

1

7

5,

4

8

8.

5

9

3

6,

1

3

4,

5

7

1.

6

7

4

0,

6

9

7,

4

1

4.

9

1

4

5,

9

7

8,

9

0

5.

9

6

5

2,

1

0

5,

4

3

5.

5

8

2

1

1,

3

9

5,

2

0

5.

7

5

3

9

7,

3

6

6,

0

1

2.

4

2

6

1

4,

9

5

1,

8

5

6.

2

2

8

7

0,

0

7

1,

2

5

8.

0

8

5

,7

1

7,

3

3

9,

8

9

3.

4

0

1

1,

4

7

3,

4

7

1,

3

9

7.

8

3

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

8.

9

7

Inter

est

Paid

($)

2

5

0,

0

0

0.

0

0

2

5

0,

0

0

0.

0

0

25

0,0

00.

00

2

5

0

,

0

0

0

.

0

0

2

5

0

,

0

0

0

.

0

0

2

5

0

,

0

0

0

.

0

0

2

5

0,

0

0

0.

0

0

2

5

0,

0

0

0.

0

0

2

5

0,

0

0

0.

0

0

2

5

0,

0

0

0.

0

0

2

5

0,

0

0

0.

0

0

2

5

0,

0

0

0.

0

0

2

5

0,

0

0

0.

0

0

2

5

0,

0

0

0.

0

0

2

5

0,

0

0

0.

0

0

2

5

0,

0

0

0.

0

0

2

5

0,

0

0

0.

0

0

2

5

0,

0

0

0.

0

0

2

5

0,

0

0

0.

0

0

2

5

0,

0

0

0.

0

0

2

5

0,

0

0

0.

0

0

2

5

0,

0

0

0.

0

0

2

5

0,

0

0

0.

0

0

2

5

0,

0

0

0.

0

0

2

5

0,

0

0

0.

0

0

2

5

0,

0

0

0.

0

0

2

5

0,

0

0

0.

0

0

2

5

0,

0

0

0.

0

0

2

5

0,

0

0

0.

0

0

2

5

0,

0

0

0.

0

0

2

5

0,

0

0

0.

0

0

Accu

mula

ted

Princ

ipal

($)

2

5

0,

0

0

0.

0

0

5

0

0,

0

0

0.

0

0

75

0,0

00.

00

1

,

0

0

0

,

0

0

0

.

0

0

1

,

2

5

0

,

0

0

0

.

0

0

1

,

5

0

0

,

0

0

0

.

0

0

1

,7

5

0,

0

0

0.

0

0

2

,0

0

0,

0

0

0.

0

0

2

,2

5

0,

0

0

0.

0

0

2

,5

0

0,

0

0

0.

0

0

2

,7

5

0,

0

0

0.

0

0

3

,0

0

0,

0

0

0.

0

0

3

,2

5

0,

0

0

0.

0

0

3

,5

0

0,

0

0

0.

0

0

3

,7

5

0,

0

0

0.

0

0

4

,0

0

0,

0

0

0.

0

0

4,

2

5

0,

0

0

0.

0

0

4

,5

0

0,

0

0

0.

0

0

4

,7

5

0,

0

0

0.

0

0

5

,0

0

0,

0

0

0.

0

0

5

,2

5

0,

0

0

0.

0

0

5

,5

0

0,

0

0

0.

0

0

5

,7

5

0,

0

0

0.

0

0

6

,0

0

0,

0

0

0.

0

0

6

,2

5

0,

0

0

0.

0

0

6

,5

0

0,

0

0

0.

0

0

6

,7

5

0,

0

0

0.

0

0

7

,0

0

0,

0

0

0.

0

0

7

,2

5

0,

0

0

0.

0

0

7

,5

0

0,

0

0

0.

0

0

7

,7

5

0,

0

0

0.

0

0

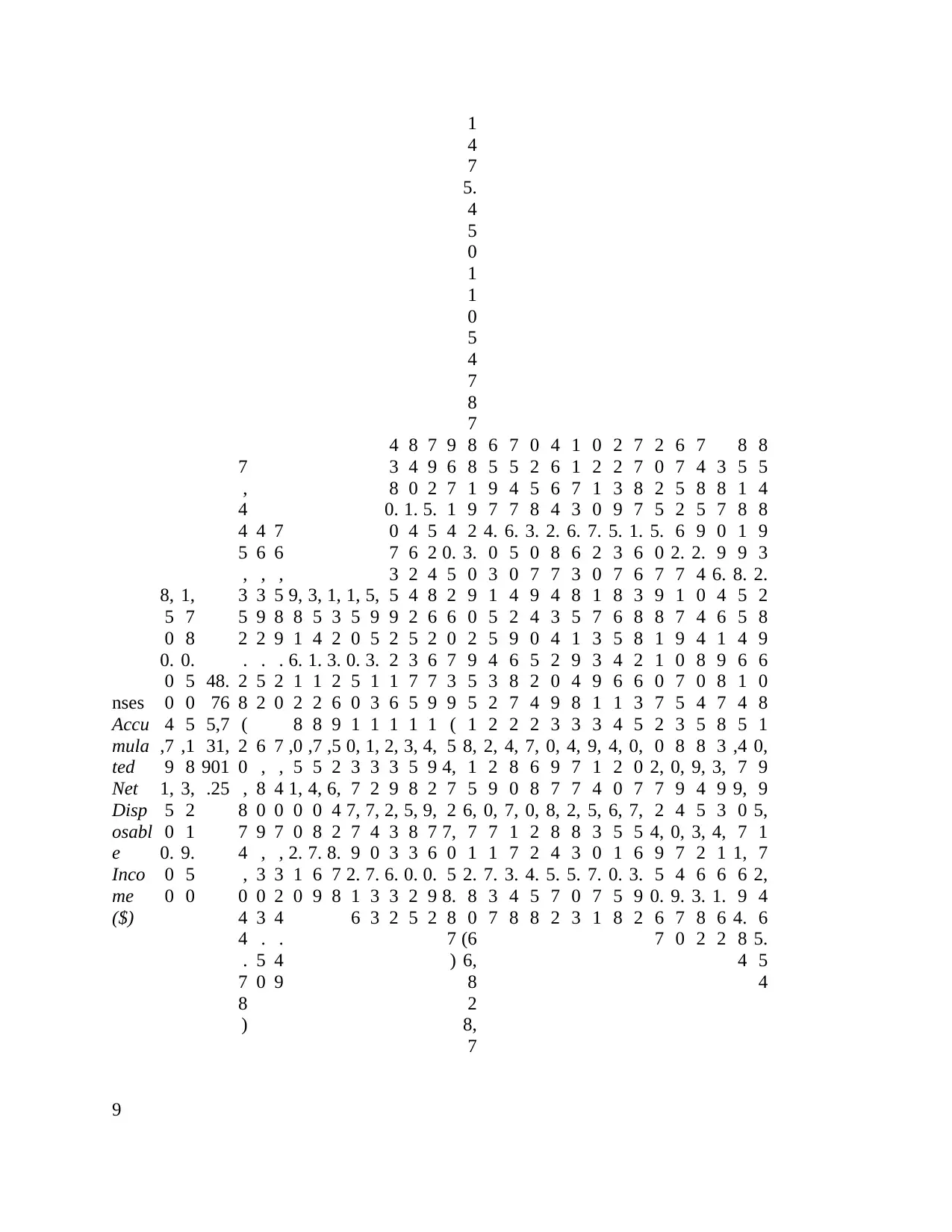

Equit

y

(%)

Equit

y

Valu

1

,0

0

1

,0

0

1,0

00,

000

1

,

1

,

1

,

1

,0

0

1

,0

0

1

,0

0

1

,0

0

1

,0

0

1

,0

0

1

,0

0

1

,0

0

1

,0

0

1

,0

0

1

,0

0

1

,0

0

1

,0

0

1

,0

0

1

,0

0

1

,0

0

1

,0

0

1

,0

0

1

,0

0

1

,0

0

1

,0

0

1

,0

0

1

,0

0

1

,0

0

11

8.

9

7

Inter

est

Paid

($)

2

5

0,

0

0

0.

0

0

2

5

0,

0

0

0.

0

0

25

0,0

00.

00

2

5

0

,

0

0

0

.

0

0

2

5

0

,

0

0

0

.

0

0

2

5

0

,

0

0

0

.

0

0

2

5

0,

0

0

0.

0

0

2

5

0,

0

0

0.

0

0

2

5

0,

0

0

0.

0

0

2

5

0,

0

0

0.

0

0

2

5

0,

0

0

0.

0

0

2

5

0,

0

0

0.

0

0

2

5

0,

0

0

0.

0

0

2

5

0,

0

0

0.

0

0

2

5

0,

0

0

0.

0

0

2

5

0,

0

0

0.

0

0

2

5

0,

0

0

0.

0

0

2

5

0,

0

0

0.

0

0

2

5

0,

0

0

0.

0

0

2

5

0,

0

0

0.

0

0

2

5

0,

0

0

0.

0

0

2

5

0,

0

0

0.

0

0

2

5

0,

0

0

0.

0

0

2

5

0,

0

0

0.

0

0

2

5

0,

0

0

0.

0

0

2

5

0,

0

0

0.

0

0

2

5

0,

0

0

0.

0

0

2

5

0,

0

0

0.

0

0

2

5

0,

0

0

0.

0

0

2

5

0,

0

0

0.

0

0

2

5

0,

0

0

0.

0

0

Accu

mula

ted

Princ

ipal

($)

2

5

0,

0

0

0.

0

0

5

0

0,

0

0

0.

0

0

75

0,0

00.

00

1

,

0

0

0

,

0

0

0

.

0

0

1

,

2

5

0

,

0

0

0

.

0

0

1

,

5

0

0

,

0

0

0

.

0

0

1

,7

5

0,

0

0

0.

0

0

2

,0

0

0,

0

0

0.

0

0

2

,2

5

0,

0

0

0.

0

0

2

,5

0

0,

0

0

0.

0

0

2

,7

5

0,

0

0

0.

0

0

3

,0

0

0,

0

0

0.

0

0

3

,2

5

0,

0

0

0.

0

0

3

,5

0

0,

0

0

0.

0

0

3

,7

5

0,

0

0

0.

0

0

4

,0

0

0,

0

0

0.

0

0

4,

2

5

0,

0

0

0.

0

0

4

,5

0

0,

0

0

0.

0

0

4

,7

5

0,

0

0

0.

0

0

5

,0

0

0,

0

0

0.

0

0

5

,2

5

0,

0

0

0.

0

0

5

,5

0

0,

0

0

0.

0

0

5

,7

5

0,

0

0

0.

0

0

6

,0

0

0,

0

0

0.

0

0

6

,2

5

0,

0

0

0.

0

0

6

,5

0

0,

0

0

0.

0

0

6

,7

5

0,

0

0

0.

0

0

7

,0

0

0,

0

0

0.

0

0

7

,2

5

0,

0

0

0.

0

0

7

,5

0

0,

0

0

0.

0

0

7

,7

5

0,

0

0

0.

0

0

Equit

y

(%)

Equit

y

Valu

1

,0

0

1

,0

0

1,0

00,

000

1

,

1

,

1

,

1

,0

0

1

,0

0

1

,0

0

1

,0

0

1

,0

0

1

,0

0

1

,0

0

1

,0

0

1

,0

0

1

,0

0

1

,0

0

1

,0

0

1

,0

0

1

,0

0

1

,0

0

1

,0

0

1

,0

0

1

,0

0

1

,0

0

1

,0

0

1

,0

0

1

,0

0

1

,0

0

1

,0

0

11

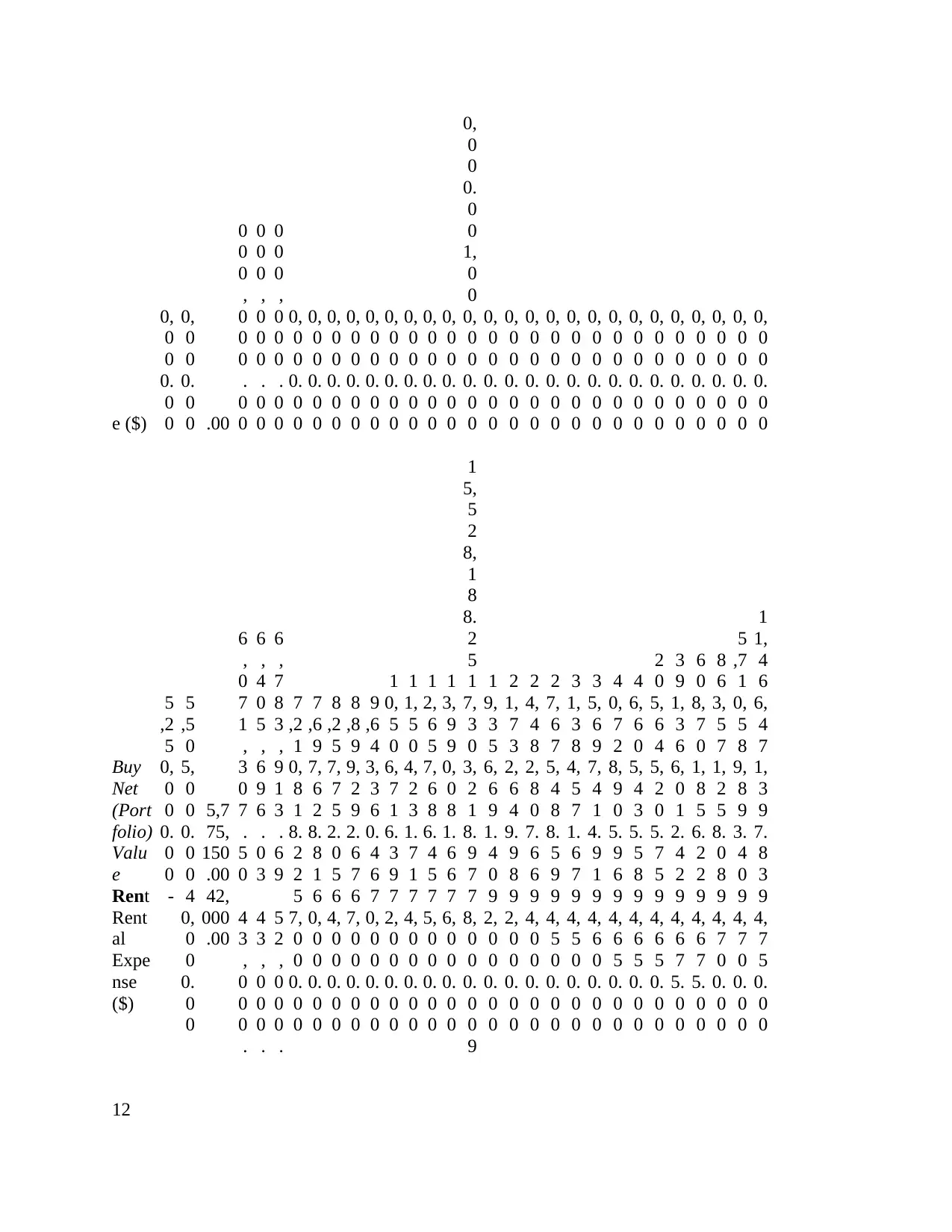

e ($)

0,

0

0

0.

0

0

0,

0

0

0.

0

0 .00

0

0

0

,

0

0

0

.

0

0

0

0

0

,

0

0

0

.

0

0

0

0

0

,

0

0

0

.

0

0

0,

0

0

0.

0

0

0,

0

0

0.

0

0

0,

0

0

0.

0

0

0,

0

0

0.

0

0

0,

0

0

0.

0

0

0,

0

0

0.

0

0

0,

0

0

0.

0

0

0,

0

0

0.

0

0

0,

0

0

0.

0

0

0,

0

0

0.

0

0

1,

0

0

0,

0

0

0.

0

0

0,

0

0

0.

0

0

0,

0

0

0.

0

0

0,

0

0

0.

0

0

0,

0

0

0.

0

0

0,

0

0

0.

0

0

0,

0

0

0.

0

0

0,

0

0

0.

0

0

0,

0

0

0.

0

0

0,

0

0

0.

0

0

0,

0

0

0.

0

0

0,

0

0

0.

0

0

0,

0

0

0.

0

0

0,

0

0

0.

0

0

0,

0

0

0.

0

0

Buy

Net

(Port

folio)

Valu

e

5

,2

5

0,

0

0

0.

0

0

5

,5

0

5,

0

0

0.

0

0

5,7

75,

150

.00

6

,

0

7

1

,

3

0

7

.

5

0

6

,

4

0

5

,

6

9

6

.

0

3

6

,

7

8

3

,

9

1

3

.

6

9

7

,2

1

0,

8

1

8.

2

2

7

,6

9

7,

6

2

8.

8

1

8

,2

5

7,

7

5

2.

0

5

8

,8

9

9,

2

9

2.

6

7

9

,6

4

3,

3

6

0.

4

6

1

0,

5

0

6,

7

1

6.

3

9

1

1,

5

0

4,

2

3

1.

7

1

1

2,

6

5

7,

6

8

6.

4

5

1

3,

9

9

0,

0

8

1.

6

6

1

5,

5

2

8,

1

8

8.

2

5

1

7,

3

0

3,

2

1

8.

9

7

1

9,

3

5

6,

6

9

1.

4

0

2

1,

7

3

2,

6

4

9.

9

8

2

4,

4

8

2,

8

0

7.

6

6

2

7,

6

7

5,

4

8

8.

5

9

3

1,

3

8

4,

5

7

1.

6

7

3

5,

6

9

7,

4

1

4.

9

1

4

0,

7

2

8,

9

0

5.

9

6

4

6,

6

0

5,

4

3

5.

5

8

2

0

5,

6

4

5,

2

0

5.

7

5

3

9

1,

3

6

6,

0

1

2.

4

2

6

0

8,

7

0

1,

8

5

6.

2

2

8

6

3,

5

7

1,

2

5

8.

0

8

5

,7

1

0,

5

8

9,

8

9

3.

4

0

1

1,

4

6

6,

4

7

1,

3

9

7.

8

3

Rent

Rent

al

Expe

nse

($)

- 4

0,

0

0

0.

0

0

42,

000

.00

4

3

,

0

0

0

.

4

3

,

0

0

0

.

5

2

,

0

0

0

.

5

7,

0

0

0.

0

0

6

0,

0

0

0.

0

0

6

4,

0

0

0.

0

0

6

7,

0

0

0.

0

0

7

0,

0

0

0.

0

0

7

2,

0

0

0.

0

0

7

4,

0

0

0.

0

0

7

5,

0

0

0.

0

0

7

6,

0

0

0.

0

0

7

8,

0

0

0.

0

0

9

9

2,

0

0

0.

0

0

9

2,

0

0

0.

0

0

9

4,

0

0

0.

0

0

9

4,

5

0

0.

0

0

9

4,

5

0

0.

0

0

9

4,

6

0

0.

0

0

9

4,

6

5

0.

0

0

9

4,

6

5

0.

0

0

9

4,

6

5

0.

0

0

9

4,

6

7

5.

0

0

9

4,

6

7

5.

0

0

9

4,

7

0

0.

0

0

9

4,

7

0

0.

0

0

9

4,

7

5

0.

0

0

12

0,

0

0

0.

0

0

0,

0

0

0.

0

0 .00

0

0

0

,

0

0

0

.

0

0

0

0

0

,

0

0

0

.

0

0

0

0

0

,

0

0

0

.

0

0

0,

0

0

0.

0

0

0,

0

0

0.

0

0

0,

0

0

0.

0

0

0,

0

0

0.

0

0

0,

0

0

0.

0

0

0,

0

0

0.

0

0

0,

0

0

0.

0

0

0,

0

0

0.

0

0

0,

0

0

0.

0

0

0,

0

0

0.

0

0

1,

0

0

0,

0

0

0.

0

0

0,

0

0

0.

0

0

0,

0

0

0.

0

0

0,

0

0

0.

0

0

0,

0

0

0.

0

0

0,

0

0

0.

0

0

0,

0

0

0.

0

0

0,

0

0