Taxation Law Report: Personal Exertion, Fringe Benefits, Capital Gains

VerifiedAdded on 2021/01/02

|9

|2602

|349

Report

AI Summary

This report provides an analysis of Australian taxation law, addressing key aspects such as personal exertion, car fringe benefits, and capital gains. It examines the treatment of income from various sources, including salaries, copyright, and photography, determining whether they fall under personal exertion. The report calculates the taxable value of car fringe benefits using the statutory formula and explores the tax implications of loans and repayments between family members. Furthermore, it analyzes net capital gains and losses, considering the sale of land and property, and discusses the relevant sections of the Income Tax Assessment Act 1997. The report offers a comprehensive overview of taxation principles and their application in different scenarios, providing insights into the Australian tax system and its impact on individuals and corporations.

Taxation Law

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

Question 1........................................................................................................................................1

Discussing whether three payments are covered under personal exertion. Would answer be

different if story is written by her and decide to sell off later?..............................................1

Question 2........................................................................................................................................2

Compute taxable value of car fringe benefit by implementing statutory formula.................2

QUESTION 3...................................................................................................................................4

QUESTION 4...................................................................................................................................5

A Analysing the net capital gain and losses in current tax year.............................................5

B. Sale of property to daughter...............................................................................................6

C. Owner of property is corporation instead of an individual................................................6

CONCLUSION................................................................................................................................6

REFERENCES................................................................................................................................7

INTRODUCTION...........................................................................................................................1

Question 1........................................................................................................................................1

Discussing whether three payments are covered under personal exertion. Would answer be

different if story is written by her and decide to sell off later?..............................................1

Question 2........................................................................................................................................2

Compute taxable value of car fringe benefit by implementing statutory formula.................2

QUESTION 3...................................................................................................................................4

QUESTION 4...................................................................................................................................5

A Analysing the net capital gain and losses in current tax year.............................................5

B. Sale of property to daughter...............................................................................................6

C. Owner of property is corporation instead of an individual................................................6

CONCLUSION................................................................................................................................6

REFERENCES................................................................................................................................7

INTRODUCTION

Australian Taxation law governs computation of tax on income earned through

profession or business. Present report deals with treatment of various kinds of taxes on the

income made from capital gains and related incomes. The scenario of Hilary is given in which

payments are evaluated as personal exertion or not. Calculation of taxable value is done with

regards to car fringe benefits. Moreover, effect on taxable income on the parent is made in

different scenario. Furthermore, net capital gain or loss is determined of Scott on the transactions

made. Thus, Taxation law of Australia provides effective way of ascertaining correct income of

taxpayers.

Question 1

Discussing whether three payments are covered under personal exertion. Would answer be

different if story is written by her and decide to sell off later?

Australian taxation law is one of the complex to treat and carry out income in the best

possible manner. It can be said that tax related laws are different and are of much complexity

towards computing tax in effective way. In relation to the case of Hilary, ITAA (Income Tax

Assessment Act) 1997 can be relevant to judge whether three payments are required to be

covered under personal exertion or not. Section 393-10 of ITAA Act 1997 is related to income

attained from salaries, commission and bonus as well.

Moreover, income garnered from pensions, fees and similar benefits attained by

employees after their retirement are also treated under the said Act. On the other hand, income

from organisation and subsidy received, income garnered from selling off property which forms

some part of service or emoluments of the workers are regarded as elements or income covered

from personal exertion (Lai and et.al, 2018). Moreover, income earned by disposing of property

is also treated within range of above listed exertion in the best possible manner. The main reason

behind such exertion is that these payments are received in lieu of payers of taxes with respect to

time and services provided to organisation.

On the other hand, Section 6 of ITAA Act prohibits interest income received. However,

such exclusion is not in the business of rents and lending and dividends of the same reason

provided in the Act. In relation to this, there are three payments namely payment made for the

copyright of story to the Daily Terror and story is published and amount is paid to her in

1

Australian Taxation law governs computation of tax on income earned through

profession or business. Present report deals with treatment of various kinds of taxes on the

income made from capital gains and related incomes. The scenario of Hilary is given in which

payments are evaluated as personal exertion or not. Calculation of taxable value is done with

regards to car fringe benefits. Moreover, effect on taxable income on the parent is made in

different scenario. Furthermore, net capital gain or loss is determined of Scott on the transactions

made. Thus, Taxation law of Australia provides effective way of ascertaining correct income of

taxpayers.

Question 1

Discussing whether three payments are covered under personal exertion. Would answer be

different if story is written by her and decide to sell off later?

Australian taxation law is one of the complex to treat and carry out income in the best

possible manner. It can be said that tax related laws are different and are of much complexity

towards computing tax in effective way. In relation to the case of Hilary, ITAA (Income Tax

Assessment Act) 1997 can be relevant to judge whether three payments are required to be

covered under personal exertion or not. Section 393-10 of ITAA Act 1997 is related to income

attained from salaries, commission and bonus as well.

Moreover, income garnered from pensions, fees and similar benefits attained by

employees after their retirement are also treated under the said Act. On the other hand, income

from organisation and subsidy received, income garnered from selling off property which forms

some part of service or emoluments of the workers are regarded as elements or income covered

from personal exertion (Lai and et.al, 2018). Moreover, income earned by disposing of property

is also treated within range of above listed exertion in the best possible manner. The main reason

behind such exertion is that these payments are received in lieu of payers of taxes with respect to

time and services provided to organisation.

On the other hand, Section 6 of ITAA Act prohibits interest income received. However,

such exclusion is not in the business of rents and lending and dividends of the same reason

provided in the Act. In relation to this, there are three payments namely payment made for the

copyright of story to the Daily Terror and story is published and amount is paid to her in

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

effective way. Another payment is made which relates to manuscript to Mitchell Library for the

amount of 5000 and amount paid for certain photographs taken while mountain climbing of

2000. These payments are to be assessed whether they are in purview of personal exertion or not.

It can be analysed by taking into account provisions imparted by ITAA Act 1997 of

Section 393-10, payment received by Hilary amounting to 10000 is regarded as personal

exertion. In relation to the relevant case law can be provided for. The case is relating to Brent V

FCT (1971) 125 CLR 418 in which taxpayer had effectively sold the copyrights of story related

to her husband and it was proven in the Court that she had not earned capital gain instead she had

garnered assessable income as payment had been made in relation to exchange of services and

devoted time (McLaren, 2017). Thus, Hilary should also be treated in accordance to above

discussed case law as income is earned on sale of rights, interest and title of her story which had

been published and payment is being made to her.

On the other hand, payment made to Hilary amounting to 5000 by selling story

manuscript to Mitchell Library is same treated as of above case of Brent V FCT (1971). It is

ought to be treated as personal exertion because Hilary did not run any business or even

profession in the best possible manner. Another payment made to her was amounting to 2000 for

sale of photographs is treated as income of personal exertion. The main reason behind is that

payment was received out of her talent in mountain climbing and as a result, it is covered under

exertion. On the other hand, the answer would be same in relation to the story written by her own

and sold it later. Treatment should be same as it is also out of her personal hard work and income

is earned quite effectually.

Question 2

Compute taxable value of car fringe benefit by implementing statutory formula

The car fringe benefits means that employer provides car to employee for his personal

use. Such benefits are taxable and needs to be paid to taxation authorities. In relation to this, non-

cash benefit is imparted such as car to an employee, organisation's liability to pay taxes arises

quite effectually which is named as Fringe Benefits Tax (FBT) as per the Australian taxation

law. There are two types of formula for calculating taxable income of car fringe benefits

(Chapter 7 Car fringe benefits. 2018). They are operating cost and statutory formula. Operating

cost is computed by taking percentage of total expenses when car is operated within the FBT

2

amount of 5000 and amount paid for certain photographs taken while mountain climbing of

2000. These payments are to be assessed whether they are in purview of personal exertion or not.

It can be analysed by taking into account provisions imparted by ITAA Act 1997 of

Section 393-10, payment received by Hilary amounting to 10000 is regarded as personal

exertion. In relation to the relevant case law can be provided for. The case is relating to Brent V

FCT (1971) 125 CLR 418 in which taxpayer had effectively sold the copyrights of story related

to her husband and it was proven in the Court that she had not earned capital gain instead she had

garnered assessable income as payment had been made in relation to exchange of services and

devoted time (McLaren, 2017). Thus, Hilary should also be treated in accordance to above

discussed case law as income is earned on sale of rights, interest and title of her story which had

been published and payment is being made to her.

On the other hand, payment made to Hilary amounting to 5000 by selling story

manuscript to Mitchell Library is same treated as of above case of Brent V FCT (1971). It is

ought to be treated as personal exertion because Hilary did not run any business or even

profession in the best possible manner. Another payment made to her was amounting to 2000 for

sale of photographs is treated as income of personal exertion. The main reason behind is that

payment was received out of her talent in mountain climbing and as a result, it is covered under

exertion. On the other hand, the answer would be same in relation to the story written by her own

and sold it later. Treatment should be same as it is also out of her personal hard work and income

is earned quite effectually.

Question 2

Compute taxable value of car fringe benefit by implementing statutory formula

The car fringe benefits means that employer provides car to employee for his personal

use. Such benefits are taxable and needs to be paid to taxation authorities. In relation to this, non-

cash benefit is imparted such as car to an employee, organisation's liability to pay taxes arises

quite effectually which is named as Fringe Benefits Tax (FBT) as per the Australian taxation

law. There are two types of formula for calculating taxable income of car fringe benefits

(Chapter 7 Car fringe benefits. 2018). They are operating cost and statutory formula. Operating

cost is computed by taking percentage of total expenses when car is operated within the FBT

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

year. However, percentage differs with respect to actual use by employee. In relation to this,

lower use of car, taxable value will be low as well. Statutory formula means that single rate of 20

% is applied and no kilometres travelled is taken into account. Car base value is multiplied by

such statutory rate.

The case of Eric is required to be calculated on the statutory formula to ascertain taxable

value. The base value of car is 50000 which he had paid last year. Employee contribution is

1000. In this, kilometres will be regardless as statutory rate is applied as per formula. The car

was available for use was 183 days which means that number of days in which car was

unavailable was 365 – 183 = 182 days. Thus, by applying formula, Gross taxable value is

5013.69, employee contribution is 1000. Hence, by subtracting gross value from contribution,

taxable value comes out to be 4013.69 on the benefits.

3

lower use of car, taxable value will be low as well. Statutory formula means that single rate of 20

% is applied and no kilometres travelled is taken into account. Car base value is multiplied by

such statutory rate.

The case of Eric is required to be calculated on the statutory formula to ascertain taxable

value. The base value of car is 50000 which he had paid last year. Employee contribution is

1000. In this, kilometres will be regardless as statutory rate is applied as per formula. The car

was available for use was 183 days which means that number of days in which car was

unavailable was 365 – 183 = 182 days. Thus, by applying formula, Gross taxable value is

5013.69, employee contribution is 1000. Hence, by subtracting gross value from contribution,

taxable value comes out to be 4013.69 on the benefits.

3

QUESTION 3

In accordance with the case and the several monetary transactions held for the purpose of

loan and repayments. Here the mother lent her son a short term loan of $40000 which will be

payable by her son within 5 year on a surplus of $10000. It will not be redetermined as the gift as

it is being repayable bys the son in due period (Wada and et.al., 2017). However, in accordance

with the Income Tax Assessment Act,1997 it can be said that the amount will be lent by a person

to another person on the purpose of having back its repayment which will be beneficial and

helpful as to meet the capital requirements of a firm or of an individual. In this regard the gifts

and grants will be exempted in the taxable payments made by an individual at the end of the

period.

Moreover, in consideration with the purpose of granting loan to son by parents will not be

treated as a part of assessable income. Moreover, here the parent has to make payment of amount

which they have received in respect of interest over such grants. Thus, it will be charged at the

end of the contract period say as 5 years. It will only be payable by the parents as it will actually

receive by them and needed to be shown as the income through interest received (Yeung and

et.al., 2017). On the other side the loan will be devoid by the parents in respects with making the

effective analysis over the formal express agreements or demand of security and a verbal

foregoing of interest income. Therefore, here the one would can easily consider the exemption of

interest income received. There will be repayment of capital for 40000 without addressing any

security in against such grant. Therefore, on which the one would easily refuse to make the

payment of interest charges over the loan taken by them. Moreover, here the 40000 will not be

any part of the assessable income of parents.

The loan has been paid by the son at the end of 2 years which will be on an interest rate

of 5% per annual that is $4000 which had been received by parents. However, in respect with the

various amendments and laws which were being assigned by Australian Taxation Office (ATO)

that will be taxable (Lauchs and Keane, R., 2017). Moreover, the parent has to make payments of

taxes on the interest received by them for such grants. Additionally, it will be payable by them at

the end of 2nd year. However, in relation with same it can be said that there will be payments with

the effects of the modes such as a single check will be satisfactory to make the appropriate

In accordance with the case and the several monetary transactions held for the purpose of

loan and repayments. Here the mother lent her son a short term loan of $40000 which will be

payable by her son within 5 year on a surplus of $10000. It will not be redetermined as the gift as

it is being repayable bys the son in due period (Wada and et.al., 2017). However, in accordance

with the Income Tax Assessment Act,1997 it can be said that the amount will be lent by a person

to another person on the purpose of having back its repayment which will be beneficial and

helpful as to meet the capital requirements of a firm or of an individual. In this regard the gifts

and grants will be exempted in the taxable payments made by an individual at the end of the

period.

Moreover, in consideration with the purpose of granting loan to son by parents will not be

treated as a part of assessable income. Moreover, here the parent has to make payment of amount

which they have received in respect of interest over such grants. Thus, it will be charged at the

end of the contract period say as 5 years. It will only be payable by the parents as it will actually

receive by them and needed to be shown as the income through interest received (Yeung and

et.al., 2017). On the other side the loan will be devoid by the parents in respects with making the

effective analysis over the formal express agreements or demand of security and a verbal

foregoing of interest income. Therefore, here the one would can easily consider the exemption of

interest income received. There will be repayment of capital for 40000 without addressing any

security in against such grant. Therefore, on which the one would easily refuse to make the

payment of interest charges over the loan taken by them. Moreover, here the 40000 will not be

any part of the assessable income of parents.

The loan has been paid by the son at the end of 2 years which will be on an interest rate

of 5% per annual that is $4000 which had been received by parents. However, in respect with the

various amendments and laws which were being assigned by Australian Taxation Office (ATO)

that will be taxable (Lauchs and Keane, R., 2017). Moreover, the parent has to make payments of

taxes on the interest received by them for such grants. Additionally, it will be payable by them at

the end of 2nd year. However, in relation with same it can be said that there will be payments with

the effects of the modes such as a single check will be satisfactory to make the appropriate

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

taxable payments. Therefore, here the need is that the parties which are dealing in the operations

were needed to reveal their intention of transacting the payments to authorities.

Similarly, in accordance with the context of purview and the consideration of the

Australian tax laws where ATO has brought the rights to individual in relation with granting the

money to the relative, friends or acquaintances in the purpose of gifts and grants. Therefore, in

this case it can be said that the parent has to make payments of the interest amount there have

received thorough the granted loan (Pearson, 2017). It is because it will be treated as the revenue

which has been received by them over the amount of loan they have spent over such transactions.

The 40000 is an amount which is only be considered as the transactional payments and the

amount of loans while the interest received by them in respects with such repayments will be

treated as the revenue generated by them. Therefore, it will be treated under the taxable income

or the assessable income.

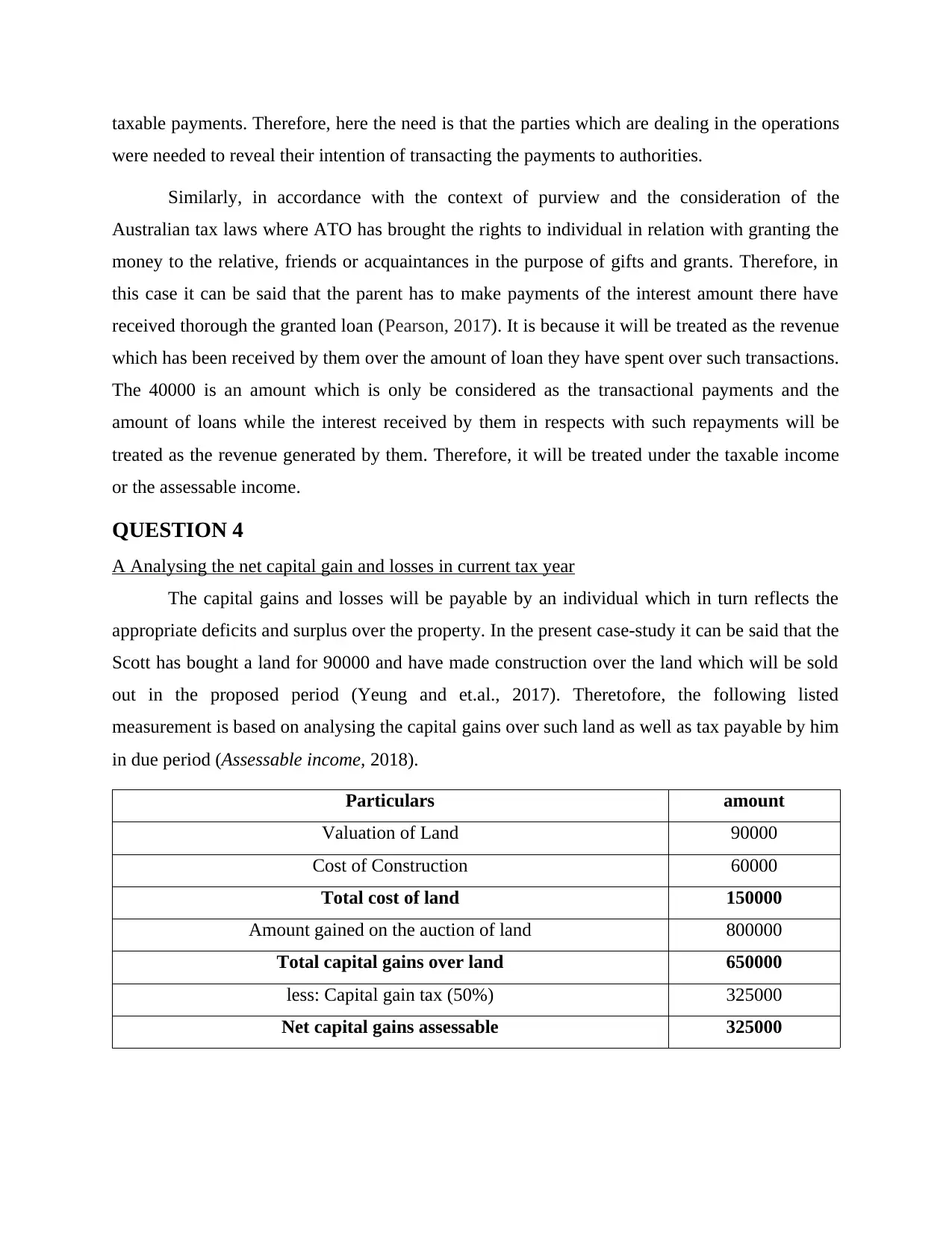

QUESTION 4

A Analysing the net capital gain and losses in current tax year

The capital gains and losses will be payable by an individual which in turn reflects the

appropriate deficits and surplus over the property. In the present case-study it can be said that the

Scott has bought a land for 90000 and have made construction over the land which will be sold

out in the proposed period (Yeung and et.al., 2017). Theretofore, the following listed

measurement is based on analysing the capital gains over such land as well as tax payable by him

in due period (Assessable income, 2018).

Particulars amount

Valuation of Land 90000

Cost of Construction 60000

Total cost of land 150000

Amount gained on the auction of land 800000

Total capital gains over land 650000

less: Capital gain tax (50%) 325000

Net capital gains assessable 325000

were needed to reveal their intention of transacting the payments to authorities.

Similarly, in accordance with the context of purview and the consideration of the

Australian tax laws where ATO has brought the rights to individual in relation with granting the

money to the relative, friends or acquaintances in the purpose of gifts and grants. Therefore, in

this case it can be said that the parent has to make payments of the interest amount there have

received thorough the granted loan (Pearson, 2017). It is because it will be treated as the revenue

which has been received by them over the amount of loan they have spent over such transactions.

The 40000 is an amount which is only be considered as the transactional payments and the

amount of loans while the interest received by them in respects with such repayments will be

treated as the revenue generated by them. Therefore, it will be treated under the taxable income

or the assessable income.

QUESTION 4

A Analysing the net capital gain and losses in current tax year

The capital gains and losses will be payable by an individual which in turn reflects the

appropriate deficits and surplus over the property. In the present case-study it can be said that the

Scott has bought a land for 90000 and have made construction over the land which will be sold

out in the proposed period (Yeung and et.al., 2017). Theretofore, the following listed

measurement is based on analysing the capital gains over such land as well as tax payable by him

in due period (Assessable income, 2018).

Particulars amount

Valuation of Land 90000

Cost of Construction 60000

Total cost of land 150000

Amount gained on the auction of land 800000

Total capital gains over land 650000

less: Capital gain tax (50%) 325000

Net capital gains assessable 325000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Interpretation: In relation with analysing the capital gain tax which is being payable by

Scott is amounted to 325000. Therefore, it can be said that there are 50% are the charges which

is has to be payable by Scott in relation with the section 104-10 of ITAA 1997.

B. Sale of property to daughter

In relation with the opinion of Scott it can be said that he is going to sell out his property

to his daughter which is amounted to 200000. Thus, in accordance with the ATO regulations the

property which is being sold by a person in respect with gifts and grant which will be not be

treated under taxable income payable by them.

C. Owner of property is corporation instead of an individual.

To consider the sale of property will be by the companies in Australia it can be said that

they will have to make the payments of 30% of the tax on the gains from such property.

Therefore, the 30% of the amount will be payable by them as to have the satisfactory payment of

the gains made by them.

CONCLUSION

On the basis of above report it can be said that there are various taxable operations made

the individuals and corporations which has been analysed and paid by the parties. Moreover, in

relation with such analysing there has been ascertainment of various amendments and laws

which will be effective and helpful ad to have appropriate knowledge and gains of effective

information.

Scott is amounted to 325000. Therefore, it can be said that there are 50% are the charges which

is has to be payable by Scott in relation with the section 104-10 of ITAA 1997.

B. Sale of property to daughter

In relation with the opinion of Scott it can be said that he is going to sell out his property

to his daughter which is amounted to 200000. Thus, in accordance with the ATO regulations the

property which is being sold by a person in respect with gifts and grant which will be not be

treated under taxable income payable by them.

C. Owner of property is corporation instead of an individual.

To consider the sale of property will be by the companies in Australia it can be said that

they will have to make the payments of 30% of the tax on the gains from such property.

Therefore, the 30% of the amount will be payable by them as to have the satisfactory payment of

the gains made by them.

CONCLUSION

On the basis of above report it can be said that there are various taxable operations made

the individuals and corporations which has been analysed and paid by the parties. Moreover, in

relation with such analysing there has been ascertainment of various amendments and laws

which will be effective and helpful ad to have appropriate knowledge and gains of effective

information.

REFERENCES

Books and Journals

Lai, F. Y. and et.al., 2018. Measuring spatial and temporal trends of nicotine and alcohol

consumption in Australia using wastewater‐based epidemiology. Addiction.

Lauchs, M. and Keane, R., 2017. An analysis of the Australian illicit tobacco market. Journal of

Financial Crime. 24(1). pp.35-47.

McLaren, J., 2017. The Economic Development of Northern Australia: A Critical Review of the

Taxation Benefits and Incentives Both Past and Present and the Potential Taxation Options

for the Future. J. Australasian Tax Tchrs. Ass'n. 12. p.1.

Pearson, G., 2017. Further challenges for Australian consumer law. In Consumer Law and

Socioeconomic Development (pp. 287-305). Springer, Cham.

Wada, Y., and et.al., 2017. A humanized mouse model identifies key amino acids for low

immunogenicity of H7N9 vaccines. Scientific Reports. 7(1). p.1283.

Yeung, V. H. W., and et.al., 2017, March. Correlations among penile length, prostate size,

testicular volume and PSA in Chinese men. In BJU INTERNATIONAL (Vol. 119, pp. 5-5).

111 RIVER ST, HOBOKEN 07030-5774, NJ USA: WILEY.

Online

Assessable income. 2018. [Online]. Available through

:<https://www.ato.gov.au/Business/Income-and-deductions-for-business/Assessable-

income/>.

Chapter 7 Car fringe benefits. 2018. [Online]. Available Through:

<http://law.ato.gov.au/atolaw/view.htm?DocID=SAV%2FFBTGEMP%2F00008>.

Books and Journals

Lai, F. Y. and et.al., 2018. Measuring spatial and temporal trends of nicotine and alcohol

consumption in Australia using wastewater‐based epidemiology. Addiction.

Lauchs, M. and Keane, R., 2017. An analysis of the Australian illicit tobacco market. Journal of

Financial Crime. 24(1). pp.35-47.

McLaren, J., 2017. The Economic Development of Northern Australia: A Critical Review of the

Taxation Benefits and Incentives Both Past and Present and the Potential Taxation Options

for the Future. J. Australasian Tax Tchrs. Ass'n. 12. p.1.

Pearson, G., 2017. Further challenges for Australian consumer law. In Consumer Law and

Socioeconomic Development (pp. 287-305). Springer, Cham.

Wada, Y., and et.al., 2017. A humanized mouse model identifies key amino acids for low

immunogenicity of H7N9 vaccines. Scientific Reports. 7(1). p.1283.

Yeung, V. H. W., and et.al., 2017, March. Correlations among penile length, prostate size,

testicular volume and PSA in Chinese men. In BJU INTERNATIONAL (Vol. 119, pp. 5-5).

111 RIVER ST, HOBOKEN 07030-5774, NJ USA: WILEY.

Online

Assessable income. 2018. [Online]. Available through

:<https://www.ato.gov.au/Business/Income-and-deductions-for-business/Assessable-

income/>.

Chapter 7 Car fringe benefits. 2018. [Online]. Available Through:

<http://law.ato.gov.au/atolaw/view.htm?DocID=SAV%2FFBTGEMP%2F00008>.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 9

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.