Financial Resources and Analysis: Belgravia Hotels Hospitality

VerifiedAdded on 2020/07/22

|21

|4816

|28

Report

AI Summary

This report provides a comprehensive financial analysis of Belgravia Hotels within the hospitality industry. It begins by identifying various financial resources, both internal and external, that can assist the hotel. The report then evaluates the contribution of different methods in generating income. Task 2 focuses on cost and profit elements, exploring their influence on service pricing and analyzing stock control techniques. Task 3 assesses business performance through trial balance analysis, budgetary control, and variance analysis. Task 4 interprets business performance using ratio analysis and provides recommendations for future management strategies. Task 5 delves into cost determination, per-customer contribution measurement, and the application of break-even analysis for short-term decision-making. The report concludes with a synthesis of the findings and recommendations for improving financial management within Belgravia Hotels.

FINANCE IN THE

HOSPITALITY INDUSTRY

HOSPITALITY INDUSTRY

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................3

TASK 1............................................................................................................................................3

1.1 Identification of various financial resources which will be assistive to Belgravia Hotels....3

1.2 Evaluating the contribution of different methods in generating income...............................5

TASK 2............................................................................................................................................6

2.1 Ascertaining the adequate elements of costs and profits and their effective influences in

setting the prices over business services......................................................................................6

2.2 Analyzing the techniques to administered stock controlling and presenting methods for

costs and benefits.........................................................................................................................9

TASK 3..........................................................................................................................................10

3.1 Assessing the sources of business performance in relation with making the effective

analysis through trial balance....................................................................................................10

3.2 Evaluating business accounts adjustments and notes..........................................................11

3.3 Demonstrating the purpose and process of budgetary control.............................................11

3.4 Analyzing budgetary variances in the context of chosen organization...............................12

TASK 4..........................................................................................................................................12

4.1 Interpreting the business performance on the basis of ratio analysis..................................12

4.2 Recommendation on the basis of future management strategies helpful in improving

business performance.................................................................................................................14

1

INTRODUCTION...........................................................................................................................3

TASK 1............................................................................................................................................3

1.1 Identification of various financial resources which will be assistive to Belgravia Hotels....3

1.2 Evaluating the contribution of different methods in generating income...............................5

TASK 2............................................................................................................................................6

2.1 Ascertaining the adequate elements of costs and profits and their effective influences in

setting the prices over business services......................................................................................6

2.2 Analyzing the techniques to administered stock controlling and presenting methods for

costs and benefits.........................................................................................................................9

TASK 3..........................................................................................................................................10

3.1 Assessing the sources of business performance in relation with making the effective

analysis through trial balance....................................................................................................10

3.2 Evaluating business accounts adjustments and notes..........................................................11

3.3 Demonstrating the purpose and process of budgetary control.............................................11

3.4 Analyzing budgetary variances in the context of chosen organization...............................12

TASK 4..........................................................................................................................................12

4.1 Interpreting the business performance on the basis of ratio analysis..................................12

4.2 Recommendation on the basis of future management strategies helpful in improving

business performance.................................................................................................................14

1

TASK 5..........................................................................................................................................14

5.1 Determining the various kinds of costs...............................................................................14

5.2 Measuring the per customer or per product contribution which will be assistive in

analyzing the relationship between cost profit and volume.......................................................15

5.3 Determining the usefulness of break-even point and short-term decision making.............17

CONCLUSION..............................................................................................................................18

REFERENCES..............................................................................................................................19

2

5.1 Determining the various kinds of costs...............................................................................14

5.2 Measuring the per customer or per product contribution which will be assistive in

analyzing the relationship between cost profit and volume.......................................................15

5.3 Determining the usefulness of break-even point and short-term decision making.............17

CONCLUSION..............................................................................................................................18

REFERENCES..............................................................................................................................19

2

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

To have managed business operations as well as set targets this in turn will be effective

for the revenue generation as well as growth of the entity. Therefore, in relation with analyzing

the effectiveness of various budgetary and costing techniques the analysis over financial

statements of the business will be helpful to the managers in decisions making. In the present

assessment there will be analysis over the various operations made by Belgravia Hotels.

However, the study comprises with the various costing budgeting techniques which will be

assertive to the managers of this hospitality industry in terms of analyzing the prices over the

services. It also comprises with the discussion based on break-even point as well as the short

terms financing technique which will make improvements in the operational practices.

TASK 1

1.1 Identification of various financial resources which will be assistive to Belgravia Hotels

Operating a business on a domestic and global level there can be essential requirements

of the financial funding. There can be various sources which will bring the satisfactory amount

of gains to the Belgravia Hotels. Therefore, in a hospitality industry there are several

departments and each of them have the different level of funds required. It can be used for

purchasing material, maintaining accommodation or infrastructure facilities, salaries to

employees etc. which can be gathered from various sources (Sipe and Testa, 2018). Moreover,

the need of satisfactory capitals from the market there are various sources which will be assistive

such as:

Internal sources of finance:

These are the sources which helps the professionals of the business to gather the effective

amount of funds from the internally available sources. It will be through the revenue gained by

3

To have managed business operations as well as set targets this in turn will be effective

for the revenue generation as well as growth of the entity. Therefore, in relation with analyzing

the effectiveness of various budgetary and costing techniques the analysis over financial

statements of the business will be helpful to the managers in decisions making. In the present

assessment there will be analysis over the various operations made by Belgravia Hotels.

However, the study comprises with the various costing budgeting techniques which will be

assertive to the managers of this hospitality industry in terms of analyzing the prices over the

services. It also comprises with the discussion based on break-even point as well as the short

terms financing technique which will make improvements in the operational practices.

TASK 1

1.1 Identification of various financial resources which will be assistive to Belgravia Hotels

Operating a business on a domestic and global level there can be essential requirements

of the financial funding. There can be various sources which will bring the satisfactory amount

of gains to the Belgravia Hotels. Therefore, in a hospitality industry there are several

departments and each of them have the different level of funds required. It can be used for

purchasing material, maintaining accommodation or infrastructure facilities, salaries to

employees etc. which can be gathered from various sources (Sipe and Testa, 2018). Moreover,

the need of satisfactory capitals from the market there are various sources which will be assistive

such as:

Internal sources of finance:

These are the sources which helps the professionals of the business to gather the effective

amount of funds from the internally available sources. It will be through the revenue gained by

3

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

the business through its operations as well as the contribution made by the directors. Therefore,

the main advantage from collecting funds through internal sources is that there is no need of

making payment of any interest (Peters and Kallmuenzer, 2018). Similarly, Belgravia Hotels will

procure the funds through several sources such as:

Retained earnings: These are the profits which are generally retained by the developing

or growing corporations. It is the amount which is not being distributed by the professionals to

their members in the form of dividends (Pérez-Pineda, Alcaraz and Colón, 2017). Therefore, use

of such funds for the operational activities. In relation with the Belgravia Hotels it will be helpful

as if they will have the appropriate amount of earnings and utilize it in the operational

functioning of the entity.

Working capital management: These are the funds which are generally required for

daily operational activities of the business. Therefore, it can be used by the firm in terms of

making the day to day operations. There can be two sources of techniques which help in

gathering the funds such as sales and payments to creditors. It insists that Belgravia Hotels will

have adequate revenue gains from the sales of its services which will be beneficial in developing

the operational efficiency as well as bring the optimum amount of funds for the operations (Mun

and Jang, 2017). On the other side, it has been assumed that if the business makes delays in

making the payments to its creditors which will also be effective in retaining the funds.

Therefore, there can be use of various operational activities which in turn bring the adequate

amount of revenue to the professionals.

External sources of finance:

There can be use of various external sources which in turn makes effective gains to the

business. Therefore, the implications of various sources which will be helpful in retaining the

adequate amount of funds, but there are is major disadvantage is that with all the sources a

company is acquiring funds needs to make payments of the proportionate returns. Moreover, it

will be a revenue sources to the parties who makes their investments in the business or from

4

the main advantage from collecting funds through internal sources is that there is no need of

making payment of any interest (Peters and Kallmuenzer, 2018). Similarly, Belgravia Hotels will

procure the funds through several sources such as:

Retained earnings: These are the profits which are generally retained by the developing

or growing corporations. It is the amount which is not being distributed by the professionals to

their members in the form of dividends (Pérez-Pineda, Alcaraz and Colón, 2017). Therefore, use

of such funds for the operational activities. In relation with the Belgravia Hotels it will be helpful

as if they will have the appropriate amount of earnings and utilize it in the operational

functioning of the entity.

Working capital management: These are the funds which are generally required for

daily operational activities of the business. Therefore, it can be used by the firm in terms of

making the day to day operations. There can be two sources of techniques which help in

gathering the funds such as sales and payments to creditors. It insists that Belgravia Hotels will

have adequate revenue gains from the sales of its services which will be beneficial in developing

the operational efficiency as well as bring the optimum amount of funds for the operations (Mun

and Jang, 2017). On the other side, it has been assumed that if the business makes delays in

making the payments to its creditors which will also be effective in retaining the funds.

Therefore, there can be use of various operational activities which in turn bring the adequate

amount of revenue to the professionals.

External sources of finance:

There can be use of various external sources which in turn makes effective gains to the

business. Therefore, the implications of various sources which will be helpful in retaining the

adequate amount of funds, but there are is major disadvantage is that with all the sources a

company is acquiring funds needs to make payments of the proportionate returns. Moreover, it

will be a revenue sources to the parties who makes their investments in the business or from

4

whom the entity has acquired funds (Jung and Yoon, 2018). Similarly, Belgravia Hotels will

have satisfactory funds from the sources like:

Equity shares: These are the sources which will be beneficial to the industry in relation

with having large numbers of monetary benefits. Therefore, selling securities in market which

will bring higher market value of entity as well as it brings required amount of capital gains.

Additionally, the equity holders make investments in the firm in relation with attaining the

appropriate future gains in terms of dividends (Munjal and Bhushan, 2017). Therefore, Belgravia

Hotels has to make a satisfactory dividend policy which in turn brings effective satisfaction

among shareholders.

Loans: The desired level of funds will be obtained by the business as to have appropriate

gains from taking loans through banks and financial institutions (Ali, 2018). Therefore, they will

require the interest on loan till the loan amount ids fully payable by the business. Belgravia

Hotels will meet the requirements of funds from taking loans through banks and financial

institutions.

Governmental grants: Belgravia Hotels can have funds from the governmental grants for

the purpose of meeting the operational requirements. Therefore, these are the welfare institution

which helps in promoting the growing business to have appropriate business activities and

developed themselves (Arbelo and et.al., 2017). Moreover, these are the most effective and

satisfactory sources which will be helpful to the hospitality industry.

Sale of assets: the sale of non useful assets will be helpful in generating the appropriate

amount of funds. Therefore, Belgravia Hotels needs to sale the assets which are not in use or

have huge depreciable value (Sipe and Testa, 2018). Therefore, these are the assets which are

needed to be sold out in the market. In relation with the assets like land, building etc which will

be helpful in giving the bulk revenue to the business.

5

have satisfactory funds from the sources like:

Equity shares: These are the sources which will be beneficial to the industry in relation

with having large numbers of monetary benefits. Therefore, selling securities in market which

will bring higher market value of entity as well as it brings required amount of capital gains.

Additionally, the equity holders make investments in the firm in relation with attaining the

appropriate future gains in terms of dividends (Munjal and Bhushan, 2017). Therefore, Belgravia

Hotels has to make a satisfactory dividend policy which in turn brings effective satisfaction

among shareholders.

Loans: The desired level of funds will be obtained by the business as to have appropriate

gains from taking loans through banks and financial institutions (Ali, 2018). Therefore, they will

require the interest on loan till the loan amount ids fully payable by the business. Belgravia

Hotels will meet the requirements of funds from taking loans through banks and financial

institutions.

Governmental grants: Belgravia Hotels can have funds from the governmental grants for

the purpose of meeting the operational requirements. Therefore, these are the welfare institution

which helps in promoting the growing business to have appropriate business activities and

developed themselves (Arbelo and et.al., 2017). Moreover, these are the most effective and

satisfactory sources which will be helpful to the hospitality industry.

Sale of assets: the sale of non useful assets will be helpful in generating the appropriate

amount of funds. Therefore, Belgravia Hotels needs to sale the assets which are not in use or

have huge depreciable value (Sipe and Testa, 2018). Therefore, these are the assets which are

needed to be sold out in the market. In relation with the assets like land, building etc which will

be helpful in giving the bulk revenue to the business.

5

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1.2 Evaluating the contribution of different methods in generating income

The impacts of various methods in generating the adequate capital funds for the business

is quite necessary in building the strong financial strength. It improves the capital stability, costs

control mechanism as well as bring the ability to prepare accurate budgets for the future

operations. Professionals at Belgravia Hotel will have appropriate information regarding the past

transaction and the level of expenses which have to be made by them in meeting profitability

level. However, in relation with considering the various methods for gathering the appropriate

amount of fund on which shareholders or equity investment will be more effective to have the

higher capital gains.

TASK 2

2.1 Ascertaining the adequate elements of costs and profits and their effective influences in

setting the prices over business services

To develop the favorable strategies will be helpful in terms of analyzing the prices over

the services offered by the business (Peters and Kallmuenzer, 2018). Therefore, Belgravia Hotels

must implicate appropriate strategies which will be helpful to business in terms of effective

growth and profitability. Similarly, there are various costs and profits on basis of which the hotel

would have ability to set the satisfactory prices.

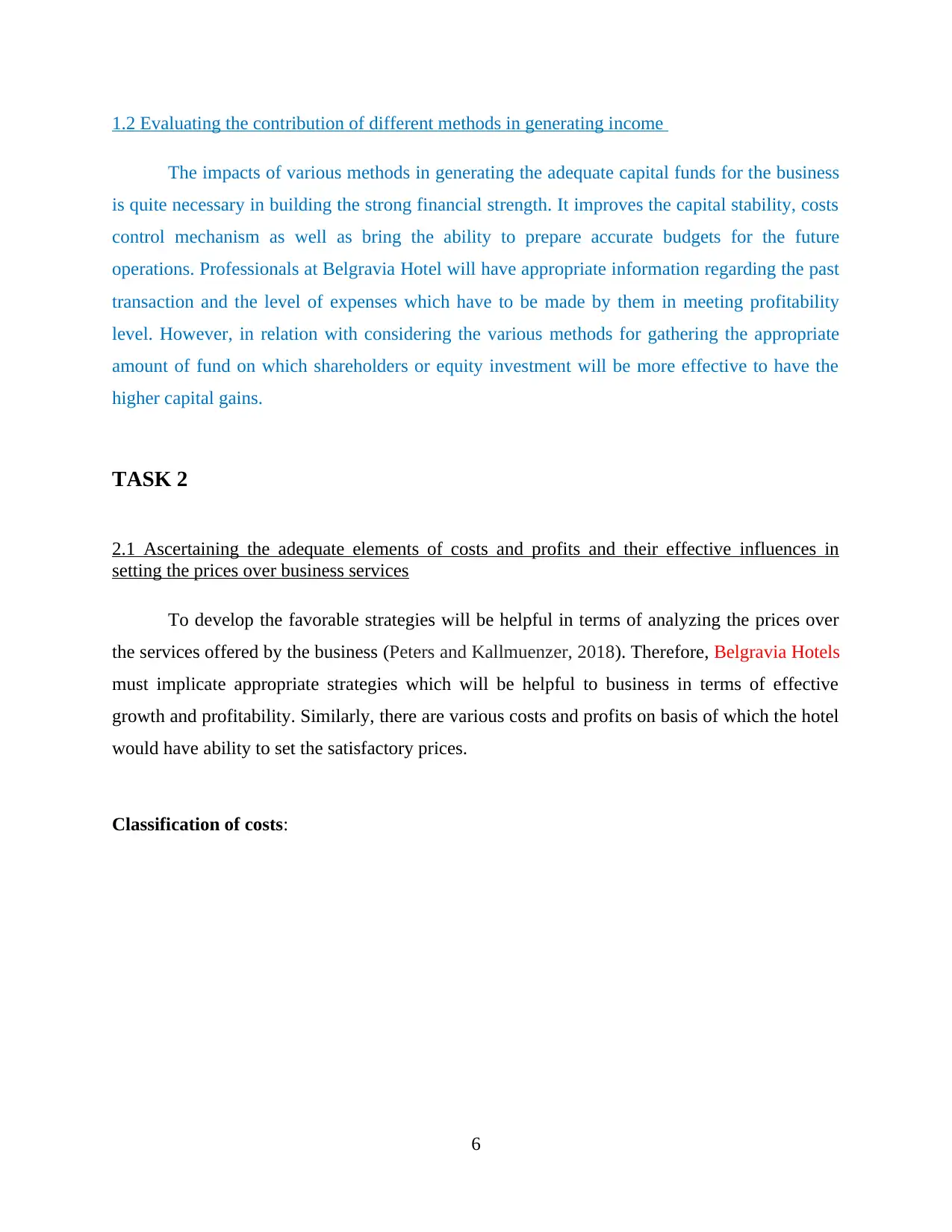

Classification of costs:

6

The impacts of various methods in generating the adequate capital funds for the business

is quite necessary in building the strong financial strength. It improves the capital stability, costs

control mechanism as well as bring the ability to prepare accurate budgets for the future

operations. Professionals at Belgravia Hotel will have appropriate information regarding the past

transaction and the level of expenses which have to be made by them in meeting profitability

level. However, in relation with considering the various methods for gathering the appropriate

amount of fund on which shareholders or equity investment will be more effective to have the

higher capital gains.

TASK 2

2.1 Ascertaining the adequate elements of costs and profits and their effective influences in

setting the prices over business services

To develop the favorable strategies will be helpful in terms of analyzing the prices over

the services offered by the business (Peters and Kallmuenzer, 2018). Therefore, Belgravia Hotels

must implicate appropriate strategies which will be helpful to business in terms of effective

growth and profitability. Similarly, there are various costs and profits on basis of which the hotel

would have ability to set the satisfactory prices.

Classification of costs:

6

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Figure 1 Types of costs associated with business

(Source: Manufacturing and Nonmanufacturing Costs. 2017)

Direct costs: these are the costs which are directly attributable to the products or services

of industry. It mainly includes direct labor, material and overhead expenses which will be

chargeable over the products and services (Pérez-Pineda, Alcaraz and Colón, 2017). Belgravia

Hotels will be beneficial if they become unable to allocate the costs of such operations.

Moreover, it might be from the room charges, rent etc. which are to be collected through to the

numbers of consumers take advantages of the business services. Moreover, it will be a

appropriate technique in analyzing the prices over services.

Indirect costs: These are the expense which was being barred by the business in indirect

manner. Therefore, there are various costs such as internet, wi-fi charges, taxi, snacks,

maintenance etc. thus, these are the costs which makes huge deficits in the profit index of the

business. Similarly, the professionals from Belgravia Hotels will be suggested to make the

7

(Source: Manufacturing and Nonmanufacturing Costs. 2017)

Direct costs: these are the costs which are directly attributable to the products or services

of industry. It mainly includes direct labor, material and overhead expenses which will be

chargeable over the products and services (Pérez-Pineda, Alcaraz and Colón, 2017). Belgravia

Hotels will be beneficial if they become unable to allocate the costs of such operations.

Moreover, it might be from the room charges, rent etc. which are to be collected through to the

numbers of consumers take advantages of the business services. Moreover, it will be a

appropriate technique in analyzing the prices over services.

Indirect costs: These are the expense which was being barred by the business in indirect

manner. Therefore, there are various costs such as internet, wi-fi charges, taxi, snacks,

maintenance etc. thus, these are the costs which makes huge deficits in the profit index of the

business. Similarly, the professionals from Belgravia Hotels will be suggested to make the

7

necessary improvements in the costing techniques and control such expense. On the other side,

they can make rise in the prices of the services so all the expense will be overcome by them.

Fixed costs: The nature of this kind of costs is that it remains constant for the longer

period. However, these are the costs which were being incurred over the expenses like, telephone

bills, rent etc. however, it remains constant and the fixed amount of charges has to be payable by

the business (Mun and Jang, 2017). In addition, Belgravia Hotels need to analyze such kinds of

costs and tried to plan strategies to resolve these issues with the alternative solutions.

Variable costs: In terms with the variable costs of the business these are costs which have

fluctuation periodically. Therefore, it does not remain same as fixed costs. The variations are due

to requirements of the costs in several activities. Therefore, it will be in travelling charges,

seasonal charges over the room rent etc. moreover; these are the costs which will be helpful in

gathering the adequate amount of gains while it will have negative outcomes too (Jung and

Yoon, 2018). Thus, in relation with such operational expenses Belgravia Hotels need to have

proper control over such kinds of expenses which will be managed and reduced by them.

Elements of profit:

Gross profit: These are the gains which were being derived from deducting the costs of

manufacturing from the sale revenue or the period. The cost includes all the manufacturing costs

such as material, labor packaging etc. these are denoted as the costs of goods sold. The motive of

deducting these costs at the initial stage is to assure that the essential requirements of the

business which were considered and the essential part has been covered. Belgravia Hotels will

analyze this profit for effective pricing decisions.

Operating profit: This profit can be known as the revenue generated by the business from

operating activities. Therefore, these are the profits which will be presented after deducting all

the operating expenses such as salaries, rent, telephone bills, selling and administrative expense,

8

they can make rise in the prices of the services so all the expense will be overcome by them.

Fixed costs: The nature of this kind of costs is that it remains constant for the longer

period. However, these are the costs which were being incurred over the expenses like, telephone

bills, rent etc. however, it remains constant and the fixed amount of charges has to be payable by

the business (Mun and Jang, 2017). In addition, Belgravia Hotels need to analyze such kinds of

costs and tried to plan strategies to resolve these issues with the alternative solutions.

Variable costs: In terms with the variable costs of the business these are costs which have

fluctuation periodically. Therefore, it does not remain same as fixed costs. The variations are due

to requirements of the costs in several activities. Therefore, it will be in travelling charges,

seasonal charges over the room rent etc. moreover; these are the costs which will be helpful in

gathering the adequate amount of gains while it will have negative outcomes too (Jung and

Yoon, 2018). Thus, in relation with such operational expenses Belgravia Hotels need to have

proper control over such kinds of expenses which will be managed and reduced by them.

Elements of profit:

Gross profit: These are the gains which were being derived from deducting the costs of

manufacturing from the sale revenue or the period. The cost includes all the manufacturing costs

such as material, labor packaging etc. these are denoted as the costs of goods sold. The motive of

deducting these costs at the initial stage is to assure that the essential requirements of the

business which were considered and the essential part has been covered. Belgravia Hotels will

analyze this profit for effective pricing decisions.

Operating profit: This profit can be known as the revenue generated by the business from

operating activities. Therefore, these are the profits which will be presented after deducting all

the operating expenses such as salaries, rent, telephone bills, selling and administrative expense,

8

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

advertisement expenses etc. Similarly, managers at Belgravia Hotels need to plan the strategies

and make replacements with the alternatives to reduce such costs (Munjal and Bhushan, 2017).

In addition, appropriate control over such expense which will lead the firm in making effective

business analysis.

Net profit: These are the annual turnover which will be received by the firm in relation

with making the appropriate gains after making payments to all the taxes, depreciation and

interest charges. Additionally, these are the revenue which will be helpful to Belgravia Hotels in

making payments to the creditors, shareholders and meet all the debts.

Selling price: A determination of a prices which will be offered to the consumers on the

basis of level of operations made by an organization with respects to atati9ning the adequate

gains. Thus, in respect with this a selling price has been determined on the basis of analyzing the

cost implied in such activity. Thus, it is mainly relevant with the Labour costs, material,

depreciation, insurance etc. thus, these are the costs which defines the selling prices for an

operation.

2.2 Analyzing the techniques to administered stock controlling and presenting methods for costs

and benefits

To administer and ascertain the availability of cash and stock in the business there is need

to have appropriate management to the work. However, there have been various techniques and

methods which bring appropriate knowledge in advancing the operational efficiencies.

Minimum stock level: this is a reorder level it funnels the professionals in analyzing the

ability of business to take reorders. Moreover, in relation with the operations of the entity it

occurs at the time when stock reaches to its minimum level.

9

and make replacements with the alternatives to reduce such costs (Munjal and Bhushan, 2017).

In addition, appropriate control over such expense which will lead the firm in making effective

business analysis.

Net profit: These are the annual turnover which will be received by the firm in relation

with making the appropriate gains after making payments to all the taxes, depreciation and

interest charges. Additionally, these are the revenue which will be helpful to Belgravia Hotels in

making payments to the creditors, shareholders and meet all the debts.

Selling price: A determination of a prices which will be offered to the consumers on the

basis of level of operations made by an organization with respects to atati9ning the adequate

gains. Thus, in respect with this a selling price has been determined on the basis of analyzing the

cost implied in such activity. Thus, it is mainly relevant with the Labour costs, material,

depreciation, insurance etc. thus, these are the costs which defines the selling prices for an

operation.

2.2 Analyzing the techniques to administered stock controlling and presenting methods for costs

and benefits

To administer and ascertain the availability of cash and stock in the business there is need

to have appropriate management to the work. However, there have been various techniques and

methods which bring appropriate knowledge in advancing the operational efficiencies.

Minimum stock level: this is a reorder level it funnels the professionals in analyzing the

ability of business to take reorders. Moreover, in relation with the operations of the entity it

occurs at the time when stock reaches to its minimum level.

9

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Just in time: This technique implies framework that the business must keep the minimum level

of stock for the operations which will be helpful to them in terms of controlling the cots as well

as managing the business operations (Ali, 2018).

Economic order quantity: These are the statistical technique which determines the costs

incurred by the business in keeping the stock such as holding cost etc. Thus, these costs bring the

proper valuation of the stock cost which is needed to be controlled as per effective decision made

by professionals.

Bank reconciliation: Apart from bank passbook and statements there is need to make a

BRS statements on own basis. Therefore, it will give proper records of monetary transactions on

which the theft and fraud will easily be tracked and the chances of repeating will be reduced.

Therefore, it administered the proper records of all the transactions and considers that there will

be no manipulation of funds.

Voucher system: It comprises with the codes and numbers of every transactional entries

which ensures that there must not be any manipulation or double entry of the same transaction

(Arbelo and et.al., 2017).

TASK 3

3.1 Assessing the sources of business performance in relation with making the effective analysis

through trial balance

By considering the proposed trail balance it can be said that there are various elements

such as sales, share capital and various operating expenses. Therefore, in accordance with the

sales of firm which are 150000, inventory at 84000 and share capital as 600,000. However, it

determined that the firm has appropriate gains during the period as well as there are satisfactory

number of shareholders in the firm.

10

of stock for the operations which will be helpful to them in terms of controlling the cots as well

as managing the business operations (Ali, 2018).

Economic order quantity: These are the statistical technique which determines the costs

incurred by the business in keeping the stock such as holding cost etc. Thus, these costs bring the

proper valuation of the stock cost which is needed to be controlled as per effective decision made

by professionals.

Bank reconciliation: Apart from bank passbook and statements there is need to make a

BRS statements on own basis. Therefore, it will give proper records of monetary transactions on

which the theft and fraud will easily be tracked and the chances of repeating will be reduced.

Therefore, it administered the proper records of all the transactions and considers that there will

be no manipulation of funds.

Voucher system: It comprises with the codes and numbers of every transactional entries

which ensures that there must not be any manipulation or double entry of the same transaction

(Arbelo and et.al., 2017).

TASK 3

3.1 Assessing the sources of business performance in relation with making the effective analysis

through trial balance

By considering the proposed trail balance it can be said that there are various elements

such as sales, share capital and various operating expenses. Therefore, in accordance with the

sales of firm which are 150000, inventory at 84000 and share capital as 600,000. However, it

determined that the firm has appropriate gains during the period as well as there are satisfactory

number of shareholders in the firm.

10

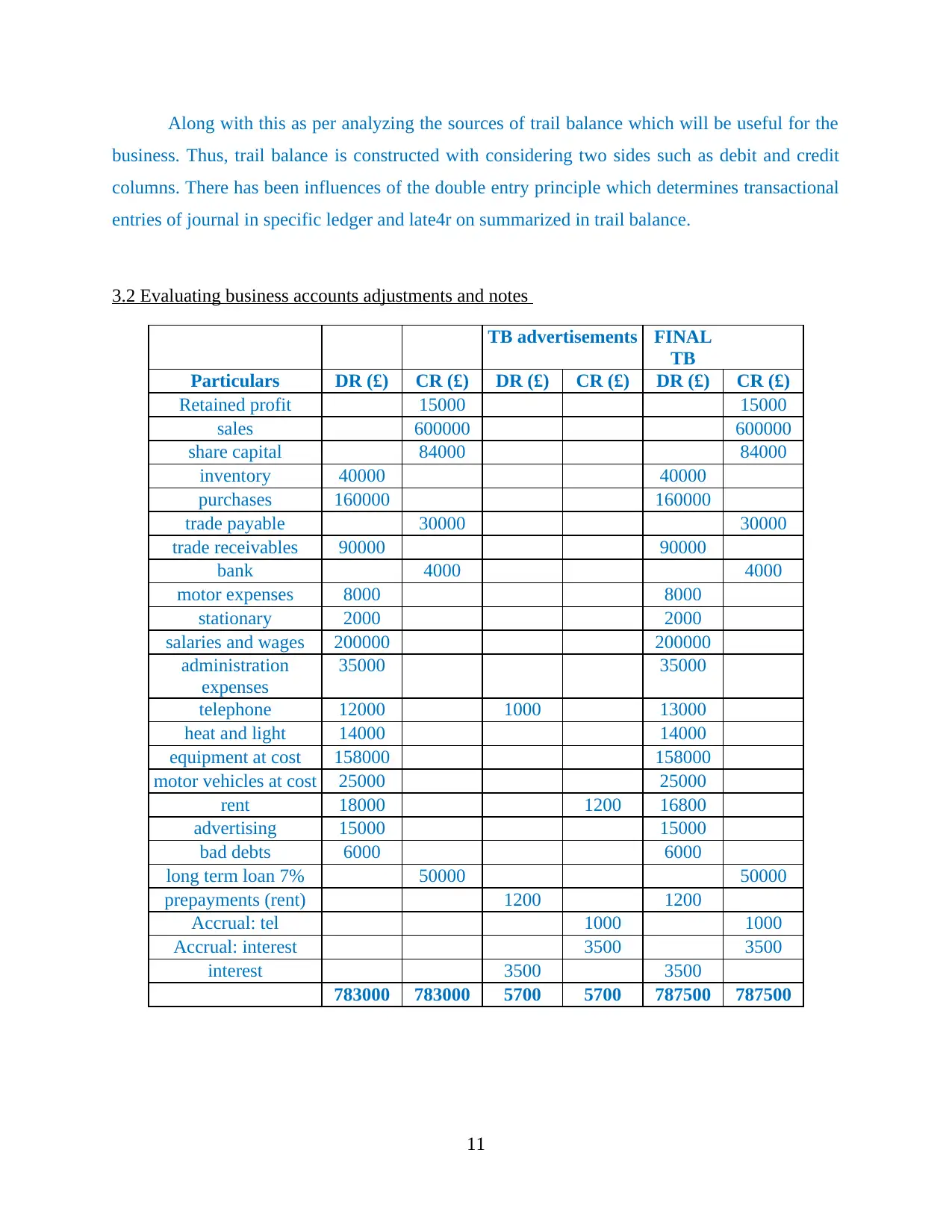

Along with this as per analyzing the sources of trail balance which will be useful for the

business. Thus, trail balance is constructed with considering two sides such as debit and credit

columns. There has been influences of the double entry principle which determines transactional

entries of journal in specific ledger and late4r on summarized in trail balance.

3.2 Evaluating business accounts adjustments and notes

TB advertisements FINAL

TB

Particulars DR (£) CR (£) DR (£) CR (£) DR (£) CR (£)

Retained profit 15000 15000

sales 600000 600000

share capital 84000 84000

inventory 40000 40000

purchases 160000 160000

trade payable 30000 30000

trade receivables 90000 90000

bank 4000 4000

motor expenses 8000 8000

stationary 2000 2000

salaries and wages 200000 200000

administration

expenses

35000 35000

telephone 12000 1000 13000

heat and light 14000 14000

equipment at cost 158000 158000

motor vehicles at cost 25000 25000

rent 18000 1200 16800

advertising 15000 15000

bad debts 6000 6000

long term loan 7% 50000 50000

prepayments (rent) 1200 1200

Accrual: tel 1000 1000

Accrual: interest 3500 3500

interest 3500 3500

783000 783000 5700 5700 787500 787500

11

business. Thus, trail balance is constructed with considering two sides such as debit and credit

columns. There has been influences of the double entry principle which determines transactional

entries of journal in specific ledger and late4r on summarized in trail balance.

3.2 Evaluating business accounts adjustments and notes

TB advertisements FINAL

TB

Particulars DR (£) CR (£) DR (£) CR (£) DR (£) CR (£)

Retained profit 15000 15000

sales 600000 600000

share capital 84000 84000

inventory 40000 40000

purchases 160000 160000

trade payable 30000 30000

trade receivables 90000 90000

bank 4000 4000

motor expenses 8000 8000

stationary 2000 2000

salaries and wages 200000 200000

administration

expenses

35000 35000

telephone 12000 1000 13000

heat and light 14000 14000

equipment at cost 158000 158000

motor vehicles at cost 25000 25000

rent 18000 1200 16800

advertising 15000 15000

bad debts 6000 6000

long term loan 7% 50000 50000

prepayments (rent) 1200 1200

Accrual: tel 1000 1000

Accrual: interest 3500 3500

interest 3500 3500

783000 783000 5700 5700 787500 787500

11

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 21

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.