BA30592E: Analyzing Business Transactions, Financial Statements

VerifiedAdded on 2023/06/14

|16

|1885

|430

Report

AI Summary

This report provides a detailed analysis of business transactions, starting with journal entries recorded in T-accounts, followed by the creation of general ledgers and a trial balance to ensure accuracy. It then prepares an income statement for the period ending October 31, 2021, and a balance sheet to present the financial position of the business. The report also includes an explanation of drawings and their impact on the company's capital. Furthermore, accounting ratios are computed and evaluated to assess the company's performance, considering the impact of the Covid-19 pandemic on the business. The conclusion summarizes the challenges faced by the business and suggests strategies for maintaining sustainability and improving financial performance, emphasizing the importance of financial statements in understanding the company's position in the market.

BA30592E Recording

Business Transactions

Business Transactions

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

INTRODUCTION...........................................................................................................................3

PART A...........................................................................................................................................3

a) Record the Journal entry in T- accounts.............................................................................3

b) General Ledgers.................................................................................................................5

c) TRIAL BALANCE..........................................................................................................10

d) Prepare Income Statement ending on 31 October 2021...................................................11

e) Balance Sheet...................................................................................................................12

f) Explanation regarding drawings.......................................................................................13

PART B..........................................................................................................................................14

a) Accounting Ratios............................................................................................................14

b) Evaluate the performance of the ratio computed above...................................................14

CONCLUSION..............................................................................................................................15

REFERENCES..............................................................................................................................16

INTRODUCTION...........................................................................................................................3

PART A...........................................................................................................................................3

a) Record the Journal entry in T- accounts.............................................................................3

b) General Ledgers.................................................................................................................5

c) TRIAL BALANCE..........................................................................................................10

d) Prepare Income Statement ending on 31 October 2021...................................................11

e) Balance Sheet...................................................................................................................12

f) Explanation regarding drawings.......................................................................................13

PART B..........................................................................................................................................14

a) Accounting Ratios............................................................................................................14

b) Evaluate the performance of the ratio computed above...................................................14

CONCLUSION..............................................................................................................................15

REFERENCES..............................................................................................................................16

INTRODUCTION

The business transactions depict the actions which can be recorded in the type of cash and

can be esteemed. These exchanges recognize the liquidity, benefit and project of business (Ali,

Ally and Dwivedi, 2020). This report comprises journal entries and their presentation on

particular records. For checking exactness preliminary equilibrium is likewise recorded in which

every one of the records having charge or credit adjusts are shown. Thereafter, the benefit and

loss account is ready to know the costs and pay off the business and with the assistance of all

assertions monetary record is ready to be aware of the genuine resources and liabilities of the

given association. Finally, proportions are additionally deciphered for its examination with

different contenders.

PART A

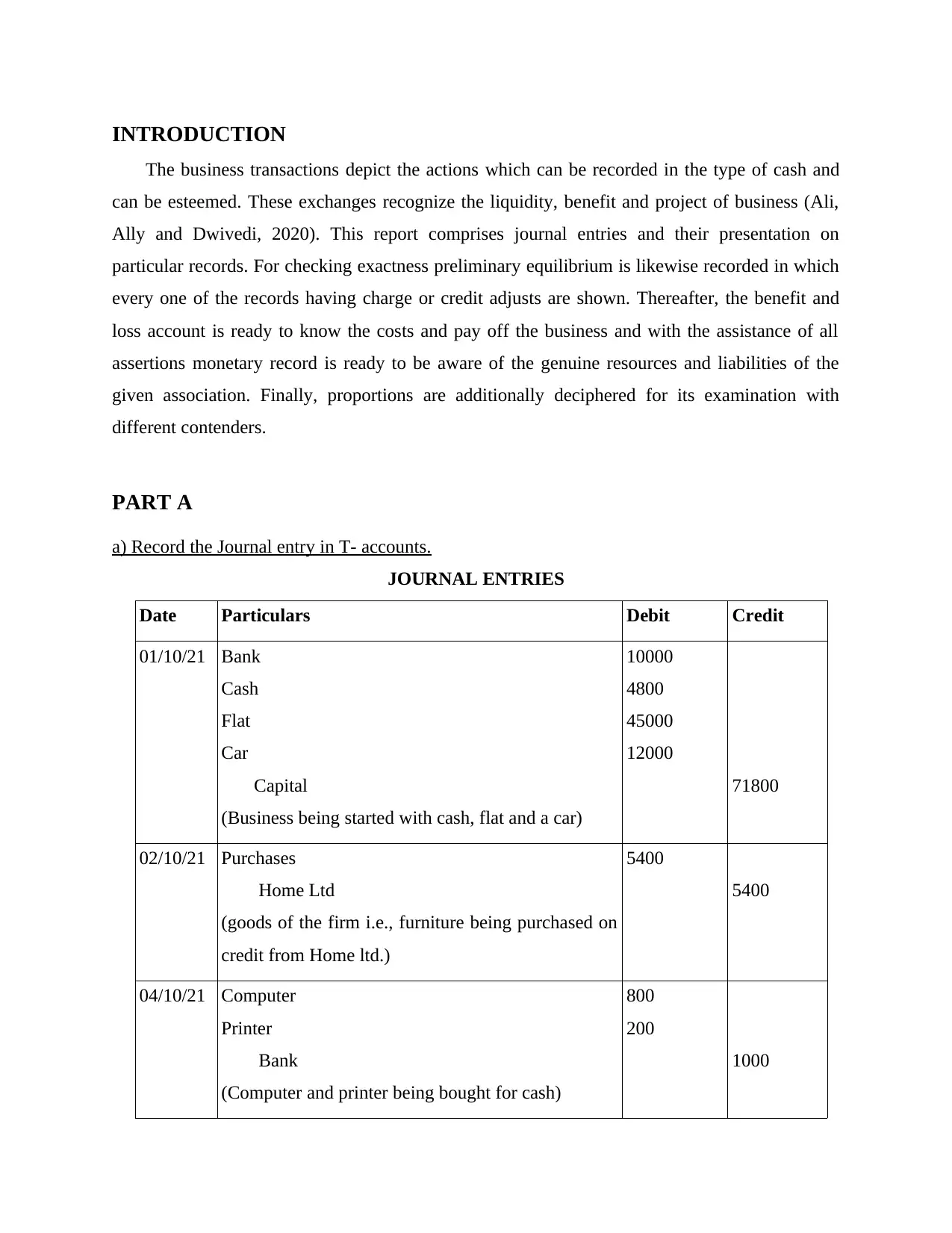

a) Record the Journal entry in T- accounts.

JOURNAL ENTRIES

Date Particulars Debit Credit

01/10/21 Bank

Cash

Flat

Car

Capital

(Business being started with cash, flat and a car)

10000

4800

45000

12000

71800

02/10/21 Purchases

Home Ltd

(goods of the firm i.e., furniture being purchased on

credit from Home ltd.)

5400

5400

04/10/21 Computer

Printer

Bank

(Computer and printer being bought for cash)

800

200

1000

The business transactions depict the actions which can be recorded in the type of cash and

can be esteemed. These exchanges recognize the liquidity, benefit and project of business (Ali,

Ally and Dwivedi, 2020). This report comprises journal entries and their presentation on

particular records. For checking exactness preliminary equilibrium is likewise recorded in which

every one of the records having charge or credit adjusts are shown. Thereafter, the benefit and

loss account is ready to know the costs and pay off the business and with the assistance of all

assertions monetary record is ready to be aware of the genuine resources and liabilities of the

given association. Finally, proportions are additionally deciphered for its examination with

different contenders.

PART A

a) Record the Journal entry in T- accounts.

JOURNAL ENTRIES

Date Particulars Debit Credit

01/10/21 Bank

Cash

Flat

Car

Capital

(Business being started with cash, flat and a car)

10000

4800

45000

12000

71800

02/10/21 Purchases

Home Ltd

(goods of the firm i.e., furniture being purchased on

credit from Home ltd.)

5400

5400

04/10/21 Computer

Printer

Bank

(Computer and printer being bought for cash)

800

200

1000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

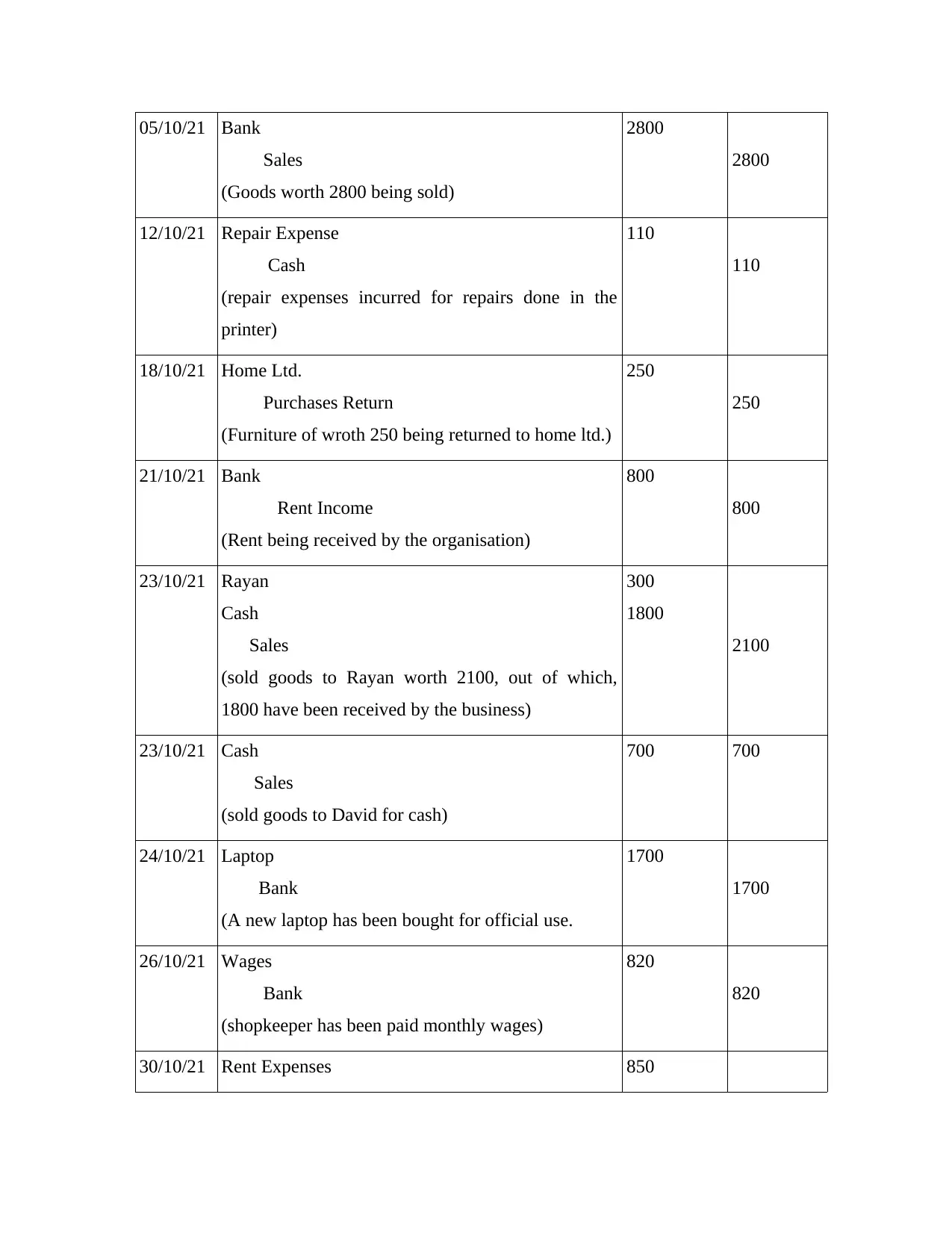

05/10/21 Bank

Sales

(Goods worth 2800 being sold)

2800

2800

12/10/21 Repair Expense

Cash

(repair expenses incurred for repairs done in the

printer)

110

110

18/10/21 Home Ltd.

Purchases Return

(Furniture of wroth 250 being returned to home ltd.)

250

250

21/10/21 Bank

Rent Income

(Rent being received by the organisation)

800

800

23/10/21 Rayan

Cash

Sales

(sold goods to Rayan worth 2100, out of which,

1800 have been received by the business)

300

1800

2100

23/10/21 Cash

Sales

(sold goods to David for cash)

700 700

24/10/21 Laptop

Bank

(A new laptop has been bought for official use.

1700

1700

26/10/21 Wages

Bank

(shopkeeper has been paid monthly wages)

820

820

30/10/21 Rent Expenses 850

Sales

(Goods worth 2800 being sold)

2800

2800

12/10/21 Repair Expense

Cash

(repair expenses incurred for repairs done in the

printer)

110

110

18/10/21 Home Ltd.

Purchases Return

(Furniture of wroth 250 being returned to home ltd.)

250

250

21/10/21 Bank

Rent Income

(Rent being received by the organisation)

800

800

23/10/21 Rayan

Cash

Sales

(sold goods to Rayan worth 2100, out of which,

1800 have been received by the business)

300

1800

2100

23/10/21 Cash

Sales

(sold goods to David for cash)

700 700

24/10/21 Laptop

Bank

(A new laptop has been bought for official use.

1700

1700

26/10/21 Wages

Bank

(shopkeeper has been paid monthly wages)

820

820

30/10/21 Rent Expenses 850

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

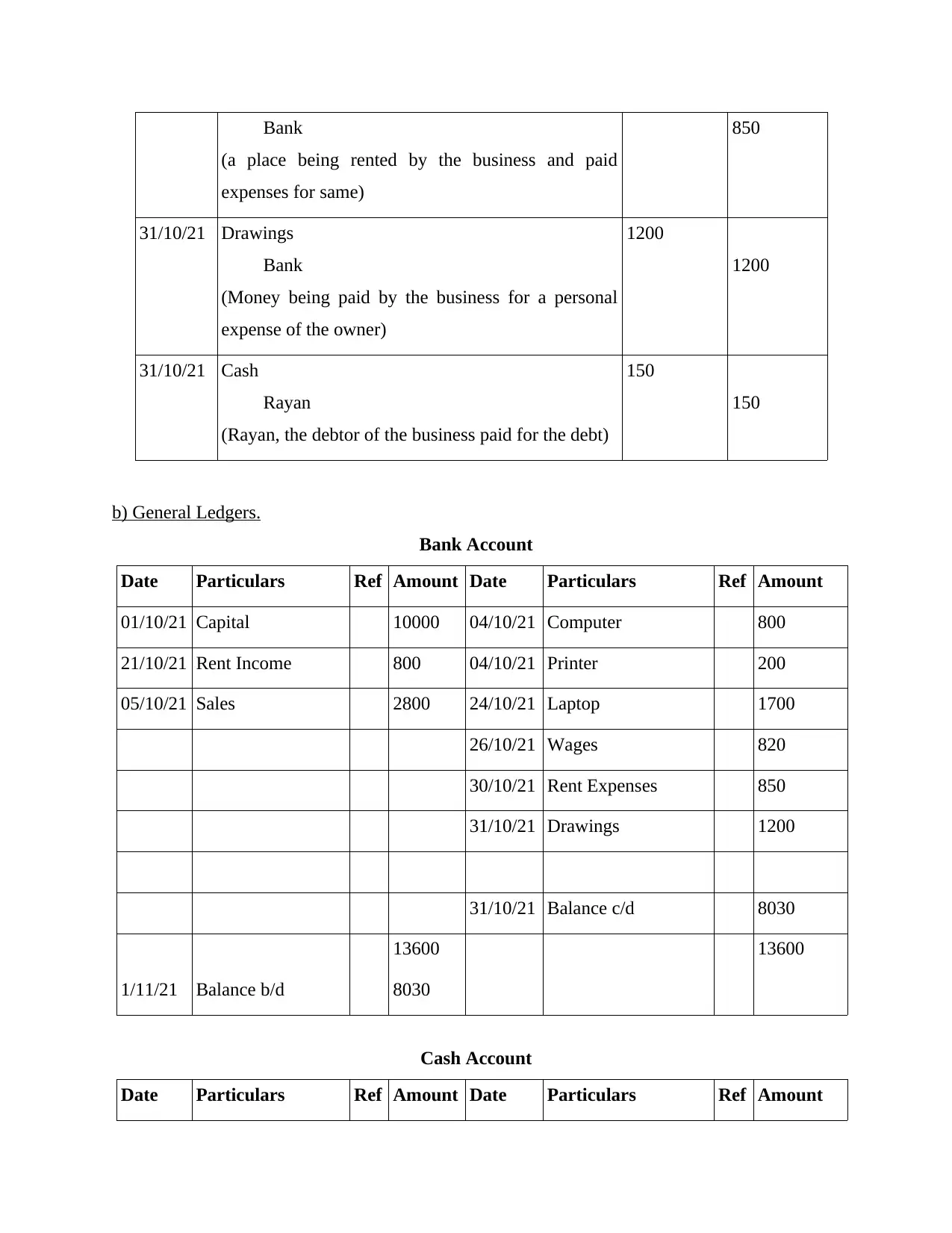

Bank

(a place being rented by the business and paid

expenses for same)

850

31/10/21 Drawings

Bank

(Money being paid by the business for a personal

expense of the owner)

1200

1200

31/10/21 Cash

Rayan

(Rayan, the debtor of the business paid for the debt)

150

150

b) General Ledgers.

Bank Account

Date Particulars Ref Amount Date Particulars Ref Amount

01/10/21 Capital 10000 04/10/21 Computer 800

21/10/21 Rent Income 800 04/10/21 Printer 200

05/10/21 Sales 2800 24/10/21 Laptop 1700

26/10/21 Wages 820

30/10/21 Rent Expenses 850

31/10/21 Drawings 1200

31/10/21 Balance c/d 8030

13600 13600

1/11/21 Balance b/d 8030

Cash Account

Date Particulars Ref Amount Date Particulars Ref Amount

(a place being rented by the business and paid

expenses for same)

850

31/10/21 Drawings

Bank

(Money being paid by the business for a personal

expense of the owner)

1200

1200

31/10/21 Cash

Rayan

(Rayan, the debtor of the business paid for the debt)

150

150

b) General Ledgers.

Bank Account

Date Particulars Ref Amount Date Particulars Ref Amount

01/10/21 Capital 10000 04/10/21 Computer 800

21/10/21 Rent Income 800 04/10/21 Printer 200

05/10/21 Sales 2800 24/10/21 Laptop 1700

26/10/21 Wages 820

30/10/21 Rent Expenses 850

31/10/21 Drawings 1200

31/10/21 Balance c/d 8030

13600 13600

1/11/21 Balance b/d 8030

Cash Account

Date Particulars Ref Amount Date Particulars Ref Amount

01/10/21 Opening Balance 4800 12/10/21 Repair 110

23/10/21 Sales 1800

23/10/21 Sales 700

31/10/21 Rayan 150 31/10/21 Balance c/d 7340

7450 7450

1/11/21 Balance b/d 7340

Flat Account

Date Particulars Ref Amount Date Particulars Ref Amount

01/10/21 Opening Balance 45000

31/10/21 Balance c/d 45000

45000 45000

1/11/21 Balance b/d 45000

Car Account

Date Particulars Ref Amount Date Particulars Ref Amount

01/10/21 Capital 12000 31/10/21 Balance c/d 12000

12000 12000

01/11/21 Balance b/d 12000

Capital Account

Date Particulars Ref Amount Date Particulars Ref Amount

01/10/21 Bank 10000

01/10/21 Cash 4800

01/10/21 Flat 45000

23/10/21 Sales 1800

23/10/21 Sales 700

31/10/21 Rayan 150 31/10/21 Balance c/d 7340

7450 7450

1/11/21 Balance b/d 7340

Flat Account

Date Particulars Ref Amount Date Particulars Ref Amount

01/10/21 Opening Balance 45000

31/10/21 Balance c/d 45000

45000 45000

1/11/21 Balance b/d 45000

Car Account

Date Particulars Ref Amount Date Particulars Ref Amount

01/10/21 Capital 12000 31/10/21 Balance c/d 12000

12000 12000

01/11/21 Balance b/d 12000

Capital Account

Date Particulars Ref Amount Date Particulars Ref Amount

01/10/21 Bank 10000

01/10/21 Cash 4800

01/10/21 Flat 45000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

31/10/21 Balance c/d 71800 01/10/21 Car 12000

71800 71800

01/11/21 Balance b/d 71800

Purchases Account

Date Particulars Ref Amount Date Particulars Ref Amount

18/10/21 Home Ltd 5400

31/10/21 Balance c/d 5400

5400 5400

01/11/21 Balance b/d 5400

Purchase Return Account

Date Particulars Ref Amount Date Particulars Ref Amount

31/10/21 Balance c/d 250 02/10/21 Home Ltd 250

250 250

01/11/21 Balance b/d 250

Home Ltd Account

Date Particulars Ref Amount Date Particulars Ref Amount

02/10/21 Purchases return 250 18/10/21 Purchases 5400

31/10/21 Balance c/d 5150

5400 5400

01/11/21 Balance b/d 5150

s

Computer Account

Date Particulars Ref Amount Date Particulars Ref Amount

71800 71800

01/11/21 Balance b/d 71800

Purchases Account

Date Particulars Ref Amount Date Particulars Ref Amount

18/10/21 Home Ltd 5400

31/10/21 Balance c/d 5400

5400 5400

01/11/21 Balance b/d 5400

Purchase Return Account

Date Particulars Ref Amount Date Particulars Ref Amount

31/10/21 Balance c/d 250 02/10/21 Home Ltd 250

250 250

01/11/21 Balance b/d 250

Home Ltd Account

Date Particulars Ref Amount Date Particulars Ref Amount

02/10/21 Purchases return 250 18/10/21 Purchases 5400

31/10/21 Balance c/d 5150

5400 5400

01/11/21 Balance b/d 5150

s

Computer Account

Date Particulars Ref Amount Date Particulars Ref Amount

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

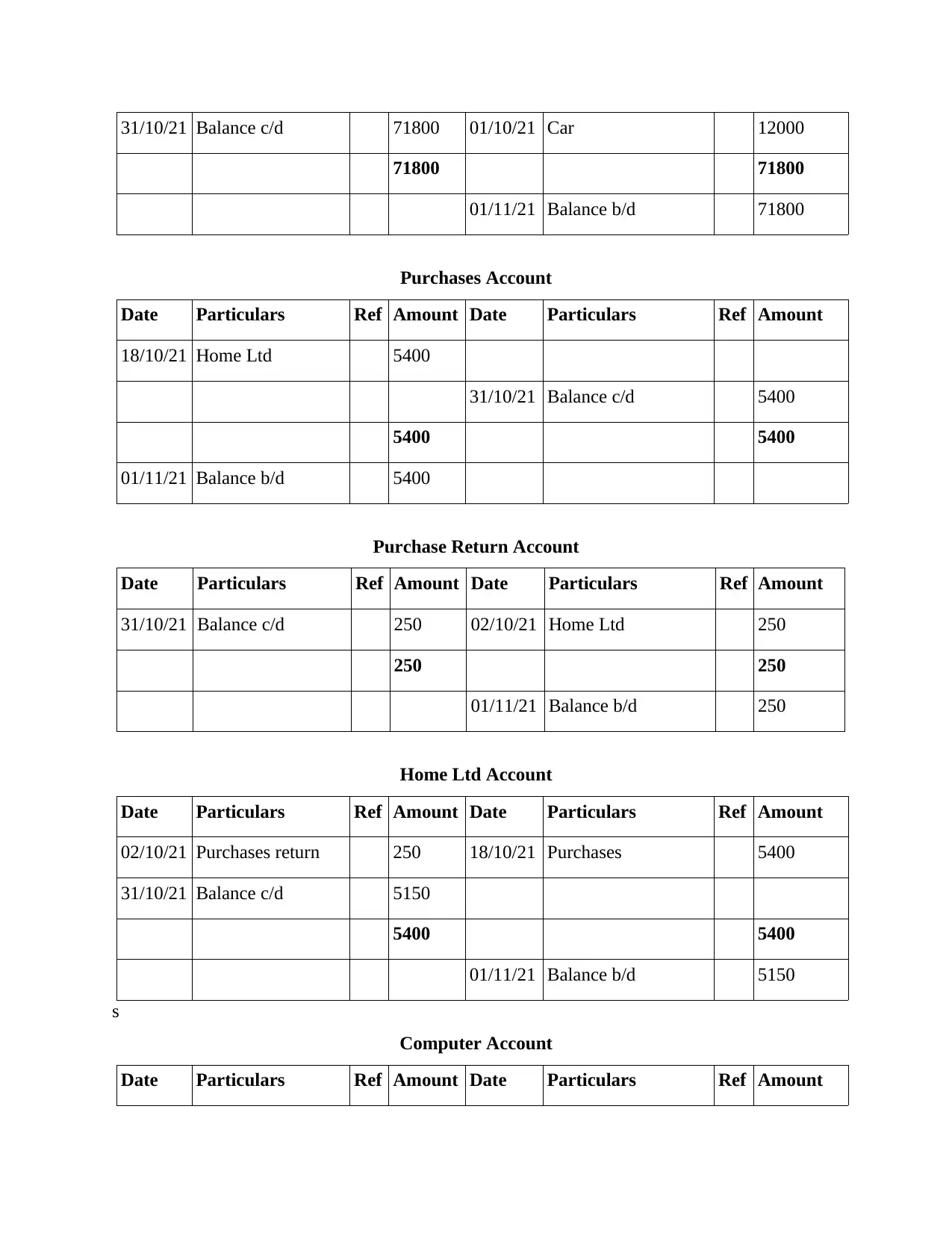

04/10/21 Bank 800 31/10/21 Balance c/d 800

800 800

01/11/21 Balance b/d 800

Printer Account

Date Particulars Ref Amount Date Particulars Ref Amount

04/10/21 Bank 200 31/10/21 Balance c/d 200

200 200

01/11/21 Balance b/d 200

Repair Expenses Account

Date Particulars Ref Amount Date Particulars Ref Amount

12/10/21 Cash 110 31/10/21 Balance c/d 110

110 110

01/11/21 Balance b/d 110

Rent Income Account

Date Particulars Ref Amount Date Particulars Ref Amount

21/10/21 Bank 800

31/10/21 Balance c/d 800

800 800

01/11/21 Balance b/d 800

Rent Expense Account

Date Particulars Ref Amount Date Particulars Ref Amount

31/10/21 Bank 850

800 800

01/11/21 Balance b/d 800

Printer Account

Date Particulars Ref Amount Date Particulars Ref Amount

04/10/21 Bank 200 31/10/21 Balance c/d 200

200 200

01/11/21 Balance b/d 200

Repair Expenses Account

Date Particulars Ref Amount Date Particulars Ref Amount

12/10/21 Cash 110 31/10/21 Balance c/d 110

110 110

01/11/21 Balance b/d 110

Rent Income Account

Date Particulars Ref Amount Date Particulars Ref Amount

21/10/21 Bank 800

31/10/21 Balance c/d 800

800 800

01/11/21 Balance b/d 800

Rent Expense Account

Date Particulars Ref Amount Date Particulars Ref Amount

31/10/21 Bank 850

31/10/21 Balance c/d 850

850 850

01/11/21 Balance b/d 850

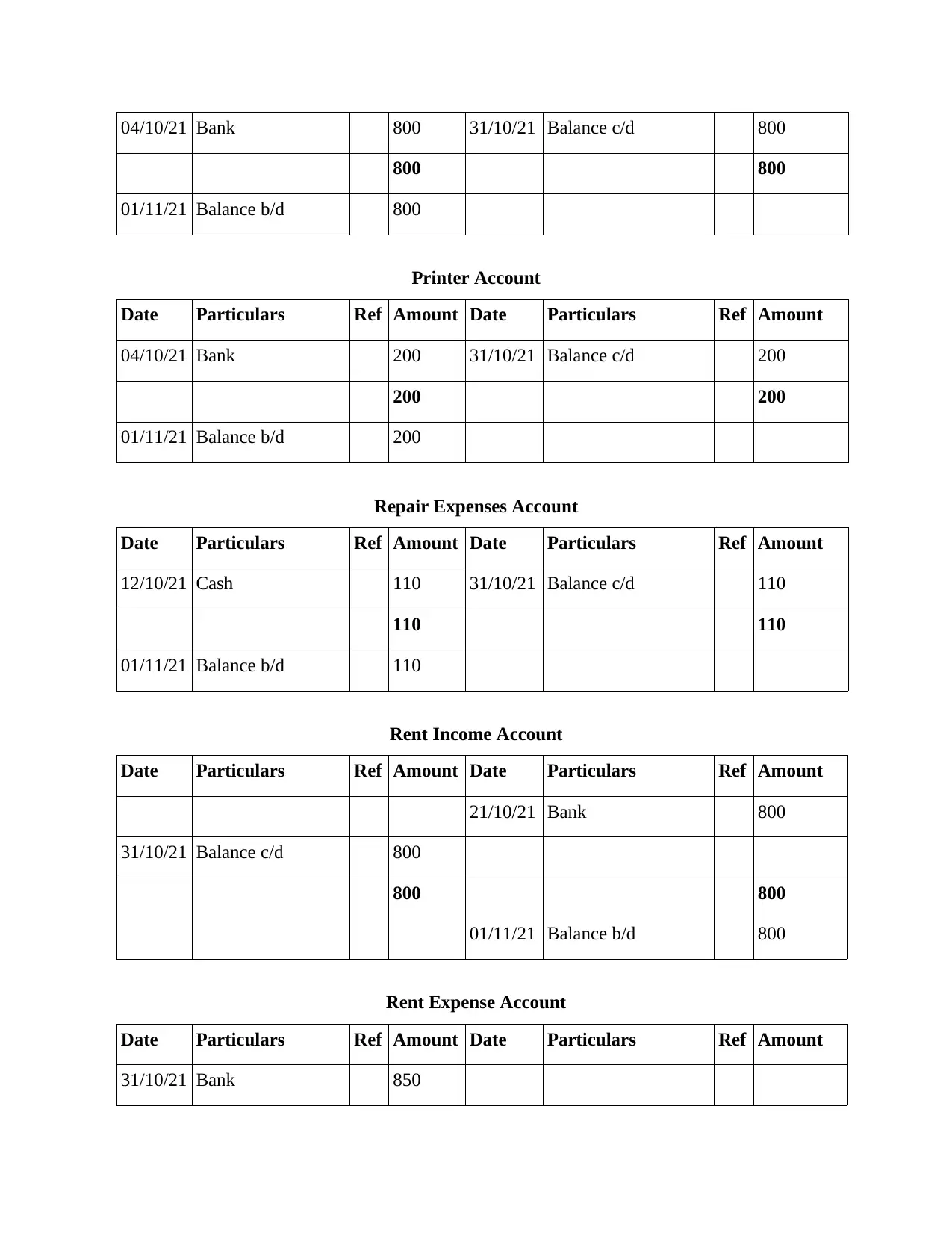

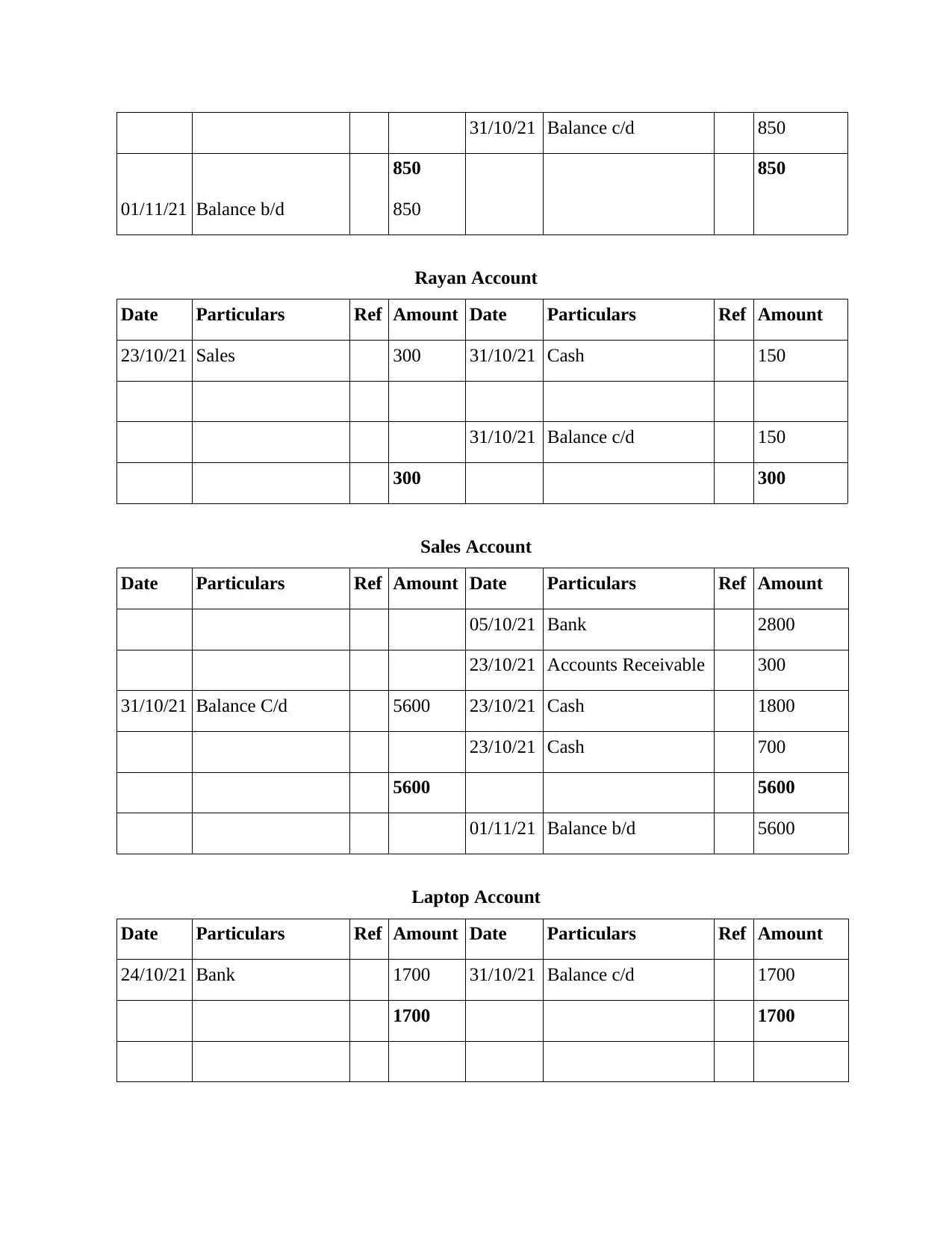

Rayan Account

Date Particulars Ref Amount Date Particulars Ref Amount

23/10/21 Sales 300 31/10/21 Cash 150

31/10/21 Balance c/d 150

300 300

Sales Account

Date Particulars Ref Amount Date Particulars Ref Amount

05/10/21 Bank 2800

23/10/21 Accounts Receivable 300

31/10/21 Balance C/d 5600 23/10/21 Cash 1800

23/10/21 Cash 700

5600 5600

01/11/21 Balance b/d 5600

Laptop Account

Date Particulars Ref Amount Date Particulars Ref Amount

24/10/21 Bank 1700 31/10/21 Balance c/d 1700

1700 1700

850 850

01/11/21 Balance b/d 850

Rayan Account

Date Particulars Ref Amount Date Particulars Ref Amount

23/10/21 Sales 300 31/10/21 Cash 150

31/10/21 Balance c/d 150

300 300

Sales Account

Date Particulars Ref Amount Date Particulars Ref Amount

05/10/21 Bank 2800

23/10/21 Accounts Receivable 300

31/10/21 Balance C/d 5600 23/10/21 Cash 1800

23/10/21 Cash 700

5600 5600

01/11/21 Balance b/d 5600

Laptop Account

Date Particulars Ref Amount Date Particulars Ref Amount

24/10/21 Bank 1700 31/10/21 Balance c/d 1700

1700 1700

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

01/11/21 Balance b/d 1700

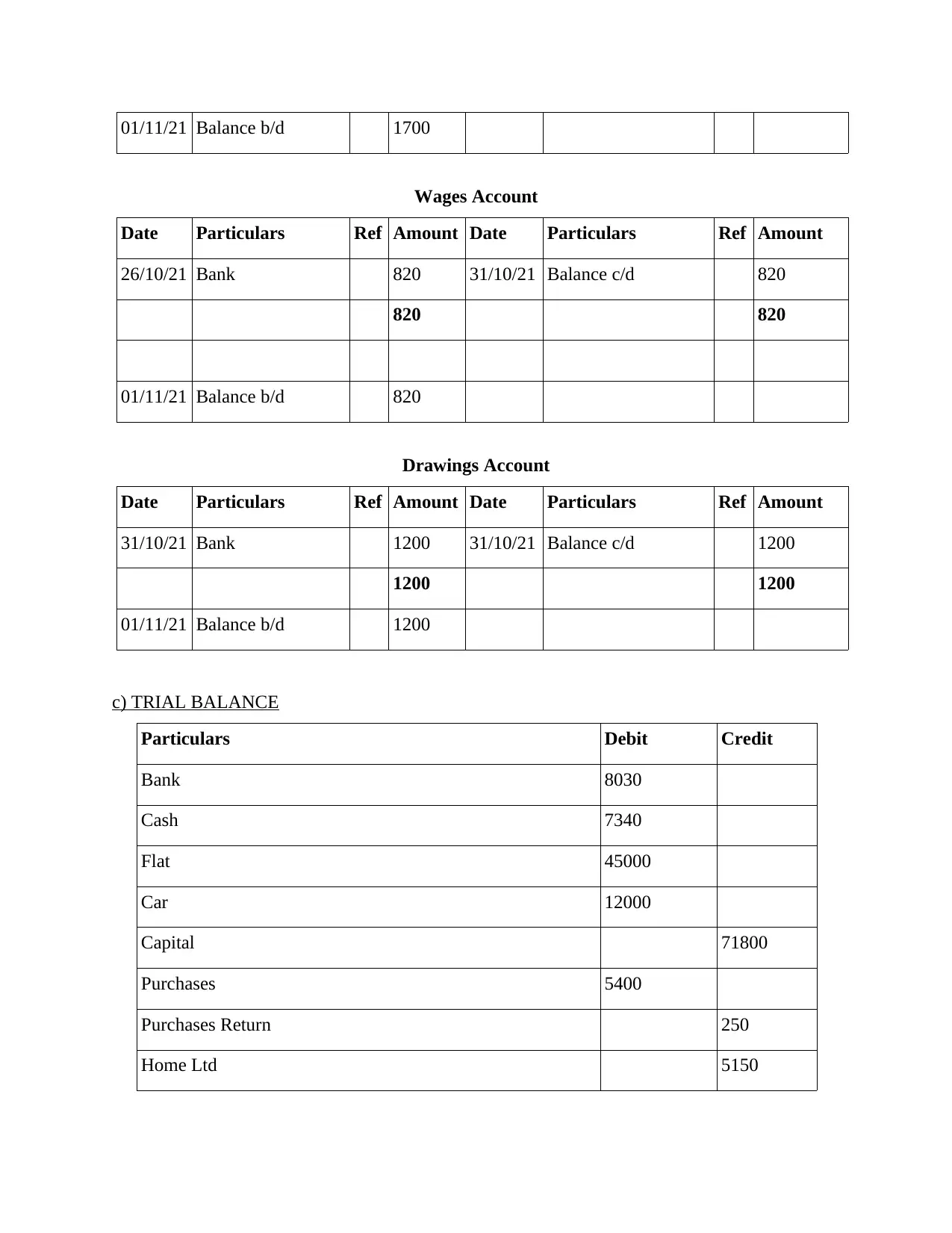

Wages Account

Date Particulars Ref Amount Date Particulars Ref Amount

26/10/21 Bank 820 31/10/21 Balance c/d 820

820 820

01/11/21 Balance b/d 820

Drawings Account

Date Particulars Ref Amount Date Particulars Ref Amount

31/10/21 Bank 1200 31/10/21 Balance c/d 1200

1200 1200

01/11/21 Balance b/d 1200

c) TRIAL BALANCE

Particulars Debit Credit

Bank 8030

Cash 7340

Flat 45000

Car 12000

Capital 71800

Purchases 5400

Purchases Return 250

Home Ltd 5150

Wages Account

Date Particulars Ref Amount Date Particulars Ref Amount

26/10/21 Bank 820 31/10/21 Balance c/d 820

820 820

01/11/21 Balance b/d 820

Drawings Account

Date Particulars Ref Amount Date Particulars Ref Amount

31/10/21 Bank 1200 31/10/21 Balance c/d 1200

1200 1200

01/11/21 Balance b/d 1200

c) TRIAL BALANCE

Particulars Debit Credit

Bank 8030

Cash 7340

Flat 45000

Car 12000

Capital 71800

Purchases 5400

Purchases Return 250

Home Ltd 5150

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Computer 800

Printer 200

Repair Expenses 110

Rent Expense 850

Rent Income 800

Rayan 150

Laptop 1700

Wages 820

Drawings 1200

Sales 5600

TOTALS 82800 82800

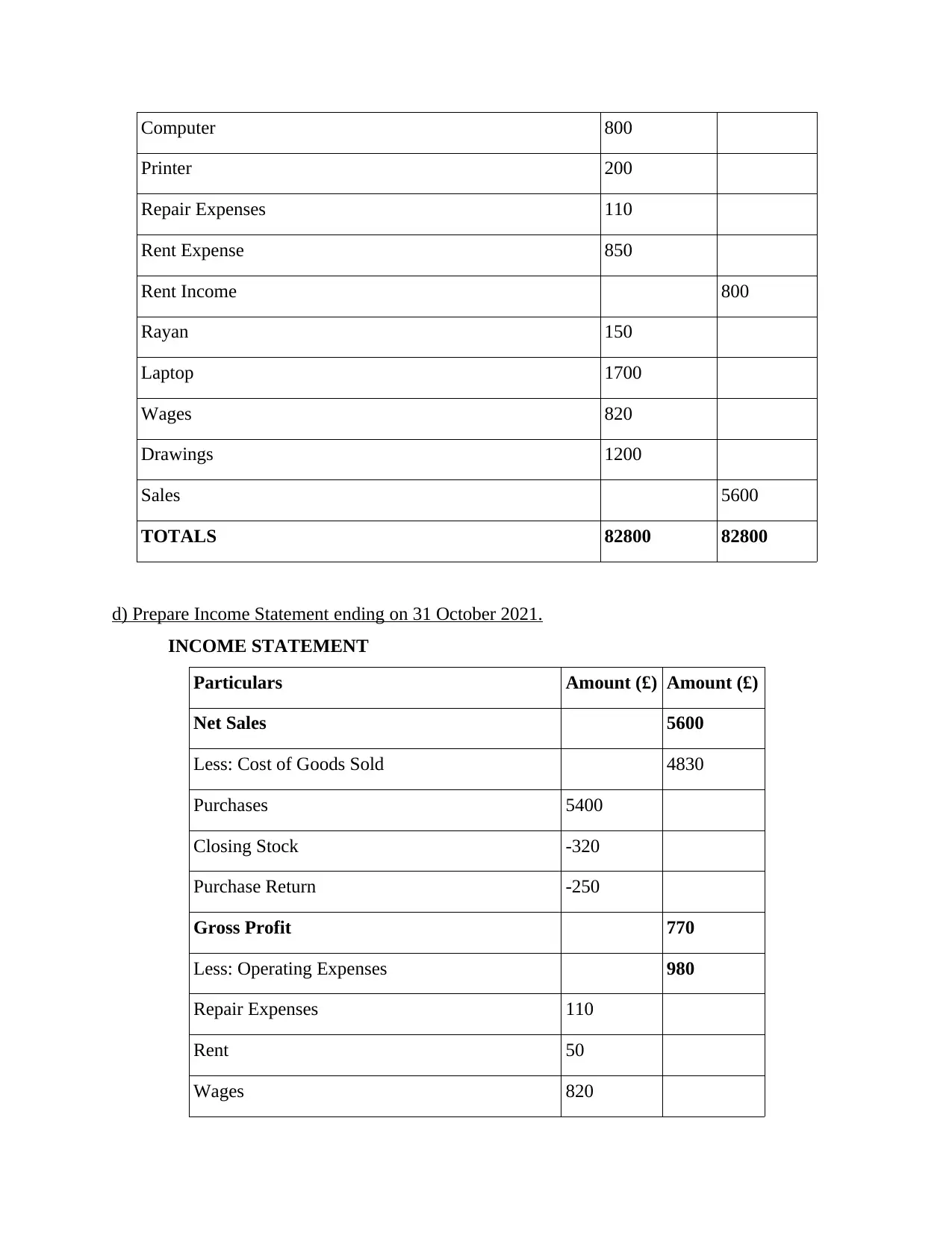

d) Prepare Income Statement ending on 31 October 2021.

INCOME STATEMENT

Particulars Amount (£) Amount (£)

Net Sales 5600

Less: Cost of Goods Sold 4830

Purchases 5400

Closing Stock -320

Purchase Return -250

Gross Profit 770

Less: Operating Expenses 980

Repair Expenses 110

Rent 50

Wages 820

Printer 200

Repair Expenses 110

Rent Expense 850

Rent Income 800

Rayan 150

Laptop 1700

Wages 820

Drawings 1200

Sales 5600

TOTALS 82800 82800

d) Prepare Income Statement ending on 31 October 2021.

INCOME STATEMENT

Particulars Amount (£) Amount (£)

Net Sales 5600

Less: Cost of Goods Sold 4830

Purchases 5400

Closing Stock -320

Purchase Return -250

Gross Profit 770

Less: Operating Expenses 980

Repair Expenses 110

Rent 50

Wages 820

Net Loss 210

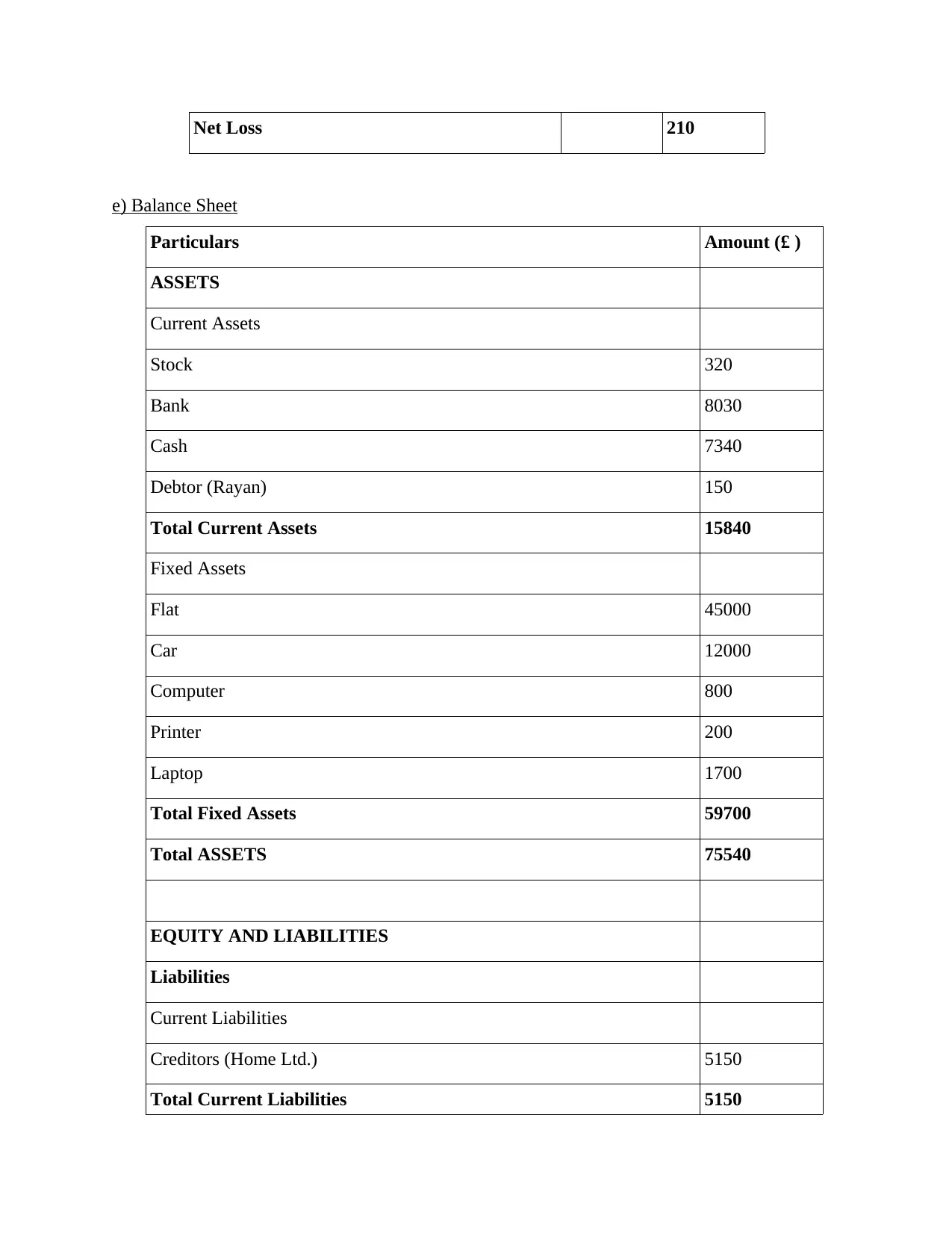

e) Balance Sheet

Particulars Amount (£ )

ASSETS

Current Assets

Stock 320

Bank 8030

Cash 7340

Debtor (Rayan) 150

Total Current Assets 15840

Fixed Assets

Flat 45000

Car 12000

Computer 800

Printer 200

Laptop 1700

Total Fixed Assets 59700

Total ASSETS 75540

EQUITY AND LIABILITIES

Liabilities

Current Liabilities

Creditors (Home Ltd.) 5150

Total Current Liabilities 5150

e) Balance Sheet

Particulars Amount (£ )

ASSETS

Current Assets

Stock 320

Bank 8030

Cash 7340

Debtor (Rayan) 150

Total Current Assets 15840

Fixed Assets

Flat 45000

Car 12000

Computer 800

Printer 200

Laptop 1700

Total Fixed Assets 59700

Total ASSETS 75540

EQUITY AND LIABILITIES

Liabilities

Current Liabilities

Creditors (Home Ltd.) 5150

Total Current Liabilities 5150

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.