Balance Scorecard Application: Management Accounting Report, Analysis

VerifiedAdded on 2021/05/31

|16

|3934

|20

Report

AI Summary

This report delves into the Balance Scorecard (BSC), a strategic performance management tool, exploring its features and application to Apple Inc. It begins with an introduction to the BSC, its characteristics, and its four perspectives: financial, customer, internal process, and learning and growth. The report then provides a detailed description of Apple Inc., including its vision, mission, and financial performance. Furthermore, it analyzes the features of the BSC, such as its focus on cause-and-effect relationships, financial evaluation, and customer perception. The report also highlights the differences between the BSC and traditional performance measurement systems, emphasizing the shift from a mass production era to a knowledge-based era. Finally, it concludes that the BSC is a suitable strategic tool for measuring Apple Inc.'s performance, enabling the company to evaluate its business performance based on its strategic goals. The report includes references to support the analysis and conclusions drawn.

RUNNING HEAD: MANAGEMENT ACCOUNTING

Balance scorecard

Balance scorecard

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Management accounting 1

Contents

Introduction................................................................................................................................2

Part A.........................................................................................................................................2

Client’s description.................................................................................................................2

Part B..........................................................................................................................................4

Balance Scorecard and its features.........................................................................................4

Part C..........................................................................................................................................8

Difference between BSC and traditional approaches.............................................................8

Part D.......................................................................................................................................11

Suitability of BSC to the client.............................................................................................11

Conclusion................................................................................................................................13

References................................................................................................................................14

Contents

Introduction................................................................................................................................2

Part A.........................................................................................................................................2

Client’s description.................................................................................................................2

Part B..........................................................................................................................................4

Balance Scorecard and its features.........................................................................................4

Part C..........................................................................................................................................8

Difference between BSC and traditional approaches.............................................................8

Part D.......................................................................................................................................11

Suitability of BSC to the client.............................................................................................11

Conclusion................................................................................................................................13

References................................................................................................................................14

Management accounting 2

Introduction

This report contains detail information about the balance scorecard approach and its features.

It clearly provides the introduction about the BSC approach and its characteristics. It says that

the BSC uses four perspectives to measure the performance of an organization. It has unique

features and is bit different from the traditional performance measurement systems. The

report also deals with the difference between the new balance scorecard approach and the

earlier or traditional systems used for measuring the performance.

Along with the above points, a description about the company is also provided which has

used BSC and for which this approach will be suitable. Apple Inc. Is been chosen as a client

of the management consultancy firm and its description is provided in the report. In the later

part, the suitability of Balance Scorecard for the client company is been discussed followed

by a conclusion. The last part of the report concludes that the BSC approach is the most

appropriate strategic tool for measuring the performance of a company. Also it is best

suitable to the Apple Inc as it allows the company to evaluate its business performance on the

basis of its strategic goals.

Part A

Client’s description

Apple Inc. is a multinational technology company operating its business in California. The

company develops and designs the customer electronics, software and online services. It also

deals in designing hardware products which includes iPhone mobile, tablets and Mac

personal computers. The other key products and services are iPod, iPad, Apple watch, Apple

TV, iTunes store, Apple play, iCloud, iBooks store and many more (Apple. 2018).

The company was founded by Steve Jobs, Steve Wozniak and Ronald Wayne in 1967 and

later it was developed as Apple Computer Inc. in 1977. The company started its business by

Introduction

This report contains detail information about the balance scorecard approach and its features.

It clearly provides the introduction about the BSC approach and its characteristics. It says that

the BSC uses four perspectives to measure the performance of an organization. It has unique

features and is bit different from the traditional performance measurement systems. The

report also deals with the difference between the new balance scorecard approach and the

earlier or traditional systems used for measuring the performance.

Along with the above points, a description about the company is also provided which has

used BSC and for which this approach will be suitable. Apple Inc. Is been chosen as a client

of the management consultancy firm and its description is provided in the report. In the later

part, the suitability of Balance Scorecard for the client company is been discussed followed

by a conclusion. The last part of the report concludes that the BSC approach is the most

appropriate strategic tool for measuring the performance of a company. Also it is best

suitable to the Apple Inc as it allows the company to evaluate its business performance on the

basis of its strategic goals.

Part A

Client’s description

Apple Inc. is a multinational technology company operating its business in California. The

company develops and designs the customer electronics, software and online services. It also

deals in designing hardware products which includes iPhone mobile, tablets and Mac

personal computers. The other key products and services are iPod, iPad, Apple watch, Apple

TV, iTunes store, Apple play, iCloud, iBooks store and many more (Apple. 2018).

The company was founded by Steve Jobs, Steve Wozniak and Ronald Wayne in 1967 and

later it was developed as Apple Computer Inc. in 1977. The company started its business by

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Management accounting 3

selling the personal computers. Later the founders hired a staff for designing and developing

the computers. Apple got public in 1980 and enjoyed an instant financial success. After

facing so many difficulties due to the high pricing of products, the company launched its own

store in 2001 in order to bring back the status of the enterprise. In 2001, Apple has made

various acquisitions of software companies and had also changed some hardware of its

computers. This resulted in the success and the profitability is again returned to the company.

In 2007, Apple Computer was renamed AS Apple Inc. and in 2011, company appointed Tim

Cook as the new CEO. Currently, Apple is the largest information technology in the world in

respect of revenue and the second largest in the list of mobile manufacturer after Samsung.

The company has almost over 123,000 full time employees and 499 retail stores across 22

countries, as reported on December 2017 (Reuters.com. 2018).

Vision

The vision of the company is to make great products with innovating technologies. The

company believes in keeping things simple and is focused to control the primary technology

used by it in its production. The vision statement of the company also deals with the fact that

it must participate in those market segments where they can make a significant contribution.

The company urges to work with pure honesty and due diligence (Forbes.com. 2012).

Mission

The recent mission statement delivered by the CEO of Apple stated that the company’s

mission is to design Macs, the best personal computers in the world including OS X, iWork

and professional software. The iPad and iTunes online store has bring a revolution in the

world of digital music. Apple focused on redefining the future of mobile media and

computing devices (Business Insider. 2013).

selling the personal computers. Later the founders hired a staff for designing and developing

the computers. Apple got public in 1980 and enjoyed an instant financial success. After

facing so many difficulties due to the high pricing of products, the company launched its own

store in 2001 in order to bring back the status of the enterprise. In 2001, Apple has made

various acquisitions of software companies and had also changed some hardware of its

computers. This resulted in the success and the profitability is again returned to the company.

In 2007, Apple Computer was renamed AS Apple Inc. and in 2011, company appointed Tim

Cook as the new CEO. Currently, Apple is the largest information technology in the world in

respect of revenue and the second largest in the list of mobile manufacturer after Samsung.

The company has almost over 123,000 full time employees and 499 retail stores across 22

countries, as reported on December 2017 (Reuters.com. 2018).

Vision

The vision of the company is to make great products with innovating technologies. The

company believes in keeping things simple and is focused to control the primary technology

used by it in its production. The vision statement of the company also deals with the fact that

it must participate in those market segments where they can make a significant contribution.

The company urges to work with pure honesty and due diligence (Forbes.com. 2012).

Mission

The recent mission statement delivered by the CEO of Apple stated that the company’s

mission is to design Macs, the best personal computers in the world including OS X, iWork

and professional software. The iPad and iTunes online store has bring a revolution in the

world of digital music. Apple focused on redefining the future of mobile media and

computing devices (Business Insider. 2013).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Management accounting 4

During the year 2017, the company earned a revenue of $229 billion and a net income of

$48.351 billion. The company has a high brand loyalty and is constant ranked as the world’s

most valuable brand. The products of the company are sold at higher prices to maintain the

competitiveness of the company among its competitors and within the industry in which it

operates. The company make its users to pay for purchases in stores by accepting contactless

payments. Also the Apple Pay accepts the debit and credit cards across the major networks in

the world. It also offers AirPod and wireless headphone that communicate with Siri

(Bloomberg.com. 2018).

Part B

Balance Scorecard and its features

A strategy performance management tool used by the organizations to keep a track record of

the activities executed by the staff and employees. This is done to establish a control within

the organizations and to monitor the consequences of these activities. In other words, it is

explained as a performance metric used in strategic management in order to improve and

identify several internal controls and their related outcomes. The balance scorecard approach

was first given by Dr. Robert Kaplan and Dr. David Norton, which was published in a

Harvard Business Review article in year 1992 (Biazzo and Garengo, 2012).

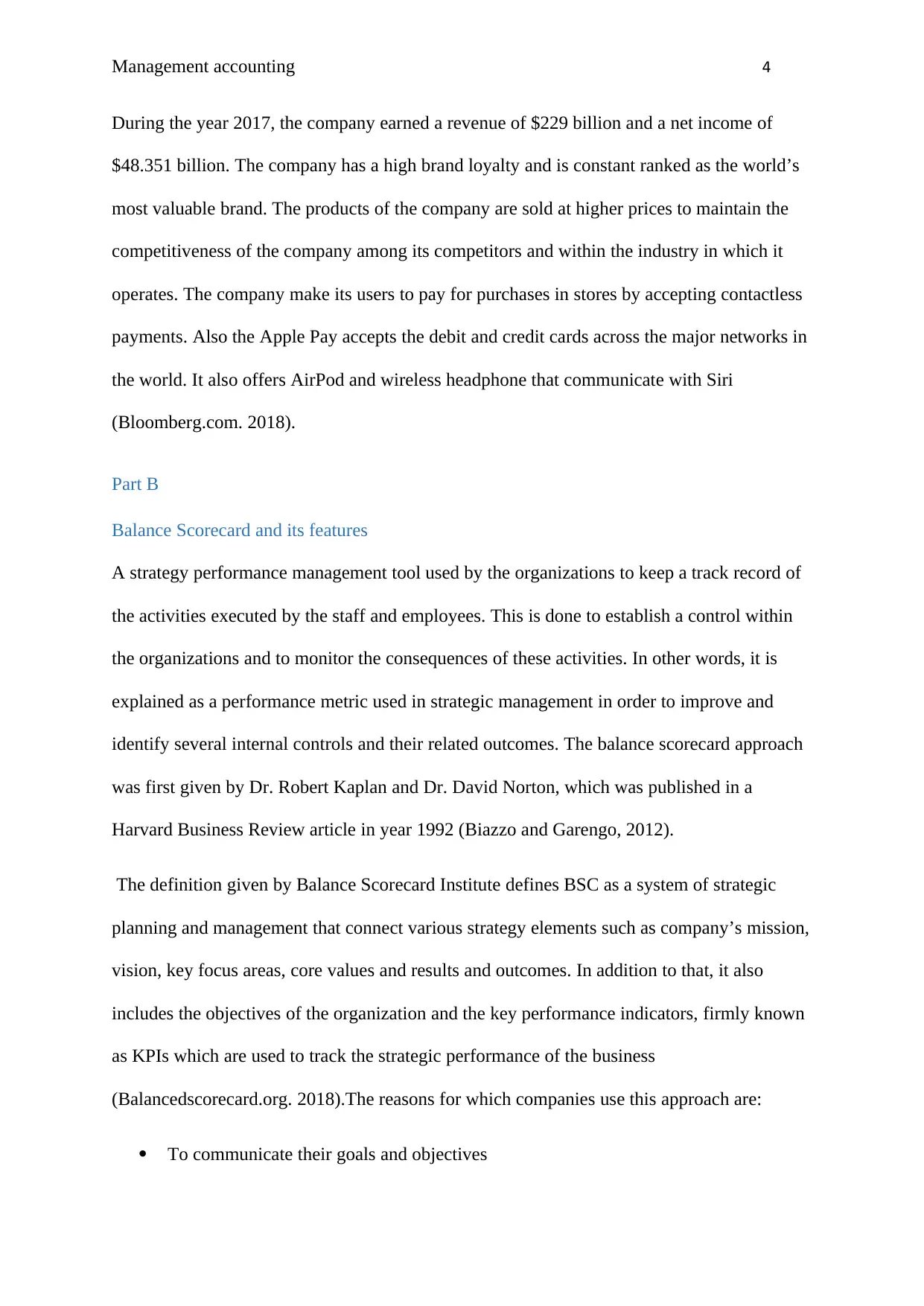

The definition given by Balance Scorecard Institute defines BSC as a system of strategic

planning and management that connect various strategy elements such as company’s mission,

vision, key focus areas, core values and results and outcomes. In addition to that, it also

includes the objectives of the organization and the key performance indicators, firmly known

as KPIs which are used to track the strategic performance of the business

(Balancedscorecard.org. 2018).The reasons for which companies use this approach are:

To communicate their goals and objectives

During the year 2017, the company earned a revenue of $229 billion and a net income of

$48.351 billion. The company has a high brand loyalty and is constant ranked as the world’s

most valuable brand. The products of the company are sold at higher prices to maintain the

competitiveness of the company among its competitors and within the industry in which it

operates. The company make its users to pay for purchases in stores by accepting contactless

payments. Also the Apple Pay accepts the debit and credit cards across the major networks in

the world. It also offers AirPod and wireless headphone that communicate with Siri

(Bloomberg.com. 2018).

Part B

Balance Scorecard and its features

A strategy performance management tool used by the organizations to keep a track record of

the activities executed by the staff and employees. This is done to establish a control within

the organizations and to monitor the consequences of these activities. In other words, it is

explained as a performance metric used in strategic management in order to improve and

identify several internal controls and their related outcomes. The balance scorecard approach

was first given by Dr. Robert Kaplan and Dr. David Norton, which was published in a

Harvard Business Review article in year 1992 (Biazzo and Garengo, 2012).

The definition given by Balance Scorecard Institute defines BSC as a system of strategic

planning and management that connect various strategy elements such as company’s mission,

vision, key focus areas, core values and results and outcomes. In addition to that, it also

includes the objectives of the organization and the key performance indicators, firmly known

as KPIs which are used to track the strategic performance of the business

(Balancedscorecard.org. 2018).The reasons for which companies use this approach are:

To communicate their goals and objectives

Management accounting 5

To coordinate the daily operations with the strategic motives

Giving priorities to the projects, products, and services

To measure and monitor the overall performance on the basis of set targets

(Hannabarger, Buchman and Economy, 2011).

(Balancedscorecard.org. 2018).

The approach of BSC is used in almost every business, industry, government, and non-

government organizations and also in non-profit entities. A research suggested that in USA,

over 50% of the companies has used or adopted BSC in their business. In addition to this,

major companies of Asia, US and Europe are using BSC and as per the global study done by

Bain & Co., balance scored is listed on fifth in the list of top ten mostly and widely used

management tools in the world. Also, Harvard Business Review selected this tool as the most

influential business ideas of the past 75 years (Niven, 2010).

Terminology or perspectives of BSC

To coordinate the daily operations with the strategic motives

Giving priorities to the projects, products, and services

To measure and monitor the overall performance on the basis of set targets

(Hannabarger, Buchman and Economy, 2011).

(Balancedscorecard.org. 2018).

The approach of BSC is used in almost every business, industry, government, and non-

government organizations and also in non-profit entities. A research suggested that in USA,

over 50% of the companies has used or adopted BSC in their business. In addition to this,

major companies of Asia, US and Europe are using BSC and as per the global study done by

Bain & Co., balance scored is listed on fifth in the list of top ten mostly and widely used

management tools in the world. Also, Harvard Business Review selected this tool as the most

influential business ideas of the past 75 years (Niven, 2010).

Terminology or perspectives of BSC

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Management accounting 6

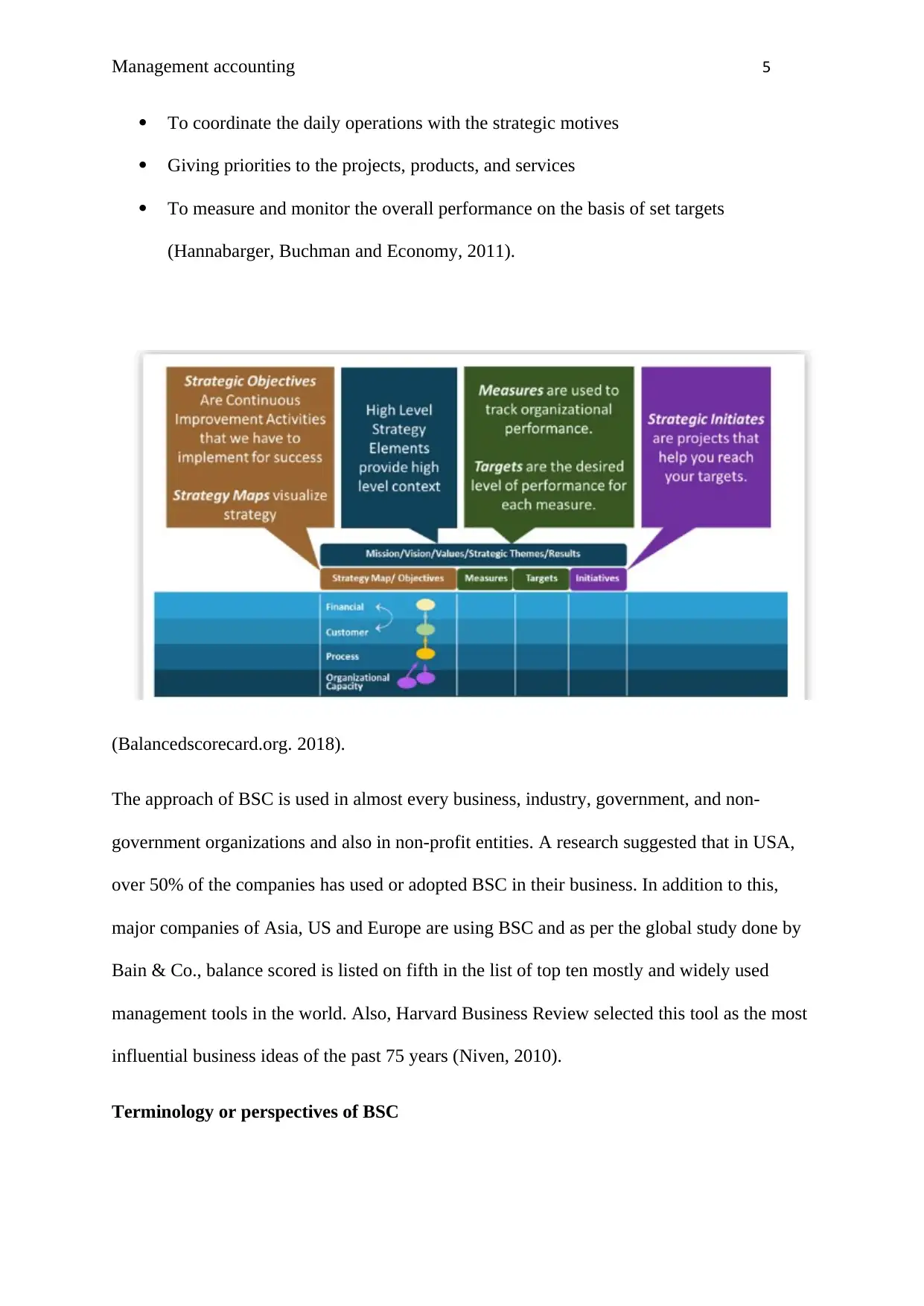

The BSC approach suggest that the organization is view from the four major perspectives

which covers all the aspects of the organization. These terminologies are used to develop

objectives, measures and initiatives (Pham-Gia, 2009).

The above perspectives are defined as follows:

Financial

This perspective views the financial performance of a company or an organization. It uses

financial measures such as net profit and return on investment, which are been used by almost

every entity to measure their financial performance. Mangers are required to keep the data up

to date and provide correct financial information on time. In order to reduce the cost data,

appropriate corporate systems must be employed and should derive that financial data which

can be used for making forecasts (Joshi, et. al., 2015).

Customer

The BSC approach suggest that the organization is view from the four major perspectives

which covers all the aspects of the organization. These terminologies are used to develop

objectives, measures and initiatives (Pham-Gia, 2009).

The above perspectives are defined as follows:

Financial

This perspective views the financial performance of a company or an organization. It uses

financial measures such as net profit and return on investment, which are been used by almost

every entity to measure their financial performance. Mangers are required to keep the data up

to date and provide correct financial information on time. In order to reduce the cost data,

appropriate corporate systems must be employed and should derive that financial data which

can be used for making forecasts (Joshi, et. al., 2015).

Customer

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Management accounting 7

Under this perspective, the performance of a company is measured through the standpoint of

customers and other stake holders, whose the organization is serving. This terminology

require the managers to identify the targeted customers and markets in which the business

will compete. It includes several core and strategic outcome measures deriving from a well

implemented strategy. These outcomes include customer satisfaction, retention, profitability

and the market share in targeted segments (Nair, 2004).

Internal Process

This perspective deals with measuring the entity’s performance through the eyes of quality

and efficiency of the products and services offered by the organization. This will help in

attracting and retaining the customers in targeted markets and satisfying the stakeholders’

expectations. Management must focus on producing reliable and consistent products as well

as control all the inputs in order to enhance and maintain a high performance (Pramudita,

2016).

Learning and Growth

It takes into account the human capital, culture, capacity, technology and infrastructure that

stimulates the outstanding performance. The key measures used under this perspective are

employee satisfaction, retention and productivity (Keyes, 2016).

Features of BSC

Following are the features or characteristics of BSC:

BSC focuses on a cause-and-effect relationship that truly highlights business strategy.

The most traditional feature of BSC is financial evaluation which makes it more

important and useful for the organizations. The feature includes measures lie return on

equity, net profit and return on assets.

Under this perspective, the performance of a company is measured through the standpoint of

customers and other stake holders, whose the organization is serving. This terminology

require the managers to identify the targeted customers and markets in which the business

will compete. It includes several core and strategic outcome measures deriving from a well

implemented strategy. These outcomes include customer satisfaction, retention, profitability

and the market share in targeted segments (Nair, 2004).

Internal Process

This perspective deals with measuring the entity’s performance through the eyes of quality

and efficiency of the products and services offered by the organization. This will help in

attracting and retaining the customers in targeted markets and satisfying the stakeholders’

expectations. Management must focus on producing reliable and consistent products as well

as control all the inputs in order to enhance and maintain a high performance (Pramudita,

2016).

Learning and Growth

It takes into account the human capital, culture, capacity, technology and infrastructure that

stimulates the outstanding performance. The key measures used under this perspective are

employee satisfaction, retention and productivity (Keyes, 2016).

Features of BSC

Following are the features or characteristics of BSC:

BSC focuses on a cause-and-effect relationship that truly highlights business strategy.

The most traditional feature of BSC is financial evaluation which makes it more

important and useful for the organizations. The feature includes measures lie return on

equity, net profit and return on assets.

Management accounting 8

BSC is able to determine and evaluate the perception of customers. It allows the

companies to understand their business from customers’ point of view.

It has clear perspectives and objectives.

It allows the management to have a full administrative control on the organisation

Data collection become easy ((Monden, Imai and Matsuo eds. 2012).

Part C

Difference between BSC and traditional approaches

Due to the variances in the traditional performance measurement systems, the need for

introducing a balance scorecard approach arises. There were many issues identified in the

earlier existing systems which eventually do not help the companies in achieving their

strategic objectives and goals. Earlier a Procurement Executives ‘Association (PEA) created

the Performance Measurement Action Team (PMAT) which observed that many companies

uses top-down approach to measure their actions in compliance with the standard process.

The approach was also used for certifying the adequacy of the acquisition system used.

BSC is able to determine and evaluate the perception of customers. It allows the

companies to understand their business from customers’ point of view.

It has clear perspectives and objectives.

It allows the management to have a full administrative control on the organisation

Data collection become easy ((Monden, Imai and Matsuo eds. 2012).

Part C

Difference between BSC and traditional approaches

Due to the variances in the traditional performance measurement systems, the need for

introducing a balance scorecard approach arises. There were many issues identified in the

earlier existing systems which eventually do not help the companies in achieving their

strategic objectives and goals. Earlier a Procurement Executives ‘Association (PEA) created

the Performance Measurement Action Team (PMAT) which observed that many companies

uses top-down approach to measure their actions in compliance with the standard process.

The approach was also used for certifying the adequacy of the acquisition system used.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Management accounting 9

However, this method was not paying more emphasis on the outcomes of the process and was

highly ineffective in obtaining the desired improvements in the quality of the operations.

In order to deal with such issues, balance scorecard was introduced and is now widely used

by almost every organization around the world. There are lot of differences between the

traditional performance measurement systems and new BSC approach. Existing systems

tracks only the financial performance of a company covering the aspects related to the profits

earned and capital required. They exclusively focus on the financial metrics such as

profitability, earnings per share, return on assets, cash flow and many other which are

mentioned in the internal annual reports of an organization. These measures or metrics are

known as lag indicators because they only show the historical data and performance. They

can only control the internal performance of an entity and may result in appropriate decisions

in long term (Griff, 2014).

The approach followed by traditional systems enable the managers to focus only on the

financial aspects and ignore the benefit of creating long term value for the organization. In

addition to this, these systems are designed and used in the industries, having companies that

were mass production based with many tangible assets such as property, plant and equipment.

In such cases, measuring the financial performance on the basis of historical facts and figures

was sufficient.

Another difference is that traditional performance measurement systems were not aligned

with the organizational strategies. These strategies contains the long term objectives and

scope of the organization. Along with this it also includes allocation of resources according to

business needs and taking into account the shareholders’ value and expectations. These

systems focuses on short term financial performance and does not purely align company’s

However, this method was not paying more emphasis on the outcomes of the process and was

highly ineffective in obtaining the desired improvements in the quality of the operations.

In order to deal with such issues, balance scorecard was introduced and is now widely used

by almost every organization around the world. There are lot of differences between the

traditional performance measurement systems and new BSC approach. Existing systems

tracks only the financial performance of a company covering the aspects related to the profits

earned and capital required. They exclusively focus on the financial metrics such as

profitability, earnings per share, return on assets, cash flow and many other which are

mentioned in the internal annual reports of an organization. These measures or metrics are

known as lag indicators because they only show the historical data and performance. They

can only control the internal performance of an entity and may result in appropriate decisions

in long term (Griff, 2014).

The approach followed by traditional systems enable the managers to focus only on the

financial aspects and ignore the benefit of creating long term value for the organization. In

addition to this, these systems are designed and used in the industries, having companies that

were mass production based with many tangible assets such as property, plant and equipment.

In such cases, measuring the financial performance on the basis of historical facts and figures

was sufficient.

Another difference is that traditional performance measurement systems were not aligned

with the organizational strategies. These strategies contains the long term objectives and

scope of the organization. Along with this it also includes allocation of resources according to

business needs and taking into account the shareholders’ value and expectations. These

systems focuses on short term financial performance and does not purely align company’s

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Management accounting 10

long term goals with its immediate actions. Due to such differences, the traditional systems

are not suitable in the today’s dynamic environment (Suri, Ratnam and Gupta, 2004).

However, now in modern business world, companies are shifting their base from mass

production era to knowledge based era. This makes them to not only rely or focus on the

measurement of tangible assets but also take into account the value of intangible assets such

as customer relationship, intellectual capital, human resources and many others. In order to

do this, they require an introduction of a new performance measurement system which allows

them to measure the quantities and qualitative aspects of their business and helps them in

achieving the strategic goals of the organization. This resulted in the adoption of new

measurement system named as Balance Scorecard.

The BSC approach eliminates the weaknesses of traditional systems and focuses on both the

financial and non-financial factors of an organization. It takes into account the qualitative

metrics also like customer satisfaction, shareholders’ expectations and many more along with

the quantitative metrics. Unlike traditional systems, BSC addresses the changes in the modern

business world by considering the values of intangible assets (Hoag and Cooper, 2006).

BSC complies with strategies of the companies completely. It aligns the business activities

with the corporate strategies by measuring the business performance on the basis of strategic

goals. It measures the performance on the basis of its four perspectives named as Financial,

customer, learning and growth and internal business perspective. By using these criteria, BSC

helps the company to take appropriate strategic decisions for their organization. It includes

both the lag and lead indicators in its four perspectives and parameters and align the

enterprise’s day to day objectives with its key strategic objectives (Ashioya, 2015).

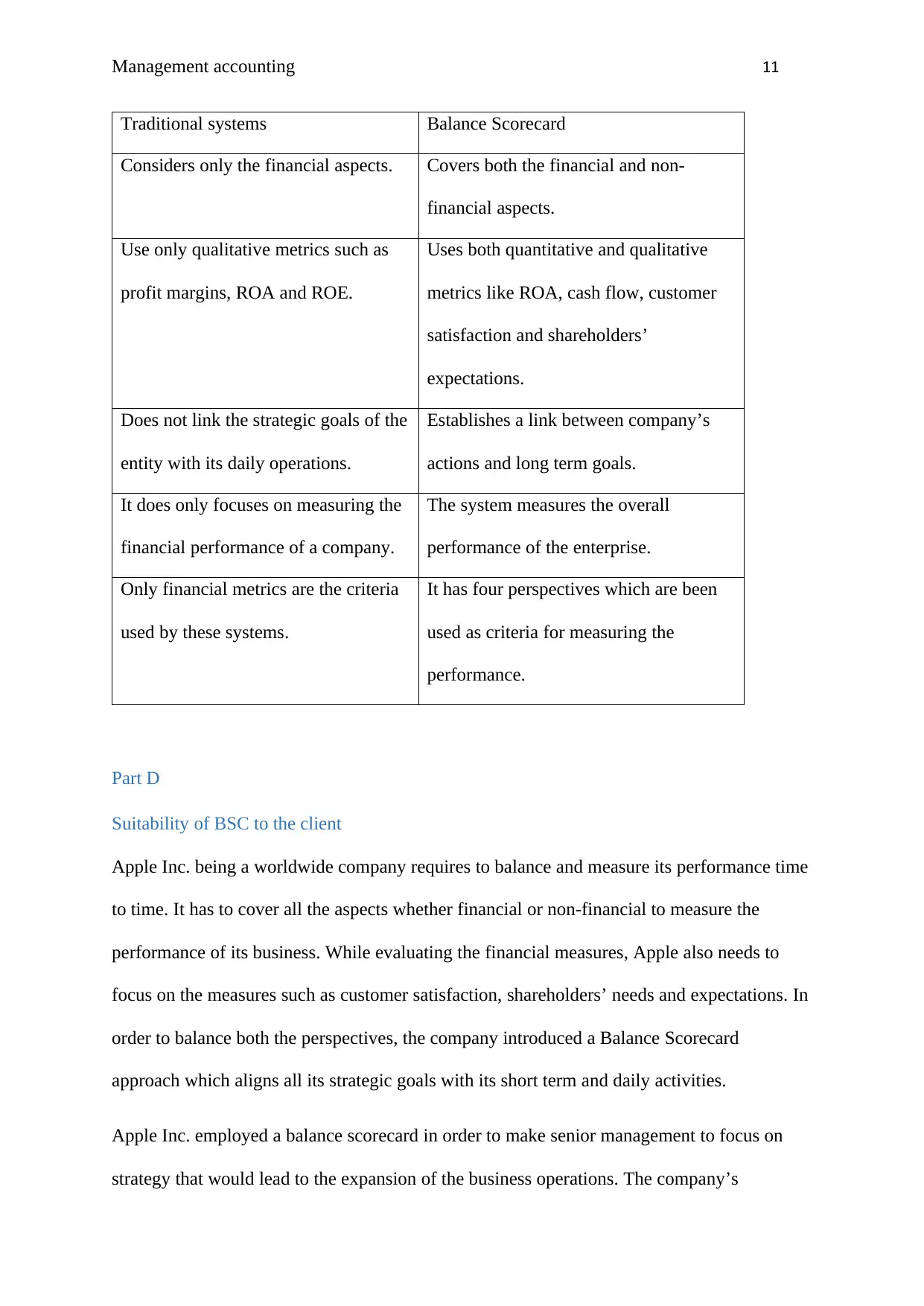

A tabular difference between the two is as follows:

long term goals with its immediate actions. Due to such differences, the traditional systems

are not suitable in the today’s dynamic environment (Suri, Ratnam and Gupta, 2004).

However, now in modern business world, companies are shifting their base from mass

production era to knowledge based era. This makes them to not only rely or focus on the

measurement of tangible assets but also take into account the value of intangible assets such

as customer relationship, intellectual capital, human resources and many others. In order to

do this, they require an introduction of a new performance measurement system which allows

them to measure the quantities and qualitative aspects of their business and helps them in

achieving the strategic goals of the organization. This resulted in the adoption of new

measurement system named as Balance Scorecard.

The BSC approach eliminates the weaknesses of traditional systems and focuses on both the

financial and non-financial factors of an organization. It takes into account the qualitative

metrics also like customer satisfaction, shareholders’ expectations and many more along with

the quantitative metrics. Unlike traditional systems, BSC addresses the changes in the modern

business world by considering the values of intangible assets (Hoag and Cooper, 2006).

BSC complies with strategies of the companies completely. It aligns the business activities

with the corporate strategies by measuring the business performance on the basis of strategic

goals. It measures the performance on the basis of its four perspectives named as Financial,

customer, learning and growth and internal business perspective. By using these criteria, BSC

helps the company to take appropriate strategic decisions for their organization. It includes

both the lag and lead indicators in its four perspectives and parameters and align the

enterprise’s day to day objectives with its key strategic objectives (Ashioya, 2015).

A tabular difference between the two is as follows:

Management accounting 11

Traditional systems Balance Scorecard

Considers only the financial aspects. Covers both the financial and non-

financial aspects.

Use only qualitative metrics such as

profit margins, ROA and ROE.

Uses both quantitative and qualitative

metrics like ROA, cash flow, customer

satisfaction and shareholders’

expectations.

Does not link the strategic goals of the

entity with its daily operations.

Establishes a link between company’s

actions and long term goals.

It does only focuses on measuring the

financial performance of a company.

The system measures the overall

performance of the enterprise.

Only financial metrics are the criteria

used by these systems.

It has four perspectives which are been

used as criteria for measuring the

performance.

Part D

Suitability of BSC to the client

Apple Inc. being a worldwide company requires to balance and measure its performance time

to time. It has to cover all the aspects whether financial or non-financial to measure the

performance of its business. While evaluating the financial measures, Apple also needs to

focus on the measures such as customer satisfaction, shareholders’ needs and expectations. In

order to balance both the perspectives, the company introduced a Balance Scorecard

approach which aligns all its strategic goals with its short term and daily activities.

Apple Inc. employed a balance scorecard in order to make senior management to focus on

strategy that would lead to the expansion of the business operations. The company’s

Traditional systems Balance Scorecard

Considers only the financial aspects. Covers both the financial and non-

financial aspects.

Use only qualitative metrics such as

profit margins, ROA and ROE.

Uses both quantitative and qualitative

metrics like ROA, cash flow, customer

satisfaction and shareholders’

expectations.

Does not link the strategic goals of the

entity with its daily operations.

Establishes a link between company’s

actions and long term goals.

It does only focuses on measuring the

financial performance of a company.

The system measures the overall

performance of the enterprise.

Only financial metrics are the criteria

used by these systems.

It has four perspectives which are been

used as criteria for measuring the

performance.

Part D

Suitability of BSC to the client

Apple Inc. being a worldwide company requires to balance and measure its performance time

to time. It has to cover all the aspects whether financial or non-financial to measure the

performance of its business. While evaluating the financial measures, Apple also needs to

focus on the measures such as customer satisfaction, shareholders’ needs and expectations. In

order to balance both the perspectives, the company introduced a Balance Scorecard

approach which aligns all its strategic goals with its short term and daily activities.

Apple Inc. employed a balance scorecard in order to make senior management to focus on

strategy that would lead to the expansion of the business operations. The company’s

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.