Labor's Tax Policies and Franking Credits: An ABC Q&A Session Analysis

VerifiedAdded on 2022/10/09

|100

|31028

|23

Report

AI Summary

This report analyzes a Q&A session with Bill Shorten, focusing on Labor's proposed changes to negative gearing and franking credits. The discussion covers the potential impact of these policies, including the removal of tax subsidies and the implications for property owners and dividend imputation. The report also examines Shorten's responses on Indigenous suicide, climate policy, and the broader context of the election campaign. Additionally, the report includes a detailed examination of the myths surrounding franking credits, their impact on capital allocation, economic growth, and corporate behavior. It also explores the potential effects of abolishing franking on government revenue and the Australian economy. The assignment considers various perspectives on these complex tax and social issues, drawing on the Q&A session as a primary source of information.

Content of Articles

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1. Shorten Grilled on Negative Gearing and Franking Credits

Labor Leader Bill Shorten has been grilled about his party's planned changes to negative

gearing and franking credits during a special episode of ABC's Q&A.

If elected on 18 May, a federal Labor government would scrap negative gearing on

investment properties from 1 January in 2020, except for newly-constructed houses.

Bill Shorten appeared on Q&A with less than two weeks to go before the May 18

election.

Bill Shorten appeared on Q&A with less than two weeks to go before the May 18

election.

ABC

Negative gearing allows property owners to claim rental losses as a tax deduction.

Speaking in front of a live studio audience in Melbourne, Mr Shorten insisted that the

changes were not tax hikes, but the removal of tax subsidies.

"You use the word tax. If I'm not giving you a subsidy for you making a loss on an

investment property, that ain't a new tax. It just means you're not getting a new subsidy,"

Mr Shorten said.

Will Labor’s negative gearing policy lead to more property owners selling then claiming

pensions? #QandA pic.twitter.com/4DH7tarWvH

Labor Leader Bill Shorten has been grilled about his party's planned changes to negative

gearing and franking credits during a special episode of ABC's Q&A.

If elected on 18 May, a federal Labor government would scrap negative gearing on

investment properties from 1 January in 2020, except for newly-constructed houses.

Bill Shorten appeared on Q&A with less than two weeks to go before the May 18

election.

Bill Shorten appeared on Q&A with less than two weeks to go before the May 18

election.

ABC

Negative gearing allows property owners to claim rental losses as a tax deduction.

Speaking in front of a live studio audience in Melbourne, Mr Shorten insisted that the

changes were not tax hikes, but the removal of tax subsidies.

"You use the word tax. If I'm not giving you a subsidy for you making a loss on an

investment property, that ain't a new tax. It just means you're not getting a new subsidy,"

Mr Shorten said.

Will Labor’s negative gearing policy lead to more property owners selling then claiming

pensions? #QandA pic.twitter.com/4DH7tarWvH

— ABC Q&A (@QandA) May 6, 2019

The Opposition Leader was also confronted by a man who said he would lose 20 per cent

of his income as a result of Labor's plans to limit franking credits.

Mr Shorten said it was a "gift" paid for by millions of working Australians.

While Labor has tried to focus on health during the election campaign, its come under

pressure to explain how it will pay for its policies.

Asked to detail the cost of its climate policy, Mr Shorten dismissed it as a "dumb

question".

"You can't have a debate about climate change without talking about the cost of

inaction," he said.

"There is a cost. The bushfires, the extreme weather events, the insurance premiums."

Indigenous suicide a 'national emergency'

During the hour-long session, Mr Shorten also declared Indigenous suicide is now at the

level of a national emergency.

The Opposition Leader was also confronted by a man who said he would lose 20 per cent

of his income as a result of Labor's plans to limit franking credits.

Mr Shorten said it was a "gift" paid for by millions of working Australians.

While Labor has tried to focus on health during the election campaign, its come under

pressure to explain how it will pay for its policies.

Asked to detail the cost of its climate policy, Mr Shorten dismissed it as a "dumb

question".

"You can't have a debate about climate change without talking about the cost of

inaction," he said.

"There is a cost. The bushfires, the extreme weather events, the insurance premiums."

Indigenous suicide a 'national emergency'

During the hour-long session, Mr Shorten also declared Indigenous suicide is now at the

level of a national emergency.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

The Labor leader said Australia needs to redefine its relationship with its indigenous

people from one of indifference or paternalism to a true partnership.

"I think it's a national disaster, (a) national emergency," he told ABC's Q&A on Monday

night.

ELECTION19 BILL SHORTEN CAMPAIGN DAY 26

Labor Leader Bill Shorten.

AAP

"The issue of suicide is massive. But also the issue of our first Australians and the

inequality of the lives that many of them live is massive. There's an intersection."

He noted both his party and the coalition had committed to a range of suicide prevention

projects, particularly ones aimed at young people, during the lead-up to the 18 May

election.

But, he said, Labor also had a unique idea to help make sure indigenous people received

holistic solutions: making an indigenous man, Pat Dodson, the minister.

How would a Shorten government reduce Indigenous youth suicide? #QandA

pic.twitter.com/AjqpkVXpru

— ABC Q&A (@QandA) May 6, 2019

people from one of indifference or paternalism to a true partnership.

"I think it's a national disaster, (a) national emergency," he told ABC's Q&A on Monday

night.

ELECTION19 BILL SHORTEN CAMPAIGN DAY 26

Labor Leader Bill Shorten.

AAP

"The issue of suicide is massive. But also the issue of our first Australians and the

inequality of the lives that many of them live is massive. There's an intersection."

He noted both his party and the coalition had committed to a range of suicide prevention

projects, particularly ones aimed at young people, during the lead-up to the 18 May

election.

But, he said, Labor also had a unique idea to help make sure indigenous people received

holistic solutions: making an indigenous man, Pat Dodson, the minister.

How would a Shorten government reduce Indigenous youth suicide? #QandA

pic.twitter.com/AjqpkVXpru

— ABC Q&A (@QandA) May 6, 2019

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

"Sometimes we judge ourselves by how many billionaires we have on the Forbes Rich

List," Mr Shorten said.

"I have a view we should judge ourselves by if we have a great disadvantage."

Mr Dodson spoke at Labor's campaign launch on Sunday, releasing the party's plans for

working with indigenous people.

These include creating a system of regional assemblies and a Voice to the national

parliament, establishing a national Makarrata commission and local truth-telling

programs, building a national resting place for the unknown warriors, and giving justice

and compensation to survivors of the stolen generation.

2. 11 Urban Myths About Franking Credits

The decision to introduce dividend imputation has provided an unforeseen benefit for

Australia, perhaps one that is still not fully appreciated by policy makers – it has made

Australian companies manage their capital more efficiently. That makes them sounder

investments.

Yet this benefit appears to be in jeopardy because the debate about the value of dividend

imputation is obscured by myths. This submission seeks to puncture these illusions in the

hope that policy makers will possess the information they need when judging the

effectiveness of a tax system that has served Australia well since 1987

List," Mr Shorten said.

"I have a view we should judge ourselves by if we have a great disadvantage."

Mr Dodson spoke at Labor's campaign launch on Sunday, releasing the party's plans for

working with indigenous people.

These include creating a system of regional assemblies and a Voice to the national

parliament, establishing a national Makarrata commission and local truth-telling

programs, building a national resting place for the unknown warriors, and giving justice

and compensation to survivors of the stolen generation.

2. 11 Urban Myths About Franking Credits

The decision to introduce dividend imputation has provided an unforeseen benefit for

Australia, perhaps one that is still not fully appreciated by policy makers – it has made

Australian companies manage their capital more efficiently. That makes them sounder

investments.

Yet this benefit appears to be in jeopardy because the debate about the value of dividend

imputation is obscured by myths. This submission seeks to puncture these illusions in the

hope that policy makers will possess the information they need when judging the

effectiveness of a tax system that has served Australia well since 1987

Myth 1: Franking is an anachronism; Australia should modernise its tax structure

Reality: Franking’s primary benefits – avoiding double taxation, removing the incentive for

high levels of corporate debt – remain valid

Dividend imputation was introduced to avoid the unfairness of taxing company profits twice.

That motivation still stands. Without franking, the interest expense deduction would be

expected to have more influence in corporate funding. Since the introduction of franking,

Australian companies have increased their gearing levels – in line with the secular decline in

interest rates in the western world – but to a lesser extent than US companies have.

Not creating further incentives for Australian corporates to take on more debt is highly

desirable since negative gearing has created an incentive for high levels of borrowing by the

household sector:

Myth 2: Franking is all about the tax refunds

Reality: Franking’s most important influence has been on capital allocation within the

economy

Reality: Franking’s primary benefits – avoiding double taxation, removing the incentive for

high levels of corporate debt – remain valid

Dividend imputation was introduced to avoid the unfairness of taxing company profits twice.

That motivation still stands. Without franking, the interest expense deduction would be

expected to have more influence in corporate funding. Since the introduction of franking,

Australian companies have increased their gearing levels – in line with the secular decline in

interest rates in the western world – but to a lesser extent than US companies have.

Not creating further incentives for Australian corporates to take on more debt is highly

desirable since negative gearing has created an incentive for high levels of borrowing by the

household sector:

Myth 2: Franking is all about the tax refunds

Reality: Franking’s most important influence has been on capital allocation within the

economy

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Growth and innovation require that funds available for investment are channelled to the most

promising opportunities. Franking facilitates this by automatically prompting companies that

generate the most cash flow to pay it out, which allows shareholders to reinvest that cash

flow into the best opportunities. Without franking, this capital-recycling process would be

diminished due to the friction of corporate tax reducing the funds available to be reinvested.

This recycling is necessary in Australia, which is an economy of cash-flow “haves” and cash-

flow “have nots”. As the charts below show, Australia has a greater proportion of its market

comprised of larger companies. Further, smaller companies in the US tend to generate higher

returns than their counterparts in Australia. This means that Australia’s smaller companies

are more reliant on attracting the dividends flowing from the largest stocks.

Myth 3: Australia has enjoyed extended economic growth. Franking has played no part in

this

Reality: It is likely that franking has contributed to Australia’s lower economic volatility

Franking constrains corporate reinvestment. If we assume that companies will fund their best

projects first, their second-best projects second, etc., then constrained reinvestment should

result in better outcomes. If only the best projects are funded, then those projects are likely to

be more robust through the economic cycle. At the margin, this likely brings greater stability

to employment, consumer sentiment, etc.

promising opportunities. Franking facilitates this by automatically prompting companies that

generate the most cash flow to pay it out, which allows shareholders to reinvest that cash

flow into the best opportunities. Without franking, this capital-recycling process would be

diminished due to the friction of corporate tax reducing the funds available to be reinvested.

This recycling is necessary in Australia, which is an economy of cash-flow “haves” and cash-

flow “have nots”. As the charts below show, Australia has a greater proportion of its market

comprised of larger companies. Further, smaller companies in the US tend to generate higher

returns than their counterparts in Australia. This means that Australia’s smaller companies

are more reliant on attracting the dividends flowing from the largest stocks.

Myth 3: Australia has enjoyed extended economic growth. Franking has played no part in

this

Reality: It is likely that franking has contributed to Australia’s lower economic volatility

Franking constrains corporate reinvestment. If we assume that companies will fund their best

projects first, their second-best projects second, etc., then constrained reinvestment should

result in better outcomes. If only the best projects are funded, then those projects are likely to

be more robust through the economic cycle. At the margin, this likely brings greater stability

to employment, consumer sentiment, etc.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

As expected, corporate returns in Australia have improved, and have advanced more than

returns in the US:

This holds true even after excluding the anomalous mining and tech sectors:

What’s more, the quality of returns has improved, as the variance of returns has diminished

and the persistence of high returns has increased:

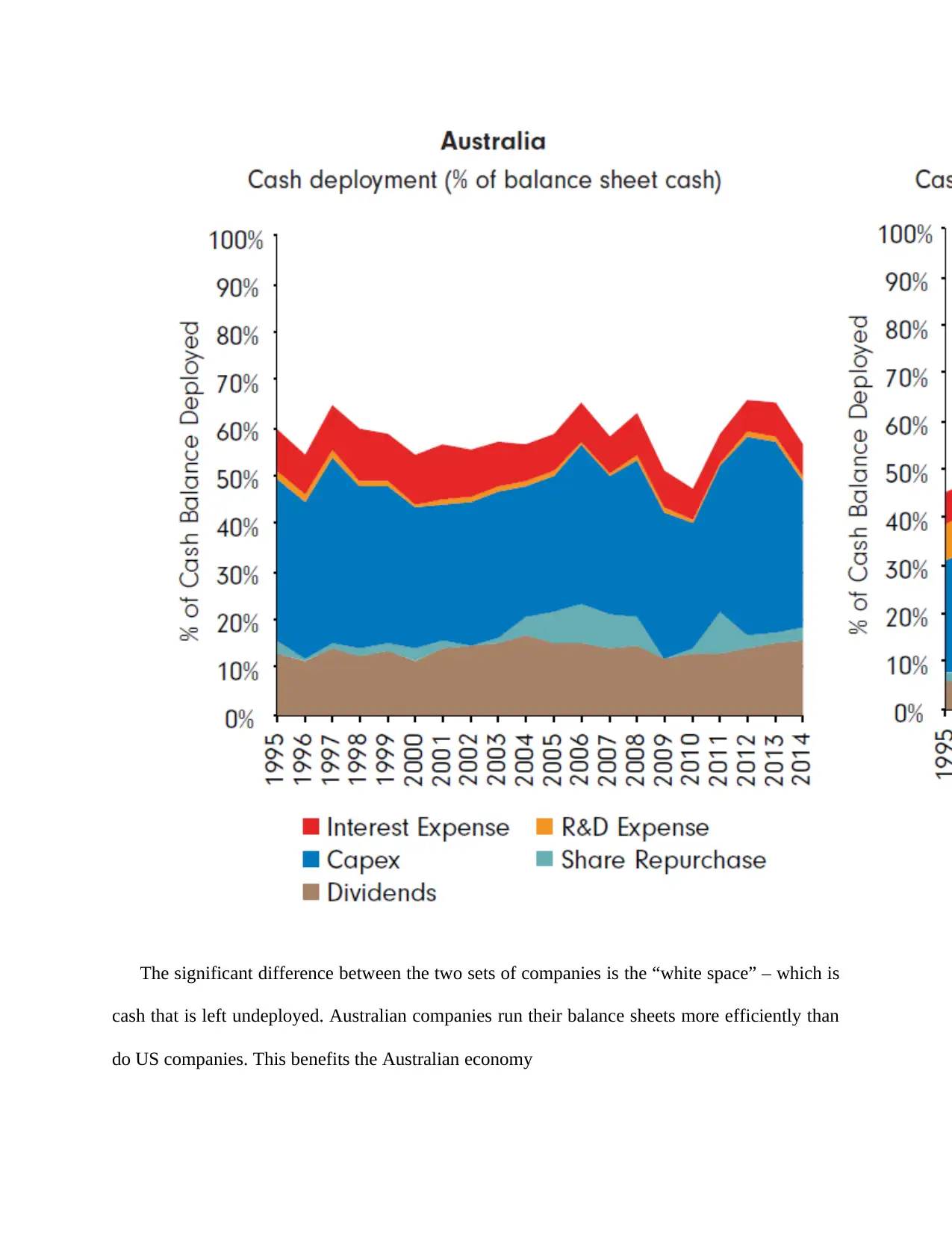

Myth 4: If Australian companies have higher payout ratios, it must be at the expense of

capex – but we need more investment now, not less

Reality: Relative to US companies, Australian companies pay higher dividends and also

invest more; the key difference is that Australian companies run their balance sheets more

efficiently

In this instance, it’s best to look at companies’ overall use of cash. Despite higher payouts

(and higher interest expense), Australian companies do not spend less on capex. There is no

evidence that higher payouts have led to lower levels of investment.

returns in the US:

This holds true even after excluding the anomalous mining and tech sectors:

What’s more, the quality of returns has improved, as the variance of returns has diminished

and the persistence of high returns has increased:

Myth 4: If Australian companies have higher payout ratios, it must be at the expense of

capex – but we need more investment now, not less

Reality: Relative to US companies, Australian companies pay higher dividends and also

invest more; the key difference is that Australian companies run their balance sheets more

efficiently

In this instance, it’s best to look at companies’ overall use of cash. Despite higher payouts

(and higher interest expense), Australian companies do not spend less on capex. There is no

evidence that higher payouts have led to lower levels of investment.

The significant difference between the two sets of companies is the “white space” – which is

cash that is left undeployed. Australian companies run their balance sheets more efficiently than

do US companies. This benefits the Australian economy

cash that is left undeployed. Australian companies run their balance sheets more efficiently than

do US companies. This benefits the Australian economy

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

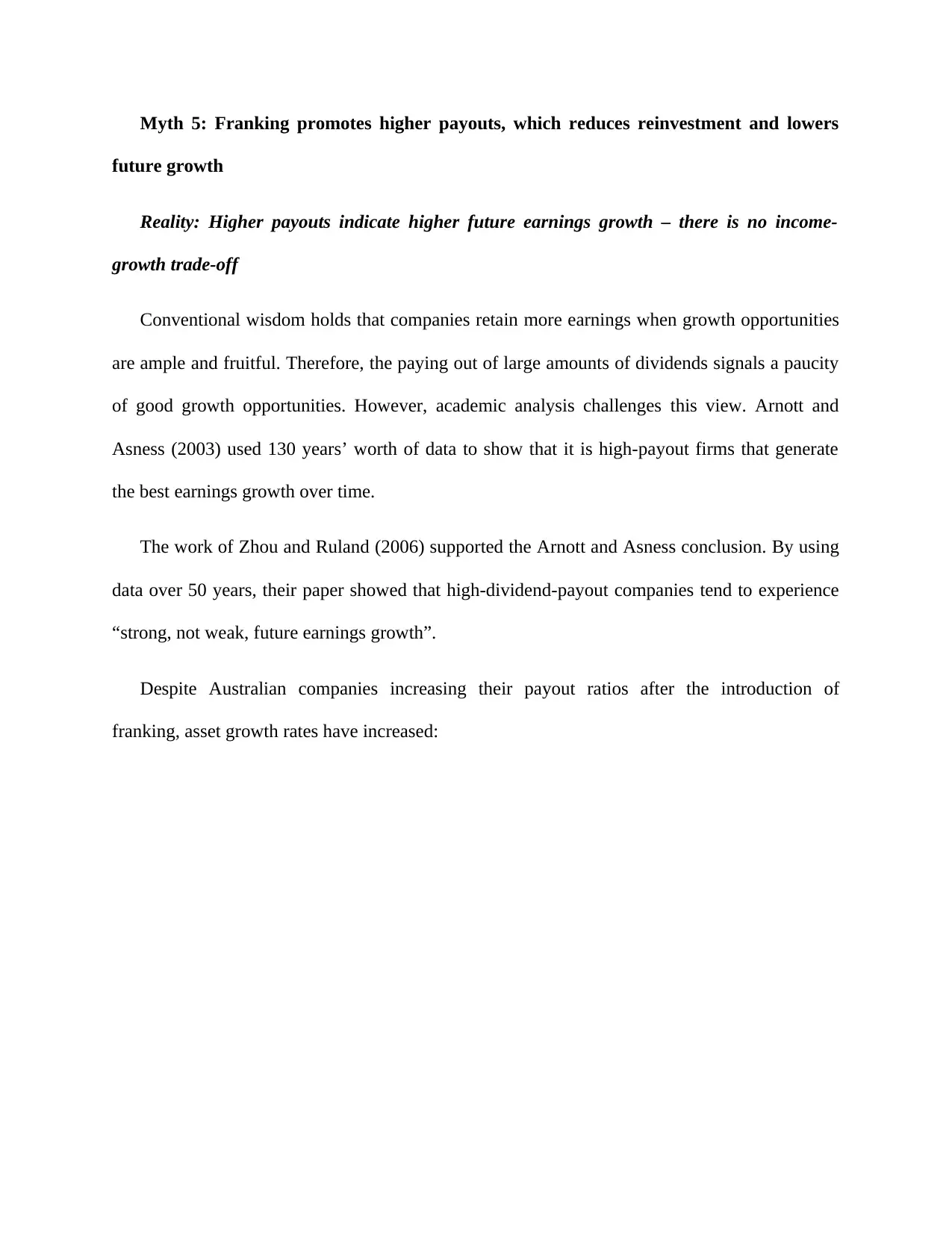

Myth 5: Franking promotes higher payouts, which reduces reinvestment and lowers

future growth

Reality: Higher payouts indicate higher future earnings growth – there is no income-

growth trade-off

Conventional wisdom holds that companies retain more earnings when growth opportunities

are ample and fruitful. Therefore, the paying out of large amounts of dividends signals a paucity

of good growth opportunities. However, academic analysis challenges this view. Arnott and

Asness (2003) used 130 years’ worth of data to show that it is high-payout firms that generate

the best earnings growth over time.

The work of Zhou and Ruland (2006) supported the Arnott and Asness conclusion. By using

data over 50 years, their paper showed that high-dividend-payout companies tend to experience

“strong, not weak, future earnings growth”.

Despite Australian companies increasing their payout ratios after the introduction of

franking, asset growth rates have increased:

future growth

Reality: Higher payouts indicate higher future earnings growth – there is no income-

growth trade-off

Conventional wisdom holds that companies retain more earnings when growth opportunities

are ample and fruitful. Therefore, the paying out of large amounts of dividends signals a paucity

of good growth opportunities. However, academic analysis challenges this view. Arnott and

Asness (2003) used 130 years’ worth of data to show that it is high-payout firms that generate

the best earnings growth over time.

The work of Zhou and Ruland (2006) supported the Arnott and Asness conclusion. By using

data over 50 years, their paper showed that high-dividend-payout companies tend to experience

“strong, not weak, future earnings growth”.

Despite Australian companies increasing their payout ratios after the introduction of

franking, asset growth rates have increased:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

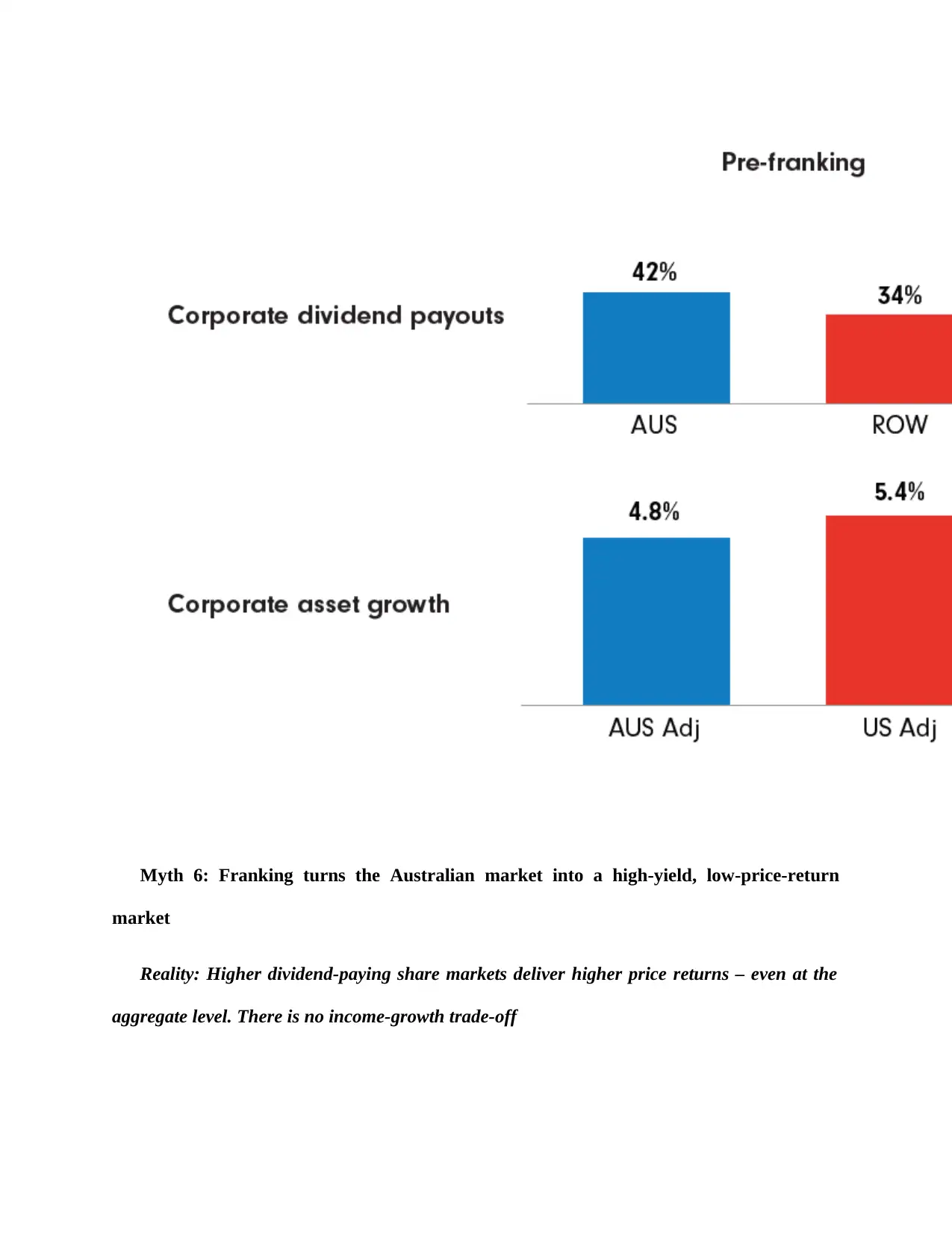

Myth 6: Franking turns the Australian market into a high-yield, low-price-return

market

Reality: Higher dividend-paying share markets deliver higher price returns – even at the

aggregate level. There is no income-growth trade-off

market

Reality: Higher dividend-paying share markets deliver higher price returns – even at the

aggregate level. There is no income-growth trade-off

Conventional wisdom assumes that high-dividend stocks offer low growth potential. The

perception is that companies that return much of their earnings to shareholders have less to invest

than companies that retain their profits. But again this is not supported by the data: over time,

high-yielding stock markets have offered the highest total shareholder returns.

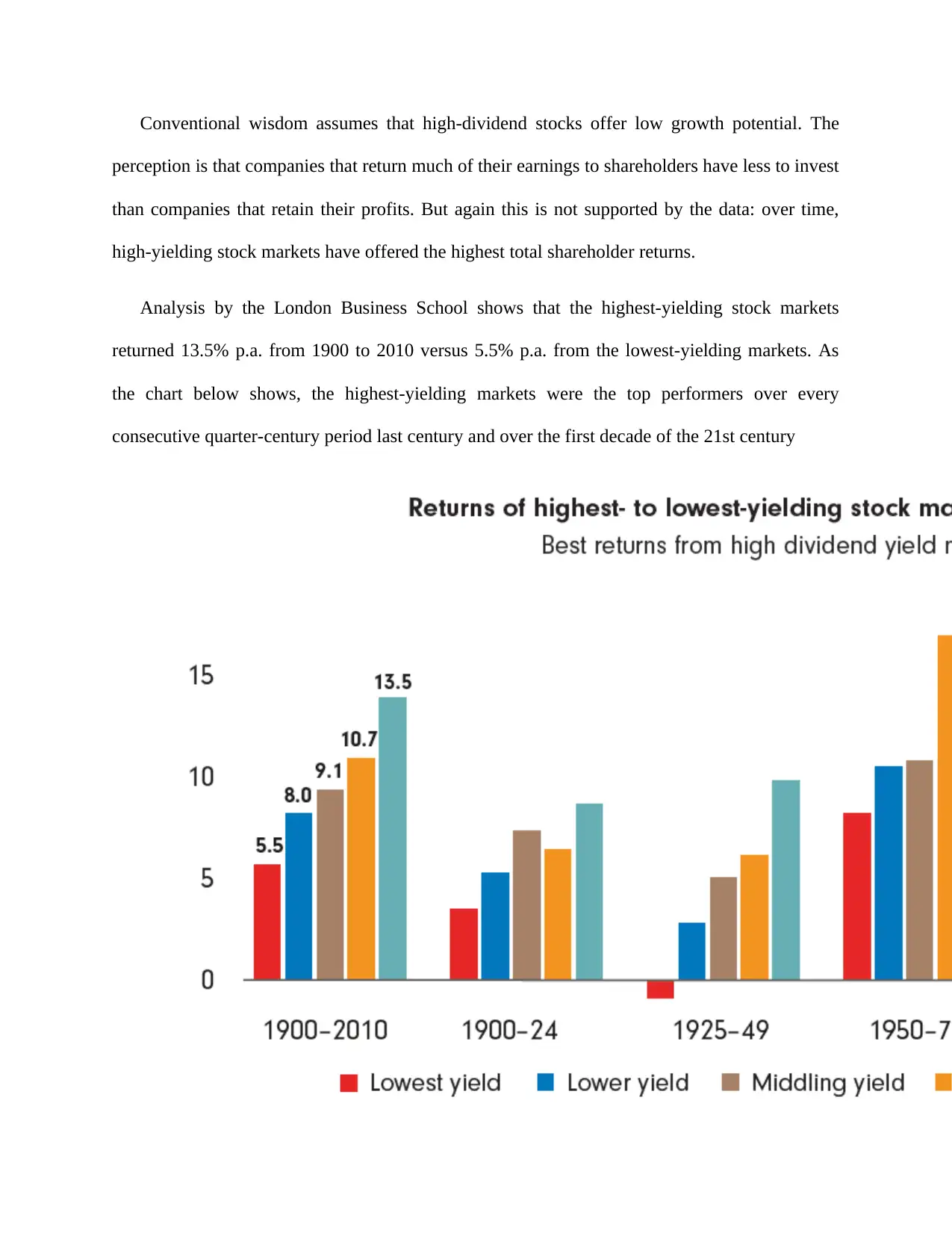

Analysis by the London Business School shows that the highest-yielding stock markets

returned 13.5% p.a. from 1900 to 2010 versus 5.5% p.a. from the lowest-yielding markets. As

the chart below shows, the highest-yielding markets were the top performers over every

consecutive quarter-century period last century and over the first decade of the 21st century

perception is that companies that return much of their earnings to shareholders have less to invest

than companies that retain their profits. But again this is not supported by the data: over time,

high-yielding stock markets have offered the highest total shareholder returns.

Analysis by the London Business School shows that the highest-yielding stock markets

returned 13.5% p.a. from 1900 to 2010 versus 5.5% p.a. from the lowest-yielding markets. As

the chart below shows, the highest-yielding markets were the top performers over every

consecutive quarter-century period last century and over the first decade of the 21st century

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 100

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.