Analysis of Bialto Beach Ltd's 2019 Abbreviated Draft Accounts

VerifiedAdded on 2022/12/29

|15

|1991

|79

Homework Assignment

AI Summary

This document presents an analysis of Bialto Beach Ltd's abbreviated draft accounts for the year ended December 31, 2019. It includes the statement of directors’ responsibilities, directors’ remuneration report, income statement, statement of financial position, and notes to the financial statements. The analysis covers revenue, cost of sales, gross profit, distribution and administrative expenses, other operating income, finance costs, and profit before and after taxation. The statement of financial position details assets (non-current and current), equity, and liabilities (non-current and current). The notes provide detailed breakdowns of property, plant, and equipment, inventories, other receivables, current and non-current liabilities, distribution and administrative expenses, and taxation. The accounting policies, including the basis of preparation, accounting convention, and policies for property, plant, and equipment and inventories, are also outlined. The document addresses the application of accounting policies and includes a comprehensive overview of the financial performance and position of Bialto Beach Ltd for the specified period, including specific adjustments and considerations such as land, vehicle sales, deposits, repair costs, dinner costs, chef losses, interest on loans, tax liabilities, food loss, and director's dividend plans.

Appendix 1

Bialto Beach Ltd

Abbreviated Draft Accounts 31 December 2019

Bialto Beach Ltd

Abbreviated Draft Accounts 31 December 2019

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Statement Of Directors’ Responsibilities

The directors are responsible for preparing the Annual Report and the financial statements in accordance with applicable laws and regulations.

Company law requires the directors to prepare financial statements for each financial year. Under that law the directors have prepared the financial statements

in accordance with International Financial Reporting Standards as adopted by the European Union. In preparing these financial statements, the directors have

also elected to comply with IFRSs, issued by the International Accounting Standards Board (IASB).

Under Company Law the directors must not approve the financial statements unless they are satisfied that they give a true and fair view of the state of affairs of

the Company and of the profit and loss of the Company for that period. In preparing these financial statements, the directors are required to:

Select suitable accounting policies and apply them consistently

Make judgements and accounting estimates that are reasonable and prudent

State whether applicable IFRS’s as adopted by the European Union and IFRSs issued by IASB have been followed, subject to any material departures disclosed

and explained in the financial statements.

The directors are responsible for keeping adequate accounting records that are sufficient to show and explain the Company’s transactions and disclose with

reasonable accuracy at any time the financial position of the Company and the enable them to ensure that the financial statements comply with the Companies

Act 2006.

They are also responsible for safeguarding the assets of the Company and hence for taking reasonable steps for the prevention and detection of fraud and other

irregularities.

The directors are responsible for the maintenance and integrity of the Company’s website. Legislation in the United Kingdom governing the preparation and

dissemination of financial statements may differ from legislation in other jurisdictions.

The directors are responsible for preparing the Annual Report and the financial statements in accordance with applicable laws and regulations.

Company law requires the directors to prepare financial statements for each financial year. Under that law the directors have prepared the financial statements

in accordance with International Financial Reporting Standards as adopted by the European Union. In preparing these financial statements, the directors have

also elected to comply with IFRSs, issued by the International Accounting Standards Board (IASB).

Under Company Law the directors must not approve the financial statements unless they are satisfied that they give a true and fair view of the state of affairs of

the Company and of the profit and loss of the Company for that period. In preparing these financial statements, the directors are required to:

Select suitable accounting policies and apply them consistently

Make judgements and accounting estimates that are reasonable and prudent

State whether applicable IFRS’s as adopted by the European Union and IFRSs issued by IASB have been followed, subject to any material departures disclosed

and explained in the financial statements.

The directors are responsible for keeping adequate accounting records that are sufficient to show and explain the Company’s transactions and disclose with

reasonable accuracy at any time the financial position of the Company and the enable them to ensure that the financial statements comply with the Companies

Act 2006.

They are also responsible for safeguarding the assets of the Company and hence for taking reasonable steps for the prevention and detection of fraud and other

irregularities.

The directors are responsible for the maintenance and integrity of the Company’s website. Legislation in the United Kingdom governing the preparation and

dissemination of financial statements may differ from legislation in other jurisdictions.

By order of the Board

Robert Holt, Managing Director 31 December 2019

Robert Holt, Managing Director 31 December 2019

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Directors’ Remuneration Report

Remuneration Policy

The Company’s remuneration policy aims to attract, retain and motivate high caliber and high performing executive directors. It does so by providing the

appropriate incentives to encourage enhanced long-term performance and by rewarding executive directors for their individual contributions to the success of

the Company in a fair, consistent and reasonable manner.

The Company is focused on creating shareholder value and on rewarding high performance with high rewards, but not rewarding failure. The five remuneration

principles set out below have been crafted by the Company to align the interests of executive directors, management and employees with those of shareholders:

1. That rewards should be fair, appropriate and reflective of the Company’s culture and values;

2. That incentives should be strategically aligned with our shareholders;

3. That base pay should be competitive, with decisions being informed by market data;

4. That the total reward cost to the Company should be affordable and sustainable;

5. That employee communications around pay and rewards should be effective and clearly understood.

In determining the practical application of the principles, the Remuneration Committee also take into account all factors which it deems necessary, including

consideration for local practices when recruiting staff internationally.

Remuneration Components

The remuneration policy of the Company has a number of principal components:

Salary and benefits

Remuneration Policy

The Company’s remuneration policy aims to attract, retain and motivate high caliber and high performing executive directors. It does so by providing the

appropriate incentives to encourage enhanced long-term performance and by rewarding executive directors for their individual contributions to the success of

the Company in a fair, consistent and reasonable manner.

The Company is focused on creating shareholder value and on rewarding high performance with high rewards, but not rewarding failure. The five remuneration

principles set out below have been crafted by the Company to align the interests of executive directors, management and employees with those of shareholders:

1. That rewards should be fair, appropriate and reflective of the Company’s culture and values;

2. That incentives should be strategically aligned with our shareholders;

3. That base pay should be competitive, with decisions being informed by market data;

4. That the total reward cost to the Company should be affordable and sustainable;

5. That employee communications around pay and rewards should be effective and clearly understood.

In determining the practical application of the principles, the Remuneration Committee also take into account all factors which it deems necessary, including

consideration for local practices when recruiting staff internationally.

Remuneration Components

The remuneration policy of the Company has a number of principal components:

Salary and benefits

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

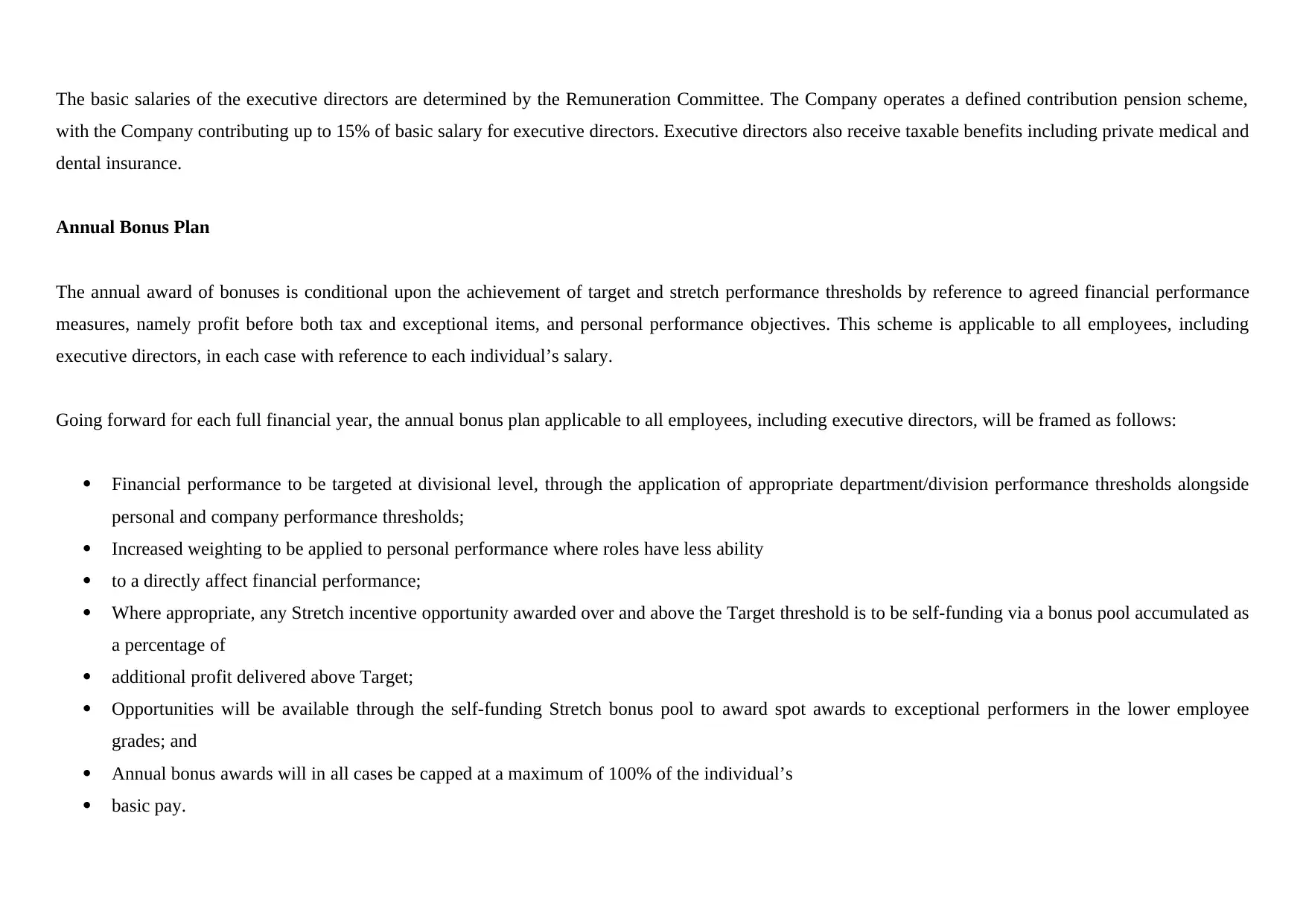

The basic salaries of the executive directors are determined by the Remuneration Committee. The Company operates a defined contribution pension scheme,

with the Company contributing up to 15% of basic salary for executive directors. Executive directors also receive taxable benefits including private medical and

dental insurance.

Annual Bonus Plan

The annual award of bonuses is conditional upon the achievement of target and stretch performance thresholds by reference to agreed financial performance

measures, namely profit before both tax and exceptional items, and personal performance objectives. This scheme is applicable to all employees, including

executive directors, in each case with reference to each individual’s salary.

Going forward for each full financial year, the annual bonus plan applicable to all employees, including executive directors, will be framed as follows:

Financial performance to be targeted at divisional level, through the application of appropriate department/division performance thresholds alongside

personal and company performance thresholds;

Increased weighting to be applied to personal performance where roles have less ability

to a directly affect financial performance;

Where appropriate, any Stretch incentive opportunity awarded over and above the Target threshold is to be self-funding via a bonus pool accumulated as

a percentage of

additional profit delivered above Target;

Opportunities will be available through the self-funding Stretch bonus pool to award spot awards to exceptional performers in the lower employee

grades; and

Annual bonus awards will in all cases be capped at a maximum of 100% of the individual’s

basic pay.

with the Company contributing up to 15% of basic salary for executive directors. Executive directors also receive taxable benefits including private medical and

dental insurance.

Annual Bonus Plan

The annual award of bonuses is conditional upon the achievement of target and stretch performance thresholds by reference to agreed financial performance

measures, namely profit before both tax and exceptional items, and personal performance objectives. This scheme is applicable to all employees, including

executive directors, in each case with reference to each individual’s salary.

Going forward for each full financial year, the annual bonus plan applicable to all employees, including executive directors, will be framed as follows:

Financial performance to be targeted at divisional level, through the application of appropriate department/division performance thresholds alongside

personal and company performance thresholds;

Increased weighting to be applied to personal performance where roles have less ability

to a directly affect financial performance;

Where appropriate, any Stretch incentive opportunity awarded over and above the Target threshold is to be self-funding via a bonus pool accumulated as

a percentage of

additional profit delivered above Target;

Opportunities will be available through the self-funding Stretch bonus pool to award spot awards to exceptional performers in the lower employee

grades; and

Annual bonus awards will in all cases be capped at a maximum of 100% of the individual’s

basic pay.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

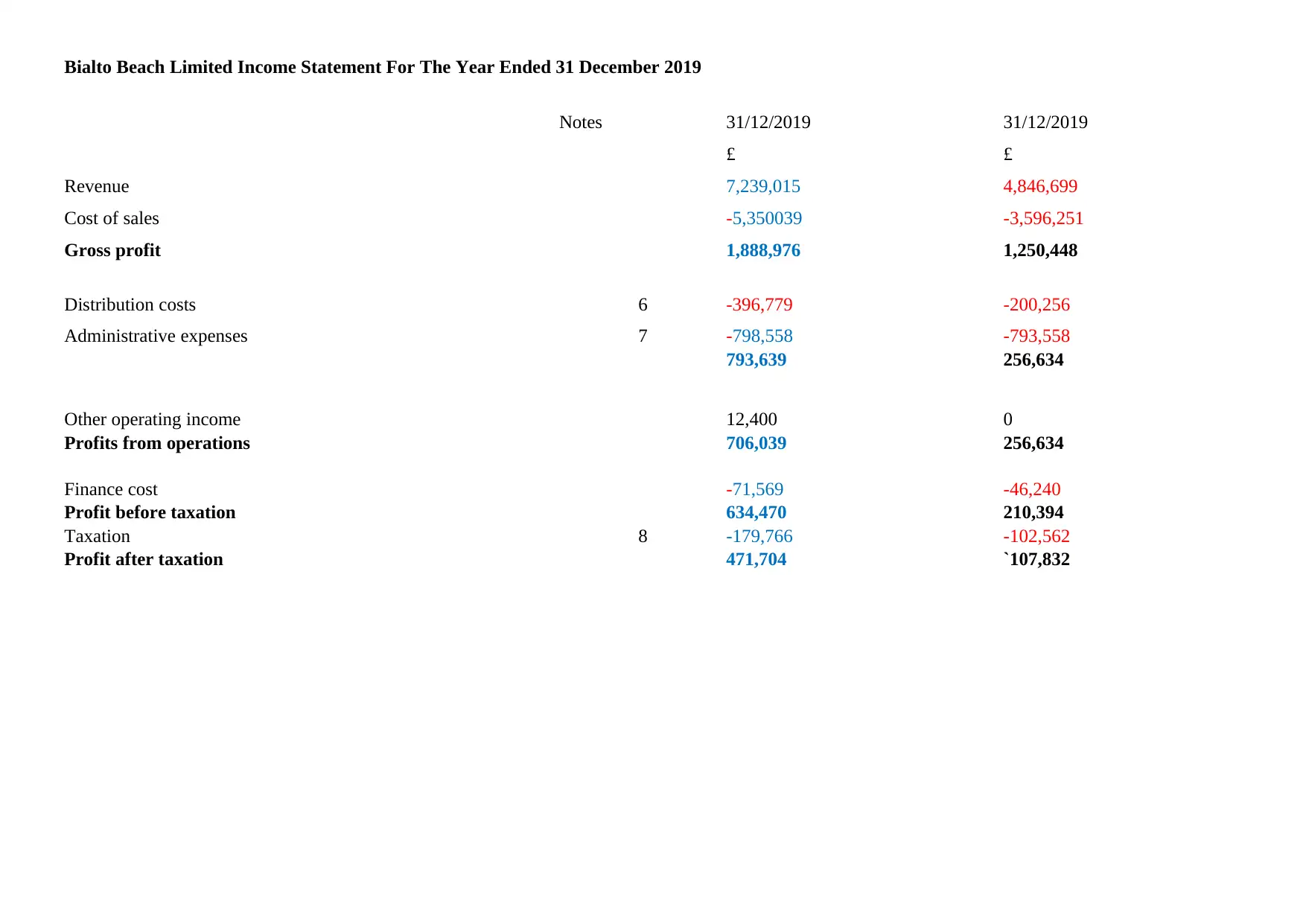

Bialto Beach Limited Income Statement For The Year Ended 31 December 2019

Notes 31/12/2019 31/12/2019

£ £

Revenue 7,239,015 4,846,699

Cost of sales -5,350039 -3,596,251

Gross profit 1,888,976 1,250,448

Distribution costs 6 -396,779 -200,256

Administrative expenses 7 -798,558 -793,558

793,639 256,634

Other operating income 12,400 0

Profits from operations 706,039 256,634

Finance cost -71,569 -46,240

Profit before taxation 634,470 210,394

Taxation 8 -179,766 -102,562

Profit after taxation 471,704 `107,832

Notes 31/12/2019 31/12/2019

£ £

Revenue 7,239,015 4,846,699

Cost of sales -5,350039 -3,596,251

Gross profit 1,888,976 1,250,448

Distribution costs 6 -396,779 -200,256

Administrative expenses 7 -798,558 -793,558

793,639 256,634

Other operating income 12,400 0

Profits from operations 706,039 256,634

Finance cost -71,569 -46,240

Profit before taxation 634,470 210,394

Taxation 8 -179,766 -102,562

Profit after taxation 471,704 `107,832

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

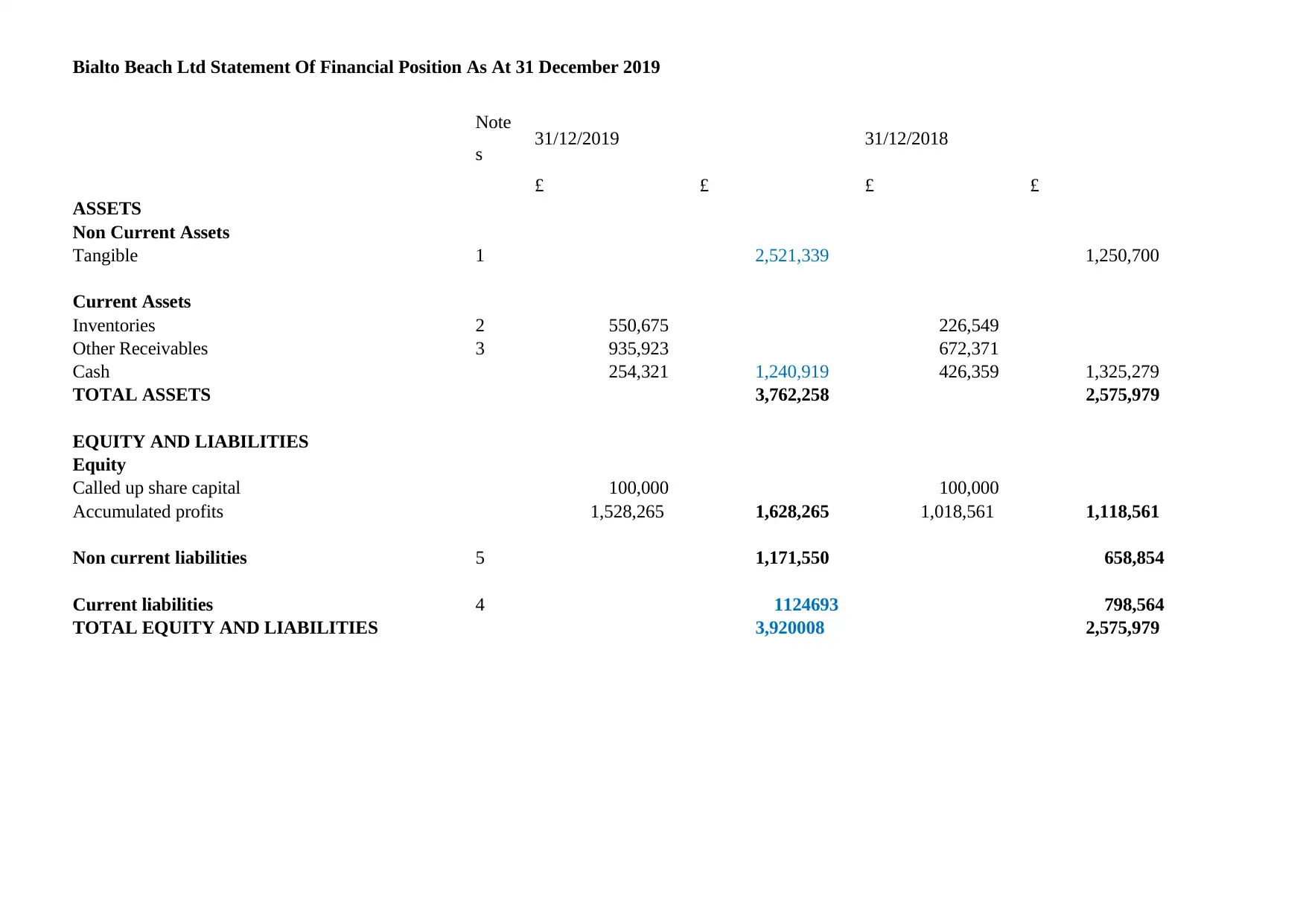

Bialto Beach Ltd Statement Of Financial Position As At 31 December 2019

Note

s 31/12/2019 31/12/2018

£ £ £ £

ASSETS

Non Current Assets

Tangible 1 2,521,339 1,250,700

Current Assets

Inventories 2 550,675 226,549

Other Receivables 3 935,923 672,371

Cash 254,321 1,240,919 426,359 1,325,279

TOTAL ASSETS 3,762,258 2,575,979

EQUITY AND LIABILITIES

Equity

Called up share capital 100,000 100,000

Accumulated profits 1,528,265 1,628,265 1,018,561 1,118,561

Non current liabilities 5 1,171,550 658,854

Current liabilities 4 1124693 798,564

TOTAL EQUITY AND LIABILITIES 3,920008 2,575,979

Note

s 31/12/2019 31/12/2018

£ £ £ £

ASSETS

Non Current Assets

Tangible 1 2,521,339 1,250,700

Current Assets

Inventories 2 550,675 226,549

Other Receivables 3 935,923 672,371

Cash 254,321 1,240,919 426,359 1,325,279

TOTAL ASSETS 3,762,258 2,575,979

EQUITY AND LIABILITIES

Equity

Called up share capital 100,000 100,000

Accumulated profits 1,528,265 1,628,265 1,018,561 1,118,561

Non current liabilities 5 1,171,550 658,854

Current liabilities 4 1124693 798,564

TOTAL EQUITY AND LIABILITIES 3,920008 2,575,979

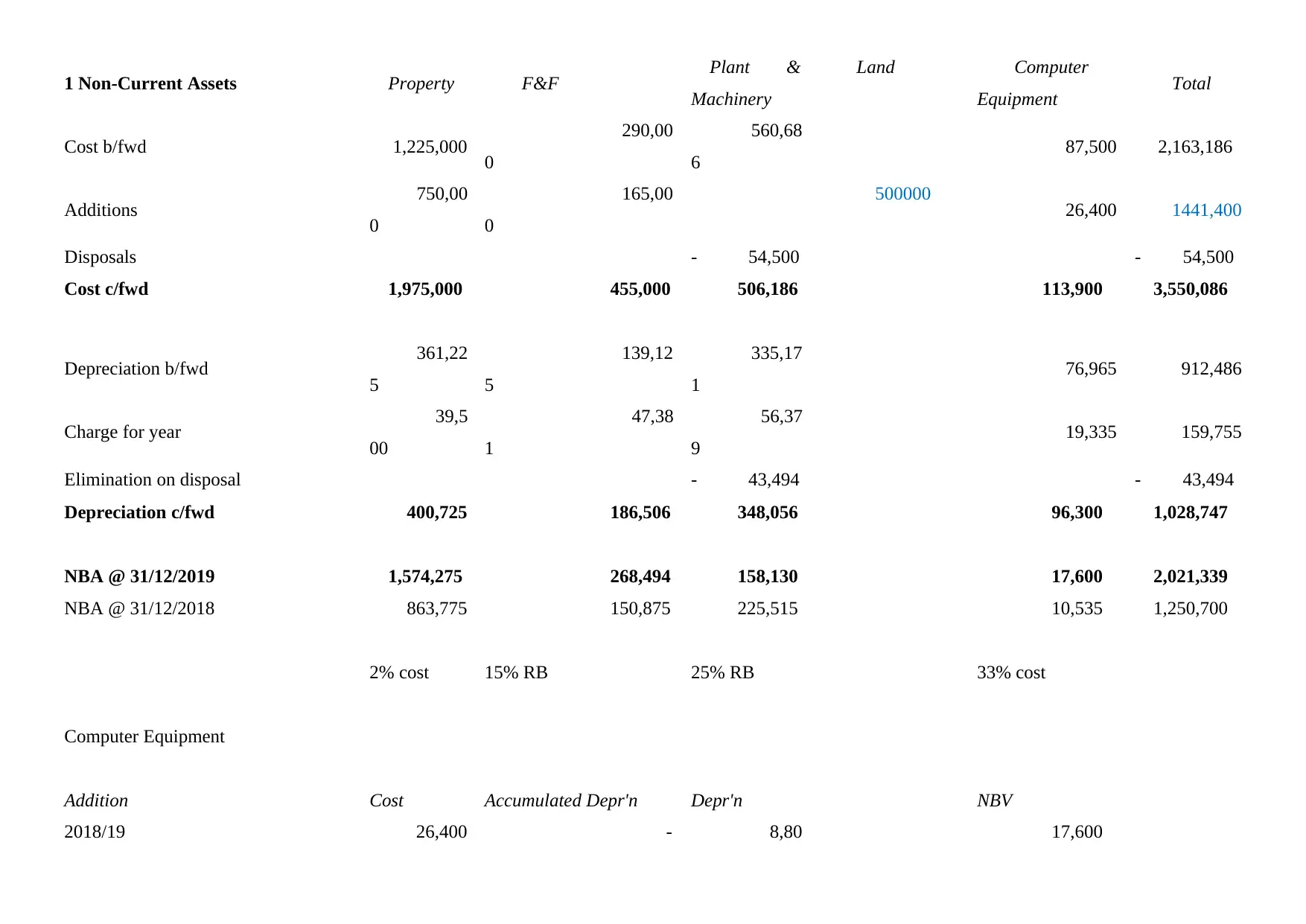

1 Non-Current Assets Property F&F Plant &

Machinery

Land Computer

Equipment Total

Cost b/fwd 1,225,000 290,00

0

560,68

6 87,500 2,163,186

Additions 750,00

0

165,00

0

500000 26,400 1441,400

Disposals - 54,500 - 54,500

Cost c/fwd 1,975,000 455,000 506,186 113,900 3,550,086

Depreciation b/fwd 361,22

5

139,12

5

335,17

1 76,965 912,486

Charge for year 39,5

00

47,38

1

56,37

9 19,335 159,755

Elimination on disposal - 43,494 - 43,494

Depreciation c/fwd 400,725 186,506 348,056 96,300 1,028,747

NBA @ 31/12/2019 1,574,275 268,494 158,130 17,600 2,021,339

NBA @ 31/12/2018 863,775 150,875 225,515 10,535 1,250,700

2% cost 15% RB 25% RB 33% cost

Computer Equipment

Addition Cost Accumulated Depr'n Depr'n NBV

2018/19 26,400 - 8,80 17,600

Machinery

Land Computer

Equipment Total

Cost b/fwd 1,225,000 290,00

0

560,68

6 87,500 2,163,186

Additions 750,00

0

165,00

0

500000 26,400 1441,400

Disposals - 54,500 - 54,500

Cost c/fwd 1,975,000 455,000 506,186 113,900 3,550,086

Depreciation b/fwd 361,22

5

139,12

5

335,17

1 76,965 912,486

Charge for year 39,5

00

47,38

1

56,37

9 19,335 159,755

Elimination on disposal - 43,494 - 43,494

Depreciation c/fwd 400,725 186,506 348,056 96,300 1,028,747

NBA @ 31/12/2019 1,574,275 268,494 158,130 17,600 2,021,339

NBA @ 31/12/2018 863,775 150,875 225,515 10,535 1,250,700

2% cost 15% RB 25% RB 33% cost

Computer Equipment

Addition Cost Accumulated Depr'n Depr'n NBV

2018/19 26,400 - 8,80 17,600

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

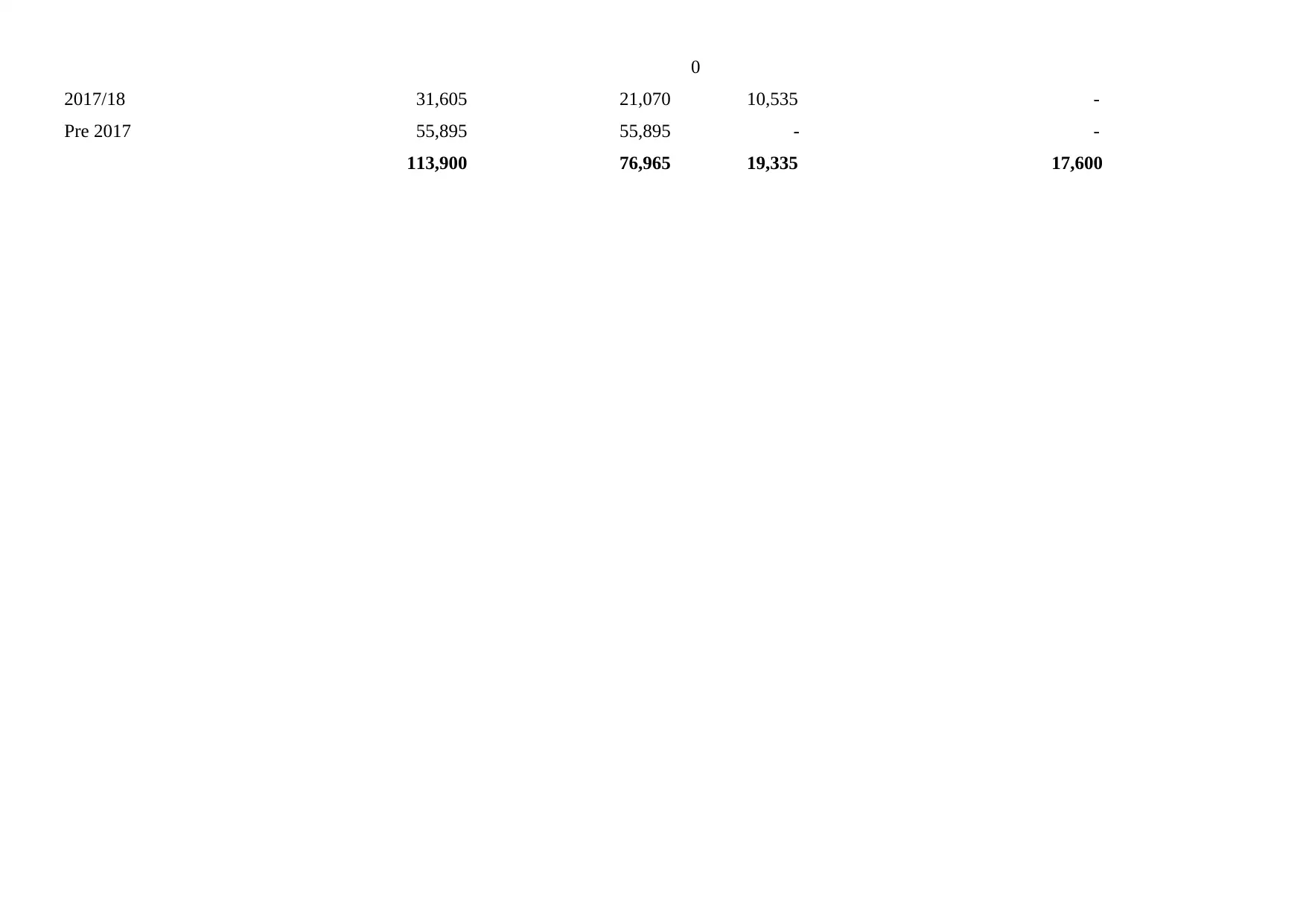

0

2017/18 31,605 21,070 10,535 -

Pre 2017 55,895 55,895 - -

113,900 76,965 19,335 17,600

2017/18 31,605 21,070 10,535 -

Pre 2017 55,895 55,895 - -

113,900 76,965 19,335 17,600

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

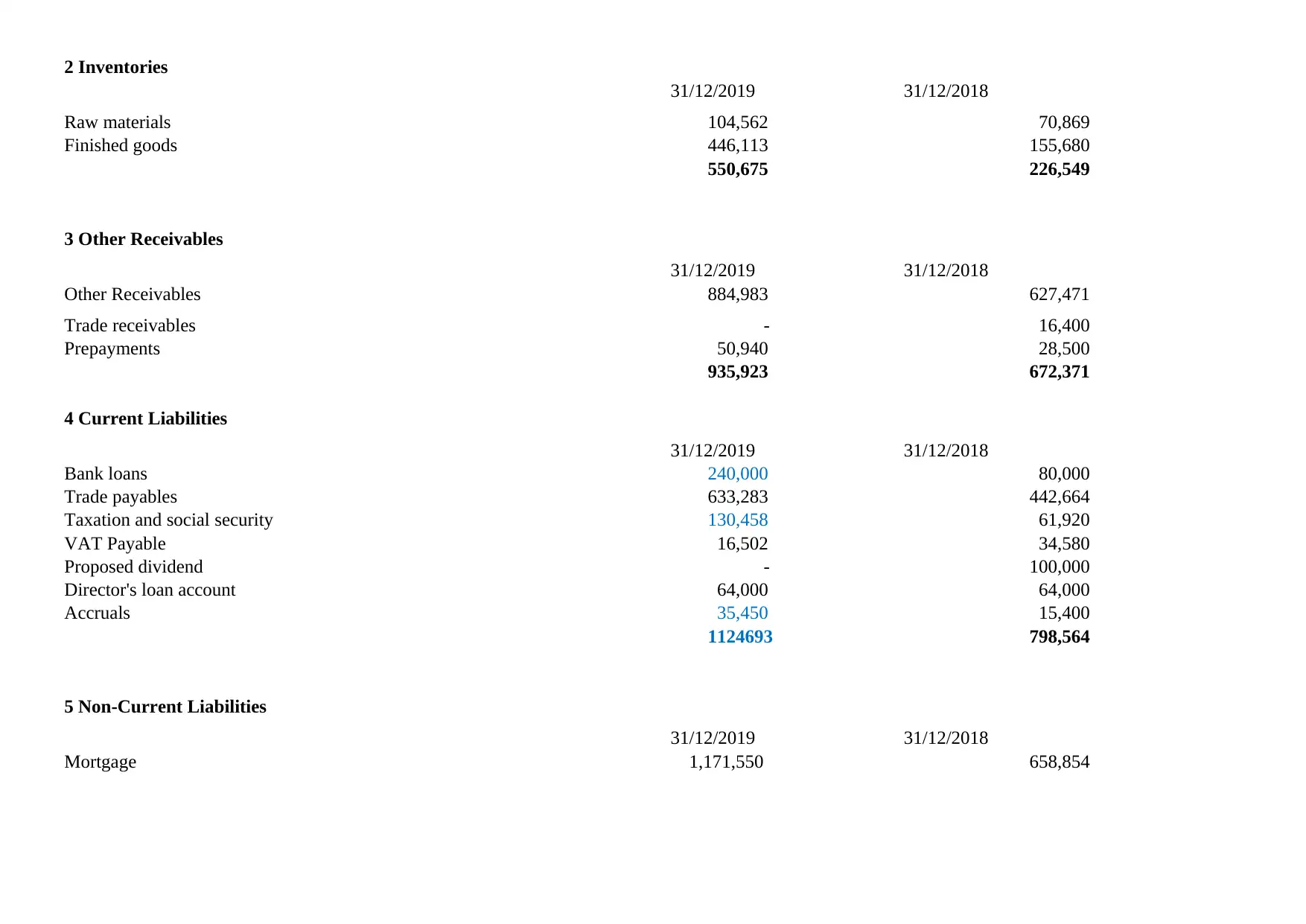

2 Inventories

31/12/2019 31/12/2018

Raw materials 104,562 70,869

Finished goods 446,113 155,680

550,675 226,549

3 Other Receivables

31/12/2019 31/12/2018

Other Receivables 884,983 627,471

Trade receivables - 16,400

Prepayments 50,940 28,500

935,923 672,371

4 Current Liabilities

31/12/2019 31/12/2018

Bank loans 240,000 80,000

Trade payables 633,283 442,664

Taxation and social security 130,458 61,920

VAT Payable 16,502 34,580

Proposed dividend - 100,000

Director's loan account 64,000 64,000

Accruals 35,450 15,400

1124693 798,564

5 Non-Current Liabilities

31/12/2019 31/12/2018

Mortgage 1,171,550 658,854

31/12/2019 31/12/2018

Raw materials 104,562 70,869

Finished goods 446,113 155,680

550,675 226,549

3 Other Receivables

31/12/2019 31/12/2018

Other Receivables 884,983 627,471

Trade receivables - 16,400

Prepayments 50,940 28,500

935,923 672,371

4 Current Liabilities

31/12/2019 31/12/2018

Bank loans 240,000 80,000

Trade payables 633,283 442,664

Taxation and social security 130,458 61,920

VAT Payable 16,502 34,580

Proposed dividend - 100,000

Director's loan account 64,000 64,000

Accruals 35,450 15,400

1124693 798,564

5 Non-Current Liabilities

31/12/2019 31/12/2018

Mortgage 1,171,550 658,854

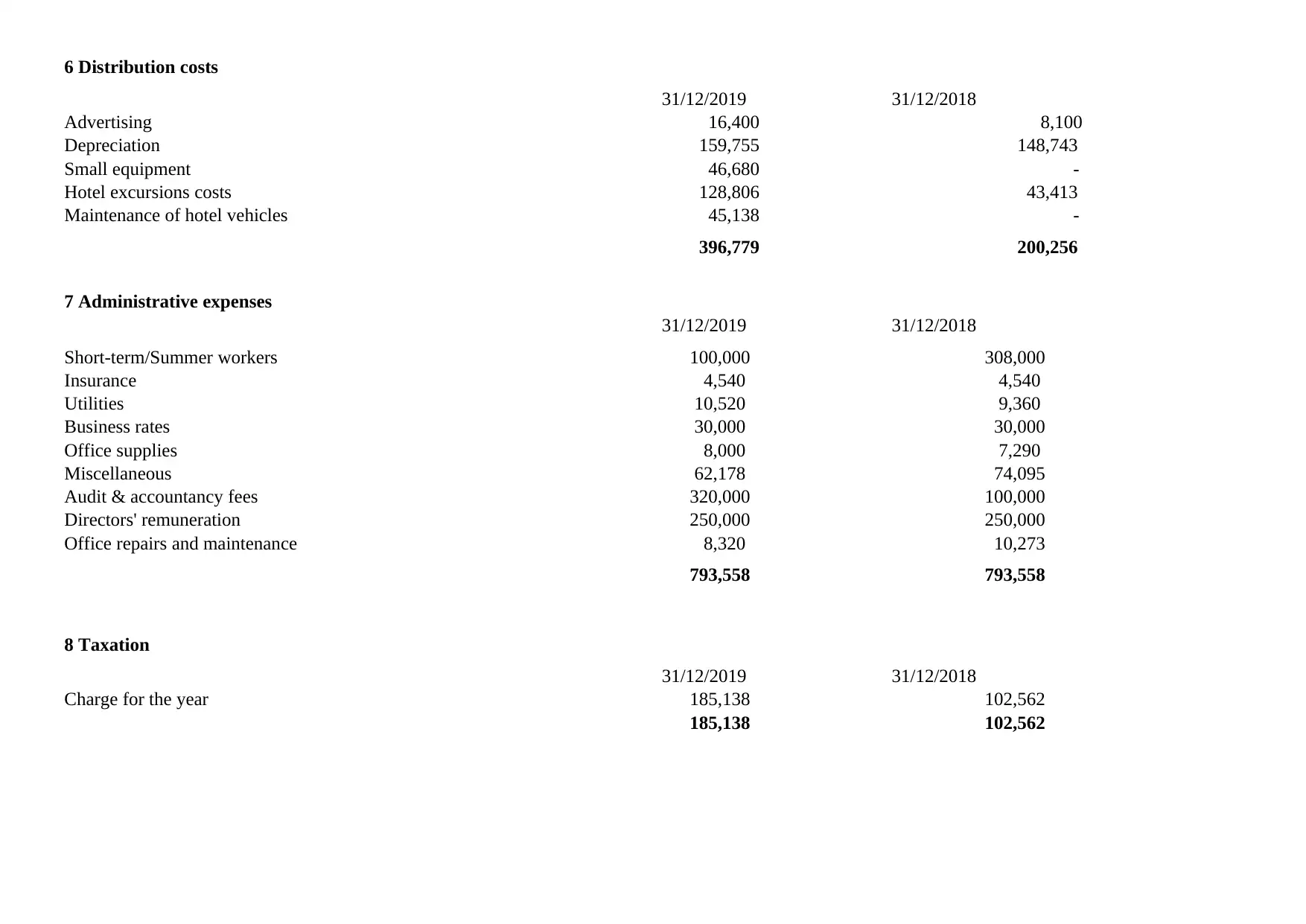

6 Distribution costs

31/12/2019 31/12/2018

Advertising 16,400 8,100

Depreciation 159,755 148,743

Small equipment 46,680 -

Hotel excursions costs 128,806 43,413

Maintenance of hotel vehicles 45,138 -

396,779 200,256

7 Administrative expenses

31/12/2019 31/12/2018

Short-term/Summer workers 100,000 308,000

Insurance 4,540 4,540

Utilities 10,520 9,360

Business rates 30,000 30,000

Office supplies 8,000 7,290

Miscellaneous 62,178 74,095

Audit & accountancy fees 320,000 100,000

Directors' remuneration 250,000 250,000

Office repairs and maintenance 8,320 10,273

793,558 793,558

8 Taxation

31/12/2019 31/12/2018

Charge for the year 185,138 102,562

185,138 102,562

31/12/2019 31/12/2018

Advertising 16,400 8,100

Depreciation 159,755 148,743

Small equipment 46,680 -

Hotel excursions costs 128,806 43,413

Maintenance of hotel vehicles 45,138 -

396,779 200,256

7 Administrative expenses

31/12/2019 31/12/2018

Short-term/Summer workers 100,000 308,000

Insurance 4,540 4,540

Utilities 10,520 9,360

Business rates 30,000 30,000

Office supplies 8,000 7,290

Miscellaneous 62,178 74,095

Audit & accountancy fees 320,000 100,000

Directors' remuneration 250,000 250,000

Office repairs and maintenance 8,320 10,273

793,558 793,558

8 Taxation

31/12/2019 31/12/2018

Charge for the year 185,138 102,562

185,138 102,562

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.